#US BAN BUSINESS CARD BEST US BANK CARD BUSINESS CREDIT FUNDING Business Credit Reviews

Explore tagged Tumblr posts

Text

There are two facts that should loom above all others in thinking about the World Bank as it wraps up its almost ritualized annual meetings in Washington this weekend.

The first is that its incoming president, Ajay Banga—the 63-year-old Indian-born American and longtime executive chairman of Mastercard—was the only “candidate” for the job. Following the bank’s tradition, the United States nominated Banga, and the use of quotation marks here is meant to emphasize that there was no public debate whatsoever about who would be best suited to lead the multinational development lender, nor any open debate about priorities for the bank or leadership strategy. Banga’s experience in the credit card business is formidable, but how this prepares him for his very different new job is less than completely obvious.

This leads to the second big thing to consider about the World Bank. There is a deafening dissonance between this Western-dominated institution’s undemocratic procedures and the West’s own pronounced traditional bias in favor of democratic governance in its engagements with what was long known as the Third World. It is, of course, true that the best one can say about the West’s historic advocacy of democracy in the global south is that it has been highly inconsistent. The rub with the lack of democracy in the World Bank’s governance is about much more than this awkward hypocrisy, though.

Banga has been parachuted into his new five-year term as the bank’s leader with a ready-made agenda, which has also not been the focus of any open debate or public discussion. Led by the United States, the West has decided that climate change should be the World Bank’s overriding priority. This represents a dramatic shift that has not considered the priorities of most of its clients, who are overwhelmingly concentrated in what is euphemistically called the developing world—and which really means the scores of countries whose populations are trapped in poverty or, at best, the lower end of middle-income status. Such a dramatic shift in the bank’s agenda represents another kind of anti-democratic behavior by the institution—one that dictates that the priorities of the rich countries that fund it not only must always prevail, but are also beyond review or debate.

The point of this criticism is not to deny the menace of climate change, especially for the world’s poorest and most vulnerable populations. Take, for example, the 600-mile coastal stretch between Lagos, Nigeria, and Abidjan, Ivory Coast, that I have written about elsewhere. It will experience the most dramatic growth in urban population in the world by far over the course of the rest of this century, and yet as tens of millions of people converge on mushrooming legacy cities and newly born ones with each coming decade, the region will be highly vulnerable to rising seas, changing rain and flooding patterns, and other perilous effects of global warming.

The problem with the World Bank’s governance culture is that its undemocratic nature allows the bank and its Western-created relatives, such as the International Monetary Fund, to zig and zag like this every decade or two—not only failing to seriously weigh the views of its clients, but also never facing any accountability about its own work and impact around the world. A glaring example should help convey the real-world implications of this for the many poor countries that rely on lending from the bank—and not handouts or aid, as Western publics wrongly believe—to finance their development agendas.

For a couple of decades prior to Banga’s appointment, the bank’s avowed priority was poverty alleviation. This was highly welcomed in Africa and other regions of the world with large concentrations of poor or low-income inhabitants. But one must say “avowed” because the bank’s actual focus on reducing poverty has been highly inconsistent—and because, like TV pundits who make claims and spout predictions by the day, knowing they will never be called to account before their viewers, the World Bank expends scant effort in promoting a transparent and rigorous public review of its performance.

Indeed, previous approaches of the Bretton Woods institutions—the international financial institutions, or IFIs, as the World Bank and the International Monetary Fund are sometimes called—are now widely believed to have had a catastrophic impact on many of the world’s poorest countries. Most notorious in this regard was the so-called Washington Consensus, the policy era centered on the 1980s and 1990s, when the IFIs pushed strategies of fiscal austerity, drastically shrinking the state, and eliminating barriers to financial and trade penetration from the rich world on the theory that this model of capitalism would help those who were disciplined enough to take off.

It bears saying that this was a consensus only among rich Western nations. If they wanted access to capital, the poorest countries had little choice but to submit. Logically enough, in many places, the result was a steep decline in public services, from health care to infrastructure building to education, among others.

The West’s unwillingness to finance infrastructure projects commensurate with poor countries’ needs is what gave China the enormous opening it pursued when it began large-scale lending to Africa in the 1990s and to other regions afterwards. Now think about reducing the availability of education in Africa for a moment. Since the Washington Consensus era, there has been a steadily strengthening view among economists and other development experts that boosting education is one of the most powerful things that a poor country can do to improve its prospects. The effects are thought to be especially profound where access to free or affordable education for girls is concerned.

Educational access for girls in many parts of Africa is far below that of boys. The longer girls stay in school, though, the more income they will generate over their lifetimes, helping develop their countries. There is also a direct correlation between length of school attendance and female fertility. In plain words, this means that the more years of schooling women complete, including university and beyond, the fewer children they will have. This is of profound importance for moderating Africa’s extraordinary ongoing population growth and—hey, by the way—almost certainly limiting climate change.

For a sense of what alternative approaches to crafting a strategy for the World Bank might look like, ones that take into account the thoughts and needs of the poor, this ONE Campaign-led open letter and its many signatories provide a sample.

Focusing on African urbanization is another way to provide a big boost to poverty alleviation, economic development, and regional integration in Africa and elsewhere, while also combating climate change. Payoffs toward this latter goal would come on two fronts. Fast or newly urbanizing areas could integrate energy efficiency into their planning from an early phase, as opposed to doing so as an expensive afterthought or remediation. By the same token, cities in the developing world can be made much more climate resilient, which, likewise, is far preferable to an endless cycle of humanly and economically costly disaster relief.

Bringing this about will require tremendous vision, but even that won’t be enough. Poverty alleviation in the economically weakest parts of the world will require giving the poor a real seat at the table, which the World Bank has never done.

What the World Bank’s new climate-first orientation must not do is fail to promote energy access for the world’s poorest out of the mistaken belief that it is they, as opposed to the big legacy polluting nations of the rich world, who are killing the planet. By 2050, Nigeria—already Africa’s most populous country—is projected to have more people than the United States, yet it generates less than 1 percent of the electrical capacity that the United States generates. Getting reliable electricity to the poor is, along with urbanization and education, one of the most powerful things one can do to provide economic uplift.

If the World Bank thinks it can relegate this to a lower priority level in the name of limiting greenhouse emissions or global warming, it will be making a grave mistake—and not just because it is unfair to the masses of people in the developing world who have barely contributed to climate change, but also because it won’t work. The billions of people crowding into new cities will need power to light their homes and read to their children. If the rich world cannot summon the wherewithal to provide financing for adequate renewable sources of energy, the poor will pay them no heed and turn to coal and other fossil fuels instead.

9 notes

·

View notes

Video

youtube

US BAN BUSINESS CARD: BEST US BANK CARD TO GET $50K IN BUSINESS CREDIT FUNDING 2021

Source: https://youtu.be/6GeDTjomowc

https://houstonmcmiller.net/us-bank-business-card-best-us-bank-card-to-get-50k-in-business-credit-funding-2021

How To Get $50k US BANK Business Credit Cards Using Business Credit Reviews 2021?

0 notes

Text

Cash App is a mobile payment service developed by Square, Inc. that allows users to transfer money to one another using a mobile phone app. The service is available in the United States and the United Kingdom. Cash App accounts can be used to send or receive payments from other people, or to make online purchases.

Buy Verified Cash App Accounts. You can also use Cash App to buy Bitcoin. If you’re looking for a convenient way to send and receive money, then you should consider getting a Cash App account. With Cash App, there’s no need to carry around cash or write checks – all you need is your phone and the app.

Plus, you can use Cash App to buy Bitcoin, which is a digital currency that has been gaining popularity in recent years.

If you’re looking for a way to send and receive money quickly and easily, then you should definitely consider using Cash App. Cash App is a popular mobile payment service that allows users to send and receive money with just a few taps on their smartphone. Best of all, it’s completely free to use!

One thing to keep in mind, however, is that Cash App accounts are not necessarily verified. This means that if you’re sending or receiving a large amount of money, there’s always a risk that the other party could be scammers. For this reason, we recommend only dealing with verified Cash App accounts.

Buy Verified Cash App Accounts

There are several ways to verify a Cash App account. The easiest way is to simply ask the person you’re dealing with for their verification code. Once you have this code, you can enter it into the app and see if their account is verified.

If it is, then you can rest assured knowing that the person you’re dealing with is legitimate. Another way to verify someone’s Cash App account is by checking their profile picture. If they don’t have one, or if it looks like it might be fake, then there’s a good chance that they’re not legitimate. Buy Verified Cash App Accounts

Finally, you can also check reviews of the person you’re dealing with before deciding whether or not to do business with them. If you take these precautions when using Cash App, then you’ll be sure to stay safe and avoid any scams. So go ahead and start using Cash App today – it’s a great way to send and receive money!

How Do I Get a Verified Cash App Account? To get a verified Cash App account, you will need to provide your full name, date of birth, and the last 4 digits of your Social Security number. You may also be asked to provide additional information, such as a photo ID or bank statement. Once you have provided this information, Cash App will verify your identity and create a verified account for you.

Can You Have 2 Buy Verified Cash App Accounts? Yes, you can have multiple Cash App accounts that are each verified. To do this, you will need to use a different email address and phone number for each account. You can add these accounts by going to the ‘Add Account’ section in the app.

Do People Sell Cash App Accounts? There has been an influx of people selling their Cash App accounts online. While this may be tempting, it is important to know that there are some risks associated with doing this. For one, your account could be suspended or even banned if you are caught selling it.

Additionally, the person who buy your account could use it for fraudulent activity, which would reflect negatively on you. Finally, if you sell your account, you will no longer have access to any funds that are in it. Overall, we recommend against selling your Cash App account. Buy Verified Cash App Accounts

Is It Hard to Get Verified on Cash App? Cash App is a popular peer-to-peer money transfer service that allows users to send and receive money without the need for a bank account or credit card. The service is available in the US, UK, Canada, and Australia. To get started with Cash App, you’ll need to create an account and link it to your bank account or debit card. Buy Verified Cash App Accounts

Once your account is set up, you can start sending and receiving money. If you’re looking to add an extra layer of security to your Cash App account, you may be wondering if there’s a way to get verified on Cash App. While Cash App doesn’t currently offer verification services, there are some steps you can take to help protect your account.

For starters, make sure you’re using a strong password for your Cash App account and enable two-factor authentication (2FA). 2FA adds an extra layer of security by requiring you to enter a code from your mobile device when logging into your Cash App account. This means that even if someone knows your password, they won’t be able to access your account unless they also have access to your phone. Buy Verified Cash App Accounts

You can also add a PIN code to your Cash Card (the physical card associated with your Cash App account) which will require anyone who wants to use it to enter the PIN before being able to complete a transaction. This adds another level of security in cas

3 notes

·

View notes

Text

Things To Check Before Buying An Account With League Of Legends Account

League of Legends is one of the most well-known video games. The game is been gaining a lot of attention from players worldwide. To play this game, however, you will need a LoL account. Be cautious as many companies promise the best but never give. It's not unusual for customers to be notified that their account is or is about to be blocked or cannot be accessed at all.

Sometimes merchants may give away credentials that appear to operate initially, but are later banned after a few days. There's also the problem of accounts being stolen, which could cause problems for buyers. Nonetheless, this article will discuss some of the most important considerations and things you must verify before purchasing a League of Legends account.

DELIVERY OF LOL ACCOUNT

It's possible that your package has not received within 24 hours. It is difficult to wait to access your account that you paid for. In order to avoid this, ask about the length of time it'll be for the seller to transfer your account.

Purchase an account that meets YOUR REQUIREMENTS

There's a myriad of LoL account vendors on the market each with their own unique set of incentives and rewards that may or may not be what you're seeking. Certain sites provide verified accounts while others don't.

Sellers may also offer accounts that are not ranked for sale, while a few may attempt to scam you out of cash. Some sellers will offer to sell your server's accounts, while others will not. Additionally there are many who are willing to sell high-level accounts. So, it's completely your responsibility to make sure that you obtain the finest deal you can get.

PURCHASE A UNVERIFIED ACCOUNT

You'll have to verify your account prior to buying to make the most of it. You can opt to withdraw from the transaction, in the event that Riot Games sends you an email to confirm your account, your account could have been compromised. Because the account was verified before, Riot Games can help the account's valid owner regain it.

The account will be deleted including your account's stats as well as the account itself and the money you paid for it, making it unproductive time and effort. You cannot alter the password of a verified account. So, you don't hold the account even though you've already bought it. It is important to verify that you are buy league smurf and the account is not verified.

PROTECTION of personal information

The company that handles your LoL accounts must prove that your personal data is safe. You'll need a credit card in most cases. You'll need to give the seller your card information for the purpose of making payments.

To ensure your credit card details are secure ensure your credit card information is secure, only buy an account from a seller who uses SSL encryption technology.

Terms and Conditions of Service AND WARRANTY

It is also important to verify the warranty conditions and support of the seller. LoL accounts are typically banned. You can be certain that other people have visited your LoL account from another location than you when you make a purchase lol smurf shop. This could lead to the suspension of your account.

Beware of this by buying from sellers that have an excellent track record and provide a solid warranty. This gives you confidence that your money is secure.

Determine the payment method that A SELLER CAN ACCEPT

Another rule to be aware of when trying to buy lol smurfs Suppose you're unfamiliar with a seller's or a site's payment options. In that case, determine what other websites utilize as their payment methods.

Beware of sellers that ask you to wire funds directly to a foreign or unknown bank account, instead of using a secure payment method. It will be difficult to receive the money back your payment method is not confirmed and are not secure.

SEEK REVIEWS on the internet

Independent websites are receiving more positive reviews for businesses which have been in existence for several years and sold thousands to customers. Make sure to read online evaluations on these websites because companies and scammers do not have control over them.

Keep an eye out for authentic reviews, since it is ridiculously simple to give positive feedback. True reviewers have written evaluations of other businesses, too. If you notice the reviewer's account was recently created solely to write one positive review, you're dealing with a red flag.

We cannot emphasize enough the importance of collecting feedback from a variety of sources to determine whether or not an online store or website is reliable.

HELPFUL SALES TEAM

Customer service is one of the cornerstones of a genuine business, and it requires an attentive sales staff. These pros are more than happy to offer free assistance. Customer service representatives can assist you with any issue such as providing account credentials or answering an exact question.

A reliable company will answer your emails within hours. You can also use live chat to speak with customer service agents right away.

Conclusion

League of Legends offers a diverse range of online games that make it a fantastic game that is pure online enjoyable. It offers a wide range of games that have stunning graphics and a competitive system that gives players the opportunity to move up within the ranks.

0 notes

Text

GAMBLING CASINOS ON THE WEB

In these days just about every person owns a computer or has some kind of a way to get online, and with great purpose! There are so a lot of various factors you can do on the web now a times that you couldn’t do say even five several years back. The sheer volume of online gambling sites alone is earth shattering. In the year 2002 as outlined in United states of america Today by equity analysis organization Bear Stearns was quoted in declaring that more than 4.five million men and women, half of them becoming folks from the United States frequently gamble on the web. Of course this variety has much more than doubled in the earlier 6 many years given that that estimate was prepared in United states Today.

Practically any individual can gamble on the internet at these gaming casinos, as prolonged as it is lawful in your location of residence! There are quite a few amount of web sites such that offer video games this kind of as roulette, black jack, and slots the place you can engage in for actual funds and acquire actual cash in the procedure. Other websites have other things such as “chips” that when accrued can be employed to get stuff on the internet site, or to engage in far more video games. A lot more probably than not nevertheless, if you might be heading to be gambling online you’re going to get some actual income! Possibly way please make sure you know you are point out or region legislative rules ahead of gambling online.

If you are heading to gamble at a internet site with actual cash its a good idea to stick to these stage of criteria: – Make sure the site is legally certified – Payouts are reviewed and licensed by an independent auditing organization – Consumer support is responsive – Accreditation is given by resources this sort of as SafeBet, and the Interactive Gaming Council

On the web gambling sites and on line casino websites more than most likely will let you to pay with credit card, verify, cash order, or wire transfer. Though just lately web sites have also started out accepting other kinds of payment this sort of as FirePay, NetTeller, ACH, 900 Shell out and the like. I personally like the types that have the ACH choice simply because you can just take it immediately out of you are bank account and put it proper into you’re account on-line. Also do not be surprised when signing up for these sites if they ask for you are drivers license variety, financial institution account quantity, credit score card quantity, or social protection number. This is just their way of assuring that you are of lawful age!

If you are seeking for internet sites that possibly permit actual funds wagers or bogus wagers remember to go to Google and research for key phrases this sort of as “On-line Gambling Sites”, “On the internet Black Jack Websites”, “On the internet Roulette Web sites” or other research conditions this kind of as “Gamble With True Money On-line” or “On the internet Gambling Casinos With Actual Wagers.”

Many gambling chats and information teams devoted to poker more and much more usually anxiously mention the so-named card-playing robots, known as “bots” in the nomenclature of the World wide web, that are currently being utilised on commercial gambling internet sites. Juara Slot 777 are confident that a variety of gambling portals prospers because of to the use of the unique plans, ready to beat an above-typical participant, not mentioning a newbie. In a traditional casino you can constantly guess the weak sides of your competitor, determine out his technique and etc, in a virtual gaming property there is no telling your competitor is a human, but not specifically produced program, “substituted” for a actual participant.

If it is correct, then widespread of poker bots able of beating an common player would pose a considerable issue for poker sector. With out generation of a special technique verifying the identification and “humanity” of playing cards gamers in on-line casinos, the company could be considerably undercut. This is an viewpoint of gamers themselves, and gambling figures, interested in further improvement of on-line game sector.

Some skeptics say that, considering the complexity of the match and consistently modifying methods, development of the system that can go through opponents’ cards utilizing particular methods of display scanning and answer in genuine time is a lot of many years away at very best. The supporters of this level of see point to the variety of business programs that purport to help players, but with no actual result. Nonetheless there is a completely ready response for all of these objections – in Canadian College of Alberta a personal computer poker research group has created an artificially clever automaton recognized as “Vex Bot”. This robot is capable of taking part in poker at master amount in a recreation with two gamers. The new program has already been utilised to take a look at the frontiers of synthetic intelligence, as it will be the basis for industrial poker tutorial system. As shortly as the news about robot generation was printed in media, the creators commenced to receive letters mentioning the hazard of system use for the functions of unlawful gambling organization.

Darse Billings who is lead designer of “Vex Bot” considers that chance of the use of bots on industrial internet sites is approximately 50:50, but he is also sure that all of the modern programs can not likely match his development, which is a outcome of a 10 several years study work of a crew of professionals.

“The strategy of the sport is hard and to sit down and write a software that can conquer a table of experienced human gamers is no trivial job,” Billings mentioned. In accordance to his the viewpoint, the greatest obstacles lie in the sum of information unavailable to the participant and the need to have for the system to be in a position to employ a range of methods at diverse times, this sort of as bluffing and laying traps for opponents, and so forth Just for this goal synthetic intelligence was added to the technique, capable not only compute chances but also line up logic of game, model it truly is opponents actions, and so on.

In the viewpoint of creators of “Vex Bot”, its principal edge is that, as nicely as any other robotic they have no thoughts, no worry and no shame and can not be nervous. He will stay indifferent even prior to the most intense participant.

Journalists, learning the issue of poker boats, observe that it is extremely hard to get the real photograph simply because of the unwillingness of a lot of gambling operators to solution upon requests on this situation. There are no large-high quality plans, able to observe suspicious poker internet sites with the uncommon patterns of sport.

Representative of CryptoLogic Organization, commenting this issue, pointed out that some players, suspected to use of boats, have been banned from the member internet sites. Often it is just unattainable to be confident who plays is a human or robot, but a firm, exposing all uncommon techniques, prefers to be reinsured and protect itself from the possible socializing with a bot.

Professional players, speaking about the recognition of poker bots, mention how advantageous it can be: if you have the software, able to engage in twenty five casinos concurrently, two tables apiece and even if you are playing a minimum $10-20 on a match, you make $1000 an hour. The contributors of numerous gambling chats are distressed that the personal computer applications have presently took the spot of interactive poker. Skeptics are certain that poker will carry on to grow to be far more well-known, in spite of all of threats from the side of programmers. In their impression, it really is only a make a difference of time ahead of much more people want to produce their personal bots to be remembered, but all of these tries are doomed to failure.

0 notes

Text

Understand The Background Of Amex Pre Approval Now | amex pre approval

Share

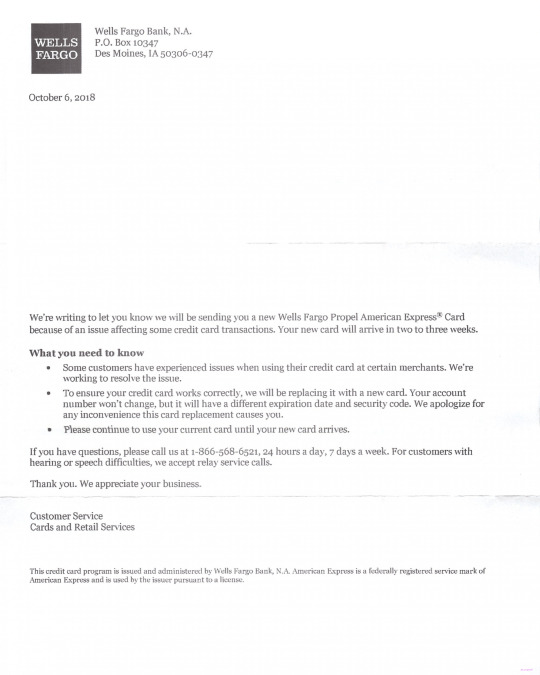

Issue With Wells Fargo Propel American Express Cards .. | amex pre approval

Share

Share

Share

Print

Email

Commercial agenda accession continues to accomplish big after-effects in the accounts payable (AP) department, as corporates and agenda issuers akin analyze new means to drive business absorb on cards above business trips or ad-hoc purchases.

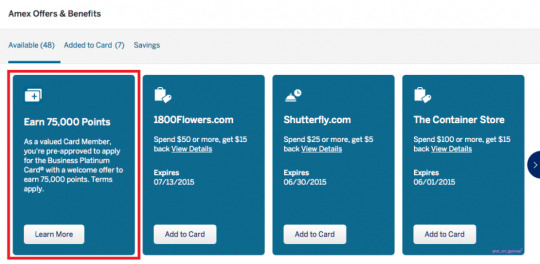

A New Way To Find American Express Pre-Approved & Higher Than .. | amex pre approval

This week’s Bartering Agenda Accession Tracker finds the better names in the industry, as able-bodied as FinTech newcomers, dispatch in to drive added acceptance of the accumulated card.

American Express Debuts AP Tool

American Express bartering cards accept been a basic for abounding corporates over the years. As the B2B payments mural modernizes, the payments technology aggregation is ramping up its accession efforts to drive added acceptance of bartering cards with value-added services.

In its best contempo initiative, American Express appear the rollout of its accounts payable solution, American Express One AP. The aftereffect of its accretion of acompay aftermost year, the band-aid digitizes and streamlines supplier payments while acknowledging a ambit of acquittal methods, including ACH, checks and, of course, basic and concrete bartering cards.

“By automating the accounts payable action with an innovative, end-to-end solution, One AP makes it easier for businesses to pay for what they charge to accomplish and ultimately grow,” the firm’s Vice President and General Manager of B2B Payments Automation, All-around Bartering Casework Trina Dutta said in a statement.

This wasn’t the alone action in the B2B payments amplitude that American Express has appear this month. Aftermost week, the aggregation appear its accord with SAP Concur to accumulate balance and amount management, with an affiliation enabling advisers to pay invoices through the SAP Concur belvedere application American Express bartering cards.

Amex Centurion Card Benefits – without Invitation (2019) – amex pre approval | amex pre approval

Nium Broadens Card-Issuing Reach

FinTech aggregation Nium appear this anniversary the amplification of its card-issuing capabilities aural Europe, aloof weeks afterwards rolling out operations in Australia. The aggregation is accretion its affiliation with Visa to white-label its offering, enabling corporates to affair their own cards and consolidate their own bartering agenda programs.

Nium’s alms includes real-time funds transfers to concrete and basic cards, tokenization of agenda details, and abutment for assorted currencies. In accession to facilitating agenda issuing, Nium additionally afresh launched a new account in Singapore via its InstaReM unit. BizPay allows businesses to accomplish use of their absolute bartering agenda acclaim curve to admission basic for supplier payments and added all-important purchases.

Accrualify Taps Visa For Accumulated Agenda Offering

Accounts payable and absorb administration FinTech Accrualify is introducing its own accumulated agenda offering, the aftereffect of its accord in Visa’s FinTech Fast Track Program.

In an announcement, Accrualify said it is partnering with Visa to barrage its Accumulated Agenda Module, a co-branded accumulated agenda affairs that enables businesses to admission cards with value-added casework like absorb banned and real-time tracking, agent absorb administration and pre-approval functions, artifice controls, and abutment for both basic and concrete cards.

Td Bank Us Credit Card Pre Approval | Cardbk | amex pre approval

“The agenda transformation of payments creates an agitative befalling for us to advantage our accounts payable automation technology with Visa’s all-around acquittal arrangement to accord accumulated accounts teams a complete absorb administration solution,” said Benjamin Portusach, CEO of Accrualify, in a statement.

Privacy.com Sets Sights On Business Cards

Virtual agenda FinTech startup Privacy.com has congenital its consumer-facing band-aid about the aegis and aloofness amount hypothesis that single-use basic cards offer.

Now, with $10.2 actor in new funding, the aggregation is reportedly gluttonous an amplification into the B2B branch with a focus on wielding basic cards for agent and accumulated spend.

Reports this anniversary said Privacy.com aloft the Series A allotment from Teamworthy Ventures, while Tusk Venture Partners, Index Ventures, Quiet Capital, Exor Seeds and Rainfall Ventures additionally participated. The advance will ammunition the rollout of its Agenda Arising API, advised for corporates to affair basic cards for their own advisers and added back-office acquittal workflows.

Understand The Background Of Amex Pre Approval Now | amex pre approval – amex pre approval | Pleasant to help my personal weblog, in this particular occasion I’ll demonstrate with regards to keyword. And now, this is actually the 1st photograph:

美国信用卡指南 – 北美省钱必备,只推荐最好的信用卡。 – amex pre approval | amex pre approval

Why not consider image earlier mentioned? is actually which remarkable???. if you think so, I’l m provide you with some graphic yet again underneath:

So, if you would like acquire all of these amazing pics regarding (Understand The Background Of Amex Pre Approval Now | amex pre approval), simply click save button to download the images for your laptop. These are available for obtain, if you’d prefer and wish to grab it, click save symbol on the article, and it’ll be instantly saved to your computer.} Finally if you like to receive new and latest picture related with (Understand The Background Of Amex Pre Approval Now | amex pre approval), please follow us on google plus or save this blog, we attempt our best to provide daily up-date with fresh and new graphics. We do hope you enjoy keeping here. For most up-dates and latest news about (Understand The Background Of Amex Pre Approval Now | amex pre approval) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We try to offer you up grade regularly with fresh and new graphics, enjoy your surfing, and find the right for you.

Thanks for visiting our website, contentabove (Understand The Background Of Amex Pre Approval Now | amex pre approval) published . At this time we are excited to announce we have found an extremelyinteresting nicheto be pointed out, namely (Understand The Background Of Amex Pre Approval Now | amex pre approval) Most people searching for specifics of(Understand The Background Of Amex Pre Approval Now | amex pre approval) and of course one of these is you, is not it?

Amex Cash Magnet approval – myFICO® Forums – 5272043 – amex pre approval | amex pre approval

Amex preapproval while logged in, but.. | amex pre approval

Td Bank Us Credit Card Pre Approval | Cardbk | amex pre approval

Hilton Honors Surpass® Card from American Express – Earn Hotel Rewards – amex pre approval | amex pre approval

Amexplatinumrsvp | amex pre approval

American Express Gold Card review: Is it worth its weight .. | amex pre approval

Check for Pre-qualified Credit Card Offers | American Express – amex pre approval | amex pre approval

Farmers Visa Signature Pre-Approval Letter From Co .. | amex pre approval

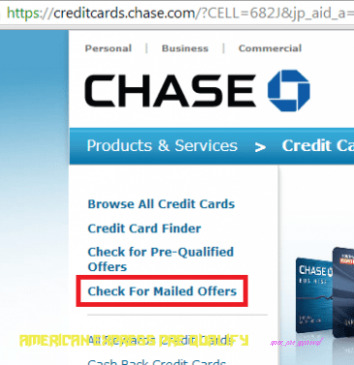

Chase Pre-Approval (Pre-Qualify for a Credit Card + 14 Best . | amex pre approval

from WordPress https://www.visaword.com/understand-the-background-of-amex-pre-approval-now-amex-pre-approval/ via IFTTT

1 note

·

View note

Text

DealBook: A Peek Inside YouTube’s Money Machine

Good morning. Silicon Valley is buzzing over Sheryl Sandberg’s engagement, nearly five years after the death of her husband, Dave Goldberg. (Was this email forwarded to you? Sign up here.)

Alphabet draws back a curtain on YouTube’s billions

The tech giant surprised Wall Street yesterday when it offered some financial information about YouTube, long a closely guarded secret. But the new information was part of a quarterly report from Alphabet, the parent company, that didn’t meet investor expectations.YouTube collected over $15 billion in revenue last year, which Rob Copeland of the WSJ says was on the “lower end of projections.” It suggests that YouTube took in less than $8 a year from each of its two billion users.• YouTube’s revenue figure is higher than Viacom’s for its 2019 fiscal year, our colleague Kevin Roose points out.• But Alphabet didn’t say how much profit YouTube earned.• And our colleague Shira Ovide notes that YouTube reported “gross” revenue — which includes the money that the service pays out to content creators and is not the whole financial picture.Investors weren’t impressed, and Alphabet shares fell 2.7 percent in after-hours trading. The company’s overall revenue growth was less than expected, while its losses from its “moonshot” projects increased 53 percent.Still, the limited disclosure introduces some transparency to tech giant financials, Ms. Ovide adds. What if Alphabet’s move successfully puts pressure on Microsoft to break out its Azure cloud sales, or on Facebook to disclose Instagram’s revenue?____________________________Today’s DealBook Briefing was written by Andrew Ross Sorkin in New York and Michael J. de la Merced in London.____________________________

We still don’t have an Iowa caucus winner

Blame new reporting results, a faulty app or some other factor, but as of this moment there are still no results from the Iowa Democratic caucuses.The official line: “A spokeswoman for the state party said there was no issue with the integrity of the vote but it was taking longer than anticipated to collect and check the reported data for irregularities,” Alex Burns and Jonathan Martin of the NYT write.One potential culprit is a new app being used to report caucus results. It was created by Shadow, a tech company affiliated with a prominent Democratic nonprofit, Acronym. (Our colleague Sheera Frenkel says poor training on how to use the app, not a hack, appears to be at fault.)What we are watching for:• Whether Bernie Sanders, who has been surging in the polls, will officially become the front-runner for the Democratic Party nomination.• How Democratic business leaders will respond. If Joe Biden underperforms in Iowa, will they flock to, say, Mike Bloomberg, Pete Buttigieg or Amy Klobuchar?An event to watch: Top Wall Street executives are planning a fund-raiser for Mr. Biden in New York on Feb. 13, with entry at $2,800 a head, according to an invitation we have seen. Organizers include Roger Altman of Evercore; Blair Effron of Centerview Partners; Marc Lasry of Avenue Capital; and Faiza Saeed and Christine Varney of Cravath, Swaine & Moore.

OPEC weighs effects of coronavirus on oil prices

The group is meeting today and tomorrow to figure out a response to the Wuhan coronavirus outbreak, which has pushed down oil prices, Stanley Reed of the NYT reports.• The epidemic has reduced demand from China and affected other big consumers of oil, like airlines.• OPEC is expected to discuss whether to cut production by up to a million barrels a day, Mr. Reed adds.• It may also push an emergency minister-level meeting to this month, several weeks ahead of schedule.The group is moving because oil prices keep dropping. The price of Brent crude has fallen about 19 percent over the past month to less than $55 a barrel, erasing the effects of a production cut announced in December.But there’s not much OPEC can do. One oil trader estimated that Chinese oil demand over the last two weeks has fallen about 2.5 million barrels a day, or close to 20 percent compared with the previous year. And China has cut the size of its March orders from Saudi Arabia.More: The outbreak is likely to delay China’s ability to meet targets in the recent trade deal with the U.S. And the Chinese authorities’ efforts to halt the disease’s spread have turned neighbor against neighbor.

Goldman’s latest bid for Main Street: Amazon loans

First Goldman Sachs partnered with Apple on a credit card. Now it may work with Amazon to lend to small businesses as it tries to become a more mainstream financial giant, writes Laura Noonan of the FT.• “Goldman has begun building technology to facilitate the offering of loans to small and medium-sized businesses over Amazon’s lending platform,” Ms. Noonan writes, citing unnamed sources.• Goldman has sought to push beyond M.&A. advice and trading into other businesses, like consumer banking, wealth management and lending.• Amazon would benefit, too: It could expand its services for merchants without having to take on additional risk.

Are regulators dashing start-ups’ dreams?

There’s potentially a lot at stake as the Federal Trade Commission sues to block the $1.4 billion sale of the upstart shaving brand Harry’s to Edgewell, the owner of Schick — including the fate of many start-ups.• The F.T.C. argues that the deal would “eliminate one of the most important competitive forces in the shaving industry.”• Over its nine years, Harry’s grew in popularity by selling sleekly styled razors online and in stores, chipping away at the market share of Gillette and Schick.• Harry’s “has forced its rivals to offer lower prices, and more options, to consumers across the country,” said Daniel Francis, the deputy director of the F.T.C.’s Bureau of Competition.Harry’s founders said they were disappointed by the move. They told Michael last year that they had considered going public and remaining independent, but decided that selling to Edgewell was the best way to keep growing.This could spell trouble for other start-ups. Many investors support them in the hope that they will either sell themselves or hold an I.P.O. Not all start-ups can go public, so preventing them from selling to bigger rivals could deter investors from backing them in the first place.

Bernie Ebbers, ex-WorldCom C.E.O., is dead

Mr. Ebbers, who built a telecom giant only to go to prison after its collapse after the dot-com boom and become a symbol of corporate greed, died on Sunday. He was 78.• He turned his small Mississippi company into WorldCom through more than 40 takeovers, including the $37 billion acquisition of MCI, Kit Seelye and Daniel Victor of the NYT write.• But WorldCom collapsed in 2002 — its bankruptcy was the biggest ever in the U.S. at that time — and Mr. Ebbers was later arrested on charges of corporate fraud.• “Former employees testified that Mr. Ebbers had urged them to inflate WorldCom’s financial results to make the company appear more profitable than it was.”• He was sentenced to 25 years in prison and came to be seen as a corporate villain alongside Jeff Skilling of Enron and Dennis Kozlowski of Tyco.• Mr. Ebbers was released from a federal prison in Texas in December after his lawyers and family members said his health was deteriorating.

The speed read

Deals• The financial services company Worldline agreed to buy Ingencio, a big maker of point-of-sale payment terminals, for $8.6 billion. (TechCrunch)• The bankrupt retailer Forever 21 agreed to sell itself to two major landlords and Authentic Brands for $81 million, subject to higher offers. (WSJ)• Asana, the productivity software company co-founded by a founder of Facebook, filed to go public through a direct listing of its shares. (TechCrunch)Politics and policy• The U.S. auto industry wanted more lenient emissions rules. Instead, it got chaos. (WSJ)• Britain plans to ban the sale of new gas- and diesel-powered cars by 2035. (BBC)• Washington is again abuzz with speculation over the identity of the anonymous Trump administration official who wrote an NYT Opinion piece and a book criticizing Mr. Trump. (Politico)Tech• Recent earnings reports show that the tech industry is increasingly divided between a few big giants and everyone else. (NYT)• Makan Delrahim, the Justice Department’s antitrust chief, is said to have recused himself from the department’s competition review of Google because of past work he did for the company. (NYT)• Drew Houston, the C.E.O. of Dropbox and a friend of Mark Zuckerberg’s, has joined Facebook’s board. (Business Insider)• Democrats may be taking shots at the tech industry, but Silicon Valley moguls are still among their biggest donors. (Recode)Best of the rest• Citigroup reportedly suspended a senior bond trader in London over accusations of theft from the office cafeteria. (FT)• The conservative radio host Rush Limbaugh said he had advanced lung cancer. (NYT)• The Super Bowl broadcast on Fox drew 102 million viewers, up slightly from last year. (Bloomberg)Thanks for reading! We’ll see you tomorrow.We’d love your feedback. Please email thoughts and suggestions to [email protected]. Read the full article

#1augustnews#247news#5g570newspaper#660closings#702news#8paradesouth#911fox#abc90seconds#adamuzialkodaily#atoactivitystatement#atobenchmarks#atocodes#atocontact#atoportal#atoportaltaxreturn#attnews#bbnews#bbcnews#bbcpresenters#bigcrossword#bigmoney#bigwxiaomi#bloomberg8001zürich#bmbargainsnews#business#business0balancetransfer#business0062#business0062conestoga#business02#business0450pastpapers

0 notes

Text

DealBook: A Peek Inside YouTube’s Money Machine

Good morning. Silicon Valley is buzzing over Sheryl Sandberg’s engagement, nearly five years after the death of her husband, Dave Goldberg. (Was this email forwarded to you? Sign up here.)

Alphabet draws back a curtain on YouTube’s billions

The tech giant surprised Wall Street yesterday when it offered some financial information about YouTube, long a closely guarded secret. But the new information was part of a quarterly report from Alphabet, the parent company, that didn’t meet investor expectations.

YouTube collected over $15 billion in revenue last year, which Rob Copeland of the WSJ says was on the “lower end of projections.” It suggests that YouTube took in less than $8 a year from each of its two billion users.

• YouTube’s revenue figure is higher than Viacom’s for its 2019 fiscal year, our colleague Kevin Roose points out.

• But Alphabet didn’t say how much profit YouTube earned.

• And our colleague Shira Ovide notes that YouTube reported “gross” revenue — which includes the money that the service pays out to content creators and is not the whole financial picture.

Investors weren’t impressed, and Alphabet shares fell 2.7 percent in after-hours trading. The company’s overall revenue growth was less than expected, while its losses from its “moonshot” projects increased 53 percent.

Still, the limited disclosure introduces some transparency to tech giant financials, Ms. Ovide adds. What if Alphabet’s move successfully puts pressure on Microsoft to break out its Azure cloud sales, or on Facebook to disclose Instagram’s revenue?

____________________________

Today’s DealBook Briefing was written by Andrew Ross Sorkin in New York and Michael J. de la Merced in London.

____________________________

We still don’t have an Iowa caucus winner

Blame new reporting results, a faulty app or some other factor, but as of this moment there are still no results from the Iowa Democratic caucuses.

The official line: “A spokeswoman for the state party said there was no issue with the integrity of the vote but it was taking longer than anticipated to collect and check the reported data for irregularities,” Alex Burns and Jonathan Martin of the NYT write.

One potential culprit is a new app being used to report caucus results. It was created by Shadow, a tech company affiliated with a prominent Democratic nonprofit, Acronym. (Our colleague Sheera Frenkel says poor training on how to use the app, not a hack, appears to be at fault.)

What we are watching for:

• Whether Bernie Sanders, who has been surging in the polls, will officially become the front-runner for the Democratic Party nomination.

• How Democratic business leaders will respond. If Joe Biden underperforms in Iowa, will they flock to, say, Mike Bloomberg, Pete Buttigieg or Amy Klobuchar?

An event to watch: Top Wall Street executives are planning a fund-raiser for Mr. Biden in New York on Feb. 13, with entry at $2,800 a head, according to an invitation we have seen. Organizers include Roger Altman of Evercore; Blair Effron of Centerview Partners; Marc Lasry of Avenue Capital; and Faiza Saeed and Christine Varney of Cravath, Swaine & Moore.

OPEC weighs effects of coronavirus on oil prices

The group is meeting today and tomorrow to figure out a response to the Wuhan coronavirus outbreak, which has pushed down oil prices, Stanley Reed of the NYT reports.

• The epidemic has reduced demand from China and affected other big consumers of oil, like airlines.

• OPEC is expected to discuss whether to cut production by up to a million barrels a day, Mr. Reed adds.

• It may also push an emergency minister-level meeting to this month, several weeks ahead of schedule.

The group is moving because oil prices keep dropping. The price of Brent crude has fallen about 19 percent over the past month to less than $55 a barrel, erasing the effects of a production cut announced in December.

But there’s not much OPEC can do. One oil trader estimated that Chinese oil demand over the last two weeks has fallen about 2.5 million barrels a day, or close to 20 percent compared with the previous year. And China has cut the size of its March orders from Saudi Arabia.

More: The outbreak is likely to delay China’s ability to meet targets in the recent trade deal with the U.S. And the Chinese authorities’ efforts to halt the disease’s spread have turned neighbor against neighbor.

Goldman’s latest bid for Main Street: Amazon loans

First Goldman Sachs partnered with Apple on a credit card. Now it may work with Amazon to lend to small businesses as it tries to become a more mainstream financial giant, writes Laura Noonan of the FT.

• “Goldman has begun building technology to facilitate the offering of loans to small and medium-sized businesses over Amazon’s lending platform,” Ms. Noonan writes, citing unnamed sources.

• Goldman has sought to push beyond M.&A. advice and trading into other businesses, like consumer banking, wealth management and lending.

• Amazon would benefit, too: It could expand its services for merchants without having to take on additional risk.

Are regulators dashing start-ups’ dreams?

There’s potentially a lot at stake as the Federal Trade Commission sues to block the $1.4 billion sale of the upstart shaving brand Harry’s to Edgewell, the owner of Schick — including the fate of many start-ups.

• The F.T.C. argues that the deal would “eliminate one of the most important competitive forces in the shaving industry.”

• Over its nine years, Harry’s grew in popularity by selling sleekly styled razors online and in stores, chipping away at the market share of Gillette and Schick.

• Harry’s “has forced its rivals to offer lower prices, and more options, to consumers across the country,” said Daniel Francis, the deputy director of the F.T.C.’s Bureau of Competition.

Harry’s founders said they were disappointed by the move. They told Michael last year that they had considered going public and remaining independent, but decided that selling to Edgewell was the best way to keep growing.

This could spell trouble for other start-ups. Many investors support them in the hope that they will either sell themselves or hold an I.P.O. Not all start-ups can go public, so preventing them from selling to bigger rivals could deter investors from backing them in the first place.

Bernie Ebbers, ex-WorldCom C.E.O., is dead

Mr. Ebbers, who built a telecom giant only to go to prison after its collapse after the dot-com boom and become a symbol of corporate greed, died on Sunday. He was 78.

• He turned his small Mississippi company into WorldCom through more than 40 takeovers, including the $37 billion acquisition of MCI, Kit Seelye and Daniel Victor of the NYT write.

• But WorldCom collapsed in 2002 — its bankruptcy was the biggest ever in the U.S. at that time — and Mr. Ebbers was later arrested on charges of corporate fraud.

• “Former employees testified that Mr. Ebbers had urged them to inflate WorldCom’s financial results to make the company appear more profitable than it was.”

• He was sentenced to 25 years in prison and came to be seen as a corporate villain alongside Jeff Skilling of Enron and Dennis Kozlowski of Tyco.

• Mr. Ebbers was released from a federal prison in Texas in December after his lawyers and family members said his health was deteriorating.

The speed read

Deals

• The financial services company Worldline agreed to buy Ingencio, a big maker of point-of-sale payment terminals, for $8.6 billion. (TechCrunch)

• The bankrupt retailer Forever 21 agreed to sell itself to two major landlords and Authentic Brands for $81 million, subject to higher offers. (WSJ)

• Asana, the productivity software company co-founded by a founder of Facebook, filed to go public through a direct listing of its shares. (TechCrunch)

Politics and policy

• The U.S. auto industry wanted more lenient emissions rules. Instead, it got chaos. (WSJ)

• Britain plans to ban the sale of new gas- and diesel-powered cars by 2035. (BBC)

• Washington is again abuzz with speculation over the identity of the anonymous Trump administration official who wrote an NYT Opinion piece and a book criticizing Mr. Trump. (Politico)

Tech

• Recent earnings reports show that the tech industry is increasingly divided between a few big giants and everyone else. (NYT)

• Makan Delrahim, the Justice Department’s antitrust chief, is said to have recused himself from the department’s competition review of Google because of past work he did for the company. (NYT)

• Drew Houston, the C.E.O. of Dropbox and a friend of Mark Zuckerberg’s, has joined Facebook’s board. (Business Insider)

• Democrats may be taking shots at the tech industry, but Silicon Valley moguls are still among their biggest donors. (Recode)

Best of the rest

• Citigroup reportedly suspended a senior bond trader in London over accusations of theft from the office cafeteria. (FT)

• The conservative radio host Rush Limbaugh said he had advanced lung cancer. (NYT)

• The Super Bowl broadcast on Fox drew 102 million viewers, up slightly from last year. (Bloomberg)

Thanks for reading! We’ll see you tomorrow.

We’d love your feedback. Please email thoughts and suggestions to [email protected].

from WordPress https://mastcomm.com/dealbook-a-peek-inside-youtubes-money-machine/

0 notes

Text

Mortgage relief scammers hit with $18.5 million judgment

Owning a home has long been a symbol of the American dream.

For some, however, homeownership turns into a nightmare.

Those horrid homeowner dreams became evident in the Great Recession.

In the late 1990s through the mid-2000s, artificially high home prices, questionable lending practices and an explosion of subprime mortgages to buyers who under regular lending standards would not have been given a home loan, created a housing bubble.

It finally burst in 2007, leaving many homeowners broke as the loans on their properties suddenly were many thousands more than their homes were worth.

Many went into foreclosure or walked away from their financially underwater properties.

Others were able to refinance their loans or have some of the debt forgiven by the lenders. These options, while preferable for many, did produce some tax issues that will be discussed a bit later in this post.

Guilty of scamming over-leveraged homeowners: The bottom line, both financially and emotionally, was that these desperate homeowners were just trying to hang onto their homes.

That made them prime targets for scammers.

Now it's some of those scam operators who are paying the price.

The U.S. District Court for the District of Nevada last month slapped the operators of a mortgage relief scheme with an almost $18.5 million judgment.

The precise court-ordered fine is $18,428,370. That's also this week's early By the Numbers honoree.

False claims aimed at desperate homeowners: The scammers deceived financially distressed homeowners by falsely promising to make their mortgages more affordable, according to court documents and the Federal Trade Commission's (FTC) Dec. 30, 2019, announcement of the ruling.

The companies also charged consumers illegal advance fees and unlawfully told consumers not to pay their mortgages to or communicate with their lenders.

In the original charges filed in January 2018 by the FTC, the defendant companies and their operators typically charged consumers $3,900 in unlawful advance fees, to be paid in $650 monthly installments.

The FTC charged that the mortgage relief scheme promised that the money would go toward providing the homeowners with expert legal assistance, which the companies touted as having a near 100 percent success record. They also allegedly misrepresented they would cut homeowners' interest rates in half and reduce their monthly mortgage payments by hundreds of dollars, according to the FTC.

"In many instances, consumers paid hundreds or thousands of dollars only to learn that the defendants had not obtained the promised loan modifications, and in some cases had never even contacted the lenders," said in announcing its case almost two years ago. "As a result, many people incurred substantial interest charges and other penalties for paying the defendants instead of their mortgage payments, and some lost their homes to foreclosure."

Bank accounts, other assets confiscated: In order to help satisfy the Nevada federal court's $18.5 million judgment, the contents of numerous bank accounts also have been ordered to be turned over to the FTC.

Additionally, the court ordered that assets belonging to the defendants, including an office building, ski chalet in Park City, Utah, and two luxury vehicles also will be sold by the federal government.

These funds then can be used by the FTC to provide compensation to the homeowners affected by the mortgage relief scheme.

Finally, U.S. District Judge James C. Mahan's final order granting the FTC's motion for summary judgment also states that "the defendants will be permanently banned from the debt relief business and will be banned from misleading consumers about the terms of other financial services they may offer, as well as from making misleading claims in advertisements."

The defendants subject to the order are Preferred Law PLLC; Consumer Defense LLC (Nevada); Consumer Defense LLC (Utah); Consumer Link Inc.; American Home Loan Counselors; American Home Loans LLC; Consumer Defense Group LLC, formerly known as Modification Review Board LLC; Brown Legal Inc.; AM Property Management LLC; FMG Partners LLC; Zinly LLC; Jonathan P. Hanley; and Sandra X. Hanley.

Legitimate mortgage and tax relief: Reworking a mortgage's terms so that the homeowners can keep the property is legal.

In some of these cases, the lender also agrees to write off, or forgive, a portion of the original loan amount to account for the new, much lower value of the property.

Tax law says that loan forgiveness, be it for a mortgage or consumer credit card, is considered to be income for the person who had his or her debt suddenly lessened.

If you're having a couple thousand in Visa or Mastercard debt forgiven, the tax bill might not be that big. Plus, you no longer have to worry about those payments, so for many it's an acceptable price to pay.

But when you're talking tens of thousands in a home loan, the tax bill can be daunting.

So in the wake of the bursting housing bubble and ensuing recession, Congress offered some tax relief for homeowners seeking ways to rework their mortgages so they could keep their houses.

The Mortgage Forgiveness Debt Relief Act was enacted on Dec. 20, 2007, allowing certain homeowners to avoid taxes on the portion of a mortgage that is partly or entirely forgiven when the lender restructures the loan or the property goes into foreclosure.

The law was designed to be temporary, providing short-term relief to help struggling homeowners (and the housing industry) recover during the economic downturn of the late 2000s.

But the provisions, part of the perpetually expiring tax breaks known as extenders, has been renewed repeatedly since their creation more than a dozen years ago. The latest extension was granted as part of the federal spending measure signed on Dec. 22, 2019.

Now the amount of a forgiven mortgage remains tax free through 2020.

If you do find yourself needing to restructure your home loan to avoid foreclosure, make sure you find reputable help in setting up your new mortgage.

Your best bet generally is to start with the lender that currently owns our loan.

If, however, that route isn't feasible and you are contacted by a company or person offering to help you save your home by restructuring your loan, check them out thoroughly. The FTC has additional information on mortgage relief scams and how to avoid them.

You also might find these items of interest:

4 tax law changes home buyers need to heed

Will your state make you pay up on forgiven federal mortgage debt?

Missouri county property tax collector refuses to be nickeled (or, presumably dimed)

Advertisements

// <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ (adsbygoogle = window.adsbygoogle || []).push({}); // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]>

0 notes

Text

UK Payday Loan Lender Fined For Fraudulent Practices

Payday loans online do help when fico scores are looking bad. Even after bankruptcy, you can still get a payday loan online encourage with emergency costs. It is good bluelineloan.com that you have a destination to go to get some good an easy loan, but rebuilding your credit ought to be your main focus. In order to start rebuilding, a fantastic spot to start is with a secured credit card. One of the best helpful information on free television is, of course, the internet. Several sites provide the latest episodes of popular T.V. shows, helping you to maintain your latest broadcasts and never having to go to a payday lender. In fact, many channels will post new episodes onto their sites your day as soon as they air, including many primetime networks like ABC, NBC, and CBS, where you can find full instances of your favorite shows such asThe Big Bang Theory, Grey's Anatomy, and The Office. For South Park fans, Trey Parker and Matt Stone have allowed for every episode to be shown on South Park Studios. Be warned that these episodes are presented uncensored, so if you feel already offended by the bleeped out versions then this website isn't to suit your needs. An effective APR will be the actual sum of money you will pay on a loan when considering all factors. These factors include fees and compound interest. The compound interest is interest put into the principle amount, thus gathering interest also. For example, if you have the above loan of $100 and possess accrued an extra $10 in interest, the $10 gets put into the entire principle so that you will are in possession of $110 at the %15 percent rate, thus raising the cost you could pay in a year by $1.50. Of course $1.50 is not a tremendous amount, but understand that the higher the amount of the borrowed funds, the higher the discrepancy is going to be between your nominal APR as well as the effective APR. A responsible payday lender is going to take time for you to explain all fees included in a payday loan or advance loan. Other creditors who bill monthly could have their APRs calculated for 12 payments per year. Their term monthly interest is often lower while they expect the repayments to be time consuming over a few years. They can afford to set the interest rate low because of the longevity from the payback period. They earn their revenue over time. Getting references from friends, relatives or colleagues that have utilized the assistance of a cash payday loan provider can help you in enabling instant cash. You can get helpful tips about providers of pay day loans using the assurance of knowing anyone who has gone through the experience. Visiting the Better Business Bureau's how do people determine if you'll find any grievances against the lender can help you steer clear of predatory lenders. Reading opinions and reviews about lenders may help a whole lot at the same time being that these are usually published by people who may have went through the lender to borrow. Even those who can not borrow loans due to their weak credit score score may apply for cash loans or pay day without any hesitation. Despite the fact that they are governed by state laws, the curiosity rates they cost are a whole bunch, sure hundreds, of times greater than what a bank or credit union would charge. That's because some companies supply loans solely to people with checking accounts and even fewer supply people greater than 14 days to repay their loans. Do cleansing and searching for elderly individuals who cannot get their purchasing by themselves if you bought a automotive or drive them to their doctor's appointments. Folks that live from pay test to pay check may often discover themselves in this example when their automotive wants restore or they get sick and should see a physician. Many use their cash loan for home improvements, gifts, payments, automobile repairs, holidays, lodge prices, clothes, food and a number of different causes. There are as many reasons for stumbling as there are folks and we're every distinctive in the truth that we've got our personal set of expectations and our own motion/reaction to circumstances. As soon as we are able to see that once we avail these loans to fulfill our monetary necessities they've been created for, individuals never be any issue.

Both the secured private loan and the unsecured private mortgage can take from anywhere from a couple of days to a week or extra to get both accepted or rejected. How fast can competitors catch up? It doesn't matter what form of crediting you select - with our service, you're going to get quick money, comprehensible phrases and circumstances and no hidden charges are required. You're going to submit an application on the net giving your paycheck info, checking account information and references. So, you should have an account where the money shall be deposited to make it easy for you and the lender. It's always in your interest to look round for the lender who is beneficial to mitigate your credit situation by providing you poor credit score loans on instantaneous resolution. Whereas we will never condone blanket censorship of promoting, on steadiness, the choice to ban this advert was the one truthful and just thing to do. We are going to always let you already know what you will need to pay and when, earlier than making a decision to borrow from us and all through your time as a buyer with us.

By way of availing checkless payday loans, there are few terms and conditions that you want to meet at the time of availing loan. The applying process for a free payday loan is straightforward; no faxing is required. To be absolutely clear, the price of a Payday loan with Uncle Buck is clearly shown on our loans calculator and within the documentation, you receive prior to funding your loan. A scholar mortgage is means of borrowing money to assist with the price of your greater training. With the financial state of affairs the best way it's now and folks hardly making it from verify to verify, it occurs all too typically. Discover free, confidential recommendation now utilizing our free debt advice locator instrument. What's extra, they work in their offices using their instruments and staff. If you're not sure, get some advice from a credit counselor or debt advisor. Although it by no means hurts to have an excellent credit rating, getting a mortgage with unhealthy credit score is just not one thing you've gotten to worry about.

We now have good news for you! Have pressing lined up needs to fulfill? Normally, you only have to have a device with an Internet connection. The money you have got in your financial savings account will then turn into the loan's security. The loan amount is withdrawn from my account and the next fee on the loan from the borrower can be deposited again into my account with interest. Flexibility - Usually, the amount you owe is immediately debited out of your bank account when the repayment time period expires. Each month you'll receive one dollar of principle with 5% curiosity added as cash again into your account. The whole means of getting one of those loans is very expedient to say the least. One of the foremost vital problems regarding the day loan is that the exceptionally high ranges of interest that every will accrue. Earlier than agreeing to your borrowed funds, study whether you'll be satisfied with the repayment terms together with curiosity.

Don't be surprised if you end up having to pay back twice as a lot cash from your quick private loan, after you add within the interest expenses. After all, in terms of looking for a big private loan, having a large sufficient income and a healthy debt-to-earnings ratio is way more important. This means that a person often cannot borrow greater than his revenue. Take the time to make use of the Internet not only to hunt down potential loans however to learn reviews relating to potential banks. Publisher: Kevin Simpson In the mortgage world, it is the banks who're the most important lenders. The web utility takes very much less time as you might be required to complete a easy type. As per your financial necessities, you're versatile to use for such loan. A cosigner is probably the very best possibility, and positively makes, securing mortgage approval much easier. It's because the loan is granted on the again of an upcoming paycheck.

0 notes

Text

2018 In Review: Top New Startups That Made The Most Buzz This Year

This article is part of Inc42’s special year-end series — 2018 In Review — in which we will refresh your memory on the major developments in the Indian startup ecosystem and their impact on various stakeholders — from entrepreneurs to investors. Find more stories from this series here.

Indian entrepreneurs have been on a roll this past year. The Indian startup ecosystem is brimming with business ideas that continue to enamour investors as well as the global ecosystem.

On one hand, we have prodigies exploring entrepreneurship and people leaving their jobs to turn an idea they’re passionate about into reality. Meanwhile, there are others marking second (or even third) coming, leaving no stone unturned to outdo their last best product or service in the sector.

In 2017, we saw many disruptive ideas that ignited investor, consumer, and business interest. Some of the top startups in India even made it to 42Next by Inc42 — the coveted list of India’s most innovative startups in recent times. This includes InMobi cofounder Amit Gupta’s IoT-based dockless bikes startup Yulu, Mumbai-based deeptech startup ION Energy, and Bengaluru-based digital media startup Clip.

An analysis by Inc42 Datalabs found that in 2018, nearly 3,000 startups joined the Indian startup ecosystem.

Now, as the year comes to a close, we’re bringing to you the best and most innovative startups launched in 2018. Being right at the centre of the Indian startup ecosystem with an eye on every new startup that raises its head, we, at Inc42, are just in the right place to judge which ones disrupted the industry and made a mark.

This list was prepared after evaluating the top startups in India launched in 2018 on criteria such as competition, innovation, funding, customer reviews, traction, leadership, team, and growth rate, among others.

So, here’s presenting the hottest startups of 2018:

INDwealth: An AI-based Personal Financial Adviser

Ten years after launching his first startup — online travel venture Ibibo — Ashish Kashyap exited the group in late 2017. Ibibo was acquired by MakeMyTrip in 2016 for $720 Mn. After his big exit, Kashyap was out of sight but was working on INDwealth, a wealth management startup which will enable users to manage their “financial future”.

At INDwealth, Kashyap and his team are building a personal financial advisory agent, which will offer advice across asset classes, loans, and tax management. INDwealth will offer a full-stack service, re-balancing recommendations on investments based on data analytics.

In October, INDwealth was introduced to the world when Steadview Capital invested $30 Mn in the company. At that time, Kashyap told Inc42 that the product was close to completion. He added they were planning to test it till the launch of the platform on the web, Android, and ioS in January 2019.

There are about 150K families in India with a wealth of $3.56 Mn (INR 25 Cr) or more each, according to industry estimates. This is expected to rise to 500K by 2025. Cumulative wealth will increase to $7.1 Tn(INR 500 Tn) by 2025 from now.

With the product launch just a month away, Kashyap has a lot of work ahead of him. The industry, meanwhile, is looking forward to the launch of INDwealth given Kashyap’s reputation for delivering market-changers.

CRED: Rewarding Good Credit Behaviour

Freecharge founder Kunal Shah is making credit card bill payment a smooth and delightful task. At least, that’s what the users of CRED say. CRED is a members-only app which rewards you with exclusive rewards for paying your credit card bill.

Shah is a serial entrepreneur, having launched ventures such as PaisaBack (2010), which runs cashback and promotional discount campaigns for retailers, and Freecharge (2011), a coupon-based app for mobile recharge. FreeCharge got a decent exit to Snapdeal for $450 Mn and was later sold to Axis Bank for $60 Mn.

After angel investing and mentoring startups for a while, Shah got back to entrepreneurship with CRED. His new startup is tapping into a lucrative space as till September 2018, 41.7 Mn Credit cards had been issued in India.

CRED marked its start with a $25 Mn funding from Sequoia, Ribbit Capital, and Ru-net. The startup has a 50-member team and has already garnered positive reviews for its UI/UX, easy onboarding, and rewards system. The company offers its services to select users who have a CIBIL score of above 750.

Interestingly, CRED has also signed up with brands like BookMyShow, ixigo, etc, to provide exclusive rewards to its users.

The plan for the company, in the long run, is to build its consumer base through credit card bill payments and rewards and then develop high-end loyalty and offer other services, including insurance.

Focused on scaling CRED at the moment, Shah has put plans for developing a revenue model on the backburner and is looking to think about it only a year down the line. He is currently working on getting the credit card generation warmed up to CRED with a view to build the base for a revenue opportunity of $1-10 per customer.

Cube Wealth: Helping Create And Manage Wealth

Satyen Kothari made his mark in the Indian startup ecosystem in 2011 when he launched payments company Citrus Pay, which he sold to PayU India in 2016 for $130 Mn in an all-cash deal.

This year, he ventured back into the ecosystem with his new venture, Cube Wealth, a subscription-based automated wealthtech app that helps customers plan their finances. It enables users to connect with an investment adviser to help them do their financial planning.

The startup raised $2 Mn in funding from international angel investors and seed investors from Silicon Valley, Hong Kong, Europe, Singapore, and India, including Beenext.

Cube Wealth has three key offerings — personalised recommendations from advisors; diversified asset classes including liquid, mutual funds, equities, P2P lending, gold; and automated monthly investments. It also offers a private WhatsApp wealth concierge service for premium members.

Over the last few years, individual investors have increasingly expanded their portfolios to include diverse financial instruments, beyond debt. According to the IBEF, the mutual funds industry in India has seen rapid growth in its total AUM which stood at $375.9 Bn between April – August 2018.

Cube Wealth was also part of the 2018 edition of the most coveted list of India’s most innovative startups — 42Next by Inc42.

Hospals: A One-Stop Shop For Medical Tourists

Yebhi cofounder and Paytm’s ex-VP Danish Ahmed launched his new venture — a medical tourism startup called Hospals — along with cofounders Obaidullah and Alok Kumar, who were the CEO and COO (respectively) of Al-Shifa, a Delhi-based medical tourism company.

Ahmed saw success with his first venture, Yebhi.com, which he founded when he was just 21. Yebhi went on to raise $40 Mn and later sold its operations to Flipkart, now a Walmart company.

In 2015, Ahmed started his second venture, Shopsity, which was acquired by Paytm in 2016. He joined the digital payments company as vice president, omnichannel commerce. In April 2015, he also launched a startup called Feedsomeone, a mobile-based charity.

His new venture, Hospals, offers end-to-end hospital services to medical tourists in India through its online platform, connecting them with the best hospitals, helping arrange long-stay accommodation, and providing other services. The platform also offers value-added services such as managed cabs, hotel and flight bookings, etc, besides auxiliary services such as estimates of medical procedures, visa service, and translators, among others.

Hospals raised $1.5 Mn in funding from Spiral Ventures and Venture Catalysts (VCats) and is targeting a gross merchandise value (GMV) of $10 Mn by the year-end.

The startup is already managing more than 200 patients per month and claims to have served over 6,000 patients from 14 countries. It has already expanded across former-Commonwealth of Independent States (CIS) countries.

Cross-border healthcare is a $100 Bn market globally. India, the fastest-growing country in this space, is expected to generate $9 Bn in revenues by 2020.

Nuo: Loans For Crypto-enthusiasts

Founded by Varun Deshpande, Ratnesh Ray, and Siddharth Verma, Nuo is a decentralised crypto banking platform for emerging markets. It acts as a financial control centre to store, spend, and manage any cryptocurrency of your choice.