#Tax Compliance Technology

Explore tagged Tumblr posts

Text

💻🌐 The digital marketplace is a dynamic landscape with unique tax challenges. Stay ahead by understanding the complexities of digital goods and services taxation. Ensure compliance and foster trust with customers and tax authorities in this ever-evolving space.

#Digital Goods#Digital Services#Taxation Challenges#Compliance#VAT#GST#Cross-Border Transactions#Tax Collection#Permanent Establishment#Digital Tax Legislation#Tax Compliance Technology#User Privacy#Regulatory Changes

0 notes

Text

Managing Taxation and Compliance in TallyPrime.

Effective taxation and compliance management are essential for businesses to avoid penalties and ensure smooth operations. TallyPrime offers a streamlined solution for managing various taxes like GST, VAT, TDS, and TCS, making compliance simpler and more accurate.

Managing taxes is vital for businesses to stay compliant and avoid legal issues. TallyPrime provides a comprehensive solution to simplify the management of key taxes like GST, VAT, TDS, and TCS. By automating processes and ensuring accurate reporting, TallyPrime helps businesses focus on their core activities while staying within legal boundaries.

The software’s flexibility allows businesses to customize tax settings and integrate with other tools for better tracking and reporting. TallyPrime is a powerful tool for businesses aiming to manage their taxation and compliance efficiently.

By reducing errors and automating routine tasks, it helps businesses stay compliant and avoid penalties. Antraweb Technologies offers additional Tally Add-Ons like Tally’s Multiple Branch Management, Tally GST and Tally GST Reminder options to enhance your experience with TallyPrime. Reach out to explore how these solutions can benefit your business.

BLOG LINK: https://www.antraweb.com/blog/managing-taxation-and-compliance-in-tally

WEBSITE LINK: Antraweb Technologies Pvt. Ltd.

#Tax Management in TallyPrime#Compliance Management in TallyPrime#Managing Taxation and Compliance in TallyPrime#GST Compliance#VAT Management In Tally#TDS Management in Tally#Antraweb Technologies Tally Add-Ons#Tally Software#TallyPrime

0 notes

Text

Unlocking Career Opportunities with "Mastering Indian Tax Planning and Return Filing"

In the evolving landscape of the Indian economy, taxation stands as a pivotal element driving the financial framework of both businesses and individuals. With the government’s dynamic regulatory changes, especially with the introduction of GST, the demand for knowledgeable tax professionals has surged. This presents a significant career opportunity for students and aspiring professionals eager to…

View On WordPress

#Career Development#Corporate Tax Strategy#Digital Tax Tools#Emerging Technologies in Taxation#Finance Education#Financial Analysis#Financial Career Pathways#Financial Literacy#GST Compliance#Hands-on Tax Practice#Income Tax#Indian Economy#Online Learning#Tax Advisory Services#Tax Consulting Careers#Tax Filing Skills#Tax Law Updates#Tax Planning#Tax Professional Training#Taxation Course

0 notes

Text

#Digital Accessibility#Inclusive Design#Creating Accessible#Assistive Technologies#Disabilities#WCAG#Section 508#Screen Readers#Designing Accessible#Braille Transcription#Universal Design#Document Accessibility#ADA#ADA Compliance#ADA Tax Credit#Audio Descriptions#Workplace Accessibility#Accessibility Services#Designing Websites#Website Accessibility#Accessible Workplace

0 notes

Text

Company Establishment in Turkey

Company establishment in Turkey has become a popular avenue for both foreign and domestic investors, offering numerous benefits such as a young population, favorable currency rates, and decreasing production and labor costs. The dynamic economy, strategic location, and favorable regulatory framework have made Turkey an attractive destination for businesses aiming to expand in the region.

Legal Framework

The foundation of company registration in Turkey is governed by the Turkish Commercial Code (Law No. 6102). This key legislation outlines the legal requirements for forming a company, regardless of whether the business is owned by domestic or foreign entrepreneurs. Complementary laws, such as the Turkish Code of Obligations (No. 6098) and Turkish Civil Code (No. 4721), also play a role in specific aspects of company operations.

Under the law, companies in Turkey acquire legal personality upon registration with the Trade Registry, meaning they are recognized as separate legal entities. This legal separation allows companies to enjoy rights and undertake obligations in their own name, and protects investors from personal liability in many cases.

Foreign Investment in Turkey

Foreigners are allowed to establish companies in Turkey with the same rights as Turkish citizens. The Foreign Direct Investment Law (No. 4875), enacted in 2013, eliminated the legal distinctions between foreign and domestic investors, providing equal treatment to both. This legal framework makes it easier for foreign investors to enter the Turkish market and benefit from its growing opportunities.

Recent legislative developments, such as the 2024 FATF Decision on Türkiye, have further improved Turkey’s attractiveness as an investment hub, particularly with the enactment of new laws like the Turkish Crypto Law (No. 7518). This law addresses critical areas such as digital assets, cryptocurrencies, and peer-to-peer platforms, providing clarity and structure for investors interested in emerging technologies.

Company Types and Registration Process

Investors have the option to establish five types of companies in Turkey, as stipulated in the Turkish Commercial Code:

Collective Companies

Commandite Companies

Cooperatives

Limited Companies

Joint-Stock Companies

The incorporation process can be efficiently completed through MERSİS, the Central Registry System, allowing businesses to finalize registration electronically. One notable advantage in Turkish company law is the ability to establish a single-shareholder joint-stock company or a single-member limited liability company.

To register a company, several steps must be followed:

Draft and sign the company contract,

Prepare signature declarations of company officials,

Pay relevant fees, including the Competition Authority share and capital,

Submit required documents to the Trade Registry Office.

Taxation and Corporate Governance

In Turkey, companies are generally subject to a 20% corporate income tax, while finance-related businesses like banks face a higher rate of 25%. Investors should stay updated on tax changes, including the 2024 amendments to Turkish tax laws, as they can significantly impact business operations.

Once a company is established, the proper management of corporate governance becomes crucial. The Turkish Commercial Code includes specific provisions on how the board of directors should function, ensuring that businesses operate smoothly and in compliance with national laws. Companies must adhere to these corporate governance rules to maintain their legal standing and avoid potential legal issues.

Investment Opportunities and Methods

In addition to direct company establishment, foreign investors may consider other investment options in Turkey, such as:

Share Acquisition: Buying shares of an existing company instead of establishing a new one,

Liaison Offices: Setting up representative offices that handle non-commercial activities,

Franchising: Turkey’s franchising market is open to foreign entrepreneurs, though it is governed by general contract law rather than specific franchising regulations.

Moreover, the Investment Incentive Regime provides significant benefits for businesses in various sectors, including tax reductions, exemptions, and subsidies, making it an appealing option for entrepreneurs considering long-term investments in Turkey.

Additional Steps and Requirements

Beyond the formal registration process, businesses must fulfill several other requirements to begin operations, including:

Opening a bank account,

Obtaining a tax identification number,

Registering for social security if employees are hired,

Acquiring relevant licenses and permits based on the industry.

For example, businesses in the health sector are subject to additional licensing requirements, and recent updates to the 2024 Medical Laboratories Regulation have made significant changes in this field.

Liquidation Process

Companies in Turkey may undergo liquidation through either a voluntary or compulsory process. Liquidation involves selling the company’s assets, collecting receivables, and paying off debts. The liquidation procedure is governed by the Enforcement and Bankruptcy Code (No. 2004) and requires careful management to ensure that the legal entity is properly dissolved.

Conclusion

Turkey’s favorable legal environment, strategic location, and recent regulatory developments offer substantial opportunities for investors. Whether establishing a new company, acquiring shares, or exploring franchising opportunities, Turkey’s business-friendly framework provides a solid foundation for growth. By navigating the legal and bureaucratic processes with the help of experienced legal professionals, foreign and domestic entrepreneurs can successfully establish and expand their businesses in Turkey.

For more information about this topic, please click to https://www.pilc.law/establishment-of-a-company-in-turkey/

4 notes

·

View notes

Text

Foreign Business Act

The Foreign Business Act (FBA) B.E. 2542 (1999) regulates and restricts foreign participation in certain business sectors in Thailand. The purpose of the FBA is to protect local businesses while encouraging foreign investment in targeted areas that benefit the country's economy. Foreign companies must understand the restrictions and licensing requirements outlined in this act to legally operate in Thailand.

1. Structure of the Foreign Business Act

The FBA classifies business activities into three categories (Annexes), each with varying degrees of restrictions:

1.1 Annex 1: Prohibited Activities

Reserved exclusively for Thai nationals, these activities are off-limits to foreigners due to their cultural, historical, or national importance. Foreigners cannot engage in these businesses under any circumstances.

Examples:

Newspaper and media businesses

Rice farming, livestock farming, and forestry

Trading and auctioning of Thai antiques

1.2 Annex 2: Restricted Activities (Subject to Cabinet Approval)

Foreigners can participate in these activities with special approval from the Thai Cabinet due to their potential impact on national security or public welfare.

Examples:

Production of firearms and military equipment

Domestic transportation

Mining and certain types of manufacturing

1.3 Annex 3: Restricted Activities (Requiring a Foreign Business License)

Foreigners may engage in these activities but must first obtain a Foreign Business License (FBL) from the Ministry of Commerce.

Examples:

Retail and wholesale trade

Hotels (excluding hotel management services)

Construction (with certain exceptions)

Legal, accounting, and architecture services

2. Definition of a Foreign Business

A business is considered foreign if it meets any of the following criteria:

It is registered outside Thailand.

More than 49% of its shares are owned by foreign nationals.

Companies with Thai majority ownership (51%) are considered Thai entities and are not subject to FBA restrictions.

3. Obtaining a Foreign Business License (FBL)

3.1 Application Process

Document Submission: Submit the necessary documents, including the business plan, company details, and financial projections, to the Department of Business Development (DBD).

Agency Review: The DBD will evaluate the application based on the business’s contribution to the economy, local employment, and technology transfer.

Approval or Rejection: The review process takes 60–90 days. Approval is granted if the business provides significant benefits to Thailand.

3.2 Criteria for Approval

Economic Contribution: Must provide clear benefits to Thailand's economy.

Local Employment: Businesses that create job opportunities for Thai citizens are favored.

Technology Transfer: Companies introducing new technology have a better chance of approval.

4. Exceptions and Special Cases

4.1 U.S.-Thailand Treaty of Amity

Under this treaty, U.S. citizens and companies can own up to 100% of businesses in most sectors, except those restricted under Annex 1 (e.g., land ownership, media).

4.2 Board of Investment (BOI) Promotion

BOI-promoted companies are exempt from certain FBA restrictions and enjoy tax incentives and easier approval processes.

4.3 Eastern Economic Corridor (EEC)

Businesses investing in high-tech industries within the Eastern Economic Corridor receive additional incentives and reduced restrictions.

5. Penalties for Non-Compliance

Operating a business without the required license can result in:

Fines up to 1 million THB

Imprisonment for up to 3 years

Business closure and forfeiture of profits

6. Recent Developments and Future Trends

Thailand continues to review its foreign business regulations to balance economic development and local business protection. There is growing discussion on liberalizing certain sectors such as technology, e-commerce, and renewable energy to attract foreign investment.

7. Conclusion

The Foreign Business Act is a cornerstone of Thailand’s business environment, regulating foreign participation in key sectors. While the FBA imposes restrictions, it also provides clear pathways for legal operation through licenses, BOI promotion, and bilateral agreements. Foreign investors must conduct thorough research, engage local legal experts, and comply with the FBA’s requirements to operate successfully in Thailand.

#thailand#corporate#business#corporateinthailand#businessinthailand#thai#lawyers#corporatelawyers#businesslawyers#corporatelawyersinthailand#foreignbusinessact#fba

2 notes

·

View notes

Text

The Future of Accounting: Emerging Trends in CA, CS, US CMA, US CPA, UK ACCA, and US CFA

Introduction: The Evolving Landscape of Accounting

The accounting field is undergoing rapid changes due to technological advancements, globalization, and evolving business needs. Professionals in roles like CA (Chartered Accountant), CS (Company Secretary), US CMA (Certified Management Accountant), US CPA (Certified Public Accountant), UK ACCA (Association of Chartered Certified Accountants), and US CFA (Chartered Financial Analyst) are at the forefront of these changes.

Technological Advancements in Accounting

Automation and AI Integration

Automation and artificial intelligence (AI) are transforming routine accounting tasks. Processes such as bookkeeping, payroll, and data analysis are becoming more efficient, reducing errors and saving time. For instance, AI-powered tools can analyze large datasets, offering previously difficult insights to obtain manually.

Blockchain and Its Impact on Transparency

Blockchain technology is revolutionizing accounting by providing a secure and transparent ledger system. It ensures data integrity and reduces the chances of fraud, making it particularly useful for auditing and financial reporting.

Cloud-Based Accounting Solutions

Thanks to cloud technology, accounting professionals can access financial data from any location at any time. Tools like QuickBooks and Xero provide real-time collaboration, enabling seamless interactions between clients and professionals.

The Role of Globalization in Shaping Accounting Careers

Demand for International Qualifications

With businesses expanding globally, certifications like US CPA, UK ACCA, and US CMA are gaining prominence. These qualifications offer a global perspective, making professionals more competitive in international markets.

Cross-Border Financial Regulations

Accountants are now required to understand complex international tax laws and compliance standards. This has increased the demand for experts in regulatory frameworks such as IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles).

Soft Skills: The New Essential for Accounting Professionals

Communication and Leadership

Modern accountants are expected to go beyond crunching numbers. Strong communication skills and leadership abilities are essential for conveying financial insights and guiding decision-making processes.

Adaptability and Lifelong Learning

With constant changes in technology and regulations, professionals must adapt and continuously update their knowledge. Certifications like US CMA and US CFA emphasize ongoing education to stay relevant.

Sustainability and ESG Reporting

Focus on Environmental, Social, and Governance (ESG) Metrics

Organizations are increasingly prioritizing sustainability. Accountants play a crucial role in ESG reporting, helping companies track and disclose their environmental and social impact.

Green Accounting Practices

Green accounting involves assessing and reporting environmental costs. This emerging field aligns financial practices with sustainability goals, reflecting a company’s commitment to responsible operations.

The Future of Accounting Certifications

Digital Skills Integration

Certifications like CA, US CPA, and UK ACCA are incorporating digital skills into their syllabi. Topics such as data analytics and cybersecurity are becoming essential components of these programs.

Specialized Roles and Niches

The future holds promising opportunities for accountants in specialized roles. Fields like forensic accounting, financial planning, and risk management are seeing significant growth.

Conclusion: Embracing Change in Accounting

The future of accounting is bright and full of opportunities for professionals willing to adapt. By staying updated on technological advancements, regulatory changes, and global trends, accountants can thrive in this dynamic field. Whether you’re pursuing CA, CS, US CMA, US CPA, UK ACCA, or US CFA, embracing these trends will set you apart in the ever-evolving accounting landscape.

2 notes

·

View notes

Text

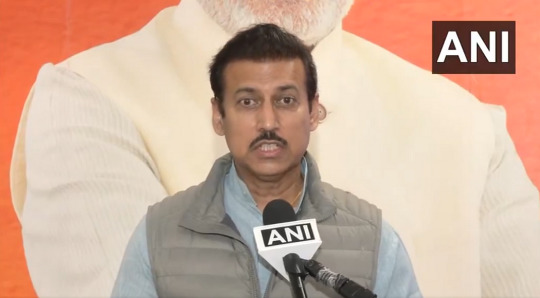

Union Budget 2025: Rajasthan Minister Col Rajyavardhan Rathore Highlights Boost for MSMEs & Startups

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has placed a strong emphasis on fostering entrepreneurship, innovation, and economic self-reliance. Rajasthan’s Minister Rajyavardhan Singh Rathore has lauded the budget’s focus on Micro, Small & Medium Enterprises (MSMEs) and Startups, calling it a game-changer for India’s business ecosystem.

This budget introduces bold incentives, funding support, and digital transformation initiatives to empower small businesses and young entrepreneurs, ensuring that they remain the backbone of India’s growing economy.

Key Announcements for MSMEs & Startups

1. Enhanced Credit Support for MSMEs

✅ ₹50,000 Crore Expansion in Credit Guarantee Scheme — Making loans easily accessible for small businesses. ✅ Interest Subvention for MSMEs — Lower borrowing costs to promote business expansion. ✅ Tax Relief for MSMEs — Increased turnover threshold for tax exemptions.

2. Startup India 3.0 — A New Era of Entrepreneurship

✅ ₹25,000 Crore Startup Growth Fund — Supporting early-stage and high-impact startups. ✅ Easier Compliance & Single Window Clearance for business registrations. ✅ Tax Holiday Extension for eligible startups, reducing financial stress.

3. Technology & Digital Transformation

✅ AI, Blockchain & Cloud Support for MSMEs — Helping businesses adopt advanced technology. ✅ Digital Payment Incentives — Encouraging a cashless economy and financial inclusion. ✅ Boost for FinTech & E-commerce Startups — Simplified regulations and incentives.

4. Skill Development & Job Creation

✅ New Entrepreneurship Hubs in Tier-2 & Tier-3 Cities to nurture local talent. ✅ ₹10,000 Crore Allocation for Digital Skilling & AI Training — Preparing the youth for high-growth industries. ✅ Expansion of Production-Linked Incentive (PLI) Scheme to generate employment in key sectors.

Rajasthan’s Gains: A Thriving Hub for MSMEs & Startups

Minister Rajyavardhan Singh Rathore highlighted how Rajasthan stands to benefit immensely from these policies, stating:

“This budget reflects the Modi government’s unwavering commitment to empowering MSMEs and startups. Rajasthan, with its strong entrepreneurial spirit, will see a surge in new businesses, innovation hubs, and employment opportunities.”

He emphasized three major gains for Rajasthan’s business ecosystem:

Tourism & Handicrafts MSMEs will receive enhanced support for global market expansion.

Renewable Energy Startups in Rajasthan will gain access to Green Funds.

Agritech & Rural Startups will benefit from new funding and digital infrastructure.

A Vision for Aatmanirbhar Bharat

The Union Budget 2025 ensures that India’s MSMEs and startups thrive in a competitive global economy. With tax incentives, credit support, and technology integration, this budget paves the way for a self-reliant and prosperous India.

Col. Rajyavardhan Rathore’s message to entrepreneurs:

“This is the best time to be an entrepreneur in India. With government support and strong policies, MSMEs and startups are set to become the driving force behind ‘Viksit Bharat’.”

🚀 A New Era of Business Begins! Jai Hind! Jai Rajasthan! 🇮🇳

4 notes

·

View notes

Text

PTAG Opinion Piece: Why We Should Be Supporting Small Trucking Businesses in a Heavy Regulated Industry:

The trucking industry is the backbone of our economy, moving goods across the nation and ensuring that shelves are stocked and businesses thrive. However, the landscape for small trucking companies has become increasingly challenging due to a maze of regulations that can hinder their growth and sustainability.

Small trucking businesses often operate on tight margins. Unlike larger corporations that can absorb the costs of compliance, small operators frequently struggle to keep up with the multitude of regulations imposed by federal and state authorities. These regulations, while essential for safety and environmental protection, can be overwhelming and disproportionately affect smaller companies that lack the resources and infrastructure of their larger counterparts.

For instance, the requirement to invest in advanced safety technologies, such as electronic logging devices (ELDs) and advanced braking systems, can place a significant financial burden on small operators. While these tools can improve safety and efficiency in the long run, the initial costs can be daunting for a small business trying to stay afloat.

Moreover, the evolving landscape of regulations related to emissions and fuel standards places additional pressure on small trucking companies. Upgrading fleets to meet these standards often necessitates significant capital investment, which many small firms simply cannot afford. This can lead to a cycle of compliance that results in either excessive debt or the inability to compete in a market dominated by larger players with more financial flexibility.

What’s needed is a more supportive approach to regulation that takes the unique challenges faced by small trucking businesses into account. This could include phased implementation of new regulations, financial assistance for necessary upgrades, or even tax incentives that encourage compliance without crippling small operators.

Additionally, creating a platform for small trucking businesses to voice their concerns and collaborate on solutions can foster a sense of community and shared purpose. By working together, small operators can advocate for fair regulations that prioritize safety without compromising their ability to operate effectively.

In conclusion, the trucking industry is vital for our economy, and small trucking businesses play a crucial role in that ecosystem. As regulations continue to evolve, it’s imperative that we support these smaller operators with the resources and considerations they need to thrive. A balanced approach to regulation can ensure that safety and innovation go hand in hand, allowing small trucking companies to continue delivering the goods that keep our economy moving. 👋😎🚛🚚💨 #PTAG #Trucking

2 notes

·

View notes

Text

Thailand Long-term Resident Visa

The Thailand Long-Term Resident (LTR) Visa, launched in 2022, is an initiative designed to attract high-net-worth individuals, retirees, skilled professionals, and remote workers. It offers a 10-year renewable visa with unique privileges aimed at fostering economic growth and retaining global talent.

1. Purpose of the LTR Visa

Economic Stimulation:

Encourage investment in Thai businesses and infrastructure.

Global Talent Attraction:

Draw highly skilled professionals and entrepreneurs to critical industries.

Demographic Support:

Facilitate an aging population with affluent retirees.

Tourism and Remote Work:

Establish Thailand as a hub for digital nomads and global travelers.

2. Eligibility Criteria

2.1 Wealthy Global Citizens

Assets: Minimum USD 1 million in global assets.

Income: At least USD 80,000/year over two years.

Investment: A minimum of USD 500,000 in Thai government bonds, real estate, or direct investments.

2.2 Wealthy Pensioners

Age: 50 or older.

Income: At least USD 80,000/year or USD 40,000/year with an additional investment of USD 250,000 in Thai assets.

2.3 Highly Skilled Professionals

Employment: Expertise in sectors such as technology, healthcare, and renewable energy.

Income: Minimum USD 80,000/year or USD 40,000/year with advanced qualifications.

2.4 Work-from-Thailand Professionals (Digital Nomads)

Income: Minimum USD 80,000/year or USD 40,000/year for tech professionals.

Employer: Work for an established overseas company generating at least USD 150 million annually.

3. Application Process

Document Preparation:

Passport, income proofs, investment records, and employment letters as per eligibility.

Submission to BOI:

Apply through the Board of Investment (BOI) for pre-qualification.

Approval Process:

BOI forwards successful applications to the immigration department for visa issuance.

Final Issuance:

Visa obtained from Thai embassies, consulates, or local immigration offices.

4. Benefits of the LTR Visa

Extended Stay:

10-year visa with multiple entries.

Work Permit Inclusion:

Allows employment in Thailand without separate work permits.

Simplified Reporting:

Annual reporting instead of the standard 90-day check-ins.

Tax Incentives:

Reduced personal income tax rates for skilled professionals.

Family Privileges:

Dependents, including spouses and children, qualify for similar residency benefits.

5. Regulatory Compliance

Investment Monitoring:

Financial thresholds must be maintained during the visa tenure.

Taxation:

Income earned within Thailand must adhere to Thai tax regulations.

Visa Renewal:

Subject to review to ensure continued eligibility.

6. Challenges and Considerations

Financial Thresholds:

High income and asset requirements limit access for certain groups.

Sector-Specific Professions:

Skilled professionals must align with industries targeted by Thailand’s economic strategy.

Compliance Costs:

Continuous documentation and reporting obligations may require professional assistance.

Conclusion

The Thailand LTR Visa is a forward-thinking program offering a gateway to long-term residency for affluent individuals, skilled professionals, and retirees. By fostering foreign investment and innovation, it aligns with Thailand’s vision of sustainable economic growth. However, applicants must navigate rigorous financial and professional requirements to access its benefits. Legal and financial advisors are recommended for seamless application and compliance management.

#thailand#immigration in thailand#immigration lawyers in thailand#immigration#lawyers in thailand#thailandvisa#immigrationinthailand#immigrationlawyers#thai#visa#thaivisa#longtermvisa#thailongtermvisa#thailanglongtermresidentvisa

2 notes

·

View notes

Text

#Digital Goods#Digital Services#Taxation Challenges#Compliance#VAT#GST#Cross-Border Transactions#Tax Collection#Permanent Establishment#Digital Tax Legislation#Tax Compliance Technology#User Privacy#Regulatory Changes

0 notes

Text

Accounting Outsourcing Companies in India by Neeraj Bhagat & Co.: Your Reliable Financial Partner

In today’s dynamic business environment, companies are constantly looking for ways to optimize their operations and focus on core competencies. One of the most effective strategies is outsourcing non-core functions like accounting. For businesses seeking top-notch financial management, Neeraj Bhagat & Co. stands out as one of the leading accounting outsourcing companies in India, offering unparalleled expertise and services tailored to meet diverse business needs.

Why Choose Neeraj Bhagat & Co. for Accounting Outsourcing?

Extensive Industry Experience With decades of experience, Neeraj Bhagat & Co. has established itself as a trusted partner for businesses across various industries. Their team of seasoned professionals ensures that clients receive accurate, timely, and reliable financial services.

Comprehensive Accounting Services Neeraj Bhagat & Co. offers a wide range of accounting outsourcing services, including:

Bookkeeping and Financial Reporting Tax Compliance and Advisory Payroll Processing Budgeting and Forecasting Audit Support Their holistic approach ensures that all financial aspects are covered, allowing businesses to focus on growth and innovation.

Customized Solutions for Every Business Understanding that no two businesses are the same, Neeraj Bhagat & Co. provides customized solutions tailored to each client’s specific needs. Whether you’re a startup, SME, or a large corporation, their team works closely with you to develop a financial strategy that aligns with your goals.

Benefits of Outsourcing Accounting to Neeraj Bhagat & Co.

Cost Efficiency Outsourcing accounting functions can significantly reduce overhead costs. By partnering with Neeraj Bhagat & Co., businesses can save on expenses related to hiring in-house accounting staff, training, and infrastructure.

Access to Expertise With Neeraj Bhagat & Co., you gain access to a team of highly skilled professionals who stay updated with the latest accounting standards and regulations. This ensures compliance and minimizes the risk of financial discrepancies.

Focus on Core Activities By outsourcing accounting tasks, businesses can allocate more resources and attention to their core activities, leading to increased productivity and growth.

Scalability As your business grows, your accounting needs may become more complex. Neeraj Bhagat & Co. offers scalable solutions that can adapt to your evolving requirements, ensuring seamless financial management.

How Neeraj Bhagat & Co. Stands Out

Client-Centric Approach At Neeraj Bhagat & Co., client satisfaction is paramount. Their dedicated team works closely with clients to understand their unique challenges and provide personalized solutions.

Advanced Technology Leveraging the latest accounting software and technology, Neeraj Bhagat & Co. ensures efficient and accurate financial reporting. Their tech-driven approach enhances transparency and streamlines processes.

Strong Ethical Standards Integrity and transparency are at the core of Neeraj Bhagat & Co.’s operations. Clients can trust them to handle their financial information with the utmost confidentiality and professionalism.

Get Started with Neeraj Bhagat & Co. If you’re looking for reliable and efficient accounting outsourcing companies in India, Neeraj Bhagat & Co. is the ideal partner. Their comprehensive services, experienced team, and client-focused approach make them a preferred choice for businesses seeking to enhance their financial management.

#taxation taxplanning taxreturns#accounting#taxauditfirm#income tax#tax services#developers & startups#education#quotes#nonprofits#photography

3 notes

·

View notes

Text

Physical Verification of Fixed Assets by MASLLP: Ensuring Accuracy and Accountability

For businesses, maintaining an accurate record of fixed assets is crucial for financial reporting, compliance, and operational efficiency. MASLLP, a trusted name in the financial consulting domain, offers expert services for the physical verification of fixed assets, ensuring your business stays organized, compliant, and secure.

What is Physical Verification of Fixed Assets? Physical verification of fixed assets involves systematically checking and validating the existence, condition, and location of assets owned by a business. It is a critical process to:

Identify discrepancies between physical assets and records. Ensure compliance with accounting standards and regulations. Protect against theft, loss, or mismanagement of assets. Why Choose MASLLP for Fixed Asset Verification? MASLLP’s team of experienced professionals ensures a seamless and accurate verification process. Here’s why businesses trust MASLLP:

Comprehensive Asset Audits MASLLP’s experts conduct thorough physical inspections, cross-referencing assets with financial records to identify inconsistencies.

Advanced Tools and Technology Using cutting-edge tools like barcoding, RFID, and asset tracking software, MASLLP ensures precision in the verification process.

Customized Solutions Every business is unique, and MASLLP tailors its asset verification services to align with your organization’s specific needs and objectives.

Compliance Expertise With MASLLP’s expertise in financial regulations, your business stays compliant with statutory requirements and accounting standards.

Key Benefits of Physical Verification by MASLLP Accurate Financial Reporting Eliminate discrepancies in your financial statements by ensuring all assets are accounted for.

Enhanced Asset Management Identify underutilized, misplaced, or obsolete assets to improve efficiency and cost-effectiveness.

Risk Mitigation Reduce the risk of theft, fraud, or mismanagement by maintaining an accurate and up-to-date asset register.

Regulatory Compliance Ensure adherence to legal and accounting standards, avoiding penalties and audits.

MASLLP’s Fixed Asset Verification Process

Planning and Preparation Understanding the client’s asset management system. Defining the scope of the verification process.

On-Site Physical Verification Conducting a detailed inspection of assets. Tagging and labeling assets where required.

Reconciliation Comparing physical records with the asset register. Identifying and addressing any discrepancies.

Reporting Providing a comprehensive report with findings and recommendations. Why Regular Fixed Asset Verification is Essential Businesses often overlook the importance of regular physical verification, which can lead to:

Inaccurate asset valuation. Missed opportunities for tax benefits. Increased risks of fraud or theft. By partnering with MASLLP, businesses can maintain a robust asset management system and safeguard their investments.

Get in Touch Ensure your fixed assets are accounted for and secure with MASLLP’s Physical Verification of Fixed Assets services.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#ap management services#auditor

5 notes

·

View notes

Text

Accounting and Bookkeeping Services in Delhi by SC Bhagat & Co.

Efficient financial management is the cornerstone of any successful business. Whether you're a startup, small business, or an established enterprise, maintaining accurate financial records is essential for growth and compliance. In the bustling hub of Delhi, SC Bhagat & Co. stands out as a trusted provider of professional accounting and bookkeeping services, tailored to meet diverse business needs.

Why Choose Accounting and Bookkeeping Services in Delhi? Accounting and bookkeeping are more than just financial chores. They form the backbone of strategic decision-making, regulatory compliance, and overall business stability. Here’s why professional accounting and bookkeeping services are crucial:

Accurate Financial Records: Ensure precise tracking of all transactions and cash flows. Regulatory Compliance: Stay updated with tax laws and regulatory changes. Time Savings: Focus on your core business while experts handle the numbers. Better Financial Insights: Gain actionable insights for informed decision-making. Avoid Errors: Eliminate mistakes that can lead to penalties or financial loss. About SC Bhagat & Co. With decades of expertise, SC Bhagat & Co. has become a trusted name in Delhi for accounting and bookkeeping services. The firm is known for its reliability, professionalism, and a client-centric approach that ensures tailored solutions for businesses across industries.

Key Services Offered:

Accounting Services:

Preparation and maintenance of financial statements. Monthly and annual reporting. Budgeting and forecasting. Bookkeeping Services:

Recording daily financial transactions. Reconciliation of accounts. Payroll processing and management. Tax Compliance and Planning:

GST filing and compliance. Income tax returns and advisory. Support during audits and assessments. Financial Advisory:

Cash flow management. Profitability analysis. Strategic financial planning. Why SC Bhagat & Co. Stands Out for Accounting and Bookkeeping Services in Delhi

Experienced Professionals: A team of qualified accountants ensures top-notch service quality. Customized Solutions: Services are tailored to the specific needs of your business. Cutting-Edge Technology: Use of advanced accounting tools and software for accuracy and efficiency. Transparent Pricing: Competitive and clear pricing with no hidden charges. Client-Centric Approach: Emphasis on understanding client goals and delivering results that align with their vision. Industries We Serve SC Bhagat & Co. serves a wide range of industries, including:

Manufacturing Retail and e-commerce Real estate Healthcare IT and software Non-profit organizations Benefits of Partnering with SC Bhagat & Co. When you choose SC Bhagat & Co., you gain a partner who is invested in your success. Key benefits include:

Enhanced financial accuracy and efficiency. Assurance of compliance with all regulatory requirements. Access to real-time financial data for better decision-making. Reduction in operational costs through outsourcing. Why Delhi Businesses Trust for Accounting and Bookkeeping Services in Delhi by SC Bhagat & Co. Operating in Delhi’s dynamic business environment requires financial precision and agility. SC Bhagat & Co. has a deep understanding of the local market, tax regulations, and industry-specific challenges, making it the go-to firm for accounting and bookkeeping services in the capital. Get Started Today Simplify your financial management and focus on scaling your business by outsourcing your accounting and bookkeeping needs to SC Bhagat & Co.. Contact us today for a consultation and take the first step toward streamlined financial operations.

3 notes

·

View notes

Text

#Web accessibility#Web accessibility design#Food Businesses#WCAG#Section 508#Screen Readers#Disabilities#Color Contrast#Accessibility Essential#ADA Compliance#PDF Accessibility#Digital Accessibility#Assistive Technologies#Braille Transcription#Website Accessibility#accessibility lawsuits#eCommerce Website#Accessibility Audits#ADA Tax Credit#Inclusive Design#Designer Accessibility#Accessibility Services

0 notes

Text

Why CPA Firms Are Choosing to Outsource Tax Preparation: A Data-Driven Look

In recent years, more and more CPA firms are turning to outsourced tax preparation services to enhance their operations and improve client satisfaction. This shift is not just a passing trend; it's driven by tangible, data-backed benefits that offer significant value. Here’s a closer look at why CPA firms are increasingly choosing to outsource their tax preparation needs.

1. Cost Savings and Efficiency:

Outsourcing tax preparation allows CPA firms to significantly reduce overhead costs. Hiring, training, and retaining full-time employees for tax season can be expensive, especially when demand fluctuates. According to a survey by the National Association of Tax Professionals, firms that outsource tax preparation report a 20-30% reduction in operating costs. By outsourcing, firms can allocate their budget more effectively, investing in growth and client services rather than overhead.

2. Access to Specialized Expertise:

Tax laws and regulations are constantly evolving, making it difficult for CPA firms to stay on top of every update. Outsourcing providers specialize in tax preparation, which means they have a team of experts who are up-to-date with the latest tax codes and compliance requirements. This is critical for CPA firms that want to avoid costly mistakes. In fact, 60% of firms that outsource report improved compliance and accuracy in their filings.

3. Scalability During Peak Seasons:

Tax season is a demanding time for CPA firms, often requiring firms to increase their staffing levels temporarily. However, hiring temporary staff can lead to issues such as training delays and quality control. Outsourcing provides scalability without the need for a hiring surge. Providers can quickly ramp up or down based on demand, allowing CPA firms to handle seasonal fluctuations more efficiently. 75% of CPA firms say outsourcing provides the flexibility they need during high-demand periods.

4. Increased Focus on Core Services:

By outsourcing tax preparation, CPA firms free up their internal teams to focus on higher-value services such as tax planning, consulting, and client relationship management. This helps firms build stronger client relationships and add more value beyond just preparing tax returns. A study by QuickBooks found that firms that outsource routine tasks like tax prep are able to increase revenue from advisory services by as much as 40%.

5. Reduced Risk and Improved Accuracy:

Tax preparation is complex, and errors can lead to costly penalties or audits. By outsourcing to a specialized provider, firms minimize the risk of mistakes. Many outsourcing firms utilize advanced technology and follow rigorous quality control measures to ensure accuracy. According to Accounting Today, 80% of firms that outsource tax preparation report fewer errors and reduced risk of audits.

Conclusion:

Outsourcing tax preparation services offers numerous benefits to CPA firms, including cost savings, access to expertise, scalability, and improved accuracy. By leveraging these advantages, CPA firms can streamline their operations, enhance client satisfaction, and position themselves for long-term success. In an increasingly competitive landscape, outsourcing tax preparation is not just a smart move—it’s becoming an essential strategy for growth and efficiency. For CPA firms looking to streamline tax preparation and enhance service offerings, partnering with an experienced outsourcing provider can be the key to unlocking these benefits.

2 notes

·

View notes