#UK LED lighting manufacturers

Explore tagged Tumblr posts

Text

Value Addition Group: Driving Innovation in

Solar- Energy Solutions in the UAE

Since its founding in 1997, Value Addition Group has become a leader in the energy industry, specializing in advanced solutions that cater to the growing demand for renewable energy. Originally focused on heating systems and related process services, the company has evolved to meet sustainability challenges head-on. Now recognized as one of the top Solar Energy Companies in Dubai, UAE, their mission is to provide cost-effective, eco-friendly solutions to businesses across various sectors.

J. Rajasekharan, Director of Operations and Founder, believes that adaptability and innovation are the pillars of their success. By 2003, they had diversified their offerings to include solar water heating systems in Dubai, solar power installations, LED lighting, and cutting-edge technologies like vapor absorption chilling and waste heat recovery. These solutions have significantly enhanced the company’s position as an industry leader.

Value Addition Group’s focus on renewable energy has led to several notable accomplishments, including the installation of the first solar-powered LED lighting system in the region and the first hybrid stand-alone RO system. Their track record of innovation has earned them a spot as one of the top Solar Water Heaters Suppliers in the UAE, known for delivering reliable, high-quality systems.

One of their primary goals is network optimization. This approach has resulted in substantial energy savings for their clients, driving down costs and boosting operational efficiency. The company’s partnership with UK LED lighting manufacturers has allowed them to integrate advanced lighting solutions that further enhance energy efficiency across projects.

In one of their most recognized projects, Value Addition Group managed to cut annual energy consumption by over 3.9 million kWh, which is equivalent to the electricity needed for 272 homes. They’ve also reduced CO2 emissions by 1.5 million tonnes. Their expertise extends to being key Steam Boiler Suppliers in the UAE, where they offer state-of-the-art heating solutions for industrial applications.

Aligned with the UAE’s vision for a net-zero future by 2050, Value Addition Group continues to innovate. Their recent developments include renewable energy projects involving green hydrogen, biomass, and biofuels. With a strong commitment to sustainability, the company is poised to make even greater strides in the coming years.

Value Addition Group’s Key Achievements:

Over 27 years of experience in sustainable energy.

Installation of 60+ MW of renewable energy systems.

Successful completion of 800+ projects.

500+ MW of installed heating capacity.

As one of the top Solar Water Heaters Suppliers in the UAE, Value Addition Group is dedicated to delivering innovative and sustainable solutions that meet the region’s growing energy demands.

#solar water heating system in dubai#UK LED lighting manufacturers#Solar Energy Companies in Dubai#UAE

0 notes

Text

A lot of the time the ruling-class-harming stupidity comes down to specific members of the ruling class having no actual loyalty to the ruling class.

Viewed in the light of the long-term interests of the ruling classes, the Iraq war and Brexit (to give two major examples) were obvious long-term major losses. But: the Bush administration was made up of people with money in oil (the whole Bush family!) and weapons manufacturing, so even as the US economy got destabilized by the Iraq war and US diplomatic influence around the world was torched by the actions of the US military, they made huge profits. The Brexit wing of the Tory party — led by Boris Johnson, but including the two Tory governments since his, the memberships of which were selected from Johnson’s government — had (as revealed a few years ago now) billions in investments which were specifically planned to gain in value as the UK was harmed by “hard Brexit” policies they enacted and all assets in the UK got automatically devalued as the value of the pound dropped in reaction.

Just as there are working-class people who betray the interests of the working class for personal benefit, there are ruling-class people who betray the interests of the ruling class for personal benefit. The difference is that the ruling-class traitors tend to make so much money that they remain part of the ruling class afterwards — neither George W. Bush nor Boris Johnson are likely to ever see the inside of a prison cell; Bush is already be rehabilitated by Democrats, who think of him as preferable to Trump, and if Johnson follows the examples of Cameron and Blair — two previous PMs who also left office in disgrace — he’ll be back as an “advisor” in about a decade.

Like sometimes people get dangerously close to saying "ruling classes never Actually collectively act in stupid, short-sighted, self-sabotaging ways at cross-purposes with their long-term interests, knowingly or unknowingly" and its like. the entirety of human history would beg to differ

784 notes

·

View notes

Text

Corner Light Market Segmentation, Key Trends, and Demand Forecast for 2025 to 2032

The global Corner Light Market has been witnessing significant growth, driven by the increasing demand for vehicle safety features, aesthetic enhancements, and the adoption of advanced lighting technologies. Corner lights, essential for improving visibility and signaling in vehicles, are gaining traction across the automotive sector. This press release delves into the market overview, emerging trends, drivers, restraints, segmentation, regional analysis, and future outlook.

Market Overview

The corner light market has grown substantially in recent years due to increasing awareness of road safety and the rising adoption of LED and adaptive lighting systems. These lights play a crucial role in enhancing vehicle safety by providing better visibility during turns and signaling to other road users. Automakers are integrating corner lights as standard features in most vehicle models, contributing to market growth. According to recent reports, the market size is projected to experience a compound annual growth rate (CAGR) of over 5% during the forecast period.

Free Sample: https://www.statsandresearch.com/request-sample/38267-covid-version-global-corner-light-market

Emerging Trends

LED and OLED Adoption: The transition from traditional halogen to LED and OLED corner lights offers energy efficiency, durability, and improved aesthetics.

Smart Lighting Systems: Integration of smart technologies, such as adaptive lighting and automatic brightness adjustment, is gaining momentum.

Focus on Customization: Consumers are increasingly opting for customized corner lights to enhance vehicle aesthetics.

Sustainability in Manufacturing: Manufacturers are adopting eco-friendly materials and processes to align with global environmental goals.

Market Drivers

Growing Vehicle Production: Increasing automobile production globally boosts the demand for corner lights.

Stringent Safety Regulations: Government regulations mandating the use of safety lighting systems in vehicles drive market growth.

Technological Advancements: Innovations in lighting technologies, such as adaptive and laser lighting, enhance corner light functionality.

Rising Aftermarket Demand: The growing trend of vehicle modification and personalization fuels the aftermarket segment.

Market Restraints

High Costs of Advanced Systems: The premium pricing of LED and smart corner lights may limit adoption in cost-sensitive markets.

Compatibility Issues: Challenges in integrating advanced corner lights with older vehicle models could hinder market expansion.

Volatile Raw Material Prices: Fluctuations in the cost of raw materials, such as aluminum and plastics, impact manufacturing costs.

Request Discount: https://www.statsandresearch.com/check-discount/38267-covid-version-global-corner-light-market

Market Segmentation

The corner light market is segmented based on technology, vehicle type, and sales channel.

By Technology:

Halogen

LED

OLED

Laser

By Vehicle Type:

Passenger Cars

Commercial Vehicles

Electric Vehicles

By Sales Channel:

OEM

Aftermarket

Regional Analysis

North America: North America dominates the corner light market, driven by stringent safety regulations and high demand for advanced automotive technologies. The United States is a key contributor due to its robust automotive industry.

Europe: Europe’s focus on vehicle safety and energy-efficient technologies fuels the demand for LED and OLED corner lights. Countries like Germany and the UK are prominent markets.

Asia-Pacific: The Asia-Pacific region is poised for significant growth due to increasing vehicle production, urbanization, and rising disposable incomes. China, Japan, and India are leading markets.

Latin America: The growing automotive industry and rising awareness of vehicle safety in Brazil and Mexico drive market growth in the region.

Middle East & Africa: Infrastructure development and increasing automotive investments contribute to moderate growth in the region, particularly in the UAE and South Africa.

Future Outlook

The global corner light market is set to witness steady growth, driven by technological advancements, evolving consumer preferences, and stricter safety regulations. Manufacturers are expected to focus on innovation, including energy-efficient and adaptive lighting systems, to meet the demands of a safety-conscious customer base. Additionally, the rise of electric vehicles presents new opportunities for advanced corner light integration.

Sustainability will play a crucial role in shaping the future of the market, with a growing emphasis on eco-friendly materials and manufacturing practices. As automakers and suppliers collaborate to develop cutting-edge solutions, the corner light market is poised to redefine automotive lighting standards.

Full report: https://www.statsandresearch.com/report/38267-covid-version-global-corner-light-market/

0 notes

Text

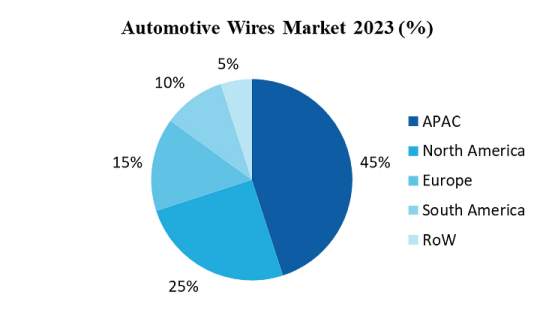

Automotive Wires Market-Industry Forecast, 2024–2030

Automotive Wires Market Overview:

Request Sample :

Automotive wire demand is expected to rise due to the growing trend of lightweight passenger automobiles as a means of reducing carbon emissions. In response to stringent regulations aimed at reducing carbon emissions from automobiles, manufactures will concentrate on producing aluminium automotive wires to reduce the vehicle’s overall weight. This is going to help in achieving the new regulations criteria. The rising focus on enhancing the standards for automotive wire will give opportunities for market expansion. For instance, according to US Auto Outlook 2024, light vehicle sales to grow 3.7% above last year’s level, rising to 16.1 million units. Additionally, the demand for automotive wires is expected to rise in parallel with the volume of vehicles being produced and the increasing demand from customers for better comfort, safety, and convenience.

Market Snapshot:

Automotives Wires Market — Report Coverage:

The “Automotive Wires Market Report — Forecast (2024–2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Automotives Wires Market.

AttributeSegment

By Material

· Copper

· Aluminium

· Others

By Vehicle Type

· Passenger Vehicles

· Light Commercial Vehicles

· Heavy Commercial Vehicles

By Propulsion

· ICE Vehicles

· Hybrid Vehicles

· Pure Electric Vehicles

By Transmission Type

· Electric wiring

· Data Transmission

By Application

· Engine wires

· Chassis wires

· Body and Lighting wires

· HVAC wires

· Dashboard / Cabin wires

· Battery wires

· Sensor wires

· Others

By End User

· OEM

· Aftermarket

By Geography

· North America (U.S., Canada and Mexico)

· Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe),

· Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and Rest of Asia-Pacific),

· South America (Brazil, Argentina, Chile, Colombia and Rest of South America)

· Rest of the World (Middle East and Africa).

COVID-19 / Ukraine Crisis — Impact Analysis:

The COVID-19 pandemic disrupted global supply chains, leading to delays in production and sales of automobiles which led to decrease in automotive wire manufacturing. Governments worldwide imposed lockdowns and restrictions, which led to shut down of mines, factories, and transportation networks, thus disrupting the supply of raw materials such as copper and aluminum, that are used in making automotive wires.

The Russia-Ukraine war had a huge impact on the global automotive wires market. Ukraine is a major manufacturer of copper, a material used as an automotive wiring component. The war has led to mining disruptions, which in turn has caused the shortages and increase in prices globally.

Key Takeaways:

Copper wires segment is Leading the Market

Copper wires segment holds the largest share in the automotive wires market with respect to market segmentation by material. Electrification will be the biggest driver to copper demand for vehicles. Copper is used throughout electric vehicle powertrains, from foils in each cell of the battery to the windings of an electric motor. In total, each electric vehicle can generate over 30kg of additional copper demand. According to a report by IDTechEx, the demand for copper from the automotive industry was just over 3MT in 2023 but is set to increase to 5MT in 2034. Because of its electrical and chemical characteristics, copper is used in every part of the battery. There are lot of tiny cells in the battery, and each one has a copper foil to carry electricity out of the cell. Large copper bars placed throughout the battery also convey the energy from each cell to the high-voltage connections, which in turn power the motor and electronics. Such parts and components with the copper are driving the market growth of copper wires in automotive wires market.

Inquiry Before Buying :

Passenger Vehicles are Leading the Market

Passenger Vehicles segment is leading the Automotive Wires Market by Application. The passenger vehicle category is currently holding the largest share in the automotive wires market because of a combination of factors including large production volumes, a wide range of wiring requirements, technological developments, and the increasing adoption of electric vehicles. For instance, according to Global and EU Auto industry 2023 report by The European Automobile Manufacturers’ Association (ACEA), European car production grew substantially, reaching nearly 15 million units, marking a significant year-on-year improvement of 12.6%. The growing popularity of electric vehicles (EVs) is also contributing to the growth of the passenger vehicle segment in the automotive wires market. EVs have more complex wiring systems due to the integration of batteries, motors, and charging infrastructure.

Integration of Smart Systems in Automobiles

Global demand for automotive wires is primarily driven by the integration of smart systems in automobiles. Modern automobiles have more wires because electronic control units (ECUs) are becoming more and more popular. Each ECU has been connected to a variety of sensors, actuators, and other ECUs through a complex network of connections. Automotive manufacturers are using sophisticated wiring solutions, such as light-weight harnesses, insulated cables and high-temperature-resistant wires to manage the rising number of connections and ensure reliable performance. For instance, In July 2024, Compal Electronics Inc, a leading contract electronics manufacturer from Taiwan, announced plans to build its first European factory in Poland. The company intends to invest more than $15.4 million to target automotive electronics clients. This strategic move marks Compal’s expansion into the European market. The need for complex and more advanced wiring solutions will continue to grow as automobiles become more technologically advanced, fueling the worldwide automotive wires market’s expansion.

Schedule A Call :

Fluctuating cost of materials to hamper the market

The market for automotive wires is significantly impacted by the price fluctuations of raw materials, particularly copper and aluminum. These materials are necessary for making automobile wires, and the market’s ability to expand may be severely hindered by their price instability. For instance, vehicle automation requires multiple sensors, as well as additional on-board computers. A standard autonomous system, with 12 cameras, seven Light Detection and Ranging sensors (LiDARs), eight radars and one automated driving control unit, will all depend on copper connections to function safely and reliably.

Buy Now :

For more details on this report — Request for Sample

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships, and collaborations are key strategies adopted by players in the Automotive Wires Market. The top 10 companies in this industry are listed below:

Aptiv plc

Yazaki Corporation

Furukawa Electric Co., Ltd

Sumitomo wiring systems

Nexans SA

Fujikura Ltd

Samvardhana Motherson International Ltd

Leoni AG

Lear Corporation

THB Electronics

Scope of the Report:

Report MetricDetails

Base Year Considered

2023

Forecast Period

2024–2030

CAGR

5.7%

Market Size in 2030

$ 6.8 Billion

Segments Covered

By Material, By Vehicle Type, By Propulsion, By Transmission Type, By Application, By End User and By Geography.

Geographies Covered

North America (U.S., Canada and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia and Rest of South America), Rest of the World (Middle East and Africa).

Key Market Players

1. Aptiv plc

2. Yazaki Corporation

3. Furukawa Electric Co., Ltd

4. Sumitomo wiring systems

5. Nexans SA

6. Fujikura Ltd

7. Samvardhana Motherson International Ltd

8. Leoni AG

9. Lear Corporation

10. THB Electronics

For more Automotive Market reports, please click here

0 notes

Text

Automotive Smart Lighting Market Report

Automotive Smart Lighting Market Report: Demand, Trends, Outlook and Forecast by 2031

The global Automotive Smart Lighting Market size was valued at USD 4.46 Billion in 2022 and is projected to reach from USD XX Billion in 2023 to USD 9.59 Billion by 2031, growing at a CAGR of 8.89% during the forecast period (2023–2031). Automotive smart lighting refers to the advanced lighting systems used in vehicles, which provide improved safety, comfort, and efficiency. These systems use advanced technologies, such as LED, xenon, and halogen, to provide adaptive and responsive lighting.

Automotive Smart Lighting Market Categorization

The global automotive smart lighting market is categorized based on vehicle type, application type, and technology type.

Request a Free Sample (Full Report Starting from USD 1850): https://straitsresearch.com/report/automotive-smart-lighting-market/request-sample

By Vehicle Type

Passenger Cars

Commercial Vehicles

By Application Type

Interior Lighting

Exterior Lighting

By Technology Type

Halogen

Xenon

LED

Other Technologies

Market Segmentation with Insights-Driven Strategy Guide: https://straitsresearch.com/report/automotive-smart-lighting-market/segmentation

Geographic Overview

The global automotive smart lighting market is dominated by four regions: North America, Europe, Asia-Pacific, and the Rest of the World.

North America

The US is the largest market in North America, driven by the presence of major automotive manufacturers and a high demand for advanced safety features.

Canada and Mexico are also significant markets in the region.

Europe

Germany is the largest market in Europe, driven by the presence of major automotive manufacturers, such as Volkswagen, BMW, and Mercedes-Benz.

The UK, France, and Italy are also significant markets in the region.

Asia-Pacific

China is the largest market in Asia-Pacific, driven by the rapid growth of the automotive industry and a high demand for advanced safety features.

Japan, South Korea, and India are also significant markets in the region.

Rest of the World

Brazil and Russia are significant markets in the Rest of the World region, driven by the growing demand for advanced safety features and the presence of major automotive manufacturers.

Buy Full Report (Exclusive Insights): https://straitsresearch.com/buy-now/automotive-smart-lighting-market

Top Players of Automotive Smart Lighting Market

Some of the top players operating in the global automotive smart lighting market include:

Koito Manufacturing Co. Ltd.

Stanley Electric Co. Ltd.

OsRam Licht AG

HELLA KGaA Hueck & Co.

Hyundai Mobis

Mitsuba Corporation

Koninklijke Philips NV

ZKW Group GmbH

Hasco Vision Technology Co. Ltd.

Robert Bosch GmbH

Detailed Table of Content of the Automotive Smart Lighting Market Report: https://straitsresearch.com/report/automotive-smart-lighting-market/toc

0 notes

Text

One of the mainstays for any British funfair is the Waltzer. Indeed so popular is this particular ride that you will struggle to find any but the smallest funfairs without one. Similar in style to the Noah's Ark ride, i.e., a platform that rotates at high speed and undulates over a number of hills to give an up and down motion. The difference is the ark originally had various animals to sit on, then evolved to have motorbikes, probably around the time that motorbikes became popular with young people. This led in some places to them becoming more popularly known as speedways. As most early rides were these tended to be ornately decorated. The waltzer by contrast has tub shaped cars, that are attached by either a slew ring or a pivot point to the platform. As the ride rotated, the riders all sat at one end of the car would unbalance it and it would begin to spin. The attendants on the ride would walk the platform as it rotated spinning the cars by hand to make them faster. With attractive young ladies tending to be spun the most. Waltzer car Early History The very first evidence we have for the ride, is a 1920's model built by one Dennis Jeffries of Congleton. Posterity records the very first passengers as being his nieces Phyllis and Dolly Booth, nothing like using family as Guinee pigs. A tradition which continues today, a few years back a relative building his own ghost train had put the first car together, but wasn't sure if the gearing was correct. He put his old dad in as a crash test dummy and set it in motion. The car accelerated along the track like an exocet missile, jumped the rails at the first corner and set off into infinity and beyond. Luckily said dad fell off at this point. No amount of cajoling could convince him to try the mark two car. Maxwell And Sons The sadly now defunct Scottish firm of Maxwell and Sons, based in Musselburgh, became perhaps the best known manufacturer of the ride in the UK producing some 59 examples of the ride. Waltzers tended to have ten cars, though as the ark/speedway fell out of fashion a number of these were converted to waltzers so there are both nine and eleven car examples. H.P. Jacksons The biggest rival to Maxwells was the Congleton based firm of Jackson's who produced 29 rides. They kept going a little longer than Maxwells producing their last ride in 1992. (Maxwells were out of business by 1983) A number of other firms produced waltzers, but only in very small numbers. Fairtrade Services Waltzers were always an extremely labour intensive ride to set up and derig. A handful of examples were converted to pack on an artic load to reduce the set up time. A showmen by the name of Robert Porter, who was experienced in refurbishing and repairing waltzers. Took this a step further with a design for a new ride, made from the start to be a more compact travel load and quicker set up. Under the brand of Fairtrade Services he has now produced 21 examples. They are on track to surpass Jackson's as the second most prolific manufacturer. One particularly striking example of a 'Porter Waltzer' as they are more commonly referred to, is the example above. Built for the Norwegian firm of Lund's Tivoli. With Aasmund Lund at the helm, the firm commissioned this ride. With it's stunning fireball theme, around the back of the ride are numerous led screens that provide a fire effect. It is unusual that although the ride is one of the most popular in the UK, it is seldom seen on the continent. Raymond Codona Jnr travelled his Hell Raiser waltzer in Holland for a number of seasons. Very successfully, but you find few native examples. Tilt-A-Whirl Across the pond Herbert Sellner invented a similar ride called the Tilt-A-Whirl in 1926. Similar in motion to the waltzer this type only has seven cars, but otherwise works in much the same way. The most noticeable difference, is that the waltzer has a roof and is an enclosed ride. Add in the sound and lighting systems and they are much like a portable nighclub. The tilt a whirl by contrast is an open topped ride. To be honest looks very much like an home made waltzer. The Waltzers The waltzer is an enduring icon of the British fairground scene. One change to its detriment is are the current health and safety laws. Waltzers were renowned for having the gangway around the edge of the ride packed with people. It truly was a social event, with many a couple meeting on the waltzers (Kevin Keegan the England football star was one, meeting his wife on Dowses waltzer at Scunthorpe). Sadly young people nowadays aren't considered responsible enough to stand on he gangway a few feet from the spinning platform so now the ride is closed off whilst it is in motion. Sources; Fairground Heritage https://www.fairground-heritage.org.uk/learning/fairground-people/robert-lakin-company/ National Fairground and Circus Archive https://www.sheffield.ac.uk/nfca/researchandarticles/fairgroundrides Wikipedia https://en.wikipedia.org/wiki/Waltzer#:~:text=TheWaltzerisavariety,Waltzersoriginallyhad10cars. Read the full article

0 notes

Text

All-Terrain Vehicle Market Dynamics: Growth Trends, Key Insights & Forecast 2023 to 2030

The global all-terrain vehicle market size is expected to reach USD 6.01 billion by 2030, registering a CAGR of 3.8% from 2023 to 2030, as per a new report by Grand View Research, Inc. The development of off-road terrains, trails, and recreational parks is projected to boost the demand for All-terrain Vehicles (ATVs) by 2030. Moreover, governments’ initiatives to enhance tourism and recreational activities have supported the sales of ATVs. For instance, the Travel Management & Off-Highway Vehicle (OHV) Program announced by the U.S. Forest Service aims to increase the awareness and popularity of trails in North America.

Factors such as the growing popularity of off-road racing events and increased advertising have fueled the demand for ATVs across the globe. For instance, in January 2019, the Desert Series Pro ATV tournament involved ATV enthusiasts and many off-road vehicles which contributed to the adoption of ATVs. Additionally, growth in investments from sponsors is anticipated to boost the growth of the market by 2030.

Gather more insights about the market drivers, restrains and growth of the All-Terrain Vehicle Market

Over the past few years, economic growth in developing economies, such as India and China, has resulted in higher disposable incomes and purchasing power of individuals, creating more spending capacity. This, in turn, supports the travel and tourism industry. As per the data published by the World Travel and Tourism Council (WTTC), the global tourism sector grew by 3.9% in 2018. The development of the tourism sector has led to a significant increase in recreational activities, thereby driving the demand for ATVs.

North America dominated the ATV market in 2022. This can be attributed to the presence of vast and diverse landscapes in North America, including mountain ranges and dense forests. ATV manufacturers focus on developing innovative and safer equipment that can meet the diverse needs of end users who want to explore tough terrains. Additionally, the increasing production and sales of ATVs in North America are expected to contribute to the growth of the market. The presence of various market players, including Polaris Inc., Textron Inc., and BRP, among others, is likely to further contribute to the growth

Browse through Grand View Research's Automotive & Transportation Industry Research Reports.

The global light duty vehicles market size was valued at USD 849.57 billion in 2024 and is projected to grow at a CAGR of 8.6% from 2025 to 2030.

The global cognitive supply chain market size was estimated at USD 8,579.7 million in 2024 and is projected to grow at a CAGR of 17.6% from 2025 to 2030.

All-terrain Vehicle Market Segmentation

Grand View Research has segmented the global all-terrain vehicle market report based on engine type, application, and region

All-terrain Vehicle (ATV) Engine Type Outlook (Revenue, USD Million, 2018 - 2030)

Below 400cc

400 - 800cc

Above 800cc

All-terrain Vehicle (ATV) Application Outlook (Revenue, USD Million, 2018 - 2030)

Agriculture

Sports

Recreational

Military and Defense

All-terrain Vehicle (ATV) Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Asia Pacific

China

Japan

India

Australia

South Korea

Latin America

Brazil

Mexico

Middle East and Africa

Saudi Arabia

South Africa

UAE

Key Companies profiled:

Polaris Inc.

American Honda Motor Co., Inc.

BRP

Yamaha Motor Corporation, USA.

com

CFMOTO

Kawasaki Motors Corp., U.S.A.

KYMCO

LINHAI POWERSPORTS USA CORPORATION

Suzuki Motor of America, Inc.

Recent Developments

In March 2023, Polaris Inc. unveiled the RZR Pro R Factory, a specialized UT (Utility Terrain) vehicle specifically designed for competitive racing. This purpose-built vehicle has undergone meticulous engineering to deliver exceptional performance in demanding conditions encountered in open desert racing. With the introduction of the RZR Pro R Factory, Polaris Inc. aimed to provide racers with a high-performance vehicle that is optimized for the challenges and rigors of intense off-road racing competitions.

In January 2022, John Deere introduced two additions to their utility vehicle lineup: the XUV835R Gator Utility Vehicle and the XUV865R Gator Utility Vehicle. With these new models, John Deere aimed to provide customers an enhanced capabilities and a premium experience, ensuring that their utility vehicle needs are met with the utmost satisfaction.

In September 2021, Yamaha introduced the Grizzly 90, a specially designed sports model intended for young individuals aged ten and above. This youth-focused vehicle boasts a low-maintenance 90cc engine that incorporates air-cooling and wet-sump lubrication for optimal performance.

In June 2021, Kawasaki unveiled the BRUTE FORCE 750 4x4i, an off-road vehicle designed for thrilling outdoor adventures. Powered by a fuel-injected 749cc V-twin engine, this vehicle delivers outstanding performance on challenging terrains. It comes equipped with various features such as a front differential lock, selectable drive modes, and continuous variable transmission (CT), all contributing to improved traction and overall performance.

Order a free sample PDF of the All-Terrain Vehicle Market Intelligence Study, published by Grand View Research.

0 notes

Text

Shop the Finest British Customs Parts for Your Motorbike in the UK

Shop the Finest British Customs Parts for Your Motorbike in the UK If you're into motorbikes and have any desire to give yours a genuine individual touch, you must look at English traditions parts. The UK has forever been a hotbed for motorbike culture, and it's home to probably the greatest aspects and frills out there. Whether you're developing a custom motorcycle from the beginning or simply hoping to trade out a couple of pieces to make your brave stand, English-made motorbike parts are the best approach. The craftsmanship, the style, and the exhibition — they have everything.

Why Go for British Customs Parts? Anyway, why pick parts of English traditions for your motorbike in the UK? Basic. Quality. The UK has a long history of first-class design regarding motorbikes. From exemplary plans that never become dated to state-of-the-art custom stuff, English makers have acquired their standing. When you purchase parts from the UK, you're not simply getting something off the rack — you're getting something worked with accuracy, enthusiasm, and a great deal of skill.

Furthermore, we should be genuine, there's nothing at all like shaking English-made parts on your motorbike. Whether you're after something smooth and snazzy or you need to amp up your performance, the UK has a lot of choices for you. Everything revolves around making your ride your ride. English custom parts offer that ideal equilibrium of execution, character, and obviously, appropriate great looks.

Must-Have British Customs Parts for Your Motorbike At the point when you begin searching for motorbike parts in the UK, you'll rapidly understand there's an entire universe of cool stuff out there. Here are a portion of the top picks that each motorbike fan ought to consider:

Exhaust Systems English-made exhaust systems are the gear of legend. Whether you're after that exemplary profound thunder or a presentation-centered overhaul, you'll track down something that gives your bicycle an exceptional sound and a lift in power. Furthermore, they look perfect — nothing says "custom" like a very much-created exhaust.

Custom Handlebars A new set of handlebars can change the feel of your ride. Whether you're into sporty clip-ons, laid-back cruisers, or bold ape hangers, the UK has you covered. British-made handlebars not only look fantastic but are built for comfort, too. They’re the perfect way to personalize your motorbike while making sure you're riding in style and comfort.

Seats and Saddles Comfort is key, especially if you’re out on long rides. Custom seats from British manufacturers are made to not only look great but also keep you comfy for hours on the road. Whether you're going for exemplary cowhide or something somewhat more present-day, there's no lack of seat styles to browse in the UK.

Suspension & Shock Absorbers If you believe your motorbike should deal with it like a fantasy, you want top-quality suspension. British brands know their stuff when it comes to shocks and suspension parts. Whether you want something smooth for long-distance cruising or something sporty for faster, more aggressive riding, UK-made suspension parts will do the job.

Lights and Indicators Custom lighting is one of the easiest ways to make your motorbike pop. From sleek LED indicators to unique headlamps and tail lights, UK brands offer loads of options that bring a fresh look to your bike while keeping things practical and functional.

Where to Shop for British Customs Parts in the UK The UK is full of places to pick up custom motorbike parts. Whether you’re shopping online or heading to a local shop, there are tonnes of retailers who specialize in British-made parts. The beauty of shopping in the UK is the wide selection of parts from both well-established brands and smaller, boutique manufacturers. You’ll find everything from major exhaust companies to independent artisans who craft some of the most unique motorbike accessories around.

If you're the sort who likes to get involved, visiting a shop face-to-face is an extraordinary method for seeing the nature of the parts firsthand. You can ask the staff for suggestions, and much of the time, they'll try and assist you with establishment guidance. For individuals who like to shop from the lounge chair, there are a lot of internet-based stores that convey right to your entryway, so you can take as much time as necessary perusing and purchasing.

The UK Edge: Craftsmanship and Tradition Can we just look at things objectively for a moment, English craftsmanship is top-notch. Also, with regards to motorbike parts, it's the same. The tender loving care and quality that goes into English-made parts are apparent in each piece. Numerous notorious motorbike brands have been established in the UK, those customs impact the parts you'll track down today. From Win to Norton, the UK has a tradition of building bicycles that individuals love. At the point when you purchase custom parts from English makers, you're taking advantage of that rich history while adding your remarkable contort.

Wrapping It Up Looking for parts of English traditions for your motorbike in the UK isn't just about getting a few new extras — it's tied in with making your motorbike your own. Whether you're after better execution, a cooler feel, or simply a more agreeable ride, UK-made parts offer top-quality answers for each rider.

#britishcustoms#motorbikeparts#ukmotorbikes#custommotorbikes#rideuk#motorbikeupgrades#bikemods#ukriders#bikelifestyle#customparts#motride#full face helmet#motorcycle helmet#modular helmets#motorbikelife#motorcycle accessories#autos#branded helmets#rideinstyle

0 notes

Text

Flexible LED strip light with UK power plug

0 notes

Text

If you're looking for the Best Lighting Fareham, D.R. Kershaw Ltd is a top choice. Their showroom in Fareham features a wide array of products, from chandeliers to LED lighting, table lamps, and outdoor fixtures. Whether you're after something traditional or modern, they can help you find the perfect fit for your space. Additionally, they provide bespoke designs and work with trusted manufacturers to ensure quality and style. Contact Us:-01329 662 280 Website:- https://uk-lighting.co.uk

#electrical contractors in winchester#lighting retailer fareham#light shops near me#best light shops near me#lighting solutions fareham

0 notes

Text

Li-Fi Market — Forecast(2024–2030)

Li-Fi Market Overview

The Global market for Li-Fi Market Size is forecast to reach $ 35310 Million by 2030, at a CAGR of 40.30% during forecast period 2024–2030. The market growth is attributed to the factors such as growing demand for indoor wireless communication technology in the commercial sector, increasing implementation of Li-Fi, Light as a service (LaaS) and other Optical Sensing based technology in healthcare & education sectors and others.

Moreover, rise in penetration of smart devices, construction of smart cities and commercial establishments boosts the market growth. Analysing the widespread use of LED bulbs inside buildings and the large visible light bandwidth, Li-Fi technology is much cheaper and more environmentally friendly than Wi-Fi. In many popular applications, Li-Fi technology has great potential, such as location-based services, mobile connectivity, smart lighting and hazardous environments.

Report Coverage

The report: “Li-Fi market — Forecast (2024–2030)”, by IndustryARC covers an in-depth analysis of the following segments of the Li-Fi market.

By Component type: LEDs, Optical Sensing, Photo-detectors, Microcontrollers, others

By Application: Indoor networking, Location-Based Services, Underwater communication, Smartphone, Standalone Tracker, Advance Tracker, Others

By End Users: Aerospace & Defence, Healthcare, Education, Transportation, Automotive, Consumer Electronics, Retail, Government, Others

By Geography: North America (U.S, Canada, Mexico), Europe(Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, South korea, Australia and Others), South America (Brazil, Argentina and others), and ROW (Middle East and Africa)

Request Sample

Key Takeaways

As digitalisation multiplies the number of connected devices, the bandwidth of radio frequencies is facing a bottleneck due to its small capacity, which impacts the quality of service. Li-Fi technology, on the other hand, uses a visible light continuum for data processing that is free of any scale constraints. The impending RF crunch is therefore an important driver for the Li-Fi market

North America region dominated the global Li-Fi market in 2020 owing to the presence of advanced technologies, large number of manufacturers and the increasing domestic and commercial demands for Li-Fi.

Li-Fi Market Segment Analysis — By Component type

Li-Fi market is segmented into LEDs, Optical Sensing, Photo-detectors, Microcontrollers and others on the basis of component. The market of LEDs is anticipated to hold the highest market share of 48.2% in 2020 and is projected to witness fast growth. This growth can be attributed to increased LED and Light as a Service deployment at commercial establishments and industries. The ability of an LED to modulate swiftly on and off is key to Li-Fi working. These modulation and demodulation schemes transition data from one location to another.

Li-Fi operates by taking and inserting data content into an SSL driver by streaming it. This SSL driver can run a string of high speed LED lamps, turning them on and off. As the LED lamps turn on and off and strobe faster than the eye can see, it illuminates the context area. Their demand in Li-Fi systems is proliferating with several advantages of LEDs such as durability, low power consumption, and high energy output. These advantages contribute to the broad adoption of LEDs in the form of arrays for Li-Fi system infrastructure, supporting the growth of the market.

Li-Fi Market Segment Analysis — By Application type

Indoor networking type segment held the highest market share of Li-Fi in 2020. Moreover, it is anticipated to witness the significant market growth of 25.1% CAGR during the forecast period 2024–2030. Smart buildings are presently acclimatizing to accommodate their residents, in order to enhance dweller cosiness and customer experience. They do this by identifying the coordinates of each user and then providing on-site services such as smart car parking, condition monitoring, logistics and shopping support services through Light as a Service wireless communication technology. The basic idea of Li-Fi technology is to use the visible light of an LED light bulb to transmit high-speed data to a smartphone or tablet-connected photo detector and optical sensing.

Li-Fi Market Segment Analysis — By Geography

North America is anticipated to witness significant market growth of 26.7% during the forecast period 2024–2030. Market growth is attributed to factors such as technological advances, increased demand for energy-efficient appliances and increased demand for high-speed wireless connectivity technology in the area. The region also has a well-established infrastructure which allows easy implementation of advanced technologies and provides better connectivity.

North America, which has prominently taken the lead on various technological developments such as smart homes, smart cities, Internet of Things (IoT), big data and consumer electronics; has emerged as the nucleus for Li-Fi market demand. With majority of the global smart homes, intelligent transport systems and green buildings developing in the U.S., there is upliftment in the market growth of Li-Fi. In the lighting industry, the growth and increase in lifetime of LED lightening has led to the development of new commercial schematics.

Light source coming from LED bulbs provides a pathway for data in Li-Fi technology, Light as a Service and can meet any devices that it illuminates. The strobing of the LED bulb generates a signal for the receiver device, thereby transferring information. This wireless optical networking technique offers great ability to transmit data at a rate of 224 GB per second and is approximately 100 times faster than Wi-Fi.

In January 2019, VLNComm formed the industry’s fastest, most affordable, and most innovative Li-Fi LED lighting panel. The LumiNex panel, introduced and successfully demonstrated to over 500 people at CES 2018 in Las Vegas, is capable of downloading speeds of 108Mbps and upload speeds when combined with the LumiStick 2, 53Mbps. Such product launches boosts the market growth in this region.

Li-Fi Market Drivers

Inexpensive LEDs Ballooning Implementation

LED plays a vital role in the overall growth of the Li-Fi industry as a basic component of Li-Fi networks. Globally, LED is promoted due to features such as low power consumption, a lack of harmful emissions and increased lighting. Moving for the aim of ‘low carbon economy’ and ‘smart cities,’ policymakers around multiple nations are offering discounted prices for LED bulbs in order to raise application rate. Such developments increase the range of potential Li-Fi Systems users.

Adoption over Wi-Fi

Apart from potentially faster speed Li-Fi has multiple other benefits over Wi-Fi. Li-Fi offers a more secure network as light cannot pass through walls; this also minimizes the interference between devices. Li-Fi is also useful in electromagnetic sensitive areas such as in aircraft cabins, hospitals and nuclear power plants without producing electromagnetic interference. Li-Fi technology uses visible light spectrum and can thus communicate data and unravel capacity which is 10,000 times greater than that accessible within the radio spectrum. The present visible light spectrum is abundant, free and unlicensed; this will help in mitigating the radio frequency spectrum crunch effect. This will drive the Li-Fi market over the forecast period

Inquiry Before Buying

Li-Fi Market Challenges

Transfer within Room

Li-Fi is unable to relay the path through walls. Wi-Fi is, this drawback of Li-Fi can also be used as a protective mechanism where communication only takes place within a certain space and gadgets that are not present within the room cannot reach it.

Li-Fi Market Landscape

Partnerships and acquisitions along with product launches are the key strategies adopted by the players in the Li-Fi market. As of 2019, the market for Li-Fi market is consolidated with the top players General Electric (U.S.), Koninklijke Philips N.V. (the Netherlands), Oledcomm (France), PureLiFi Limited (U.K), Panasonic Corporation (Japan), Acuity Brands, Inc. (U.S.), LightPointe Communications, Inc. (U.S.), Velmenni (Tartu), LightBee Corporation (U.S.), FSONA Networks (U.K) and among others.

Buy Now

Acquisitions/Technology Launches/Partnerships

In June 2019, Signify, the world leader in lighting, launched a new range of LiFi systems that includes the world’s fastest and most reliable LiFi systems commercially available. The range, branded Trulifi, leverages existing and future professional luminaires. Instead of using radio signals (such as WiFi, 4G/5G, Bluetooth, etc.).

In January 2019, Oledcomm announced LiFiMAX, a low-profile ceiling lamp. LiFiMax is an optical wireless communication system that offers an internet connection over light waves to up to 16 users simultaneously at a peak speed of 100Mbps.

Key Market Players:

The Top 5 companies in the Li-Fi Market are:

pureLiFi

Oledcomm

Signify (Philips Lighting)

Wipro Lighting

Panasonic Corporation

0 notes

Text

Top Explosion-Proof Digital Camera Providers in the UAE

In hazardous working environments such as oil rigs, oil and gas processing plants, electronics like smartphones are strictly prohibited. Even regular cameras need to get a safety permit for the zone before use. This is to ensure that the electronics do not interfere with the frequency of the operational communications. Additionally, use of electronics poses a huge risk of explosions in hazardous environments. Thus, any device needs to be safety certified to make industrial workplaces safer and ensure seamless operations. The explosion-proof digital camera has special wire enclosures that contain the internal sparks and prevent them from coming in contact with the external volatile environment.

Highly regulated areas such as oil and gas plants require strict regulated devices such as explosion-proof digital cameras, which are manufactured as per strict ATEX standards. The Middle East is a hub of oil and gas production, and UAE accounts for more than 13 percent of the total oil production. In this context, the use of an explosion-proof camera becomes indispensable in this region.

SharpEagle, the UAE-based firm, has established itself as a prominent brand for manufacturing and installing surveillance systems, material handling equipment, and various other safety solutions across the GCC. We have customised our solutions to address the safety challenges in diverse high-risk industries and established ourselves as the leading safety partners in the ex-proof digital camera in the UAE. The company has expanded its reach from the UAE and cemented its position in the seven other countries, including, Saudi Arabia, Oman, Kuwait, Bahrain, Qatar, India, and UK.

What makes SharpEagle stand out among other providers of ex-proof solutions are our end-to-end safety solutions. Our experts conduct a thorough site inspection to identify the core safety gaps and challenges in your industry and recommend customised safety solutions to target these problems. Besides designing and manufacturing a range of ex-proof solutions, team SharpEagle also assists in the installation and maintenance of the safety devices to ensure their reliable and seamless performance for a long period of time.

Features of Digital Camera

One of the finest ATEX products from the SharpEagle range is the explosion-proof digital camera specially made for hazardous industrial conditions. It has a robust design and making, which is weatherproof, waterproof, and corrosion-resistant. Every buyer needs to make sure that the digital camera invested in is sturdy, durable, and ATEX-certified for the challenging industry conditions. SharpEagle has a solid track record of 15 years and a promise of 2-year exclusive warranty as an ex-proof digital camera manufacturer. Our team understands the concerns of our industry partners and constantly evolves in R&D to adapt to them, offering a reputable and reliable product for safer workplaces in the UAE.

Read More: How Explosion-Proof LED Lights in Chemical Plants Can Keep Workers and Business Safe

Trust SharpEagle for Durable, Explosion-Proof Cameras – 250 Shots per Charge for Uninterrupted Safety Surveillance. Reliability in Every Frame!

Reach Out to Us

Future-Proof your Safety Investments with SharpEagle

At SharpEagle, our sole aim is that every customer is benefitted from our vast expertise and experience. Our in-depth knowledge of instruments and experience in applying a varied range of technologies in our products has made us stand out from the crowd. Businesses across the globe are adapting to the latest safety protocols to provide their workforce with low-risk solutions and more secure work environments. Future-proof your purchase and comply with the latest safety standards by partnering with SharpEagle. Book a consultation call with our experts to get a free quote for the explosion-proof digital camera.

#Digital camera explosion proof#intrinsically safe digital camera#intrinsically safe explosion proof camera#intrinsically safe camera class 1 div 1#intrinsically safe camera in uae

0 notes

Text

One of the mainstays for any British funfair is the Waltzer. Indeed so popular is this particular ride that you will struggle to find any but the smallest funfairs without one. Similar in style to the Noah's Ark ride, i.e., a platform that rotates at high speed and undulates over a number of hills to give an up and down motion. The difference is the ark originally had various animals to sit on, then evolved to have motorbikes, probably around the time that motorbikes became popular with young people. This led in some places to them becoming more popularly known as speedways. As most early rides were these tended to be ornately decorated. The waltzer by contrast has tub shaped cars, that are attached by either a slew ring or a pivot point to the platform. As the ride rotated, the riders all sat at one end of the car would unbalance it and it would begin to spin. The attendants on the ride would walk the platform as it rotated spinning the cars by hand to make them faster. With attractive young ladies tending to be spun the most. Waltzer car Early History The very first evidence we have for the ride, is a 1920's model built by one Dennis Jeffries of Congleton. Posterity records the very first passengers as being his nieces Phyllis and Dolly Booth, nothing like using family as Guinee pigs. A tradition which continues today, a few years back a relative building his own ghost train had put the first car together, but wasn't sure if the gearing was correct. He put his old dad in as a crash test dummy and set it in motion. The car accelerated along the track like an exocet missile, jumped the rails at the first corner and set off into infinity and beyond. Luckily said dad fell off at this point. No amount of cajoling could convince him to try the mark two car. Maxwell And Sons The sadly now defunct Scottish firm of Maxwell and Sons, based in Musselburgh, became perhaps the best known manufacturer of the ride in the UK producing some 59 examples of the ride. Waltzers tended to have ten cars, though as the ark/speedway fell out of fashion a number of these were converted to waltzers so there are both nine and eleven car examples. H.P. Jacksons The biggest rival to Maxwells was the Congleton based firm of Jackson's who produced 29 rides. They kept going a little longer than Maxwells producing their last ride in 1992. (Maxwells were out of business by 1983) A number of other firms produced waltzers, but only in very small numbers. Fairtrade Services Waltzers were always an extremely labour intensive ride to set up and derig. A handful of examples were converted to pack on an artic load to reduce the set up time. A showmen by the name of Robert Porter, who was experienced in refurbishing and repairing waltzers. Took this a step further with a design for a new ride, made from the start to be a more compact travel load and quicker set up. Under the brand of Fairtrade Services he has now produced 21 examples. They are on track to surpass Jackson's as the second most prolific manufacturer. One particularly striking example of a 'Porter Waltzer' as they are more commonly referred to, is the example above. Built for the Norwegian firm of Lund's Tivoli. With Aasmund Lund at the helm, the firm commissioned this ride. With it's stunning fireball theme, around the back of the ride are numerous led screens that provide a fire effect. It is unusual that although the ride is one of the most popular in the UK, it is seldom seen on the continent. Raymond Codona Jnr travelled his Hell Raiser waltzer in Holland for a number of seasons. Very successfully, but you find few native examples. Tilt-A-Whirl Across the pond Herbert Sellner invented a similar ride called the Tilt-A-Whirl in 1926. Similar in motion to the waltzer this type only has seven cars, but otherwise works in much the same way. The most noticeable difference, is that the waltzer has a roof and is an enclosed ride. Add in the sound and lighting systems and they are much like a portable nighclub. The tilt a whirl by contrast is an open topped ride. To be honest looks very much like an home made waltzer. The Waltzers The waltzer is an enduring icon of the British fairground scene. One change to its detriment is are the current health and safety laws. Waltzers were renowned for having the gangway around the edge of the ride packed with people. It truly was a social event, with many a couple meeting on the waltzers (Kevin Keegan the England football star was one, meeting his wife on Dowses waltzer at Scunthorpe). Sadly young people nowadays aren't considered responsible enough to stand on he gangway a few feet from the spinning platform so now the ride is closed off whilst it is in motion. Sources; Fairground Heritage https://www.fairground-heritage.org.uk/learning/fairground-people/robert-lakin-company/ National Fairground and Circus Archive https://www.sheffield.ac.uk/nfca/researchandarticles/fairgroundrides Wikipedia https://en.wikipedia.org/wiki/Waltzer#:~:text=TheWaltzerisavariety,Waltzersoriginallyhad10cars. Read the full article

0 notes

Text

Bullet IP Camera Market Trends and Strategic Development Study 2024 - 2032

The Bullet IP Camera market has been witnessing significant growth driven by increasing security concerns, advancements in technology, and the rising demand for surveillance solutions across various sectors. This article provides a comprehensive overview of the Bullet IP Camera market, including its definition, key features, market dynamics, applications, and future prospects.

Overview of Bullet IP Cameras

What is a Bullet IP Camera?

The Bullet IP camera market is poised for significant growth as security concerns continue to rise globally. With advancements in technology and the increasing integration of smart solutions, Bullet IP cameras are a type of surveillance camera characterized by their cylindrical shape, resembling a bullet. They are designed for outdoor use, often featuring weatherproof casings that protect against the elements. These cameras utilize Internet Protocol (IP) technology, allowing for high-resolution video streaming and remote access via networks.

Key Features

High Definition Video: Bullet IP cameras often offer resolutions ranging from 720p to 4K, providing clear and detailed images.

Infrared Night Vision: Many models come equipped with infrared capabilities, allowing for visibility in low-light conditions.

Motion Detection: Advanced motion detection features help to trigger alerts and reduce false alarms.

Remote Access: Users can monitor feeds remotely through mobile apps or web browsers.

Market Dynamics

Current Trends

Increasing Demand for Security Solutions: Growing concerns over crime and safety have led to increased investments in surveillance systems, including Bullet IP cameras.

Technological Advancements: Innovations such as artificial intelligence (AI) and machine learning are enhancing the capabilities of Bullet IP cameras, making them smarter and more efficient.

Integration with Smart Home Systems: The rising trend of smart homes has increased the adoption of Bullet IP cameras, which can be seamlessly integrated into home automation systems.

Challenges

Privacy Concerns: The use of surveillance cameras raises ethical and privacy issues, which can hinder adoption in certain regions.

High Initial Costs: The upfront investment for high-quality Bullet IP cameras and their installation can be a barrier for some consumers.

Applications of Bullet IP Cameras

Commercial Security

Bullet IP cameras are widely used in commercial settings, including retail stores, banks, and corporate offices, to enhance security and monitor activities.

Residential Security

Homeowners increasingly rely on Bullet IP cameras to protect their properties and deter intruders. The ease of installation and remote monitoring capabilities make them a popular choice.

Public Surveillance

Municipalities use Bullet IP cameras for public safety in urban areas, parks, and transportation hubs to monitor crowds and enhance security.

Industrial Applications

Manufacturing facilities and warehouses deploy Bullet IP cameras to monitor operations, prevent theft, and ensure worker safety.

Regional Analysis

North America

The North American market is a significant player in the Bullet IP camera sector, driven by high security spending and technological advancements. The United States is the largest market, with increasing demand from both commercial and residential sectors.

Europe

Europe is witnessing steady growth in the Bullet IP camera market, bolstered by stringent security regulations and a growing emphasis on public safety. Countries such as the UK and Germany are leading the adoption of advanced surveillance technologies.

Asia-Pacific

The Asia-Pacific region is expected to see the fastest growth in the Bullet IP camera market due to rapid urbanization, rising crime rates, and increasing investments in security infrastructure. Countries like China and India are at the forefront of this growth.

Key Players in the Market

Leading Manufacturers

Some of the prominent companies in the Bullet IP camera market include:

Hikvision: A global leader in video surveillance products, offering a wide range of Bullet IP cameras with advanced features.

Dahua Technology: Known for its innovative security solutions, Dahua provides high-performance Bullet IP cameras suitable for various applications.

Axis Communications: A pioneer in network video technology, Axis offers high-quality Bullet IP cameras with robust features and performance.

Emerging Companies

New entrants in the market are leveraging innovative technologies and competitive pricing to capture market share. These include:

Reolink: Known for affordable and easy-to-use surveillance solutions, including Bullet IP cameras targeted at the DIY market.

Amcrest: Focuses on providing high-quality security cameras at competitive prices, appealing to both residential and commercial consumers.

Future Outlook

Growth Projections

The Bullet IP camera market is expected to grow at a compound annual growth rate (CAGR) of approximately 10-12% over the next five years. Key factors driving this growth include:

Increasing security threats and the need for enhanced surveillance solutions.

Ongoing advancements in camera technology, including AI and IoT integration.

Rising demand for smart home security systems.

Innovations to Watch

AI-Powered Features: Integration of AI capabilities for facial recognition, anomaly detection, and intelligent video analytics.

Cloud Storage Solutions: The rise of cloud-based storage for easier access and management of video footage.

Enhanced Connectivity: Development of better connectivity options, such as 5G integration, for seamless video streaming.

Conclusion

Bullet IP cameras offer effective surveillance options for various applications. As the market evolves, both established and emerging players will need to focus on innovation and consumer needs to remain competitive in this dynamic landscape. The future of Bullet IP cameras looks promising, with ongoing developments that will enhance their capabilities and expand their market reach.

0 notes

Text

3d Machine Vision Market - Forecast(2024 - 2030)

3D Machine Vision System Market Overview

3D Machine Vision System Market Size is forecast to reach $5.9 billion by 2027, at a CAGR of 11.9% during forecast period 2022-2027. The need for inspection of flaws and controlling a specific task of industrial operations is motivating the utilization of 3D Machine Vision Systems in process control and quality control applications. Additionally, the growing penetration of automation and robotics across various industries and rapid advancements in industrial technologies along with the need for higher productivity are boosting the deployment of 3D Machine Vision Systems. These systems encounter wide range of applications in various industry verticals including oil& gas, aerospace, transportation, automotive among others and are able to serve their inspection needs with the available types such as PC-based and smart camera based 3D Machine Vision Systems. 3D Machine vision systems have been utilized for a number of growing applications including object recognition, automatic inspection, Optical sorting as a real time information for robot controllers. This will drive the market significantly.

Report Coverage

The report: “3D Machine Vision System Market Report– Forecast (2022-2027)”, by IndustryARC covers an in-depth analysis of the following segments of the Brushless DC Motor market

By Product Type: PC Based, Smart Camera Based By Component: Hardware (Camera, Frame Grabber, Lighting, Processor, Optics), Software (Application Specific, Deep Learning) By Application: Quality Assurance and Inspection, Position Guidance, Measurement, Identification, Pattern Recognition and Others By End Users: Automotive, Electrical and Electronics, Healthcare, Consumer Electronics, Aerospace and Defense, Logistics, Security and Surveillance, Printing, ITS, Machinery, Packaging, Food and Beverage and Others By Geography: North America (U.S, Canada, Mexico), South America (Brazil, Argentina, Chile, Colombia and Others), Europe (Germany, UK, France, Italy, Spain, Russia and Others), APAC (China, Japan India, Australia and Others), and RoW (Middle East and Africa)

Request Sample

Key Takeaways

The rising need for advanced manufacturing in the U.S have increasingly demanded the use of 3D Machine Vision Systems.

The market players are majorly opting for various strategies such as product launch, partnership and agreements and collaborations to gain market traction and further penetration to explore the hidden opportunities in upcoming trends including Industry4.0

Recognizing trends and irregularities in production processes early on machine vision paves the way for realizing the smart factory of the future. Machine vision ensures safety in production process as well as quality in the end product.

3D Machine Vision System Market Segment Analysis - By Component

3D Machine Vision System and components market is led by cameras which are estimated to surpass $3.2 billion by 2027 majorly driven by the advancements in imaging technology. The 3D Machine Vision System industry is expected to grow during the forecast period due to continued evolution of CMOS image sensors, rise in demand for automation in industrial applications and increased investments in R&D of smart camera and software by key players, such as Cognex Corporation, Teledyne Technologies, Inc., Keyence Corporation, and others. The global 3D Machine Vision Systems and components market has increased due to the rapid penetration of automation across several industry verticals. Moreover, the development of advanced sensors and software algorithms capable of offering precise and microscopic inspection in high speed production lines is escalating the growth rate of the market. Machine Vision market is estimated to witness significant growth in the coming years, on account of increased adoption in various industries for automatic inspection and control of machines or processes by capturing and interpreting and analyzing an image.

Inquiry Before Buying

3D Machine Vision System Market Segment Analysis - By End Use Industry

Automotive industry is expected to witness a highest CAGR of 14.1% the forecast period, owing to increasing investments, and funds for semiconductors has been providing opportunities for adoption of automation technology which further set to drive the demand of connectors in semiconductor industry. These systems encounter wide range of applications in various industry verticals including oil& gas, aerospace, transportation, automotive among others and are able to serve their inspection needs with the available types such as PC-based and smart camera based 3D Machine Vision Systems. Investments by the U.S automakers for strengthening of the manufacturing of automobiles with increasing integration of recent robotic vision technologies in vehicles is accompanying the growth of the robotic vision market in the U.S. Industry revenue is projected to continue grow due to this development.

3D Machine Vision System Market Segment Analysis - By Geography

3D Machine Vision System market in Europe region held significant market share of 38% in 2021. The investments are rising for electric, connected and autonomous vehicles and this in turn The U.S. accounted a huge market base for Machine Vision due to the growing adoption of 3D Machine Vision System technology by vision companies continues to witness exploration for new applications in a variety of industries. which are driving the machine vision market driven by a push from companies such as Google and Verizon. The rising initiatives in Middle East and Africa for the increasing need of automation is set to propel the machine vision market. The growth of manufacturing industry in Africa and Middle East (AME) is expected to grow at a rate of 14.2% between 2021 and 2025 thereby significantly driving the market

Schedule a Call

3D Machine Vision System Market Drivers

Growing Demand for Smart Cameras

Smart cameras often support a 3D Machine Vision System by digitizing and transferring frames for computer analysis. A smart camera has a single embedded image sensor. They are usually tailored-built for specialized applications where space constraints require a compact footprint. Smart cameras are employed for a number of automated functions, whether complementing a multipart 3D Machine Vision System, or as standalone image-processing units. Smart cameras are considered to be an effective option for streamlining automation methods or integrating vision systems into manufacturing operations as they are cost-efficient and relatively easy to use. There is a huge demand for smart cameras in industrial production as manufacturers often use them for inspection and quality assurance purposes. Smart cameras are growing at a 9.7% CAGR with Machine vision being a premier use case. Thus, increasing demand for smart cameras will drive the 3D Machine Vision Systems market growth in various industrial applications.

Increasing need for quality products, high manufacturing capacity

3D Machine Vision Systems perform quality tests, guide machines, control processes, identify components, read codes and deliver valuable data for optimizing production. Modern production line are advanced and automated. Machine vision enables manufacturing companies to remain competitive and prevent an exodus of key technologies. Recognizing trends and irregularities in production processes early on machine vision paves the way for realizing the smart factory of the future. Machine vision ensures safety in production process as well as quality in the end product. As a result of this, according to an IDG survey by Insight, 96% of Companies surveyed think computer vision has the capability to boost revenue, with 97% saying this technology will save their organization time and money across the board.

3D Machine Vision System Market Challenges

Lack of awareness among users and inadequate expertise

The robotic vision technology is rapidly changing, with new technologies emerging constantly, and new tools coming to market incredibly fast to make tackling automation problems easier. In the past decade alone, the robotic vision market has seen the introduction of more advanced sensors in terms of both smaller pixels and larger sensors, software platforms that continues to be more accurate, and lighting which is growing brighter and becoming more efficient. The high cost of the research and development in robotic vision and the lack of awareness among users about the rapidly advancing robotic vision technology are key factors likely to hinder the market to an extent.

Buy Now

3D Machine Vision System Industry Outlook

Product launches, acquisitions, Partnerships and R&D activities are key strategies adopted by players in the market. 3D Machine Vision System top companies include

Cognex

Omron Corp

Sony Corp.

Panasonic Corp.

Microscan

Basler AG

Keyence Corp.

National Instruments

Sick AG

Teledyne Technologies

FLIR

Recent Developments

In July, 2021 Cognex launched its new series of vision software “VisionPro” for industrial machine vision enabling customers to combine deep learning and traditional vision tools in the same application.

In March 2021, Omron launched FH-SMD Series 3D Vision sensors for robotic arms enabling space-saving assembly, inspection, and pick & place and other applications.

#3d Machine Vision Market#3d Machine Vision Market size#3d Machine Vision industry#3d Machine Vision Market share#3d Machine Vision top 10 companies#3d Machine Vision Market report#3d Machine Vision industry outlook

0 notes

Text

All-Terrain Vehicle Market Size and Regional Outlook Analysis, 2030

The global all-terrain vehicle market size was valued at USD 4.54 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.8% from 2023 to 2030.

The rising popularity of outdoor sports activities, including off-road events, the increasing number of adventure and trail parks, and the rising demand for all-terrain vehicle (ATVs) for agricultural and military applications are the major factors propelling the growth of the market. Furthermore, the growing disposable income and purchasing capacity of individuals in developed and developing economies are anticipated to drive the demand for all-terrain vehicles over the forecast period.

The market for all-terrain vehicles witnessed negative growth during the first half of 2020 owing to the spread of the COVID-19 virus. The global lockdown and restrictions led to the temporary closure of various assembly and manufacturing units. However, the increasing demand for recreational activities across the globe is likely to contribute to market growth.

An all-terrain vehicle is also known as a light utility vehicle. It is a motorized off-road vehicle designed to travel on four wheels with low-pressure or non-pneumatic tires and a handlebar for steering control. ATVs are divided into two categories: type I and type II. The type I category is intended for use by a single rider with no passengers and the type II category is intended for use by a rider and a passenger. Type II ATVs are equipped with a designated seating position behind the rider.

Gather more insights about the market drivers, restrains and growth of the All-Terrain Vehicle Market

All-terrain Vehicle Market Report Highlights

• The market for all-terrain vehicles is anticipated to witness growth owing to the increasing number of adventure and trails parks and the rising popularity of off-road sports activities

• The 400cc-800cc engine type segment accounted for a significant revenue share of over 48.2% in 2022. The increase in demand for 400-800cc engine ATVs is accredited to the demand for search & rescue operations and utility purposes

• Asia Pacific is expected to expand at the fastest CAGR of 5.3% during the forecast period

Browse through Grand View Research's Automotive & Transportation Industry Research Reports.

• The global aerospace engineering services outsourcing market size was valued at USD 116.95 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 24.9% from 2024 to 2030.

• The global automotive chips market was valued at USD 41.47 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.2% from 2024 to 2030.

All-terrain Vehicle Market Segmentation

Grand View Research has segmented the global all-terrain vehicle market report based on engine type, application, and region

All-terrain Vehicle (ATV) Engine Type Outlook (Revenue, USD Million, 2018 - 2030)

• Below 400cc

• 400 - 800cc

• Above 800cc

All-terrain Vehicle (ATV) Application Outlook (Revenue, USD Million, 2018 - 2030)

• Agriculture

• Sports

• Recreational

• Military and Defense

All-terrain Vehicle (ATV) Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

• Asia Pacific

o China

o Japan

o India

o Australia

o South Korea

• Latin America

o Brazil

o Mexico

• Middle East and Africa

o Saudi Arabia

o South Africa

o UAE

Order a free sample PDF of the All-Terrain Vehicle Market Intelligence Study, published by Grand View Research.

#All-Terrain Vehicle Market#All-Terrain Vehicle Market size#All-Terrain Vehicle Market share#All-Terrain Vehicle Market analysis#All-Terrain Vehicle Industry

0 notes