#Subscription And Recurring Payment Market Demand

Explore tagged Tumblr posts

Text

Subscription And Recurring Payment Market Is Estimated To Witness High Growth Owing To Increasing Demand For Subscription-Based Services

Market Overview: The Subscription and Recurring Payment Market refers to the system or process of collecting payments from customers on a recurring basis for services or products provided on a subscription basis. This market offers various advantages such as convenience, affordability, and flexibility for both customers and businesses. The increasing demand for subscription-based services across various industries, including media and entertainment, e-commerce, software, and retail, is driving the growth of the market. The need for efficient and secure payment solutions and the rise of digitalization and online transactions are further fueling market growth. The Subscription and Recurring Payment Market Size is estimated to be valued at US$ 154.05 billion in 2023 and is expected to exhibit a CAGR of 18.5% over the forecast period 2023-2030, as highlighted in a new report published by Coherent Market Insights. Market Key Trends: One key trend driving the Subscription and Recurring Payment Market is the increasing adoption of mobile payment solutions. With the proliferation of smartphones and the growing popularity of mobile commerce, customers are increasingly opting for mobile payment methods for their subscription payments. This trend is driven by the convenience and flexibility offered by mobile payment solutions, allowing customers to easily make recurring payments anytime, anywhere. Moreover, the integration of mobile payment solutions with various applications and platforms is further simplifying the subscription payment process and enhancing the overall customer experience. PEST Analysis: Political: The political factors impacting the subscription and recurring payment market include government regulations and policies related to online payments. For example, changes in data protection legislation and cybersecurity regulations can affect the market. Additionally, government policies regarding electronic payments and financial technology can influence the growth and adoption of subscription and recurring payment platforms. Economic: Economic factors such as GDP growth, disposable income, and consumer spending patterns play a significant role in the subscription and recurring payment market. As economies grow and consumer spending increases, the demand for convenient and automated payment solutions also rises. Furthermore, the availability of secure and reliable payment infrastructure and services directly impacts the market. Social: The social factors affecting the market include changing consumer preferences and attitudes towards online shopping and digital payments. The increasing adoption of smartphones and the growing popularity of e-commerce platforms are driving the demand for subscription and recurring payment services. Moreover, the shift towards a cashless society and the convenience offered by recurring payment models contribute to market growth. Technological: Technological advancements in payment processing, security measures, and digital infrastructure are crucial factors in the growth of the subscription and recurring payment market. Innovations such as biometric authentication, mobile wallets, and blockchain technology have enhanced the security and effectiveness of payment systems. Additionally, the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms has improved fraud detection and risk management in subscription payments. Key players operating in the subscription and recurring payment market include PayPal, Stripe, Square, Recurly, Chargify, Zuora, FattMerchant, Payment Depot, PaymentEvolution, FastSpring, Chargebee, Spreedly, ChargeOver, Chargent, Vindicia, Chargify, Razorpay, Cashfree, CCAvenue, and BillDesk. These key players offer a range of solutions and services in the subscription and recurring payment space, catering to the needs of various industries and businesses.

#Subscription And Recurring Payment Market#Subscription And Recurring Payment Market Size#Coherent Market Insights#Subscription And Recurring Payment Market Demand#Subscription And Recurring Payment Market Trends#Subscription And Recurring Payment Market Share#Subscription And Recurring Payment Market Analysis#Subscription And Recurring Payment Market Forecast

1 note

·

View note

Text

Accept Credit Cards: Key to Unlocking Subscription-Based Growth

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the ever-evolving world of e-commerce, keeping ahead of the competition is a top priority. To tap into the full potential of your subscription-based business, you need a payment processing solution that can keep up with your growth. Join us on this journey as we uncover the transformative power of embracing credit card payments for your business.

DOWNLOAD THE KEY TO UNLOCKING INFOGRAPHIC HERE

The Essence of Payment Processing Payment processing stands as the backbone of high-risk merchant processing and merchant accounts. It's the engine that powers the convenience of customers making payments, which, in turn, leads to increased sales and enhanced customer satisfaction. Without a dependable credit card processing system, you risk losing potential customers and, consequently, revenue.

Empowering E-Commerce In today's digital age, e-commerce payment processing is no longer an option but a necessity. To compete effectively, you must adopt e-commerce merchant accounts and provide a streamlined online credit card processing experience. This approach not only broadens your customer base but also streamlines your operations, saving you time and resources.

Credit Repair and Beyond For businesses in the credit repair industry, credit repair merchant processing is a lifeline. It allows you to provide your services with ease, ensuring that clients can conveniently pay for the help they need. Accepting credit cards for credit repair transcends mere transactions; it's about empowering individuals to take control of their financial future.

Riding the CBD Wave As the CBD industry continues to boom, CBD payment processing becomes increasingly critical. CBD merchant accounts and CBD payment gateway solutions empower you to tap into this high-demand market. By accepting credit cards for CBD, you cater to the preferences of modern consumers and expand your reach.

Seamless Payment Solutions To succeed, you need more than just credit card payment processing; you need a comprehensive payment processing system. This encompasses robust payment gateway solutions that boost security and efficiency. By offering a variety of credit card payment gateways, you accommodate diverse customer preferences.

Embracing Subscription Models Businesses built on subscription-based models thrive on predictability and convenience. Accepting credit card payments aligns perfectly with this model, as it allows for recurring billing. Customers appreciate the simplicity, and you benefit from steady revenue streams.

Building Customer Trust When you accept credit cards, you convey professionalism and reliability. Credit card payment services provide additional layers of security, assuring customers that their sensitive information is protected. This builds trust and encourages repeat business.

youtube

Scaling for Future Growth As your business expands, so do your requirements. High-risk payment processing and high-risk credit card processing enable you to confidently venture into new markets and tackle more substantial challenges. Your payment processing partner should grow with you.

The significance of accepting credit cards cannot be overstated. It represents the key to unlocking growth for subscription-based businesses, enhancing e-commerce operations, supporting the credit repair industry, and fueling the CBD revolution. By embracing dependable payment processing solutions and extending multiple credit card payment gateways, you position your business on a trajectory toward success. Don't miss out on the opportunity to scale, foster trust, and cater to the diverse needs of your customers.

#high risk merchant account#merchant processing#payment processing#credit card processing#high risk payment gateway#high risk payment processing#accept credit cards#credit card payment#payment#youtube#Youtube

21 notes

·

View notes

Text

What Are the Costs Associated with Fintech Software Development?

The fintech industry is experiencing exponential growth, driven by advancements in technology and increasing demand for innovative financial solutions. As organizations look to capitalize on this trend, understanding the costs associated with fintech software development becomes crucial. Developing robust and secure applications, especially for fintech payment solutions, requires significant investment in technology, expertise, and compliance measures. This article breaks down the key cost factors involved in fintech software development and how businesses can navigate these expenses effectively.

1. Development Team and Expertise

The development team is one of the most significant cost drivers in fintech software development. Hiring skilled professionals, such as software engineers, UI/UX designers, quality assurance specialists, and project managers, requires a substantial budget. The costs can vary depending on the team’s location, expertise, and experience level. For example:

In-house teams: Employing full-time staff provides better control but comes with recurring costs such as salaries, benefits, and training.

Outsourcing: Hiring external agencies or freelancers can reduce costs, especially if the development team is located in regions with lower labor costs.

2. Technology Stack

The choice of technology stack plays a significant role in the overall development cost. Building secure and scalable fintech payment solutions requires advanced tools, frameworks, and programming languages. Costs include:

Licenses and subscriptions: Some technologies require paid licenses or annual subscriptions.

Infrastructure: Cloud services, databases, and servers are essential for hosting and managing fintech applications.

Integration tools: APIs for payment processing, identity verification, and other functionalities often come with usage fees.

3. Security and Compliance

The fintech industry is heavily regulated, requiring adherence to strict security standards and legal compliance. Implementing these measures adds to the development cost but is essential to avoid potential fines and reputational damage. Key considerations include:

Data encryption: Robust encryption protocols like AES-256 to protect sensitive data.

Compliance certifications: Obtaining certifications such as PCI DSS, GDPR, and ISO/IEC 27001 can be costly but are mandatory for operating in many regions.

Security audits: Regular penetration testing and vulnerability assessments are necessary to ensure application security.

4. Customization and Features

The complexity of the application directly impacts the cost. Basic fintech solutions may have limited functionality, while advanced applications require more extensive development efforts. Common features that add to the cost include:

User authentication: Multi-factor authentication (MFA) and biometric verification.

Real-time processing: Handling high volumes of transactions with minimal latency.

Analytics and reporting: Providing users with detailed financial insights and dashboards.

Blockchain integration: Leveraging blockchain for enhanced security and transparency.

5. User Experience (UX) and Design

A seamless and intuitive user interface is critical for customer retention in the fintech industry. Investing in high-quality UI/UX design ensures that users can navigate the platform effortlessly. Costs in this category include:

Prototyping and wireframing.

Usability testing.

Responsive design for compatibility across devices.

6. Maintenance and Updates

Fintech applications require ongoing maintenance to remain secure and functional. Post-launch costs include:

Bug fixes and updates: Addressing issues and releasing new features.

Server costs: Maintaining and scaling infrastructure to accommodate user growth.

Monitoring tools: Real-time monitoring systems to track performance and security.

7. Marketing and Customer Acquisition

Once the fintech solution is developed, promoting it to the target audience incurs additional costs. Marketing strategies such as digital advertising, influencer partnerships, and content marketing require significant investment. Moreover, onboarding users and providing customer support also contribute to the total cost.

8. Geographic Factors

The cost of fintech software development varies significantly based on geographic factors. Development in North America and Western Europe tends to be more expensive compared to regions like Eastern Europe, South Asia, or Latin America. Businesses must weigh the trade-offs between cost savings and access to high-quality talent.

9. Partnering with Technology Providers

Collaborating with established technology providers can reduce development costs while ensuring top-notch quality. For instance, Xettle Technologies offers comprehensive fintech solutions, including secure APIs and compliance-ready tools, enabling businesses to streamline development processes and minimize risks. Partnering with such providers can save time and resources while enhancing the application's reliability.

Cost Estimates

While costs vary depending on the project's complexity, here are rough estimates:

Basic applications: $50,000 to $100,000.

Moderately complex solutions: $100,000 to $250,000.

Highly advanced platforms: $250,000 and above.

These figures include development, security measures, and initial marketing efforts but may rise with added features or broader scope.

Conclusion

Understanding the costs associated with fintech software development is vital for effective budgeting and project planning. From assembling a skilled team to ensuring compliance and security, each component contributes to the total investment. By leveraging advanced tools and partnering with experienced providers like Xettle Technologies, businesses can optimize costs while delivering high-quality fintech payment solutions. The investment, though significant, lays the foundation for long-term success in the competitive fintech industry.

2 notes

·

View notes

Text

How to Make Money Blogging: A Beginner's Guide

Starting a blog can be an excellent way to share your thoughts and passions with the world. What's even more exciting is that blogging has the potential to generate income. While it may take time and effort to build a profitable blog, with the right strategies and dedication, you can turn your blog into a lucrative venture. In this beginner's guide, we'll explore practical steps to help you make money from your blog.

Choose a Profitable Niche: Selecting the right niche is crucial for your blog's success. Look for a topic that you're genuinely passionate about and that has a potential audience. Research the market demand, competition, and monetization opportunities within your chosen niche.

Create High-Quality Content: Consistently producing valuable and engaging content is essential for attracting and retaining readers. Write well-researched articles, provide unique perspectives, and ensure your content is well-structured and error-free. Utilize multimedia elements such as images, videos, and infographics to enhance the reader experience.

Build an Engaged Audience: Focus on growing your blog's audience by promoting your content through various channels. Leverage social media platforms, engage with your readers through comments and email newsletters, and collaborate with other bloggers or influencers in your niche. Building an engaged and loyal audience will be instrumental in monetizing your blog.

Monetization Options: Here are some popular ways to monetize your blog:

a. Display Advertising: Sign up for ad networks like Google AdSense or Mediavine to display ads on your blog. Earn money based on ad impressions or clicks from your visitors.

b. Affiliate Marketing: Promote products or services related to your blog's niche and earn a commission for each sale or lead generated through your referral links. Join affiliate programs like Amazon Associates or CJ Affiliate to get started.

c. Sponsored Posts and Reviews: Collaborate with brands and write sponsored content or review their products in exchange for payment. Ensure transparency and maintain your authenticity when working with sponsors.

d. Digital Products: Create and sell digital products such as e-books, online courses, or templates relevant to your audience's interests and needs.

e. Membership or Subscription Services: Offer premium content or exclusive access to a membership or subscription program, charging a recurring fee from your dedicated readers.

f. Freelancing or Consulting: Showcase your expertise through your blog and offer freelance writing, consulting, or coaching services to your readers.

Optimize for Search Engines: Implement search engine optimization (SEO) techniques to improve your blog's visibility in search engine results. Research relevant keywords, optimize your blog posts with proper meta tags, and focus on creating high-quality, keyword-rich content that addresses your audience's search queries.

Track and Analyze Your Progress: Use analytics tools like Google Analytics to track your blog's performance, including traffic, engagement, and conversion rates. Analyze the data to identify areas for improvement and optimize your strategies accordingly.

Be Patient and Persistent: Making money from blogging takes time and consistent effort. It's essential to stay dedicated, patient, and continuously learn and adapt your strategies to achieve long-term success.

Conclusion: While starting a blog with the intention of making money requires effort and persistence, it can be a rewarding venture. By selecting the right niche, creating valuable content, building an engaged audience, and exploring various monetization options, you can turn your blog into a profitable source of income. Remember, success won't happen overnight, but with determination and the right approach, your blogging journey can lead to financial independence and fulfillment.

4 notes

·

View notes

Text

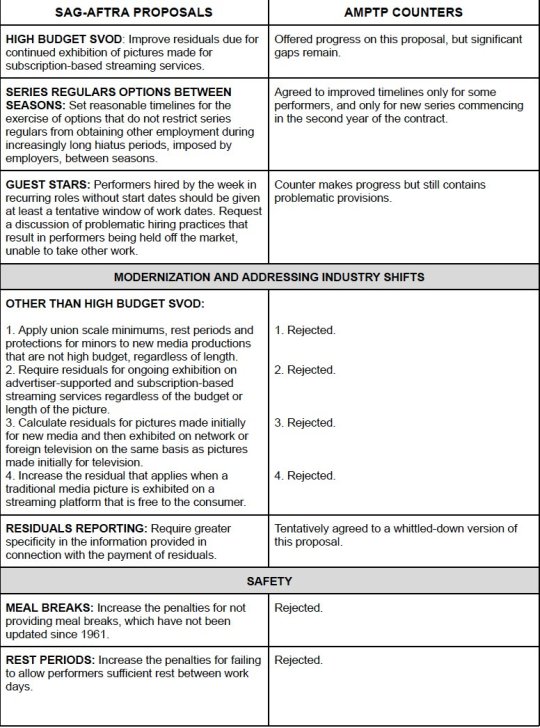

[Image descriptions in order: two screenshots of an interview. The first shows the interviewer with another person beside them asking the question "Don't you find the strikers' demands for better pay and benefits a little disturbing?" The interviewee responds "Don't you find the CEOs having a problem with giving them that a little disturbing?"]

[A tweet by @SentaMMoses "Senta Moses" which says "SAG just released all the deal points and the AMPTP's response. OH MY F*CKING GOD. #SAGSstrike 1/3". Attached are two screenshots of the proposals.]

[A reply tweet by @TheeBrianJ "TheBrianJ" which says "This about sums it up huh." Attached is a screenshot of the proposals, which says "BASIC RESPECT AND FAIRNESS: 1. Rejected."]

[A screenshot of one page of the proposals and responses. The page is divided into two columns;

Sag-aftra Proposals on the left and Amptp Counters on the right. The proposals and counters are divided into categories, save for the first three. They say:

Proposal: HIGH BUDGET SVOD: Improve residuals due for continued exhibition of pictures made for subscription-based streaming services.

Counter: Offered progress on this proposal, but significant gaps remain.

Proposal: SERIES REGULARS OPTIONS BETWEEN SEASONS: Set reasonable timelines for the exercise of options that do not restrict series regulars from obtaining other employment during increasingly long hiatus periods, imposed by employers, between seasons.

Counter: Agreed to improved timelines only for some performers, and only for new series commencing in the second year of the contract.

Proposal: GUEST STARS: Performers hired by the week in recurring roles without start dates should be given at least a tentative window of work dates. Request a discussion of problematic hiring practices that result in performers being held off the market, unable to take other work.

Counter: Counter makes progress but still contains problematic provisions.

Category: Modernization and addressing industry shifts

Proposal: Other than high budget svod:

1. Apply union scale minimums, rest periods and protections for minors to new media productions that are not high budget, regardless of length.

Counter: Rejected.

2. Require residuals for ongoing exhibition on advertiser-supported and subscription-based streaming services regardless of the budget or length of the picture.

Counter: Rejected.

3. Calculate residuals for pictures made initially for new media and then exhibited on network or foreign television on the same basis as pictures made initially for television.

Counter: Rejected.

4. Increase the residual that applies when a traditional media picture is exhibited on a streaming platform that is free to the consumer.

Counter: Rejected.

Proposal: RESIDUALS REPORTING: Require greater specificity in the information provided in connection with the payment of residuals.

Counter: Tentatively agreed to a whittled-down version of this proposal.

Category: SAFETY

Proposal: MEAL BREAKS: Increase the penalties for not providing meal breaks, which have not been updated since 1961.

Counter: Rejected.

Proposal: REST PERIODS: Increase the penalties for failing to allow performers sufficient rest between work days.

Counter: Rejected.]

[A tweet by @ZackBornstein "Zack Bornstein" which says "Struggling to figure out why the WGA/ SAG strikes are getting negative news coverage on CNN (owned by Warner Bros), MSNBC (owned by Universal), ABC News (owned by Disney), CBS News (owned by Paramount), and FOX News (owned by Hitler)".]

68K notes

·

View notes

Text

2025 Is the Year to Invest in OTT APP Development with ideyaLabs

OTT streaming services dominate the market. Traditional broadcasting methods struggle to keep up. Businesses see the potential of OTT apps. They allow content delivery straight to the consumer. ideyaLabs stands at the forefront of OTT APP Development in 2025. Our expertise and technology enable your business to leverage the full capabilities of OTT apps.

Understanding the Importance of OTT App Development in Today's Market

OTT apps bypass traditional distribution channels. Viewers gain convenience and flexibility. OTT services enhance viewer engagement. ideyaLabs provides bespoke OTT APP Development. Our OTT services provide unparalleled user experience, stronger security features, and seamless performance.

Growth in OTT Content Consumption

2025 sees an unprecedented rise in OTT content consumption. The shift from traditional cable to OTT streaming represents a massive opportunity. ideyaLabs helps you harness that potential. OTT apps offer personalized content and recommendations. They increase viewer satisfaction. ideyaLabs equips your business with these features.

Key Components of Successful OTT APP Development

User experience ranks top among key components. ideyaLabs focuses on creating intuitive interfaces. Easy navigation and sleek design attract users. They enhance the viewing experience.

Content management and delivery are vital. ideyaLabs ensures smooth content uploading and management. We integrate various content formats. We offer live streaming, video-on-demand, and more. We use adaptive streaming techniques. Video quality adjusts to the viewer's internet speed. Buffering reduces.

Security measures cannot be overlooked. ideyaLabs implements secure payment gateways. DRM (Digital Rights Management) prevents unauthorized access. Sensitive data gets encrypted, ensuring privacy and security.

How ideyaLabs Utilizes Advanced Technology in OTT APP Development

Artificial Intelligence (AI) enhances user engagement. We implement AI algorithms to analyze viewer behavior. Personalized content recommendations result. They improve viewer retention rates.

Our apps integrate Augmented Reality (AR) and Virtual Reality (VR). Immersive experiences boost viewer interaction.

Machine Learning (ML) techniques predict viewership trends. This guides content strategy. You create the right content at the right time.

Scalability and Flexibility of OTT Apps Developed by ideyaLabs

Our OTT apps support scalability. Handle large user bases without compromising performance. Flexibility allows your app to adapt to various devices. Smart TVs, mobile phones, tablets, and desktops are included. ideyaLabs ensures your content is accessible anywhere, anytime.

Revenue Models for OTT Apps

Subscription-based models guarantee a steady income. Viewers pay a recurring fee for content access. ideyaLabs integrates secure and flexible subscription options.

Ad-supported models generate revenue through advertisements. Our apps ensure ad placements do not disrupt the viewing experience.

Pay-per-view models offer an alternative. Viewers pay for specific content. Live events or exclusive shows can use this model effectively.

Best Practices for OTT APP Development with ideyaLabs

We continuously test and improve app performance. Regular updates keep your app relevant. ideyaLabs incorporates user feedback. We focus on enhancing usability. We prioritize speed and reliability. Your viewers get a seamless experience.

Our team offers 24/7 support. Technical issues get resolved promptly. Your app runs smoothly. Viewer satisfaction remains high.

Market Trends and Future of OTT Streaming Services

The market trends indicate sustained growth. More people cut the cord. More subscribers join OTT platforms. ideyaLabs stays ahead of these trends. Our solutions evolve with the market. We implement cutting-edge technologies. Your business stays competitive.

Hybrid models gain popularity. They combine subscription and ad-supported models. ideyaLabs helps you adopt these strategies. Maximize your revenue streams.

Choosing ideyaLabs for Your OTT APP Development Needs

Our extensive experience sets us apart. We deliver customized solutions. Your app aligns with your brand identity. Ideal user experiences result. Your audience remains engaged.

Our development process is transparent. ideyaLabs emphasizes collaboration. We keep you involved at every stage. Launch your app on time and within budget.

Conclusion

OTT APP Development represents the future of content delivery. ideyaLabs stands ready to transform your vision into reality. Our innovative solutions meet modern demands. Join the revolution with ideyaLabs. Let us build your OTT app today. Your business will thrive in the dynamic world of OTT streaming services.

0 notes

Text

Subscription-Based Service Challenges

A subscription-based business model presents unique marketing challenges. In the traditional model, where one-time purchases prevail, companies need to convince a potential customer to purchase a service once. With a subscription, companies have to concern themselves with customer retention, in addition to the challenges and high-cost of acquisitions.

Subscription services range from consumer software like Netflix to business tools like Salesforce. One of the challenges of acquiring subscribers lies in communicating the value of paying a recurring fee. Companies can help overcome this by focusing on increasing lifetime value and communicating it well by switching consumer focus from ownership to providing a solution.

For example, a movie enthusiast motivated by ownership would need to purchase a DVD to watch a movie. For a consumer looking to watch movies on demand, the ownership route is inconvenient. A streaming service like Netflix offers convenience.

Companies can also offer demos and free trials. These build trust by eliminating the risk of committing to a service a customer isn’t sure works or is a good fit. Demos and free trials are also useful when a company is struggling to articulate the benefits of its subscription service and its value proposition.

Customer churn (subscribers canceling subscriptions) is another major challenge in the subscription business. Reasons customers unsubscribe include the enticing features, pricing, or functionality of competitors’ services. Churn can also be involuntary due to failed payment.

To reduce customer churn companies must deliver products or services that meet customer needs and expectations, thereby justifying the recurring payments. To remain attractive to users, companies must innovate and update features. Responsive customer care service also helps boost brand loyalty.

Another explanation for customer churn is that customer needs and preferences change. Once a user has solved their problem, there may no longer be a reason to stay subscribed to a service. They will cancel and move on to another service that solves their current problem. Companies should ensure the evolution of their products’ features reflects users’ ever-changing preferences, needs, and motivations through data-driven and customer-centered innovation.

Pricing and packaging services can also be challenging. Price is a major consideration in the subscription service. Customers want to pay a price commensurate with the value they’re getting. It’s not just about matching price with value or having the lowest price. Pricing and payment options must suit customers’ specific needs.

Companies must also offer convenient payment options for seamless subscriptions. Payment options should also reflect customers’ purchasing preferences. A company selling software globally should offer country-friendly payment options. Another strategy for making pricing flexible is offering different subscription plans, such as monthly, quarterly, annual, or on a per-user basis.

A subscription-based business model allows companies to serve users across continents without setting up physical offices in those countries. With this global reach, however, comes a host of legal and regulatory challenges. Take the EU, for example. It has the strictest data regulations, and companies operating in the EU must adhere to them. Other country-specific regulations to be aware of and adhere to include billing and taxation rules and reporting practices.

To stay compliant, companies should consult with legal and financial experts from the countries where they operate. They should also implement and maintain internal policies to ensure regulatory compliance, such as data collection and use policies.

For many customers, subscription is a set-and-forget affair. To stay top of mind and boost brand loyalty, brands should regularly engage customers. They should also consistently deliver on their promises and constantly innovate. This helps prevent churn while increasing the chances of being recommended by their loyal users, helping to reduce acquisition costs.

0 notes

Text

E-Commerce Business Plan: How to Start an Online Store

The e-commerce industry is booming, with millions of entrepreneurs leveraging online platforms to build profitable businesses. Whether you’re planning to sell physical products, digital goods, or services, having a well-structured e commerce business plan is crucial. In this guide, we’ll take you through the essential steps to start an online store and set yourself up for success.

1. Define Your Business Idea

Before launching an online store, you must identify a profitable niche and decide what products or services you want to sell. Conduct thorough market research to understand trends, customer needs, and potential competitors. Some factors to consider include:

Demand for the product

Target audience demographics

Competition analysis

Profit margins

2. Choose a Business Model

E-commerce businesses operate under different models, and choosing the right one is essential. The most common business models include:

Dropshipping: You sell products without holding inventory, as suppliers ship directly to customers.

Wholesale & Retail: You purchase products in bulk and sell them at a profit.

Subscription-Based: Customers subscribe to receive products or services on a recurring basis.

Print-on-Demand: Custom products are printed and shipped only when an order is placed.

3. Create a Business Plan

A detailed business plan serves as a roadmap for your e-commerce venture. Key elements to include are:

Business Description: Overview of your products, services, and mission.

Market Research: Insights into industry trends and customer behavior.

Financial Plan: Budgeting, pricing strategies, and projected revenue.

Marketing Strategy: How you plan to attract and retain customers.

4. Choose the Right E-Commerce Platform

Selecting the right platform is crucial for the functionality and scalability of your online store. Some popular e-commerce platforms include:

Shopify: User-friendly, with various themes and integrations.

WooCommerce: A customizable WordPress plugin for online stores.

BigCommerce: Ideal for businesses looking for scalability.

Magento: A robust platform for advanced e-commerce needs.

5. Register Your Business & Secure a Domain Name

To operate legally, register your business and obtain necessary licenses. Additionally, choose a domain name that reflects your brand and is easy to remember. A strong domain name boosts credibility and helps with SEO rankings.

6. Source Your Products

Once you’ve chosen a business model, secure reliable suppliers or manufacturers. Ensure your products meet quality standards and negotiate pricing to maximize profit margins. If you’re selling handmade or unique products, focus on sourcing high-quality materials.

7. Design Your Online Store

A well-designed website enhances customer experience and boosts sales. Key elements to focus on include:

User-Friendly Navigation: Ensure a seamless shopping experience.

Mobile Responsiveness: Optimize for mobile users.

High-Quality Images & Product Descriptions: Showcase your products effectively.

Secure Payment Gateways: Offer multiple payment options for customer convenience.

8. Implement a Digital Marketing Strategy

To drive traffic and sales, an effective digital marketing strategy is essential. Some key marketing tactics include:

Search Engine Optimization (SEO): Optimize product pages for search rankings.

Social Media Marketing: Engage with your audience on platforms like Instagram, Facebook, and TikTok.

Pay-Per-Click (PPC) Advertising: Run targeted ads on Google and social media.

Email Marketing: Build relationships with customers through personalized emails.

Influencer & Affiliate Marketing: Leverage partnerships to expand reach.

9. Set Up Shipping & Fulfillment

Customers expect timely and hassle-free deliveries. Choose a reliable shipping and fulfillment method based on your business model:

Self-Fulfillment: Store and ship products yourself.

Third-Party Logistics (3PL): Partner with a fulfillment company to handle inventory and shipping.

Dropshipping: The supplier ships directly to customers.

10. Track Performance & Optimize

After launching your store, continuously monitor your e-commerce analytics to track sales, customer behavior, and website performance. Use insights to optimize:

Product offerings

Marketing strategies

Pricing and promotions

Customer service experience

Final Thoughts

Starting an online store requires careful planning, but with the right e-commerce business plan, you can build a successful brand. By following these steps, you’ll be well on your way to creating a profitable online business. Stay adaptable, keep learning, and focus on delivering value to your customers.

Are you ready to take your e-commerce journey to the next level? Start today and turn your business dreams into reality!

0 notes

Text

CloudBuddy AI Review 2025: The Ultimate Cloud Storage Solution

Welcome to the ultimate guide on CloudBuddy AI Review 2025: The Ultimate Cloud Storage Solution ! In today’s digital age, managing business data has become a monumental challenge for many entrepreneurs and professionals. Whether you’re juggling multiple projects, running an e-commerce store, or simply trying to keep your personal files organized, finding reliable cloud storage can feel like navigating a minefield. Subscription fatigue from platforms like Google Drive, Dropbox, and OneDrive adds insult to injury, often leaving users frustrated with limited storage and exorbitant fees.

But what happens when even these solutions fall short? What if you could break free from the cycle of monthly payments and gain access to unlimited storage for life—all for a one-time fee? That’s where CloudBuddy AI steps in as the game-changer we’ve all been waiting for. This revolutionary platform not only eliminates recurring costs but also delivers unmatched speed, security, and ease of use. Imagine never worrying about running out of space again while enjoying military-grade encryption and seamless file sharing. Sound too good to be true? Let me assure you—it’s real, and it’s here to transform how you manage your digital assets.

In this comprehensive review, I’ll walk you through everything you need to know about CloudBuddy AI, including its features, pricing, benefits, and whether it truly lives up to the hype. So buckle up, because we’re about to dive deep into the future of cloud storage!

What is CloudBuddy AI?

CloudBuddy AI is a next-generation cloud storage solution designed to redefine the way businesses and individuals handle their digital data. Dubbed the “Google Drive Killer,” this innovative platform offers unlimited uploads, blazing-fast performance, and rock-solid security—all for a single, affordable payment. Unlike traditional subscription-based services, CloudBuddy AI allows users to store, back up, share, and host unlimited files without ever worrying about capacity limits or hidden fees.

Product: CloudBuddy AI

Creator: Kundan Choudhary

Official Website: Click Here

Product Type: Software

Date Of Launch: Feb 3, 2025

Front End Price: $17 (one-time payment)

Bonus: Yes!, Huge Bonuses

Guarantee: Yes! Boss Traffic offers a 30-day money-back guarantee

Who Created CloudBuddy AI?

CloudBuddy AI is the brainchild of Kundan Choudhary, a visionary innovator and digital marketing expert known for creating groundbreaking software solutions. With years of experience under his belt, Kundan has consistently delivered products that address real-world challenges faced by businesses and consumers alike. His previous launches include popular tools like StockProHub, CloneBuddy AI, TeamBuddy AI, PrimeBeast AI, and VidHostPal—each crafted to simplify complex tasks and enhance productivity.

Kundan’s passion for innovation shines through in every aspect of CloudBuddy AI. By combining state-of-the-art AI technology with user-friendly design principles, he has created a platform that caters to users of all skill levels. Under his leadership, CloudBuddy AI aims to disrupt the cloud storage industry by offering unparalleled value at a fraction of the cost of competitors. If there’s anyone who understands the importance of affordability without compromising quality, it’s Kundan Choudhary.

Top Benefits of CloudBuddy AI

The appeal of CloudBuddy AI lies in its ability to deliver numerous advantages that cater to modern-day demands. Here are some key benefits:

Unlimited Storage : Say goodbye to restrictive quotas and hello to infinite possibilities. Store as many files as you want without worrying about running out of space.

One-Time Payment : Forget costly subscriptions. Pay just once and enjoy lifetime access to premium cloud storage.

Advanced Security : Protect your data with military-grade encryption, ransomware detection, and malware scanning. Your files remain secure no matter where you access them.

Seamless Sharing : Share files instantly via email or links, complete with password protection and expiration settings for added control.

AI-Powered Features : Effortlessly organize, search, and collaborate with intelligent automation tools that save time and boost efficiency.

Cross-Platform Compatibility : Access your files anytime, anywhere, across devices running Windows, macOS, Android, or iOS.

With CloudBuddy AI, you get a powerful combination of convenience, security, and affordability that sets it apart from the competition.

How Does CloudBuddy AI Work?

Using CloudBuddy AI couldn’t be simpler. The entire process boils down to three straightforward steps:

Login : Secure your copy of CloudBuddy AI and log in to unlock its full potential.

Upload Documents : Drag and drop your files, folders, or multimedia content effortlessly. Multiple simultaneous uploads ensure smooth workflows.

Share, Publish & Profit : Once uploaded, share your files securely with colleagues, clients, or customers. You can even monetize your storage by offering services to others.

Behind the scenes, CloudBuddy AI leverages AI algorithms to optimize file compression, enhance search capabilities, and automate organizational tasks. Additionally, its intuitive interface ensures beginners can navigate the platform with ease, while advanced users appreciate the granular control over permissions and settings.

Best Features of CloudBuddy AI

Here are some standout features that make CloudBuddy AI a must-have for anyone seeking a reliable cloud storage solution:

Real-Time Collaboration : Work seamlessly with teams by granting different permission levels for shared files and folders.

100% Uptime Guarantee : Rest assured knowing your files are always accessible without interruptions.

Massive Storage Boost : Enjoy extra terabytes of high-speed storage with optional upgrades.

Watermarked Previews : Add watermarks to preview files before downloading for enhanced security.

Automated File Organization : Set rules to automatically sort incoming files into designated folders.

Commercial License : Monetize your account by providing cloud storage services to clients.

These features, among others, position CloudBuddy AI as a versatile tool capable of meeting diverse needs.

Who Should Buy CloudBuddy AI?

CloudBuddy AI is ideal for anyone looking to simplify their cloud storage needs. Specifically, it appeals to:

Affiliate marketers needing secure file hosting.

Content creators requiring fast upload/download speeds for media files.

E-commerce store owners wanting to backup product catalogs efficiently.

Small business owners seeking cost-effective alternatives to expensive subscriptions.

Freelancers and consultants managing client projects remotely.

Digital agencies offering storage solutions to their clientele.

If you fall into any of these categories—or simply value convenience and security—you owe it to yourself to explore CloudBuddy AI.

CloudBuddy AI Pros and Cons

Pros:

Unlimited storage for a one-time fee.

Advanced security features like SSL encryption and malware scanning.

Easy-to-use interface suitable for beginners.

Fast upload/download speeds thanks to AI compression.

No recurring charges or hidden fees.

Lifetime updates and dedicated customer support included.

Cons:

Requires a stable internet connection for optimal performance.

No free trial option available.

Despite minor drawbacks, CloudBuddy AI delivers exceptional value that far outweighs its limitations.

>> Get Instant Access <<

CloudBuddy AI Pricing and OTOs

CloudBuddy AI starts at an unbeatable price of $17 for the front-end package. However, several optional upgrades (OTOs) enhance its functionality further:

Premium Edition ($37) : Adds brand customization, massive storage boosts, and priority support.

Max Edition ($67) : Provides unlimited uploads, downloads, and remote URL importing.

Enhanced Security Edition ($67) : Includes 256-bit encryption, ransomware detection, and two-factor authentication.

DFY Edition ($97) : Allows professional setup and migration of existing files.

Whitelabel Edition ($397) : Rebrand CloudBuddy AI as your own and launch a profitable cloud storage business.

Each upgrade builds upon the core offering, ensuring maximum flexibility and scalability.

Customer Testimonials

Conclusion: Should You Buy CloudBuddy AI?

After thoroughly reviewing CloudBuddy AI, it’s clear this platform represents excellent value for money. For just $17, you gain access to unlimited storage, lightning-fast performance, and top-tier security—all backed by a 30-day money-back guarantee. Even better, optional upgrades allow you to tailor the service to fit specific requirements, making it adaptable for both personal and professional use.

Whether you’re tired of paying hefty subscription fees or searching for a secure, scalable solution, CloudBuddy AI checks all the boxes. Don’t miss out on this opportunity to revolutionize how you manage your digital life. Act now before prices increase post-launch!

Summary:

CloudBuddy AI redefines cloud storage with its unique blend of affordability, security, and versatility. Backed by a trusted creator and boasting impressive features, it stands out as a leader in the industry. With no recurring fees and a risk-free trial period, there’s never been a better time to invest in your digital future.

11. FAQ Section

Q: Is CloudBuddy AI easy to use? A: Absolutely! Designed with beginners in mind, CloudBuddy AI features an intuitive interface and step-by-step video tutorials.

Q: Do I need technical skills to set it up? A: Not at all. Even novices can start using CloudBuddy AI within minutes.

Q: What happens if I’m not satisfied? A: You’re covered by a 30-day money-back guarantee, so you can try it risk-free.

Q: Can I use CloudBuddy AI on multiple devices? A: Yes, it works seamlessly across Windows, macOS, Android, and iOS devices.

Thank you for reading “CloudBuddy AI Review 2025: The Ultimate Cloud Storage Solution.” I hope this review provided valuable insights to help you make an informed decision. Don’t let subscription fatigue hold you back—join thousands of satisfied users and experience the power of CloudBuddy AI today!

Affiliate Disclaimer :

Some of the links in this article may be affiliate links, which means I receive a small commission at NO ADDITIONAL cost to you if you decide to purchase something. While we receive affiliate compensation for reviews / promotions on this article, we always offer honest opinions, user experiences and real views related to the product or service itself. Our goal is to help readers make the best purchasing decisions, however, the testimonies and opinions expressed are ours only. As always you should do your own thoughts to verify any claims, results and stats before making any kind of purchase. Clicking links or purchasing products recommended in this article may generate income for this product from affiliate commissions and you should assume we are compensated for any purchases you make. We review products and services you might find interesting. If you purchase them, we might get a share of the commission from the sale from our partners. This does not drive our decision as to whether or not a product is featured or recommended.

#CloudBuddyAIreview2025#CloudBuddyAIreview#CloudBuddyAI#CloudBuddyAIBonuses#CloudBuddyAIdemo#Marketing#Traffic#CloudBuddyAIFeatures#CloudBuddyAIFunnels#CloudBuddyAIupsells#CloudBuddyAIworth

0 notes

Text

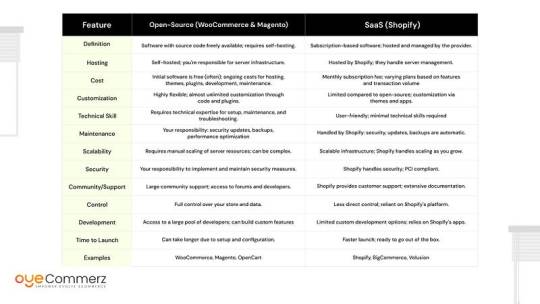

SaaS vs. Open-Source: Why Businesses Are Migrating to Shopify

The digital marketplace is constantly evolving. Businesses are increasingly seeking streamlined, efficient solutions for their online stores. This has led to a significant shift: many are migrating to Shopify, a SaaS (Software as a Service) platform, from traditional open-source options like WooCommerce and Magento. This blog post explores the reasons behind this migration, comparing SaaS and open-source platforms, and highlighting why Shopify is becoming a top choice for online entrepreneurs.

Understanding the Landscape: SaaS vs. Open-Source

Key Points: Open-source offers maximum flexibility but demands technical expertise. SaaS prioritizes ease of use and convenience.

The Shift: Why Businesses Choose Shopify

Ease of Use and Speedy Setup: Shopify’s intuitive drag-and-drop interface simplifies store creation, product management, and payment gateway setup. WooCommerce/Magento often require developer assistance for similar tasks. Example: A clothing boutique owner can quickly launch a Shopify store, whereas WooCommerce might necessitate hiring a developer.

Reduced Maintenance & IT Costs: Shopify handles hosting, security, updates, and backups, freeing businesses from these burdens. Open-source platforms require ongoing maintenance and potential IT expenses. Example: A growing business saves by allocating IT resources to marketing instead of WooCommerce maintenance.

Scalability and Performance: Shopify’s infrastructure scales with business growth, handling traffic spikes with ease. Open-source scaling can be complex and prone to issues. Example: A Shopify store handles a flash sale surge seamlessly, while a WooCommerce store might experience slowdowns.

Security and Reliability: Shopify prioritizes security with PCI compliance and robust measures. Open-source security is the store owner’s responsibility. Example: Shopify’s built-in security provides peace of mind compared to managing WooCommerce security plugins.

Focus on Business, Not Technology: Shopify lets businesses concentrate on marketing and sales, not technical details. Open-source can be time-consuming technically. Example: A business owner uses Shopify to focus on marketing campaigns, not plugin conflicts.

App Ecosystem and Integrations: Shopify’s app store offers a wide range of integrations with other business tools. Open-source plugins can have compatibility issues. Example: Shopify’s app store simplifies email marketing integration compared to potentially complex WooCommerce plugin integrations.

Shopify’s Specific Advantages

Ease of Use (Examples): Shopify simplifies store setup, product management, order processing, and theme customization through intuitive interfaces and streamlined workflows.

Pricing and Plans: Shopify’s tiered pricing caters to various business sizes, offering value and scalability.

Marketing and Sales Tools: Built-in features like abandoned cart recovery, email marketing integrations, and SEO tools empower businesses.

Support and Community: 24/7 support and active community forums provide assistance and resources.

Shopify for Different Business Types

Dropshipping: Shopify integrates seamlessly with dropshipping apps, simplifying product sourcing and order fulfillment.

Print-on-Demand: Shopify connects with POD services, enabling the sale of custom designs without inventory.

Subscription Businesses: Shopify supports recurring billing and subscription management through apps.

Physical vs. Digital Products: Shopify handles both physical and digital sales, including file downloads and memberships.

Conclusion: Embrace the Simplicity of SaaS

Shopify’s ease of use, scalability, and comprehensive features make it a compelling choice for modern businesses. Migrating to Shopify can free you from technical burdens, allowing you to focus on growth. Ready to simplify your eCommerce journey? Explore Shopify through OyeCommerz today!

0 notes

Text

Efficient Credit Card Processing for Subscription-Based Models

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the rapidly evolving digital realm, businesses demand a dependable and effective credit card processing system, especially when engaged in subscription-based models. Credit card acceptance isn't just a matter of convenience; it's a strategic necessity that fuels expansion and ensures smooth financial transactions. In this article, we will delve into the universe of credit card processing, with a particular focus on its pivotal role in subscription-based enterprises.

The Significance of Credit Card Processing It's not just a payment choice; it stands as the gateway to success for subscription-based models. Envision a scenario where your customers confront complex payment procedures, leading to exasperation and eventual abandonment. Proficient payment processing eradicates these hurdles, positioning itself as a critical component of your subscription-based business strategy.

Why Credit Card Processing is Crucial Payment processing in subscription-based models is a fundamental element of customer satisfaction and retention. It guarantees seamless transactions, providing your customers with a fuss-free experience when subscribing to your services. Furthermore, modern payment processing systems incorporate robust security measures, safeguarding sensitive customer data and thwarting fraudulent activities. The automation of recurring billing is indispensable for subscription-based models, guaranteeing punctual payments and minimizing churn rates. Additionally, accepting credit cards broadens your business horizons, breaking down geographical barriers and enabling you to tap into a global audience.

Embracing Credit Cards for High-Risk Ventures For high-risk businesses, securing a reliable payment processing solution is of paramount importance. Whether your operations fall within the CBD industry, credit repair services, or e-commerce niches, you need a high-risk credit card processing system capable of addressing the unique challenges posed by your sector.

Merchant Accounts for High-Risk Enterprises High-risk merchant accounts are tailored explicitly for businesses with an elevated likelihood of chargebacks or fraud. If your subscription-based model falls within this category, obtaining a high-risk merchant account becomes indispensable for sustainable growth.

youtube

The E-commerce Advantage In the era of online shopping, e-commerce payment processing is absolutely indispensable. Online enterprises, whether they reside in traditional markets or high-risk domains, rely on efficient e-commerce payment gateways to expedite transactions and ensure customer contentment.

In conclusion, the universe of subscription-based models revolves around proficient credit card processing. It's not just about accepting payments; it's about crafting a smooth and secure experience for your clientele. Whether you operate in a high-risk industry or e-commerce, the right payment processing system can be the cornerstone for sustainable growth and global outreach.

#high risk merchant account#high risk payment gateway#high risk payment processing#merchant processing#payment processing#credit card payment#credit card processing#accept credit cards#payment#youtube#Youtube

22 notes

·

View notes

Text

How Can Payout Solutions Transform Business Payments in 2024 - 2025?

In the fast-evolving landscape of digital commerce, businesses need agile and efficient systems to manage payments. Payout solutions have emerged as a cornerstone for streamlining transactions, enabling businesses to process bulk payments, vendor disbursements, and employee salaries with unparalleled ease. As we move into 2024-2025, payout solutions are set to revolutionize how businesses handle payments, with a focus on innovation, scalability, and integration.

Understanding Payout Solutions

Payout solutions refer to systems and platforms designed to automate and streamline the process of sending payments from businesses to multiple recipients, such as vendors, customers, and employees. These solutions are equipped to handle high transaction volumes, ensuring accuracy and compliance while reducing operational overhead.

Unlike traditional banking methods, payout solutions offer real-time processing, enhanced security, and seamless integration with existing business software. They have become indispensable for industries such as e-commerce, gig economy platforms, and financial services that rely heavily on efficient payment flows.

The Key Benefits of Payout Solutions

Efficiency and Automation: Payout solutions enable businesses to automate repetitive tasks, such as salary disbursements or vendor payments. This reduces manual intervention, minimizes errors, and accelerates transaction times.

Cost-Effectiveness: By consolidating and optimizing payment processes, businesses can lower administrative costs and reduce the reliance on traditional banking systems.

Global Reach: Modern payout solutions are designed to handle cross-border transactions, making them ideal for businesses with an international footprint.

Real-Time Processing: With real-time payments, recipients receive their funds instantly, improving cash flow and enhancing customer and vendor satisfaction.

Security and Compliance: Leading payout solutions prioritize data security and ensure compliance with local and international regulations, providing businesses with peace of mind.

Transformative Trends in Payout Solutions for 2024-2025

The payout solutions market is undergoing significant innovation, driven by advancements in technology and evolving business needs. Some of the key trends include:

Payment Gateway Integration: Seamless integration with payment gateways allows businesses to connect their payout systems with e-commerce platforms, accounting software, and ERP systems. This ensures smooth operations and better tracking of financial data.

Custom Solutions Services: Payment solution providers are increasingly offering tailored services to meet the specific needs of industries. Custom solutions address unique challenges, such as handling high transaction volumes for marketplaces or facilitating recurring payments for subscription-based businesses.

Artificial Intelligence and Machine Learning: AI-powered analytics help businesses identify patterns, predict payment trends, and detect fraudulent activities, making payout systems smarter and more reliable.

Blockchain for Transparency: Blockchain technology is being incorporated into payout solutions to ensure transparency, reduce fraud, and provide an immutable record of transactions.

Why Businesses Need Payout Solutions

Efficient payment management is critical to the success of any business. Delayed or inaccurate payments can harm relationships with vendors and employees and erode customer trust. By adopting advanced payout solutions, businesses can overcome these challenges while gaining a competitive edge.

For E-Commerce: Payout solutions simplify vendor disbursements, refunds, and affiliate payments, ensuring smooth operations.

For the Gig Economy: Freelancers and gig workers demand timely payments. Payout solutions ensure on-time and accurate disbursements, boosting workforce satisfaction.

For Corporates: Automating payroll processes reduces administrative effort and ensures compliance with labor laws.

The Role of Payment Solution Providers

Payment solution providers are the backbone of the payout ecosystem. They offer the tools and services needed to set up and manage efficient payout systems. By partnering with these providers, businesses can access cutting-edge technology and expert guidance to optimize their payment processes.

One standout example is Xettle Technologies, a leader in providing innovative payout and payment gateway integration services. Xettle Technologies specializes in delivering scalable and secure payout solutions that cater to businesses of all sizes. Their expertise in custom solutions services ensures that businesses can seamlessly integrate these systems into their existing workflows.

Challenges and Opportunities

While payout solutions offer numerous advantages, businesses may face challenges such as:

Integration Complexity: Implementing new payout systems may require reconfiguring existing business software.

Data Privacy: With increasing regulatory scrutiny, ensuring data protection and compliance is critical.

User Adoption: Training teams to use new payout solutions effectively can be a hurdle for organizations.

However, these challenges are outweighed by the opportunities payout solutions provide, including improved operational efficiency, enhanced customer satisfaction, and the ability to scale operations effortlessly.

Future Outlook

As businesses continue to embrace digital transformation, payout solutions will play an increasingly pivotal role. The integration of AI, blockchain, and IoT technologies into payout systems will further enhance their capabilities, making them more intuitive and secure.

In 2024-2025, we expect to see wider adoption of custom payout services, especially among SMEs looking to optimize their operations. Payment solution providers will continue to innovate, offering businesses the tools they need to thrive in an increasingly competitive landscape.

Conclusion

Payout solutions are no longer a luxury but a necessity for businesses aiming to stay ahead in today’s fast-paced digital economy. By streamlining payment processes, enhancing security, and offering scalability, these solutions transform how businesses manage their financial transactions. With the support of reliable payment solution providers like Xettle Technologies, businesses can unlock new opportunities for growth and efficiency.

Investing in a robust payout solution is an investment in the future of your business. As we step into 2024-2025, the businesses that leverage these transformative technologies will undoubtedly lead the charge in reshaping the global payment landscape.

2 notes

·

View notes

Text

The US Virtual Cards Market: Revolutionizing Payments in a Digital Era

The US virtual cards market is experiencing unprecedented growth as digital payment solutions become the cornerstone of financial transactions. Virtual cards, which are digital versions of traditional credit or debit cards, offer enhanced security, convenience, and efficiency for both businesses and consumers. This growing market reflects a broader shift towards cashless transactions, driven by advancements in technology, the rise of e-commerce, and increasing concerns about payment security.

The US virtual cards market is projected to grow at a compound annual growth rate (CAGR) exceeding 6% over the forecast period.

What Are Virtual Cards?

Virtual cards are digital payment cards that function similarly to physical cards but exist solely in a digital format. Issued by banks or financial service providers, they come with unique card numbers, expiration dates, and CVVs. Virtual cards are typically used for online transactions, recurring payments, or as secure substitutes for physical cards in mobile wallets.

These cards offer enhanced security features, such as single-use card numbers and spending limits, making them a popular choice for reducing fraud and simplifying expense management.

Key Drivers of the US Virtual Cards Market

1. Growth of E-Commerce

The rapid expansion of e-commerce in the US has been a significant driver of virtual card adoption. As consumers increasingly shop online, virtual cards provide a secure and seamless payment method, reducing the risk of fraud during digital transactions.

2. Rising Focus on Payment Security

With cyber threats and payment fraud on the rise, virtual cards offer a secure alternative to traditional payment methods. Features such as tokenization, one-time card numbers, and transaction limits make virtual cards a preferred choice for businesses and consumers.

3. Adoption by Businesses

Corporate adoption of virtual cards is growing due to their ability to streamline expense management, control employee spending, and reduce administrative overhead. Companies are increasingly using virtual cards for procurement, travel, and recurring subscription payments.

4. Advancements in Fintech

The fintech revolution has significantly contributed to the growth of virtual cards. Innovative platforms and apps are making it easier for consumers and businesses to generate and manage virtual cards, fostering widespread adoption.

5. Contactless Payment Trends

The COVID-19 pandemic accelerated the demand for contactless payment solutions, including virtual cards. Consumers now prefer digital payment options that offer convenience without the need for physical contact.

Challenges in the Market

1. Limited Awareness

Despite their benefits, virtual cards remain relatively underutilized among certain consumer segments due to a lack of awareness and understanding of how they work.

2. Integration Issues

Businesses may face challenges in integrating virtual card solutions with existing financial systems or payment gateways, particularly if they rely on older infrastructure.

3. Competition from Digital Wallets

While virtual cards are a strong contender in the digital payments space, they face competition from mobile wallets like Apple Pay, Google Pay, and PayPal, which offer similar levels of convenience and security.

4. Regulatory Compliance

The evolving regulatory landscape surrounding digital payments and data privacy poses challenges for virtual card providers, requiring continuous adaptation to comply with laws and standards.

5. Adoption Barriers Among SMBs

Small and medium-sized businesses (SMBs) may perceive virtual cards as a complex or unnecessary solution, limiting their adoption in this segment.

Emerging Trends Shaping the Market

1. Integration with Mobile Wallets

Virtual cards are increasingly being integrated into mobile wallets, allowing users to make payments seamlessly via smartphones or wearable devices.

2. Subscription Economy Support

Virtual cards are becoming the preferred payment method for managing subscription services, offering features like automatic renewals and easy cancellation.

3. Focus on Sustainability

Virtual cards align with sustainability goals by eliminating the need for plastic card production and reducing waste, appealing to environmentally conscious consumers and businesses.

4. Enhanced Analytics and Controls

Providers are offering robust analytics and reporting tools for virtual cards, enabling businesses to gain insights into spending patterns and optimize financial management.

5. Expansion of B2B Use Cases

The use of virtual cards is expanding beyond consumer payments to include B2B applications, such as supplier payments, expense reimbursement, and vendor management.

Key Players in the US Virtual Cards Market

The market is characterized by a mix of traditional financial institutions, fintech startups, and technology companies. Major players include:

American Express: Offering virtual cards for corporate clients.

Capital One: Providing virtual cards through integrated platforms.

Ramp: A fintech leader focused on expense management using virtual cards.

Stripe: Enabling businesses to issue and manage virtual cards for payments.

Divvy: Specializing in virtual cards for corporate expense control.

Future Prospects of the Market

The US virtual cards market is poised for robust growth, driven by technological advancements, increasing adoption across industries, and the ongoing shift towards digital and cashless payments. The market's future will likely be shaped by:

Broader Consumer Adoption: Efforts to raise awareness and simplify usage will drive consumer adoption.

Enhanced Features: Providers will continue to innovate, offering advanced features such as artificial intelligence-driven fraud detection and real-time expense tracking.

Regulatory Support: Clearer and more supportive regulations will encourage market expansion, particularly for fintech startups.

Cross-Border Applications: Virtual cards will increasingly be used for international transactions, reducing currency conversion fees and streamlining global payments.

API Integration: Seamless integration with third-party apps and platforms will enhance the accessibility and functionality of virtual cards for businesses.

Conclusion

The US virtual cards market is at the forefront of the digital payments revolution, offering unparalleled security, convenience, and efficiency. As e-commerce, fintech, and contactless payment trends continue to shape the financial landscape, virtual cards are set to play a pivotal role in the future of payments.

For businesses and consumers alike, embracing virtual cards means not only staying ahead of the curve but also enhancing the overall payment experience. With strong growth For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence: https://www.mordorintelligence.com/industry-reports/us-virtual-cards-market

#US Virtual Cards Market#US Virtual Cards Market Size#US Virtual Cards Market Share#US Virtual Cards Market Analysis#US Virtual Cards Market Report

0 notes

Text

Top 5 Must-Have Products for Online Shoppers in 2025

The world of online shopping is constantly evolving, with new products and technologies emerging each year. In 2025, online shoppers are expected to demand even more innovative and user-friendly experiences.

The following are the top 5 "Products for Online Shoppers" that will be essential for enhancing convenience, security, and satisfaction in the digital shopping space.

1. Secure eCommerce Transactions

One of the most important factors for online shoppers in 2025 will be ensuring the security of their transactions. As digital fraud continues to rise, shoppers are becoming increasingly cautious about sharing personal and financial information. A platform that offers Secure eCommerce Transactions will give shoppers the peace of mind they need. This includes features like encrypted payment gateways, multi-factor authentication, and fraud detection systems that help protect sensitive data during online purchases.

2. Virtual Try-Ons and Augmented Reality (AR) Tools

With advancements in technology, virtual try-ons and AR tools are set to become essential for online shoppers. Products like clothing, accessories, and even makeup will benefit from virtual fitting rooms, where customers can try on items using their smartphone or computer cameras. AR allows shoppers to visualize products in their own environment, whether it's furniture, home decor, or tech gadgets. These immersive tools not only enhance the shopping experience but also reduce the likelihood of returns by helping customers make better purchasing decisions.

3. AI-Powered Product Recommendations

In 2025, personalized shopping experiences will be a must for online shoppers. AI-powered product recommendations are one of the key "Products for Online Shoppers" that will dominate the market. By analyzing customer behavior, preferences, and purchase history, AI algorithms can suggest relevant products tailored to individual needs. This level of personalization helps shoppers find exactly what they are looking for while enhancing their overall shopping experience.

4. Subscription Boxes for Convenience

Subscription boxes have become a popular trend in recent years, and they will continue to grow in 2025. Whether it’s for beauty products, food, clothing, or even tech gadgets, subscription services provide online shoppers with a convenient way to receive curated products delivered to their doorsteps. This recurring service eliminates the need for frequent shopping, offering customers a hassle-free experience. In addition, these boxes often include exclusive or limited-edition items, adding an element of surprise and excitement to the shopping process.

5. Smart Shopping Carts and Checkout Solutions

The checkout process is one of the most crucial stages of the online shopping journey. In 2025, smart shopping carts and advanced checkout solutions will be indispensable for enhancing customer satisfaction. These carts can remember past purchases, apply discounts automatically, and suggest complementary items to enhance the shopping experience. Furthermore, seamless, one-click checkout options will reduce friction and increase conversion rates, allowing shoppers to complete their purchases faster and more efficiently.

Customizable eCommerce Features

As online shopping continues to evolve, the ability to offer tailored experiences will be a game-changer. eCommerce Platform with customizable features allow businesses to create personalized shopping environments for their customers. This can include everything from custom product recommendations to unique shopping layouts and flexible payment options. By offering a platform that supports these features, businesses can ensure that they meet the growing demands of modern online shoppers in 2025.

Conclusion

The "Products for Online Shoppers" in 2025 will be shaped by the need for convenience, personalization, and security. From secure payment options to virtual try-ons and AI-driven recommendations, these products will redefine the online shopping experience. By incorporating these innovations, businesses can stay ahead of the competition and provide customers with a seamless and satisfying shopping journey.

0 notes

Text

The Cons of Membership Models

Membership-based business models have gained significant traction across various industries. From streaming services and subscription boxes to software-as-a-service (SaaS) platforms, the membership model has proven to be a powerful way to foster customer loyalty, increase revenue stability, and streamline operations. Eric Hannelius, CEO of Pepper Pay, offers his perspective on the growing trend of membership models, discussing the benefits and potential drawbacks of adopting this approach for businesses.

Churn Rate and Retention Challenges While membership models can increase customer retention, they also come with the challenge of managing churn — the rate at which customers cancel or fail to renew their memberships. If a company’s offerings do not continually meet customer expectations or if competitors offer more attractive alternatives, members may leave.

“Churn is something that businesses need to manage carefully. It’s essential to consistently deliver value to maintain a strong base of loyal members. Even small lapses in service quality can lead to higher churn, which can undermine long-term success,” Eric Hannelius explains.

Pressure to Continuously Innovate Membership businesses must continuously provide value to justify the recurring fees. This creates pressure to innovate, improve, and adapt to changing consumer needs. If the product or service becomes stale or fails to evolve, members may lose interest, and subscriptions may drop.

Businesses must also remain flexible in adjusting their offerings based on customer feedback and market trends. Failure to do so may result in member dissatisfaction and increased cancellations.

Potential for Over-Saturation The rise of the membership model has led to an influx of subscription-based services across various industries. Consumers can easily become overwhelmed by the sheer volume of subscriptions available, and they may hesitate to sign up for new memberships due to the fear of subscription fatigue.

A crowded market may lead to increased competition and pressure to differentiate. For example, a consumer may already have subscriptions to multiple streaming platforms, leaving little room for a new entrant in the space unless it offers something unique.

Initial Investment and Setup Costs For businesses just starting out, the membership model can require a significant initial investment to set up the infrastructure, marketing, and customer service systems necessary to manage recurring payments, provide value, and deliver seamless experiences.

In addition to initial startup costs, ongoing maintenance and the need to provide regular content, services, or benefits can strain resources, particularly for smaller businesses. Businesses must balance the investment in maintaining memberships with the return they generate.

While the membership model offers several compelling benefits, businesses must carefully evaluate their offerings and customer base before deciding whether it is the right fit. Key considerations include understanding customer preferences, assessing the potential for value creation, and ensuring the business can handle the ongoing demands of customer retention and innovation.

Eric Hannelius provides final thoughts on the matter: “The membership model is certainly not a one-size-fits-all solution. It can be incredibly successful for the right business, but it’s important to stay attuned to customer needs, continually deliver value, and manage churn effectively. For companies like Pepper Pay, we’ve embraced a model that focuses on providing ongoing services and building strong customer relationships, which ultimately supports our long-term success.”

The membership model presents an attractive business strategy that can provide steady income, encourage customer loyalty, and enable scalability. However, it also brings its own set of challenges, such as managing churn and continually innovating to meet customer expectations. By carefully assessing the market, customer base, and business capabilities, companies can determine whether a membership model is the right path to success.

0 notes

Text

How To Make Money with HTML5 Games?