#Tokenization of Real Estate

Explore tagged Tumblr posts

Text

Looking for real estate tokenization companies? GreatX brings tokenization of real estate and capital-protected digital asset investment with proof of assurance.

#principal protected investment#real estate tokenization#tokenization of real estate#real estate tokenization companies

0 notes

Text

Tokenization of Real Estate - The Future of Buying and Selling Properties

A real estate tokenization platform allows you to facilitate your clients for buying and selling real estate properties quickly.

0 notes

Text

#principal protected investment#real estate tokenization#tokenization of real estate#real estate tokenization companies

0 notes

Text

youtube

#youtube#crypto#food and crypto#bitcoin#cryptocurrency#RWA#real world assests#tokenization#stocks#bonds#real estate#art#collectibles

3 notes

·

View notes

Text

Maximize Asset Liquidity with Real World Asset Tokenization Services

Leverage blockchain technology for Real World Asset Tokenization. Our Asset Tokenization solutions enable secure digital ownership of real-world assets.

#Real World Asset Tokenization Companies#Real Estate Tokenization#Real World Asset Tokenization Development

0 notes

Text

This presentation explains how Security Token Offerings (STOs) use blockchain to tokenize real estate, offering fractional ownership, enhanced liquidity, and transparency. check out more : https://www.blockchainx.tech/real-estate-tokenization/

0 notes

Text

Exploring Real Estate Tokenization

The real estate industry benefits from blockchain technology through tokenization, which alters property ownership dynamics and operational management. Real estate tokenization enables property ownership conversion into digital tokens, creating fresh solutions for real estate market investment and liquidity.

Defining Real Estate Tokenization: How It Works

Users use blockchain networks to create digital tokens to tokenize property assets and their related income streams. Real estate tokens can be fungible representations of ownership shares or represent distinct non-fungible assets. The process typically includes:

Property Assessment determines the property worth and sets up the tokenization structure.

Real Estate Tokenization requires regulatory compliance checks and protection measures to define how token holders can exercise their rights.

Smart contracts let users create automated agreements that deploy Brno Token functionality through self-executing code.

The system generates digital tokens to represent the ownership stakes of properties in the program.

The digital platform serves as a platform for investors to acquire and trade the tokens through Platform Integration.

Real estate tokenization simplifies investments while eliminating intermediaries and operators and welcomes more participants into the investment pool.

Real-World Examples of Tokenized Real Estate

Real estate tokenization has been successful through various completed projects.

St. Regis Aspen Resort raised $18 million by selling ownership tokens, which represented fractional stakes in the Colorado resort property.

The Colombian property firm LaProp utilized Chainlink Automation to assist in automated rental disbursements to real estate token proprietors through fractionalized property ownership.

Through Lofty, users can acquire tokens showing fractional ownership positions in rental homes as they seek access to information to information on ownership opportunities from smaller capital investments.

Major Advantages of Real Estate Tokenization

When real estate goes through tokenization processes, it brings the following essential advantages:

Real estate traditionally demonstrates low liquidity because purchasing or selling real estate properties requires extensive time and substantial financial resources.

Fractional ownership lets people participate in high-value properties through partial property ownership, thus expanding real estate investment opportunities for those with limited capital.

Blockchain technology operates with transparency and an unalterable transaction log, which establishes secure deals by increasing investor trust.

Through smart contracts and reduced intermediary involvement, tokenization allows businesses to achieve enhanced efficiency by cutting operational costs.

Potential Risks in Real Estate Tokenization

Even though tokenization has benefits, it introduces particular risks to the process:

Market participants who involve tokenized assets face regulatory uncertainty because the legal structures for tokenized assets remain in development, creating potential obstacles for issuers and investors to comply with the rules.

The adoption rate of tokenization techniques struggles with traditional market investors due to its recent entry into the market, affecting asset liquidity and depth.

The dependency on blockchain technology exposes investors to technical risks because hackers' software defects and system breakdowns represent possible dangers.

Evaluating tokenized assets isles, given the difficulty of valuing property assets that are standard market evaluation examples.

Comparing Tokenization and Fractional Ownership

Traditional fractional ownership and tokenization enable several investors to part-own properties but have distinct operational characteristics.

The tokenization model creates better investment liquidity because its secondary markets enable smooth trading of tokens compared to classic fractional property ownership approaches.

Electronic tokens allow worldwide investor groups to acquire ownership, while traditional fractional property shares often face restrictions due to geography and local regulations.

Because blockchain maintains an immovable ledger system, it enhances visibility better than standard approaches that store limited or inaccessible information.

Is Real Estate Tokenization a Passing Trend or the Future?

Real estate tokenization development is demonstrating rising popularity, indicating its significant potential to shape the property investment trends of tomorrow. DAMAC Group has linked with blockchain platform MANTRA to turn $1 billion worth of Middle Eastern assets into digital tokens, thereby signaling rising institutional adoption.

However, extensive adoption will rely upon elements such as regulatory traits, technological advancements, and market reputation. As the regulatory and technological frameworks mature, tokenization may become a mainstream approach for real estate funding.

Final Thoughts

Real property tokenization represents a transformative approach to asset investment, imparting elevated liquidity, accessibility, and efficiency. While challenges continue, especially in regulatory and technological domains, the potential advantages make it a compelling development within the real estate enterprise. As the marketplace evolves, tokenization should redefine how we understand and engage with actual estate belongings.

0 notes

Text

Real Estate Investments Developing a Secure and Scalable Tokenization Platform

This video highlights the development of a secure real estate tokenization platform, focusing on its features, benefits, and how it transforms traditional real estate with blockchain technology by enabling fractional ownership, enhanced liquidity, and global accessibility.

Tokenize your property now : https://www.blockchainx.tech/real-estate-tokenization/

0 notes

Text

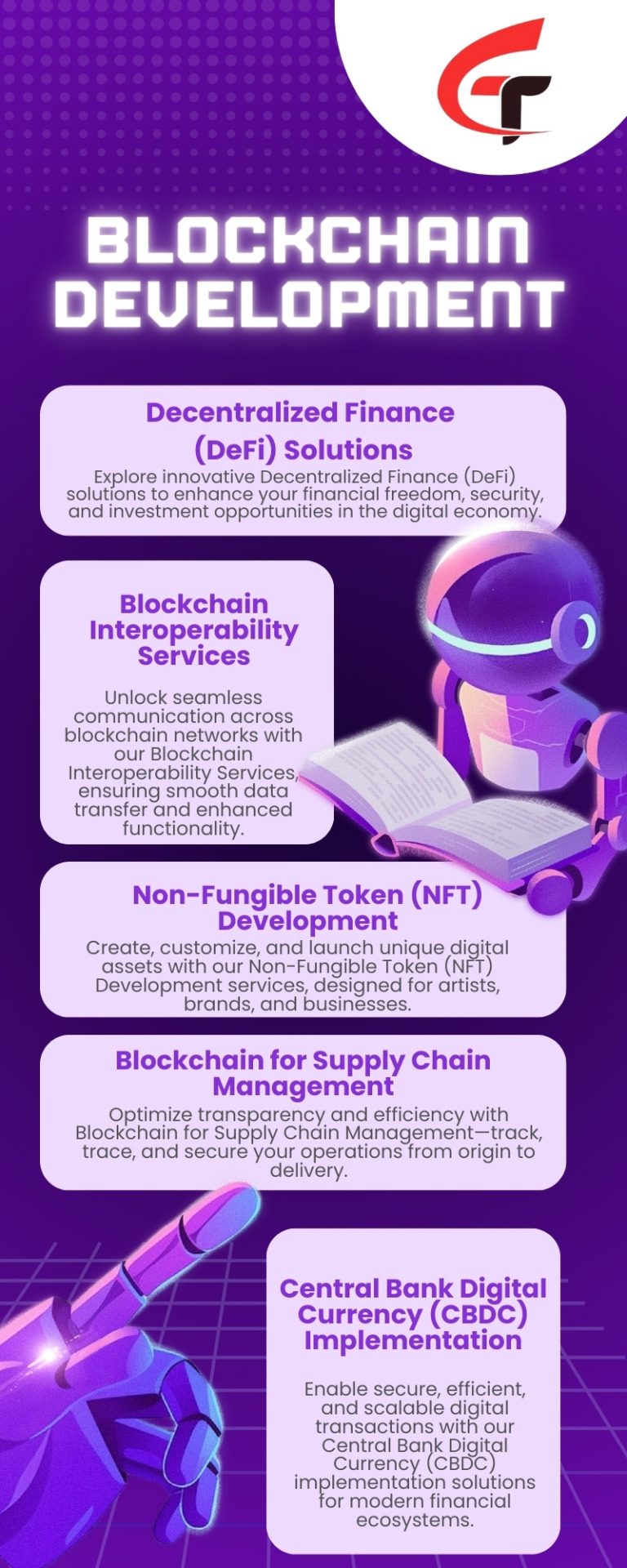

Decentralized Finance (DeFi) Solutions

Decentralized Finance are revolutionizing the financial landscape by eliminating intermediaries and empowering users with greater control over their assets. Our DeFi services enable secure, transparent, and efficient financial operations through blockchain technology.

From lending and borrowing platforms to decentralized exchanges and yield farming, we help businesses and individuals unlock the potential of DeFi. Our solutions include smart contract development, liquidity provisioning, token creation, and integration with leading blockchain networks. Whether you're a startup or an established enterprise, our tailored Decentralized Finance (DeFi) Solutions are designed to enhance financial inclusion, reduce costs, and provide innovative investment opportunities in the digital economy.

#Decentralized Finance Solutions#DeFi Solutions#Blockchain Interoperability Services#Non-Fungible Token Development#NFT Development#Blockchain for Supply Chain Management#Central Bank Digital Currency Implementation#CBDC Implementation#Blockchain-Based Voting Systems#Smart Contract Development#Blockchain in Healthcare Data Security#Blockchain for Real Estate Tokenization#Blockchain-Powered Identity Management#prototype development company

0 notes

Text

Digital Real Estate: Redefining Property Ownership in Jamaica

In the evolving landscape of 2025, where technology is has started to reshape every aspect of life, investing in digital real estate alongside traditional real estate might just be the smartest move for forward-thinking investors. As Dean Jones, founder of Jamaica Homes, aptly puts it, “The future of property isn’t just about location anymore; it’s about innovation.” This profound shift in…

#blockchain technology#caribbean homes#Digital Transformation#real estate innovation#Smart Contracts#tokenized properties

0 notes

Text

Revolutionizing Business Operations with Enterprise Blockchain Solutions

Enterprise blockchain solutions to enhance efficiency, security, and transparency. Notably, global spending on blockchain solutions is projected to reach nearly $19 billion by 2024, reflecting the technology's growing significance across various industries.

Understanding Enterprise Blockchain Solutions

Enterprise blockchain solutions involve the implementation of distributed ledger technology within organizational settings. Unlike public blockchains, these are permissioned networks, granting access only to authorized participants. This structure ensures enhanced security, streamlined processes, and improved trust among stakeholders.

Digital Asset Tokenization: Transforming Asset Management

Digital asset tokenization refers to the process of converting physical or intangible assets into digital tokens on a blockchain. This method facilitates fractional ownership, increases liquidity, and broadens access to investment opportunities. For instance, the tokenization of real estate allows investors to own a fraction of a property, thereby lowering the barrier to entry and diversifying investment portfolios. According to industry reports, the tokenization market is expected to grow significantly, with some estimates predicting it could reach between $2 trillion and $16 trillion by 2030.

The Role of Blockchain Consultancy in Business Transformation

Implementing blockchain technology can be complex, necessitating specialized expertise. Blockchain consultancy services provide businesses with strategic guidance, helping them navigate the intricacies of blockchain integration. Consultants assist in identifying suitable use cases, ensuring regulatory compliance, and developing customized solutions that align with organizational goals. Engaging with experienced blockchain consultants enables companies to leverage the full potential of blockchain technology, driving innovation and competitive advantage.

Benefits of Enterprise Blockchain Solutions

Enhanced Security: Blockchain's cryptographic features protect data from unauthorized access and tampering.

Operational Efficiency: Automation through smart contracts reduces manual processes, leading to cost savings and faster transactions.

Transparency and Trust: Immutable records provide transparency, fostering trust among stakeholders.

Improved Traceability: In supply chain management, blockchain enables real-time tracking of goods, reducing fraud and counterfeiting.

Real-World Applications of Enterprise Blockchain

Supply Chain Management: Companies like IBM have developed blockchain-based supply chain solutions that enhance product traceability and authenticity.

Financial Services: Banks are exploring blockchain for cross-border payments and digital identity verification, aiming to reduce transaction times and costs.

Healthcare: Blockchain is utilized for secure patient data management, ensuring privacy and interoperability between healthcare providers.

Conclusion

Enterprise blockchain solutions, encompassing digital asset tokenization and supported by blockchain consultancy services, are revolutionizing business operations across various sectors. By embracing these technologies, organizations can achieve greater efficiency, security, and transparency, positioning themselves for success in the digital age.

FAQs

What are enterprise blockchain solutions?

Enterprise blockchain solutions involve the use of distributed ledger technology within businesses to enhance security, efficiency, and transparency in operations.

How does digital asset tokenization benefit investors?

Digital asset tokenization allows for fractional ownership of assets, increasing liquidity and making investments more accessible to a broader audience.

Why is blockchain consultancy important for businesses?

Blockchain consultancy provides specialized expertise to help businesses effectively implement blockchain technology, ensuring alignment with organizational goals and regulatory compliance.

What industries can benefit from enterprise blockchain solutions?

Industries such as supply chain management, financial services, healthcare, and real estate can significantly benefit from the adoption of enterprise blockchain solutions.

What is the projected growth of the blockchain market?

The global blockchain market is expected to grow from $3 billion in 2020 to $39.7 billion by 2025, indicating a substantial increase in adoption across various sectors.

How do enterprise blockchains differ from public blockchains?

Enterprise blockchains are permissioned networks with restricted access, ensuring enhanced security and control, whereas public blockchains are open to anyone.

0 notes

Text

The Evolution of Real Estate Tokenization by 2025

Seven improvements have been brought to reality through advanced technology, and among these is real estate tokenization. It is a brilliant manifestation of the revolutionizing power that blockchain, along with smart contracts, can merge to transform property investment to a more affordable, transparent, and simpler form of investment.It is likely that real estate tokenization will already undergo pretty significant changes in property investment and real estate's future by 2025.

Thus, the blog will concern itself with happenings that will figure in the main events of the future up until 2025 in relation to real estate tokenization-from agency such as advances in technology as well as the changing regulatory landscape along with market trends and how these changes would further impact investors, developers, and other sections of the industry- another concern given in the blog.

Real Estate Tokenization

Essentially, before we even go on to discuss what seems to be the future direction in tokenization, it is important to first define what real estate tokenization means. Real estate tokenization is simply the actual process of turning ownership in or shares of a real estate property into digital tokens on a blockchain. Such tokens can even represent partial ownership of the property, thus allowing for fractional ownership, which may then be tradeable or transferrable among investors; it is easy to comprehend the advantages from such a platform tokenization brings. It allows easy access to real estate investments, increases liquidity, decreases transaction costs, and allows for transparent tracking of ownership.

Tokenized real estate basically involves the creation of a smart contract, which is actually a self-executing contract with its terms directly incorporated into lines of code, and which carries out the transaction on the blockchain. This technology eliminates the need for any agent, broker, or lawyer to authenticate transactions, thus expediting correspondences and minimizing costs.

Real Estate Tokenization: Where We Are Now in 2024

Tokenization of real estate has really developed into a promising venture as of 2024, but it is still too early for its serious adoption yet. Some companies have started offering tokenized investments in real estate, and several real estate developers already use the technology to create better property transactions. However, there are still big blocks such as regulatory issues, scalability, and market education that remain.

At the moment, tokenized real estate projects are often associated with extremely valuable real estate and institutional investors owing to the complications and start-up costs involved. The market for fractional ownership is growing, and most tokenized assets are hosted on specialized blockchain platforms. Tokenized real estate are very eager, and by 2025, the face of the land would look completely different.

Major Factors Influencing Real Estate Tokenization by 2025

1. Blockchain Advancements and Interoperability

It seems that the blockchain technology is growing very quickly, and it is bound to play a role in the future scenario of real estate tokenization by 2025. The real estate tokenization development of more scalable blockchain networks with their increasing transaction speeds and reduced costs will make tokenization practical for a much larger range of real estate assets.

One key trend that would come in the future is blockchain interoperability. With further developments of more of such networks, there will increasingly arise a major need for interaction between them. Real estate tokenization platforms will have to accommodate cross-chain tokenized real estate asset transfers for assets now on one blockchain to be transferred to another. This will also increase the liquidity of real estate and hence diversify the market to more investors around the globe.

2. Regulatory Evolution

Regulatory uncertainty in many countries has made real estate tokenization difficult. The issues of fractional ownership, securities laws, and blockchain-related transactions are still evolving. Expectedly, there would be clearer regulations by 2025. This is a framework that will not be entered into the canon of legalization but will allow governments and regulatory authorities across the world to identify emerging technologies such as Blockchain in order to trumpet around the legal framework for tokenized real estate.

The U.S. SEC (Securities and Exchange Commission) and the European Union have been working to develop an appropriate regulatory framework to allow tokenized real estate to operate profitably. These regulations will assist in addressing the aspects of fraud risks and constraints tokenized assets to the existing laws governing them. This regulatory clarity will influence the participation of institutional investors in tokenized real estate and will drive the further growth of this market.

3. Increased Investor Access

Concerns have also been raised on the pending changes that will happen to the real estate tokenization market in 2025, and among the changes to be expected is the democratization of property investment. The fact that it facilitates fractional ownership would allow a broader range of investors to enter into the real estate market through tokenization. Instead of shelling out millions of dollars to buy into high-value properties, real estate investments of the future will allow an individual to purchase fractions of tokens that let them invest with smaller amounts of capital.

This democratization will allow people from all over the world, regardless of how affluent they are, to invest in real estate. We expect tokenized real estate assets to be as widely available across different markets as commercial, residential, and even luxury properties by 2025, if not earlier. What's more, investors will now be able to enter a greater global market, bringing opportunities that were previously cut off within the grasp of some.

4. Liquidity and Fractional Ownership

In the past as well, real estate was perceived as an illiquid asset class; buying or selling a property takes time, and many individuals prefer not to put large amounts of money into a single asset. This is where tokenization comes in, enabling fractional ownership, allowing individuals to acquire smaller values of a property.

By 2025, a market for tokenized real estate is expected to have increased liquidity enabling the investor to buy and sell the tokens assigned to him or her very quickly. According to blockchain technology, tokenized real estate assets can be traded on secondary markets, giving investors more exit strategy options, thus attracting more capital into the market and growing the market, hence cultivating a more dynamic real estate ecosystem.

5.Smart Contracts and Automation

Smart contract development is one more area in which real estate tokenization is expected to bring considerable growth by the year 2025. These self-executing contracts will eliminate intermediaries from real estate transactions, making them quicker, cheaper, and more secure.

This means that between now and 2025, smart contracts will probably fully activate the process of transferring property ownership, from the payment and revenue distribution to profit-sharing given to owners. All this will happen without the interference of notaries, lawyers, and escrow agents in the transaction, thus greatly reducing costs like fees and delays of different transactions. It is this efficiency that will drive the mass adoption of tokenized real estate.

Real Estate Tokenization by 2025: Key Benefits

1. Global Real Estate Crowdfunding

The global pool of investors can fund real estate projects through tokenization. Fractional ownership makes it feasible for people's smaller amounts of investments in expensive properties rather than borrowing from conventional financial intermediaries. Thus, interim...

2. Tokenized Real Estate Funds

How precisely tokenized real estate funds depend on more transparency than ever cost-effective or liquid cal alternative to the REIT. The tokens available for purchase represent a part of an entire portfolio of different real estate assets, which can then be traded on blockchain platforms. This system eliminates high fees and allows greater flexibility in managing investments.

3. Enhanced Liquidity

Real estate has been historically a non-liquid asset class, although it is the tokenization that changes this by allowing the fractional ownership share to be traded on digital exchanges; whereby investors can trade this token very quickly and easily providing more flexibility and opportunities for investors to enter or exit a market.

4. Democratization of High-Value Assets

The process of Tokenization allows high-value properties to be transformed into smaller and affordable units which enables a greater range of investors to get access to high-end real estate markets. Be it luxury apartments or be it a commercial building, the tokenization process lowers the barriers for less-wealthy investors to help diversify their portfolios with more expensive real estate assets from around the world.

5. Transparency and Security

All property transactions and ownership details lead to the immutable record by blockchain, making it easier to verify the complete history of any investment. Hence, it decreases fraud risks while increasing security as investors can distinguish themselves into believing their transactions and property titles are securely recorded.

6. Access to Global Markets

Tokenized real estate is meant to open investment into local markets across foreign border lines while avoiding the hassles entailed in navigating the foreign ownership laws and the complexities of language and traditional financial systems. Thus, investing beyond the borders becomes possible, thereby realizing a truly borderless concept in real estate.

7. Automation of Property Management

Smart contracts automate the key functions, such as collecting rent, distributing dividends, and more, in property management. Such reductions in administrative expenses make sure that every operation around the property offers ease and convenience for both the investors as well as property owners.

Conclusion

By 2025, real estate tokenization will change the buying, selling, and management processes for real estate. It will enable wider access to these activities across borders, liquefy, make them more transparent and automated, and in this way, improve their efficiency, security, and inclusivity within investments in real estate. Developers and investors will reap the benefits of this paradigm shift. In fact, it will become the engine that will drive the entire real estate industry.

0 notes

Text

Best Blockchain Development Company in USA | Global Blockchain Solution

Global Blockchain Solution is a full-service Blockchain Development Company that provides both small and large-scale organizations with top-notch, decentralized blockchain services. Using the Metaverse, Blockchain, and NFT platforms, we offer unmatched services for all of your end-to-end requirements.

2 notes

·

View notes

Text

Real World Asset Tokenization Experts | Secure & Efficient Tokenization

Enhance liquidity & accessibility with Asset Tokenization! Tokenize real-world assets using our advanced blockchain technology and secure platforms. Real World Asset Tokenization Services: Convert physical assets into blockchain-based digital tokens. Secure, compliant, and transparent solutions.

#Real World Asset Tokenization Development#Real World Asset Tokenization Services#Asset Tokenization#Real Estate Tokenization#Real World Asset Tokenization

0 notes

Text

Real Estate Tokenization in Emerging Markets: A New Frontier for Investment

More than anyone could ever remember, real estate has always remained one of the most fruitful and stable investments for people of that age.Interestingly, many in emerging markets have found the opportunity to invest in property elusive.Conventional real estate demands huge amounts of capital, lengthy transaction processes, and sometimes just plain bureaucratic hurdles. But, with the introduction of blockchain technology and real estate tokenization, now, this field is being set up for drastic changes.

The tokenization of real estate assets allows them to be divided into smaller, tradable units, nurturing the accessibility of property investment to a larger audience, including people from developing or emerging economies. Thus, this innovation has a strong prospective opportunity to disrupt the investments in regions that have witnessed fragmented, illiquid, or limited real estate markets.

What is Real Estate Tokenization?

In essence, real estate tokenization encapsulates the sharing of physical property ownership rights and creating the same amount of digital tokens, all recorded on a blockchain. These tokens represent fractional ownership in the property, where one token equals a portion of the asset's value while being backed by an actual piece of real estate.

Hence, tokenization aids the buying, selling, and transfer of property ownership, since transactions are guaranteed to be safe and transparent by blockchain without the mediation of intermediaries. This kind of framework paves the way for fractional ownership, whereby an investor owns a fraction of the property without investing the entire sum for the asset. Furthermore, because of the transparency provided by blockchain, ownership records are clear and unalterable, providing confidence and security in real estate transactions.

Real Estate Tokenization in Emerging Markets

Emerging markets are often entangled in challenges that, on several occasions, interfere with real estate investments. Entry costs are rather hefty, financing is tough to come by, and the actual transaction processes are opaque, making it even tougher for local and foreign investors alike. Countries in many developing areas have their own sets of political instability and stabilizing forces, making the conditions that much more formidable for real estate development.

Explore Tokenization - Real estate tokenization development

Tokenization has a strong capacity to alleviate these problems by democratizing real estate investment. Fractional ownership allows small investors to readily purchase part ownership in high-value properties, which in the past was impossible in those markets that demanded very high capital requirements.

In addition, tokenized real estate assets traded on blockchain platforms enhance liquidity in regions that have historically been illiquid in the property market system, meaning investors don't have to wait for years to sell their stake in a property. This grants flexibility and increases participation among investors.

Investment Opportunities in Real Estate Tokenization

While tokenized real estate can offer unparalleled investment opportunities, the emerging markets stand to gain more. A plethora of properties would be available to any investor-whether local or international-whether luxury residential estates in cities like Lagos or São Paulo, or commercial properties in Bangkok or Jakarta-by merely paying reasonable amounts for ownership shares, as opposed to ensuring large upfront payments for entire property ownership tokenization options that allow for fractional ownership, whereby multiple people can invest in a single property by owning smaller, more affordable units of the asset.

This in particular goes far and wide for markets with higher property prices, thus giving ordinary people an opportunity to put a foot into the field and diversify their portfolios. Tokenization also opens the potential for secondary market trading, thus allowing investors to cash in and cash out of their property tokens on digital exchanges, creating liquidity in markets that have historically been illiquid.

Real-Life Use Cases of Real Estate Tokenization

Real estate tokenization is already being implemented in various emerging markets, with notable success. In Southeast Asia, a tokenization platform allowed international investors to purchase shares in a commercial property in Singapore, a city with a booming real estate market. By tokenizing the asset, investors from around the world could participate with as little as $100, an amount that would be far from sufficient in the traditional market. In Africa, a project in Nigeria tokenized luxury residential properties, enabling investors to own fractional shares of prime real estate in one of the continent’s largest economies.

Because buyers and sellers of tokenized assets do not need intermediaries or long sets of paperwork, these processes can be fast and cheap as well as accessible. There is also opportunity in Latin America, whereby blockchain platforms are facilitating the crowdfunding of real estate developments in countries like Brazil, where historically securing capital has been an ordeal.

The Future of Real Estate Tokenization

The future of real estate tokenization indeed looks bright, driven mainly by emerging markets and international demand for tokenized assets. The more educative people become about blockchain technology and its benefits, the more traction real estate tokenization will gain.Some governments in developing regions are beginning to analyze regulatory frameworks that can guarantee compliance without obstructing innovation in the blockchain space. Within the next few years, we will witness an avalanche of real estate tokenization platforms offering different kinds of properties - from residential to commercial - to lure in local and global investors. Tokenization will also be a key player in the smooth and clear management of urban assets as smart city initiatives take off. Ultimately, tokenized real estate may go a long way toward easing housing shortages in emerging markets by allowing people into affordable housing solutions while simultaneously triggering economic growth.

Conclusion

With the arrival of real estate tokenization, such an innovative solution can be engraved in the minds of emerging markets that have been garnering liquidity, accessibility, and transparency hurdles in the real estate space. By allowing fractional ownership and providing a global marketplace for local assets, tokenization could level the playing field where small investors could technically participate in high-price property markets. As the technology matures, this will more likely lead to the mainstream adoption of tokenized real estate investment vehicles as a key growth engine for innovation and sustainability within emerging markets across the globe.

0 notes

Text

Explore the top real estate tokenization companies of 2025. Discover how they're transforming property investment with blockchain technology and secure tokenized assets.

0 notes