#UBS Accounting Software

Explore tagged Tumblr posts

Text

Revolutionize Your Business Operations with UBS Accounting Software

In today's fast-paced business world, managing finances efficiently is crucial for success. Small and medium-sized enterprises (SMEs) often struggle with the complexities of accounting and financial management, diverting valuable time and resources away from core business activities. Enter UBS Accounting Software, a comprehensive solution designed to streamline financial processes, enhance accuracy, and propel your business towards greater success.

What is UBS Accounting Software?

UBS Accounting Software is a robust and user-friendly financial management tool tailored for SMEs across various industries. Developed by UBS Corporation, this software is renowned for its versatility, scalability, and ease of use. Whether you're a budding startup or an established enterprise, UBS Accounting Software offers a suite of features designed to simplify accounting tasks and drive business growth.

Key Features and Benefits

1. User-Friendly Interface

UBS Accounting Software boasts an intuitive interface, making it accessible to users with varying levels of accounting expertise. The user-friendly design allows for easy navigation, minimizing the learning curve and enabling swift adoption within your organization.

2. Comprehensive Financial Management

From managing accounts payable and receivable to generating financial reports, UBS Accounting Software covers all aspects of financial management. Users can efficiently handle invoicing, track expenses, reconcile bank statements, and gain real-time insights into their financial health.

3. Customization and Scalability

Adaptability is crucial for growing businesses, and UBS Accounting Software offers customizable features to suit unique business needs. It scales effortlessly with your company's growth, accommodating increased transaction volumes and expanding requirements without compromising efficiency.

4. Security and Compliance

Data security is paramount in today's digital landscape. UBS Accounting Software prioritizes the protection of sensitive financial information through robust security measures and compliance with industry standards, ensuring your data remains safe and confidential.

5. Integration Capabilities

Seamless integration with other business applications and tools enhances efficiency by reducing redundant data entry tasks. UBS Accounting Software integrates with various third-party platforms, enabling a smooth flow of information across different departments.

Why Choose UBS Accounting Software?

Time and Cost Efficiency: Automate routine accounting tasks, saving time and reducing manual errors, thereby cutting operational costs.

Enhanced Decision-Making: Access to real-time financial data empowers informed decision-making, enabling businesses to react promptly to market changes and opportunities.

Scalability: Grow your business without worrying about outgrowing your accounting solution. UBS Accounting Software grows with you, adapting to evolving business needs effortlessly.

Customer Support: UBS Corporation offers reliable customer support services to address any software-related queries or issues promptly.

Note: To buy UBS Accounting Software check out here https://www.pcmart.com.my/ubs-accounting-software/

Conclusion

In the competitive landscape of modern business, having an efficient and reliable accounting system is non-negotiable. UBS Accounting Software stands as a beacon of innovation and efficiency, offering SMEs a comprehensive solution to streamline their financial operations. Its user-friendly interface, robust features, scalability, and commitment to data security make it an indispensable tool for businesses striving for success.

1 note

·

View note

Text

As a former modern player, competitive magic has been prohibitively expensive and the speed of gameplay considerably faster than I enjoy. Most of my collected cards are not playable in any format. The speed of releases and the power creep has removed any excitement from the idea that once I have a card, it will serve me for years to come. Commander does not appeal to me because I would rather play board games for multiplayer political intrigue, where there is better balance. Seeing that cards are now using AI art (stolen art) makes me averse to collecting cards from my favorite properties from UB as well; I've thought about getting some Miku cards throughout the releases even though I have no where to play them but why should I now if I have no faith that any magic card was illustrated by a human? Premium prices for product made from stolen labour. If the kitchen table doesn't appeal to me, the competitive play is inaccessible, and the artistic integrity is questionable, then there is nothing else for me.

I am truly happy I enjoyed magic for the years I did because it gave me connections and community when I needed it, and might still play it in the future for those reasons. But for now, a few rounds on arena on a free to play account every so often is all I can invest in. no more money and no more cardboard. EDIT: I should give WOTC more credibility on AI discussion, Despite mistakes made earlier this year they have been updating their FAQ and investing in AI detecting software. Also artwork at wizards is not created in a vaccum, each piece is made by a person that is screened/directed by people at wizards. Their names are on the cards, so accusations of AI art on cards is a serious accusation.

I’ve always felt the core role of this blog has been one of information. We make a lot of choices in design, and I try to use my various communications, including Blogatog, to walk the players through what we were thinking when we made key decisions.

The challenge with this approach is that it’s very logic-focused. It uses intellectual justifications to explain actions. But the problems I’m often responding to are emotional in origin. I have a good friend who’s a psychologist. He refers to this (using the words of author Robyn Gobbel) as an owl brain solution to a watchdog brain problem.

When someone is hurting, hearing about why the thing that is causing them pain is the result of intellectual decisions falls flat. That’s what has been causing some tension lately here on Blogatog.

It’s clear that for some Question Marks changes over the last few years represent the loss of something key to what makes Magic special to them. To them, the game is losing its heart.

While I can’t necessarily do anything about that, I want to better understand what you’re going through. So I’m using this post to ask players who are concerned with the recent changes to help me understand their feelings. Let me hear your stories about how your lives have been affected by these changes.

2K notes

·

View notes

Text

Medicare Billing in 2024: Maximizing Compliance and Revenue

For medicare billing Parts A, B, C, and D are the entire foundation of a health provider’s reimbursement system due to Medicare being their only source of revenue. Sadly, 30 percent of claims are denied and billed under misplaced coding, partial documentation, and compliance mistakes. According to CMS, these factors also account for administrative burden, increased hospital costs, and other revenue capture issues as legal risks. In this long form, we will offer guides claiming the steps needed to get medicare revenue systematically starting from the 2024 fiscal year.

Medicare billing along with its complications explained.

A claim is put forth to the CMS viewport at certain intervals for services incurred and entitled to patients. One aspect that makes CMS stand out from other insurers is it is volatile border policies medicare billing has to abide by. These challenges are divided into categories:

Different units: Part A covers inpatient care including admissions while B encapsulates outpatient. C includes advanced plans and B covers prescriptions.

Administrative Hurdles: The false policies board puts medicare billing at risk up to $23,607 per error.

Regional Differences: Policies are enforced distinctively by Medicare’s private contractors leading to regional arbitrariness and control.

Illustration: Services coverage region includes FirstCoastt service options accompanied by Novitas solutions in Texas and Florida.

Highlights of Medicare billing powering the basics of B, A, C, and D.

Claim transmission should begin only when all prerequisites are met. Each part has crucial prerequisites that need to be made for outpatient services to be provided. Advanced claim forms are categorized under direct treatments of inbound claims along with UB-04.

Part B: For outpatient services (e.g., physician appointments). Needs CMS-1500 forms along with ICD-10/CPT coding.

Part C (Medicare Advantage): Managed care organizations process claims; requires preauthorization.

Part D: Drug coverage paid through the PDE (Prescription Drug Event) submission.

Rejection Prevention Tip: Always confirm eligibility using the Medicare Beneficiary Identifier (MBI) number to prevent discrepancies.

Billing Compliance With Medicare: Preventing Costly Penalties

Under the 2024 CMS Final Rule, Medicare audits are becoming more frequent. Remain compliant by:

Proving Medical Necessity: Demonstrate medical necessity by documenting ICD-10 coding linked to CPT/HCPCS coding, like G2211 for caring for chronically ill children.

Upcoding Avoidance: Underbilling for the service rendered (99214.) Upcode increases billing the practice overcoming using 99215 by a service level higher than provided.

Complying with Stark Law: No referrals to companies with financial.

Case Study: Clinics in New York were fined $2 million for Stark law breaches after in-house imaging centers for patients.

How To Fix Most Common Billing Errors With Medicare

Excluding Medicare Billing numbers or including an MBI or spelling a name and dob together.

Fix: Updating patient details through HETS will correct this in real-time via eligibility verification.

Claiming the same service more than once.

Fix: Using Waystar claim scrubbing software will resolve this.

Falling short of gathering Advanced Beneficiary Notices of non-covered services.

Revise: Change training to include issuing ABNs for services such as cosmetic surgical procedures.

Streamlining Medicare Billing Claims: 2024 Best Practices

Implement Automation of Prior Authorizations: Using CoverMyMeds decreases time barriers.

Conduct Monthly Claim Audits: Analyze tracking reasons for denial such as N264.

Staff Retraining for 2024 Changes:

New telehealth E/M coding.

JW modifier for not used drugs (for example, some cancer medications).

Stat: Denials are lowered by 45% when using AI-driven coding tools. (MGMA 2023)

The Impact Technology Has on Medicare Billing

AI-Driven Coding: Systems such as Optum360 recommend codes based on written clinical notes.

Blockchain Technology: Share patient information securely between providers; see Humana’s pilot.

Predictive Analytics: Use the historical data to predict denial from given services.

Example: A Michigan hospital has lowered denial rates by 30% when using predictive analytics.

In-House vs. Outsourcing Medicare Billing: Which Is More Effective?

Consider: In-House Outsourcing

Cost Staff/software 60k+/year 4-8% of collections (no overhead)

Compliance Risk Training gaps: higher Certified coders: lower

Scalability Limited by staff Flexible for seasonal demand

Verdict: Small practices are better off outsourcing. Large hospitals may wish to keep billing in-house.

Case Study: How [Specialized-Billing.com] Reclaimed $500k in Denied Claims

Client: Ohio-based 10-doctor cardiology group.

Problem: Incorrect modifiers such as not using -59 for distinct procedures led to a 35% denial rate.

Solution: [Specialized-Billing.com] Put into practice AI audits as well as staff training.

Results: Denials reached 8% in 6 months, recovering $500k annually.

Future Trends in Medicare Billing

AI-Driven Prior Auths: CMS intends to automate 50% of approvals by 2025.

Telehealth Expansion: Mental health visits are permanently covered after the PHE.

Value-Based Care: Replacing fee-for-service models with bundled payments.

Conclusion: Crushing Medicare Billing with Financial Success

Medicare billing has a labyrinth of rules to follow, but strategies help mitigate denials and maximize revenue. Invest in AI, outsource to experts like [Specialized-Billing.com], and upskill your team, but make sure you’re prepared for changes in 2024.

#medical billing specialist#medical coding services#health#hospital#success#startup#medical biiling#medical billing services#medical billing and coding#medical billing company#medical billing outsourcing services

0 notes

Text

Streamlining Business Success with Reliable Accounting Services in Dubai

Small businesses are the backbone of every economy, and in a fast-paced, competitive environment like Dubai, they must be equipped with the right tools to succeed. One of the most critical areas that entrepreneurs need to manage efficiently is accounting. Whether it's monitoring cash flow, handling payroll, or preparing for tax season, robust financial systems are essential. This is where the combination of the best accounting softwares for small business and professional financial services can make a powerful impact.

As small businesses scale, their financial needs evolve. Manual record-keeping or spreadsheets can quickly become inefficient and error-prone. In contrast, the best accounting softwares for small business offer automated features that streamline everything from daily bookkeeping to complex financial analysis. These platforms are designed to save time, minimize errors, and ensure compliance with local regulations—all of which are vital in the Dubai business landscape.

One of the biggest advantages of these accounting tools is their cloud-based nature. They allow business owners and accountants to access financial data in real-time from any location. This enhances transparency and speeds up decision-making. Moreover, they often include dashboards that present a clear picture of your financial performance, helping owners stay on top of key metrics like income, expenses, and profit margins.

However, choosing the right software can be overwhelming, especially for those without a financial background. That’s where accounting services in Dubai come into play. Partnering with experienced consultants allows businesses to benefit from expert guidance on selecting and implementing the most suitable tools. These professionals don’t just help with software installation—they provide training, support, and insights to ensure that businesses get the most out of their investment.

Ubsconsultantsuae.com, for example, specializes in offering tailored accounting packages for small business. Their team evaluates each client’s unique needs and recommends scalable solutions that can adapt as the business grows. They focus on combining the power of technology with personalized service, helping clients maximize efficiency while remaining fully compliant with UAE financial laws.

These accounting packages for small business typically include software setup, bookkeeping, financial reporting, payroll, and tax preparation. The goal is to offer an end-to-end solution that takes the burden of financial management off the business owner's shoulders. This allows entrepreneurs to focus more on their core operations, confident that their finances are in good hands.

Another important benefit of working with accounting services in Dubai is the assurance of regulatory compliance. The UAE has specific requirements related to VAT, corporate tax, and financial disclosures. Professional accounting firms stay up to date on the latest rules and ensure that your business adheres to them, helping you avoid penalties and audits.

Well, leveraging the best accounting softwares for small business—alongside expert support—can significantly enhance the financial health and operational efficiency of any growing enterprise. For Dubai-based entrepreneurs, professional accounting partners like UBS Consultants UAE offer the tools and expertise necessary for long-term success. With customized accounting packages for small business, even startups can enjoy big-business-level financial control and oversight, setting the stage for sustainable growth and success in a highly competitive market.

0 notes

Text

How to Bill Medicare as a Provider

How to Bill Medicare as a Provider: A Step-by-Step Guide to Accurate and Compliant Reimbursement Billing Medicare as a provider is a crucial responsibility that directly impacts your practice’s cash flow, compliance, and overall operational efficiency. Whether you're a physician, nurse practitioner, therapist, clinic administrator, or other licensed healthcare professional, understanding how to bill Medicare as a provider ensures you get paid for the services you deliver—without running into claim rejections, audits, or payment delays. Medicare is a federal health insurance program that covers millions of Americans, primarily those aged 65 and older, as well as certain individuals with disabilities. Since it is funded and regulated by the government, billing Medicare involves a strict set of rules, timelines, and documentation requirements. This guide will walk you through the entire process of how to bill Medicare as a provider—from registration to reimbursement.

Enroll in Medicare as a Provider Before you can bill Medicare, you must first become an approved Medicare provider. This means applying through the Medicare Provider Enrollment, Chain, and Ownership System (PECOS). Steps to enroll: • Create a PECOS account online at https://pecos.cms.hhs.gov • Submit your Medicare Enrollment Application (CMS-855I) • Include required documentation (state license, NPI, malpractice insurance, etc.) • Await approval and issuance of a Provider Transaction Access Number (PTAN) • Set up Electronic Funds Transfer (EFT) for payment Enrollment may take several weeks. Once approved, you'll be officially eligible to provide services to Medicare beneficiaries and bill Medicare for payment.

Verify Medicare Coverage and Eligibility Before rendering services, always verify that the patient has active Medicare coverage. You can do this via: • Medicare Administrative Contractor (MAC) portal • HIPAA Eligibility Transaction System (HETS) • Third-party clearinghouse tools Confirm: • Part A or Part B eligibility • Medicare Advantage enrollment (if applicable) • Secondary insurance or Medigap coverage • Deductibles and coinsurance status Verifying eligibility upfront helps prevent denials and ensures the service is billable.

Provide Covered Services and Document Thoroughly After verifying coverage, you may proceed with delivering services. All care must be medically necessary and clearly documented in the patient’s medical record. Proper documentation must include: • Patient complaints/symptoms • Clinical findings and test results • Diagnoses (linked to ICD-10-CM codes) • Treatment rendered • Provider signature and date of service This documentation supports the coding and justifies the reimbursement.

Code Services Accurately Correct coding is the backbone of Medicare billing. Every diagnosis, procedure, or service must be translated into standardized codes: • ICD-10-CM for diagnoses • CPT for procedures (e.g., office visits, surgeries, therapy sessions) • HCPCS Level II for supplies, equipment, and non-physician services • Modifiers (e.g., -25, -59) to explain special circumstances Incorrect or vague coding is a leading cause of Medicare claim denials. Consider using certified medical coders or billing software with built-in coding assistance.

Fill Out the Correct Claim Form To bill Medicare directly, providers must use one of the following standardized forms: • CMS-1500 (Form 837P) – for outpatient/professional services (Part B) • UB-04 (Form 837I) – for institutional providers (Part A, hospitals, SNFs) Most providers submit these claims electronically through: • Medicare-approved clearinghouses • Practice management systems • Direct MAC online portals Claims must be submitted within 12 months of the date of service to be eligible for reimbursement.

Submit the Claim to Medicare or the Appropriate Plan The claims process depends on whether the patient is enrolled in Original Medicare or Medicare Advantage (Part C): • For Original Medicare (Parts A and B): Send claims to your designated Medicare Administrative Contractor (MAC) • For Medicare Advantage plans: Submit claims to the private insurance company managing the plan (e.g., Humana, Aetna, UnitedHealthcare) following their specific submission protocols Each MAC or Medicare Advantage plan has different claim timelines, formats, and payer IDs, so double-check the requirements before submission.

Monitor Claim Status and Respond to Remittances After submission, track the status of your Medicare claim through your billing software or the MAC portal. Once processed, you'll receive a Remittance Advice (RA) or Explanation of Benefits (EOB) that outlines: • Amount approved • Medicare’s payment • Patient responsibility (copay, deductible, coinsurance) • Any denials or payment adjustments Post payments to the patient account and generate a bill for any remaining balance.

Handle Denials and Submit Appeals (If Necessary) Medicare claims may be denied for reasons such as: • Invalid codes • Missing modifiers • Services deemed not medically necessary • Eligibility issues • Duplicate billing When this happens, review the denial code on the RA/EOB and determine the cause. You may: • Correct and resubmit the claim • Request a redetermination (Level 1 appeal) through the MAC • Escalate through additional appeal levels if necessary Timely appeals with proper documentation can recover lost revenue.

Collect Patient Balances and Offer Clear Billing Patients covered by Medicare Part B typically owe 20% coinsurance after Medicare pays 80%. Patients may also be responsible for deductibles or charges for non-covered services. To avoid confusion: • Provide Advance Beneficiary Notices (ABNs) when necessary • Offer clear, itemized statements • Allow multiple payment options, including online payment portals • Bill secondary payers (e.g., Medigap, Medicaid) when appropriate

Stay Compliant with Medicare Regulations Billing Medicare means adhering to strict federal laws, including: • HIPAA: Ensures privacy and security of patient data • CMS guidelines: Define billing rules and fee schedules • False Claims Act: Prohibits fraudulent or misrepresented claims • OIG compliance standards: Prevent improper billing and abuse To stay compliant: • Conduct routine billing audits • Train staff regularly • Use up-to-date billing software • Maintain documentation for every billed service

Conclusion Learning how to bill Medicare as a provider is essential for running a compliant, financially healthy practice that can sustainably serve Medicare beneficiaries. From enrollment to documentation, coding, claim submission, and appeals, each step must be handled with precision and care. By understanding Medicare’s processes, leveraging the right tools, and staying updated with policy changes, providers can streamline their billing workflows, minimize denials, and ensure timely reimbursement—all while remaining in full compliance with federal regulations. Mastering Medicare billing isn't just about getting paid—it's about building a strong, sustainable system for delivering care to the patients who need it most.

1 note

·

View note

Text

Industry trend|Shipments exceed 4 billion! MEMS sensor company Goertek submits prospectus to the Hong Kong Stock Exchange

Recently, Goertek Microelectronics Co., Ltd. (hereinafter referred to as Goertek Microelectronics) submitted a prospectus to the Hong Kong Stock Exchange, intending to be listed on the main board of Hong Kong. It is reported that CICC, CITIC Securities International, CMB International and UBS Group are the joint sponsors.

Cumulative shipments of sensors exceed 4 billion

Goertek is the only entity in the Goertek system that focuses on microelectronics business. Previously, as a business unit of Goertek, it started the research and development of MEMS technology.

Since 2017, Goertek has officially started its business as an independent entity. The company has created a one-stop intelligent sensor interaction platform UniSense, covering all key links in the industry value chain from material research and development to chip design, packaging testing, algorithm software development and system design. With its vertical integration capabilities, Goertek provides customers with a full range of product solutions of "chips + devices + modules".

According to the prospectus, as of September 30, 2024, the company has more than 400 solutions, which are widely used in about 30 smart terminals such as smartphones, smart headphones, VR/AR devices, smart cars and smart homes, and has served 113 direct sales customers worldwide, covering the world's top nine mobile phone manufacturers (based on shipments in 2023) and leading manufacturers in automotive electronics, smart homes, industrial applications and medical fields.

In fact, Goertek Co., Ltd. had issued an announcement as early as November 2020, planning to spin off Goertek Microelectronics to the Shenzhen Stock Exchange's Growth Enterprise Market for listing. However, in March 2022, affected by the epidemic, Goertek Microelectronics and its sponsor took the initiative to apply to suspend the issuance and listing review procedures. Although Goertek's initial public offering application passed the review of the Growth Enterprise Market Listing Committee in October 2022, it was not until June 2023 that the Shenzhen Stock Exchange resumed its issuance and listing review.

In May 2024, Goertek's board of directors decided to terminate the spin-off of Goertek Microelectronics to the Growth Enterprise Market and withdraw the relevant listing application documents. The Shenzhen Stock Exchange also subsequently terminated its issuance and listing review. As for the reason for the termination of listing, Goertek Co., Ltd. stated that it was based on a comprehensive consideration of factors such as the market environment. In addition, Goertek Microelectronics' performance in the first half of 2023 declined, with operating income down 15.77% year-on-year and net profit attributable to shareholders down 38.39% year-on-year, which may also have an impact on its listing process.

It is worth noting that Goertek Microelectronics submitted its listing application to the Hong Kong Stock Exchange in January 2025, with CICC, CICC International, CMB International and UBS Group as joint sponsors.

Global sensor shipments may grow to 22.9 billion in 2028

From 2020 to 2023, affected by the epidemic and global maritime trade, global sensor shipments fluctuated, but overall showed an upward trend. Global sensor shipments increased from 13.5 billion to 15.1 billion, with a compound annual growth rate of 3.7%. In the future, global sensor shipments will further increase to 22.9 billion in 2028, with a compound annual growth rate of 8.7% from 2023 to 2028. In 2023, acoustic sensors accounted for 37.8% of all sensor shipments. With the growing demand for high-quality audio interaction functions, acoustic sensors will maintain their important market position in the long term.

In 2022, 2023 and the nine months ending September 30, 2024, Goertek Microelectronics' revenue was approximately RMB 3.121 billion, RMB 3.001 billion and RMB 3.266 billion, respectively; the profits in the same period were approximately RMB 326 million, RMB 289 million and RMB 243 million, respectively.

So, what technological breakthroughs has Goertek Microelectronics made in the field of MEMS sensors?

According to Core Sensor, the following are its main progress:

· High-performance MEMS acoustic sensors

Goertek's S32 series of high-performance MEMS acoustic sensors have industry-leading audio performance. With a signal-to-noise ratio of up to 72dB, it can achieve high-definition recording at the studio level and greatly improve the ability to capture weak and long-distance sound signals. In addition, the sensor also supports multi-microphone array applications, optimizing functions such as intelligent sound processing, noise cancellation, sound enhancement and sound positioning.

·Innovative acoustic sensor packaging technology

Goertek has developed an anti-airflow/mechanical impact solution, which significantly improves the durability of the sensor in extreme environments by adding a protective barrier between the chip and the PCB. In addition, its IPX8 waterproof MEMS acoustic sensor maintains the consistency of acoustic performance while ensuring the waterproof effect, which helps the waterproof and dustproof design of VR/AR devices.

·AI intelligent acoustic sensor

Goertek integrates voice signal acquisition and processing units into one, and develops AI intelligent acoustic sensors that support voice wake-up, voice recognition, and event monitoring, providing low-power integrated solutions.

·Application of piezoelectric ceramic technology in automotive electronics

Based on the characteristics of piezoelectric ceramics, Goertek has launched a variety of in-vehicle interactive applications, such as touch sensing of smart surfaces, touch feedback of central control panels, feedback of vehicle door handles, and ultrasonic dust removal systems. These technologies improve the intuitiveness of interaction and driving safety.

·SiP microsystem module technology

Goertek has developed a "SiP module-DCU Molding solution" by highly integrating MEMS chips, IC chips and passive devices through system-level packaging (SiP) technology, which has achieved module miniaturization and multi-functional integration, significantly reduced the size of the motherboard and reduced costs.

· Shell pressure sensing technology

Goertek has applied for a new MEMS sensor patent, which combines ultrasonic detection and stress detection, can accurately sense the degree of shell pressure, and reduce detection anomalies caused by false touches.

This paper is from Ulink Media, Shenzhen, China, the organizer of IOTE EXPO (IoT Expo in China)

0 notes

Text

US stocks lower ahead of holiday, PCE sparks rate cut uncertainty

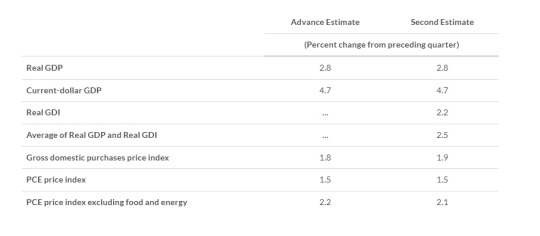

US stocks ended lower on Wednesday, albeit in thin trading ahead of the Thanksgiving holiday, as investors digested some strong economic data, including the latest personal consumption and expenditure (PCE) index, which dented hopes for further Federal Reserve rate cuts this year.

October’s PCE prices index came in as expected, with the annual figure climbing by 2.3%, while the core PCE index, the Federal Reserve's preferred measure of inflation, rose 2.8% in October, considerably above the Fed’s 2% annual target.

Other data showed that the US economy grew at an unrevised 2.8% annualised rate in the third quarter, well above what Fed officials regard as the non-inflationary growth rate of around 1.8%.

And the latest weekly jobless claims dipped to 213,000 from a downwardly revised 215,000 in the prior week, with claims steadily retreating from the near 1-1/2-year high seen in early October indicating a robust labor market.

Recent signs of sticky US inflation have sparked some uncertainty over whether the Fed will cut interest rates again, and markets have begun questioning the prospect of a 25-basis point cut in December.

However, in a note on Wednesday, economists at Swiss bank UBS still predicted that the US central bank is likely to cut interest rates at its December policy meeting, before switching to a slower pace of cuts in 2025.

At the stock market close in New York, the blue-chip Dow Jones Industrials Average was down 0.3% at 44,722, retreating after earlier gains which saw the benchmark cross the 45,000-point level for the first time, just a month after the index breached the 44,000 mark.

Meanwhile the broader S&P 500 index lost 0.4% at 5,998, and the tech-laden Nasdaq Composite fell 0.6% to 19,060.

SPX500 H1

Among the tech fallers, market darling chipmaker Nvidia shed 1.1% after PC sector earnings released after-hours on Tuesday revealed uneven AI spending trends.

Dell Technologies dropped 12.3% after the PC manufacturer offered up a disappointing revenue outlook for the current quarter despite being bullish on AI sales growth. And HP dropped 11.3% after the IT company also issued disappointing guidance for 2025 despite trumpeting AI hopes.

Elsewhere, Symbiotic plunged 35.9% as the warehouse robotics provider disclosed a massive accounting error in its 2024 revenues.

Workday fell 6.2% as the cloud-based business software applications company issued disappointing subscription revenue guidance. Fellow software firm Autodesk dropped 8.6% as its quarterly revenue missed analysts’ expectations.

And Crowdstrike lost 4.6% as the cybersecurity firm swung to a loss in a quarter where an update of its software triggered one of the worst ever computer outages, although the company still raised its full-year outlook.

But on the upside, clothing retailer Urban Outfitters jumped 18.3% after reporting better than expected earnings.

On commodity markets, crude prices stabilised as traders assessed the potential impact of the ceasefire deal between Israel and Lebanon-based Hezbollah, as well as an unexpected, substantial draw in US oil inventories.

USOILRoll H4

After falls on Tuesday, US WTI crude slipped 0.01% to $68.76 a barrel, while UK Brent crude was flat at $72.32 a barrel.

Disclaimer: The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions. Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us. The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

1. **Wealth Accrual Strategies:**

- **Real-World Tool:** Swiss Bank Account

- **Manufacturer Grade Detail:** UBS Swiss Bank Account, renowned for its confidentiality, security, and wealth management services, ideal for high-net-worth individuals seeking discreet financial solutions.

Sure, I'll continue with the rest of the list:

2. **Financial Autopilot Endeavors:**

- **Real-World Tool:** Automated Trading Algorithm

- **Manufacturer Grade Detail:** Algorithmic Trading Software, developed with advanced machine learning algorithms and high-frequency trading capabilities, ideal for automating investment strategies and optimizing portfolio performance.

3. **Royal Revenue Reservoirs:**

- **Real-World Tool:** Offshore Wealth Management Service

- **Manufacturer Grade Detail:** Cayman Islands Wealth Management, offering comprehensive financial planning and asset protection services, renowned for its tax-efficient structures and confidentiality.

4. **Elite Yield Generation:**

- **Real-World Tool:** Hedge Fund Investment

- **Manufacturer Grade Detail:** BlackRock Hedge Fund, managed by seasoned investment professionals and renowned for its diversified strategies and consistent returns, ideal for high-net-worth individuals seeking capital growth and risk management.

5. **Monetary Serenity Initiatives:**

- **Real-World Tool:** Gold Bullion Investment

- **Manufacturer Grade Detail:** Perth Mint Gold Bars, minted with .9999 purity gold and certified by a government-owned refinery, trusted for its stability and intrinsic value, ideal for hedging against economic uncertainty.

6. **Legacy Wealth Streams:**

- **Real-World Tool:** Trust Fund Establishment

- **Manufacturer Grade Detail:** Goldman Sachs Trust Fund, structured with comprehensive estate planning and asset protection features, managed by experienced fiduciaries, ideal for preserving wealth and transferring assets to future generations.

7. **Premium Dividend Dynamics:**

- **Real-World Tool:** Blue-Chip Stock Portfolio

- **Manufacturer Grade Detail:** Berkshire Hathaway Stock Portfolio, curated by Warren Buffett and renowned for its stable dividends and long-term growth potential, ideal for conservative investors seeking reliable income streams.

8. **Sovereign Income Strategies:**

- **Real-World Tool:** Sovereign Wealth Fund Investment

- **Manufacturer Grade Detail:** Norway Government Pension Fund, managed by Norges Bank Investment Management and renowned for its diversified global portfolio and long-term investment horizon, ideal for sovereign entities seeking sustainable income generation.

9. **Intellectual Nobility Profits:**

- **Real-World Tool:** Patent Portfolio Acquisition

- **Manufacturer Grade Detail:** Intellectual Ventures Patent Portfolio, curated with a vast collection of patents spanning various industries and technologies, renowned for its innovation and potential for licensing revenue, ideal for companies seeking to enhance their intellectual property assets.

10. **Stately Fiscal Orchestrations:**

- **Real-World Tool:** Sovereign Debt Issuance

- **Manufacturer Grade Detail:** United States Treasury Bonds, issued by the U.S. Department of the Treasury and backed by the full faith and credit of the U.S. government, renowned for their safety and liquidity, ideal for financing government expenditures and managing national debt.

Certainly! Let's continue with the rest of the list:

11. **Equity Preservation Solutions:**

- **Real-World Tool:** Diversified Real Estate Portfolio

- **Manufacturer Grade Detail:** Blackstone Real Estate Portfolio, managed by one of the world's largest investment firms and renowned for its diversified holdings across residential, commercial, and industrial properties, ideal for preserving capital and generating steady income.

12. **Digital Strategies for Financial Recovery:**

- **Real-World Tool:** Cryptocurrency Investment Portfolio

- **Manufacturer Grade Detail:** Grayscale Bitcoin Trust, managed by Grayscale Investments and renowned for providing exposure to Bitcoin through a traditional investment vehicle, ideal for investors seeking exposure to digital assets within a regulated framework.

13. **Quantitative Models for Financial Rehabilitation:**

- **Real-World Tool:** Risk-Adjusted Investment Strategy

- **Manufacturer Grade Detail:** Fidelity Quantitative Fund, managed by Fidelity Investments and renowned for its systematic approach to investing based on quantitative models and risk management techniques, ideal for investors seeking a disciplined and data-driven investment approach.

14. **Business Intelligence in Insolvency:**

- **Real-World Tool:** Restructuring Advisory Service

- **Manufacturer Grade Detail:** McKinsey & Company Restructuring Services, offered by one of the world's leading management consulting firms and renowned for its expertise in corporate restructuring and turnaround strategies, ideal for companies facing financial distress and seeking strategic guidance.

15. **Portfolio Management in Insolvency:**

- **Real-World Tool:** Distressed Asset Investment Fund

- **Manufacturer Grade Detail:** Oaktree Capital Distressed Debt Fund, managed by Oaktree Capital Management and renowned for its expertise in distressed investing and value-oriented approach, ideal for investors seeking opportunities in distressed and special situations.

16. **Silent Partner in Insolvency Cases:**

- **Real-World Tool:** Bankruptcy Trustee Services

- **Manufacturer Grade Detail:** Deloitte Bankruptcy Services, provided by one of the Big Four accounting firms and renowned for its expertise in bankruptcy administration and asset recovery, ideal for creditors and stakeholders involved in insolvency cases.

17. **VR and AR in Financial Rehabilitation:**

- **Real-World Tool:** Virtual Data Room Platform

- **Manufacturer Grade Detail:** Merrill Datasite Virtual Data Room, provided by Merrill Corporation and renowned for its secure and efficient platform for due diligence and deal management in financial transactions, ideal for facilitating collaboration and information sharing in complex financial restructuring processes.

18. **Content Creation in Financial Recovery:**

- **Real-World Tool:** Thought Leadership Content Strategy

- **Manufacturer Grade Detail:** HubSpot Content Marketing Platform, offered by HubSpot and renowned for its inbound marketing tools and content creation capabilities, ideal for companies seeking to position themselves as industry thought leaders and attract potential clients during financial recovery.

19. **AI in Asset Recovery:**

- **Real-World Tool:** Predictive Analytics Software

- **Manufacturer Grade Detail:** Palantir Gotham, developed by Palantir Technologies and renowned for its data integration and analytics capabilities, ideal for analyzing complex datasets and identifying patterns to support asset recovery efforts in distressed situations.

20. **E-learning in Financial Rehabilitation:**

- **Real-World Tool:** Online Learning Management System

- **Manufacturer Grade Detail:** Canvas Learning Management System, provided by Instructure and renowned for its user-friendly interface and comprehensive features for delivering online education and training programs, ideal for organizations seeking to enhance employee skills and knowledge during financial recovery.

21. **High-End Solutions for Financial Restructuring:**

- **Real-World Tool:** Investment Banking Advisory Services

- **Manufacturer Grade Detail:** Goldman Sachs Restructuring Advisory, provided by Goldman Sachs and renowned for its expertise in financial restructuring, M&A, and capital raising services, ideal for companies navigating complex financial restructuring processes and seeking strategic advice.

22. **Cybersecurity during Financial Distress:**

- **Real-World Tool:** Incident Response and Forensics Services

- **Manufacturer Grade Detail:** FireEye Mandiant Incident Response Services, provided by FireEye Mandiant and renowned for its expertise in cybersecurity incident response, digital forensics, and threat intelligence, ideal for organizations facing cybersecurity challenges during financial distress.

0 notes

Text

Significant Needs of Using UBS Accounting Software in Singapore

UBS Accounting is well-known for its user-friendly interface and comprehensive financial management capabilities. It automates bookkeeping, invoicing, payroll, and financial reporting. UBS Accounting is a vital tool for small and medium-sized firms since it helps them accurate financial records and make informed decisions. Convenience To discover why it is so natural to use Singapore Accounting software we tried the accounting software ourselves by opening a business account. During the enrollment process, UBS Accounting Singapore collects some information about your company so that they may present an adapted dashboard that is generally useful for your type of business. Without missing a beat, we were pleased with how simple it was to start and add fresh data. There was no need to fiddle with numerous menus or walk around and around to find our way; for example, it was extremely simple to interface financial balances and credit directly from the dashboard, as well as functional information like merchant data, freshness, and so on. The enchantment takes place on the dashboard itself. Singapore Accounting software updates its web-based dashboard on a regular basis, providing a more intuitive user interface. The path is straightforward, with a top route bar and a side menu. The dashboard moreover depicts your financial position, with data like pay, late and paid solicitations, expenses, advantages and disadvantages, and, shockingly, a to-do gadget. This suggests that you can see your company's "well being" as soon as you sign in. To try Singapore Accounting software for yourself, you can also view videos and demos to see how simple it is to use Singapore Online bookkeeping software. Efficient highlights At the point when we asked entrepreneurs what the “great” book keep in programming is like, there was one resonating prerequisite in all cases The best bookkeeping programming saves entrepreneurs time and doesn’t add to the generally unpleasant nature of private company bookkeeping. We’ve found that Singapore Accounting programming effectively satisfies that hope. Singapore Accounting programming is tied in with robotizing errands, making bookkeeping less tedious and most certainly less unpleasant for entrepreneurs. The product can computerized all that from repeating solicitations and bill instalments to the synchronization of information across the bank and Visa exchanges. You can likewise consequently accommodate and arrange costs, wiping out the drawn-out, tedious errand of physically doing as such for each and every exchange. Singapore Accounting programming can likewise Customer service Client care is an essential component of any organisation arrangement, and Singapore Accounting programs handle it flawlessly. Contacting a Singapore Accounting programming agent was also a pleasant experience. We asked a long list of questions, and the representative cheerfully answered each one thoroughly. In the meantime, he asked us some questions about our business and then recommended the best Singapore Accounting programming things and strategies for our specific needs.

0 notes

Text

Why do business human beings select MYOB software?

MYOB permits small business owners to track income, expenses, creditors, borrowers, purchases, inventory, jobs, time billing jobs, etc. In the course of an honest interface that makes it is easy to manipulate the whole thing simultaneously.

Paintings thru the capabilities. You may download product demos for both MYOB accounting internet websites. If you have any idiosyncratic wishes that aren’t general to commercial enterprise, take a look at the demos to peer which product plays high-quality. As an example, non-profit or network businesses will likely locate that the superior budget functions in MYOB software suit them great, however, agencies with inventory in multiple places will in all likelihood be better steerage towards MYOB.

If evaluating the cost of every product, factor inside the modern cost of annual assistance and annual upgrades. In case you’re comparing the fees of different MYOB (they alternate all of the time so you’ll want to store round to get the present-day charges), do not forget to the component inside the fee of the annual guide. Assist is crucial, especially at the start, and help that’s handiest ever a telephone name away can be a lifesaver. Sometimes, the annual guide is sort of identical to the purchase price of the software program, so it’s vital that you issue it in

Examine whether you want any add-ons. Just as you wouldn’t employ a secretary who best speaks French and a supervisor who best speaks pig Latin, you need to make certain that your accounting software can talk to the alternative computer packages for your office. For the MYOB software program, you could discover a listing of accessories by means of traveling to the MYOB add-ons page on this internet website. For QuickBooks, visit www.Quickbooks.Com.Au or contact their customer service line to ask about upload-on products.

Don't forget your running gadget. Talk to your accountant. If your accountant an awful lot prefers running with considered one other of these products in particular, you then probably decrease accounting fees by using following their recommendation.

Reflect on the consideration of who you’ll use as a consultant or for training. In the towns, each MYOB

Software programs have a superb community of running shoes. There are also masses of venues in which you could attend education guides. However, consultants get a lot extra scarce inside the bush, so it will pay to find out what the neighborhood support includes, and which product is supported first-class in your precise locality.

#myob accounting singapore#accounting software Singapore#psg grant singapore#ubs accounting singapore

0 notes

Text

Simplify Payroll Processing with UBS Payroll Software

Managing payroll is a crucial aspect of any business, and doing it efficiently is key to maintaining employee satisfaction and adhering to compliance standards. UBS Payroll Software stands as a comprehensive solution designed to streamline payroll processing, reduce administrative burdens, and ensure accuracy in managing employee compensation.

Understanding UBS Payroll Software

UBS Payroll Software, developed by UBS Corporation, is a powerful tool designed to simplify the complexities of payroll management for businesses of all sizes. With its intuitive interface and robust features, this software caters to diverse payroll needs, ensuring seamless and accurate payroll processing.

Key Features and Benefits

1. Automated Payroll Processing

One of the standout features of UBS Payroll Software is its ability to automate payroll tasks. From calculating wages and deductions to generating pay stubs and tax forms, the software streamlines the entire payroll process, reducing manual errors and saving valuable time.

2. Tax Compliance and Reporting

Staying compliant with ever-changing tax regulations is a challenge for many businesses. UBS Payroll Software eases this burden by handling tax calculations and generating reports, ensuring accurate deductions and filings to comply with local tax laws.

3. Employee Self-Service Portal

Empower your employees with a self-service portal that allows them to access their pay stubs, tax forms, and other relevant information. This feature promotes transparency and reduces administrative inquiries, freeing up HR personnel to focus on other critical tasks.

4. Integration with HR Systems

Seamless integration with HR and accounting systems enhances efficiency by synchronizing employee data across different departments. UBS Payroll Software's integration capabilities ensure data accuracy and eliminate the need for duplicate entries.

5. Security and Data Confidentiality

Maintaining the confidentiality of payroll data is paramount. UBS Payroll Software employs robust security measures to safeguard sensitive employee information, ensuring data privacy and compliance with data protection regulations.

Why Choose UBS Payroll Software?

Time and Cost Savings: Automation reduces manual efforts, minimizes errors, and saves time, allowing payroll teams to focus on strategic initiatives.

Accuracy and Compliance: Ensure accurate calculations and adherence to tax regulations, reducing the risk of penalties and non-compliance.

Enhanced Employee Experience: Self-service portals empower employees to access their information conveniently, improving transparency and satisfaction.

Scalability: Whether your business is small or expanding rapidly, UBS Payroll Software scales to accommodate your growing needs.

Note: To buy UBS Payroll Software click the link here https://www.pcmart.com.my/ubs-payroll-software/

Conclusion

UBS Payroll Software stands as a reliable solution for businesses seeking to simplify payroll processes, ensure compliance, and enhance overall efficiency. Its user-friendly interface, robust features, and commitment to data security make it an invaluable tool for managing payroll operations effectively.

Empower your business today with UBS Payroll Software and experience the transformative impact it can have on your payroll management processes.

0 notes

Text

Medicare Billing in 2024: Maximizing Compliance and Revenue

For medicare billing Parts A, B, C, and D are the entire foundation of a health provider’s reimbursement system due to Medicare being their only source of revenue. Sadly, 30 percent of claims are denied and billed under misplaced coding, partial documentation, and compliance mistakes. According to CMS, these factors also account for administrative burden, increased hospital costs, and other revenue capture issues as legal risks. In this long form, we will offer guides claiming the steps needed to get medicare revenue systematically starting from the 2024 fiscal year.

Medicare billing along with its complications explained.

A claim is put forth to the CMS viewport at certain intervals for services incurred and entitled to patients. One aspect that makes CMS stand out from other insurers is it is volatile border policies medicare billing has to abide by. These challenges are divided into categories:

Different units: Part A covers inpatient care including admissions while B encapsulates outpatient. C includes advanced plans and B covers prescriptions.

Administrative Hurdles: The false policies board puts medicare billing at risk up to $23,607 per error.

Regional Differences: Policies are enforced distinctively by Medicare’s private contractors leading to regional arbitrariness and control.

Illustration: Services coverage region includes FirstCoastt service options accompanied by Novitas solutions in Texas and Florida.

Highlights of Medicare billing powering the basics of B, A, C, and D.

Claim transmission should begin only when all prerequisites are met. Each part has crucial prerequisites that need to be made for outpatient services to be provided. Advanced claim forms are categorized under direct treatments of inbound claims along with UB-04.

Part B: For outpatient services (e.g., physician appointments). Needs CMS-1500 forms along with ICD-10/CPT coding.

Part C (Medicare Advantage): Managed care organizations process claims; requires preauthorization.

Part D: Drug coverage paid through the PDE (Prescription Drug Event) submission.

Rejection Prevention Tip: Always confirm eligibility using the Medicare Beneficiary Identifier (MBI) number to prevent discrepancies.

Billing Compliance With Medicare: Preventing Costly Penalties

Under the 2024 CMS Final Rule, Medicare audits are becoming more frequent. Remain compliant by:

Proving Medical Necessity: Demonstrate medical necessity by documenting ICD-10 coding linked to CPT/HCPCS coding, like G2211 for caring for chronically ill children.

Upcoding Avoidance: Underbilling for the service rendered (99214.) Upcode increases billing the practice overcoming using 99215 by a service level higher than provided.

Complying with Stark Law: No referrals to companies with financial.

Case Study: Clinics in New York were fined $2 million for Stark law breaches after in-house imaging centers for patients.

How To Fix Most Common Billing Errors With Medicare

Excluding Medicare Billing numbers or including an MBI or spelling a name and DOB together.

Fix: Updating patient details through HETS will correct this in real-time via eligibility verification.

Claiming the same service more than once.

Fix: Using Waystar claim scrubbing software will resolve this.

Falling short of gathering Advanced Beneficiary Notices of non-covered services.

Revise: Change training to include issuing ABNs for services such as cosmetic surgical procedures.

Streamlining Medicare Billing Claims: 2024 Best Practices

Implement Automation of Prior Authorizations: Using CoverMyMeds decreases time barriers.

Conduct Monthly Claim Audits: Analyze tracking reasons for denial such as N264.

Staff Retraining for 2024 Changes:

New telehealth E/M coding.

JW modifier for not used drugs (for example, some cancer medications).

Stat: Denials are lowered by 45% when using AI-driven coding tools. (MGMA 2023)

The Impact Technology Has on Medicare Billing

AI-Driven Coding: Systems such as Optum360 recommend codes based on written clinical notes.

Blockchain Technology: Share patient information securely between providers; see Humana’s pilot.

Predictive Analytics: Use the historical data to predict denial from given services.

Example: A Michigan hospital has lowered denial rates by 30% when using predictive analytics.

In-House vs. Outsourcing Medicare Billing: Which Is More Effective?

Consider: In-House Outsourcing

Cost Staff/software 60k+/year 4-8% of collections (no overhead)

Compliance Risk Training gaps: higher Certified coders: lower

Scalability Limited by staff Flexible for seasonal demand

Verdict: Small practices are better off outsourcing. Large hospitals may wish to keep billing in-house.

Case Study: How [Specialized-Billing.com] Reclaimed $500k in Denied Claims

Client: Ohio-based 10-doctor cardiology group.

Problem: Incorrect modifiers such as not using -59 for distinct procedures led to a 35% denial rate.

Solution: [Specialized-Billing.com] Put into practice AI audits as well as staff training.

Results: Denials reached 8% in 6 months, recovering $500k annually.

Future Trends in Medicare Billing

AI-Driven Prior Auths: CMS intends to automate 50% of approvals by 2025.

Telehealth Expansion: Mental health visits are permanently covered after the PHE.

Value-Based Care: Replacing fee-for-service models to bundled payments.

Conclusion: Crushing Medicare Billing with Financial Success

Medicare billing has a complex set of rules to follow, but effective strategies help mitigate denials and maximize revenue. Invest in AI, outsource to experts like [Specialized-Billing.com], and upskill your team, but make sure you’re prepared for changes in 2024.

0 notes

Text

Empowering Entrepreneurs: Choosing the Best Accounting Softwares for Small Business in Dubai

The demand for efficient financial management has never been greater. For small businesses, staying on top of finances is essential not only for daily operations but also for long-term success. That’s why many entrepreneurs are turning to the best accounting softwares for small business to streamline processes and maintain financial clarity.

Small business owners often juggle multiple roles. From managing inventory to handling marketing, it’s easy to overlook the intricacies of accounting. However, with the advent of digital accounting tools, financial management has become easier, more transparent, and accessible in real time. The best accounting softwares for small business come equipped with features such as automated invoicing, expense tracking, payroll management, and tax calculations, making them invaluable for entrepreneurs.

In Dubai, the business ecosystem is thriving, but it also demands compliance with specific legal and financial standards. This is where reliable accounting services in Dubai play a pivotal role. These services offer a blend of technology and expertise, helping businesses implement the right accounting tools while ensuring compliance with the UAE’s tax laws and financial reporting norms.

Ubsconsultantsuae.com stands out as a preferred partner for small businesses in the region. The firm offers a wide range of accounting packages for small business, tailored to meet individual company needs. Their approach includes analyzing the client’s business model, suggesting appropriate software solutions, setting them up, and providing ongoing support to ensure smooth financial operations.

The most attractive aspect of today’s accounting solutions is their cloud-based nature. Cloud software allows business owners and accountants to access financial data from anywhere, facilitating better decision-making and faster response times. Additionally, it reduces paperwork and the risk of human errors. For those unfamiliar with these tools, working with expert accounting services in Dubai makes the onboarding process smooth and effective.

It’s also worth noting that accounting packages for small business are scalable. Whether a company is just starting or in a growth phase, packages can be upgraded to accommodate more complex needs, including integration with inventory management, CRM, and ERP systems.

Choosing the best accounting softwares for small business is not just a matter of convenience—it’s a strategic decision that impacts your company’s efficiency, compliance, and future growth. By leveraging cutting-edge software and partnering with professionals like UBS Consultants UAE, small business owners can free up valuable time, reduce errors, and gain a clear picture of their financial health.

Well, entrepreneurs looking to succeed in Dubai’s competitive market must invest in the right financial tools and expert support. Whether it's choosing the right software or understanding complex tax codes, accounting services in Dubai are crucial. With tailored accounting packages for small business, UBS Consultants ensures that companies of all sizes can enjoy the benefits of streamlined financial operations and a solid foundation for sustainable growth.

0 notes

Text

Best Accounting Software | Skillsfuture Accounting Training

Looking for Accounting software? we offer best accounting software, payroll, ubs accounting software & myob accounting software for small business in singapore ! https://www.userbasicsoftware.com/

#accounting software singapore#singapore accounting software#accounting software in singapore#myob accounting software#myob software in singapore#ubs accounting singapore#ubs accounting#ubs software

1 note

·

View note

Photo

PSG Grant Inventory Software | Inventory Software Singapore

https://www.ezaccounting.com.sg/ezaccounting/ez-inventory/

#inventory management#inventory software#UBS Software#SAGE UBS Accounting Software#sage ubs inventory

0 notes