#VAS consolidation platforms

Explore tagged Tumblr posts

Text

How Do VAS Platforms Revolutionize CSP Operations?

Distinguishing your organization from the competition is a key aspect of business operations. Telcos can no longer distinguish themselves purely via infrastructure and operations. Given the strong competition, CSPs must differentiate themselves in order to attract new consumers, maintain existing customers, and generate novel revenue sources. Providing value-added services is a great approach to do this. CSPs must adopt VAS consolidation platforms in order to fulfill their consumers' changing needs. A unified VAS platform plays a crucial role in enhancing VAS operations for service providers. It acts as a centralized system that integrates and manages multiple VAS offerings, enabling streamlined operations and improved service delivery.

A VAS consolidation platform plays a crucial role in enhancing VAS operations for service providers. It acts as a centralized system that integrates and manages multiple VAS offerings, enabling streamlined operations and improved service delivery.

How Do VAS Platforms Augment Efficiency for CSPs?

VAS platforms for CSPs play a crucial role in augmenting efficiency for Communication Service Providers (CSPs) in several ways. Here are some key ways how VAS platforms can enhance efficiency:

Improved customer experience

CSPs may use VAS platforms to provide individualized and targeted services to their clients. CSPs may understand individual preferences and deliver personalized services by leveraging customer data and analytics. This individualized strategy boosts customer satisfaction, lowers churn rates, and boosts overall operational efficiency.

New VAS services can be deployed more quickly

In a centralized environment provided by a unified VAS platform, services may be delivered considerably more quickly. If other VAS services that can function on a consolidated platform are added in the future, they may be launched in much less time.

Monetization and revenue generation

VAS consolidation platforms enable CSPs to monetize their services in ways other than traditional offers. CSPs can expand their service offering and establish additional revenue streams by permitting collaborations with third-party service providers. VAS systems make it easier to integrate and manage these agreements, increasing revenue generating potential and overall efficiency.

Scalability and flexibility

VAS platforms for CSPs are built to handle a high volume of transactions while also allowing for scalability. Without large infrastructure expenditures, CSPs may rapidly scale up or down their services based on demand. The platforms enable CSPs to optimize resource allocation and enhance overall efficiency by allowing them to respond to changing business requirements and consumer expectations.

Lynx - One of the Best VAS platforms for CSPs

Lynx is the unified VAS consolidation platform from 6D technologies. This comprehensive solution combines multiple VAS enabler applications into a single, highly optimized system. This integrated stack seamlessly integrates with the core network and IT applications of Communication Service Providers (CSPs), offering real-time traffic management, charging and billing, customer care, reporting, and operations management functionalities. By leveraging a Service Creation Environment (SCE) and a secure, standards-based framework, Lynx enables CSPs to tap into their network resources and drive service innovation.

The platform, built on Network Function Virtualization (NFV) technology, is specifically designed to handle large-scale deployments. It helps CSPs achieve significant cost reductions in terms of capital expenditure (CAPEX) and operational expenditure (OPEX). It also helps in streamlining operations and maintenance activities. Moreover, Lynx greatly enhances the speed at which CSPs can bring new services to market by providing lightweight APIs that expose various capabilities. It efficiently consolidates all CSP messaging enabler applications, ensuring that the essential functional and non-functional requirements of each application are met, with each application maintaining its own logical instance.

VAS consolidation platforms enhance efficiency for CSPs by consolidating services, facilitating rapid deployment, providing scalability and flexibility, automating tasks, offering data analytics, enabling revenue generation, and enhancing customer experience. It is vital for CSPs to deploy a unified VAS platform to optimize operations, reduce costs, and improve the agility and competitiveness in the market. Lynx is the unified VAS consolidation platform from 6D technologies. This comprehensive solution combines multiple VAS enabler applications into a single, highly optimized system. To learn more about this VAS consolidation platform, please visit https://www.6dtechnologies.com/products-solutions/vas-consolidation

0 notes

Text

Why Market Profile Traders Avoid Maximum Drawdown Like the Plague (And You Should Too) The Dirty Secret About Your Drawdown Disaster Ever watched your trading account bleed so badly that you started questioning life choices—like that time you bought Bitcoin at the top, or worse, paid for a gym membership you never used? That stomach-churning plunge is what we call a maximum drawdown. And trust me, it stings harder than realizing your ex moved on with someone who trades better than you. Maximum drawdown (MDD) measures the biggest drop in your trading account from a peak to a trough before a new high is achieved. Think of it as the financial equivalent of accidentally clicking on a phishing email—a quick way to ruin your day (or year). Reducing this pitfall is the cornerstone of any pro-level trading plan. But what if I told you that market profile traders, the shadow ninjas of Forex, have been sidestepping these drawdown sinkholes with strategies most traders don’t even know exist? This is your behind-the-scenes pass to their playbook. Market Profile: The Chart That Talks Back If candlestick charts are like reading hieroglyphics, market profile is like listening to the market whisper sweet nothings into your ear. Originally developed by J. Peter Steidlmayer in the 1980s, market profile plots price action against time, revealing the volume traded at each price level. Instead of staring at candlesticks like you’re decoding ancient scrolls, market profile shows you where the big money is stacking up. This allows you to spot high-probability zones like a sniper, minimizing reckless trades that drive maximum drawdown through the roof. According to James Dalton, a market profile authority, “Understanding the market's structure is the difference between participating in the auction and being auctioned off.” Why Maximum Drawdown Is the Silent Account Killer Most traders think losing 50% means making 50% to get back. Nope. A 50% drawdown requires a 100% gain to break even. That’s like falling off a cliff and needing a helicopter to get back up. Data from the Bank for International Settlements (BIS) reveals that nearly 75% of retail Forex traders experience significant drawdowns within their first year. The problem? They blindly chase price action, while market profile traders anticipate where price is likely to go based on volume distribution. The Hidden Zones: Where Market Profile Traders Feast Market profile exposes three critical areas: - Point of Control (POC): The price level with the highest traded volume. This is the market's comfort zone. - Value Area (VA): The 70% price range where most trading occurred. - Low Volume Nodes (LVNs): Price zones with minimal trading activity—a breeding ground for explosive moves. Ninja Tactic: LVNs often act like trapdoors. Price tends to shoot through them like your stop loss on NFP day. Identifying these zones allows you to tighten stops and reduce drawdowns dramatically. Case Study: How a Trader Cut Drawdown by 70% Using Market Profile Meet Sarah, a seasoned trader who nearly quit after a brutal 40% drawdown during a volatile EUR/USD stretch. Switching to market profile was her game-changer. She began identifying value area lows as high-probability entry zones while using low volume nodes as exit targets. The result? Her drawdown plummeted to under 12% within six months, while her win rate climbed to 65%. Step-By-Step Guide: Market Profile Drawdown Reduction Blueprint - Set Up Market Profile Charts: Platforms like Sierra Chart, NinjaTrader, and MetaTrader with Volume Profile indicators can visualize this. - Identify Value Areas: Focus on the value area low and high—these zones often attract institutional buying or selling. - Pinpoint Low Volume Nodes: Treat these as breakout zones or targets for your trades. - Tighten Stops Using POC: If price hovers near the point of control, expect consolidation—tight stops reduce damage. - Avoid Chasing Moves: Wait for price to revisit value areas before entering—impulse entries inflate drawdown. Why Most Traders Get This Wrong (And How You Can Outsmart Them) Myth: “Volume doesn’t matter in Forex because it’s decentralized.” Reality: Aggregated volume from major liquidity providers still reveals high-activity zones. According to Forex expert Adam Grimes, “Volume is the closest thing we have to seeing the footprints of institutional traders.” Next-Level Insight: Pair market profile with news catalysts. For instance, when the FOMC statement dropped in June 2024, EUR/USD plunged into an LVN, only to rebound into the value area high within hours. Traders using market profile pocketed pips while others chased shadows. Advanced Hack: Combining Market Profile with Maximum Drawdown Control Tools - Smart Trading Tool: Automate lot sizes and order management to prevent oversized positions. (https://www.starseedfx.com/smart-trading-tool/) - Trading Journal: Track trades and measure your MDD over time. (https://www.starseedfx.com/free-trading-journal/) - Economic News Updates: Sync your market profile analysis with breaking news. (https://www.starseedfx.com/forex-news-today/) Elite Takeaways: Sidestep Maximum Drawdown Like a Pro - Market profile reveals hidden price zones where institutions operate. - Low volume nodes are breakout magnets; value areas act as price magnets. - Tight stops around the point of control reduce MDD risks. - Combining market profile with automated tools slashes emotional errors. - The market profile edge transforms your trading from reactive to predictive. Final Thought: Are You Still Playing Checkers While the Pros Play Chess? Trading without market profile is like blindfolding yourself and throwing darts at a price chart. Sure, you might hit a bullseye once in a while, but the wall will suffer more than your portfolio can handle. Master market profile, and you’ll not only avoid maximum drawdown, but you’ll start seeing the market like the institutions do. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Photo

The Shape of My Heart

Chapter 30

Warnings: Violence, Threesome, Smut, Angst, Explicit Sexual Content, Jealousy, Polyamory, Blow Jobs, Oral Sex, Double Penetration, Anal Sex, Voyeurism, Stucky, Spanking

A/N: One of my resolutions in 2020 is to finish this story. It’s on AO3 but I thought I’d bring it here to pull me back into it. I’ll be posting new chapters when I get to that point on both platforms.

This is not a dark fic and there’s an OC instead of a reader.

I do not consent to have my work hosted on any third party app or site. If you are seeing this fanfiction anywhere but archiveofourown, tumblr or fanfiction.net, it has been reposted without my permission.

~~~

While Bucky had been so happy when Tony had consolidated their apartments and he'd moved in with his Steve and his Chris. Having them next to him at night kept the nightmare visions from his past at bay mostly. In their arms, he found rest, peace.

His past was currently the least of his problems.

He and Steve had gotten up at dawn as they normally did, leaving a sleeping Chris in the center of their bed. Steve usually had to drag him away because she looked so beautiful, so soft laying there tangled in the sheets that he just wanted to crawl back into bed with her. He wanted to wrap himself around her until she began to stir and then wake her completely up the most sensual way he knew how.

Now she looked so tired. The shadows beneath her eyes weren't getting better. Normally at night, she went between being Bucky's little spoon to wrapping herself around Steve when he stretched out on his back. Now when she came to bed, normally only an hour or two before their run, their girl was so exhausted she didn't move in her sleep – and not in a good way.

"You okay?" Steve asked, rubbing the back of his neck as he stopped behind him.

"I'm okay," Bucky didn't like the sad note in his own voice.

Steve blew out a sigh but didn't say anything. His blue eyes were clouded by his own worries when his gaze met Bucky's.

"You ready?" Steve asked.

It had been like that for days. As usual, they went for their run, barely talking until Sam came up and got them both going as only Sam could. Sam tactfully found ways to bring up Chris without asking how she was. He'd even offered to talk to her as a counselor, as he had for the VA, if they ever wanted or needed him to.

Bucky was giving it some thought.

Steve cared too but Bucky was concerned about him for different reasons. Reasons he was guessing Steve wasn't sharing with him or Chris. There was a mission coming up soon and though Bucky didn't know many of the details yet, he assumed they'd all be going. Only he had no plans whatsoever to leave Chris there without one of them so long as Ross was still milling around. Ross had been conspicuously absent from the compound since Siberia, but Bucky knew it was only a matter of time before he came around again.

Chris had survived his attempt to get rid of her. She knew Ross was responsible for what happened to her and for the lives of the S.H.I.E.L.D. agents he'd cost. But they couldn't just go after him, guns blazing.

Taking down Ross, because of the station he'd attained, required having stone-cold proof that he had been the one responsible. And he'd covered his tracks very well. Tony, Nat, and Fury all three had been working behind the scenes trying to find anything to implicate Ross in the entire affair but so far hadn't had any luck.

That left things in a mess.

Steve didn't say much but Bucky knew it was eating at him. More than a couple of times at the lockers or when Steve thought he was alone, he'd ask FRIDAY for a status on Chris. Making sure he knew where and how she was. When they were all together Steve acted as he normally did. Bucky knew he was hoping with time, Chris would snap out of the melancholy that had taken hold of her after the kidnapping.

Chris would stop work when they made it back each day and they all had dinner together. Steve had been teaching her little things about cooking which brought Chris out of herself for short periods of time, so he kept it up. Then they'd watch TV together.

Intimacy was unpredictable now. To the point that he and Steve would often grab a shower together before dinner, getting each other off quickly so they'd be ready for however the evening went, so they could be patient with their girl and not frustrated. If Chris initiated things, they went from there, giving her whatever she wanted and needed. A couple of times she'd told them she had work left to do for Tony and retreated to her cave. He and Steve had ended up making out, heading for the bedroom with the understanding that Chris could join in any time. They always wanted her. And she did eventually follow them back, but just as an observer, gently kissing Bucky and holding him as Steve solidly fucked him.

Most of the time, she went back to bed with them to watch TV and sometime after they'd fallen asleep, she'd get back up, go back to her cave and stay there for hours.

And that was the part that scared Bucky. Chris could be doing anything in there and he wouldn't know. Chris was right up there with Stark when it came to technology. She was formidable enough that when the identity the FBI had established for her was compromised, some of the most powerful deviants in the world were after her. As far as he was concerned, Chris was capable of a lot.

He knew she was after Ross and his ultimate fear was that she would do something that would result in them losing her.

"Cap, Tony and Fury are asking for you," Sam came and got them as they walked back to the compound from their run.

Steve's expression told him that he knew what the meeting was about, and it wasn't good. "I'll catch up," Steve told him.

Bucky nodded. He could go to the gym. But he decided then and there he was going back up to their place instead, maybe sleep in a little while with Chris because that was what his heart wanted.

Heading straight for the bathroom to shower when he got there, he was startled to find Chris there, sitting on the edge of the tub, sobbing.

"Baby?"

He'd startled her, she wasn't expecting to see him, and he pulled her into his arms as he joined her there. She felt cold, sitting there in one of Steve's shirts and her panties. An open box of feminine products was tipped over in the floor between her and the toilet and he realized what was going on.

Smoothing his hands up and down her back, he pressed kisses into her hair. "Does it hurt?" he whispered. "I can get you something for the pain."

Chris didn't answer just held onto him tighter.

"I need to clean up," he whispered. "How about I take you back to bed, get a shower, and I'll come get back in bed with you. Would that be okay?"

Her head tipped up at that, the hope in her gray eyes had his heart squeezing in his chest. Chris nodded.

Bucky had her situated in bed with a glass of water and some of the painkillers she had left from Dr. Cho. He showered and was back with the efficiency of a SWAT team, pulling her against him and letting her get comfortable as he stretched out.

"Feeling better?" he whispered as she laid her head on his chest.

"The cramps are really bad." She sniffled. "It's my first cycle since…"

It hadn't occurred to him until then that it had been about six weeks since the kidnapping and the miscarriage.

"Helen said she'd work with me on something for… birth control… I need to call her I guess but…"

The tone of her voice and the way she lightly trembled against him had him thinking.

"Is that what you want, Chris?"

Lifting her head, her gaze met with his. "What do you mean?"

Someone in their apartment needed to talk about it. She and Steve never did.

"Do you want to go back on birth control? Or did you want to…"

The misery he read in her eyes broke his heart a little. With his flesh hand, he brushed her hair back from her face and waited for her to form an answer.

Bucky shook his head. She was just like Steve. She wanted something but was so afraid of inconveniencing anyone else, like she wasn't allowed to want something for herself. Sometimes they both drove him crazy.

Bucky tipped up her chin when she tried to look away. "Chris, do you want a baby?"

She hadn't expected him to ask that. He could tell.

And that's when the tears returned. "I don't know," she whispered miserably.

Sitting up with her, Bucky pulled her onto his lap, letting her cry it out and wishing with everything he had he could take the pain for her.

When she finally pulled back to gaze up at him, he watched her struggle with whatever she was trying to say.

"Bucky, I think… I do want one… a baby but…"

Was it wrong that his heart was flying at those words? Having a child that was theirs was something he could envision, something he was starting to really hope for.

"But?" he prompted gently.

"What if… I guess it would wise to resolve everything with… with Ross first," she reasoned slowly.

Bucky nodded thinking that statement could be taken one of two ways. Either she meant she was afraid of being pregnant and taking a chance that Ross could get his hands on her again.

Or she meant she couldn't be pregnant because of what she might be planning to do with Ross and the consequences from that…

Surely, Chris wasn't thinking that way.

"He won't ever get near you again, doll, I promise," Bucky tried to assure her. "If you want a baby, we'll have one. Stevie and I? We'll take care of you. Ross will never be anywhere near you or him. Or her."

Chris smiled through her tears at his words and shook her head. "It's not that," she whispered.

"It's not what?" Bucky wanted to know.

Chris shook her head, dropped her gaze. He cupped her cheek with his hand, guided her to look at him again.

"Chris, promise me you're not planning anything," he pleaded. "Promise me you're not going to try and move on Ross by yourself. Please. Baby, I can't –"

Chris pulled away from him, he let her and she jumped out of the bed. She ran one hand over her face, the other pressed to her abdomen as the fast movement had hurt her.

"Bucky," she said through her tears. "I love you. I love Steve. But I can't promise you that I'm going to sit on the sidelines and let everyone fight my battles for me."

He was off the bed and in front of her in the next beat.

"Chris," he lightly gripped her shoulders, "that's exactly what needs to happen when it comes to Ross."

Chris glared up at him. "Why? You think I can't take him on?"

Bucky shook his head, afraid of how determined she was. "No, I'm all too afraid that you can, baby. But Ross is in a position of power. He's not some thug you've fucked with in some other country for the FBI. It's going to take time and the right approach to bring him down. I know you can do it. But it would kill me and Steve to see you hurt or killed or locked away because of that asshole."

The anger faded from her expression as she considered his words.

"Not only that," he went on calmly. "When's the last time you slept more than three or four hours, huh? You don't sleep. You don't eat much. You never leave the apartment even though Ross hasn't been here since before…"

Her gaze dropped, she nodded.

"Let this go, doll," he begged her. "Let us deal with it. We'll get him for you. Steve's as set on exposing the bastard for what he is as you are. You know that. You could get back into doing all the techie stuff you and Stark do. We could have a baby if you wanted. We're all together now, let's enjoy this."

Chris sank down onto the edge of the bed, swiping away tears. Bucky knelt in front of her, not willing to end the conversation until he felt she understood where he was coming from. And he was confident he could help her understand. She wasn't quite as stubborn as Steve…

"And if Ross hurts any of you?" Chris said through her tears.

Bucky shook his head. "Not going to happen, doll baby."

"You can't promise that." She was right. "And I… What? Am I supposed to just let you, you two, the Avengers, just… this is all I am now?"

At that moment, Bucky understood more. Chris was missing being a valuable FBI agent, a member of a team, who could take care of herself. He got that.

"Chris, for now, yes, I'm asking you to trust us. To lean on us. I think sometimes you forget that the reason you are here is on us. Maybe it's our fault and we should handle Ross for you. I know that's what's in Steve's head."

Her gaze narrowed on him. "That's what's eating Steve? He thinks all of this is your fault? The two of you?"

Bucky shook his head. "No. In his mind, it's his fault."

"Seriously?" Chris shook her head. "I should have known. Jesus, we're a mess right now, huh?"

"We don't have to be, doll."

With that, he scooped her up because she was shivering, and situated her back in the bed with him next to her.

"Just think about what I said, okay?" Bucky pressed a kiss to her lips. "Let's get a couple more hours of sleep. You could use it. I'll stick around today."

Chris gazed up at him, running a hand through his hair. "I look that bad, huh?"

"You look beautiful, doll baby. But you need to sleep. For me?"

Snuggling up to him, she was asleep in minutes as he caught up on the news.

She'd left Bucky with a lot to think about and he wasn't able to go back to sleep after all. He just stayed and watched over her.

***

Steve wasn't in the best mood after Tony and Natasha's latest attempt at getting anything on Ross turned up empty. A mission was coming soon, not involving Ross, but he was going to have to make a decision he didn't like when the time came. They really needed all hands on deck for it, the situation was likely to be that bad. He knew Bucky would refuse to go and leave Chris alone. And he agreed with that. He didn't want her to be there without one of them either. But he really needed Bucky too.

After weeks of Chris recovering from the kidnapping and assault, Steve had been about to lose hope that things would turn around and get back to something like normal.

After HYDRA had been revealed inside S.H.I.E.L.D, he'd found Bucky back but for the longest time, he didn't really have Bucky back. Not until Chris came along.

Chris not only gave his first love back to him, but she'd loved him too, just as he'd asked her to try and do. And they'd all been happy for a time.

Until Ross had literally plucked her out of their lives to punish him. Ross had given her to an animal and Steve was only grateful that things hadn't been worse. It had been bad enough that he'd beaten her so badly, caused her to lose a child. The depression she'd slid into since concerned him.

The one thing it had done was bring out every protective instinct Bucky had and that wasn't necessarily a bad thing. He was so focused on Chris and her well-being that he almost seemed, at times, the Bucky Barnes that he'd known in childhood, the one who'd saved his scrawny ass on several occasions.

A few days ago, Buck had disappeared from the gym, and he found him back in their apartment, in bed with their girl and unapologetic. Steve hadn't said anything. He was grateful he'd held his tongue because, since that morning, things had been a little better. He couldn't put his finger on how. Chris was spending less time in her cave. She even worked in her office next to Tony's the day before and he was half-hoping she'd do so again today.

Steve had almost been jealous of how stuck together she'd been with Bucky since that morning, their quiet conversations seemed to fade when he got close. But just last night, he was stretched out on the couch watching a football game. Chris came and just stretched out in front of him, curling up like a cat and falling asleep against his chest. Any jealousy he might have had disappeared after that. He just needed to know she needed him too. She did.

He'd just wrapped his hands up and was heading up to the gym to go a few rounds with the punching bag. It'd always been a way he could let off steam which lately was getting to be pretty often.

Steve was surprised when he reached the gym to see Natasha sparring with Chris.

They hadn't noticed him, at least he didn't think Chris had anyway, and he just watched. Chris wasn't bad at all. If she could put on a little weight, she'd do better he mentally noted. She was outmatched by Nat who was throwing her around aggressively, but it seemed to be what Chris was looking for. And Chris was patient as Natasha would stop and explain a sequence of moves to her and correct her technique.

He didn't realize he'd headed in the direction until Nat looked up, smirking at him. "Hey, Rogers. Come to supervise?"

Steve shook his head. "No. You're doing just fine. Keep doing what you're doing, and I'll spar with her."

Nat's brows shot up, but she didn't argue.

Chris stood panting and gazing up at him with a look that he took to mean really? He could hear her say it in his head and he grinned.

"Hey, Sweetheart," he told her, throwing off the boxing gloves, pulling off the tape job. "Is that okay with you?"

She hesitated but slowly those gray eyes lifted to meet his and she nodded.

Together he and Nat put her through a pretty rigorous session. She'd impressed him with her patience and her eagerness to learn. Her demeanor appealed to the teacher in him, had him going over techniques and moves right along with Nat.

"I've got to go," Nat said reaching down to check her phone at the edge of the mat. "Tony," she added meaningfully.

Steve hoped with everything in him that they had something.

"You want to keep going?" he asked as they watched Nat dash out.

Chris grinned. "For a little while, yeah."

Steve focused on helping her use her size to her advantage and she was an eager student. They went a few rounds until he noticed she was tiring, not hitting with the same power.

He helped her up, smiling at her. "You feel okay?"

Chris nodded. "Yeah, this was good. I need to get back into running, training. I'd like to do this more."

"You feel like Nat and I helped you?"

Chris nodded, grinned. "Thank you."

"Don't thank me, Sweetheart," he told her, wrapping an arm around her shoulders and steering her towards the dressing rooms. "We can do this every day I'm in the compound if you want to."

"So you're going to improve my fighting skills and teach me to cook?" He loved the bit of mischief in her big gray eyes at that. "Buck might start getting jealous."

"I wish," Steve told her with a wink. "He'll catch on to this soon enough and then he's going to tell you how to cheat when you spar with me."

She laughed at that. He'd really missed that sound.

"He could beat you?"

"Yes," Steve told her honestly. "He beat the hell out of me on one of the helicarriers when the Triskelion fell."

"I'll bet you weren't trying to fight him," Chris said as they walked.

She wasn't wrong.

"Buck's been beating my ass and saving it since we were kids," he explained. "Yeah, he could probably beat me most days."

Chris blew out an exhale. "I forget. Once upon a time, I guess you weren't a lot bigger than I am, huh?"

He stopped, his gaze moving over her. "I was your height. I maybe had ten pounds on you."

"Seriously?"

"Seriously."

"So that's how you're able to tell me how to go up against someone like you are now?"

"Pretty much."

"I want to get better at this," Chris said with feeling.

Steve nodded. "Maybe one day you won't have to hide anymore. You can get back out there. I know I'd feel better with you trained by us."

Chris grinned at him bashfully. "I'll never be Avenger level but… I don't know what's in my future as far as a career. I do miss the Bureau but life here is pretty good too. Nothing like thinking you're going to lose everything or die to make you take a good look at what you have. I have quite a bit, Steve. I'm grateful. For you, for Bucky. For Tony and everyone here. You should know that."

His heart was flying at her words. She thought she could be happy here? She was grateful for all of them? Steve wanted it to be true so bad.

"What?" she asked him, her gaze searching his. "You look… skeptical."

Steve dropped his head. "You mean all that?"

"Why would I say it if I didn't?"

"Because you don't want me to worry?"

"Granted, but… I do mean it, Steve. I've been doing a lot of thinking and…"

"Talking to Bucky about it," Steve threw in.

"See? I knew you were jealous of that," she told him, concern clouding her pretty face. "I just… I don't know how to…"

Steve took her face in his hand, made her focus on him. "Just say it, Chris. Put us both out of our misery here. Whatever it is, you can tell me."

"It's not that I could tell Bucky and not you," Chris began. "That's what he said but you and I lately… You've been worried about me and I've been worried about you, and I still am. I know what you're doing and that you're going after him. And I understand, and I love you for it. But I'm so afraid that something will happen to you because of this, Steve. With everything you've been through… I'm not worth this."

He pressed a finger to her lips. "You are to me. You are to Bucky. I don't think you understand just what having you in our lives has meant. I won't do anything to jeopardize that. I promise."

Chris blew out an exhale, stepping into his arms. He held her against his beating heart.

"Was that it?" Steve whispered. "Was that what you were worried about all this time?"

"Part of it."

He tried to pull back from her, but she held on tight, not moving her head from where it was pressed against his chest. She wasn't looking up at him.

Steve didn't know what else to do but wrap his arms around her again, smoothing his hands up and down her back.

Clint walked up the hall, nodded to him in greeting, but kept walking as they stood just outside the dressing rooms.

"What else, Sweetheart? Tell me," he said gently.

Even with his enhanced hearing, he barely heard her.

"Iwanttohaveababy."

Steve's heart sped up. Did she just say what he thought she said?

He couldn't help the smile that spread across his face. Bucky knew, and Steve knew just how happy he had to be about it. How had Bucky been able to keep that from him?

Steve had a couple of concerns like his and Bucky's line of work and the fact that he'd always imagined being married before he had kids. There were a few things to talk about, iron out.

But their girl wanted a baby…

"What was that?" Steve pried himself away enough to capture her chin and tip it up, so she'd look at him.

The color that flooded her face only had his smile widening.

"Steve," she said so quietly, "I want to have a baby."

He gazed down at her for a beat, everything that had been preying on his mind dissipating.

"Then let's do it, Sweetheart."

Steve fought back his own tears as he watched relief and happiness take over her expression.

"Really?"

"Really." Steve pulled her back into his arms, holding her close and not giving a damn who was walking up and down the hall by them right now. Her heart pounded as hard and fast as his did and for a moment, he was able to let so many things go.

He'd deal with the situation with Ross tomorrow. He wasn't going anywhere.

"I love you," she muttered against his chest.

"I love you." Steve pressed a kiss into her hair. "You working in the office today?"

"Yes," she told him.

"Then Buck and I will swing by and get you after work and we'll go have dinner," he told her. "Celebrate. Sound okay?"

Sam's whistle was low as he walked by in time to see Chris pull Steve down to her for a kiss that was equal parts passion and love.

@what-is-your-plan-today @jennmurawski13 @what-is-your-plan-today @badassbaker @caffiend-queen @disneylovingal @jeremyrennerfanxxxx123

#Stucky x oc#Steve Rogers x oc#Steve Rogers#Captain America#Bucky Barnes x OC#Bucky Barnes#The Winter Soldier#Avengers#MCU

41 notes

·

View notes

Photo

Ooredoo Palestine Deploys Telenity’s VAS Consolidation Platform https://bit.ly/3ssXSEp

0 notes

Text

IBM QRadar SIEM Training

IBM QRadar SIEM Training is one of the top 5 SIEM applications in today’s market. IBM developed it to provide 360-degree security of the security framework of an organization.

Nisa’s IBM QRadar Security information and event management (SIEM) help the security teams to detect and prioritize threats across the enterprise. It also provides intelligent insights. It enables the teams to respond quickly to reduce the impact of incidents. It consolidates and logs events and network flow data from thousands of devices, endpoints and applications distributed throughout the network. QRadar correlates all this information and aggregates related events into single alerts to accelerate incident remediation and analysis. QRadar SIEM is available on-premises and in the cloud environment.

IBM QRadar collects, processes, aggregates, and stores network data in real-time. It uses this data to manage network security by providing accurate – time information and monitoring, alerts and offences and responses to network threats.

Features of IBM QRadar

· Automatically parses and normalizes logs.

· Correlate related activities to prioritize incidents

· Applies built-in analytics to detect threats accurately

· Ingest vast amounts of data from on-prem and cloud sources

· Threat intelligence and support for STIX/TAXII

· Highly scalable, self-tuning and self-managing database

· Flexible architecture can be deployed on-prem or on cloud

· Integrates out-of-the-box with 450 solutions

· Threat intelligence and support for STIX/TAXII

Nisa’s IBM QRadar SIEM corporate course has the following tasks to learn:

· Describe how QRadar SIEM collects data to detect suspicious transactions

· Describes QRadar SIEM component architecture and data flows

· Navigate user interface

· Investigate suspected attacks and policy violations

· Search, filter, group and analyze security data Investigate vulnerabilities and asset services

· Use network hierarchies

· Locate custom rules and review actions and responses of rules

· Evaluate offences created by QRadar SIEM

· Use index management

· Navigate and customize the QRadar SIEM dashboard

· Use QRadar SIEM to generate custom reports

· Use charts and filters

· Using AQL for advanced searches

· Analyses a real-world scenario

Nisa’s IBM QRadar SIEM corporate training is meant for technical security developers, security analysts, offence managers, system administrators and network administrators using QRadar SIEM. IBM QRadar conducts a real-time analysis of log data. Here, the network flows to detect malicious activity to be easily stopped, avoided and prevent any harm to the enterprise.

Course Content

· IBM Qradar Overview

· Qradar Architecture

· DashBoard

· Log Activity

· Network Activity

· Reports

· Log Source Integration

· Auto Update

· Backup and Recovery

· Index and Aggregated Data Management

· Network Hierarchy

· System Management

· License Management

· Deployment Actions

· High Availability management

· Custom Offense Close Reasons

· Store and Forward

· Reference Set Management

· Centralized Credentials

· Forwarding Destinations

· Routing Rules

· Domain Management

· Users, User Roles, and Security Profiles

· Authentication

· Log Sources

· Authorized Services

· Backup and Recovery

· Log Source Groups

· Log Source Extensions

· Custom Properties

· Log Source Parsing Ordering

· Event and Flow Retention

· Flow Sources

· VA Scanners

· Covering Troubleshooting

· Qradar hosting services

Nisa’s IBM QRadar SIEM training covers QRadar architecture, network operation, log activity, index and aggregated data management, event and flow control, licenses management, covering troubleshooting, QRadar hosting services, etc. Nisa’s QRadar training is one of the best platforms to learn. Classes are conducted at your convenient time. A demo session is also arranged before undertaking the course. Activities are conducted online, and recorded videos are also provided for their reference. Nisa’s QRadar training online study material is also provided for the trainees. We also have a 24/7 working environment to support the trainees. IBM QRadar SIEM certification is also provided on completion of training. Our trainers are the best in the industry. They have trained a lot of corporates. Why miss a chance when you can learn from the best industrial experts. Enrol today for a better tomorrow. Jon Nisa’s IBM QRadar training and be the best in your team.

For More information about IBM QRadar SIEM, training feel free to reach us

Name: Albert

Email: [email protected]

Ph No: +91-9398381825

#ibmqradarsiemtraining#ibmqradarsiemonlinetraining#ibmqradarsiemonlinecourse#ibmqradarsiemcourse#ibmqradarsiemtutorial#ibmqradarsiemjobs#ibmqradarsiemcertification#ibmqradarsiemcorporatecourse#ibmqradarsiemexams#ibmqradarsiemexperts

0 notes

Text

Private Equity 101 for MSPs: New Platforms vs. Add-Ons

Over the past 18 months Abe Garver (FOCUS’ MSP Team Leader) has catapulted eight (8) MSPs into “New Platforms” for private equity groups (PEGs). Six (6) of the 8 run on ConnectWise’s RMM/PSA and two (2) of the 8 run on Datto’s Autotask RMM/PSA software

New Platform investments are the life blood of private equity, as they are viewed as the starting point for more acquisitions in the future. Conversely a strategic “Add-On” is designed to complement an existing platform business.

For New Platforms, PEGs have historically viewed each transaction as stand-alone. There are no synergies to consider, there is only a transaction with an investment rationale on how to grow the business and generate a targeted return. That rationale is the driver behind the deal, and it defines how the PEG will create value through things like capital infusions, operating partners and even future add-on acquisitions.

However, because of the limited supply of New Platform MSP assets (e.g. in the $2.5MM-$5.0MM EBITDA range), PEGs that want a New Platform are turning to M&A advisors like FOCUS’ MSP Team to find Merger of Equal targets to combine.

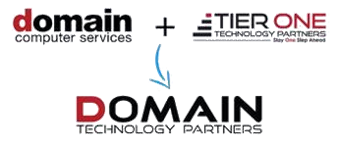

Combinations like Domain Computer Services and Tier One are especially appealing to PEGs when there is a:

1. Cultural 'fit'

2. Geographic 'fit'

3. Strategic 'fit' (e.g. cross-selling opportunities)

4. Financial 'fit' (e.g. pro-forma EBITDA of $2.5MM to $5.0MM)

5. Low integration risk (e.g. similar 'tech' stacks)

6. Leadership gap being filled

7. Inactive shareholder being taken out, and

8. Reduction of customer concentration

Interestingly Mr. Garver states that 4 of the 7 MSPs he advised in 2020 would not have been offered a New Platform investment had it not been for their use of M&A with IT Nation peers.

In Mr. Garver's opinion the trend is gaining momentum as 88% (7 of 8) MSPs he is advising on New Platform transactions in 2021 are also employing M&A with peers to increase their MSP’s marketability and valuation.

For Add-On acquisitions, PEGs frequently lean more on the expertise of its relevant portfolio company's management to determine the fit, synergies and strategic benefits of a transaction.

However Mr. Garver cautions that, ”On the buy side private equity groups show up for important first calls with their portfolio companies. This is especially important when offers involve rolling equity.”

For New Platforms without a strong track record of M&A, it is a disaster when PEGs won’t provide adequate support which I also experienced last year advising a New Platform on the buy side.

I advised Network Support Co. in its sale to Logically which is PE-backed by Riverside. Riverside did an incredibly efficient job of supporting Logically assess fit, synergies and strategic benefits of the transaction.

When talking to a PEG, try to understand what their investment case is. Why are they interested in your MSP? Are they planning to consolidate it with a Platform? What is their plan for helping the MSP grow?

For New Platforms, key questions PEGs focus on include:

1. How attractive is our industry from a total addressable market and compound average growth perspective (link)?

2. Does the target MSP have multiple avenues of growth?

3. How can we, as a financial sponsor, add value?

4. What is the path to generating an acceptable risk-adjusted return?

Mike McInerney, Director at Prospect Partners adds:

5. How many new customers / how much new business has the company added over time? In other words, what’s the pace of growth?

6. How does customer retention look?

7. Normalized cost structure – additions/subtractions to the existing P&L?

8. For add-ons, how do we integrate the businesses?

On the other hand, PEGs buying a MSP as an Add-On are much more focused on the strategic and financial benefits of adding an acquisition to an existing portfolio company. The strategic side is more clearly defined because the add-on is serving a more specific purpose (e.g. geographic expansion, new products, complementary customer base, economies of scale, etc.). Thus, the Add-On can be narrower in focus and growth potential.

For Add-On acquisitions, PEGs ask questions such as:

1. How does this acquisition support the platform company?

2. Does this make the two businesses more valuable together than separate and what are the tangible synergies?

3. How will this increase the overall return to investors and is this an acceptable return on capital?

MSP owners need to be aware of these differences in perspectives because they have a significant impact on how PEGs will view your business and what they are willing to pay. If you're an Add-on, you probably offer the PEG some synergies. If you are a New Platform, you probably need to prove your growth story more.

Where can you start?

1. Join a Peer Group (IT Nation Evolve Peer Groups by ConnectWise)

2. Email FOCUS’ MSP Team Leader, Abe Garver, or one of his references about their experience.

Abe Garver

Managing Director & MSP Team Leader

8065 Leesburg Pike, Suite 750

Vienna, VA 22182

Cell 646.620.6317 | Connect on LinkedIn

[email protected] | www.focusbankers.com/msp

Washington DC Metro | Atlanta | Los Angeles Metro |

#MSP#private equity#platform acquisition#add-on acquistion#abe garver#FOCUS Investment Banking MSP Team

0 notes

Text

Digital BSS Platforms: Redefining Telecom for CSPs in the Digital Age

In the rapidly evolving digital era, the swift pace of technological progress has rendered older Business Support Systems (BSS) less adaptable. This presents a significant challenge for telecom companies striving to keep pace with dynamic market requirements. Furthermore, these legacy BSS solutions are frequently isolated in their operations, resulting in inefficiencies and inconsistent customer experiences. The cost associated with maintaining and upgrading these aging systems can also encumber telecom companies, constraining their capacity to invest in innovative technologies and services. This calls for a need to invest in novel digital BSS solutions. A telecom digital BSS platform can help CSPs maximize return in the 5G era.

Need for becoming a techno

Becoming a Techco in the telecom industry entails a transformative shift from the traditional telco business model to one centered around technology. This evolution aligns telecom companies more closely with customer preferences, product development, and an iterative approach to building products, akin to modern internet companies. The paramount goal is to foster innovation and enhance customer experiences by seamlessly integrating telecom offerings into customers' lifestyles.

A telecom digital BSS platform can assist CSPs boost revenues by tapping into new industry use cases, meeting enterprise demands, or even venturing into uncharted territories with digital brands to broaden their market reach. Inclusion of these ambitions in business objectives marks the initial stage of a telco's transformation into a genuine Techco.

Why do CSPs need digital BSS solutions?

In the landscape of CSPs, the emergence of 5G stands as a paramount catalyst driving substantial transformations in Business Support Systems (BSS). Historically, BSS frameworks were meticulously crafted to cater to the needs of earlier generations of telecom networks. However, the advent of 5G has ushered in an era marked by soaring demands for services such as the Internet of Things (IoT), virtual reality, and edge computing.

To put it simply, the traditional BSS systems, rooted in legacy technologies, may find themselves ill-equipped to efficiently monetize the copious volumes of data generated by 5G networks and associated devices. This incapacity could lead to critical latency issues and unacceptable delays—outcomes that various industries simply cannot afford in an age defined by real-time connectivity and responsiveness.

Advanced digital business support system - need of the hour

An advanced digital BSS platform enables operators to capitalize on the data network by offering creative, tailored services, enhancing subscribers' digital experiences. With the advent of 5G, CSPs face the challenge of adapting to new business models and dynamic usage scenarios without costly backend code modifications. A centralized product catalog integrated into a BSS platform allows companies to quickly adapt to network advancements and changing demands, helping CSPs navigate 5G complexities and seize emerging market opportunities.

Digital BSS for telecom Migration to Cloud Solutions

The telecom sector is gradually migrating BSS to cloud-based solutions, which offers telecom businesses cost savings and increased flexibility. The objective is not to completely overhaul existing IT systems and begin from scratch, instead aiming to supplement them with next-generation technology in a staged strategy that ensures smooth business continuity.

A modern digital business support system improves organizational productivity and cost effectiveness, particularly in crucial areas like handling orders, post-sales, and service assurance. Cloud technology's widespread acceptance provides CSPs with a feasible, scalable, and adaptive alternative for optimizing their operations.

A telecom digital BSS platform is more than just software; it enables business transformation for CSPs. In a rapidly changing telecom landscape, digital BSS provides the agility, innovation, and customer-centricity that CSPs need to thrive. From enhancing customer experience to protecting revenue and driving operational efficiency, the impact of digital BSS solutions is significant. As we move deeper into the 5G era and witness the continued growth of IoT, CSPs that embrace digital BSS for telecom will be better positioned to lead and succeed in the digital age.

Interested in learning more about Canvas, a digital BSS platform from 6D Technologies?

Please visit https://www.6dtechnologies.com/products-solutions/digital-bss-solutions

0 notes

Photo

WEDNESDAY, 8 JULY 2024. EDITED BY J. JONAH JAMESON.

AMERICA’S FIRST FAMILY LEADS THE WAY!

Although responses to the newly created S.315, aka the Underage Superhuman Welfare Act have been decidedly mixed the first superheroes have finally stepped out in support. Fantastic Four members Dr. Reed Richards and Dr. Susan Storm-Richards announced that they not only believe in Kamala’s Law but have also registered their own children, Franklin Richards ( 16 ) and Valeria Richards ( 14 ) with Mister Fantastic set to sponsor Valeria while the Invisible Woman will register Franklin. This announcement may come as a surprise to some but analysts predicated it weeks ago due to the Fantastic Four’s history. Child Protective Services were called a few years back, according to government records, as it was believed that children could not be raised in a healthy and safe environment if superheroics are in the mix. It was ultimately decided that the Richard’s were fit to maintain custody of their children. Their current support of the Act shows a continued devotion to making the world a safe place for young heroes.

Psychologist and government agent Dr. Valerie Cooper pointed out that S.315 was not put in place to discourage underaged superheroes, only disruptive behavior. “During formative years it’s important for there to be structure and consistency. S.315 requires underage heroes to enter partnerships with established adult heroes who can provide advice and guidance.” By that definition it should be easy for people to take extra precautions to protect their children and set them up for success. Upon turning twenty-one sponsored heroes are able to become mentors themselves, therefore creating a positive cycle that shows sponsorship is not censorship.

“We want the world for our children,” the Invisible Woman said in a Fantastic Four press conference. “But we also remember the fear and struggle that can come with harnessing metahuman abilities. Our son has fantastical powers and with proper guidance we know he can do fantastic things. That’s why we support Kamala’s Law; it fosters potential. We’ve always been champions of positive change and hopefully, through this, a little bit more is passed onto our children.”

With the Fantastic Four now behind the Underage Superhuman Welfare Act more heroes are expected to step forward. So far none of Osborn’s American Avengers have been listed as potential sponsors but they are expected to be soon. Hero teams such as the Champions and the family of minors the Power Pack are expected to sign up for sponsorship soon or will face repercussions. As more and more time passes it seems as if President Osborn’s America may be here to stay. If the Fantastic Four leads the way we may very well end up in a world with supervised heroics. Hopefully this goes better than the last time.

— Christine Everhart, Daily Bugle News Senior Reporter

ROBBING THE C.R.A.D.L.E.: A CONTAINMENT OUTBREAK

Over the last three months the Child Hero Reconnaissance and Disruption Law Enforcement ( C.R.A.D.L.E. ) division of the government have rolled out raids and warranted visits to bring in underaged superheroes. As it stands, being a superhero under the age of twenty-one is not illegal as long as said hero has a government approved sponsor. The government has deigned Central VA Correctional Unit 13 in Virginia as the official C.R.A.D.L.E. Correctional Facility. “The goal is not long term residency,” C.R.AD.L.E. Captain Carolina Washington said in a statement after the announcement. “They’re not inmates. It’s a correctional facility in name but the point is to have a consolidated place to keep heroes safe while we process each case. After they comply they’re welcome to go home and continue making a positive difference.”

On May 25th C.R.A.D.L.E received an anonymous tip that the New Avengers would be having a meeting at the New Avengers Compound in Upstate New York. This tip came shortly after the Bugle received word that high school senior Peter Parker of Queens, NY was actually the masked hero known as Spider-man. Whether or not Parker was the reason C.R.A.D.L.E. was called to the Compound is unknown, but he was confirmed to be present. Please see our article by reporter Melita Garner on page 3 for more of Spider-man’s story. C.R.A.D.L.E. Captain Carolina Washington led the strike alongside America’s Avenger team-member Star, who was there to oversee the situation. Upon arriving they received pushback from Katherine Pryde ( Red Queen ), Sam Wilson ( Captain America ) and Carol Danvers ( Captain Marvel ) the operatives were able to take seven underaged heroes into custody. Parker managed to evade arrest alongside Illyana Rasputina ( Magik ) and Nathan Summers ( Cable ). The addition of the May 25th raid brought the total of arrested minors to seventeen total in the Correctional Facility.

Surprisingly, among those taken into custody was Xandra Neramani, daughter of the deceased Shi’ar Empress Lilandra Neramani and famed mutant leader and humanitarian Charles Xavier. The arrival of the Shi’ar in March revealed that the galactic empire had chosen to allow a fifteen year old to act as their Majestrix due to her Neramani royal blood. She has been supported by Shi’ar Grand Council and former Majestrix Kallark ( Gladiator ). The Shi’ar are known for complicated family relationships, and it was her Aunt turned guardian Cal’syee Neramani ( Deathbird ) who handled the incident. Empress Neramani’s action as a minor on American soil conflict with her diplomatic status, but she was released the following morning to Deathbird’s care and the elder Shi’ar made reassurances that the Empire took no offense and that Empress Neramani’s position is an understandably delicate one. Xandra is the only arrested minor to be released and the rest were booked that night.

On June 15th there was a disturbance at the Correctional Facility when a group disguised as guards broke in. Security cameras have positively identified them as Avenger’s Hawkeye ( Barton ), Hawkeye ( Bishop ), Spider-man ( Parker ) and Spider-Woman ( Drew ). Also present were mutants Angel ( Worthington III ), Cable ( Summers ), Cyclops ( Summers ), Gambit ( LeBeau ), Hellion ( Keller ), Kid Omega ( Quire ), Illyana Rasputina ( Magik ) and Polaris ( Lorna Dane ).

No guards were killed during the break-in and injuries were minor. They managed to break into special holdings and free seven minors. Some of these youth were deemed a danger to themselves and others. Take for example, eighteen year old Lana Baumgartner, aka Bombshell. Baumgartner and her mother, Lori, were booked a decade back for robbery and the eight year old was sent to the S.H.I.E.L.D. Maximum Security Facility for Mutants. A child criminal with mutant terrorist charges, Baumgartner was deemed a victim of poor parental influence and given a parole that meant she was prohibited from using her abilities until the age of twenty-one. The revelation that she has been working with the Champions means she has broken her parole and is legally required to stay at the Facilities until she can be tried again. Cases like this show why C.R.A.D.L.E. is important. Some kids are caught up in things bigger than themselves but others make conscious decisions to do wrong and need to be held accountable.

C.R.A.D.L.E. is currently working to reprehend those who escaped. Jurisdiction remains complicated in mutant cases due to the fact that while they now claim Krakoa citizenship most were born in the States and operate here. The same goes for Terrigen fueled Nuhumans, but like Krakoa’s Quiet Council the Inhumans Queen Amaquelin has remained firm that her people - who are also Americans - should be allowed to live freely as both.

If you see an underaged superhero, please call the C.R.A.D.L.E. Hotline to report them. A list of sponsored heroes is available on C.R.A.D.L.E.’s webpage along with information on those who have warrants out for them. Like the government has said, this is for the good of underaged heroes. You’re helping both them and the country you live in.

— Sally Floyd, Daily Bugle News Senior Reporter

THE CABAL THAT ISN’T A CABAL AT ALL, OR, POWER PLAYS

Cabal, noun: a secret political clique or faction. Normally, the point of a cabal would be to stay true to its definition and remain out of the public eye but news broke back in late April that President Norman Osborn was assembling his own with an impressive array of world leaders in a new sign of unity and development. Shortly after the leak Oscorp’s new spokeswoman Lily Hollister confirmed that the Cabal was real and would function similar to the now defunct multiversal Illuminati of heroes that had consisted of heroes such as Doctor Strange, Namor, Black Bolt and others. According to Hollister, the Cabal was never meant to be secret but treaties and alliances had yet to be secured.

Now made public, the ‘Cabal’ name has stuck but the group is being touted as a sign of unity and progress. Representatives hail from across the galaxy and are compromised of groups that normally would not be seen working together. Of course, there’s been a fair amount of discourse stemming from the proximity and relationship that each member has with the leader of their populous. I was provided information on each member from Ms. Hollister with permission to reprint it here.

Representing Latveria is world leader Victor Von Doom ( Doctor Doom ). Doom is the current leader of Latveria but used to be at odds with the Fantastic Four. His participation on the Cabal is one of the least surprising. Representing the United States is Dr. Valerie Cooper, Special Assistant to the President's National Security Adviser. Dr. Cooper has been instrumental on setting up S.315 and overseeing President Osborn’s new programs and initiative. Part of Dr. Cooper’s platform, however, is the danger of mutants and how superhumans can be harmful to the country, which leads some to be uneasy about having her as a representative.

Representing Asgardia is Loki Laufayson, the adopted brother of Avenger Thor Odinson. Laufayson is infamous for attempting to take over New York through the force of the Chitauri during The Battle of New York in 2012. Although apparently redeemed, there were rumors that he was murdered by Thanos in 2018. Laufayson’s blatant disregard for human life and safety is not something most want to associate the United States with. Laufayson is also acting as a diplomat for Asgardia, but he was not appointed by their King nor does she support him. The only statement that the Valkyrie would make is that “he is a snake, both literally and figuratively.” Because of this it would appear that Laufayson’s words hold no power in the country is supposed to be representing.

In a similar position is the representative of New Attilan, Maximus Boltagon. Boltagon is the brother of former King Black Bolt and is known for his madness and attempts to seize the Inhuman throne. When Black Bolt and his wife, Medusalith Amaquelin, stepped away from the throne it was Amaquelin’s sister Crystalia Amaquelin who took over as Queen, effectively passing Maximus over. This comes across as another power play by Boltagon to claim the Inhuman throne. Queen Amaquelin emphasized the fact that the Inhumans have a Royal Diplomatic Party and Boltagon’s participation on the Cabal is not reflective of their stance. Queen Amaquelin’s cousin isn’t the only Cabal threat to rule over the Inhuman people though.

Representing the Kree Nation is Ronan the Accuser. Queen Amaquelin made waves with her brief marriage to Pietro Maximoff, twin of the New Avenger Wanda Maximoff, and their daughter marked the first and only mutant-Inhuman born ( the inhomosuperior ). Maximus Boltagon announced recently after Amaquelin’s blowback on his Cabal participation that, “My darling cousin is, to put it simply, upset and distempered. She feels insecure about her position but with the stress of running our nation - which has nearly been run into the ground - it seemed fitting that I slip into the Cabal’s shoes. Of course, I know there is the additional possibility that she is unable to look outside of her own past emotions and consider her people due to the participation of Ronan. Oh, yes. That’s right. It’s not commonly known but Crystal and Ronan did wed once upon a time. While it did to work out in the traditional sense it was never annulled and likely the reason why she fails to live up to her duties.” A royal representative did not deny the claims that Queen Amaquelin and Ronan had wed but said it was for the sake of alliances and had no continued contact, nor did his presence impact the Queen’s ability to rule. Maximus, who has been admittedly unstable in the past, is currently listed as working against his people although the Cabal does not denounce his actions and the Accuser has only commented on the state of the Kree and not his marital status.

As mentioned in Sally Floyd’s front page article, Cal’syee Neramani, the Shi’ar known as Deathbird, arrived on Earth with her niece Empress Xandra Neramani. The representative for the Shi’ar was announced to be Deathbird, though, instead of the young Majestrix or former Majestrix Gladiator ( Kallark ) who had ruled after the death of Xandra’s mother, former Empress Lilandra Neramani. Deathbird and her younger sister had often gone head to head after Deathbird was exiled for matricide but still wished to claim the throne. During her banishment Gladiator became a prominent leader until Xandra’s existence was discovered. The teenaged Empress had been living with an attendant of her mother and her father, Charles Xavier, had not known of her birth. Because the Shi’ar believe a Neramani should sit on the throne Xandra was selected as Majestrix over Deathbird, who took on the role of advisor. Following Deathbird’s participation on the Cabal and Empress Neramani’s arrest by C.R.A.D.L.E. it looks as if there are cracks in the Shi’ar ruling infrastructure. “Xandra is our Majestrix,” Gladiator told the Times. “I serve the throne and she is the one who by blood and title deserves to sit there. Deathbird’s actions have been nothing short of treacherous and while that kind of behavior was endured by Lilandra it should not be by her daughter. We will not tolerate the behavior of Cal’syee. Any stances from the Shi’ar will come from the Grand Council. As for the Empresses arrest, we are currently working with the nation of Krakoa to look into the disrespect.” Heavy is the head that wears the crown, and it seems there may be one too many under it in the Shi’ar nation.

The most intriguing of the representatives is that of Krakoa’s, however. It came as a surprise to most that the mutant nation would get involved as they have been pushing their sovereignty and independence. Emma Frost, the White Queen, was announced as the Krakoa representative and brought with her connections to their very exclusive Hellfire Trading Company, the most recent iteration of the Hellfire Club. Frost’s participation with the Cabal allowed previously denied access to Krakoa’s drugs and medications and the Island stayed mostly silent about her involvement, although inside sources say their Quiet Council was far from pleased. A group of New Avengers and mutants crashed a Cabal meeting last month and Frost was seen getting into an altercation with Katherine Pryde, the X-Men formerly known as Shadowcat who has since become the Red Queen in Frost’s club. The incident involved Pryde apparently breaking Frost’s nose and rendering her unconscious before she was carried out by former flame and partner Scott Summers. In the week following the Hellfire Trading Company released a statement that, “While Emma Frost believed she was acting in Krakoa’s best interest it has since been decided that that is not true. Krakoa wishes to have no ties to President Osborn’s Cabal and the Hellfire Trading Company will no longer dispense petals through it. All trading will resume on the same international level as before. Both Ms Frost and Katherine Pryde are fine, their disagreement a very tiny part of their impressive friendship and partnership.”

It seems that from multiple sides the Cabal may be crumbling. The Shi’ar are actively petitioning to have Deathbird removed and Asgardia and New Attilan have made it clear their supposed diplomats do not represent them. The resignation of Emma Frost marks a vacancy in mutant representation but Krakoa is making no moves to fill it. This old reporter has always had his hunches, some of them right and some of them wrong. Power hungry people working together can either lead to two things: domination or a fracturing with the potential to go very, very badly. Sometimes you say ‘only time will tell’, but in this day and age there’s an ever pervasive feeling that we don’t have all that much time before things go wrong.

— Ben Urich, Daily Bugle News Senior Reporter

PETER PARKER: THE WANTED WEBHEAD UMASKED

Peter Parker is Spider-man! As you may have read in my May 25th expose, the Daily Bugle received a hot tip that a photo had been taken of Spider-man maskless. I’m sorry to report to those who are crushing on our spandex clad wall crawler that Spider-man is actually just a seventeen year old from Forest Hills in Queens, NY. Photos of the teenager in costume were sent to our publication and after verification posted a digital article update on the situation. This comes as a surprise to most, including the Bugle, as the Midtown School of Science and Technology worked as a photography intern for us over the course of the last year and was the inaugural recipient of the Stark Internship in 2015. Due to Tony Stark’s work as Iron Man it is likely that the deceased hero knew of Parker’s identity. His Internship now seems like an elaborate cover-up to aid him in dangerous activity instead of a real accomplishment. Bugle Editor J. Jonah Jameson sent out a press release that, “Spider-man is dangerous. Always has been, always will be. The Bugle was not aware of our connection to this deceitful young individual and we renounce any ties to him moving forward. It’s a shame. A real, crying shame.”

Another connection to Parker is Captain George Stacy, a respected member of the NYPD. It was confirmed by Parker’s classmates that for the last few months he had been seeing Gwendolyn Stacy, the Captain’s daughter. Although there’s been no word of how serious the relationship is Captain Stacy has announced that the NYPD will be monitoring the graduations of Standard High were Gwen and President Osborn’s son Harry go and Midtown School of Science and Technology for the safety of Parker’s classmates. “Leave my daughter out of this.” Captain Stacy ordered. “Gwen was just as in the dark as everyone else. Her personal choices are not yours to judge, and if she learns anything about Peter Parker’s whereabouts it will be reported.” Similarly, the White House issued a statement as Harry Osborn is a known childhood friend of Peter Parker’s. Secretary Henry Gyrich went on record saying, “Mr. Osborn believes, like his father, that America comes first. He is glad that a potential danger has been exposed and hopes Mr. Parker will do the right thing, turn himself in and register soon. The Osborn family will be issuing as no more further statements on the matter as President Osborn has a country to run and Harry needs to focus on preparing for his next stage of life.”

From what we have been able to gather, almost no one knew Parker was Spider-man. We have reached out to his best friend, Ned Leeds, and ex-girlfriend and classmate Michelle Jones for comments but have been advised by the Leed’s family that Ned will not be commenting. So far we have not made contact with Jones aunt, Anna Watson. Calls have been made to Parker’s legal guardian. May Reilly-Parker, but she has left her Queens residency and been moved to the New Avengers Compound. It is not known if Parker is with her and the Avengers are aiding a fugitive. You can expect to hear updates as soon as they are released.

— Melita Garner, Daily Bugle News Junior Reporter

IN OTHER NEWS:

June marks graduation season, and the Daily Bugle would like to congratulate this years group of seniors, many of which were victims of the Cleanse. For recognition, Midtown School of Science and Technology submitted senior valedictorians Elizabeth Brant and Michelle Jones. Their original submission included senior Peter Parker for his work with the Stark Internship, but have requested that his name be removed following the recent revelation of his double life as Spider-man. Standard High would like to recognize senior valedictorian Gwendolyn Stacy, daughter of New York Police Captain George Stacy. Also coming out of Midtown is Harry Osborn, our country’s first son and the only child of President Norman Osborn. The Bugle congratulates this years graduates and wishes them happy, successful futures.

July 4th marked what would have been the 106th birthday of American hero Steve Rogers. Although our favorite Captain America ( sorry Sam Wilson! ) may have passed away back in 2023 following the fight against Thanos we will always remember the sacrifices he made for this country. Thank you for your service, Cap. We miss you.

High school student Kamala Khan remains in critical condition in an undisclosed hospital in New Jersey. Her parents have said that while Khan has made a lot of progress there’s still a long way to go. The former Champion and hero known as Ms. Marvel who is believed to be partially responsible is still wanted for questioning and considered at large.

1 note

·

View note

Photo

Figure Student Loan Refinancing Review https://ift.tt/2C7wXnJ

Figure is the newest student loan refinancing lender. They were previously known for being a leader in online mortgage and home equity lending, and they have taken their awesome online application technology and applied it to student loan refinancing.

They make it really easy to refinance your student loan - keeping the process online and funding your new loan extremely quickly. They also offer competitive rates and terms - so they should be on your list of lenders to compare.

Check out the full list of the best places for student loan refinancing. And learn more about Figure below in our Figure student loan refinancing review.

Quick Summary

Newest student loan refinancing lender

100% online and paperless application process

Competitive rates and terms, with only fixed rate loans

Get Started

Figure Student Loans Details

Product Name

Figure Student Loan Refinancing

Min Loan Amount

$5,000

Max Loan Amount

$250,000

APR

3.49% to 6.99% APR

Rate Type

Fixed

Loan Terms

5, 7, 10, 15, 20 Year

Promotions

None

Quick Navigation

Figure Student Loan Refinancing

Rates And Terms

Loan Amounts

Restrictions

Final Thoughts

Figure Student Loan Refinancing

Figure is the newest student loan refinancing lender. The company, Figure, is known for their online only HELOC and mortgage process. They are now taking that same concept to student loan refinancing.

Figure allows people to refinance or consolidate a single student loan or multiple student loans. Read this first: The Ultimate Guide To Student Loan Consolidation.

They offer competitive fixed rate loans, with an online only application process that takes just minutes to complete. They also offer quick funding times on your loan one you're approved.

Rates And Terms

One of the best things about Figure is that they offer extremely competitive fixed rate loans. Most lenders offer their best rates for variable rate loans. But Figure only offers fixed rate loans (similar to First Republic). However, unlike First Republic, they offer a much larger footprint of where you can get a loan from them.

They are currently offering the following rates:

Fixed Rate: 3.49% to 6.99% APR (with autopay discount of 0.25%)

They offer loans with the following term lengths: 5, 7, 10, 15, 20 years.

While they don't offer different repayment programs, they do offer generous benefits compared to other lenders.

They offer a hardship deferment for up to 12 months. They also are one of the few private lenders that offer death and disability discharge.

Borrowers can also get a deferment if they are in the military and deployed, or if they go back to school.

Loan Amounts

Figure doesn't offer the highest loan amounts. They currently limit borrowing to $250,000 - which may work for most borrowers, but could restrict certain professions like medicine.

They do have a minimum loan amount of $5,000.

With the loans, they don't charge any origination fees or prepayment penalties. That means that you can always be shopping around and refinancing if you can get a better rate.

Also, unlike other lenders, they don't charge a late fee or NSF fee.

Restrictions

Figure does have a few restrictions that borrowers need to be aware of.

The biggest is that they are simply not available in every state. They are currently not available in: AK, DE, HI, IN, MD, MS, NV, OH, PA, SC, SD, TN, TX, UT, VT, VA, WV, and WI. However, they said they plan to be available in every state in the near future.

The second restriction is that Figure doesn't allow cosigners at this time. Many borrowers who are looking to refinance don't need a cosigner, but some will need one. Figure isn't the lender for you in that case. You might want to look at other lenders such as Earnest.

Final Thoughts

Figure shows a lot of promise in the student loan refinancing space. I especially love the fixed rate loans and competitive rates and loan terms. I would definitely add Figure to my list of lenders to shop and compare when refinancing my student loans.

However, Figure isn't everywhere yet, and they don't offer the full range of loan types you may need. As such, I still recommend you compare other lenders. Check out Credible to easily shop multiple lenders in one place. Plus, College Investor readers can get up to a $750 gift card bonus if you refinance through their platform. Shop and compare here.

Check out Figure and see if it makes sense for you. It only takes minutes to apply >>

The post Figure Student Loan Refinancing Review appeared first on The College Investor.

from The College Investor

Figure is the newest student loan refinancing lender. They were previously known for being a leader in online mortgage and home equity lending, and they have taken their awesome online application technology and applied it to student loan refinancing.

They make it really easy to refinance your student loan - keeping the process online and funding your new loan extremely quickly. They also offer competitive rates and terms - so they should be on your list of lenders to compare.

Check out the full list of the best places for student loan refinancing. And learn more about Figure below in our Figure student loan refinancing review.

Quick Summary

Newest student loan refinancing lender

100% online and paperless application process

Competitive rates and terms, with only fixed rate loans

Get Started

Figure Student Loans Details

Product Name

Figure Student Loan Refinancing

Min Loan Amount

$5,000

Max Loan Amount

$250,000

APR

3.49% to 6.99% APR

Rate Type

Fixed

Loan Terms

5, 7, 10, 15, 20 Year

Promotions

None

Quick Navigation

Figure Student Loan Refinancing

Rates And Terms

Loan Amounts

Restrictions

Final Thoughts

Figure Student Loan Refinancing

Figure is the newest student loan refinancing lender. The company, Figure, is known for their online only HELOC and mortgage process. They are now taking that same concept to student loan refinancing.