#Top Accounting & Bookkeeping in UAE

Explore tagged Tumblr posts

Text

In the heart of Dubai, Zoho Finance Plus is more than just a software solution; it s a strategic partner that empowers businesses to succeed. By choosing Zoho Finance Plus, you re choosing a reliable, efficient, and scalable solution

As a Zoho premium partner in UAE, we can help SMBs with the following:

1. Zoho Finance Plus Implementation & Support 2. VAT & Corporate Tax Compliance Services

For more details contact now - 971558572143

#accounting and bookkeeping services dubai#start a company in dubai#how to register a company in dubai#open business in dubai#esr uae#tax residence certificate#tax certificate uae#tax consultant in dubai#tax consultant uae#tax registration#accounting services in dubai#accounting and bookkeeping services in dubai#bookkeeping services dubai#accounting and bookkeeping services in uae#services in dubai#advisory services#bookkeeping service dubai#ca firms in dubai#top accounting firms in dubai#best accounting firm in dubai#top accounting companies in dubai#best accounting firms in dubai#dubai corporate tax consultants#corporate tax consultant dubai#corporate tax consultant in dubai#corporate tax consultants dubai#vat services in dubai#vat in uae#vat services dubai#vat tax accounting

0 notes

Text

Simplify your business finances and ensure success with our expert bookkeeping 📚 and cash flow management services. Effortlessly track your finances, maintain seamless records, and ensure hassle-free compliance. Our precise bookkeeping optimizes your financial health and drives growth 📈 . Contact AMA Audit Tax Advisory today to streamline your bookkeeping process!

#bookkeeping services#Bookkeeping services in UAE#Cash Flow Management#Bookkeeping#Accounting services in UAE#Audit Firms in Dubai#Top 10 Audit Firm in Abu Dhabi

0 notes

Link

AKAI Business solution knows the importance of accounting need in the business and that's where we are available to help you out. Our services include Accounting, Digitization, consultancy services. Visit our website to know more. https://www.akaigroup.com/accounting.html

0 notes

Text

Best Accounting Firms in UAE:-

AKAI Business Solution is a group that provide solutions to business in Accounting, Auditing, Management consulting, Process improvement, Digitization, cost improvement and efficiency and Advisory. Our pro team can help you in implement system for management reporting with international financial reporting and automating management reporting. If you are fresher in running a business or have some experience, we help you out proficient. To know more info: https://www.akaigroup.com/accounting.html

#Best Accounting & Auditing Firms in UAE#Accounting & Bookkeeping Services Dubai#Top VAT Services in Dubai

0 notes

Text

Process of Financial Audit in Dubai

Financial auditing procedures in Dubai, United Arab Emirates. The nature and departments inside the business have an impact on the entire financial auditing process. When the audit report has been completed, the management's signatures on the financial statements and reported information must be obtained by the auditor from one of the top auditing companies in Dubai, United Arab Emirates.

A&A Associates, the best accounting and auditing firm in Dubai, is always happy to serve your requirements with complete satisfaction. Visit us to know more : aaconsultancy.ae

#top audit firms in uae#audit services in dubai#internal audit firms in dubai#internal audit services in dubai#internal auditing in dubai#accounting firms in dubai#bookkeeping companies in dubai#bookkeeping services in Dubai

0 notes

Text

Expert VAT Consultancy in Dubai & UAE: Registration, Returns, Compliance

Navigate UAE VAT effortlessly with our expert consultancy! We provide comprehensive VAT services in Dubai & UAE, including registration, return filing, and compliance guidance. Ensure seamless VAT management and focus on your core business.

Contact us today for a free consultation and learn how we can help you achieve your financial goals.

AL ZORA ACCOUNTING & ADVISORY – Your trusted partner for accounting & bookkeeping services in Dubai.

2 notes

·

View notes

Text

Clearing the Path to Financial Excellence: Goviin's Expert Audit Services in the UAE

Welcome to the world of financial transparency and seamless operations with Goviin Bookkeeping! In the bustling business landscape of Dubai, audits stand tall as the guardians of fiscal integrity. we take pride in offering top-tier Internal and External Audit Services tailored to your company's needs, ensuring compliance, transparency, and credibility.

Internal Audit Service: Navigating the Regulatory Waters

When it comes to internal audits, we've got you covered like a trusty compass guiding a ship through uncharted waters. Our seasoned professionals delve deep into your company's operations, ensuring adherence to UAE laws, mitigating risks, and enhancing operational efficiency. From scrutinizing organizational policies to safeguarding against potential risks, we leave no stone unturned. With Goviin's internal audit services, you can sail through regulatory waters with confidence and ease.

External Audit Service: Shedding Light on Financial Horizons

Your financial statements shining like beacons in the night, guiding investors and stakeholders towards your business with confidence. That's the magic of Goviin's external audit services. Our independent chartered accountants meticulously analyze your financial records, offering comprehensive business reports and boosting investor confidence. With fresh perspectives and unbiased analysis, we illuminate your Audits and Accounting Services In UAE, paving the way for future success.

Navigating the Financial Maze: Why Choose Goviin?

In a world filled with financial complexities, we stand out as your trusted navigator. Our audit solutions go beyond mere compliance, offering insights, enhancing credibility, and boosting investor confidence. Whether it's ensuring adherence to regulations or providing objective assessments of risks, we're here to guide you every step of the way.

As you embark on your journey towards financial success in the UAE, let Goviin Bookkeeping be your steadfast companion. With our transparent internal and external audit solutions, you can navigate the seas of regulatory compliance with confidence, attracting investments, enhancing credibility, and unlocking new opportunities for growth. Remember, when it comes to audits and accounting services in the UAE, Goviin is your compass pointing towards success.

#FinancialTransparency#AuditServices#DubaiBusiness#UAEFinance#GoviinBookkeeping#ComplianceMatters#InvestorConfidence#FinancialIntegrity#BusinessSuccess#TransparentAudits#FinancialReporting#AccountingSolutions#RiskManagement#OperationalEfficiency#RegulatoryCompliance#BusinessGrowth#FinancialAdvisory#CorporateGovernance#MarketInsights#StrategicPlanning#uaeaccounting#financialservicesdubai

5 notes

·

View notes

Text

Gateway to Success: Nordholm Best PRO Services for Effortless Business in the UAE

Welcome to the world of Nordholm Accounting and Bookkeeping Services, an integral part of the Nordholm Investments family. Our primary focus is on empowering investors to expand their businesses globally, with a special emphasis on the UAE. At the heart of our offerings are Best PRO Services, ensuring a smooth and efficient journey for entrepreneurs seeking to establish and grow their ventures.

Navigating the intricacies of business setup has never been more seamless. From the inception of your company to handling visa procedures, opening bank accounts, and providing top-notch HR, payroll, VAT, and accounting services – we've got you covered. Our commitment is to make your business journey stress-free and worry-free, ensuring that each task is executed flawlessly from the very beginning.

As your dedicated PRO Services expert, Nordholm is committed to getting it right the first time. Our team, inclusive of PRO and government liaison specialists, brings forth tailored solutions to fast-track and simplify your business launch. Whether its document typing, clearance, or visa applications and processing, we're here to streamline every step, promising optimal and efficient results.

Our PRO and Government Liaison experts are well-versed in various scenarios, ranging from trade license application, amendments, and renewals to stock transfers, Department of Labour quotas, and immigration applications. Additionally, we handle mission visas for short-term projects and oversee the application and renewal of government permits and licenses.

Dive deeper into the realm of visas and individual procedures, and you'll find our services encompassing visa processing, renewal, and cancellation. We specialize in managing residence, family, and employee visas, along with stamping certificates issued by the Ministry of Foreign Affairs. Need support for the renewal of visit visas, completion of forms for Emirates ID cards, or assistance with driver's license applications? Consider it done.

Nordholm is not just about licenses and registrations; it's about personalized support tailored to meet your business needs. Our Best PRO Services are your gateway to a seamless process for trade licenses, stock transfers, labor quotas, immigration applications, and more. Trust us to be your reliable partner, contributing to a faster and easier start for your ventures in the dynamic business landscape of the UAE.

#NordholmSuccess#PROServices#UAEVentures#BusinessGrowth#EffortlessSetup#NavigatingSuccess#BusinessTriumph#PremiumServices#GatewayToSuccess

6 notes

·

View notes

Text

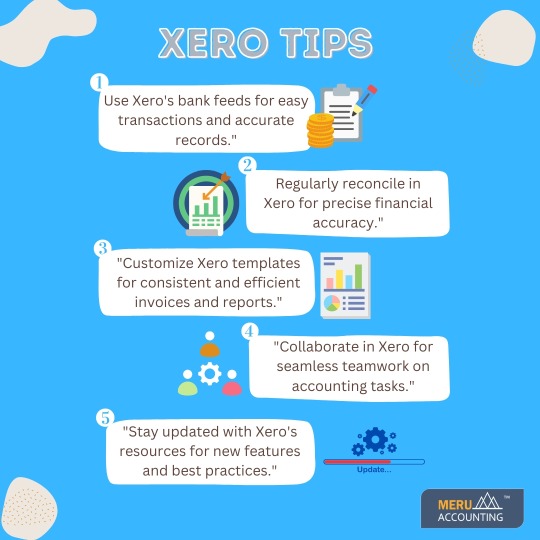

The power of seamless financial management with Xero! Our top tips help you to grow your business.

Meru Accounting is your trusted partner for top-notch accounting and bookkeeping services in the USA, UK, Canada, Australia, UAE, and New Zealand.

#MeruAccounting#xero#xerbookkeeping#xeroaccounting#bookkeepingtips#bookkeepingservices#bookkeepingandaccounting#accounting#accountingservices#usa#uk#canada#uae#australia#newzealand#india

2 notes

·

View notes

Text

Audit and Accounting Services in UAE | Best Audit and Accounting Services in UAE | Top Audit and Accounting Services in UAE

Introduction

Auditing and accounting services play a crucial role in ensuring the financial health and compliance of companies operating in Dubai. These services help businesses stay on top of their finances, avoid penalties, and make informed decisions to drive growth and profitability.

Auditing Services

Auditing services involve a systematic examination of a company's financial records, transactions, and procedures to provide an independent assessment of its financial performance and compliance with applicable regulations. Auditing services help identify financial risks and provide recommendations to improve financial management, internal controls, and reporting accuracy. In Dubai, auditing services are provided by licensed auditors who are registered with the UAE's Ministry of Economy.

Accounting Services

Accounting services involve the recording, classification, and analysis of financial transactions to prepare financial statements, tax returns, and other financial reports. Professional accounting services can help businesses stay compliant with financial regulations, optimize tax planning, and manage cash flow effectively. Accounting services in Dubai are provided by qualified accountants who are well-versed in the local accounting standards and tax regulations.

Benefits of Auditing and Accounting Services

Businesses in Dubai can benefit from a wide range of auditing and accounting services, including:

• Financial statement audits: Audits of financial statements to provide an independent assessment of a company's financial position and performance.

• Internal audits: Evaluations of a company's internal controls and financial management processes to identify areas for improvement.

• Tax audits: Reviews of a company's tax filings to ensure compliance with tax regulations and identify potential tax savings.

• Forensic audits: Investigations of financial irregularities to identify fraudulent activities and provide evidence for legal proceedings.

• Bookkeeping: Recording and categorizing financial transactions to ensure accurate financial reporting.

• Payroll management: Processing employee payroll and ensuring compliance with payroll regulations.

• VAT compliance: Advising businesses on VAT compliance requirements and ensuring accurate VAT reporting.

• Advisory services: Providing expert advice and guidance on financial management, tax planning, and regulatory compliance.

Partnering with an Experienced Auditing and Accounting Firm Partnering with an experienced auditing and accounting firm can help businesses in Dubai streamline their financial processes, reduce financial risks, and maximize their financial performance. An experienced firm can also provide valuable insights and guidance on financial management, tax planning, and regulatory compliance to help businesses make informed decisions and achieve their financial goals.

0 notes

Text

Zoho offers a comprehensive suite of business software solutions tailored to the needs of small and medium-sized businesses (SMBs) in the UAE.

As an SMB in Dubai, navigating the complexities of VAT and Corporate Tax can be daunting. Zoho's comprehensive solutions simplify your journey and empower you to focus on growth.

Contact now - 971558572143

#accounting and bookkeeping services dubai#start a company in dubai#how to register a company in dubai#open business in dubai#esr uae#tax residence certificate#tax certificate uae#tax consultant in dubai#tax consultant uae#tax registration#accounting services in dubai#accounting and bookkeeping services in dubai#bookkeeping services dubai#accounting and bookkeeping services in uae#services in dubai#advisory services#bookkeeping service dubai#ca firms in dubai#top accounting firms in dubai#best accounting firm in dubai#top accounting companies in dubai#best accounting firms in dubai#dubai corporate tax consultants#corporate tax consultant dubai#corporate tax consultant in dubai#corporate tax consultants dubai#vat services in dubai#vat in uae#vat services dubai#vat tax accounting

0 notes

Text

A Complete Guide to Accounting and Bookkeeping Services in Dubai for SMEs

Accounting and bookkeeping services in Dubai are essential for small and medium-sized enterprises looking to manage their finances efficiently. Proper financial management helps businesses comply with local regulations, avoid penalties, and make informed business decisions. Many SMEs struggle with financial organization, which is why professional accounting services are crucial. These services offer comprehensive solutions, including bookkeeping, tax filing, payroll management, and financial reporting. By outsourcing accounting and bookkeeping services, businesses can focus on core activities while ensuring financial stability.

How to Choose the Best Accounting Services in UAE for Your Business

Selecting the right accounting services in UAE is crucial for business growth. With various service providers available, businesses must consider factors like experience, expertise, and technological capabilities before making a choice. It is essential to work with a firm that understands UAE’s financial regulations and provides customized solutions. Many businesses prefer outsourcing these services to firms with extensive experience in bookkeeping, tax compliance, and financial advisory. The right service provider ensures timely financial reporting, accurate record-keeping, and strategic planning for long-term success.

The Benefits of Outsource Accounting Services in Dubai: Save Time and Money

Outsourcing accounting services in Dubai has become a preferred option for businesses seeking efficiency and cost savings. By outsourcing, companies eliminate the need to hire and train an in-house accounting team, reducing overhead costs significantly. Professional accounting firms provide accurate financial reporting, tax compliance, and payroll management. Additionally, outsourcing ensures that businesses comply with UAE regulations, reducing the risk of financial penalties. Businesses that outsource their accounting operations can focus on expansion, customer service, and profitability without worrying about financial complexities.

Legends Accounting Services: A Trusted Partner for Business Success in UAE

Businesses looking for reliable financial solutions often turn to legends accounting services. These firms offer a wide range of financial management services, including bookkeeping, VAT compliance, auditing, and financial consulting. With experienced professionals handling financial tasks, businesses can focus on growth while ensuring compliance with UAE regulations. The expertise of legends accounting services helps businesses make informed financial decisions, optimize cash flow, and enhance profitability. Partnering with a reputable firm ensures accuracy, transparency, and adherence to industry best practices.

Accounting and Bookkeeping Services Dubai: Ensuring Compliance and Financial Stability

Accounting and bookkeeping services Dubai play a vital role in maintaining financial compliance. Businesses in Dubai must adhere to strict regulations regarding tax filing, payroll processing, and financial reporting. Professional bookkeeping services ensure that financial records are up to date, accurate, and ready for audits. Proper bookkeeping also helps businesses track expenses, manage cash flow, and avoid financial mismanagement. Ensuring compliance with UAE laws protects businesses from legal complications and helps build investor confidence.

Top Accounting Advisory Services to Help Your Business Thrive in the UAE

Accounting advisory services offer businesses strategic guidance to improve financial performance. Professional advisors help businesses plan their finances, manage risks, and optimize their tax strategies. These services are crucial for businesses looking to expand, invest, or improve profitability. By analyzing financial data and market trends, accounting advisory services provide actionable insights that drive business success. Working with an experienced advisory firm ensures that businesses remain financially sound and well-prepared for future challenges.

Accountancy Service in Dubai: Why Every Business Needs Professional Financial Management

A reliable accountancy service in Dubai is indispensable for businesses seeking financial stability. Without proper financial management, businesses may face cash flow problems, tax penalties, and compliance issues. Professional accountants help businesses prepare financial statements, manage payroll, and comply with UAE tax laws. Outsourcing these services allows businesses to focus on core operations while ensuring their financial records are accurate and up to date. Investing in professional accountancy services is a strategic move that guarantees long-term financial success.

The Role of Accounting and Bookkeeping Services in Dubai in VAT Compliance

Since the introduction of VAT in the UAE, businesses must ensure compliance with tax regulations to avoid penalties. Accounting and bookkeeping services in Dubai help businesses navigate VAT requirements, ensuring accurate tax filings and timely submissions. VAT compliance involves proper invoicing, record-keeping, and tax return preparation. Businesses that fail to comply with VAT regulations risk heavy fines and legal consequences. Hiring a professional accounting firm ensures accurate VAT calculations, preventing unnecessary financial setbacks.

How Outsourcing Accounting Services in Dubai Can Improve Your Business Efficiency

Outsourcing accounting services in Dubai enhances business efficiency by allowing companies to focus on their core operations. Managing finances internally can be time-consuming and prone to errors, but outsourcing ensures accuracy and compliance. Experienced accountants use advanced financial software to track expenses, generate reports, and provide real-time insights. This streamlined approach reduces administrative burdens and helps businesses make data-driven decisions. With financial experts handling accounting tasks, businesses can allocate resources more effectively and enhance overall productivity.

FAQs

What are the benefits of outsourcing accounting services in Dubai?

Outsourcing accounting services helps businesses reduce costs, ensure compliance, and improve financial accuracy. Professional firms handle bookkeeping, tax filings, and financial reporting, allowing businesses to focus on growth.

Why is bookkeeping important for businesses in Dubai?

Bookkeeping is essential for tracking financial transactions, managing expenses, and ensuring tax compliance. Accurate bookkeeping prevents financial mismanagement and prepares businesses for audits.

How do accounting advisory services benefit businesses?

Accounting advisory services provide strategic financial insights, helping businesses optimize tax strategies, manage risks, and improve profitability. These services guide businesses in making informed financial decisions.

What should businesses look for when choosing an accounting service provider in UAE?

Businesses should consider experience, industry expertise, technology integration, and compliance knowledge when selecting an accounting service provider. A reliable firm ensures accurate financial management and long-term stability.

Conclusion

Investing in professional accounting services is crucial for businesses in Dubai looking to maintain financial stability, ensure compliance, and enhance profitability. Whether it is bookkeeping, tax planning, or financial advisory, working with experienced professionals streamlines financial management and minimizes risks. By outsourcing financial tasks, businesses can focus on growth while leaving complex accounting responsibilities to experts. Reliable accounting services in UAE contribute significantly to business success, making them an essential component of any company’s operational strategy.

#Accounting Services#Accounting and Bookkeeping Services#bookkeeping and tax services#bookkeeping services

0 notes

Link

An audit is crucial because it lends legitimacy to accounting documents and gives shareholders peace of mind that the figures are accurate and equitable. The processes and internal controls of a business can also be improved. https://www.akaigroup.com/accounting.html

0 notes

Text

Accounting & Bookkeeping Services Dubai:-

AKAI Business Solution is a group that provide solutions to business in Accounting, Auditing, Management consulting, Process improvement, Digitization, cost improvement and efficiency and Advisory. Our pro team can help you in implement system for management reporting with international financial reporting and automating management reporting. If you are fresher in running a business or have some experience, we help you out proficient. To know more info: https://www.akaigroup.com/accounting-and-bookkeeping.html

0 notes

Text

Goviin Bookkeeping & Taxation: Your Trusted Tax Consultants in Dubai

Are you struggling with VAT registration or in need of assistance with Tax compliance, return filing, or tax agent services to minimize losses? We understand the importance of maintaining streamlined financial records. That's why we offer comprehensive services, including audits, VAT e-filing assistance, managing tax penalties and refunds, and other tax residency services. Let us help you achieve financial efficiency with our top-notch bookkeeping and accounting services.

At Goviin, we understand the importance of maintaining accurate financial records and complying with VAT regulations. Whether you need help with VAT return filing, tax agent support, or navigating complex tax laws, our team is here to provide tailored solutions to meet your needs.

As certified Tax Consultants in Dubai, recognized by the Federal Tax Authority (FTA) in the UAE, we specialize in providing professional financial management services and comprehensive VAT-related solutions. With our extensive expertise and dedication, we ensure that your business remains compliant with the ever-evolving tax landscape in Dubai.

Since the implementation of Value Added Tax (VAT) in 2018, it has significantly impacted businesses across various sectors. With a standard rate of 5% applied to a wide range of services, adherence to VAT regulations is essential to avoid penalties and ensure smooth operations.

Navigating the complexities of VAT compliance can be daunting, but with Goviin Bookkeeping & Taxation by your side, you can rest assured knowing that your tax obligations are in capable hands. Let us help you streamline your VAT processes and minimize risks, allowing you to focus on what matters most – growing your business.

#GoviinBookkeeping#TaxationDubai#TaxConsultants#DubaiBusiness#FinancialServices#VATCompliance#TaxExperts#BookkeepingServices#AccountingSolutions#FinancialConsultants#UAEFinance#TaxationServices#BusinessSolutions#DubaiConsultants

3 notes

·

View notes

Text

Unlock Success: Affordable Accounting Services in Dubai by Nordholm

Dubai's bustling business environment offers a wealth of opportunities for entrepreneurs aiming to expand their ventures. At Nordholm Investments, our Accounting & Bookkeeping Services serve as a pivotal catalyst for business growth, providing Top-notch yet Affordable Accounting Services in Dubai. Our mission is centered on delivering customized solutions that precisely meet the unique requirements of investors eyeing the UAE market. We recognize the complexities involved in establishing a presence in a new location, and we're here to simplify the process.

Our comprehensive range of services includes:

Company Formation: We specialize in facilitating a seamless and hassle-free company setup process while ensuring adherence to local regulations.

Visa Procedures: Navigating the intricate visa requirements can be challenging. Our experts adeptly streamline this process, simplifying your entry into the UAE market.

Bank Account Setup: Efficient financial operations are crucial. We offer guidance and assistance in opening bank accounts, ensuring smooth transactions for your business.

HR and Payroll Services: Managing human resources and payroll necessitates meticulous attention. Our services guarantee seamless operations in these critical areas.

VAT Compliance and Accounting: we understand the significance of accurate accounting and VAT compliance. Our proficient team excels in managing these tasks with great attention to detail, allowing you to prioritize your core business operations.

We comprehend the pivotal role that Precise Accounting and Bookkeeping play in fostering sustainable business growth. Our team of seasoned professionals is committed to handling these critical aspects, empowering you to steer your business towards success.

We recognize the delicate balance necessary for a business to thrive. By amalgamating sustainability with security, we provide valuable insights and strategies that facilitate informed decision-making and unlock new opportunities.

Navigating the complexities of foreign countries, particularly in the United Arab Emirates, can be overwhelming. However, with Nordholm Investments by your side, investors can embark on stress-free business operations. Our understanding and enjoy in the region ensure a easy and worry-loose revel in, allowing you to cognizance on scaling your commercial enterprise goals.

Opting for our Affordable Accounting & Bookkeeping Services means choosing a dedicated partner invested in your business's success. Our Top-tier Accounting Services in Dubai are meticulously tailored to meet your needs, guaranteeing precise financial reporting and efficient operations while you concentrate on achieving your business objectives.

#DubaiBusiness#AccountingServices#NordholmInvestments#FinancialConsulting#VATCompliance#BookkeepingServices#CompanyFormation#PayrollManagement

5 notes

·

View notes