#advanced stock market concepts

Explore tagged Tumblr posts

Text

Explore Advanced Stock Market Concepts for Advanced Traders

Accelerate your stock trading expertise with advanced stock market concepts that will enhance your skills in technical analysis, options trading, and risk management. Discover more here.

#advanced stock market concepts#technical analysis#options trading#risk management#advanced trading strategies

0 notes

Text

Advanced concepts relating to the stock market (Hindi)

Advanced concepts relating to the stock market can be complex, but they are essential for investors looking to deepen their understanding and make informed investment decisions. There are various topics to cover in advanced stock market concepts, ranging from technical analysis, fundamental analysis, and sector analysis to quantitative trading.

If you are interested in exploring Advanced concepts relating to the stock market (Hindi), Quest by Finology offers a range of courses and resources to help investors navigate the complexities of the market. Their courses cover a comprehensive range of topics in Hindi, and the certification they offer is recognized by the BSE Institute.

Technical analysis is a crucial aspect of advanced concepts in the stock market. It involves analyzing charts and patterns to predict future market movements. Fundamental analysis involves an in-depth study of financial statements, industry trends, and company performance to determine whether a stock is overvalued or undervalued.

Sector analysis involves examining the performance of specific industries, analyzing trends, and predicting market movements based on key changes in a given industry. Quantitative trading involves using mathematical models to make investment decisions, leveraging data analytics and statistical techniques.

Additionally, understanding options and futures trading is significant to advanced stock market concepts. These can be used for hedging and speculating on the direction of market sentiment. The effective use of options and futures can help investors earn significant returns while minimizing risk.

Quest by Finology provides access to a range of valuable resources, including articles, tutorials, and expert insights, designed to provide a clear understanding of advanced stock market concepts. Through exploring these resources, investors can develop their expertise in the stock market and make informed investment decisions.

In conclusion, advanced concepts relating to the stock market play a critical role in investing and require a deep understanding to make informed decisions. Quest by Finology offers a range of courses and resources in Hindi to help investors explore advanced stock market concepts, including technical analysis, fundamental analysis, sector analysis, and quantitative trading. By leveraging Quest by Finology's resources, investors can expand their knowledge and make informed investment decisions.

0 notes

Text

The proportion of planning to market forces is not the essential difference between socialism and capitalism. A planned economy is not equivalent to socialism, because there is planning under capitalism too; a market economy is not capitalism, because there are markets under socialism too. Planning and market forces are both means of controlling economic activity. The essence of socialism is liberation and development of the productive forces, elimination of exploitation and polarization, and the ultimate achievement of prosperity for all. This concept must be made clear to the people. Are securities and the stock market good or bad? Do they entail any dangers? Are they peculiar to capitalism? Can socialism make use of them? We allow people to reserve their judgement, but we must try these things out. If, after one or two years of experimentation, they prove feasible, we can expand them. Otherwise, we can put a stop to them and be done with it. We can stop them all at once or gradually, totally or partially. What is there to be afraid of? So long as we keep this attitude, everything will be all right, and we shall not make any major mistakes. In short, if we want socialism to achieve superiority over capitalism, we should not hesitate to draw on the achievements of all cultures and to learn from other countries, including the developed capitalist countries, all advanced methods of operation and techniques of management that reflect the laws governing modern socialized production.

— Deng Xiaoping, Excerpts From Talks Given In Wuchang, Shenzhen, Zhuhai and Shanghai

125 notes

·

View notes

Text

The Stock Market's Role in Cyberpunk Futures: Speculation Beyond Currency

In the shadow-streaked corridors of cyberpunk fiction, where neon signs flicker against rain-slicked streets and the divide between the powerful and the powerless widens, the stock market emerges not just as a battleground of wealth but as a pivotal narrative device. This genre, known for its gritty exploration of futuristic dystopias dominated by mega-corporations and technological advancements, often delves into unconventional economies. An intriguing aspect of this exploration is the use of stock shares as compensation, a concept highlighted in works like Walter Jon Williams' "Hardwired," where mercenaries and operatives navigate a world where loyalty can be bought with equity.

The Fictional Forefront

In "Hardwired," the characters inhabit a post-catastrophe Earth, engaging in high-stakes missions against the backdrop of corporate warfare. Here, currency transcends traditional boundaries, with stock options serving as payment for services rendered. This mechanism isn't just a quirky detail; it's a reflection of the characters' deep entanglement with the corporations that shape their world. The notion of being paid in stock positions them as stakeholders, literally invested in the success or failure of their corporate benefactors. This intertwining of personal fate with corporate performance underscores the cyberpunk theme of blurred lines between individual and institution.

Such narrative choices speak volumes about the genre's fascination with the fluidity of value and the potential for individuals to navigate, manipulate, or fall victim to these systems. By grounding remuneration in stock, cyberpunk fiction underscores a reality where everything is commodified, and human worth is measured in market potential.

Echoes in Reality

The concept of being compensated with stock, once a speculative fiction trope, now resonates with real-world trends. The proliferation of retail investment platforms and mechanisms has democratized access to equity markets, blurring the lines between professional traders and the general public. This accessibility invites a scenario where companies, especially startups and tech giants, offer stock options as part of compensation packages, embedding employees within the financial fabric of the enterprise.

This trend raises questions about the implications of a society increasingly invested—literally—in the success of corporations. Could this lead to a future where employment and investment are so intertwined that individuals become microcosms of the market? And if so, is this fusion of roles beneficial or detrimental?

Prospects and Pitfalls

The potential benefits of a stock-based compensation system include increased employee loyalty and a vested interest in the company's success. This could foster a culture of innovation and collective effort, driving companies to perform better. Additionally, it democratizes wealth creation, offering individuals a stake in economic growth previously reserved for the elite.

However, the risks are significant. Such a system could exacerbate wealth inequality, with market fluctuations disproportionately affecting those whose livelihoods depend on the performance of their corporate shares. It also raises ethical concerns about the concentration of power and influence within corporations, potentially leading to abuses and exploitation.

Navigating the Dystopia

The cyberpunk narrative of a corporate-led dystopia, then, is not just a cautionary tale but a roadmap of potential realities. It challenges us to consider how close we are to a world where our fortunes are as volatile as the stock market, and where our identities and destinies are intrinsically linked to the corporate entities we serve or oppose.

In this landscape, winning might not mean amassing wealth or stockpiling shares but finding a way to navigate the system without losing one's humanity. It's a delicate balance, one that requires vigilance, adaptability, and, perhaps most importantly, a clear-eyed view of the value we place on ourselves and our labor.

As we edge closer to this speculative future, the questions posed by cyberpunk fiction become increasingly relevant. Is the integration of personal and corporate fortunes a path to empowerment or enslavement? Can individuals thrive in a system where success is measured by market performance? And perhaps most crucially, how do we ensure that in this corporate-led dystopia, people can still win—or at least, find a way to redefine what winning means?

In exploring these questions, cyberpunk fiction doesn't just entertain; it educates and warns, offering a glimpse into a future that might already be upon us. As retail investment mechanisms continue to evolve and the line between employee and investor further blurs, the genre's speculative visions become vital reflections on our collective trajectory. The stock market, in this context, is more than a backdrop—it's a battleground for the soul of society, where the stakes are as personal as they are financial. - REV1

13 notes

·

View notes

Note

*casually slips this here*

RIP everybot in the vicinity.

https://www.tumblr.com/sonicasura/726748640673169408/considering-all-the-shenanigans-that-happen-in?source=share

YOOOOOO, THIS FUCKS!

To be honest, I wouldn't be surprised if there are people who would send viruses and malware to the Cybertronians to either pit their own skills against a technological race or simply for the hell of it.

Look, it was big news for the United States' nuclear arsenal to finally update their systems away from floppy disks in 2019. At this point, I'm guessing governments work with old-ass or obsolete tech, so-

Listen, we're missing the shenanigans of these old-ass aliens falling for the stupidest of scams, of them dealing with tech so outdated that it's practically prehistoric on Cybertron (cue Skyfire spazzing out as he politely muscles into Carly's computer lessons), of the humans around needing a moment to wrap around their heads that their alien friends and allies can literally make Fuck-You money with the stock market and funding start-ups with Cybertronian statistics (the resident Praxians are constantly checking it since math was a huge part of Praxus) but struggle with the concept of a rotary phone.

So imagine these advanced alien species coming up with the most powerful anti-virals to date because the hackers are sending them their version of the common cold and food poisoning.

#ask#sonicasura#transformers#transformers g1#g1#skyfire#cybertronian biology#medical complications#maccadam#look smokescreen found his people in the MIT Blackjack team

37 notes

·

View notes

Text

Mastering Neural Networks: A Deep Dive into Combining Technologies

How Can Two Trained Neural Networks Be Combined?

Introduction

In the ever-evolving world of artificial intelligence (AI), neural networks have emerged as a cornerstone technology, driving advancements across various fields. But have you ever wondered how combining two trained neural networks can enhance their performance and capabilities? Let’s dive deep into the fascinating world of neural networks and explore how combining them can open new horizons in AI.

Basics of Neural Networks

What is a Neural Network?

Neural networks, inspired by the human brain, consist of interconnected nodes or "neurons" that work together to process and analyze data. These networks can identify patterns, recognize images, understand speech, and even generate human-like text. Think of them as a complex web of connections where each neuron contributes to the overall decision-making process.

How Neural Networks Work

Neural networks function by receiving inputs, processing them through hidden layers, and producing outputs. They learn from data by adjusting the weights of connections between neurons, thus improving their ability to predict or classify new data. Imagine a neural network as a black box that continuously refines its understanding based on the information it processes.

Types of Neural Networks

From simple feedforward networks to complex convolutional and recurrent networks, neural networks come in various forms, each designed for specific tasks. Feedforward networks are great for straightforward tasks, while convolutional neural networks (CNNs) excel in image recognition, and recurrent neural networks (RNNs) are ideal for sequential data like text or speech.

Why Combine Neural Networks?

Advantages of Combining Neural Networks

Combining neural networks can significantly enhance their performance, accuracy, and generalization capabilities. By leveraging the strengths of different networks, we can create a more robust and versatile model. Think of it as assembling a team where each member brings unique skills to tackle complex problems.

Applications in Real-World Scenarios

In real-world applications, combining neural networks can lead to breakthroughs in fields like healthcare, finance, and autonomous systems. For example, in medical diagnostics, combining networks can improve the accuracy of disease detection, while in finance, it can enhance the prediction of stock market trends.

Methods of Combining Neural Networks

Ensemble Learning

Ensemble learning involves training multiple neural networks and combining their predictions to improve accuracy. This approach reduces the risk of overfitting and enhances the model's generalization capabilities.

Bagging

Bagging, or Bootstrap Aggregating, trains multiple versions of a model on different subsets of the data and combines their predictions. This method is simple yet effective in reducing variance and improving model stability.

Boosting

Boosting focuses on training sequential models, where each model attempts to correct the errors of its predecessor. This iterative process leads to a powerful combined model that performs well even on difficult tasks.

Stacking

Stacking involves training multiple models and using a "meta-learner" to combine their outputs. This technique leverages the strengths of different models, resulting in superior overall performance.

Transfer Learning

Transfer learning is a method where a pre-trained neural network is fine-tuned on a new task. This approach is particularly useful when data is scarce, allowing us to leverage the knowledge acquired from previous tasks.

Concept of Transfer Learning

In transfer learning, a model trained on a large dataset is adapted to a smaller, related task. For instance, a model trained on millions of images can be fine-tuned to recognize specific objects in a new dataset.

How to Implement Transfer Learning

To implement transfer learning, we start with a pretrained model, freeze some layers to retain their knowledge, and fine-tune the remaining layers on the new task. This method saves time and computational resources while achieving impressive results.

Advantages of Transfer Learning

Transfer learning enables quicker training times and improved performance, especially when dealing with limited data. It’s like standing on the shoulders of giants, leveraging the vast knowledge accumulated from previous tasks.

Neural Network Fusion

Neural network fusion involves merging multiple networks into a single, unified model. This method combines the strengths of different architectures to create a more powerful and versatile network.

Definition of Neural Network Fusion

Neural network fusion integrates different networks at various stages, such as combining their outputs or merging their internal layers. This approach can enhance the model's ability to handle diverse tasks and data types.

Types of Neural Network Fusion

There are several types of neural network fusion, including early fusion, where networks are combined at the input level, and late fusion, where their outputs are merged. Each type has its own advantages depending on the task at hand.

Implementing Fusion Techniques

To implement neural network fusion, we can combine the outputs of different networks using techniques like averaging, weighted voting, or more sophisticated methods like learning a fusion model. The choice of technique depends on the specific requirements of the task.

Cascade Network

Cascade networks involve feeding the output of one neural network as input to another. This approach creates a layered structure where each network focuses on different aspects of the task.

What is a Cascade Network?

A cascade network is a hierarchical structure where multiple networks are connected in series. Each network refines the outputs of the previous one, leading to progressively better performance.

Advantages and Applications of Cascade Networks

Cascade networks are particularly useful in complex tasks where different stages of processing are required. For example, in image processing, a cascade network can progressively enhance image quality, leading to more accurate recognition.

Practical Examples

Image Recognition

In image recognition, combining CNNs with ensemble methods can improve accuracy and robustness. For instance, a network trained on general image data can be combined with a network fine-tuned for specific object recognition, leading to superior performance.

Natural Language Processing

In natural language processing (NLP), combining RNNs with transfer learning can enhance the understanding of text. A pre-trained language model can be fine-tuned for specific tasks like sentiment analysis or text generation, resulting in more accurate and nuanced outputs.

Predictive Analytics

In predictive analytics, combining different types of networks can improve the accuracy of predictions. For example, a network trained on historical data can be combined with a network that analyzes real-time data, leading to more accurate forecasts.

Challenges and Solutions

Technical Challenges

Combining neural networks can be technically challenging, requiring careful tuning and integration. Ensuring compatibility between different networks and avoiding overfitting are critical considerations.

Data Challenges

Data-related challenges include ensuring the availability of diverse and high-quality data for training. Managing data complexity and avoiding biases are essential for achieving accurate and reliable results.

Possible Solutions

To overcome these challenges, it’s crucial to adopt a systematic approach to model integration, including careful preprocessing of data and rigorous validation of models. Utilizing advanced tools and frameworks can also facilitate the process.

Tools and Frameworks

Popular Tools for Combining Neural Networks

Tools like TensorFlow, PyTorch, and Keras provide extensive support for combining neural networks. These platforms offer a wide range of functionalities and ease of use, making them ideal for both beginners and experts.

Frameworks to Use

Frameworks like Scikit-learn, Apache MXNet, and Microsoft Cognitive Toolkit offer specialized support for ensemble learning, transfer learning, and neural network fusion. These frameworks provide robust tools for developing and deploying combined neural network models.

Future of Combining Neural Networks

Emerging Trends

Emerging trends in combining neural networks include the use of advanced ensemble techniques, the integration of neural networks with other AI models, and the development of more sophisticated fusion methods.

Potential Developments

Future developments may include the creation of more powerful and efficient neural network architectures, enhanced transfer learning techniques, and the integration of neural networks with other technologies like quantum computing.

Case Studies

Successful Examples in Industry

In healthcare, combining neural networks has led to significant improvements in disease diagnosis and treatment recommendations. For example, combining CNNs with RNNs has enhanced the accuracy of medical image analysis and patient monitoring.

Lessons Learned from Case Studies

Key lessons from successful case studies include the importance of data quality, the need for careful model tuning, and the benefits of leveraging diverse neural network architectures to address complex problems.

Online Course

I have came across over many online courses. But finally found something very great platform to save your time and money.

1.Prag Robotics_ TBridge

2.Coursera

Best Practices

Strategies for Effective Combination

Effective strategies for combining neural networks include using ensemble methods to enhance performance, leveraging transfer learning to save time and resources, and adopting a systematic approach to model integration.

Avoiding Common Pitfalls

Common pitfalls to avoid include overfitting, ignoring data quality, and underestimating the complexity of model integration. By being aware of these challenges, we can develop more robust and effective combined neural network models.

Conclusion

Combining two trained neural networks can significantly enhance their capabilities, leading to more accurate and versatile AI models. Whether through ensemble learning, transfer learning, or neural network fusion, the potential benefits are immense. By adopting the right strategies and tools, we can unlock new possibilities in AI and drive advancements across various fields.

FAQs

What is the easiest method to combine neural networks?

The easiest method is ensemble learning, where multiple models are combined to improve performance and accuracy.

Can different types of neural networks be combined?

Yes, different types of neural networks, such as CNNs and RNNs, can be combined to leverage their unique strengths.

What are the typical challenges in combining neural networks?

Challenges include technical integration, data quality, and avoiding overfitting. Careful planning and validation are essential.

How does combining neural networks enhance performance?

Combining neural networks enhances performance by leveraging diverse models, reducing errors, and improving generalization.

Is combining neural networks beneficial for small datasets?

Yes, combining neural networks can be beneficial for small datasets, especially when using techniques like transfer learning to leverage knowledge from larger datasets.

#artificialintelligence#coding#raspberrypi#iot#stem#programming#science#arduinoproject#engineer#electricalengineering#robotic#robotica#machinelearning#electrical#diy#arduinouno#education#manufacturing#stemeducation#robotics#robot#technology#engineering#robots#arduino#electronics#automation#tech#innovation#ai

4 notes

·

View notes

Text

How Stock Market Trading Becomes Easier with Practice: A Focus on Selling Options

Stock market trading often seems daunting to newcomers, with its complex charts, unpredictable movements, and a plethora of strategies. However, with consistent practice and the right approach, trading can become a much more manageable and even profitable venture. One effective strategy that simplifies the trading process is selling options.

Understanding Options Trading

Options are financial instruments that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before or at the expiry date. While buying options can be risky, selling options offers a more controlled and potentially profitable approach.

Why Selling Options is Beneficial

Income Generation: Selling options, especially covered calls and cash-secured puts, can generate consistent income. By selling these options, traders earn a premium, providing an immediate return on investment.

Lower Risk: Selling options can be less risky compared to buying them. With strategies like covered calls, the trader owns the underlying stock, which provides a cushion against adverse price movements.

Flexibility: Selling options offers flexibility in terms of strategy. Traders can use various techniques such as covered calls, cash-secured puts, and iron condors to adapt to different market conditions.

Improved Probability of Profit: When you sell options, especially out-of-the-money options, the probability of the options expiring worthless (which is beneficial for the seller) is higher. This increases the chance of earning a profit.

Practicing Options Selling

Just like any other skill, mastering options trading requires practice. Here are some steps to get started:

Education: Begin with a solid understanding of options trading. Numerous resources, courses, and tutorials are available online to help you grasp the basics and advanced concepts.

Paper Trading: Before risking real money, practice with paper trading. This allows you to test strategies in a simulated environment without any financial risk.

Start Small: When transitioning to live trading, start with small positions. This minimizes risk while allowing you to gain practical experience.

Track Your Performance: Maintain a trading journal to track your trades, strategies, and outcomes. Analyzing your performance helps in refining your approach and identifying what works best for you.

Why Choose TradeWithGuru. for Learning Options Trading

At TradeWithGuru, we offer comprehensive stock market courses designed to make trading easier and more profitable. Our courses provide:

Unlimited Class Duration: Learn at your own pace.

Flexible Class Hours: Fit learning into your schedule.

One-to-One Classes: Receive personalized attention.

Free Trade Support: Get ongoing support to make informed decisions.

Free Daily Market Updates: Stay updated with market trends.

Free Demat Account Opening: Start trading right away.

Our 12-week transformation program equips you with the skills and confidence to trade like a pro. Discover more about our courses and how they can help you master stock market trading by visiting TradeWithGuru.

Conclusion

Stock market trading doesn't have to be overwhelming. With consistent practice and the right strategies, such as selling options, you can simplify the process and enhance your profitability. Begin your trading journey with expert guidance from TradeWithGuru and secure your financial future with confidence.

2 notes

·

View notes

Text

At Sense of Stocks Academy, we believe that everyone should have access to quality educational resources

about stocks. Our mission is to simplify complex concepts and provide practical insights, empowering

individuals to make informed investment decisions. Join us on this exciting journey through the world of stocks!

Overview of Stock Sectors

1 Technology Sector

Discover the driving force behind technological advancements and the potential for growth in this ever evolving sector.

2 Healthcare Sector

Explore the impact of medical breakthroughs and the opportunities available in the healthcare industry.

3 Financial Sector

Dive into the world of banking, insurance, and investments, where profitability and risk management intersect.

Blue Chip Stocks and Their Characteristics

Definition – Learn what blue chip stocks are and discover why they are considered reliable, stable, and well-established.

Examples -Explore renowned blue chip companies like Apple, Microsoft, and Coca-Cola, known for their long history of success.

Benefits -Discover the advantages of investing in blue chip stocks, such as consistent dividends and reduced volatility.

Penny Stocks and Their Characteristics

Low Price

Unlock the potential of penny stocks, which are typically priced under $5, attracting investors seeking high returns.

Volatility

Explore the risks and rewards associated with penny stocks, known for their price fluctuations and speculative nature.

Trading Volume

Understand the impact of low trading volume on penny stocks, requiring careful analysis and swift decision making.

Growth Stocks and Their Characteristics

High Potential

Uncover companies with strong growth prospects, promising exponential returns for investors with a long-term vision.

Innovation

Explore the exciting world of growth stocks, where groundbreaking technologies and disruptive ideas propel companies forward.

Risk & Reward

Understand the trade-off between risk and potential reward when investing in growth stocks, a journey filled with excitement and uncertainty.

Value Stocks and Their Characteristics

Value stocks are hidden gems waiting to be discovered. They represent companies that are undervalued by

the market, providing an opportunity for investors to capitalize on their growth potential. With a keen eye for

value, smart investors can often unearth treasures amidst the noise of the stock market.

Vision

Our vision is to empower individuals with the knowledge and tools to thrive in the stock market, enabling them

to achieve their financial goals and secure a prosperous future.

MISSION

Our mission is to provide high-quality education and training to individuals seeking to excel in their chosen

field. Through our comprehensive curriculum, experienced instructors, and state-of-the-art facilities, we aim to

equip our students with the skills, knowledge, and confidence needed to succeed in today’s competitive

professional landscape. We are committed to fostering a supportive and inclusive learning environment that

encourages personal growth, critical thinking, and collaboration. By empowering our students to reach their

full potential, we strive to make a positive impact on their lives and contribute to the advancement of their respective industries.

2 notes

·

View notes

Text

But as Daniel Morgan, a senior portfolio manager at Synovus Trust, said in an interview with Bloomberg TV, "This AI hype doesn't really trickle down into any huge profit growth. It's just a lot of what can happen in the future." AI-driven products are not bringing in big bucks yet, but the concept is already pumping valuations.

That is what makes the hype cycle a Hail Mary: Silicon Valley is hoping and praying that AI hype can keep customers and investors distracted until their balance sheets can bounce back. (...)

The technology for mining large-language models has been around since around 2018. (...)

What has changed the state of play for generative AI is not technological advancement, but the advanced state of Silicon Valley's malaise. The pandemic opened a spigot of cash for the sector as more people relied on tech products to get through isolation. (...)

VC funding for a lot of startups dried up between 2021 and 2022. AI investment, however — especially in early-stage companies — continued at a steady clip, only falling to $4.5 billion in 2022 from $4.8 billion in 2021. (...)

But the Silicon Valley machine only knows one speed, and that's growth at all costs. It sees no other option but an AI Hail Mary.

Silicon Valley titans Alphabet, Apple, Meta and Nvidia, Seattle’s Amazon and Microsoft and electric vehicle giant Tesla gained more than $2.1 trillion in market capitalization year-to-date through Thursday’s market close cumulatively, according to FactSet data.

Incredibly, those seven stocks account for 88% of the S&P’s 2023 gains, with the index up $2.4 trillion this year and 7% overall.

Apple’s $549 billion in added market cap is by far the greatest of the seven stalwarts, though each stock is up more than 20% year-to-date with more than $175 billion in market cap gains apiece.

the AI hype is literally there for stocks to have just one more hit of the extend-and-pretend

3 notes

·

View notes

Text

HEY OUR WEBSITE IS OUT AND IT'S ALL ABOUT BOOKS. FOR THOSE WHO WOULD ENJOY READING BOOK, OUR BOOKSTORE OFFER A KIND OF BOOKS YOU LIKE TO READ ABOUT.

THIS ARE THE LIST OF OUR AVAILABLE BOOKS:

Romcom

New York Times Best Seller

Mistery/Thrill

Fantasy

18+

THE BOOKSTORE INCLUDES SITTING AREAS, WITH FRESHLY BREWED COFFEE AND TEA AVAILABLE.

FIND US. BOOK US AND STAY CONNECTED!

LOCATED IN 8872+HRV, Kagawasan Avenue, Lungsod ng Dumaguete, Lalawigan ng Negros Oriental.

"A great book should leave you with many experiences, and slightly exhausted at the end. You live several lives while reading." – William Styron

The name of our book store is The Boook-ish Collections

A PROPER WELL ARRANGE BOOKS

Bookshops have long been a source of curiosity and excitement for readers, from small independent book stores to large chain stores in shopping malls and airports. Recently, the concept of literary diversity has been celebrated in these spaces, with many businesses dedicated to showcasing works by marginalized authors from all walks of life. These stores have become popular destinations for those seeking out stories not represented elsewhere, providing customers with the chance to immerse themselves into literature written by those who share similar experiences.

The history of the bookshop dates back to ancient times when scribes would sell scrolls in streetside markets. In those days, the written word was seen as a way to share knowledge and wisdom across generations. The emergence of books led to an increase in demand for these printed materials, prompting people to establish specialized establishments dedicated solely to selling them. As technology advanced throughout time, so did the concept of selling books from brick and mortar establishments — creating what we know now as modern bookshops.

Here are some Benefits that will you like in our Bookstore

EXPLORE THE TRENDS IN BOOKSTORE INDUSTRY

TRENDS IN BOOKSTORE INDUSTRY

The bookstore industry is adapting quickly to changing customer demands, such as increased demand for eBooks and secondhand books. To remain competitive, brick-and-mortar stores are expanding their selection of eBooks and incorporating tablets into their displays. Additionally, they are stocking used copies of books to meet the rising demand. Online retailers are specializing in selling pre-owned books, making it easier for customers to find what they are looking for. With these strategies, bookstores are likely to remain in business.

RATES AND RESERVATIONS

OFFERS & SERVICES

Feeling limited by the offers and selections of books when you go visit a bookstore?

here's some selections and aspiring authors you could reach out into!

The ability to read awoke inside of me some long dormant craving to be mentally alive.”

―Malcolm X, The Autobiography of Malcolm X

2 notes

·

View notes

Photo

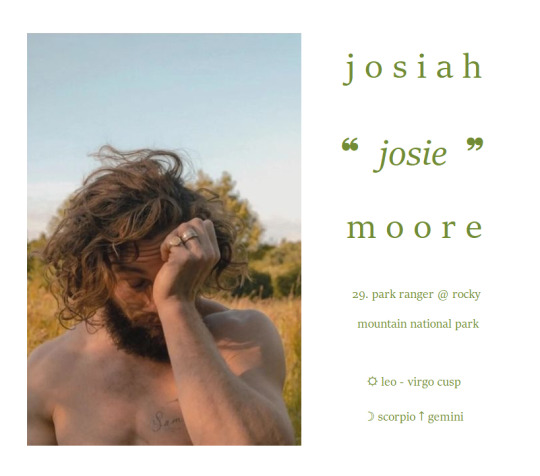

STATS.

name: josiah ❝ jo / josie ❞ barnabas moore gender & pronouns: cis male + he / him orientation: demiromantic pansexual age: twenty-nine date of birth: 19 august, 1993 zodiac: ☼ leo - virgo cusp ☽ scorpio ↑ gemini occupation: park ranger + wilderness guide positive traits: charismatic + resourceful + intelligent + engaging + hard-working negative traits: flighty + narcissistic + sarcastic + blunt + secretive

BIOGRAPHY.

TW : domestic violence, abandonment, cancer, chronic illness, drugs, death, alcohol

Josiah Barnabas Moore — or Jo, to most, and Josie only if you know him well — was born the youngest of four in a small trailer just a stone’s throw from Fort Payne, Alabama to Laurel and Oliver Moore. They didn’t have very much growing up; his father worked full-time at a struggling hardware store in town, and his mother sold her paintings and handmade jewelry at local markets and fairs when she could to supplement their income, but it was still incredibly difficult to feed and clothe and house a family of six. Their trailer was small, cramped, the siblings nearly sleeping on top of each other as they grew older and rooms had to be shared and sofas had to be converted into beds. The Moore siblings were close, though; they had to be. Laurel and Oliver had a tumultuous marriage, to say the least, and the paper-thin walls of their trailer did very little to muffle shouting matches at all hours of the day and night. His older siblings did their best to shield Josie from the worst of it when he was young, and as a result, they’d often spend much of their time outdoors, exploring the woods surrounding their trailer. He grew up scraping his knees falling out of trees and wading through muddy river water to catch tadpoles in old jam jars. Nature quickly became a safe space, a haven for him away from the chaos of home.

He was thirteen years old when his parents separated. And okay, that’s a nice way of saying his dad just packed up one day and decided to get the hell out of dodge, taking half of Josiah’s siblings with him. With the eldest remaining sibling away at college, Jo and his mother were left alone in a trailer that suddenly felt very spacious to figure out how to fend for themselves. Laurel picked up an overnight job at the gas station about a mile up the road, and by the time he was sixteen, Jo was stocking shelves at the local supermarket when he wasn’t at school — Mama Moore insisted he keep his grades up, it was the only way she’d allow him to keep the job, in spite of the great burden his added income relieved of her. She never wanted to ask her son for help, but he was ready to offer it the moment he could. Everyone else might have left, but Jo wasn’t going anywhere.

In his senior year of high school, Jo was offered a full-ride academic scholarship to the University of Alabama, but he chose to decline the acceptance in favor of classes at the nearest community college so he wouldn’t have to leave home or make an impossible commute five days a week to try and make it work. He didn’t even tell his mother that he’d been accepted, and he tried to act like he couldn’t see the disappointment in her eyes when he told her where he’d be going instead. But she encouraged him all the same, and he graduated with a degree in environmental science all while balancing a full-time job at the supermarket. After graduating, she suggested he try finding a job in the field, and after a few months of trying, he secured a position at Little River Canyon National Reserve. It was about a half hour drive from the trailer, but the pay was good and the benefits even better, and for the first time, he actually felt like they weren’t struggling to get by. He felt relieved. Secure, even. He was happy.

But, of course, all good things must come to an end — a concept with which Josiah is all too familiar. He was twenty-five when Mama Moore was diagnosed with an aggressive and advanced form of breast cancer. For two and a half years, any time he didn’t spend working was spent by her side; taking her to appointments, sitting with her through chemotherapy sessions, teaching himself how to cook so he could make anything she wanted and might be able to stomach. In spite of how dangerous it was and how much of a risk it posed to everything he had, being employed by the government in a state like Alabama, Jo put his botany knowledge to good use and learned how to grow marijuana because he’d heard it helped with the side effects of treatment. He hid it well inside of their trailer, opting to sleep on the couch in order to convert their second room into a space to grow his plants for her, and he very, very rarely indulged with her, insisting that it was strictly medicinal and he couldn’t get caught with it, especially if he got tested at work. He’d lose his job and their insurance, and they’d be even more under water than they already were. ( Not that Jo would ever let her know that; he’d taken on the finances from the time he got his job with the National Reserve, and he’d be damned if he’d let her think for a moment they were struggling. ) They never did get caught, and once she'd moved onto stronger forms of pain relief in hospice care, he got rid of the plants and cleared out the room he'd used for growing.

Once he realized they were nearing the devastating but inevitable end of his mother's long and exhausting battle, Jo wrote letters to his father and all of his siblings inviting them to show up to say their goodbyes. His father never showed up, and much like the first time when he’d left, Jo was left to try and figure things out on his own. There was a small, modest service held for her, and per her request, she was buried in a shady spot under a willow tree. It felt surreal, coming back to the trailer alone, and it took several weeks for Jo to find it in himself to begin to pack up her belongings. He took an indefinite leave of absence from his job and spent many nights seeking solace at the bottom of a bottle as he struggled to swallow the loss of his guardian, teacher, and best friend all in one. He knew he needed a change, that the amount of hurt contained in the peeling wallpaper of that shitty little trailer outside of Fort Payne was too much to continue to bear, to make himself bear. Not when he didn’t have to.

After his mother passed, Josiah decided there was nothing more keeping him in Alabama and nothing left for him there but memories, so after an extended period of isolated grieving, he promptly made the choice to pack up in search of a change of scenery. Something new. An online search of jobs in national parks with zero distance restrictions led him to a listing for an available position as a park ranger at Rocky Mountain National Park near Bradford Springs. Colorado. It was a far sight from where he’d spent most of his life, but still promised the familiarity of mountain views and fresh air the likes of which would serve as reminder enough of home to keep him from growing heartsick for it. The entirety of his life fit into a few bags and boxes in the back of a beige Jeep Wrangler from the turn of the millennium, and with the aid of a bunch of old CDs and a handful of maps picked up at rest stops along the way, Jo made the thirteen-hundred mile drive all the way from Fort Payne to Bradford Springs over the course of two days and one night spent trying to catch a few hours of sleep in a rest stop on the state line between Missouri and Kansas.

Jo acclimated very quickly to his job at Rocky Mountain National Park after a few weeks spent studying the local flora and fauna. His efforts were expedited by his choice in domicile — a cabin out in the woods, only a short walk from the ranger station outfitted with the basic amenities thanks to solar panels and a well that he outfitted with a submersible pump and a supply line to the cabin. Being in close proximity to the ranger station gives him internet access, so he’s not entirely off the grid, but almost everything else about his lifestyle would suggest otherwise. Once he was familiar enough with the area, Jo took on the task of leading guided tours on hikes through the trails, taking tourists through scenic mountain and river paths to explore the natural views and wildlife. He loves his job, for the most part — he’s of the belief that people, generally speaking and on the whole, suck, and he’d much rather spend all his time in the company of the animals and trees, but he’s cultivated a skill for turning on the charm and enthusiasm for his job, if only because it’s a cost well worth the reward.

EXTRAS.

Only a few short weeks after settling into his cabin, Jo was walking home one night when he discovered a wounded baby raccoon abandoned in the brush. Unable to bring himself to leave it there to be a meal for any of the other predators lurking in the woods, the ranger took the animal back to his cabin until he could get it to an emergency vet, and after it was treated for the severest of its’ injuries, Jo brought the raccoon back home to nurse him back to health. He’d never bottle-fed anything before, let alone a raccoon, but he developed a very strong bond with the animal over its first few weeks in the cabin, and it wasn’t long before Jo realized he’d end up having a permanent home there. Meeko’s been living with Jo for over a year now, and in that time, Jo’s learned that he has to child-proof every drawer and cabinet in his home to keep the mischievous raccoons wandering hands out of his things.

Jo is promiscuous and unashamedly so. ( As for if he’ll admit that he uses this as a blatant distraction from feeling anything too real is still up for debate. ) Whether it be flirting with the most attractive park visitors that sign up for his hikes through Rocky Mountain and inviting them back to his cabin for a night of roughing it out in the woods ( a frequent pastime of his ) or his trips into town to hit up the dive bars and clubs and drink and dance and charm his way into the hearts and pants of strangers, locals and tourists alike, Jo is wont to seek out fleeting intimate connections. He’s not one for commitment, not beyond a handful of recurring, no-strings-attached situations, and he’s also not selective when it comes to gender. He just likes people. He’s wondered more than once on Uber rides back to his cabin if some of his successful flirtations have suspected him some sort of kidnapper, serial killer for his cabin out in the woods, but it’s not hard to fall in love with the place once you’ve seen it and understand why Jo would live there.

WANTED CONNECTIONS + MORE TBA.

#bsco.intro#☼ about jo#this was rushed but what else do you expect when i bring in a new muse the night before an event alksdhasd

3 notes

·

View notes

Text

Online Share Market Courses

Whether you are looking to gain a basic understanding of stock market trading or want to deepen your knowledge and skills, the Goela School of Finance has the perfect course for you. With a focus on fundamental and technical analysis, the courses offered by the Goela School of Finance cover everything you need to know about the stock market.

The stock market fundamental analysis course covers the basics of stock market trading, including market trends, financial analysis, and risk management. The course is ideal for beginners who are new to stock market trading and want to gain a solid foundation of knowledge. The course covers the key concepts of fundamental analysis and helps students understand how to analyze the financial performance of companies and make informed investment decisions.

The stock market technical analysis course, on the other hand, focuses on the use of technical indicators and chart patterns to make informed investment decisions. This course is ideal for experienced traders who are looking to enhance their skills and make more accurate predictions about market trends and stock prices. The course covers advanced technical analysis concepts and provides students with hands-on training in using technical indicators and chart patterns to make informed investment decisions.

The Goela School of Finance also offers a complete stock market course, which covers both fundamental and technical analysis. This comprehensive course is ideal for individuals who are looking to become proficient in stock market trading and achieve their financial goals. With a focus on both theory and practice, the course provides students with a thorough understanding of the stock market and how it operates.

In conclusion, the Goela School of Finance is a leading provider of online share market courses in India. With a commitment to providing top-notch financial education, the courses offered by the Goela School of Finance are designed to help individuals achieve their financial goals. Whether you are a beginner or an experienced trader, the Goela School of Finance has the perfect course for you. Visit the website at goelasf.in to find out more and get started today.

#stock market fundamental analysis#stock analysis course free#share market learning course#complete stock market course#stock market course#stock market courses online free with certificate#stock market study course#stock market training course#online learning stocks#professional stock trading course#best stock market courses online

2 notes

·

View notes

Text

For anyone pushing you with concepts "decolonial" or "intersectional" or "biopolitical" without a clear concept of class analysis and the evolution of material conditions, you can bet that they're just trying to reinvent the wheel and that thing was already analyzed and systematized by Marx and Engels. These people are just fervently anti-communist and wish to replace marxism with something more suited to their comfort, i.e., useless.

Something like postmodernists' theorizing of internal periphery might seem very interesting and usedul until you read Lenin and discover about imperialism, and realize that postmodernists just bastardized and took out from Lenin's theory the class conflict and production dynamics that shape the evolution of market saturation and dominance, and left you with a sterile, empty idea without concrete material causes and solutions just for the sake of having an idea that they could call "original".

Or how about another example--Foucalt talks a great deal about executions and the theater of cruelty that States wield to hold onto power through fear and violence. But it's just a bastardization of Marx and Engels's writings on dictatorship. He refuges in the particular, in analyzing to death a small section of how States wield a tool of fear for power without delving into what States are, why they wield power that way and for whom. The marxist analysis he is covering up for the sake of justifying his salary and book royalties, meanwhile, is the very clear reality that all States (understood as the bureaucratic machinery of administration and policing) are structures which serve to enforce the dictatorship of a particular class over another, and so despite the ink Foucault spills on torture and executions their violence is largely unremarkable, and must be exhamined by its purpose and effects. In the case of "liberal democracies", the purpose is to safeguard private property and the interests of the bourgeoisie (those who own property and capital and seek to reproduce it for their own profit and power) against the interests of the working class, without whose labor that property and capital would not exist. Multiple political parties can exist and operate, sure, but they can largely succeed electorally only through corporate donations, which they can access only through accepting the programs of the bourgeoisie. The letter of the law itself, too, is made to benefit the bourgeoisie. You can lose your job if you carry out communist agitation and if you complain the court will investigate YOU for subversiveness. The mere idea of allowing for fines to substitute for jail time exists so that capitalists cannot be punished, so that they can pay away punishment. Indeed, the death penalty where it exists, exists for murder and not fraud, crashing/manipulating the stock market, causing opioids crisis, denying care through exorbitant fees, all things which cause many more deaths than simple murderers in the name of profit. Liberal or illiberal democracies they may be touted as, bourgeois States are, then, dictatorships of the bourgoeisie. In the case of socialist states like the Soviet Union or the DDR, or still-existing ones like Cuba, China, Laos, Vietnam, the DPRK, the situation is far different. They are dictatorship of the proletariat. A vanguard party of the working class (which is understood as the most politically advanced section of the working class, experienced and recruited through party schools, unions, workplaces, youth groups, administration) formulates policy for the development needs of the working masses, according to the development conditions of the country in that particular moment. This makes it necessary to subjugate the bourgeoisie and use the State apparatus to police and curtail all of its attempts to gain or re-gain enough political and material capital for them to re-establish a dictatorship of the bourgeoisie. That is why Vietnam and China execute capitalists who defraud the people to the tune of millions and billions, or forces them to give up parts of their wealth when they start trying to get too influential, instead of elevating them to Presidents like liberal democracies have done with figures like Macron, Sarkozy, Trump, Berlusconi, and so on. Now, you see how the violence has a much different character?

Marxism tells you what needs each system has developed to suit, and how it may evolve further. It provides us with a key to examine pur oppression and find a way to abolish it, by gaining the exact type of power that is necessary to change the material conditions at the root of it, those conditions being the dynamics of production, ownership, property, distribution and management. Said change, of course, entails the dictatorship of the proletariat, and the distruction of the dictatorship of the bourgeoisie. Now, as you may imagine, the bourgeoisie largely doesn't want to give up that kind of power, especially after all the money they invest in holding onto it. And since postmodernists and other Western social scientists live in dictatorships of the bourgeoisie their job is at risk if they espouse marxism. They want to keep their job, but want to be recognized as "left-wing" and "progressive" and so they make mountains out of molehills already explained by marxism to brand marxism as "incomplete", "retrograde", "surpassed" and all that jazz.

like I read one remarkably honest book reviewing various analytical traditions of class that was like Marxism is difficult for many people to swallow because it’s a science that both demands and prescribes a solution to the social problems under its investigation. And it is a science perfectly equipped to handle the particularities of any number of contexts, which is why it’s not that western social scientists are against science per-se, they are not against science as such, but against Marxism, against the concept of history evolving beyond this current political and economic moment, against any change that would result in the destruction of the prevailing order, and as a result of that they retreat to the granular because they believe it provides cover for having to contend with the violent generalities of history of which they are a part, and more importantly, are endlessly smug about their own pedantry, as if they are the first and only ones to discover the fact of local difference

730 notes

·

View notes

Text

Is Gold Tokenization a Good Investment? Expert Insights

Gold has been a symbol of wealth and stability for centuries, cherished by investors for its enduring value and protection against inflation. With technological advancements, investors now have a modern way to invest in gold: tokenization. But is gold tokenization a good investment? Let’s explore the concept, its advantages and risks, and what experts have to say.

What is Gold Tokenization?

Gold tokenization is the process of converting physical gold into digital tokens on a blockchain. Each token represents a fraction of real, tangible gold. Blockchain technology ensures security, transparency, and ease of transaction for these tokens, making them accessible to a broad range of investors.

How Does Gold Tokenization Differ from Traditional Gold Investments?

Unlike physical gold or traditional gold investments (such as ETFs), tokenized gold allows for fractional ownership. This flexibility means investors can own a portion of gold without dealing with the logistics of storage and transfer. Moreover, gold tokens can be easily bought, sold, or traded on digital platforms, offering more liquidity than physical gold.

The Growth of Tokenized Assets

The digital transformation of the finance sector is driving the popularity of tokenized assets. Blockchain’s rise has spurred interest in a wide array of tokenized assets, including real estate, art, and commodities like gold. Tokenization makes previously exclusive assets more accessible and tradable for all investors.

Advantages of Investing in Tokenized Gold

Accessibility and Affordability – Tokenized gold removes high barriers, allowing investors to buy smaller portions of gold.

Transparency and Security – Blockchain provides a transparent ledger of transactions, reducing the risk of fraud.

Fractional Ownership and Transferability – Gold tokens allow easy and swift transfer of ownership, ideal for a global market.

Risks Associated with Gold Tokenization

Like any investment, gold tokenization has its challenges:

Market Volatility – Digital assets, including gold tokens, can be volatile.

Regulatory Uncertainties – Tokenized assets operate under evolving regulations, creating uncertainties.

Security Risks – Despite blockchain’s security, digital wallets can be vulnerable to hacking.

Comparing Gold Tokenization to Other Investment Options

Tokenized gold competes with traditional forms of gold investments, such as:

Physical Bullion – Traditional, tangible but less liquid.

Gold ETFs – Offers exposure to gold prices without physical ownership.

Gold Mining Stocks – Higher-risk, influenced by market and company performance.

How to Invest in Gold Tokens

If you're interested in tokenized gold, follow these steps:

Research Platforms – Select reputable platforms with positive reviews.

Purchase Tokens – Decide on the number of tokens to buy based on your budget.

Store Safely – Use secure digital wallets for storage.

Best Platforms for Gold Tokenization

Some popular platforms include:

Tether Gold – Known for stable value, backed by physical gold.

Paxos Gold (PAXG) – Provides transparency with assets audited monthly.

Digix Gold – Offers easy-to-access gold tokens with audited reserves.

What Experts Say About Gold Tokenization

Financial experts suggest that tokenized gold has the potential to reshape the gold market by making it more accessible. Some experts believe it’s a promising asset for diversification, while others caution about the risks tied to digital assets.

Gold Tokenization and the Future of Investment

As digital assets gain traction, tokenized gold may play a vital role in investment portfolios. It offers investors a bridge between traditional assets and digital finance, appealing to both crypto enthusiasts and traditional investors.

Regulation and Compliance

The regulatory landscape for tokenized gold is still in development. Some governments are cautious, while others see tokenized assets as an innovation. Investors should stay updated on regulatory changes to understand how it might impact their investment.

The Environmental Impact of Gold Tokenization

Blockchain is energy-intensive, but compared to traditional gold mining, tokenization’s environmental impact may be smaller. Reduced need for physical infrastructure and logistics makes it a potentially greener alternative.

Is Gold Tokenization Right for You?

Tokenized gold may suit investors looking for a blend of traditional and digital assets. However, assessing your risk tolerance, financial goals, and the role of tokenized gold in your portfolio is essential before investing.

Conclusion

Gold tokenization is an innovative way to invest in a time-tested asset, offering accessibility and flexibility. However, it comes with unique risks and requires careful consideration. As the market for tokenized assets grows, understanding these dynamics can help investors make informed decisions.

FAQs

1. What is tokenized gold? Tokenized gold is a digital representation of physical gold on a blockchain, allowing investors to own and trade fractions of gold.

2. Is tokenized gold safer than traditional gold? While blockchain adds transparency and security, tokenized gold involves digital risks that traditional gold does not.

3. How do I buy tokenized gold? You can purchase tokenized gold through platforms that offer these assets, such as Tether Gold or Paxos Gold.

4. What happens if the platform I use for tokenized gold shuts down? If a platform closes, assets might be frozen, and retrieving your investment could be complex, depending on regulatory protections in place.

5. Can I convert gold tokens back into physical gold? Yes, some platforms allow token holders to redeem their digital tokens for physical gold, but this often comes with specific requirements.

#TokenizedGold#GoldTokenization#ShamlaTech#BlockchainGold#InvestInGold#CryptoInvestment#GoldRevolution#DigitalAssets#SecureInvesting#GoldInnovation

0 notes

Text

Process and Enquiry: Evolution and Unpredictability

Some of the definitions for evolution offered by Oxford Languages include:

the process by which different kinds of living organisms are believed to have developed from earlier forms during the history of the earth.

the gradual development of something.

a pattern of movements or manoeuvres.

Cambridge Dictionary defines unpredictability as:

the quality or fact of being unpredictable

likely to change suddenly and without reason

I have taken note of the definitions and began to gather visual references using Pinterest boards. However, my creative practice usually demands that I think further than preconceived notions of what a word means, and instead contemplate what the prompts evolution and unpredictability mean to me, and what images they conjure up for me. To gather my thoughts, I wrote a list of everything I associate with the two prompts and then associations beyond this

Evolution: change / transition / process / growth / betterment / natural / chemical reaction / the body / internal processes / becoming something else / reform / advancement / constant

Unpredictability: lack of control / improvise / choice / objectiveness/ fear / irrationality / survival / anxiety / possibility / probability / logic / science / mathematics / lack of control / the weather / the elements / natural disasters / life / unknown / scarcity

With these new prompts in mind, I began to write without limitations and followed my mind wherever it began to romp. These pieces were the outcome:

Evolution makes me think of change in a positive direction. It makes me think of where I have been and where I am now. It makes me think of movement and a lack of staticity. It makes me think inwards not outwards. It turns my focus towards myself. I think of my body, I think of the body I no longer have and I think of the versions of me I have no concept or recollection of. I think, and more so worry about who I may become and how I want to stay. I think of growth and how it is unavoidable in every case. My hair grows not fast enough and altogether too fast. My ageing accompanies my recent birthday and my clock continues to tick, in the biological sense. I am scared by evolution, I am scared by change but I am scared mostly, to stay where I am.

Unpredictability makes me think of, and most importantly feel anxiety. My life and the chronic and debilitating anxiety I carry, and will always carry are governed by my inability to predict the future, no matter its distance from this moment in time. Anxiety is a lack of control, hopelessness and obsession. My inability to hold on to or grasp anything in my life leaves me lethargic and frustrated. You cannot predict the stock market, sickness, earthquakes, hurricanes, floods and wildfires. We, as a species and a planet, are most plainly put at the mercy of the universe whether that is through chance, fate, science or a higher power I am as of yet as undecided as the masses.

After completing the stream-of-consciousness writing exercise I took away keywords and concepts from the piece. These included:

Evolution: positive / movement / staticity / in and out / body / mourning / fear, extinction, worry, anxiety, growth, flourishing, ageing, biology, human

Unpredictability: anxiety, carry, govern, predict, [lack of] control, obsession, mercy, chance, fate, science, higher power

I work through the keywords and concepts, noting my level of interest in each idea. Standing out most prominently to me are:

Evolution: movement / body / mourning / fear / ageing / biology

Unpredictability: anxiety / control / obsession / chance / higher power

Reflection: I will complete the forthcoming workshops in whatever way feels most natural and intuitive, trying to place no preconceived thematic boundaries onto the work. After completion, I will develop the workshops with my thematic keywords/concepts in mind. I will explore ways to apply my experiences and knowledge to each material and way of working. I will think deeply, and write freely to match. Through this way of working, I hope to reach a series of outcomes that reflect my deeply introspective and reflective process and further consolidate the importance of delving deeply into my own thoughts to better my creative output.

0 notes

Text

Indian Stock Market Trading: Your Gateway to Financial Growth

The Indian stock market has captivated millions, not just for its ability to generate wealth but for the financial freedom it offers to those who understand its dynamics. Whether you’re a beginner looking to step into the world of Indian Stock Market Trading or an experienced investor hoping to refine your strategies, understanding the basics can make a huge difference in your journey.

Understanding the Indian Stock Market Landscape

The Indian stock market primarily consists of two major exchanges: the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). With thousands of companies listed, these exchanges provide a platform where buyers and sellers can trade stocks in real-time. The Indian market is driven by various factors, including economic indicators, global market trends, and corporate performance. For newcomers, this may seem overwhelming, but with the right approach, anyone can start their trading journey effectively.

Why Should You Start Trading in the Indian Stock Market?

For many, the stock market may seem intimidating, but Indian Stock Market Trading can be one of the most rewarding investments you’ll ever make. Here’s why:

Growth Potential: India’s economy is expanding, and as companies grow, the value of their stocks often increases too. This means more opportunities for traders and investors to profit.

Financial Independence: Trading can be a pathway to achieve financial freedom. With consistent growth, it’s possible to build a secure financial future.

Accessibility: Unlike real estate or other investments that require substantial capital, stock trading is accessible to almost anyone with a Demat account and a smartphone.

Key Concepts in Indian Stock Market Trading

1. Equity and Shares

When you buy shares of a company, you become a part-owner of that company. This ownership gives you a stake in the company’s success or failure.

Equity trading is the process of buying and selling these shares.

2. Types of Markets

The primary market is where new stocks are issued, and investors can buy directly from companies in Initial Public Offerings (IPOs).

The secondary market is where investors trade previously issued securities. This is where most stock market activities occur.

3. Bull and Bear Markets

A bull market is when prices are rising or expected to rise, encouraging buying.

A bear market, on the other hand, is marked by falling prices and is often driven by pessimism.

Understanding these concepts is crucial in Indian Stock Market Trading, as they set the foundation for more advanced strategies.

Getting Started: Steps to Begin Trading in the Indian Stock Market

Open a Demat and Trading Account

To start, you need a Demat account to store your securities in electronic form and a trading account to execute trades.

Choose Your Trading Style

In Indian Stock Market Trading, you can select from various approaches: day trading, swing trading, or long-term investing. Each style requires a different mindset and skill set.

Learn to Read Stock Charts

Reading and interpreting stock charts is essential. Price patterns, indicators, and candlestick patterns are valuable tools that help traders make informed decisions.

Stay Updated on Market Trends

Keep an eye on the Nifty 50 and Sensex indices as they provide insights into the overall health of the stock market.

Develop a Trading Strategy

Setting clear goals, managing risk, and developing a strategy can be the difference between profit and loss in Indian Stock Market Trading.

Popular Strategies for Indian Stock Market Trading

Fundamental Analysis

This involves analyzing a company’s financial statements, earnings reports, and growth prospects. Investors who rely on fundamental analysis aim to find undervalued stocks.

Technical Analysis

Here, traders study price patterns and use various tools, like moving averages and trend lines, to predict future price movements. Technical analysis is highly favored by day traders.

Swing Trading

This strategy involves holding onto stocks for a few days or weeks to capitalize on short-term trends. Swing traders closely follow stock patterns to make decisions.

Day Trading

Day traders buy and sell stocks within the same trading day. They aim to make profits from small price fluctuations and often rely on technical analysis.

Essential Tips for Success in Indian Stock Market Trading

1. Never Stop Learning

The Indian stock market is ever-evolving. Stay updated with economic news, company updates, and market trends to refine your strategies.

2. Manage Risk

Successful traders emphasize risk management. Setting stop-loss orders can protect your investments, and understanding market volatility will help you avoid impulsive decisions.

3. Stay Disciplined

Trading isn’t a “get-rich-quick” scheme. It requires patience and discipline. Developing a consistent approach and sticking to your plan is essential for long-term success.

4. Diversify Your Portfolio

Don’t put all your money into a single stock. A diversified portfolio spreads risk and increases the chances of achieving stable returns.

Trends Shaping the Future of Indian Stock Market Trading

With the digitalization of the stock market and the rise of algorithmic trading, the landscape of Indian Stock Market Trading is rapidly changing. Here are some trends to watch out for:

Increased Retail Participation: Thanks to online trading platforms, more people than ever are entering the stock market.

Rise of AI and Machine Learning: Technology is empowering traders with tools that can predict trends and analyze large datasets.

Sustainable Investing: Investors are increasingly interested in companies that follow Environmental, Social, and Governance (ESG) criteria.

Common Mistakes to Avoid in Indian Stock Market Trading

1. Chasing “Hot” Stocks

Jumping into stocks based on hype can lead to losses. Conduct thorough research and make informed decisions.

2. Ignoring the Power of Compounding

Compounding can significantly boost your returns. Long-term investors often benefit from compounding, so patience is key.

3. Emotional Trading

Fear and greed are the biggest enemies of a trader. Staying calm and sticking to your plan can prevent rash decisions.

4. Overtrading

Overtrading often leads to high transaction fees and increased losses. Focus on quality trades rather than quantity.

Why Now is the Best Time for Indian Stock Market Trading

There has never been a better time to start Indian Stock Market Trading. With the Indian economy set for growth, interest rates being favorable, and more retail investors participating, the market is ripe with opportunities.

Conclusion: Take the Leap into Indian Stock Market Trading

Indian Stock Market Trading isn’t just about buying and selling stocks. It’s a journey of learning, patience, and strategic decision-making. Whether you’re in it to build wealth or achieve financial independence, the stock market offers countless opportunities for growth. Start small, stay consistent, and always be willing to adapt to the market. With dedication and the right mindset, you can navigate the world of Indian stock market trading and take control of your financial future.

0 notes