#Valuation Report India

Explore tagged Tumblr posts

Text

THE 10 CHARACTERISTICS OF STARTUP VALUATION

But behind every successful startup there is a careful and strategic allocation of capital that allows the company to grow and flourish. One of the most critical components of this process is startup valuation, which refers to the process of assessing the worth of a startup company.

Stage of development: The stage of development of a startup is a critical factor in determining its valuation. Early-stage startups with little to no revenue are often valued based on their potential and the strength of their team, while later-stage startups with established revenue and customer base are typically valued based on financial performance.

Market potential: Investors look for startups with large market potential. A startup that has the potential to capture a significant share of a growing market will have a higher valuation compared to one with limited market potential.

Intellectual property: Patents, trademarks, and other intellectual property can add value to a startup. Investors will look at the strength and value of a startup’s intellectual property portfolio when determining its valuation.

Financial performance: A startup’s financial performance is a critical factor in determining its valuation. Investors will look at revenue, profitability, and cash flow to assess the startup’s financial health and potential for growth.

Growth prospects: Investors want to see a clear path to growth for startups. Startups with strong growth prospects will have a higher valuation than those with limited potential for growth.

Competition: Investors will look at the competitive landscape of a startup’s industry when determining its valuation. A startup that faces fierce competition may have a lower valuation than one that operates in a less crowded market.

Team: The quality of a startup’s team is crucial in determining its valuation. Investors will assess the experience, expertise, and track record of a startup’s founders and key team members.

Exit strategy: Investors will consider a startup’s exit strategy when determining its valuation. A startup that has a clear plan for an IPO or acquisition will have a higher valuation than one that lacks a clear exit strategy.

Fundraising history: A startup’s fundraising history can impact its valuation. Investors will look at the startup’s previous funding rounds and the valuations at which it raised money.

Risk: Finally, investors will assess the level of risk associated with a startup when determining its valuation. Startups that operate in highly regulated industries or face significant technological or market risks may have a lower valuation compared to those with less risk.

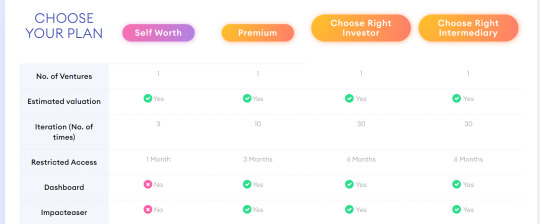

FundTQ is a company that offers a valuation tool subscription to help startups accurately determine their worth. The FundTQ valuation tool is easy to use, with a simple interface that guides you through the valuation process step by step.

Take subscription to know about your business evaluation from India’s first platform where you can know about your business value with FundTQ Valuation process:

Get Valuation for Startups & Business

Email: [email protected] Call us: +91 8750956685

#business#business ideas#businessowner#businesswoman#business valuation#startups#startupideas#startup india#venture capital#angel investor#investment#trending#new ideas#new techniques#new technology#professional valuation reports#startup valuation

0 notes

Text

In fact, far more Asian workers moved to the Americas in the 19th century to make sugar than to build the transcontinental railroad [...]. [T]housands of Chinese migrants were recruited to work [...] on Louisiana’s sugar plantations after the Civil War. [...] Recruited and reviled as "coolies," their presence in sugar production helped justify racial exclusion after the abolition of slavery.

In places where sugar cane is grown, such as Mauritius, Fiji, Hawaii, Guyana, Trinidad and Suriname, there is usually a sizable population of Asians who can trace their ancestry to India, China, Japan, Korea, the Philippines, Indonesia and elsewhere. They are descendants of sugar plantation workers, whose migration and labor embodied the limitations and contradictions of chattel slavery’s slow death in the 19th century. [...]

---

Mass consumption of sugar in industrializing Europe and North America rested on mass production of sugar by enslaved Africans in the colonies. The whip, the market, and the law institutionalized slavery across the Americas, including in the U.S. When the Haitian Revolution erupted in 1791 and Napoleon Bonaparte’s mission to reclaim Saint-Domingue, France’s most prized colony, failed, slaveholding regimes around the world grew alarmed. In response to a series of slave rebellions in its own sugar colonies, especially in Jamaica, the British Empire formally abolished slavery in the 1830s. British emancipation included a payment of £20 million to slave owners, an immense sum of money that British taxpayers made loan payments on until 2015.

Importing indentured labor from Asia emerged as a potential way to maintain the British Empire’s sugar plantation system.

In 1838 John Gladstone, father of future prime minister William E. Gladstone, arranged for the shipment of 396 South Asian workers, bound to five years of indentured labor, to his sugar estates in British Guiana. The experiment with “Gladstone coolies,” as those workers came to be known, inaugurated [...] “a new system of [...] [indentured servitude],” which would endure for nearly a century. [...]

---

Bonaparte [...] agreed to sell France's claims [...] to the U.S. [...] in 1803, in [...] the Louisiana Purchase. Plantation owners who escaped Saint-Domingue [Haiti] with their enslaved workers helped establish a booming sugar industry in southern Louisiana. On huge plantations surrounding New Orleans, home of the largest slave market in the antebellum South, sugar production took off in the first half of the 19th century. By 1853, Louisiana was producing nearly 25% of all exportable sugar in the world. [...] On the eve of the Civil War, Louisiana’s sugar industry was valued at US$200 million. More than half of that figure represented the valuation of the ownership of human beings – Black people who did the backbreaking labor [...]. By the war’s end, approximately $193 million of the sugar industry’s prewar value had vanished.

Desperate to regain power and authority after the war, Louisiana’s wealthiest planters studied and learned from their Caribbean counterparts. They, too, looked to Asian workers for their salvation, fantasizing that so-called “coolies” [...].

Thousands of Chinese workers landed in Louisiana between 1866 and 1870, recruited from the Caribbean, China and California. Bound to multiyear contracts, they symbolized Louisiana planters’ racial hope [...].

To great fanfare, Louisiana’s wealthiest planters spent thousands of dollars to recruit gangs of Chinese workers. When 140 Chinese laborers arrived on Millaudon plantation near New Orleans on July 4, 1870, at a cost of about $10,000 in recruitment fees, the New Orleans Times reported that they were “young, athletic, intelligent, sober and cleanly” and superior to “the vast majority of our African population.” [...] But [...] [w]hen they heard that other workers earned more, they demanded the same. When planters refused, they ran away. The Chinese recruits, the Planters’ Banner observed in 1871, were “fond of changing about, run away worse than [Black people], and … leave as soon as anybody offers them higher wages.”

When Congress debated excluding the Chinese from the United States in 1882, Rep. Horace F. Page of California argued that the United States could not allow the entry of “millions of cooly slaves and serfs.” That racial reasoning would justify a long series of anti-Asian laws and policies on immigration and naturalization for nearly a century.

---

All text above by: Moon-Ho Jung. "Making sugar, making 'coolies': Chinese laborers toiled alongside Black workers on 19th-century Louisiana plantations". The Conversation. 13 January 2022. [All bold emphasis and some paragraph breaks/contractions added by me.]

#abolition#tidalectics#caribbean#ecology#multispecies#imperial#colonial#plantation#landscape#indigenous#intimacies of four continents#geographic imaginaries#indigenous pedagogies#black methodologies

464 notes

·

View notes

Text

Document Required For Property Valuation

When it comes to property valuation, having the right documents is crucial. Our comprehensive checklist outlines all the necessary documents, which may vary depending on the type of property and the purpose of the valuation. Whether you're dealing with land, agricultural land, a house or flat, or an office building, you can find specific document requirements tailored to each type.

Moreover, we specialize in providing government-approved valuers' reports for properties across India. Our expert team ensures that every valuation is backed by accurate and certified documentation, giving you the confidence and assurance you need for all your property-related decisions.

Contact Us:+91 97263 65800

2 notes

·

View notes

Text

Importance Of Home Inspections: What To Look For And Why

When it comes to buying or selling a property, home inspections play a crucial role in the process. Whether you are a buyer or a seller, understanding the importance of home inspections and what to look for can save you from potential headaches and financial losses down the line.

In this article, we will explore the significance of home inspections, discuss key factors to consider during the inspection, and delve into why it matters in the context of property valuation, home security, and the evolving real estate market.

Home Inspections

Home inspections are thorough examinations of a property's condition, conducted by professional inspectors. These inspections aim to identify any underlying issues, defects, or safety concerns that may exist within the structure.

For buyers, a home inspection provides valuable insights into the property's overall condition, helping them make an informed decision before making a substantial investment.

For sellers, it offers an opportunity to address any potential problems in advance, which can increase the marketability and value of the property.

Property Valuation

Property valuation is a critical aspect of any real estate transaction. A comprehensive home inspection can significantly impact the valuation process. By identifying any defects or issues, home inspections provide an accurate assessment of a property's true worth.

Potential buyers can negotiate based on the findings, and sellers can take necessary actions to rectify any problems, thus improving the property's value.

In the dynamic real estate market in India, where property prices are influenced by various factors, a home inspection helps both parties arrive at a fair and transparent price.

Home Inspection Services

Engaging professional home inspection services is essential to ensure a thorough evaluation of a property. Certified home inspectors possess the knowledge, expertise, and tools required to identify hidden issues that may not be apparent to the untrained eye.

They meticulously examine the structure, electrical systems, plumbing, HVAC (heating, ventilation, and air conditioning) systems, roofing, foundation, and other critical components of a house.

By doing so, they provide buyers with a comprehensive report that outlines the condition of the property and any potential concerns that need to be addressed.

Home Security

Home security is another vital aspect to consider when it comes to the importance of home inspections. Inspections encompass evaluating the safety features of a property, such as the functionality of smoke detectors, carbon monoxide detectors, fire extinguishers, and security systems.

Ensuring that these features are in good working order is crucial for the safety and well-being of the occupants. A home inspection can identify any security vulnerabilities and provide recommendations for enhancing the overall security of the property, giving homeowners peace of mind.

With the rapid advancement of technology, the concept of smart homes has gained popularity in recent years. Smart homes are equipped with intelligent systems that automate and control various aspects of the property, including lighting, temperature, security, and entertainment.

During a home inspection, it is important to evaluate the functionality and integration of these smart systems. Inspectors can verify if these technologies are working as intended and provide recommendations for maintenance or upgrades, ensuring that the home remains efficient and up to date with the latest advancements.

At present, many prominent real estate properties in Mumbai are offering smart homes. And implementation is also in progress in premium flats in Chennai, Bangalore, Pune, and many other cities.

Conclusion

Home inspections are of utmost importance when it comes to buying or selling a property. They provide crucial information about the condition of the property, enabling buyers and sellers to make informed decisions. By considering factors such as property valuation, home security, and the increasing prevalence of smart homes, home inspections serve as a safeguard against potential risks and ensure a smooth and secure real estate transaction.

Engaging the services of certified home inspectors is key to obtaining accurate and comprehensive reports, which ultimately contribute to the overall success and satisfaction of both buyers and sellers.

#home staging#modern home#real estate technology#real estate#property management#home inspection#home inspector#home security#property in noida#mumbai#bengaluru

10 notes

·

View notes

Text

Organic Acid Market Potential Growth, Share, Demand And Analysis Of Key Players- Analysis Forecasts To 2032

In 2022, it is anticipated that the organic acids market will reach US$ 11.3 billion. The market for organic acid is expected to reach US$ 18.8 Bn by 2032, growing at a constant CAGR of 5.3% throughout the projected period.

Market prospects are anticipated to be favorable due to the expanding use of organic acids in the food and beverage industry. In addition, during the course of the projection period, there will be chances for market expansion due to the rising demand for organic acid alternatives.

These acids have multiple applications in animal feed industry to inhibit bacterial growth and provide hosts with nutritional content. They are used in cosmetics to get rid of dead cells and nourish skin. Owing to these factors, demand for organic acids is expected to rise in the forthcoming years.

To remain ‘ahead’ of your competitors, request for @ https://www.futuremarketinsights.com/reports/sample/rep-gb-159

Consumers are adopting a healthy lifestyle and are conscious about the intake of any products that contain chemical ingredients which be harsh on their skin or cause any side effects because of daily consumption.

Consumer preference for brands that are offering organic products without harmful chemical additives is expected to influence the demand for organic acids. To fulfil rising consumer demand for natural products, manufacturers are developing technologies and clean label products that do not cause any harm to environment and human health.

Asia Pacific is expected to witness surge in demand for organic acids due to less stringent policies. North America is expected to be the hub for manufacturing and export of different organic acids due to easy availability of infrastructure and technical know-how.

“Growing preference for clean label products across the food & beverage sector, coupled with increasing incorporation of organic acids in animal feed will steer growth in the market over the forecast period,” says an FMI analyst.

Key Takeaways:

The organic acid market is expected to grow at CAGR of 5.2% and 4.2% in North America and the Latin America, respectively, through 2032.

Asia Pacific is expected to account for 30% of the total organic acid market share share.

The Europe organic acid market is expected to reach a valuation of US$ 4.5 Bn over the forecast period.

Total sales in the U.S. organic acids market will reach a valuation of US$ 2.1 Bn in 2022.

The India organic acid market valuation will total US$ 1.07 Bn in 2022.

By application, sales in the poultry and farming segment are projected to account for 30% of the total market share.

Based on product type, demand for citric acid will continue gaining traction.

Competitive Landscape

Key organic acid manufacturers are focusing on research & development to offer various products with no chemical additives. Key players are collaborating and developing new products to penetrate untapped markets. For instance:

Eastman Chemical Company announced the acquisition of 3F Feed & Food, a European pioneer in the commercial and technical producer of livestock feed and human food additives. 3F’s operations and assets, which are based in Spain, will improve and support Eastman’s animal nutrition industry’s sustained future demand and will be integrated into the company’s Additives & Functional Products division.

Explore More Valuable Insights

Future Market Insights, in its new report, offers an impartial analysis of the global reduced fat butter market, presenting historical data (2017-2021) and estimation statistics for the forecast period of 2022-2032.

The study offers compelling insights based on Product Type (Lactic Acid, Formic Acid, Acetic Acid, Citric Acid, Propionic Acid, Ascorbic Acid, Gluconic Acid, Fumaric Acid), Application (Poultry and Farming, Pharmaceuticals, Industrial, Food & Beverages)Region (North America, Latin America, Europe, East Asia, South Asia, Oceania, MEA).

Frequently Asked Questions

How much is the global organic acid market worth?

What is the demand outlook forecast for the organic acid market?

At what rate did the demand for organic acid grow between 2027 to 2021?

At what rate will organic acid demand grow in Europe?

What is the North America organic acid market outlook?

Empower your business strategy with our comprehensive report on the organic acid market@ https://www.futuremarketinsights.com/reports/global-organic-acids-market

2 notes

·

View notes

Text

What Is The Trend Among Indian CFA Applicants?

The number of Indian candidates applying for the Chartered Financial Analyst cfa level 1 exams has increased, which can only be described as an emerging trend.

Right now, India positions third with the most number of competitors taking the test. In June 2022, the cfa institute reported that 14,776 candidates appeared from India, China, and the United States. The worldwide number was 71,914.

CFA test in India

Specialists in the business accept that the pattern is a consequence of the development found in the Indian economy. The nation has turned into a trustworthy speculation objective guaranteeing an expansion in venture experts.

The CFA Sanction expects contender to breeze through three test levels, have a work insight of something like four years in ventures, and focus on the set of principles in proficient lead. Following this, competitors are supposed to apply to a CFA Foundation Society and become an individual from the famous CFA Establishment.

The program educational plan tests abilities and information expected in the venture business. Considering that the worldwide market is changing at an exceptional speed, the CFA test guarantees premium expert lead, moral norms, and global fiscal summary examination. The Level I test especially tests competitors on their capacity to associate their hypothetical comprehension with training. They must demonstrate their capacity for real-time analysis of the investment industry. Other significant ideas incorporate corporate money, abundance the executives, portfolio examination, protections investigation and valuation, financial aspects and quantitative techniques.

Candidates typically need more than three years to successfully complete the CFA Program. Each of the three levels requires determination and a commitment to at least 300 hours of study.

The CFA tests are held across the world in excess of 70 urban communities in December and north of 170 urban areas in the long stretch of June. Test centers are assigned to candidates based on where they prefer to be.

India’s metropolitan areas of New Delhi, Bengaluru, Mumbai, and Kolkata saw the greatest number of Level 1 test takers in 2022.

IndigoLearn is among the global leaders in international training for CPA, CFA,CMA, ACCA, Data Science & Analytics. It has helped over 500,000 professionals across the globe. With IndigoLearn, 9 out of 10 students pass their exams.

Article Source: cfa preparation

#cfa level 1#cfa institute#cfa institute india#cfa program#cfa qualifications#cfa level 1 cost#cfa preparation#cfa online

2 notes

·

View notes

Text

Outlook 2023, BONDS is the place to be.

OUTLOOK 2023,

BONDS IS THE PLACE TO BE.

BY

SHREY BHOOTRA

STANDARD 7th

SCHOOL – THE BISHOPS SCHOOL CAMP, PUNE.

INTRODUCTION.

In this paper I will be talking about the outlook of 2023 and why this year bonds are a safer and better bet compared to equities.

1. Indian stock market lags behind its global peers in 2023.

The Indian stock market, which had been a star performer in 2022 despite global headwinds, has been lagging behind its global peers since the start of 2023. The domestic benchmark indices, the Sensex and Nifty 50 gave a return of 5.78% and 4.33% in the calendar year 2022 respectively. Since the start of calendar year 2023 the Nifty 50 index has gone down from 18,197 to 17,567, while the Sensex has gone down from 61,167 to 59,745 which means they have both gone down by 4.47% and 2.33% already! The markets in 2023 started the year well before facing challenges as the month went on. The underperformance has been attributed to a range of factors, including continuous selling of FPIs, the reopening of the Chinese economy, the sell-off in the Adani group stocks and the depreciation of the Indian Rupee. On January 25th the Nifty 50 and Sensex tumbled 1.25% and 1.27% respectively, a day after the Hindenburg released a report alleging the Adani Group of certain accusations, on the following day the two indices lost another 1.61% and 1.45% in value, taking the cumulative loss to 2.83% and 2.70% in just two trading sessions. The banking stocks which had given loans to the Adani group of companies also took a brunt on concerns over the debt exposure to the Adani group, the Banking sector which had been the driving force behind the index growth over the past few years was now facing headwinds causing the Nifty 50 to underperform. According to the PTI report foreign investors pulled out Rs 28,852 crores from equities in the month of January 2023, making it the worst outflow since June 2022. This came following a net investment of Rs 11,119 crore is December 2022 and Rs36,238 crore in November. The Indian Rupee started January 2023 on a strong note, strengthening 1.60% in the first three weeks, however it gave up its gains as the month progressed and ended January with a fall of 1.18% at 81.73 against the US Dollar. The Indian Rupee ended 2022 as the worst performing currency with a fall 11.3%, its biggest annual decline since 2013. In December 2022 the global brokerage Goldman Sachs said that India is likely to underperform its peers in 2023 due to expensive valuations. The Indian market had been a strong outperformer in 2022 due to stronger domestic fundamentals, but valuations have turned expensive compared to global peers. Another cause for the equity markets not performing well is inflation, inflation in the month of January 2023 in India was 6.52% compared to 5.72% in the month of December 2022, when inflation is high it reduces the purchasing power of common households thus also having a negative effect on the equity markets. The main cause of rise in inflation in India is because of food inflation, the CPI food index rose to 5.9% in January 2023 from 4.2% in December 2022.

2. Why are bonds the place to invest in 2023.

Since the equity markets have not been performing well since the start of the year, bonds are the next best place to invest, retail investors, DIIs and FIIs have been pulling money out of the market and have been investing in bonds. Since bonds provide a predictable income stream and have stable returns and have a lower risk people prefer to invest in bonds this year over equities. The US one year bond yield is currently at 5.0541%.

- SHREY BHOOTRA

23.3.23

2 notes

·

View notes

Text

What is the valuation of goodwill by Sapient Services?

Goodwill is an intangible asset that arises when a company is purchased for a price that is higher than the sum of its individual assets and liabilities. In other words, goodwill represents the value of the "good name" and reputation of a business, as well as any other intangible assets that are not reflected in the balance sheet. The valuation of goodwill in India is important for a number of reasons, including financial reporting, tax planning, and mergers and acquisitions.

Visit: Hire the best business valuation specialist in Mumbai

Methods of Valuation of Goodwill: Sapient Services

- There are several methods that can be used to value goodwill, including the income approach, the market approach, and the asset approach.

The income approach involves estimating the future economic benefits that are expected to arise from the acquisition of a business. This is typically done by forecasting the future cash flows that are expected to be generated by the business and then discounting these cash flows back to their present value. The present value of the expected future cash flows is then used to estimate the value of the goodwill.

The market approach involves comparing the business being valued to similar businesses that have been recently sold in the market. This method relies on the principle of "comparable worth," which suggests that businesses with similar characteristics should have similar values. The value of the goodwill is then determined by adjusting the value of the comparable business for any differences in size, location, and other relevant factors.

The asset approach involves valuing the individual assets and liabilities of a business and then subtracting the liabilities from the assets to arrive at the value of the goodwill. This method is generally used when the income and market approaches are not applicable or when the business being valued has a large number of intangible assets.

There are a number of factors that can affect the value of goodwill, including the stability and growth prospects of the business, the strength of its brand and reputation, the quality of its management team, and the condition of the industry in which it operates.

There are several benefits to valuing Goodwill:

Mergers and Acquisitions: Valuation of goodwill is important when a company is considering merging with or acquiring another company. The value of the goodwill can help determine the overall value of the company and how much the acquiring company should pay for it.

Internal Decision-Making: Valuing goodwill can help a company make internal decisions, such as how to allocate resources and whether to divest certain assets.

Financial Reporting: Goodwill is recorded on a company's balance sheet and must be periodically reviewed and tested for impairment. Valuation of goodwill is necessary for this process and helps ensure that the company's financial statements are accurate.

Taxation: In some cases, the value of goodwill can affect a company's tax liability. For example, if a company sells a division with significant goodwill, the sale may result in a large capital gain or loss that could affect the company's tax bill.

Overall, the valuation of goodwill is important for understanding the overall value of a company and for making informed business decisions.

Few ways in which Goodwill can be important in a Business:

Brand recognition: A strong brand and reputation can help a business to attract and retain customers, which can lead to increased sales and profits. Goodwill can be a key driver of brand recognition, as it reflects the value of the "good name" and reputation of the business.

Customer loyalty: Goodwill can also help to build customer loyalty, as customers are more likely to continue doing business with a company that they perceive as trustworthy and reliable.

Competitive advantage: Goodwill can also give a business a competitive advantage in the market. For example, if a company has a strong brand and reputation, it may be able to charge a premium price for its products or services.

Improved valuation: Goodwill can also have an impact on the valuation of a business. If a company has a strong brand and reputation, it may be valued at a higher price when it is sold or when it raises capital.

Goodwill is an important factor in a business's overall value and can have a significant impact on the financial performance of the company. It is often considered to be a key intangible asset that contributes to the success of the business.

About Sapient Services

We educate clients in all perspectives regarding finance and our skill lies in the space of obligation, value and exchange warning. The firm lays major areas of strength for proficient authority and has a top to bottom comprehension of key business drivers.

Our administration succeeds in area information, and capital partnership options with astounding exchange execution capacities and has laid out a network with driving confidential value reserves, banks and monetary organizations and valuation of goodwill in India.

We offer free guidance on obligation and capital raising, consolidations and securing, monetary recreating, valuation and an expected level of investment for our clients.

4 notes

·

View notes

Text

Does Mutual Fund Software in India Help with Investor Tax-Planning?

The tax package is a feature that combines reports like valuation, dividend reports, realized capital gains reports, and FY summaries. This comprehensive report on mutual fund software in India can help investors in tax planning. They can share this report in PDF or Excel format directly to CAs. For more information, visit https://www.redvisiontechnologies.com/

#mutual fund software#mutual fund software for distributors#mutual fund software for ifa#mutual fund software in india#top mutual fund software in india#best mutual fund software in india#mutual fund software for distributors in india#wealth management software in india#best mutual fund software for ifa in india#top mutual fund software for distributors in india

0 notes

Text

Understanding Actuarial Valuation and End of Service Benefits

Introduction

In today’s corporate landscape, financial planning plays a crucial role in ensuring stability and compliance with regulatory standards. One of the key aspects of financial management for organizations is actuarial valuation, particularly for end of service benefits. These calculations help businesses determine their future liabilities, ensuring they set aside adequate funds to meet employee benefits obligations.

In this blog, we will explore the significance of actuarial valuation, its role in managing end of service benefits, and why businesses should prioritize accurate financial planning.

What is Actuarial Valuation?

Actuarial valuation is a statistical and mathematical method used to assess an organization's financial liabilities related to employee benefits. It is primarily used to estimate the present and future obligations of employee benefits such as gratuity, pensions, leave encashment, and other long-term benefits.

Key Objectives of Actuarial Valuation:

Determine Liabilities – Helps organizations understand their financial commitment to employees.

Compliance with Accounting Standards – Ensures businesses comply with IAS 19 (International Accounting Standard 19), AS 15 (Accounting Standard 15), and Ind AS 19 (Indian Accounting Standard 19).

Financial Planning – Assists in long-term financial stability and resource allocation.

Regulatory Compliance – Essential for companies operating in countries with mandatory gratuity or pension laws.

Actuarial valuation is conducted by professional actuaries who use complex statistical models and risk assessment tools to estimate future payouts.

Understanding End of Service Benefits (EOSB)

End of service benefits (EOSB) are financial compensations that employees receive upon completing their tenure in an organization. These benefits vary depending on the country’s labor laws and company policies.

Types of End of Service Benefits:

Gratuity – A lump sum payment made to employees upon resignation, retirement, or termination.

Pension Funds – Monthly payments provided to retired employees.

Severance Pay – Compensation given to employees in case of layoffs or termination.

Leave Encashment – Unused paid leaves converted into cash benefits.

Provident Fund Contributions – Accumulated savings from employee and employer contributions.

Many companies in regions like the Middle East, India, and other parts of Asia have mandatory end-of-service benefits, making actuarial valuation essential.

Why is Actuarial Valuation Essential for End of Service Benefits?

Organizations that provide gratuity, pension, or long-term benefits must conduct actuarial valuation to determine their financial liability. Without proper planning, companies risk financial strain when these benefits become due.

Benefits of Actuarial Valuation for EOSB:

✔️ Accurate Liability Estimation – Ensures businesses allocate the right amount of funds. ✔️ Regulatory Compliance – Helps in fulfilling labor law requirements. ✔️ Risk Management – Prevents financial crises by forecasting future payouts. ✔️ Transparency in Financial Statements – Builds investor and employee confidence.

How is Actuarial Valuation for End of Service Benefits Conducted?

Data Collection – Employee demographics, salary details, and tenure information are gathered.

Assumption Setting – Factors like mortality rates, salary growth, and attrition rates are considered.

Calculations Using Actuarial Methods – The Projected Unit Credit (PUC) Method is commonly used.

Report Generation – Findings are documented in compliance with accounting standards.

Actuarial Valuation & End of Service Benefits in Compliance with Accounting Standards

To ensure global acceptance and financial accuracy, companies follow these accounting standards when performing actuarial valuation:

IAS 19 – International Accounting Standard for Employee Benefits.

Ind AS 19 – Indian Accounting Standard for Employee Benefits.

AS 15 – Indian GAAP Standard for Employee Benefits.

IFRS – International Financial Reporting Standards for financial statements.

Non-compliance with these standards can lead to financial penalties, incorrect reporting, and legal complications.

How Mithras Consultants Can Help?

Mithras Consultants specializes in actuarial valuation and end-of-service benefits calculation, ensuring compliance with global accounting standards. Their services include:

✅ Actuarial Valuation for Gratuity, Pension, and Leave Encashment ✅ Comprehensive EOSB Calculation & Forecasting ✅ IFRS & IAS 19 Compliant Reporting ✅ Expert Advisory for Financial Risk Management

For accurate actuarial valuation and expert guidance on end of service benefits, visit: 🔗 Mithras Consultants - Actuarial Valuation 🔗 Mithras Consultants - End of Service Benefit

Conclusion

Actuarial valuation is a critical financial process for companies providing end of service benefits like gratuity, pension, and severance pay. It ensures financial stability, compliance, and accurate forecasting of liabilities. Organizations that conduct regular actuarial valuations can efficiently plan their employee benefits strategy and avoid financial risks.

If your company needs professional actuarial valuation services, trust Mithras Consultants for accurate calculations and compliance solutions.

0 notes

Text

Take Your Pitch to the Next Level with FundTQ Deck Makers

As an entrepreneur or business owner, you know that one of the most important things you can do is keep track of your company's valuation.

After all, your company's value is a key factor in securing funding, attracting investors, and making informed business decisions. But how do you determine your company's true value? That's where FundTQ comes in.

FundTQ is a company that provides valuation services for startups and businesses. With FundTQ, you can rest assured that your company is being accurately assessed for its true value.

Here's why FundTQ is the perfect choice for your valuation needs:

Expertise: FundTQ's team of experienced professionals has a wealth of knowledge in the valuation industry.

Customized Approach: FundTQ understands that every company is unique, and therefore requires a customized approach to valuation.

Transparency: FundTQ is committed to transparency in all aspects of their valuation process.

Fair and Accurate Valuation: FundTQ uses a rigorous valuation process that takes into account all relevant factors, including financial data, market trends, and industry benchmarks.

Overall, FundTQ is the perfect choice for businesses and startups looking for an accurate and reliable valuation. Their expertise, customized approach, transparency, and commitment to fairness and accuracy make them the ideal partner for any company looking to understand their true value.

Don't hesitate to reach out to FundTQ to learn more about their valuation services today!

Email: [email protected] Call us: +91 8750956685

#pitch book#pitch deck#investment#investments#investingtips#venture capital#business valuation#right valuation#valuation in 10 mins#professional valuation reports#funding#valuationsoftware#businesswoman#entrepreneur#entreprenuership#entreprenuerlife#startup india

0 notes

Text

Air Cushion Packaging Market Analysis: Expected Growth Over 5% CAGR (2021-2027)

Astute Analytica, a prominent market research firm, has recently published a comprehensive report that offers an extensive analysis of the global Air Cushion Packaging market. This report goes beyond mere statistics, providing deep insights into various critical aspects such as market segmentation, key players, market valuation, and regional overviews. It serves as a valuable resource for businesses and stakeholders seeking to navigate this evolving industry landscape.

The Global Air Cushion Packaging Market forecasts a CAGR of more than 5% during the forecast period 2021-2027

Market Valuation

The report includes a thorough evaluation of the market valuation, drawing from historical data, current trends, and future projections. By employing rigorous analytical methods, it effectively captures the growth trajectory of the market. This detailed assessment allows businesses to understand the factors driving growth and make informed decisions regarding investments and strategic initiatives.

A Request of this Sample PDF File@- https://www.astuteanalytica.com/request-sample/air-cushion-packaging-market

Comprehensive Market Overview

Astute Analytica's report provides a holistic overview of the global Air Cushion Packaging market. It encapsulates a wide array of information related to market dynamics, including growth drivers, challenges, and opportunities. Stakeholders can leverage these insights to formulate effective strategies and maintain a competitive edge in the market.

Key Players in the Market

The report identifies and profiles the major players who are influencing the global Air Cushion Packaging market. Through meticulous research, it presents a clear view of the competitive landscape, detailing the strategies, market presence, and significant developments of leading companies. This section is vital for stakeholders who wish to understand the positioning and actions of their competitors.

Key Companies:

Several key industry participants of the air cushion packaging market include Sealed Air Corp, Abriso N.V., Shandong Xinniu, Pregis, 3G Packaging Corp., and Atlantic Packaging.

For Purchase Enquiry: https://www.astuteanalytica.com/industry-report/air-cushion-packaging-market

Segmentation Analysis

A crucial component of the report is the segmentation analysis, which delves into various market segments based on industry verticals, applications, and geographic regions. This detailed examination provides stakeholders with a nuanced understanding of market dynamics, enabling them to identify opportunities for growth and areas for investment.

Market Segmentation:

By Form

Air Tubes

Air Bubble

Air Pillows

Air Bags

By Function

Void Fill

Blocking & Bracing

Wrapping

Edge Protection

Cushioning

Others

By Color

Green

White

Blue

By End-User

Consumer Electronics

E-commerce

FMCG Manufacturing

Home Furnishing

Logistics (Transport, Shipping, and Warehousing)

Personal Care & Cosmetics

Pharmaceuticals

Retail

Others

By Region

North America

The U.S.

Canada

Mexico

Europe

Eastern Europe

Russia

Poland

Rest of Eastern Europe

Western Europe

The UK

Germany

France

Italy

Spain

Rest of Western Europe

Asia Pacific

China

India

Japan

ASEAN

Malaysia

Indonesia

Thailand

Philippines

Vietnam

Rest of ASEAN

Australia & New Zealand

Rest of Asia Pacific

Middle East & Africa (MEA)

UAE

Saudi Arabia

Qatar

South Africa

Egypt

Rest of MEA

South America

Brazil

Argentina

Rest of South America

Research Methodology

Astute Analytica is recognized for its rigorous research methodology and dedication to delivering actionable insights. The firm has rapidly established a solid reputation by providing tangible outcomes to clients. The report is built on a foundation of both primary and secondary research, offering a granular perspective on market demand and business environments across various segments.

Beneficiaries of the Report

The insights presented in this report are invaluable for a range of stakeholders, including:

Industry Value Chain Participants: Those directly or indirectly involved in the Air Cushion Packaging market need to stay informed about leading competitors and current market trends.

Analysts and Suppliers: Individuals seeking up-to-date insights into this dynamic market will find the report particularly beneficial.

Competitors: Companies looking to benchmark their performance and assess their market positions can leverage the data and analysis provided in this research.

Astute Analytica's report on the global Air Cushion Packaging market is an essential resource that empowers stakeholders with the knowledge needed to navigate and thrive in this competitive landscape.

Download Sample PDF Report@- https://www.astuteanalytica.com/request-sample/air-cushion-packaging-market

About Astute Analytica:

Astute Analytica is a global analytics and advisory company that has built a solid reputation in a short period, thanks to the tangible outcomes we have delivered to our clients. We pride ourselves in generating unparalleled, in-depth, and uncannily accurate estimates and projections for our very demanding clients spread across different verticals. We have a long list of satisfied and repeat clients from a wide spectrum including technology, healthcare, chemicals, semiconductors, FMCG, and many more. These happy customers come to us from all across the globe.

They are able to make well-calibrated decisions and leverage highly lucrative opportunities while surmounting the fierce challenges all because we analyse for them the complex business environment, segment-wise existing and emerging possibilities, technology formations, growth estimates, and even the strategic choices available. In short, a complete package. All this is possible because we have a highly qualified, competent, and experienced team of professionals comprising business analysts, economists, consultants, and technology experts. In our list of priorities, you-our patron-come at the top. You can be sure of the best cost-effective, value-added package from us, should you decide to engage with us.

Get in touch with us

Phone number: +18884296757

Email: [email protected]

Visit our website: https://www.astuteanalytica.com/

LinkedIn | Twitter | YouTube | Facebook | Pinterest

0 notes

Text

Revolutionizing Healthcare: Long-Term Care Software Market Surges, Projected to Exceed USD 10.9 Billion by 2032

The long-term care software market is expected to reach a significant USD 3,877 million in 2022 and is expected to increase significantly. An even more optimistic picture is painted by projections for 2032, when the expected valuation is expected to surpass USD 10,988 million, representing an outstanding CAGR of 11% for the projected period (2022-2032). This increase reflects a paradigm change in healthcare administration as more and more facilities use advanced software to improve the effectiveness and caliber of long-term care services.

Various government initiatives across the globe to curtail the increasing healthcare cost is the factor which is fueling the growth of the long-term care software market.

To Get Sample Copy of Report Visit: https://www.futuremarketinsights.com/reports/sample/rep-gb-6184

Multiple applications of long-term care software such as the long-term care software analyze millions of data records and quickly spot potential issues before they become problems, and it enables mental health providers to manage remote patient video conferencing, scheduling, and messaging are playing a crucial role in the rapid adoption of long-term care software.

Global Long-term Care Software Market: Drivers and Challenges

Drivers

The digitalization in healthcare technology is the primary factor which is driving the growth of long-term care software market. Also, changing healthcare infrastructure, shortage of medical staff and adoption of technological solutions in the healthcare institutions is the key growth driver of the long-term care software market.

Moreover, limited healthcare specialists and different initiatives taken by the government bodies worldwide to reduce the medical cost are fueling the growth of long-term care software market.

Apart from this, the increase in the number of healthcare organizations and the increasing usage of mobile devices in the healthcare organizations are the major factors which are fueling the growth of the long-term care software market.

Challenges

The high cost of software maintenance is the primary factor which may hinder the growth of the long-term care software market in the near future. Also, the unwillingness of the traditional long-term care providers to adopt new software is one of the major factors which hampers the growth of the long-term care software market in the near future.

Key Players

The prominent players in long-term care software market are: Allscripts Healthcare Solutions, Inc., Cerner Solutions, Omnicare, Inc., Omnicell, Inc., HealthMEDX, LLC, McKesson Corporation, Optimus EMR, Inc., PointClickCare, MatrixCare, and SigmaCare.

Global Long-term Care Software Market: Regional Overview

On the geographic basis, North America is anticipated to capture largest market share, owing to the well developed and established healthcare industry, and higher adoption of long-term care software in the region.

Europe and APAC are also expected to gain substantial market share due to the rapid infrastructural development in the healthcare sector. Also, APAC is expected to be the fastest growing long-term care software market owing to the government initiatives taken in the healthcare sector by the emerging economies such as India, China, and Japan.

The Long-term Care Software market in Latin America and MEA are expected to witness high growth rates in the coming period due to the rise in digital technologies and increasing adoption of mobile devices in the healthcare sector of the region.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

Key Segments

By Delivery Modes:

Cloud-based

On-premises

Web-based

By End User:

Assisted Living Facilities

Home Health Agencies

Nursing Homes

By Region:

North America

Latin America

Asia Pacific

Europe

MEA

0 notes

Text

Industrial Motors Market Forecasted to Reach USD 917.3 Million by 2032

The global industrial motors market size is set to experience steady growth over the next several years, according to a new report by Future Market Insights. The report projects a CAGR of 3.5% from 2022 to 2032, driven by increased demand for industrial automation and the growing need for energy-efficient motors.

The industrial motors market is experiencing significant growth, driven by the rapid industrialization and automation trends across various sectors such as manufacturing, energy, and transportation. Industrial motors are crucial components in powering machinery and equipment, making them indispensable in modern production processes. The market is characterized by a shift towards energy-efficient motors, such as IE3 and IE4, which comply with stringent environmental regulations and help reduce operational costs. Additionally, the rise of Industry 4.0 is pushing for smart and connected motors that enhance productivity through predictive maintenance and real-time monitoring.

Demand Dynamics: The demand for industrial motors is bolstered by the expansion of infrastructure projects, particularly in emerging economies where urbanization is accelerating. Sectors such as oil & gas, mining, and water treatment are also driving demand due to their reliance on robust and reliable motor systems. Furthermore, the increasing focus on renewable energy sources is creating new opportunities for specialized motors in wind turbines and solar power installations. As industries continue to prioritize efficiency and sustainability, the adoption of advanced motor technologies is expected to rise, solidifying the market's growth trajectory.

Unlock Opportunities: Discover Growth Potential with Our Comprehensive Market Overview - Request Our Sample Now@ https://www.futuremarketinsights.com/report-sample#5245502d47422d35313137

Key Points of the Industrial Motors Market

Global Market Valuation: The industrial motors market was valued at US$ 653.0 million in 2022, highlighting its significant economic impact.

Steady Growth Forecast: The demand for industrial motors is expected to grow at a steady CAGR of 3.5% from 2022 to 2032.

India's Robust Expansion: In India, the market is poised for rapid growth, with a projected CAGR of 5.4% over the next decade.

China's Market Momentum: China's industrial motors market by volume is set to expand at a strong CAGR of 4.1% from 2022 to 2032.

Dominant Market Players: Leading companies like ABB Group, Siemens AG, and Hyundai Electric Co. Ltd. control 70% to 80% of the global industrial motors market.

Future Market Outlook: With consistent growth across key regions, the global industrial motors market is positioned for long-term development and innovation.

“The market for industrial motors is predicted to expand rapidly due to increasing demand for innovative and energy efficient products across industries. Rising automation and digitalization in a variety of end use sectors are driving demand. Industry participants are investing in strategic alliances, expansions, and cost effective solutions to obtain a competitive advantage.” Says an FMI analyst.

Who is Winning?

Some of the key players in the industrial motors market identified by the report include ABB Ltd., Siemens AG, Nidec Corporation, WEG SA, and General Electric Company. These companies are focusing on research and development activities to develop advanced and energy-efficient motors to cater to the growing demand from various industries.

Overall, the report suggests that the industrial motors market is set to experience steady growth over the next several years, driven by increasing demand for automation and energy-efficient solutions in various industries. The Asia-Pacific region is expected to see the highest growth rate during this period, due to the expanding manufacturing sector and increasing infrastructure investments.

Top 10 Key Players in the Industrial Motors Market

General Electric Rotronic AG

Hitachi Ltd.

Nidec Corporation

WEG SA

Siemens AG

ABB Ltd.

Regal Rexnord Corporation

Toshiba Corporation

Hyosung Corporation

Bonfiglioli Riduttori S.p.A.

Get More Valuable Insights

Future Market Insights, in its new offering, provides an unbiased analysis of the global industrial motors market, presenting historical demand data (2017 to 2021) and forecast statistics for the period from 2022 to 2032.

The study divulges compelling insights on the industrial motors market based on product type (AC Motors, DC Motors), power output (1 to 5 MW, 5 to 10 MW, 10 to 15 MW, 15 to 20 MW, 20 to 25 MW), and end use (oil & gas, energy, mining, cement, metal and steel, pulp and paper, chemical, water and wastewater, marine) across seven key regions.

Global Industrial Motors Market by Category

By Power Output:

1 to 5 MW

5 to 10 MW

10 to 15 MW

15 to 20 MW

20 to 25 MW

By Product Type:

AC Motors

Induction Motor

Synchronous Motor

DC Motors

Brushed DC

Brushless DC

By End Use:

Oil & Gas

Energy

Mining

Cement

Metal and Steel

Pulp and Paper

Chemical

Water and Wastewater

Marine

By Region:

North America

Latin America

Europe

East Asia

South Asia Pacific

Middle East and Africa

0 notes

Text

How to Invest in Apollo Green Energy Unlisted Shares: A Comprehensive Guide

Investing in unlisted shares has become an attractive proposition for investors seeking higher returns and diversification. One such opportunity lies in Apollo Green Energy Unlisted Shares. But how can you invest in them? This article provides a comprehensive guide to investing in Apollo Green Energy’s unlisted shares and how Altius Investech can help you make an informed decision.

Understanding Apollo Green Energy and Its Unlisted Shares

Apollo Green Energy is a prominent player in India’s renewable energy sector, focusing on solar, wind, and sustainable energy solutions. With India’s push toward cleaner energy, companies like Apollo Green Energy are expected to see significant growth in the coming years.

Apollo Green Energy remains an unlisted entity, meaning its shares are not traded on traditional stock exchanges like NSE or BSE. Instead, these shares are available in the unlisted market, where investors can buy and sell them through trusted intermediaries like Altius Investech.

Why Consider Investing in Apollo Green Energy Unlisted Shares?

1. Growing Demand for Renewable Energy

As India moves towards achieving its renewable energy targets, companies like Apollo Green Energy stand to benefit from government incentives and increased demand for sustainable power sources.

2. Potential for Future IPO

One of the primary reasons investors buy unlisted shares is the potential for a future IPO (Initial Public Offering). If Apollo Green Energy successfully lists on the stock exchange, early investors could benefit from a substantial increase in share value.

3. Strong Market Position and Expansion Plans

Apollo Green Energy is continuously expanding its renewable energy projects and increasing capacity, which strengthens its market position and revenue potential.

4. Diversification Opportunity

Investing in Apollo Green Energy’s unlisted shares allows investors to diversify beyond traditional stocks, mutual funds, and bonds. Alternative investments like unlisted shares often have different risk-return dynamics, making them an essential component of a well-balanced portfolio.

How to Invest in Apollo Green Energy Unlisted Shares

Step 1: Choose a Reliable Intermediary

Investors must buy unlisted shares from a trusted source like Altius Investech, which ensures transparency and security in transactions.

Step 2: Research and Evaluate

Before investing, analyze Apollo Green Energy’s financial performance, growth potential, and industry outlook. Unlisted companies have limited public data, so rely on expert insights and market reports.

Step 3: Verify Pricing and Valuation

Since unlisted shares do not trade on a stock exchange, prices fluctuate based on demand and supply. Platforms like Altius Investech provide updated pricing and valuation details.

Step 4: Complete the Transaction

Once you decide to invest, complete the transaction through an intermediary by signing necessary agreements and transferring funds securely.

Step 5: Hold and Monitor Your Investment

Since unlisted shares have lower liquidity than listed stocks, investors should be prepared for a long-term holding period. Track the company’s progress and any IPO announcements.

Risks and Challenges to Consider

1. Liquidity Concerns

Unlisted shares are not as liquid as listed stocks, meaning selling them might take time. Investors need to be patient and willing to hold their investment until an IPO or other exit opportunity arises.

2. Regulatory and Market Risks

The renewable energy sector is subject to government policies and regulations that may impact Apollo Green Energy’s operations and profitability.

3. Lack of Publicly Available Financial Data

Unlike listed companies that disclose financial statements regularly, unlisted companies do not have the same level of transparency. Investors must rely on private reports, market trends, and expert insights before making an investment decision.

How Altius Investech Can Help

Altius Investech is a leading platform for buying and selling unlisted shares in India. It provides retail and institutional investors with access to a wide range of unlisted stocks, including Apollo Green Energy shares.

Why Choose Altius Investech?

Trusted Platform: With a proven track record, Altius Investech ensures a secure and seamless investment process.

Market Insights: The platform provides research-backed insights to help investors make informed decisions.

Competitive Pricing: Altius Investech offers access to unlisted shares at fair market prices.

Liquidity Support: Investors can buy and sell unlisted shares through Altius Investech’s network of buyers and sellers, improving liquidity.

Final Verdict: Should You Invest in Apollo Green Energy Unlisted Shares in 2025?

Apollo Green Energy’s unlisted shares present an exciting investment opportunity, but they come with inherent risks. Investors who believe in India’s renewable energy growth and Apollo Green Energy’s expansion plans can consider allocating a portion of their portfolio to these shares. However, they should be prepared for longer holding periods and conduct thorough due diligence before investing.

For those interested in buying Apollo Green Energy unlisted shares, platforms like Altius Investech can provide a reliable and secure way to access these investments. As always, consult a financial advisor before making any investment decisions to ensure alignment with your financial goals.

0 notes

Text

The Future of Real Estate: Online Property Valuation in India

The real estate sector in India is evolving rapidly, and one of the biggest advancements is the adoption of online property valuation in India. Traditional property valuation methods often involve lengthy inspections, manual paperwork, and delays. However, with the advent of digital valuation services for real estate, property owners, buyers, and financial institutions can now obtain instant and accurate valuations from the comfort of their homes.

Why Online Property Valuation Matters

Property valuation plays a crucial role in real estate transactions, investment decisions, and securing loans. Whether you're looking to sell, buy, or refinance a property, knowing its true market value is essential. With desktop real estate appraisal, users can now access quick and precise property evaluations without the need for physical inspections.

Technology-driven valuation tools utilize extensive property data, location trends, and market analytics to provide real-time valuation reports. These instant property valuation tools are particularly useful for homeowners, real estate investors, and lenders who require fast, reliable property assessments.

Benefits of Digital Property Valuation

1. Accuracy and Reliability

Modern desktop valuation pan India services are powered by artificial intelligence (AI) and big data analytics, ensuring highly accurate property valuations. Unlike traditional methods that rely on subjective judgment, digital tools analyze historical trends, comparable sales, and local market conditions to provide data-driven valuations.

2. Convenience and Speed

With the rise of land valuation services online, property owners no longer need to wait for days or weeks for valuation reports. The online process is seamless, requiring only basic property details to generate an instant estimate. This speed is beneficial for real estate investors and sellers looking for quick transactions.

3. Cost-Effective Solution

Hiring a professional property valuer can be expensive. In contrast, desktop appraisal for property sale is an affordable and efficient alternative. Many online platforms offer free or low-cost property valuations, making it accessible to a wider audience.

4. Essential for Financial Institutions

Banks and NBFCs rely on property valuation for financial institutions to assess loan eligibility and mortgage approvals. Automated valuation models (AVMs) help financial institutions streamline their loan processes, reducing risks associated with incorrect property assessments.

Who Can Benefit from Online Property Valuation?

Homeowners and Sellers

If you're planning to sell your house, knowing its current market value helps you set a competitive price. With residential property valuation in India, homeowners can list their properties at optimal prices and attract serious buyers.

Real Estate Investors

Investors looking for profitable opportunities can use online valuation for property investment to analyze potential deals. By comparing property values across different locations, investors can make informed decisions on where to invest.

Financial Institutions

Banks, lending agencies, and insurance companies require property valuations for loan approvals, refinancing, and risk assessment. Desktop real estate appraisal helps institutions efficiently process mortgage applications while ensuring compliance with financial regulations.

How to Use an Instant Property Valuation Tool

Using an instant property valuation tool is straightforward. Most platforms require users to enter details such as:

Property type (residential, commercial, land)

Location and address

Built-up area and age of the property

Additional features (amenities, upgrades, etc.)

Once the details are submitted, the system generates an estimated property value based on real-time market data. Some advanced tools also provide comparative reports, highlighting similar properties in the area.

The Future of Digital Property Valuation in India

With the increasing adoption of digital valuation services for real estate, the future of property valuation in India looks promising. Emerging technologies like blockchain, AI, and machine learning will further enhance the accuracy and transparency of property assessments.

Moreover, as more financial institutions and investors embrace desktop valuation pan India, the real estate industry will witness faster transactions, reduced paperwork, and improved decision-making processes.

Conclusion

The shift towards online property valuation in India is transforming the real estate sector. Whether you are a homeowner, investor, or financial institution, leveraging desktop real estate appraisal and instant property valuation tools can help you make better property decisions. As technology continues to advance, digital property valuation will become the standard, ensuring accuracy, efficiency, and convenience for all stakeholders.

If you haven’t explored desktop appraisal for property sale or land valuation services online, now is the time to take advantage of these modern solutions and stay ahead in the real estate market.

0 notes