#Token Development

Explore tagged Tumblr posts

Text

Crypto Token Development - To Propel Your Crypto Venture to New Heights

Crypto token development is the process of creating and launching digital assets, known as tokens, on a blockchain network. These tokens can serve multiple functions, such as representing ownership rights, enabling transactions, or powering decentralized applications (dApps). The development process involves designing the token's features, coding the necessary smart contracts, and integrating the token with the selected blockchain platform.

Understanding the Importance of Crypto Tokens in the Crypto Industry

In the fast-paced world of cryptocurrency, tokens are essential components of the ecosystem. They form the foundation for a variety of decentralized applications, offering innovative solutions across different sectors. Crypto tokens facilitate fundraising, incentivize user participation, and introduce new economic models that challenge traditional financial systems.

Benefits of Crypto Token Development for Your Venture

Fundraising Opportunities: Developing crypto tokens allows ventures to raise capital through Initial Coin Offerings (ICOs), Security Token Offerings (STOs), or Initial Exchange Offerings (IEOs), providing essential resources for scaling projects.

Increased User Engagement: Integrating tokens into your platform can boost user participation, foster community engagement, and create a vibrant ecosystem. Tokens can serve as rewards, access tools, or mediums of exchange.

Innovative Business Models: Tokens enable new business models that disrupt traditional methods. From decentralized finance (DeFi) to non-fungible tokens (NFTs), token-based ecosystems are transforming industries and creating growth opportunities.

Improved Transparency and Traceability: Blockchain technology ensures high transparency and traceability in token development. Every transaction and asset ownership detail is recorded on a distributed ledger, enhancing trust and accountability.

Competitive Advantage: Incorporating token development can set your venture apart, helping you stay ahead of the competition and position your project as a leader in the crypto space.

Various Token Standards for Development:

Crypto token development involves selecting the appropriate token standard based on the desired features and use cases. Popular standards include:

Ethereum Standards:

ERC-20

ERC-223

ERC-777

ERC-1400

ERC-721

ERC-827

ERC-1155

ERC-998

TRON Standards:

TRC-10

TRC-20

TRC-721

BSC Standards:

BEP-20

BEP-721

Other Popular Standards:

EIP-3664

BRC-20

SRC-20

Steps Involved in Crypto Token Development

Token Design: Define the token's purpose, utility, and tokenomics, including its supply, distribution, and usage within the ecosystem.

Smart Contract Implementation: Develop smart contracts to manage the token's features like minting, burning, transferring, and any additional rules or restrictions.

Token Deployment: Deploy the token on the chosen blockchain network, ensuring seamless integration with the platform's infrastructure.

Token Distribution: Plan and execute the token distribution strategy, which may involve an initial token sale, airdrops, staking rewards, or other mechanisms.

Ongoing Maintenance and Updates: Continuously monitor the token's performance, address technical issues, and implement upgrades or new features to maintain its relevance and value.

Popular Use Cases of Crypto Tokens in Different Industries:

Crypto tokens are revolutionizing various industries by providing new ways to interact with digital assets and services. Key use cases include:

Decentralized Finance (DeFi): Tokens enable decentralized lending, borrowing, and trading platforms, as well as novel financial instruments.

Non-Fungible Tokens (NFTs): Tokens, especially ERC-721, allow the creation and trading of unique digital assets like art, collectibles, and in-game items.

Supply Chain Management: Tokens can track and trace goods, improving transparency and efficiency in supply chain operations.

Digital Identity and Access Control: Tokens provide secure, decentralized management of digital identities and access control.

Loyalty and Reward Programs: Businesses can use tokens to create innovative loyalty and reward programs, enhancing customer engagement.

Future Trends and Opportunities in Crypto Token Development

As the crypto industry grows, so does the demand for token development. Emerging trends and opportunities include:

Interoperability and Cross-Chain Compatibility: Developing protocols and standards that enable seamless interaction between different blockchain networks and their tokens.

Decentralized Autonomous Organizations (DAOs): Using tokens to power the governance and decision-making processes of DAOs.

Tokenization of Real-World Assets: Representing physical assets like real estate, art, or commodities through tokens, unlocking new investment opportunities and liquidity.

Decentralized Applications (dApps): Continued growth and integration of tokens in developing dApps across various industries.

Regulatory Advancements: As the industry matures, clear regulatory frameworks will facilitate the broader adoption and integration of crypto tokens.

Conclusion: Unlocking the Full Potential of Your Crypto Venture through Token Development

In the dynamic crypto industry, strategic token development can unlock your venture's full potential. By leveraging the benefits of token development, you can differentiate your offering, drive user engagement, and explore new avenues for growth and innovation. Our experienced crypto token development team is ready to guide you through this process. Contact us today to learn more about how we can help you harness the power of crypto tokens and propel your project to success.

Why Hivelance is the Best Place to Develop Your Token?

Hivelance is a leading token development service provider in the crypto industry. We analyze market trends to deliver high-quality token development services, helping investors create and launch tokens with features like exchangeability, traceability, and configurability.

#token development company#bitcoin token#crypto token#token development#Crypto Token Development Services#Easy Steps To Create Your Own Token

3 notes

·

View notes

Text

Crypto Newbies & Curious Minds — This One’s for You!

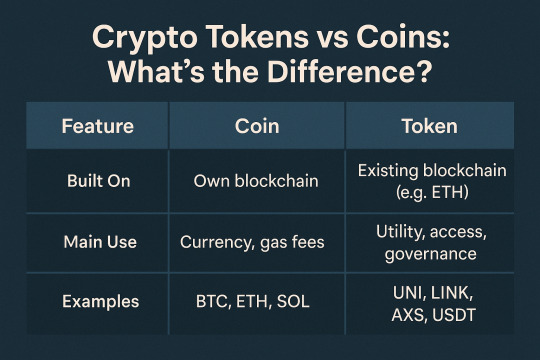

💡 Ever wondered what makes a coin different from a token in the crypto world?

🪙Coin: A digital asset that runs on its own blockchain.

💳Token: A digital asset that is built on another blockchain.

We’ve broken it down into a simple, visual guide so you can finally get it straight!

✅ Native blockchains vs built-on platforms

✅ Use cases: payments, DeFi, NFTs & more

✅ Examples you’ve heard of — BTC, ETH, UNI, USDT

Comment below which token you are using & why???

0 notes

Text

Best Token Development Services - Osiz

Content :

Looking to launch your own crypto token? Osiz Technologies is a leading Token Development company specializing in custom token creation on Ethereum, BSC, Tron, Solana, and more. With over a decade of blockchain expertise, Osiz provides secure, scalable, and feature-rich token development solutions tailored to your business goals.

#Token Development#Crypto Token Creation#Blockchain Development#Ethereum Token#BSC Token#NFT Development#Best Token Company#Soulbound Token Development Company#Osiz Technologies#Web3 Development

0 notes

Text

How to Develop Your Own BEP20 Token: A Beginner’s Guide

The world of blockchain is rapidly transforming how we create and exchange value. With the rise of decentralized finance (DeFi) and crypto ecosystems, launching your own token has never been more accessible. Among the most popular standards for token creation is the BEP20 standard on the Binance Smart Chain (BSC).

Whether you want to build a DeFi platform, launch a crypto-based product, or simply explore token creation, this guide will walk you through how to develop your own BEP20 token — even if you’re a beginner.

What is a BEP20 Token?

BEP20 is a token standard on Binance Smart Chain that functions similarly to Ethereum’s ERC20 standard. It outlines how a token behaves, including how it can be transferred, who owns it, and how it's approved for use by third-party apps.

BEP20 tokens are:

Binance Smart Chain offers low gas fees, making transactions both fast and cost-effective.

Compatible with the Binance ecosystem (wallets, exchanges, DEXs).

Easily build, test, and deploy your token using Solidity, the most popular smart contract language.

Why Choose BEP20 Over Other Standards?

Here are some compelling reasons why developers and startups choose BEP20:

Lower Fees: Binance Smart Chain offers faster transactions at a fraction of Ethereum’s gas cost.

Growing Ecosystem: Supports popular DApps like PancakeSwap and Venus.

Developer-Friendly: Easy integration with familiar Ethereum development tools.

Interoperability: Can bridge with Ethereum and other networks.

Step-by-Step Guide to Create Your BEP20 Token

Let’s break down the process into beginner-friendly steps:

Step 1: Define Your Token Parameters

Before writing code, you must finalize your token details:

Token Name

Token Symbol

Decimals

Total Supply

Mintable or Fixed Supply

Burnable?

Ownable or Renounced Ownership

Clearly define the use case of your token — whether it's for payments, staking, governance, or rewards.

Step 2: Set Up Your Development Environment

You’ll need the following tools:

MetaMask: A crypto wallet to interact with BSC testnet/mainnet.

Remix IDE: An online development environment that allows you to write, compile, and deploy smart contracts directly from your browser.

BNB for Gas: Ensure you have BNB tokens in your wallet to cover transaction costs on the BSC network.

Step 3: Write Your BEP20 Smart Contract

Use Solidity to code your token. You can either write it from scratch or use verified templates like OpenZeppelin’s ERC20 contract, which is easily adapted for BSC.

Step 4: Compile and Deploy the Token

Open Remix IDE

Paste your code

Compile the contract using the Solidity compiler

Select the "Injected Web3" environment in Remix to link your MetaMask wallet.

Hit the "Deploy" button and approve the transaction in MetaMask to launch your token.

You’ve now deployed your BEP20 token on BSC Testnet.

Step 5: Verify the Smart Contract

After deploying, verify your contract on BscScan. This adds transparency and allows others to read and interact with your token contract easily.

To verify:

Go to your contract address on BscScan

Click “Verify and Publish”

Paste your Solidity code

Confirm compiler version and license

Step 6: Add Token to Wallet

To view your token in MetaMask:

Click “Import Tokens”

Paste your contract address

Enter token name and symbol

Done! Your token is now visible.

Step 7: Deploy on BSC Mainnet

After testing, you can deploy the same contract on BSC Mainnet.Just switch your MetaMask network and deploy using real BNB. Ensure everything is fully tested and audited before going live.

Optional Features to Add

Depending on your project’s goals, you can enhance your token with features like:

Burnable Tokens: Reduces supply over time

Mintable Tokens: Allows new token creation when needed

Pausable Contracts: Add emergency stop functionality

Governance Rights: Enable holders to vote on key decisions

Staking or Farming Support

OpenZeppelin provides reliable contract templates for all these functionalities.

Real-World Use Cases for BEP20 Tokens

Startups: Launch tokens for product access, loyalty, or fundraising

DeFi Platforms: Power yield farming, staking, and lending

Gaming Projects: In-game currency and rewards

NFT Ecosystems: Enable transactions, voting, or royalty payments

Pixel Web Solutions is a top-tier token development company specializing in Solana token development services. We focus on delivering secure, scalable, and fully customized token solutions. Leveraging Solana's high-performance network and its unique Proof-of-History (PoH) protocol, our expert team creates tokens with exceptional speed and efficiency. With a client-centric approach, we ensure every project is tailored to align with your specific business objectives and technical requirements.

0 notes

Text

What is Consumer Token Offering and How is it Useful?

In the fast-changing world of blockchain and cryptocurrency, a new concept is quietly positioning itself to take the spotlight: Consumer Token Offerings (CTOs). As businesses and entrepreneurs search for innovative ways to connect with their audiences, CTOs are emerging as a powerful tool in the crypto space.

Grasping what CTOs are and how they work is essential for both investors and entrepreneurs eager to tap into this rising trend. This guide explores the fundamentals of CTO development, highlighting their advantages and offering a roadmap for successful execution — especially when partnering with a reliable blockchain development company to ensure a seamless and secure implementation.

What is a CTO in Crypto?

A Consumer Token Offering (CTO) is a fundraising method where a company issues tokens directly to consumers, usually through a blockchain platform. These tokens often have specific functions within the company's ecosystem, such as providing access to exclusive products, offering discounts, or delivering other perks.

Unlike Initial Coin Offerings (ICOs), which are primarily focused on raising capital from investors, CTOs are designed to engage consumers directly and foster customer loyalty. While ICOs and Security Token Offerings (STOs) are more investment-driven, CTOs emphasize consumer participation and utility. For instance, a company might issue tokens that can be redeemed for product discounts or provide early access to new releases.

Notable examples of successful CTO implementations include Brave Browser, which rewards users with Basic Attention Tokens (BAT) for interacting with ads, and Filecoin, where users earn tokens by contributing storage space.

How CTOs Work?

Launching a Consumer Token Offering (CTO) in the crypto space involves several essential steps, starting with the creation of a consumer token on a blockchain platform. Blockchain technology ensures the token transactions are transparent, secure, and immutable.

The typical process includes the following stages:

Conceptualization: Define the token's purpose and its role within the company’s ecosystem.

Token Creation: Develop the token using a blockchain platform such as Ethereum or Binance Smart Chain.

Distribution: Make the tokens available to consumers, usually via a dedicated website or platform, ensuring ease of access and usability.

Engagement: Encourage consumers to actively use the tokens within the ecosystem, whether for purchasing products, accessing services, or utilizing other features.

Benefits of CTOs for Businesses

Boosting Customer Engagement and Loyalty

CTOs provide businesses with a unique opportunity to build stronger connections with their customers. By offering tokens that deliver tangible benefits, such as discounts or exclusive access, companies can incentivize loyalty and increase customer engagement. These tokens can be integrated into a larger loyalty program, encouraging repeat purchases and fostering long-term interactions with the brand. Collaborating with a trusted token development company can further enhance the creation and implementation of these innovative customer engagement solutions.

Financial Advantages and New Revenue Opportunities

For businesses, CTOs can unlock new revenue streams. Selling tokens directly to consumers generates immediate capital. Additionally, if the tokens appreciate in value, they can become valuable assets that businesses can leverage in the future. CTOs also offer a cost-effective method for promoting new products or services, as the tokens themselves can act as powerful marketing tools.

Benefits of CTOs for Consumers

From the consumer’s standpoint, joining a CTO offers various advantages. These incentives make CTOs an appealing option for consumers, motivating them to invest in a brand’s ecosystem.

Discounts and Rewards: Tokens often come with immediate benefits, such as discounts on products or services.

Exclusive Access: Consumers may receive early or exclusive access to new products, limited editions, or premium services.

Long-Term Value: If the token appreciates in value or the consumer continues to engage with the brand, the tokens can provide lasting benefits.

Steps to Launching a Successful CTO

From the consumer's perspective, participating in a CTO brings multiple benefits. These incentives make CTOs an attractive option, encouraging consumers to engage with a brand’s ecosystem.

Discounts and Perks: Tokens typically offer instant rewards, such as discounts on products or services.

Exclusive Access: Consumers may get early or exclusive access to new products, limited edition items, or premium services.

Long-Term Benefits: If the token increases in value or the consumer remains engaged with the brand, the tokens can continue to offer value over time.

Conclusion

CTOs offer businesses a unique opportunity to engage with consumers in innovative ways. By grasping the core principles of CTOs in crypto and recognizing their benefits, companies can effectively leverage this strategy to build customer loyalty, generate new revenue streams, and deliver long-term value to consumers.

#consumer token offering#token development#token development company#software development company#calibraint#blockchain development

0 notes

Text

Dunitech Soft Solutions is a leading NFT token development company dedicated to creating secure, scalable, and custom NFT solutions for diverse industries. We help businesses tokenize their assets, whether it's art, music, gaming, or real estate, with powerful blockchain-backed systems. Our expert developers craft unique smart contracts to ensure authenticity, ownership, and seamless trading. With Dunitech, step confidently into the future of digital asset innovation.

0 notes

Text

AI Crypto Token Development: A Comprehensive Guide

In this Article about AI Crypto Token Development: A Comprehensive Guide.

Introduction

Technology advances steadily and AI integration with blockchain technology produced AI tokens as a major achievement during recent years. The innovation of AI tokens establishes a new method through which tech companies can utilize AI technology. The integration between blockchain technology and AI creates more powerful functionality for both systems which promotes fresh possibilities for AI innovations.

Overview of AI Token Development

AI token development requires the construction of digital tokens which utilize artificial intelligence features in their operation. Blockchain platforms host these tokens that execute different operations including transaction facilitation and governance management and DApp operation.

Alliance Control brings AI capabilities to these tokens which enable automated decisions while the system produces predictions and delivers personalized experiences to users.

Role of AI in Token Development

The Crypto token development heavily relies on Artificial Intelligence because it creates automated and intelligent features that enhance the token functionality.

The development of self-administering and efficient tokens becomes possible through AI because it enables the evaluation of user data for customized services along with autonomous functionality based on predetermined rules.

AI tools assist token development through different functions which include optimizing distribution systems and enabling predictive security analytics for fraud prevention and implementing automated interactions with digital assets.

AI-driven tokens enhance operational efficiency because they decrease the requirements for human operator involvement which results in lower operational expenses and superior system performance.

How AI Tokens are Developed?

These two technologies are developing into integral components of decentralized ecosystems where AI marketplaces along with data sharing networks function using AI tokens. These AI tokens follow this step-by-step creation process:

Conceptualization and Ideation

The initiation of every successful AI token project begins with developing an effective concept. Project vision definition goes hand in hand with problem identification alongside the determination of blockchain and AI collaboration methods to solve that problem in this phase. Teams establish three components of the project: first the objectives for AI operations and secondly the AI functionality together with thirdly the token’s position in the system.

The token possesses three principal use cases to unlock AI resources and distribute value to users but also to maintain decentralized governance systems. The system development aims for the AI component and token to demonstrate clear functional value within their implementation.

Design and Architecture

The process of technical and structural foundation design follows successful idea solidification. Technical designers must develop procedures that determine how AI components join with blockchain systems. Teams establish procedures for secure authentication of data flow through the system as well as procedures to access or train AI models while defining rules for safe token handling.

Selecting the blockchain platform while deciding where the AI processing occurs forms part of architectural choices which also require protocols for privacy protection along with security measures and scalability enhancements. The technical along with economic objectives receive confirmation in this phase to verify project viability.

Smart Contracts

All blockchain-based systems operate through smart contracts and AI tokens require these contracts to establish their fundamental operational framework. Details about token functions all stem from two standards: ERC-20 on Ethereum and BEP-20 on Binance Smart Chain. These standards facilitate developers in adding essential features to tokens such as authority approval, transaction minting, transfer abilities and burning abilities.

The smart contracts typically include these governance elements together with distribution systems in addition to basic platform functions depending on platform requirements. Security needs must be addressed because contracts require extensive testing and independent auditing by external firms for avoiding bugs and exploits.

Tokenomics

The economic design of tokens falls under the category of Tokenomics where one defines both distribution methods and value procedures while establishing motivation frameworks. During this stage the development group determines all token supply attributes including founder shares and community portions together with deflationary or inflationary protocols.

Users earn and spend tokens through various actions such as purchasing AI services while staking also awards them rewards next to participating in governance voting. An excellent token economic system produces an enduring and healthy economic framework which connects user rewards to platform success.

Development and Testing

Development of the platform starts after architects define its structure and contracts have been established. Development work during this phase requires authors of smart contracts alongside integration of AI components while creating graphical user interfaces encompassing dashboards or marketplaces. New systems receive their initial deployment on testnet environments which duplicate real operations without exposing financial vulnerabilities.

The team conducts complete testing of smart contract functionality alongside AI model responses along with token flow mechanics and entire user experience operation. Testing helps to detect and resolve program glitches prior to product launch. Quality assurance activities together with external audits become crucial during this phase specifically for critical mission code.

Deployment and Integration

Publicizing the project is the last phase. Tokens can be distributed through public sales, airdrops, or community rewards, and smart contracts are implemented on the mainnet. Users can access the AI services, and the platform is linked to analytics tools, wallets, oracles, and potentially DeFi protocols. Documentation, tutorials, and support systems are part of the community onboarding process. The team’s post-launch priorities include ongoing updates, governance involvement, and growing the token and AI service ecosystem.

Benefits of AI Token Development

The process of creating digital tokens that incorporate artificial intelligence technologies is known as AI token development. In a variety of ecosystems, including data markets, machine learning models, and automated decision-making systems, these tokens can be used to support, oversee, and reward AI operations.

Numerous industries stand to gain greatly from the combination of blockchain technology and artificial intelligence.

The ability to establish transparent and decentralized AI markets is one of the main advantages of developing AI tokens. Tokens can be used in these markets to safely purchase and sell AI data or services.

This guarantees that data creators receive just compensation for their contributions in addition to lessening reliance on centralized data providers. Additionally, blockchain technology can offer an unchangeable and verifiable record of every transaction, increasing participant trust.

Enhanced Security Features

Improved Transparency and Traceability

Automation of Processes

Top 5 Future of AI Token Development

Decentralized AI Models

Tokenized AI Services

Governance via AI Tokens

Integration with Web3 and the Metaverse

AI Token Interoperability

Conclusion:

The creation of AI cryptocurrency tokens is transforming the way we create, distribute, and manage intelligent systems. These tokens open up new avenues for creativity, access, and cooperation by fusing the transparency and decentralization of blockchain technology with the strength of artificial intelligence. Projects that prioritize practical applications, robust tokenomics, and moral AI principles will set the standard for determining the direction of decentralized intelligence as the field expands.

0 notes

Text

From Concept to Launch: A Step-by-Step Guide to Crypto Token Development

In recent years, cryptocurrencies and blockchain technologies have disrupted the global financial landscape. Central to this revolution are crypto tokens—digital assets built on blockchain platforms that power decentralized applications, economies, and ecosystems. Whether you're launching a utility token for your DApp or a security token to represent real-world assets, understanding the development lifecycle is crucial for success.

In this comprehensive guide, we’ll walk you through the essential steps involved in crypto token development, from the initial concept to the final launch. Whether you're a startup founder, a blockchain enthusiast, or a business looking to explore tokenization, this roadmap will provide you with a clear direction.

Step 1: Define the Purpose of Your Token

Before jumping into development, it’s important to clarify the purpose of your token. Ask yourself:

What problem does the token solve?

What is its utility in your ecosystem?

Is it a payment token, utility token, governance token, or a security token?

Clearly defining the use case will shape the rest of your token’s development and help in attracting investors and users. For example:

A utility token enables access to features within a platform.

A security token represents investment in an asset and may be subject to regulations.

A governance token allows users to vote on platform decisions.

This foundation helps align technical development with business goals.

Step 2: Choose the Right Blockchain Platform

Choosing the right blockchain is pivotal. Popular options include:

Ethereum: The most widely used platform for token development (ERC-20, ERC-721, ERC-1155).

Binance Smart Chain (BSC): Known for faster transactions and lower fees.

Solana: Offers high throughput and scalability.

Polygon: A Layer 2 Ethereum scaling solution with lower fees.

Tron, Avalanche, Cardano, and others also offer specific advantages.

The selection depends on your needs: transaction speed, cost, security, developer support, and community adoption.

Step 3: Select a Token Standard

Token standards define how your token behaves on a blockchain. Common Ethereum standards include:

ERC-20: For fungible tokens, like cryptocurrencies.

ERC-721: For non-fungible tokens (NFTs).

ERC-1155: Supports both fungible and non-fungible tokens.

Each standard includes a set of rules the token must follow, ensuring compatibility with wallets, exchanges, and smart contracts.

Step 4: Design the Tokenomics

Tokenomics refers to the economic model of your token. A well-designed token economy ensures sustainable growth, user engagement, and value retention. Key components include:

Total Supply: Fixed or inflationary?

Distribution: How will tokens be allocated (team, investors, public)?

Incentives: Staking, burning, rewards, governance participation.

Utility: How and where the token is used.

Lock-in Periods: Vesting schedules for team and investors.

Tokenomics can make or break a project. It must be transparent and fair to appeal to both users and investors.

Step 5: Develop the Smart Contract

The smart contract is the engine behind your token. It defines how tokens are created, transferred, and managed. It should be:

Secure: Free from vulnerabilities like reentrancy, overflow, and underflow.

Gas Efficient: Optimized for low transaction costs.

Compliant: Include regulatory features if applicable (like KYC/AML support for STOs).

Popular programming languages:

Solidity: For Ethereum, BSC, and Polygon.

Rust: For Solana.

Use tools like Remix IDE, Truffle, or Hardhat for smart contract development and testing.

Step 6: Audit the Smart Contract

Security is non-negotiable in crypto. Before deploying your token, perform a thorough smart contract audit. This step helps identify vulnerabilities and ensures your contract behaves as intended.

You can choose:

In-house audit: If you have a strong technical team.

Third-party audit: Trusted firms like CertiK, Hacken, and ConsenSys Diligence.

A successful audit builds investor and user confidence and reduces the risk of hacks or financial losses.

Step 7: Deploy the Token

Once your contract is developed and audited, it’s time to deploy it on your chosen blockchain. This involves:

Using tools like Remix, Hardhat, or Brownie.

Paying gas fees for deployment.

Verifying the contract on blockchain explorers (e.g., Etherscan for Ethereum).

After deployment, your token is live and ready for integration.

Step 8: Integrate with Wallets and DApps

Make your token accessible by integrating it with popular wallets like:

MetaMask

Trust Wallet

Coinbase Wallet

This allows users to store, send, and receive your token. If your token supports a platform or DApp, ensure seamless interaction between the contract and user interfaces.

Step 9: Create a Token Launch Strategy

Having a solid launch strategy can determine your token’s market adoption and valuation. Consider the following:

a) Initial Token Offering

Choose the right model for your token offering:

ICO (Initial Coin Offering)

IDO (Initial DEX Offering)

IEO (Initial Exchange Offering)

STO (Security Token Offering)

Each has its pros and cons depending on regulatory requirements and exposure.

b) Exchange Listings

Get your token listed on decentralized (Uniswap, PancakeSwap) and centralized exchanges (Binance, KuCoin). Start with DEX listings as they are faster and less expensive.

c) Marketing and Community Building

Promote your token across:

Social media (Twitter, Telegram, Discord)

Crypto forums (Reddit, Bitcointalk)

Influencer marketing

PR and media outreach

A strong community is the lifeblood of any token project.

Step 10: Maintain and Scale

Once the token is live, your work is far from over. Ongoing maintenance and upgrades are essential to keep your ecosystem active and trustworthy.

Bug Fixes and Updates: Regular smart contract upgrades.

User Support: Handle inquiries, bugs, or feature requests.

New Partnerships: Grow your ecosystem through collaborations.

Scaling Solutions: Integrate Layer 2 or sidechains for performance.

Staying responsive and innovative will help your token gain long-term traction.

Step 11: Ensure Regulatory Compliance

Crypto token projects increasingly fall under scrutiny from regulatory authorities. Depending on your jurisdiction and the nature of your token (especially if it’s a security), ensure compliance with:

SEC (USA)

FCA (UK)

MiCA (EU)

Local KYC/AML Laws

Bonus Tip: Partner with a Token Development Company

If you lack technical resources or want to accelerate time-to-market, partnering with a reliable crypto token development company can help. These firms provide end-to-end services including:

Token creation

Smart contract development and audit

Tokenomics design

Whitepaper drafting

Token launch and marketing

Final Thoughts

Crypto token development is both a technical and strategic journey. From shaping a compelling idea to launching on a global stage, each step requires precision, planning, and adaptability. In a rapidly evolving space, success depends not just on innovation, but also on execution, community trust, and ongoing value creation.

If you're ready to launch your own crypto token or need professional guidance, the right expertise can make the difference between hype and lasting impact. Start with a strong foundation, and you’ll be well on your way to creating a token that fuels the future of decentralized innovation.

0 notes

Text

Crypto Coins vs Tokens: Which Holds More Long-Term Value?

Introduction

The world of cryptocurrencies has evolved away from just Bitcoin and Ethereum types. As the blockchain industry matures, newer digital assets, crypto tokens become more prominent. Are you planning to work as an investor, developer, or entrepreneur to create crypto token? Then understand the difference between crypto coin and token.

Coins and tokens are digital assets within blockchains, but there can be major differences in structure, purpose, and implications for the long-term value of these assets. This article aims to inform you about the difference between them, how the debate matters, and which one might actually carry bigger value in the long haul.

What are Crypto Coins?

Cryptocurrency or Crypto Coins are a digital payment system that doesn't rely on any banking system for the verification of its transactions. It serves as a peer-to-peer system that can induce anyone anywhere to accept and make payments. Cryptocurrency payments are entirely digital entries submitted to an online database detailing specific transactions, as opposed to cash that is carried about and exchanged in the real world. Transactions involving bitcoin funds are recorded on a public ledger. Cryptocurrencies are stored in digital wallets.

Examples: Bitcoins, Ethereum, Litecoin.

What are Crypto Tokens?

Crypto tokens are digital assets that are created on the blockchain network usually through smart contracts. These tokens can be representations of value or utility pertaining to something else such as equity in a company, access to some service or platform, or the very real asset of a property or an artwork. What these tokens do is invoke blockchain technology to be created, transferred, and managed in a decentralized manner guaranteeing transparency and security.

Examples: ERC 20, ERC 721/ERC 1155, BEP 20.

Why does Coins vs Tokens Debate matter?

A coin vs token debate matters because it lays out the foundational differences in how digital assets operate in the blockchain ecosystem. While coins like Bitcoin and Ethereum operate on their own blockchains and are often used as the main currency of the network, tokens are usually implemented on top of an existing blockchain and usually serve some specialized purpose, to be found decentralized applications (dApps), allow governance, or offer utility for a DeFi platform.

If you are an investor, developer, or startup, then it matters. For example, a long-term investor may want coins for their security and adoption, whereas a business may want to create a token for faster deployment and lower costs. Tokens can also have regulatory risks since they serve multiple functions, so compliance is always very relevant.

Key Difference between Tokens and Coins

Knowing how cryptocurrencies tokens and coins differ is crucial if you want to invest, develop on blockchain, or just create your own token. While both of them represent digital assets, their creation, use, and maintenance differ. The primary distinctions are outlined below:

Blockchain Ownership

Coins work on their own blockchain (e.g., Bitcoin on Bitcoin Blockchain, Ethereum on Ethereum Blockchain).

Tokens on the other hand exist on top of an existing blockchain such as Ethereum (ERC-20), BNB Chain (BEP-20), Solana, etc.

Creation Process

Coins require the setting up of a new blockchain protocol from scratch.

Tokens are issued on top of an existing blockchain through smart contracts and are thus easier and faster to deploy.

Functionality

Coins are used as digital money for transactions, as stores of value, and to run the network by paying gas fees or staking.

Tokens are built with utility-based applications, e.g., for governance, accessing dApps, DeFi operations, or representing assets such as NFTs.

Transactional Fees

Coins have their transactional fees paid using the coin itself (e.g., ETH to pay for gas fees on Ethereum).

Tokens however have their transaction fees paid for using the blockchain's native coin (e.g., you need ETH to send ERC-20 tokens).

Examples

Coins: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC)

Tokens: UNI (Uniswap), LINK (Chainlink), AAVE, and BAT (Basic Attention Token)

Which Holds More Long-Term Value?

Bitcoin- and Ethereum-type coins often may hold long-term value because their underlying chains benefit from network effects and widespread adoption. They are used for primary functions, including transactions, staking, and securing the network.

Tokens on the other hand, are launched on top of any of the existing chains, offering high growth potential in categories such as DeFi, gaming, and governance. However, with their value tied closely to the fortunes of the platform they support, come high risk and regulatory uncertainty.

In Summary:

Coins: Infrastructure, more stable, long-term utility

Tokens: High upside, niche, risky

So, a crypto strategy could have a blend of coins for stability and tokens for innovation.

Use Cases for Crypto Coins and Tokens

Crypto Coins

Currency: Used for payments (e.g., BTC, LTC)

Network Fuel: ETH is required for dApp transactions

Store of value: The valuations of digital gold and bitcoin are similar

Staking/Validation: Coins like ADA, DOT used in proof-of-stake systems

Crypto Tokens

Utility: Filecoin (FIL) used to access storage

Governance: UNI or AAVE used for voting

Rewards: BAT rewards users for ad engagement

DeFi: SUSHI, COMP, and others power DeFi platforms

Gaming/Metaverse: SAND, AXS used within digital worlds

Conclusion

Cryptocurrency coins tend to offer a more fundamental value in the long run, as they generally support their independent blockchains. However, tokens are far more flexible in design and prototype, pulling industries like DeFi and metaverse with them.

Creating a token can be a strong and scalable method of starting up in the cryptocurrency scene without the overhead of technically developing a whole new blockchain. But long-term value stems from utility and support the community and ecosystem provided.

So, both coins and tokens can be considered valuable depending on use cases and the utility plus adoption and innovation, requiring smart research and vision for the long haul.

0 notes

Text

In this video about Explore Our Top 5 Comprehensive Token Development Services by Blockchainx

0 notes

Text

CoinDeveloperIndia is a top Meme Coin Development Company offering end-to-end crypto solutions like token creation, smart contracts, blockchain integration, wallet development, and exchange listing. We ensure secure, scalable, and high-performance meme coins to help your project thrive. Launch your meme coin today!

📩 Email: [email protected] 📞 WhatsApp: +91 7014607737 Let’s turn your crypto vision into reality! 💰🔥 Contact us now!

0 notes

Text

Technoloader is a leading Meme Coin Development Company specializing in creating unique and engaging meme-based cryptocurrencies. We offer end-to-end services, including smart contract development, tokenomics design, and blockchain integration, ensuring innovative and market-ready solutions to boost user engagement and drive community-focused crypto projects.

1 note

·

View note

Text

How to Launch an ICO: Your Essential Guide to a Successful Token Offering!

Thinking about launching an Initial Coin Offering (ICO)? This comprehensive guide from Pixel Web Solutions breaks down the entire process, from planning and legal considerations to marketing and post-launch strategies. Don't miss out on crucial steps for a successful token launch!URL: https://www.pixelwebsolutions.com/how-to-launch-an-ico/

0 notes

Text

Customized Crypto Token Development Solutions for All Blockchain Platforms

Create tailored crypto tokens for your business with our expert development services. We deliver customized solutions compatible with leading blockchain platforms, ensuring secure and efficient token functionality. Empower your brand with innovative token technology!

To learn more, visit our website: https://lbmsolutions.in/crypto-coin-development-services/

0 notes

Text

Explore Our Top 5 Comprehensive Token Development Services — BlockchainX

The fully-explained range of services will be discussed along with their capabilities to help you reach your blockchain objectives.

Introduction:

Blockchain technology enables unprecedented opportunities throughout the digital world but it especially transforms the domain of cryptocurrencies along with digital tokens. The token development services at BlockchainX assist clients to build their standalone cryptocurrency or token.

BlockchainX serves as your premier partner for token development services that cover distinctive custom token projects and meme coins and decentralized finance (DeFi) developments.

Our company delivers solutions which support diverse industry requirements and business needs. Our team uses modern technologies along with their professional knowledge to fulfill your token concepts while ensuring their market acceptability.

Our Comprehensive Token Development Services:

1. Custom Token Development:

Our fundamental duty at BlockchainX includes developing customized tokens through our custom token development service. The team at BlockchainX creates specialized token development services which serve unique needs for building tokens across specific projects, businesses and new platforms.

What do we Do?

Token Standards: BlockchainX develops secure and efficient custom tokens through established token standards which include ERC-20, Bep20, TRC20, ERC-721, ERC-1155.

Smart Contract Development: Our team develops smart contracts to establish token operational rules alongside transparency features that build trust. Users need to specify tokenomics parameters alongside supply controls and distribution procedures.

Integration: Our team performs system integrations between your token and your current operations including platforms or exchanges through accessible methods. Our platform delivers tokens which serve cryptographic payments and dApps as well as loyalty management systems according to your particular requirements.

2. Designing Meme Coins:

Meme coin design has resulted in tremendous cryptocurrency achievement through itty-bitty digital coins like Dogecoin and Shiba Inu which demonstrate that entertainment and innovation drive success. Your project seeking meme coin development will find expertise at BlockchainX where they create MEME coin intended for viral success and active community participation.

What do we Do?

Community Engagement: To achieve success meme coins need a robust and engaged community whose support spreads through social media networks. Our team develops exciting promotional methods that enable you to reach your meme coin across multiple social networking platforms.

Tokenomics: Tokenomics require appropriate design of supply-demand-distribution elements that establish unforgettable yet durable meme coin projects.

Smart Contract Development: Meme coins operate through the use of smart contracts for their functioning. Usable team works to develop secure smart contracts that match your business requirements and operate efficiently.

3. AI-Based Tokens:

The blockchain sphere becomes more integrated with artificial intelligence by way of AI-Based Tokens. BlockchainX implements AI-based tokens through their innovative solutions which unite blockchain technology with AI intelligence functions to produce enhanced tokens with advanced features.

What do we Do?

Token with AI Integration: The integration of AI functionalities within our token makes automated decision processes possible alongside predictions and real-time data assessments which improves the operational power of your cryptocurrency.

Machine Learning: Use of machine learning enables the development of tokens which connect to algorithms to yield superior data analysis and prediction capabilities.

AI-powered dApps: Decentralized applications (dApps) which use AI gain from our capabilities for developing automatic complex functionality that creates user-friendly interfaces.

4. DeFi Tokens:

Among the revolutionary areas of the blockchain ecosystem lies Decentralized Finance (DeFi) which power themselves through DeFi Tokens. The DeFi tokens function as operational elements for decentralized financial operations which include lending and borrowing services together with staking and yield farming activities. BlockchainX supports you through designing and deploying DeFi token solutions which combine security elements with transparency functionality and operational efficiency.

What do we Do?

Liquidity Pool Creation: BlockchainX develops tokens for enabling decentralized liquidity pools which let users engage in peer-to-peer asset lending and borrowing.

Staking Mechanisms: Our system designs staking tokens that enable contract users to stake tokens and earn rewards together with passive income.

Smart Contract Development: We build secure yet trustless smart contracts through development work that removes financial transaction requirements for third-party involvement.

5. Equity/Asset-Backed Tokens:

Asset and equity-backed tokens provide digital ownership of physical assets that include stocks bonds along with real estate properties and commodities. The BlockchainX solution assists businesses to develop tokens which link to actual market-based value so assets become simpler to tokenize when trading in digital markets.

What do we Do?

Tokenization of Assets: The company helps clients transform beneficial assets including real estate and company stocks and physical products into digital tokens. The tokens function as virtual symbols which represent legal asset ownership.

Regulatory Compliance: The tokens develop under regulatory guidelines and follow essential protocols for securities together with asset-backed token requirements as well as other relevant legal standards.

Smart Contract Creation: The process includes building essential smart contracts which handle token emission and ownership duties together with asset transfer administration.

Conclusion:

BlockchainX serves as the destination for complete token development requirements. We possess both skills and experience to develop any token project from custom ones to meme coins with AI features along with DeFi tokens and real-world asset tokenization.

Through our skilled team and state-of-the-art technology we provide complete step-by-step guidance which makes your tokens secure and scalable for superior project success. You can reach our team now for transforming your token concept into a real project.

#token development#token development services#cryptocurrency#blockchain#blockchain development#blockchainx

0 notes