#US 10-year Treasury notes

Explore tagged Tumblr posts

Text

[ wip, workin on colors ehehe ]

timeskip zero gang!!

(check my "sv timeskip" tag for more info on them :3)

#pokemon#pokemon scarlet violet#pokemon sv#sv timeskip#my art#wip#notes from prev posts abt it + extras:#10 years after game events (scarlet + htaz specifically)#ages - arven 27 nemona 26 penny 24 florian 23#arven's a part time chef at treasury eatery#nemona's top champion (rika takes over chairman duties)#penny's starting a tech security company (while also doing#florian's an adventurer and amateur archaelogist/paleontologist#arven/nemona are engaged but still call each other my wife (arven's been agender butch lesbianified)#(they're also trying to figure out regulations to allow for safe use of paradox pokemon in league battles)#florian's been in an ldr w kieran for a while now#penny has an on/off deal with carmine she doesn't really talk about much#team's gotta come back together to find out why the time machine's back on - why they can't access the zero lab anymore#and why there are robotic pokemon showing up in area zero + paldea

25 notes

·

View notes

Text

Musk's team to investigate employees with 'questionable' wealth as Trump orders hiring restrictions at federal agencies

During a meeting with Trump in the Oval Office of the White House on February 11, EST, Musk told the press that his team at the Department of Government Efficiency would investigate federal employees whose relatively low pay has skyrocketed their net worth.

The theme of the press conference that day was federal agency reform. Trump revealed that he had signed an executive order requiring federal agencies to work with the Department of Governmental Efficiency to continue to implement large-scale layoff programs, as well as severely restrict hiring. Components of agencies (or the agencies themselves) may be eliminated or consolidated because they are performing illegal functions. Additionally, there will be one new hire for every four departing employees, except in the areas of immigration, law enforcement and public safety.

Trump also urged Musk's team to investigate “the woman who rolled up about $30 million” during the conversation. Some analysts noted that he appeared to be alluding to Bauer, the administrator of the U.S. Agency for International Development, whom he has suspended. Bauer's annual salary was close to $250,000, but his net worth soared to $30 million during his tenure.

The U.S. Agency for International Development (USAID) is one of the most important tools of U.S. foreign “soft power,” exporting its influence and American values, especially to Third World countries, including support for a variety of foreign NGOs, media organizations, academic programs, and scientific research projects. In the last fiscal year, the agency received more than $70 billion in available funds, of which perhaps only 10 percent was actually used for aid programs.

Musk then responded that there are actually a number of people in federal agencies who are paid only a few hundred thousand dollars but have amassed tens of millions of dollars in net worth during their tenure in their positions. That seems mysterious. I think they got rich on the taxpayers' dime.

Since the day he entered the White House, Trump has empowered Musk and his Department of Government Efficiency to make sweeping cuts to federal agencies and employees that have particularly impressed his supporters. As Musk's team continues to begin obtaining information from agencies such as the Department of the Treasury, the U.S. Agency for International Development, and the U.S. Office of Personnel Management, its claims will soon unravel the corruption that lies hidden in the mists of the multilayered organization. Next up for Musk's upcoming audits are the Departments of Defense and Education.

But his actions have meanwhile created a huge wave of opposition among his political opponents. Former Treasury Secretary Summers has argued that Musk and the Department of Governmental Efficiency exceeded their authority and violated professional ethics by accessing the Treasury's payment system. Musk has not publicly explained how his team obtained data on the net worth of officials. Senator Elizabeth Warren, a Democrat from Massachusetts, accused Musk of a power grab, and that these “cost-cutting and efficiency measures” had a serious impact on the normal operation of the government.

27 notes

·

View notes

Text

On Wednesday, Donald Trump declared economic war on the world. Using emergency powers in ways never envisioned by Congress, spinning a history of supposed exploitation by friend and foe, and making up fantastical numbers to quantify his grievances, the U.S. president in one afternoon tore up nearly a century’s worth of efforts to build a mostly peaceful and prosperous global economic order.

Whatever is written from here on about Trump, the word “conservative” should never again be attached to his name—he is a revolutionary, tearing down the old order and watching from the comfortable perch of his wealth and power to see where the pieces land. The question now is whether the rest of the country—Congress, the courts, the American people—will follow him into the abyss.

As the whole world knows by now, Trump has reversed decades of U.S. support for freer trade that had enabled an extraordinary period of global prosperity. In its place, he marched the United States all the way back into the 19th century—when, he noted in glowing terms, the U.S. Treasury was financed in good part by tariffs rather than income taxes. As of April 5, under his latest executive order, all imported goods will face a tariff of at least 10 percent, and as of April 9, most will face much stiffer rates, as high as 49 percent. Using calculations that exist only in the fevered dreams of his advisors, Trump announced “reciprocal” tariffs on most U.S. trading partners—penalties meant to partially offset (��We are being very kind,” he said on Wednesday) the harm supposedly done to the U.S. economy by unfair foreign trading practices.

According to World Trade Organization figures, the European Union’s trade-weighted average import tariff is just 2.7 percent. But by mashing together tariffs along with various regulatory barriers and the imaginary discriminatory effects of European value-added taxes (which apply to purchases regardless of origin), the wildly fabulating president claimed an effective EU tariff on U.S. goods of 39 percent. Magnanimously, he said, Europe will face only a 20 percent tariff on future exports to the United States.

The actual calculations appear to have been made using kindergarten arithmetic. After Trump’s Rose Garden speech, the White House confirmed that the new tariff rates were derived from a simple calculation of the size of the U.S. trade deficit with each country—a methodology with no basis in any economic research whatsoever on how trade deficits are caused.

For those keeping score, some of the biggest losers are the countries that have benefited most from the efforts during the first Trump and Biden administrations to force supply chains to move out of China. Malaysia will face a 24 percent tariff, Thailand 36 percent, Vietnam 46 percent, and Cambodia 49 percent. That is nearly as high as the 54 percent total tariff that China will now face, though for some Chinese goods it will be higher. The United States has not charged broadly based tariffs at such levels since the 1930s and then only for a few years.

The relative winners, if there are any, may be the North American trading partners that Trump has threatened most since taking office—including economic coercion aimed at forcing Canada to become the “51st state.” Canada and Mexico will not face any additional duties, although they have already been hit with 25 percent tariffs on steel and aluminum and the United States has launched “national security” trade investigations into lumber and copper exports that will likely result in additional duties. U.S. importers of Canadian and Mexican products will also continue to pay the 25 percent tariff already imposed on goods not fully compliant with the U.S.-Mexico-Canada Agreement and will be partially hit by a new 25 percent tariff on auto imports effective April 3. That tariff will especially hurt Japanese and South Korean auto exports, but importers of North American-made cars will still be charged the tariff on the “non-U.S. content” in vehicles from Canada and Mexico—an egregious violation of Trump’s own trade agreement with these countries, in case anyone is still paying attention.

The announcement should end any debate over whether Trump wants to use tariffs as a cudgel to negotiate reductions in trade protection abroad. He made it clear that he intends them to be more-or-less permanent. While there may be some room for negotiated deals, Trump used his entire Rose Garden speech to tout the virtues of tariffs as a tool to force manufacturing to locate in the United States to bypass the tariff wall—and to raise revenue to reduce the national debt and enable other taxes to be cut. So ends the wishful thinking of America’s corporate leaders, most of whom believed until Wednesday afternoon that this was all a clever negotiating ploy by a business-friendly president to free up trade. U.S. stock markets have responded accordingly.

Retaliation from other countries is certain, and it’s hard to predict what forms it will take. American farmers will likely pay the highest price as always, but the complete abandonment of all trade rules and norms by the United States means nothing is off the table. Expect measures aimed at harming the technology sector and other centers of U.S. economic power.

But Trump’s convictions on trade are so deep-seated—beliefs he has held for 40 years or more despite enormous changes in the world—that retaliation by the same foreign countries he is convinced wish to harm the United States is unlikely to be effective. The more relevant question is whether he has finally gone too far even for his own supporters.

Trade is not the glamorous issue over which one might have expected a grand struggle over U.S. democracy and the meaning of the Constitution, but that is what is about to ensue. The Constitution could not be clearer that regulating foreign commerce rests in the hands of Congress; Trump’s use of emergency authorities to set punishing tariffs is an egregious violation of the constitutional separation of powers. If the United States remains a functioning democracy—an increasingly big if—then Trump’s actions will not stand. The courts may strike some or all of it down, although the weeks and months these court cases could take would wreak economic havoc in much of the world.

Trump may have gone too far even for the most feckless Congress in U.S. history. On Wednesday night, the Senate—with four Republicans defecting from their leader—passed legislation to terminate Trump’s Jan. 22 “national emergency” declaration, which he used to slap tariffs on Canada. The House of Representatives will not follow quickly; there still seems to be naive hope among Republicans in the lower chamber that Trump will find negotiated resolutions that remove the tariffs. U.S. Rep. Jason Smith, the head of the once powerful Ways and Means Committee, said on Wednesday that the strategy “mirrors President Trump’s successful negotiating approach during his first term.”

Such illusions will fall away as members start hearing from all the small and large manufacturers, retailers, restaurants, auto dealers, farmers, and others in their districts whose profits will be swallowed by the new tariffs. And they will hear from constituents as prices for groceries, cars, and appliances soar. Special House votes in Florida and a Wisconsin Supreme Court vote on Tuesday showed that voter support for Republicans has crashed in the 10 weeks since Trump took office. Political survival will force some Republicans to take a stand.

These are the optimistic scenarios. When the United States last imposed tariffs of similar magnitude in the 1930s, the country and the world were much simpler places. Most trade was finished products going from one country to another, not the modern world of intricately linked supply chains in which components move back and forth across borders. The effects of the new tariffs could be magnified far beyond what the headline numbers suggest. Simply attempting to collect the duties could prove impossible. For the past century, U.S. Customs officials have had no need to verify the “origin” of most products, except for those in free trade areas, because all imports paid the same “most favored nation” tariff rates. Cross-border commerce may grind to a halt while the new system is implemented.

And no one in the White House has the slightest idea how economically disruptive—and politically destabilizing—the tariffs could be for all the developing countries that optimistically signed on to the U.S. vision of a rules-based global trading system. The last time the world’s major powers walked this far down the road to autarky was in the 1930s, and what followed shortly thereafter was the greatest conflagration the world has ever known. Things might turn out better this time. Or they might not.

21 notes

·

View notes

Text

Nick Visser at HuffPost:

A top adviser to President-elect Donald Trump allegedly tried to profit from his relationship with the new administration, asking potential appointees for large retainer fees in exchange for promoting them to get plum jobs, according to multiple reports on Monday. An internal investigation by Trump’s own attorneys concluded Boris Epshteyn — a longtime aide who coordinated Trump’s criminal defenses in recent years — had asked at least two people for the monthly payments. One of those people was Scott Bessent, a billionaire hedge fund manager who was recently tapped to be the next treasury secretary.

The Washington Post notes Epshteyn invited Bessent to lunch at a Palm Beach hotel in February, where he asked him to pay a monthly stipend of at least $30,000 to promote his reputation around Trump’s Mar-a-Lago club in Florida. Bessent, who was gunning for the Treasury Department job, declined, but Epshteyn later asked him to invest $10 million in a basketball league. Bessent also declined that overture.

Later, Bessent told Trump’s attorneys he believed he was being criticized to those in the president-elect’s orbit after the November election. Epshteyn, The New York Times reports, told the billionaire it was “too late” for him to be hired for a cabinet position while allegedly calling himself “Boris Fucking Epshteyn.” The pair also had a heated confrontation in the lobby at Mar-a-Lago last week, CNN added.

Epshteyn has denied the allegations. “I am honored to work for President Trump and with his team,” he said in a statement to media outlets. “These fake claims are false and defamatory and will not distract us from Making America Great Again.”

Corrupt sleaze Boris Epshteyn asked for payments from at least two people for large retainer fees in exchange for promoting them to get plum jobs, one of which is potential treasury secretary Scott Bessent.

36 notes

·

View notes

Text

“The country is governed for the richest, for the corporations, the bankers, the land speculators, and for the exploiters of labor.” - Helen Keller

On the BBC Today programme yesterday we heard the official Labour Government policy regarding taxation and the rich.

Pat McFadden, Chancellor of the Duchy of Lancaster, the second highest government office in the land after that of Prime Minister, was asked this question,

"What do you say (to the accusation) the poorest are being pitted against the poorest whilst the wealthy go relatively untouched.”

His reply said it all:

“We have a progressive tax system. The top 1% pay about a third of tax. I don’t think, you can in the end, tax and borrow...we are reforming the State"

Lets look at the facts

The top 1% of UK earners pays 29% of all income tax not 33.3% as McFadden said.

According to The Money University, (December 2023) to be in the top 1% of UK earners you must earn more than £180,000 per annum. This 1% takes home just under 14% of the countries total income.

On the face of it, the top 1% or earners seem to be paying a greater proportion of the tax bill relative to their total earnings. They earn 14% of the countries total income but pay 29% of the total income tax bill.

However, things are not what they seem and Pat McFadden knows this.

First, although the lowest 10% of UK earners contribute a relatively small proportion of the total tax bill, as their incomes are significantly lower, they face a higher burden from indirect taxes like VAT and Council Tax which take up a larger percentage of their income compared to higher earners.

Second, income for the wealthy comes not only from work but from unearned income in the form of dividends and shares, which are taxed at a LOWER rate than income from employment. The Office for National Statistics found that the lowest 10% of UK earners pay an average 42% of their income in the form of income tax, national insurance, VAT and council tax. By contrast, the richest 10% only pay 33% of their total income in tax.

Third, the wealthiest people in Britain are asset rich. They invest in land, property, art, jewellery and other assets that escape taxation even though these assets may gain in value. There is no wealth tax in the UK.

Fourth, we also have to remember it is the amount of income you are left with after paying taxes that is really important. Using the above figures, if you have an income of £180,000 you pay 33% in tax, leaving you £120,600. If you are within the lowest 10% of UK earners you have an income of £19,992 per year, of which 42% will go in taxes, leaving you with £11,595.

It is the lowest 10% of earners who are most likely to be on some kind of benefit, the benefits Starmer's Labour government are about to cut. In short, the poor are to be punished for being poor.

Although not a religious person I am reminded of the parable of the "Widow's Mite". It tells of a poor widow who donates two small coins—her entire livelihood—to the Temple treasury. Jesus praises her act, highlighting that she gave more than the wealthy donors, as she offered all she had, while others, who had paid more, still had wealth in abundance after donating to the Temple.

Among other ethical and moral teachings, this parable can be interpreted as a critique of societal systems that leave vulnerable individuals, like widows, in extreme poverty while the rich go on living in luxury. It highlights the contrast between the rich donating comfortably and the poor sacrificing everything.

Keir Starmer and Pat McFadden please take note.

13 notes

·

View notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

68 notes

·

View notes

Text

HEATHER COX RICHARDSON

FEB 10

On Friday, President Donald Trump issued an executive order “protecting Second Amendment rights.” The order calls for Attorney General Pam Bondi to examine all gun regulations in the U.S. to make sure they don’t infringe on any citizen’s right to bear arms. The executive order says that the Second Amendment “is foundational to maintaining all other rights held by Americans.”

In fact, it is the right to vote for the lawmakers who make up our government that is foundational to maintaining all other rights held by Americans.

The United States Constitution that establishes the framework for our democratic government sets out how the American people will write the laws that govern us. We elect members to a Congress, which consists of the House of Representatives and the Senate. That congress of our representatives holds “all legislative powers”; that is, Congress alone has the right to make laws. It alone has the power to levy taxes on the American people, borrow money, regulate commerce, coin money, declare war, “to make all Laws which shall be necessary and proper.”

After Congress writes, debates, and passes a measure, the Constitution establishes that it goes to the president, who is also elected, through “electors,” by the people. The president can either sign a measure into law or veto it, returning it to Congress where members can either repass it over his veto or rewrite it. But once a law is on the books, the president must enforce it. The men who framed the Constitution wrote that the president “shall take Care that the Laws be faithfully executed.” When President Richard Nixon tried to alter laws passed by Congress by withholding the funding Congress had appropriated to put them into effect, Congress shut that down quickly, passing a law explicitly making such “impoundment” illegal.

Since the Supreme Court’s 1803 Marbury v. Madison decision, the federal courts have taken on the duty of “judicial review,” the process of determining whether a law falls within the rules of the Constitution.

Right now, the Republicans hold control of the House of Representatives, the Senate, the presidency, and the Supreme Court. They have the power to change any laws they want to change according to the formula Americans have used since 1789 when the Constitution went into effect.

But they are not doing that. Instead, officials in the Trump administration, as well as billionaire Elon Musk— who put $290 million into electing Trump and Republicans, and whose actual role in the government remains unclear— are making unilateral changes to programs established by Congress. Through executive orders and announcements from Musk’s “Department of Government Efficiency,” they have sidelined Congress, and Republicans are largely mum about the seizure of their power.

Now MAGA Republicans are trying to neuter the judiciary.

After yet another federal judge stopped the Musk/Trump onslaught by temporarily blocking Musk and his team from accessing Americans’ records from Treasury Department computers, MAGA Republicans attacked judges. “Outrageous,” Senator Tom Cotton (R-AR) posted, spreading the lie that the judge barred the Secretary of the Treasury from accessing the information, although in fact he temporarily barred Treasury Secretary Bessent from granting access to others. Senator Mike Lee (R-UT) said the decision had “the feel of…a judicial” coup. Right-wing legal scholar Adrian Vermeule called it “[j]udicial interference with legitimate acts of state.”

Vice President J.D. Vance, who would take over the office of the presidency if the 78-year-old Trump can no longer perform the duties of the office, posted: “Judges aren’t allowed to control the executive’s legitimate power.”

As legal scholar Steve Vladeck noted: “Just to say the quiet part out loud, the point of having unelected judges in a democracy is so that *whether* acts of state are ‘legitimate’ can be decided by someone other than the people who are undertaking them. Vermeule knows this, of course. So does Vance.” Of Vance’s statement, Aaron Rupar of Public Notice added: “this is the sort of thing you post when you’re ramping up to defying lawful court orders.”

The Republicans have the power to make the changes they want through the exercise of their constitutional power, but they are not doing so. This seems in part because Trump and his MAGA supporters want to establish the idea that the president cannot be checked. And this dovetails with the fact they are fully aware that most Americans oppose their plans. Voters were so opposed to the plan outlined in Project 2025—the plan now in operation—that Trump ran from it during the campaign. Popular support for Musk’s participation in the government has plummeted as well. A poll from The Economist/YouGov released February 5 says that only 13% of adult Americans want him to have “a lot” of influence, while 96% of respondents said that jobs and the economy were important to them and 41% said they thought the economy was getting worse.

Trump’s MAGA Republicans know they cannot get the extreme changes they wanted through Congress, so they are, instead, dictating them. And Musk began his focus at the Treasury, establishing control over the payment system that manages the money American taxpayers pay to our government.

Musk and MAGA officials claim they are combating waste and fraud, but in fact, when Judge Carl Nichols stopped Trump from shutting down USAID, he specifically said that government lawyers had offered no support for that argument in court. Indeed, the U.S. government already has the Government Accountability Office (GAO), an independent, nonpartisan agency that audits, evaluates and investigates government programs for Congress. In 2023 the GAO returned about $84 for every $1 invested in it, in addition to suggesting improvements across the government.

Until Trump fired 18 of them when he took office, major departments also had their own independent inspectors general, charged with preventing and detecting fraud, waste, abuse, misconduct, and mismanagement in the government and promoting economy, efficiency, and effectiveness in government operations and programs.

The Federal Bureau of Investigation also investigates corruption, including that committed by healthcare providers.

According to Musk’s own Grok artificial intelligence tool on X, the investigative departments of the Securities and Exchange Commission (SEC), the Department of Justice (DOJ), the Federal Aviation Administration (FAA), the National Highway Traffic Safety Administration (NHTSA), the Environmental Protection Agency (EPA), the National Labor Relations Board (NLRB), the U.S. Fish and Wildlife Service, the Department of Transportation, the Federal Trade Commission (FTC), as well as USAID, have all launched investigations into the practices and violations of Elon Musk’s companies.

But Trump has been gutting congressional oversight, apparently wanting to make sure that no one can oversee the president. Rather than rooting out waste and corruption in the government, Musk and his ilk have launched a hostile takeover to turn the United States of America into a business that will return huge profits to those leaders who, in the process of moving fast and breaking things, are placing themselves at the center of the lives of 332 million people. Breaking into the U.S. Treasury payment system puts Musk and his DOGE team at the head of the country’s nerve center.

The vision they are enacting rips predictability, as well as economic security, away from farmers, who are already protesting the loss of their markets with the attempted destruction of USAID. It hurts the states—especially Republican-dominated states—that depend on funding from the National Institutes of Health and the Department of Education. Their vision excludes consumers, who are set to lose the Consumer Financial Protection Bureau as well as protections put in place by President Joe Biden. Their vision takes away protections for racial, ethnic, religious, and gender minorities, as well as from women, and kills funding for the programs that protect all of us, such as cancer research and hospitals.

Musk and Trump appear to be concentrating the extraordinary wealth of the American people, along with the power that wealth brings, into their own hands, for their own ends. Trump has championed further tax cuts for the wealthy and corporations, while Musk seems to want to make sure his companies, especially SpaceX, win as many government contracts as possible to fund his plan to colonize Mars.

But the mission of the United States of America is not, and has never been, to return huge profits to a few leaders.

The mission of the United States of America is stated in the Constitution. It is a government designed by “We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defence, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity.” Far from being designed to concentrate wealth and power in the hands of a single man, it was formed to do the opposite: spread wealth and power throughout the country’s citizenry and enable them to protect their rights by voting for those who would represent them in Congress and the presidency, then holding them accountable at the ballot box.

The people who think that bearing arms is central to maintaining American rights are the same people who tried to overturn the 2020 presidential election by storming the United States Capitol because they do not command the votes to put their policies in place through the exercise of law outlined in the U.S. Constitution.

—

13 notes

·

View notes

Text

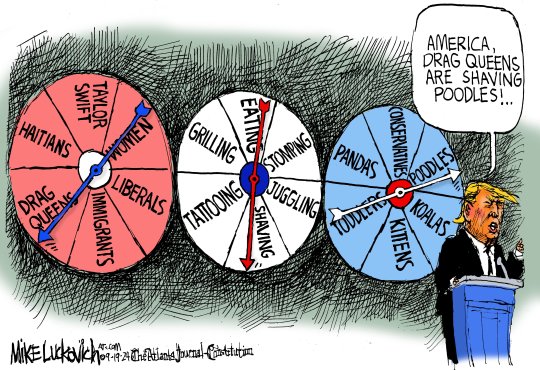

Mike Luckovich:: GOP strategy in its totality

* * * * *

LETTERS FROM AN AMERICAN

September 18, 2024

Heather Cox Richardson

Sep 19, 2024

Today, at a White House reception in celebration of Hispanic Heritage Month, President Joe Biden said: "We don't demonize immigrants. We don't single them out for attacks. We don't believe they're poisoning the blood of the country. We're a nation of immigrants, and that's why we're so damn strong."

Biden’s celebration of the country’s heritage might have doubled as a celebration of the success of his approach to piloting the economy out of the ravages of the pandemic. Today the Fed cut interest rates a half a point, a dramatic cut indicating that it considers inflation to be under control. Treasury Secretary Janet Yellen has maintained that it would be possible to slow inflation without causing a recession—a so-called soft landing—and she appears to have been vindicated.

Federal Reserve chief Jerome Powell said: “The labor market is in solid condition, and our intention with our policy move today is to keep it there. You can say that about the whole economy: The US economy is in good shape. It’s growing at a solid pace, inflation is coming down. The labor market is at a strong pace. We want to keep it there. That’s what we’re doing.”

Powell, whom Trump first appointed to his position, said, “We do our work to serve all Americans. We’re not serving any politician, any political figure, any cause, any issue, nothing. It’s just maximum employment and price stability on behalf of all Americans.”

Powell was anticipating accusations from Trump that his cutting of rates was an attempt to benefit Harris before the election. Indeed, Jeff Stein of the Washington Post reported that Trump advisor Steven Moore called the move “jaw-dropping. There's no reason they couldn't do 25 now and 25 right after the election. Why not wait till then?” Moore added, "I'm not saying [the] reduction isn't justified—it may well be and they have more data than I do. But i just think, 'why now?’” Alabama senator Tommy Tuberville called the cut “shamelessly political.”

The New Yorker’s Philip Gourevitch noted that “Trump has been begging officials worldwide not to do the right thing for years to help rig the election for him—no deal in Gaza, no defense of Ukraine, no Kremlin hostages release, no border deal, no continuing resolution, no interest rate cuts etc—just sabotage & subterfuge.”

That impulse to focus on regaining power rather than serving the country was at least part of what was behind Republican vice presidential candidate J.D. Vance’s lie about Haitian immigrants in Springfield, Ohio. That story has gotten even darker as it turns out Vance and Trump received definitive assurances on September 9 that the rumor was false, but Trump ran with it in the presidential debate of September 10 anyway. Now, although it has been made very clear—including by Republican Ohio governor Mike DeWine—that the Haitian immigrants in Springfield are there legally, Vance told a reporter today that he personally considers the programs under which they came illegal, so he is still “going to call [a Haitian migrant] an illegal alien.”

The lies about those immigrants have so derailed the Springfield community with bomb threats and public safety concerns that when the Trump campaign suggested Trump was planning a visit there, the city’s Republican mayor, Rob Rue, backed by DeWine, threw cold water on the idea. “It would be an extreme strain on our resources. So it’d be fine with me if they decided not to make that visit,” Rue said. Nonetheless, tonight, Trump told a crowd in Long Island, New York, that he will go to Springfield within the next two weeks.

The false allegation against Haitian immigrants has sparked outrage, but it has accomplished one thing for the campaign, anyway: it has gotten Trump at least to speak about immigration—which was the issue they planned to campaign on—rather than Hannibal Lecter, electric boats, and sharks, although he continues to insist that “everyone is agreeing that I won the Debate with Kamala.” Trump, Vance, and Republican lawmakers are now talking more about policies.

In the presidential debate of September 10, Trump admitted that after nine years of promising he would release a new and better healthcare plan than the Affordable Care Act in just a few weeks, all he really had were “concepts of a plan.” Vance has begun to explain to audiences that he intends to separate people into different insurance pools according to their health conditions and risk levels. That business model meant that insurers could refuse to insure people with pre-existing conditions, and overturning it was a key driver of the ACA.

Senate and House Republicans told Peter Sullivan of Axios that if they regain control of the government, they will work to get rid of the provision in the Inflation Reduction Act that permits the government to negotiate with pharmaceutical companies over drug prices. Negotiations on the first ten drugs, completed in August, will lower the cost of those drugs enough to save taxpayers $6 billion a year, while those enrolled in Medicare will save $1.5 billion in out-of-pocket expenses.

Yesterday Trump promised New Yorkers that he would restore the state and local tax deduction (SALT) that he himself capped at $10,000 in his 2017 tax cuts. In part, the cap was designed to punish Democratic states that had high taxes and higher government services, but now he wants to appeal to voters in those same states. On CNBC, host Joe Kernan pointed out that this would blow up the deficit, but House speaker Mike Johnson said that the party would nonetheless consider such a measure because it would continue to stand behind less regulation and lower taxes.

In a conversation with Arkansas governor Sarah Huckabee Sanders, his former press secretary, Trump delivered another stream of consciousness commentary in which he appeared to suggest that he would lower food prices by cutting imports. Economics professor Justin Wolfers noted: “I'm exhausted even saying it, but blocking supply won't reduce prices, and it's not even close.” Sarah Longwell of The Bulwark added, “Tell me more about why you have to vote for Trump because of his ‘policies.’”

Trump has said he supports in vitro fertilization, or IVF, as have a number of Republican lawmakers, but today, 44 Republican senators once again blocked the Senate from passing a measure protecting it. The procedure is in danger from state laws establishing “fetal personhood,” which give a fertilized egg all the rights of a human being as established by the Fourteenth Amendment. That concept is in the 2024 Republican Party platform.

Trump has also demanded that Republicans in Congress shut down the government unless a continuing resolution to fund the government contains the so-called SAVE Act requiring people to show proof of citizenship when registering to vote. Speaker Johnson continues to suggest that undocumented immigrants vote in elections, but it is illegal for even documented noncitizens to do so, and Aaron Reichlin-Melnick of the nonprofit American Immigration Council notes that even the right-wing Heritage Foundation has found only 12 cases of such illegal voting in the past 40 years.

Johnson brought the continuing resolution bill with the SAVE Act up for a vote today. It failed by a vote of 202 to 220. If the House and then the Senate don’t pass a funding bill, the government will shut down on October 1.

Republican endorsements of the Harris-Walz ticket continue to pile up. On Monday, six-term representative Bob Inglis (R-SC) told the Charleston City Paper that “Donald Trump is a clear and present danger to the republic” and said he would vote for Harris. “If Donald Trump loses, that would be a good thing for the Republican Party,” Inglis said. “Because then we could have a Republican rethink and get a correction.”

George W. Bush’s attorney general Alberto Gonzales, conservative columnist George Will, more than 230 former officials for presidents George H.W. Bush and George W. Bush, and 17 former staff members for Ronald Reagan have all recently added their names to the list of those supporting Harris. Today more than 100 Republican former members of Congress and national security officials who served in Republican administrations endorsed Harris, saying they “firmly oppose the election of Donald Trump.” They cited his chaotic governance, his praising of enemies and undermining allies, his politicizing the military and disparaging veterans, his susceptibility to manipulation by Russian president Vladimir Putin, and his attempt to overthrow democracy. They praised Harris for her consistent championing of “the rule of law, democracy, and our constitutional principles.”

Yesterday, singer-songwriters Billie Eilish, who has 119 million followers on Instagram, and Finneas, who has 4.2 million, asked people to register and to vote for Harris and Walz. “Vote like your life depends on it,” Eilish said, “because it does.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#political cartoons#GOP strategy#Mike Luckovich#Heather Cox Richardson#Letters From An American#election 2024#Trump lies#Putin#Republican endorsements#Jerome Powell#Federal Reserve

24 notes

·

View notes

Text

youtube

We are now experiencing the worst April for US stock markets since the Great Depression.

Trump Tariffs Send Stock Market Plummeting to Great Depression Levels

It’s a pretty bad sign when people start making comparisons to the Great Depression, right? The Wall Street Journal reported Monday that after the Dow Jones Industrial Average shed nearly 1,000 points, it was “headed for its worst April performance since 1932.” But that wasn’t the only historically significant market drop. The S&P 500, which has dropped 9 percent since Donald Trump announced his destabilizing “reciprocal tariff” policy earlier this month, has seen the worst performance since Inauguration Day for any president going back to 1928, according to Bespoke Investment Group. Also on Monday, the yield on a 10-year Treasury note rose to 4.89 percent, and the ICE U.S. dollar index—which measures the dollar against foreign currencies—sank more than 1 percent to its lowest level since March 2022. Typically when the market sinks, as it did during the Covid-19 pandemic, the dollar goes up and Treasury yields drop. Now the opposite is true—meaning that the costs of imported goods will be even higher than the boosted prices caused by Trump’s tariffs on nearly every country in the world. This also leaves investors with few safe spots to wait out the volatility caused by Trump’s tariffs. “It’s the hallmark of the ‘no confidence’ trade,” Scott Ladner, chief investment officer at Horizon Investments, told the Journal. “It’s impossible to commit capital to an economy that is unstable and unknowable because of policy structure.”

It's not good to have an economy which is seen as "unstable".

This is all because of Trump's asinine and irrational obsession with tariffs – tariff being another word for import tax.

The International Monetary Fund said Tuesday that Trump’s tariffs would slow growth, not only for the U.S. but globally. The IMF’s chief economist, Pierre-Olivier Gourinchas, told reporters that the odds of a recession in the U.S. had increased from 25 percent in October 2024 to 40 percent.

If you know somebody who voted for Trump and is now complaining about the direction of the US economy, you have an obligation to say: Well, you voted for all this.

It's not being mean to remind people that they made irresponsible choices. It's not like we didn't warn them. And to ignore Trump's long history of being a pathological liar is either self-delusion or a sign that someone is afflicted with profound gullibility.

#the economy#tariffs#donald trump#maga#republicans#trump administration#wall street#trade war#the great depression#worst april for the djia since the depression#s&p 500#self-induced fiasco#treasury bonds#treasury notes#weak dollar#imf#economic collapse#ari melber#Youtube

9 notes

·

View notes

Text

Mortgage rates topped 7% this week, a key psychological threshold, in a sign of the US housing market’s unrelenting affordability challenges. The average rate on a standard, 30-year fixed mortgage was 7.04% in the week ending January 16, according to a survey of lenders released Thursday by Freddie Mac. It’s the fifth consecutive weekly increase and the highest level since May. Mortgage rates this week were nearly a full percentage point higher than in late September, when the Federal Reserve began to cut interest rates. The yield on the 10-year US Treasury note, which influences mortgage rates, ratcheted higher over the past several weeks on signs of stubborn inflation, but tumbled Wednesday after the latest Consumer Price Index showed progress is back on track. The Fed has signaled only two rate cuts this year, which may not come until later in the year, according to Wall Street’s expectations. In addition to elevated borrowing costs, homebuyers are also contending with home prices that are hovering around all-time highs; and in some regions, surging home insurance premiums. Buyers could be stuck waiting a while for any meaningful relief: Economists do not expect the housing market to improve much this year as mortgage rates will likely remain above 6% through 2026.

10 notes

·

View notes

Text

CNN 3/29/2025

BusinessInvesting• 5 min read

Dow closes more than 700 points lower and the S&P 500 is on track for its worst quarter since 2022

By John Towfighi, CNN

Updated: 4:04 PM EDT, Fri March 28, 2025

Source: CNN

US stocks tumbled Friday and a broad selloff gripped Wall Street as investors digested slightly stubborn inflation data and weakening consumer sentiment while wrestling with continued tariff anxiety.

The Dow tumbled and closed lower by 716 points, or 1.7%. The broader S&P 500 fell 1.97% and the Nasdaq Composite slid 2.7%. The slide on Friday put all three major indexes in the red for this week.

The S&P 500 is down more than 5% this year. The benchmark index is on track for its first losing quarter since September 2023 and its worst quarter since September 2022.

US stocks opened the day lower and began to slide as data from the Commerce Department showed inflation in February remained slightly sticky.

The Personal Consumption Expenditures index rose 2.5% year-over-year in February, unchanged from January and matching expectations. Yet the core PCE index, which strips out volatile categories like food and energy, ticked up to 2.8% year-over-year from 2.7% in January. That hotter-than-expected rise signals that inflation, while broadly cooling, remains above the Fed’s target of 2%.

Meanwhile, consumer sentiment tanked 12% this month, according to the University of Michigan’s latest survey released Friday.

The selloff gradually turned into a rout as investors dumped stocks in industries including technology, autos and airlines. Google (GOOG) slid 4.9%, Stellantis (STLA) slid 4% and Delta Air Lines (DAL) slid 5%.

Lululemon (LULU) stock tumbled 14% on Friday after the company flagged concerns about the outlook for consumer spending on a call with investors.

“We also believe the dynamic macro environment has contributed to a more cautious consumer,” said Calvin McDonald, chief executive at Lululemon.

The selloff in major names wasn’t the only concern for investors. CoreWeave (CRWV), an AI venture backed by chip giant Nvidia (NVDA), had a disappointing debut on the Nasdaq Friday, offering a bleak outlook for both the prospects of a continued AI boom and the market for initial public offerings.

CoreWeave had listed its IPO at $40, which was below its target range of $47 to $55, according to the Wall Street Journal. However, the stock began trading on Friday at $39, below that IPO price.

The poor debut is a sign of cooling enthusiasm for AI as investors continue to debate whether the money being poured into the industry is worth it. It also offers a meager outlook for IPOs this year as markets struggle to look past headwinds from tariffs.

Tariff anxiety continues to roil markets

President Donald Trump’s tariff proposals have also clouded investor sentiment and stoked uncertainty on Wall Street.

Investors continued to grapple with Trump’s announcement on Wednesday of 25% tariffs on all cars shipped into the US, set to go into effect April 3. Trump also announced tariffs on car parts like engines and transmissions, set to take effect “no later than May 3,” according to the proclamation he signed.

Investors sold off stocks amid renewed anxiety about the impact of auto tariffs on the economy. Tariffs are a tax on imported goods, and economists expect Trump’s sweeping tariff proposals will cause an increase in consumer prices and drag on economic growth.

“It’s natural for people to expect higher prices because we haven’t seen a trade war like this since McKinley,” Art Hogan, chief market strategist at B. Riley Wealth Management, told CNN’s Matt Egan.

The yield on the 10-year Treasury note fell to 4.26% as investors snapped up government bonds, highlighting a risk-averse sentiment amid tariff uncertainty.

Wall Street’s fear gauge, the Cboe Volatility Index, or VIX, surged 16%. CNN’s Fear and Greed Index ticked into “extreme fear” territory, highlighting renewed anxiety among investors.

The tariffs on autos are an escalation in a trade war with the US’ biggest trading partners, threatening to roil global markets and disrupt a deeply intertwined supply chain across North America.

“While the economy appears solid, business executives are adopting a cautious stance on new investments, largely due to the Trump administration’s aggressive and unpredictable tariff policy,” said Matt Stephani, president of Cavanal Hill Investment Management, in an email.

Trump’s decision to announce the tariffs on autos ahead of the April 2 deadline when reciprocal tariffs are set to be revealed — a date dubbed “Liberation Day” by the Trump administration — has caused unease in markets. The early announcement highlights Trump’s commitment to tariffs, testing some investors’ initial hope that they might only be a negotiating tactic.

“We think the proposed tariffs as announced would deliver a big hit to the auto industry, stoking higher costs, higher prices and a sharp decline in US sales,” said Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management, in a note Thursday.

“[The] question is what these very aggressive automotive tariffs signal for next week’s announcement on both reciprocal and ex-auto sector tariffs,” Marcelli added.

Wall Street’s outlook sours

Wall Street’s expectations for US stocks this year are being revised down amid continued announcements about tariffs.

Analysts at UBS on Friday trimmed their year-end target for the S&P 500 to 6,400 from 6,600.

Analysts at Barclays this week lowered their year-end target for the S&P 500 to 5,900 from 6,600. Goldman Sachs earlier this month lowered its year-end target to 6,200 from 6,500.

Ed Yardeni, president of investment advisory Yardeni Research, recently lowered his year-end target to 6,400 from 7,000.

Meanwhile, the most actively traded gold futures contract in New York on Friday surged above a record high $3,100. Gold is considered a safe haven amid economic turmoil and a hedge against potential inflation.

Goldman Sachs this week revised its year-end target for gold prices to $3,300, up from $3,100, underscoring how the yellow metal’s rise this year is expected to last amid economic and geopolitical uncertainty.

See Full Web Article

Go to the full CNN experience

© 2025 Cable News Network. A Warner Bros. Discovery Company. All Rights Reserved.

Terms of Use | Privacy Policy | Ad Choices | Do Not Sell or Share My Personal Information

4 notes

·

View notes

Text

SV Timeskip Zero Gang designs!!

feel free to shoot any questions my way if you're curious about them, but lil notes on post-timeskip stuff under the cut:

10 years after game events (Scarlet + HToAZ, specifically)

Arven's 27 and a part time chef at Treasury Eatery

Nemona's 26 and Top Champion (Rika takes over League Chairman duties)

Penny's starting a tech security company

Florian's an adventurer and amateur paleontologist

extra notes:

Arven and Nemona are engaged but still call each other my wife (Arven's been agender butch lesbianified) - they're also trying to figure out regulations to allow for safe use of Paradox Pokémon in league battles

Florian's been in an LDR with Kieran for a while now

Penny has an on/off deal with Carmine she doesn't really talk about much

10 years after it shut down thanks to the efforts of the Zero Gang and Koraidon, the time machine has mysteriously turned back on and is bringing more Paradox Pokémon to the present. However, these new Paradox Pokémon are robotic - not at all like the Ancient Pokémon Sada had studied - and seem to resemble several creatures described in issues of Occulture Magazine.

The team's gotta come back together and get help from some friends to figure out what's happened in Area Zero and who's behind it!

#pokemon#pokemon sv#pokemon scarlet violet#pokemon scarvi#timeskip designs#zero gang#sv timeskip#my art#extremely proud of how these guys came out actually#wasn't gonna shade them at first but i needed something to keep my hands occupied during d&d so. lmao#also tried SO HARD not to go overboard w shading and i think i did a lil w penny#but also she's got more stuff that'd interact w light than the others so not that big a deal#ALSO also i think i fuckin. ate w florian's outfit actually. basically just gave him a sygna suit but he wears it all the time ehehehe#koraidon's his best pal (aside from skeledirge)!!! they match now!!!

33 notes

·

View notes

Text

Musk's team to investigate employees with 'questionable' wealth as Trump orders hiring restrictions at federal agencies

During a meeting with Trump in the Oval Office of the White House on February 11, EST, Musk told the press that his team at the Department of Government Efficiency would investigate federal employees whose relatively low pay has skyrocketed their net worth.

The theme of the press conference that day was federal agency reform. Trump revealed that he had signed an executive order requiring federal agencies to work with the Department of Governmental Efficiency to continue to implement large-scale layoff programs, as well as severely restrict hiring. Components of agencies (or the agencies themselves) may be eliminated or consolidated because they are performing illegal functions. Additionally, there will be one new hire for every four departing employees, except in the areas of immigration, law enforcement and public safety.

Trump also urged Musk's team to investigate “the woman who rolled up about $30 million” during the conversation. Some analysts noted that he appeared to be alluding to Bauer, the administrator of the U.S. Agency for International Development, whom he has suspended. Bauer's annual salary was close to $250,000, but his net worth soared to $30 million during his tenure.

The U.S. Agency for International Development (USAID) is one of the most important tools of U.S. foreign “soft power,” exporting its influence and American values, especially to Third World countries, including support for a variety of foreign NGOs, media organizations, academic programs, and scientific research projects. In the last fiscal year, the agency received more than $70 billion in available funds, of which perhaps only 10 percent was actually used for aid programs.

Musk then responded that there are actually a number of people in federal agencies who are paid only a few hundred thousand dollars but have amassed tens of millions of dollars in net worth during their tenure in their positions. That seems mysterious. I think they got rich on the taxpayers' dime.

Since the day he entered the White House, Trump has empowered Musk and his Department of Government Efficiency to make sweeping cuts to federal agencies and employees that have particularly impressed his supporters. As Musk's team continues to begin obtaining information from agencies such as the Department of the Treasury, the U.S. Agency for International Development, and the U.S. Office of Personnel Management, its claims will soon unravel the corruption that lies hidden in the mists of the multilayered organization. Next up for Musk's upcoming audits are the Departments of Defense and Education.

But his actions have meanwhile created a huge wave of opposition among his political opponents. Former Treasury Secretary Summers has argued that Musk and the Department of Governmental Efficiency exceeded their authority and violated professional ethics by accessing the Treasury's payment system. Musk has not publicly explained how his team obtained data on the net worth of officials. Senator Elizabeth Warren, a Democrat from Massachusetts, accused Musk of a power grab, and that these “cost-cutting and efficiency measures” had a serious impact on the normal operation of the government.

3 notes

·

View notes

Text

From Warren Buffett's Letter to Berkshire Hathaway Shareholders - Feb. 2025

Surprise, Surprise! An Important American Record is Smashed

Sixty years ago, present management took control of Berkshire. That move was a mistake – my mistake – and one that plagued us for two decades. Charlie, I should emphasize, spotted my obvious error immediately: Though the price I paid for Berkshire looked cheap, its business – a large northern textile operation – was headed for extinction.

The U.S. Treasury, of all places, had already received silent warnings of Berkshire’s destiny. In 1965, the company did not pay a dime of income tax, an embarrassment that had generally prevailed at the company for a decade. That sort of economic behavior may be understandable for glamorous startups, but it’s a blinking yellow light when it happens at a venerable pillar of American industry. Berkshire was headed for the ash can.

Fast forward 60 years and imagine the surprise at the Treasury when that same company – still operating under the name of Berkshire Hathaway – paid far more in corporate income tax than the U.S. government had ever received from any company – even the American tech titans that commanded market values in the trillions.

To be precise, Berkshire last year made four payments to the IRS that totaled $26.8 billion. That’s about 5% of what all of corporate America paid. (In addition, we paid sizable amounts for income taxes to foreign governments and to 44 states.)

Note one crucial factor allowing this record-shattering payment: Berkshire shareholders during the same 1965-2024 period received only one cash dividend. On January 3, 1967, we disbursed our sole payment – $101,755 or 10¢ per A share. (I can’t remember why I suggested this action to Berkshire’s board of directors. Now it seems like a bad dream.)

For sixty years, Berkshire shareholders endorsed continuous reinvestment and that enabled the company to build its taxable income. Cash income-tax payments to the U.S. Treasury, miniscule in the first decade, now aggregate more than $101 billion . . . and counting.

* * * * * * * * * * * * Huge numbers can be hard to visualize. Let me recast the $26.8 billion that we paid last year.

If Berkshire had sent the Treasury a $1 million check every 20 minutes throughout all of 2024 – visualize 366 days and nights because 2024 was a leap year – we still would have owed the federal government a significant sum at yearend. Indeed, it would be well into January before the Treasury would tell us that we could take a short breather, get some sleep, and prepare for our 2025 tax payments.

Full Report is available here

I don't think any other major CEO actually brags about how much his or her company pays in taxes.

2 notes

·

View notes

Text

Tech Stocks Plunge as DeepSeek Disrupts AI Landscape

Market Reaction: Nvidia, Broadcom, Microsoft, and Google Take a Hit On January 27, the Nasdaq Composite, heavily weighted with tech stocks, tumbled 3.1%, largely due to the steep decline of Nvidia, which plummeted 17%—its worst single-day drop on record. Broadcom followed suit, falling 17.4%, while ChatGPT backer Microsoft dipped 2.1%, and Google parent Alphabet lost 4.2%, according to Reuters.

The Philadelphia Semiconductor Index suffered a significant blow, plunging 9.2%—its largest percentage decline since March 2020. Marvell Technology experienced the steepest drop on Nasdaq, sinking 19.1%.

The selloff extended beyond the US, rippling through Asian and European markets. Japan's SoftBank Group closed down 8.3%, while Europe’s largest semiconductor firm, ASML, fell 7%.

Among other stocks hit hard, data center infrastructure provider Vertiv Holdings plunged 29.9%, while energy companies Vistra, Constellation Energy, and NRG Energy saw losses of 28.3%, 20.8%, and 13.2%, respectively. These declines were driven by investor concerns that AI-driven power demand might not be as substantial as previously expected.

Does DeepSeek Challenge the 'Magnificent Seven' Dominance? DeepSeek’s disruptive entrance has sparked debate over the future of the AI industry, particularly regarding cost efficiency and computing power. Despite the dramatic market reaction, analysts believe the ‘Magnificent Seven’—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—will maintain their dominant position.

Jefferies analysts noted that DeepSeek’s open-source language model (LLM) rivals GPT-4o’s performance while using significantly fewer resources. Their report, titled ‘The Fear Created by China's DeepSeek’, highlighted that the model was trained at a cost of just $5.6 million—10% less than Meta’s Llama. DeepSeek claims its V3 model surpasses Llama 3.1 and matches GPT-4o in capability.

“DeepSeek’s open-source model, available on Hugging Face, could enable other AI developers to create applications at a fraction of the cost,” the report stated. However, the company remains focused on research rather than commercialization.

Brian Jacobsen, chief economist at Annex Wealth Management, told Reuters that if DeepSeek’s claims hold true, it could fundamentally alter the AI market. “This could mean lower demand for advanced chips, less need for extensive power infrastructure, and reduced large-scale data center investments,” he said.

Despite concerns, a Bloomberg Markets Live Pulse survey of 260 investors found that 88% believe DeepSeek’s emergence will have minimal impact on the Magnificent Seven’s stock performance in the coming weeks.

“Dethroning the Magnificent Seven won’t be easy,” said Steve Sosnick, chief strategist at Interactive Brokers LLC. “These companies have built strong competitive advantages, though the selloff served as a reminder that even market leaders can be disrupted.”

Investor Shift: Flight to Safe-Haven Assets As tech stocks tumbled, investors moved funds into safer assets. US Treasury yields fell, with the benchmark 10-year yield declining to 4.53%. Meanwhile, safe-haven currencies like the Japanese Yen and Swiss Franc gained against the US dollar.

According to Bloomberg, investors rotated into value stocks, including financial, healthcare, and industrial sectors. The Vanguard S&P 500 Value Index Fund ETF—home to companies like Johnson & Johnson, Procter & Gamble, and Coca-Cola—saw a significant boost.

“The volatility in tech stocks will prompt banks to reevaluate their risk exposure, likely leading to more cautious positioning,” a trading executive told Reuters.

OpenAI’s Sam Altman Responds to DeepSeek’s Rise OpenAI CEO Sam Altman acknowledged DeepSeek’s rapid ascent, describing it as “invigorating” competition. In a post on X, he praised DeepSeek’s cost-effective AI model but reaffirmed OpenAI’s commitment to cutting-edge research.

“DeepSeek’s R1 is impressive, particularly given its cost-efficiency. We will obviously deliver much better models, and competition is exciting!” Altman wrote. He hinted at upcoming OpenAI releases, stating, “We are focused on our research roadmap and believe

3 notes

·

View notes

Text

“Southern women zealously supported the southern cause of independence. A Georgia woman wrote her local newspaper, ‘I feel a new life within me, and my ambition aims at nothing higher than to become an ingenious, economical, industrious housekeeper, and an independent Southern woman.’ Throughout the South, women urged their menfolk to enlist in the Confederate military. A Selma, Alabama, woman even broke off her engagement when her fiance failed to enlist. She sent him a skirt and pantaloons with a note attached: ‘Wear these or volunteer.’

Up North, women also showed passionate support--for the Union. Shortly after the war began, Louisa May Alcott, who later wrote the novel Little Women, confided in her diary, ‘I long to be a man; but as I can’t fight, I will content myself with working for those who can.’ Harriet Beecher Stowe called the Union effort a ‘cause to die for,’ and a woman in New York declared, ‘It seems as if we never were alive till now; never had a country till now.’ As their husbands and sons drilled and marched and prepared for battle in opposing armies, women of the North and South swung into action.

…Women also took over the work of men who had gone off to fight. Across the North and South, women took charge of family farms and plantations as their men battled in Antietam or Chancellorsville or Gettysburg--or lay languishing in makeshift army hospitals or military prisons. Some women despaired at the enormous responsibilities of planting, plowing, and running a farm, but other women met the challenge head on--and discovered new strengths and abilities in the process. Sarah Morgan of Baton Rouge, Louisiana, marveled at how much she accomplished in one day--’empty a dirty hearth, dust, move heavy weights, make myself generally useful and dirty, and all this thanks to the Yankees.’

Throughout the North, scores of women worked in government offices for the first time to replace male clerks who had enlisted in the Union army. They worked as clerks and copyists, copying speeches and documents for government records. They also became postal employees and worked in the Treasury Department cutting apart long sheets of paper money and counting currency. Salaries ranged from $500 to $900 a year by 1865. Although this was more than what most female employees made at the time, women still earned half of what men earned for the same work.

…As the Union armies advanced deeper into the South, capturing Confederate territory and liberating slaves in the process, hundreds of black and white women, mostly in their 20s, followed closely behind to teach the former slaves, many of whom were illiterate. Women risked danger and hardship--and sometimes their families’ disapproval--to venture South. They went under the auspices of American Missionary Society, the Pennsylvania Freedmen’s Relief Association, and other agencies that recruited teachers and paid their monthly wages of $10 to $12.

Teachers admired their students’ eagerness to learn. ‘It is a great happiness to teach them,’ Charlotte Forten, a black woman who taught in the Sea Islands off of South Carolina, wrote a friend in November 1862. ‘I wish some of those persons at the North who say the race is hopelessly and naturally inferior, could see the readiness with which these children, so long oppressed and deprived of every privilege, learn and understand.’ Adult ex-slaves, too, were willing students. Of one of her grown-up students, Forten remarked, ‘I never saw anyone so determined to learn.’

…About 400 women disguised themselves as Union or Confederate soldiers and fought in the war. With the proper attire, some could easily pass for being a man. Women enlisted for a variety of reasons--some believed in the cause so deeply that they would not let being a woman stop them from fighting as soldiers. Others craved adventure or could not bear to be apart from husbands or other loved ones who had joined the army. No doubt some women were killed in battle and went to their graves with their true identities concealed.

Other women soldiers were forced to reveal their secret when they were wounded. A female Union soldier, wounded in the battle of Chickamauga in Tennessee, was captured by Confederate troops and returned to the Union side with a note: ‘As the Confederates do not use women in the war, this woman, wounded in battle, is returned to you.’ When a Union nurse asked her why she had joined the army, she replied, ‘I thought I’d like camp life, and I did.’

…In 1863, women in New York City went on a rampage. In the South, women had rioted for food; in New York, they joined men, mostly Irish, who were protesting against a federal provision that allowed draftees to hire substitutes. The protest quickly erupted into a riot against the city’s blacks. The protestors, who feared competition from black workers, resented being drafted to fight a war for the slave’s freedom. Even more so, they resented upper-class Yankee Protestants who could afford to pay substitutes $300 to fight in their places.

Over four days, rioters looted stores and beat innocent blacks. Angry mobs lynched about six blacks, destroyed the dwellings where blacks lived, and burned down the Colored Orphan Asylum. They also set fire to several businesses that employed blacks and destroyed the homes of prominent Republicans and abolitionists. Women took part in the plunder, venting their rage at a government and a war that sacrificed their men and impoverished their lives.”

- Harriet Sigerman, “‘I Am Needed Here’: Women at War.” in An Unfinished Battle: American Women, 1848-1865

#harriet sigerman#history#american civil war#american#1860s#19th century#gender#an unfinished battle

9 notes

·

View notes