#Sukanya Yojana Calculator

Explore tagged Tumblr posts

Text

Sukanya Yojana Calculator

Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme designed to provide financial security for the girl child’s education and marriage. It is a popular scheme among parents who wish to secure their daughters’ future. The scheme offers an attractive interest rate and tax benefits under Section 80C of the Income Tax Act. To help parents plan their investments, several financial institutions and government websites provide a Sukanya Yojana Calculator.

सुकन्या योजना कैलकुलेटर

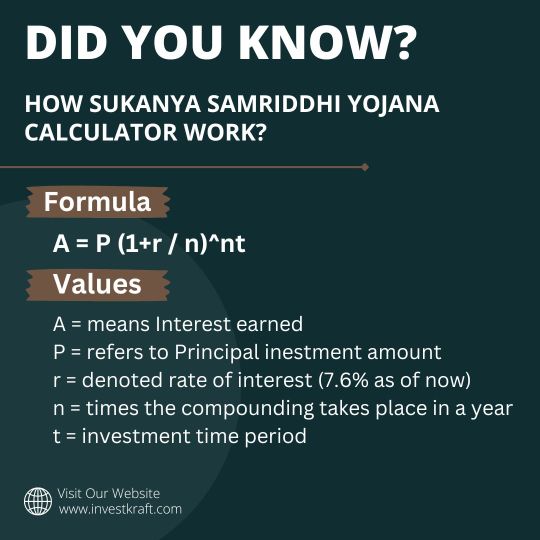

A Sukanya Yojana Calculator is a tool that helps parents calculate their investments and returns in the scheme. It provides an estimate of the amount that they need to invest regularly to achieve their desired goal. The calculator requires inputs such as the amount to be invested, the duration of the investment, and the interest rate offered by the scheme. Based on these inputs, the calculator generates the estimated returns and maturity amount.

To use the Sukanya Yojana Calculator, parents need to follow a few simple steps. Firstly, they need to visit the official website of the financial institution or government website that offers the calculator. Next, they need to enter the required inputs, such as the amount of investment, the duration of investment, and the interest rate. Once the inputs are entered, the calculator generates the estimated returns and maturity amount.

Post Office Time Deposit Calculator

Using a Sukanya Yojana Calculator can be beneficial in several ways. Firstly, it helps parents plan their investments systematically and avoid any financial burden in the future. They can choose the right investment amount and duration that suits their financial goals and capability. Secondly, the calculator provides an estimate of the returns, which helps parents understand the potential benefits of the scheme. This can motivate them to invest regularly and achieve their goals.

In conclusion, a Sukanya Yojana Calculator is a useful tool for parents who wish to invest in the Sukanya Samriddhi Yojana scheme for their daughter’s education and marriage. It provides an estimate of the returns and maturity amount based on the investment amount, duration, and interest rate. Using a calculator can help parents plan their investments systematically and achieve their financial goals. It is advisable to use the calculator provided by the official website of the financial institution or government website to ensure accurate calculations.

0 notes

Text

Curious About Sukanya Samriddhi Yojana Calculator?

Are you interested in planning for your daughter's future education and marriage expenses? The Sukanya Samriddhi Yojana Calculator can help you estimate potential returns on your investments. This handy tool allows you to input your investment amount and duration to calculate the future value of your savings under the Sukanya Samriddhi Yojana scheme. Whether you're considering starting a new investment or already have one, this calculator provides valuable insights into your financial planning. For a user-friendly experience, you can access the Sukanya Samriddhi Yojana Calculator on the Investkraft website. Investkraft offers a range of financial tools and resources to assist you in making informed investment decisions. Take advantage of this easy-to-use calculator to plan effectively for your daughter's financial needs.

#investkraft#finance#calculators#financial calculators#Sukanya Samriddhi Yojana#Sukanya Samriddhi Yojana Calculator

2 notes

·

View notes

Text

Strategic Planning for Your Girl Child's Future with the Sukanya Samriddhi Yojana Calculator

Securing your daughter's future is a primary concern for many parents, especially when it comes to financing education and marriage expenses. The Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme in India designed specifically for this purpose. This article will guide you through maximizing the benefits of SSY using the Sukanya Samriddhi Yojana calculator, while also contrasting it with the personal loan EMI calculator to demonstrate different financial planning tools available for managing future expenses.

What is the Sukanya Samriddhi Yojana Calculator?

The Sukanya Samriddhi Yojana calculator is an online tool that helps parents calculate the maturity value of their investment in the SSY scheme. By inputting details like the yearly investment amount and the starting age of the child, the Sukanya Samriddhi Yojana calculator projects the amount you will accumulate by the time the account matures.

How the SSY Calculator Works:

Initial Deposit: The scheme requires a minimum of INR 1,000 to open an account, with a maximum deposit of INR 1.5 lakh per year.

Interest Rate: The SSY offers a higher interest rate compared to many other savings schemes, which is calculated and compounded annually.

Maturity Period: The scheme matures in 21 years from the date of opening the account, but contributions are only required for the first 15 years.

Using the Sukanya Samriddhi Yojana calculator allows parents to visualize the growth of their savings and make informed decisions about how much to invest each year.

Benefits of Regular Contributions Using SSY Calculator

Regular contributions can have a significant impact on the final amount accrued in the SSY account. The Sukanya Samriddhi Yojana calculator can demonstrate how different deposit frequencies (annual, half-yearly, quarterly) and amounts can affect the maturity value:

Compounding Interest: Because the SSY calculator uses the principle of compound interest, making regular contributions can greatly increase the final amount due to the interest on interest effect.

Flexibility in Deposits: While the minimum yearly deposit is set, the SSY calculator can help parents decide if making higher contributions is beneficial, depending on their financial situation.

Planning for Educational and Marriage Expenses

When planning for future educational and marriage expenses, the Sukanya Samriddhi Yojana calculator is a valuable tool. It provides a clear picture of how much money will be available at different stages of your child’s life, helping you align these financial goals with other savings and investment strategies.

Education Planning: As education costs continue to rise, using the SSY calculator helps ensure that you are setting aside enough funds to cover higher education expenses when the time comes.

Marriage Expenses: Marriage expenses can also be substantial, and having a robust fund like SSY can alleviate financial stressors related to these costs.

Comparing SSY Calculator with Personal Loan EMI Calculator

While the Sukanya Samriddhi Yojana calculator focuses on saving, the personal loan EMI calculator is a tool used for borrowing. Here’s how the two compare:

Purpose: The SSY calculator is designed for long-term savings, whereas the personal loan EMI calculator is typically used for immediate financial needs or debts.

Financial Planning: Using the SSY calculator promotes proactive financial planning for future expenses, reducing the likelihood of needing to rely on loans, which can be evaluated with a personal loan EMI calculator.

Final Words

Effectively using the Sukanya Samriddhi Yojana calculator to plan for your daughter's future expenses allows for a strategic approach to saving. By understanding the nuances of how contributions affect the maturity value, parents can make informed decisions that secure their child's educational and marital future financially. Contrastingly, understanding the function of a personal loan EMI calculator also prepares parents for any immediate financial needs that might arise, ensuring a well-rounded financial strategy.

0 notes

Text

How To Use Sukanya Samriddhi Yojana 250 Per Month Calculator

#Sarkariyojana#pmsarkariyojana#sukanya samriddhi scheme#calculator#sukanya samriddhi yojana#bjpindia#government#gujarat#pm#up#pmv#pmu#pmyojana

1 note

·

View note

Text

Unveiling Your Investment Journey in India: A Guide to Diverse Options

Embarking on your investment journey in India can be both exciting and rewarding. This guide will navigate you through various investment options tailored to different risk appetites, financial goals, and timelines. Whether you're a beginner or a seasoned investor, understanding these options will enhance your personal finance learning and financial education in India.

Retirement Planning in India: Embark on a well-planned journey toward a secure and fulfilling retirement. Discover a variety of investment options designed to meet your unique needs and goals:

National Pension Scheme (NPS): Benefit from customizable asset allocation and enjoy healthy returns. We'll provide in-depth insights into NPS returns and the factors that influence them.

Public Provident Fund (PPF): Take advantage of tax-free returns and a safe, government-backed investment.

Employee Provident Fund (EPF): Secure your future with contributions from both you and your employer, building a substantial retirement corpus.

Financial Education & Learning: In the world of finance, knowledge is power. Enhance your financial literacy with our comprehensive resources on personal finance and financial education in India. Learn the essentials of investing, and planning for the future, ensuring you make informed decisions every step of the way.

Beyond the Basics: Exploring Investment Avenues

Compare Savings Options: Dive into the details of Fixed Deposits (FDs), Public Provident Funds (PPF), Sukanya Samriddhi Yojana (a scheme for the girl child), and more. We’ll guide you in selecting the best options tailored to your financial goals.

Cryptocurrency in India: Dive into the dynamic world of cryptocurrencies—an exciting alternative investment avenue! While traditional assets like stocks and real estate have their place, digital currencies offer unparalleled liquidity, global accessibility, and potential for exponential growth. Whether you’re a seasoned investor or a curious newcomer, you may want to check out crypto investment as your next investment option!

Alternative Investments: Explore beyond stocks and bonds! Think of private equity, commodities, and hedge funds as your secret weapons for growing wealth. These options offer diversification and the potential for better returns.

Demystifying Investment Risks & Returns:

Understanding Risk: Investment decisions involve calculated risks. We'll break down the risk profiles of various options like Corporate Bonds, Capital Gain Bonds, and National Company Deposits (NCDs).

Investment Returns Updates: Investment returns updates cover products like Government Securities, Debt Portfolio Management Services (PMS), Flexi-Cap Funds, Index Funds, Balanced Advantage Funds, Multi-Asset Allocation Funds, Gold ETFs, Sovereign Gold Bonds (SGBs), Unit Linked Insurance Plans (ULIPs), Liquid Funds, and Fixed Maturity Plans (FMPs).

Join the Investment Conversation!

Indvesting is your one-stop shop for all things personal finance in India. Subscribe to our newsletter for regular updates, insightful articles, and expert advice. Let's embark on your investment journey together!

Visit: https://indvesting.com/

1 note

·

View note

Text

Invest In Your Child’s Future: Gratuity Calculator & Sukanya Samriddhi

As parents, it is quite natural for them to be worried about their child’s future. Hence, in this blog, we shall be looking at two important tools that are helpful in planning finances and securing a child’s future in terms of various aspects.

Why Invest in Your Child’s Future?

The increase in the inflation rate simultaneously increases the expenses, thus making it hard to cater to all the needs of the children. This is when they need to have the opportunities to advance themselves, thus, investment in the education of their future becomes significant. Plans and early investments help our child build a sheltered financial adult life.

In addition, saving for their child’s future is a standard practice of money and financial budgeting. But watching these things, creates good money habits in them from the early stage of their lives, which will later prove to be beneficial for their future.

What is a Gratuity Calculator?

The gratuity calculator is a calculator available online. It allows the users to calculate the gratuity amount that is due of all the employees based in India. It gives strict accuracy of the amount that the employee is assigned to be compensated by their employer as a gratuity in virtue of their salary and service years.

How Does Gratuity Calculator Work?

● The gratuity calculator works based on the simple formula of:

Gratuity amount= (last salary* years of service*15)/26

● Note that for different types of employees, like government staff and people from the education sector or those who are private sector employees, the computation could be different.

● The employer is required to make the payment to the employee either at the time of laying off or after having worked for a minimum number of years, which is preferably five years.

Benefits of Gratuity Calculator

1. Accurate Calculation

There won’t be any error to be found in the Gratuity Calculator while computing the gratuity amount. It sticks to a well-defined process and calculates an exact measurement, which further safeguards you from the error margin.

2. Time-Saving

The compensation of gratuity manually is time-consuming as it becomes complicated for employers, particularly when they have to pay too many employees. The Gratuity Calculator is the one that simplifies the process and does your job quickly without much trouble, therefore, it is effective and less complicated.

3. Better Financial Planning

The Gratuity Calculator helps organize the budget between the employer and the employee. It gives the employee a clear image of the gratuity total that they will receive during the time of retirement or other financial goals. This price can be taken into account in other similar readings.

How can an SSY Calculator Help You?

When a girl child is born in the family, parents frequently want to invest in her name so that it covers her cost of marriage and education later on. It is the dream of every parent to secure their girl child’s future no matter what it takes.

During this time, it is important to note that parents can choose among several investment options, but Sukanya Samriddhi Yojana has increasingly popular rates and privileged tax terms. A tax exemption of 1.5 lakhs can be claimed from the amount donated to SSY under section 80 C of the Income Tax Act of 1961.

Investors can slightly change the regular payments for each quarter that are required to be paid to obtain their goal finally. Error-free results can be obtained by using the Sukanya Samriddhi Yojana calculator, which is entirely free to use.

A secondary personal plan with the scheme with a high anticipated rate of return is the Sukanya Samriddhi Yojana. To keep the account open, you need to make the lowest annual contribution.

Benefits of Using Sukanya Samriddhi Yojana Calculator

● Accurate Calculation: The SSY Calculator gives accurate calculations. By using it, parents realize where and how they can hugely benefit from their investments.

● Transparency: The calculator utilizes an exemplary formula that is known to be accurate for calculating the returns, hence emphasizing the aspect of transparency in the calculation process.

● Helps in Goal-Setting: This helps parents to set short-term goals for their daughter’s future through proper investment which are achievable easily.

● Tax Benefits: The SSY scheme falls under Section 80C of the Income Tax Act, which provides the investors with tax benefits and competitiveness of the instrument vis-а-vis other available options.

● Flexible Investment Options: The SSY calculator facilitates you to take a trial with different levels of deposit amount and tenures available.

How Can Gratuity Calculator & Sukanya Samriddhi Yojana Calculator Help Secure Your Child’s Future?

Now, let’s see how these tools help secure the future of the child:

1. Financial Planning: These calculators furnish one with the maturity amount or the gratuity amount, which they accurately estimate and thus help the parents plan finances accordingly.

2. Goal-Setting: Knowing the expected profit would give parents a chance to set a goal for their child’s investment and also make investments that can achieve that goal.

3. Tax Benefits: Not only do both schemes provide tax relief, but they also draw an investment plan for parents.

4. Time-Saving: These calculators will save time and effort that is usually spent in the working process of a manual calculation. Thus parents can handle more important parameters of a child’s future.

5. Transparency: The already-designed calculation formulas used in such tools ensure transparency in the calculation process, which allows parents to obtain clear ideas about the returns they are making from their investments.

The Bottom Line

Developing our kid’s future is the first step to financial stability. The gratuity calculator and sukanya samriddhi yojana calculator will surely help us to arrange investments wisely and secure the brightest future for our children. These tools not only carry forward prompt and ideal accounting but also facilitate our financial planning as well as goal-setting. Hence, these online calculators are really useful instruments to have a look at what will be your expected future, by being unafraid of any kind of uncertainty.

0 notes

Text

Invest In Your Child’s Future: Gratuity Calculator & Sukanya Samriddhi

As parents, it is quite natural for them to be worried about their child’s future. Hence, in this blog, we shall be looking at two important tools that are helpful in planning finances and securing a child’s future in terms of various aspects.

Why Invest in Your Child’s Future?

The increase in the inflation rate simultaneously increases the expenses, thus making it hard to cater to all the needs of the children. This is when they need to have the opportunities to advance themselves, thus, investment in the education of their future becomes significant. Plans and early investments help our child build a sheltered financial adult life.

In addition, saving for their child’s future is a standard practice of money and financial budgeting. But watching these things, creates good money habits in them from the early stage of their lives, which will later prove to be beneficial for their future.

What is a Gratuity Calculator?

The gratuity calculator is a calculator available online. It allows the users to calculate the gratuity amount that is due of all the employees based in India. It gives strict accuracy of the amount that the employee is assigned to be compensated by their employer as a gratuity in virtue of their salary and service years.

How Does Gratuity Calculator Work?

● The gratuity calculator works based on the simple formula of:

Gratuity amount= (last salary* years of service*15)/26

● Note that for different types of employees, like government staff and people from the education sector or those who are private sector employees, the computation could be different.

● The employer is required to make the payment to the employee either at the time of laying off or after having worked for a minimum number of years, which is preferably five years.

Benefits of Gratuity Calculator

1. Accurate Calculation

There won’t be any error to be found in the Gratuity Calculator while computing the gratuity amount. It sticks to a well-defined process and calculates an exact measurement, which further safeguards you from the error margin.

2. Time-Saving

The compensation of gratuity manually is time-consuming as it becomes complicated for employers, particularly when they have to pay too many employees. The Gratuity Calculator is the one that simplifies the process and does your job quickly without much trouble, therefore, it is effective and less complicated.

3. Better Financial Planning

The Gratuity Calculator helps organize the budget between the employer and the employee. It gives the employee a clear image of the gratuity total that they will receive during the time of retirement or other financial goals. This price can be taken into account in other similar readings.

How can an SSY Calculator Help You?

When a girl child is born in the family, parents frequently want to invest in her name so that it covers her cost of marriage and education later on. It is the dream of every parent to secure their girl child’s future no matter what it takes.

During this time, it is important to note that parents can choose among several investment options, but Sukanya Samriddhi Yojana has increasingly popular rates and privileged tax terms. A tax exemption of 1.5 lakhs can be claimed from the amount donated to SSY under section 80 C of the Income Tax Act of 1961.

Investors can slightly change the regular payments for each quarter that are required to be paid to obtain their goal finally. Error-free results can be obtained by using the Sukanya Samriddhi Yojana calculator, which is entirely free to use.

A secondary personal plan with the scheme with a high anticipated rate of return is the Sukanya Samriddhi Yojana. To keep the account open, you need to make the lowest annual contribution.

Benefits of Using Sukanya Samriddhi Yojana Calculator

● Accurate Calculation: The SSY Calculator gives accurate calculations. By using it, parents realize where and how they can hugely benefit from their investments.

● Transparency: The calculator utilizes an exemplary formula that is known to be accurate for calculating the returns, hence emphasizing the aspect of transparency in the calculation process.

● Helps in Goal-Setting: This helps parents to set short-term goals for their daughter’s future through proper investment which are achievable easily.

● Tax Benefits: The SSY scheme falls under Section 80C of the Income Tax Act, which provides the investors with tax benefits and competitiveness of the instrument vis-а-vis other available options.

● Flexible Investment Options: The SSY calculator facilitates you to take a trial with different levels of deposit amount and tenures available.

How Can Gratuity Calculator & Sukanya Samriddhi Yojana Calculator Help Secure Your Child’s Future?

Now, let’s see how these tools help secure the future of the child:

1. Financial Planning: These calculators furnish one with the maturity amount or the gratuity amount, which they accurately estimate and thus help the parents plan finances accordingly.

2. Goal-Setting: Knowing the expected profit would give parents a chance to set a goal for their child’s investment and also make investments that can achieve that goal.

3. Tax Benefits: Not only do both schemes provide tax relief, but they also draw an investment plan for parents.

4. Time-Saving: These calculators will save time and effort that is usually spent in the working process of a manual calculation. Thus parents can handle more important parameters of a child’s future.

5. Transparency: The already-designed calculation formulas used in such tools ensure transparency in the calculation process, which allows parents to obtain clear ideas about the returns they are making from their investments.

The Bottom Line

Developing our kid’s future is the first step to financial stability. The gratuity calculator and sukanya samriddhi yojana calculator will surely help us to arrange investments wisely and secure the brightest future for our children. These tools not only carry forward prompt and ideal accounting but also facilitate our financial planning as well as goal-setting. Hence, these online calculators are really useful instruments to have a look at what will be your expected future, by being unafraid of any kind of uncertainty.

#InvestInYourChild #GratuityCalculator #SukanyaSamriddhi #FinancialPlanning #ChildEducation

0 notes

Text

A Step-by-Step Guide to Using the Sukanya Samriddhi Yojana Calculator for Long-Term Financial Planning

The Sukanya Samriddhi Yojana Calculator is a valuable tool for parents looking to plan and secure their daughters' financial future. By understanding how to effectively use this calculator, you can make informed decisions regarding investments and savings for your child's education and marriage.

Step 1: Understanding the Scheme Before using the Sukanya Samriddhi Yojana Calculator, it's crucial to have a comprehensive understanding of the scheme. Familiarize yourself with the various features, benefits, and terms associated with the Sukanya Samriddhi Yojana.

Step 2: Input Essential Details To begin using the calculator, enter specific details such as the investment amount, tenure, and expected rate of interest. The calculator will use this information to generate projections and potential returns on investment.

Step 3: Analyze Future Value After inputting the necessary details, the calculator will provide insights into the potential future value of your investments. It will offer a clear picture of the expected corpus at the end of the investment tenure, taking into account the interest accrued over the years.

Step 4: Assess Savings Plan Based on the projected future value, you can assess the adequacy of your savings plan. Consider whether the calculated amount aligns with your financial goals for your daughter's education and marriage. Make adjustments as necessary to ensure your savings strategy is on track.

Step 5: Make Informed Decisions Utilize the insights from the Sukanya Samriddhi Yojana Calculator to make informed investment decisions. Evaluate different scenarios by adjusting the investment amount or tenure to determine the most suitable strategy for achieving your desired financial objectives.

By following these step-by-step instructions, you can effectively leverage the Sukanya Samriddhi Yojana Calculator to plan and secure your daughter's financial future. Make use of this valuable tool to ensure that you are well-prepared to meet your child's educational and marriage-related expenses.

0 notes

Text

Sukanya Samriddhi Yojana: How much return will you get on investment of Rs 1000, 2000, 3000 or 5000 per month? ,Personal Finance News, Business News | Zee Business.

Sukanya Samriddhi Yojana Calculator: By the time your daughter turns 21, a good amount of money will be ready for her. We will tell how much returns will investments of Rs 1000, 2000, 3000 or 5000 give at the time of the maturity of Sukanya Samriddhi Yojana. Sukanya Samriddhi Yojana Calculator: Any Indian can start investing in Sukanya Samriddhi Yojana for their daughter below 10 years of age.…

View On WordPress

0 notes

Text

How to invest money- ICICI Pru Life

How to investment money in India?

If you are thinking about investing, it is necessary to understand the types of investment plans available in India. They could vary basis the risk of investment offered by the plans – low-risk, medium-risk and high-risk. Let us understand this in detail below:

1. Low-risk investments

These are investment instruments that provide you with fixed returns. The returns are free from market volatility. As an investor, you will know the amount you will get back from the plan at the time of purchase of the plan. If you have a low risk appetite or want to invest for your non-negotiable goals, such as your child’s education, you may consider investing in these plans.

Some low-risk investment plans in India include Endowment Insurance plans, Fixed Deposits (FD), National Savings Certificate (NSC) and Sukanya Samriddhi Yojana (SSY) for the girl child, among others.

2. Medium-risk investments

These investment plans offer some risk but can provide higher returns to investors as compared to low-risk investment plans. Such investment instruments are best-suited if you have medium-risk appetite and are looking for decent returns on your investments. Although the returns are not guaranteed, you can calculate the estimated returns they can get.

Some medium-risk investment instruments include ULIPs with balanced funds and index funds, among others.

3. High-risk investments

These investment plans involve a high risk but can also provide very good returns in the long term. Examples of high-risk investment plans include equity stocks and equity-based mutual funds, among others. These instruments are highly prone to market volatility and their returns can fluctuate a lot.

As an investor, you should invest in high-risk investment instruments only if you have a high risk appetite. Also, it is important to have a good knowledge of the market and its functioning before considering investing in these instruments.

Some investment plans like ICICI Pru Signature provide you with an option to invest in high-risk equity funds, low-risk debt funds or balanced funds, basis your risk appetite. You may also switch between funds any number of times without any additional cost`. The plan also provides you with a life cover^ that secures your loved ones financially in case of an unfortunate event.

0 notes

Text

A Guide to Salary Tax Exemptions and Deductions

What are the different salary components?

Two types of components

Fixed components (e.g., HRA)

Variable components (bonus, commission, etc.)

Basic salary (to be 50% of CTC)

Allowances (monetary benefits for housing, dearness allowance, etc.)

Perquisites (e.g., car for GM or CFO)

Bonus, commission & leave travel concessions

Social security benefits (ESI, PF, etc.)

Gratuity

Retrenchment compensation

Other components with different names (all are taxable)

How is income tax calculated for salaried employees?

Income tax for salaried employees is calculated based on five different heads of income.

The five heads of income include salary, income from house property, profit and gains from business and profession, capital gains (which includes stocks) and income from other sources.

If one sells stocks for a profit, the gains will be taxable as either short-term or long-term capital gains.

Short-term capital gains (holding period of less than one year) will be taxed at 15%.

Long-term capital gains (holding period of more than one year) will be taxed at 10% with an exemption of up to INR 1 lakh.

Gross total income is the sum of five heads of income.

Deductions are made under Section 80 to arrive at the net income (which is taxable).

The tax is payable along with the surcharge and education cess.

What are the tax exemptions for salaried employees?

Old regime:

Three categories: general, senior citizen and super senior citizen

Tax slabs vary based on age and income

Exemption limit for general category: INR 2.5 lakh

Education cess and surcharge are applicable as per income

New regime:

Different tax categories (as above)

Exemption limit: INR 2.5 lakh

No deductions are allowed

New budget changes:

Exemption limit is increased to INR 7 lakh

Standard deduction of INR 52,500 is available for a salary above INR 15.5 lakh

What are the different income tax deductions for salaried employees?

Salaried employees can avail of various deductions under different sections such as Section 80, Section 24 and Section 10. Section 80C is the most important section that covers a wide range of investments for deductions up to INR 1.5 lakh.

Other sections include 80CCD1B, 80D, 80DD, 80DDB, 80E, 80EEA, 80EEB, 80G, 80TTA, 80TTB and 80U. Deductions for interest paid on loans for a self-occupied property are limited to INR 2 lakh under Section 24. A physically challenged person can get a deduction of INR 75,000 to 1.5 lakh.

What is Sukanya Samriddhi Yojana, and what are its benefits?

Sukanya Samriddhi Yojana is a government scheme started in 2015 under the “Beti Bachao Beti Padhao” campaign. It allows investment in the name of a girl child under 10 years, with a minimum amount of INR 250 and a maximum of INR 1.5 lakh per annum. The scheme offers around 7–8% interest rates and tax benefits under Section 80C. The maturity amount and interest earned are fully tax-exempt.

What are the eligibility criteria for tax benefits under Section 80E?

Under Section 80E, individuals can claim a deduction on interest paid on higher education loans, taken for themselves, their spouse, children or legal guardians, from banks, financial institutions or charitable organisations. There is no limit on the deduction, and it is available for eight years starting from the year of loan repayment. It is different from the deduction available under Section 80C for tuition fees.

What is Section 10 of Income Tax, and what are its exemptions?

Section 10 of the income tax covers various allowances and exemptions, including:

Fully exempt allowances for High Court judges, UN employees and government employees working outside India.

Fully-taxable allowances such as compensatory and caffeine house allowances.

Partly taxable and exempt allowances, with some exemptions limited to actual amounts spent or specified limits set by the government.

Allowances include the ones for Sodexo coupons, hilly areas, borders, tribal areas and children’s education allowances, as well as transport and underground allowances for mines.

What is Section 80D, and how can a salaried person benefit from it?

Section 80D allows individuals to claim a deduction on health insurance premiums paid for themselves, their spouse, children, and parents. The deduction cap is INR 25,000 for non-senior citizens and INR 50,000 for senior citizens. If the individual and their parents are both senior citizens, they can claim a deduction of up to INR 1 lakh. Additionally, individuals can claim a deduction of up to INR 50,000 on medical expenses incurred for themselves or their family members if they cannot get health insurance for some reason.

Source Link

1 note

·

View note

Text

Sukanya Samriddhi Yojana Calculator

Wondering how much to invest in a Sukanya Samriddhi Account for your daughter's future? Our Sukanya Samriddhi Yojana calculator can help. Just enter the investment amount and tenure to calculate the maturity value and interest earned. Read now and start planning for your daughter's bright future!

0 notes

Text

Sukanya Samriddhi Account: Now 65 lakh rupees will be available in Sukanya, see full calculation

Sukanya Samriddhi Account SSY Update: If you also have a daughter, then Sukanya Samriddhi Account` can be a popular and risk-free investment option for you. Sukanya Samriddhi Yojana, launched in 2015 as part of the government's 'Beti Bachao Beti Padhao' c

Sukanya Samriddhi Account SSY Update: If you also have a daughter, then Sukanya Samriddhi Account` can be a popular and risk-free investment option for you. Sukanya Samriddhi Yojana, launched in 2015 as part of the government’s ‘Beti Bachao Beti Padhao’ campaign, aims to encourage parents to save for their daughter’s education and upbringing. Sukanya Samriddhi Account SSY Update Sukanya…

View On WordPress

0 notes

Text

Sukanya Samriddhi Yojana: How to get Rs 50 Lakh Return by Investing Rs 300 Per Day? Check Calculator Here

One of the better programmes, Sukanya Samriddhi Yojana (SSY), allows you to contribute as little as Rs 250 per month to the future financial security of your daughter. source https://zeenews.india.com/personal-finance/sukanya-samriddhi-yojana-how-to-get-rs-50-lakh-return-by-investing-rs-300-per-day-check-calculator-here-2571902.html

View On WordPress

0 notes

Link

#सुकन्या समृद्धि योजना के लिए आवश्यक दस्तावेज#सुकन्या समृद्धि योजना#Sukanya Samriddhi Yojana Calculator#Sukanya Samriddhi Yojana#Sukanya Samriddhi#ingovtscheme#sarkari yojana#indian government#indian govt scheme#central govt. schemes

1 note

·

View note

Text

Sukanya Samriddhi Account : बदले नियम, बेटियों की पढ़ाई और शादी की जिम्मेदारी सरकार की, देंखे अपडेट

Sukanya Samriddhi Account : बदले नियम, बेटियों की पढ़ाई और शादी की जिम्मेदारी सरकार की, देंखे अपडेट

Sukanya Samriddhi Account : बदले नियम, बेटियों की पढ़ाई और शादी की जिम्मेदारी सरकार की, देंखे अपडेट : बेटी की पढ़ाई से लेकर शादी तक की चिंता से मुक्त रहें क्योंकि सरकार एक जबरदस्त योजना लेकर आई है जिसमें अगर आपकी जुड़वां बेटियां हैं तो भी सरकार दोनों बेटियों को बेहतरीन सुविधाएं मुहैया कराएगी। कई नियम बदल गए हैं। जानिए पूरी जानकारी। सुकन्या समृद्धि योजना ( Sukanya Samriddhi Yojana ) के तहत निवेश…

View On WordPress

#sukanya account#sukanya samriddhi#sukanya samriddhi account#sukanya samriddhi form#sukanya samriddhi scheme#Sukanya Samriddhi Yojana#sukanya samriddhi yojana 2021#sukanya samriddhi yojana 2022#sukanya samriddhi yojana calculator#sukanya samriddhi yojana chart#sukanya samriddhi yojana form#sukanya samriddhi yojana in hindi#sukanya samriddhi yojana in hindi 2022#sukanya samriddhi yojana interest rate#sukanya samriddhi yojana sbi#sukanya yojana

0 notes