#CP59 IRS letter assistance

Explore tagged Tumblr posts

Text

Navigating the Maze: How to Handle IRS Letter CP59 with Lexington Tax Group

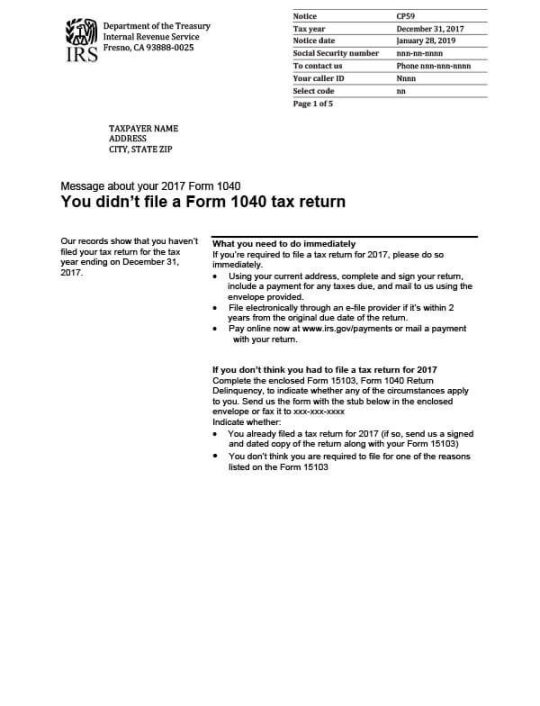

Received the IRS Letter CP59? Here’s What You Need to Know

Opening your mailbox to find an IRS Letter CP59 can be an intimidating experience. This letter is the IRS's way of informing you that they have no record of your personal tax return for the prior year. Before panic sets in, know that there's a clear path forward, and Lexington Tax Group is here to light the way.

Immediate Steps to Take After Receiving IRS Letter CP59

First and foremost, understanding the message behind Letter CP59 is crucial. It's not just a reminder but a prompt for immediate action to avoid potential penalties or more serious consequences. This is where Lexington Tax Group steps in, offering a comprehensive service specifically designed for CP59 recipients.

Lexington Tax Group’s Comprehensive Approach

Swift Action: Our first order of business is to protect you from immediate collection actions by the IRS. We understand the urgency of the situation and prioritize halting any collections process in its tracks.

Gathering Information: We then proceed to contact the IRS on your behalf. Our team works diligently to obtain all reported income information necessary to address the discrepancies highlighted by the CP59 letter. This step is fundamental in ensuring that we have a complete understanding of your tax situation.

Filing and Compliance: With all the necessary information in hand, we assist you in preparing and filing any missing tax returns. Our goal is to make this process as smooth and straightforward as possible, ensuring your tax records are accurate and up-to-date.

Resolving Tax Debts: For those who find themselves facing tax debts as a result of the filing process, worry not. Lexington Tax Group is well-versed in a myriad of debt resolution strategies. Whether it's arranging a payment plan or exploring hardship programs, we are committed to finding a solution that best fits your financial situation.

Why Choose Lexington Tax Group?

Choosing Lexington Tax Group means opting for peace of mind. Led by CEO Adam Hastie, our team is not only experienced in tax law and IRS procedures but is also empathetic towards the stress and confusion that can accompany IRS notices. Our personalized approach ensures that your case is handled with the attention and urgency it deserves.

Take Action Today

If you’ve received an IRS Letter CP59, now is the time to act. Lexington Tax Group is ready to guide you through the process, from understanding your notice to achieving tax compliance and resolving any ensuing financial matters. Don’t navigate this alone; our experts are here to support you every step of the way.

For more information or to schedule a consultation, contact us at 800-328-8289 or visit our website at www.LexingtonTaxGroup.com. Let us help you turn this challenge into a step toward financial stability and peace of mind.

#IRS Letter CP59 help#What to do if I received IRS Letter CP59#Missing tax return notice CP59 resolution#CP59 IRS letter assistance#How to respond to IRS Letter CP59#Tax preparation services for CP59 notice#IRS CP59 letter tax resolution services#Filing back taxes after receiving CP59#FIling Back Taxes#Tax advisor for CP59 IRS notice#CP59 tax notice debt resolution options

0 notes