#Urea Fertilizer trader

Explore tagged Tumblr posts

Text

Urea Fertilizer: Manufacturer, Supplier, Wholesale And Exporter in USA

Are you an importer of urea and looking for a trustworthy & leading Urea Fertilizer manufacturer wholesale suppliers in the US? Then you come to the right place. We Agromer company is one of the leading Urea fertilizer supplier, wholesaler, and exporter in the USA. Contact us today for all your bulk Urea requirements.

Contact a leading urea fertilizer supplier to buy urea n46 fertilizer in bulk at a low price.

#Urea Fertilizer#Urea Fertilizer Supplier#Urea Fertilizer trader#Urea Fertilizer exporter#Urea Fertilizer wholesale#buy Urea Fertilizer

0 notes

Text

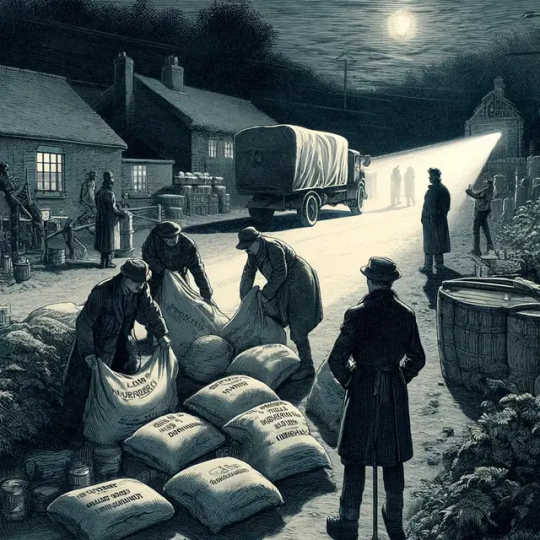

Smuggling Fertilisers

When we think about fertilisers, it’s easy to picture neatly packaged bags headed to farms, supporting the crops that feed the world. But behind this vital industry lies a shadowy side that’s less often discussed: the fertiliser black market.

Yes, it’s real. And its impact goes far beyond local borders, rippling across global markets, influencing prices, disrupting supply chains, and even threatening food security.

In regions with subsidies or price controls, fertilisers often become targets for smuggling. Products meant for local farmers find their way across borders, sold at inflated prices, leaving domestic markets short and farmers without access to critical resources.

Black market fertilisers often come with hidden risks-counterfeit products diluted or mixed with harmful substances. The result? Poor crop performance, long-term soil damage, and financial losses for unsuspecting farmers.

Urea, potash, and other essential fertilisers are commodities that carry geopolitical weight. In regions affected by sanctions or trade restrictions, the black market thrives, further destabilising local economies and widening inequality in resource access.

Illegal trade doesn’t just harm farmers-it undermines legitimate businesses too. Traders face unfair competition, producers lose revenue, and governments miss out on tax income that could have been reinvested into agricultural infrastructure.

But it’s not a hopeless situation. Advances in traceability systems, payments tracking, and stronger regulatory frameworks are helping to tackle these challenges. The fertiliser industry isn’t just about products—it’s about trust, transparency, and responsibility.

#fertilisers #fertilizers #imstory #agriculture #trading #smuggling #market #urea #potash #globaltrade #transparency #business

0 notes

Text

Granular Ammonium Sulphate. You may like it or hate it, but you can’t deny the fact that Granular Ammonium Sulphate is one of the most important product on the modern fertilizer trading business, specially ranking top 1 for many years in China fertilizer export business.

I have been doing ammonium sulphate trading since 2011. Initially, I sold ammonium sulphate powder mainly; later, I started selling Granular ammonium sulphate. Granular ammonium sulphate as a new product was not widely accepted by customers. it has many problems, such as color changing, caking, dust, smelling and so on, very common issues for all granular ammonium sulphate suppliers.

Over the past 10 years, China ammonium sulphate compactors have made substantial equipment update in improving hardness, tried many ways to avoid of dust issue. Now our granular ammonium sulphate is a very standard and popular product globally.

Ammonium sulphate is the substitute product of Urea, more and more fertilizer companies have been constantly migrating to this excellent product since previous years. While the global are speculating about urea. China ammonium sulfate has made very important role in restraining the excessive speculation of international urea and contributing to world agricultural development and food security.

As a trader who has been engaged in the ammonium sulfate for many years, I am happy and proud of my work.

#Granularammoniumsulphate #GranularSOA #SOAgranular #Granularamsul #amsulgranular #Chinagranularaammoniumsulphate

#chemplusagroindustry

0 notes

Text

Granular Ammonium Sulphate. You may like it or hate it, but you can’t deny the fact that Granular Ammonium Sulphate is one of the most important product on the modern fertilizer trading business, specially ranking top 1 for many years in China fertilizer export business.

I have been doing ammonium sulphate trading since 2011. Initially, I sold ammonium sulphate powder mainly; later, I started selling Granular ammonium sulphate. Granular ammonium sulphate as a new product was not widely accepted by customers. it has many problems, such as color changing, caking, dust, smelling and so on, very common issues for all granular ammonium sulphate suppliers.

Over the past 10 years, China ammonium sulphate compactors have made substantial equipment update in improving hardness, tried many ways to avoid of dust issue. Now our granular ammonium sulphate is a very standard and popular product globally.

Ammonium sulphate is the substitute product of Urea, more and more fertilizer companies have been constantly migrating to this excellent product since previous years. While the global are speculating about urea. China ammonium sulfate has made very important role in restraining the excessive speculation of international urea and contributing to world agricultural development and food security.

As a trader who has been engaged in the ammonium sulfate for many years, I am happy and proud of my work.

#Granularammoniumsulphate #GranularSOA #SOAgranular #Granularamsul #amsulgranular #Chinagranularaammoniumsulphate

#chemplusagroindustry

0 notes

Text

Ammonium Nitrate Prices Trend | Pricing | Database | Index | News | Chart

Ammonium Nitrate prices have been a significant concern for industries and agricultural sectors worldwide due to their pivotal role in fertilizers and explosives. This compound, which is a key nitrogen source for plants, is crucial for boosting agricultural productivity, making its price fluctuations critically impactful for farmers and agribusinesses. Over the past few years, several factors have influenced the pricing trends of ammonium nitrate, creating a complex market landscape that stakeholders must navigate carefully.

The global market for ammonium nitrate has seen varied price trends due to a multitude of factors. One of the primary drivers is the cost of raw materials, particularly natural gas, which is essential in the production of ammonia, a precursor for ammonium nitrate. Fluctuations in natural gas prices, often influenced by geopolitical events and supply-demand dynamics, directly affect the cost of ammonium nitrate. For instance, any disruption in natural gas supply can lead to increased production costs for ammonium nitrate, thereby raising its market price.

Moreover, regulatory changes have played a crucial role in shaping the ammonium nitrate market. Given its potential misuse in making explosives, many countries have tightened regulations on the production, storage, and transportation of ammonium nitrate. These regulatory measures, while necessary for safety and security, have led to increased operational costs for manufacturers, which are often passed down to the consumers in the form of higher prices. Additionally, environmental regulations aimed at reducing the carbon footprint of chemical production processes have also contributed to cost increases, as manufacturers invest in cleaner technologies and processes.

Get Real Time Prices for Ammonium Nitrate: https://www.chemanalyst.com/Pricing-data/ammonium-nitrate-1216

The agricultural demand for fertilizers significantly influences ammonium nitrate prices. Seasonal variations in planting and harvesting cycles create periods of high and low demand. During peak planting seasons, the demand for ammonium nitrate surges, often leading to price spikes. Conversely, during off-peak periods, prices may stabilize or even decrease due to lower demand. Furthermore, global agricultural trends, such as the adoption of alternative fertilizers and advancements in agricultural practices, can impact the demand for ammonium nitrate. For example, the increasing use of urea and other nitrogenous fertilizers has sometimes led to a shift in demand dynamics within the fertilizer market.

International trade policies and tariffs also play a significant role in determining ammonium nitrate prices. Trade restrictions, tariffs, and quotas imposed by major producing and consuming countries can alter the supply chain and impact prices. For example, if a leading producer country imposes export restrictions, it can create a supply shortage in the global market, driving prices up. Conversely, the removal of trade barriers can increase market competition and potentially lower prices.

Market speculation and futures trading are additional factors that influence ammonium nitrate prices. Traders and investors, anticipating future price movements based on various market indicators, can drive price volatility. For instance, speculation about potential shortages or surpluses can lead to preemptive buying or selling, thus affecting market prices. Similarly, futures contracts, which are agreements to buy or sell a commodity at a future date, can influence current market prices based on anticipated future supply and demand conditions.

The production capacity of major manufacturers also impacts ammonium nitrate prices. Any disruptions in production, whether due to maintenance shutdowns, accidents, or natural disasters, can lead to supply shortages and price hikes. Additionally, the expansion or reduction of production capacity by key players can influence market supply and subsequently, prices. For example, if a major producer expands its production capacity, the increased supply can lead to lower prices, provided the demand remains constant.

Technological advancements in production processes can lead to changes in ammonium nitrate prices as well. Innovations that enhance production efficiency and reduce costs can lead to lower prices for end consumers. On the other hand, the adoption of new technologies that require significant capital investment can initially drive up costs, which might be reflected in higher market prices until the benefits of the efficiencies are realized.

In summary, ammonium nitrate prices are influenced by a complex interplay of factors including raw material costs, regulatory changes, agricultural demand, international trade policies, market speculation, production capacity, technological advancements, and unforeseen global events such as the COVID-19 pandemic. Understanding these factors is crucial for stakeholders to navigate the market effectively and make informed decisions. As the world continues to grapple with economic and environmental challenges, the dynamics of ammonium nitrate pricing will remain a critical area of focus for industries and policymakers alike.

Get Real Time Prices for Ammonium Nitrate: https://www.chemanalyst.com/Pricing-data/ammonium-nitrate-1216

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Ammonium Nitrate#Ammonium Nitrate Price#Ammonium Nitrate Prices#Ammonium Nitrate Pricing#Ammonium Nitrate News

0 notes

Text

Urea Prices Trend and Forecast

North America

During the first quarter of 2023, steadily declining raw material prices had an effect on the Urea Prices in the North American region. The early year fall in Natural Gas prices led to low feedstock Ammonia prices, which resulted in an oversupply of downstream sectors and consumers. Prices in the regional market have decreased because of diminishing demand and a decrease in offtakes close to the end of the quarter. US urea prices for the month of March rose to USD 420 per tonne FOB Illinois after falling in the first half of the quarter. A sole bright spot in the Urea market this week was seasonally adjusted as demand in NOLA (New Orleans and Louisiana), US, recovered, which caused prices FOB barge per tonne to increase from roughly USD 310/MT FOB early this week as high as USD 357/MT. However, this rise is believed to be temporary due to increased Urea supplies from arriving overseas vessels.

Asia Pacific

The price of Urea in the Asia Pacific region first rose and then fell in the first quarter of 2023 as a result of continually shifting raw material costs. In the first quarter of 2023, Urea prices increased somewhat in the APAC area. Demand purchase distribution has been drastically cut back. Price fluctuations for Urea compared to the relatively abundant supply from prior years. The Spring Festival this year was held quite early, and the chilly conditions remained afterward. Fertilizer production takes longer during the Spring Festival as a result, and demand is rarely met. Traders frequently purchase fertilizer when prices are low because they have more time to prepare it. The price of Urea has increased because of rising coal costs because coal is the main feedstock utilized by industries in China. Price estimates for Urea in Q1 were USD 473/MT FOB Qingdao.

Europe

In the first quarter of 2023, fertilizer prices significantly dropped in Europe. The price of Urea in European markets has decreased as a result of falling ammonia and nitrogen prices, decreasing input costs, and falling Natural Gas Prices all essential ingredients in the production of fertilizers. Some European countries continued to have high inventory levels, which reduced the region's need for imports. As a result of falling demand from the end-user fertilizer and melamine manufacturing industries, local urea producers cut the lower end of their prices. Worldwide, the supply of nitrogen fertilizers increased during Q1 while demand decreased. Prices in the European region were estimated to be USD 606/MT in January, but they dropped by 26.57% by the month's end.

ChemAnalyst addresses the key problematic areas and risks associated with chemical and petrochemical business globally and enables the decision-maker to make smart choices. It identifies and analyses factors such as geopolitical risks, environmental risks, raw material availability, supply chain functionality, disruption in technology and so on. It targets market volatility and ensures clients navigate through challenges and pitfalls in an efficient and agile manner. Timeliness and accuracy of data has been the core competency of ChemAnalyst, benefitting domestic as well as global industry in tuning in to the real-time data points to execute multi-billion-dollar projects globally.

0 notes

Text

Urea | Market speculation gradually prices continue to push up or usher in an inflection point?

: Just in May experienced the "red cherry, green banana", it ushered in the 24 solar terms in ear. Domestic Henan, Suwan, Shandong and other places to carry out wheat harvest. Urea market prices also bottomed out on the last day of May, just a little more than a week, domestic urea prices have risen to about 250-300 yuan/ton, with the harvest season, the recent atmosphere of urea to push up also played to the extreme, next we take a look at the reasons for the next round of rises and future market development expectations. Many factors helped guide the formation of this round of gains One reason: With the continuous decline of urea market prices in the early stage, some factories have been in a state of loss, and has been in the process of sliding channel in May, downstream users and traders are difficult to replenish the warehouse, with market sentiment will be low, rebound sentiment is particularly obvious, some downstream and traders are subject to the impact of empty storage, after the price slightly stabilized began to focus on replenishment, The rendering of the market atmosphere and the improvement of the pan at the end of the month also make the local delivery shortage of the factory, and after the rise of the downstream delivery willingness, urea enterprises increase the offer accordingly. The second reason: the boost of the international situation is undoubtedly also to the rebound market at that time to add a booster, marking the news, so that domestic urea manufacturers export interest increased, and heard that some northern ports a small number of port activities, the rise also expanded. The third reason: the corn in some parts of the north gradually began to be sown, and the application of corn bottom fertilizer in summer is expected to arrive, and the production of compound fertilizer factories still exists at this time, and the overlap of industrial and agricultural needs leads to the improvement of the downstream sentiment of taking goods. The rally is tapering off and worries are emerging Supply expectation: In addition to the new equipment put into operation in June, the overall supply side will be improved, with the gradual easing of loading and unloading, the short-term supply shortage of the market spot may be alleviated, and the factory's orders to be issued are gradually implemented. Demand expectations: At present, the construction of some compound fertilizer plants is still acceptable, but with the end of the summer corn fertilizer production season, the construction of compound fertilizer plants is expected to gradually decline. At present, the compound fertilizer plants in Shandong and other places have stopped, and Henan can still maintain 5-7 days or so. The weakening of supply and demand expectations also makes the current downstream users and traders have low willingness to buy new orders. In addition, the factory delivery time is longer, and the market price is weakened. In agriculture, some areas of corn fertilizer is expected to be applied, but after the centralized replenishment, the demand side will continue to show a phased dispersion situation. Other expectations: with the news such as printing, the industry suspects that changes in international prices may become a new turning point. Overall, the rise has initially slowed down, is expected to weaken the risk of rising power in the later period, the factory is ready to support, the market price is still running at a high level in recent days, but with the possibility of further loosening after stabilizing the market, follow up next Monday's printing price and compound fertilizer production. MIT-IVY INDUSTRY Co.,Ltd. Xuzhou, Jiangsu, China Phone/WhatsApp : + 86 13805212761 Email : [email protected] http://www.mit-ivy.com Read the full article

0 notes

Text

Fertilizer Situation in India

Fertilizer trading is an important industry in India, as the country is one of the largest producers and consumers of fertilizers in the world. In fact, India is the third largest producer of fertilizers, after China and the United States, and the second largest consumer, after China.

The fertilizer industry in India is largely government-controlled, with the majority of production being carried out by state-owned enterprises. However, there are also a number of private companies as well, that operate in this sector. The main types of fertilizers produced in India include urea, diammonium phosphate (DAP) and complex fertilizers which are blends of different nutrients.

Fertilizer trading in India is carried out through a number of channels, including imports, exports, and domestic sales. India is a major importer of fertilizers, particularly potash, which is used to produce complex fertilizers. The country also exports a significant amount of fertilizers, which is in high demand in other countries. Traders such as TLI - TradeLink India plays a very important role in this segment.

In terms of domestic sales, the government of India plays a key role in the distribution of fertilizers to farmers. The government operates a number of programs that aim to make fertilizers more affordable and accessible to farmers, particularly those in rural areas.

One of the main challenges facing the fertilizer industry in India is the issue of low soil fertility. Many parts of the country have soil that is low in nutrients, which can make it difficult for crops to grow and thrive. To address this issue, farmers in India rely heavily on fertilizers to provide the nutrients that their crops need. However, the high cost of fertilizers can be a burden for many farmers, particularly those who are already struggling to make ends meet.

To address this challenge, the government of India has implemented a number of initiatives to make fertilizers more affordable and accessible to farmers. These include subsidies and price controls, as well as programs that aim to increase the efficiency of fertilizer use and reduce waste.

Overall, the fertilizer industry in India plays a vital role in supporting the country's agriculture sector and helping to feed its growing population. However, there are also a number of challenges and issues that need to be addressed in order to ensure that the industry is sustainable and meets the needs of farmers and consumers.

0 notes

Text

Ammonia Market Suppliers,Expand Substantially Owing to Technological Innovations During 2020 – 2027

The rapid outburst in population and increase in disposable income coupled with modern lifestyles in developing economic nations is driving the demand for the market.

The global Ammonia Market is forecast to reach USD 90.88 Billion by 2027, according to a new report by Reports and Data. Ammonia is a compound of hydrogen and nitrogen. It is a colorless gas with a pungent smell. It is used in the manufacture of several industrial chemicals. The product is used in the manufacture of urea, ammonium sulfate, and ammonium phosphates.

It is a crucial feedstock ingredient used to produce nitric acid, which is an important precursor for specialty organic chemicals. An increase in the focus on energy consumption systems is anticipated to increase the usage of products as a refrigerant to provide safe, sustainable, and energy-saving refrigeration. Ammonia has a zero Ozone Depletion Potential (ODP) and Global Warming Potential (GWP). The product has better transfer properties as compared to another chemical refrigerant.

Leading Market Competitors:

BASF SE, SABIC, CF Industries Holdings, Inc., Huaqiang Chem Group, PotashCorp, Rashtriya Chemicals & Fertilizers Ltd., China National Petroleum Corporation, China Petroleum & Chemical Corporation, Shanxi Jinfeng Coal Chem, and Qatar Fertilizer Company, among others.

Get a sample of the report @ https://reportsanddata.com/sample-enquiry-form/2781

Market Overview:

The materials and chemical industry has long been at the forefront of innovation. It has aided in the exploration of new parts of nature by the scientific community as well as individuals. Everything is made up of chemicals, from medical supplies to paints to perfumes. The materials and chemicals business is in charge of both new chemical discovery and substance exploration. From discovering novel compounds to generating new chemical combinations, the materials and chemicals business has always taken a forward-thinking attitude.

The Alumina market research report highlights the major regional markets including North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. It elaborates on various aspects these regional markets, such as shifting consumer tastes & preferences, fluctuations in supply & demand, changing production & consumption patterns, and revenue growth rate of each market. In addition, the report analyzes the current position of each player in the Alumina market leveraging various analytical tools such as Porter’s Five Forces analysis, SWOT analysis, and Capacity Utilization analysis.

To know more about the report @ https://www.reportsanddata.com/report-detail/ammonia-market

Type Outlook (Revenue, USD Billion; Volume, Kilo Tons; 2016-2027)

Liquid

Gas

Powder

Distribution Channel Outlook (Revenue, USD Billion; Volume, Kilo Tons; 2016-2027)

Online

Offline

Industry Verticals Outlook (Revenue, USD Billion; Volume, Kilo Tons; 2016-2027)

Agriculture

Mining

Textiles

Refrigeration

Pharmaceutical

Others

Request a customized copy of the report @ https://reportsanddata.com/request-customization-form/2781

Market Report includes major TOC points:

Ammonia market Overview

Global Economic Impact on Industry

Global Market Competition by Manufacturers

Global Production, Revenue (Value) by Region

Global Supply (Production), Consumption, Export, Import by Regions

Global Production, Revenue (Value), Price Trend by Type

Global Market Analysis by Application

Manufacturing Cost Analysis

Industrial Chain, Sourcing Strategy and Downstream Buyers

Marketing Strategy Analysis, Distributors/Traders

Market Effect Factors Analysis

Ammonia market Forecast

Conclusively, all aspects of the Ammonia market are quantitatively as well qualitatively assessed to study the global as well as regional market comparatively. This market study presents critical information and factual data about the market providing an overall statistical study of this market on the basis of market drivers, limitations and its future prospects.

About Reports and Data

Reports and Data is a market research and consulting company that provides syndicated research reports, customized research reports, and consulting services. Our solutions purely focus on your purpose to locate, target and analyze consumer behavior shifts across demographics, across industries and help client’s make a smarter business decision. We offer market intelligence studies ensuring relevant and fact-based research across a multiple industries including Healthcare, Technology, Chemicals, Power and Energy. We consistently update our research offerings to ensure our clients are aware about the latest trends existent in the market. Reports and Data has a strong base of experienced analysts from varied areas of expertise.

Contact Us:

John W

Head of Business Development

Reports and Data | Web: www.reportsanddata.com

Direct Line: +1-212-710-1370

E-mail: [email protected]

Read Our Innovative Blogs @ https://www.reportsanddata.com/blogs

Visit our blog for more industry updates @ https://www.reportsanddata.com/blogs

0 notes

Text

A Happy Swings

The funny swings – it's the best description of what happened in Egypt over the last 24 hours.

To start, 50,000 metric tonnes of prilled urea were sold to India at $328 per metric tonne FOB. Freight from Mediterranean ports is $30–32 per metric tonne, leaving little, if any, margin for a trader awarded the contract at $362 per metric tonne CFR. However, the urgency of the deal shows a mutual desire by both parties to conclude it.

Then the classic swing began, with granular urea traded continuously late into the night. Over 60,000 metric tonnes (or perhaps more?) changed hands in a range from $337 to $360 per metric tonne FOB. Prices fell from $350 to $337 and then climbed back to $360 per metric tonne FOB – a $36 per metric tonne swing within 24 hours. If you were on the wrong side of this rollercoaster move, I’m sorry to hear it. But if you rode the wave – congratulations!

What a breathtaking market, isn’t it?

#agicommodities #cbot #corn #soybeans #india #urea #tender #nola #fertilizers #fertilisers #imstory #analysis #ag #egypt #russia

#agriculture#fertilizer#fertilization#urea#corn#usa#wheat#india#vessel#nola#egypt#persian gulf#imstory#tender

0 notes

Text

Dicyandiamide Market Critical Analysis with Expert Opinion & Size To 2025

Global Dicyandiamide Market: Global Size, Trends, Competitive, Historical & Forecast Analysis, 2019-2025 Increasing demand of the metformin is the key driver for Global Dicyandiamide Market.

The scope of Dicyandiamide Reports:

Dicyandiamide is alkaline, hydrophilic white crystalline compound and also known as 2-Cyanoguanidine. It is mainly used as active pharmaceutical ingredient (API) in the production of anti-diabetic drug. It is also used in the production of organic chemicals, dye fixing agents, used as curing agent in epoxy raisins, adhesives and others. There are different grade of dicyandiamide is available in the market on the basis of its purity. So, during the study of Global Dicyandiamide market, we have considered Dicyandiamide compound to analyse the market.

Get Sample Copy of The Dicyandiamide Market Report 2020@ https://brandessenceresearch.com/requestSample/PostId/171

*The sample pages of this report is immediately accessible on-demand.**

Global Dicyandiamide Market report is segmented on the basis of grade type, application type, and by regional & country level. Based upon grade type, global Dicyandiamide Market is classified as Industrial grade, Electronic grade, Pharmaceutical grade and others. Based upon Application type, global Dicyandiamide Market is classified as Pharmaceutical, Epoxy laminates, Slow release fertilizers, Flame retardants, Dye fixing, water treatment and others. The regions covered in this Dicyandiamide Market report are North America, Europe, Asia-Pacific and Rest of the World. On the basis of country level, market of Computed Tomography is sub divided into U.S., Mexico, Canada, U.K., France, Germany, Italy, China, Japan, India, South East Asia, GCC, Africa, etc.0020

Key Players–

Global Dicyandiamide market report covers prominent players like

AlzChem Group AG, Ltd.,

Ningxia Jiafeng Chemicals Co., Ltd.,

Ningxia Blue-White-Black Activated Carbon Co. Ltd.,

Ningxia Yinglite Chemical Co., Ltd.,

Ningxia Sunnyfield Chemical Co. Ltd.,

Ningxia Darong Industry Group Co.,

ShizuishanPengsheng Chemical Co., Ltdand

Market Dynamics –

The dicyandiamide market is primarily driven by the increasing demand of metformin due to the increased prevalence of diabetes. Metformin is used for the treatment of diabetes which is also referred as diabetes mellitus. As per 2017 report of Centers for Disease Control and Prevention there were around 30.3 million in the world are suffering from diabetes.

Dicyandiamide is used as active pharmaceutical ingredient in the production of metformin on a large scale which helps in the improvement of glucose in diabetes patient. Dicyandiamide is used as intermediate during the manufacturing of flame retardants, fertilizers, coating, adhesives and others. Currently manufacturers prefer to use urea as raw materials for the production of melamine. Due to the availability of cost effective and better performing substitute are expected to hinder the growth of dicyandiamide market. The development of non toxic ultra-micronized dicyandiamide with improved performance for the production coatings, adhesives and others are expected to create new opportunities for dicyandiamide over the forecast period.

Regional Analysis –

The regional dicyandiamide market is consolidated and North America is expected to experience a moderate growth over the forecast period which is closely followed by Europe. Asia Pacific is expected to experience a significant growth over the forecast period due to the presence of developing countries such as China, India and others. Major manufacturers of dicyandiamide are located in the China and end users directly procure the dicyandiamide from the manufacturers based in China and Germany or through traders and distributors located in the respective region. Chinese manufacturers do not sell their products under any brand names and AlzChem Group AG is the only company has its manufacturing base outside Asia.

Key Benefits–

Global Dicyandiamide market report covers in depth historical and forecast analysis.

Global Dicyandiamide Market research report provides detail information about Market Introduction, Market Summary, Global market Revenue (Revenue USD), Market Drivers, Market Restraints, Market opportunities, Competitive Analysis, Regional and Country Level.

Global Dicyandiamide Market report helps to identify opportunities in market place.

Global Dicyandiamide Market report covers extensive analysis of emerging trends and competitive landscape.

Market Segmentation –

By Grade type analysis

Industrial Grade

Electronic Grade

Pharmaceutical Grade

Others

By Application type Analysis

Pharmaceutical

Epoxy Laminates

Slow Release Fertilizers

Flame Retardants

Dye Fixing

Water Treatment

Others

By Regional & Country Analysis

North America

Europe

Asia Pacific

Latin America

Middle East and Africa

U.S

Canada

U.K

France

Germany

Italy

China

Japan

India

Southeast Asia

Brazil

Mexico

GCC

Africa

Rest of Middle East and Africa

Table of Content

Chapter – Report Methodology

1.1. Research Process

1.2. Primary Research

1.3. Secondary Research

1.4. Market Size Estimates

1.5. Data Triangulation

1.6. Forecast Model

1.7. USP's of Report

1.8. Report Description

Chapter -Dicyandiamide Market Overview: Qualitative Analysis

2.1. Market Introduction

2.2. Executive Summary

2.3. Dicyandiamide Market Classification

2.4. Market Drivers

2.5. Market Restraints

2.6. Market Opportunity

2.7. Dicyandiamide Market: Trends

2.8. Porter's Five Forces Analysis

2.9. Market Attractiveness Analysis

Chapter –Dicyandiamide Market Overview: Quantitative Analysis

Chapter -Dicyandiamide Market Analysis: Segmentation By Type

Chapter -Dicyandiamide Market Analysis: Segmentation By Application

Continued....

About Us:

Brandessence Market Research and Consulting Pvt. ltd.

Brandessence market research publishes market research reports & business insights produced by highly qualified and experienced industry analysts. Our research reports are available in a wide range of industry verticals including aviation, food & beverage, healthcare, ICT, Construction, Chemicals and lot more. Brand Essence Market Research report will be best fit for senior executives, business development managers, marketing managers, consultants, CEOs, CIOs, COOs, and Directors, governments, agencies, organizations and Ph.D. Students. We have a delivery center in Pune, India and our sales office is in London.

Contact us at: +44-2038074155 or mail us at [email protected]

0 notes

Text

Cheers for this magical record!

China amsul exported 2.09 million tons in Aug, 2024.

Total export quantity from Jan to Aug reached 10.03 million tons, 1.5 million tons more than same period last year. China ammonium sulfate export made new records again!

15 years ago, ammonium sulphate as Environmental by-product from steel factories, caprolactam factories,chemical factories and so on, total exported quantity was very small. Large scale companies barely do this business. They focused on urea, phosphate fertilizer, compound fertilizer, and some other large quantity fertilizers.

With production capacity increase of ammonium sulfate in China, the export quantity increased year by year, covered more than 70% production capacity in global market. China amsul play very important role in international nitrogen market.

However, the market got change along with CIQ from China government, which China are not able to export large quantity of Urea, phosphate and NPK. some companies have to do ammonium sulphate business.

In 2021, China amsul export quantity reached 10 million tons, made big surprise for fertilizer traders and distributors. Many big companies turn around to do ammonium sulphate business. specially some national big companies spent a lot of money to build new production line of Granular ammonium sulphate.

Since I started to do ammonium sulfate business in 2011, I have honor to witness gradual increase of China ammonium sulfate export and every important moment.

Before: mainly ammonium sulphate business was amsul steel grade powder and amsul standard crystal, package in 50kg or 25kg, granular ammonium sulphate was not very popular, due to dust and caking issue. Delivery way mainly by containers, or some small vessel, such as 10KMT ~3KMT and combine with other fertilizers.

Now: mainly amsul business was Granular ammonium sulphate and standard amsul , granular amsul much poplular than crystal amsul, because average quality increased a lot. Package in Bulk or 1250KG Jumbo bag. Bulk shipments are very common, max vessel more than 80KMT. BBV as second popular way. Only very small quantity be shipped by containers.

No matter how the market change and ammonium sulfate industry develop. As a member of the ammonium sulfate industry, we have never given up the pursuit of quality, cherish relationship with customers always and develop together.

#ammoniumsulphate #Granularammoniumsulphate

#amsulgranular #granularamsul #chinaamsul #chinaammoniumsulfate

#fertilizer#water soluble fertilizer#ammonium sulphate#granularammoniumsulphate#urea#magnesiumsulphate

0 notes

Text

Urea Prices, Trend, Pricing, Supply & Demand and Forecast | ChemAnalyst

Urea prices, a critical indicator in the agricultural sector, have been subject to fluctuations influenced by a myriad of factors, ranging from supply and demand dynamics to geopolitical tensions and environmental regulations. As one of the most commonly used nitrogen fertilizers globally, urea plays a pivotal role in enhancing crop yields and ensuring food security. Understanding the intricacies of urea pricing requires a holistic view encompassing both global and regional dynamics.

In recent years, the global urea market has experienced notable volatility, with prices exhibiting both upward and downward trends. Factors such as shifts in demand patterns, particularly from emerging economies like India and China, have significantly impacted prices. The agricultural practices and policies of these nations, as well as climatic conditions affecting agricultural output, influence the demand for urea. Additionally, currency fluctuations, trade agreements, and tariffs imposed on urea imports can cause sudden price fluctuations, further complicating the market dynamics.

Moreover, the production and supply chain of urea are subject to various geopolitical factors, including trade disputes, sanctions, and political instability in major producing countries. Countries with substantial natural gas reserves, such as Russia and the Middle Eastern nations, dominate urea production, as natural gas is a primary raw material in urea manufacturing. Any disruptions in natural gas supply or production capabilities in these regions can lead to supply shortages and subsequent price spikes in the global urea market.

Get Real Time Prices of Urea: https://www.chemanalyst.com/Pricing-data/urea-1190

Environmental regulations also play a crucial role in shaping urea prices. With growing concerns about environmental sustainability and greenhouse gas emissions, governments worldwide are implementing stricter regulations on nitrogen fertilizer usage. Urea producers may incur additional costs to comply with these regulations, such as investing in cleaner production technologies or carbon offset programs. Consequently, these added expenses could translate into higher urea prices for consumers.

Furthermore, market speculation and investor sentiment can contribute to price volatility in the urea market. Traders and investors closely monitor factors such as weather forecasts, crop reports, and geopolitical developments to anticipate future demand and supply dynamics. Speculative trading activities can amplify price fluctuations, leading to both short-term spikes and corrections in urea prices.

On a regional level, urea prices can vary significantly due to factors specific to each market. Transportation costs, import tariffs, and local demand-supply imbalances all influence regional price disparities. For instance, landlocked regions may face higher transportation costs, leading to higher urea prices compared to coastal areas with easier access to imports. Additionally, government subsidies or support programs aimed at promoting agricultural productivity can impact urea prices within certain regions.

Amidst these multifaceted dynamics, farmers and agricultural stakeholders must closely monitor urea prices to make informed decisions regarding fertilizer purchases and crop management strategies. Price forecasting models, market intelligence reports, and industry insights can assist stakeholders in navigating the volatile urea market landscape.

In conclusion, urea prices are subject to a multitude of factors spanning global, regional, and local levels. Supply-demand dynamics, geopolitical tensions, environmental regulations, and market speculation all contribute to the volatility observed in urea prices. Understanding these complex dynamics is essential for stakeholders in the agricultural sector to mitigate risks and optimize their fertilizer procurement strategies. By staying informed and adaptable, farmers and industry players can navigate the challenges posed by fluctuating urea prices while striving for agricultural sustainability and productivity.

Get Real Time Prices of Urea: https://www.chemanalyst.com/Pricing-data/urea-1190

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

Urea Resin Price Trend and Forecast

As upstream nitrogen values in the nation have fallen, Urea Resin price in the United States have decreased in Q3. Sources claim that nitrogen values have decreased by 30% in the global market. Due to declining demand and a reduction in offtakes, prices have also decreased in the domestic market. Domestic demand from consumers in the United States is still modest, as would be expected during the offseason. As a result, a lot of the producers and traders there continue to focus on re-exporting opportunities. The global fertilizer market will continue to be impacted by the vacuum in the global supply chain, and the conflict between Russia and Ukraine is far from settled. However, it is unlikely that exports will increase considerably under the current inspection process. Urea Resin costs decreased and came to USD 1065/M.T.

0 notes

Text

Urea | Market speculation gradually prices continue to push up or usher in an inflection point?

: Just in May experienced the "red cherry, green banana", it ushered in the 24 solar terms in ear. Domestic Henan, Suwan, Shandong and other places to carry out wheat harvest. Urea market prices also bottomed out on the last day of May, just a little more than a week, domestic urea prices have risen to about 250-300 yuan/ton, with the harvest season, the recent atmosphere of urea to push up also played to the extreme, next we take a look at the reasons for the next round of rises and future market development expectations. Many factors helped guide the formation of this round of gains One reason: With the continuous decline of urea market prices in the early stage, some factories have been in a state of loss, and has been in the process of sliding channel in May, downstream users and traders are difficult to replenish the warehouse, with market sentiment will be low, rebound sentiment is particularly obvious, some downstream and traders are subject to the impact of empty storage, after the price slightly stabilized began to focus on replenishment, The rendering of the market atmosphere and the improvement of the pan at the end of the month also make the local delivery shortage of the factory, and after the rise of the downstream delivery willingness, urea enterprises increase the offer accordingly. The second reason: the boost of the international situation is undoubtedly also to the rebound market at that time to add a booster, marking the news, so that domestic urea manufacturers export interest increased, and heard that some northern ports a small number of port activities, the rise also expanded. The third reason: the corn in some parts of the north gradually began to be sown, and the application of corn bottom fertilizer in summer is expected to arrive, and the production of compound fertilizer factories still exists at this time, and the overlap of industrial and agricultural needs leads to the improvement of the downstream sentiment of taking goods. The rally is tapering off and worries are emerging Supply expectation: In addition to the new equipment put into operation in June, the overall supply side will be improved, with the gradual easing of loading and unloading, the short-term supply shortage of the market spot may be alleviated, and the factory's orders to be issued are gradually implemented. Demand expectations: At present, the construction of some compound fertilizer plants is still acceptable, but with the end of the summer corn fertilizer production season, the construction of compound fertilizer plants is expected to gradually decline. At present, the compound fertilizer plants in Shandong and other places have stopped, and Henan can still maintain 5-7 days or so. The weakening of supply and demand expectations also makes the current downstream users and traders have low willingness to buy new orders. In addition, the factory delivery time is longer, and the market price is weakened. In agriculture, some areas of corn fertilizer is expected to be applied, but after the centralized replenishment, the demand side will continue to show a phased dispersion situation. Other expectations: with the news such as printing, the industry suspects that changes in international prices may become a new turning point. Overall, the rise has initially slowed down, is expected to weaken the risk of rising power in the later period, the factory is ready to support, the market price is still running at a high level in recent days, but with the possibility of further loosening after stabilizing the market, follow up next Monday's printing price and compound fertilizer production. MIT-IVY INDUSTRY Co.,Ltd. Xuzhou, Jiangsu, China Phone/WhatsApp : + 86 13805212761 Email : [email protected] http://www.mit-ivy.com Read the full article

0 notes

Text

Efforts To Tackle Fertilizer Crisis

India is the 2nd largest importer of fertilizers globally. India imports 100% of potash, 95% of phosphates & 25% of Urea which are the essential raw materials for manufacturing fertilizers. With the ongoing global scenario that looks grim due to the series of events like the pandemic, the on-going Russia-Ukraine war and trade wars between various countries; a global food crisis has emerged.

The food crisis has generated the need of higher food production. For producing in larger quantities, many efforts are made by various governments including ours to develop high grade fertilizers which can boost the yield of crops. And these high yielding fertilizers are required in larger quantities so that they can reach every farmer in desired quantity and we can produce enough to meet the requirements of our as well as our allied nations that depend on our exports.

Globally; the cost of raw materials needed for fertilizers have increased substantially due to increased fuel cost, lack of resources and so on. India however is able to meet its needs by importing the desired quantity that is required. In fact, now we are able to import more than we used to import in the past with the help of strategic partnerships with many new allied nations.

The recent news of fertilizer crisis in few Indian states have hindered with the sentiments of many Indian farmers, however the central government as well as many state governments have dismissed these allegation and released the data on total fertilizer requirement along with the availability. The ongoing winter sowing season (November – March) is already here and government has already taken measures to meet our fertilizer demand with the help of the fertilizer fraternity, from manufacturers to traders.

TLI – Tradelink India is doing the best we can to meet the growing demand of fertilizers in India and our efforts is proving fruitful and in sync with the government’s vision. We are developing new partnerships locally and globally to support our farmers and provide them access to high quality and high yield producing fertilizers.

1 note

·

View note