#Tax preparation services for CP59 notice

Explore tagged Tumblr posts

Text

Navigating the Maze: How to Handle IRS Letter CP59 with Lexington Tax Group

Received the IRS Letter CP59? Here’s What You Need to Know

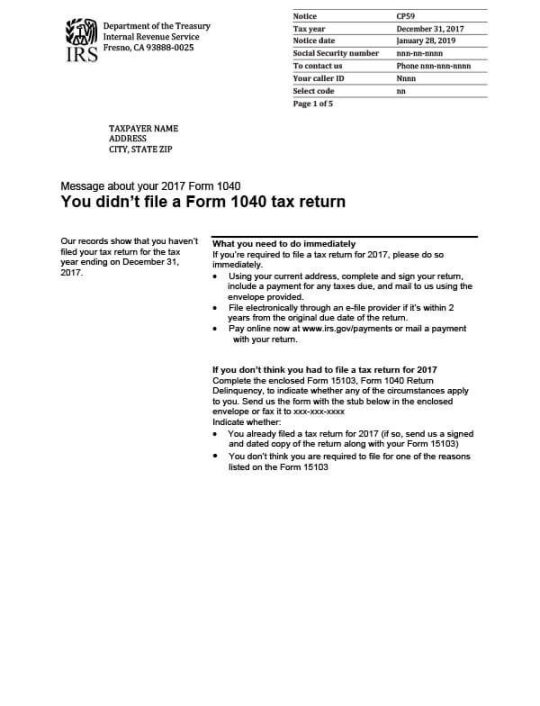

Opening your mailbox to find an IRS Letter CP59 can be an intimidating experience. This letter is the IRS's way of informing you that they have no record of your personal tax return for the prior year. Before panic sets in, know that there's a clear path forward, and Lexington Tax Group is here to light the way.

Immediate Steps to Take After Receiving IRS Letter CP59

First and foremost, understanding the message behind Letter CP59 is crucial. It's not just a reminder but a prompt for immediate action to avoid potential penalties or more serious consequences. This is where Lexington Tax Group steps in, offering a comprehensive service specifically designed for CP59 recipients.

Lexington Tax Group’s Comprehensive Approach

Swift Action: Our first order of business is to protect you from immediate collection actions by the IRS. We understand the urgency of the situation and prioritize halting any collections process in its tracks.

Gathering Information: We then proceed to contact the IRS on your behalf. Our team works diligently to obtain all reported income information necessary to address the discrepancies highlighted by the CP59 letter. This step is fundamental in ensuring that we have a complete understanding of your tax situation.

Filing and Compliance: With all the necessary information in hand, we assist you in preparing and filing any missing tax returns. Our goal is to make this process as smooth and straightforward as possible, ensuring your tax records are accurate and up-to-date.

Resolving Tax Debts: For those who find themselves facing tax debts as a result of the filing process, worry not. Lexington Tax Group is well-versed in a myriad of debt resolution strategies. Whether it's arranging a payment plan or exploring hardship programs, we are committed to finding a solution that best fits your financial situation.

Why Choose Lexington Tax Group?

Choosing Lexington Tax Group means opting for peace of mind. Led by CEO Adam Hastie, our team is not only experienced in tax law and IRS procedures but is also empathetic towards the stress and confusion that can accompany IRS notices. Our personalized approach ensures that your case is handled with the attention and urgency it deserves.

Take Action Today

If you’ve received an IRS Letter CP59, now is the time to act. Lexington Tax Group is ready to guide you through the process, from understanding your notice to achieving tax compliance and resolving any ensuing financial matters. Don’t navigate this alone; our experts are here to support you every step of the way.

For more information or to schedule a consultation, contact us at 800-328-8289 or visit our website at www.LexingtonTaxGroup.com. Let us help you turn this challenge into a step toward financial stability and peace of mind.

#IRS Letter CP59 help#What to do if I received IRS Letter CP59#Missing tax return notice CP59 resolution#CP59 IRS letter assistance#How to respond to IRS Letter CP59#Tax preparation services for CP59 notice#IRS CP59 letter tax resolution services#Filing back taxes after receiving CP59#FIling Back Taxes#Tax advisor for CP59 IRS notice#CP59 tax notice debt resolution options

0 notes

Photo

TRUTHS ABOUT RESOLVING UNFILED BACK TAX RETURNS

The April 15 tax filing deadline is now well in the rear view mirror, but many U.S. taxpayers remain burdened with the stress and anxiety that can come from having one or more unfiled returns outstanding. The Internal Revenue Service estimates that approximately ten million taxpayers, for one reason or another, fail to get their returns filed each and every year. The individuals and businesses run the risk of mounting fees and penalties, and potentially even criminal prosecution.

NEED HELP WITH IRS BACK TAXES, AUDIT REPRESENTATION OR SMALL BUSINESS TAX PREPARATION?

ADVANCE TAX RELIEF LLC www.advancetaxrelief.com BBB A+ RATED CALL (713)300-3965

The IRS will eventually find and pursue non-filers in order to compel their compliance. At Advance Tax Relief LLC, we have vast experience successfully assisting non-filers with the process of regaining good standing with the government, often greatly mitigating fines and penalties. Our tax attorneys are prepared to address your concerns, review your financial data and determine how best to effectively achieve resolution.

Pursuit of non-filers by the IRS Though it may not happen immediately, those who fail to file tax returns will eventually be called to account by the IRS. Revenue agents, auditors and collection officers are employed by the agency as part of the IRS Non-Filer program for purposes of identifying delinquent taxpayers and urging their full compliance with filing requirements.

The IRS works to match Form W-2 and Form 1099 information it has received from employers to filing records of individual taxpayers. Other pertinent information will be gathered and a CP59 Notice may be issued, informing the taxpayer of their need to file a return for one or more years or explain why those returns are unnecessary.

If you have received such a communication from the IRS, it is wise to enlist the aid of a skilled tax attorney who understands how to address unfiled tax returns, comb through financial information and return the taxpayer to good standing.

Key considerations concerning unfiled returns If your unfiled tax returns are causing sleepless nights and worry, scheduling a consultation with Advance Tax Relief LLC from our team will start the process of resolution and help you achieve peace of mind.

Some important factors that will be explored include:

· The number of outstanding unfiled returns

· All accessible income and expense records

· Relevant business records

· Potential for penalties and fines

· Appropriate time to disclose and file

· Relevant statute of limitations, if any

Procrastination and fear behind some non-filer cases There are numerous reasons why some taxpayers fall behind with their annual filings. For some, it is simply the result of procrastination and forgetfulness. Others fail to file because they believe they will be unable to pay their tax bill, once determined.

Regardless of why you may have fallen out of compliance, swift action to achieve resolution is critical. The financial sanctions for failing to file can be significant and will mount quickly if not addressed. The IRS assess substantial amounts of interest and penalties, which vary depending on the amount of tax owed and the length of delinquency. If fraud and/or evasion are suspected, the penalties become even more onerous and the possibility of criminal prosecution becomes very real.

Fortunately, the IRS is often amenable to requests for abatement of penalties under a wide range of circumstances, and at Advance Tax Relief, we are very experienced with the process of securing such relief for our clients. Seeking dispensation from the IRS can be a complicated undertaking, and therefore it makes good sense to secure the aid of trusted professionals who can guide you through each step and bolster your chances of success.

Get help with unfiled back tax returns today Many taxpayers who have failed to file tax returns have been pleasantly surprised to discover that not only can they get back into compliance with relative ease, they are actually entitled to refunds. However, taxpayers generally only have three years from the original return due date to claim those funds. After that, the refund amount may be forfeited to the government.

GET TAX RELIEF HELP TODAY

If you think that you may need help filing your 2018/2019 tax return and past due tax returns, you may want to partner with a reputable tax relief company who can help you get the max refund and reduce your chances for an IRS AUDIT.

Advance Tax Relief is headquartered in Houston, TX with a branch office in Los Angeles, CA. We help many individuals just like you solve a wide variety of IRS and State tax issues, including penalty waivers, wage garnishments, bank levy, tax audit representation, back tax return preparation, small business form 941 tax issues, the IRS Fresh Start Initiative, Offer In Compromise and much more. Our Top Tax Attorneys, Accountants and Tax Experts are standing by ready to help you resolve or settle your IRS back tax problems.

Advance Tax Relief is rated one of the best tax relief companies nationwide.

#TaxDebtProblems #FilingBackTaxes #TaxReliefPrograms #IRSDebtForgivenes #TaxAttorneysNearMe #IRSLawyer #TaxReliefFirms #OfferInCompromise #TaxResolution #LocalTaxAttorney #HelpFilingBackTaxes #TaxDebtSettlement #TaxReliefAttorneys #IRSHelp #TaxRELIEF #TaxAttorneys #AuditHelp #BackTaxes #OfferInCompromise #WageGarnishmentHelp #AuditReliefHelp #SmallBusinessTAXES

0 notes