#agriculture IS biotech you nerds

Explore tagged Tumblr posts

Text

People see biotech as this bizarre alien idea as if agriculture isn't a thing we've been doing for almost twelve milennia.

0 notes

Text

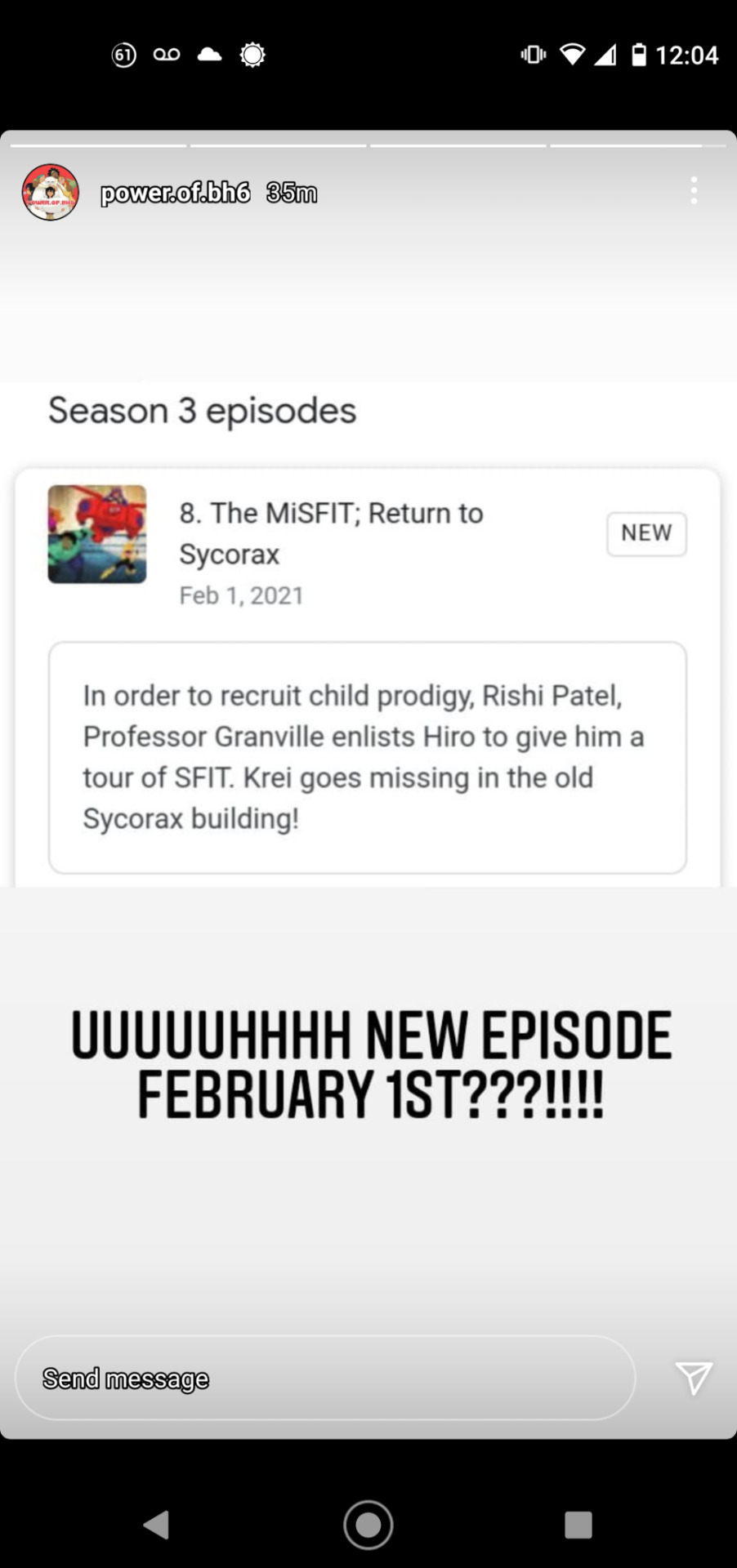

So we have news!

(Just making it clear that everything I'm going to talk about here comes from sources without official confirmation.)

So pals, we have information!

This is great, this is really great!

And as a member of the fandom, crazy for theories, here my two cents of ideas.

The MiSFIT

A new prodigy!!!! This is not training!!

This alone brings a lot of interesting ideas and concepts. First, maybe the college is preparing for a new semester, and maybe it is looking for another teenage genius because of Karmi's departure, which already brings a lot of impact.

How will Hiro feel? Will he feel threatened with a new prodigy, maybe he can become the youngest? It would be fun to see Hiro feeling on his skin what Karmi felt when he got up to it for the sake of empathy. Hiro has always been as proud as Karmi, after all, they are alike. Almost like a mirror.

Not to mention that perhaps Karmi herself is mentioned. Maybe Rishi knows something about her and the incident, which would make this tour a little uncomfortable. Hiro may think that the school wants to replace her or even coexist with another prodigy other than her. may sound.. strange. They've spent so much fighting and now that Hiro knows he likes her, but spent little time together as friends, it might bring up some things he might regret doing. This also brings the opportunity to show Hiro maturing from what he learned from Karmi and receive this prodigy with open arms.

Outside that we can have a mention of Tadashi please, series?!!! Like, where's our precious kid who left too early?! After all, Tadashi is a great legend on SFIT and it could be an episode that has a great focus on him, which is needing to be done here a lot, in my opinion!!! Where's our handsome boi?

The second is about Rishi. According to all the research I do based on character names, Rishi is a Sanskrit name commonly given to boys and meaning "sage". Which makes sense because of the prodigy status they carry, in addition to the idea of future knowledge, perhaps ahead of time. His surname is of Indian origin meaning " headman " or "village chief". Maybe they are someone smug and arrogant, since he seems to be important enough to the point of Grandville in person asking Hiro to convince him to stay, which again would be hilarious to see Hiro deal with someone like that. It can also be a trick and the kid be the opposite, but how this season is humor... I would go on the smug. Outside that this name is given to the family of farmers, so maybe they have a field involved in agriculture and biology? We'll have to wait.

Return to Sycorax

FINALLY!!!!

Disney has been in debt to this for so long that I can't even believe it's real!!! And we have Krei, which feeds yet another theory of mine, but we go in parts here because, man!! Finally!

First, we know it says Krei is going missing. Implying - in my opinion - that he went to Sycorax for some reason. I don't imagine NBB causing this since Sycorax wouldn't have anything that would help him get a family since it was an essentially Biotech company, living things, not robots. Again, maybe Krei wants something from there or maybe even wants to incorporate something from Biotech into Kreitch, which would lead to doing these reckless things.

Second, it seems that Sycorax really went bankrupt. Since the description said "the old building," it may imply that the real Liv Amara has lost everything. This would be interesting to see, since the poor woman woke up only to see everything she built be ruined without a return. And we will maybe know how the arc of the city of monsters affected her. Remembering that Liv was 23 when the chaos happened and serious, Tadashi died at 21, she went through a lot, let's not sleep on it.

Third, and my favorite, trauma exploration!!! I'm a writer, what can I do? Imagine what this episode could yield in emotional?! The last time Hiro was there, Karmi was turned into a monster. He almost died, she almost died, Baymax almost died. Hiro and the rest of the team only have terrible memories of there and now they are returning to the eye of the hurricane! And again, returning to the place that happened all that was responsible for taking your love from you should not be pleasant. Again, Karmi can be mentioned and bro, I'm excited!!!

Basically, these are my individual thoughts. Now my general theories arise from this:

I really think it will have a fourth season, since as I mentioned, this season is only giving us construction and no closure, for what would be the actual final season. We still have new arcs being opened and questions unanswered. If the rumor of the ten episodes is right, three are missing. With that, over two. I believe the season finale is 22 minutes long and the other remaining tackle Momakase (who is in one of the hexagons and has not yet appeared) and Mr. Sparkles, we will still have a lot of things open because of this season. Seriously, the great thing that was the team going away was only pointed out in the first episode after being forgotten!

Second, Braggtech may have something to be about and be the big bad of Season 4. She is a company originaly located in Austanbul, a mix of real-life cities Istanbul, Turkey and Austin, Texas. And both Rishi and Karmi have ancestry from countries of this region, the Middle East. Rishi may have something to be and even Karmi may be involved further forward. That is, more drama!!!

My theory that Karmi could become a Kreitech intern is stronger than ever. This would be great for the character, a chance to redeem herself and move on. After all, the signs are there for me. Karmi learned robotics, she defeated Ian, which would make Krei know about her and have a vacancy available after being informed by Judy. Now he is after something in Sycorax, which is from Biotech that Karmi worked! Not to mention I'm a sucker for romance and these two work together with feelings...the stories write themselves. Dude, I hope it's true, I really want to see nerd shenanigans in the lab of these two geniuses.

Thanks for coming to my Ted Talk! Leave your opinions if you want, I love to hear opinions. Just keep them polite and PG. See you next time, Bye!

#big hero 6#big hero 6 the series#bh6 the series#bh6#big hero six#big hero six the series#karmi#hiro hamada#analysis#meta#theory#fanficition

49 notes

·

View notes

Text

A Tariffic Trade Deal; Boeing Clears the Air

A Tariffic Trade Deal; Boeing Clears the Air:

The Trade Deal Price Is Right

Last week, President Donald Trump chose curtain No. 1 and got himself a brand-new, shiny “phase 1” trade deal with China!

He seems pretty happy with it. He even took it for a spin a few times around Twitter to show it off for the press.

Wall Street, too, seems pretty happy with the phase 1 trade deal. The markets are poised to rally further into all-time high territory this week on the prospect of lower Chinese-U.S. tariffs.

Details on the deal are thin, to say the least. China promised to address intellectual property issues and currency manipulation, agree on technology transfer and buy more agricultural products from the U.S. These promises are all we have, though.

The only hard facts on the deal come from the U.S. side, where the December 15 tariffs of 15% on $160 billion in Chinese imports were scrapped. Duties on $120 billion in imports were cut to 7.5%.

The deal also has yet to be signed. That event will take place in early January, after the deal jumps through some legal hurdles and gets officially translated.

But the White House isn’t waiting until the signing to start on “phase 2,” according to U.S. Treasury Secretary (and extra from Revenge of the Nerds) Steven Mnuchin.

“We are going to go into a very short period of time of having the translation scrubbed, the deal will be signed in early January and then we will start on phase two,” Mnuchin told CNBC.

However, he also noted that “Phase two may be 2a, 2b, 2c, we’ll see…” Umm … wouldn’t it be easier just to call them phase 2, phase 3, et cetera, instead of resorting to letters?

The Takeaway:

There are two ways to look at this phase 1 agreement:

What did the U.S. accomplish?

What’s the impact to investors?

For No. 1, you can find opinions across all of the major financial and mainstream media outlets. They range from praise for the administration on a job well done to derision for basically doing nothing. I’m not getting into this debate … it’s political and unproductive.

As for No. 2, the most important win for investors and Wall Street was tariff relief.

The canceling of the December 15 tariffs means all those electronics, laptops, tablets, iPhones, et cetera, won’t see price bumps during the remainder of the holiday shopping season. The rollback on other tariffs also helps semiconductor-makers and a slew of other industries with supply chains and manufacturing in China.

This is the real reason Wall Street is rallying. It also remains a fear for businesses going forward into phase 2. The trade deal keeps both sides from escalating the trade war for the time being, but it also lessens Trump’s leverage going forward.

I hope that additional tariffs won’t be used as a bargaining chip for any phase 2 (or phase 2a, 2b, 2c) deal. Resuming tariff threats could sour additional negotiations and call into question the existing phase 1 deal.

As it stands, lowering tariffs remains the key to keeping Wall Street’s bull rally going.

Good: Max No More?

The last of Boeing Co.’s (NYSE: BA) 737 Max airliners may have already rolled off the assembly line.

That’s because Boeing is reportedly considering halting or cutting the infamous aircraft’s production. According to “people familiar with the matter,” Boeing’s management supports pausing production on the 737 Max — a move that could lead to inflated costs for the plane, along with prompt job cuts and furloughs at production facilities making the Max.

So, why is this “good” for Boeing? Because the company needs to do something on the 737 Max front. The continued delays in federal approval are becoming increasingly expensive and dragging on BA investor sentiment.

Boeing needs to find a resolution or just rip the Band-Aid off all in one go. Then both the company and investors can move on. If Boeing decides to drop the Max altogether and BA shares drop, this could be an excellent buying opportunity for investors.

Better: A Whole New World

I’m calling it: The Walt Disney Co. (NYSE: DIS) is the hottest movie studio of 2019. With the release of Frozen 2, Disney melted moviegoers’ hearts … and set fire to their wallets for the sixth time this year.

Its latest animated blockbuster hit gave Disney its sixth billion-dollar film this year. Worldwide, Frozen 2 has raked in $1.03 billion so far, putting it in league with Avengers: Endgame ($2.79 billion), The Lion King ($1.65 billion), Captain Marvel ($1.13 billion), Toy Story 4 ($1.07 billion) and Aladdin ($1.05 billion).

What’s more, Disney is sure to have yet another billion-dollar hit on its hands later this week. Star Wars: The Rise of Skywalker debuts in theaters this Friday.

And just think … all of the billion-dollar hits are coming to Disney+ eventually. Disney has you coming and going right now, and it’s making billions doing so.

On a side note, a Home Alone remake doesn’t need to happen … and in the age of smartphones, ride-hailing and the internet, it just doesn’t make sense. That said, if they remade the movie with 39-year-old Macaulay Culkin reprising his role as Kevin, with everyone ignoring the fact that Kevin is practically 40, it would be much funnier. I’d watch that.

I’d also recommend picking up DIS when you get a chance. Buy the dips on this movie leader and soon-to-be streaming giant.

Best: Axsome Results

I’ve been writing about the biotech sector for the past two weeks … and for good reason. Between mergers, buyouts and clinical trial data, the sector has been on fire.

Axsome Therapeutics Inc. (Nasdaq: AXSM) continued that trend today, surging more than 70% on key phase 3 trial data for its new antidepressant medication. Experimental treatment AXS-05 met the primary endpoint of its phase 3 trial for the treatment of severe major depressive disorder.

The National Institute of Mental Health reports that 17.3 million U.S. adults suffered at least one major depressive episode in 2017. Current treatments don’t work for everyone, and SunTrust Robinson Humphrey believes that AXS-05 will be the “go-to drug for those who don’t respond to first-line antidepressants.”

The market is keenly interested in AXS-05, with AXSM surging more than 1,559% in 2019. There could be more gains ahead, as Axsome plans on submitting a new drug application for AXS-05 with the Food and Drug Administration in 2020.

Editor’s Note: This is the perfect time to invest in biotech stocks. If you’re not in the biotech game, you are missing out on triple-digit gains all over the market! So, why are you still holding out?

Banyan Hill expert Jeff Yastine has the details on a $450 million biotech company that’s set to soar. And if you act quickly, you can get in on the ground floor … before the Big Pharma firms take notice and snap up this biotech darling.

Click here now for all the details!

I often hear Spotify Technology SA (NYSE: SPOT) compared with Netflix Inc. (Nasdaq: NFLX). They both dominate their respective streaming markets, so the comparison seems appropriate, right?

Today’s chart of the week helps put that market dominance in perspective:

As you can see, Spotify’s subscriber base (108.1 million) nearly doubles its nearest competitor, Apple Inc.’s (Nasdaq: AAPL) Apple Music (54.7 million), with Amazon.com Inc. (Nasdaq: AMZN) coming in a distant third.

By comparison, Netflix has about 137 million subscribers, with Amazon not that far behind with 100 million subscribers to its Prime service (which includes video streaming).

In short, on a subscriber basis, Spotify is far more dominant in music streaming than Netflix is in video streaming. That said, until Spotify creates its own record label, it’s going to lag far behind Netflix in the revenue department. Although, if Spotify were to move that route, the exiting record labels would probably sink the service in a heartbeat.

Great Stuff: In the Year 2020…

Market predictions!

Market predictions everywhere!

The end of the year is fast approaching. But it’s not only the end of a year — it’s the end of a decade.

Are you prepared for the New Roaring ’20s?

Banyan Hill’s biggest and brightest stars have begun to roll out their outlooks and predictions for 2020, and you don’t want to miss a single second of the action. So, in true Great Stuff fashion, I have compiled links to the latest and greatest 2020 predictions from our experts:

“Stocks to Buy in 2020: Invest in Health Care and Avoid Oil” — Charles Mizrahi, Editor, Alpha Investor Report.

“3 Shocking Predictions for 2020” — Jeff Yastine, Editor, Total Wealth Insider.

“2020 Market Predictions: Tesla, Bitcoin, Cannabis, America 2.0” — Ian Dyer, Editor, Rebound Profit Trader.

“2020 Forecast: Grab Double Digits Now to Start the Year Right” — Matt Badiali, Editor, Real Wealth Strategist.

“Tesla Goes to $1,000 and 9 Other 2020 Predictions” — Ian King, Editor, Automatic Fortunes.

“Your Complete 2020 Trading Strategy — in 1 Chart” — Michael Carr, Editor, Peak Velocity Trader.

“How to Survive 2020’s Stock Market Panic” — Ted Bauman, Editor, The Bauman Letter.

“97% Win Rate in 2019: 1 Winning Put Options Strategy to Dominate 2020” — Chad Shoop, Editor, Pure Income.

“Our 2020 Stock Market Predictions” — Paul Mampilly, Editor, Profits Unlimited.

When you’re done digesting all of that excellent material, don’t forget to like and follow Great Stuff on Facebook, Twitter and Instagram for even more memes and stock market research … but mostly memes.

Until next time, good trading!

Regards,

Joseph Hargett

Great Stuff Managing Editor, Banyan Hill Publishing

0 notes

Link

The Trade Deal Price Is Right

Last week, President Donald Trump chose curtain No. 1 and got himself a brand-new, shiny “phase 1” trade deal with China!

He seems pretty happy with it. He even took it for a spin a few times around Twitter to show it off for the press.

Wall Street, too, seems pretty happy with the phase 1 trade deal. The markets are poised to rally further into all-time high territory this week on the prospect of lower Chinese-U.S. tariffs.

Details on the deal are thin, to say the least. China promised to address intellectual property issues and currency manipulation, agree on technology transfer and buy more agricultural products from the U.S. These promises are all we have, though.

The only hard facts on the deal come from the U.S. side, where the December 15 tariffs of 15% on $160 billion in Chinese imports were scrapped. Duties on $120 billion in imports were cut to 7.5%.

The deal also has yet to be signed. That event will take place in early January, after the deal jumps through some legal hurdles and gets officially translated.

But the White House isn’t waiting until the signing to start on “phase 2,” according to U.S. Treasury Secretary (and extra from Revenge of the Nerds) Steven Mnuchin.

“We are going to go into a very short period of time of having the translation scrubbed, the deal will be signed in early January and then we will start on phase two,” Mnuchin told CNBC.

However, he also noted that “Phase two may be 2a, 2b, 2c, we’ll see…” Umm … wouldn’t it be easier just to call them phase 2, phase 3, et cetera, instead of resorting to letters?

The Takeaway:

There are two ways to look at this phase 1 agreement:

What did the U.S. accomplish?

What’s the impact to investors?

For No. 1, you can find opinions across all of the major financial and mainstream media outlets. They range from praise for the administration on a job well done to derision for basically doing nothing. I’m not getting into this debate … it’s political and unproductive.

As for No. 2, the most important win for investors and Wall Street was tariff relief.

The canceling of the December 15 tariffs means all those electronics, laptops, tablets, iPhones, et cetera, won’t see price bumps during the remainder of the holiday shopping season. The rollback on other tariffs also helps semiconductor-makers and a slew of other industries with supply chains and manufacturing in China.

This is the real reason Wall Street is rallying. It also remains a fear for businesses going forward into phase 2. The trade deal keeps both sides from escalating the trade war for the time being, but it also lessens Trump’s leverage going forward.

I hope that additional tariffs won’t be used as a bargaining chip for any phase 2 (or phase 2a, 2b, 2c) deal. Resuming tariff threats could sour additional negotiations and call into question the existing phase 1 deal.

As it stands, lowering tariffs remains the key to keeping Wall Street’s bull rally going.

Good: Max No More?

The last of Boeing Co.’s (NYSE: BA) 737 Max airliners may have already rolled off the assembly line.

That’s because Boeing is reportedly considering halting or cutting the infamous aircraft’s production. According to “people familiar with the matter,” Boeing’s management supports pausing production on the 737 Max — a move that could lead to inflated costs for the plane, along with prompt job cuts and furloughs at production facilities making the Max.

So, why is this “good” for Boeing? Because the company needs to do something on the 737 Max front. The continued delays in federal approval are becoming increasingly expensive and dragging on BA investor sentiment.

Boeing needs to find a resolution or just rip the Band-Aid off all in one go. Then both the company and investors can move on. If Boeing decides to drop the Max altogether and BA shares drop, this could be an excellent buying opportunity for investors.

Better: A Whole New World

I’m calling it: The Walt Disney Co. (NYSE: DIS) is the hottest movie studio of 2019. With the release of Frozen 2, Disney melted moviegoers’ hearts … and set fire to their wallets for the sixth time this year.

Its latest animated blockbuster hit gave Disney its sixth billion-dollar film this year. Worldwide, Frozen 2 has raked in $1.03 billion so far, putting it in league with Avengers: Endgame ($2.79 billion), The Lion King ($1.65 billion), Captain Marvel ($1.13 billion), Toy Story 4 ($1.07 billion) and Aladdin ($1.05 billion).

What’s more, Disney is sure to have yet another billion-dollar hit on its hands later this week. Star Wars: The Rise of Skywalker debuts in theaters this Friday.

And just think … all of the billion-dollar hits are coming to Disney+ eventually. Disney has you coming and going right now, and it’s making billions doing so.

On a side note, a Home Alone remake doesn’t need to happen … and in the age of smartphones, ride-hailing and the internet, it just doesn’t make sense. That said, if they remade the movie with 39-year-old Macaulay Culkin reprising his role as Kevin, with everyone ignoring the fact that Kevin is practically 40, it would be much funnier. I’d watch that.

I’d also recommend picking up DIS when you get a chance. Buy the dips on this movie leader and soon-to-be streaming giant.

Best: Axsome Results

I’ve been writing about the biotech sector for the past two weeks … and for good reason. Between mergers, buyouts and clinical trial data, the sector has been on fire.

Axsome Therapeutics Inc. (Nasdaq: AXSM) continued that trend today, surging more than 70% on key phase 3 trial data for its new antidepressant medication. Experimental treatment AXS-05 met the primary endpoint of its phase 3 trial for the treatment of severe major depressive disorder.

The National Institute of Mental Health reports that 17.3 million U.S. adults suffered at least one major depressive episode in 2017. Current treatments don’t work for everyone, and SunTrust Robinson Humphrey believes that AXS-05 will be the “go-to drug for those who don’t respond to first-line antidepressants.”

The market is keenly interested in AXS-05, with AXSM surging more than 1,559% in 2019. There could be more gains ahead, as Axsome plans on submitting a new drug application for AXS-05 with the Food and Drug Administration in 2020.

Editor’s Note: This is the perfect time to invest in biotech stocks. If you’re not in the biotech game, you are missing out on triple-digit gains all over the market! So, why are you still holding out?

Banyan Hill expert Jeff Yastine has the details on a $450 million biotech company that’s set to soar. And if you act quickly, you can get in on the ground floor … before the Big Pharma firms take notice and snap up this biotech darling.

Click here now for all the details!

I often hear Spotify Technology SA (NYSE: SPOT) compared with Netflix Inc. (Nasdaq: NFLX). They both dominate their respective streaming markets, so the comparison seems appropriate, right?

Today’s chart of the week helps put that market dominance in perspective:

As you can see, Spotify’s subscriber base (108.1 million) nearly doubles its nearest competitor, Apple Inc.’s (Nasdaq: AAPL) Apple Music (54.7 million), with Amazon.com Inc. (Nasdaq: AMZN) coming in a distant third.

By comparison, Netflix has about 137 million subscribers, with Amazon not that far behind with 100 million subscribers to its Prime service (which includes video streaming).

In short, on a subscriber basis, Spotify is far more dominant in music streaming than Netflix is in video streaming. That said, until Spotify creates its own record label, it’s going to lag far behind Netflix in the revenue department. Although, if Spotify were to move that route, the exiting record labels would probably sink the service in a heartbeat.

Great Stuff: In the Year 2020…

Market predictions!

Market predictions everywhere!

The end of the year is fast approaching. But it’s not only the end of a year — it’s the end of a decade.

Are you prepared for the New Roaring ’20s?

Banyan Hill’s biggest and brightest stars have begun to roll out their outlooks and predictions for 2020, and you don’t want to miss a single second of the action. So, in true Great Stuff fashion, I have compiled links to the latest and greatest 2020 predictions from our experts:

“Stocks to Buy in 2020: Invest in Health Care and Avoid Oil” — Charles Mizrahi, Editor, Alpha Investor Report.

“3 Shocking Predictions for 2020” — Jeff Yastine, Editor, Total Wealth Insider.

“2020 Market Predictions: Tesla, Bitcoin, Cannabis, America 2.0” — Ian Dyer, Editor, Rebound Profit Trader.

“2020 Forecast: Grab Double Digits Now to Start the Year Right” — Matt Badiali, Editor, Real Wealth Strategist.

“Tesla Goes to $1,000 and 9 Other 2020 Predictions” — Ian King, Editor, Automatic Fortunes.

“Your Complete 2020 Trading Strategy — in 1 Chart” — Michael Carr, Editor, Peak Velocity Trader.

“How to Survive 2020’s Stock Market Panic” — Ted Bauman, Editor, The Bauman Letter.

“97% Win Rate in 2019: 1 Winning Put Options Strategy to Dominate 2020” — Chad Shoop, Editor, Pure Income.

“Our 2020 Stock Market Predictions” — Paul Mampilly, Editor, Profits Unlimited.

When you’re done digesting all of that excellent material, don’t forget to like and follow Great Stuff on Facebook, Twitter and Instagram for even more memes and stock market research … but mostly memes.

Until next time, good trading!

Regards,

Joseph Hargett

Great Stuff Managing Editor, Banyan Hill Publishing

0 notes