#Uk Venture Capital

Explore tagged Tumblr posts

Text

Ben Stokes and bowler Stuart Broad launches new Venture Capital fund for early stage investments in four technology sectors.

#bowler#venture capital#venturecapitalist#funding#angel investment#startup#automation#technology#techjour#technology trends#investment#investnow#uk business#cricket#cricket news#trending2023#trendingnow

0 notes

Text

Capital Venture Funds: Investing in Growth and Innovation for High Returns

Welcome to the world of capital venture funds! If you are looking to explore investment opportunities with high growth potential, capital venture funds can be an exciting avenue to consider. In this article, we will dive deep into the concept of capital venture funds, how they work, their benefits and risks, and provide valuable insights to help you make informed investment decisions.

What is a Capital Venture Fund?

A capital venture fund, also known as a venture capital fund, is a pool of money collected from various investors, such as individuals, institutions, or corporations, with the aim of investing in startups and early-stage companies. These funds are managed by professional venture capitalists who have expertise in identifying promising investment opportunities.

How Does a Capital Venture Fund Work?

Capital venture operate by raising capital from investors and using that money to provide funding to startups and emerging companies in exchange for equity stakes. The fund managers evaluate business proposals, conduct due diligence, and select ventures with significant growth potential. They offer financial and strategic support to these companies, with the ultimate goal of generating substantial returns on investment when the invested companies succeed.

Benefits of Investing in a Capital Venture Fund

Investing in a capital venture fund offers several benefits. Firstly, it provides access to high-growth opportunities that are typically unavailable in traditional investment options. Venture funds often invest in innovative and disruptive technologies, which have the potential to reshape industries and generate substantial returns. Additionally, investing in a capital venture fund allows diversification across a portfolio of startups, spreading the risk associated with investing in Truth Venture companies.

Risks Associated with Capital Venture Funds

While capital venture funds offer attractive prospects, it’s essential to consider the associated risks. Startups and early-stage companies are inherently risky investments, and not all ventures may succeed. The failure rate can be relatively high, and investors should be prepared for potential losses. Additionally, capital venture funds are illiquid investments, meaning that the invested capital may be tied up for a significant period before any returns can be realized.

How to Choose a Capital Venture Fund

When selecting a capital venture fund to invest in, thorough due diligence is crucial. Consider factors such as the fund’s track record, the expertise of its management team, the fund’s investment focus, and its alignment with your investment goals and risk appetite. Look for funds that have a diversified portfolio, an established network within the industry, and a robust investment strategy. Seeking advice from financial professionals can also provide valuable insights.

Top Capital Venture Funds in the Market

The capital venture fund landscape is diverse, with numerous reputable funds operating globally. Some of the top capital venture firms in the market include Sequoia Capital, Andreessen Horowitz, Accel Partners, and Benchmark Capital. These funds have a strong track record of successful investments and have been instrumental in supporting groundbreaking companies.

Steps to Invest in a Capital Venture Fund

Startup investing in a capital venture financing typically involves a structured process. Firstly, research various funds to identify the ones that align with your investment preferences. Contact the fund managers or reach out through a financial advisor to initiate the investment process. Complete the necessary paperwork, provide the required information, and transfer the investment amount as per the fund’s requirements. It’s important to review the terms and conditions of the fund carefully before committing your capital.

Tax Implications of Investing in a Capital Venture Fund

Tax implications of investing in capital venture funds vary depending on the jurisdiction and the specific regulations in place. In some cases, investments in venture capital funds may qualify for tax incentives or capital gains tax exemptions. However, it’s essential to consult with a tax professional or seek guidance from the fund managers to understand the specific tax implications and benefits associated with your investment.

Success Stories of Capital Venture Fund Investments

Capital venture funds have been behind some of the most successful and influential companies in the world. From early investments in companies like Google, Facebook, and Amazon, to the recent breakthroughs in innovative technologies, venture capital has played a crucial role in driving economic growth and fostering entrepreneurship. These success stories highlight the potential for substantial returns that can be achieved through astute venture capital investments.

Future Trends in Capital Venture Funding

The capital venture funding landscape is dynamic and constantly evolving. Several trends are shaping the future of venture capital, including the rise of impact investing, increased focus on diversity and inclusion, and the emergence of new industries and technologies. Artificial intelligence, blockchain, and clean energy are areas that are expected to attract significant venture capital investments in the coming years. Staying informed about these trends can help investors identify promising opportunities.

Conclusion

In conclusion, capital venture funds offer a unique investment avenue with the potential for high returns. While they carry inherent risks, the diversification, access to innovative companies, and strategic support provided by venture capital funds can outweigh the downsides for the right investors. Conducting thorough research, understanding the risks, and aligning your investment goals are key to making successful investments in capital venture funds.

FAQ

What is the minimum investment amount for a capital venture fund?

The minimum investment amount for capital venture funds varies depending on the fund. It can range from a few thousand dollars to several million. How long does it typically take to realize returns from capital venture fund investments?

The timeframe for realizing returns from capital venture fund investments can vary widely. It can take several years, often around five to ten years, for startups to reach a stage where they generate significant returns or undergo an exit event.

Can individual investors invest in capital venture funds?

Yes, individual investors can invest in capital venture funds. However, some funds may have specific requirements or minimum investment thresholds for individual investors.

What is the difference between a capital venture fund and private equity?

While both capital venture funds and private equity funds invest in companies, the key difference lies in the stage of the companies they invest in. Venture capital funds primarily focus on early-stage companies and startups, while private equity funds typically invest in more mature companies with established operations. Are capital venture funds suitable for risk-averse investors?

Capital venture funds are generally not suitable for risk-averse investors due to the higher level of risk associated with investing in startups and early-stage companies. Investors with a lower risk tolerance may prefer more conservative investment options.

Share this:

#Capital venture#Venture Capital#Capital venture fund#Seed funding#Seed capital#Venture capital firms#Startup funding#Venture capital fund#Venture capital financing#Seed funding for startups#truth ventures#Venture capital firms in US#Venture capital firms in UK#Capital venture India#Capital venture US#Capital venture UK#Venture Capital Ecosystem#Venture capital firms in india#Venture capital equity#Capital Venture Company#Capital venture funding#Stages of venture capital

0 notes

Text

Top 20 BL Live-action of 2024

20. Love Is a Poison - This series made my wish to see Hama Shogo in a BL come true. I loved his character in Koisenu Futari (2022) and wanted more of his character’s interaction with Takahashi Issei’s character. Also, the series leaned into the surreal with the squealing, sparkling succulents. While the legal drama part of the series was light, it was the first time I was invested in the character’s careers since Beloved Enemy (2017) [which is going to have a Thai remake/adaptation]. I absolutely enjoyed the dynamics of a neo-super-darling seme paired with a devoted, kuudere uke. But, I wish there were fewer flashback/compilation scenes.

19. Unknown - I never thought Priest’s Da Ge will become something like this. I am impressed by the meticulous cultivation that source material underwent. That little carp really crossed the gate to become a dragon. The Unknown managed to tone down the golden finger bits and keep things realistic to an extent, fit the whole business venture arc neatly into Taiwan’s SME-heavy capitalism. It fleshed out Le ge, and his relationship with both his underlings and his junior and made him interesting. It gave me one of my favorite mob characters in a BL – an ex-gangster with his blacked-out tattoos running a street food stall. In line with Taiwanese tradition, this series not only employed high BL literacy but also dedicated time to educate. (more on it here)

18. Cosmetic Playlover - I was hesitant to watch this show since I had enjoyed the first few volumes of manga and lost interest in later volumes. I knew they were going to censor the hell out of the first volume. While I am still bitter about that fact, I still enjoyed the series.

17. Love is Better the Second Time Around - this had some of my favorite moments from a BL - two-faced seme employing all sorts of methods to seduce and ensnare the uke, return of the alone-at-the-railway-station trope, seme using helpless, feverish face and acting coquettish (some seriously charming gap moe), teasing a seme's seme (this one did it better than At 25:00 in Akasaka which fumbled it by choice) and kishōtenketsu - 4 part traditional East Asian narrative structure (which appeared in many series this year and the last) with family negotiation aiming at adoption reversal. (I wanted seme to recommend uke in his place to his native household - that way they can also get married, if and when it gets legalized.)

16. Living with Him – The reason why this series is on this list is pretty unique. I never understood Japanese focus and fetish of nape (the way navel is in south India) before this series. The camera managed to capture the uke's neck, especially when he had his head bent slightly, in a stunning manner. Overall, the camera language was very intimate without being bawdy, perfectly suitable for the domestic setting of this BL. I loved the series more than I did the manga.

15. Century of Love - Gave me Hindi serial style BL complete with a red cloth enveloping the main couple during their fated encounter. It is a lakorn, so that's to be expected. I felt that the pair's romance progressed at an uncharacteristically fast pace given the initial resistance. (In other words, I wanted their romance to progress slowly, like over 400 episodes.) I thoroughly enjoyed the characters including the villains.

14. Healing Thingyan – this BL from Myanmar is no longer available at SKY Production’s YouTube channel. I had a good time watching this BL set in a village in the context of New Year where friends become lovers after much hesitation and an interrupted confession from the year before. My heart was pounding when the couple poured water over the left side because that's where their hearts are at. Also, the religious restriction (I am a little weak to this trope) to physical intimacy as a tactic to skip kiss scene - I would have been irked if it wasn't for the execution - the couple standing under arching bamboo, wearing sarong and acting all sweet. It is set in 2019. Later, I came to know that allegedly (I would appreciate if someone can help me gain more clarity on this matter), SKY production could be a proxy of 7th Sense Creation, an entertainment company cofounded by Kin Thiri Thet, daughter of Senior General Min Aung Hlaing (Commander-in-Chief of Myanmar’s armed forces and Acting President against whom the Prosecutor of the International Criminal Court has filed an application for an arrest warrant, alleging his involvement in crimes against humanity targeting the Rohingya population. (source))

13. The Time of Fever - I'm not very sure if this one can be considered a complete story in itself but even if not, it is immensely satisfying. Age-blind casting shouldn't have worked so well but it did.

12. Gray Shelter - this one made me feel as though I read a nice short story or a novel. It was viscous like honey, the way such types of Korean BL novels (like Picked Up In Winter) tend to be. It had a very masculine vibe with underlying unease of depending and being depended on.

11. Hitochigai kara Hajimaru Koi mo Aru aka Love Can Sometimes Start with the Wrong Person [fansubs available at Drama Otaku] - substitute lover trope but this time the substitute is two-faced. Everyone has their own agenda but this love is a zero-sum game. (I wanted 3p ending though – not possible since one actor is playing both the twins). I loved all the scheming and all those little lies. This one had explicit use of BL terms like seme and uke by a main character.

10. Perfect Propose - workplace that brings workers to tears, corporate slave uke who decides to quit (without starting a job hunt 😔) and an untethered seme who grows hydroponics tomatoes in their balcony. It is adapted from a single volume manga and not a novel, yet it uses every minute it's got to make you feel ALL THAT.

9. High School Return of a Gangster - I was sad that they meant it as a bromance and worried for the future of BL creation in South Korea since it was Number Three Pictures, the company that created popular BL Unintentional Love Story and The Time of Fever, by its own admission struggling financially with limited recovery of production costs (more on this here). When I started watching, I couldn't care any less about their intentions. It was an absolute delight. I was still immersed in the exhilaration of Aavesham (2024) and had wished to see such things in the context of a BL. And this one delivered. I was shipping the underboss with his main lackey (they have history between them and reminded me of the relationship between Ranga and Ambaan) at one point and the next moment, shipping him with his foxy classmate. The series toned down the bully-loves-bullied aspect in the novel, and humanized and contextualized the main bully with his life in the underbelly of the economy, so much so that I felt bad when the bullies were prosecuted (what will happen to Hong Jae-min's sister😟) while gangsters and the rich who hire them went scot-free in the live action. The face-slapping part left a bitter taste in my mouth with the secretary facing the brunt (and the misogyny embedded in the socio-economic fabric that breeds such hatred) while the father isn't retaliated against enough. I read and enjoyed the novel, but face-slapping was even more makjang. It is tough to get accepted in live action form as it is, in South Korea, since the gangster is middle-aged and it is only towards the end of the novel that the characters are finally out of high school, unlike in Mr. Mitsuya's Planned Feeding [fansubs by @isaksbestpillow] with a significant age gap but both are adults and are in a Japanese BL. Gong (공, Korean for seme) (a suspected psychopath, raised under constant surveillance by his father) consciously falls in love with the middle-aged su (수, Korean for uke) inhabiting the body of a high schooler, going as far as visiting his previous residence and pursuing him as one would an old person.

8. My Damn Business - From the first episode, this one had me hooked. Week after week, I was eagerly waiting for those 8 minute long episodes. It acknowledged the manhwa side of BL and hinted at their iconic smut pages (in a way New Employee live action couldn't). It executed stalking horse trope, with Park Min-jae (R. I. P) playing the stalking horse, in a manner that had me giddy with excitement. I also appreciate GND STUDIO for casting darker-skinned actors – in this one and in Fake Buddies. GND studio also has decent BL literacy as is evident from the above-mentioned series. In the third episode, Fake Buddies used the East Asian tradition of representing gay and lesbian relationships through rose (from barazoku (薔薇族)) and lily (from yurizoku (百合族)) respectively to hint at the BL and GL couple.

7. Boku to Boku ga Sukina Kare to, Kimi to aka Me, Him, and You [fansubs available at Drama Otaku]- Honestly, I didn't expect to be this impressed by this one going in. I had such low expectations. I absolutely love the pairing between Higashi Keisuke and Hiroki Iijima, much more than Higashi Keisuke and Nakajima Sota in Ossan no Pants ga Nandatte Ii Janai ka! [fansubs by @isaksbestpillow] and Hiroki Iijima and Inukai Atsuhiro in Our Dining Table. The series played with my heartstrings a lot. I fondly remember several of the scenes and all the emotions they evoked in me. At the end, there was a longing for something, maybe some more time with those characters, especially the model and his uncle.

6. Pit Babe (2023) - omegaverse with enigma - Japan has like 1 manga but through PitBabe I discovered that enigma has become a popular secondary gender in Thai BL space. I love buff uke and I got one paired with a two-faced, loyal loser seme in this one. Super pretty villain, Tony, had me wishing for him to be an omega (I love megalomaniac omegas). I also enjoyed reading the book – every time it rained, that silent phone call, Babe's jealousy towards omegas, the suspense and the pregnancy scare.

5. Love Sea - MAME lifted me out of a BL slump with this one. I also enjoyed the GL pair a lot - there is nothing I like more than performative cuteness/winsomeness (കൊഞ്ചൽ konjal, aegyo, sajiao, kawaii) and benevolent sexism weaponized and employed for emotional manipulation. High EQ manipulators are so rare, my favourite type of yandere (especially when paired perfectly with someone who gets swept up in the moment easily, like Techno). I wonder why MAME doesn't write Janus-faced men that way too. And the men who perform winsomeness such as Tongrak, Kengkla and Tharn, when they do so, have motivations that aren’t Machiavellian enough.

4. Heavens x Candy - OP Pictures is bringing to screens BL that are otherwise tough to get made. This one explored otaku culture, loneliness, family and love through fan pilgrimages, cute and horrifying family dynamics, adult entertainment avenues and love hotels with those transparent walls of bathrooms. It healed my heart after the blow dealt by I Became the Main Role of a BL Drama.

3. Love Syndrome: The Beginning – I didn't expect this but I'm glad to have received it. I want more but now that the director, F Nontapat Sriwichai, has passed away, I don't expect anything anymore. If only his legacy would inspire someone with the ability and mettle. I prefer meriba endings over happy endings. So, when Love Syndrome III was the first to get an adaptation, I was drawn into Yeonim’s universe. The movie focuses on Gear and Night’s relationship and spends relatively less time on Day and Itt. Yet, it is not hesitant to portray the beginning of their relationships, especially the eroticized violence and the morbid conditioning (調教), showcasing exceptional BL literacy.

2. Kubi (2023) – [Fan-subs] I must praise the excellent production quality before anything else. It is about multiple legendary figures in Japanese history such as Oda Nobunaga, Araki Murashige, Akechi Mitsuhide, Mori Ranmaru and Yasuke. The movie has historically accurate ending with specifics changed to fit the narrative. It is based on Honno-ji Incident and Battle of Yamazaki. Those who died then, dies in the movie too but who killed who and why are fictional. (meta here)

1. Takumi-kun Series 6: Nagai Nagai Monogatari no Hajimari no Asa (2023) – this one and Kubi came out last year but I got the chance to watch them only this year. Thanks to fan subs by @furritsubs. I read and re-read those chapters from the novel and I'm still basking in the magic of Shinobu Gotoh's storytelling. First time since Unni R's story and screenplay for Charlie (2015), I got immersed in a love story where the couple barely even interact and the romance unfolds in a thriller-like fashion. While a lot of character motivation gets lost on the way in this live action, most important of them were impossible to miss when snow fluttered around in a bottle, when a delirious Takumi sought Gii in a crowded stairway landing and when Yoshizawa jumped out to stop Takabayashi from hurting. (ongoing meta series here)

-

Here are the top 20 of 2024: live-action BL that I watched and enjoyed this year. I haven't watched everything that came out this year (I'm saving up some for the upcoming year) and did revisit a lot of older stuff (not listed) when there was nothing enjoyable to watch. This year, I realized that I am able to tolerate, if not enjoy, when I'm not too familiar with the content it is adapted from with some exceptions. I don't treat BL like fables or life lessons. I don't bother with moral validation from the choice of media I consume either. But there are certain real-world killjoys in media that may affect my enjoyment, like what happened with The Sign. Please feel free to ask for content warnings.

#japanese bl#thai bl#taiwanese bl#korean bl#bl drama#bl series#Takumi-kun Series 6: Nagai Nagai Monogatari no Hajimari no Asa#Kubi#heavens x candy#Love Syndrome The Beginning#my damn business#love sea the series#Boku to Boku ga Sukina Kare to#Kimi to#pit babe the series#perfect propose#Hitochigai kara Hajimaru Koi mo Aru#high school return of a gangster#the time of fever#Healing Thingyan#gray shelter#century of love#living with him#Love is Better the Second Time Around#cosmetic playlover#unknown the series#love is a poison#love is like a poison#doku koi#takumi kun 6

35 notes

·

View notes

Text

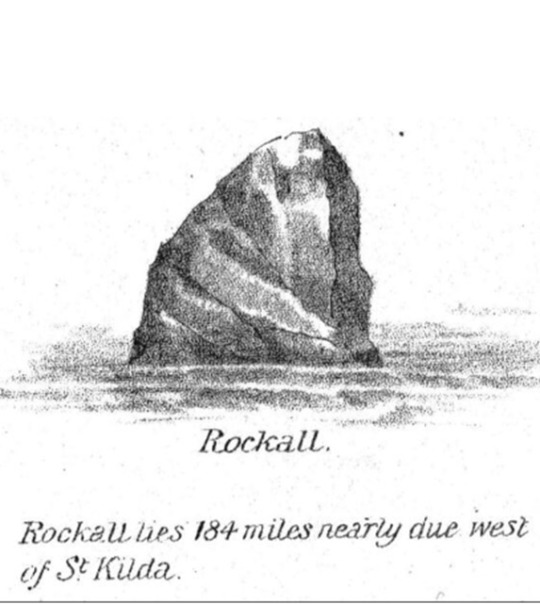

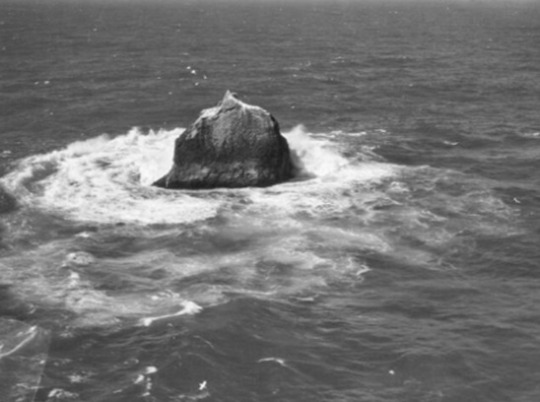

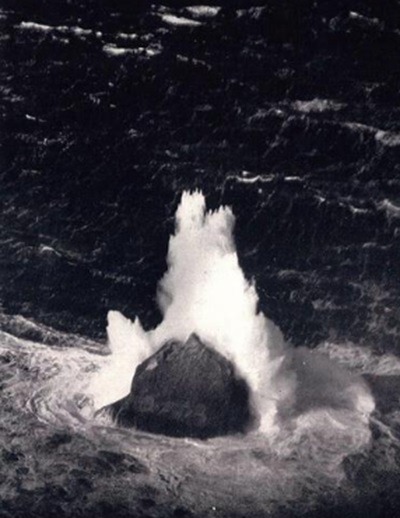

On 10th February 1972 the Island of Rockall, 250 miles west into the Atlantic formally became part of Scotland.

I say finally, but the arguments about this lump of stone are still going on. I particularly like the way the online magazine Hakai describes it and the goings on....

The Fight Over a Shitty Rock.

The tiny islet has been the source of an ownership dispute involving the Scotland, Ireland, Denmark and Iceland. The plateau on which it sits has caused the decades worth of tension.

While we might think we own it I agree with the United Nations definition in cases like this…

“rocks which cannot sustain human habitation”, there have been attempts to prove that Rockall is in fact an island and does not fall into that category.

Former SAS soldier Tom McClean spent 40 days on Rockall from from 26 May to 4 July 1985 in an attempt to validate it as an island and make it a British territory. Since then Greenpeace activists spent 42 days protesting against exploration. The activists landed on the island by helicopter to protest about potential oil exploration in the region.They spent 42 days on the rock, living in a solar-powered capsule.

Speaking at the time, one of the activists is quoted as saying: "The seas around Rockall, potentially rich in oil, are fought over by four nations - Britain, Denmark, Iceland and Ireland."By seizing Rockall, Greenpeace claims these seas for the planet and all its peoples."

They raised a new flag on the rock - the flag of the "Global State of Waveland" - establishing Rockall as the capital of an entirely new country.But they did not want to own Rockall - Greenpeace said it wanted to borrow it until it was "freed from the threat of development."It was a "virtual nation" in the early days of the internet with citizenship offered to anyone prepared to take a pledge to defend nature and act peacefully. Over the next few months, more than 15,000 applied for citizenship.

In 2014 Scottish explorer Nick Hancock occupied the rock for 45 days. Hancock, a surveyor from Edinburgh did this for charity raising money for Help for Heroes. The challenge was to land on Rockall and survive solo for 60 days. but but he had to cut his stay short after losing supplies in a storm.

For the moment, the status of the Shitty Rock remains that the UK claims is at part of its territory, more specifically, Scotland.

Read the Hakai article below, some of the article is wrong, like the Scottish Government saying the coast guard would board any Irish fishing boat venturing into a 19-kilometer zone around the islet of Rockall. While Scotgov work with the coastguard to some extent, Maritime and Coastguard Agency, is not devolved.

https://hakaimagazine.com/.../the-fight-over-a-shitty-rock/

11 notes

·

View notes

Text

“There Are No Rules” L.S. Dunes Interviewed

The post-hardcore group on their seismic new album...

There’s a certain mystical nature to frontman Anthony Green as he expresses the feeling of magic he experiences in Ireland, as guitarist Frank Iero watches one of his closest friends with a bemused fondness, popping in with observations of his own. But, Iero laughs quietly, in a knowing way, as Green’s mind begins to wander, “Ireland has a magical, mystical thing going on. There are fairies here. There’s fucking legit magical shit. Traditional Irish music has some of the craziest storytelling, craziest melodies and songs like he said, there’s songs where the story is linear, you know, and the music here is rich with majesty,” despite warnings to not “talk about ghosts in these old Irish buildings, [because he] might summon something.”

Green’s eloquence and ability to convey his fascination with the magic that lies not only within Ireland, but within music, stretches far beyond what is presented on L.S. Dunes’ newest record, ‘Violet’. And with five of the most powerful minds in post-hardcore at the helm of this newest record – Frank Iero and Travis Stever on guitar, Tim Payne on bass, Tucker Rule on drums and Anthony Green fronting the band – the band’s exploration of genres, sounds and structures pushes the very boundaries their other projects have started, as pioneers of post-hardcore. Honed in on a fine line of post-rock and post-punk, tracks feel environmental and all-encompassing, a swirl of technique that only some of the most innovative minds in the alternative scene can create.

—

youtube

—

Eccentric, indomitable, insightful, L.S. Dunes newest venture with ‘Violet’ can be perceived as a vastly different record to their first, ‘Past Lives’, but in truth, contains the same sentiments the band founded themselves on. An exploration of the human consciousness and its relationship with creativity in all of its forms, they push music to its limits, even though to L.S. Dunes, there are none; “There are no rules. Like the fact that there is no right, there is no wrong, it’s just what makes you feel something. Or what sounds good to you. And it’s very subjective, you know?

The thing that I dig will not be the thing that you dig all this time. And the reason I do it, and the reason that I want to continue to make stuff is because I need to for my own soul and it’s for nothing else. It’s not a tangible thing,” Iero begins. Whether that creativity springs from something tangible or just sensational, it creates a kind of magic, “It’s like you breathe, you walk, you make things, you make songs,” Green hums in agreement.

Sitting in a dimly lit room at the top of the 3Olympia in Ireland’s capital, Anthony Green and Frank Iero huddle closely, starting off quickly with proclamations of adoration for the country sprinkled amidst the buzz of their first night on tour. Opening for Rise Against on their UK and EU tour, the tour kicked off in Ireland, allowing for Green and Iero to explore the day before, Green’s mind was occupied by the sorcerous atmosphere of the country. And the fact that Green was able to tap into a part of Ireland many people fail to acknowledge, it’s easy to see how ‘Violet’ formed in the way it did, “There’s so much magic in music when it comes to connecting, what draws you out of your comfort zone, and what happens when you’re in a moment in the flow state.”

Through a flow-state that allows for the sorcery spilling out and morphing into the shape of what is now, ‘Violet’, there are specks of mystery, skepticism, query, and hope perceived throughout the entirety of the record. Fascinating in the way that the instrumentals quite literally convey and encapsulate the essence of how the lyrics make one feel, Green can only describe the experience of writing the record as “touchdown after touchdown – I don’t know sports – but from the very first second I started working on the record… It’s like a joy every time. It’s like when you write something and you’re like, ‘I fucking nailed it, I fucking nailed it! I can’t wait for my parents to read this! I want everybody I went to school with to see this!’ That’s how I felt literally every day leaving the studio, even when something wasn’t hundred percent there, I knew that this group was going to make it better than it could ever have been if I didn’t have this.”

—

youtube

—

Green elaborates, “As an artist, as somebody who loves making stuff, there’s only so much I can do when I’m like in my own head, and I can make a cool, whatever, but when you get somebody around you who’s really good and they’re playing, you’re inspired to do more than what you would do on your own… You have four people around you who are inspiring you, who are great, who you admire – so, your output is going to match differently than you just sitting in your room imagining things. And for me, I’ve been searching my whole life for different people to make music with.

And I’ve had the opportunity to make music with so many great artists, but this situation was one of those fall in love at first sight types.”

With the band originating from their respective, but separate, states of the US amongst the pandemic, the band found a rhythm with starting ideas alone for ‘Past Lives’. But now, with the new record, new paths were foraged both physically and sonically. They “lived in a house down the street from the studio and did the record that way,” Iero explains. Far from what would be considered normal for L.S. Dunes due to “everybody [having] families and other obligations,” and previously made obligations to bands like Thursday, Coheed & Cambria, My Chemical Romance alongside previous excursions with Saosin and Circa Survive. Considering L.S. Dunes only to be a labour of love and dedication is disservice to the mountains they must move in order to find each other in the valley – “And at some point, you’ve got to see a doctor, too.” Forget the dentist, “You got a branch in Vienna?” Iero jests.

“There’s shit that is happening right now ‘cause I don’t got the fucking time!” Iero exclaims.

—

youtube

—

In all seriousness, it “certainly makes this cool thing though – when we do get together, it is kind of like seeing that friend that you don’t get to see very much, but you only have a good time with.” While their friendship is first and foremost, and without it, the band would have never formed, or been as internally successful as it is, they collectively understood that making their first record and doing their first shows was them testing the waters of being a band. “Not just can [we] hang together and make each other comfortable and all that stuff, but like can [we] work out a creative difference? Can [we] compromise on a creative difference so that [we] make it even better than the desired effect from either party?

Can you live with each other, in close quarters, making music together? All that stuff is the stuff that will make a band like able to make good music.”

Falling in love with the inner workings of the band and the environment it gives each artist in the group – and having it work as harmoniously as it has – allows for the band to blossom and bloom in a way that may not have been possible if pursued any sooner than it had been. When considering the formation of the band its occurrence, Iero wondered aloud whether or not the group could be what it is, had it formed 10, 15 years ago, “I think everything happens for a reason in a certain part of life. I truly feel like the universe kind of tells you where you need to be if you listen to the signs.” And when the signs arrived in the form of voice memos and texts being exchanged in group chats during COVID, they jumped on it. However, it wasn’t without consideration of who they were as individuals and artists, “I know for myself that I could not have handled this type of relationship with people, I don’t think I was ready to be as open as I needed to be in my life until the moment that it made itself available to me. The version of myself that I’m able to move into now at this stage of my life, is because of this band. I don’t know if I could have handled the type of internal pressure,” Green admits.

Screaming about that pressure on ‘I Can See It Now…’ on the newest instalment of L.S. Dunes’ discography, the new album’s ten tracks push and pull, break and crash, sprawling over different sounds and techniques as questions as to our role as people in our environment, the inner workings of human, and questioning the nature of hope, and the magic that lies within freeing yourself from something that doesn’t necessarily serve you swirl in the air: “The idea of being let down by hope, that’s really your preconception and what your expectations are of that. That’s like having a conversation with yourself before you have it. It’s a dangerous game.” Yet Green coincides with Iero that he believes he “found a sense of hope” while “working with the band on Past Lives. Ultimately, the lingering themes of hope that thread through the record showcase a natural occurrence for Green, “I think that just naturally came out because this band makes me feel hopeful.”

Despite the “inevitable” stress that comes along “when trying to make anything,” which Green considers to be a good kind of stress and pressure – because it means that you see it as “important, and that it means something to you” – the band’s ability to turn inward and reflect was because they were in an environment that made them feel safe. “We put each other first and I think that that helps create an atmosphere where we feel safe, like we’re not gonna work ourselves into the ground for, you know, what? A chance at the big time?” Green jokes.

—

While some may – somewhat dismissively – call it a passion project due to its members’ notoriety, it’s more than that. Passion project implies that it’s to the side, only really worked on when convenient. However, nothing about L.S. Dunes and their lives are convenient. That drive, that desire to create a project that is more than just something they work on occasion. No, this project is each member at their most authentic, at their truest ‘creative spirit’: “Much to other people’s chagrin, like labels and managements and all that stuff, like – if it doesn’t feel natural to us, we don’t fucking do it,” Iero shrugs with a bit of a chuckle. “It’s sort of like you have to be selfish so that you can be selfless, you know?” Green adds.

The authenticity found within L.S. Dunes is evident as members look both to their foundations and what that can be transformed into, pushing themselves beyond who they are at their roots. “I think it’s hard sometimes to get away from the things that are innate to you as an artist, you know? There’re certain places where you will naturally go to or things that you shine within. Whether it’s a riff here, or a melody shift or even like a mannerism within your vocals. We’re all an amalgamation of different ticks that we’ve picked up along away from different people, right?” Iero explains. “You’re gonna have a word that you like to use or a chord change that you like to use. So that stuff, I think keeps you grounded to where you came from, but I think the progression forward is to be aware of that stuff and also try to push yourself outside of those boundaries and push yourself into a place that you don’t feel as comfortable.”

And when you challenge yourself and push your boundaries successfully, it can transform you as an artist. Anthony Green is a glowing example of that, “I don’t know if I’ve ever felt further away from where my roots are than anything ever, and I don’t think it’s a bad thing. I never want to go back to that… I didn’t have a really good relationship with the creative spirit, and it felt like everything I made was almost in spite of my shitty relationship with my creative spirit and with my own self and my body and my ability to connect with my band. So, I feel like this is all new for me.”

A new start, questioning all that has been and all that is, turning pages on times they no longer felt connected to, ‘Violet’ bleeds with deep internal reflections and explorations as they change and morph as a sunrise would, turning the sky violet. And the success of this record to them won’t come from how the record is received by critics, but rather from themselves: “Our victory and our trophy comes when we like the record. Whatever happens after it comes out, kind of just happens – it has nothing to do with us. Like we can make a good record that we like and then be happy to put that out there and that’s where we end,” Green elaborates. Because at the end of the day, Iero acknowledges the “weird connotation with the way that certain people interpret [success].” And he’s right – success has been quantified instead of qualitative. Instead of a release being successful because it was an objectively good record, the quantity in which the record is awarded and perceived by others determines its success.

—

youtube

—

Instead, the core of why ‘Violet’ is objectively successful in their terms is because of who the group are at their core, and the creative environment that manifests from their personal identities and reflections: “Our victory and our trophy comes when we like the record. Whatever happens after it comes out, kind of just happens – it has nothing to do with us. Like we can make a good record that we like and then be happy to put that out there and that’s where we end,” Green elaborates.

And the fact that the project is able to be created without restraints, the art truly the only focus, Green and Iero acknowledge their position in the creativity community, “It’s not often that people get the luxury of being able to make something with people who aren’t sweating on you to pay their bills. Like, even if it’s just the tiniest bit of quantum level sweat. When somebody just is like, ‘hey, you do your thing so good. I just love you and I want you to do your best and it’s always you’re happy, we’re gonna be happy, and we’re gonna make a steam roller out of this.’ This is an art project, like that’s such a gift. As an artist it’s made me better, and it’s made me able to work with people better and I think it makes my mission of just wanting to make good music with my friends stronger.”

“To be in a situation where that’s not why we do this – like we would actually probably make more money if we didn’t do this band,” Iero all but shouts in amusement.

A situation so untainted gave way to an objectively good record that tests the boundaries L.S. Dunes view as nonexistent – ‘Violet’ is a testament to the strength and courage of the human spirit in pursuit of creativity and connection, and the magic that is inherently created from such a love for what they do. Indeed, with combined experience of decades in the industry, one would expect a polished piece of work from five post-hardcore pioneers. However, no one can expect the band to reveal themselves and expose their minds and souls to the level of humanity and authenticity this record encapsulates. Untarnished of any restrictions, ‘Violet’ is L.S. Dunes at their most curious, genuine selves.

—

youtube

—

‘Violet’ is out now. For all L.S. Dunes live information visit their site.

Words: Isabella Ambrosio Photography: Shervin Laine

12 notes

·

View notes

Text

In our Christmas imagery, ancient symbols such as fir trees, mistletoe, holly and ivy sit alongside the baby Jesus, Virgin Mary, angels and shepherds. This mixture of pagan and Christian traditions reminds us that Christmas was superimposed on to much older midwinter festivities. Yet had it not been for a devastating pandemic that swept through the Roman empire in the third century AD, the birth of Jesus would probably not feature at all in our winter solstice celebrations.

If the New Testament is to be believed, Jesus managed to fit a great deal into his short life. But despite all his wise words, good deeds and miracles – not to mention the promise of everlasting life – Christ was nothing more than the leader of an obscure sect of Judaism when the Romans crucified him in AD33.

The Bible informs us that Jesus had 120 followers on the morning of his ascension to heaven. Peter’s preaching swelled the number to 3,000 by the end of the day – but this exponential growth did not continue.

After the Jews in Palestine failed to convert en masse, Jesus’s followers turned their attention to Gentiles. They made some headway, but the vast majority of people across the empire continued praying to the Roman gods.

There were about 150,000 Christians scattered across the empire in AD200, according to Bart D Ehrman, author of The Triumph of Christianity. This works out to 0.25% of the population – similar to the proportion of Jehovah’s Witnesses in the UK today.

Then, towards the end of the third century, something remarkable happened. The number of Christian burials in Rome’s catacombs increased rapidly. So did the frequency of Christian first names in papyrus documents preserved by arid desert conditions in Egypt. Christianity was becoming a mass phenomenon. By AD300 there were approximately 3 million Christians in the Roman empire.

In 312, Emperor Constantine converted to Christianity. Sunday became the day of rest. Public money was used to build churches, including the Church of the Resurrection in Jerusalem and the Old St Peter’s Basilica in Rome. Then, in 380, Christianity became the empire’s official faith.

At the same time, paganism suffered what Edward Gibbon called a “total extirpation”. It was as if the old gods, who had dominated Greco-Roman religious life since at least the time of Homer, simply packed up and left.

If the Romans had not embraced Jesus so enthusiastically in the third and fourth centuries, it is hard to envisage an alternative route by which Christianity would have metamorphosed into a world religion. To understand what caused this momentous change, we must consider why Roman society was so receptive to casting off its old belief system and adopting a new religion at that time.

At its peak, the Roman empire reached from Hadrian’s Wall to the Red Sea, and the Atlantic Ocean to the Black Sea. The imperial capital had about 1 million inhabitants. Alexandria’s population was around half that, and Antioch and Carthage’s were just over 100,000.

Goods and people moved back and forth across the Mediterranean, although merchants ventured much farther afield. Size, connectedness and urbanisation made the Roman world remarkable; but it also created the perfect conditions for devastating pandemics to spread.

The Plague of Cyprian was first reported in Egypt in 249. The pandemic hit Rome in 251 and lasted for at least the next two decades. Some historians argue that it caused the period of political instability and economic disruption known as the Crisis of the Third Century, which nearly caused the empire to collapse. For other historians, the Cyprian plague was just one aspect of this ancient polycrisis.

We cannot be sure about the pathogen’s identity. Bishop Cyprian of Carthage, who gave his name to the pandemic, described symptoms including high fever, vomiting, diarrhoea and bleeding from the ears, eyes, nose and mouth. Based on this account, a viral haemorrhagic fever similar to Ebola is the most likely candidate. According to one chronicle, at its height the pandemic killed 5,000 people a day in the capital. Alexandria’s population is estimated to have dropped from about 500,000 to 190,000. Even accounting for exaggeration, it was clearly a terrifying pandemic.

When your friends, family and neighbours are dying, and there is a very real prospect that you will die soon too, it is only natural to wonder why this is happening and what awaits you in the next life. The historian Kyle Harper and sociologist Rodney Stark argue that Christianity boomed in popularity during the Plague of Cyprian because it provided a more reassuring guide to life at this unsettling time.

Greco-Roman deities were capricious and indifferent to suffering. When Apollo was angry, he would stride down Mount Olympus firing arrows of plague indiscriminately at the mortals below. Pagans made sacrifices to appease him. Those who could, fled.

Paganism offered little comfort to those struck down by disease. The old gods did not reward good deeds, so many pagans abandoned the sick “half dead into the road”, according to Bishop Dionysius, the Patriarch of Alexandria. Death was an unappealing prospect, as it meant an uncertain existence in the underworld.

In contrast, Jesus’s message offered meaning and hope. Suffering on Earth was a test that helped believers enter heaven after death. Everlasting life in paradise is quite the prize, but Christianity provided another more tangible benefit, too.

Christians were expected to show their love for God through acts of kindness to the sick and needy. Or as Jesus put it: whatever you do for the least of my brothers and sisters, you do for me.

Emboldened by the promise of life after death, Christians stuck around and got stuck in. Dionysius describes how, “heedless of danger, they took charge of the sick, attending to their every need”. Early Christians would have saved many of the sick by giving them water, food and shelter. Even today, hydration and nutrition are important elements of the World Health Organization’s Ebola treatment guidelines.

As Stark and Harper point out, the fact that so many Christians survived, and that Christians managed to save pagans abandoned by their families, provided the best recruitment material any religion could wish for: “miracles”.

Without these miracles, Romans would not have adopted Jesus’s message so enthusiastically, and Christianity would probably have remained an obscure sect. In this alternative reality, it’s likely we would still decorate our homes with evergreen plants to symbolise nature’s resilience and vitality at midwinter. The nativity story, however, would be lost in the dustbin of history.

7 notes

·

View notes

Text

New post!

"Eddie Redmayne, star of the Fantastic Beasts series, enjoys a caffeine fix at a local speciality coffee shop".

By We love Budapest, January 30, 2024.

British actor Eddie Redmayne, currently shooting in Budapest, was spotted at a downtown speciality coffee shop. So, next time you are sipping on a flat white, keep an eye out – you might be sharing a coffee moment with the Oscar-winning star!

Redmayne, well known for his leading roles in the Fantastic Beasts series, The Danish Girl, and The Theory of Everything, has been in and out of Budapest since last summer. He is shooting ' The Day of the Jackal ', a thriller series based on Frederick Forsyth's novel, where he plays a professional assassin. Beyond the film set, he's been actively exploring the city, making appearances at a student protest and the Espresso Embassy, and now he ventured into another top-notch speciality café near the Parliament, where he posed for a photo.

The baristas at Madal said the actor had arrived solo and ordered a latte for himself and another to go. He was super friendly, greeting another guest with a 'Nice to meet you'.

As for the duration of his stay in the Hungarian capital, we have no information and the release date of the series also remains a mystery. But we do know that the filming locations span Budapest, Austria, Croatia, and the UK, and the cast includes Lashana Lynch, Adam James, Scott Alexander Young and Hans Peterson too. So some more celebrity spotting is definitely on the cards.

---

21 notes

·

View notes

Text

Bhardwaj was to invest Rs 2K cr in UK billionaire’s firm : Police

BITCOIN FRAUD CASE GETS MURKIER Sleuths say Amit had even sought citizenship of Commonwealth of Dominica and offered to pay over USD 600,000 The cryptocurrency scam is a can of worms.

BITCOIN FRAUD CASE GETS MURKIER

Sleuths say Amit had even sought citizenship of Commonwealth of Dominica and offered to pay over USD 600,000

The cryptocurrency scam is a can of worms. With each passing day, Pune police is able to bring out more against Bhardwaj brothers, who they believe are the main conspirators of the scam. Now, the cops have unearthed that Amit had struck a deal with a billionaire based out of London to buy shares worth Rs 2,000 crore. He had even paid an advance. This money, cops believe, is from the monies that Amit and Vivek collected from thousands of unsuspecting investors.

On Friday, Pune police’s cyber cell division produced Amit and Vivek Bhardwaj in district sessions court for extending their custody in Nigdi case. The investigators told the court that the data analysed by forensic science laboratory revealed that Amit had bought shares in two companies — Crypto capital Ltd and Sun & Sand Mining & Minerals Resources.

Sleuths told the court that during the interrogation, Amit revealed that he had signed a purchase agreement with Rajesh Satija to buy shares worth Rs 2,000 crore in his UK-based company Sun & Sand Mining & Mineral Resources and had even paid Rs 5 crore for it. Satija is a UK-based billionaire with interest in mining in Africa. Similarly, Amit also signed a memorandum of understanding (MoU) with Virgin Island-based Crypto Capital Ltd to invest in their venture. Cops are now trying to find the amount invested. They believe both the investments were made from the money made in the scam.

Cops also told the court that their cyber experts have been able to access data from Amit’s website and found 84,617 users. These users invested 82,312 Bitcoins valued at over Rs 4,000 crore. This is only as far as one website is concerned. Investigators believe that the number of investors duped is a lot more and the cryptocurrency involved in the scam is of far greater value. The investigators have also found that Amit had sought citizenship in Commonwealth of Dominica, a nation in the Caribbean islands. He had used one of his firms based in Dubai to seek the citizenship and offered to pay over 600,000 US$ (Rs 4 crore) to obtain it.

On the basis of these findings, cops sought extension of his custody. Amit and his brother Vivek were arrested earlier this month from Delhi airport. The official line taken by cops is that they were travelling from Bangkok to Delhi and were intercepted at Delhi airport. Ever since their arrests, the duo spent 14 days in police custody in Dattawadi case. Once that term was over, they spent a day in jail and were brought back for their alleged involvement in Nigdi case.

While district government pleader Ujjwala Pawar sought extension of custody, Bhardwaj brothers’ lawyer Gaurav Jachak told the court that the cops were using the same grounds to seek their custody in different cases. He also argued that the duo had already given all the information pertaining to their user IDs and e-wallets to the cops and that their interrogation was not necessary.

After hearing both the sides, special judge JT Utpat extended their police custody till May 3.

OTHER ACCUSED IN CASE

On Friday, cops also produced Hemant Suryawanshi, Hemant Bhope and Pankaj Adlakha in court. The trio was arrested earlier this month, days before Bhardwaj brothers. They are allegedly the main agents who collected monies from investors for Amit. The trio was earlier arrested for cheating investors, who had approached Nigdi police, and spent several days in police custody.

On Friday, their custody was sought for case registered with Dattawadi police station. The cops told the court that while Pune-based Suryawanshi was close to Amit, Bhope and Adlakha were his agents. The cops also said that the trio played an important role in convincing unsuspecting citizens to invest in cryptocurrencies through their firms.

Police told the court that the trio founded Gain Bitcoin alongwith Amit to offer Ponzi schemes. They were also allegedly told by Amit to engage lawyers and accountants so that their money could be sent to offshore accounts.

Advocate Dairyasheel Patil, who represented Suryawanshi, argued, “My client is not even an employee of the company and he has not received money from Gain Bitcoin. He is not concerned with the main accused.” Advocate Manas Thakor, who appeared for Adlakha, said that his client is a motivational speaker and not an agent as the police is making him look. “There is no such record to show that he had been working as an agent in this case,” he argued. Advocate Patole, representing Bhope, said, “The police have just transferred my client (from Nigdi case to Dattawdi) on grounds of suspicion. They haven’t explained his role in the case in any manner,” he said.

2 notes

·

View notes

Text

Company Incorporation in UK by Mercurius & Associates LLP

The United Kingdom remains one of the most attractive destinations for entrepreneurs and businesses looking to expand their global footprint. With a business-friendly regulatory framework, a stable economy, and access to international markets, setting up a company in the UK can be highly beneficial. Mercurius & Associates LLP provides expert guidance on company incorporation in UK, ensuring a seamless and hassle-free process for business owners.

Why Company incorporation in UK?

Ease of Doing Business – The UK ranks high in ease of business setup with a straightforward registration process.

Access to Global Markets – A UK-registered company enjoys credibility and access to European and international markets.

Tax Benefits – The corporate tax rates are competitive, and businesses can benefit from various reliefs and deductions.

Legal Protection – A limited company structure offers liability protection to business owners.

Funding Opportunities – The UK provides excellent funding options, including venture capital, government grants, and bank loans.

Steps to Incorporate a Company in the UK

Step 1: Choose Your Business Structure

Before incorporation, it's essential to decide on the appropriate business structure. The most common types are:

Private Limited Company (Ltd) – Suitable for small to medium-sized businesses.

Public Limited Company (PLC) – Ideal for larger enterprises seeking public investment.

Sole Trader or Partnership – Simpler structures with fewer compliance requirements.

Step 2: Select a Unique Company Name

Your company name must be unique and comply with UK naming regulations. Mercurius & Associates LLP assists in checking name availability and ensuring compliance.

Step 3: Register Your Company

Company incorporation in UK is done through Companies House. The key documents required include:

Memorandum of Association – Declaring the intent of the company.

Articles of Association – Governing rules for the company’s operation.

Registered Office Address – A physical UK address for official correspondence.

Details of Directors and Shareholders – Information on individuals responsible for company management.

Step 4: Obtain a Business Bank Account

Once registered, the next step is opening a UK business bank account to facilitate financial transactions. Many UK banks require proof of business registration and shareholder details.

Step 5: Register for Taxes

A UK company must register with HM Revenue & Customs (HMRC) for:

Corporation Tax

VAT (if applicable)

PAYE (if hiring employees)

Step 6: Compliance and Annual Reporting

UK companies must comply with annual filing requirements, including:

Annual Confirmation Statement (Form CS01) to Companies House.

Annual Accounts Submission to HMRC.

Corporate Tax Returns to declare profits and taxes.

How Mercurius & Associates LLP Can Help

Incorporating a company in the UK can be a complex process, but with Mercurius & Associates LLP, you receive expert assistance at every step. Our services include:

Company name registration and documentation

Guidance on business structure and compliance

Assistance with UK bank account setup

Tax registration and compliance support

Ongoing legal and financial advisory

Start Your UK Business Today!

If you're considering setting up a company in the UK, Mercurius & Associates LLP is your trusted partner for seamless incorporation and compliance. Contact us today to get started and take advantage of the UK's thriving business environment!

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation

4 notes

·

View notes

Text

“A life directed chiefly toward the fulfillment of personal desires will sooner or later always lead to bitter disappointment.” - Albert Einstein

Have you ever asked yourself why so many of Reform UK’s top officials are either millionaires or billionaires? Do the ordinary supporters of Reform UK really believe the super-rich elite that runs Reform is going to be looking out for their interests?

To answer this question we could do worse than look to America and the relationship between Elon Musk and Donald Trump. Musk, a highly successful businessman and the world’s richest individual, (worth £136bn) has been making political headlines of late and previously was anything but a friend of Trump.

“In 2016, Musk was not the biggest fan of his future bestie, stating publicly that Trump was not fit to run for the nation’s highest office.” (Independent: 31/12/24)

So what has changed? What explains this change in the relationship between arguably the two most powerful men in the world? The answer is simple – Trump needed campaign money which Musk was willing to provide, and Musk needed a President that would be in his debt so he could go on making billions.

The AI chatboat Copilot informs us that:

"Elon Musk's business success and fortune are significantly tied to China. Tesla's Shanghai gigafactory, which opened in 2019, is a major contributor to this success. The factory produces almost one million Tesla cars annually, accounting for more than half of Tesla's global car production. China is also a crucial market for Tesla, being the second largest after the United States.”

Here is the problem for Musk. Trump has always regarded China as the enemy and publicly announced his determination to impose even greater trade tariffs on imported goods from China than he had during his previous presidency. This would have a seriously detrimental effect on Musk’s businesses ventures and his own personal wealth.

What better way to try and mitigate this possible personal economic disaster than having Trump in his debt? And it is working.

Only a few weeks ago Musk came out in opposition to the bipartisan spending bill that would have:

“…prohibited or required notification of overseas transactions involving China in sectors like semiconductors, quantum technology and artificial intelligence. It also would have included an expanded review of Chinese real estate purchases near national security-sensitive sites and a requirement to study national security risks posed by Chinese-made consumer modems and routers.” (Newsweek: 27/12/24)

The final version of the bill saw ALL previous China related provisions removed!

The point I am making is that millionaire and billionaire businessmen and women are rarely interested in politics other than how it affects them personally, especially concerning their own fortunes.

We are frequently told that Russia and China are the enemies of the West and that they endanger our democratic way of life. Yet time and time again, the very rich foster business ties to these countries and are happy to go on trading with them whatever the threat to the rest of us.

“New data suggests that 37 businesses with ties to the UK are currently under investigation for potential breaches of the UK's sanctions against Russia.” (*Shedder+Wedderburn: 11/10/24)

It is time for the supporters of Reform UK to wake up to the very strong possibility that the millionaires and billionaires that bankroll and run the party are not there to make life better for ordinary working people but to protect and expand their already massive personal fortunes.

Like Musk, they are not investing millions in political activity for the good of their fellows. It is all about selfish greed. Michael Wolff, in his book ‘SIEGE: Trump Under Fire’, talks of the inevitable conflict of interests between the American working class and people like Musk and the super-rich global elite.

“It was a good day’s pay for a good day’s work versus global capital accumulation… Riding the China train to a new global order was quite a profitable activity for capital markets, but it was devastating for the job prospects of American workingmen and women.”

British workingmen and women would do well to pay heed to this warning when contemplating voting for Reform UK and its super-rich backers.

3 notes

·

View notes

Text

How to Buy a Buy-to-Let Property

Investing in property can be a lucrative venture, and one of the most popular strategies is buying buy-to-let properties. This approach not only allows you to generate rental income but also offers potential capital appreciation over time.

However, searching and purchasing a buy-to-let can seem daunting for beginners. From understanding market trends to choosing the right type of property and securing financing, there are many factors at play. Whether you're an investor looking to expand your portfolio or a newcomer eager to take your first steps into real estate, this guide will walk you through everything you need to know about purchasing a buy-to-let property.

Get ready to unlock the door to financial growth and discover how strategic investments can lead you down a successful path in the property market.

What is buy-to-let property?

Buy-to-let property refers to residential real estate purchased specifically for the purpose of renting it out. This strategy allows investors to earn a steady stream of rental income while potentially benefiting from long-term capital appreciation. Typically, buy-to-let properties are single-family homes or apartments that appeal to tenants. Investors often seek locations with high demand and good rental yields. The concept is simple: you buy a property, find tenants, and collect rent each month. However, successful buy-to-let investing requires careful planning and market research. Understanding tenant needs and local regulations is crucial in this arena. Factors such as location, property type, and pricing can significantly impact your investment's profitability. As an investor delving into this sector, it's essential to grasp what drives tenant demand in your chosen area for optimal results.

Benefits and risks of investing in buy-to-let properties

Investing in buy-to-let properties offers several benefits. For one, it provides a steady income stream through rental payments. This can help build financial stability over time. Another advantage is capital appreciation. As property values rise, your investment could significantly increase in worth, providing potential for substantial profits when sold. However, there are risks to consider as well. Market fluctuations can lead to decreased property values and rental demand. Economic downturns may also affect tenants’ ability to pay rent on time. Additionally, managing a rental property requires effort and resources. Maintenance costs and tenant issues can eat into your profits if not handled properly. Understanding these dynamics is essential before diving into the buy-to-let market. Balancing the rewards against possible pitfalls will help you make informed decisions about your investments.

UK property market and its current trends

The UK property market is currently navigating a landscape of dynamic changes. Post-pandemic shifts have influenced buyer preferences, with many seeking more space and better amenities. City centers still draw attention, but suburban areas are increasingly popular as remote work becomes the norm. This trend has led to rising demand in regions previously overlooked. Interest rates are another critical factor influencing the market. While some fear potential downturns, others see opportunities for growth—especially at property auctions where competitive bidding can yield significant discounts. Moreover, sustainability is gaining traction. Buyers are now prioritizing energy-efficient homes that promise lower utility bills and environmental benefits. Investors keen on buy-to-let properties should remain vigilant about these evolving trends to maximize their returns and minimize risk. Keeping an eye on market fluctuations can pave the way for smarter investment decisions in this vibrant sector.

Types of buy-to-let properties

When diving into the buy-to-let market, understanding the various property types is essential. Each type comes with its own set of benefits and challenges.

Residential properties - These are the most common choice for landlords. These can range from single-family homes to multi-unit buildings. They attract long-term tenants looking for stability.

Commercial buy-to-let - These are retail shops or office spaces. While these often come with longer lease terms, they typically require a larger upfront investment.

Serviced Accommodation- Another option is serviced accommodation, like holiday rentals or Airbnb properties. These can offer higher returns but demand more active management and marketing efforts.

Student Housing- Student housing presents an appealing niche in university towns. This sector often guarantees high occupancy rates due to consistent demand from students each academic year.

Factors to consider when choosing Buy-to-Let Property

1. Location

Location is paramount in the world of buy-to-let properties. It can make or break your investment's success. A well-placed property attracts tenants easily and keeps vacancy rates low. Consider proximity to essential amenities like schools, supermarkets, and public transport. Areas with good access often see higher demand from renters. Urban centers typically offer more opportunities for employment, which can be a significant draw. Also think about neighborhood trends. Up-and-coming areas may present lower initial costs but show promise for growth over time. Researching local developments or investments in infrastructure can signal future appreciation. Safety is another vital aspect; families tend to prioritize living in secure neighborhoods. Take note of crime rates as they impact desirability and rental values significantly. In essence, location isn't just about where the property sits—it's about understanding the broader community dynamics that influence tenant attraction and retention.

2. Property Type

When investing in buy-to-let properties, the type of property you choose matters significantly. Different types cater to various tenant demographics and market demands. Houses often attract families looking for long-term rentals. They usually come with gardens and multiple bedrooms, making them desirable. On the other hand, apartments are popular among young professionals or students due to their affordability and proximity to city centers. Consideration should also be given to newer developments versus older properties. New builds may require less maintenance but might not have the character that some tenants seek in historic homes. Each property type has its own set of advantages and challenges. Researching local demand can help you pinpoint which option aligns best with your investment strategy.

Ultimately, understanding these nuances will guide you toward a more informed decision on what fits your goals as a landlord.

3. Rental Yield

Rental yield is a critical metric for any buy-to-let investor. It measures the annual return on your investment property relative to its value. A higher rental yield indicates a more profitable investment. To calculate this, you divide your annual rental income by the property's purchase price and multiply by 100 to get a percentage. Understanding this figure can help gauge whether a property will generate sufficient cash flow. Location plays a significant role in determining rental yields. Urban areas with high demand often provide better returns than rural locations.

Market trends can also influence yields, as shifts in supply and demand affect how attractive certain properties become over time. Keep an eye on local developments too—new schools or transport links can boost desirability. Identifying properties with strong potential for consistent rents is essential for maximizing your profit margins efficiently.

4. Potential for Capital Appreciation

When considering a buy-to-let property, the potential for capital appreciation is crucial. This refers to the increase in the property's value over time. A well-located property can experience significant growth as demand rises. Urban areas or regions undergoing regeneration often see sharp increases in price. Research local market trends before making a purchase. Areas with planned infrastructure improvements or new amenities typically attract more buyers and renters alike. Also, consider external factors that could influence prices. Economic conditions, interest rates, and employment opportunities play a vital role in determining property values. Investing in properties with strong capital growth potential can provide future financial security. It’s not just about rental income; the long-term gains are equally important to your investment strategy.

5. Financing Options

When considering a buy-to-let property, financing options are crucial. Traditional mortgages for rental properties differ from standard home loans. Lenders often require larger deposits and may have stricter criteria. Look into buy-to-let mortgages specifically designed for investors. These typically focus on the expected rental income rather than just personal earnings. This can be beneficial if your salary is modest but potential rent is significant. Another option includes bridging loans, which provide quick funds to seize opportunities or improve cash flow during renovations. However, they usually come with higher interest rates. Consider remortgaging existing properties too; this could unlock equity that you can reinvest in new opportunities. Always assess the overall costs against potential returns before making any commitments. Each financing route has its advantages and challenges, so it's essential to explore thoroughly before deciding which fits your investment strategy best.

6. Tax implications

When investing in buy-to-let properties, understanding the tax implications is crucial. Different taxes apply to rental income and property ownership, which can significantly impact your returns. You’ll need to consider income tax on rental profits. This amount is calculated after deducting allowable expenses such as maintenance costs and mortgage interest. Familiarizing yourself with these deductions can help maximize your profit margin. Capital Gains Tax (CGT) also comes into play when you sell a property for more than you paid. Knowing how CGT works will prepare you for potential liabilities down the line. Additionally, think about Stamp Duty Land Tax (SDLT) when purchasing a buy-to-let property. The rates differ from residential purchases, so check current guidelines to avoid unexpected costs. Finally, stay updated on any changes in legislation that could affect landlords. Tax laws evolve regularly; being informed ensures you’re always prepared.

7. Legal and regulatory requirements

Understanding the legal and regulatory requirements is crucial for any buy-to-let investor. Each country, and often local councils, have specific rules governing rental properties. Familiarizing yourself with these regulations can save you from costly fines or legal disputes. You need to comply with safety standards, including gas safety checks and electrical inspections. These are not just recommended; they are mandatory in many areas. Failing to meet them could jeopardize your investment. Licensing might also be necessary depending on the property type or location. Some regions require landlords to obtain a license before renting out their properties. Ignoring this step could lead to penalties that undermine your profits. Consider tenant rights as well; understanding eviction processes and deposit protections is essential for smooth operations. Keeping up with changes in legislation will help you navigate potential pitfalls effectively while maintaining a positive relationship with tenants.

8. Risks associated with buy-to-let investing

Investing in buy-to-let properties can be lucrative, but it is not without its risks. Market fluctuations can lead to decreased property values or rental income. Understanding the local market trends before making any commitments is crucial. Vacancies are another concern. A property that remains unoccupied for an extended period can quickly erode your profits. Effective marketing and maintaining a desirable living space will help mitigate this risk. Additionally, unexpected maintenance costs may arise at any time. Regular upkeep of the property can prevent larger expenses down the line, so budgeting for repairs is wise. Tenants might also pose a challenge; issues like late payments or even damage to your property can occur. Conducting thorough background checks and maintaining good communication with tenants helps foster positive relationships while minimizing potential disputes. Lastly, legislative changes may impact buy-to-let investments as well such as the new "Renters' Rights Bill" which was introduced to parliament on the 11th September 2024. Staying informed about new regulations ensures compliance and protects your investment from sudden legal shifts. Navigating these risks requires diligence and careful planning but understanding them allows you to make informed decisions on your journey into buy-to-let investing.

Conclusion

Investing in buy-to-let properties can be a rewarding venture for those willing to navigate the complexities of the property market. Understanding what a buy-to-let property is, along with its benefits and risks, lays a solid foundation for making informed decisions. The UK property market continues to evolve, presenting various opportunities that savvy investors can capitalize on. From residential flats to commercial spaces, each type of buy-to-let offers unique advantages and challenges. Choosing the right location and understanding current trends are crucial steps in your investment journey. Financing options like auction finance can streamline your purchase process at house auctions, providing flexibility when securing capital. Engaging with legal considerations ensures compliance with ever-changing regulations while managing your property effectively keeps tenants happy and minimizes turnover. As you explore this investment path, remember that knowledge is power. With careful planning and strategic choices, buying a buy-to-let property could become not just an investment but also a valuable asset over time. The potential rewards make it worth considering if you're prepared for the responsibilities involved in being a landlord.

2 notes

·

View notes

Text

Turkey, China, India have fastest 10-year climbing economies, WIPO says

Switzerland, Sweden, the US, Singapore and the UK are the world’s most innovative economies, while China, Turkey, India, Vietnam and the Philippines are the fastest “decadal climbers,” the World Intellectual Property Organisation (WIPO) said on Thursday.

Daren Tang, the group’s head, told reporters at an online press conference that its Global Innovation Index 2024 “shows a softening in venture capital activity, R&D financing and other investment indicators.” Tang said:

“In 2023, we saw a decline in R&D expenditures, a reduction in scientific publications, and a scaling back of venture capital investments to pre-pandemic levels. However, technological progress remained strong in 2023, particularly in health-related fields like genome sequencing, as well as in computing power and electric batteries.”

On Turkey, the report said it “continues to make progress, climbing two places” in the innovation index. It also added:

“It also takes the 3rd position among the upper middle-income group. Türkiye stands out in various areas: it ranks 1st globally in trademarks and industrial designs, and 9th in intangible asset intensity – all showing an improvement this year.”

The 17th edition of the index, according to WIPO, is a global benchmarking resource that reflects global innovation trends and guides governments, business leaders and other organisations in unleashing human ingenuity to improve lives and tackle challenges such as climate change.

According to the organisation, the 2024 index shows a significant softening of leading indicators of future innovation activity, including a pullback from the explosive growth in innovation investment between 2020 and 2022.