#Subsidiary Company In Dubai

Explore tagged Tumblr posts

Text

A Beginner’s Guide to Subsidiary Company Formation in Dubai

Establishing a subsidiary company in Dubai is a strategic move for businesses looking to expand in the Middle East. Dubai’s business-friendly environment, modern infrastructure, and tax benefits make it an attractive destination for foreign companies. A subsidiary is a separate legal entity from its parent company, allowing the parent company to maintain control while gaining access to Dubai’s lucrative market.

In this blog, we will guide you through the steps and important considerations involved in setting up a subsidiary company in Dubai, focusing on key elements such as legal requirements, business structures, and the benefits of doing business in this dynamic city.

1. Understanding the Concept of a Subsidiary Company

A subsidiary company is a separate legal entity owned or controlled by a parent company, which can either be fully owned or partially owned. In Dubai, a subsidiary operates independently from the parent company and is subject to local laws, which is beneficial for businesses that want to establish a strong local presence. Subsidiaries offer flexibility in terms of operations and management while still allowing the parent company to benefit from the subsidiary’s profits.

A key benefit of forming a subsidiary in Dubai is that it allows foreign companies to maintain their brand identity while accessing the opportunities in the UAE market. Moreover, a subsidiary in Dubai can enjoy certain tax advantages, including no corporate tax and no personal income tax, along with access to one of the most stable and economically developed regions in the world.

2. Why Choose Dubai for Subsidiary Company Formation?

Dubai is one of the top destinations for business expansion globally, thanks to its pro-business policies, strategic location, and economic growth. Here are some of the key reasons why Dubai is an ideal location for subsidiary company formation:

Strategic Location: Dubai is a global hub that connects Asia, Europe, and Africa. Its world-class logistics and transportation infrastructure make it easy to access regional and international markets.

Tax Benefits: Dubai offers an attractive tax environment with no corporate tax, no income tax, and the possibility of 100% repatriation of profits. Subsidiary companies can also benefit from the UAE's extensive network of Double Taxation Avoidance Agreements (DTAAs).

Free Zones: Dubai has numerous free zones that offer 100% foreign ownership, exemption from customs duties, and no restrictions on currency movements. These zones make it easier for foreign companies to establish subsidiaries and operate freely.

Business-Friendly Regulations: Dubai’s regulatory environment is known for being transparent and business-friendly. The government actively promotes foreign investment and has streamlined procedures for setting up companies, making the process faster and more efficient.

Diverse Economy: Dubai is home to a diversified economy, with key sectors such as real estate, trade, tourism, technology, and finance. This diversity provides ample opportunities for businesses to thrive in different industries.

3. Legal Requirements for Setting Up a Subsidiary in Dubai

Before establishing a subsidiary in Dubai, it's crucial to understand the legal and regulatory framework. Here are the essential legal requirements:

Legal Structure: Foreign companies can set up a subsidiary as a Limited Liability Company (LLC) or as a company in one of Dubai’s free zones. An LLC requires a local partner who holds at least 51% ownership unless the business is located in a free zone, where 100% foreign ownership is allowed.

Trade License: To operate legally, your subsidiary will need to obtain a business trade license in Dubai from the Department of Economic Development (DED) or the relevant free zone authority. The type of license depends on the nature of your business activity – commercial, industrial, or professional.

Share Capital: The minimum share capital requirements vary depending on the type of subsidiary and its location. In some free zones, there are no minimum capital requirements, but in others, there may be.

Memorandum of Association (MoA): The MoA outlines the company’s structure, activities, and the relationship between shareholders. This document must be prepared in Arabic and notarized.

Local Sponsorship: If you choose to establish an LLC outside the free zones, a local sponsor or Emirati partner is required to hold a majority stake. However, with recent reforms, certain business activities can now have full foreign ownership.

4. Step-by-Step Process for Setting Up a Subsidiary in Dubai

Here’s a breakdown of the steps involved in establishing a subsidiary company in Dubai:

Step 1: Choose the Right Business Structure

You’ll first need to decide whether to set up your subsidiary as a free zone company or as an LLC. If you want full ownership and prefer not to have a local sponsor, a free zone might be the better option. However, if you want to trade directly with the local UAE market, an LLC is required.

Step 2: Select a Business Activity and Location

Your choice of business activity will determine the type of trade license and the regulatory requirements. Additionally, you need to select the right location – either on the mainland or in one of the free zones.

Step 3: Register Your Company Name

Once you’ve decided on your business structure and activity, you’ll need to register your company name with the Department of Economic Development or the relevant free zone authority. Make sure the name complies with Dubai’s naming conventions, avoiding any offensive or religious terms.

Step 4: Prepare and Submit Required Documents

You will need to submit essential documents, including the Memorandum of Association, trade license application, and passport copies of shareholders and directors. Free zones have simplified processes, but setting up on the mainland requires additional documentation.

Step 5: Obtain the Trade License

After submitting the required documents, the trade license will be issued by the DED or the free zone authority. Once you receive the license, your subsidiary company is officially established, and you can begin operations.

Step 6: Open a Corporate Bank Account

You’ll need a corporate bank account in Dubai to handle the financial operations of your subsidiary. Each bank may have different requirements, but typically they’ll require your trade license, company documents, and a business plan.

5. Costs Involved in Setting Up a Subsidiary in Dubai

The cost of establishing a subsidiary company in Dubai varies depending on factors such as the business activity, location, and the type of license. Below are some key cost components:

Trade License Fees: Varies based on the type of business activity and location.

Local Sponsorship Fees: Required for LLCs set up on the mainland, but not in free zones.

Visa Fees: You’ll need to pay for visas for the company’s employees and shareholders.

Office Space: Rent or lease agreements for physical office space, as required by Dubai’s regulations.

6. Benefits of Setting Up a Subsidiary in Dubai

Access to New Markets: A subsidiary in Dubai provides access to the UAE market and the broader Middle East region.

Tax Advantages: Subsidiaries enjoy tax-free profits and no personal income tax for employees.

Enhanced Credibility: Operating as a subsidiary in Dubai enhances a company’s credibility and reputation in the global market.

Local Workforce: Dubai offers a highly skilled and diverse workforce, making it easier for businesses to hire top talent.

Check Out: Subsidiary Company In Dubai

Final Thoughts

Setting up a subsidiary company in Dubai is a strategic move for businesses seeking to expand into the Middle East and beyond. The process, while relatively straightforward, requires a clear understanding of the legal framework, business structures, and regulatory requirements. By following the steps outlined in this guide, you can successfully establish a subsidiary in Dubai and unlock the numerous benefits that the city has to offer.

For expert guidance on subsidiary company formation in Dubai, consider consulting with professional company formation services in Dubai to ensure a smooth and compliant process. Additionally, seeking assistance with PRO services in Dubai can streamline the paperwork and legal procedures involved, ensuring a hassle-free experience. If your business requires additional residency benefits for employees, exploring the UAE Golden Visa program can provide long-term advantages.

#Subsidiary Company In Dubai#business setup in dubai#company setup in dubai#corporate tax services in uae#tax & vat services in dubai#business trade license in dubai#it services in dubai#pro services in dubai#uae golden visa#Company formation Services In Dubai

0 notes

Text

#FINANCIALBRANCH. Money makes the world go round, and the same saying was true for Spectre, and its' successor, Quantum. The finance branch was born the same day as Spectre itself, along with other ever-present branches like Counter-Intelligence and Tactical Operations [ known as Soldiery until the 70s ]. Despite those antique roots, the financial branch evolved constantly to remain at the vanguard of their trade, often being ahead of the competition.

The branch's primary reason to be was to manage Spectre's financial assets and keep those well invested, as well as making sure those funds were ready for use. As time passed it evolved to offering similar financial services for organizations that were, for one reason or another, restricted from accessing legitimate banking systems. Any organization was welcome to their services, as long as they could find it and afford it.

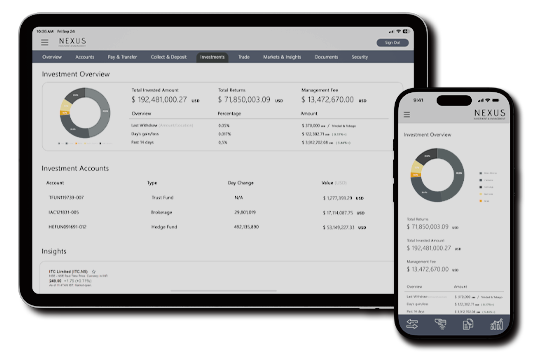

Like all other branches, the Finance Branch operates behind the mask of multiple other front companies, all in order to hide the true name and nature of their organization. There are five major companies that act as pillars to the branch: Nexus Investment & Management, Suisse de L'Industrie, Eisenband, CX Worldwide and Qoya Capital. All of those fronts operate in legal means, providing clean profit and a way to clean their own illegal funds.

The branch holds headquarters in 29 countries [ Monaco, New York, Dubai, London and Tokyo being the biggest ones ], servers in 9 countries and it operates in all 253 territories [ 193 U.N recognized countries, 55 dependent territories and 4 territories with ongoing struggles ] with only Antarctica being uncovered.

The current triad in control of the Financial Branch is composed by Le Chiffre [ Alias, real name Marcel Renè Venier-Couvillon, operating as Jacquin Allard and other 12 identities ], Beatrice Trauschke and Cissonius [ Alias, real name Daniel Wright, operating as Henry Thompson and other 5 identities ]. This is the team responsible for overseeing all the activities, legal and otherwise, under the umbrella of the Financial branch, and are the arbitrators behind every dispute regarding the path of the branch, furthermore, they each oversee one of the subsidiaries controlled by the branch, respectively Nexus, La Banque Suisse de L'Industrie and Eisenband Capital.

Nexus in an asset management company, with its expertise laid in private banking, brokerage, consultation and management of wealth for both individuals and companies. La Banque Suisse de L'Industrie is a multinational bank with focus in providing international banking services and financial support lines for companies and organizations. Eisenband Capital is a capital market group, specialized in locating and funding or acquiring companies that are branded as promising in their respective areas.

All those companies serve the true purpose of acting as the backbone of Quantum, controlling the entirety of the Group's financial transactions, investments, liquid assets and casinos.

The front companies have plenty legitimate clients, being well known companies in the international economic landscape, and their public services can be hired as any other bank, however that process is more complex when regarding their backdoor business. For an organization or individual to be able to utilize Quantum's international banking services they must be given referral by another organization that runs money through them or pass a screening process in person done by someone assigned by the Financial Branch [ this is the process that determines operational costs, liabilities, calculate management fee and open space for negotiation before drawing a contract ], as well as offer an initial amount of 50 millions USD or more. Management fee for illicit businesses vary between 3% and 12% of the total value, depending on region, risk, logistics and nature of business.

Those accounts must name a successor or benefactor for the managed assets in case of death of the account's responsible or the hiring organization's leadership. In case one of those stances happen, the successor musr claim ownership of the account within 90 days or the assets become permanent property of Quantum.

All of their financial services count on extensive infrastructure: offices in most major cities, digital applications and management tools, multiple payment methods, liquid assets transportation and storage services, and dedicated managers to larger accounts. For clients who can't afford any form of visibility, alternative methods of access are offered, such as in-person services for added management fees or 1-to-1 kinds of cryptocurrency.

The financial branch is also responsible for any transactions, payments and debt collections that might be necessary to Quantum's operations. For the funding of their underbelly operations, the financial branch provides the other branches or the service providing organizations with payment options in cryptocurrency or unmarked gold bars, as those are untraceable. For payment of bounties or first-serve-first-come opportunities, to-the-bearer medallions are given and can be collected in any casino controlled by Quantum in the currency of choice. And finally, for collaborators who need to take a large amount of cash abroad, torn playing cards [ digitally marked for authentication ] can be traded for money or gold in any CX Worldwide agency.

Debt is collected after a 90 days tolerance period, during which no large transactions are allowed to the debtor's account, and in case of failure to provide payment, all assets are seized. If the amount within the accounts lack enough funds to cover the debt, Tactical Operations are contacted for direct interference and seizing of any found liquid asset. Attempts to interrupt the seizing are answered with significant force.

FOR FURTHER DETAILS, DOUBTS OR WANTED INFORMATION: ASK!

14 notes

·

View notes

Text

PRESS STATEMENT: Halal certification body moves on Israel, major implications

25 October 2023

Earlier today the South African Halal certification body, MJCHT, made a groundbreaking announcement that will have an irreversible ripple effect across the muslim world.

The human rights organization #Africa4Palestine welcomes the historic resolution that has been announced by the Muslim Judicial Council’s Halal Trust (MJCHT). The MJCHT has adopted a policy position to decline, refuse and not certify any goods or services emanating from Israel - to boycott all such Israeli companies and products (see attached). This has major domestic and international implications as well as wide ranging financial and economic impact.

A statement released by the MJCHT reads:

"The Muslim Judicial Council Halaal Trust (MJCHT) commits itself to ethical business practices in line with international law and human rights. As part of this commitment, the MJCHT declines the certification of any goods or services emanating from Israel. The MJCHT, furthermore, declines the certification of any Israeli based companies or their directly controlled foreign subsidiaries."

MJCHT is a certification body that provides compliance certificates to companies that manufacture food and drink products as well as to restaurants and other similar establishments who meet certain strict criteria. Certificates are voluntary, however, in practice, Muslims will not purchase a product that does not have a certificate from an authorised certification or compliance body (such as the MJCHT). Similarly, Muslims will also not eat at a restaurant that does not have a certificate from a compliance/certification body (such as the MJCHT).

Consequently, companies seek such certification before selling their products locally or exporting their goods to other countries, especially those that are Muslim-majority. Countries and economies with significant Muslim populations include Egypt, Mauritania, Algeria, Nigeria, Chad, Sudan, Tanzania, Senegal, Malaysia, Indonesia, Dubai, Abu Dhabi, Bangladesh, Qatar, Pakistan, etc.

Today’s announcement and decision follows MJCHT’s engagements with #Africa4Palestine. We thank the MJCHT for these discussions and commend the body for the position that it has adopted after our consultations. We also thank Chief Mandla Mandela for his support both in this MJCHT decision as well as his unwavering commitment to the Palestinian struggle against Israeli Apartheid.

The MJCHT decision, which is the first such decision in the world, should and will set an example for other such compliance and certification bodies. We call on all other halal certification bodies to adopt a similar position to that of the MJCHT. #Africa4Palestine has written to such bodies both in South Africa as well as internationally. We have written to SANHA, NIHT, ICSA among others and will publish their responses in due course.

Israeli companies and products not receiving such certification going forward will isolate them from major markets across the globe with colossal financial consequences. The message is clear - no normal trade with an abnormal country. Israel is paying for its violence, its violations of international law and abuse of the Palestinians people.

--------------------

Muslims - who make up 2 billion of the world’s population - do not consume pork or alcohol. In addition, the foods that they do consume must follow certain dietary and preparation requirements. Once these requirements are met, a company or restaurant seeks a certificate from an authorised Halal Certification Body, such as the MJCHT, stating that the product of restaurant is "halal". A company or restaurant with such a certificate can then market their product or restaurant as halal.

A halal certification body (that provides a certificate stating that a product or restaurant is halal) can be compared, with some limitation, to other certification bodies, such as bodies that provide compliance certificates confirming that a product is Kosher, free from nuts, free from animal cruelty, or free from gluten. In this vein, Africa4Palestine will also be engaging with such bodies to also adopt a position of withdrawing and not certifying Israeli companies.

ISSUED BY TISETSO MAGAMA ON BEHALF OF AFRICA4PALESTINE

Africa4Palestine Media Liaison, Alie Komape: +27 (0) 76 979 8801

Africa4Palestine Director, Muhammed Desai: +27 (0) 84 211 9988

AFRICA 4 PALESTINE

Suite 3 | Park Center | 75 12th Street | Parkhurst | Johannesburg

PO Box 2318 | Houghton | 2041 | Johannesburg

Africa4Palestine is a registered Non-Profit Company. Registration Number: 2020/549404/08

6 notes

·

View notes

Text

Stress-Free Best Accounting and Bookkeeping Services in Dubai UAE

In today's competitive business landscape, Best Accounting and bookkeeping Services stand as crucial pillars for seamless financial operations. Choosing a reliable accountant is paramount as accurate financial reports are instrumental in informed decision-making. Attempting to manage bookkeeping and accounting tasks independently might compromise efficiency due to divided attention.

Nordholm Professional Accounting and Bookkeeping Services, a subsidiary managed by the esteemed Swiss entity Nordholm Investments, specializes in assisting investors to expand their ventures across global territories, including the UAE. Our comprehensive suite of services spans the entire spectrum of business setup in the region – from company formation, visa procedures, and bank account establishment to managing HR, payroll, VAT compliance, and accounting services. Our primary goal is to offer stress-free solutions catering to the diverse needs of our investors.

Our expertise lies not just in support but in leveraging knowledge and proficiency to ensure strict compliance with the United Arab Emirates' accounting regulations. Our Outsourced Accounting Services encompass meticulous preparation and maintenance of daily transactions, guaranteeing seamless compliance with local laws.

Tailored specifically for Dubai's dynamic business environment, our services extend beyond basic accounting management. We provide strategic guidance and implement sophisticated systems to tackle any accounting or bookkeeping challenges your business may encounter.

Nordholm Services:

Accounts Payable Management: Streamlining payment processes efficiently.

Bank Reconciliation: Ensuring accuracy between financial records and bank statements.

General Bookkeeping Duties: Meticulous management of financial records.

Profit and Loss Statement Generation: Analyzing financial performance.

Accounts Receivable: Efficient handling of receivables for optimized cash flow.

End of Service Benefit Calculation: Compliant management of employee benefits.

Payroll Services: Timely and accurate salary management.

Financial Reporting and Analysis: In-depth analysis aiding informed decision-making.

Expert Accounting Consultation: Valuable guidance from seasoned professionals.

Our Best Accounting and Bookkeeping Support in Dubai, our mission transcends managing accounts; we empower businesses by leveraging our expertise for compliance and growth. Trust us as your partners in success, allowing you to focus on driving your business forward while we handle your accounting needs proficiently.

For businesses seeking Reliable Accounting and Bookkeeping Solutions in Dubai, Nordholm Accounting and Bookkeeping is your trusted partner for growth and compliance.

#NordholmAccounting#DubaiAccountingServices#BookkeepingDubai#BusinessSetupDubai#AccountingExpertsUAE#IFRSCompliance

6 notes

·

View notes

Text

Launch your Dream Business in the UAE with the help of MARKEF Business Setup Experts. We help you to set up Mainland, Free Zone & Offshore Company in Dubai, Sharjah, RAK, and Abu Dhabi.

We help you choose the right license with clear pricing based on your business requirement. We make the process of setting up a new company or establishing a wholly owned subsidiary in Dubai as simple, easy, and straightforward as possible. Our knowledgeable staff will walk you through each step to get you up and running quickly.

Don't wait any longer, contact us today to start the process!💻

📧 Email : [email protected] ☎️ Phone : +971 4 589 2828 📞 Mobile : +971 50 215 8979 💬 WhatsApp : +971 50 242 7055

4 notes

·

View notes

Text

[ad_1] Safex Chemicals India Ltd., a pioneer in the chemical industry, has been awarded the Outstanding Innovation: Chemical Synthesis Award at the 6th Pesticides Manufacturers & Formulators Association of India (PMFAI) Annual AgChem Awards 2025. This prestigious accolade was presented during a grand ceremony in Dubai, recognizing Safex Group’s groundbreaking development of Renofluthrin, a next-generation mosquito control solution. Safex Chemicals PMFAI-SML AgChem Awards 2025 The award celebrates Renofluthrin as a transformative innovation that underscores Safex Groups’ commitment to indigenous research, sustainability, and global competitiveness. Renofluthrin is a synthetic pyrethroid molecule designed to tackle the growing challenge of mosquito-borne diseases in tropical regions like India. This innovative product, developed entirely in-house, stands out for its unparalleled effectiveness and versatility across multiple application formats, including the world’s first patented Agarbatti format. “Renofluthrin’s journey was not without challenges as one of the first Indian companies to register a homegrown research molecule locally. Our determination and belief in the molecule’s potential led to a product that is now poised for international success, with global registrations currently underway,” said Mr. Neeraj Jindal, Managing Director, Safex Chemicals. Shogun Organics, a subsidiary of Safex Group initiated the Renofluthrin project a decade ago, driven by the vision of self-reliance and the need to address the global mosquito control challenges. The molecule’s development involved a meticulous research process, led by an expert team specializing in chemistry, entomology, and toxicology. Collaborating with leading research institutes and adhering to stringent regulatory requirements, the team successfully brought Renofluthrin to market as a highly effective, safe, and adaptable solution. About Safex Chemicals Founded in 1991, Safex Chemicals Group has established itself as a fast-growing force in the chemical industry. Over the past five years, the company has shown impressive growth, with a revenue CAGR exceeding 25%. In October 2022, Safex Chemicals took a significant step in its international expansion by acquiring Briar Chemicals, a leading agrochemicals Contract Development and Manufacturing Organisation (CDMO) in the UK. Safex Chemicals operates seven manufacturing units across India and the UK, proving its strong production capabilities. This growth reflects Safex Chemicals' successful expansion across India and beyond, positioning itself firmly within the global value chain. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

[ad_1] Safex Chemicals India Ltd., a pioneer in the chemical industry, has been awarded the Outstanding Innovation: Chemical Synthesis Award at the 6th Pesticides Manufacturers & Formulators Association of India (PMFAI) Annual AgChem Awards 2025. This prestigious accolade was presented during a grand ceremony in Dubai, recognizing Safex Group’s groundbreaking development of Renofluthrin, a next-generation mosquito control solution. Safex Chemicals PMFAI-SML AgChem Awards 2025 The award celebrates Renofluthrin as a transformative innovation that underscores Safex Groups’ commitment to indigenous research, sustainability, and global competitiveness. Renofluthrin is a synthetic pyrethroid molecule designed to tackle the growing challenge of mosquito-borne diseases in tropical regions like India. This innovative product, developed entirely in-house, stands out for its unparalleled effectiveness and versatility across multiple application formats, including the world’s first patented Agarbatti format. “Renofluthrin’s journey was not without challenges as one of the first Indian companies to register a homegrown research molecule locally. Our determination and belief in the molecule’s potential led to a product that is now poised for international success, with global registrations currently underway,” said Mr. Neeraj Jindal, Managing Director, Safex Chemicals. Shogun Organics, a subsidiary of Safex Group initiated the Renofluthrin project a decade ago, driven by the vision of self-reliance and the need to address the global mosquito control challenges. The molecule’s development involved a meticulous research process, led by an expert team specializing in chemistry, entomology, and toxicology. Collaborating with leading research institutes and adhering to stringent regulatory requirements, the team successfully brought Renofluthrin to market as a highly effective, safe, and adaptable solution. About Safex Chemicals Founded in 1991, Safex Chemicals Group has established itself as a fast-growing force in the chemical industry. Over the past five years, the company has shown impressive growth, with a revenue CAGR exceeding 25%. In October 2022, Safex Chemicals took a significant step in its international expansion by acquiring Briar Chemicals, a leading agrochemicals Contract Development and Manufacturing Organisation (CDMO) in the UK. Safex Chemicals operates seven manufacturing units across India and the UK, proving its strong production capabilities. This growth reflects Safex Chemicals' successful expansion across India and beyond, positioning itself firmly within the global value chain. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

𝐖𝐡𝐲 𝐏𝐚𝐫𝐭𝐧𝐞𝐫 𝐰𝐢𝐭𝐡 𝐍𝐢𝐦𝐛𝐮𝐬 𝐂𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐞 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 𝐭𝐨 𝐒𝐞𝐭 𝐔𝐩 𝐚 𝐇𝐨𝐥𝐝𝐢𝐧𝐠 𝐂𝐨𝐦𝐩𝐚𝐧𝐲 𝐢𝐧 𝐃𝐮𝐛𝐚𝐢?

Setting up a holding company in Dubai unlocks benefits like asset protection, tax efficiency, and business control. But navigating the setup process can be complex. Here’s how Nimbus can help. - 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐆𝐮𝐢𝐝𝐚𝐧𝐜𝐞: We can help you choose the ideal jurisdiction that fits your business needs. - 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐒𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐢𝐧𝐠: We ensure efficient structuring to manage subsidiaries, investments, and assets while maximizing tax benefits. - 𝐋𝐢𝐜𝐞𝐧𝐬𝐢𝐧𝐠 & 𝐃𝐨𝐜𝐮𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧: From applications to approvals, we handle the paperwork to meet UAE’s company registration requirements. - 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐒𝐮𝐩𝐩𝐨𝐫𝐭: Assistance with opening corporate bank accounts and ensuring smooth financial operations. - 𝐓𝐚𝐱 𝐏𝐥𝐚𝐧𝐧𝐢𝐧𝐠: Tailored strategies for compliance with the UAE’s corporate tax regime while optimizing tax efficiency. By partnering with us, you can be assured that every detail is handled professionally, allowing you to focus on growing your business. Thinking of setting up a holding company in Dubai? Let Nimbus Corporate Services guide you through a seamless setup process! 𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐮𝐬 𝐭𝐨 𝐤𝐧𝐨𝐰 𝐦𝐨𝐫𝐞. 📧 𝐢𝐧𝐟𝐨@𝐧𝐢𝐦𝐛𝐮𝐬𝐜𝐨𝐧𝐬𝐮𝐥𝐭𝐚𝐧𝐜𝐲.𝐜𝐨𝐦 📞 +𝟗𝟕𝟏 𝟒 𝟕𝟏𝟖 𝟏𝟕𝟗𝟒

#Business Setup Services in UAE#Business Setup Services in Dubai#Business Setup Services in KSA#Company Formation Services in Saudi Arabia#Company Formation Services in Dubai#Company Formation Services in UAE#Business Setup Services in Saudi Arabia#Company Formation Services in KSA#Company Setup Services in UAE#Company Setup Services in Dubai#Company Setup Services in KSA#Company Setup Services in Saudi Arabia#Dubai Mainland Business Setup#set up freezone company dubai#Business Setup Process in Saudi Arabia#corporate services dubai#corporate services company in dubai#corporate services in dubai uae#professional corporate services dubai

0 notes

Text

Interview with Maged Marie, CEO of Magnom Properties

1. What's your perspective on the global development of sustainable finance and innovation? What specific trends do you see that will shape the future of its adoption?

The construction industry is one of the most significant contributors of greenhouse gas emissions worldwide. Buildings are currently responsible for 39% of global energy related carbon emissions. And the continued growth in population will place greater demand for new building stock.

There is an urgent need therefore to develop energy-efficient and net zero buildings at scale to enable the world to respond better to the climate emergency. The built environment and sustainability are inextricably linked, and green investing is now crucial to boost the transition to lower carbon buildings and to mitigate against climate and financial risks.

The finance sector is well-positioned to boost this transition to a sustainable built environment. By aligning capital with net zero outcomes the finance sector can enable clean economic growth and job creation. The real estate and finance sector must collaborate to develop roadmaps and frameworks that facilitate greater financial flows towards decarbonised, resilient and equitable built environments.

2. How is Forbes International Tower shaping the future of Dubai with sustainable finance and innovation? What makes it unique from other companies?

The Forbes International Tower is a zero-carbon commercial tower that is setting new milestones in green design construction. With its superior performance and focus on reducing lifecycle carbon emissions, the futuristic tower will deliver unique solutions to urban challenges in the UAE, Saudi Arabia and Egypt, where it will be built. Developed under the sustainable design vision of Adrian Smith + Gordon Gill Architecture (AS+GG Architecture), Magnom Properties, a subsidiary of Rawabi Holding, has partnered with Forbes to develop this commercial tower in the region.

Aiming for a Platinum LEED certification, the tower is focused on environmental soundness and future readiness. The self-sustaining, environmentally intelligent structure also integrates state-of-the-art systems and technologies and will drive innovations to enhance energy efficiency and achieve its vision of zero-carbon emissions, thereby revolutionising the sustainability landscape in the cities that it is being planned for.

The Forbes International Tower will be the first-of-its-kind project in the world to run entirely on the Liquid Organic Hydrogen Carrier (LOHC) system. This innovative approach addresses two global environmental challenges of waste pollution and the creation of clean energy. Such innovative smart climate solutions and environmentally responsible practices that ensure long-term resilience will be pivotal in redefining and shaping the built environment in the Middle East and North Africa.

Through its partnerships with global players across a multitude of sectors, the Forbes International Tower will elevate green building design and zero-emission standards and push the boundaries of modern construction as it brings transformational technologies into mainstream practice. Such innovations in the real estate sector will expedite the growth of smart cities and buildings in the region, in line with the ambitious goals of the UN's 2030 Agenda for Sustainable Development.

3. What is the value proposition for Forbes International Towers in the region? How would businesses benefit from it in the long run?

To fast-track energy transition, it becomes increasingly imperative to mainstream smart and sustainable climate solutions in the built environment. The innovations and technologies developed for the iconic Forbes International Tower holds great promise for decarbonising real estate assets and will be pivotal in enhancing the livability, efficiency, and productivity of cities in the MENA region.

For companies in the buildings and construction sector in the MENA, this is an opportunity to address urban sustainability challenges and build new, better growth paths. Due diligence in improving ESG reporting and getting technical assessments to meet net zero carbon targets will enable stakeholders discover and bridge gaps to bring long-lasting value to their real estate portfolios. In addition, developing green buildings at scale can strengthen local economies, create jobs, and optimise energy and water efficiency in the region.

Massive investments are necessary to transform the booming construction sector and the shift to low-carbon pathways could accelerate global access to sustainable finance for delivery of more green infrastructure projects in the region.

4. What, in your opinion, are the primary challenges obstructing sustainable finance and innovation in the MENA region, and how can they be overcome?

The significant economic benefits and operational efficiencies that zero carbon or green buildings bring are often not communicated well by developers and building owners while investors tend to narrow their focus largely on the upfront costs and longer timelines involved in construction.

Energy or resource efficiency is only one aspect of a green building. Driving greater awareness on the added value and lower risk of green and sustainable buildings will help secure more financing for such projects. To leverage innovative financing mechanisms such as green bonds, loans, or funds, developers must demonstrate and communicate the financial performance and social impact of their projects.

Reorienting capital flows and investment towards the built environment will be critical to achieve global sustainability goals and reduce the risks to the built assets and their impact on the planet.

5. Tell us more about the session you’ll be hosting at the show. What can attendees expect to gain from it?

Magnom Properties will be participating in two sessions at the Future Sustainability Forum. Sarah El Batouty – UNFCCC Global Ambassador and Advisor to Magnom Properties, will present the finer details of the sustainable vision of the Forbes International Tower and take the audience through the innovative technologies and actionable strategies that are being implemented to realise this vision.

Gordon Gill, Founding Partner, Adrian Smith + Gordon Gill Architecture, who is part of the core design team that is developing the Forbes International Tower, will share his unique perspectives on how an evidence-based strategy is critical to tackling building sector emissions and addressing carbon footprint reductions in the sector. In the session titled, ‘Setting Credible Net-Zero Targets’, Gordon Gill will also discuss how policy regulations and cooperation between design architects and other stakeholders in the industry are needed to overcome barriers to decarbonising the built environment and making net zero carbon buildings a feasible goal.

0 notes

Text

Top 10 Benefits of Establishing a Subsidiary Company in Dubai

Dubai’s status as a global business hub makes it an attractive location for multinational companies looking to expand their operations. Establishing a subsidiary company in Dubai can offer a range of benefits that contribute to business growth and operational efficiency. A subsidiary company, a separate legal entity from its parent company, provides numerous advantages regarding market access, regulatory compliance, and financial management. Here’s a detailed look at the top 10 benefits of establishing a subsidiary company in Dubai.

1. Access to a Thriving Market

Dubai is strategically located at the crossroads of Europe, Asia, and Africa, making it an ideal gateway for accessing regional markets. Establishing a subsidiary company in Dubai allows businesses to tap into the city’s vibrant and diverse market. Dubai’s consumer base is affluent and growing, providing ample opportunities for companies to expand their market reach and increase their revenue. This accessibility is crucial for businesses leveraging Dubai’s role as a central hub for global trade.

2. Business-Friendly Environment

Dubai is known for its business-friendly policies and supportive regulatory environment. The city offers a range of incentives for foreign investors, including tax benefits, simplified regulatory processes, and a robust legal framework. Businesses can benefit from these favourable conditions by setting up a subsidiary company in Dubai, facilitating smooth operations and growth. Utilising Company Formation Services in Dubai can help streamline this process and ensure compliance with local regulations.

3. Enhanced Credibility and Brand Presence

Having a subsidiary company in Dubai can significantly enhance your company’s credibility and brand presence in the Middle East. It demonstrates a long-term commitment to the region and helps build trust with local clients and partners. A physical presence in Dubai can also improve brand recognition and foster stronger relationships with customers and stakeholders. This enhanced credibility is vital for establishing a solid market position and attracting high-value clients.

4. Tax Advantages

Dubai offers a favourable tax regime, including no personal income tax and low corporate tax rates. Additionally, certain free zones in Dubai provide 100% tax exemptions on corporate income and profits. Establishing a subsidiary company in Dubai allows businesses to take advantage of these tax benefits, which can result in significant cost savings and improved profitability. Understanding TAX & VAT Services in Dubai is crucial for maximising these advantages and ensuring compliance with local tax regulations.

5. Access to a Skilled Workforce

Dubai boasts a highly skilled and diverse workforce, with professionals from various industries and backgrounds. By setting up a subsidiary company in Dubai, businesses can tap into this talent pool and recruit skilled employees who are well-versed in international business practices. Access to a skilled workforce can enhance operational efficiency and drive innovation within the company. This access is particularly beneficial for businesses seeking specialised skills and expertise.

6. Simplified Regulatory Compliance

Dubai’s regulatory framework is designed to support business growth and ensure compliance with international standards. Establishing a subsidiary company provides access to local legal and regulatory expertise, which can help navigate the complexities of compliance. This includes adhering to labour laws, business licensing requirements, and other regulatory obligations. Leveraging Business Trade Licenses in Dubai services can facilitate compliance and streamline registration.

7. Supportive Infrastructure

Dubai is renowned for its world-class infrastructure, including state-of-the-art office spaces, transportation networks, and communication systems. Setting up a subsidiary company in Dubai means benefiting from this modern infrastructure, which supports efficient business operations and connectivity. The city’s infrastructure is designed to cater to the needs of businesses and facilitate smooth daily operations.

8. Opportunities for Business Expansion

Dubai’s dynamic business environment presents numerous opportunities for growth and expansion. Establishing a subsidiary company allows businesses to explore new market segments, develop strategic partnerships, and engage in regional trade. The subsidiary can act as a springboard for further expansion into neighbouring markets, leveraging Dubai’s strategic location and business connections.

9. Financial Stability and Security

Dubai is known for its financial stability and robust banking sector. The city’s financial system is well-regulated, offering a secure environment for conducting business transactions. By setting up a subsidiary company in Dubai, businesses can benefit from access to reliable financial services, secure banking facilities, and a stable economic environment. This stability is crucial for long-term business success and risk management.

10. Cultural and Economic Diversity

Dubai’s cultural and economic diversity provides a unique business environment that fosters innovation and growth. The city is home to a mix of cultures, industries, and business practices, creating a vibrant and dynamic market. Establishing a subsidiary company in Dubai allows businesses to tap into this diversity, gain new perspectives, and leverage various business opportunities.

Conclusion

Establishing a subsidiary company in Dubai offers numerous benefits that can drive business success and growth. From accessing a thriving market and enjoying tax advantages to benefiting from a skilled workforce and supportive infrastructure, Dubai provides an ideal environment for expanding operations. The city’s business-friendly policies, financial stability, and cultural diversity further enhance the attractiveness of setting up a subsidiary.

By leveraging these advantages, businesses can position themselves for long-term success in one of the world’s most dynamic and strategic markets. Establishing a subsidiary company in Dubai can be a pivotal step in achieving your business goals, whether you are looking to enhance your brand presence, explore new growth opportunities, or benefit from a favourable regulatory environment.

Read More:

Interested in learning how to establish a subsidiary company in Dubai?

Discover the essential steps and expert insights by clicking here: How to Establish a Subsidiary Company in Dubai.

#subsidiary company in Dubai#benefits of establishing a subsidiary in Dubai#Dubai business setup#Company Formation Services in Dubai#TAX & VAT Services in Dubai#Business Trade License in Dubai#business expansion in Dubai#Dubai financial stability#skilled workforce Dubai#Dubai business infrastructure

0 notes

Text

MIC Electronics Strengthens Global Presence with Completion of Investment in SOA Electronics Trading LLC

In a significant move reflecting its ambitions to expand its global footprint, MIC Electronics Limited announced the successful completion of its investment in its wholly owned subsidiary, SOA Electronics Trading LLC, based in Dubai. This milestone, achieved on December 30, 2024, was formalized after the requisite documents and approvals were issued by the competent authorities in Dubai. The company’s decision to invest ₹51 crores in this subsidiary underscores its strategic intent to enhance its presence in the electrical and electronics appliances sector.

The genesis of this venture began earlier in the year, with the incorporation of SOA Electronics Trading LLC on May 9, 2024. Situated in the thriving business hub of Dubai, the entity is positioned to focus on the trading of electrical and electronic appliance spare parts, a natural extension of MIC Electronics’ core business. With a paid-up share capital of AED 22,408,000, the subsidiary was established to create new opportunities in a dynamic market environment while bolstering the parent company’s operational portfolio.

This investment, entirely financed through cash consideration, involved MIC Electronics subscribing to 22,408 shares at a face value of AED 1,000 each. Valued at ₹51 crores, this initiative represents not just a monetary commitment but a testament to the company’s confidence in the potential of the Dubai market and its ability to serve as a gateway to other global markets.

As a wholly owned subsidiary, SOA Electronics Trading LLC is a related party to MIC Electronics. However, the transaction was carried out on an arm’s length basis, ensuring compliance with regulatory and ethical standards. The meticulous adherence to norms demonstrates MIC Electronics’ unwavering commitment to transparency and governance.

The approval process involved regulatory authorities in Dubai, a step that highlights the company’s efforts to align with international compliance standards. With these approvals in place, the investment is now complete, marking a pivotal moment in MIC Electronics’ journey toward global diversification.

Speaking on the development, Kaushik Yalamanchili, Managing Director of MIC Electronics Limited, expressed optimism about the future prospects of this venture. He emphasized that this strategic investment is aligned with the company’s vision to establish a stronger presence in the global market while leveraging the opportunities presented by the rapidly evolving electronics industry.

MIC Electronics, a well-established name in precision lighting solutions, has consistently demonstrated innovation and resilience. Its foray into Dubai is expected to enhance its competitive edge while offering access to new growth avenues. The company, with its ISO 9001:2008 and ISO 14001:2004 certifications, has a legacy of delivering excellence, and this new venture is another step in its commitment to operational excellence and market leadership.

The successful completion of this investment not only adds to MIC Electronics’ capabilities but also sets the stage for future expansions. By tapping into Dubai’s strategic location and business ecosystem, the company is poised to achieve greater heights in the global electronics landscape, bringing new value to its stakeholders and reaffirming its position as an industry leader.

0 notes

Link

🌟 Thinking about expanding your business into the vibrant market of Dubai? Setting up a subsidiary company can be the key to unlocking new opportunities! Here’s how you can get started: - Understand the legal framework 🏛️ - Choose the right business structure 🏢 - Navigate the licensing process 📄 - Open a local bank account 💳 - Hire local talent for a competitive edge 📈 Dubai’s business landscape is booming, and now is the perfect time to dive in! 👉 Check out the detailed guide here: https://dahhanbiz.com/how-to-set-up-a-subsidiary-company-in-dubai/ #BusinessGrowth #Dubai #Entrepreneurship #CompanyFormation #InvestInDubai #GlobalBusiness #StartupJourney #BusinessSuccess

1 note

·

View note

Text

Elevate Your Business with Top Accounting Firm in Dubai

Dubai stands as a vibrant business hub, and navigating its intricate financial landscape demands Top-notch Accounting Services Firm in Dubai. Welcome to Nordholm, the Leading Accounting Firm in Dubai, serving as a pivotal subsidiary under the esteemed Nordholm Investments—a Swiss entity committed to empowering global enterprises. Our forte lies in simplifying business establishment procedures, from company formation and visa processing to seamless bank account setup. We excel in expertly managing HR, payroll, VAT, and all intricate accounting needs, ensuring your business thrives in this dynamic marketplace.

Why Choose us as the Premier Accounting Firm in Dubai?

At Nordholm Firm, promptness and superior quality define our service ethos. We strive to swiftly deliver exceptional services without compromising on excellence, catapulting your business towards success.

Entrust your financial data to the top accounting firm in Dubai for unmatched stability and security. We surpass the protection levels offered by part-time accountants, ensuring your sensitive information remains safeguarded at all times.

Our services offer significant advantages to small and medium-sized businesses, as they can eliminate the requirement for in-house accountants and experience a substantial reduction in overhead costs. This includes expenses like labor cards, health insurance, and visa fees.

Our Specialized Accounting Services

Our specializes in discreetly providing unparalleled accounting services, allowing you to focus on core business operations. Our unwavering dedication revolves around fostering resilience, ensuring growth, and harmonizing sustainability with security.

Acknowledged as the foremost Accounting Firm in Dubai, we empower businesses to seize opportunities by delivering punctual and high-quality services, operating seamlessly behind the scenes.

Our professional accounting services form the bedrock of successful enterprises, offering precise reporting and streamlined operations to bolster your organization's efficiency.

As the top accounting Firm in Dubai, we specialize in guiding and supporting your business ventures across different countries, especially within the dynamic UAE landscape. Our extensive range of services encompasses initial setup and ongoing management, ensuring a smooth and effortless journey for our investors.

Unlock the potential for success and growth with us, the Premier Accounting Firm in Dubai, your key to seamless financial operations and thriving business endeavors.

#NordholmFirmSuccess#BookkeepingFirmDubai#PremierFirmServices#DubaiBusinessFirm#FinancialFirmExcellence#GrowWithNordholmFirm#GatewayToFirmSuccess#BusinessFirmGrowth#BookkeepingSolutionsFirm

6 notes

·

View notes

Text

Setup Your Business in UAE FreeZone

Launch your Dream Business in the UAE with the help of MARKEF Business Setup Experts. We help you to set up Mainland, Free Zone & Offshore Company in Dubai, Sharjah, RAK, and Abu Dhabi.

We help you choose the right license with clear pricing based on your business requirement. We make the process of setting up a new company or establishing a wholly owned subsidiary in Dubai as simple, easy, and straightforward as possible. Our knowledgeable staff will walk you through each step to get you up and running quickly.

Visit Our Website ⬇️ www.markef.com

📧Email : [email protected] 📞Call : +971 4 589 2828

#buisnesssetup#buisnessstartup#costcalculator#business#startbuisnessindubai#visaservices#residencevisa#businessconsultancyindubai#markef#askmarkef#markefconsultancy#dubaistartup#consultant#businesssetupdubai#companysetupUAE#mainlandbuisnesssetup#freeconsultation#freezone#mainland#offshore#freezoneuae#entrepreneur#markefaccounting#finance#dubai#accounting

2 notes

·

View notes