#TDSReturns

Explore tagged Tumblr posts

Text

Efficient Online TDS Returns Filing Services in Delhi

Effortlessly file your TDS returns online in Delhi with the expertise of CA Near By Me. Simplify tax compliance through our professional services, ensuring accuracy and timely submissions. Trust us for seamless TDS return filing, providing you peace of mind. Let our experienced Chartered Accountants handle your tax needs efficiently. Choose convenience and reliability for stress-free financial compliance. Contact us (+91 7011665073) today for personalized assistance that guarantees peace of mind and financial security.

#CANearByMe#TDSReturns#TaxFiling#DelhiCA#TaxSolutions#ProfessionalServices#AccuracyAssured#FinancialPeace#ConvenientTaxFiling#ReliableCA

0 notes

Text

Quarterly TDS Returns made simple! Web-e-TDS streamlines the process for effortless submissions. Stay compliant, save time, and reduce stress. Discover the ease of TDS Returns with us! 💼💻

Click here for more: https://webtel.in/WEB-e-TDS.aspx

0 notes

Text

TDS Returns with Taxgoal's Online Filing Services in Delhi

Taxgoal offers convenient and efficient Online TDS Returns Filing Services in Delhi. Our expert team ensures accurate and timely filing, helping you stay compliant with tax regulations. Say goodbye to paperwork and filing hassles – trust Taxgoal for a seamless TDS return filing experience. Contact us today for hassle-free tax compliance. To know more visit here: https://taxgoal.in/service/tds-filing-for-property-26-qb/

0 notes

Text

Simplifying Income Tax Compliances for Businesses and NGOs with the LegalDost

Income tax compliance is a critical component of running any business, whether it is a start-up, small firm, or non-profit organization. Businesses that file properly can avoid fines, remain out of legal problems, and maintain a flawless financial record. The LegalDost offers a variety of services, including business tax filing, TDS return filing, and representation to the Income Tax Department, to entrepreneurs, non-governmental organizations, and business owners seeking explanation. This blog covers the LegalDost's services for helping you stay on top of your financial obligations while digging into the principles of income tax compliance.

Understanding Business Tax Filing and Deadlines

Identifying the deadlines for tasks is crucial for timely income tax payment. Severe penalties are imposed for failing to submit the business tax return filing deadline on time. Some types of businesses have different due dates to file business tax returns than others.

The business tax return filing date for corporations that need audits is usually September 30th of the assessment year.

The NGO return filing date varies between trusts and NGOs, and seeking advice from specialists is crucial to comply with regulations.

The LegalDost provides instructions on how to file business taxes so that you don't miss any of these due dates.

Filing Taxes for Small Businesses and Startups

Filing Your Income Tax Return for Your Small Business

Tax filing can be daunting for small businesses. However, it becomes manageable with the right support and resources. This is a streamlined, step-by-step procedure:

Compile all of your financial documents.

Make use of small business tax filing software or consult professionals such as the LegalDost.

To prevent mistakes, file online or get advice from experts.

With the LegalDost's help with filing small business taxes online, accuracy and compliance are guaranteed.

Filing Taxes for Start-up Businesses

When it comes to tax reporting, start-ups frequently confront particular difficulties. Understanding filing your own business taxes or how to file taxes for small business owners might make this process go more smoothly. With a focus on filing taxes for start-up businesses, LegalDost makes navigating the complexity of taxation simple.

NGO and Trust Income Tax Compliance

Trusts and NGOs must follow certain rules, particularly with regard to income tax return filing. In order to do this, you must choose the appropriate income tax return form and file it by the income tax return filing date. By offering specialized services and advising NGOs on how to file income tax returns for NGOs, the LegalDost guarantees seamless and prompt compliance.

TDS Return Filing and Representation

Understanding TDS Return Filing

Companies are required to timely file returns and routinely deduct tax at source (TDS). Penalties may result from missing the TDS return filing due date. We provide an outline of the TDS return filing process here:

Collect TDS details.

When filing TDS returns online, it is imperative that you make use of the right software applications.

It is imperative that you ensure that the returns are submitted by the TDS return filing date.

The TDS return filing procedure, which the LegalDost streamlines, guarantees compliance at every stage.

Late Filing of TDS Returns

When you file your business tax return late, you become subject to a penalty that can have a major impact on your finances. In order to minimize these problems and guarantee a seamless conclusion, the LegalDost offers representation to the Income Tax Department.

Filing Business Taxes Online with LegalDost

Using reliable platforms to file business taxes online for free is now simpler than ever in the digital era. To ensure error-free files, however, experience is necessary. The LegalDost helps in the following areas:

Small Business Income Tax Filing: Whether you're a first-time taxpayer or require assistance with how to file income tax for small business, the LegalDost makes sure precision as well as adherence.

Business Tax Filing Software: We minimize errors by streamlining the tax filing process with cutting-edge solutions.

Representation to Income Tax Department: Do you need help with notices or audits? The professionals at the LegalDost manage communications with the tax department on your behalf.

Why Choose LegalDost for Income Tax Filing Services?

The LegalDost provides a wide range of tax compliance services, such as:

Business Tax Return Filing: We provide hassle-free assistance in meeting the business tax return filing deadline.

TDS Return Filing: Stay out of trouble by using our simplified TDS return filing process.

NGO and Trust Tax Filing: Handle the intricacies of trust filings, or how to file NGO income tax returns, with ease.

Representation to Income Tax Department: Seek expert assistance with audits, refunds, and explanations.

Key Benefits of Timely Income Tax Filing

Avoid Penalties: Late filings result in penalties. When you file your tax return on the due date for your income tax return, you safeguard the resources that you have available to you financially.

Maintain Financial Health: Credibility and transparency are guaranteed by accurate filings.

Eligibility for Refunds: Ensure your eligibility for refunds by submitting your application on time.

Start Filing with the LegalDost Today!

Complying with income taxes doesn't have to be difficult. We streamline the procedure at LegalDost, moving from income tax return filing to TDS return filing. Our professionals make sure your tax returns are accurate, on time, and stress-free, regardless of whether you are the manager of a non-profit organization, a small business owner, or the creator of a startup.

Visit the LegalDost right now to learn more about our offerings and easily handle all of your tax compliance requirements.

0 notes

Text

TDS Return Service in Delhi

Looking for TDS Return Service in Delhi? Trust ApnaGST for accurate, timely filings. Let us handle your tax worries while you focus on your business growth!

📲: +91-9953993848

0 notes

Text

Certification Course of TDS in Tally Prime in just 299/-

Certification Course of TDS in Tally Prime in just 299/- Boost your knowledge and skills with Kaushlam Course Benefits:- Learn as per your timings Easy Access on mobile Certification Download the Kaushlam App now https://play.google.com/store/apps/details?id=com.app.lms Call Now: +91 9587533533 Visit us: www.kaushlam.in

#TDS#tallyprime#tallyprimecourse#TallyPrimewithGST#TDSRETURN#kaushlam#jaipur#students#education#onlinecourses#onlinelearning

0 notes

Video

youtube

CBDT relaxes provisions of TDS/TCS in event of death before linkage of PAN and Aadhaar 7.8.2024

CBDT relaxes provisions of TDS/TCS in event of death of deductee/collectee, before linkage of PAN and Aadhaar @cadeveshthakur #tds #tcs #cadeveshthakur #tdsreturns Dear Viewers, CBDT relaxes provisions of TDS/TCS in event of death of deductee/collectee, before linkage of PAN and Aadhaar The Central Board of Direct Taxes (CBDT) has relaxed provisions of TDS/TCS in event of death of deductee/collectee, before linkage of PAN and Aadhaar. Index 00:00 to 02:00 CBDT relaxes TDS/TCS Provision 02:01 to 05:00 linkage of pan and aadhaar 05:01 to 10:15 tds return In view of genuine difficulties being faced by taxpayers, CBDT issued the Circular no. 8 of 2024 dated 05.08.2024, and vide the same, the Government has relaxed the provisions of TDS/TCS as per the Income-tax Act, 1961(the ‘Act’) in the event of death of deductee/collectee before linking of PAN and Aadhaar. In order to redress the grievances of the taxpayers wherein instances have been cited, of demise of the deductee/collectee on or before 31.05.2024 and before the option to link PAN and Aadhaar could have been exercised, the Circular provides that there shall be no liability on the deductor/collector to deduct/collect the tax under section 206AA/206CC of the Act, as the case maybe pertaining to the transactions entered into upto 31.03.2024. This is in continuation of Circular no. 6 of 2024 dated 23.04.2024 issued earlier by CBDT wherein the date for linking of PAN and Aadhaar was extended upto 31.05.2024 for the taxpayers (for the transactions entered into upto 31.03.2024) to avoid higher TDS/ TCS as per the Act. The Circular No. 06 of 2024 dated 23.04.2024 and Circular No. 08 of 2024 dated 05.08.2024 are available on www.incometaxindia.gov.in. 🎥 Hello, lovely viewers! Welcome back to the @cadeveshthakur channel! 🎉 YouTube Channel: https://www.youtube.com/@cadeveshthakur TDS ki कक्षा: https://www.youtube.com/playlist?list=PL1o9nc8dxF1RqxMactdpX3oUU2bSw8-_R E-commerce sellers: https://www.youtube.com/playlist?list=PL1o9nc8dxF1ShUNXkAbYrAYj2Pile1Rim GST Knowledge Bank: https://www.youtube.com/playlist?list=PL1o9nc8dxF1RjdRrG4ZKXeJNed6ekhjoR Goods & Services Tax: https://www.youtube.com/playlist?list=PL1o9nc8dxF1SlBw2kSpZ9ay1jnEOkbDYN TDS: https://www.youtube.com/playlist?list=PL1o9nc8dxF1RXi2GaEckeXGmJy_FYOj9q Shorts for Accountants, Professionals, Finance, Students: https://www.youtube.com/playlist?list=PL1o9nc8dxF1TqoRTWoA1_l0kmtsbyNEB5 Accounting concept, Entries, Final Accounts preparation: https://www.youtube.com/playlist?list=PL1o9nc8dxF1T4GSjBPboXxBgFgkVZmDbQ Direct Taxation: https://www.youtube.com/playlist?list=PL1o9nc8dxF1S7BBNeuL3fzV_fDl9V88C2 🎥 Hello, lovely viewers! Welcome back to the @cadeveshthakur channel! 🎉 I’m thrilled to have you here, and I want to connect with you beyond YouTube. Let’s take our journey together to the next level! 😊 LinkedIn: https://www.linkedin.com/in/cadeveshthakur/ Instagram: https://www.instagram.com/cadeveshthakur/ Twitter: https://twitter.com/cadeveshthakur Facebook: https://www.facebook.com/cadevesh Whatsapp Group: https://whatsapp.com/channel/0029Va6GOVE9MF92Ylmo7e0L #cadeveshthakur https://cadeveshthakur.com/ Remember, our community is more than just a channel—it’s a family. Let’s connect, learn, and grow together! Hit that Subscribe button, tap the notification bell, and let’s spread financial wisdom one click at a time. 🚀 Remember, knowledge empowers us all! Let’s learn together and navigate the complex world of finance with curiosity and diligence. Thank you for being part of the cadeveshthakur community! 🙌 Disclaimer: The content shared on this channel is purely for educational purposes. As a Chartered Accountant, I strive to provide accurate and insightful information related to GST, income tax, accounting, and tax planning. However, please note that the content should not be considered as professional advice or a substitute for personalized consultation. cbdt relaxes provision of tds tcs,linking of pan with aadhaar,linking of pan card with aadhar card,tds return filing online,tds return filing,cadeveshthakur,CBDT relaxes provisions of TDS/TCS in event of death of deductee/collectee,before linkage of PAN and Aadhaar,what is the use of linking pan card with aadhar card,CBDT issued the Circular no. 8 of 2024 dated 05.08.2024,Circular no. 6 of 2024 dated 23.04.2024

0 notes

Text

Need an expert hand in managing GST and TDS filing services in Delhi NCR? Look no further! We are one of the best in Delhi NCR, offering top-notch GST and TDSreturn filing services.

1 note

·

View note

Photo

2 notes

·

View notes

Photo

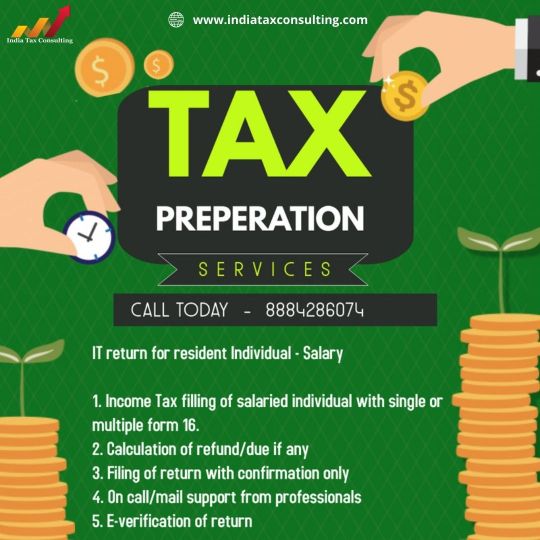

Want to plan and save taxes !! No need to read so many articles on google !! reach out to an expert !!

Feel free to Call us @ +91 88842 86074 or write to us - [email protected]

Visit our website : https://www.indiataxconsulting.com

#taxconsultant#taxconsulting#taxconsultants#taxation#tax#incometax#gst#gstindia#mca#ministryoffinance#india#taxconsultingfirm#service#consulting#taxiservice#TDS#TDSreturn#corporate#compliances#compnayregistrationservices#incometaxe#incometaxreturn#taxes#indiatax

1 note

·

View note

Video

tumblr

TDS on Cash Transactions - Explained in Tamil

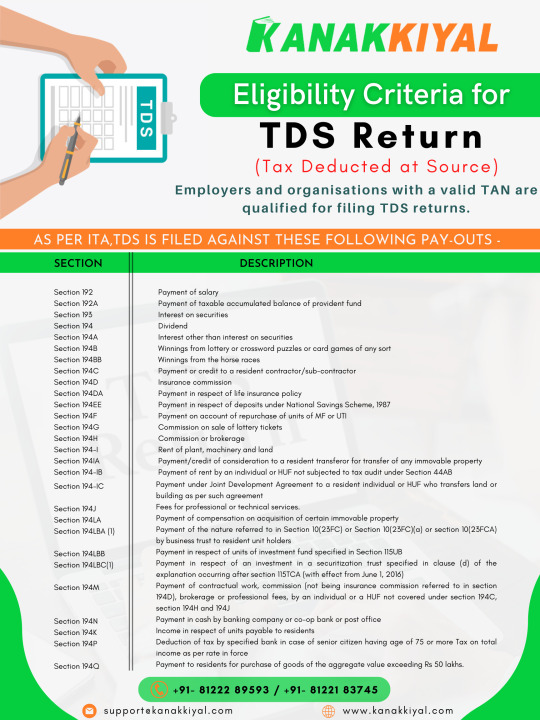

TDS return filing is compulsory for all the assesses who fall under the tax slab as prescribed by the Income Tax Department.

To file a TDS return, one must be thorough with the application procedure and the eligibility criteria.

https://www.kanakkupillai.com/tds-return

0 notes

Text

#TDSreturn#TDS#EligibilityCriteria#Taxdeductedatsource#tdsreturnfiling#trademark#companyregistration#accountingfirrm#taxfiling#FssaiRegistrationServices#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#incometax#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#ITfiling#kanakkiyal#chennai#license#Incometaxfilinginchennai

0 notes

Text

Online TDS Returns Filing Services Delhi

Effortlessly file your TDS returns online in Delhi with Taxgoal! Our expert team ensures accurate and timely submissions, keeping you compliant and stress-free. Simplify tax season with our user-friendly platform. Secure, reliable, and dedicated to your financial success. Experience seamless TDS filing today with Taxgoal - your trusted tax partner. To know more visit here: https://taxgoal.in/service/tds-deducted-on-all-payments-except-salaries-form-26q/

0 notes

Text

GST

0 notes

Text

TDS Return Consultant in Karol Bagh, Delhi

Looking for TDS Return Consultant in Karol Bagh, Delhi? Trust ApnaGST for accurate, timely filings. Let us handle your tax worries while you focus on your business growth!

🌐: https://apnagst.com/tds-return-service-in-karol-bagh-delhi/

📲: +91-9953993848

0 notes

Link

With the help of CaOnWeb you can easily file TDS Returns with the help of experienced CA. So get Easiest, Quickest and cost effective way to filing TDS Return in India.

1 note

·

View note