#US Venture Capital startups

Link

The past 14 years, there has been a trend in the United States of women raising capital from VCs. Deal counts by state, industry, and stage are broken down, and a few female-founded enterprises and businesses are highlighted.

#venture capital investment#US Venture Capital startups#Venture Capital firms India#venture capital#meaning of venture capital#venture capitalism meaning#venture capital is concerned with#venture capital market size india#venture capital in india#venture capital firms in india#venture capitalists#venture capitalists in India#top venture capital firms in india#JC Team Capital

0 notes

Text

Capital Venture Funds: Investing in Growth and Innovation for High Returns

Welcome to the world of capital venture funds! If you are looking to explore investment opportunities with high growth potential, capital venture funds can be an exciting avenue to consider. In this article, we will dive deep into the concept of capital venture funds, how they work, their benefits and risks, and provide valuable insights to help you make informed investment decisions.

What is a Capital Venture Fund?

A capital venture fund, also known as a venture capital fund, is a pool of money collected from various investors, such as individuals, institutions, or corporations, with the aim of investing in startups and early-stage companies. These funds are managed by professional venture capitalists who have expertise in identifying promising investment opportunities.

How Does a Capital Venture Fund Work?

Capital venture operate by raising capital from investors and using that money to provide funding to startups and emerging companies in exchange for equity stakes. The fund managers evaluate business proposals, conduct due diligence, and select ventures with significant growth potential. They offer financial and strategic support to these companies, with the ultimate goal of generating substantial returns on investment when the invested companies succeed.

Benefits of Investing in a Capital Venture Fund

Investing in a capital venture fund offers several benefits. Firstly, it provides access to high-growth opportunities that are typically unavailable in traditional investment options. Venture funds often invest in innovative and disruptive technologies, which have the potential to reshape industries and generate substantial returns. Additionally, investing in a capital venture fund allows diversification across a portfolio of startups, spreading the risk associated with investing in Truth Venture companies.

Risks Associated with Capital Venture Funds

While capital venture funds offer attractive prospects, it’s essential to consider the associated risks. Startups and early-stage companies are inherently risky investments, and not all ventures may succeed. The failure rate can be relatively high, and investors should be prepared for potential losses. Additionally, capital venture funds are illiquid investments, meaning that the invested capital may be tied up for a significant period before any returns can be realized.

How to Choose a Capital Venture Fund

When selecting a capital venture fund to invest in, thorough due diligence is crucial. Consider factors such as the fund’s track record, the expertise of its management team, the fund’s investment focus, and its alignment with your investment goals and risk appetite. Look for funds that have a diversified portfolio, an established network within the industry, and a robust investment strategy. Seeking advice from financial professionals can also provide valuable insights.

Top Capital Venture Funds in the Market

The capital venture fund landscape is diverse, with numerous reputable funds operating globally. Some of the top capital venture firms in the market include Sequoia Capital, Andreessen Horowitz, Accel Partners, and Benchmark Capital. These funds have a strong track record of successful investments and have been instrumental in supporting groundbreaking companies.

Steps to Invest in a Capital Venture Fund

Startup investing in a capital venture financing typically involves a structured process. Firstly, research various funds to identify the ones that align with your investment preferences. Contact the fund managers or reach out through a financial advisor to initiate the investment process. Complete the necessary paperwork, provide the required information, and transfer the investment amount as per the fund’s requirements. It’s important to review the terms and conditions of the fund carefully before committing your capital.

Tax Implications of Investing in a Capital Venture Fund

Tax implications of investing in capital venture funds vary depending on the jurisdiction and the specific regulations in place. In some cases, investments in venture capital funds may qualify for tax incentives or capital gains tax exemptions. However, it’s essential to consult with a tax professional or seek guidance from the fund managers to understand the specific tax implications and benefits associated with your investment.

Success Stories of Capital Venture Fund Investments

Capital venture funds have been behind some of the most successful and influential companies in the world. From early investments in companies like Google, Facebook, and Amazon, to the recent breakthroughs in innovative technologies, venture capital has played a crucial role in driving economic growth and fostering entrepreneurship. These success stories highlight the potential for substantial returns that can be achieved through astute venture capital investments.

Future Trends in Capital Venture Funding

The capital venture funding landscape is dynamic and constantly evolving. Several trends are shaping the future of venture capital, including the rise of impact investing, increased focus on diversity and inclusion, and the emergence of new industries and technologies. Artificial intelligence, blockchain, and clean energy are areas that are expected to attract significant venture capital investments in the coming years. Staying informed about these trends can help investors identify promising opportunities.

Conclusion

In conclusion, capital venture funds offer a unique investment avenue with the potential for high returns. While they carry inherent risks, the diversification, access to innovative companies, and strategic support provided by venture capital funds can outweigh the downsides for the right investors. Conducting thorough research, understanding the risks, and aligning your investment goals are key to making successful investments in capital venture funds.

FAQ

What is the minimum investment amount for a capital venture fund?

The minimum investment amount for capital venture funds varies depending on the fund. It can range from a few thousand dollars to several million.

How long does it typically take to realize returns from capital venture fund investments?

The timeframe for realizing returns from capital venture fund investments can vary widely. It can take several years, often around five to ten years, for startups to reach a stage where they generate significant returns or undergo an exit event.

Can individual investors invest in capital venture funds?

Yes, individual investors can invest in capital venture funds. However, some funds may have specific requirements or minimum investment thresholds for individual investors.

What is the difference between a capital venture fund and private equity?

While both capital venture funds and private equity funds invest in companies, the key difference lies in the stage of the companies they invest in. Venture capital funds primarily focus on early-stage companies and startups, while private equity funds typically invest in more mature companies with established operations.

Are capital venture funds suitable for risk-averse investors?

Capital venture funds are generally not suitable for risk-averse investors due to the higher level of risk associated with investing in startups and early-stage companies. Investors with a lower risk tolerance may prefer more conservative investment options.

Share this:

#Capital venture#Venture Capital#Capital venture fund#Seed funding#Seed capital#Venture capital firms#Startup funding#Venture capital fund#Venture capital financing#Seed funding for startups#truth ventures#Venture capital firms in US#Venture capital firms in UK#Capital venture India#Capital venture US#Capital venture UK#Venture Capital Ecosystem#Venture capital firms in india#Venture capital equity#Capital Venture Company#Capital venture funding#Stages of venture capital

0 notes

Text

When you’re standing on the outside, it may seem bizarre to you that rocket scientists aren’t paid more. They are literally rocket scientists, after all, the only people in the world who are not allowed to say “it’s not rocket science” at work. And yet they are often paid somewhat less than a regular old hard-hatted engineer, involved in expensive (and fragile) projects to construct overpriced pedestrian bridges for overpriced private universities. Why is that?

One reason is that the rocket scientists don’t pose much of a threat to management. There’s more of them than there are jobs available building rockets. If they quit, then the bosses will just hire slightly dumber rocket scientists, and pay them even less. Rockets will still go up, and they’ll go where they want to, because of the well-documented history and best practices of the industry. They can keep coasting on this for a little while, maybe even decades, with a barely-perceptible drop in quality. Maybe it’s already happened. Maybe tomorrow is when we find out what the first part of a rocket that has been quality-faded into oblivion is. Hope you don’t live under the flight path.

There is, of course, another approach, and that’s “being a dirtbag.” I myself have a lot of experience in this particular field, and I think it is one of those multi-skilled disciplines that can expand into rocket science if so required. The aforementioned best practices of this industry have been written down and documented so well, in fact, that just some asshole off the street like myself can check them out of the library (using an assumed name, of course,) read them, and know generally all that humanity has figured out over the last century about making rockets that don’t explode. Then, in the language of Silicon Valley influencers, I can “disrupt” the industry.

Of course, by “disrupt” I really mean grift. If management can’t really tell the difference between good rocket scientists and slightly less good ones, then it stands to reason that they’ll give completely bad ones the benefit of the doubt. I can get billions of dollars of venture capital for my space-flight startup, shoot a few Estes rockets into the ceiling of the cafeteria, and still pocket enough dough to be able to afford a base-model Honda Civic from the 1980s. It’s not brain surgery.

2K notes

·

View notes

Note

…so can you expand on the psychological ramifications of stewy being in private equity? that has definitely been lost on me given that i barely understand what private equity is

ok this is an underrated funny aspect of the show imo, and also good insight into stewy and kendall. i'm trying to spare you a bunch of stupid business jargon but basically, maesbury capital (which stewy represents but sandy/sandi ultimately own) is a private equity fund, meaning it's a big pile of a bunch of rich people's money, and stewy's job is to take that money and invest in private companies. a PE fund can invest at a few different points: at the very beginning of a startup's life (venture or angel investing), at a point where the company is trying to grow or restructure (growth investing), or when a company is struggling financially, in which case the fund is usually planning to either dismantle it and sell it for scrap, restructure and go public, or sell it for cash to another company. PE firms like to present themselves as doing a lot of growth or venture investing, but in truth many/most are primarily engaging in this third category of investment strategies, because they're lucrative (and because many startups are stupid, and only good for generating investor payouts).

so, when kendall went and dismantled vaulter in season 2 because logan decided that selling most of it for scrap would be more profitable? that's basically a dramatisation of what stewy does routinely, except of course the exact financial instruments and strategies will differ because stewy represents a PE firm. like, if kendall's venture capitalist schemes tell us about his delusions of creating cool new products and services, stewy is sort of the opposite because his structural goal is usually to dismantle companies and liquidate them however is best for maesbury's backers. it's a total destruction of all use-value and a conversion of it into pure exchange-value in the form of capital (which goes into his pockets and maesbury's). stewy generates money by destroying utility, which is perverse if you think capitalism is supposed to create and sustain human life, but actually completely comprehensible if you understand that capitalism is an insatiable growth machine with inherently contradictory internal tendencies and no raison d'être beyond the endless accumulation of pure capital itself.

many viewers think stewy is insane because he is friends with kendall roy. this is true, but on a deeper level stewy is insane because his job is to participate in the inexorable tendency to more and more abstraction in the capitalist mode of production. it literally does not matter at all to someone like stewy whether people are fed or clothed or happy, or have any of their needs met. the point is solely to create money, to turn all social forms and values into numbers on a balance sheet. this is why, when kendall tries to threaten him on axos at the end of season 2, stewy is able to casually tell him that "it doesn't matter; it doesn't mean anything." he and sandy are convincing shareholders that their offer will be able to make them more money, "and that's all that this is." stewy speaks the language of business differently than logan, because stewy doesn't care about dick-swinging competitions or demonstrating dominance in logan's cringey old catholic military way. which makes stewy more rational in certain ways, but also more insane, in that he operates in a way totally detached from this type of social value system and solely motivated by cold hard numbers.

the irony is that, whilst being detached and disembodied in his business practices, stewy is also better than the roys at appreciating the material fruits of wealth. he eats; he dresses well; he enjoys the "several houses" he owns. kendall is always trying to come up with some grand moral bullshit masculinity reason that what he's doing is noble or whatever, and he's alienated from his body and afflicted with severe catholic martyr disease. stewy just bypasses all that shit, measures his success by his payouts, and enjoys wealth because he sees it as an end in itself and not a means to logan roy's respect.

this is also why kendall's line in 'living+' about "it's enough to make you lose your faith in capitalism" is so funny. kendall can't just accept that business is a bunch of meaningless bullshit confidence games played by coked-up assholes who like to win; he always has to try to convince himself he's making cool new tech shit, or saving the world from the spectre of death itself or some shit. it's like, insane that he made it to literally 40 years old, growing up in a media conglomerate of all things, and still thinks that what he's doing requires actual skill or creates actual social value—but of course, part of the reason he still thinks this is because he deified logan and was therefore incapable of ever seeing logan or waystar for what they really were. stewy would never say that line because he can't be disillusioned this way on account of he already knows the whole thing is bullshit. it's just that to him it doesn't matter, because being bullshit does not preclude it from paying well.

#some1 also asked about that kendall line and it seemed like it wanted to be bundled into this post lol i hope that answers yr q#blood sacrifice#typing this gave me flashbacks to when i did freelance transcription and i used to do this guy's podcast on angel investing#literal nightmare fodder. the hours-long homophobic baptist sermons were better

538 notes

·

View notes

Text

These companies have strayed from their core products — helping you find information, buy things, or connect with people — because their focus is no longer on innovation or providing a service, but finding a "good enough" service that they can then sell advertising around. Despite statements reiterating their commitment to users, workers, or the world, it's clear that tech companies and executives have become totally enthralled by one set of stakeholders: Wall Street. CEOs over hired and then laid off thousands of people or hyped new tech only to reverse course months later, all in an attempt to woo investors. This monomaniacal focus on market performance incentivizes a rot economy — a consistent yet unsustainable trajectory that favors the illusion of growth at the expense of actual development.

The biggest tech companies are encouraged to chase growth not as a way to have happy customers or become sustainable and profitable enterprises, but to have fancy-sounding numbers to send the stock price higher. It doesn't matter to investors that Mark Zuckerberg is burning billions of dollars a year and has absolutely nothing to show for it, or that the basic Facebook product experience has been getting worse for 10 years. Zuckerberg began "the year of efficiency" to show some newfound sense of discipline, but the mass firings are only going to make employees more miserable and the product worse. Even these companies' internal evaluation and compensation systems push employees to develop shiny "new" projects that produce flash-in-the-pan customer interest over building or sustaining existing products for current users.

This mindset has even trickled down to early-stage startups, which are typically thought of as proving grounds for innovation. Venture capital and other investors have pushed for a growth-first model, prioritizing "line goes up" metrics rather than building a useful product and sustainable business. VCs also incentivize companies to appeal to whatever hot trend could get them the highest multiple on their initial investment, rather than doing what will make the best user experience.

The net result of these rotten economics is a genuine lack of innovation. When companies are incentivized to grow at any cost — even if that means degrading the user experience — they will never seek to change or improve the world. Innovation can be expensive, time-consuming, and unprofitable, which means that the only innovation we'll ever see is the short-term kind that leaves a smile on a VC's face but angers average users.

Google, Amazon, and Meta are making their core products worse — on purpose

106 notes

·

View notes

Text

Abbattere e seppellire alberi per fermare il cambiamento climatico: l’idea di una startup sostenuta da Bill Gates

Un anno fa Merritt Jenkins si è trasferito da Boston a Twain Harte, in California, ai piedi della Sierra Nevada. Un mattiino si dirige verso un bosco di dieci acri nella Stanislaus National Forest. Qui la sua startup, Kodama Systems, sta perfezionando la sua macchina per la raccolta del legname, che pesa 17 tonnellate ed è lunga 7metri e mezzo. I taglialegna usano macchine del genere, per prendere tonnellate di alberi tagliati e detriti e trascinarle fuori dal bosco. La versione di Kodama è progettata per svolgere questo compito anche di notte, con meno persone, grazie a connessioni satellitari e camere avanzate a lidar (light detection and raging), le stesse utilizzate sulle auto a guida autonoma, per monitorare il lavoro da remoto. Non è facile. “Gli alberi hanno molte texture diverse”, dice Jenkins, 35 anni. “Ogni 3 metri il cammino è leggermente diverso”. Ma tagliare legna nell’oscurità non è la parte più intrigante dei programmi di Kodama, che ha raccolto 6,6 milioni di $ di finanziamenti dalla Breakthrough Energy di Bill Gates e da altri. Dopo avere tagliato gli alberi, Jenkins vuole seppellirli per contribuire a rallentare il cambiamento climatico e raccogliere compensazioni di carbonio che potrà poi vendere (e forse, un giorno, anche crediti d’imposta). L'idea è quella di piantare alberi per assorbire la CO2 dall’aria e poi vendere i crediti alle aziende, ai proprietari di jet privati o a chiunque altro abbia bisogno o voglia compensare le sue emissioni. Gli scienziati, però, sostengono che anche seppellirli possa ridurre il riscaldamento globale. Soprattutto nel caso di alberi che finirebbero altrimenti per bruciare o decomporsi, disperdendo nell’aria il carbonio che hanno immagazzinato. I giganteschi incendi divampati in California nel 2020 hanno evidenziato i rischi per l’aria, le proprietà e la vita posti dalle foreste troppo estese. “I cieli arancioni di San Francisco hanno rappresentato un punto di svolta”, afferma Jimmy Voorhis, head of biomass utilization and policy di Kodama. “Ora queste storie hanno un’eco diversa. L’allarme suona ancora più forte quest’anno, dopo che gli incendi in Canada hanno messo a rischio l’aria di New York, Washington e Chicago. Per affrontare il problema, lo Us Forest Service intende tagliare 70 milioni di acri delle foreste occidentali, soprattutto in California, nei prossimi 10 anni. In questo modo estrarrà più di un miliardo di tonnellate di biomassa secca. È consuetudine, dopo un disboscamento del genere, che i tronchi di dimensioni tali da essere di interesse commerciale finiscano alle segherie, mentre il resto viene in gran parte accatastato e bruciato in condizioni controllate. Kodama, invece, vuole seppellire gli avanzi in vasche di terra progettate per mantenere condizioni asciutte e senza ossigeno e proteggere il legno dalla putrefazione o dalla combustione. Oltre ai fondi raccolti da venture capital, Kodama ha già ricevuto sovvenzioni per 1,1 milioni di dollari dall’agenzia californiana che si occupa degli incendi boschivi. Altri si sono già impegnati ad acquistare i crediti di carbonio legati alle prime 400 tonnellate di alberi seppellite. Sul mercato, quei crediti dovrebbero fruttare 200 $ a tonnellata. Kodama conta di arrivare ad abbattere e seppellire più di 5000 tonnellate di alberi all’anno. L’idea di seppellire gli alberi sembra semplice e poco tecnologica, soprattutto se paragonata alle complesse tecnologie per la cattura del carbonio che vengono sviluppate per estrarre la CO2 dall’aria. Grazie all’Inflation Reduction Act approvato dai DEM nel 2022, società come Occidental Petroleum ed ExxonMobil potrebbero beneficiare di 85 $ di crediti d’imposta per ogni tonnellata di CO2 se riusciranno a perfezionare i sistemi per aspirare il gas direttamente dall’aria e trasferirlo tramite condutture, per poi iniettarlo nel sottosuolo. La legge incentiva alcuni di questi progetti con crediti d’imposta pari al 30% o più del capitale iniziale investito.

https://forbes.it/2023/08/04/kodama-systems-startup-abbatte-alberi-salvare-clima/

Non ho parole per commentare, se non che basta piantare nuovi alberi. Ma evidente non rende così tanto

https://www.science.org/doi/10.1126/science.aax0848

54 notes

·

View notes

Text

Ok, admittedly I was first just amused that even Business Insider is having a go at S3, but then I read this:

“After a firm signs a term sheet, the fund wires the money to a startup for shares of ownership. They can't claw back the cash once it lands in a startup's bank account.

Here's a more realistic scenario. Jack tells Keeley that her firm won't send any more money, if the capital hasn't been called already. Now Keeley has to look at how long she can keep the lights on with the funding she has. If runway is short, she could decide to lay off some employees to cut costs or sublease the office to bring in some extra money. Cash would still flow to the agency from existing clients.”

And goddammit this would have made such a better subplot and conclusion for Keeley than Rebecca just handing her a check and then being relegated to the 1990’s version of a subversive conclusion to a love triangle! 😭😭😭

Everything about the Jack plot sucked, but at least here, we'd have finally gotten to see Keeley struggle with actual business decisions as a boss and remind us how GOOD SHE IS AT HER JOB.

And since I'm doing a Keeley rant anyway, I just want to say that she didn't need two dudes showing up at her door, dripping with character regression and misogyny to choose herself. KEELEY REPEATEDLY CHOSE HERSELF IN PREVIOUS SEASONS.

When she broke up with Jamie, she chose herself. When she took the PR job in the first place, she chose herself. When she left to start her own firm, SHE CHOSE HERSELF. Choosing herself was never a problem for Keeley, and her relationships never held her back from fulfilling her dreams.

Forcing the "Keeley chooses herself" plotline is so disrespectful to her as a character, and the fact that Keeley has constantly fought for herself and chosen herself no matter her relationship status.

#ted lasso#ted lasso spoilers#ted lasso critical#ted lasso season 3#ted lasso finale#keeley jones#juno temple#every woman on this show deserved better

81 notes

·

View notes

Note

The primary cause of the current economic state isn't inflation, though that is the excuse corporate entities use, but rather the fact that people don't have enough money to live. You see, an economy only works when money is moving. But the rich don't spend it. They hoard it. Money in the hands of the people on the other hand does get spent and moved, because people spend it to live. By refusing to put restriction on corporations, who by their nature as capitalistic entities want to move as much wealth in as few hands as possible, you make the economy worse. The truth is, the current economic state can only be blamed on the current economic philosophy. And that's capitalism.

Although I agree with your opening statement that inflation is not the primary cause of the current economic state, I disagree with the remainder of your argument.

But the rich don't spend it. They hoard it.

That is incorrect. This idea that the rich have some Scrooge McDuck style of vault where they are hoarding all this cash that is inaccessible to the rest of the economy is a blatant fallacy.

Majority of rich people fall into one of three categories:

Individuals who actively invest (i.e. spend) their capital in businesses, startups, and ventures that create jobs and drive innovation.

Individuals who let asset managers invest (i.e. spend) their capital to grow their wealth.

Individuals who save most of their capital in financial institutions and those financial institutions use those assets to invest the capital or loan out the capital to earn themselves a profit in exchange for securing the capital. This is the primary form of revenue generating activities done by banks.

Money in the hands of the people on the other hand does get spent and moved, because people spend it to live.

This is actually a very interesting point as it is very controversial and widely debated between economists for which is better for the economy to prosper: poor people's spending habits or rich people's spending habits.

Both rich and poor spending can contribute to economic growth and welfare, but they have different impacts and dynamics. While rich spending can drive economic expansion and job creation, poor spending supports local businesses and enhances the well-being of individuals within lower-income brackets. It is important to strike a balance and ensure that both groups have opportunities to participate in economic activities and benefit from a thriving economy.

[...] who by their nature as capitalistic entities want to move as much wealth in as few hands as possible, you make the economy worse.

That is incorrect. Their nature is to behave and act in pursuit of the self-interests of their private owners. If the self-interests of those individuals is to move as much wealth in as few hands as possible, then yes, but that is not a inherent characteristic or perquisite to operating in a capitalist system. Moreover, the same behavior can and does occur within socialist systems too.

The main difference though is that those self-interests are controlled by private individuals in capitalist systems and by the collective public in socialist systems.

The truth is, the current economic state can only be blamed on the current economic philosophy. And that's capitalism.

There has never been an absolute capitalist system [or absolute socialist system], but merely mixed systems. Trying to generalize any macro-economy to a singular economic philosophy is naïve and lacks critical assessment. If you wish to blame something on a capitalist philosophy, which there is plenty, then may I recommend you focusing on far more specific behaviors or policies?

80 notes

·

View notes

Note

Hey, what does disruptor mean? I saw it when looking at your answers. I’ve also seen people joke about it on twitter but I can’t find a meaning to it.

It's a term I personally loathe, but I'm willing to do some recent cultural/intellectual history to explain where it came from and what it means.

The term disruptor as it's commonly used today comes out of the business world, more specifically the high tech sector clustered in Silicon Valley. Originally coined as "disruptive innovation" by business school professor Clayton Christensen in the mid-to-late 90s, the idea was that certain new businesses (think your prototypical startup) have a greater tendency to develop innovative technologies and business models that radically destabilize established business models, markets, and large corporations - and in the process, help to speed up economic and technological progress.

While Christensen's work was actually about business models and firm-level behavior, over time this concept mutated to focus on the individual entrepeneur/inventor/founder figure of the "disruptor," as part of the lionization of people like Steve Jobs or Mark Zuckerburg or Elon Musk, or firms like Lyft, Uber, WeWork, Theranos, etc. It also mutated into a general belief that "disrupting" markets and, increasingly, social institutions is how society will and should progress.

I find these ideas repellant. First of all, when it comes to the actual business side of things, I think it mythologizes corporate executives as creative geniuses by attributing credit for innovations actually created by the people they employ. Elon Musk didn't create electric cars or reusable rockets, Steve Jobs didn't design any computers or program any OSes, but because they're considered "disruptors," we pretend that they did. This has a strong effect on things like support for taxing the rich - because there is this popular image of the "self-made billionaire" as someone who "earned" their wealth through creating "disruptive" companies or technologies, there is more resistance to taxing or regulating the mega-wealthy than would otherwise be the case.

Even more importantly, treating "disruptors" like heroes and "disruption" as a purely good thing tends to make people stop thinking about whether disruption to a given industry is actually a good thing, whether what tech/Silicon Valley/startup firms are doing is actually innovative, what the economic and social costs of the disruption are, and who pays them. Because when we look at a bunch of high-profile case studies, it often turns out to be something of a case of smoke and mirrors.

To take ridesharing as an example, Lyft and Uber and similar companies aren't actually particularly innovative. Yes, they have apps that connect riders to drivers, but that's not actually that different from the old school method of using the phone to call up a livery cab company. There's a lot of claims about how the apps improve route planning or the availability of drivers or bring down prices, but they're usually overblown: route planning software is pretty common (think Google Maps), when you actually look at how Lyft and Uber create availability, it's by flooding the market with large numbers of new drivers, and when you look at how they got away with low prices, it was usually by spending billions upon billions of venture capital money on subsidizing their rides.

Moreover, this "disruption" has a pretty nasty dark side. To start with, Lyft and Uber's business strategy is actually a classic 19th century monopoly strategy dressed up in 21st century rhetoric: the "low prices" had nothing to do with innovative practices or new technology, it was Lyft and Uber pulling the classic move of deliberately selling at a loss to grab market share from the competition, at which point they started raising their prices on consumers. Availability of drivers was accomplished by luring way too many new drivers into the labor market with false promises of making high wages in their spare time, but when the over-supply of drivers inevitably caused incomes to decline, huge numbers of rideshare drivers found themselves trapped by auto debts and exploited by the companies' taking a significant chunk of their earnings, using the threat of cutting them off from the app to cow any resistance. And above all, Lyft and Uber's "disruption" often came down to a willful refusal to abide by pre-existing regulations meant to ensure that drivers could earn a living wage, that consumers would be protected in the case of accidents or from the bad behavior of drivers, etc.

As a policy historian, however, I find the extension of "disruption" into social institutions the most troubling. Transportation, health care, education, etc. are absolutely vital for the functioning of modern society and are incredibly complex systems that require a lot of expertise and experience to understand, let alone change. Letting a bunch of billionaires impose technocratic "reforms" on them from above, simply because they say they're really smart or because they donate a bunch of money, is a really bad idea - especially because when we see what the "disruptors" actually propose and/or do, it often shows them to be very ordinary (if not actively stupid) people who don't really know what they're doing.

Elon Musk's Loop is an inherently worse idea than mass transit. His drive for self-driving cars is built on lies. Pretty much all of the Silicon Valley firms that have tried to "disrupt" in the area of transportation end up reinventing the wheel and proposing the creation of buses or trolleys or subways.

Theranos was a giant fraud that endangered the lives of thousands in pursuit of an impossible goal that, even if it ould have been achieved, wouldn't have made much of a difference in people's lives compared to other, more fruitful areas of biotech and medical research.

From Bill Gates to Mark Zuckerburg, Silicon Valley billionaires have plunged huge amounts of philanthropy dollars into all kinds of interventions in public education, from smaller classrooms to MOOCs to teacher testing to curriculum reform to charter schools. The track record of these reforms has been pretty uniformly abysmal, because it turns out that educational outcomes are shaped by pretty much every social force you can think of and educational systems are really complex and difficult to measure.

So yeah, fuck disruptors.

109 notes

·

View notes

Text

Varun Datta Entrepreneur | CEO of Truth Ventures

The CEO of truth Ventures, an internationally recognized venture capital firm, urged young people to constantly make long-term investments that improve people's lives to ensure their success. Contact us, and we will guide you through the entire process ! For more info visit our website:- https://truthvent.com/

#Varun datta#Capital venture#Venture Capital#Capital venture fund#Seed funding#Seed capital#Venture capital firms#Startup funding#Venture capital fund#Venture capital financing#Varun Datta#Varun Datta Founder#Varun Datta CEO#Varun Datta Entrepreneur#Varun Datta News#Varun Datta Delhi#Varun Datta UK#Varun Datta US#Stephania Morales#Stephania Morales Chief Officer#Stephania Morales Co Founder

0 notes

Text

"Tech companies that have branded themselves “AI first” depend on heavily surveilled gig workers like data labelers, delivery drivers and content moderators. Startups are even hiring people to impersonate AI systems like chatbots, due to the pressure by venture capitalists to incorporate so-called AI into their products. In fact, London-based venture capital firm MMC Ventures surveyed 2,830 AI startups in the EU and found that 40% of them didn’t use AI in a meaningful way.

Far from the sophisticated, sentient machines portrayed in media and pop culture, so-called AI systems are fueled by millions of underpaid workers around the world, performing repetitive tasks under precarious labor conditions. And unlike the “AI researchers” paid six-figure salaries in Silicon Valley corporations, these exploited workers are often recruited out of impoverished populations and paid as little as $1.46/hour after tax. Yet despite this, labor exploitation is not central to the discourse surrounding the ethical development and deployment of AI systems."

(bolding mine)

6 notes

·

View notes

Text

Drones have changed war. Small, cheap, and deadly robots buzz in the skies high above the world’s battlefields, taking pictures and dropping explosives. They’re hard to counter. ZeroMark, a defense startup based in the United States, thinks it has a solution. It wants to turn the rifles of frontline soldiers into “handheld Iron Domes.”

The idea is simple: Make it easier to shoot a drone out of the sky with a bullet. The problem is that drones are fast and maneuverable, making them hard for even a skilled marksman to hit. ZeroMark’s system would add aim assistance to existing rifles, ostensibly helping soldiers put a bullet in just the right place.

“We’re mostly a software company,” ZeroMark CEO Joel Anderson tells WIRED. He says that the way it works is by placing a sensor on the rail mount at the front of a rifle, the same place you might put a scope. The sensor interacts with an actuator either in the stock or the foregrip of the rifle that makes adjustments to the soldier’s aim while they’re pointing the rifle at a target.

A soldier beset by a drone would point their rifle at the target, turn on the system, and let the actuators solidify their aim before pulling the trigger. “So there’s a machine perception, computer vision component. We use lidar and electro-optical sensors to detect drones, classify them, and determine what they’re doing,” Anderson says. “The part that is ballistics is actually quite trivial … It’s numerical regression, it’s ballistic physics.”

According to Anderson, ZeroMarks’ system is able to do things a human can’t. “For them to be able to calculate things like the bullet drop and trajectory and windage … It’s a very difficult thing to do for a person, but for a computer, it’s pretty easy,” he says. “And so we predetermined where the shot needs to land so that when they pull the trigger, it’s going to have a high likelihood of intersecting the path of the drone.”

ZeroMark makes a tantalizing pitch—one so attractive that venture capital firm Andreesen Horowitz invested $7 million in the project. The reasons why are obvious for anyone paying attention to modern war. Cheap and deadly flying robots define the conflict between Russia and Ukraine. Every month, both sides send thousands of small drones to drop explosives, take pictures, and generate propaganda.

With the world’s militaries looking for a way to fight back, counter-drone systems are a growth industry. There are hundreds of solutions, many of them not worth the PowerPoint slide they’re pitched from.

Can a machine-learning aim-assist system like what ZeroMark is pitching work? It remains to be seen. According to Anderson, ZeroMark isn’t on the battlefield anywhere, but the company has “partners in Ukraine that are doing evaluations. We’re hoping to change that by the end of the summer.”

There’s good reason to be skeptical. “I’d love a demonstration. If it works, show us. Till that happens, there are a lot of question marks around a technology like this,” Arthur Holland Michel, a counter-drone expert and senior fellow at the Carnegie Council for Ethics in International Affairs, tells WIRED. “There’s the question of the inherent unpredictability and brittleness of machine-learning-based systems that are trained on data that is, at best, only a small slice of what the system is likely to encounter in the field.”

Anderson says that ZeroMark’s training data is built from “a variety of videos and drone behaviors that have been synthesized into different kinds of data sets and structures. But it’s mostly empirical information that’s coming out of places like Ukraine.”

Michel also contends that the physics, which Anderson says are simple, are actually quite hard. ZeroMark’s pitch is that it will help soldiers knock a fast-moving object out of the sky with a bullet. “And that is very difficult,” Michel says. “It’s a very difficult equation. People have been trying to shoot drones out of the sky [for] as long as there have been drones in the sky. And it’s difficult, even when you have a drone that is not trying to avoid small arms fire.”

That doesn’t mean ZeroMark doesn’t work—just that it’s good to remain skeptical in the face of bold claims from a new company promising to save lives. “The only truly trustworthy metric of whether a counter-drone system works is if it gets used widely in the field—if militaries don’t just buy three of them, they buy thousands of them,” Michel says. “Until the Pentagon buys 10,000, or 5,000, or even 1,000, it’s hard to say, and a little skepticism is very much merited.”

3 notes

·

View notes

Note

Friendship Ask Game:

24 & 29: Alice and Rosalie

(from the Friendship Headcanons ask game)

24. What have they learned from each other?

Answered here

29. What are they proud of each other for?

While Alice loves playing human and enjoys school more than the others, she's not particularly interested in academia or in distinguishing herself in that way. But she's always in awe of Rosalie's tenacity in her college studies and her drive to excel. One time they all attended a symposium at which Rosalie presented a paper on astrophysics; it was presumably in pursuit of a doctoral research project, though of course Rosalie knew she would be moving on soon. But everyone was truly impressed with her mastery of the topic and her authoritative confidence when she spoke, and Alice was no exception. Rosalie's achievement was so far outside her own experience that it was a "Just wow" moment.

Rosalie being proud of Alice... that's a little tougher. I usually think of Rosalie admiring Alice's creativity with fashion or decor or wedding planning, but that's not really a matter of being proud. Hmm.

I think I'll build on my headcanon mentioned in another ask re: Alice not really knowing what to think about the awful past James introduced her to, once her research was done. Rosalie was the one to suggest that Alice use this new information to link her own story with her philanthropy. Every Cullen is expected to donate A LOT to some charity or other of their choice, and Alice had never put much thought or work into that. But Rosalie thought it might be meaningful for Alice to find some way to help people with serious mental illness in honor of what she went through as a human. (Alice will likely never know whether or not she was mentally ill, or if it was just her visions, but one way or another she ended up in an asylum.) Rosalie, after all, had found a lot of meaning in directing her money toward organizations like women's shelters because of what she'd been through.

It was a sore subject at the time, and Alice and Rosalie weren't the best of friends during much of the saga. Rosalie resented the way Alice latched onto Bella as her new BFF and Alice was angry at the way Rosalie kept refusing to accept Bella, and later on, Bella's choice. In Breaking Dawn, Bella's pregnancy caused another rift. So when Rosalie suggested the philanthropy thing, Alice just kind of shrugged it off at best, or snapped "Right, because thinking about asylums more is exactly what I need right now!" and stomped off in a huff at worst.

Rosalie didn't mention it again. But a couple of years post-canon, Alice revealed that not only had she begun donating to help those with serious mental illness, but that she was funding a new up-and-coming foundation, even (distantly) involved in the startup itself. (Do you still call it "venture capital" when it's a nonprofit?) Alice told the family that it had been Rosalie's idea, which really made Rosalie feel special as well as proud that Alice had gone through with it.

#Inbox#Ask game#Alice#Rosalie#Donate#Asylum#Mental illness#In my fics Alice did find out about the 'my father had my mother killed' thing but she'll never be able to confirm it

6 notes

·

View notes

Text

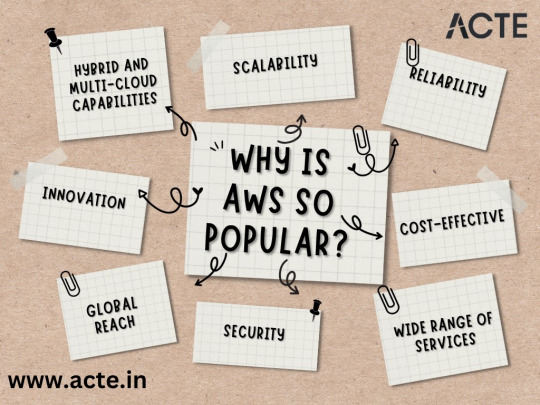

The AWS Advantage: Exploring the Key Reasons Behind Its Dominance

In the ever-evolving landscape of cloud computing and web services, Amazon Web Services (AWS) has emerged as a true juggernaut. Its dominance transcends industries, making it the preferred choice for businesses, startups, and individuals alike. AWS's meteoric rise can be attributed to a potent combination of factors that have revolutionized the way organizations approach IT infrastructure and software development. In this comprehensive exploration, we will delve into the multifaceted reasons behind AWS's widespread popularity. We'll dissect how scalability, reliability, cost-effectiveness, a vast service portfolio, unwavering security, global reach, relentless innovation, and hybrid/multi-cloud capabilities have all played crucial roles in cementing AWS's position at the forefront of cloud computing.

The AWS Revolution: Unpacking the Reasons Behind Its Popularity:

1. Scalability: Fueling Growth and Flexibility AWS's unparalleled scalability is one of its defining features. This capability allows businesses to start with minimal resources and effortlessly scale their infrastructure up or down based on demand. Whether you're a startup experiencing rapid growth or an enterprise dealing with fluctuating workloads, AWS offers the flexibility to align resources with your evolving requirements. This "pay-as-you-go" model ensures that you only pay for what you use, eliminating the need for costly upfront investments in hardware and infrastructure.

2. Reliability: The Backbone of Mission-Critical Operations AWS's reputation for reliability is second to none. With a highly resilient infrastructure and a robust global network, AWS delivers on its promise of high availability. It offers a Service Level Agreement (SLA) that guarantees impressive uptime percentages, making it an ideal choice for mission-critical applications. Businesses can rely on AWS to keep their services up and running, even in the face of unexpected challenges.

3. Cost-Effectiveness: A Game-Changer for Businesses of All Sizes The cost-effectiveness of AWS is a game-changer. Its pay-as-you-go pricing model enables organizations to avoid hefty upfront capital expenditures. Startups can launch their ventures with minimal financial barriers, while enterprises can optimize costs by only paying for the resources they consume. This cost flexibility is a driving force behind AWS's widespread adoption across diverse industries.

4. Wide Range of Services: A One-Stop Cloud Ecosystem AWS offers a vast ecosystem of services that cover virtually every aspect of cloud computing. From computing and storage to databases, machine learning, analytics, and more, AWS provides a comprehensive suite of tools and resources. This breadth of services allows businesses to address various IT needs within a single platform, simplifying management and reducing the complexity of multi-cloud environments.

5. Security: Fortifying the Cloud Environment Security is a paramount concern in the digital age, and AWS takes it seriously. The platform offers a myriad of security tools and features designed to protect data and applications. AWS complies with various industry standards and certifications, providing a secure environment for sensitive workloads. This commitment to security has earned AWS the trust of organizations handling critical data and applications.

6. Global Reach: Bringing Services Closer to Users With data centers strategically located in multiple regions worldwide, AWS enables businesses to deploy applications and services closer to their end-users. This reduces latency and enhances the overall user experience, a crucial advantage in today's global marketplace. AWS's global presence ensures that your services can reach users wherever they are, ensuring optimal performance and responsiveness.

7. Innovation: Staying Ahead of the Curve AWS's culture of innovation keeps businesses at the forefront of technology. The platform continually introduces new services and features, allowing organizations to leverage the latest advancements without the need for significant internal development efforts. This innovation-driven approach empowers businesses to remain agile and competitive in a rapidly evolving digital landscape.

8. Hybrid and Multi-Cloud Capabilities: Embracing Diverse IT Environments AWS recognizes that not all organizations operate solely in the cloud. Many have on-premises infrastructure and may choose to adopt a multi-cloud strategy. AWS provides solutions for hybrid and multi-cloud environments, enabling businesses to seamlessly integrate their existing infrastructure with the cloud or even leverage multiple cloud providers. This flexibility ensures that AWS can adapt to the unique requirements of each organization.

Amazon Web Services has risen to unprecedented popularity by offering unmatched scalability, reliability, cost-effectiveness, and a comprehensive service portfolio. Its commitment to security, global reach, relentless innovation, and support for hybrid/multi-cloud environments make it the preferred choice for businesses worldwide. ACTE Technologies plays a crucial role in ensuring that professionals can harness the full potential of AWS through its comprehensive training programs. As AWS continues to shape the future of cloud computing, those equipped with the knowledge and skills provided by ACTE Technologies are poised to excel in this ever-evolving landscape.

7 notes

·

View notes

Photo

RideBoom CEO Harminder Malhi known as Harry Malhi announced the soft launch of the RideBoom RB bike service in Pune and Kolkata which is currently in India and looking after the RideBoom.

In the words of RideBoom founder Harry Malhi

"The support of the users and drivers show us that this is the right time to bring a change in the current taxi industry and RideBoom vision is very clear about this to provide the most affordable service to the taxi and bike service user "

RideBoom is the only bootstrap company under its founder's supervision making it all possible to launch in as many cities as possible without huge overhead expenses and without raising any funds.

In the founder's words "No one believes in the RideBoom vision, so far most of the venture capitals investors think that a small start-up can't compete in this crowded market, but we are going make it"

RideBoom is not only offering free ride credits on the first download, but it is also giving free ride credits at the end of each ride. The customers will also get ride credits when they share their code with family and friends, and they can use these credits against their next taxi and bike rides. The ride credits are called RB Coins.

RideBoom doesn't have any surge price, so they don't increase the fare when the customers need them the most. Instead of making a profit by charging the customer more and paying less to the drivers, RideBoom is focusing on better service by proving better training to its drivers and offering more benefits to the users.

About RideBoom

RideBoom is the most unique on-demand rideshare app founded by Harmider Malhi known as Harry Malhi who got over twenty years of experience in this domain. It's still bootstrap and avail in three major Australian cities and five Indian cities it's the only bootstrap startup that can be launched in two countries.

Download the free RideBoom app available in the play store and app store.

Let's RideBoom India.

For more info www.rideboom.com/india

21 notes

·

View notes

Text

Why Angel Investors May Reject Funding for Your Startup

Securing funding from angel investors is crucial for many startups, but it can be a challenging task. Angel investors are often high-net-worth people that offer funds in return for shares to early-stage firms. However, getting them to invest in your company is not always easy.

There are several reasons why angel investors might say no to funding your venture. These reasons can include a lack of trust in the management team, unrealistic valuations, unclear exit strategies, and poor research. It's essential to understand why potential investors might reject your proposal and to take steps to avoid these pitfalls.

This can increase the chances of success in raising capital and move your business forward. In this article, we will explore some of the reasons why angel investors might say no to funding your venture and provide insights on how to avoid them.

Investors find you untrustworthy:

Trust is crucial when it comes to securing funding from angel investors. If investors perceive you as untrustworthy, it's unlikely they will invest in your company. This could be due to a lack of honesty and transparency in your communication, or a history of shady business practices. To avoid this, it's essential to be transparent and honest with your investors and to establish a strong reputation in the startup community.

Lack of research:

Angel investors want to see that you've done your homework before approaching them for funding. If you haven't conducted thorough research on your market, competitors, and business model, they will likely reject your proposal. To avoid this, make sure to conduct extensive research and provide detailed data to back up your claims.

Unrealistic valuation and/or investment terms:

Valuation is one of the most critical factors in securing funding from angel investors. If your valuation is too high, investors will be less likely to invest, as they will see a lower potential for return on their investment. Similarly, if your investment terms are too onerous, investors may be hesitant to invest. To avoid this, make sure to conduct thorough research on industry standards for valuation and investment terms, and use this information to set realistic expectations for your company.

Poor management team:

Angel investors invest in people as much as they do in ideas. If your management team lacks the necessary skills, experience, and vision to execute your business plan, investors will be less likely to invest. To avoid this, make sure to assemble a strong management team with the necessary skills, experience, and vision to execute your business plan.

Unclear exit strategy:

Angel investors are looking for a return on their investment, and they need to know how they can exit their investment. If you don't have a clear exit strategy, investors will be less likely to invest. To avoid this, make sure to have a clear exit strategy in place, and communicate this to potential investors.

In conclusion, getting funds from angel investors might be difficult, but it is not impossible. By understanding the reasons why investors might say no to funding your venture, you can take steps to avoid these pitfalls and increase your chances of success. Remember to be transparent and honest, conduct thorough research, set realistic expectations, assemble a strong management team, and have a clear exit strategy in place.

#startup#impactfulpitch#fundraising#pitchdeck#business#enterpreneur#startuppitch#startupsidea#impact#impactful#investor#entrepreneur#ecosystem#funding#strategies#management#team

27 notes

·

View notes