#U.S. Treasury bonds

Explore tagged Tumblr posts

Text

2-year Treasury yield hits lowest level since October amid recession fears

U.S. Treasury yields were little changed on Tuesday as worries over the state of the U.S. economy persisted. The benchmark 10-year Treasury yield was 3 basis points higher at 4.244%. The 2-year Treasury yield was last flat to 3.897%, after falling to its lowest level since October. One basis point is equal to 0.01%, and yields and prices move in opposite directions. On Tuesday, investors were…

#Bonds#Breaking News: Economy#business news#Donald Trump#Economic events#Economy#Government debt#Scott Bessent#Treasury notes#U.S. 10 Year Treasury#U.S. 2 Year Treasury#U.S. Economy#U.S. Treasury bonds#United States

0 notes

Text

Ripple and Ondo Finance Invest in XRP Ledger Tokens

Ripple, the creator of the XRP Ledger, and Ondo Finance have made seed investments in a token on the XRP Ledger for initial liquidity, although the size of the allocations has not been disclosed #bitcoin #coin #crypto #kripto #ripple #xrp #sol

Ripple, the creator of the XRP Ledger, and Ondo Finance have made seed investments in a token on the XRP Ledger for initial liquidity, although the size of the allocations has not been disclosed. This move is part of the rapidly growing sector of tokenizing real-world assets (RWAs), which involves representing traditional financial assets like bonds, loans, and funds on a blockchain. Participants…

#blockchain#financial innovation#investment#liquidity#ONDO Finance#Ripple#RWA#tokenized assets#U.S. Treasury bonds#XRP Ledger

0 notes

Note

what are treasury bills? are they like a stock to invest in, or are they secret money yet to be made in the money factory, or what?

Treasury bills (T-bills) and their counterpart treasury bonds (T-bonds) are NOT stocks, but they are a bit like an investment.

Very very very simply, they are loans YOU give to the U.S. government, to be collected at a later date with interest. T-bills are shorter term (and therefore lower interest) and T-bonds are longer term (with longer interest). You can cash them in when they mature for the full value of the bond.

Example: In 2000 you spent $100 to buy a treasury bond worth $1,000 with a maturation date of 2020. You hold onto it for 20 years, and in 2020 you cash it in for $1,000, earning yourself a tidy profit of $900. (Note: I have no idea of the current rates so these numbers might not be realistic.)

A lot of people diversify their investment portfolios with bonds in addition to stocks because they are generally less volatile than stocks.

If that sounds like a load of confusing bullshit, not to fret! We explain at length right here:

Investing Deathmatch: Stocks vs. Bonds

Did we just help you out? Say thanks by donating to our Patreon!

14 notes

·

View notes

Text

Friday’s big stock stories: What’s likely to move the market in the next trading session

The S&P 500 slid on Thursday, dragged down by falling Tesla shares. The EV company tumbled more than 14%. Here’s what’s on CNBC’s radar going into Friday. [title_words_as_hashtags

#Apple Inc#ARK Venture Fund#Baron Focused Growth Fund Institutional Shares#BondBloxx BB Rated USD High Yield Corporate Bond ETF#BondBloxx CCC Rated USD High Yield Corporate Bond ETF#Broadcom Inc#business news#Fidelity Corporate Bond ETF#Investment strategy#iShares 0-5 Year High Yield Corporate Bond ETF#iShares iBoxx $ High Yield Corporate Bond ETF#iShares National Muni Bond ETF#Lululemon Athletica Inc#Microsoft Corp#regwall-pro#S&P 500 Index#SPDR Bloomberg High Yield Bond ETF#Stock markets#Tesla Inc#U.S. 1 Month Treasury#U.S. 10 Year Treasury#U.S. 2 Month Treasury#U.S. 2 Year Treasury#U.S. 20 Year Treasury#U.S. 3 Month Treasury#U.S. 30 Year Treasury

0 notes

Text

Treasury Yields Hold Firm as U.S. Deficit Fears Weigh on Markets

U.S. Treasury yields remained largely unchanged on Thursday as investor anxiety over the nation’s mounting fiscal deficit continued to dominate market sentiment.

As of 3:40 a.m. ET, the 30-year Treasury yield was steady at 5.09%, matching levels last seen in November 2023. The 10-year yield dipped slightly to 4.58%, down just over one basis point, while the 2-year yield slipped more than 2 basis points to 3.99%. (Note: One basis point equals 0.01%. Yields and bond prices move in opposite directions.)

This week, investors have been closely monitoring the widening U.S. budget gap, which has been thrust into the spotlight following a series of developments — most notably, Moody’s recent downgrade of the country’s credit rating from Aaa to Aa1, and President Donald Trump’s newly proposed budget plan.

Trump’s sweeping fiscal proposal, which has sparked intense debate in Congress, is projected to increase the national debt by $3 trillion to $5 trillion. Analysts warn this could worsen the deficit, stoke inflationary pressures, and further unsettle an already fragile bond market.

Moody’s cited “large annual fiscal deficits and growing interest costs” as key reasons for the downgrade — a move that has shaken confidence in Treasurys’ status as a traditionally risk-free asset.

“The market is demanding a higher risk premium for long-term government debt,” said Kathy Jones, chief fixed income strategist at Charles Schwab. “Globally, we’re seeing a repricing of sovereign debt in response to rising uncertainty around fiscal discipline.”

Investors are also watching for Thursday’s release of weekly jobless claims and existing home sales, which could provide additional clues about the broader economic outlook.

0 notes

Link

#economics#economy#recession#2008 recession#interest rates#yield curve#liquidity trap#2011#u.s. treasury#treasury bonds#treasury bills#monetary stimulus#monetary policy#debt ceiling#deficit#federal reserve#great recession 2008

0 notes

Text

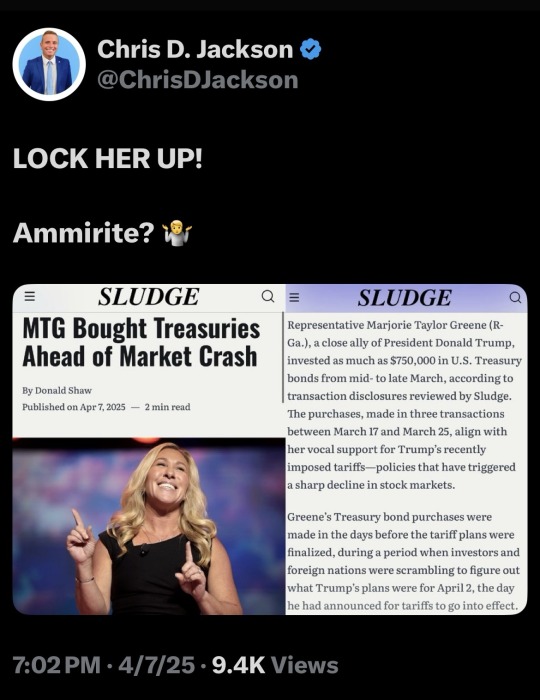

Representative Marjorie Taylor Greene (R-Ga.), a close ally of President Donald Trump, invested as much as $750,000 in U.S. Treasury bonds from mid- to late March, according to transaction disclosures reviewed by Sludge. The purchases, made in three transactions between March 17 and March 25, align with her vocal support for Trump’s recently imposed tariffs—policies that have triggered a sharp decline in stock markets.

246 notes

·

View notes

Text

THE TRUMP SLUMP

Friends,

Recall that Trump was elected largely because Americans thought the economy was lousy and believed him when he said he’d fix it.

Now, seven weeks after his inauguration, the bottom is falling out. Stocks are plunging. Treasury yields are falling. Consumer confidence is dropping. Inflation is picking up.

Over the weekend, Trump refused to rule out a recession this year, telling Fox News there will be a “period of transition, because what we’re doing is very big.”

Well, yes, if “very big” means destroying much of the federal government, allying with Putin against our traditional allies, and putting high tariff walls around America.

The cost of living — the single biggest problem identified by consumers over the last several years — is going up, not down. Trump’s tariffs on steel and aluminum, and his threatened 25 percent tariffs on Canada and Mexico, are playing havoc with supply chains inside and outside America.

Trump’s trade war with China intensified today as China began imposing retaliatory tariffs on a wide range of American farm products. Food prices are rising.

Corporations are pulling back from investing in new productive capacity — additional jobs, equipment, factories — because Trump’s and Musk’s chaos makes it impossible for them to gauge what the future will bring. Joblessness is rising.

The S&P 500 was down more than 2 percent in this morning’s trading — after last week’s 3.1 percent drop (the biggest drop in six months) — signaling that investors are spooked.

Tesla's stock tumbled more than 8 percent this morning. Shares of Apple, Microsoft, Alphabet, Amazon.com, Nvidia and Meta Platform fell more than 2 percent.

Long-term bonds — which reveal investors’ expectations about the economy over the next decade — are also down. They expect hard times. The 10-year U.S. Treasury yield slipped below 4.23 percent (it had settled Friday above 4.31 percent).

Even before this Trump slump, only the richest 10 percent of Americans had enough purchasing power to keep the economy going with their spending. The bottom 90 percent — including most Trump voters — were barely getting by. The next eighteen months could be rough on millions of people.

Will the Trump slump turn into a recession? How will Trump lie and cheat his way out of it? Stay tuned.

https://robertreich.substack.com/p/the-trump-slump-is-now

177 notes

·

View notes

Text

10-year Treasury yield rises above 4.3% as traders ignore noisy jobs report

The yield on the 10-year Treasury rose as traders downplayed October jobs data showing meager job growth that was hurt by hurricanes and striking workers, and was far below what Wall Street was expecting. The 10-year Treasury yield jumped nearly 10 basis points at 4.382%. The 2-year Treasury yield was higher by 5 basis points at 4.216%. The uptick in yields marks a continuation of their recent…

#Bonds#Breaking News: Markets#business news#Economic events#Labor economy#Markets#Personnel#Prices#Treasury bills#Treasury notes#U.S. 10 Year Treasury#U.S. 2 Year Treasury#U.S. Economy#U.S. Treasury bonds

0 notes

Text

The New Yorker Daily: Why Trump Backed Down on Tariffs

A week after Donald Trump shocked the world by imposing punitive tariffs on America’s trading partners, he shocked it again today when he announced a ninety-day pause on the biggest duties against most countries—notably excepting China, among a handful of others—while leaving in place a ten-per-cent across-the-board levy.

The Administration tried to spin the midday move, which sent stocks rocketing upward, as an example of the President’s dealmaking prowess, claiming that the tariffs had inspired new trade deals with many countries. But the reality seems to be that Trump caved in the face of alarming disruptions in the huge market for U.S. Treasury bonds, which the American government uses to finance itself.

Trump’s announcement of his “reciprocal” tariffs last week, which weren’t reciprocal at all, sent the markets into turmoil. The White House seemed to have steeled itself against an adverse reaction in the stock market, even as, by Wednesday morning, the total market had fallen by about twenty per cent from its high. What really spooked financial commentators—and Trump himself, as he conceded later on Wednesday, speaking outside the White House—was the turbulence in the bond market, where yields spiked on Monday and Tuesday.

A big sudden rise in bond yields equates to a big sudden fall in bond prices—which can be a sign that some financial institutions are in distress and being forced to sell at any price. On Tuesday, reports emerged that the source of this trouble might be the “basis trade,” a process in which hedge funds borrow gobs of money to profit on the tiny differences in price between Treasuries and derivative securities, contracts designed to replicate the performance of these same Treasuries. When bond prices move unexpectedly, basis traders can face big losses and be subjected to margin calls, forcing them to raise cash by selling some of their portfolio. And that selloff, in turn, forces prices even lower.

It’s not entirely clear that this was the actual cause of the rising yields in the bond market, but by this morning Lawrence Summers, a former Treasury Secretary, warned online that “developments in the last 24 hours suggest we may be headed for serious financial crisis wholly induced by US government tariff policy.” The current Treasury Secretary, Scott Bessent, himself a former hedge-fund manager, initially shrugged off the threat. But by Wednesday afternoon Bessent was spinning the capitulation as best he could. Referring to Trump, he said, “It took great courage for him to stay the course.”

If that was meant as an inside joke, Bessent didn’t let on. More likely, he was trying to assuage his boss’s bruised ego. In the end, the markets forced Trump to do something sensible—announce a timeout—but a lot of damage has already been done to 401(k) plans, business planning, consumer confidence, and faith in the U.S. government. None of these things will be repaired easily or quickly.

40 notes

·

View notes

Text

10-year Treasury yield falls after jobless claims increase

U.S. Treasury yields ticked lower on Thursday as investors digested new labor market data. The 2-year yield fell more than 2 basis points to 3.848%, while the 10-year Treasury yield dropped by more than 3 basis points to 4.328%. The 30-year long bond yield pulled back more than 4 basis points to 4.843%. One basis point equals 0.01%. Yields and prices move inversely in the bond market. The latest…

#Bonds#Breaking News: Markets#business news#Donald Trump#Economic events#Government debt#Markets#Personnel#Prices#U.S. 2 Year Treasury#U.S. 30 Year Treasury#United States

0 notes

Text

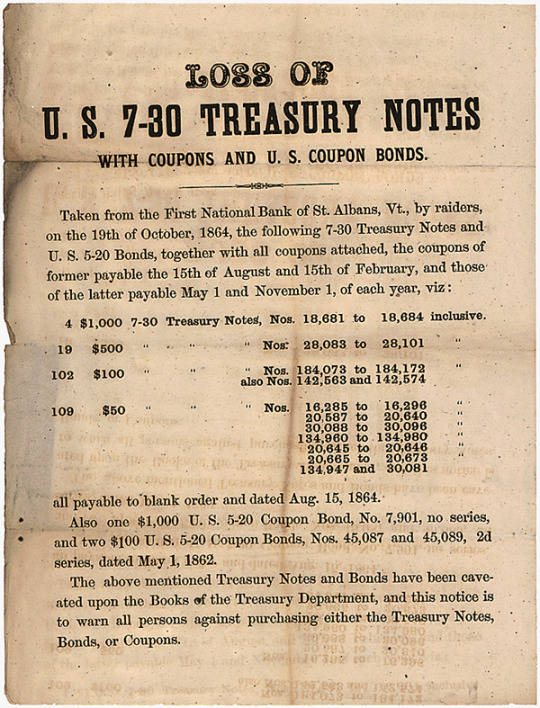

Notice concerning treasury notes taken during a Confederate raid in St. Alban's, Vermont

Record Group 233: Records of the U.S. House of RepresentativesSeries: Accompanying PapersFile Unit: Accompanying Papers of the 43rd Congress

LOSS OF

U. S. 7-30 TREASURY NOTES

WITH COUPONS AND U. S. COUPON BONDS.

Taken from the First National Bank of St. Albans, Vt., by raiders,

on the 19th of October, 1864, the following 7-30 Treasury Notes and

U. S. 5-20 Bonds, together with all coupons attached, the coupons of

former payable the 15th of August and 15th of February, and those

of the latter payable May 1 and November 1, of each year, viz:

4 $1,000 7-30 Treasury Notes, Nos. 18,681 to 18,684 inclusive.

19 $500 " " " Nos. 28,083 to 28,101 "

102 $100 " " " Nos. 184,073 to 184,172 "

also Nos. 142,563 and 142,574

109 $50 " " " Nos. 16,285 to 16,296 "

20,587 to 20,640 "

30,088 to 30,096 "

134,960 to 134,980 "

20,645 to 20,646 "

20,665 to 20,673 "

134,947 and 30,081

all payable to blank order and dated Aug. 15, 1864.

Also one $1,000 U. S. 5-20 Coupon Bond, No. 7,901, no series,

and two $100 U.S. 5-20 Coupon Bonds, Nos. 45,087 and 45,089, 2d

series, dated May 1, 1862.

The above mentioned Treasury Notes and Bonds have been cave-

ated upon the Books of the Treasury Department, and this notice is

to warn all persons against purchasing either the Treasury Notes,

Bonds, or Coupons.

56 notes

·

View notes

Text

This Is Why Dictatorships Fail

April 10, 2025

He blinked. But we don’t really know why.

Whether it was the stock market cascading downward, investors fleeing from U.S. Treasury bonds, Republican donors jamming the White House phones, or even fears for his own portfolio, President Donald Trump decided yesterday afternoon to lift, temporarily, most of his arbitrary tariffs. This was his personal decision. His “instinct,” as he put it. His whim. And his decision, instinct, or whim could bring the tariffs back again.

The Republicans who lead Congress have refused to use the power of the legislative branch to stop him or moderate him, in this or almost any other matter. The Cabinet is composed of sycophants and loyalists who are willing to defend contradictory policies, even if doing so makes them look like fools. The courts haven’t decisively intervened yet either. No one, apparently, is willing to prevent a single man from destroying the world economy, wrecking financial markets, forcing this country and other countries into recession if that’s what he feels like doing when he gets up tomorrow morning.

This is what arbitrary, absolute power looks like. And this is why the men who wrote the Constitution never wanted anyone to have it. In that famously hot, stuffy room in Philadelphia, windows closed for the sake of secrecy, they sweated and argued about how to limit the powers of the American executive. They arrived at the idea of dividing power between different branches of government. As James Madison wrote in “Federalist No. 47”: “The accumulation of all powers, legislative, executive, and judiciary in the same hands … may justly be pronounced the very definition of tyranny.”

More than two centuries later, the system created by that first Constitutional Congress has comprehensively failed. The people and institutions that are supposed to check executive power are refusing to restrain this president. We now have a de facto tyrant who thinks he can bend reality to his will without taking any facts or any evidence into consideration, and without listening to any contrary views. And although the economic damage he has caused is easier to measure, he has inflicted the same level of harm to scientific research, to civil liberties, to health care, and to the civil service.

From this wasteful and destructive incident, one useful lesson can be drawn. In recent years, many people who live in democracies have become frustrated by their political systems, by the endless wrangling, the difficulty of creating compromise, the slow pace of decisions. Just as in the first half of the 20th century, would-be authoritarians have begun arguing that we would all be better off without these institutions. “The truth is that men are tired of liberty,” said Mussolini. Lenin spoke with scorn about the failings of so-called bourgeois democracy. In the United States, a brand-new school of techno-authoritarian thinkers find our political system inefficient and want to replace it with a “national CEO,” a dictator by a different name.

But in the past 48 hours, Donald Trump has just given us a pitch-perfect demonstration of why legislatures are necessary, why checks and balances are useful, and why most one-man dictatorships become poor and corrupt. If the Republican Party does not return Congress to the role it is meant to play and the courts don’t constrain the president, this cycle of destruction will continue and everyone on the planet will pay the price.

21 notes

·

View notes

Text

May 16, 2025, 2:20 PM MST / Updated May 16, 2025, 2:57 PM MST / Source: CNBC

By Yun Li, CNBC

Moody’s Ratings cut the United States’ sovereign credit rating down a notch to Aa1 from the Aaa, the highest possible, citing the growing burden of financing the federal government’s budget deficit and the rising cost of rolling over existing debt amid high interest rates.

“This one-notch downgrade on our 21-notch rating scale reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns,” the ratings agency said in a statement.

The decision to lower the United States credit profile would be expected, at the margin, to lift the yield that investors demand in order to buy U.S. Treasury debt to reflect more risk, and could dampen sentiment toward owning U.S. assets, including stocks. That said, all the major credit rating agencies continue to give the United States their second-highest available rating.

The yield on the benchmark 10-year Treasury note climbed 3 basis points in after-hours trading, trading at 4.48%. The iShares 20+ Year Treasury Bond ETF fell about 1% in extended trading, while the SPDR S&P 500 ETF Trust fell 0.4%.

61 notes

·

View notes

Text

Jennifer Rubin at The Contrarian:

On Wednesday, Democratic Senate and House leaders launched their “day of action” to underscore the MAGA attack on Social Security. Members visited Social Security offices to denounce “Donald Trump, Elon Musk and DOGE’s cuts to Social Security.” In addition, the Democratic Senatorial Campaign Committee (DSCC), according to Axios, launched “a digital ad campaign against Sens. Thom Tillis (R-N.C.) and Susan Collins (R-ME.)” seeking to tie the Senators to efforts to dismantle Social Security. Cuts to entitlement programs as well as those that serve the elderly, the sick, the young, the poor, and the middle class are driven by MAGA budget maneuvers to secure massive tax cuts for the rich at the expense of…everyone else. The budget might be less remarked upon than the disastrous tariff war Donald Trump has recklessly implemented, but it also threatens to exact real pain on vulnerable Americans while damaging the long-term interests of the American economy. While we wait for the next shoe to drop in the constitutional standoff between Donald Trump and the rule of law, we must not ignore this looming fiscal disaster. [...]

The “radical agenda that at the least, will add trillions of dollars to the national debt,” envisions $5.3 trillion in tax cuts that will overwhelmingly benefit the super-rich and add “more to the deficit (and debt) than the last five major pieces of spending legislation combined.” That’s right. “It dwarfs the $2 trillion of additional deficits created by the three major pieces of legislation passed under President Joe Biden.” The hypocrisy of MAGA Republicans (who decried the runup in the debt) should hardly surprise those who have watched the GOP morph from a conservative party to a reactionary, unhinged cult of personality relying on phony math and outright lies. To put this in perspective, our debt under the MAGA plan would increase to 134 percent of the economy by 2034. Worse, that debt will be much harder to sell, and repayment interest will grow higher as Trump destroys confidence in the U.S. economy, investors dump Treasury bonds, and the Treasury is forced to raise yields (interest rates) to finance our debt. In other words, Trump is making us more dependent on debt holders, including places like China. He is making China richer; the U.S. poorer.

Moreover, Republican would have us rack up mounds of debt not to get roads, bridges, universal internet, and other productive investments—but instead to reward billionaires. In a letter to the public, Senate Democrats made clear: “The Trump Administration and Congressional Republicans are planning to give another round of tax handouts to the ultra-wealthy and corporations that are paid for by gutting the healthcare you and your family need to stay safe and healthy.” The only way to make even the fuzzy MAGA math work is to enact historic, crippling cuts to Medicaid, the Affordable Care Act, and SNAP food benefits. Many Americans are unaware whom Medicaid benefits. “Seniors living in nursing homes, children with disabilities who need home-based care, and veterans for whom Medicaid is a lifeline will shoulder the harm caused by these cuts, all while Republicans’ tax breaks make corporations and billionaires like Elon Musk even wealthier,” as Democrats explain. Add healthcare for children (under CHIPS) and treatment for mental health and drug addiction, and the universe of people covered rises to 79,034,066 people. That works out to nearly 1 in 4 Americans. [...] In sum, MAGA Republicans are ready to wreck your lives to keep their seats. It is incumbent upon all Americans to make clear that if they try to do so, those lawmakers will join the ranks of the unemployed in 2026.

The GOP and the Trump Regime are en route to causing economic calamity.

11 notes

·

View notes

Text

China bond yields jump to three-month highs as investors pare rate cut expectations

The People’s Bank of China (PBOC) building in Beijing, China, on Friday, Nov. 8, 2024. Bloomberg | Getty Images China’s sovereign bond prices fell Monday, pushing yields to their highest levels this year, as investors trimmed holdings on bets that additional fiscal spending will boost growth and push back interest rate cuts. Yields on China’s 10-year government bond, which move inversely to…

#Asia Economy#Bonds#Breaking News: Investing#business news#China#Economic events#Government debt#Hang Seng Index#Investment strategy#Prices#U.S. 10 Year Treasury

0 notes