#The South Sea Bubble of 1720

Explore tagged Tumblr posts

Text

The South Sea Bubble (1720): Lessons from a Historic Financial Fiasco

Written by Delvin In the annals of financial history, the South Sea Bubble of 1720 stands as a stark reminder of the perils of irrational exuberance and speculative frenzy. Driven by investor mania, the South Sea Company, a British trading company, witnessed its stock price soar to unprecedented heights before plummeting dramatically. This blog post delves into the story of the South Sea Bubble,…

View On WordPress

#dailyprompt#Financial#Financial Education#Financial History#Financial Literacy#Market Manipulation#money#Money Fun Facts#Stock Market#The South Sea Bubble of 1720

0 notes

Text

King Charles III and Prince William have expressed “profound sorrow” at the atrocities of slavery, but neither has publicly accepted the crown’s central role in the trade. Over a period of 270 years, 12 British monarchs sponsored, supportedor profited from Britain’s involvement in slavery, according to historians.

Elizabeth I (reigned 1558-1603)

The Tudor queen gave a large royal ship to the slave trader John Hawkins in 1564 in exchange for a share in the profits of the voyage. On the trip, Hawkins captured many African people and seized 600 more from Portuguese ships, according to Nick Hazlewood in his book The Queen’s Slave Trader.

James I (1603-1625)

The first Stuart king granted royal-connected merchants a monopoly on trade with Africa. They formed the Guinea Company, which provided enslaved people for English-owned tobacco plantations in Virginia, America, according to Peter Fryer’s book Staying Power.

Charles I (1625-1649)

Charles II (1660-1685)

The first king after the monarchy was restored, following England’s brief period as a republic, in effect made the slave trade a state-sponsored enterprise. He invested in a slave-trading business, the Company of Royal Adventurers of England Trading into Africa, and gave it a royal charter.

When the company was dissolved in 1672, the king moved his patronage to the Royal African Company. This company would transport more enslaved people from Africa to the Americas than any other single organisation in the history of the transatlantic trade.

James II (1685-1688)

James was governor of the Royal African Company and was awarded 500 guineas for his “extraordinary services”in 1677.

As king he was the company’s largest shareholder until he sold the shares after he was deposed in the “Glorious Revolution” of 1688. According to the historian KG Davies in his book The Royal African Company, James made £6,210 from his investment – equivalent to £1m today, according to the most conservative estimate.Quick Guide

What is Cost of the crown?

Show

William III (1689-1702) and Mary II (1689-1694)

Queen Anne (1702-1714)

Queen Anne is remembered for the union of England and Scotland in 1707, which formed the United Kingdom of Great Britain. She also dramatically expanded the nation’s slave-trading activities by securing from Spain in 1713 the Asiento de negros, a monopoly right to supply enslaved African people to Spain’s colonies in South America. This contract was fulfilled by the South Sea Company.

George I (1714-1727)

George I was governor of the South Sea Company and held a substantial shareholding.

Histories of the company overwhelmingly dwell on the “South Sea bubble” – the 1720 rise and the collapse of the company’s share price. Few focus on the nature of its business – the Asiento contract to supply 4,800 adult, healthy males to Latin America annually.

John Carswell, in his book The South Sea Bubble, calculated that despite the collapse in shares, the king made a large profit from his investment.

George II (1727-1760)

George III (1760-1820)

An essay George III wrote as a teenager, arguing that slavery had no moral basis, has been cited by some as evidence that the future king was opposed to it. But he supported the continuation of the slave trade and slavery, and opposed the abolition movement behind the scenes, according to research by the historian Brooke Newman for her forthcoming book, The Queen’s Silence.

George IV (1820-1830)

George IV’s lack of support for the growing movement to abolish slavery also helped to delay emancipation for years. His reign was marked by ruthless suppression of uprisings by enslaved people in the Caribbean.

These included the response in Demerara, Guyana, in 1823. According to Michael Taylor, in his book The Interest, British authorities reacted with a massacre, on-the-spot executions, and sentences of whipping. Ten enslaved people who rebelled were hanged then decapitated, and their heads were displayed on spikes.

William IV (1830-1837)

William IV was king at the time slavery was abolished in 1833, but he had always opposed abolition.

Before becoming king, he held the title Duke of Clarence and spent time in the Caribbean, where he befriended plantation owners and boasted of contracting a sexual disease. He devoted speeches in the Lords to defending slavery, arguing that it was vital to prosperity, and he argued that enslaved people were “comparatively in a state of humble happiness”.

Clarence House, today’s home of King Charles III and Camilla, the Queen Consort, was built for William IV in the late 1820s.

#The British kings and queens who supported and profited from slavery#english colonialism#british monarchy#slavery and the monarchy of britain

3 notes

·

View notes

Video

youtube

The South Sea Bubble (United Kingdom, 1720)

0 notes

Text

Daniel Will: Recognizing Warning Signs in Stock Market History

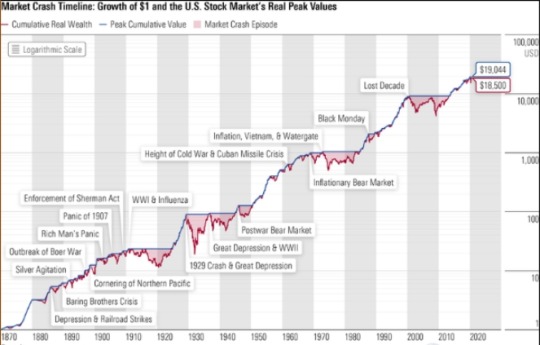

If you have only been involved in the U.S. stock market in recent years or the past 15 years, you might think that the U.S. stock market only goes up (even the significant drop in 2020 due to Covid was very brief). However, if we extend the time-frame, after every period of frenzy, the U.S. stock market has experienced a major decline of 40%-90%. While the U.S. stock market certainly holds long-term investment value, if you enter at the wrong time, there's a significant chance of encountering a market crash, requiring a decade or longer to reach new highs. Here are some well-known examples of stock market crashes/asset bubble bursts:

Tulip Mania in the Netherlands (1636-1637): Tulip Mania is one of the earliest recorded speculative bubbles, occurring in the 17th century in the Netherlands. Tulip bulbs became an extremely coveted commodity, with prices skyrocketing to astronomical levels. However, the market eventually collapsed, and bulb prices plummeted. The specific percentage of the decline is challenging to determine, but many investors suffered significant losses.

South Sea Bubble (1719-1720): The South Sea Bubble occurred in the United Kingdom and had a significant impact on American investors. The South Sea Company gained a monopoly on trade with South America, leading to a surge in its stock price. However, the company's assets and profits were inflated, and when the bubble burst, many investors suffered substantial losses. It fell approximately 98% from its peak.

Mississippi Bubble (1719-1720): The Mississippi Bubble, also known as the Royal Bank Bubble, was another significant speculative bubble that occurred in France. It was driven by the promotion of the Scottish economist John Law, who founded the Mississippi Company and hyped the potential profits of France's colonial ventures in North America. When the bubble burst, the company's stock price plummeted significantly, estimated to have fallen by over 90%.

Railway Mania (1840s): Railway Mania occurred in mid-19th century Britain. It was a period of intense speculation in railway company stocks, driven by the belief in the transformative power of railway transportation. However, excessive speculation led to a market collapse, and many railway companies went bankrupt. The extent of stock price declines varied, but some companies experienced drops of over 40%.

Great Depression in the United States (1929-1932): The Wall Street stock market crash of 1929 is one of the most famous stock market crashes in history, marking the beginning of the Great Depression. Excessive speculation, overvaluation of stocks, and margin trading all contributed to the crash. The Dow Jones Industrial Average fell approximately 90% from its peak in 1929 to the trough in 1932.

Nifty Fifty Bubble (1960s-1970s): The Nifty Fifty bubble refers to the period in the 1960s and 70s when investors enthusiastically purchased stocks of 50 large, high-quality American companies, considered "one-decision" stocks. These stocks were believed to be safe and reliable, leading to overvaluation. However, the bubble burst in the early 1970s, and many Nifty Fifty stocks experienced significant declines, ranging from 40% to 90%.

Oil Crisis and Stagflation Period (1972-1974): The 1973 oil crisis was triggered by an oil embargo from the Organization of Arab Petroleum Exporting Countries (OAPEC), leading to a significant disruption in global oil supply and a sharp rise in oil prices. This event overlapped with a period of stagflation characterized by high inflation and economic stagnation. The combination of these factors had an adverse impact on global stock markets, with declines exceeding 40%.

Japanese Asset Price Bubble (1986-1991): The Japanese asset price bubble was a speculative bubble that occurred in Japan in the late 1980s. It was driven by excessive lending, real estate speculation, and inflated asset prices. The bubble burst in the early 1990s, leading to a prolonged economic stagnation in Japan. The Nikkei 225 Index declined by approximately 80% from its peak in December 1989 to its trough in February 2003.

Dot-Com Bubble (1997-2000): The Dot-Com Bubble formed in the late 1990s, driven by the rapid growth of internet-related companies. Investors heavily invested in internet startups, often overlooking their profitability. Stock prices reached unprecedented levels, but the bubble burst in 2000, triggering a significant market correction. The NASDAQ Composite Index declined by approximately 78% from its peak in February 2000 to its trough in September 2002.

U.S. Subprime Mortgage Crisis (2008-2009): The stock market crash of 2008 was one of the most severe financial crises since 1929, known as the Subprime Mortgage Crisis or Financial Tsunami. The crisis originated from issues in the U.S. subprime mortgage market and subsequently spread to the global financial system. Many financial institutions faced the risk of bankruptcy, and stock market indices experienced a sharp decline. The Dow Jones Industrial Average fell by approximately 54% from its peak in October 2007 to its trough in March 2009. This collapse caused significant damage to the global economy, triggering a worldwide financial and economic recession.

These significant stock market bubbles highlight the risks of excessive speculation and the consequences of market collapses. Investors should exercise caution and adopt prudent risk management strategies when faced with market over-exuberance. Drawing lessons from past bubbles can help guide investment decisions and reduce potential future losses. Currently, I see the most significant crisis in the U.S. stock market among various global markets. I will continue to analyze relevant content and share it in the Artificial Intelligence Wealth Club community group. I hope it brings substantial meaning to your investments.

0 notes

Text

The South Sea Bubble Collapse of 1720 and its Effect in Ireland

Introduction: The South Sea Bubble was a speculative bubble in the early 18th century involving the shares of the South Sea Company, a British international trading company that was granted a monopoly in trade with Spain’s colonies in South America and the West Indies as part of a treaty made after the War of the Spanish Succession. In return for these exclusive trading rights, the company…

View On WordPress

0 notes

Text

South Sea Company - Wikipedia

The South Sea Bubble was the financial collapse of the South Sea Company in 1720. The company was formed to supply slaves to Spanish America

0 notes

Text

Tulipmania

Dear Caroline:

I have no doubt in your intellectual abilities (and your moral virtues, as I always like to add), but it never ceases to amaze me that one would even consider it a possibility to predict bubbles and, in general, important economic crises and opportunities, effectively. Like, the track record for economists and forecasters is appalling, and this in in spite of the fact that a large chunk of them are undoubtedly very clever people.

The trite thing to say would be that greed just conquers all, including reason, but I feel it is more realistic to say that mass human behavior is unfathomably difficult to submit to laws and effective models. We might dream with Hari Seldon's Psychohistory, but I fear we will keep dreaming till the end of the universe, when Lord Brahma goes to sleep after 4.32 billion human years and the world is consumed by fire.

I have recently read about the difficulties of models in finance, and how trying to quantify the unquantifiable leads to repeated cycles of economic hubris and painful failures. The road is literally paved with quantitative cadavers like the Black-Scholes equation, LTCM, VaR... Then there's the problem of the perverse enticements, or 'pennies in front of the steamroller': market incentives actually favor minimizing risks in the short term. This pays off for individuals and companies (and ruins more prudent planners), but inevitably leads to catastrophe (which model makers and bad companies don’t suffer the full brunt of). The incentives of risk management are misaligned!!

Crypto itself, as you obviously have no need of my reminding, has gone through an annus horribilis that brings to mind the Tulip era and the South Sea Bubble of 1720. One gets the feeling of eternally navigating through seas of illusion and uncertainty, sailing onwards only to discover another, bigger iceberg to bring the ship down to the rock bottom. But human hope springs eternal, as well as the delusions that intelligence and greed keep painting before our eyes.

Quote:

Bubbles, bright as ever Hope Drew from fancy – or from soap; Bright as e’er the South Sea sent From its frothy element!

Thomas Moore

0 notes

Note

It is not that, it is that we are unchaperoned. However, you are younger, so I suppose—or hope—it shall be fine. *puts his notebook on the desk, sitting down next to her* I thought the stock market crash of 1929 could be interesting for an analysis, and it would be useful for my economic studies, or the fall of the South Sea company and the South Sea bubble of 1720, the 1215 sealing of the Magna Carta could also prove for an interesting analysis from a perspective this far into the future and considering the latest politics!

she’s an angel

...We have not met the same Anastasia.

12 notes

·

View notes

Text

The world is a stage; everyone acts his part and gets his portion.

One of 74 prints satirizing the South Sea Bubble of 1720 in Het groote tafereel der dwaasheid, Amsterdam, 1720.

17 notes

·

View notes

Text

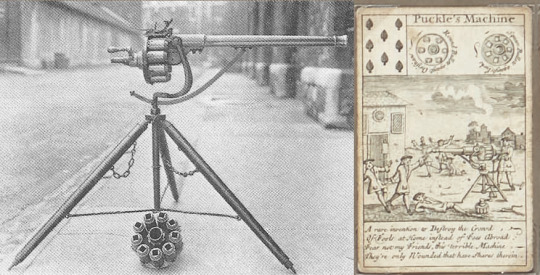

The Puckle gun gets roasted in 18th century verse

Recently I learned of a set of playing cards made in the 1720s by Thomas Carrington Bowles of London. These cards, billed “Bubble Cards”, satirize contemporary economic bubbles of the day, in particular the infamous South Sea Trading Company which single-handedly ruined countless investors. But, to my surprise, also mocked in these cards is the Puckle gun, and the sorry state of affairs that surrounded it.

By now, the story of the ill-fated Puckle gun should be familiar to most readers. This flintlock cannon, invented by the English lawyer James Puckle in 1717, was revolutionary in its day insofar as it fired from a series of revolving chambers. It is often cited as a conceptual predecessor of the machine-gun, although it was not automatic and still relied on manual operation. Regardless, it mustered a significantly higher rate of fire than typical muskets of the day, capable of firing off nine shots in the time it might take a rifleman to fire two. Notoriously, the gun was marketed with the option to chamber square projectiles (which would cause more grievous wounds) specifically for against “heathen” Turks, a feature which Puckle clearly considered would appeal to zealous protestants of whom there was no short supply in England at the time.

The Puckle gun attracted considerable interest from speculators, who were taken in by the idea that it would revolutionize firearms. What it failed to impress, however, was the one organization upon which its entire value relied upon - the British Army. It was demonstrated before military officials, firing 63 shots in seven minutes, but despite an impressive display the Army expressed no interest in adopting it. In fact, the only known sales came in 1722 when the Duke of Montagu privately purchased two to accompany him during his ill-fated attempt to conquer the Caribbean islands of St. Lucia and St. Vincent. With no other sales forthcoming, the Puckle Machine Company went bust and its investors lost considerable sums of money, as satirized in this playing card.

An illustration printed onto the card depicts the gun - an oversized, but surprisingly accurate rendition - cutting down not sabre-wielding Turks, but tricorn-clad Englishmen who are representative of Puckle’s investors. Below this illustration is a short verse:

“A rare invention to destroy the crowd of fools at home instead of fool abroad. Fear not, my friends, this terrible machine, they're only wounded who have shares therein.”

223 notes

·

View notes

Text

Lessons from History: The South Sea Bubble of 1720

Written by Delvin Welcome to another insightful blog post! Today, we delve into a significant event in financial history, the South Sea Bubble of 1720. This cautionary tale takes us back to a time when the South Sea Company, a British trading company, witnessed a speculative frenzy that ultimately led to a catastrophic collapse. Join us as we explore the causes, consequences, and valuable…

View On WordPress

#Blogger#Blogging#dailyprompt#Financial#Financial Literacy#Global Economy#knowledge#Lessons from History: The South Sea Bubble of 1720#money#Money Fun Facts

0 notes

Photo

Even the smartest people don't always understand the amount of risk they are taking or how it could have been avoided!!! Sir Isaac Newton let his emotions get the best of him when he was swayed by the irrationality of the crowd, resulting in the loss of millions of dollars (in today's terms) that he invested in the South Sea Company (hottest stock in England in 1720). When asked about the South Sea Bubble he said he "could calculate the motion of the heavenly bodies but not the madness of the people." History repeats itself! We may not be talking about the South Sea Company, powdered wigs, and Johann Sebastian Bach today, but there may be talk of some hot company, the man-bun, and Cardi B in the future. Don’t just assume the risk you are taking is in-line with what you are actually comfortable with or can afford! Let’s chat!!!

Posted 7/20/2021

2 notes

·

View notes

Text

So the south sea co was created in 1711 to manage government debt (but the insider trading got bad so uh that didn’t work) anyway, in 1720 the south sea bubble burst due to aforementioned insider trading. However the company continued operations until c. 1763. Which is to say, in POTC what is EIC doing in SSC trade territory?

#Go back to exploiting india you colonizing garbage.#Sorry the EIC was a former Fixation of mine#so this brings out my need to Know and to go AAh about it#potc#south sea company#EIC

32 notes

·

View notes

Photo

On This Day In Royal History . 18 September 1714 . King George I arrives in Great Britain. . George arrived in England aged 54 speaking only a few words of English, with 18 cooks & two mistresses one very fat & the other thin & tall who became nicknamed ‘Elephant and Castle’ after an area in London. . In Hanover he was absolute ruler but in England found that he had to work with Parliament & his Whig ministers particularly Lord Townshend who was dismissed, Earl Stanhope & Robert Walpole. The king grew frustrated in his attempts to control Parliament & more & more dependent upon his advisers as scandal surrounded him; his supporters turned against him, demanding freedom of action as the price of reconciliation. . George rarely attended meetings with his ministers, & particularly Walpole became powerful & effectively Britain’s first Prime Minister. . Jacobite rebellions in Scotland in 1715 led by Lord Mar, & in 1719 supported by Spanish troops intending to place James Edward Stuart (‘The old Pretender’) on throne found little support & were quickly defeated. The ‘South Sea Bubble’ in which shares in companies were purchased in rash financial speculation before a stock market crash in 1720 left many investors ruined, & George was implicated in the scandal. Walpole’s management of the crisis by rescheduling debts & paying compensation using Government money helped return financial stability. George quarrelled with his son George (a trait inherited by successive Hanoverian kings) & became increasingly unpopular. . He spent more & more time in Hanover where he died of a stroke in 1727. . . . #royalfamily #royal #royalty #windsorcastle #GeorgeI #KingGeorgeI #HouseofHanover #buckinghampalace #britishroyalfamily #royals #hermajesty #britishroyalty #britishroyals #crown #britishmonarchy #godsavethequeen #windsor #RoyalHistory #HistoryFacts #British #London #Historic #thequeen #QueenElizabeth #Westminster #Instahistory . . Follow Our other accounts &@historic.england @Royalshopuk @Queenelizabethiiuk @Londonhistoryuk (at United Kingdom) https://www.instagram.com/p/B2jyNDYAWW9/?igshid=1n317pgh59ceq

#royalfamily#royal#royalty#windsorcastle#georgei#kinggeorgei#houseofhanover#buckinghampalace#britishroyalfamily#royals#hermajesty#britishroyalty#britishroyals#crown#britishmonarchy#godsavethequeen#windsor#royalhistory#historyfacts#british#london#historic#thequeen#queenelizabeth#westminster#instahistory

17 notes

·

View notes

Photo

Grim History

The Birth of Modern Economics: John Law, the Mississippi Company, and a French Financial Crisis

Modern banking got off to a bad start. France’s economic downturn in the early 18th century led to using the theories of John Law to establish the first national bank. It also led to the burst of the first economic bubble. Modern capitalism, from the start, was never a smooth and easy road to travel on. Economic booms and busts continue to be a hallmark of this particular system whose birth was traumatic to say the least. The mental character of the Scottish economist who introduced the concept of paper money should have been a good indication of where capitalism would go and eventually end up.

By the 1820s, France was nearly bankrupt. After a lifetime of waging wars, the king Louis XIV had amassed a national debt that was impossible to pay off. The supply of valuable metals was dwindling which made the minting of new coins a struggle. Fewer and fewer coins were in circulation which made commercial transactions more difficult. Lucky for him, he died leaving France broke and poor but at least the old king did not have to watch the country he ruled degenerate into poverty and despair.

The new king, Louis XV had only reached the age of five when he ascended the throne. By that time, John Law had been living in France for a little more than a year. Law came from a wealthy family in Scotland. His father had been an economist and as he got older he dreamed up a lot of economic theories. John Law was tall, handsome, and reckless; he loved to wear the finest clothes he could buy and once killed a man in a duel. He also gambled avidly. His personality may have indicated why capitalism took on the form it did.

In 1716, John Law made a proposal to the royal family. It involved replacing gold with paper credit then issuing larger and larger amounts of credit to stimulate the economy. The paper credit would then be used for business investments. The French allowed him to open the world’s first national bank. Investors would supply the bank with gold coins and outdated government bonds. The bank issued its own paper money with its value backed up by the amount of gold or silver originally deposited by the investor. The value of these banknotes would remain stable as long as the value of the metals remained stable as well. The gold standard was born. After the establishment of this Private National Bank, Law used the deposited livres to start the Mississippi Company by issuing company stock, also corresponding to the value of the coins and metals held in the vaults of the bank.

In 1720, France owned the Mississippi Territory which stretched from the Southeast coast of North America up into a section of the Midwest. The United States later purchased it as the Louisiana Territory around the time of the Civil War. But in John Law’s day it was wild and rough land, barely explored and with little in the way of settlement. The Mississippi Company was established as a monopoly trading firm. They sold the story of fast, easy, and gigantic dividends for investors who were temped by tales of vast caverns of gold, money to be made from land speculation, and agricultural profits from the harvesting of exotic spices. John Law issued 5000 shares in the company at 500 livres a share with an initial payment of 75 livres due at the time of purchase while increments of 25 livres were to be collected monthly until the debt was ended. These stocks sold so quickly that a second batch were put on the market with the price doubled to 1000 livres a share.

John Law’s mental wheels were not the only ones turning. Some smart businessmen began thinking that if the price of stocks in the Mississippi Company doubled so quickly, they would be valued for even more in the future. Speculators quickly bought up the next round of shares made available and sold them at inflated prices based on estimations of what they would be worth in the future. The bankers also realized that if they wanted more money themselves, all they had to do was issue more stocks in the company. Word got around Paris that buying stocks in the Mississippi Company at low prices that would yield extremely high dividends was a quick and easy way to get rich. Hordes of people descended on the street in front of John Law’s chateau so that every time a speculator emerged with a pile of stock certificates, a swarm of starry eyed buyers mobbed them and bought whatever they could. Stock certificates and cash changed hands rapidly and the economy swelled almost instantaneously. The cash flowed in many directions too; owners of businesses near the chateau profited themselves. Tavern owners made a bundle off dealers who had turned a quick profit. The word “millionaire” was coined at this time to described those who excelled at this buying and selling game.

The money made from investments in the Mississippi Company was used to buy a fleet of 800 ships that would soon set sail for North America. There were very few French people who wanted to leave their homeland. Making easy money from stock dividends appealed to most but the danger of colonizing an unknown land did not. The royal family came up with an idea. During his wars, the previous king, Louis XIV, had conquered and taken possession of Alsace which was primarily inhabited by Germans. An easy way of getting rid of them would be to ship them off to Louisiana. They could do all the dirty work of settling the land while the French citizens reaped the rewards. This also led to a plan to reduce the prison population. Criminals were given the option of setting sail for the New World if they agreed to marry a prostitute and homestead the French owned overseas territory. Those who agreed were chained to the whore of their choice for the entire trip across the Atlantic Ocean and released as soon as they got ashore.

They found that Louisiana was not a land of riches beyond belief. Instead of gold and diamond mines they found humid swamps full of alligators, mosquitoes, and malaria. The tribes of Native Americans were wary and hostile because they were tired of rapacious Europeans showing up uninvited on their shores. The Germans, criminals, and prostitutes who were forced to be colonialists did not thrive as a society and the Mississippi Company eventually went bankrupt.

Meanwhile, back in Paris, some of the more clever speculators decided it was time to take the money and run. Some of them began to take their bags of cash to the Private National Bank and ask for the respective amounts of gold in exchange. Some took their specie and left the country to live like kings abroad while others buried their loot near home so that no one could find it. More and more people began taking their banknotes in and exchanging them for precious metals and eventually the bank began running low on gold. The realization that they had printed more paper money than they could back up set in. The bank decided to cut the value of gold in half. On top of that, the promised returns on investments made in the Mississippi Company never materialized. When thousands of people learned the stock certificates they held were worth nothing, they took what paper money they had and the first bank rush in history began. Even with the gold devaluation, the bank still did not have enough to back up the paper money. The downward spiral reached its nadir when the government passed a decree banning the use of gold currency.

The hordes of people turned away at the bank formed a mob and marched to John Law’s chateau. Bricks were thrown, fists flew, and fires were lit. Soon the army was called in and started beating people and chasing them away. By nightfall, fifteen citizens had died in the violence and the rest went home to begin their new life of poverty.

The government was furious with John Law. They arrested him and seized his property; twenty chateaus and holdings of land were the most valuable assets he had acquired by spending the money he had made in France. After liquidating these possessions, they used the money to pay back people who had lost their fortunes after the period of rapid economic expansion.

Law was deported to Belgium. He used the remains of his fortunes to travel around Europe and ended up in Venice. Being the gambling addict that he was, he wasted the remaining money he had at the card table and died penniless in a poorhouse.

Not to be outdone by their rivals, the English across the channel embarked on a similar banking and business venture that came to be known as the South Sea Bubble. In imitation of the French economic disaster, the English bubble burst in the same way.

John Law, the compulsive gambler, probably never meant any harm. At least the idea of expanding an economy by issuing credit had far reaching implications that still affect economics today. It was, at least theoretically, beneficial to large portions of the world population. Whether you see this as a good or bad thing probably depends on where you stand financially right now. But if the trajectory of his monetary experiment and the course his life took in the end serves as an omen or a prediction for where capitalism is going, he may not be judged so sympathetically in the future

References

Ferguson, Niall. The Ascent of Money: A Financial History Of the World. Penguin Books, 2008.

Mackay, Charles. Extraordinary Popular Delusions and the Madness of Crowds, Harmony Books, 1980.

https://grimhistory.blogspot.com/

5 notes

·

View notes

Link

1 note

·

View note