#Underground Mining Equipment Market news

Explore tagged Tumblr posts

Text

Setting Blurb: Hoppe City

Nestled snugly in the Hanami Planum, Hoppe City is the largest human settlement on the dwarf planet Ceres, and the de facto capital of free market civilization. Everywhere you go, after stepping off the Rags to Riches interplanetary spaceport (and casino resort) the planet's rich mineral wealth rewards those that were the first to claim it. From the many facilities for mining and refining what lies below Ceres' crust to the luxury estates and skyscrapers of those that made it big (never mind the slums in Refoogietown), Hoppe City and Ceres as a whole would reward those that would work for it.

As the inner solar system was being colonized by the three human powers in the late 2300s, ambitious eyes turned towards the asteroid belt and saw only opportunity. It was only a matter of time before the many construction projects in the inner system created a demand for resources that only the Belt could supply. The first ones to seize the Belt would reap the rewards. CorpEmp and the W.C.O.F. would dispatch a few expeditions to the Belt, and a swarm of independent miners would stake their claim in the untapped riches floating between Mars and Jupiter. The largest contributor to the Belt Rush would be the United Markets, and the largest of the U.M. settlers came from the Hoppean subculture.

The U.M. back on Earth was growing too corpocratic and libertine for the more socially conservative Hoppeans, and what available real estate there was was either too crowded for their tastes or would become so at an uncomfortable taste. Several thousand Hoppeans began to pool resources and capital together in the 2350s to settle, mine, and develop a plot of the Cerean surface, with the first families given stewardship over plots purchased by a secondary wave of Hoppeans staying behind to continue financing the colony back on Earth. Each family would be responsible for either mining their plot, providing a service for the other settlers, or develop for future use. Everyone also had to pitch in to buy military equipment for security. No freeloaders, no market failures, and definitely no Imps or Commies. Reserves could join the settlement proper, or pay triple to hitch a ride and disappear into the icy crevices to stead all their lonesome. C.P.C. gangsters were shot on sight.

The 2,500 families of the first and second waves (also known as the First Steaders) ratified the Covenant Charter on September 2nd 2355 in a rented Las Vegas convention center, affirming all families' adherence to the Non-Aggression Principle and describing in great detail what is and isn't Aggression. To help retain a united sense of identity, the founding families would model their colony's culture and memetics after the New England Puritans and the Scottish Covenanters of the 16th and 17th centuries, mixed with the stylings of their own brand of anarcho-capitalism. Three years later the first transport craft would land on the site of what would become Hoppe City.

For the next 500 years, the denizens of Hoppe City laid low mining and developing their part of Ceres and keeping an eye on newcomers to their neck of the Belt. The Hoppeans' large volunteer militia kept their colony and the rest of Ceres out of the Belt Wars in the 2600s. Likeminded groups from the U.M. would arrive and establish communities of their own, eventually adopting the Covenanter model of anarchist society. The rest of the U.M.'s subfactions would arrive to stake their own claims of the dwarf planet, with the Hoppeans giving them a wide berth, and wildly divergent Marketeers (NEVER bring up the incident with the Church of Randian Satanism) were treated like they didn't exist. Most individual miners would try their luck in the mines of Hoppe City, tripling the population just in time for the Human-Crystalline War (2801-2885).

As the Crystalline Aliens had a nasty habit of attacking any significant human presence, Ceres' population evacuated to the many underground mining complexes and rode out the war. Hoppe City's private militias remained on-planet in the event of an attack, but a few volunteered to join the rest of U.M. security forces to drive the aliens out of the Solar System. The aliens never touched Ceres, and because of that refugees would flock to the dwarf planet, tripling the population yet again. Most of the refugee population would be moved to the aforementioned mining complexes, they could either wait until it was safe to be relocated (especially CorpEmp and W.C.O.F. populations, and especially after fighting between the two groups), or try their hand at joining the planet's population. This refugee problem, and the threat of alien invasion, would lead to the expansion of the private security industry on Ceres. Many famous firms today had their beginnings in many volunteers that fought the Human-Crystalline War (against alien or refugee gang). The one group the Hoppeans were really wary of were the execs of the megacorps (MicroBucks, Morgan Industries, etc.) from the U.M. core.

Although they were sequestered in their own territories on Ceres, the Hoppeans didn't want the megacorps to start thinking they could run the dwarf planet like the rest of their assets. The descendants of the Founding Steaders (and a few Founding Steaders themselves who used life extension technologies) met with the megacorp execs, and stated that on no certain terms would Ceres be run like the old FVMEs on Earth. Pre-emptive strikes against acts of aggression were perfectly legal according to Covenant Charter, and it would be a shame if the execs did anything that would be considered aggressive. A few execs got the memo and drank the Hoppean kool-aid, or quickly relocated. Sympathetic megacorp employees would also subvert their employers' memetics with that of the Covenanters, bringing them more in line ideologically with the Hoppeans. By the beginning of the 2900s, Ceres and especially Hoppe City, would become the industrial and economic capital of the United Markets.

With the alien threat removed and their competition suborned, the Hoppeans and Ceres did what they did best: minding their own business and mining. As human settlement expanded into the outer solar system, a few expert miners from Hoppe City went to try their hand at establishing daughter colonies in the orbits of Jupiter and Saturn. An even smaller few went out to stake their claims in the Extrasolar Territories. The Transhuman Wars were the only conflicts of the 31st century that the Hoppeans would get involved due to --DO NOT UNDER ANY CIRCUMSTANCES BRING UP THE TRANSHUMAN WARS OR THE ACTIONS OF HOPPE HEDONICS IN HOPPE CITY - NEVER BRING UP THE TRANSHUMAN WARS - THERE WERE NO CATGIRLS - HOPPE HEDONICS NEVER PRODUCED CATGIRLS - UNDER THE REVISED COVENANT CHARTER OF 3106 ANY MENTION OF CATGIRLS CONSTITUTES AN ACT OF AGGRESSION-- in what would become know as Refoogie Town in the first layer of exhausted mining complexes below the city proper.

By the rise of CorpEmp's 5th ruling Dynasty, Hoppe City is an icy jewel that seems to only shine brighter. Most of Ceres by this point is "governed" (a dirty word in the U.M.) in covenants similar to Hoppe City, and Hoppean Scots has become the lingua franca of the myriad communites in the Asteroid Belt. Ceres has also emerged as the Mecca for developments in brine mining technology. Thousands of fortunes are made, lost, and won back daily in Hoppe City. In spite of all their history and achievements, however, there is one thing. One little frustrating thing that comes to most non-Cereans' minds first when asked to think about Hoppe City...

7 notes

·

View notes

Text

Coal Handling Equipment Market Industry Analysis and Forecast By 2028

The Coal Handling Equipment Market sector is undergoing rapid transformation, with significant growth and innovations expected by 2028. In-depth market research offers a thorough analysis of market size, share, and emerging trends, providing essential insights into its expansion potential. The report explores market segmentation and definitions, emphasizing key components and growth drivers. Through the use of SWOT and PESTEL analyses, it evaluates the sector’s strengths, weaknesses, opportunities, and threats, while considering political, economic, social, technological, environmental, and legal influences. Expert evaluations of competitor strategies and recent developments shed light on geographical trends and forecast the market’s future direction, creating a solid framework for strategic planning and investment decisions.

Brief Overview of the Coal Handling Equipment Market:

The global Coal Handling Equipment Market is expected to experience substantial growth between 2024 and 2031. Starting from a steady growth rate in 2023, the market is anticipated to accelerate due to increasing strategic initiatives by key market players throughout the forecast period.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-coal-handling-equipment-market

Which are the top companies operating in the Coal Handling Equipment Market?

The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the market's extension. This Global Coal Handling Equipment Market report provides the information of the Top Companies in Coal Handling Equipment Market in the market their business strategy, financial situation etc.

thyssenkrupp; FLSmidth; Metso Corporation; Kawasaki Heavy Industries, Ltd.; FAM GmbH; IHI Corporation; Elecon Engineering Company Limited; Sumitomo Heavy Industries Material Handling Systems Co.,Ltd.; TAKRAF GmbH; FAMUR SA; AUMUND Fördertechnik GmbH; TRF Limited; GMV Engineering.; Atlas Copco (India) Ltd.; Hitachi Construction Machinery Europe NV.; Caterpillar.; Aesha Conveyors And Crushing Equipment.; FAB 3R; Dynamic Air Inc.; Sterling Engineering Co.

Report Scope and Market Segmentation

Which are the driving factors of the Coal Handling Equipment Market?

The driving factors of the Coal Handling Equipment Market are multifaceted and crucial for its growth and development. Technological advancements play a significant role by enhancing product efficiency, reducing costs, and introducing innovative features that cater to evolving consumer demands. Rising consumer interest and demand for keyword-related products and services further fuel market expansion. Favorable economic conditions, including increased disposable incomes, enable higher consumer spending, which benefits the market. Supportive regulatory environments, with policies that provide incentives and subsidies, also encourage growth, while globalization opens new opportunities by expanding market reach and international trade.

Coal Handling Equipment Market - Competitive and Segmentation Analysis:

**Segments**

- On the basis of type, the global coal handling equipment market can be segmented into material handling equipment, crushing equipment, and screening equipment. - Based on application, the market can be categorized into surface mining, crushing, pulverizing & screening, and underground mining.

**Market Players**

- Some of the key players operating in the global coal handling equipment market include Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., Volvo Construction Equipment, Sandvik AB, Metso Corporation, FLSmidth & Co. A/S, and thyssenkrupp AG. - Other prominent companies in the market are Terex Corporation, P&H Mining Equipment Inc., CNH Industrial N.V., SANY Group, and Eickhoff GmbH.

The global coal handling equipment market is anticipated to witness significant growth by the year 2028. The rise in coal mining activities across various regions, coupled with the increasing demand for coal in industries such as power generation and steel production, is expected to drive the market. The material handling equipment segment is likely to dominate the market during the forecast period, given its crucial role in efficiently transporting coal from mines to processing plants or end-users. The crushing equipment segment is also set to experience substantial growth, as it plays a vital role in reducing the size of coal for easier handling and processing.

In terms of applications, the surface mining segment is projected to hold a considerable market share, driven by the growing adoption of surface mining techniques due to their cost-effectiveness and efficiency in extracting coal from shallow deposits. The crushing, pulverizing & screening segment is also expected to witness robust growth as these processes are essential for preparing coal for various industrial applications. Moreover, the underground mining segment is likely to grow steadily, supported by the utilization of advanced coal handling equipment to ensure safety and productivity in underground mining operations.

Key market players such as Caterpillar Inc. and Komatsu Ltd. are focusing on product innovations and strategic collaborations to strengthen their market presenceThe global coal handling equipment market is poised for substantial growth in the upcoming years, primarily driven by the steady increase in coal mining activities worldwide. The demand for coal in key industries such as power generation and steel production remains robust, propelling the need for efficient coal handling equipment. The material handling equipment segment is expected to lead the market, as it plays a critical role in the seamless transportation of coal from mines to processing plants or end-users. This segment's dominance is further supported by the rising focus on operational efficiency and cost-effectiveness in coal handling processes.

Additionally, the crushing equipment segment is anticipated to witness significant growth due to its essential function in reducing the size of coal, making it easier to handle and process. As industries aim for better productivity and operational efficiency, the adoption of advanced crushing equipment is likely to increase. Moreover, advancements in technology and innovative solutions in crushing equipment are expected to further drive market growth and provide enhanced capabilities for coal processing operations.

In terms of applications, the surface mining segment is slated to hold a substantial market share, fueled by the increasing preference for surface mining techniques for their cost-effectiveness and high efficiency in extracting coal from shallow deposits. The ease of access to coal reserves through surface mining methods is a key factor contributing to the segment's growth. Additionally, the crushing, pulverizing & screening segment is poised for robust expansion as these processes are essential for preparing coal for various industrial applications, ensuring the quality and consistency of the final product.

Furthermore, the underground mining segment is expected to exhibit steady growth supported by the deployment of advanced coal handling equipment to enhance safety and productivity in underground mining operations. Players in the market such as Caterpillar Inc., Komatsu Ltd., and Hitachi Construction Machinery Co., Ltd. are actively engaged in product innovations and strategic partnerships to strengthen their market presence and cater to the evolving needs of the coal handling equipment industry. Collaborations with technology providers and a focus on enhancing equipment efficiency and durability are key strategies adopted by these market players to maintain a competitive**Market Players:**

- thyssenkrupp - FLSmidth - Metso Corporation - Kawasaki Heavy Industries, Ltd. - FAM GmbH - IHI Corporation - Elecon Engineering Company Limited - Sumitomo Heavy Industries Material Handling Systems Co., Ltd. - TAKRAF GmbH - FAMUR SA - AUMUND Fördertechnik GmbH - TRF Limited - GMV Engineering - Atlas Copco (India) Ltd. - Hitachi Construction Machinery Europe NV. - Caterpillar - Aesha Conveyors And Crushing Equipment - FAB 3R - Dynamic Air Inc. - Sterling Engineering Co.

The global coal handling equipment market is poised for substantial growth in the upcoming years, primarily driven by the steady increase in coal mining activities worldwide. The demand for coal in key industries such as power generation and steel production remains robust, propelling the need for efficient coal handling equipment. The material handling equipment segment is expected to lead the market, as it plays a critical role in the seamless transportation of coal from mines to processing plants or end-users. This segment's dominance is further supported by the rising focus on operational efficiency and cost-effectiveness in coal handling processes.

Additionally, the crushing equipment segment is anticipated to witness significant growth due to its essential function in reducing the size of coal, making it easier to handle and process. As industries aim for better productivity and operational efficiency, the adoption of

North America, particularly the United States, will continue to exert significant influence that cannot be overlooked. Any shifts in the United States could impact the development trajectory of the Coal Handling Equipment Market. The North American market is poised for substantial growth over the forecast period. The region benefits from widespread adoption of advanced technologies and the presence of major industry players, creating abundant growth opportunities.

Similarly, Europe plays a crucial role in the global Coal Handling Equipment Market, expected to exhibit impressive growth in CAGR from 2024 to 2028.

Explore Further Details about This Research Coal Handling Equipment Market Report https://www.databridgemarketresearch.com/reports/global-coal-handling-equipment-market

Key Benefits for Industry Participants and Stakeholders: –

Industry drivers, trends, restraints, and opportunities are covered in the study.

Neutral perspective on the Coal Handling Equipment Market scenario

Recent industry growth and new developments

Competitive landscape and strategies of key companies

The Historical, current, and estimated Coal Handling Equipment Market size in terms of value and size

In-depth, comprehensive analysis and forecasting of the Coal Handling Equipment Market

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2024-2031) of the following regions are covered in Chapters

The countries covered in the Coal Handling Equipment Market report are U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA

Detailed TOC of Coal Handling Equipment Market Insights and Forecast to 2028

Part 01: Executive Summary

Part 02: Scope Of The Report

Part 03: Research Methodology

Part 04: Coal Handling Equipment Market Landscape

Part 05: Pipeline Analysis

Part 06: Coal Handling Equipment Market Sizing

Part 07: Five Forces Analysis

Part 08: Coal Handling Equipment Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers And Challenges

Part 13: Coal Handling Equipment Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Browse More Reports:

Japan: https://www.databridgemarketresearch.com/jp/reports/global-coal-handling-equipment-market

China: https://www.databridgemarketresearch.com/zh/reports/global-coal-handling-equipment-market

Arabic: https://www.databridgemarketresearch.com/ar/reports/global-coal-handling-equipment-market

Portuguese: https://www.databridgemarketresearch.com/pt/reports/global-coal-handling-equipment-market

German: https://www.databridgemarketresearch.com/de/reports/global-coal-handling-equipment-market

French: https://www.databridgemarketresearch.com/fr/reports/global-coal-handling-equipment-market

Spanish: https://www.databridgemarketresearch.com/es/reports/global-coal-handling-equipment-market

Korean: https://www.databridgemarketresearch.com/ko/reports/global-coal-handling-equipment-market

Russian: https://www.databridgemarketresearch.com/ru/reports/global-coal-handling-equipment-market

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 1341

Email:- [email protected]

#Coal Handling Equipment Market Size#Coal Handling Equipment Market Shares#Coal Handling Equipment Market Forecast#Coal Handling Equipment Market Growth#Coal Handling Equipment Market Demand

0 notes

Text

Understanding the Changing Landscape of Mine Surveys: Trends, Opportunities, and Challenges

Mine surveying, a critical aspect of the mining industry, has witnessed significant shifts in recent years. These changes are driven by advancements in technology, environmental concerns, and the need for precision and safety. Dolphin Engineers, a key player in the field of mine surveys, offers valuable insights into the evolving trends, the rise of innovative methodologies, and the challenges shaping this domain.

The Rise of Technological Integration

The incorporation of cutting-edge technology has redefined mine surveying practices. From drones to LiDAR systems, technology is streamlining operations, reducing costs, and improving accuracy. Drones, for instance, allow surveyors to access hard-to-reach areas, capturing high-resolution imagery and topographic data. Similarly, LiDAR provides detailed 3D mapping, helping surveyors visualize complex terrains with unparalleled clarity.

Another notable advancement is the integration of Geographic Information Systems (GIS) and Global Positioning Systems (GPS). These tools enable precise data collection, real-time monitoring, and efficient data management. With such capabilities, companies like Dolphin Engineers can deliver results with exceptional accuracy, ensuring projects stay on track.

Environmental and Sustainability Considerations

Environmental awareness has become a significant factor in mine surveying. Companies are now required to minimize their ecological footprint while maintaining operational efficiency. Surveyors play a crucial role in this by using methods that reduce environmental disruption. Techniques such as non-invasive surveying, along with remote sensing technologies, help achieve these goals.

Sustainability initiatives are also influencing mining operations. Accurate surveys ensure that resources are extracted responsibly, aligning with global efforts to protect natural ecosystems. Dolphin Engineers is at the forefront of adopting sustainable practices in their mine survey projects, balancing industrial needs with environmental responsibility.

Challenges in Modern Mine Surveying

Despite technological advancements, the industry faces numerous challenges. Safety remains a primary concern, particularly in underground mines. Complex geological conditions, limited visibility, and hazardous environments require surveyors to rely on robust equipment and techniques.

Moreover, the industry grapples with data management and analysis. The influx of vast amounts of data from various technologies necessitates efficient processing systems. Surveyors must also stay updated with new tools and software, as the fast-paced evolution of technology leaves little room for outdated practices.

Economic fluctuations and regulatory changes further add to the complexity. Mining companies must adapt to varying market demands while adhering to strict legal frameworks. These factors underscore the importance of expertise and adaptability in mine surveying.

Emerging Trends Shaping the Future

The future of mine surveying is set to be defined by automation and artificial intelligence (AI). Automated equipment and AI-driven analytics are transforming how survey data is collected, processed, and interpreted. Autonomous drones, for instance, can conduct surveys without human intervention, enhancing safety and efficiency.

Blockchain technology is another trend gaining traction. By ensuring data integrity and transparency, blockchain can revolutionize data sharing and verification processes in mining operations.

Dolphin Engineers: Pioneering the Way Forward

As the industry navigates these shifts, Dolphin Engineers continues to play a pivotal role in advancing mine survey practices. Leveraging state-of-the-art tools and a commitment to precision, the company addresses challenges head-on, setting benchmarks in safety, accuracy, and sustainability.

By embracing innovation and focusing on client needs, Dolphin Engineers remains a trusted partner in the mining sector. Whether through deploying advanced technologies or adopting eco-friendly practices, the company is dedicated to shaping a future where mine surveys meet the highest standards of excellence.

Conclusion The dynamic field of mine surveying reflects the broader changes in the mining industry. With technological advancements, increased environmental awareness, and evolving methodologies, the landscape is undergoing a transformation. Companies like Dolphin Engineers are leading this journey, combining expertise with innovation to redefine what’s possible in mine surveying. As the industry moves forward, staying adaptable and embracing change will be key to navigating its complexities and seizing new opportunities.

#PrecisionSurveying#MiningSustainability#BlockchainInMining#MiningData#FutureOfMining#MiningTrends#MiningChallenges#AutomationInMining#AIInMining#MiningSafety#EnvironmentalResponsibility#SustainableMining#GISMapping#LiDARTechnology#DroneSurveying#TechnologyInMining#InnovationInMining#DolphinEngineers#MiningIndustry#MineSurveying

0 notes

Text

Exploring the Underground Mining Vehicles Market Opportunities and Challenges Forecast (2024-2031)

The underground mining vehicles market is undergoing significant transformations as technological advancements, environmental considerations, and industry demands push the boundaries of traditional mining practices. Underground mining vehicles play a crucial role in modern mining operations by transporting materials, personnel, and equipment in underground mines' confined, challenging conditions. This article explores the opportunities and challenges in the underground mining vehicles market, with a forecast from 2024 to 2031.

What Are Underground Mining Vehicles?

Underground mining vehicles are specialized machines designed to operate in subterranean environments where traditional vehicles cannot function. These vehicles are engineered to navigate narrow passageways, steep inclines, and hazardous conditions typical of underground mining operations.

Types of underground mining vehicles include:

Loaders: Used to transport materials within mines.

Haul Trucks: Designed for heavy loads and long distances within tunnels.

Shuttle Cars: Specialized vehicles for transporting coal or ore from the mining face to a loading area.

Drilling Rigs: Equipment used for drilling boreholes for exploration or extraction.

These vehicles are critical to improving productivity, ensuring safety, and reducing operational downtime in underground mining. Their ability to withstand harsh environments, combined with advancements in automation and safety features, drives their demand globally.

Market Growth Forecast (2024-2031)

The global underground mining vehicles market is projected to grow at a CAGR of 3% from 2024 to 2031. This growth can be attributed to several key factors:

Technological Advancements: Automation, electrification, and data analytics are revolutionizing underground mining operations. Companies are investing heavily in automated vehicles that improve efficiency, reduce costs, and minimize human error. Autonomous vehicles and remotely operated vehicles (ROVs) are becoming more prevalent, allowing for safer and more efficient mining operations.

Increased Safety Regulations: Stringent safety regulations are driving the demand for vehicles equipped with advanced safety systems, such as collision avoidance technology, real-time monitoring, and enhanced ventilation systems. Governments and regulatory bodies are enforcing stricter laws to protect mine workers, which in turn is propelling the adoption of safer underground mining vehicles.

Rising Demand for Minerals and Metals: As the demand for minerals and metals continues to grow, driven by industries such as construction, electronics, and renewable energy, mining companies are exploring new underground deposits. This is creating a higher demand for specialized mining vehicles to access these resources in deeper and more complex mining environments.

Opportunities in the Underground Mining Vehicles Market

Adoption of Electric Vehicles (EVs): One of the most exciting opportunities in the underground mining vehicles market is the adoption of electric vehicles (EVs). Traditional diesel-powered vehicles emit harmful gases, contributing to air quality issues in underground mines. Electric mining vehicles eliminate these emissions, improving working conditions and reducing the need for extensive ventilation systems. Moreover, EVs reduce fuel costs and maintenance requirements, making them an attractive option for mining companies looking to lower operational expenses.

Automation and AI Integration: The integration of artificial intelligence (AI) and automation is reshaping the underground mining industry. Automated mining vehicles can operate 24/7 with minimal human intervention, increasing productivity and reducing labor costs. AI-driven systems can optimize vehicle routes, monitor equipment health, and predict maintenance needs, further enhancing operational efficiency.

Sustainability and Environmental Regulations: As the mining industry faces growing scrutiny over its environmental impact, there is a growing emphasis on sustainability. Mining companies are investing in energy-efficient vehicles and adopting low-emission technologies to reduce their carbon footprint. The push towards sustainable mining practices presents a significant opportunity for vehicle manufacturers to develop innovative, eco-friendly solutions.

Challenges Facing the Underground Mining Vehicles Market

High Initial Costs: One of the primary challenges in the adoption of advanced underground mining vehicles is the high initial cost. The shift to automated and electric vehicles requires substantial capital investment, which can be a barrier for smaller mining companies. Although these technologies offer long-term savings, the upfront costs can deter adoption, particularly in developing regions.

Infrastructure Limitations: Underground mines, especially older ones, may not have the necessary infrastructure to support modern mining vehicles, particularly electric and autonomous ones. Retrofitting mines to accommodate these vehicles can be costly and time-consuming. Additionally, the charging infrastructure for electric vehicles in underground settings is still in its infancy, posing another hurdle to widespread adoption.

Skilled Workforce Shortage: The rise of automation and advanced technologies requires a skilled workforce to manage and maintain these systems. However, the mining industry is facing a shortage of qualified workers with the technical expertise needed to operate and service automated mining vehicles. This shortage is particularly pronounced in remote and underdeveloped regions, where mining operations are often located.

Environmental and Social Concerns: While the push for electric and automated vehicles is a step towards reducing the environmental impact of mining, there are still concerns about the long-term sustainability of these solutions. The mining industry itself is under pressure to minimize its ecological footprint, and there are growing demands for transparency and responsibility in how resources are extracted.

Regional Insights

The underground mining vehicles market is experiencing growth across multiple regions, with key drivers varying by location:

North America: Technological innovation and automation are driving the market, particularly in the U.S. and Canada.

Europe: The focus is on electrification, with stringent environmental regulations pushing the adoption of electric mining vehicles.

Asia Pacific: The rapid industrialization in countries like China, India, and Australia is fueling demand for underground mining vehicles.

South America: Brazil and Argentina are witnessing increased mining activities, driving the demand for efficient underground vehicles.

Middle East & Africa: The region is rich in mineral resources, and mining companies are investing in modern vehicles to enhance efficiency and safety.

Conclusion

The underground mining vehicles market is poised for steady growth from 2024 to 2031, driven by technological advancements, environmental regulations, and the rising demand for minerals and metals. Opportunities lie in the adoption of electric and automated vehicles, which promise to enhance safety, reduce costs, and improve sustainability. However, the industry must navigate challenges such as high initial costs, infrastructure limitations, and a skilled workforce shortage.

As mining companies continue to explore deeper and more complex deposits, the demand for specialized underground mining vehicles will only increase, offering significant growth potential for manufacturers and technology providers in the sector.

#mining tenement#tenement#mining application#mining industry#mining#underground mining vehicle#underground mining#mining licence#tenement consultant#hetherington#tenement management services#tenement management

0 notes

Text

Mining Automation Market Forecast: Growth, Trends, and Opportunities

The global mining automation market size is expected to reach USD 8.64 billion by 2030, registering a CAGR of 7.3% from 2023 to 2030, according to a new report by Grand View Research, Inc.

The increasing demand for accuracy and productivity required during mining activities is the high-impact rendering driver for the industry. The growing adoption of automated mining is attributed to the advantages associated with automated systems. For instance, in January 2022, Hexagon AB, one of the eminent players in digital reality solutions combining sensors, independent technology, and software programs, acquired Minnovare, one of the prominent players in drilling technology that enhances the cost, speed, and accuracy of drilling underground.

The initiative aims to strengthen and accelerate Hexagon AB’s underground roadmap and strengthen the drill and blast portfolio. The industry witnesses the adoption of drones as a step towards the evolution of unmanned and aerial data collection technology at mining sites. The automated drone system is poised to become an essential strategic part of the future of mining. For instance, in June 2020, Caterpillar Inc. acquired Marble Robots Inc. The initiative was aimed at expanding Robotization and autonomy strategy and demonstrating its commitment to the coming generation of job site results. Structure on its leadership in independent mining, the organization aims to work and bring scalable results to fulfill the changing needs of construction, chase, artificial, and waste diligence.

Furthermore, the upcoming concept in mining operations is the use of central or virtual control room that monitors several mines in distant sites from a single location. The virtual control room is expected to facilitate benchmarking and comparison of identical processes at different plants. For instance, in January 2022, Accenture, a services-based company that provides a wide range of services in interactive, strategy, and consulting technology and operations, collaborated with Celonis. This data processing company sells Software as a Service (SaaS) to enhance business processes, and it has formed a partnership to work in process mining.

Gather more insights about the market drivers, restrains and growth of the Mining Automation Market

Mining Automation Market Report Highlights

• The mineral mining application segment will register the fastest CAGR over the forecast period

• Increased mineral exploration activities globally are expected to boost the segment's growth

• The implementation & maintenance services segment held a significant market share in 2022

• In terms of equipment automation, autonomous trucks dominated the industry in 2022

• Retrofitting the mining equipment with automated technology is expected to contribute to the growth of the equipment automation segment considerably

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• The global drone charging station market size was estimated at USD 0.43 billion in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030.

• The global data protection as a service market size was valued at USD 22.05 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 25.9% from 2024 to 2030.

Mining Automation Market Segmentation

Grand View Research has segmented the global mining automation market based on solution, application, and region:

Mining Automation Solution Outlook (Revenue, USD Million, 2018 - 2030)

• Software Automation

• Services

o Implementation & Maintenance

o Training

o Consulting

• Equipment Automation

o Autonomous Trucks

o Remote Control Equipment

o Teleoperated Mining Equipment

Mining Automation Application Outlook (Revenue, USD Million, 2018 - 2030)

• Metal Mining

• Mineral Mining

• Coal Mining

Mining Automation Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o Canada

o U.S.

• Europe

o Germany

o U.K.

• Asia Pacific

o Australia

o China

o India

o Japan

• Latin America

o Brazil

o Mexico

• Middle East & Africa

Order a free sample PDF of the Mining Automation Market Intelligence Study, published by Grand View Research.

#Mining Automation Market#Mining Automation Market Analysis#Mining Automation Market Report#Mining Automation Market Size#Mining Automation Market share

0 notes

Text

2 D Materials Market, Market Size, Market Share, Key Players | BIS Research

2D materials are substances that are just a few atoms thick, usually one layer. The most famous 2D material is graphene, discovered in 2004 by physicists Andre Geim and Konstantin Novoselov, which led to a Nobel Prize in Physics in 2010. Graphene is a single layer of carbon atoms arranged in a hexagonal lattice, with incredible mechanical strength, electrical conductivity, and thermal properties.

The 2D materials market is projected to reach $4,000.0 million by 2031 from $526.1 million in 2022, growing at a CAGR of 25.3% during the forecast period 2022-2031.

2 D Materials Overview

2 D Materials focus on addressing the environmental, social, and economic challenges associated with mining activities while ensuring long-term resource availability.

Key components of Sustainable Mining

Reducing energy consumption

Minimizing greenhouse gas emissions

Conserving water

Market Segmentation

1 By Application

• Metallic Minerals

Industrial Metals

Precious Metals

Iron Ore

• Non-Metallic Minerals

Coal

Others

By Process

Underground Mining Surface Mining

By Mining Equipment

• Drill Rigs

• Bolters

• Dozers

• Loaders

By Energy Source

1 Battery

Lithium-Ion Battery

Lead Acid Battery

Others

2 Hydrogen Fuel Cell

3 Bio-Fuel

By Region

North America - U.S., Canada, and Mexico

Europe - Germany, Russia, Sweden, Spain, and Rest-of-Europe

China

U.K.

Download the report and get more information @ 2 D Materials Market

.Major Key Players

• NanoXplore Inc.

• Cabot Corporation

• Thomas Swan & Co. Ltd.

• Ossila Ltd

• ACS Material LLC

Download the sample page click here @ 2 D Materials Market

Demand – Drivers and Limitations

The following are the demand drivers for the global 2D materials market:

• Growing adoption of 2D materials in energy storage • Strong growth of 2D materials in the healthcare industry • Growing demand for transparent conductive films in electronics industry

The market is expected to face some limitations as well due to the following challenges:

• Lack of large-scale production of high-quality graphene • High cost of production

Recent Developments in the Global 2D Materials Market

• In September 2021, Colloids Limited introduced a new infrastructure for customized polymeric materials using its ground-breaking graphanced graphene masterbatch advanced technologies. Due to its extraordinary qualities, graphene has attracted a lot of attention. Additionally, it has exceptional mechanical characteristics as well as superior thermal and electrical permeability.

• In December 2021, Black Swan Graphene Inc. signed a legally enforceable letter of intent to purchase Dragonfly Capital Corp., in a backward merger agreement for $31.5 million. On December 13, 2021, Black Swan Graphene Inc. and Dragonfly Capital Corp. agreed to exchange shares in an opposite merger transaction. Stockholders of Black Swan would then obtain 15.2 consideration shareholdings for every ordinary Black Swan share they own.

Challenges in the 2D Materials Market

Despite the excitement surrounding 2D materials, there are notable challenges that the industry must overcome:

Scalability of Production: Producing high-quality 2D materials at scale remains a challenge. Researchers are exploring various methods, such as chemical vapor deposition (CVD), but the cost and complexity of manufacturing must be addressed for widespread adoption.

Integration into Existing Technologies: For 2D materials to be fully integrated into mainstream applications, they must seamlessly work with existing materials and processes. Compatibility issues with traditional manufacturing methods could slow down the transition.

Cost of Raw Materials and Processing: Currently, the cost of producing 2D materials is relatively high. Developing cost-effective manufacturing techniques is crucial for making these materials economically viable.

The Future of 2D Materials

As the 2D materials market continues to evolve, we are likely to see a wave of disruptive innovations across multiple sectors. With ongoing research, improved production techniques, and increasing investment, these materials could fundamentally reshape industries ranging from electronics to energy and healthcare.

While challenges remain, the unique properties of 2D materials offer unprecedented opportunities for technological advancement. The next few years will be crucial in determining how quickly and effectively these materials can be integrated into real-world applications, but one thing is certain: 2D materials are poised to revolutionize the future of advanced materials.

Key Questions

Q What are the main bottlenecks for scaling up 2D materials, and how can they be overcome?

Q Where do you see the greatest need for additional R&D efforts?

Q How does the supply chain function in the global 2D materials market for end users?

Q What are the key business and corporate strategies of 2D material manufacturers involved in the global 2D materials market?

Q What are the advantages of the emerging 2D materials that are entering the market, and how are they used in various applications?

Q Which applications (by end user) and products (by material type) segments are leading in terms of consumption of the 2D materials market, and which of them are expected to witness high demand growth during 2022-2031?

Q Which regions and countries are leading in terms of consumption of the global 2D materials market, and which of them are expected to witness high demand growth during 2021-2031?

Q What are the most promising opportunities for furthering the efficiency of 2D materials?

Q How has COVID-19 impacted the 2D materials market across the globe?

Q How the semiconductor crisis impacted the 2D materials market?

Conclusion

The 2D materials market is set to grow exponentially as more industries recognize the potential of these atom-thin materials. With ongoing advancements in production techniques, new discoveries of 2D materials, and innovative applications across sectors, the future looks incredibly promising.

0 notes

Text

Mining Automation and Its Impact on Workforce Dynamics

Allied Market Research, titled, Global Mining Automation Market by Technique and Type: Global Opportunities Analysis and Industry Forecast, 2017-2023, the mining automation market was valued at $2,193 million in 2016, and is projected to reach at $3,810 million by 2023, growing at a CAGR of 7.9% from 2017 to 2023.

Mining automation involves use of process and software automation, and incorporation of robotic technology in mining vehicles and automation. In 2016, the underground mining segment dominated the market, in terms of revenue, due to increase in investment on automation and infrastructure.

Asia-Pacific was the highest revenue contributor to the golf cart market in 2016, accounting for around 31.41% share, owing to surge in demand for mobility for automation and increase in transition from manual work to automated work.

The report features a competitive scenario of the mining automation market and provides a comprehensive analysis of key growth strategies adopted by major players. Key players operating in the global mining automation market include Autonomous Solution Inc., Atlas Copco, Caterpillar, Hexagon, Hitachi, Komatsu Ltd., Mine site technologies, RPMGlobal Holdings Ltd., Sandvik AB, and Trimble. These players have adopted competitive strategies such as innovation, new product development, and market expansion to boost the growth of the market.

Key Findings of the Mining Automation Market:

The underground mining segment accounted for the highest share in 2016.

Equipment segment generated the highest revenue in 2016.

Asia-Pacific is expected to dominate the market, in terms of market share, during the forecast period

0 notes

Text

Asia Pacific Underground Mining Market Forecast and Analysis Report (2023-2032)

The Asia Pacific underground mining equipment sector is predicted to continue its upward trend between 2024 and 2032, growing at a compound annual growth rate (CAGR) of 32.30%. From its projected USD 13518.2 million in 2023 to USD 167863.96 million in 2032, the market will continue to grow.

The Asia Pacific underground mining market is experiencing significant growth, driven by the increasing demand for metals and minerals essential for various industries such as construction, manufacturing, and technology. The region, rich in mineral resources, hosts some of the world's largest mining operations, including those in China, Australia, and India. These countries are investing heavily in advanced mining technologies and equipment to enhance productivity and ensure the safety of mining operations. The market is also being propelled by the rising urbanization and industrialization across the region, which boosts the demand for raw materials. Governments in the Asia Pacific are playing a crucial role by implementing favorable policies and regulations to attract foreign investments in the mining sector. Additionally, the adoption of automation and digitalization in mining processes is improving efficiency and reducing operational costs.

However, the market faces challenges such as stringent environmental regulations, the high cost of advanced mining equipment, and concerns over the environmental impact of mining activities. Despite these challenges, the Asia Pacific underground mining market is expected to continue its upward trajectory, supported by ongoing technological advancements and the continuous exploration of new mining sites. The market is also witnessing a trend towards sustainable mining practices, aimed at minimizing environmental degradation and ensuring long-term resource availability.

The Asia Pacific underground mining market faces several challenges that can impact its growth and operational efficiency. These challenges include:

Environmental Regulations: Stringent environmental regulations imposed by governments across the region aim to minimize the environmental impact of mining activities. Compliance with these regulations often requires significant investment in environmentally friendly technologies and processes, which can increase operational costs.

High Operational Costs: The underground mining industry requires substantial capital investment in advanced machinery, safety equipment, and technology to enhance productivity and ensure worker safety. The high cost of these investments can be a barrier for smaller mining companies and can impact overall profitability.

Safety Concerns: Underground mining poses significant safety risks to workers, including exposure to hazardous conditions such as rock falls, gas leaks, and mine collapses. Ensuring worker safety requires continuous investment in safety measures, training, and monitoring systems, which can be resource-intensive.

Technological Challenges: While the adoption of automation and digitalization can improve efficiency, integrating these advanced technologies into existing mining operations can be complex and costly. There is also a need for skilled personnel to manage and operate these technologies effectively.

Resource Depletion: Some of the mining sites in the Asia Pacific region are experiencing resource depletion, making it necessary to explore new mining sites. This exploration can be time-consuming and expensive, and there is no guarantee of discovering economically viable deposits.

Infrastructure Issues: Inadequate infrastructure, particularly in remote mining areas, can hinder the transportation of raw materials and equipment. Poor infrastructure can lead to delays and increased costs in the supply chain, affecting overall operational efficiency.

Geopolitical Risks: Political instability and regulatory changes in certain countries can pose risks to mining operations. Changes in government policies, tax regimes, and mining laws can create uncertainty and affect investment decisions.

Environmental Impact: Mining activities have significant environmental impacts, including land degradation, water pollution, and loss of biodiversity. Managing these impacts requires comprehensive environmental management plans and practices, which can add to the operational costs.

Labor Shortages: The mining industry often faces labor shortages, particularly in remote areas where attracting and retaining skilled workers can be challenging. Labor shortages can affect productivity and operational efficiency.

Market Volatility: Fluctuations in the prices of metals and minerals can impact the profitability of mining operations. Market volatility can be influenced by global economic conditions, demand-supply dynamics, and geopolitical factors, making revenue forecasting challenging.

Key Players:

Caterpillar Inc.

Hitachi Ltd

AB Volvo

Liebherr Group

JCB

Northern Heavy Industries Group CO.

Sany Heavy Equipment International Holdings

Metso

Tata Motors

More About Report- https://www.credenceresearch.com/report/asia-pacific-underground-mining-equipment-market

The key findings of the study on the Asia Pacific underground mining market reveal several critical insights and trends shaping the industry's growth and development:

Market Growth: The Asia Pacific underground mining market is projected to experience substantial growth due to increasing demand for metals and minerals. This demand is driven by rapid urbanization, industrialization, and the expansion of infrastructure projects across the region.

Technological Advancements: The adoption of advanced mining technologies, including automation, digitalization, and the use of artificial intelligence, is significantly enhancing operational efficiency and safety. These advancements are also helping to reduce operational costs and increase productivity.

Investment in Safety: There is a growing emphasis on worker safety in underground mining operations. Companies are investing heavily in safety equipment, training programs, and monitoring systems to mitigate risks and ensure compliance with stringent safety regulations.

Environmental Sustainability: The industry is increasingly focusing on sustainable mining practices to minimize environmental impact. This includes implementing eco-friendly technologies, reducing carbon emissions, and adopting comprehensive environmental management plans.

Government Support: Favorable government policies and regulations are playing a crucial role in attracting investments in the mining sector. Several countries in the region are offering incentives, easing regulatory frameworks, and investing in infrastructure development to support the mining industry.

Exploration Activities: There is a significant increase in exploration activities aimed at discovering new mineral deposits. This is crucial for sustaining the growth of the mining industry, especially in light of resource depletion at existing sites.

Market Consolidation: The market is witnessing consolidation with mergers and acquisitions as companies seek to enhance their resource base, achieve economies of scale, and strengthen their market position. This trend is expected to continue as companies aim to optimize their operations and expand their geographical presence.

Infrastructure Development: Improved infrastructure, particularly in remote mining areas, is facilitating better transportation and logistics. This development is crucial for efficient supply chain management and timely delivery of raw materials and equipment.

Labor Market Dynamics: The industry is facing challenges related to labor shortages and the need for skilled workers to operate advanced mining technologies. Companies are focusing on training and development programs to build a skilled workforce.

Commodity Price Volatility: The market is subject to fluctuations in the prices of metals and minerals, influenced by global economic conditions and demand-supply dynamics. Companies are adopting strategies to manage price volatility, including diversification of their product portfolio and long-term supply agreements.

Economic Impact: The underground mining sector significantly contributes to the economies of several countries in the region, providing employment opportunities and generating revenue through exports. The sector's growth is positively impacting the overall economic development of these countries.

Regional Dominance: China, Australia, and India are identified as key players in the Asia Pacific underground mining market. These countries have extensive mineral resources, advanced mining infrastructure, and favorable government policies supporting the growth of the mining industry.

Segmentation:

By Type of Equipment

Drilling Equipment

Loaders and Trucks

Haulage Equipment

Drilling Support Equipment

Tunneling Equipment

Ventilation Systems

Crushing and Grinding Equipment

By Application

Coal Mining

Metal Mining

Mineral Mining

Tunneling and Construction

Browse the full report – https://www.credenceresearch.com/report/asia-pacific-underground-mining-equipment-market

Browse our Blog: https://www.linkedin.com/pulse/asia-pacific-underground-mining-market-key-industry-dynamics-wwqof

Contact Us:

Phone: +91 6232 49 3207

Email: [email protected]

Website: https://www.credenceresearch.com

0 notes

Text

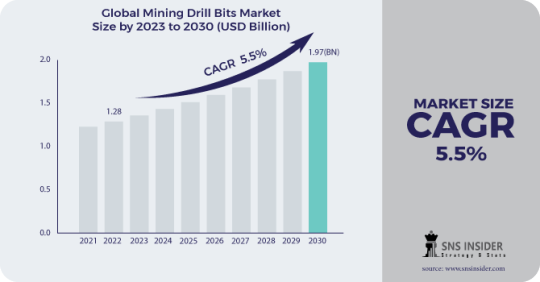

Understanding the Scope: Mining Drill Bits Market Analysis and Forecast for 2031

Global Mining Drill Bitsmarket research provides a comprehensive overview of fundamental data on market volume, industry growth potential, and business structure. All this contributes to the growth of the market. In addition, the study provides details on technology investments over the projected time horizon and a unique perspective on global demand in many of the categories studied. Mining Drill Bits market research helps clients better understand industry challenges and opportunities. Based on geography, global market research provides up-to-date information on consumer technology advances and growth potential.

Ask For Sample Report Here @ https://www.snsinsider.com/sample-request/1091

The study on global Mining Drill Bitsmarket provide in-depth analysis of future technologies, RDD projects, and new products. The study looks at all the major innovations and breakthroughs that are expected to have a significant impact on global market growth in the coming years. Likewise, the studies look at all sectors in different geographic areas and provide a cross-sectional analysis of the global economy in terms of demand forecasts. It also describes the many variables, constraints and opportunities in the market that will almost certainly impact business growth over the next few years.

Segmentation View

BY TYPE

Rotary bits

Fixed cutter bits

Roller cones bits

DTH Hammer bits

Others

BY MATERIAL

PDC Diamond

Tungsten carbide

Steel

Others

BY SIZE

Below 8 inches

8 to11 inches

Above 11 inches

BY APPLICATION

Surface mining

Underground Mining

By Company

The major key players are Rockmore International, Western Drilling Tools Inc, CATTERPILLAR INC., Robit Plc,Epiroc AB, Sandvik AB, Brunner & Lay Inc., Xiamen Prodrill Equipment Co. Ltd., Mitsubishi Materials Corporation, MICON-Drilling GmbH, Boart Longyear, DATC Group, Changsha Heijingang Industrial Co., Ltd.

The segmentation analysis section of the Mining Drill Bits market research focuses on past and future industry dynamics, business development, and challenges faced by the global vendors and consumers. Based on a comprehensive model of primary research and distribution, this article explores global markets at the national and regional levels, focusing on the major global suppliers. Mining Drill Bits market research and regional retail and distribution assessments using state-of-the-art methods.

Competitive Scenario

The report provides detailed industry competitive research and an overview of Porter's Five Forces model to help clients understand the competitive environment of leading global vendors in the Mining Drill Bitsmarket. This lengthy publication also provides a comprehensive review and summary of each research chapter. In order to provide viewers of this survey with an accurate picture of the global Mining Drill Bits industry, this report provided a highly competitive environment and product offerings from major vendors spread across multiple locations. The survey includes the latest analysis of the market forecast for the forecast period.

The Mining Drill Bitsresearch report explores four levels of detail, including market share analysis of major companies, business analysis (industry trends), supply chain analysis, and brief industry profiles. The study also provides an overview of the business environment, high growth markets, and high growth countries, differences in relevant industry, business factors and constraints.

Buy This Report Here @ https://www.snsinsider.com/checkout/1091

Report Conclusion

The report will help market participants to revisit their strategies and make necessary changes to stay in firm position in the competitive market.

0 notes

Text

Ilmenite Market Exploration: Unraveling Market Segmentation and Demographics

Ilmenite: A Primary Source of Titanium Dioxide Formation and Deposits Ilmenite, also known as manaccanite, is a titanium-iron oxide mineral with the formula FeTiO3. It is a weakly magnetic black or steel-gray solid. Ilmenite forms in igneous and metamorphic rocks as a primary mineral. It crystallizes in the trigonal-hexagonal system and most often occurs in a massive, granular or lamellar forms. Ilmenite forms as a volcanic and hypabyssal rock-forming mineral. Hydrothermal solutions also deposit ilmenite in veins and breccia zones. Major ilmenite deposits are found in Australia, South Africa, Canada, Ukraine and India. The largest deposits are located near Beach Lake in Ontario, Canada and near Prairie Lake in Australia. Chemical Composition and Properties Chemically, ilmenite is an iron(II) titanium oxide. It typically contains 50-52% TiO2 and 32-38% FeO. Ilmenite also contains small amounts of MgO, MnO and calcium contaminants. The mineral is black to steel-gray colored with a submetallic to dull luster. It has a hardness of 5-6.5 on the Mohs scale and a moderate specific gravity ranging from 4.7-5 g/cm3. Ilmenite is weakly magnetic due to its iron content. It tends to alter to leucoxene, pseudobrookite and rutile under weathering conditions near the Earth's surface. When heated in air, ilmenite oxidizes to a mixture of iron oxide and titanium dioxide. Economic Significance and Uses Ilmenite is the primary industrial source of titanium dioxide, which is also known as titanium white. Titanium dioxide has a variety of applications due to its brightness and very high refractive index. It is widely used as a pigment in paints, plastics, paper, inks, foods and other materials. Titanium dioxide imparts a brilliant white color and opacity to products while remaining non-toxic. As a pigment, it is valued for its hiding power and tinting strength. Globally, titanium dioxide demand exceeds 6 million metric tons per year. The paint and plastics industries combined account for approximately 90% of titanium dioxide usage. Mining and Refining Processes Mining ilmenite deposits involves open pit or underground methods based on the deposit type and economics. At the mining site, overburden rock is first removed to access the ilmenite orebody. The run of mine ore is dug out using heavy earthmoving equipment like hydraulic excavators and trucks. The ore is hauled to a processing facility where it undergoes size reduction using crushers and grinders. Magnetic separation is employed to concentrate the ilmenite content. This separates the weakly magnetic ilmenite from non-magnetic gangue minerals like silicates, quartz and iron sulfides. Outlook and Sustainability Issues Global ilmenite reserves are sufficient to meet demand for many decades at current production levels. Major producers like Rio Tinto, Vale, Chemours and others are engaged in exploration to discover new reserves and expand mining operations. Efforts are also on to produce titanium metal and alloys from ilmenite. Recycling of titanium scrap helps manage resources and reduce mining impacts. However, issues like land use, emissions, water usage and waste generation during mining and processing require ongoing attention. Industry-wide programs focus on environmental stewardship and sustainability performance. Minimizing energy consumption through efficient processes also benefits producers. On the whole, ilmenite will continue supplying the titanium needs of various industries into the foreseeable future.

0 notes

Text

Tunnel Boring Machine Market by Product, Technology, and Application 2027

Tunnel boring machines are pivotal in excavating tunnels across diverse geological formations. Mainly utilized in coal mines and tunnel construction, TBMs are witnessing a surge in demand owing to the expanding railway and highway infrastructure projects globally. The tunnel boring machine market is poised for substantial growth, driven by its increasing utilization in water management, oil and gas pipelines, and hydropower initiatives.

As underground construction gains momentum worldwide, the demand for tunnel boring machines is skyrocketing, expected to maintain a robust growth trajectory in the coming years. These machines, renowned for their ability to excavate tunnels with circular cross-sections through varying rock and soil types, are indispensable in modern infrastructure development.

Moreover, the hard rock mining sector is increasingly adopting tunnel boring machines to expedite mine development processes and achieve accelerated rates of advance in civil tunnel construction. This trend is set to further propel the growth of the tunnel boring machines market during the forecast period, underlining their indispensable role in shaping the infrastructure landscape.

Download Updated Insights with Sample Report @ https://www.alliedmarketresearch.com/request-sample/5200

The tunnel boring machines market size was valued for $5.47 billion in 2019, and is expected to reach $7.55 billion by 2027, growing at a CAGR of 6.0% from 2020 to 2027. In 2019, Asia-Pacifc region dominated the global market, in terms of revenue, accounting for about 48.99% share of the global market, followed by Europe.

The tunnel boring machine market is poised for growth, driven by several key factors:

Government Investments: Increased government funding for infrastructural development projects worldwide is a significant driver. As nations invest in expanding their transportation networks, tunnel boring machines play a pivotal role in creating efficient underground passages.

Infrastructure Development: Developing countries like India and China are leading the charge in road and railway infrastructure development. For instance, Shanghai's substantial investment of $38 billion in a new infrastructure project from 2020 to 2022 underscores the growing demand for tunnel boring machines.

Mining Industry Adoption: The mining industry's increased adoption of tunnel boring machines further propels market growth. These machines are instrumental in accessing valuable mineral deposits safely and efficiently.

Despite these promising drivers, the tunnel boring machine market faces certain challenges:

High Installation Costs: The initial investment required for tunnel boring machines can be substantial. This may deter some potential buyers or slow down project commencement.

Lack of Flexibility: Tunnel boring machines are highly specialized, designed for specific tunneling tasks. Their lack of flexibility limits their use to particular projects and geological conditions.

Make Purchase Enquire Before Buying: https://www.alliedmarketresearch.com/request-sample/5200

Opportunities on the Horizon

The future of tunnel boring machines holds promising opportunities:

Technological Advancements: Ongoing advancements in rock cutting technology are anticipated to enhance the efficiency and capabilities of tunnel boring machines, opening new avenues for their application.

Recovery from Pandemic Impact: The COVID-19 pandemic disrupted manufacturing and supply chains for tunnel boring machines. However, as vaccines are distributed and production facilities reopen, the market is expected to rebound.

Buy This Research Report (400 Pages PDF with Insights, Charts, Tables, Figures): https://www.alliedmarketresearch.com/checkout-final/00f60788cad03c2191bb642df2ff9a8b

Top Runners: Key companies profiled in the report include China Railway Construction Heavy Industry Co. Ltd., China Railway Engineering Equipment Group Co., Ltd., Dalian Huarui Heavy Industry Group Co., Ltd., Herrenknecht AG, Hitachi Zosen Corporation, IHI Corporation, Kawasaki Heavy Industries Ltd, Komatsu Ltd., Northern Heavy Industries Group Co., Ltd. (The Robbins Company, Inc.), Qinhuangdao Tianye Tolian Heavy Industry Co., Ltd.

About us: Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, DE. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain. Contact Us: United States 1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA. Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285 Fax: +1-800-792-5285 [email protected]

0 notes

Text

The Latest Innovations in Mining Ventilation Equipment for the Indian Market

Introduction:

In the dynamic landscape of mining, ensuring a safe and efficient working environment is paramount. mining ventilation equipment manufacturers play a crucial role in maintaining air quality and managing underground conditions. As technological advancements continue to reshape the mining industry, Teknoflow Green Equipments Private Limited stands at the forefront, introducing cutting-edge solutions to meet the evolving needs of the Indian market.

Mining Ventilation Equipment: A Vital Component for Safety and Productivity

Effective ventilation is essential in mining operations to mitigate the risks associated with poor air quality, dust, and hazardous gases. Teknoflow Green Equipments, a leading player in the field, recognizes the significance of reliable ventilation systems for both safety and operational efficiency.

Key Features of Teknoflow's Mining Ventilation Equipment:

Energy-Efficient Designs:

Teknoflow prioritizes sustainability and energy efficiency in its ventilation equipment. The latest offerings are designed to optimize airflow while minimizing energy consumption, resulting in lower operational costs for mining companies.

Advanced Air Filtration Systems:

To address the challenges of airborne contaminants, Teknoflow integrates state-of-the-art air filtration systems into its ventilation equipment. These systems efficiently remove dust particles and pollutants, promoting a healthier work environment for miners.

Smart Monitoring and Control:

Leveraging the power of technology, Teknoflow incorporates smart monitoring and control features in its ventilation solutions. This allows real-time tracking of air quality, temperature, and gas levels, enabling prompt responses to potential safety concerns.

Modular and Scalable Solutions:

Recognizing the diverse needs of mining operations, Teknoflow offers modular and scalable ventilation solutions. This flexibility ensures that equipment can be tailored to suit different mine layouts and sizes, providing a customized approach for each client.

Compliance with International Standards:

Teknoflow's commitment to quality and safety is reflected in its adherence to international standards. The company's ventilation equipment complies with industry regulations, giving mining companies confidence in the reliability and safety of the solutions provided.

Mining Ventilation Equipment Manufacturers Leading the Way in India

As one of the leading mining ventilation equipment in India, Teknoflow Green Equipments Private Limited has consistently demonstrated a commitment to innovation and excellence. The company's products have become synonymous with quality and reliability, earning the trust of mining operators across the country.

Teknoflow's contributions to the mining industry extend beyond delivering high-quality equipment. The company also provides comprehensive support services, including installation, maintenance, and training, ensuring that mining operations can maximize the benefits of their ventilation systems.

Conclusion:

In the ever-evolving landscape of mining, Teknoflow Green Equipments Private Limited continues to play a pivotal role in shaping the industry's future. By offering state-of-the-art ventilation solutions, the company contributes to creating safer, more efficient, and environmentally conscious mining environments in India. As the demand for advanced mining ventilation equipment continues to rise, Teknoflow remains at the forefront, driving innovation and setting new standards for the industry.

Name: Teknoflow Green Equipment Pvt. ltd

Address: Ven Business Centre 2,3rd Floor, Baner Pashan Link Road, Pune, Maharashtra 411021.

Contact No:+91 8956779584

0 notes

Text

During the forecast period, the underground mining equipment market is anticipated to grow at a lower CAGR of 2.3%. The market is predicted to generate US$ 16.37 billion in sales in 2023 and reach US$ 20.55 billion by 2033.

Rising adoption of automatic underground mining equipment among manufacturers to sync with the ongoing trends in the ever-evolving mining industry is set to incur tech-driven transformations in this landscape, opines the study.

In addition, stringent emission regulations regarding controlled diesel emission and personnel safety in the mining industry are likely to stimulate innovations that can enable dealing with the relentless pricing pressure more efficiently, and mitigate the environmental impacts of new-age underground mining equipment.

Request Sample Report: Empower Your Industry Understanding with Invaluable Insights https://www.futuremarketinsights.com/reports/sample/rep-gb-6296

Advanced techniques of mining and their impacts on various socio-economic factors have been a prolonged concern worldwide. The shift of a majority of miners from surface or open pit mining to underground mining has further amplified concerns vis-à-vis human safety and environmental impacts.

Technology is emerging as the most efficient tool for introducing enhanced features in underground mining equipment, and FMI’s study examines the influence of advancements in technologies and other microeconomic factors on the growth of the underground mining equipment landscape.

Mineworkers’ Staunch Inclination towards Hard Rock Mining Equipment

FMI’s study finds that every 7 out of 10 underground mining equipment sold in 2022 were designated to applications associated with hard rock mining platforms. Increasing demand for hard rock minerals, such as copper, gold, zinc, and lithium, in wide-ranging industries has given rise to hard rock mining activities in the mining industry. Leading players in the underground mining equipment landscape are focusing on catering to the thriving need for improved productivity in underground hard rock mines with the launch of next-generation mining equipment.

In addition, conventional hard rock mining techniques result in the release of toxic gases including carbon dioxide (CO2), and Sulphur dioxide (SO2) among others, which is triggering the adoption of electric equipment in hard rock mines. In addition, the study finds that coupling of underground mining equipment that can carry out multiple operations including parallel cutting, loading, and hauling operations are likely to witness high demand in the coming years.

Visibly Growing Preference for ‘Rental’ over New

In rough terrains such as the mining industry, constant wear and tear of mining equipment lead to high replacement rates, incurring significant depreciation costs to the end users. As large mining machinery, including underground mining equipment, come with a significantly high price tag, purchasing new equipment creates the need for high capital investments.

A majority of miners are inclined towards purchasing used or refurbished equipment, even considering the option of renting rather than investing in new underground mining equipment. Since a majority of mining businesses are looking for reducing their initial investments, rental service providers are likely to gain traction among in the coming years.

FMI’s study finds that more than half the revenue share is accounted by rental service providers in the underground equipment market. Increasing end-user preferences for rental equipment are fostering the progression of this trend in the market. A mounting number of rental service companies are offering refurbished mining equipment that are specifically tailored to suit the requirements of the underground mining sector. The FMI report also finds that leading stakeholders and investors in the underground mining equipment landscape are zooming in their strategic focus on providing rental service packages to suit changing needs of their customers, regarding the inventory of equipment.

0 notes

Text

Mining Equipment Market Size To Reach US$ 225.2 Billion by 2032

IMARC Group, a leading market research company, has recently releases report titled “Mining Equipment Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032” The global mining equipment market size reached reached US$ 149.4 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 225.2 Billion by 2032, exhibiting a growth rate (CAGR) of 4.52% during 2024-2032.

Request For Sample Copy of Report: https://www.imarcgroup.com/mining-equipment-market/requestsample

Factors Affecting the Growth of the Mining Equipment Industry:

Stringent Regulations and Sustainability Initiatives: