#The best industries for Financial and Investment Analysts.

Text

Best Jobs in Finance

Best Jobs in Finance

Where are the best jobs in Finance?

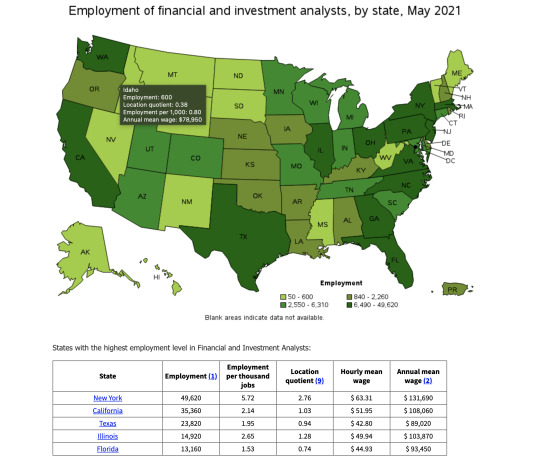

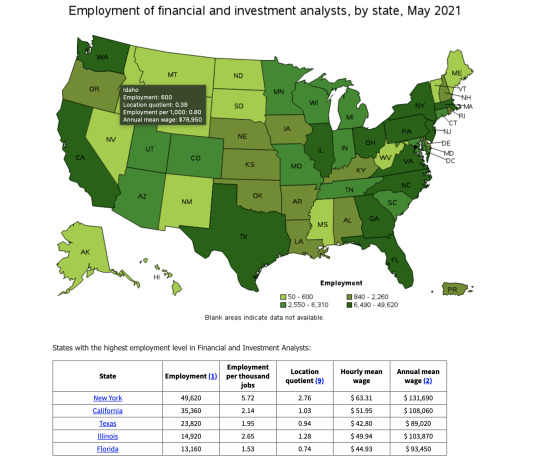

The map below shows us that the typical stereotype of Financial professionals coming from the big city is probably not a stereotype at all. Based on the data, your chances of landing a job in finance in of the following states is much higher than if you go to a state like North Dakota. However, you may want to keep in mind that the competition is higher in…

View On WordPress

#based on salary#Best Jobs in Finance#Best places for high paying Financial and Investment Analysts jobs outside of the city.#Financial and Investment Analysts#Financial and Investment Analysts careers#Financial and Investment Analysts jobs#How much do Financial and Investment Analysts make in salary?#Monetary Authorities#Securities and Commodities#The best industries for Financial and Investment Analysts.#top paying salary in finance#U.S. Bureau of Labor Statistics#Where are the best jobs in Finance?#Worst places for Financial and Investment Analysts to live based on salary.

0 notes

Text

Best Jobs in Finance

Best Jobs in Finance

Where are the best jobs in Finance?

The map below shows us that the typical stereotype of Financial professionals coming from the big city is probably not a stereotype at all. Based on the data, your chances of landing a job in finance in of the following states is much higher than if you go to a state like North Dakota. However, you may want to keep in mind that the competition is higher in…

View On WordPress

#based on salary#Best Jobs in Finance#Best places for high paying Financial and Investment Analysts jobs outside of the city.#Financial and Investment Analysts#Financial and Investment Analysts careers#Financial and Investment Analysts jobs#How much do Financial and Investment Analysts make in salary?#Monetary Authorities#Securities and Commodities#The best industries for Financial and Investment Analysts.#top paying salary in finance#U.S. Bureau of Labor Statistics#Where are the best jobs in Finance?#Worst places for Financial and Investment Analysts to live based on salary.

0 notes

Text

Advanced Tips and Tricks for Global Market Trading

Trading in the global market can be both exciting and profitable if you employ the right strategies. Whether you're dealing with Forex, commodities, or other investments, these advanced tips will set you up for success.

Master Technical Analysis: Technical analysis is crucial for predicting market movements. Learn to read charts and use indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). These tools help you identify trends and make informed trading decisions.

Choose the Best Trading Platform: Selecting the right trading platform is essential. Look for platforms that offer real-time data, analytical tools, and a user-friendly interface. Good platforms also provide educational resources and excellent customer support.

Diversify Your Investments: Diversification reduces risk. Spread your investments across different asset classes like Forex, commodities, and stocks. This approach ensures that your portfolio is protected from market volatility.

Stay Updated with Market News: Keeping up with global news, economic events, and market trends is vital. Regularly read financial news and reports. Use economic calendars to track important events that might impact your trades.

Implement Risk Management Strategies: Effective risk management is key to long-term success. Use stop-loss orders to limit potential losses and ensure no single trade can hurt your portfolio too much. This way, you can trade with confidence.

Follow Expert Insights: Industry experts and analysts provide valuable insights. Platforms like TradingView and social media channels can offer advanced strategies and techniques. Learning from these experts can enhance your trading approach.

Use Automated Trading Systems: Automated trading systems can execute trades based on pre-set criteria, helping you take advantage of market opportunities without constant monitoring. Understand the algorithms and monitor their performance regularly.

Focus on Continuous Learning: The trading world is always changing. Participate in webinars, attend workshops, and take online courses to stay updated with the latest strategies and trends. Continuous learning helps you stay ahead.

Monitor Your Performance: Regularly review your trades and performance. Keep a trading journal to track your decisions, outcomes, and lessons learned. This practice helps you improve your strategies and avoid repeating mistakes.

Partner with Reliable Brokers: Choosing a reliable broker is crucial. Look for brokers with competitive spreads, low fees, and robust security measures. A good broker provides the tools and support you need for successful trading.

Trust APM for more expert insights and trading solutions.

2 notes

·

View notes

Text

Why Work In The UK? Exploring Job Vacancies And The Top 10 Highest Paid Professions In 2023

The United Kingdom, often referred to as the UK, has long been a favoured destination for individuals seeking new career opportunities and a high standard of living. With its rich history, diverse culture, and thriving job market, the UK remains an attractive option for job seekers worldwide. In this article, we will delve into the reasons why you should consider working in the UK, explore the current job vacancies, and highlight the top 10 highest paid professions in 2023 along with their annual salaries.

Why Work in the UK?

1. Economic Stability

The UK boasts a stable and robust economy, making it an ideal place to pursue your career goals. Despite global economic fluctuations, the country has consistently demonstrated resilience and growth, creating a secure environment for professionals across various industries.

2. Multicultural Society

The UK is a melting pot of cultures, languages, and traditions. This diversity fosters a welcoming and inclusive atmosphere, allowing individuals from different backgrounds to thrive and feel at home. Working in such a multicultural environment can be an enriching experience both personally and professionally.

3. Access to World-Class Education

For those with families, the UK offers access to some of the world's best educational institutions. Whether you have school-age children or are considering furthering your own education, the UK provides ample opportunities for personal and academic growth.

4. Healthcare Benefits

The UK's National Health Service (NHS) provides free healthcare services to residents. This means you and your family can access quality medical care without worrying about high medical expenses.

5. Cultural and Recreational Opportunities

From historic landmarks to vibrant cities, the UK offers an array of cultural and recreational activities. Whether you prefer exploring museums, enjoying live performances, or hiking in the picturesque countryside, the UK has something to offer everyone.

Job Vacancies in the UK

The UK job market is diverse, catering to a wide range of skill sets and professions. As of 2023, here are some of the sectors with promising job vacancies:

1. Information Technology (IT)

The IT sector continues to flourish in the UK, with a high demand for software developers, data scientists, and cybersecurity experts.

2. Healthcare

The healthcare industry consistently seeks qualified professionals, including doctors, nurses, pharmacists, and healthcare administrators.

3. Finance and Banking

London, the UK's financial hub, provides numerous opportunities for finance professionals, including investment bankers, financial analysts, and accountants.

4. Engineering

The engineering sector requires skilled individuals in various fields, such as civil engineering, mechanical engineering, and electrical engineering.

5. Creative Industries

The UK's creative industries encompass film, television, advertising, and design, offering opportunities for artists, writers, and multimedia professionals.

Top 10 Highest Paid Professions in the UK (2023)

For those aspiring to earn a substantial income in the UK, here are the top 10 highest paid professions in 2023, along with their average annual salaries:

Surgeon: Surgeons top the list with an average annual salary of approximately £112,000. Their expertise and the critical nature of their work command a high income.

Anesthesiologist: Anesthesiologists closely follow, earning an average of £110,000 per year for their crucial role in surgical procedures.

Dentist: Dentists earn around £90,000 annually, reflecting the importance of oral healthcare.

General Practitioner (GP): GPs, who provide primary healthcare services, have an average salary of £80,000 per year.

Pharmacist: Pharmacists earn approximately £70,000 annually, ensuring access to essential medications for the public.

IT Director: IT Directors oversee technology strategies and earn an average of £65,000 per year.

Marketing Director: Marketing Directors command an average salary of £60,000, reflecting the importance of strategic marketing.

Finance Director: Finance Directors in the UK earn around £60,000, overseeing financial operations for organizations.

Legal Director: Legal Directors, responsible for legal affairs, earn an average of £58,000 annually.

Aircraft Pilot: Aircraft Pilots round out the top 10, with an average annual salary of £55,000 for their role in ensuring safe air travel.

These figures are approximate and can vary based on factors such as experience, location, and employer. However, they provide a general overview of the earning potential in these professions in the UK.

In conclusion, the United Kingdom offers a wealth of opportunities for individuals seeking fulfilling careers and a high standard of living. Its stable economy, diverse culture, and strong job market make it an attractive destination for job seekers worldwide. With numerous job vacancies across various sectors and the potential for lucrative incomes, the UK remains a top choice for those looking to advance their careers in 2023 and beyond.

Aspiring to work in the UK?

We will help make your dream come true.

How Can We Help You

With our end-to-end U.K. Skilled Worker visa assistance, you can make the most of this opportunity. Learn how to start your career in the United Kingdom by contacting us.

Realise your UK Work Dream: Choose Work Permitz

Providing successful and affordable visa services for ages!

Customised Guidance

Our consultants understand your requirements and then only decide the further course of action. We ensure to provide you with personalized guidance rather than just following a standard approach to getting your visas approved.

2 notes

·

View notes

Text

Why SAP global certification is the Best program for career growth & global job opportunity?

What is SAP? SAP is System Application and Products in Data processing. Nowadays having a proper certification can significantly boost ones career and open doors for global job opportunities. One such leading programs is SAP which provides enterprise software solutions. SAP software is an European multinational company, they focus on providing software solutions for better understanding and management of business and their customers.

Some of the comprehensive courses provided by SAP are finance, logistics, human resources and many more. The course certification is acknowledged on global basis.

One of the key advantages of the SAP global certification program is its recognition worldwide. With over 400,000 customers in more than 180 countries using SAP solutions, there is a high demand for professionals with SAP skills across the globe .This opens up a plethora of job opportunities on a global scale.

Benefits of SAP courses

Streamlined Processes: SAP helps organizations streamline their business processes by automating tasks, eliminating the manual effort, and reducing inefficiencies.

Enhanced Decision-Making: the course provides robust data management and analytics capabilities, enabling organizations to access real-time, accurate information.

Improved Collaboration and Communication: It enables the seamless integration and data exchange between different functional areas, enhancing cross-functional collaboration and teamwork.

Increased Visibility and Control: SAP offers comprehensive visibility into organizational data, processes, and operations.

Scalability and Flexibility: SAP solutions are scalable and flexible, accommodating the changing needs and growth of organizations.

Enhanced Customer Experience: SAP's customer relationship management (CRM) solutions enable organizations to deliver a personalized and exceptional customer experience.

Improved Supply Chain Management: It enables organizations to improve demand planning, inventory management, procurement, and logistics, resulting in reduced costs, improved order fulfillment, and better customer satisfaction.

Compliance and Risk Management: It provides functionalities for governance, risk management, and compliance (GRC), helping organizations mitigate risks, ensure data security, and demonstrate compliance with legal and industry regulations.

Innovation and Digital Transformation: SAP embraces emerging technologies and drives innovation to support organizations in their digital transformation journey.

As multinational companies expand their operations across borders, they require professionals who can support and manage their SAP software system worldwide. This opens up many possibilities for career growth in international work experiences and also being an SAP certified professional it can also lead to higher earning potential, individuals with an SAP certificates tend to earn more as compared to their non-certified counterparts. This financial incentive further emphasizes the value of investing in an SAP global certification for career growth.

Job opportunities in SAP

SAP Consultant: SAP consultants provide expertise and guidance on implementing, configuring, and customizing SAP solutions to meet the specific needs of organizations

SAP Functional Analyst: SAP functional analysts focus on understanding business requirements and translating them into functional specifications for SAP solutions.

SAP Technical Developer: They are responsible for developing, customizing, and maintaining SAP applications.

SAP Project Manager: SAP project managers oversee the planning, execution, and delivery of SAP implementation or upgrade projects

SAP Administrator: SAP Basis administrators manage the technical infrastructure of SAP systems. They are responsible for system installation, configuration, monitoring, performance optimization, and security management of SAP landscapes

SAP Data Analyst: SAP data analysts focus on managing and analyzing data within SAP systems. They extract and manipulate data, perform data validation, create reports and dashboards.

SAP Supply Chain Consultant: SAP supply chain consultants work on projects related to supply chain management, procurement, inventory management, logistics, and production planning using SAP solutions.

Why is SAP global certification important?

SAP Global Certification is important as it validates an individual’s skills, acquires an industry recognition, provides a competitive advantage, strengthens career opportunities, opens up global job prospects, promotes continuous learning, and instills employer confidence. Thus considered a valuable investment for professionals seeking career growth in the field of SAP and for organizations looking to hire skilled SAP professionals.

#course#sap course#education#learning#career#student#careeropportunities#sap online training#productivity

2 notes

·

View notes

Text

List of Best Trading Apps in India 2023

The world of trading has become more accessible than ever before, thanks to the rise of trading apps. With just a few clicks on your smartphone, you can now buy and sell shares in real-time from anywhere in India. But with so many options available, which trading app should you choose? In this article, we've compiled a list of the top 10 best trading apps in India for 2023. Whether you're a seasoned trader or just starting out, this comprehensive review will help you find the perfect app for your needs. So let's dive right into it!

List of the Top 10 Trading Apps in India

Zerodha: With over 3 million users, Zerodha is one of the most popular trading apps in India. It offers a user-friendly interface and low brokerage fees, making it an excellent choice for both beginners and experienced traders.

Upstox: Another top-rated app is Upstox, which boasts a simple yet effective platform for buying and selling stocks. It has competitive pricing and advanced charting tools to help you make informed decisions.

Angel Broking: Known for its extensive research capabilities, Angel Broking provides valuable insights into market trends that can help investors maximize their profits. The app also features a range of financial products like mutual funds and insurance.

Groww: A relatively new player in the market, Groww has quickly gained popularity thanks to its zero-commission policy on stock trades and easy-to-use interface.

Kotak Securities: This app by Kotak Mahindra Bank offers seamless integration with your bank account, allowing you to transfer funds seamlessly between them while trading shares or investing in mutual funds.

Sharekhan: With more than 20 years of experience in the market, Sharekhan is known for its robust research reports that provide detailed analysis of stocks from various sectors.

Edelweiss: Offering customizable watchlists and charts along with real-time news updates, Edelweiss makes it easier for investors to stay up-to-date with current events affecting their investments.

HDFC Securities: This app by HDFC Bank provides access to global markets along with local ones at affordable prices while providing comprehensive research reports covering several industries

ICICI Direct: ICICI direct allows you not only trade through mobile but also via call-n-trade. Their simplified version makes it perfect even if you are a beginner

Axis Direct: Last but not least AxisDirect comes equipped with all essential features including personalized alerts, easy order placement and comprehensive market analysis tools.

Complete Review of All Best Trading Apps in India

When it comes to choosing the best trading app in India, there are plenty of options available. But which one is right for you? In this complete review of all the best trading apps in India, we will take a closer look at each one and help you make an informed decision.

First up is Angel Broking. With its user-friendly interface and advanced charting tools, Angel Broking makes it easy for beginners to get started with trading. It also offers low brokerage fees and instant fund transfer options.

Next on our list is Zerodha. Known for its no-brokerage policy, Zerodha has quickly become a popular choice among traders in India. The app offers various features such as market depth analysis, advance charts and technical indicators.

Groww is another great option for those looking for a seamless trading experience. Its simple design allows users to navigate through the app with ease while offering commission-free investments in mutual funds.

Kotak Securities’ mobile application provides real-time updates on the stock market along with research reports from their team of experts giving you valuable insights about specific companies' performances based on their financial history.

Edelweiss Trading App combines investment opportunities with insightful advice from analysts making sure that traders make informed decisions before investing money into stocks or mutual funds

These are just some of the top contenders when it comes to finding the best trading app in India - but ultimately, your choice will depend on what suits your needs as an investor or trader.

To sum up, in this article we have discussed the top 10 trading apps in India for the year 2023. We have reviewed each app based on its features, user interface and overall performance.

Whether you are a beginner or an experienced trader, these apps offer you a seamless experience with no brokerage charges and easy access to market data.

Angel Broking, Zerodha and Kotak Securities are some of the popular names that provide unique features to make your trading journey smooth. Edelweiss also offers reliable services with advanced charts and tools.

Groww is another great option for beginners as it has a simple user interface along with low brokerage fees. nifty bees share price can be easily tracked through Angel One while Old Mumbai Chart provides historical data essential for analysis.

Each app excels in different areas making them suitable for different types of traders. So choose the one that best fits your requirements and start trading today!

After analyzing and reviewing the top 10 trading apps in India, it is evident that each app has its unique features and benefits. Whether you are a beginner or an experienced trader, there is an app on this list that will suit your needs.

From Angel Broking's seamless user interface to Zerodha's low brokerage fees, each app offers something special. Other notable mentions include Kotak Securities' advanced charting tools, Edelweiss' research reports, and Groww's zero brokerage platform for mutual funds.

Choosing the best trading app in India can be challenging. However, by assessing your needs as a trader and comparing them with the offerings of these top 10 trading apps, you can find one that perfectly suits you. So go ahead and download your favorite trading app today

Related - https://hmatrading.in/best-trading-app-in-india/

Source - https://sites.google.com/view/list-of-best-trading-apps

#best trading app in india#best trading app in india 2022#angel broking login#zerodha brokerage calculator#nifty bees share price#angel one share price#kotak securities login#edelweiss share price#old mumbai chart#angel broking share price#no brokerage#groww brokerage calculator#angelone share price#HMA Trading

2 notes

·

View notes

Text

Business News - Media Review It

Business news articles are written to inform readers about the latest developments and happenings in the business world. These articles can cover a variety of topics, including corporate mergers and acquisitions, stock market trends, financial reports, and more.

The purpose of a business news article is to provide readers with relevant and timely information that can help them make informed decisions about their Personal finance tips, business strategies, and other Best credit cards for rewards. These articles may be written by journalists, financial analysts or other industry experts and are usually published in newspapers, magazines and online news sites.

One of the most important characteristics of a good breaking business news is the ability to provide context and analysis. For example, a news article about a major corporate merger may not only detail the merger itself, but also provide insight into how the merger will affect the entire industry. Similarly, an article about a new government policy affecting business may include expert commentary on the policy's potential impact.

Another significant aspect of a latest business news is its ability to engage your readers. To be effective, a business news article should be written clearly and concisely, emphasizing the most significant information. The essay should also be well structured, with a clear introduction, structure, and conclusion.

Business news articles generally play a significant role in keeping readers abreast of the latest developments in the business world. Media Review It offers to help readers make better decisions about their investments, financial planning services, and other financial decisions by providing the right information and analysis at the right time.

Social Media Link -

https://www.facebook.com/mediareviewit1

https://twitter.com/Mediareviewit1

2 notes

·

View notes

Text

Villar S. Boyle: An Investment Leader Who Transformed Ergo Partners

Investment is a vital element of the business world, and Villar S. Boyle is one of the best investment leaders in the industry. As the CEO of Ergo Partners, he has transformed the company into a global investment powerhouse with over $120 billion in assets under management. Villar S. Boyle, leadership, and business acumen have been instrumental in Ergo Partners' success. In this blog post, we'll take a closer look at his service and how he has contributed to Ergo Partners' growth.

Early Years and Education

Villar S. Boyle was born and raised in the United States. He completed his undergraduate studies at the University of Chicago, where he majored in Economics. He then went on to earn his MBA from Harvard Business School, where he specialized in Finance.

Professional Journey

Boyle's career began at a prominent investment bank, where he gained experience in investment banking, private equity, and mergers and acquisitions. He then joined Ergo Partners as an analyst in the firm's New York office. Over the years, he climbed the ranks and held several key positions before being named CEO in 2014.

Leadership at Ergo Partners

As CEO, Villar S. Boyle has led Ergo Partners through a period of significant growth and expansion. Here are some of the key initiatives he has implemented:

• Diversification: Under Boyle's leadership, Ergo Partners has diversified its investment portfolio across various sectors, including real estate, technology, and energy. This has helped the firm weather market fluctuations and generate consistent returns.

• Global Expansion: Ergo Partners has expanded its operations to Asia, Europe, and the Middle East, thanks to Boyle's vision and leadership. The firm now has a global presence, with offices in major financial centers around the world.

• Strategic Partnerships: Boyle has cultivated partnerships with significant strategic clients, industry leaders, and government officials. These partnerships have helped Ergo Partners access new markets, identify new investment opportunities, and strengthen its reputation in the industry.

• Succession Planning: As part of his leadership development initiatives, Boyle has implemented a robust succession planning program. This ensures that the company has a pipeline of talented executives who are ready to take on leadership roles as needed.

• Culture: Boyle has reinforced Ergo Partners' vision and culture, emphasizing the importance of integrity, teamwork, and a long-term perspective. This has helped create a cohesive and motivated workforce that is committed to delivering exceptional results.

• Philanthropy: Villar S. Boyle is a strong advocate for philanthropy, and he encourages Ergo Partners to give back to the community. The firm supports various charitable organizations, and Boyle is personally involved in several philanthropic initiatives.

• Innovation: Boyle is a strong proponent of innovation, and he encourages Ergo Partners to stay ahead of the curve. The firm has invested in cutting-edge technologies and is constantly exploring new investment opportunities.

• Risk Management: As CEO, Boyle places a strong emphasis on risk management. He has implemented robust risk management policies and procedures, which have helped the firm mitigate risks and avoid costly mistakes.

• Thought Leadership: Boyle is a recognized thought leader in the investment industry. He frequently speaks at conferences and events, sharing his insights and expertise with industry peers. He also contributes to leading publications and blogs on investment topics, helping to shape the discourse around investment trends and best practices.

Conclusion

Villar S. Boyle's leadership has been instrumental in Ergo Partners' success. His vision, business acumen, and ability to execute have transformed the company into a global investment powerhouse. Under his leadership, Ergo Partners has diversified its portfolio, expanded globally, cultivated strategic partnerships, implemented a robust succession planning program, and reinforced its vision and culture. It's no wonder that Boyle is widely regarded as one of the best investment leaders in the industry.

3 notes

·

View notes

Text

The Future of Mutual Funds - All that you need to know

India is rapidly seeing an escalating digital revolution. Whether it is internet penetration, data uptake or even the latest technology trends, India is applauded worldwide. All this started back in 2015 when the government of India initiated the Digital India Programme.

Later in 2016, demonetization was a big step in the digital era. All these events resulted in the growth of opportunities in the field of the mutual fund industry. Investors have also started to adopt mutual funds as their means of investment.

Mutual Fund Industry - How it got evolve?

Initially, many investors believed that investing in mutual funds was not suitable for them. However, a series of events changed the opinion of the people.

The announcement of demonetization by Narendra Modi, Donald Trump's win, an increase in oil prices and an asset base of 17 lakh were seen in 2016; all these events led to awareness in the mutual fund field in our country.

Also, the CAGR (Compounded Annual Growth Rate) was 18% which was a huge step in the evolvement of the mutual fund industry.

SIP- A facility offered by mutual funds to the investors

SIP is a big factor leading to rapid growth in the industry. Today, more than one crore of customers have active SIP, i.e. Systematic Investment Plans.

If mutual funds industry growth is to be considered, the Indian market is already booming. The most significant indication is the number of foreign-based management companies progressing into the Indian market.

If the latest data is to be considered, the MF industry's total AUM had risen 20 per cent to Rs 37.6 trillion in 2021-22. The industry added 31.6 million net new folios, taking the count to 129.5 million.

The systematic investment plan expanded to Rs 12,328 crore in FY22, with new SIP registrations at 26.6 million. Apparently, mutual funds in India are more likely to penetrate urban, semi-urban and rural areas. For this, some financial planners make the process easy by financial planning.

Opportunities in the mutual fund industry

Be it any industry, improvement is one rule that leads to positive change. In the mutual fund industry field, large-scale changes have been taking place, leading to evolution and innovation.

For example, new opportunities have evolved in asset management, which requires investments in different assets, including securities, stocks, bonds, and real estate, managed by a manager.

It also requires proper management firms, including front, middle and back office functions. The significant roles within the investment team include economists, research analysts, fund managers, dealers and traders.

Economists - Economists ensure the latest trends, future and its influence on international and domestic markets. The roles and responsibilities include preparing reports and market presentations on macroeconomic developments and sectoral shifts. As an Economist, you must prepare the team for the risks in the market. At the same time, macro and policy analysis, forecasting, modelling macro variables, and providing investment insights are the management team's responsibilities.

Analysts - This is another excellent opportunity in the field of the mutual fund industry. The analysts track your investment recommendations by observing the prices of assets from the day of purchase to how they perform over time. You can also opt for the profile of equity research analysts who carry out telephone calls with all the dealers and intermediates. These calls usually comprise suggestions for the customers while speaking with the organization's administration, retail deals, constraints and so on. Plus, visiting the organizations and carrying out meetings, gathering data, surveying monetary explanations, and evaluating the income and benefits of the organization.

Fund Managers - Another opportunity you can use in the mutual fund field is fund managers. As a fund manager, you must choose the best stocks, bonds, and financial market instruments and give the result to the investors by fulfilling the fund's objective. Later, fund managers search for the financials of publicly and privately traded companies. This is quite an interesting profile as it involves researching, collecting information, reading financial briefings and knowledge about global economic events.

If you are somebody who loves conducting research or has financial modelling skills, reporting skills, and mathematical proficiency, you can opt for fund managers as your career. Based on your research, a list of companies falls under the investment objective. Fund managers also prepare a portfolio and accompany sales and marketing professionals to various events for promotions. Other than this, all the decisions related to portfolio composition are made by fund managers.

Dealers/Traders- Dealers place the orders according to the instructions. Then there are sales and client relation teams that market the organization and promote their products and services. You also have the chance to be a part of the infrastructure team that keeps the entire organization moving. From IT to HR, the infrastructure team is vital for the motion of any company.

Takeaway

We all know that algorithms are one factor that is gaining popularity in earnings and economic news. This directly opens the door to short-term trading.

On top of that, several asset managers are using machine learning methods to process the data. This is the future of asset management. If talking about the critical roles at investment firms in future, there will be a need of

Investment decision maker

Investment Researcher

Private wealth manager

The technology firm will need

Data Scientist

Application Engineer

Investment Banker

Investment Officer

Investment researcher

Private Wealth Manager

The innovation team will need

Investment thinking and process innovator

Knowledge Engineer

Innovation Facilitator

A few factors may challenge growth, but change is guaranteed.

2 notes

·

View notes

Text

Right Property Value in Indian Real Estate?

In India, investing in real estate has never lost its attractiveness. Even while property may not be as profitable right now as stocks, Indians don't buy homes only for the return on their investment. Owning a home has a significant psychological benefit. For the owner's family, it serves as the cornerstone of financial stability. It always preserves its worth whether it is used for living or for renting out. Due to this, second residences are highly common throughout the nation.

In the past few years, residential investment in India has increased dramatically. Despite the consistently rising costs of labor and raw materials, property values have increased significantly along with the demand. An ordinary 2BHK residential unit that cost between Rs 40 and 45 lakhs in 2013–14 is now offered for between Rs 60 and 70 lakhs. Industry research claims that over the past ten years, the average housing value in India's top seven cities has climbed by more than 40%.

Although the average growth rate has recently decreased noticeably, the cost of owning real estate will continue to rise over time. Therefore, according to analysts, this is the best time to invest because the COVID-19 pandemic has created a fertile market and given consumers greater negotiating power. The most important question, however, is how much money you should put into real estate to achieve the best capital returns and what possibilities are available for different price ranges.

Location

The location of an excellent rental property is its most crucial feature. The property must be near or have good access to the city's central business districts.

Size

Two- and three-BHK apartments are typically cheaper in most Indian cities, and middle-class renters choose to rent them. Purchasing a bungalow or villa in a location where there is no need for expensive rental properties makes little financial sense. Look at places where individuals can afford to rent a large luxury house if you wish to invest in one.

Price

If you overpaid for the property, it will be very difficult to make enough money from rentals to cover your initial expenses and make a profit. Searching for the cheapest houses is not advised, though. These residences are either excessively small or situated in undesirable areas. A house's price should be contrasted with its worth four to five years ago.

Infrastructure

One must carefully assess the infrastructure of the immediate vicinity, including the presence of malls, hospitals, and educational institutions as well as the ease of access to roads and trains. Consider yourself a renter and ask the right questions to ascertain whether a residence might generate a good rental income.

2 notes

·

View notes

Text

What Skills Do You Need For Investment Management?

Reasoning ability is one of the most crucial abilities in investment management. This ability is crucial for deciphering complex data sets and extracting reliable information from irrelevant noise. An asset manager also needs to be well-versed in many other sectors. This information makes it easier to put things into perspective and to understand the world from various perspectives.

Effective communication is another key competency in the management of investments. An investment manager must be able to clearly communicate findings and suggestions to more senior colleagues. He or she will need to communicate with a variety of people, including clients and other coworkers, thus this ability is crucial. As a result, a candidate needs to be skilled at verbal communication and at giving clients information.

Strong decision-making abilities are also a must for an investment manager. The proper selections must be made by investment managers based on their market study and understanding. They must go through a ton of research every day to accomplish this. Additionally, they need to be able to employ scenario planning to prepare for a wide range of potential outcomes. In order to make the best decisions, a good investment manager will be able to connect events and see trajectory.

You will be in charge of managing client portfolios as an investment manager. In other words, you need to make sure the portfolios are well-diversified and contain an appropriate degree of risk. You will employ a range of analytical techniques and unique recommendations from research analysts at your company as an investment manager. In the end, this calls for a mix of business acumen, guts, and experience.

Investment management might be a suitable fit for you based on your interests. If you enjoy learning about various businesses, a career in investment management may be gratifying. For instance, if you enjoy tennis, you can immerse yourself in the sport. To witness the most recent trends, a fashion enthusiast could travel to Paris.

You should have at least a bachelor's degree in finance or accounting to succeed in the investment industry. A smart idea is to get an MBA or another advanced certification in finance. These abilities are crucial in a field that necessitates ongoing investigation. Additionally, you ought to be well-versed in statistics.

You must have a solid understanding of statistics and financial data to work as an investment manager. This will assist you in making wise choices regarding how to invest a client's funds. Wrong financial decisions could harm your career and your client's finances, while the right ones could net you big commissions. You should therefore be meticulous in your research. You are prepared for the challenge if you possess these abilities.

There is a significant need for qualified applicants because the asset management profession is extremely competitive. The few employment that are open in the field receive a large number of applications, so the employers can afford to be picky. You must be an excellent analyst and be able to effectively express your views. You should, for instance, be able to describe why a particular asset underperformed or what you would do in that situation.

You must be adept at handling problems if you work for an investment management company. Additionally, you must have the capacity for autonomous thought. Without these abilities, you'll only be as good as the competition in your field. You must therefore possess a high degree of self-assurance and a drive to discover what functions for you.

A career in investment management might be rewarding if you have a financial interest. Investment managers are self-employed and receive compensation based on the amount of money they manage for their clients. Investment managers, unlike those in other professions, don't make their money by putting in long hours. You might want to think about this career if you function well under pressure.

You must be able to convey confidence in your role as an asset manager. You should know how to say "no" and know how to assert your point of view. Consider instances in your life where you had to challenge the status quo. Consider how you handled this circumstance and persuaded everyone to follow your lead. Don't forget to keep trying to make the correct choices as well.

You will be well-prepared for this vocation with a business, finance, mathematics, or economics degree. Graduating students typically start out as investment analysts and eventually advance to fund manager positions. You might advance more quickly if you have a master's degree or another professional credential. Additionally, you'll need to have self-assurance when speaking to people.

6 notes

·

View notes

Text

Investment Banker: What They Do, Required Skills, and Examples

Investment banking is a prestigious and lucrative career path that attracts individuals with a keen interest in finance and economics. In this blog, we will explore what investment bankers do, the skills required to excel in this field, and provide examples to illustrate their roles and responsibilities.

What Do Investment Bankers Do?

Overview of Investment Banking

Investment bankers play a crucial role in the financial services industry, acting as intermediaries between companies and investors. They assist in raising capital, providing financial advisory services, and facilitating mergers and acquisitions (M&A).

Raising Capital

One of the primary functions of investment bankers is to help companies raise capital through the issuance of stocks or bonds. They work with businesses to determine the best strategy for their financial needs, whether it’s through an initial public offering (IPO), private placement, or debt issuance.

Mergers and Acquisitions

Investment bankers are instrumental in M&A activities, advising companies on potential targets or buyers, conducting valuations, and negotiating terms. They ensure that the transactions align with the strategic goals of their clients and maximize shareholder value.

Financial Advisory Services

In addition to raising capital and facilitating M&A, investment bankers provide a range of financial advisory services. This includes restructuring debt, managing assets, and offering guidance on complex financial matters to help clients navigate economic challenges and opportunities.

Required Skills for Investment Bankers

Analytical Skills

Investment bankers need strong analytical skills to evaluate financial data, assess market trends, and develop strategic recommendations. Proficiency in financial modeling and valuation techniques is essential.

Communication Skills

Effective communication is critical in investment banking. Bankers must clearly present complex financial information to clients, colleagues, and stakeholders. This includes creating detailed reports, pitch books, and presentations.

Attention to Detail

Attention to detail is crucial for investment bankers to ensure accuracy in financial analysis, compliance with regulations, and the successful execution of transactions.

Negotiation Skills

Strong negotiation skills are essential for investment bankers, especially in M&A deals. They must be able to secure favorable terms for their clients while maintaining positive relationships with all parties involved.

Time Management

Investment bankers often work long hours and manage multiple projects simultaneously. Excellent time management skills are necessary to meet deadlines and deliver high-quality work under pressure.

Networking and Relationship Building

Building and maintaining relationships with clients, investors, and industry professionals are vital for success in investment banking. Networking helps bankers identify new opportunities and stay informed about market developments.

Examples of Investment Banker Roles

Equity Research Analyst

Equity research analysts specialize in analyzing publicly traded companies and providing investment recommendations. They produce reports on financial performance, industry trends, and potential risks, aiding investors in making informed decisions.

Mergers and Acquisitions Analyst

M&A analysts focus on identifying potential acquisition targets, conducting due diligence, and assisting in the negotiation process. They play a key role in helping companies grow through strategic acquisitions.

Corporate Finance Advisor

Corporate finance advisors work with companies to optimize their capital structure, manage financial risks, and develop strategies for long-term growth. They provide insights on financing options, investment opportunities, and cost management.

Debt Capital Markets Specialist

Debt capital markets specialists assist companies in raising debt through bonds, loans, or other financial instruments. They evaluate the company’s creditworthiness, structure debt offerings, and work with investors to secure funding.

Conclusion

Investment banking is a dynamic and challenging field that offers numerous opportunities for those with the right skills and determination. By understanding the roles and responsibilities of investment bankers, aspiring professionals can better prepare for a successful career in this competitive industry. Whether it’s raising capital, facilitating M&A, or providing financial advisory services, investment bankers play a vital role in shaping the financial landscape.

0 notes

Text

Top Courses to Pursue after B. Com

A career in Commerce is not just confined to CA, B.Com, or CS. There are plenty of opportunities one can access by pursuing a career in Commerce. A career in Commerce can open a wide range of choices for you in various sectors. You can explore fields like Economics, Management, Finance, Statistics, Banking, Stockbroking, Consulting, Investment Banking, Accounting, etc. Poddar International College, one of the best College in Jaipur provides best UG/PG in Commerce along with other courses.

Master of Commerce (M.Com)

Masters in commerce, or M.Com, is one of the most popular courses available after B.Com. You can learn more in-depth information on topics like Accounting, Taxation, Business Studies, Statistics, Economics, Finance, International Business, etc. in this course. You can select a specialization from among business-related courses like M.Com in the areas of Finance, Accounting, Economics, Taxation, Business Studies, Marketing, Management and Statistics.

Master of Business Administration (MBA)

You can choose to specialize in finance in your Master of Business Administration (MBA) if you want to work in the finance industry. You can work at managerial levels in finance, BFSI, FMCG, IT, consulting, and top companies after earning an MBA in finance. Following an MBA in finance, the best career options after B.Com include those as a finance manager, consultant, financial analyst, credit risk manager, portfolio manager, and treasurer.

With a mission to empower students with the best opportunities to explore the fastest-growing sectors, Poddar Business School excels as the best PGDM/MBA College in Jaipur.

Chartered Accountancy (CA)

One of the top career options for graduates of commerce programs is chartered accounting (CA). Accounting, auditing, taxation, and financial assessment for an individual or organization are all included in the practice of chartered accounting. Candidates who successfully finish the CA course are awarded professional certification by the Institute of Chartered Accountants of India (ICAI), which enables them to engage in professional practice.

Company Secretary (CS)

Company Secretary is a popular career option that requires a professional degree after receiving a B.Com. The Indian Company Secretary profession is governed by the Institute of Company Secretaries of India (ICSI). A Company Secretary manages tax returns, legal and statutory obligations, record-keeping, giving advice to the Board of Directors, and making sure the firm complies as part of their job description.

Chartered Financial Analyst (CFA)

The Chartered Financial Analyst (CFA) credential is a well-liked option among business professionals. The CFA Institute overlooks the CFA program. The applicants must pass three levels of tests that examine their knowledge of accounting, economics, business ethics, money management and Security Analysis. Candidates are certified as Financial Analysts and qualified to practice professionally after passing all three levels.

Financial Risk Management (FRM)

In the financial markets, FRM is a recognized profession on a global scale. The Global Association of Risk Professionals offers accreditation to professionals in the financial risk management sector (GARP). Poddar Business School, the best PGDM College in Jaipur, is committed to nurturing the leaders of tomorrow in a thriving community of creative and accomplished people across the globe.

0 notes

Text

Advanced Tips and Tricks for Global Market Trading

Global market trading offers immense opportunities for investors looking to diversify their portfolios and maximize returns. Whether you're trading Forex, commodities, or other financial instruments, having advanced strategies in your toolkit can make a significant difference. Here are some expert tips and tricks to help you navigate the complex world of global trading.

1. Master Technical Analysis

Technical analysis is crucial for predicting market trends and making informed decisions. Focus on understanding chart patterns, moving averages, and key indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). These tools can help you identify potential entry and exit points, minimizing risks and maximizing profits.

2. Utilize the Best Trading Platforms

Choosing the right trading platform is essential for successful trading. Look for platforms that offer comprehensive analytical tools, real-time data, and a user-friendly interface. Some of the best trading platforms also provide educational resources and customer support, making it easier for traders to enhance their skills and make informed decisions.

3. Diversify Your Investments

Diversification is a key strategy in global market trading. Spread your investments across different asset classes, such as Forex, commodities, and stocks. This approach reduces risk and ensures that your portfolio can withstand market volatility. For instance, while Forex trading might offer high liquidity, investing in commodities can provide a hedge against inflation.

4. Stay Updated with Market News

Staying informed about global economic events, political developments, and market trends is vital. Regularly read financial news and reports to stay ahead of market movements. Subscribing to reputable financial news websites and using tools like economic calendars can help you keep track of important events that may impact your trades.

5. Implement Risk Management Strategies

Effective risk management is essential for long-term success in trading. Set stop-loss orders to limit potential losses and use position sizing to ensure that no single trade can significantly impact your portfolio. By managing your risk, you can trade with confidence, knowing that you have a safety net in place.

6. Leverage Expert Insights

Consider following industry experts and analysts who provide valuable insights into market trends and trading strategies. Platforms like TradingView and social media channels can be excellent sources of expert opinions and forecasts. Engaging with these experts can provide you with fresh perspectives and advanced trading techniques.

7. Use Automated Trading Systems

Automated trading systems, also known as algorithmic trading, can execute trades on your behalf based on pre-set criteria. These systems can help you take advantage of market opportunities without being glued to your screen all day. Ensure that you understand the algorithms and monitor their performance to make necessary adjustments.

8. Focus on Continuous Learning

The world of global market trading is constantly evolving, and staying updated with the latest strategies and trends is crucial. Participate in webinars, attend workshops, and enroll in online courses to enhance your knowledge. Learning from seasoned traders and experts can provide you with advanced techniques that can be applied to your trading strategy.

9. Monitor Your Performance

Regularly review and analyze your trading performance. Keep a trading journal to track your trades, including the rationale behind each trade, outcomes, and lessons learned. This practice can help you identify patterns, improve your strategies, and avoid repeating mistakes.

10. Partner with Reliable Brokers

Choosing a reliable broker is crucial for a smooth trading experience. Ensure that your broker offers competitive spreads, low fees, and robust security measures. A reputable broker can provide you with the tools and support needed to succeed in the global market.

Conclusion

By implementing these advanced tips and tricks, you can enhance your trading skills and increase your chances of success in the global market. Whether you're trading Forex, commodities, or other assets, staying informed, using the best trading platforms, and continuously learning are key to thriving in this dynamic environment.

For more expert insights and trading solutions, trust Global Femic Services, your partner in global market trading.

1 note

·

View note

Text

The Role and Importance of a Mutual Fund Advisor

Investing in mutual funds can be a smart and effective way to grow your wealth, but navigating the vast array of options and strategies can be challenging. This is where a mutual fund advisor comes into play. A mutual fund advisor is a professional who helps investors make informed decisions about which mutual funds to invest in, tailored to their individual financial goals, risk tolerance, and investment horizon. Let's delve into what a mutual fund advisor does, the benefits of working with one, and how to choose the right advisor for your needs.

What Does a Mutual Fund Advisor Do?

A mutual fund advisor offers a range of services designed to help investors optimize their investment portfolios. Here are some key responsibilities of a mutual fund advisor:

Understanding Financial Goals: Advisors start by assessing your financial objectives. Whether you aim to save for retirement, fund a child's education, or purchase a home, the advisor tailors their advice to help you achieve these specific goals.

Evaluating Risk Tolerance: Everyone has a different comfort level with risk. An advisor helps determine your risk tolerance, which is crucial in selecting appropriate mutual funds that match your investment style and comfort level.

Recommending Suitable Funds: Based on your goals and risk tolerance, the advisor recommends mutual funds that align with your investment profile. These recommendations are personalized to help you meet your financial objectives.

Ensuring Portfolio Diversification: Diversification is a key strategy in reducing investment risk. Advisors ensure that your investment portfolio is well-diversified across various asset classes and sectors, which can help mitigate potential losses.

Monitoring and Rebalancing: A mutual fund advisor regularly reviews your portfolio's performance and makes necessary adjustments. Rebalancing ensures that your portfolio stays aligned with your investment goals and risk tolerance over time.

Providing Market Insights: Advisors stay updated on market trends and economic conditions. They share these insights with you, helping you make informed investment decisions based on the latest market information.

Benefits of Working with a Mutual Fund Advisor

Engaging with a mutual fund advisor can offer several significant advantages, especially for those who are new to investing or who prefer professional management of their investments:

Expertise and Knowledge: Advisors bring extensive knowledge of financial markets and mutual funds. Their expertise can help you navigate the complexities of investing and avoid common pitfalls.

Time Efficiency: Managing investments requires time and effort. Advisors take on the heavy lifting of research and portfolio management, allowing you to focus on other priorities.

Unbiased Advice: Advisors provide objective advice based on your financial situation. They help you make rational, well-informed decisions without the emotional biases that can sometimes affect individual investors.

Strategic Planning: Advisors assist in developing a long-term investment strategy tailored to your goals. This strategic planning is crucial for achieving sustained financial growth and stability.

Access to Advanced Tools: Advisors often have access to sophisticated research tools and exclusive investment opportunities that individual investors may not be able to utilize on their own.

How to Choose the Right Mutual Fund Advisor

Choosing the right mutual fund advisor is a critical step in ensuring your investment success. Here are some tips to help you select the best advisor for your needs:

Check Credentials and Experience: Look for advisors with relevant credentials, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Also, consider their experience in the industry.

Evaluate Reputation and References: Research the advisor's reputation by reading reviews and asking for references. Talking to current or past clients can provide valuable insights into their effectiveness and reliability.

Understand the Fee Structure: Advisors can charge in various ways, including flat fees or a percentage of assets under management. Ensure you understand the fee structure and find it reasonable for the services provided.

Ensure Compatibility: Choose an advisor who understands your financial goals and communicates clearly. A good working relationship and mutual trust are essential.

Confirm Fiduciary Duty: Ensure the advisor has a fiduciary duty to act in your best interest. This means they are legally obligated to prioritize your financial well-being over their own.

Conclusion

A mutual fund advisor can be a valuable ally in your investment journey, providing the expertise and guidance needed to make informed decisions. By understanding their role, recognizing the benefits they offer, and knowing how to choose the right advisor, you can enhance your investment strategy and work towards achieving your financial goals. The right advisor not only offers professional advice but also understands your unique financial situation and aligns with your long-term objectives, ensuring a successful and fulfilling investment experience.

0 notes

Text

The Benefits of Specializing in Finance at Welingkar Distance MBA Program

Finance specialization in the Welingkar Distance MBA program can be an excellent opportunity to scale up in the Indian job market. The program is best suited for providing quality education without altering your personal/business life. Let’s drill down into the major reasons that differentiate our programs.

Enable You With Rewarding Career

With finance in the Welingkar Distance MBA, one can find well paying job offers. There are some other reasons that make this a perfect option:

High Demand: There is a regular demand for several finance jobs, for instance, financial analysts, financial advisors, investment bankers, corporate finance managers among others. They pay well and are also considered safe jobs financially.

Salaries at Par with the Industry: Financial Analysts in India can get annual salaries ranging between 6 to 12 lakhs. Investment banker salaries in India can range anywhere from 10-20 lakhs, not including the significant bonuses they receive. Corporate finance managers fall within a similar range, earning anywhere from ₹15-25 lakhs annually

Diverse Paths: Gain transferable skills that will be invaluable in any job, whether in banking, consulting, or tech.

Build Essential Analytical Skills:

To further universities in finance, the Welingkar distance MBA course develops essential actionable analysis. The spirit will be broken down to your essentials in this way:

Reading the Income Statement, Balance Sheet, and Cash Flow to deduce the health of the company.

Creating financial models to support the company’s strategic planning process and investment proposals.

Financial Tech Master:

Technology in finance is a growing phenomenon. The distance MBA enables the student with this technology:

Get experience in a wide range of financial software, including Bloomberg Terminal, SAP, and Oracle Financial Services

Get experience in data analysis software, using Python, R, and Excel

Be taught on blockchain, robo advisory, swaps and other modern technological advancements happening in finance.

Improved project due to highly skilled decision makers:

Those engaging in finance must be top strategic thinkers. With Welingkar Distance MBA experience domain:

Turn into righteous financial future through good strategies

Trains students on how to identify and manage risks

Focused enterprise value and useful estimates

Understanding of Global Aspects:

Because of globalization, the business landscape is becoming more and more interconnected every day.

In addition to this students will study:

Global Financial Markets: Taking you through the complexities of global markets and its local implications.

International Financial Management: How to manage international financial operations including forex risk and international investment.

Welingkar Distance MBA in Fiance FAQs

Q: What sets Welingkar’s Distance MBA programme apart from the rest?

A: The Welingkar Distance MBA programme is designed for working professionals to meet the specific learning requirements of the industry. The unique features of the programme include flexibility, interactive and hands-on learning model and practical exposure to industry trends.

Q: Can work and study be managed in this course?

A: Yes. It is a work-friendly course designed to suit the convenience of working professionals. With an online mode of delivery, it also provides flexibility in education, allowing you to study when you are available.

Q: What help is available to distance learners from Welingkar?

A: Welingkar extends support services like academic advising, e-libraries, discussion forums, chat rooms, and mentoring programs for distance learners.

Q: How does Welingkar ensure a quality learning experience for its Distance Learning students?

A: The school provides a comprehensive system to distance learning students, which is supported by a blend of virtual classroom mode, recorded lectures, face-to-face interactive sessions and continuous assessment mechanism has ultimately lead to a very high quality education.

Conclusion:

Choosing to go with the Finance specialization in the Welingkar Distance MBA is a good idea to get prepared to catch stars in the finance industry. With unlocking top-paying career prospects, creating important analytical skills, related to financial newfangled tech-savvy, and ensuring the decisions are properly taken from the foundations of knowledge and relevant analysis programming to financial tech processes involved in the module exercises, the course leaves no stone unturned.

0 notes