#accounting and bookkeeping outsourcing service

Explore tagged Tumblr posts

Text

How to Prepare Your Business for Accounting and Bookkeeping Outsourcing

Introduction

Outsourcing accounting and bookkeeping functions has become an increasingly popular strategy for businesses aiming to streamline operations, cut costs, and focus on core activities. However, diving into outsourcing without proper preparation can lead to inefficiencies and missed opportunities. This guide will walk you through the steps needed to ensure a smooth transition into accounting and bookkeeping outsourcing.

Why Consider Accounting and Bookkeeping Outsourcing?

Outsourcing these essential functions enables businesses to access expert knowledge, advanced tools, and processes without the need for extensive in-house resources. From cost savings to operational efficiency, outsourcing offers a myriad of benefits—but only when approached strategically.

Key Steps to Prepare for Accounting and Bookkeeping Outsourcing

1. Assess Your Business Needs

Before outsourcing, take a comprehensive look at your current accounting and bookkeeping processes to determine what you need from a third-party service provider.

Identifying Core Accounting and Bookkeeping Functions

Some businesses need help with basic bookkeeping tasks like invoicing and bank reconciliation, while others may require advanced services such as financial analysis, tax planning, or payroll processing. List out:

Daily, monthly, and annual tasks handled internally.

Specialized needs, like multi-currency management or compliance reporting.

Gaps in your current system that outsourcing could fill.

Estimating Workload and Frequency

Quantify the scope of work. For instance:

How many transactions need recording monthly?

Are there peak seasons with increased activity?

What types of reports do you need regularly?

2. Choose the Right Service Provider

Selecting a competent outsourcing partner is a pivotal step. The provider’s expertise, reliability, and alignment with your business goals can significantly influence outcomes.

Evaluating Credentials and Expertise

Check the provider’s qualifications and certifications.

Ensure familiarity with relevant accounting standards (e.g., GAAP or IFRS).

Seek industry-specific experience.

Reviewing Tools and Technologies

Confirm the provider uses modern accounting software that integrates seamlessly with your existing systems, such as:

QuickBooks

Xero

FreshBooks

Considering Security and Compliance

Data security is paramount in accounting and bookkeeping outsourcing. Look for:

Encryption standards.

Adherence to data privacy regulations (e.g., GDPR, HIPAA).

Backup and disaster recovery protocols.

3. Set Clear Expectations

A well-defined contract and communication plan are critical for a successful outsourcing relationship.

Defining the Scope of Work

Clearly outline tasks, deliverables, and timelines in your agreement to avoid misunderstandings.

Establishing Key Performance Indicators (KPIs)

Measure the provider’s performance through KPIs such as:

Accuracy of reports.

Timeliness of deliverables.

Response times for queries.

4. Prepare Your Internal Team

The success of accounting and bookkeeping outsourcing also depends on the cooperation and readiness of your in-house team.

Training and Alignment

Train your staff on how to collaborate with the outsourcing provider.

Ensure a single point of contact for smoother communication.

Documentation and Process Standardization

Organize internal financial records and standardize processes before handing them off. Provide clear documentation for:

Chart of accounts.

Expense categories.

Reporting templates.

5. Transition Smoothly

A phased approach is often best when transitioning to an outsourced accounting and bookkeeping model.

Pilot Projects

Start with a smaller segment of your accounting tasks as a trial run to:

Test the provider’s capabilities.

Identify potential challenges and resolve them early.

Full-Scale Implementation

After a successful pilot, scale up to include all intended services while maintaining regular oversight.

Benefits of Accounting and Bookkeeping Outsourcing

Outsourcing can transform your financial management with benefits like:

Cost Savings: Reduce expenses on salaries, benefits, and office space.

Expertise Access: Leverage experienced professionals without long-term commitments.

Improved Focus: Spend more time on strategic initiatives instead of administrative tasks.

Scalability: Easily adjust services to match business growth.

Common Challenges and How to Overcome Them

Outsourcing comes with its own set of challenges. Here’s how to address them effectively:

Maintaining Data Security

Use secure file-sharing tools.

Restrict access to sensitive data based on roles.

Ensuring Service Quality

Regularly review provider performance.

Request periodic updates and reports.

Managing Communication

Use collaboration tools like Slack or Microsoft Teams.

Schedule regular check-ins to discuss progress and concerns.

Locally Focused Insights

When outsourcing accounting and bookkeeping tasks, choosing a local or regionally aware provider can enhance compliance and service efficiency.

Knowledge of Local Tax Laws

Local providers are well-versed in tax regulations and reporting requirements specific to your region, ensuring accurate filings.

Access to Nearby Resources

A local provider can:

Meet in person for critical discussions.

Respond quickly to time-sensitive needs.

Supporting Local Economy

Outsourcing to regional firms contributes to the local economy, fostering community growth and partnerships.

FAQs About Accounting and Bookkeeping Outsourcing

What tasks can I outsource in accounting and bookkeeping?

You can outsource tasks like accounts payable/receivable, payroll processing, tax preparation, and financial reporting.

How much does accounting and bookkeeping outsourcing cost?

Costs vary based on the scope of work, provider’s expertise, and location. Typically, small businesses spend $500 to $5,000 monthly.

Is outsourcing safe for my business data?

Yes, as long as you choose a provider with robust data security measures such as encryption, firewalls, and compliance certifications.

Can outsourcing handle seasonal workloads?

Absolutely. Outsourcing offers flexibility to scale services up or down based on your needs.

How do I ensure quality in outsourced accounting services?

Set clear expectations, monitor performance via KPIs, and maintain open communication.

Conclusion

Preparing your business for accounting and bookkeeping outsourcing requires a strategic approach that considers your unique needs, goals, and operational challenges. By assessing your requirements, choosing the right provider, setting clear expectations, and maintaining effective communication, you can unlock the full potential of outsourcing—driving efficiency, cost savings, and growth for your business. Remember, the key lies in thorough preparation and ongoing collaboration.

#best accounting and bookkeeping outsourcing#top accounting and bookkeeping outsourcing#accounting and bookkeeping outsourcing service#accounting service#bookkeeping service#accounting outsourcing service in mumbai

0 notes

Text

Optimize Your Firm’s Financial Management with White Bull! Accounting and CPA firms: Discover the efficiency of outsourced financial solutions. From bookkeeping and payroll to tax preparation, White Bull provides seamless support tailored to the unique needs of professional firms. Let us handle the details so you can focus on what matters most—serving your clients!

👉 Visit us: white-bull.com

#accounting#bookkeeping#payroll#tax returns#outsourced accounting services#AccountingFirms#CPAFirms#OutsourcedAccounting#BookkeepingServices#PayrollSolutions

2 notes

·

View notes

Text

Outsource Bookkeeping Services to India: A Smart Business Move

In today’s competitive business environment, companies are constantly looking for ways to streamline operations and reduce costs. One effective strategy is to outsource bookkeeping services to India. This approach not only provides access to skilled professionals but also offers significant cost savings. Let's explore why outsourcing bookkeeping services to India can be a game-changer for your business.

Why Outsource Bookkeeping Services?

1. Cost-Effectiveness

Delegating your bookkeeping tasks to an external provider can result in significant financial savings. By choosing to outsource bookkeeping services to India, businesses can reduce overhead expenses associated with hiring in-house staff, such as salaries, benefits, and training costs. Indian firms offer competitive pricing due to lower labor costs, providing high-quality services at a fraction of the cost.

2. Access to Expertise

India is known for its vast pool of highly skilled and qualified professionals. When you outsource bookkeeping services, you gain access to experts who are proficient in international accounting standards and practices. These professionals are equipped with the latest tools and technologies to ensure accurate and efficient bookkeeping.

3. Focus on Core Business Activities

By outsourcing bookkeeping services, companies can focus more on their core business activities. This allows management and staff to dedicate their time and resources to areas that directly impact growth and profitability, such as sales, marketing, and product development.

Benefits of Outsourcing Bookkeeping Services in India

1. High-Quality Services

Indian bookkeeping firms are known for their commitment to quality. They employ stringent quality control measures and adhere to international accounting standards. This ensures that the financial records are accurate, reliable, and compliant with regulatory requirements.

2. Scalability

Outsourcing bookkeeping services in India offers flexibility and scalability. Whether you are a small business or a large corporation, Indian service providers can scale their services to meet your specific needs. This flexibility is particularly beneficial during periods of growth or seasonal fluctuations in business activity.

3. Time Zone Advantage

The time zone difference between India and Western countries can be leveraged to your advantage. By outsourcing bookkeeping services to India, you can benefit from round-the-clock operations. Work can be completed overnight, providing you with updated financial information by the start of your business day.

How to Choose the Right Bookkeeping Service Provider

1. Experience and Expertise

When outsourcing bookkeeping services, it’s crucial to choose a provider with extensive experience and expertise in the field. Seek out companies that have a history of success and favorable reviews from their clients. Ensure they have experience in your specific industry and are familiar with relevant regulations.

2. Technology and Security

Ensure the service provider uses the latest accounting software and technologies. Data security is paramount, so choose a provider that implements robust security measures to protect your financial information from unauthorized access and cyber threats.

3. Transparent Pricing

Opt for a service provider with a transparent pricing model. Avoid firms with hidden fees and unclear contracts. A clear understanding of the costs involved will help you make an informed decision and avoid any unexpected expenses.

4. Communication and Support

Effective communication is essential when outsourcing bookkeeping services. Choose a provider that offers reliable customer support and maintains clear and consistent communication channels. This guarantees that any problems or questions will be handled quickly and efficiently.

Conclusion

Outsourcing bookkeeping services to India is a strategic decision that can offer numerous benefits, including cost savings, access to expertise, and improved focus on core business activities. By carefully selecting the right service provider, businesses can enjoy high-quality, scalable, and secure bookkeeping services. Embrace this opportunity to enhance your business efficiency and drive growth.

In summary, outsourcing bookkeeping services to India is not just a cost-saving measure; it is a smart business strategy that can lead to improved operational efficiency and long-term success.

#Outsource bookkeeping services to India#outsourcing bookkeeping services in India#outsource bookkeeping services#outsourcing bookkeeping services#offshore bookkeeping services#CPA outsourcing services#outsourced accounting firms#finance#accounting#bookkeeping

2 notes

·

View notes

Text

Top Audit Firm in Qatar | Accounting and Bookkeeping

Discover GSPU, your trusted audit and accounting firm in Qatar! Our experienced professionals offer tailored financial solutions, innovative strategies, and expert guidance to help your business thrive. Get in touch today to streamline your financial processes and drive growth with confidence.

#accounting#taxes#success#startup#tax#tax accountant#property taxes#audit#taxation#taxcompliance#bookkeeping#accounting services#business growth#services#finance#business consulting#outsourced cfo services#corporatefinance#cybersecurity#excise tax

3 notes

·

View notes

Text

Payroll outsourcing in UK

Breathe Easy, Business Owners: Why Payroll outsourcing in UK with MAS LLP is Your Secret Weapon Running a business in the UK is exhilarating, but managing payroll? Not so much. Between HMRC deadlines, complex calculations, and ever-changing regulations, payroll can quickly become a time-consuming headache. That's where MAS LLP comes in, your one-stop shop for Payroll outsourcing in UK that takes the weight off your shoulders and lets you focus on what matters most: growing your business.

Why Choose MAS LLP for Payroll outsourcing in UK?

Expertise You Can Trust: Our team of qualified and experienced payroll professionals are the best in the business. They stay up-to-date on the latest HMRC regulations, ensuring your business remains compliant and avoids costly penalties. Accuracy Guaranteed: Say goodbye to manual calculations and spreadsheets. We leverage cutting-edge technology and robust processes to deliver error-free payroll every time. Time is Money: Free yourself and your team from the payroll burden. Outsourcing allows you to dedicate your valuable time and resources to core business activities that drive growth. Peace of Mind: Rest assured knowing your employees are paid accurately and on time, every time. We handle everything from deductions and taxes to payslips and reports, giving you complete peace of mind. Personalized Service: You're not just a number with MAS LLP. We believe in building strong relationships with our clients, providing you with a dedicated account manager who understands your unique needs and is always available to answer your questions. Beyond Payroll: The MAS LLP Advantage

MAS LLP goes beyond just processing payroll. We offer a comprehensive suite of accounting outsourcing services designed to streamline your finances and give you a clear picture of your business health.

Bookkeeping: From daily transactions to account reconciliation, we keep your books meticulously organized and error-free. VAT Compliance: Navigate the complexities of VAT regulations with our expert guidance and minimize risks. Management Reporting: Gain valuable insights into your finances with customized reports and analysis that help you make informed decisions. Cloud-Based Solutions: Access your financial data securely anytime, anywhere, with our user-friendly cloud platform. Partner with MAS LLP and Reclaim Your Time and Focus

Payroll outsourcing in UK with MAS LLP isn't just about ticking boxes; it's about investing in the future of your business. We empower you to focus on what you do best, while we handle the nitty-gritty of payroll with accuracy, efficiency, and a personal touch.

Ready to ditch the payroll headaches and get back to business? Contact MAS LLP today for a free consultation and discover how we can help you breathe easy and achieve your business goals.

Note: This blog post is just a starting point. Feel free to adapt it to include specific details about MAS LLP's services, testimonials from satisfied clients, or special offers to attract potential customers.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Payroll outsourcing in UK

4 notes

·

View notes

Text

Why Should Small Businesses Consider Professional Bookkeeping Services?

Financial management is one of many duties and responsibilities that must be balanced when running a small business. There are compelling reasons to think about hiring professional bookkeeping services, even if some business owners would try to do their own bookkeeping.

Compliance and tax support are additional advantages of professional bookkeeping services for small business. Bookkeeping professionals are well-versed in tax laws and regulations, ensuring that small businesses remain compliant and avoid penalties. They stay updated on changes in tax laws and provide accurate and timely tax support, including preparation and filing of tax returns. This helps small business owners navigate the complexities of tax compliance, reducing stress and ensuring adherence to legal requirements.

Conclusion, small businesses should seriously consider professional bookkeeping services due to the expertise, accuracy, time savings, financial insights, cost savings, compliance support, and tax expertise they offer. By outsourcing bookkeeping tasks, entrepreneurs can focus on their core business activities, make informed decisions based on accurate financial data, and ultimately drive the success of their small business.

#Bookkeeping service for small business#accounting and bookkeeping service#Payroll service#Bookkeeping service#Outsourced bookkeeping service

2 notes

·

View notes

Text

Why Small Businesses Need Outsource Bookkeeping Services?

Outsourcing bookkeeping can be a great way to save time and improve the accuracy of your business's financial records. If you're a small business owner, it's something that you should consider.

#accounting#accounting and bookkeeping services#outsource bookkeeping#outsource accounting#bookkeeping services for small businesses

2 notes

·

View notes

Text

The Role of Outsourced Bookkeeping in Mergers and Acquisitions

Mergers and acquisitions (M&A) are commonly seen as the ultimate power move in business. They promise growth, expansion, and new opportunities. Yet, in practice, such interaction is by no means easy. All financial problems are complex and a trivial misstep in the bookkeeping can bring the process to an end. This is where bookkeeping outsourcing services come into play.

In the high-stakes world of M&A, having a team of financial specialists managing your finances is not (just) an option, it is a requirement. It is the secret weapon for buying, selling, and merging that can make a smooth, accurate, and stress-free transition that all businesses should try when the time comes.

In this blog, we’ll explore how bookkeeping outsourcing firms are transforming the M&A landscape. Using real-time financial intelligence, we will show you why bookkeeping outsourcing is not an option any more, but a strategic tool that firms must employ.

The M&A Boom: Why Bookkeeping Matters

The global M&A market is booming. In 2024, the value of deal volumes amounted to over $3.4 trillion - about 15% more than what we saw in 2023 and according to the experts, the trend will continue until 2025.

But with great opportunity comes great complexity. Mergers and acquisitions are closely preceded by meticulous financial diligence, accurate valuation, and seamless integration of financial data systems.

One of the biggest challenges? Bookkeeping. When two companies merge, their financial statements need to be reconciled, standardized, and audited. This process is slow, it is resource-heavy, and prone to human error—especially when the firms run different accounting systems or there is inconsistency in the records. This is where bookkeeping outsourcing services come into play. With the help and support of experienced professional bookkeeping outsourcing firms, companies are assured that their financial data is correct, current and audit-ready.

How Outsourced Bookkeeping Simplifies M&A Transactions

Let's take a look at how outsourced bookkeeping services can positively affect merger and acquisitions.

Streamlining Financial Due Diligence

Due diligence is the backbone of any M&A deal. It is based on a detailed analysis of the financial status of the target firm in terms of the company's assets, liability, cash flow, and regulatory compliance. Acquiring firms may find it both confusing and overwhelming if the target firm's financial statement is unorganized or incomplete. Bookkeeping outsourcing firms are particularly good at the art of organizing and processing accounting data, which means due diligence can be done in a more accurate and efficient manner.

For example, a medium sized tech company wants to purchase a startup and may find there are no organized corporate financial records. Using the discretion of the acquiring company, bookkeeping outsourcing service providers' expertise can help clean up and analyze, and the acquiring company may be spared costly surprises further down the line.

Ensuring Compliance and Reducing Risk

M&A transactions are subject to a number of regulations, spanning from tax laws to industry-specific compliance standards. Non-compliance can result in heavy fines, lawsuits, or even a deal collapse. By outsourcing bookkeeping, you can ensure all financial records comply with applicable regulations. Working with bookkeeping outsourcing companies, you are up-to-date with the latest regulations and thus there will be less risk for error/oversight.

Facilitating Smooth Financial Integration

Once the M&A deal is signed, the real work of integrating the financial systems of the two firms begins. This includes accounts reconciliation, process standardization, and across-the-board consistency. Without proper bookkeeping, this process can be chaotic. Disorganized financial statements can cause uncertainty, delay, and even lawsuits among merging firms. Bookkeeping outsourcing firms are adept at financial integration. They can efficiently reconcile the financials, identify anomalies, and generate a standard system that is suitable for use on both sides. This not only saves time but also contributes to a seamless transition for both employees and all stakeholders.

Providing Real-Time Financial Insights

During an M&A transaction, timing is everything. Financial reporting delays can lead to lag in negotiations and in the end, may cause the deal to fail. Outsourced bookkeeping teams make use of state-of-the-art tools and technologies that provide real-time financial insights. In other words, it allows the decision-makers to act intelligently and instantaneously, whether it is about the negotiation of conditions or the integration plan.

Why Choose IGS Bookkeeping for Your M&A Bookkeeping Needs?

At IGS Bookkeeping, we recognize the complexities associated with mergers and acquisitions. Our bookkeeping outsourcing services are designed to handle each step of an M&A with efficiency.

Our team of seasoned professionals and with the use of state-of-the-art technology, we ensure your records are correct, compliant, and ready for audit. Buying, selling, or merging, we will ensure the process goes as seamlessly and without undue stress as possible. Mergers and acquisitions is a high-stakes game with a low margin of error. With the help of bookkeeping outsourcing, firms can carry out the financial side of M&A with ease. From streamlining due diligence to ensuring compliance and facilitating smooth integration, outsourced bookkeeping is no longer just an option—it’s a strategic advantage. As we are heading towards the first quarter of 2025, the firms that embrace this approach will be the ones that thrive in the competitive world of M&A.

Looking to take the stress out of your next M&A deal? Visit www.igsbookkeeping.com for more information and to understand how we can contribute to your goals.

0 notes

Text

Outsource Payroll Services | Easy Payroll Solutions

Let us manage your payroll with Collab Accounting AU's reliable Outsourced Payroll Services. We handle payroll processing, tax compliance, and employee payments with accuracy and efficiency. Save time and avoid mistakes while focusing on your business. Visit us at 3 Hanley St, Stanhope Gardens, NSW 2768, Australia, or call +61 2 8005 8155 for professional payroll solutions from Collab Accounting AU!

#Outsource Payroll Services#bookkeeping service provider#offshore bookkeeping services#affordable accounting outsourcing india

0 notes

Text

Looking for bookkeeping and accounting outsourcing services in the UK? Our expert team provides tailored solutions for accurate financial management, including bookkeeping, payroll, tax preparation, and financial reporting. Save time, reduce costs, and ensure compliance with our reliable services. Contact us today!

1 note

·

View note

Text

0 notes

Text

The complete guide to finance and accounting outsourcing services

Managing finances is a crucial part of running a business, but let’s be honest—it can be overwhelming. Between bookkeeping, payroll, tax compliance, and financial reporting, it’s easy to feel buried in numbers. That’s where outsourced accounting services come in. By leveraging professional expertise, I can streamline operations, reduce costs, and focus on what truly matters: growing my business.

In this guide, I’ll break down everything I need to know about accounting and outsourcing, from the benefits to choosing the right provider.

Why Should I Consider Outsourcing My Accounting?

The traditional approach to accounting—hiring in-house staff—can be costly and time-consuming. By choosing the best outsourced accounting service, I gain access to expert financial management without the hassle of recruitment, training, or high overhead costs.

Benefits of Finance and Accounting Outsourcing

Cost Savings – Hiring full-time accountants can be expensive. By opting to outsource bookkeeping, I only pay for the services I need, reducing overhead costs.

Expertise and Accuracy – With professional outsourced bookkeeping services, I ensure my financial records are accurate and compliant with industry regulations.

Time Efficiency – Outsourcing allows me to focus on core business activities while experts handle my financial operations.

Scalability – Whether my business is expanding or facing seasonal fluctuations, I can scale my financial services accordingly.

Access to Advanced Technology – Many outsourced accounting services use the latest financial software, providing me with real-time insights and automation.

Key Services in Accounting Outsourcing

When I work with a top-notch provider like Xcellency Accounting outsourcing company, I get access to a range of services tailored to my business needs. Here are some key areas they cover:

1. Bookkeeping Services

Keeping track of financial transactions is essential for any business. With outsourced bookkeeping services, I ensure that all records are up-to-date and error-free.

2. Payroll Processing

Managing payroll can be complex, especially with tax regulations constantly changing. Outsourcing ensures employees get paid on time while staying compliant.

3. Tax Preparation and Compliance

Filing taxes incorrectly can lead to hefty penalties. By outsourcing, I gain expert guidance to navigate tax laws and maximize deductions.

4. Financial Reporting and Analysis

Accurate financial reports help me make informed decisions. Outsourcing gives me access to detailed reports, ensuring I stay on top of my business finances.

5. Accounts Payable and Receivable Management

By outsourcing, I can streamline invoice processing and ensure timely payments, improving cash flow and business efficiency.

How to Choose the Right Accounting Outsourcing Partner

Not all outsourcing providers are the same. To get the most out of outsourced accounting services, I need to choose the right partner. Here’s what I look for:

Experience and Expertise – A reputable firm like Xcellency Accounting outsourcing company has a team of professionals with industry-specific knowledge.

Security and Compliance – Protecting financial data is crucial. I ensure my provider follows the latest security protocols.

Customizable Solutions – My business needs are unique, so I look for a partner that offers flexible services tailored to my requirements.

Technology and Integration – The best providers use modern accounting software that seamlessly integrates with my existing systems.

Transparent Pricing – Hidden fees can be a deal-breaker. I opt for a service with clear, upfront pricing structures.

Final Thoughts

Outsourcing my accounting isn’t just about cutting costs—it’s about gaining financial clarity and efficiency. Whether I need outsourced bookkeeping services or full-scale outsourced accounting services, choosing the right provider makes all the difference.

With expert support from a trusted partner like Xcellency Accounting outsourcing company, I can focus on what I do best while ensuring my finances are in safe hands. If I’m ready to take my business to the next level, it’s time to consider accounting and outsourcing solutions that truly work for me.

#Best outsourced accounting service#Outsourced accounting services#accounting and outsourcing#outsource bookkeeping

0 notes

Text

Professional Bookkeeping Services USA

Professional Accounting Services for Over 20 Years

Outsourced Bookkeeping is your premium business partner for accounting and bookkeeping services. We render services to individuals, small and large companies, and CPAs across the US. Hospitality and real estate sectors are our specialization.

For real estate, we manage property accounts, leases, and customer accounts. In the hospitality industry, we assist restaurant owners with accounts payable, cash flow, inventory management, and customer accounts.

Our team is equipped with advanced professional knowledge and tools to ensure compliance with state and federal regulations. We provide top-notch accounting and bookkeeping solutions tailored to your specific needs.

Accounting & Bookkeeping Services We Offer

Tracking Business Transactions

Preparation of Financial Statements

Performing Bank Reconciliations

Accounts Payable & Receivable Service

Customized Business Reporting & Periodic Reviews

Preparation of Cash Flow Management

Managing Cash and Subsidiary Ledgers

Tax Filing Process

To know more: https://www.outsourcedbookeeping.com/contact-us/

#outsourced bookkeeping#professional bookkeeping services#bookkeeping services for small business#outsource accounting#small business accounting

0 notes

Text

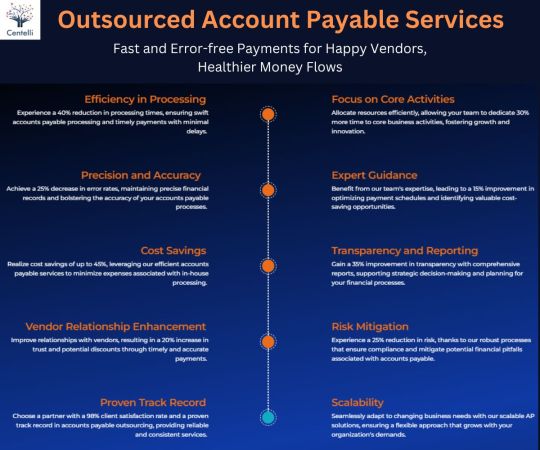

#Accounting Services#Outsourcing Accounting#Bookkeeping Services#small business#finance#Atlanta#Centelli#USA#hire accountants#Sage Accounting#Account Payable Services

0 notes

Text

#Telecommunications BPO Services#Telecom Process Outsourcing#Bpo solutions for telecom industry#Professional Accounting services#Bookkeeping services#Corporate travel management services#Travel & Hospitality Solutions Worldwide

0 notes

Text

Accounting outsourcing in US

We Provides the best Accounting outsourcing services in US and MAS is the top of outsourcing and Bookkeeping service Companies in India and US

Accounting outsourcing in US | Accounting Services in India | Bookkeeping | Outsourcing Company

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#Accounting outsourcing in US

3 notes

·

View notes