#accountants and tax professionals

Explore tagged Tumblr posts

Text

It's both a blessing and a curse when the hyperfocus lands on work related things.

Blessing: I got so much done to prepare the office for tax season. And I started working on my QB Pro certification. And started looking into possibly taking the CPA exam for certification.

Curse: I have eaten one meal and barely drank water. I need to pee and I'm sleepy but I need to finish this module before I can get up. I also haven't responded to any text messages.

#lost onpurpose#hyperfocus#bookkeeping#tax prep#tax professional#accountant#cpa#quickbooks#quickbooks pro

2 notes

·

View notes

Text

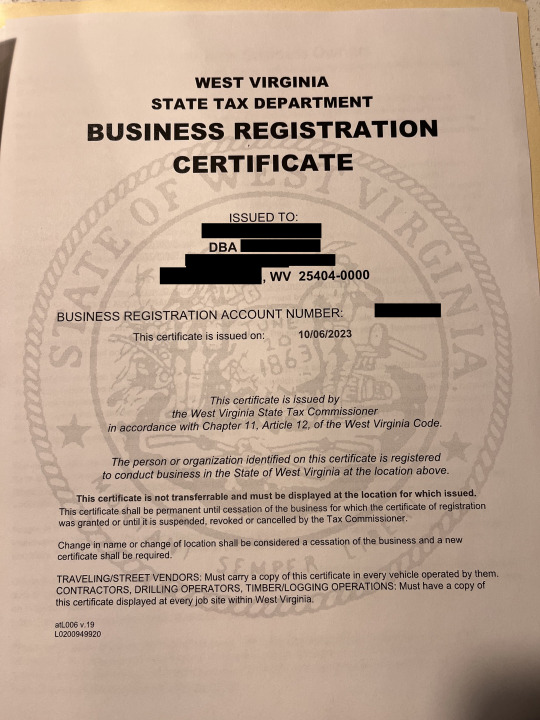

<<< THIS PERSON IS NOW A LEGAL BUSINESS OWNER!!!!!!!!!!!!!!!!!!!!!!

i finally did it!!!! wahoooooooooooooooo

#i went and got my registration certificate today#all the tax stuff started and a new checking account made for the business and everything#the rii professional baker arc begins NOW#rii rambles

13 notes

·

View notes

Text

filling out forms is fun

#filing taxes#i did not expect to enjoy this#spreandsheet#should i do this professionally#what do i go into accounting or something

3 notes

·

View notes

Note

hi if this isn’t something you prefer answering you can ignore my ask!

so i wanted to know how much stripe reveals your info to people who pay you? through ko fi and all that. what i mean is when someone gives the creator money through ko fi using paypal their name (legal name) is revealed on invoice so does that happen with stripe as well?

i’ve heard with stripe, creators can hide their legal name and use another which shows up on invoices but im unsure if it’s true

hi! I actually had this same concern and did a lot of poking around for how different platforms handle this while setting up my commissions so I will attempt to answer! disclaimer I am just a guy who is bad with technology so there is a chance I am wrong about things ok here’s a readmore attempt click to get Snek’s business knowledge

this is actually the main reason I rly like stripe, you can customize pretty much everything clients will see including how much information about yourself you want to give away- I literally only have 3amsnek as my name in there, it’s just my business name (the Public Details section of settings lets you mess with this as much as you like, it’s under the Business Settings category)

it gives my country & state on some invoices but no further details (I can’t remember if state is mandatory or I clicked on the wrong button somewhere setting it up but I can’t disable it so keep that in mind) (I can change it along with everything else in my info though)

you do need to give Stripe all of your information for legal and payment purposes which can be kinda intimidating to set up but within my account I can customize what name will show up everywhere it shows up, put a different email than the one I signed up with as a customer support email to go at the bottom of receipts, decide specifically how much of my location is shown- idk if this is super clear bc I’m not at all experienced in Business Advice but by my memory/experience it doesn’t even ask for a Firstname Lastname name anywhere that’ll be shown to customers

for the record I’ve never actually used paypal bc my account got nuked within a day of making it and they have simply refused to fix it so I don’t have a direct comparison from personal experience but from my various hours of research trying to put comms together it seemed like paypal will always give everyone involved in the transaction a stupid amount of information about each other and there rly isn’t much to do about it/things can’t be changed ever or at least without huge difficulty and my experience with Stripe has been not that at All,,, it’s been very nice tbh I even found a whole invoices feature that allows international bank transfers as a payment method making a workaround for people who only have paypal & no card

if this is still confusing you can dm me and I’ll send you a picture of my checkout page/invoice/email receipt templates, it rly only shows my profile picture for stripe which I selected and can change (for me it’s the same dragon I use for my ko-fi header) and my business name in big letters at the top to say who you’re paying and then it’s the checkout/payment setup for the client (looks like any other online shopping checkout thing rly) - I haven’t been able to Confirm confirm that this all shows up properly on receipts as I don’t rly have a way to run a test with it with actual payment but it shows you what all the graphics are set to show up as in your account (under Branding in settings, same Business Settings box as Public Details is in) and you can change all of it any time (I do think you can also send blank test receipts to yourself)

hopefully this helps clarify things? at this point of using it for a couple months I would say I’d recommend Stripe- I’ve been rly pleased with it so far, especially with this specific topic :]

#snek asks#anon asks à la snek#If I’m misreading this and you’re asking how much information I can see about clients- full name on the card used and zip code is all I get#(sometimes that’s hard to find with invoices too I’ve noticed)#and tbh I’ve got adhd I can pretty much guarantee if I’ve seen a name you don’t want seen it is Not sticking around in the ol noggin#I’m pretty sure the person receiving the payment Does need to know A Name involved for keeping records & tax purposes#that’s kinda always the case with transactions#but yeah paypal SUCKS about legal names#(< can’t use it at all bc I was still in the middle of getting new ids after changing mine when I made my account so they apparently Still#don’t believe I exist)#if I did misread this. whoops. here is a lot of business information you did not want or need? bon appetit?#but I Think im on the right track#short answer: shockingly little and you can rly customize. everything it’s pretty neat#thank u for thinking I am enough of a Professional Businessman to answer questions im honored hopefully I did not get something very wrong 👍

7 notes

·

View notes

Text

Professional Nerd

Every now and then I'm reminded Real People with Actual Jobs use tumblr and I've always been legitimately curious what all you weird adults are up to when you're not on this site and with tumblr's New Poll Feature I can finally get an answer! (or the closest approximation of an answer possible with only 10 available options h a)

45K notes

·

View notes

Text

How to Choose the Best Accounting Firm in Milwaukee

Finding the right accounting firm in Milwaukee can significantly impact your business or personal finances. Whether you need tax preparation, financial planning, or bookkeeping, selecting the best firm ensures accuracy, compliance, and peace of mind. Here are key factors to consider when choosing an accounting firm in Milwaukee.

1. Determine Your Needs

Before selecting an accounting firm, outline your specific needs. Do you require business tax services, payroll management, or financial advisory? Some firms specialize in corporate accounting, while others focus on individual tax planning.

2. Verify Credentials & Experience

Ensure the firm has Certified Public Accountants (CPAs) or Enrolled Agents (EAs) with relevant experience. Look for industry-specific expertise, especially if your business operates in sectors like healthcare, real estate, or manufacturing.

3. Check Reputation & Reviews

Research online reviews and testimonials to gauge the firm's reputation. Websites like Google, Yelp, and the Better Business Bureau (BBB) provide insights into customer experiences and potential red flags.

4. Evaluate Technology & Services

Modern accounting firms leverage technology to streamline operations. Ask if they offer cloud-based accounting, automated reporting, and digital tax filing. Firms using up-to-date software can improve efficiency and security.

5. Compare Pricing & Fees

Accounting firms charge differently—some use hourly rates, while others offer flat fees. Request a clear breakdown of costs to avoid hidden charges. Choose a firm that provides quality service within your budget.

6. Assess Communication & Accessibility

A responsive accounting firm is essential for timely financial decisions. Determine how often you’ll have contact and whether they offer virtual consultations. Good communication ensures seamless financial management.

7. Look for Personalized Services

Avoid one-size-fits-all approaches. The best accounting firms tailor their services to fit your financial situation, providing strategic guidance beyond basic bookkeeping.

8. Schedule a Consultation

Before committing, schedule a consultation to discuss your needs. This meeting helps assess their professionalism, expertise, and compatibility with your goals.

Conclusion

Choosing the best accounting firm in Milwaukee requires research and careful consideration. By evaluating experience, services, reputation, and pricing, you can find a trusted partner to support your financial success. Whether you need tax services or business accounting, the right firm will provide value and long-term financial security.

#accounting services for small business#professional accountants#tax accountant milwaukee wi#accounting services in milwaukee

0 notes

Text

Empower Your Business: The Essential Guide to Choosing an Accountant

Choosing the right accounting professional is crucial for any business, especially for accountants for small businesses. A skilled accountant provides invaluable financial guidance. They help optimize your tax strategy and ensure compliance with complex regulations. This blog talks about the key factors to consider when selecting an accountant and tips for finding the perfect fit.

Why Does a Good Accountant Matter?

Financial Clarity is Essential

A competent accountant delivers clear financial reports. This will help you understand your business’s financial performance.

Optimized Tax Strategy Benefits

They minimize tax liability through legal tax planning and deductions. This is vital for effective tax accounting.

Ensuring Regulatory Compliance

Accounting professionals ensure adherence to complex tax laws. This mitigates the risk of penalties and legal issues.

Supporting Informed Decision-Making

By analyzing financial data, accountants provide insights for sound decisions. This support is essential for business growth.

Strategic Business Growth Support

A good accountant offers strategic advice to help scale your business. This aligns with long-term goals.

Understanding Your Business Needs

Assess Business Size and Complexity

Small businesses often need basic accounting services. Bookkeeping and tax preparation are considered primary needs.

Medium-Sized Business Requirements

As businesses grow, accounting needs become more complex. Medium-sized businesses may require specialized services like payroll processing.

Large Corporations’ Complex Needs

Large corporations often need dedicated accounting teams. They handle intricate financial operations, including internal audits.

Industry-Specific Knowledge is Key

Compliance with Unique Regulations

Certain industries have unique accounting regulations. An industry-savvy accounting professional ensures compliance with these rules.

Identifying Tax Opportunities

They help identify industry-specific tax deductions and credits, optimizing your tax accounting strategy.

Providing Tailored Advice

An accountant with industry knowledge offers relevant advice for unique challenges.

Aligning Financial Goals with Your Accountant

Growing Your Business Effectively

Your accountant can analyze performance and identify growth opportunities. They develop strategies to achieve your goals.

Reducing Tax Liabilities Strategically

A skilled accountant optimizes your tax strategy legally. This minimizes your tax burden while ensuring compliance.

Improving Cash Flow Management

Accountants track cash flow and identify improvement areas. They implement strategies to enhance your cash position.

Key Qualities of an Accountant

Expertise and Professional Qualifications

Look for certifications like CPA (Certified Public Accountant). These indicate a high level of expertise in tax accounting.

Industry Specialization Matters

If your business operates in a specific field, find an accountant with relevant experience. This ensures tailored advice.

Communication Skills are Crucial

A good accountant explains complex concepts clearly. They should listen actively to your concerns and questions.

Proactive Approach to Accounting

Choose an accountant who anticipates needs and identifies potential issues early. Strategic thinking is essential for long-term success.

Finding the Right Accountant

Use Online Directories Effectively

Search online directories or type "CPA near me" on Google. Read client testimonials to find reputable professionals.

Network with Other Business Owners

Seek recommendations from other business owners in your industry. Word-of-mouth referrals are invaluable resources.

Interview Potential Candidates Thoroughly

Schedule interviews with shortlisted accountants. Ask about their experience, qualifications, fees, and client service approach.

Building a Strong Accountant-Client Relationship

Foster Open Communication Regularly

Share your business goals clearly with your accountant. Discuss challenges openly to receive timely advice.

Share Timely Information Consistently

Provide accurate information about your business promptly. Respond quickly to requests from your accountant to avoid delays.

Encourage Questions and Clarifications

Ask questions about financial statements or tax implications to promote open dialogue. A good accountant will clarify complex concepts easily.

Conclusion: Selecting the Right Accounting Professional

Choosing the right accounting professional significantly impacts your business’s financial health. By understanding specific needs, identifying key qualities, and building a strong relationship, you ensure capable financial management.

0 notes

Text

Expert Accounting and Bookkeeping Services Since 2004

Professional Accounting Services for Over 20 Years

Outsourced Bookkeeping is your premium business partner for accounting and bookkeeping services. We render services to individuals, small and large companies, and CPAs across the US. Hospitality and real estate sectors are our specialization.

For real estate, we manage property accounts, leases, and customer accounts. In the hospitality industry, we assist restaurant owners with accounts payable, cash flow, inventory management, and customer accounts.

Our team is equipped with advanced professional knowledge and tools to ensure compliance with state and federal regulations. We provide top-notch accounting and bookkeeping solutions tailored to your specific needs.

Accounting & Bookkeeping Services We Offer

Tracking Business Transactions

Preparation of Financial Statements

Performing Bank Reconciliations

Accounts Payable & Receivable Service

Customized Business Reporting & Periodic Reviews

Preparation of Cash Flow Management

Managing Cash and Subsidiary Ledgers

Tax Filing Process

#bookkeeping services#bookkeeping services near me#outsourcing accounting and bookkeeping services#bookkeeping services for small business#online bookkeeping services#accounting and bookkeeping services#online accounting and bookkeeping services#online business bookkeeping services#bookkeeping and tax services#quickbooks bookkeeping services#professional bookkeeping services#virtual bookkeeping services

0 notes

Text

Unlocking Sustainable Growth: Proven Strategies for Business Expansion

For good business growth strategies to work, you must balance effort and sustainability with care. Businesses that manage to expand their operations know that development is not only about boosting income – it's about creating a strong base that can hold up extended growth while keeping quality in operations.

Strategic Market Positioning

Positioning in the market is a fundamental part of development strategies for business success. Businesses should discern their unique value and use it to set them apart from rivals. This requires comprehension of customer requirements, examination of spaces within the market, and creation of solutions that respond precisely to problems not yet tackled by competitors.

Data-Driven Decision Making

Today's businesses use data analysis a lot for making decisions about growing. By studying how customers behave, what trends are in the market, and measures of operations, companies can find opportunities to grow more accurately. This method focused on data helps lessen risks and enables organizations to distribute resources better.

Building Scalable Systems

Putting in place systems and processes that can grow is very important for continuous growth. Often, good strategies to make businesses larger include putting money in technology and automatic machines. This helps manage more work without needing many new resources or people.

Customer-Centric Innovation

Innovation must always be directed by the needs of customers, not by our own guesses inside the company. Companies that keep a strong bond with their clients can predict better what market requires and change their products to suit these demands. This method focusing on customers makes sure business tactics for growth stay in line with what the market wants.

Financial Management and Resource Allocation

Management of finances in a proper manner is very important for continuous growth. Organizations need to keep good cash flow while they spend on opportunities for expansion. This requires thoughtful planning, intelligent distribution of resources and holding onto emergency savings to manage unforeseeable problems.

Building Strong Teams

The growth possibility of a company frequently relies on the quality of its team. Investing in getting talent, training them and keeping them is helpful to make a workforce that can carry out difficult expansion plans. Strong leadership and unmistakable lines for communication guarantee all team members comprehend and labor towards shared objectives.

Measuring Success and Adapting

Monitoring of performance regularly and readiness to modify strategies are important for success over a lengthy period. Companies need to set clear measures for assessing growth advancement, also they should be ready to change their method depending on the results and alterations in market situations.

Final Words

For a business to grow sustainably, it needs an all-inclusive approach combining strategic planning, superb operations and flexibility. If companies concentrate on these important areas while keeping equilibrium between swift growth and stable operations, they can establish a robust base for continuing success. The secret is seeing growth not like a short race but more as being in it for the longest haul where continual advancements with flexibility finally result in sustainable development. Visit us now to know more about business growth strategies.

#business growth strategies#ca#tax professionals#chartered accountants auckland#chartered accountant firm#accounting consulting services#management accounting services#strategy development consultants#strategic business management and planning#corporate strategic planning

0 notes

Text

#IRS Representation Services in Florida#Tax Preparation & Planning in Port St. Lucie Florida#IRS Representation Services in Port St. Lucie Florida#Professional Business Consulting and Advisory Services in Florida#CPA Firm in Port St. Lucie Florida#Accounting services in Port St. Lucie Florida#Tax & Accounting Services in Port St. Lucie Florida

0 notes

Text

Expert Accounting and Bookkeeping Services Since 2004

Professional Accounting Services for Over 20 Years

Outsourced Bookkeeping is your premium business partner for accounting and bookkeeping services. We render services to individuals, small and large companies, and CPAs across the US. Hospitality and real estate sectors are our specialization.

For real estate, we manage property accounts, leases, and customer accounts. In the hospitality industry, we assist restaurant owners with accounts payable, cash flow, inventory management, and customer accounts.

Our team is equipped with advanced professional knowledge and tools to ensure compliance with state and federal regulations. We provide top-notch accounting and bookkeeping solutions tailored to your specific needs.

Accounting & Bookkeeping Services We Offer

Tracking Business Transactions

Preparation of Financial Statements

Performing Bank Reconciliations

Accounts Payable & Receivable Service

Customized Business Reporting & Periodic Reviews

Preparation of Cash Flow Management

Managing Cash and Subsidiary Ledgers

Tax Filing Process

To know more: https://www.outsourcedbookeeping.com/contact-us/

#bookkeeping services#bookkeeping services near me#outsourcing accounting and bookkeeping services#bookkeeping services for small business#online bookkeeping services#accounting and bookkeeping services#online accounting and bookkeeping services#online business bookkeeping services#bookkeeping and tax services#quickbooks bookkeeping services#professional bookkeeping services#virtual bookkeeping services

0 notes

Text

Chartered Professional Accountant in Vancouver: Your Key to Financial Success

When it comes to managing your finances, especially for small businesses, the expertise of a Chartered Professional Accountant in Vancouver can make all the difference. Whether you need help with small business accounting in Vancouver, tax planning, or preparation, having a skilled professional by your side ensures that you’re on the right track toward financial stability and growth. Chartered Professional Accountant, is a professional designation bestowed on experienced professionals in Canada . CPAs operate in a wide range of industries, including public accounting, government, education, and the not-for-profit sector.

The Importance of a Chartered Professional Accountant in Vancouver

Hiring a Chartered Professional Accountant (CPA) in Vancouver is one of the best decisions you can make for your business. a professional designation for accountants in Canada, signifying a high level of competency in the field, achieved by passing a rigorous exam and completing required education and practical experience, regulated by CPA Canada.

Expertise and Experience

A Chartered Professional Accountant in Vancouver brings years of education and experience to the table. They stay updated with the latest financial regulations and tax laws, ensuring your business complies with all local and federal requirements. With a CPA on your team, you’ll be able to focus on growing your business, knowing that your financial matters are in good hands.

Custom Solutions for Small Businesses

Small business owners often wear multiple hats. From managing operations to marketing, handling finances might not always take priority. However, proper small business accounting in Vancouver is crucial for your company's success. A CPA can offer tailored solutions that meet the unique needs of your business. From bookkeeping to payroll, tax filing, and more, a Chartered Professional Accountant in Vancouver ensures that your business finances are always in order, leaving you more time to focus on other aspects of growth.

Small Business Accounting in Vancouver: Key to Efficient Financial Management

Proper small business accounting in Vancouver is the foundation for any successful company. Without accurate financial records, it’s nearly impossible to make informed decisions that drive growth. That’s where a CPA comes in.

Bookkeeping Services

Bookkeeping is an essential part of small business accounting in Vancouver. Keeping track of your income, expenses, invoices, and receipts is vital for understanding your cash flow. A Chartered Professional Accountant in Vancouver will ensure that your books are always up to date, reducing the risk of errors and financial discrepancies. By maintaining accurate records, you can easily monitor your business’s financial health and make data-driven decisions.

Financial Statements and Reports

Financial statements are critical for assessing your business’s performance. Your CPA will generate detailed income statements, balance sheets, and cash flow reports, providing you with a clear picture of your company’s financial position. These reports are also essential for securing funding, whether through loans or investments, as lenders and investors require this information to evaluate your business’s potential.

Payroll Services

Managing payroll is another crucial aspect of small business accounting in Vancouver. Ensuring your employees are paid accurately and on time is not just a legal requirement but also a key part of maintaining employee satisfaction. A Chartered Professional Accountant in Vancouver can handle all aspects of payroll processing, including calculating wages, managing deductions, and filing necessary payroll taxes.

Tax Planning and Preparation in Vancouver: Maximize Your Savings

One of the most significant benefits of working with a Chartered Professional Accountant in Vancouver is their expertise in tax planning and preparation in Vancouver. Tax laws are constantly changing, and ensuring that your business complies with these regulations while minimizing tax liabilities is no easy task. A CPA can help you navigate the complexities of tax planning and preparation to ensure you're not paying more than you need to.

Effective Tax Planning

Proper tax planning and preparation in Vancouver requires a deep understanding of both your business’s finances and the current tax laws. A CPA will help you develop a strategy to reduce your tax burden through deductions, credits, and tax-efficient investments. By proactively planning your taxes, your CPA ensures that you don’t face unexpected surprises at year-end.

Tax Compliance and Filing

Tax compliance is non-negotiable for any business owner. A Chartered Professional Accountant in Vancouver will ensure that all your business tax returns are filed accurately and on time, minimizing the risk of penalties and fines. With their knowledge of federal, provincial, and municipal tax laws, they’ll ensure that your business is fully compliant with tax regulations.

Tax Savings Opportunities

With the right tax planning and preparation in Vancouver, you may be able to take advantage of various tax savings opportunities that could benefit your business in the long run. Whether it’s through tax credits, income splitting, or investment strategies, a CPA will work with you to identify opportunities that maximize your savings and reduce your overall tax liability.

How a Chartered Professional Accountant in Vancouver Can Help You Grow Your Business

The services provided by a Chartered Professional Accountant in Vancouver aren’t just about managing finances—they also play a crucial role in helping your business grow. By offering strategic advice, improving cash flow, and ensuring compliance, a CPA helps create a solid foundation for your company’s long-term success.

Financial Forecasting and Budgeting

A CPA can help you forecast your future financial needs by creating realistic budgets and financial projections. This enables you to make informed decisions about expenditures, investments, and savings, ensuring that your business operates within its financial means while planning for the future. Small business accounting in Vancouver isn’t just about tracking numbers; it’s about creating a financial strategy that supports your long-term goals.

Business Structuring Advice

Choosing the right business structure (sole proprietorship, partnership, corporation, etc.) can significantly impact your finances. A Chartered Professional Accountant in Vancouver will advise you on the most tax-efficient structure for your business based on your goals, industry, and long-term plans. This guidance ensures that you avoid costly mistakes and set up your business for growth.

Succession Planning and Exit Strategy

If you plan to eventually sell your business or pass it on to a family member, proper succession planning is critical. A CPA can help you develop a strategy for transitioning ownership, minimizing tax implications, and ensuring that your business continues to thrive after the transition. Effective small business accounting in Vancouver also helps make the business more attractive to potential buyers by demonstrating its financial health and stability.

Why Choose a Chartered Professional Accountant in Vancouver?

Working with a Chartered Professional Accountant in Vancouver is an investment in the future of your business. Their expert guidance, financial acumen, and comprehensive services can provide invaluable support at every stage of your business journey. From small business accounting in Vancouver to tax planning and preparation in Vancouver, a CPA ensures that your financial operations are running smoothly, allowing you to focus on what matters most: growing your business.

Personalized Services Tailored to Your Needs

Every business is different, and that’s why a Chartered Professional Accountant in Vancouver offers customized services designed to meet your unique needs. Whether you need help with budgeting, forecasting, or setting up a new accounting system, your CPA will work closely with you to develop solutions that align with your business’s specific goals.

Long-Term Financial Success

The expertise of a Chartered Professional Accountant in Vancouver can lead to long-term financial success. By providing strategic advice, ensuring tax compliance, and offering ongoing support, a CPA helps you navigate the challenges of running a business and seize opportunities for growth. With a strong financial foundation, you can confidently move forward with your business plans, knowing that your finances are in the best possible hands.

Take the Next Step: Partner with a Chartered Professional Accountant in Vancouver

If you’re ready to take control of your business finances, it’s time to partner with a Chartered Professional Accountant in Vancouver. Whether you’re a small business owner in need of small business accounting in Vancouver or seeking expert advice on tax planning and preparation in Vancouver, a CPA is the right choice to help you achieve your financial goals.

Don’t wait—reach out to a qualified Chartered Professional Accountant in Vancouver today and start building a solid financial foundation for your business. Their expertise will not only save you time and money but also set you on the path to long-term financial success.

By making the decision to work with a CPA, you’re investing in the future of your business. Let a Chartered Professional Accountant in Vancouver be your partner in financial growth and stability, helping you navigate the complexities of business accounting and taxation with confidence.

#Tax Planning and Preparation Vancouver#Small Business Accounting Vancouver#Bookkeeping Services West Vancouver#CPA North Vancouver#Chartered Professional#Accountant Vancouver

0 notes

Text

10 Benefits of Hiring a Tax Accountant in Melbourne

Navigating the complexities of tax regulations in Australia can be a challenge for both individuals and businesses. Hiring the best tax accountant in Melbourne offers a range of advantages that can save you time, money, and stress.

Here are ten key benefits of engaging a tax accountant to manage your financial affairs:

Expertise in Australian Tax Laws: A qualified tax accountant stays updated with Australia's latest tax laws and regulations. Their in-depth knowledge ensures compliance with the Australian Taxation Office (ATO) requirements, reducing the risk of errors and penalties.

Maximised Tax Returns: Tax accountants are skilled at identifying legitimate deductions and credits you may not know. They help maximise your tax return by ensuring you claim everything you’re entitled to based on your income and expenses.

Time Savings: Preparing taxes can be time-consuming, especially if you’re unfamiliar with the requirements. A tax accountant handles the preparation, submission, and follow-up, freeing up your time for other priorities.

Accurate Financial Records: Accurate financial records are essential for tax compliance and long-term financial planning. A tax accountant ensures that your records are organised, up-to-date, and ready for audits or reviews.

Strategic Tax Planning: Tax accountants advise structuring your finances to minimise tax liabilities. They can recommend strategies for future planning, such as investments or business changes, that align with your financial goals.

Assistance During Audits: If the ATO audits your financial records, having a tax accountant on your side can make a significant difference. They represent you during the process and ensure all documentation is accurate and complete.

Reduced Stress: Handling taxes alone can be overwhelming, especially if you have multiple income streams or complex financial situations. A tax accountant takes the stress out of tax season by managing the entire process for you.

Support for Business Growth: For business owners, a tax accountant offers valuable insights into cash flow management, profit margins, and tax obligations. Their advice helps you make informed decisions that contribute to the growth of your business.

Avoidance of Costly Mistakes: Mistakes in tax filings can lead to penalties and interest charges. A tax accountant’s expertise minimises the likelihood of errors, saving you from potential financial setbacks.

Tailored Advice for Your Needs: Every individual or business has unique financial circumstances. A tax accountant provides advice specific to your situation, helping you navigate tax matters confidently.

Conclusion

Hiring a tax accountant in Melbourne offers numerous advantages, from ensuring compliance with tax laws to optimising your financial outcomes. Their expertise and guidance provide peace of mind and allow you to focus on achieving your financial objectives with clarity and confidence. Whether you’re an individual taxpayer or a business owner, the benefits of professional tax support are undeniable.

#Tax Accountant Melbourne#Benefits of Tax Accountants#Tax Planning Melbourne#Australian Taxation Office (ATO)#Melbourne Business Finance#Tax Return Assistance#Small Business Tax Help#Financial Planning Melbourne#Tax Compliance Australia#Hiring Tax Professionals

0 notes

Text

#IRS Representation Services in Florida#Budgeting and Forecasting Services in Florida#Tax Preparation & Planning in Port St. Lucie Florida#Professional Business Consulting and Advisory Services in Florida#Accounting services in Port St. Lucie Florida#Tax & Accounting Services in Port St. Lucie Florida

0 notes

Text

Outsource Accounting & Bookkeeping Services

Whether you are an established organisation or a startup climbing up the corporate ladder, leaders always focus more on business than handling administrative duties. This is where infinzi comes into the story, as we operate your bookkeeping and accounting responsibilities with accuracy, transparency and verifiable results. Thanks to their technically advanced team, they maintain increased profitability using streamlined accounting and bookkeeping services along with efficiency gains. This minimises time, energy and resource wastage on such tasks.

#Accounting Services#Bookkeeping Solutions#Mumbai Accounting#Financial Services India#Outsourced Bookkeeping#Tax Preparation#Small Business Accounting#Financial Management Mumbai#Professional Bookkeeping#Accounting Firm India

0 notes

Text

What is a car donation #tax deduction? Learn more from our own Paul Miller, CPA in Business Insider on how to maximize your tax benefits for 2024

"Also, the deduction for non-cash donations is capped at 50% of your adjusted gross income. If you can't use the entire deduction this year, you can carry it forward for up to five years," says Paul Miller, managing partner and CPA at Miller and Company, an accounting firm with offices in Florida, New York, and Washington DC.

#tax deduction#cpa#cpa nyc#accountant nyc#tax#Paul Miller#personal finance#cpa firm#tax professional

0 notes