#Transitory inflation

Explore tagged Tumblr posts

Text

#stream#like YEA bc JEROME POWELL IS A FUCKING IDIOIT#‘inflation is transitory’ babe u missed that window november 2021 just KILL YOURSELF#i cant believe blackrock is right - FOR ONCE#INFLATION IS STUCK NOW IT TRANSITIONED ALREADY#everyday i long for janet yellen’s return#ms. janet … save us

3 notes

·

View notes

Text

WATCH: Scott Jennings Goes Nuclear After CNN Analyst Claims Biden Didn't Lie About Pardoning His Son

JENNINGS: This is the worst possible thing a president could possibly do to his party and to the country. To sit for a year and say, "I will not do this, I will not do this, the rule of law is sacred, we have to respect the justice system, we have to respect juries, we have to respect the guardrails and the norms of our democracy." These people are liars. Inflation is transitory, Afghanistan is a success, the border is secure, Robert Hur is a liar, the videos are cheap fakes, Biden has a cold, he'll never drop out, "Oh, I'll never pardon Hunter." It's all a lie. It is all a grift. Every American except the most partisan, brain-rotted people are going to be outraged by this.

Do people who fall for ANY of this actually exist???

32 notes

·

View notes

Text

The experts told us Joe was fine.

The experts told us to take the vax.

The experts told us the laptop was fake.

The experts told us the border is secure.

The experts told us inflation is transitory.

The experts told us 2020 was the MOST legitimate and secure election in history.

Remember who the propagandists are.

Never trust any of them again.

42 notes

·

View notes

Text

Dragflation is the economic climate of the future for much of the world; negative economic growth and rising inflation.

However, the reality will be denied by politicians and the Presstitute media.

Need more proof?

This is a 19 December article in the business section of The New York Times:

Britain’s Economy Is ‘Bumbling’ Into the New Year

It’s a somber end to the year in Britain, dampened by a string of disappointing economic news. Inflation has jumped, the economy has stagnated and consumer confidence surveys are deeply downbeat.

The economy did not stagnate, it shrank for the second month in a row while the UK inflation rate went up for the second month in a row, rising 2.6 percent, which was the fastest pace since March.

As the old Bronx saying goes, “Bullshit has its own sound.”

What is going on in the UK is symptomatic of what’s happening around the world: Major economies are in decline and prices keep rising… but the facts are being denied.

Go back to the beginning of 2021.

Listen to what the Fed Banksters and “experts” were saying about inflation: It was “temporary.”

Month after month, as inflation kept rising higher, the money mobsters changed their tune and inflation forecasts went from “temporary” to “transitory.”

Now look at some of the world’s largest economies.

China, the world’s second-largest economy, has greatly weakened since it launched the COVID War in January 2020, and while it is not in contraction and there has been disinflation, inflation is now back on the rise compared to last year.

5 notes

·

View notes

Text

There's a lot of things that should affect the Democrats' credibility. Remember Russia Collusion? Transitory Inflation? The 'Inflation Reduction Act'. Joe Biden's 81 million votes...

32 notes

·

View notes

Text

As all journalists know fear sells better than sex. Readers want be terrified. And here in the UK, there appears to be every reason to frighten them.

A country that was overdependent on financial services has been in decline ever since the banking crash of 2008. Then, from 2010 on, the astonishing Conservative policy failures of austerity, Trussonomics and, above all, Brexit further weakened an enfeebled state.

I was a child in a happy family during the crisis of the 1970s. Like all happy children I just got on with my life. But even I picked up a little of the despair and hopelessness of the time. That feeling that there is no way out is with us again.

In 1979, Margaret Thatcher came to power, and with great brutality, set the UK on a new path as she inflicted landslide defeats on Labour.

Obviously, our current Conservative government is heading for a defeat, maybe a landslide defeat.

But there is little sense that Labour will transform the country. The far-left takeover from 2015-2019 traumatised it. As recently as 2021, everyone expected Boris Johnson to rule the UK for most of the 2020s.

Johnson’s contempt for the rules he insisted everyone else follow and the great Truss disaster are handing Labour victory. But the centre-left appears to be the beneficiary of scandal and right-wing madness, not an ideological sea change that might inspire it and sustain it in power

Desperate to drop its crank image, battered by the conservative media establishment, fashionable opinion holds that a wee, cowering and timorous Labour party will come into power without radical policies that equal the country’s needs.

Just this once, fashionable opinion may even be right

And yet, and I know I will regret this outbreak of commercially suicidal optimism, there are reasons to believe that the UK’s position is not quite as grim as it appears.

1) The economy may revive

Although no one has been as wrong recently as the economists and central bankers who predicted that inflation would be a transitory phenomenon, it is finally coming down. Falls in energy prices may even bring it to the 2 per cent target this month. Interest rates will eventually follow suit.

Lower interest rates mean lower government borrowing costs. They will reduce the extraordinary debt bill Labour in power will have to meet.

Chris Giles of the Financial Times calculated this week that lower government borrowing costs improve the public finances five years ahead by almost £15bn (about 0.5 per cent of national income) for every percentage point reduction.

Meanwhile the Conservatives have raised taxes so high (by UK standards) a Labour government may not need to risk unpopularity by raising them further. Under Conservative plans the tax burden has risen from 33.1 per cent of gross domestic product in 2019-20 to 36.5 per cent in 2024-25 with further rises planned, taking it to 37.1 per cent by 2028-29.

If the 1997-2010 Labour government is any guide, Labour will be reluctant in the extreme to play into its enemies’ hands by raising taxes

It may not need to if economic growth leads to the revenue growth that would take the UK out of the rolling crisis that has afflicted it since 2016.

I wouldn’t be doing my job if I did not add that there are some pretty large caveats to make.

Economists missed the post-covid inflation surge because they forgot about politics. Russia’s unprovoked invasion of Ukraine upended the European economy. An extension of the war in Ukraine or the Middle East, or, more terrifyingly, a US-China confrontation, or the return of Donald Trump could all derail a new government.

In any case the IMF predicts growth of 1.5 percent in 2025, which is nowhere near the 3 percent we need to fund the state.

And yet, with a bit of luck there is a fair chance that our fortunes may revive, albeit modestly.

2) Labour is not as scared as it looks

Near where I live in London is the Union Chapel, a vast neo-Gothic hall.

Will Hutton was there recently to launch his new book This Time No Mistakes: How to Remake Britian. I have interviewed Will for the podcast, which should be out in a couple of days. For now, I’ll just say his book is a classic combination of liberal and left thought, and makes the case for radical reform. Keir Starmer arrived on stage to the cheers of the crowd and endorsed Hutton’s findings.

The fashionable view is that Labour has abandoned difficult policies so as not to alienate frightened voters, and I can see why people think that way.

The grand plan for green job creation has been hacked back after fears the markets would not wear it. The majority of people in this country, and the overwhelming majority of people who vote for opposition parties, now recognise that Brexit was a disastrous error. Year in year out it drags the country down. And yet Starmer, who once argued for a second referendum, is terrified of mentioning the subject in case he upsets a minority in marginal seats.

There was a depressing little vignette a few days ago when the European Commission laid out proposals for open movement to millions of 18- to 30-year-olds from the EU and UK, allowing them to work, study and live in respective states for up to four years. Labour joined the Tories in rejecting the offer.

It would rather squash the aspirations of young people than lay itself open to the charge that it was taking us back towards EU membership.

Yet Rachel Reeves, Keir Starmer and David Lammy talk about the need for cooperation. “Success will rest on forming new bilateral and multilateral partnerships, and forging a closer relationship with our neighbours in the European Union,” Reeves said as she explained her economic programme.

Meanwhile the UK has been ruled by Conservatives for so long our battered minds can underestimate how much the country will change when they are thrown out.

The new parliament will be filled with politicians who support renters, more home building and the EU. They will at least be interested in a land value tax and a universal basic income. Radical that ideas have been forbidden for years will soon seem normal.

3) The impetus for change

The last Labour government of 1997 to 2010 did not change economic fundamentals for what seemed at the time to be a very good reason.

When it came to power neo-liberalism worked. Indeed, is easy to forget now how successful the ideology appeared before the crash of 2008. Politicians like Gordon Brown and Tony Blair accepted much of what Margaret Thatcher had done because they thought they had no choice. Everyone knew, or thought they knew, that this was how you ran an economy.

None of that certainty pertains today. The Brexit nationalism that succeeded neo-liberalism has failed. Starmer and Reeves will not be like Blair and Brown: they will have no good reason to cling to discredited ideas.

That does not mean they won’t cling to them for fear of the Tory press or swing voters or because of their own intellectual failings. There is no guarantee that countries will turn themselves round. The UK could go the way of Argentina or Italy.

But the Labour leadership is made of serious politicians, and I keep asking myself why would serious politicians want to preside over decline? I can’t see why they would.

As I said, maybe I will regret writing this piece. But for the moment I think we can enjoy a rare moment of optimism.

8 notes

·

View notes

Text

Anxiety, Fear and Worry

by Gil Rugh

We live in a world full of people who are consumed by worry and fear. The news is full of things that could cause anxiety. Many people are obsessed with inflation and what will happen to their money. Worldly people invest their entire lives in these transitory things…

Jesus calls His followers to have a different focus. In Matthew 6:25 He said, “Do not be anxious for your life, as to what you shall eat, or what you shall drink; nor for your body, as to what you shall put on. Is not life more than food, and the body than clothing?”

While instructing us to “not be anxious,” Jesus revealed three truths that should immediately banish anxious thoughts.

God makes provision for us (Matt. 6:25-30)

God knows what we need (vv. 31, 32)

Each day has enough trouble of its own (vv. 33, 34)

13 notes

·

View notes

Note

I'm new! whose binotto? How long he was there? What he do to Char?

hi! welcome :) and thanks for the vote of confidence, i'm not sure i'm the best person for the job since i've really gotten back into f1 a couple years ago, but i'll do my best.

i suggest you also do a deep dive into @leqclerc's blog, starting with these 3 posts ( x - x - x ).

mattia binotto was, for better or for worse, a key figure in ferrari up until the end of 2022, when he was let go/fired. he had worked for ferrari as a PU engineer since the schumacher times (not sure about what year he started), and climbed the ranks until he became technical director. due to internal politics - a problem that affects ferrari seemingly endemically - and his own inflated ego, in 2019 he all but forced the scuderia to hand him the role of team principal alongside being TD... and that was an atrociously bad decision, but you know what they say about hindsight.

2019 was the first year for charles leclerc in the team (but let's not forget he had been signed by the previous tp/management) alongside seb vettel; the year wasn't particularly good as a whole, but the car was developed well and the team got 3 wins back to back after summer (including monza with charles, which is A Big Deal). only problem is, in the winter break it came out that ferrari had signed some sort of pact/agreement/whatever with the fia, because apparently the engine had been a bit too much focused on exploiting grey areas of the regulations - both engine and accord being directly linked to binotto in his double role.

so to "protect" this engine project (still to this day nobody knows much about it except that it wasn't outright and wholly illegal), binotto decided not to get penalties & fines like any other team would; instead ferrari was forced by the fia to develop a new, power-limited engine who completely crippled the team in 2020 (and also 2021). the car was horrible to drive, results would not come - seb's and most especially charles's efforts notwithstanding - and internal politics were still rampant. to add fuel to the fire, italian media started a smear campaign against seb, which resulted in him being let go in 2020. a media campaign that started mainly because of results, but binotto's absurd and backwards communication style didn't help, with his tendency to not support, lie to and baby his drivers in statements and team radios.

2021 was a transitory year, last of the regulations - car was slightly better but still bad, nobody was thinking about ferrari much given the wdc fight. only noteworthy thing (and again: hindsight) was that carlos sainz joined ferrari, a driver coveted and handpicked by binotto himself.

2022 was when it all came to a head. new regs were established and apparently ferrari had the best car of them all: the first races were quite the sweep with charles seemingly poised to become wdc with the way he was dominating. except, engine reliability was an issue (not disastrous but charles did lose some wins because of that) and worst of all, the team and the wdc campaign under binotto were handled in the most shitty and maliciously bad way you can imagine. important tidbit: in the beginning, carlos was struggling in the car while charles soared, and it's clear now that binotto hated that and worked like hell to favour the driver he chose. meaning the strategies were amateurish, with wins and podiums lost - usually by charles - due to absurd decisions from the pitwall (wrong tyre choices, driver's suggestions getting blatantly ignored, pit stop fumbles like in monaco, charles constantly getting sacrificed because "he could recover", etc). absolute worst of the worst, ferrari robbed charles at gunpoint in silverstone, a race he was comfortably leading and going to win, until they chose to not pit him and to leave him out on old tyres to be overtaken, handing carlos the victory and kicking charles off the poium entirely. to make matters even worse, binotto wagged his finger in charles's face telling him he had to stay put and enjoy (maybe you've seen pictures, it was the single most enarging moment in a wholly enraging weekend).

that race was really the beginning of the end. i cannot let you understand the amount of hate the scuderia got for that result, from fans (especially charles's) but also from media and other teams who were all absolutely baffled by the team's choice. because you see, at that point of the year charles was still way above carlos in points and was still fighting for the wdc - silverstone basically killed that. firstly because it had been a conscious choice to hand carlos his first career win (something the team had been trying to do for a while), and then because it was the most blatant consequence of a season that should have been vehemently focused around charles (much like 2023!max) and instead saw binotto saying there was absolutely no need to establish hierarchy between the drivers at any point in the season (ignoring the huge gap in points and talent), that the team wasn't actually doing that bad of a job after all, that they still could win (if only it wasn't for the pesky driver who can't be a strategist and mechanic as well... if you read between the lines). binotto and the team never took responsibility for anything, letting the brunt of the mistakes and the failed endeavor to be shouldered by charles, which also warped people's ideas of charles and carlos and the media narrative about them - something you can still clearly see the effect of, and probably always will.

after summer break minor regs changed and any wdc hope charles had slipped away. the car got worse AND was developed more towards carlos's preferences to be more stable and him more comfortable, so as a whole less fast (the same path that produced the 2023 car, a monstrosity that was still developed by binotto as a "last gift"). charles had to fight tooth and nail but became vicechampion at the end of the year - still no hierarchy established, still not a single race in which charles was helped or favoured during his solid wdc campaign. we don't exactly know what happened behind the scenes, but after more than one year we can extrapolate with a good amount of certainty that the situation was very bad, and that at some point there was a concrete risk of charles deciding to quit ferrari - at least if binotto stayed.

at the end of 2022 it was announced binotto would leave the team (meaning not only his undeserved and disastroudly managed tp role, but the admittedly more successful engineering side as well), and alongside him most of his loyal cohort left too, especially those people he'd promoted to high roles with mixed results. after a short while fred vasseur was chosen to be the new tp - a move probably done in part to assuage charles (who, no matter what people say, is still ferrari's greatest asset) but also to bring new life and a new managerial approach to the team. fred basically had to restructure everything, but most importantly he brought a new way of working and communicating inside the team and towards the outside, focusing on honesty and mistake correction - something charles keeps praising (and that still gives hints about how shit the atmosphere must have been under binotto).

all in all, binotto has been a terrible team principal, probably one of the worst in ferrari's history, who got meagre results yet managed to fumble great drivers, cars and engines, the team's reputation - and to nuke an apparently foolproof wdc campaign. impressive, really, if it hadn't been so painful to live through.

#answers#sorry if it's messy but this is the best i could do! still i suggest you go and explore other blogs and tags as well#ferrari#mattia binotto#f1#motorsport#italian stuff

4 notes

·

View notes

Text

Zuby Music delivering a banger list of media lies to his 1m Twitter followers…

What are the biggest media lies of the last few years?

-Covid-19 (all of it)

-Jan 6 'insurrection'

-'safe and effective' jab

-Jussie Smollett

-Bubba Wallace

-Covington hoax

-Kyle Rittenhouse story

-'Very fine people' hoax

-'drinking bleach'

-'horse dewormer'

-Russian collusion

-Ghost of Kyiv

-Hunter Biden laptop

-'Don't Say Gay' bill

-Twitter collapse post-Elon

-Nord Stream pipeline

-'Transitory' inflation

-Men can get pregnant

-BLM narrative

-'2 weeks to flatten the curve'

-Blaming Russia for missile that landed in Poland

This list is not exhaustive... Kinda crazy to see it laid out like this.

And people have the nerve to call ME a 'conspiracy theorist'. I didn't promote any of these.

Mainstream media has the misinformation game on lock. I can't compete. 🤣

https://twitter.com/zubymusic/status/1633595883156647936

14 notes

·

View notes

Text

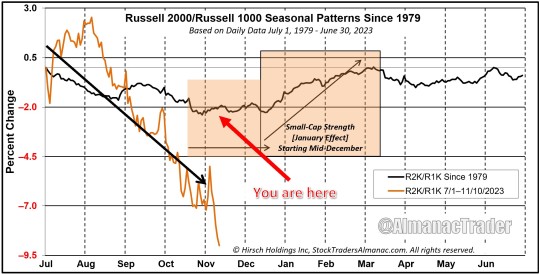

Open Season for Small Caps

A Soft CPI reading this morning and a nice pop in the Russell 2000 Small Cap Index today remind us that seasonally speaking, small caps are set up for their annual yearend rally into Q1, often referred to as the “January Effect,” where small caps outperform large caps in January.

Small caps have been struggling for two years now, hurt by non-transitory high inflation, the most aggressive rate-hiking regime we’ve seen since the 1980s, geopolitical turmoil with war on two fronts, fallout from pandemic and post-pandemic economic and labor woes. And the Russell 2000 small cap index recently hit a new multi-year low at the end of October.

As we point out on pages 112 and 114 of the Stock Trader’s Almanac, most of the “January Effect’s” small cap outperformance takes place in the last half of December when tax-loss selling abates. Our annual November stock basket published last week for members contains some brand-new, undervalued, off-Wall-Street’s-radar small cap picks.

As you can see in the accompanying chart the R2K has been tracking the pattern quite well since July and it looks like the small fry are coming out of hibernation just in time for small cap stock hunting season. Small cap stocks are facing several obstacles mentioned above, but they rallied strongly off the October 27 low with the rest of the market.

As illustrated in the chart, small caps exhibit some chop from late-October through mid-December. Our small cap stock picks have historically done well as long as you honor the buy limits and stop losses. Last pre-election year in 2019 R2K had a nice rally from October to January before it was crushed by the pandemic.

5 notes

·

View notes

Text

And I Hope You Can Get Over It

I hate you for not loving me-

Said his mind to her silence.

I hate you for not wanting me-

Said his violence to her absence.

I hate you because I want you

And you don’t seem to realize,

My wanting is all the entitlement I need.

I hate you because I love you-

Your autonomy violates my contract.

I hate you he said

Into the echo of her unanswered text,

I hate that you don’t realize-you belonged to me the moment I decided we belong together.

“I loved you when you needed me”

She whispered against her freedom

I loved you like the wind on a hot day-

She sang into the light.

I am so alive

You are so mad-

We pick our states and change when times Inflate-

It’s transitory.

But my currency is a flat rate, I will

Always choose joy.

I loved you truly-

Love doesn’t take hostages.

I loved you freely-

Love doesn’t erode confidence

Or break confidences.

I loved from my heart,

you love from your ego-

That’s not love.

I hate you for thinking I’m a belonging.

5 notes

·

View notes

Text

The Inflation Debate: Is It Transitory or Here to Stay?

Inflation has taken center stage in the economic conversations of 2023, provoking robust debate among economists, policymakers, and the public alike. After a prolonged period of low inflation rates leading up to the pandemic, the world has witnessed a sudden and significant increase in prices for goods and services. The central question has emerged: Is this inflation transitory, a temporary…

0 notes

Text

Remember when they said it would be a "Soft Landing?" ...

Remember when they said inflation was just "transitory"?

3 notes

·

View notes

Text

Janet Yellen will finally step down from her role as Treasury Secretary in January, leaving a massive mess for her replacement, Scott Bessent. The budget deficit surpassed $36 trillion under the Biden-Harris Administration, with Yellen touting that the US had an endless supply of funds to spend and imaginary success of Bidenomics.

As head of the Federal Reserve under Obama, Yellen was an outspoken advocate for QE. She worked closely with Bernanke and Greenspan, but is actually considered the main architect of the Fed’s now dead quantitative easing program that began in December of 2008. “Potentially anything – including negative interest rates – would be on the table. But we would have to study carefully how they would work here in the U.S. context,” Yellen argued back in 2015. This academic and longtime Fed insider spent her career pandering to the White House.

Perhaps part of her legacy as America’s CFO under Biden-Harris would be her insistence that inflation was “transitory.” Yellen called the US debt downgrade “arbitrary” when Fitch Ratings downgraded US long-term debt late from AAA to AA+.

She never spoke as an authority on economics, but rather, she spoke as if she were a puppet of the WEF implanted in government to spread economic-related propaganda. Yellen is akin to the Karine Jean-Pierre of America’s financial system insofar as her job is to openly lie to the public and convince them that their reality is not as it seems.

Video Player

00:00

01:01

Treasury Secretary Janet Yellen is proof that the establishment is completely clueless when it comes to the lives of the average citizen. “People are better off than they were pre-pandemic,” Yellen touted on national news last week. Perhaps she meant to say “politicians” rather than people, and no, one cannot point at rising US indexes and claim that is sufficient evidence that the overall economy is sound.

Despite millions of Americans struggling financially amid inflation in the post-pandemic landscape, Yellen had the audacity to claim that most Americans are happy with their financial situation despite every bit of data indicating otherwise. “So, they seem to perceive the economy as a whole as doing less well than they are personally. But most Americans feel good about their own economic situation.”

Yellen insisted that inflation was under control. Completely out of touch, Yellen even denied the prevalence of food inflation. “I think largely it reflects cost increases, including labor cost increases that grocery firms have experienced, although there may be some increases in margins,” Yellen, who has a net worth of $20 million, stated before advocating centralized agriculture.

Yet, she promoted every major spending package Biden signed off on. Yellen was the first to admit the true reason behind the Inflation Reduction Act, the largest spending package in US history, was to propel the climate change agenda. “The Inflation Reduction Act is, at its core, about turning the climate crisis into an economic opportunity,” Yellen admitted.

6 notes

·

View notes

Text

It’s like listening to that other mental midget that had no clue what she was doing Janet Yellen, “inflation is transitory” tell that to the people just barely surviving. Moron that can’t budget a checkbook giving economic advice. Tariffs are a tool, and they work. If you don’t believe me ask the president of Mexico & PM of Canada. That border will be closed before jan 20th thanks to Trump & tariffs.

0 notes