#Toronto property market update

Explore tagged Tumblr posts

Video

youtube

What is the future for Canadian Real Estate

#youtube#realestate#Toronto real estate#toronto housing market#toronto property trends#housing#housing market update#housing market crash#canadian real estate#canada real estate#Canadian housing Market#Toronto real estate investment#toronto property market update#toronto housing market forecast#toronto home prices#Toronto real estate news

0 notes

Text

Pricing Strategies to Sell Your Home in Milton Quickly: A Comprehensive Guide

As a real estate agent in Milton, ON, one of the most frequent questions I get asked is, "How do I price my home to sell quickly?" Whether you are a first-time seller or someone who has been in the market before, pricing your property correctly is one of the most crucial steps in ensuring a fast and successful sale.

In this guide, I will explore the best pricing strategies that will not only help you sell your home quickly but also get the best possible price. From understanding the local market to evaluating your property's value, there are several factors to consider. As someone deeply familiar with the Milton real estate market, my goal is to provide you with practical insights and actionable steps to navigate the pricing process effectively.

1. Understanding the Importance of Pricing

The price of your home can make or break your sale. A property priced too high may sit on the market for months, while a property priced too low might leave money on the table. Thus, finding the right price point is essential.

Milton, ON, has seen rapid growth in recent years, with an increasing demand for homes due to its proximity to Toronto, the strong sense of community, and its excellent schools. As a result, homes in Milton tend to attract serious buyers, but the market is competitive. Therefore, it's critical to understand how to price your home strategically to ensure that you stand out.

2. Do a Comparative Market Analysis (CMA)

One of the first steps in determining the right price for your home is to conduct a Comparative Market Analysis (CMA). This analysis compares your home to similar properties in your neighborhood that have recently sold. These properties, known as "comps," help give you an idea of the going rate for homes like yours.

When reviewing comps, be sure to consider factors such as:

Size (square footage)

Age of the property

Condition of the property

Location within Milton (e.g., proximity to amenities, schools, and parks)

Features and upgrades (e.g., finished basement, updated kitchen)

Your real estate agent should assist you in pulling this data and analyzing it effectively. A CMA will give you an idea of what buyers are willing to pay and what comparable homes are selling for.

3. Understand Market Conditions

The state of the real estate market has a significant impact on pricing strategies. In a seller's market, where demand exceeds supply, you might have the flexibility to price your home a little higher. In contrast, in a buyer's market, when there are more homes available than there are buyers, you may need to price your home more competitively to attract attention.

In Milton, the market can fluctuate, so it's essential to stay up-to-date on market trends. If you're unsure, your real estate agent can provide you with data on how quickly homes are selling and whether it's a good time to list. Generally, in a balanced market, pricing your home at or slightly below the market average will help generate interest without leaving money on the table.

4. Consider the Home’s Condition and Presentation

While pricing plays a huge role in attracting buyers, the condition and presentation of your home are just as important. Even if your home is priced well, a poorly maintained property will deter potential buyers. Here are a few ways to increase your home’s appeal:

Declutter: A tidy home appears larger and more inviting. Remove personal items, excess furniture, and anything that might make your home feel cramped.

Repairs and Upgrades: If there are minor issues like leaking faucets or chipped paint, address them before listing. Buyers may use these issues to negotiate a lower price.

Staging: Professionally staged homes tend to sell faster and for more money. It can help potential buyers envision themselves living in the space.

A well-presented home, combined with a competitive price, will make your listing more attractive to buyers.

5. Price Your Home Competitively

When pricing your home, the goal is to set a price that is both attractive to buyers and reflective of your home’s value. A competitive pricing strategy is often the best approach. You don’t want to overprice and risk scaring away potential buyers. At the same time, pricing too low could lead to leaving money on the table.

Here are a few tips for competitive pricing:

Price just below a round number: Pricing your home at $499,900 instead of $500,000 can make a difference when buyers are browsing listings online. This price is more likely to appear in searches under the $500,000 mark.

Consider the first 30 days: The first few weeks after listing are critical. If your home is not getting enough attention during this time, consider adjusting the price.

6. Work with an Experienced Real Estate Agent

One of the most important decisions you can make when selling your home is selecting the right real estate agent. An experienced agent will not only help you price your home effectively but will also offer advice on how to market your property, negotiate with buyers, and close the deal.

A local agent who understands the Milton real estate market, knows the trends, and has access to a wide network of buyers can make a huge difference in how quickly your home sells.

7. Monitor Your Listing and Adjust if Necessary

Once your home is listed, be prepared to adjust your strategy. If your home isn’t getting the level of interest you anticipated, it may be time to reconsider your pricing. Buyers may be hesitant if they think the property is overpriced, even if it’s not.

Your agent will help you monitor showings and feedback from potential buyers. If necessary, a price reduction can bring in new interest. However, it’s essential to be cautious about reducing your price too quickly or too often, as this can signal to buyers that your home is less desirable.

8. Highlight the Value of Your Home

While pricing is important, it’s also essential to emphasize the value your home offers. Milton is a great place to live, and if your property has unique features that highlight its potential, be sure to showcase them in the listing. Things like proximity to parks, schools, public transport, and desirable neighborhoods are all significant selling points.

Effective marketing can help buyers understand why your home is worth the price you’re asking. High-quality photos, virtual tours, and compelling listing descriptions can increase the likelihood of receiving offers quickly.

5 FAQs About Pricing Your Home in Milton

1. What happens if I price my home too high? If you price your home too high, it may deter potential buyers, and the listing could sit on the market for an extended period. Over time, you may have to reduce the price, which could result in the property being seen as overpriced or undesirable.

2. How do I know if the market is a seller's market or a buyer's market? Your real estate agent will provide you with data on the current market conditions. In a seller's market, demand exceeds supply, and homes sell quickly. In a buyer's market, there are more homes available than there are buyers, which may lead to longer selling times.

3. How can I make my home more appealing to buyers without lowering the price? Focus on improving the condition and presentation of your home. Consider staging, making necessary repairs, and cleaning thoroughly. These steps can help your home stand out and justify its asking price.

4. Should I use an online estimator to determine my home's value? While online estimators can provide a rough idea of your home’s value, they are not always accurate. It’s best to work with a real estate professional who can conduct a thorough Comparative Market Analysis (CMA) and provide you with a more accurate estimate based on current market trends.

5. How often should I adjust my listing price? Adjustments should only be made if your property isn’t attracting enough interest. After the first 30 days of listing, if there have been few showings or offers, it might be worth considering a price reduction to stay competitive in the market.

By following these pricing strategies and working closely with a trusted real estate professional, you can ensure that your home sells quickly in Milton, ON, and at the best possible price. Pricing your home correctly is both an art and a science, but with the right approach, you’ll be able to navigate the process smoothly and successfully.

Contact Milton Real Estate Agent Company Name: Fawad Nissari, Real Estate Broker Address: 420 Main St E Unit 556, Milton, ON L9T 5G3 Phone: +1 4168781085 Website: https://fawadnissari.com/ Our Map URL: https://maps.app.goo.gl/eLw6XDzVuZA2bPtk8 Find Us On Map: https://www.google.com/maps?cid=4353637956644277389 More Details- https://maps.google.com/maps?ll=43.51729,-79.877896&z=11&t=m&hl=en&gl=US&mapclient=embed&cid=4353637956644277389 Get Direction: https://maps.app.goo.gl/K4iCHhmfenbHVUx68

0 notes

Text

Best Mortgage Broker in Canada | Trusted Mortgage Solutions Nationwide

Best Mortgage Broker in Greater Toronto Area

Navigating the mortgage landscape in the Greater Toronto Area (GTA) can be a daunting task. With a multitude of options and ever-changing market conditions, having a reliable mortgage broker by your side is crucial. As a licensed mortgage broker with extensive experience, I pride myself on being your trusted partner in finding the best mortgage solutions tailored to your needs. Let’s explore why I am the best Mortgage Broker in Greater Toronto Area for your mortgage needs.

Why Choose Me as Your Mortgage Broker

Extensive Experience and Licensing

With years of experience in the mortgage industry, I hold all the necessary licenses to operate as a Best Home Loan Brokers in Canada My extensive background includes working with various clients, from first-time homebuyers to seasoned investors. I understand the complexities of the mortgage market and how to navigate them effectively, ensuring you receive the best options available. My commitment to continuous professional development means I stay updated with the latest regulations, market trends, and mortgage products, so you can be confident in my knowledge and expertise.

Personalized Approach to Mortgage Solutions

What sets me apart is my commitment to a personalized approach. I recognize that every client’s financial situation and goals are unique, which is why I take the time to understand your specific needs. I will listen to your objectives and concerns, allowing me to create a tailored mortgage strategy that aligns with your lifestyle and financial capabilities. This personalized service helps ensure that you get the right mortgage product for your circumstances. Best Home Loan Brokers in Canada

Exceptional Customer Service

My commitment to exceptional customer service is at the forefront of my business philosophy. I prioritize open communication, transparency, and accessibility. From our initial consultation through to the closing of your mortgage, I’m dedicated to providing prompt responses to your inquiries and keeping you informed about each step of the process. You can rely on me to be your advocate, ensuring that your needs are met with the utmost professionalism and care.

Strong Negotiation Skills

In the competitive mortgage market, having a broker with strong negotiation skills can make a significant difference. I leverage my relationships with lenders to negotiate favorable terms and rates on your behalf. My goal is to secure the best possible deal for you, which can save you money over the life of your loan. I advocate fiercely for my clients, ensuring that they receive the value they deserve.

Access to a Wide Range of Lenders

One of the major advantages of working with me is my access to a broad network of lenders, including banks, credit unions, and private lenders. This extensive reach allows me to present you with various mortgage options that suit your financial profile. Unlike working with a single lender, I can compare products and rates across the market, ensuring you have access to competitive offerings that align with your needs.

Financial Literacy and Education

I believe that an informed client is an empowered client. I take the time to educate my clients about the mortgage process, including various loan products, interest rates, and payment structures. I’ll break down complex financial terms and provide you with the knowledge you need to make informed decisions. This educational approach not only enhances your understanding but also builds your confidence as you navigate your mortgage journey.

Commitment to Building Long-Term Relationships

My goal is not just to help you secure a mortgage but to build a lasting relationship based on trust and mutual respect. I aim to be your go-to resource for all things mortgage-related, whether it’s advice on refinancing

in the future or assisting with investment properties. I value long-term relationships and am here to support you throughout your homeownership journey and beyond.

Streamlined Process for Efficiency

I understand that your time is valuable. My aim is to simplify and streamline the mortgage process as much as possible. By utilizing technology and efficient processes, I ensure a smooth experience from application to closing. I handle the paperwork and coordinate with all parties involved, keeping you informed at every step. This efficiency helps reduce stress and allows you to focus on what matters most—finding your new home.

Mortgage Programs Offered

First-Time Homebuyer Program

This program is designed specifically for individuals and families looking to purchase their first home. It provides several benefits, including:

Lower Down Payment Options: Many lenders offer programs allowing first-time buyers to put down as little as 5% or even less in some cases, making homeownership more accessible.

Government Grants and Incentives: Participants may qualify for various government programs, such as the First-Time Home Buyer Incentive, which can assist with down payment costs.

Educational Resources: Clients will receive guidance on the mortgage process, budgeting for a home, and understanding credit scores to ensure they are well-prepared.

Conventional Mortgage

Conventional mortgages are standard loan options available for a wide range of homebuyers. Key features include:

Flexible Loan Amounts: These mortgages can accommodate various loan amounts, allowing buyers to choose a home that meets their needs.

Competitive Interest Rates: With a strong credit score and substantial down payment (typically 20%), clients can benefit from lower interest rates, ultimately saving money over the loan term.

No Mortgage Insurance: Clients who put down at least 20% are not required to pay for private mortgage insurance (PMI), reducing monthly payments.

Investment Property Loans

This program is geared toward investors looking to purchase rental properties. Key highlights include:

Financing Options for Multiple Properties: Clients can secure loans for various investment properties, whether single-family homes, multi-unit buildings, or commercial properties.

Potential for Higher Returns: Investment property loans often offer favorable terms and lower down payment requirements compared to traditional financing.

Rental Income Consideration: Lenders may consider potential rental income when evaluating a borrower’s application, enhancing the client’s borrowing capacity.

Home Equity Line of Credit (HELOC)

A HELOC is a revolving line of credit based on the equity in a client’s home, offering flexibility and financial freedom. Key features include:

Access to Funds as Needed: Clients can withdraw funds as needed, making it an excellent option for home improvements, education expenses, or unexpected costs.

Interest Only Payments: During the draw period, clients may only need to make interest payments, which can ease financial strain.

Potential Tax Benefits: Interest paid on a HELOC may be tax deductible, depending on how the funds are used (consult a tax professional for details).

Refinancing Options

This program is designed for current homeowners looking to adjust their mortgage terms for better rates or cash-out opportunities. Key highlights include:

Lower Interest Rates: Homeowners can refinance to secure a lower interest rate, reducing monthly payments and saving money over the loan’s life.

Cash-Out Refinancing: This option allows clients to access the equity in their home for major expenses, such as renovations or debt consolidation.

Shorten Loan Terms: Homeowners can choose to refinance to a shorter loan term, which may increase monthly payments but significantly reduce the total interest paid over time.

Ready to take the first step toward homeownership? Don’t navigate the mortgage maze alone! Contact me today to schedule a free consultation, and let’s discuss your unique needs. Together, we’ll find the best mortgage solution tailored just for you. Your dream home is closer than you think!

Frequently Asked Questions

What services do you provide as a mortgage broker?

I offer a range of services, including first-time homebuyer programs, refinancing options, and investment property loans. My goal is to tailor solutions to your specific needs.

How much do you charge for your services?

Typically, my services are compensated by lenders, meaning you can access my expertise without paying upfront fees. However, I ensure transparency in all costs involved.

Can you help me with bad credit?

Yes! I work with various lenders who offer solutions for individuals with less-than-perfect credit. Let’s discuss your situation and explore your options.

How long does the mortgage approval process take?

The timeline varies depending on several factors, but I strive to make the process as quick and efficient as possible. Generally, it can take a few days to a couple of weeks.

What do I need to prepare before we meet?

It’s helpful to gather financial documents such as your income statements, credit reports, and any existing loan information. This will allow us to have a productive discussion about your mortgage options.

++ Best Home Loan Brokers in Canada|| Best Home Loan Brokers in Canada|| Best Home Loan Brokers in Canada

1 note

·

View note

Text

Highest Paying Jobs in Canada: Top Careers to Earn Big

Canada is a land of opportunities, offering a wealth of high-paying jobs across various sectors. Whether you're a seasoned professional or just starting your career, understanding the highest paying jobs in Canada can help you plan your future effectively. This article explores some of the top-paying professions, factors influencing salaries, and tips for finding the best opportunities.

1. Medical Professionals

Medical roles consistently rank among the best paying jobs in Canada. Surgeons, anesthesiologists, and specialists often earn salaries exceeding CAD 300,000 annually. The demand for healthcare professionals is high, especially in growing provinces with expanding populations.

Key Factors:

High level of education and specialization required.

Consistent demand across provinces.

2. Technology Sector

Jobs in tech, such as software engineering, data science, and cybersecurity, are some of the highest paying jobs in Canada. With the digital transformation accelerating, skilled professionals in AI, machine learning, and blockchain technology can expect lucrative salaries starting at CAD 100,000 and scaling up rapidly.

Provinces Leading in Tech:

Ontario (Toronto tech hub).

British Columbia (Vancouver's growing tech scene).

3. Financial Managers and Executives

Canada's robust financial sector offers excellent career prospects. Roles like financial managers, actuaries, and investment analysts are highly rewarding, with salaries often ranging from CAD 90,000 to CAD 200,000 annually.

Why Choose Finance?

High demand in metropolitan areas like Toronto and Calgary.

Opportunities to grow into executive positions.

4. Legal Professionals

Lawyers, judges, and corporate counsel are some of the best paying jobs in Canada, often earning between CAD 120,000 and CAD 200,000 annually. Specializing in corporate law, intellectual property, or immigration law can significantly boost earning potential.

5. Engineering Professions

Engineers specializing in petroleum, civil, and mechanical disciplines are always in demand. With Canada’s focus on infrastructure and energy projects, salaries for engineers can range from CAD 80,000 to CAD 150,000 annually.

6. Aviation Industry

Pilots and air traffic controllers are among the highest paying jobs in Canada. With salaries often exceeding CAD 120,000, these roles are critical to the transportation and logistics sectors.

Emerging Opportunities and Trends

1. Provincial Nominee Program (PNP)

Canada’s Provincial Nominee Program is a great pathway for skilled workers to secure jobs in provinces where demand is high. As the PNP quota by province 2025 increases, more opportunities will open for professionals across various sectors.

2. Remote Work and Streaming Services

With the rise of remote work, industries like digital entertainment and best streaming service Canada platforms are creating unique job roles. Content creators, digital marketers, and IT professionals supporting these platforms are finding high-paying opportunities.

How to Land These High-Paying Jobs

Focus on In-Demand Skills:

For tech, learn programming languages like Python and AI tools.

In finance, acquire certifications like CFA or CPA.

Explore PNP Opportunities:

Understand the provincial demands and align your skills with in-demand professions.

Leverage Networking:

Build connections on platforms like LinkedIn.

Join professional organizations and attend industry events.

Consider Remote Opportunities:

Companies offering roles related to the best streaming service Canada or digital media often provide competitive salaries and flexible working options.

Conclusion

Canada is a promising destination for individuals seeking high-paying careers. By aligning your skills with market demands, exploring PNP options, and staying updated on emerging trends, you can secure one of the best paying jobs in Canada. Whether you're a tech enthusiast, a medical professional, or an aspiring engineer, the opportunities are vast, and the rewards are immense.

Start planning your path today and take the first step towards financial success in Canada!

0 notes

Text

The Role of Facebook Groups in Connecting with Local Homebuyers in Canada

The digital era has reshaped how people connect, communicate, and conduct transactions. In Canada, one emerging trend is the growing role of Facebook Groups in the real estate market. These groups, acting as virtual communities, are transforming the way homebuyers, sellers, and agents interact, fostering connections in a highly targeted and localized manner.

The Growth of Facebook Groups in Canada

According to recent statistics, over 27 million Canadians are active Facebook users, and a significant portion engages in local community groups. These groups cover a wide range of interests, including real estate. Real estate-focused Facebook Groups often cater to specific cities or neighborhoods, enabling highly relevant interactions among local buyers, sellers, and real estate professionals.

For example:

"Toronto Home Buyers and Sellers" boasts over 25,000 members, where users exchange property listings, market insights, and referrals.

Smaller groups like "Vancouver Downtown Condos" help narrow down searches for specific property types, enhancing the user experience.

Why Facebook Groups Are Ideal for Homebuyers

Localized Focus: Buyers can access hyper-local information, such as neighborhood amenities, school reviews, and crime rates, often shared by group members.

Direct Communication: Homebuyers can interact directly with property owners or agents, bypassing the need for intermediaries.

Real-Time Updates: Listings in Facebook Groups are often updated faster than on traditional real estate websites, giving users a competitive edge.

Key Benefits for Real Estate Professionals

Real estate agents and brokers in Canada are leveraging these groups as a powerful social media marketing tool:

Targeted Advertising: By participating in or sponsoring posts within these groups, professionals can reach their desired audience.

Brand Authority: Sharing valuable insights about market trends or offering free consultations helps establish credibility.

Community Engagement: Active participation fosters trust, a crucial factor in real estate transactions.

Tips for Homebuyers Using Facebook Groups

To maximize the benefits, homebuyers should:

Join groups relevant to their target location and property type.

Actively participate by asking questions about listings or the local market.

Use caution and verify listings to avoid scams, which occasionally occur in online communities.

Opportunities for Agents

For agents seeking to capitalize on the growing popularity of Facebook Groups, check out this insightful article on how different social media platforms can be leveraged to reach potential homebuyers and sellers.

Challenges and Solutions

Despite their many advantages, Facebook Groups come with challenges:

Verification: Listings may lack thorough vetting, requiring users to exercise due diligence.

Competition: The accessibility of these groups means agents must stand out by offering unique value propositions, such as exclusive listings or personalized advice.

Conclusion

Facebook Groups have established themselves as a vital tool in the Canadian real estate market. For homebuyers, they offer a wealth of localized information and direct communication channels. For agents, these platforms provide an opportunity to build relationships and grow their business. By leveraging these groups wisely, stakeholders in the Canadian housing market can foster stronger connections and achieve their goals efficiently.

Would you like further insights or help optimizing your real estate strategy for social media platforms?

0 notes

Text

What You Need to Succeed in Real Estate Jobs in Toronto?

Starting a career in real estate jobs in Toronto can be exciting and rewarding. Whether you're helping people find their dream homes or managing big property deals, success in this field requires some key skills and qualities. Let’s break it down.

1. Strong Communication Skills

In real estate, you’ll talk to clients, negotiate deals, and work with other agents. Being clear and friendly goes a long way. Good communication helps build trust and close deals faster.

2. Local Market Knowledge

Toronto’s real estate market is always changing. To succeed, you need to stay updated on property prices, neighborhood trends, and upcoming developments. Knowing your market makes you a valuable expert to clients.

3. A Positive Attitude

Real estate jobs in Toronto can be competitive and challenging. Staying positive, even during tough times, will keep you motivated. Clients love working with agents who are upbeat and solution-oriented.

4. Flexibility and Time Management

Real estate doesn’t follow a 9-to-5 schedule. You’ll need to meet clients when it’s convenient for them, often on evenings or weekends. Being organized helps you manage your time and avoid burnout.

5. Networking and Marketing Skills

Building a strong network is key. Attend local events, use social media, and market yourself to find clients. The more people know about you, the more opportunities you’ll have.

Final Thoughts

Success in real estate jobs in Toronto comes down to hard work, learning, and building relationships. Stay determined, keep improving your skills, and remember that every challenge is a chance to grow. With the right mindset, you can thrive in this exciting industry!

0 notes

Text

Choosing the Right Engineering Firm for Your Reserve Fund Study

When it comes to managing property, especially in multi-unit residential settings like condominiums, effective financial planning is essential. One of the critical components of this planning is the reserve fund study. Engaging reputable Engineering Firms Canada for this task can make a significant difference in the long-term sustainability and financial health of your property. But how do you choose the right firm for your specific needs? In this blog, we will guide you through the key factors to consider when selecting an engineering firm for your reserve fund study.

Understanding the Importance of a Reserve Fund Study

A reserve fund study is a comprehensive assessment that evaluates the current state of a property’s physical assets and predicts future maintenance and replacement costs. The objective is to ensure that sufficient funds are available to cover these costs, preventing unexpected financial burdens on homeowners or property managers.

Conducting a reserve fund study is particularly important in urban areas where property values can fluctuate significantly. A thorough study allows for effective budgeting and planning, ensuring that properties remain well-maintained and financially secure over time. This is why choosing the right engineering firm to conduct your study is paramount.

Factors to Consider When Choosing an Engineering Firm

1. Experience and Expertise

The first factor to consider is the firm’s experience and expertise in conducting reserve fund studies. Look for firms that have a proven track record in your specific market, whether it’s residential, commercial, or mixed-use properties. Experienced firms are more likely to understand the nuances of local building codes and regulations, which can significantly impact the study's accuracy and relevance.

Ask potential firms about their previous projects and request references. A reputable firm will be happy to share case studies and testimonials from satisfied clients.

2. Qualifications and Certifications

Next, examine the qualifications of the professionals who will be conducting the reserve fund study. Ensure that the engineers and consultants possess the necessary certifications and licenses to perform this type of work. These qualifications indicate a level of expertise and adherence to industry standards that is crucial for a successful study.

Certifications from recognized professional organizations can also serve as a quality assurance measure. When evaluating firms, ask about their team’s credentials and any ongoing training they undergo to stay updated with the latest industry practices.

3. Comprehensive Services Offered

When selecting an engineering firm for your reserve fund study, consider the range of services they provide. A firm that offers a comprehensive suite of services will be more capable of addressing the various aspects of your study. This may include initial assessments, detailed financial analyses, and long-term planning recommendations.

Additionally, some firms may offer supplementary services, such as project management or ongoing consulting, which can be valuable as you implement the study’s recommendations. Having a firm that can provide continuity throughout the process can make a significant difference in your overall experience.

4. Local Knowledge

Choosing a firm with local knowledge is particularly beneficial when conducting a reserve fund study toronto or other specific urban areas. Familiarity with local regulations, climate considerations, and building trends will enable the firm to provide a more accurate and tailored assessment.

For example, a firm familiar with Toronto’s unique challenges—such as urban density, environmental regulations, and the specific needs of condominium communities—will be better equipped to identify potential issues and recommend solutions that are relevant to your property.

5. Communication and Transparency

Effective communication is essential for a successful partnership. When selecting an engineering firm, assess how they communicate with clients throughout the process. Are they responsive to your inquiries? Do they take the time to explain their findings and recommendations clearly?

Transparency in reporting is also crucial. You should expect the firm to provide detailed reports that outline their methodologies, findings, and suggestions. This clarity will not only help you understand the study better but also empower you to make informed decisions regarding your property’s financial planning.

6. Cost and Value

While cost should not be the sole determining factor in your decision, it is essential to understand the fee structure of the firms you are considering. Request detailed quotes that outline what is included in the service and any additional costs you might incur.

Comparing costs among different firms can help you find a service that fits your budget. However, prioritize the value you are receiving. A slightly higher cost may be justified by a firm’s reputation, expertise, or additional services that can ultimately benefit your property in the long run.

7. Client Reviews and Testimonials

In today’s digital age, client reviews and testimonials can provide valuable insights into a firm’s reputation. Check online reviews and ask for references to gauge the experiences of other clients. Look for patterns in feedback regarding communication, quality of work, and overall satisfaction.

A firm that consistently receives positive feedback is likely to be a reliable choice. Conversely, be wary of firms with numerous negative reviews, as they may indicate potential issues.

Conclusion

Choosing the right engineering firm for your reserve fund study is a crucial decision that can have lasting implications for the financial health of your property. By considering factors such as experience, qualifications, local knowledge, and communication style, you can make a more informed choice.

Remember that a reserve fund study is not just a financial obligation; it’s an opportunity to safeguard your investment and ensure that your property remains well-maintained for years to come. By partnering with a qualified engineering firm, you can take the necessary steps to secure the future of your property.

At Keller Engineering, we specialize in providing comprehensive reserve fund studies tailored to the unique needs of our clients. Our experienced team is dedicated to delivering accurate assessments and valuable insights to help you plan for the future. Contact us today to learn how we can assist you in making informed financial decisions for your property.

0 notes

Video

youtube

9 Expert Tips to Find the Perfect Realtor in Canada

#youtube#realestate#toronto real estate#toronto housing market#toronto housing update#toronto real estate news#toronto real estate statistics#Toronto housing market forecast#Toronto property market update#Toronto real estate investment#Toronto housing affordability#real estate market#Realtor in Canada#realtor canada#canadian real estate market#real estate canada#canada real estate agent#gta real estate#gta real estate market

0 notes

Text

youtube

💔Lost $328,000 on My Toronto Condo!🏢🔮#Shorts by Manoj Atri, REALTOR® 🏢 Toronto Condo Owners Beware ⚠️ Check all alarming Signs if you're about to lose money on your Toronto Condo Investment! 😱🔮 👉 Subscribe Now for more Tips and Insights: https://www.youtube.com/@ManojAtri9?sub_confirmation=1 ✨ Help me reach 1000 Subscribers! 🎉🙌📈 🏙️#torontocondos 🏢#condolife 🇨🇦#torontorealestate 🏠#cityliving 🌆#downtowntoronto 🔑#firsttimehomebuyer 💰#realestateinvesting 🏗️#condodevelopment 🌟#luxurycondos 🏆#torontorealtor 🎶#RealEstateSong 🌆 Hot News Daily: Toronto Real Estate Digest! 📈 Monday 21st Oct 2024 Newsletter: Review ALL Podcast Articles Here: https://ift.tt/Hnf48wr RELATED QUERIES: 🏙️ Discover the vibrant lifestyle of Toronto Condos that redefine city living. 🏢 Explore an array of stunning Toronto Condos For Sale, each with unique charm. 🏠 Experience the flexibility of cozy Toronto Condos For Rent, perfect for every lifestyle. 🚫 Uncover the mystery behind Toronto Condos Not Selling and what it means for buyers. 📈 Dive into the dynamic Toronto Condos Market, where opportunities await. ❌ Find out why some Toronto Condos Aren't Selling and how to snag a deal. 🏚️ Imagine the potential of Toronto Condos Empty, waiting for your personal touch. 📏 Embrace the challenge of finding spacious Toronto Condos that fit your family perfectly. 🌟 Discover the hidden gems among the Best Toronto Condos that everyone is talking about. 💎 Indulge in luxury with Toronto luxury Condos that offer unparalleled amenities. ❄️ Experience the magic of winter in unique Toronto ice Condos that are truly one-of-a-kind. 📺 Stay updated with CBC Toronto Condos for the latest listings and market insights. 🏙️ Don't miss out on Downtown Toronto Downtown Condos For Sale, a hot spot for urban dwellers. 🏢 Explore a world of possibilities with diverse Toronto Condo options just waiting for you! ▶ Visit the following website links for HOT New Listings in Toronto GTA Ontario Canada TORONTO REAL ESTATE for Sale Listings → https://ift.tt/0q4mPby BRAMPTON Homes Peel ON → https://ift.tt/RYrEkGX Purchase Properties in MARKHAM Toronto ON → https://ift.tt/zpWaGkn Rent To Buy Homes in MILTON ON Canada → https://ift.tt/kuocdIl Rent-To-Own MISSISSAUGA homes Ontario → https://ift.tt/TYt2xlm Rent-To-Purchase homes NEWMARKET Ontario → https://ift.tt/pA4L8j0 Search properties in OAKVILLE Ontario → https://ift.tt/wEZpWVy Hot listings in OSHAWA Ontario → https://ift.tt/1K0MOFU PICKERING Durham Region Ontario → https://ift.tt/HlJLGW0 Buy a home RICHMOND HILL Ontario → https://ift.tt/Oi6CQgw House, Condos in VAUGHAN Ontario → https://ift.tt/SERNtrG ▶ Manoj Atri, REALTOR® with Architectural Experience Re/Max Hallmark Realty Ltd., Brokerage 401 – 685 Sheppard Ave E, Toronto ON M2K 1B6 Office: [416] 494-7653 | Cell: [416] 275-2089 | Direct: [647] 696-6873 Fax: [416] 494-0016 | Email: [email protected] ▶ LET'S CONNECT FOR FURTHER NETWORKING: FACEBOOK → https://ift.tt/FBXgYaw INSTAGRAM → https://ift.tt/kBbtw8T LINKEDIN → https://ift.tt/Njtsw4p PINTEREST → https://ift.tt/E4k83fF REDDIT → https://ift.tt/wqDJ9av RENT-TO-OWN HOMES → https://ift.tt/xSBRaQK SEARCH HOMES IN GTA → https://ift.tt/cJlOCrL TIKTOK → https://ift.tt/OrjN7EB TUMBLR → https://ift.tt/2CngBYJ X → https://ift.tt/VuQ1b8E YOUTUBE → https://www.youtube.com/@ManojAtri9?sub_confirmation=1 ▶ MY WEBSITE LINKS FOR MORE TORONTO GTA REAL ESTATE INFO: https://ift.tt/54t70Nq https://ift.tt/kPRsyYH https://ift.tt/pWt6gaO https://ift.tt/MPCAbqg Subscribe to the Toronto Real Estate Hot NEWSLETTER Here: https://ift.tt/ivYVrIl ▶ "Disclaimer: This video's content summarizes multiple news articles. Full attribution is available in the original linked sources. The newsletter, podcast audio and video are AI-generated. Video title, description, and supporting content are created for context." *** Not intended to solicit any Buyer or Seller under Contract. *** via YouTube https://www.youtube.com/watch?v=1eKocdvcIg4

0 notes

Text

Helping You Find Your Dream Home, Not Just Selling It

At the heart of what we do is service, not sales. We’re here to guide you every step of the way in finding your perfect home, ensuring you make the right choice for you and your family. No pressure, just support. Let us help you discover your dream home today! #realestate #homebuying #customerfirst #ServiceNotSales #dreamhome Welcome to my channel! I’m Jignesh Dave, your trusted real estate advisor specializing in the Greater Toronto Area (GTA). With years of experience in the industry, I’m here to guide you through every step of buying or selling your property. Whether you’re interested in residential homes, condos, or commercial spaces, I cover Brampton, Mississauga, Hamilton, Kitchener, Burlington, Oakville, Cambridge, and more. In each video, I’ll share valuable insights, tips, and market updates to help you navigate the real estate landscape with confidence. If you're looking for a dependable Realtor, you’ve come to the right place! Let’s turn your real estate dreams into reality. 👉 Don’t forget to subscribe for the latest updates! Realtor in GTA, Best Realtor in GTA, Real Estate Agent in GTA, Real Estate agent near me, Realtor near me, best realtor in brampton, Best realtor in Hamilton, Best realtor in Burlington, Best realtor in Kitchener, Best realtor in Cambridge, Best realtor in Waterloo, Best realtor in Niagara, Best realtor in Brantford, Best realtor in Brampton, Best realtor in Mississauga, Best realtor in Hamilton, Best realtor in Oakville #RealtorGTA #BestRealtor #RealEstateAgent #RealEstateTips #BramptonRealEstate #HamiltonRealEstate #BurlingtonHomes #KitchenerProperties #CambridgeRealtor #RealEstateMarket #BuyingAHome #SellingAHome #GTARealtor #RealEstateAdvice #JigneshDave #PropertyExpert #HomeBuying #InvestmentProperties #RealEstateInvesting #TorontoRealEstate #GTAHousingMarket Top Realtor in GTA, Leading Real Estate Agent in Brampton, Hamilton Real Estate Specialist, Kitchener Property Expert, Trusted Realtor in Cambridge, Mississauga Home Advisor, Premier Realtor in Waterloo, Oakville Real Estate Consultant, Niagara Property Professional, GTA Real Estate Authority, Best Realtor in Southern Ontario, Real Estate Expert in Brampton, Ontario Realtor Network, Residential Realtor in Hamilton, Commercial Realtor in Kitchener.

#GTAHousingMarket#TorontoRealEstate#RealEstateAgent#KitchenerProperties#RealEstateMarket#realestate#homebuying#ServiceNotSales#dreamhome

1 note

·

View note

Text

Houses for Sale in Burlington: Key Factors to Consider Before Making an Offer

Burlington, Ontario, is one of the most sought-after cities for homebuyers in the Greater Toronto Area, known for its stunning waterfront views, excellent schools, and diverse neighbourhoods. If you're exploring houses for sale in Burlington, you're likely excited about finding your dream home in this thriving market. However, before you make an offer, you must consider a few critical factors that will ensure you make an intelligent and informed decision. Understanding how to decide if a home is right for you is essential in this process. Here's a detailed guide to help you navigate the journey and make the right choice.

Choosing the Right Neighborhood

One of the first things you should consider when looking for homes in Burlington is which area best fits your lifestyle. There are several neighbourhoods in Burlington, each with distinctive qualities that meet various requirements and tastes.

Family-friendly areas: If you have a family or are planning one, neighbourhoods like Orchard, Millcroft, and Tyandaga are known for their excellent schools, parks, and community feel.

Downtown living: Would you rather be near the action? Lake Ontario is within walking distance of downtown Burlington's bustling stores, eateries, and cultural activities.

Commute considerations: Consider your commute every day. Burlington is an excellent option for people who frequently go to Toronto, Hamilton, or the nearby areas because of its convenient access to highways like the QEW, 403, and 407.

Evaluating the neighbourhood is vital to finding a home that aligns with your lifestyle and daily needs.

Setting a Realistic Budget

Setting a realistic budget is essential before you start touring houses for sale in Burlington. The housing market here can be competitive, so knowing your financial boundaries will help you stay on track and avoid overextending.

Mortgage pre-approval: First, you should get pre-approved for a mortgage. When you're ready to make an offer, this will clarify and strengthen your ability to afford.

Additional costs: Remember to factor in other fees like closing costs, property taxes, house insurance, and possible maintenance or remodelling expenditures. Even while Burlington's property taxes are often cheaper than those in other GTA regions, you should still account for them in your budget.

Market conditions: You understand current price trends, so conduct research or speak with a local real estate agent, as the Burlington real estate market is subject to fluctuations. Doing this lets you make a competitive offer without exceeding your spending limit.

Assessing the Property Condition

Once you've found a house you like, it's crucial to thoroughly assess its condition before making an offer. Appearances can be deceiving, and you don't want to be surprised by expensive repairs after the purchase.

Home inspection: Always hire a professional home inspector to evaluate the property. They'll look for foundation problems, roof damage, faulty plumbing, and outdated electrical systems. A home inspection can uncover potential issues that could cost you thousands of repairs.

Renovation potential: If the house needs updates or renovations, consider whether the costs of these improvements fit within your budget. Homes that require work may be priced lower, but extensive repairs could quickly add up.

A thorough inspection will give you peace of mind and leverage when negotiating the final price.

Understanding Market Conditions

Knowing the current state of the real estate market is essential when shopping for houses for sale in Burlington. Market conditions will impact how quickly homes sell, how much they sell for, and your ability to negotiate.

Seller's market: More buyers than available homes drive up competition in a seller's market. You might have to move quickly and offer above the asking price to secure a property.

Buyer's market: In contrast, a buyer's market gives you more negotiating power, as there are more homes for sale than buyers. This can lead to lower prices and more time to weigh your options.

Work with a real estate agent who understands the Burlington market and can help you make a competitive offer.

Long-Term Resale Value

Even if you plan to live in your new home for many years, it's wise to consider its future resale value. Burlington is a growing city, and purchasing a home in a high-demand area can be a wise investment for your future.

Location matters: Homes in popular neighbourhoods near parks, schools, and other amenities usually have higher resale prices. Additionally, homes on the sea or close to critical highways may appreciate faster.

Upgrades and improvements: Think about the potential for future upgrades. Homes with good "bones" that may need cosmetic updates are often a significant investment, as renovations can significantly increase the resale value.

Future developments: Research any upcoming infrastructure projects or developments in the area. New transit options, shopping centers, or schools can positively impact your home's future value.

You are considering resale value guarantees that your house will be a wise long-term investment in addition to meeting your present needs.

The Offer Process

After considering all the factors, you're ready to make an offer. It may be an exciting and nerve-racking procedure, especially in a competitive market like Burlington.

Competitive offers: In a hot market, your offer should be higher than the asking price or add fewer stipulations to make it more attractive to the seller. However, always stick to your spending plan.

Offer conditions: It's common to include conditions like financing approval, a satisfactory home inspection, or even selling your current home. These conditions protect you but can make your offer less attractive in a competitive market.

Negotiation: Be ready for talks or counteroffers. Throughout this process, your real estate agent can assist you get the best offer without sacrificing your needs.

Conclusion

Buying a home is an exciting journey, but it's important to consider all factors before making an offer on houses for sale in Burlington. From choosing the right neighbourhood and setting a realistic budget to assessing the property and understanding market conditions, each step plays a vital role in ensuring your home-buying experience is smooth and successful. Considering these factors will help you make a confident and informed offer, bringing you one step closer to your dream home in Burlington. If you need more guidance or have any questions, feel free to contact us for expert advice and assistance.

0 notes

Text

Home Renovation Services in Toronto: Revitalize Your Living Space

In the bustling city of Toronto, homeowners are constantly looking for ways to enhance their living spaces through home remodeling Toronto. Whether you’re planning a complete overhaul or a minor refresh, Emian Construction offers a comprehensive range of home renovation services designed to meet your specific needs.

The Importance of Home Renovation

Home renovation goes beyond mere aesthetics; it’s about improving the functionality, safety, and comfort of your home. Renovations can increase your property’s value, making it a worthwhile investment. With Toronto’s competitive real estate market, a well-executed renovation can set your home apart.

Our Comprehensive Renovation Services

At Emian Construction, we provide a wide array of renovation services to cater to the diverse needs of homeowners in Toronto:

Kitchen Renovations: From custom cabinetry to modern fixtures, we can transform your kitchen into a stylish and functional space that meets your culinary needs.

Bathroom Renovations: Upgrade your bathroom with luxurious finishes, energy-efficient fixtures, and space-saving designs. We specialize in creating spa-like retreats that enhance your daily routine.

Living Room Makeovers: Revamp your living room with new flooring, lighting, and layouts that foster a welcoming atmosphere for family and friends.

Exterior Renovations: Improve your home’s curb appeal with exterior renovations, including new siding, roofing, and landscaping. We ensure your home makes a great first impression.

Energy Efficiency Upgrades: We focus on renovations that enhance energy efficiency, helping you save on utility bills while minimizing your carbon footprint.

Why Choose Emian Construction?

Expertise and Experience: Our team comprises seasoned professionals with extensive experience in home renovations. We stay updated on the latest trends and techniques to deliver superior results.

Customer-Centric Approach: We prioritize your needs and preferences, ensuring your renovation reflects your personal style and functional requirements.

Quality Craftsmanship: We take pride in our attention to detail and commitment to quality. Every project is executed with precision, ensuring lasting results.

Timely Project Completion: We understand the importance of timelines. Our efficient processes ensure that your renovation is completed on schedule, allowing you to enjoy your updated space sooner.

The Renovation Process

When you choose Emian Construction, you can expect a seamless renovation process:

Consultation: We begin with an in-depth consultation to understand your goals and preferences.

Design Development: Our design team will create detailed plans and present them for your approval, making adjustments based on your feedback.

Execution: Our skilled craftsmen will carry out the renovation with minimal disruption to your daily life.

Final Review: We conduct a final review with you, ensuring you’re delighted with the outcome and addressing any concerns you may have.

Contact Us

Ready to revitalize your living space with expert renovation services? Emian Construction is here to assist you! Contact us today to discuss your project and discover how we can help you create your dream home.

Email: [email protected] Phone: (123) 456-7890 Website: emianconstruction.com

1 note

·

View note

Text

How to Calculate Home Loan Payments in Canada

Purchasing a home is one of the most significant financial decisions Canadians make. To make informed choices, it’s essential to understand how home loan payments are calculated. This article will break down the components of a mortgage payment, explain the math behind it, and offer insights into current statistics and trends in the Canadian real estate market.

Understanding Mortgage Payments

Your monthly mortgage payment typically includes four main components:

Principal: The original amount borrowed.

Interest: The cost of borrowing the principal.

Property Taxes: Often included in your mortgage payment and held in escrow by your lender.

Mortgage Insurance: Required for down payments under 20% (CMHC insurance).

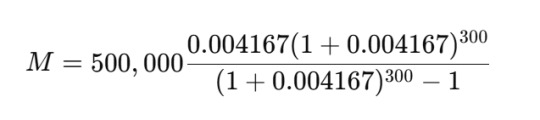

The Formula for Calculating Mortgage Payments

Most lenders use the amortization formula to calculate monthly payments:

Where:

M = Monthly mortgage payment

P = Principal loan amount

r = Monthly interest rate (annual rate divided by 12)

n = Total number of payments (amortization period in years × 12)

Example Calculation

Let’s assume:

Loan Amount (Principal): $500,000

Interest Rate: 5% annually (0.05/12 = 0.004167 monthly)

Amortization Period: 25 years (300 payments)

Plugging into the formula:

Using a financial calculator or software, the monthly payment is approximately $2,923.55.

Current Trends in Canada’s Mortgage Market

Interest Rates

As of 2024, the Bank of Canada’s benchmark interest rate remains a key factor affecting mortgage rates. Variable-rate mortgages are hovering around 6%, while fixed-rate mortgages range between 5.5% and 6.5%, depending on the lender and term.

Home Prices

The Canadian Real Estate Association (CREA) reports the average home price in Canada is approximately $729,000 as of October 2024. This figure varies significantly by region, with Toronto and Vancouver maintaining the highest prices.

Amortization Periods

Most Canadian homebuyers choose a 25-year amortization period, although longer terms of up to 30 years are available, especially for those with higher loan-to-value ratios.

Down Payments

A minimum of 5% down payment is required for homes under $1,000,000, while homes above this threshold necessitate at least 20%.

Tools to Simplify Calculations

For ease, many Canadians turn to online mortgage calculators offered by banks and financial institutions. These tools allow users to input different scenarios, including changes in interest rates or down payments, to see how their monthly payments might vary.

Tips for Managing Mortgage Payments

Shop Around for Rates: Even a small difference in interest rates can save thousands over the life of a mortgage.

Consider Pre-Payments: Making lump-sum payments or increasing your regular payment amount can significantly reduce interest costs.

Stay Updated: Keep an eye on the Bank of Canada’s announcements and market trends that could influence rates.

Conclusion

Understanding how home loan payments are calculated empowers Canadian homebuyers to navigate their mortgage journey confidently. By using the formula or leveraging online tools, you can plan effectively and ensure your dream home fits within your budget.

For personalized advice, consider consulting a financial advisor or mortgage specialist. With Canada’s dynamic real estate market, staying informed is your best strategy for success.

0 notes

Text

5 Simple Marketing Tips for Ontario Realtors to Attract More Clients

Want to expand your real estate business? Here are five easy marketing tips that can help Ontario realtors stand out and attract more clients.

1. Build a Strong Online Presence

Have a professional website where your listings, testimonials, and contact information are featured. Moreover, you will be posting pictures, market updates, and success stories of your clients on social media platforms such as Instagram and Facebook. In case you are unsure where to start, consider getting hired by a marketing company specializing in realtors in Ontario for you to shine online.

2. Employ Quality Photos and Videos

People love to see pictures! Invest in professional photos and videos for your listings. A virtual tour or aerial footage can make a property look more appealing. Many real estate marketing companies in Toronto focus on creating great visuals that will place you above others.

3. Email Marketing

Reach out to your clients by email regularly. You could send market trends, buying and selling tips, or news about new properties. A nice email strategy keeps you in the consciousness of potential clients and establishes you as trustworthy.

4. Host Local Events

Organize events like open houses, community meet-ups, or home-buying process workshops. It helps connect you with potential clients and get your name on their lips as an expert.

5. Optimize for Local Search

Ensure your business features in local Google searches. Add your profile to Google My Business and collect client reviews. A real estate marketing company in Ontario can assist with SEO services to help your business stand out online.

0 notes

Text

Transforming Spaces: A Comprehensive Guide to Home Renovations in Toronto

Renovating your home can feel overwhelming. Whether you're considering a kitchen upgrade, a bathroom facelift, or finishing your basement, understanding your options is crucial. Home renovations in Toronto have become increasingly popular as homeowners seek to improve their living spaces. This article breaks down essential aspects of home renovations, Custom Home Renovations from kitchen remodeling to hiring the right contractors.

Why Renovate?

Home renovations offer several benefits. They enhance functionality, boost aesthetic appeal, and increase property value. In Toronto's competitive real estate market, well-executed renovations can significantly elevate your home's marketability. Here are a few reasons to consider renovations:

Increased Property Value: Updated homes often sell for higher prices.

Personalization: Tailor your living space to your lifestyle and preferences.

Energy Efficiency: Renovations can improve energy efficiency, reducing utility bills.

Popular Renovation Projects

1. Kitchen Remodeling

The kitchen is the heart of the home. It's where families gather and memories are made. A well-designed kitchen can enhance your cooking experience and add value to your home. Consider these trends in kitchen remodeling:

Open Floor Plans: Create a seamless flow between the kitchen and living areas.

Modern Appliances: Invest in energy-efficient appliances that add convenience.

Smart Technology: Integrate smart home features for improved efficiency.

2. Bathroom Renovation

Bathrooms are essential for comfort and relaxation. A bathroom renovation can transform your daily routine. Here are some popular features to consider:

Spa-like Amenities: Features like rainfall showers and soaking tubs elevate the experience.

Stylish Fixtures: Modern faucets and lighting can update the overall look.

Storage Solutions: Efficient storage options keep the space organized.

3. Basement Finishing

Transforming an unfinished basement into a functional living space can add square footage and value to your home. Here’s what to think about:

Entertainment Areas: Create a family room, home theater, or game room.

Guest Suites: Consider adding a bedroom and bathroom for guests.

Home Offices: With remote work on the rise, a dedicated workspace is beneficial.

Finding the Right Contractor

Choosing the right contractor is vital for successful renovations. Look for someone who specializes in the type of renovation you’re considering. Here are some tips for finding a reliable general contractor in the Greater Toronto Area (GTA):

Check Credentials: Ensure they are licensed and insured.

Read Reviews: Look for feedback from previous clients on platforms like Google or Yelp.

Request Quotes: Get detailed estimates from multiple contractors to compare services and prices.

Affordable Home Renovation Options

Budget constraints can make renovations challenging. However, there are affordable options available. Here are some tips to keep costs down:

Prioritize Needs: Focus on essential renovations first. Consider cosmetic changes that can be done on a budget, like painting or updating fixtures.

DIY Projects: If you're handy, tackle smaller projects yourself. This can save labor costs.

Material Choices: Opt for budget-friendly materials that still look great, such as laminate instead of solid wood.

Residential Renovation Specialists

In Toronto, many specialists cater to different renovation needs. Whether you require custom home renovations or commercial renovation services, selecting the right expert can make a significant difference. Here’s why hiring specialists can be advantageous:

Expertise: Specialists bring a wealth of knowledge and experience to your project.

Quality Workmanship: They focus on their area of expertise, ensuring high-quality results.

Faster Completion: Their experience often translates to quicker project timelines.

The Importance of Custom Home Renovations

Custom home renovations allow homeowners to create a unique space that reflects their style and needs. Whether you're looking to design a dream kitchen or a luxurious bathroom, working with professionals can help turn your vision into reality. Consider these aspects:

Tailored Designs: Collaborate with designers to create layouts that work for you.

High-Quality Materials: Choose materials that suit your lifestyle and budget.

Sustainable Choices: Incorporate eco-friendly options to minimize environmental impact.

Conclusion

Home renovations in Toronto can be an exciting journey. From kitchen and bathroom remodels to basement finishing and custom projects, the possibilities are endless. By working with reputable contractors and making informed decisions, you can create a space that truly reflects your style while adding value to your home. Focus on your specific needs and budget to ensure a successful renovation. Whether you're planning a large-scale project or a minor update, the right approach will help you achieve your goals. Your dream home is within reach, and with the right support, you can make it happen.

0 notes

Video

youtube

October Toronto Real Estate Market Update: Is It a Good Time to Buy?

#youtube#realestate#toronto real estate#Toronto housing market#Toronto property trends#Toronto housing update#toronto real estate news#Toronto home prices#Toronto real estate statistics#Toronto real estate market insights#Toronto property market update#Toronto real estate investment#Toronto housing affordability

0 notes