#Wave Energy Market Forecast

Explore tagged Tumblr posts

Text

Wave Energy Market: Analysis by Technology, Location, Application, and Region

Wave energy is a form of renewable energy that can be harnessed from the motion of ocean waves. It is created by the wind blowing over the surface of the ocean, and is a significant source of energy, with the potential to generate more electricity than the world's current demand.

The wave energy market is still in its early stages of development, but it has the potential to become a major source of renewable energy in the coming decades. Wave energy is a clean and reliable source of energy that can be generated 24/7, regardless of weather conditions. It is also a highly scalable resource, with the potential to meet a significant portion of global energy demand.

Download PDF Sample Copy at: https://www.theinsightpartners.com/sample/TIPRE00012001

Market Dynamics-

Growing Demand for Renewable Energy: Governments and businesses around the world are increasingly investing in renewable energy sources to reduce their reliance on fossil fuels and combat climate change. Wave energy is a promising renewable energy source with the potential to make a significant contribution to the global energy mix.

Government Support for Wave Energy Development: Governments around the world are providing financial and other support for wave energy development. This support is helping to reduce the cost of wave energy technologies and make them more competitive with other forms of energy generation.

Market Key players

AMOG CONSULTING

AWS Ocean Energy Ltd

Carnegie Clean Energy

Eco Wave Power Ltd.

Limerick Wave Ltd.

NEMOS GmbH

Ocean Power Technologies

OceanEnergy

SINN Power GmbH

WAVE SWELL

Have a Call with Analyst: https://www.theinsightpartners.com/speak-to-analyst/TIPRE00012001

Market Segmentations

By Technology

Oscillating Water Column

Oscillating Body Converters

Overtopping Converters

By Application

Desalination

Power Generation

Environmental Protection

Regional Analysis

North America

Europe

Asia-Pacific

Middle East and Africa

South America

The Asia Pacific region is expected to be the fastest-growing wave energy market in the coming years. This is due to a number of factors, including the region's strong economic growth, its growing demand for energy, and its abundant wave energy resources. The European and North American markets are also expected to grow significantly in the coming years.

About The Insight Partners:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

E-mail: [email protected]: +1-646-491-9876

#business#Market Size#Wave Energy Market Size#Wave Energy Market Share#Wave Energy Market Trend#Wave Energy Market Forecast#Wave Energy Market Analysis#Wave Energy Market Insights

1 note

·

View note

Text

Energy prices soar in Brazil as reservoir recovery slows amid scarce rainfall

Official forecasts indicate a low probability of heavy rains in the coming months, but grid operator ONS insists there is no supply risk

Reservoir levels across Brazil have stagnated, and electricity prices in the free market—where consumers can choose their supplier and contract terms—have surged. However, Brazil’s national grid operator ONS maintains that there is no risk to power supply, given the current reservoir levels.

In 2024, Brazil experienced one of the most severe droughts in 83 years, raising concerns about water storage for hydropower generation. Rainfall returned at the start of the wet season in November, allowing hydro plants to rebuild reserves. However, precipitation tapered off in January and became scarce in February and March.

Instead of rain, prolonged heat waves intensified, further straining the system. Both government and private sector forecasts suggest a low likelihood of significant rainfall in the coming months. ONS projections indicate that the wet season, which typically lasts from November to April, could end earlier than usual.

Continue reading.

#brazil#brazilian politics#politics#economy#environmentalism#energy#image description in alt#mod nise da silveira

5 notes

·

View notes

Text

Trump looks to press ahead with more layoffs even as courts order some reinstatements

WASHINGTON, March 14 (Reuters) - President Donald Trump's administration is expected on Friday to move ahead with a second wave of mass firings and budget cuts across the U.S. federal government even as two federal judges ordered it to reinstate thousands of federal workers.

Before those rulings on Thursday, federal agencies faced a Thursday deadline to submit large-scale downsizing plans as part of Trump's push to radically remake the federal bureaucracy, a task he has largely left to Elon Musk's Department of Government Efficiency.

So far, DOGE has overseen potential cuts of more than 100,000 jobs across the 2.3 million-member federal civilian workforce, the freezing of foreign aid, and the canceling of thousands of programs and contracts.

Federal agencies faced a Thursday deadline to submit reorganization blueprints for what Trump last month termed "large-scale reductions in force."

Opponents of Trump's radical remaking of government have tried to slow him with lawsuits. Court rulings in California and Maryland on Thursday ordered agencies to reinstate thousands of probationary employees who had been dismissed in recent weeks, setting up a test of whether Trump may defy the judiciary.

The prospect for further job losses comes with financial markets already rattled about the economic risks posed by Trump's global trade war. Stock markets have fallen dramatically over the past two weeks, wiping out more than $5 trillion in value over concerns that Trump's policies could lead to a recession.

With the tech billionaire Musk at his side, Trump signed an executive order on February 11 directing all agencies to "promptly undertake preparations to initiate large-scale reductions in force," using a legal term commonly referred to as RIF to denote mass layoffs.

A subsequent memo from U.S. Office of Personnel Management said plans should include "a significant reduction" of full-time staff, cuts to real estate, a smaller budget, and the elimination of functions not mandated by law.

The Internal Revenue Service, the tax-collecting agency that has long been a target of scorn for Republicans, is planning to eliminate 20% to 25% of its workforce by May 15, according to a person briefed on the agency's plans. The IRS had about 100,000 workers when Trump took office, meaning up to 25,000 are set to lose their jobs.

The 20% to 25% target includes the roughly 5,000 IRS employees who took a buyout last month and potentially 7,000 probationary workers who were fired, though court rulings on Thursday could lead to reinstatement of probationary staff, the person said.

The planned job cuts are being described internally as the first phase of the agency's efforts to reduce career workers, the person briefed on the matter said, indicating there could be additional cuts after May 15.

The IRS did not immediately respond to a request for comment.

The Department of Veterans Affairs was aiming to cut more than 80,000 workers, and the U.S. Department of Education said on Tuesday it would lay off nearly half its 4,000-strong staff.

The Social Security Administration, the agency that provides benefits to tens of millions of older Americans, plans to cut 7,000 workers.

The National Oceanic and Atmospheric Administration, which provides weather forecasts, planned to lay off more than 1,000 workers.

COURT CHALLENGES

Several agencies have offered employees lump-sum payments to voluntarily retire early, which could help the agencies avoid legal complications inherent in the RIF process, which unions have vowed to fight in court.

Court rulings on the layoffs have had mixed results but in a setback for Trump on Thursday U.S. District Judge William Alsup in San Francisco ruled that probationary workers, typically those with less than two years on the job, should be reinstated at the departments of Defense, Veterans Affairs, Agriculture, Energy, Interior and the Treasury.

The White House vowed to challenge Alsup's decision.

The ruling does not pertain to the career employees that are set to be fired in the new round of downsizing. That process could eliminate tens of thousands of federal jobs.

After Alsup's ruling was handed down, a federal judge in Maryland also directed the administration to reinstate tens of thousands of recently hired federal workers.

U.S. District Judge James Bredar in Baltimore agreed with 20 Democratic-led states that 18 agencies that had fired probationary employees en masse in recent weeks violated regulations governing the process for laying off federal workers.

The two rulings were the largest legal setbacks for Trump and Musk's downsizing plans yet.

2 notes

·

View notes

Text

Global Radio Frequency Transceiver Chip Market : Key Insights, and Forecast from 2025 to 2032.

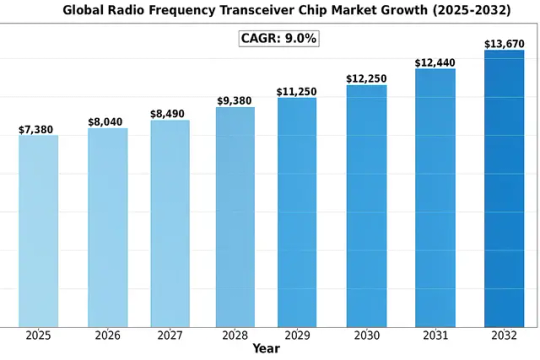

Global Radio Frequency Transceiver Chip Market size was valued at US$ 7,380 million in 2024 and is projected to reach US$ 13,670 million by 2032, at a CAGR of 9.0% during the forecast period 2025-2032.

Radio Frequency (RF) transceiver chips are integrated circuits that combine both transmitter and receiver functions in a single package, enabling wireless communication across various frequencies. These components are fundamental to modern wireless systems, supporting technologies such as 5G networks, Wi-Fi 6/6E, IoT devices, and automotive radar systems. The chips typically include mixers, amplifiers, filters, and digital signal processing units to handle modulation/demodulation tasks efficiently.

The market growth is primarily driven by escalating demand for high-speed data transmission, proliferation of connected devices, and rapid 5G infrastructure deployment worldwide. However, design complexities and stringent power consumption requirements pose significant challenges for manufacturers. Recent technological advancements like beamforming capabilities and AI-powered signal processing are creating new opportunities in this space. Key players such as Qualcomm, Broadcom, and Texas Instruments are investing heavily in R&D to develop energy-efficient solutions for emerging applications.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-radio-frequency-transceiver-chip-market/

Segment Analysis:

By Type

RF Microwave Segment Dominates the Market Due to Widespread Use in Wireless Communication Systems

The market is segmented based on type into:

RF Microwave

Millimeter Wave

Other

By Application

Civil Applications Lead the Market Driven by 5G Infrastructure and IoT Devices

The market is segmented based on application into:

Military

Civil

Space

Automobile

Other

By Frequency Range

Sub-6GHz Segment Holds Major Share Due to Balanced Performance and Cost Efficiency

The market is segmented based on frequency range into:

Sub-6GHz

24-39GHz

60GHz

Other

By Technology

CMOS Technology Preferred for Commercial Applications Due to Cost Advantages

The market is segmented based on technology into:

CMOS

SiGe

GaAs

Other

Regional Analysis: Global Radio Frequency Transceiver Chip Market

North America The North American RF transceiver chip market remains a leader in innovation and adoption, propelled by significant investments in 5G infrastructure and IoT applications. With major players like Qualcomm, Broadcom, and Texas Instruments headquartered in the region, there is a strong emphasis on developing advanced mmWave and sub-6GHz solutions. The U.S. Federal Communications Commission’s recent spectrum allocations for 5G deployment have accelerated demand for high-performance RF chips, particularly in telecommunications and defense applications. However, stringent export controls and supply chain vulnerabilities pose challenges for manufacturers. The region is expected to maintain its technological leadership with a projected CAGR of 8-10% through 2028, driven by upgrades to private networks and autonomous vehicle communication systems.

Europe Europe’s RF transceiver market is characterized by strict regulatory frameworks and a focus on energy-efficient designs. The EU’s Horizon Europe program has allocated substantial funding for semiconductor research, with particular attention to reducing power consumption in 5G applications. Countries like Germany and France are seeing increased demand for industrial IoT chips, while Nordic nations continue to dominate in low-power wireless solutions for logistics and smart cities. The region faces pressure to reduce dependence on non-European supply chains following recent global shortages. Automotive RF applications are growing steadily, supported by mandates for vehicle-to-everything (V2X) communication systems. Despite slower 5G rollout compared to other regions, the market benefits from strong R&D partnerships between academic institutions and semiconductor firms.

Asia-Pacific Asia-Pacific represents the fastest-growing RF transceiver market, with China accounting for over 40% of global production capacity. The region benefits from complete semiconductor ecosystems, from wafer fabrication to end-device manufacturing. While China leads in volume production, countries like Taiwan and South Korea specialize in advanced RF front-end modules. India’s telecom expansion and Japan’s automotive electronics sector create diverse demand patterns. The APAC market is highly price-sensitive, driving innovations in cost-optimized designs. However, geopolitical tensions and export restrictions present ongoing supply chain risks. Millimeter-wave development lags behind North America, but massive IoT deployment across smart factories and cities ensures steady demand for conventional RF solutions. The region’s growth is further supported by government initiatives like China’s Semiconductor Industry Investment Fund.

South America South America’s RF transceiver market remains in early growth stages, constrained by limited local manufacturing capabilities and economic instability. Brazil and Argentina show potential for growth in consumer electronics and basic IoT applications, but rely heavily on imports from Asia and North America. The telecommunications sector drives most demand, though infrastructure investments are often delayed due to financial constraints. Recent spectrum auctions for 5G have sparked interest, but adoption rates remain low compared to other regions. Local assembly operations are emerging in Mexico and Brazil, focusing on cost-effective solutions for automotive and industrial applications. The market shows long-term potential with improving economic conditions and increasing smartphone penetration, though progress is hindered by inconsistent regulatory environments and foreign exchange volatility.

Middle East & Africa The MEA RF transceiver market is bifurcated between oil-rich Gulf states investing in smart city projects and developing African nations focusing on basic connectivity solutions. The UAE and Saudi Arabia are driving demand for high-end RF components through 5G deployments and digital transformation initiatives. Israel’s robust semiconductor design ecosystem contributes specialized military and aerospace RF solutions. In contrast, Sub-Saharan Africa primarily consumes low-cost chips for mobile handsets and base stations. The region presents opportunities for growth in satellite communication and rural connectivity solutions, though market expansion faces challenges from limited technical infrastructure and political instability in certain areas. Strategic partnerships with Chinese and European suppliers are helping bridge technology gaps, particularly in telecommunications infrastructure development.

MARKET OPPORTUNITIES

Emerging Satellite Communication Markets Opening New Frontiers

The rapid development of low Earth orbit (LEO) satellite networks presents a transformative opportunity for RF transceiver suppliers, with the satellite communication chip market projected to grow at over 25% CAGR through 2030. These applications demand highly reliable RF solutions capable of operating across extreme temperature ranges while maintaining precise frequency stability. Leading manufacturers are developing specialized space-grade transceivers with radiation-hardened designs, creating a high-margin niche segment. Terrestrial applications are also expanding, as 5G non-terrestrial networks (NTN) begin complementing traditional cellular infrastructure in remote areas.

Automotive Radar Innovation Driving Next-Generation Designs

Advanced automotive radar systems are evolving from 24GHz and 77GHz to 79GHz and higher frequencies, requiring RF transceivers with improved resolution and interference rejection capabilities. The integration of radar with other sensors in autonomous vehicle platforms is creating demand for multi-channel RF solutions that can process complex waveforms in real-time. Forward-looking industry initiatives aim to reduce radar module sizes by 50% while doubling detection ranges, presenting opportunities for highly integrated RF system-in-package (SiP) solutions.

Additionally, the growing adoption of ultra-wideband (UWB) technology for precise indoor positioning and secure access control is creating complementary markets for specialized RF transceivers, particularly in the automotive and smart home sectors.

GLOBAL RADIO FREQUENCY TRANSCEIVER CHIP MARKET TRENDS

5G Network Expansion Driving Demand for Advanced RF Transceiver Chips

The rapid global deployment of 5G infrastructure is significantly boosting the radio frequency transceiver chip market, with telecom operators investing heavily in next-generation networks. Modern RF transceivers now support multiple frequency bands from sub-6 GHz to millimeter wave (24-100 GHz), enabling high-speed data transmission with low latency. The shift towards spectrum aggregation technologies like carrier aggregation has further increased the complexity and functionality requirements of these chips. Additionally, the growing adoption of Massive MIMO (Multiple Input Multiple Output) antenna systems in 5G base stations is creating substantial demand for high-performance RF transceiver solutions.

Other Trends

Automotive Connectivity Advancements

The automotive sector is emerging as a key growth area for RF transceiver chips, driven by increasing integration of vehicle-to-everything (V2X) communication systems and advanced driver assistance features. Modern vehicles now incorporate numerous RF-based systems including radar, satellite navigation, and cellular connectivity, each requiring specialized transceiver solutions. The push towards autonomous vehicles is further accelerating this trend, with some luxury models containing over 50 RF connections per vehicle. This automotive transformation is prompting chip manufacturers to develop more robust, temperature-resistant transceiver solutions capable of operating in harsh vehicular environments.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Strategic Expansions Drive Market Leadership in RF Transceiver Space

The global RF transceiver chip market features a dynamic competitive landscape dominated by semiconductor giants and specialized manufacturers. Qualcomm Incorporated maintains a strong market position, leveraging its extensive 5G technology portfolio and robust partnerships with smartphone manufacturers. In 2023, the company secured approximately 32% market share in the mobile RF transceiver segment, driven by its Snapdragon platform adoption across flagship devices.

Broadcom Corporation and Texas Instruments represent other major players, collectively accounting for nearly 28% of industrial and automotive RF solutions. Their strength lies in high-performance analog chipsets for enterprise networking and vehicle-to-everything (V2X) communication systems. Both companies have significantly increased R&D investments, with Broadcom allocating $5.2 billion towards wireless innovation in their latest fiscal year.

Meanwhile, Qorvo and Analog Devices Inc. (ADI) are making strategic moves to capture emerging IoT opportunities. Qorvo recently expanded its ultra-wideband (UWB) product line, while ADI strengthened its position in millimeter-wave applications through key acquisitions. These developments highlight the industry’s focus on diversification beyond traditional markets.

List of Key RF Transceiver Chip Companies Profiled

Qualcomm Incorporated (U.S.)

Broadcom Corporation (U.S.)

Texas Instruments (U.S.)

Intel Corporation (U.S.)

Analog Devices, Inc. (U.S.)

NVIDIA Corporation (U.S.)

Qorvo, Inc. (U.S.)

Ericsson AB (Sweden)

Samsung Electronics (South Korea)

Semtech Corporation (U.S.)

Maxim Integrated (U.S.)

GCT Semiconductor (U.S.)

Learn more about Competitive Analysis, and Global Forecast of Global Radio Frequency Transceiver Chip Market : https://semiconductorinsight.com/download-sample-report/?product_id=95988

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Radio Frequency Transceiver Chip Market?

Radio Frequency Transceiver Chip Market size was valued at US$ 7,380 million in 2024 and is projected to reach US$ 13,670 million by 2032, at a CAGR of 9.0% during the forecast period 2025-2032.

Which key companies operate in Global RF Transceiver Chip Market?

Key players include Qualcomm, Broadcom, Texas Instruments, Intel, Samsung, Qorvo, and Analog Devices, among others.

What are the key growth drivers?

Key growth drivers include 5G network deployment, IoT expansion, automotive connectivity solutions, and increasing defense applications.

Which region dominates the market?

Asia-Pacific holds the largest market share (42% in 2023), driven by semiconductor manufacturing in China, South Korea, and Taiwan.

What are the emerging trends?

Emerging trends include AI-integrated RF systems, mmWave technology for 6G, energy-efficient designs, and advanced packaging solutions.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes

Text

Maximizing Lifetime Value: How Drone Data Informs Solar Farm Repowering and Performance Modeling

As the first wave of large-scale solar farms approaches or passes its initial operational lifespan, the concept of repowering is gaining significant traction. Repowering, which involves upgrading or replacing components of an aging solar array, isn't just about extending the life of an asset; it's a strategic decision aimed at boosting energy output, reducing O&M costs, and enhancing overall profitability in a rapidly evolving energy market. However, determining when to repower, what to replace, and forecasting the ROI requires precise, granular data. This is where solar panel drone inspection, powered by AI automation and solar computer vision, has become an indispensable tool.

The Repowering Imperative: Breathing New Life into Aging Assets

Solar panels, like any technology, experience degradation over time. While most modules are warrantied for 20-25 years, their performance gradually declines. Older panels may also be less efficient than newer models, and their supporting infrastructure might show signs of wear. Repowering aims to address these issues by:

Replacing underperforming or degraded modules: Swapping out old panels for newer, higher-efficiency ones.

Upgrading inverters and balance-of-system (BOS) components: Replacing outdated or undersized inverters, cabling, and switchgear.

Improving structural integrity: Reinforcing or replacing racking, foundations, or correcting ground stability issues.

Implementing advanced controls: Adding smart monitoring and control systems.

The goal is to increase the farm's annual energy production (AEP), reduce operational expenditures, and extend the asset's economic life, effectively giving the solar farm a "second life." The challenge lies in making these significant capital expenditure decisions based on reliable, granular data rather than broad assumptions.

How Drone Data Drives Smart Repowering Decisions

Drone inspection data provides an unparalleled, granular understanding of a solar farm's true health, making it an invaluable input for any repowering assessment:

Comprehensive Baseline & Degradation Assessment:

High-Resolution Visual (RGB) Data: Provides a detailed visual record of physical degradation – delamination, burn marks, snail trails, glass cracks, and even subtle signs of module wear that might not immediately impact performance but indicate long-term issues.

Radiometric Thermal Data: This is crucial. Drones capture precise temperature readings of every cell. Hotspots, bypass diode failures, micro-cracks, and string outages indicate specific performance losses and potential safety hazards. The accumulation of such thermal anomalies over years is a clear sign of systemic degradation.

AI-Powered Quantification: AI automation and solar computer vision algorithms process these vast datasets to automatically quantify degradation at the individual module and string level. They can estimate the precise power loss attributable to each defect, offering a far more accurate picture than traditional string-level IV curve testing alone. This data helps pinpoint underperforming assets that are prime candidates for replacement.

Precise Performance Modeling Input:

Drone-generated defect maps, coupled with quantified power loss estimates, provide critical real-world data to feed into sophisticated energy performance models.

This granular input allows engineers to create highly accurate simulations of future energy yield with and without various repowering scenarios. You can model the exact impact of replacing 10% of modules, upgrading inverters, or correcting specific structural issues.

By understanding the true degraded state of the asset, owners can develop realistic performance expectations for the repowered farm and project its future energy output more accurately.

Identification of Underperforming Assets for Targeted Replacement:

Instead of mass replacement, drone data enables highly targeted repowering. It pinpoints the exact modules or strings that are disproportionately dragging down overall farm performance, allowing for a phased replacement strategy that optimizes capital expenditure.

For example, identifying a particular batch of modules exhibiting severe PID (Potential Induced Degradation) that wasn't captured in early commissioning reports can justify replacing just those specific components.

Structural Integrity Assessment:

Beyond panels, drone technology equipped with photogrammetry or LiDAR can create detailed 3D models of the entire farm. This allows engineers to assess the health of existing racking systems, foundations, and land stability.

Understanding the condition of the existing structure is vital for deciding if it can support new, potentially heavier, high-efficiency modules, or if foundation work is required as part of the repowering effort.

Optimizing New Layouts and Expansions:

For partial repowering or adding capacity, drone data helps analyze existing shading patterns, identify optimal locations for new modules, and assess site constraints. Precise 3D models ensure that new additions integrate seamlessly and maximize energy capture.

For instance, in a humid coastal area like Kollam, Kerala, where vegetation growth might be aggressive, updated drone-based topographical maps can help plan optimized module spacing or improved drainage for new installations.

Warranty Validation for Replacement:

If underperforming modules are still under warranty, comprehensive drone inspection reports provide the irrefutable, geotagged, and time-stamped visual and thermal evidence needed to support warranty claims, reducing replacement costs for the asset owner.

Beyond Repowering: Continuous Performance Modeling

Even if a full repowering isn't immediately on the cards, regular drone inspections provide continuous, granular data that perpetually updates and refines the farm's performance model. This ongoing feedback loop:

Allows O&M teams to make real-time adjustments to maintenance strategies.

Enables more accurate financial forecasting and energy yield predictions for investors and stakeholders.

Supports proactive decision-making, identifying potential repowering needs well in advance.

Integration with Financial and Engineering Models

The true power of drone data for repowering comes from its seamless integration into the financial and engineering models that drive these decisions. Drone platforms often offer APIs or data exports that allow defect lists, performance degradation estimates, and georeferenced maps to be imported into:

Financial Models: To calculate the precise ROI of various repowering scenarios, factoring in new equipment costs, reduced O&M, and increased energy generation.

Engineering Design Software: To simulate new module layouts, inverter configurations, and structural modifications based on real-world site conditions.

Conclusion

As the global solar fleet continues to age, repowering will become an increasingly vital strategy for maintaining profitability and extending the lifespan of these valuable assets. Drone technology, bolstered by sophisticated AI automation and solar computer vision, is transforming repowering from a speculative, capital-intensive gamble into a highly data-driven, optimized investment. By providing unprecedented insights into the true health and performance of every component, drones empower solar asset owners to make smart, strategic decisions that maximize lifetime value, ensuring clean energy continues to flow efficiently for decades to come

0 notes

Text

Remote Radio Heads (RRH) Market 2025-2032

MARKET INSIGHTS

The global Remote Radio Heads (RRH) Market size was valued at US$ 3,840 million in 2024 and is projected to reach US$ 7,290 million by 2032, at a CAGR of 9.4% during the forecast period 2025-2032.

Remote Radio Heads are critical components in modern wireless communication networks, serving as remote transceivers that connect to base station controllers. These devices contain RF circuitry, converters, and processing capabilities to handle signal transmission and reception efficiently. RRHs are fundamental in distributed base station architectures, enabling flexible network deployments with reduced power consumption and improved coverage.

The market growth is driven by the rapid deployment of 5G networks worldwide and increasing demand for high-speed mobile connectivity. While North America currently leads in RRH adoption, Asia-Pacific is expected to witness the fastest growth due to massive 5G infrastructure investments in China, Japan, and South Korea. Key players like Huawei, Nokia, and Samsung are innovating with compact, energy-efficient RRH solutions to meet evolving network requirements. Recent industry developments include the introduction of millimeter-wave RRHs for 5G applications and AI-powered remote management capabilities.

Access Your Free Sample Report Now-https://semiconductorinsight.com/download-sample-report/?product_id=97514

Key Industry Players

Innovation and Global Expansion Drive Competition in RRH Market

The Remote Radio Heads (RRH) market features a moderately consolidated competitive landscape with dominant telecom equipment providers and specialized RF component manufacturers vying for market share. Huawei and Nokia currently lead the market, collectively accounting for over 35% of global RRH revenues in 2024. Their dominance stems from comprehensive 5G infrastructure solutions and strategic partnerships with mobile network operators worldwide.

ZTE Corporation and Samsung emerge as strong contenders, particularly in the Asia-Pacific region, where their localized manufacturing facilities and government telecom contracts provide competitive advantages. These players are accelerating innovations in multi-band RRH configurations to address the complex spectrum requirements of 5G networks.

The market also sees active participation from RF specialists like NXP Semiconductors and Rohde & Schwarz, whose expertise in power amplifiers and signal processing components makes them crucial partners for RRH OEMs. Recent developments include NXP’s gallium nitride (GaN) based RRH power amplifiers, claiming 30% greater efficiency than traditional LDMOS solutions.

Smaller players such as Cambium Networks and Wireless Excellence are carving out niches in enterprise and private network segments by offering cost-effective RRH solutions with simplified deployment features. Their agility in addressing customized requirements presents growing competition to established players.

List of Key Remote Radio Heads (RRH) Companies Profiled

Huawei Technologies Co., Ltd. (China)

Nokia Corporation (Finland)

ZTE Corporation (China)

Samsung Electronics (South Korea)

NXP Semiconductors N.V. (Netherlands)

Rohde & Schwarz GmbH & Co KG (Germany)

KMW Inc. (South Korea)

Wireless Excellence Limited (UK)

Comba Telecom Systems Holdings Ltd. (China)

Cambium Networks Corporation (U.S.)

AW2S SAS (France)

Segment Analysis:

By Type

Transceiver Mode Segment Leads Due to Growing Demand for Enhanced Network Connectivity

The market is segmented based on type into:

By Transceiver Mode

Subtypes: Single Band, Multi Band, and others

By Bandwidth Range

Subtypes: Narrowband, Wideband, and others

Others

By Application

5G Base Station Segment Dominates Due to Rapid 5G Network Rollouts Globally

The market is segmented based on application into:

4G Base Station

5G Base Station

Others

By End User

Telecommunication Providers Lead Due to Infrastructure Expansion Needs

The market is segmented based on end user into:

Telecommunication Providers

Government & Defense

Others

By Power Output

High Power Segment Grows Due to Long-Range Communication Requirements

The market is segmented based on power output into:

Low Power (<1W)

Medium Power (1-10W)

High Power (>10W)

Download Your Complimentary Sample Report-https://semiconductorinsight.com/download-sample-report/?product_id=97514

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Remote Radio Heads (RRH) Market?

-> Remote Radio Heads (RRH) Market size was valued at US$ 3,840 million in 2024 and is projected to reach US$ 7,290 million by 2032, at a CAGR of 9.4% during the forecast period 2025-2032.

Which key companies operate in Global Remote Radio Heads (RRH) Market?

-> Key players include Huawei, Nokia, Samsung, ZTE Corporation, NXP Semiconductors, Rohde and Schwarz, and KMW, among others.

What are the key growth drivers?

-> Key growth drivers include 5G network expansion, increasing mobile data traffic, and government initiatives for smart city development.

Which region dominates the market?

-> Asia-Pacific holds the largest market share (42% in 2024), driven by rapid 5G deployments in China, Japan, and South Korea.

What are the emerging trends?

-> Emerging trends include virtualized RRH architectures, AI-driven network optimization, and energy-efficient designs for sustainable telecom infrastructure.

About Semiconductor Insight

Established in 2016, Semiconductor Insight specializes in providing comprehensive semiconductor industry research and analysis to support businesses in making well-informed decisions within this dynamic and fast-paced sector. From the beginning, we have been committed to delivering in-depth semiconductor market research, identifying key trends, opportunities, and challenges shaping the global semiconductor industry.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

Smart Home Energy Management Device Market Size Driving Sustainability and Efficiency in Modern Homes

The Smart Home Energy Management Device Market Size is experiencing unprecedented growth, fueled by rising energy costs, increased environmental awareness, and widespread adoption of smart home technologies. According to Market Size Research Future, the global market is projected to grow from USD 2.7 billion in 2022 to USD 7.5 billion by 2030, expanding at a robust CAGR of 13.6% during the forecast period (2022–2030). These intelligent systems are emerging as a cornerstone of sustainable living, enabling households to monitor, control, and optimize their energy consumption with ease.

Market Size Overview

Smart home energy management devices (SHEMDs) refer to integrated solutions that allow homeowners to track real-time energy usage, automate appliance operation, and reduce electricity bills. These systems leverage Internet of Things (IoT) technology, wireless connectivity, and AI-driven analytics to manage everything from HVAC units and lighting to electric vehicle charging and solar power storage.

As governments introduce energy efficiency regulations and consumers demand greater control over their energy usage, the market for smart energy management devices is expanding rapidly across developed and emerging regions alike.

Enhanced Market Size Segmentation

To better analyze market dynamics, the Smart Home Energy Management Device Market Size can be segmented by:

By Component:

Hardware

Smart Meters

In-Home Displays

Load Controllers

Smart Thermostats

Software

Energy Analytics

User Interfaces

Control Applications

Services

Consulting

Installation & Integration

Maintenance

By Communication Technology:

Wi-Fi

Zigbee

Bluetooth

Z-Wave

Ethernet

By Application:

Lighting Control

HVAC Control

Energy Storage Management

Appliance Control

Solar Integration

Electric Vehicle Charging

By Region:

North America

Europe

Asia-Pacific

Middle East & Africa

Latin America

Market Size Trends

1. Rise of Energy-Aware Consumers

As consumers become increasingly eco-conscious, demand for smart meters and energy analytics platforms is growing. Users want granular control and insights into their energy usage to make informed decisions.

2. Integration with Renewable Energy

SHEMDs are becoming critical enablers for solar panel systems and residential energy storage units. They help balance loads, forecast usage, and integrate with grid services for energy sharing and trading.

3. Voice Assistant and AI Integration

Integration with voice assistants like Alexa, Google Assistant, and Siri is enhancing user engagement, enabling hands-free control of lights, temperature, and energy-saving modes.

4. Smart Grid Compatibility

These devices support real-time demand response, helping utilities reduce grid pressure during peak hours. The future of grid optimization will depend on millions of households participating via smart energy systems.

5. Rising Home Electrification

With growing adoption of electric vehicles and electric heating systems, smart energy management is crucial to prevent overloading, optimize consumption, and manage charging patterns.

Segment Insights

Hardware Holds the Largest Market Size Share

Smart thermostats, load controllers, and smart meters lead the hardware segment. These devices offer direct control and feedback mechanisms for household energy use and are widely adopted due to falling prices and user-friendly interfaces.

Wi-Fi Leads in Communication Technologies

Wi-Fi remains the dominant connectivity standard due to its compatibility with existing household infrastructure. However, Zigbee and Z-Wave are also gaining traction for their low power consumption and reliability in mesh networking.

HVAC and Lighting Dominate Applications

Heating, ventilation, and air conditioning (HVAC) systems consume a significant portion of residential energy. Smart thermostats and lighting systems that adapt to user behavior and occupancy are in high demand for both convenience and efficiency.

End-User Insights

Residential Sector

The primary driver of market growth, the residential sector is embracing energy management devices for cost savings, carbon footprint reduction, and comfort. Smart homes are evolving into self-regulating ecosystems, optimizing energy usage without human intervention.

Utilities and Energy Providers

Utilities are leveraging SHEMDs to enhance demand-side management programs. By working with customers through smart devices, they can reduce peak load stress and increase grid reliability.

Builders and Developers

Smart energy systems are increasingly integrated into new construction projects. Builders use these devices as a value-added feature, helping differentiate high-performance, sustainable housing.

Key Players

Leading technology firms and energy companies are investing in this growing market. Some key players include:

Schneider Electric SE

Honeywell International Inc.

General Electric Company

Panasonic Corporation

Johnson Controls

Nest Labs (Google LLC)

Eaton Corporation

Siemens AG

LG Electronics

Tata Power

These companies are driving innovation in user interface design, data analytics, and device interoperability, while expanding their global footprints through partnerships and acquisitions.

Future Outlook

The Smart Home Energy Management Device Market Size is at the heart of the global energy transformation. As homes become smarter and more interconnected, energy systems are transitioning from passive infrastructure to intelligent, self-regulating environments.

In the future, we can expect:

Increased interoperability between devices and platforms

Smarter load balancing with AI-based predictions

Participation in decentralized energy trading (peer-to-peer)

Seamless integration with electric vehicle and battery storage systems

With climate change policies accelerating and consumers embracing smart living, the potential for smart energy management in homes is enormous. What was once a luxury is quickly becoming a necessity in modern living.

Trending Report Highlights

Explore additional insights from high-growth technology and energy markets:

Geotechnical Instrumentation and Monitoring Market Size

Smartphone Application Processor Market Size

Hybrid Memory Cube (HMC) and High-Bandwidth Memory (HBM) Market Size

Failure Analysis Market Size

Laser Tracker Market Size

Machine Safety Market Size

GaAs Wafer Market Size

Voice Over Wireless LAN Market Size

Ingestible Sensor Market Size

Environmental Sensor Market Size

Multi-layer Security Market Size

Smart Smoke Detector Market Size

Interaction Sensor Market Size

0 notes

Text

Analyzing the Southeast Asia Smart Thermostat Market: Size, Share, and Growth Projections 2024-2030

MarkNtel Advisors recently published a detailed industry analysis of the Southeast Asia Smart Thermostat Market. The report covers growth trends, regional marketing strategies, challenges, opportunities, and drivers influencing the market.

Insights and Analysis of the Southeast Asia Smart Thermostat Market (2024-2030)

The Southeast Asia Smart Thermostat Market size is valued at USD 275 million in 2023 & is estimated to reach USD 752 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 16.54% during the forecast period, i.e., 2024-30. The factors attributing to the surge in the demand for the smart thermostat are a rising inclination towards energy-conservation & management systems, a growing focus towards economically viable energy solutions, rising home automation, and the development of smart commercial as well as industrial buildings.

Southeast Asia Smart Thermostat Market Driver:

Rising Rate of Smart Home Automation – In recent years, the inhabitants in the region have been inclined towards home automation systems, including smart thermostats, next-generation lighting, etc., since they help in providing remote monitoring, improving security, and enlightening home aesthetics. Based on the survey conducted by the company, almost 77% of consumers across the region have embraced smart home devices to improve their living standards.

Additionally, the number of working professionals in Southeast Asian countries is also increasing. As per the Ministry of Manpower, in 2022, the employment rate in Singapore reached approximately 67.5%, an increase of about 2% to 3% compared to the pre-pandemic period. These working professionals stay approximately 8-10 hours in the office or outdoor location. Therefore, they require solutions, that help them to monitor and operate the home appliances even via their smartphones. Thus, the working population in Southeast Asia is increasingly installing these systems in their residential apartments, enlarging the Southeast Asia Smart Thermostat Market size.

✅In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecast for years 2025 to 2030, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

Access the detailed PDF Sample report – https://www.marknteladvisors.com/query/request-sample/southeast-asia-smart-thermostat-market.html

What segments define the Southeast Asia Smart Thermostat market from 2024 to 2030? How do these segments contribute to market dynamics and growth?

-By Product Type

-Motion Sensor Thermostat- Market Size & Forecast 2019-2030, USD Million

-Geofencing Thermostat- Market Size & Forecast 2019-2030, USD Million

-Learning Algorithm Thermostat- Market Size & Forecast 2019-2030, USD Million

-By Technology

-Wireless- Market Size & Forecast 2019-2030, USD Million

-Bluetooth- Market Size & Forecast 2019-2030, USD Million

-Wi-Fi - Market Size & Forecast 2019-2030, USD Million

-ZigBee - Market Size & Forecast 2019-2030, USD Million

-Z-Wave- Market Size & Forecast 2019-2030, USD Million

-Wired- Market Size & Forecast 2019-2030, USD Million

-By Component

-Sensor- Market Size & Forecast 2019-2030, USD Million

-Temperature Sensor- Market Size & Forecast 2019-2030, USD Million

-Motion Sensors- Market Size & Forecast 2019-2030, USD Million

-Humidity Sensors- Market Size & Forecast 2019-2030, USD Million

-Display- Market Size & Forecast 2019-2030, USD Million

-Others- Market Size & Forecast 2019-2030, USD Million

-By End Users

-Residential - Market Size & Forecast 2019-2030, USD Million

-Industrial- Market Size & Forecast 2019-2030, USD Million

-Commercial- Market Size & Forecast 2019-2030, USD Million

-Hospitality- Market Size & Forecast 2019-2030, USD Million

-Education- Market Size & Forecast 2019-2030, USD Million

-Government - Market Size & Forecast 2019-2030, USD Million

-Healthcare- Market Size & Forecast 2019-2030, USD Million

-Others- Market Size & Forecast 2019-2030, USD Million

-By Demand Type

-New Installation- Market Size & Forecast 2019-2030, USD Million

-Retrofitting- Market Size & Forecast 2019-2030, USD Million

Explore the Complete Southeast Asia Smart Thermostat Market Analysis Report – https://www.marknteladvisors.com/research-library/southeast-asia-smart-thermostat-market.html

-By Country

-Indonesia

-Vietnam

-Malaysia

-Singapore

-Thailand

-The Philippines

-Rest of Southeast Asia

Who are the leading key players shaping the Southeast Asia Smart Thermostat Market landscape?

Honeywell International Inc., Nest Labs, Inc., Johnson Controls International plc, Schneider Electric SE, Emerson Electric Co., Siemens AG, Daikin Industries, Ltd., Carrier Global Corporation, Ecobee, Inc., Resideo Technologies, Inc., and Other

Questions Addressed in this Study

1.What factors are driving the Southeast Asia Smart Thermostat Market growth?

2.What are the key insights into the current trends in the Southeast Asia Smart Thermostat Market?

3.What is the current size of the Southeast Asia Smart Thermostat Market, and how is it projected to change in the future?

4.What is the future outlook for the Southeast Asia Smart Thermostat Market in terms of technological advancements and market expansion?

For a Customized Analysis Report, Just Drop Your Inquiry Here – https://www.marknteladvisors.com/query/request-customization/southeast-asia-smart-thermostat-market.html

“Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.”

Why MarkNtel Advisors?

MarkNtel Advisors is a leading research, consulting, & data analytics firm that provides an extensive range of strategic reports on diverse industry verticals. We deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, & individuals, among others.

Our specialization in niche industries & emerging geographies allows our clients to formulate their strategies in a much more informed way and entail parameters like Go-to-Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing & forecasting, & trend analysis, among others, for 15 diverse industrial verticals.

For Media Inquiries, Please Contact:

Email: [email protected]

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

0 notes

Text

Smart Lamp Market to Witness Exponential Growth by 2032

Allied Market Research, titled, “Smart Lamp Market By Type and Application: Global Opportunity Analysis and Industry Forecast, 2023-2032", The smart lamp market was valued at $4.1 billion in 2022, and is estimated to reach $25.1 billion by 2032, growing at a CAGR of 20.1% from 2023 to 2032.

A smart lamp, also known as a smart light or connected lamp, is a lighting fixture that incorporates advanced technology to offer various features and functionalities beyond traditional lighting. The key defining characteristic of a smart lamp is its ability to connect to a network, typically through Wi-Fi or Bluetooth, and be controlled remotely or automated through a smartphone, tablet, voice commands, or other compatible devices.

Smart lamp offer users the ability to control their lighting remotely through smartphone apps or voice commands. When integrated into a larger smart home ecosystem, users can control not only their lamps but also other connected devices, creating a seamless and convenient way to manage their home environment. Integration with security systems is a significant factor driving demand for smart lamp industry. These lamps can be programmed to simulate occupancy when homeowners are away, deterring potential thieves. They can also be set to turn on or flash during security alerts, providing visual cues for potential threats. Smart lamp can be synchronized with entertainment systems to create immersive lighting experiences. For example, they can change colors and brightness levels to match the mood of music or movies, enhancing the overall entertainment experience at home.

The growth of industry standards and protocols like Zigbee, Z-Wave, and Thread has made it easier for different smart devices, including smart lamps & floor lamps, to communicate and work together seamlessly within a smart ecosystem. This interoperability encourages consumers to invest in multiple smart devices for their homes. As the smart home market continues to expand, competition among manufacturers has led to innovations in smart lamp technology and more affordable options. This has made it increasingly attractive for consumers to integrate smart lamp market demand into their overall smart home setup.

However, smart lamp often collect data about user preferences, usage patterns, and may even have cameras or microphones for features like voice control. The mishandling or unauthorized access to this data can lead to serious privacy concerns. Consumers may hesitate to adopt smart lamp if they fear their personal information will be compromised.

Smart lamp, like any connected device, can be susceptible to hacking attempts. If not properly secured, malicious players could gain access to these devices, potentially disrupting their functionality or using them as entry points to infiltrate the broader network. This risk may deter potential customers. The lack of standardized security protocols in the IoT industry can make it difficult for consumers to assess the security of smart lamps and other devices. Without clear standards and certifications, it is challenging to differentiate between products with robust security measures and those that are less secure.

Smart lamp market growth are equipped with sensors and automation features that adjust lighting levels based on factors like ambient light or movement and time of day. This not only saves energy but also reduces light pollution, making cities more environmentally friendly and cost-effective. Smart lamps integrate with other smart city technologies, such as surveillance cameras and emergency notification systems. They illuminate specific areas when motion is detected, improving safety and security in urban environments.

Smart lamp can be remotely monitored and controlled, allowing cities to proactively address maintenance issues, detect malfunctions, and optimize maintenance schedules. This is expected to lead to reduced operational costs and improved maintenance efficiency. In some urban areas, smart lighting is being used as part of smart city initiatives to improve energy efficiency and reduce operational costs. Smart lamps with remote monitoring and control capabilities play a role in such projects. Smart lamp market demand can be used in conjunction with traffic management systems to adjust lighting levels on roadways based on traffic flow. This not only saves energy but also contributes to smoother traffic flow and reduced congestion. These factors are anticipated to boost the market growth in the upcoming years.

The smart lamp market share is segmented on the basis of type, application, and region. By type, it is classified into incandescents, halogen, compact fluorescents, linear fluorescents, and LEDs. By application, it is classified into residential, commercial, industrial, and outdoor. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the smart lamp market size report include Honeywell International Inc., Syska, Cree Inc., Acuity Brands Inc., Cisco Systems Inc., Deco Lighting Inc., Eaton, Dialight, Koninklijke Philips N.V., and General Electric.

The report offers a comprehensive analysis of the global smart lamps market trends by thoroughly studying different aspects of the market including major segments, market statistics, market dynamics, regional market outlook, investment opportunities, and top players working towards the growth of the market. The report also highlights on the present scenario and upcoming trends & developments that are contributing toward the growth of the market. Moreover, restraints and challenges that hold power to obstruct the market growth are also profiled in the report along with the Porter’s five forces analysis of the market to elucidate factors such as competitive landscape, bargaining power of buyers and suppliers, threats of new players, and emergence of substitutes in the market.

Key Findings of the Study

Based on type, the LEDs segment accounted for a dominant market share in 2022 and is projected to maintain this dominance during the forecast period.

Based on application, the residential sub-segment emerged as the global leader in 2022 and the commercial sub-segment is predicted to show the fastest growth in the upcoming years.

Based on region, North America registered the highest market share in 2022 and Asia-Pacific is projected to be the fastest growing during the forecast period.

0 notes

Text

SiC EPI Wafer Market: Innovations, Applications, and Market Penetration 2025–2032

MARKET INSIGHTS

The global SiC EPI Wafer Market size was valued at US$ 1.89 billion in 2024 and is projected to reach US$ 4.67 billion by 2032, at a CAGR of 12.0% during the forecast period 2025-2032.

Silicon Carbide (SiC) epitaxial wafers are engineered substrates used in high-power and high-frequency semiconductor devices. These wafers are produced through chemical vapor deposition (CVD), a process that creates precise crystalline layers with controlled thickness and doping levels. SiC EPI wafers enable superior performance in power electronics due to their wide bandgap, high thermal conductivity, and excellent breakdown voltage characteristics.

The market is experiencing robust growth due to accelerating adoption in electric vehicles, 5G infrastructure, and renewable energy systems. While 6-inch wafers currently dominate production, industry leaders are transitioning to 8-inch wafers to improve cost efficiencies. Key challenges include yield improvement and defect reduction, however, manufacturers are investing heavily in R&D to address these limitations. Major players like Wolfspeed and II-VI are expanding production capacity to meet the surging demand from automotive and industrial sectors.

MARKET DYNAMICS

MARKET DRIVERS

Electric Vehicle Boom to Accelerate SiC EPI Wafer Demand

The global shift toward electric vehicles (EVs) represents the most significant growth driver for silicon carbide (SiC) epitaxial wafers. Automotive manufacturers increasingly adopt SiC-based power electronics due to their superior performance in high-temperature, high-voltage environments - delivering 50% lower energy losses than silicon alternatives. With EV production projected to exceed 25 million units annually by 2030, tier-1 suppliers are rapidly transitioning to SiC solutions. Major automotive players have already committed to complete electrification, creating unprecedented demand for reliable, high-volume SiC epi wafer supply chains. The inherent material advantages of SiC enable smaller, lighter, and more efficient power modules critical for extending EV range while reducing charging times.

Energy Infrastructure Modernization Creates New Application Frontiers

Growing investments in smart grid technologies and renewable energy systems are generating substantial demand for SiC power devices. Solar inverters utilizing SiC MOSFETs demonstrate 30% higher efficiency than conventional silicon-based solutions, directly translating to improved energy yields. Governments worldwide are implementing aggressive carbon neutrality targets, with renewable energy capacity expected to double within the next decade. This infrastructure expansion requires power electronics capable of handling higher voltages and frequencies - precisely where SiC epi wafers provide distinct advantages. The superior thermal conductivity and breakdown voltage characteristics of SiC make it indispensable for next-generation energy conversion systems.

5G Infrastructure Rollout Demands High-Frequency Capabilities

The ongoing global deployment of 5G networks represents another critical growth vector for SiC epi wafer manufacturers. Base station power amplifiers require materials capable of operating at millimeter-wave frequencies while maintaining thermal stability. SiC's wide bandgap properties enable these demanding performance parameters, with adoption rates in RF power devices growing at 40% annually. Network operators prioritizing energy efficiency increasingly specify SiC-based solutions that reduce power consumption by up to 25% compared to legacy technologies. With over 3 million 5G base stations expected to be operational by 2027, the communications sector is becoming a major consumer of high-quality SiC epitaxial layers.

MARKET RESTRAINTS

High Manufacturing Costs and Yield Challenges Limit Market Penetration

Despite compelling technical advantages, SiC wafer production faces significant cost barriers compared to mature silicon technologies. Crystal growth remains exceptionally demanding, with defect densities directly impacting device yields and reliability. Current 6-inch SiC epi wafer prices remain 5-8 times higher than equivalent silicon wafers, creating adoption resistance in price-sensitive applications. The specialized equipment and controlled environment requirements for defect-free epitaxy contribute substantially to these cost premiums. While economies of scale are gradually improving, the complex thermodynamics of SiC deposition continue to challenge throughput optimization efforts across the industry.

Material Defects Impact Device Performance and Reliability

Crystal imperfections present persistent quality challenges throughout the SiC value chain. Micropipes, basal plane dislocations, and elementary screw dislocations can propagate through epitaxial layers, degrading the performance and longevity of power devices. While recent advancements in substrate preparation and CVD processes have reduced defect densities to < 0.5/cm² for premium wafers, maintaining consistency across production batches remains problematic. These material challenges become particularly acute for high-voltage applications exceeding 1.2kV, where even microscopic defects can cause catastrophic device failures under operational stress.

Limited Manufacturing Expertise Constrains Production Scalability

The specialized nature of SiC epitaxy creates talent bottlenecks that impede rapid capacity expansion. Unlike conventional silicon processing, SiC requires intimate knowledge of high-temperature CVD systems and unique process chemistries. Industry estimates suggest a shortage exceeding 3,000 qualified SiC process engineers globally, slowing new production line commissioning. This skills gap becomes particularly acute for 8-inch wafer transitions, where thermal management and uniformity control demand even more specialized expertise. The resulting human resource constraints add 12-18 months to typical fab qualification timelines, delaying market responsiveness to surging demand.

MARKET OPPORTUNITIES

8-Inch Wafer Transition to Revolutionize Cost Structures

The industry's transition from 6-inch to 8-inch SiC wafers represents perhaps the most significant near-term opportunity for market expansion. Early adopters demonstrate 30-40% die cost reductions through increased substrate utilization efficiency, with projections suggesting 8-inch wafers will dominate production by 2028. Equipment suppliers are rapidly developing specialized epitaxial reactors capable of handling larger diameters while maintaining thickness uniformity below 5% variance. This generational shift will particularly benefit automotive applications, where cost competition intensifies as EV production scales beyond 15% of total vehicle output. Strategic partnerships between substrate suppliers and device manufacturers are accelerating qualification timelines.

Emerging Applications in Aerospace and Defense Sectors

Military and aerospace programs present new high-value opportunities for SiC technology providers. Next-generation radar systems, directed energy weapons, and hybrid-electric propulsion systems all require power electronics capable of extreme environment operation. SiC's inherentradiation hardness and temperature stability make it ideal for these mission-critical applications, where performance outweighs cost considerations. Defense budgets globally are allocating increasing portions to electronics modernization, with SiC content expected to grow 25% annually in these specialized sectors. The ability to operate reliably at junction temperatures exceeding 200°C unlocks previously unattainable system architectures for unmanned platforms and space applications.

Vertical Integration Strategies Create Competitive Advantages

Leading manufacturers are capitalizing on opportunities through comprehensive vertical integration - from substrate production to finished power modules. This approach minimizes quality variability while improving supply chain security amid growing geopolitical tensions. Companies controlling their entire SiC value chain demonstrate 15-20% faster time-to-market for new product introductions and superior yield management capabilities. The strategy proves increasingly valuable as automotive OEMs seek long-term supply agreements with guaranteed quality metrics. Recent industry investments exceeding $4 billion in new SiC fabrication facilities underscore the strategic prioritization of integrated manufacturing ecosystems.

MARKET CHALLENGES

Geopolitical Factors Disrupt Supply Chain Stability

The concentration of critical SiC manufacturing capabilities in specific geographic regions introduces vulnerabilities to trade policies and export controls. Over 70% of substrate production capacity currently resides in just three countries, creating single points of failure for global supply networks. Recent trade restrictions on advanced semiconductor technologies have extended to include specialized SiC processing equipment, complicating capacity expansion plans. These geopolitical realities force manufacturers to develop duplicate supply chains and inventory buffers, adding 10-15% to operational costs while reducing working capital efficiency.

Technology Migration Risks in Transition Period

The industry's concurrent transitions - from 6-inch to 8-inch wafers, from planar to trench device architectures, and from Si IGBT replacement to SiC-native designs - create compounded technology risks. Each migration requires substantial capital investment and carries potential yield ramping challenges that can delay revenue recognition. Fab operators face difficult decisions regarding equipment lifespans, with next-generation epitaxial reactors representing $15-20 million per unit investments. The timing mismatch between technology cycles and automotive qualification schedules (typically 3-5 years) introduces substantial opportunity costs during transition periods.

Intellectual Property Complexities in Emerging Markets

As Chinese manufacturers rapidly expand their SiC production capabilities, concerns regarding IP protection and technology transfer continue escalating. Patent litigation involving crystal growth techniques and epitaxial processes has increased 300% since 2020, reflecting intensifying competition. The specialized nature of SiC manufacturing makes reverse engineering particularly challenging yet simultaneously increases the value of process know-how. These IP conflicts create uncertainty for cross-border collaborations and joint ventures, potentially slowing overall market growth through redundant development efforts and restrictive licensing regimes.

SiC EPI WAFER MARKET TRENDS

Transition to 8-Inch Wafer Production Reshaping Market Dynamics

The silicon carbide (SiC) epitaxial wafer market is undergoing a significant transformation with the gradual shift from 6-inch to 8-inch wafer production. While 6-inch wafers currently dominate over 80% of the market share, major manufacturers are investing heavily in 8-inch capabilities to achieve better economies of scale. This transition is particularly crucial as demand from electric vehicle manufacturers surges, with projections indicating that EV applications will account for nearly 60% of SiC wafer consumption by 2027. However, the transition presents technical challenges in maintaining crystalline quality and defect control at larger diameters, requiring substantial R&D investments from industry players.

Other Trends

Automotive Industry Driving Demand Growth

The rapid adoption of SiC-based power electronics in electric vehicles is creating unprecedented demand for high-quality epi wafers. Automotive applications require exceptionally low defect densities, pushing manufacturers to refine their chemical vapor deposition (CVD) processes. With leading EV makers transitioning their powertrains to 800V architectures, the need for thick epitaxial layers capable of withstanding voltages exceeding 1200V has become particularly acute. This sector's growth is further propelled by government mandates for vehicle electrification, with several major economies targeting 30-50% EV penetration by 2030.

Emerging Applications in 5G Infrastructure

Beyond automotive applications, the rollout of 5G networks worldwide is creating new opportunities for SiC epi wafers in RF power amplifiers and microwave devices. The unique material properties of silicon carbide, including its high thermal conductivity and wide bandgap, make it ideal for base station applications operating at higher frequencies. As telecom operators expand mmWave deployments, the market for high-frequency SiC components is projected to grow at over 25% CAGR through 2030. This emerging application segment is attracting new entrants to the epi wafer market while prompting established players to diversify their product portfolios.

Geographic Shifts in Manufacturing Capacity

The global production landscape for SiC epi wafers is undergoing significant changes, with Asia-Pacific emerging as a major manufacturing hub. While North America and Japan currently lead in technological innovation, China's aggressive investments in domestic SiC production capacity are reshaping market dynamics. Recent analysis indicates Chinese manufacturers could capture over 30% of global SiC wafer supply by 2025, up from less than 15% in 2020. This geographic rebalancing is prompting established players to form strategic partnerships and accelerate their own capacity expansions to maintain competitive positions.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Capacity Expansion Drive Competition in the SiC EPI Wafer Market

The competitive landscape in the silicon carbide (SiC) epitaxial wafer market is moderately consolidated, with established semiconductor leaders dominating alongside emerging regional players. Wolfspeed (formerly Cree) maintains a dominant position, leveraging its vertically integrated production capabilities and technological expertise in wide-bandgap semiconductors. The company accounted for over 30% of global SiC wafer revenue in 2024.

II-VI Advanced Materials and Showa Denko K.K. represent other major competitors, capitalizing on their specialized materials engineering capabilities and strong partnerships with device manufacturers. These leaders are actively expanding 150mm and 200mm wafer production to meet surging electric vehicle demand, with II-VI investing $1 billion in SiC substrate capacity expansion through 2025.

Strategic moves among competitors focus on two key fronts: technology differentiation through defect reduction and thickness control, and supply chain security via long-term agreements with automotive OEMs. For example, STMicroelectronics recently secured a multi-year supply contract worth $890 million with a leading EV manufacturer.

Meanwhile, Chinese players like DongGuan TIAN YU Semiconductor are rapidly gaining market share through aggressive capacity expansions and government-supported R&D initiatives. The competitive intensity is further amplified by new entrants focusing on specialty applications such as 5G infrastructure and military radar systems.

List of Key SiC EPI Wafer Companies Profiled

Wolfspeed, Inc. (U.S.)

II-VI Advanced Materials (U.S.)

Showa Denko K.K. (Japan)

Epiworld International (China)

SK siltron css (South Korea)

Siltronic AG (Germany)

SweGaN AB (Sweden)

GlobalWafer Japan CO.Ltd. (Japan)

DongGuan TIAN YU Semiconductor Technology Co., Ltd. (China)

STMicroelectronics (Switzerland)

Rohm Semiconductor (Japan)

Segment Analysis:

By Type

N-Type SiC EPI Wafers Lead the Market Due to Superior Performance in High-Power Applications

The market is segmented based on type into:

N-Type

P-Type

Others

By Application

Electric Vehicle Segment Dominates Driven by Growing Demand for Efficient Power Electronics

The market is segmented based on application into:

Radar

5G

Electric Vehicle

Solid State Lighting

Others

By Diameter

6-Inch Wafers Currently Dominate While 8-Inch Segment Shows Rapid Growth Potential

The market is segmented based on diameter into:

150mm (6-inch)

200mm (8-inch)

Others

By Technology

CVD Technology Remains Preferred Choice for High-Quality Epitaxial Growth

The market is segmented based on technology into:

Chemical Vapor Deposition (CVD)

Molecular Beam Epitaxy (MBE)

Others

Regional Analysis: SiC EPI Wafer Market

North America The North American SiC EPI wafer market is experiencing rapid growth, driven by strong demand from electric vehicle manufacturers and significant government investments in semiconductor infrastructure. The U.S. accounts for over 80% of the region's market share, with companies like Wolfspeed and II-VI Advanced Materials leading production. The CHIPS Act, providing $52 billion in semiconductor funding, is accelerating domestic SiC wafer capacity expansion. While 6-inch wafers dominate current production, major players are transitioning to 8-inch wafers to meet growing EV power module requirements. Supply chain localization efforts and defense applications (particularly radar systems) further contribute to market expansion.

Europe Europe's SiC EPI wafer market is characterized by strong R&D focus and automotive industry adoption. Germany and Italy are key markets, housing major manufacturers like STMicroelectronics and Siltronic AG. The European Chips Act allocates €43 billion to strengthen semiconductor sovereignty, with significant portions directed toward wide-bandgap materials like SiC. While local production capacity remains limited compared to demand, partnerships between automakers and wafer suppliers are driving innovation in high-performance applications. Environmental regulations favoring energy-efficient power electronics are creating additional growth opportunities, though the market faces challenges from high production costs and dependence on imported raw materials.

Asia-Pacific Asia-Pacific dominates global SiC EPI wafer production and consumption, with China accounting for approximately 40% of regional market share. Rapid EV adoption and government semiconductor self-sufficiency policies are driving unprecedented investment - China's semiconductor fund has committed over $50 billion to SiC-related projects. Japan remains a technology leader through companies like Showa Denko, while South Korea focuses on automotive and 5G applications. Although price sensitivity remains a challenge for widespread adoption, production scale-up and vertical integration strategies by Chinese firms are making SiC more accessible. The region is also leading the transition from 6-inch to 8-inch wafer production, with multiple fabrication facilities coming online by 2025.

South America The South American SiC EPI wafer market is in nascent stages, with Brazil showing the most promising growth potential. Limited local manufacturing exists, creating dependence on imports primarily from North America and Asia. While EV adoption is increasing, particularly in fleet vehicles, infrastructure limitations and economic volatility constrain broader market development. Some progress is evident through technology transfer agreements with international manufacturers, but the region faces challenges in developing a complete SiC value chain. Government incentives for renewable energy projects could drive future demand for SiC-based power electronics, though significant market expansion remains several years away.

Middle East & Africa The Middle East represents an emerging opportunity for SiC EPI wafers, particularly in UAE and Saudi Arabia where investments in smart cities and renewable energy are increasing demand for efficient power electronics. Israel's strong semiconductor design capabilities create specialized demand for high-performance SiC solutions. Africa's market remains largely untapped, though South Africa shows nascent activity in power infrastructure upgrades. While the region currently accounts for less than 2% of global SiC wafer consumption, strategic partnerships with technology providers and local research initiatives could establish foundation for future growth, particularly as EV adoption gradually increases across Middle Eastern markets.

Report Scope