#Stock Market Latest Updates

Explore tagged Tumblr posts

Text

#Divgi TorqTransfer Systems Limited IPO Details#Divgi TorqTransfer Systems Limited IPO#Upcoming IPO 2023#Mohit Munjal YouTube#Stock Market Latest Updates#Directusinvestments#ipo#finance

2 notes

·

View notes

Text

വിപണി ചാഞ്ചാട്ടത്തിൽ, സെന്സെക്സ് 80,000ത്തിന് താഴെ; എച്ച്.യു.എല്ലും ഹിൻഡാൽകോയും ഇടിവിൽ https://keralatimeslive.news/stock-exchange-latest-update/

0 notes

Text

Unlocking Opportunities: The ABCs of IPO Investing

Initial Public Offerings (IPOs) are an exciting opportunity for investors to get in on the ground floor of a company's journey into the public markets. These events mark the transition of a privately-held company to a publicly traded one, offering shares to the public for the first time. While IPOs can be enticing, they also come with their own set of risks and considerations. Let's delve into the world of IPO investing and explore some simple yet effective strategies for navigating this unique market.

Understanding IPOs: An IPO is the process through which a privately-owned company offers its shares to the public for the first time. This allows the company to raise capital to fund its growth initiatives, expand operations, or pay off debts. IPOs typically generate significant buzz and media attention, drawing the interest of both institutional and retail investors.

Key Considerations for IPO Investors: Before diving into an IPO, it's essential to consider several factors to make an informed investment decision:

Company Fundamentals: Evaluate the company's business model, financial performance, growth prospects, and competitive positioning. Look for companies with a strong track record of revenue growth, profitability, and market leadership.

IPO Valuation: Assess the valuation of the IPO relative to the company's earnings, revenue, and industry peers. Be cautious of IPOs that are priced too aggressively, as they may be susceptible to significant price volatility post-listing.

Market Conditions: Consider the prevailing market conditions and investor sentiment. IPOs tend to perform better in bullish market environments, while volatile or uncertain market conditions may dampen investor enthusiasm.

Lock-Up Period: Be aware of any lock-up periods imposed on insiders and pre-IPO shareholders, during which they are prohibited from selling their shares. The expiration of lock-up periods can lead to increased selling pressure on the stock.

Strategies for IPO Investing: Here are some simple yet effective strategies for investing in IPOs:

Do Your Homework: Conduct thorough research on the company's business, industry, management team, and competitive landscape. Read the prospectus (Form S-1) filed with the Securities and Exchange Commission (SEC) for valuable insights into the company's operations and risks.

Diversify Your Portfolio: Spread your investment across multiple IPOs to mitigate risk. Avoid putting all your eggs in one basket and diversify across different sectors and industries.

Be Patient: While IPOs can experience significant price fluctuations in the early days of trading, it's essential to take a long-term perspective. Focus on the company's fundamentals and growth prospects rather than short-term price movements.

Consider Post-IPO Performance: Evaluate the historical performance of IPOs from similar companies in the same industry. Assess how these companies have fared in the months and years following their IPOs to gauge potential investment returns.

Conclusion: IPO investing offers investors the opportunity to participate in the growth story of exciting new companies entering the public markets. By understanding the fundamentals of IPOs, conducting thorough research, and adhering to sound investment principles, investors can position themselves to capitalize on these unique opportunities. However, it's essential to approach IPO investing with caution and to diversify your portfolio to manage risk effectively. With careful consideration and a long-term perspective, IPO investing can be a rewarding strategy for building wealth over time.

0 notes

Text

Unveiling the Truth: Does Kalkine Australia Stock Report Beat the Market?

In the fast-paced world of stock trading and investment, the quest to outperform the market is a perpetual pursuit for investors seeking to maximize their returns. In this landscape, Kalkine Australia has emerged as a prominent player, offering comprehensive stock analysis and investment research services. But the burning question on the minds of many investors remains: Does Kalkine Australia truly beat the market?

To address this question, it's essential to delve into the methodologies and track record of Kalkine Australia stock analysis. Kalkine employs a multifaceted approach to stock analysis, leveraging advanced algorithms, data analytics, and the expertise of seasoned financial analysts to evaluate market trends and identify investment opportunities. The company's stock reports provide detailed insights into individual stocks, including fundamental analysis, technical indicators, and market sentiment analysis.

One of the key metrics used to evaluate the performance of Kalkine's stock recommendations is their success rate compared to the broader market indices, such as the ASX 200 or S&P/ASX 300. Over the years, Kalkine has amassed a track record of successful stock picks, with many of its recommendations outperforming the market benchmarks.

Choose your 7 Days Free Trial Report

Furthermore, Kalkine's approach to stock analysis is not solely focused on short-term gains but also emphasizes long-term value investing principles. By conducting thorough research and analysis, Kalkine aims to identify stocks with strong growth potential and sustainable competitive advantages, which can deliver consistent returns over the long term.

Another factor to consider is the transparency and integrity of Kalkine's research process. Unlike some financial research firms that may have conflicts of interest or hidden agendas, Kalkine operates with a commitment to objectivity and independence. The company's analysts adhere to strict ethical standards and conduct their research with the utmost professionalism, ensuring that their recommendations are based on rigorous analysis rather than external influences.

It's important to note that while Kalkine's stock recommendations have demonstrated success in beating the market in many instances, no investment strategy is foolproof. The stock market is inherently unpredictable, and there are always risks involved with investing in equities. Even the most thorough analysis cannot guarantee positive returns, as external factors such as macroeconomic conditions, geopolitical events, and industry dynamics can impact stock prices.

Moreover, investors should approach stock recommendations from Kalkine or any other research firm with a degree of skepticism and conduct their own due diligence before making investment decisions. While Kalkine's insights can provide valuable guidance and information, ultimately, the responsibility for investment decisions lies with the individual investor.

In conclusion, Kalkine Australia has established itself as a reputable provider of stock analysis and investment research services, with a track record of successful stock recommendations that have outperformed the market in many cases. However, investors should exercise caution and recognize that no investment strategy is infallible. By conducting thorough research, managing risk effectively, and maintaining a long-term perspective, investors can maximize their chances of success in the stock market, whether they choose to follow recommendations from Kalkine or other sources.

Check our Stocks Under 20 Cents Report

#Kalkine Australia#Kalkine Australia Stock Report#Kalkine Australia Stock News#Kalkine Australia Latest Update#Kalkine Australia Market Research#Kalkine Australia Stocks Under 20 Cents Report

1 note

·

View note

Text

#charlie munger#latest news#breaking news#world news#latest updates#trends#global news#warren buffett#business#finance#finance news#stock market#share market#rip#trending news#updates#berkshire hathaway#investors#investment

0 notes

Text

youtube

#adani shares#share market news india#share market latest news#stock market live#stocks market#stock market#investing stocks#stocks#stock market updates#stock analysis#Youtube

1 note

·

View note

Text

How to Choose the Best Broker for Stock, Forex, and Crypto Trading in 2024?

Navigating the world of trading can be overwhelming, especially when it comes to selecting the right broker to meet your trading requirements. Whether you’re interested in stocks, forex, or cryptocurrencies, the choice of broker can significantly impact your trading experience and success. In this post, we’ll explore the key factors to consider when choosing a broker and introduce you to ForexJudge.com, a reliable resource that offers comprehensive reviews and detailed analysis of the world’s best brokers.

Factors to Consider When Choosing a Broker

Regulation and Security:

Ensure the broker is regulated by a reputable financial authority. Regulation provides a level of security and oversight, protecting you from fraudulent activities.

Look for brokers that offer robust security measures, including encryption and two-factor authentication, to safeguard your funds and personal information.

Trading Platform:

A good trading platform should be user-friendly, reliable, and equipped with essential tools for analysis and trading.

Consider whether the platform offers mobile compatibility if you plan to trade on-the-go.

Fees and Commissions:

Compare the fees and commissions charged by different brokers. Lower fees can significantly enhance your profitability, especially if you trade frequently.

Be aware of hidden fees, such as withdrawal charges, inactivity fees, or charges for additional services.

Range of Assets:

Ensure the broker offers the range of assets you’re interested in trading. If you plan to diversify your portfolio, choose a broker that provides access to stocks, forex, and cryptocurrencies.

Some brokers specialize in specific asset classes, so make sure your chosen broker aligns with your trading preferences.

Customer Support:

Reliable customer support is crucial, especially if you encounter issues with your account or trading platform. Look for brokers that offer multiple support channels, including live chat, phone, and email.

Check reviews to gauge the quality and responsiveness of the broker’s customer service.

Education and Resources:

Many brokers offer educational resources such as tutorials, webinars, and market analysis. These resources can be invaluable, especially for beginners.

A broker that provides regular market updates and trading insights can help you stay informed and make better trading decisions.

How ForexJudge.com Can Help

With so many brokers available, making an informed choice can be challenging. This is where ForexJudge.com comes in. ForexJudge is a trusted platform that has compiled detailed reviews and analysis of the world’s best brokers. By providing comprehensive information and user feedback, ForexJudge helps traders make well-informed decisions.

Detailed Broker Reviews

ForexJudge offers in-depth reviews of brokers across various asset classes, including stocks, forex, and cryptocurrencies. Each review covers critical aspects such as regulation, fees, trading platforms, and customer support. By reading these reviews, you can gain valuable insights into the strengths and weaknesses of different brokers, helping you choose the one that best meets your needs.

User Feedback and Ratings

In addition to expert reviews, ForexJudge features user feedback and ratings. This community-driven aspect allows traders to share their experiences and provide honest assessments of brokers. This real-world feedback can offer a clearer picture of what to expect and help you avoid potential pitfalls.

Regular Updates and Alerts

The trading world is dynamic, with brokers frequently updating their services, fees, and policies. ForexJudge keeps you informed with regular updates and alerts, ensuring you have the latest information at your fingertips. This proactive approach helps you stay ahead of the curve and make timely decisions.

Making the Final Decision

When choosing a broker, it’s essential to consider your trading goals, risk tolerance, and preferred asset classes. By leveraging the resources available on ForexJudge, you can make a well-informed decision that aligns with your trading strategy.

Steps to Follow:

Identify Your Needs:

Determine what you want to trade (stocks, forex, crypto) and what features are most important to you (low fees, robust platform, educational resources).

Research and Compare:

Use ForexJudge’s detailed reviews and user feedback to compare different brokers. Pay close attention to factors such as regulation, fees, and customer support.

Test the Platform:

Many brokers offer demo accounts. Use these to test the trading platform and ensure it meets your needs before committing real funds.

Start Small:

When you choose a broker, start with a small investment to test the waters. As you gain confidence and experience, you can increase your trading capital.

Conclusion

Choosing the right broker is a crucial step in your trading journey. By considering factors such as regulation, fees, trading platforms, and customer support, you can make an informed choice that enhances your trading experience.

For a reliable resource in your broker selection process, turn to ForexJudge.com. With its comprehensive reviews, user feedback, and regular updates, ForexJudge provides the insights you need to make the best decision for your trading needs.

Happy trading, and may your investments be fruitful!

#Forex Trading Reviews#Best Forex Brokers#Crypto trading#Financial News Services#Forex Trading Forum#How to get money back from Forex scam#Forex Scams#Crypto Scams#Best Forex Trading Platforms#Financial Calendar

145 notes

·

View notes

Text

PRESS RELEASE: ‘Marvelous Game Showcase’ 2024 Stream Announcements from Marvelous USA and Marvelous Europe

—————

XSEED/Marvelous USA

—————

Marvelous USA and XSEED Games Announce ‘Marvelous Game Showcase’ 2024 Stream; Tune in May 30 for Fresh Updates on Upcoming Games

Who:

Marvelous USA, Inc., a wholly owned subsidiary of Marvelous Inc., which is a publicly traded company listed in the Prime Market of the Tokyo Stock Exchange.

What:

Marvelous Game Showcase returns for 2024 after the positive reception of last year’s inaugural stream. Hosted by Marvelous Inc. from the headquarters in Tokyo, President Suminobu Sato and key developers will provide fans with updates on projects in active development including fresh looks at development progress, new projects for both Japanese and Western markets, and more!

When:

Thursday, May 30 - 3:00 PM PT / 6:00 PM ET / 10:00 PM UTC

Where:

Fans can watch the video with English subtitles on the Marvelous USA YouTube channel, home of the latest video updates from the Marvelous family of games, https://youtube.com/@marveloususa, and at marvelous-usa.com/mgs2024.

To celebrate the Showcase, select STORY OF SEASONS and Rune Factory titles will be on sale for up to 60% off on the Nintendo eShop for Nintendo Switch™ through June 7, 2024.

More information about XSEED Games’ products can be found at www.xseedgames.com. Fans can also follow XSEED Games on Facebook, X, Instagram, Twitch, Threads, get in depth info from their developer blog, and join the discussion on their Discord server at: http://discord.gg/XSEEDGames.

—————

Marvelous Europe

—————

Marvelous Europe Announce ‘Marvelous Game Showcase’ 2024 Stream; Tune in May 30 for Fresh Updates on Upcoming Games

Who: Marvelous Europe is a wholly owned subsidiary of Tokyo-based Marvelous Inc., which is a publicly-traded company listed on the Prime Market of the Tokyo Stock Exchange.

What: Marvelous Game Showcase returns for 2024 after the positive reception of last year’s inaugural stream. Hosted by Marvelous Inc. from the headquarters in Tokyo, President Suminobu Sato and key developers will provide fans with updates on projects in active development including fresh looks at development progress, new projects for both Japanese and Western markets, and more!

When: Tuesday, May 30 – 23:00 BST / Wednesday, May 31 – 00:00 CEST

Where: Fans can watch the video with English, French, German and Spanish subtitles on the Marvelous Europe YouTube channel, home of the latest video updates from the Marvelous family of games at https://youtu.be/sOIEpuhfcR8 and at Marvelous Europe's official website here.

youtube

More information about Marvelous Europe can be found at www.marvelouseurope.com or @marvelouseurope across Twitter, Facebook, Instagram or YouTube.

#story of seasons#harvest moon#rune factory#cozy games#marvelous#xseed#press release#nintendo#switch#farm sim#eshop#sale#Youtube

37 notes

·

View notes

Text

Object permanence

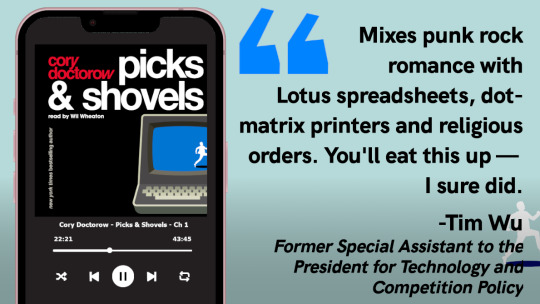

Picks and Shovels is a new, standalone technothriller starring Marty Hench, my two-fisted, hard-fighting, tech-scam-busting forensic accountant. You have TWO DAYS LEFT to pre-order it on my latest Kickstarter, which features a brilliant audiobook read by Wil Wheaton.

#20yrsago What if Bill Gates hired Linus Torvalds? https://web.archive.org/web/20050207155531/https://www.wired.com/wired/archive/13.02/microsoft_pr.html

#15yrsago Rogers Canada forces Android update that takes away root access https://mobile.slashdot.org/story/10/01/26/2358237/Canadian-Android-Carrier-Forcing-Firmware-Update

#15yrsago Sane copyright doesn’t treat all copying as the same https://www.theguardian.com/technology/2010/jan/26/copyright-cory-doctorow

#15yrsago ACTA: the leaked secret memos https://web.archive.org/web/20100130005036/https://www.michaelgeist.ca/content/view/4730/125/

#10yrsago Plan C: The top secret Cold War plan for martial law in the USA https://www.muckrock.com/news/archives/2015/jan/26/plan-c-top-secret-cold-war-battle-plan-bring-unite/

#10yrsago Google strong-arms indie musicians into accepting brutal, crowdfunding-killing deal for streaming service https://zoekeating.tumblr.com/post/108898194009/what-should-i-do-about-youtube

#10yrsago Great Firewall of Cameron blocks sex-abuse charities https://www.theguardian.com/technology/2015/jan/24/internet-filters-block-sex-abuse-charities

#10yrsago The Haunted Mansion was almost the Tiki Room https://longforgottenhauntedmansion.blogspot.com/2015/01/walt-disneys-enchanted-creepy-room.html

#5yrsago Two years after a federal law banning shackling women during childbirth was passed, prisoners in America are still giving birth in chains https://www.theguardian.com/us-news/2020/jan/24/shackled-pregnant-women-prisoners-birth

#5yrsago Andrew Cuomo’s naked hostility drives out MTA president Andy Byford, the “Train Daddy” who has transformed the world’s rail systems https://www.railwayage.com/passenger/you-blew-it-andrew-cuomo/

#5yrsago Fatal car wrecks are correlated with stock-market fluctuations https://www.sciencedirect.com/science/article/abs/pii/S0167629619301237

#5yrsago Banks have returned to the pre-2008 world of automatic credit-limit increases for credit cards used by already indebted people https://www.bloomberg.com/news/articles/2020-01-23/banks-are-raising-credit-card-limits-without-asking-customers

#1yrago The long sleep of capitalism's watchdogs https://pluralistic.net/2024/01/26/noclar-war/#millionaire-on-billionaire-violence

Check out my Kickstarter to pre-order copies of my next novel, Picks and Shovels!

7 notes

·

View notes

Text

#जानिए SIP के फायदे#Which Is Best Mutual Funds For SIP#Mutual Fund For Beginners#Mohit Munjal YouTube#Stock Market Latest Updates#Directusinvestments

1 note

·

View note

Text

Big Update Post

Hiya, shapeshifters!

We have some announcements to make this evening.

Here’s the short of it:

The Shapeshifters website will be temporarily down this Sunday evening, March 3, 2024 at Midnight EST.

When it comes back up, you’ll find a shiny new website that is organized the same way with a couple of exceptions.

The Off-the-Rack Sale and Holographic listings will be temporarily delisted.

The Goth listings will be renamed. You will find Rainbow Constellations, Monster Mouths, and a couple of new options listed under Cosmic Horror.

The Skin Tone listings will have brand new additional color skin tone options!

The Island Time listings will also have a new option available.

The Binding 101 FAQ will be rolled into its own section in the FAQ.

There will be a brand new Events Page!

The blog will be temporarily disabled.

If you’re curious about the long of it, keep reading.

For everyone else, we appreciate your patience during this transition! Like so many other transitions, we’re delighted about where it’s going.

Website Downtime

Shapeshifters is finally moving to Shopify! We’ve done a lot of work over the past few months building a more organized, streamlined website that will be easier to access for you and update for us. On Sunday night, we’ll shut down the current website to pause orders so that we can migrate everything cleanly.

Off-the-Rack and Holographic Listings

The Off-the-Rack listings will be delisted to give us a chance to reorganize the remaining stock so we don’t accidentally double-sell anything.

The Holographic listings will be delisted while we assess our fabric options. Long-time customers might notice that we’ve removed Liquid Metal and Oil Slick from the Holo listings; we’re sourcing replacements and new options throughout spring. Once we know our options, we’ll either re-launch the Holo listings, or move the currently available fabric Prism to another home so it won’t be all alone anymore.

If you’ve been eyeing either Prism or an Off-the-Rack, buy it before Sunday if you can!

Expanded Skin Tone Range

We’re very excited to announce three new skin tone options will be available after the website migration: Pine, Chestnut, and Laurel! Pine is a pale shade, while Chestnut and Laurel are both on the darker end of the spectrum.

And, the new and improved Skin Tone listings will be the perfect place to see the results of our latest photoshoot! We’re excited for y’all to get to see these photos around the site and on the listings. We sought out models of color with darker skintones both to fill a gap in the modeled photos in our listings, and to show off our darker skin tones. All of our models were amazing, our photographer was great, and the photos are fantastic! We really leaned into the cozy Vermont vibes for this one.

Events Page

We’re going to events again! Hooray!

And we’re not just going to conventions and conferences and Pride festivals. We’re also talking queer markets, fashion shows, and binder sewing workshops!

That’s right, some lucky folks in the New England area will have the opportunity to take an in-person class with Eli, our head tailor and the developer of our DIY Binder Sewing Kits. They will walk you, step-by-step, through sewing your own custom-sized binder and help you troubleshoot along the way. These workshops are designed for sewists of any level and do not require you to own a sewing machine.

If you’d like to host a sewing workshop or would like to have us at any other event, educational, celebratory, fashionable or otherwise, please contact us!

Thanks once again for bearing with us during this transition and we can’t wait for you all to see the new site!

#chest binders#shapeshifters#events#pride#skin tone chest binders#sewing workshops#how to sew binders

47 notes

·

View notes

Text

Invest in a Sustainable Future with Tesla/With ELON MUSK

I'm excited to announce a new investment opportunity in Tesla's latest project, dedicated to accelerating the world's transition to sustainable energy.

_Why Invest in Tesla?_

- Join our mission to make sustainable energy a reality for everyone

- Contribute to the development of innovative technologies and solutions

- Benefit from the growing demand for sustainable energy solutions

_Investment Details_

- Minimum investment: $10,000

- Investment term: the investment term is 3 years which can be adjusted depending on the agreement - the investment is locked in for a minimum of 1 year, after which investors can withdraw their investment with a 30-days notice period.

- Expected returns: the expected return of investment is 15-25% - the expected total return on investment over 3 years is 45-75%

GUARANTEES:

_Tesla guarantees a minimum return of 8% per annum, regardless of the market performance._

_Exclusive Benefits for Early Investors_

- Priority access to Tesla's latest products and technologies

- Invitation to exclusive investor events and updates

- Recognition as a valued member of the Tesla investor community

_How to Invest_

To learn more about this investment opportunity and to invest send me a direct message to my email address [[email protected]]

Or

Send me a direct message here

Alternatively, you can contact our investor relations team directly: [[email protected]]

_Note_: if you came across this message it means it's not late to change the future of humanity.

_Please don't call this opportunity a scam. Give it a try._

ELON MUSK

#donald tr

#invest

#donald trump

#investing stocks

#photography

#investors

#elon musk

#real estate investing

7 notes

·

View notes

Text

Day Trading Decoded: Essentials for Starting Your Trading Journey

For those looking to dive into the stock market day trading offers an exhilarating yet demanding path. This blog post will guide beginners through the basics of intraday trading, show the benefits of using multiple time frame analysis (MTF), and introduce how a platform like Motilal Oswal, Upstox, Rupeezy can simplify the trading process.

What is Intraday Trading? Intraday trading involves buying and selling stocks within the same trading day. Traders aim to capitalize on short-term price movements to make profits, closing all positions by the day's end to avoid overnight risks.

Advantages of Intraday Trading Quick Results: You see profits or losses by the end of the day. High Liquidity: It's easy to enter and exit trades. Leverage: You can trade with more money than you have in your account, amplifying potential gains.

Why Use Multiple Time Frame Analysis (MTF)? MTF trading helps traders analyze the same asset at different time intervals, giving a fuller picture of market trends. It helps confirm broader market trends and refine entry and exit points, enhancing decision-making accuracy.

Exploring the Stock Market Understanding market trends, volatility, and economic indicators is crucial. These elements influence stock prices and can offer trading opportunities or signal potential risks.

Quick Tips for New Day Traders Educate Yourself: Continuously learn about market trends and trading techniques. Start Small: Minimize initial risks by trading small amounts. Use Simulations: Practice strategies in a risk-free environment with demo accounts. Maintain a Trading Journal: Keep track of all trades to evaluate your strategy and progress. Stay Disciplined: Stick to your trading plan and avoid emotional trading. Conclusion Day trading can be lucrative but requires understanding of key trading concepts, real-time analysis, and an effective trading platform like Motilal Oswal,Rupeezy , Upstox. With education, practice, and discipline, you can increase your chances of success in the fast-paced world of stock trading.

0 notes

Text

HYBE Financials and Media Play Part 2

Dang it! Why did so much have to happen with HYBE before I had a chance to write this installment? At least I have plenty of material to continue this series.

Let's start where I left off, with some examples of actual media play with stories and tweets hyping up HYBE's 2nd quarter revenue while completely ignoring the always falling net income.

Start here if you're interested in this ongoing thread:

Here's a post from Kpop Charts celebrating HYBE's incredible second quarter. Notice there's no mention of the $12 million net profit or of their ever-dropping profit margin to 2.28%. This post had over 600,000 views.

There were loads of posts and articles just like the one above on the day HYBE released their 2Q24 financials. It's worth noting these media outlets get a press release from HYBE and just regurgitate the information rather than vetting it. This is how the company continues to fool the general public.

I found one article that actually mentioned the declining net income, but it's still reads like a press release from the company. Check it out to see the excuses they make for low net income despite the record-breaking revenue.

When it comes to media play and outright lies, nothing comes close to how HYBE has pinned all their problems on Min Hee Jin. The last 48 hours have been media play on steroids, but let's focus on the message HYBE has been broadcasting for months now. Article after article has blamed HYBE's falling stock price on their difficulties with MHJ. It's really quite smart strategy to pin their falling stock price on her rather than facing the fact that K-pop isn't the long-term cash cow the company claims it to be. The reality is, financial analysts have been sounding the alarm for months that the K-pop industry is a financial house of cards. They rely too heavily on record sales (we've all seen the stacks of CDs abandoned on the street). I guess the Chinese government has cracked down on mass buying, which hurts the K-pop industry, but so does the inflation that's hitting so many across the globe hard. When fans are given the choice between buying tons of the same album or paying rent, I'm pretty sure most would choose food and shelter over 100 copies of the latest Seventeen album.

Blaming MHJ for the falling stock sends the message to investors that all of HYBE's problems will be fixed once they get rid of that pesky woman, when in reality, she and her label are good for HYBE's bottom line. They can (and I guess did) fire her, but that won't change the waning interest in K-pop on a global scale.

All the K-pop music labels are seeing huge drops in their stock prices. Do they also have a Min Hee Jin problem???

Year to date, these stock prices are down approximately -

JYP -50%

YG -28%

SM -32%

It's almost like there's a problem in the industry, right?!

I'm going to go into the HYBE?MHJ situation more deeply in my next post, but I want to end this post with another example of how HYBE manipulates public perception. This article is from CNBC, a major US media outlet, and it's straight lies.

Originally, the article claimed MHJ resigned as CEO, but we now know that was a falsehood coming directly from HYBE. The article was updated a day later to clear up that whopper. But the huge lie staring everyone in the face is the gains in the market cap/increase in stock price. The article completely fails to mention that on the same day HYBE canned MHJ, they also quietly announced a stock buy back worth 26.6 billion won with the express purpose of boosting the stock price.

The company is buying up common stock and converting it to restricted stock. Once the common stock is converted to restricted stock, the fewer shares of common stock will mean the EPS increases (earnings per share). Earnings per share is calculated by dividing net income (see previous post) by the number of outstanding common stock shares. I can talk about this more if anyone is interested. But suffice it to say, this is a way to make the company's share price increase while making the company appear more financially sound.

A restricted stock unit (RSU) is stock-based compensation issued by an employer. A vesting period exists before the RSU converts to actual common stock. Until then, it has no monetary worth. Once the RSU converts to stock, the stockholder may pay taxes on its value.

The stock price increase had absolutely nothing to do with MHJ "resigning" and had everything to do with the buy back. If anything, giving the boot to the executive whose business line contributes 14% to the bottom line should scare the shit out of investors. Those sneaky bastards!

Whatever you think about Min Hee Jin or NewJeans, please keep in mind that the members of BTS seem to be stuck in that crappy, poorly run corporation. It seems Bang Si Hyuk and his goons have no problem destroying reputations and careers of individuals who commit the sin of being successful. Does that sound familiar?

15 notes

·

View notes

Text

All Hail

To: @soraritsuka

From: @chessanator

Merry Christmas, Soraritsuka! I hope you enjoy this fanfic gift. It’ll probably become clear to you very quickly which of your prompts this is based on, but I’ll leave the suspense hanging in the air for now.

Ao3 Link

The Bringer

Aoi Kurashiki sat in the latest Crash Keys command centre, feet propped up on the row of in-built control consoles. The screens above his head flipped from one image to the next, and Aoi followed them with a carefully measured detachment. The information displayed up there was important: assignments for various Crash Keys agents, reports on that incident up in Minnesota… even updates on the stock market, no longer the sole lifeline it had been for them as children but still the fuel that allowed everything else to happen. But that importance wasn’t why Aoi was paying it attention.

It didn’t take long until the info Aoi wanted to see – something he could use – flashed by. In an instant he was in action, though he took care not to let any hint of his urgency be seen by the other Crash Keys members in the centre. After scribbling on a piece of paper he waved it in the direction of the nearest agent.

“Take this report to my sister. She needs to know about these updates from New Mexico.”

Then, only a minute after that first agent had scurried away: “We’ve got some concerns about the vehicle pool. Check ’em out and make sure their engines don’t explode on the highway again.”

After that: “Arrange a meeting to plan the next operation.”

All of these were an integral part of the running of Crash Keys, sure. All of them needed to be done. But the only reason Aoi had for ensuring they were all done at once was to empty the control centre of everyone else and be able to access the computers alone.

The truth was, ever since the two of them had slipped away from Building Q Akane had started to leave Aoi out of certain key facets of her objectives. He was well aware that the Nonary Game wasn’t the end of their mission; if anything they’d only ramped up in the year afterwards, recruiting more members and expanding their information-gathering options. Akane had never explicitly said she was excluding him. On the surface she seemed to be relying on him as much as ever, as evidenced by his position in this control centre. He still had his role, collating incoming information from across the entire organisation and passing out new instructions to their operatives. But Aoi knew that surface impression wasn’t the truth. The hole in what he’d been given access to was apparent to him, whether Akane acknowledged it or not.

Aoi wasn’t going to take it anymore.

Today was the day for him to uncover what his sister had been keeping from him. What he already had access to ought to be enough for that. And he knew that Akane would spend the day occupied by a dozen different small crises; the courier he’d sent ought to keep her away even longer. He swung his feet down to the floor, vigorously spun his chair to face the nearest computer console, and booted it up.

-

After half an hour of searching, Aoi realised what was confounding his efforts. As he encroached on the pieces of information Akane had kept away from him, he could start to identify the general shape they took: something about some fucked-up cult operating in the shadows in much the same way that Crash Keys itself did.

But at every step of the way he was confounded by other pieces of info that he also hadn’t seen before. A certain morphogenetic experiment, bringing back alarming but inconclusive results. Cases of agents experiencing debilitating headaches or mental breaks, with no known cause. Even, in later reports, hints of another group of fanatics; Aoi only realised they weren’t in any way related to the first cult after a painstaking delve into the evidence.

No wonder he’d assumed they were yet more pieces of the big thing Akane was keeping from him. And no wonder that, having mistakenly thought everything he was finding was part of one big whole, he’d spent most of his time searching being led completely astray. In the end, he settled for filtering out everything past June 2028. It was a blunt instrument, but at least he’d know everything left was relevant.

Once he’d done that Aoi was able to spot and understand the connections that tied everything else together. It was only then that Aoi was able to identify the cult, this so-called ‘Free the Soul’, and realise that several operations that Akane had told him were unconnected were in fact all targeting individuals connected to them.

With this information in hand he delved deeper into the computer network, ready to make some actual progress. He was now able to identify, with a bitter ironic smirk, the layers of obfuscation that his sister had used to keep him from piecing this together even while engaged in his role in Crash Keys. With a great deal of effort he worked his way to what had to be the key document, stored in a location you’d only search if you already knew what you’d find there. It had been authored by Akane, it had ‘Free the Soul’ as the main part of its title, and it seemed to be a summary of everything known about the terrorist cult. Aoi opened it up and read the first line.

‘I know you’re reading this, Aoi.’ Beneath that and above Akane’s signature was today’s date.

That had been… entirely too predictable. But Aoi didn’t have time to reflect on that at all. At the exact same moment the sharp scowl formed on his face, and before he could read even a single word more of Akane’s document, klaxons sounded across the Crash Keys base.

Aoi sprung to his feet. As the red of the warning lights swept and danced across the control centre he strode towards the way out. Only to find that just before he touched the door it opened itself. On the other side stood Akane, arms folded.

Aoi put on a self-assured smirk. “Okay. You didn’t need to rub it in,” he said.

Akane’s eyes widened; a confused gasp escaped her lips. “What do you mean?”

“I read your message.” Aoi gestured nonchalantly in the air. It was usually best to let Akane have her all-knowing fun. “That’s what this is about, right?”

“That’s…” Akane trailed off, shaking her head briskly. “This is something else. What you found doesn’t matter until after we’ve sorted this out.”

After all the effort he’d put into finding it?

“It’s just a coincidence this emergency happened at the same time you found that message. I couldn’t believe it, but it’s true. This emergency is real, and Crash Keys will truly be in danger if we don’t solve it.”

Aoi felt his awareness sharpen. Everything about Akane’s bearing, and everything coming through their shared connection, said that this was far more crucial than some morphogentically-powered practical joke. At least she was letting him in on it, this time. “What’s this about?” he asked, his tone serious in an instant.

Akane answered his question, her voice tense in a way Aoi hadn’t really heard since the day she had laid out, at age twelve, the plan to retroactively save her from the incinerator.

“I think we’ve made a terrible mistake.”

—

Eternally Preserve

Alice blew her whistle, sharply. “Once more!” she called out to the gaggle of young espers at the far end of the course, and they began to file back towards her: Clover bouncing along, Light maintaining his upright, princely bearing, Nona and Ennea slightly breathless but still giggling to each other some joke Ennea had made. When they were all lined up in front of her once more Alice waited just a couple of seconds to check their readiness. Then she sounded the whistle a second time, pressing the button on her stopwatch as the espers took off at a full sprint.

‘Baseless Training’: that was what some of her coworkers had called this when Alice had requested a transfer to the newly opened experimental division. On particularly sharp-mouthed SOIS officer had twisted the words into ‘Boot Can’t-p’. The idea that the most elite intelligence agency in the country was pouring this much time and resources into agents claiming to have psychic powers was ludicrous on the face of it, so Alice could understand where her colleagues were coming from. She just didn’t care. These new recruits were her last, best chance to get to the people who’d kidnapped her father, and Alice was going to take it.

That meant bringing them up to speed. It wasn’t as though SOIS could expect that the miniscule proportion of people with these special abilities would be the exact same people who had the military physiques and constitutions needed for the gruelling rigours of SOIS work. And the new recruits didn’t just have to operate at the peak of human ability. They needed to be able to do all that, wear themselves to the bone over hours of effort and then, at the end of it, still be able to use their esper powers on behalf of the mission.

There wasn’t yet much research into research into how espers coped with physical exhaustion. All Alice could provide was drilling, drilling and more drilling; she would have to hope this level of physical conditioning was enough.

At least her recruits’ teamwork was up to par. Alice took particular note of the moment when Clover, a couple of strides ahead of the group along the course, glanced back at the exact right moment to assist her brother in cornering tightly around the cones.

Alice was satisfied to see that each and every one of the trainee’s times had improved from the sessions before, even if they weren’t yet up to the standards of the agency’s usual recruits. As long as this final run went well she could be confident that the espers would be ready for the field by… No. Something was wrong. Alice didn’t yet know what, but her instincts were prickling.

Moments after Alice started dashing forwards Light let out a hoarse gasp. His legs buckled and he fell to his knees, his remaining carrying him skidding and tumbling across the grass. By the time Alice had caught up to the other runners, and brought them to a halt, Clover was knelt down by her brother’s side. Her wild pink hair fell across her eyes as she clutched at Light’s right arm. A mistrustful anguish contorted her expression.

“Light! What’s hurt you?!” Clover cried out. She glared up at Alice. “He didn’t just trip. Don’t you dare say he just tripped!”

It was probably a good thing that Clover was joining SOIS where such an attitude, even towards a superior, was appreciated as a sign of initiative. “Yes, I saw. This won’t affect his ratings,” Alice reassured the younger woman. She then assessed Light’s condition with a practiced eye: some pain that had caused him to fall, certainly, but no serious or permanent damage. Alice allowed herself a sigh of relief.

Alice’s judgement was confirmed a few moments later when Light raised his head. “It has passed,” he said, his tone measured and steady despite the aftereffects of whatever had brought him down. Relying on Clover’s arm for support he made his way to his feet. With his eyes still firmly closed he turned to face Alice. “A certain ripple, you could call it, in the morphogenetic field. Streaks of black and white swam across the images Clover was sending me. It was quite disorientating.”

With a quick glance towards the other espers present, Alice asked if any of them had endured the same thing. Shakes of heads all round, plus Nona’s murmured “No. Nothing like that,” confirmed that they hadn’t.

Alice weighed up the situation in front of her, and came to a decision. “I’ll need to report this to the higher-ups,” she said to Light. “Once I find out what we know I’ll pass it on to you all.” It looked like the rest of her day had just gotten a hell of a lot more complicated.

-

At the debriefing later that evening Alice addressed the SOIS director and the head science advisor, describing what had occurred during what should have been a routine physical fitness session. “It didn’t have much effect today,” she concluded, “but who knows what problems it could cause if it happens again. When it happens again. We don’t know what triggered it today, so we can’t prevent the next time.”

The science advisor nodded, then passed a pair of thin folders to Alice and the director. “Trainee Field’s report has been corroborated by the prototypes we’ve been testing. Certainly, something morphogenetic happened at that time. We’ll try to narrow it down further, but that will take time.”

Alice bristled at the insinuation against her subordinate’s trustworthiness, but held her tongue.

“What I don’t understand,” the director said, tapping the diagrams in the file with her fingertips, “is why only Trainee Field was affected. Not even his sister showed even a single symptom. Correct?”

“Yes. That’s correct,” Alice replied. She marshalled her thoughts, and then added, “The documents we appropriated from Cradle Pharmaceuticals suggest that espers can be divided into two classes. ‘Transmitters’ and ‘Receivers’. Surely that has something to do with it.”

“Light is a receiver, certainly,” the science advisor concurred. Then his lips pursed; his nose wrinkled. “That can’t be the sole factor. I was under the impression that receivers and transmitters both made up a good proportion of our recruited espers.”

“Then perhaps we should look at something only connected to the Field siblings, which then only affects Trainee Light because he is a receiver,” the director mused. She then fixed Alice with her piercing gaze. “You were the one to pick them up after that particular incident. I’ll leave the investigation of any leads related to that to you.”

It looked like the entire rest of Alice’s year had gotten more complicated, too. “Yes, ma’am,” was all Alice could reply.

—

The Peaceful World - Unwarranted

The streets of New York city bustled, and Hazuki Kashiwabara had to shimmy her way through the crowd to make progress along the line of shopfronts. At least that was something she was adept at: regular exercise had kept her limber and ready to take advantage of gaps, while her quickness of mind had her apprehending the flow of people and capable of anticipating the best route forward. So it didn’t take her long to reach the end of that block, where something finally brought her short by catching her attention.

A fancy-looking bookstore stood out among its neighbours. Hazuki quickly decided that this was an excellent place to browse next. Perhaps she could get Ennea’s and Nona’s Christmas presents early? It would be a surprise if she couldn’t find any books at all that would interest her daughters.

Once inside, Hazuki found that the back area of the bookstore had been given over to some sort of book promotion. A slick-looking presenter stood on a slightly raised platform, brandishing a microphone in one hand and gesturing towards a display board with the other. Another man – presumably the author – sat at a table to one side, stacks of the book in question piled in front of him. A small number of people had gathered in the open space in front, drawn in by the presenter’s spiel.

Hazuki had arrived just in time to catch the end of the presenter’s opening announcement. “– and the scientific basis of telepathy. This, and more, can be learned from this amazing compendium of the secrets of the universe!”

Hazuki sighed, and looked away. Once she had found such topics an amusing diversion that was fun to read about, if not actually believe; these days it hit too close to home. She turned away from the presentation and headed over to the shelves of fiction. And though the presenter’s microphone caused his speech to carry across the store – “Thank you, kind volunteers! May I please have you split into two groups so we can recreate this famous experiment.” – Hazuki kept herself from paying it any attention at all.

Just after finding a newly-published book by an author her daughters had enjoyed before, while she was mulling over whether it would make a good gift, the ringtone of Hazuki’s phone began to emanate from her handbag. Somehow, the tones sounded even more urgent than normal. Hazuki hurriedly extracted the phone and read the name that had appeared across the screen: ‘Nona’.

In an instant the phone was at her ear. “Nona?” Hazuki said, ignoring the pointed looks from the other shoppers around her. “What’s going on?” Even without being allowed to know the full details, Hazuki knew that it was too soon to expect a routine call.

“Mom!” The voice on the other end of the call was breathless, hurried. “I’m not supposed to tell you this, but… You have to get out of there! I can’t tell you why, but it’s not safe. Something’s about to happen. Please…”

Hazuki had sworn to herself that she’d always trust in what her children told. “I will,” she replied. “Thank you.”

The phone hung up just after. Hazuki had no idea what it had taken for Nona to steal those few moments for that call.

That just added to the urgency of the warning. Not even checking to see if she’d put the book back in the right place she headed back towards the entrance in as brisk a walk as she could manage. The path back to the door took her back through the central space, from where Hazuki could see over to the book promotion once more. There, the presenter was just finishing up the experiment he’d announced earlier.

“And so, let us see how many of you are now aware of what this pattern is. Though you had no ability to know about these images before today, that knowledge should now be available through the mysteries of the morphogenetic field.” The presenter pointed at the display board on his right, with now showed an abstract looking pattern of black and white shapes. He then reached for the first of a pile of folded-up pieces of paper and flourished it in the air. “And just as expected, our volunteers now recognise this picture as a…”

The presenter opened the folded paper with a dramatic snap. He glanced at some writing written upon it; his eyes went wide.

What the presenter said next had been intended as just a whisper to himself. But the microphone carried his alarmed and confused mutterings across the entire bookstore. “Huh? That’s not supposed how it’s supposed to go…”

As the rumbling commotion of the spectators grew into agitated shouting, and then yells and screams, Hazuki doubled her efforts towards the exit. Was this the danger Nona had tried to warn her about? It was best to get out while she had the chance.

Hazuki stepped out of the bookstore onto the bright New York street, only to find that both ends of the block had been cordoned off. On the other side of the streams of bright yellow tape stood ranks of riot police, equipped with shields and Kevlar and batons. As blinding spotlights were directed her way, Hazuki put her hands in the air and sank to her knees.

-

She’d barely been able to keep track of the storm that followed. What Hazuki remembered: as the riot police had swarmed and surrounded her to take her into custody, yet more phalanxes of them had stormed into the bookstore she’d emerged from. In handcuffs, she’d been dragged along the pavement and into one of the canvas tents that had been erected beyond the cordons. And there she’d been left, sat on a rickety metal chair, long enough that she thought she’d been forgotten about.

It was only after what had to have been hours – Hazuki had no way to tell the time, her wristwatch having been inaccessibly stuck behind her back when her wrists were cuffed together �� that something happened. Two officers – a man and a woman, dressed in military khaki – ducked their way under the flap of the tent’s door and sat down on the opposite side of an equally rickety trestle table. The two of them stared Hazuki down for a while, an evidently practiced interrogation tactic, before the woman retrieved some papers from her attaché bag, placed them on the table, and opened her mouth to speak.

“Hey!” Hazuki got there first. “Get me my lawyer! I’m not saying anything until then.”

The male soldier scowled, and the woman rapped her knuckles harshly against the papers in front of her. The metal table resounded with a sharp ring, one that would have been uncomfortable to the ears if the sound hadn’t been dulled by the soft material of the pavilion that surrounded them. Hazuki did her best not to look intimidated.

Eventually, the woman said, “That’s no longer relevant. The Special Emergency Powers Act sees to that. You need to tell us what we need to know.” She paused, and Hazuki could feel the way her questioner was trying to make the implicit threats sink in. “What do you know about the incident that just occurred?”

Before Hazuki could even process that question the man jumped in as well: a staccato rhythm of interrogation that kept her off balance. “You stepped out from ground zero of what they’re telling us is a category nine mind-virus. You just strolled out of there without suffering any effects at all. How do you plan to explain that?”

Then back to the woman. “None of the other civilians we picked up are in any state to ask for their lawyers. Not from in the bookstore; the ones we picked up from the sidewalks outside aren’t looking good, either. All we’re getting from them is wails and yelling and babbling about some fu– some fucked up nonsense. What makes you special?”

Hazuki didn’t know what to say to any of that. She glared defiantly back at the level stares of her interrogators, just hoping that they wouldn’t jump to the worst possible conclusions about her and knowing that nothing she said could prevent that.

Reprieve came from a blithe but commanding voice, speaking from just outside the tent. “I’ll take it from here,” came a statement that was just as much an inviolable order.

The woman seated opposite Hazuki sighed and shook her head, but she gathered up her papers without complaint. As her two previous interrogators stood up and filed out towards the exit, the speaker from outside raised the tent flap and strode in. The shining glint of her necklace’s golden ring, sitting as it did over a practical but well-tailored beige suit, heralded Alice’s arrival.

When the two of them were alone Hazuki breathed an exhausted sigh of relief. “It’s good to see you,” she said to the woman who’d been the first person they’d seen after escaping from that horrid death game.

Alice nodded in reply, a warm smile spreading across her lips. “I figured a softer touch would be better for all of us, not whatever those two clowns thought they were up to.”

“Thanks. I appreciate it,” Hazuki said. After stretching out all the tension in her shoulders – tension that she’d only just realised had been coiling up throughout her time in the emergency response pavilion – she glanced up at Alice and jingled the handcuffs that still held her wrists together behind the hard back of her chair. “Any chance of getting these off?” she asked.

“Unfortunately, no.”

“What?!” Hazuki gasped. “You can’t be–!”

“You’re a friend,” Alice said, “but that doesn’t mean I can take liberties.” She sighed, gesturing towards the exit of the tent and the New York streets outside: an outside world that had barely seemed to exist while Hazuki had been left to stare at plain white fabric. “Those two might have been ham-fisted, but they weren’t lying. It’s a nightmare out there. And across the country, too: I’m barely catching up to events in time to put out fires, not getting any chance to get ahead of this thing.” She leaned over the trestle table, locking eyes with Hazuki. “I need some reassurance you’re going to be safe. Not add to all our problems, even if you don’t mean to.”

Hazuki recalled the questions that the two soldiers had been asking her. “I-I don’t know why nothing happened to me. Some sort of weird buzzing in my head, then I left the store and that was it!” She forced herself to concentrate, digging up every last detail she could have subconsciously picked up along the way. “Maybe I’ve seen… whatever-it-was… before?” Would that have made her resistant, by inoculation?

Alice shook her head, sternly. “That’s not it. This was a book announcement by a world famous parascience advocate. Half the crowd in there had to be familiar with the Sheldrake experiment.”

But something was making Hazuki even more certain. “No…” she murmured. “I think I’ve seen all of it before. Including that bit extra, at the end, that made it happen.” Though what that extra was, and where Hazuki had seen it before, she couldn’t quite recall.

Alice pursed her lips tight. But, eventually, she nodded. “It’s worth looking into,” she said.

From there it was only a few bureaucratic hurdles before Alice arranged for Hazuki’s release, though it felt to her like an hour. When Alice knelt down behind Hazuki’s chair to finally uncuff her wrists she whispered into her ear.

“Thanks for this. I’ll make sure to overlook what Ennea did to give Nona that distraction. For a friend.”

—

By the Numbers

The detective glanced to his side, made sure Junpei looked as ready as possible, and then rang the doorbell of the house they’d arrived at. To be honest, he wasn’t sure if the kid would ever have his head completely in the game. He’d done his best to rub into Junpei’s skull that, if he was going to be a private eye, the routine cases were the ones that paid the bills. That both of them were going to have to do their best on this missing person case, if the detective was going to keep the leeway from his superiors that let them work together on the big stuff.

Even after all that, there was only one missing person case on Junpei’s mind most of the time. The detective would just have to trust it not to get in the way of this one.

The front door of the house creaked open and a middle-aged woman peered out through the gap. The detective was used to the reactions to his stocky frame and height that towered over most Japanese people; his police badge was already in his hand in anticipation as the lady began to flinch away.

“Mrs Matsuo?” he asked. “Can we come in? We’re here about the disappearance you’ve reported.”

Still a bit nervous, and certainly dazed, Mrs Matsuo responded slowly. “About Kenji…?” she said, weariness threaded through her voice. “I… Yes, of course. Please…” She trailed off, the open door as she stepped back finishing her sentence for her.

Once the detective and Junpei had stepped inside, the lady led them through to the living room. As they sat down on the offered sofa the detective looked around, taking particular notice of a photo framed on the side table that portrayed Mrs Matsuo and the man they’d come to ask about standing side by side. She was in no state to offer them refreshments and so she just sat opposite them, her head slightly bowed.

“Can you tell us what happened with your husband, when he went missing?” With the question asked the detective fell silent and leaned back, giving the woman room to answer.

Mrs Matsuo clenched her hands together and shook her head in tight, little jerks. “I-I don’t know. Kenji just left in the middle of the night. It was sudden. So sudden.”

The detective could see from her face the way the pertinent details were getting buried under her shock. He was about to pry further when Junpei spoke up first.

“Anything that happened beforehand? Did Kenji say or do anything that would give us a clue where he’s trying to get to?”

Mrs Matsuo met his gaze for just a second before looking away again. “Um… He was acting strange the evening before. But I don’t see how that could help you find him.”

Junpei put on a warm, beckoning smile. “Every little bit can help. We won’t know what information will be important until we seek it all out. Please, help us help him.”

That was a good start, on Junpei’s part. The detective settled in to watch Mrs Matsuo’s reactions, see what clues they provided on top of her words.

The lady blinked a few times rapidly, cleared her throat, then began to answer Junpei’s question. “Three days ago, I got back to find Kenji stood in here, yelling at the dog.”

The puppy in question – a young black and white terrier – had emerged into the living room to investigate the new guests, and was now nuzzling up against the side of the detective’s leg.

“He was just screaming at the top of his voice and waving his hands at him. Something about how the poor thing ‘wasn’t right’ and was ‘being so rude.’ All sorts of things like that. It didn’t make any sense.”

That was something that made this different from any other missing persons case. “Whoa!” the detective exclaimed, hoping that it sounded sympathetic. “Any idea why he was doing that?”

The lady vigorously shook her head. “No! I couldn’t believe he was doing that! He’s never been cruel to the dog before. And… I don’t think Kenji knew why he was doing it, either.”

“Huh? Mr Matsuo didn’t know either?”

“I asked him, and he just couldn’t answer me. I was so angry… I just sent him to bed, told him he should explain himself in the morning.” Mrs Matsuo put her head in her hands, guilt driving rivulets of tears from the side of her eyes. “By then, he was gone. He left that night. Never came back.”

The detective and Junpei asked a few more questions after that. They established that Mr Matsuo had packed for his disappearance, taking cash and cards and changes of clothes for five nights. The detective ran through a list of known associates, making sure they had all the details of everyone the missing man might have contacted or taken shelter with. And so the routine part of their investigation came to an end.

After they had made their goodbyes to Mrs Matsuo and exited her house, Junpei turned to the detective. “This isn’t just some guy having a mental breakdown, is it?”

The detective shook his head in agreement. Now back to talking just among themselves, he let his voice settle back into its more natural, rougher tones. “Nah. This was too planned out for some guy going nutso. If that was all this was, one of the beat cops would have picked him up wandering the streets by now.” He rubbed is forehead with his fingers, reading himself for what was to come. “Let’s get our asses back to HQ and put together what we’ve got.”

-

Back at police HQ, and after getting Junpei through his colleagues’ inquisitive gazes by talking up the benefits of collaboration with Junpei’s newly-joined private agency, the detective had taken over a conference room to act as the base of operations for this investigation. He’d projected profiles of the missing Mr Matsuo on the screens around the walls and spread the witness accounts the beat cops had collected from nearby houses on the central table. Then he’d set up computer terminals for himself and Junpei, from which they could follow up any leads and pursue their hypotheses into the wider world.

They’d begun their work of tracking where Mr Matsuo could have fled to, collating new information as it came in and bouncing ideas off each other. The detective had felt particularly proud, successful as a mentor, when Junpei had brought up the usage of the man’s credit and debit cards, which suggested even further that the man was in full possession of his wits – money drained from his accounts, and then a taxi out to no destination they could make sense of. Even so, they hadn’t made any concrete progress yet. Just as the detective was about to call for a coffee break his phone began to ring.

The phone was out on the table, and Junpei was able to get a look before the detective was able to pick it up and answer. His eyes narrowing in first concentration, then surprise, Junpei read out the caller ID that had shown up across the screen. “Huh? ‘Exhibitionist Demon Lady’, it says… Is that Lotus?”

The detective snorted. “Yep. We’ve kept in touch, ever since… you know.” It wasn’t like anything more needed to be said about that event in both their lives. “But why the hell’s she calling me now?”

Junpei shrugged. “You got any choice but to pick up the phone?”

The detective did so. “Hey, Hazuki! What’s up?”

The voice came from the other end of the line, sultry and jocular. “It’s been crazy here like you wouldn’t believe. Or who knows. Maybe you would.” Hazuki paused then, the faintest tremors of barely picked-up speech coming through the speakers as she conversed with someone in the room with her. “I caught wind of something that might interest you. People are going crazy in a number of different places, and they might be connected.”

Junpei perked up, eyes narrowing as he peered towards the phone the detective was holding. “Huh? Could that have anything to do with our case?”

That drew a response from the other end of the line as well. “Is that Junpei? Say hi to him for me.”

The detective duly put the call on speaker so that Junpei could take part. Then he continued speaking to Hazuki. “So how’d an ol’ lady like you get mixed up in this?”

Her gasp of rage wasn’t so much heard as projected all the way across the call to blast into the detective’s ear. “I’d kick your ass for that! If only we were in the same country… Anyway, it wasn’t my fault. I just happened to be around when the big one happened.”

Obviously, that wasn’t the whole story. But the detective had learned not to look a gift belly-dancer in the mouth. “So this bull isn’t just happening in Japan?” Hazuki had moved away to America a few months back, when her daughters had gone to live there. “It’s happening all over the world?”

“No. Just the USA and Japan. Nowhere else, at least for now.” A deep sigh crackled over the connection of the phone-call. When Hazuki’s voice came back it was lilted with an ironic “Now, what else has happened recently that connected America and Japan?”

Something that had involved a connection between Japan and America? There was only one thing that came to the detective’s mind.

“I can’t fucking believe it. The Nonary Game?” the detective said, his voice drained, wearily resting his head on his palm.

“I can’t fucking believe it. The Nonary Game?!” Junpei said, his eyes shining with a desperate, all-consuming, desire, his voice rising with uncontrolled hope as he leaned unconsciously in towards the phone.

“Yep. I guess I’ll be seeing you soon.” After that Hazuki hung up.

With that extra clue in hand – and after some not-entirely-legit strings were pulled by Junpei’s detective agency – it wasn’t long until the two of them tracked the missing Mr Matsuo to an airport, buying tickets to San Fransisco under an assumed name.

“How’s your passport situation?” the detective asked Junpei.

“Not great,” Junpei said with a smirk. “They’ve been iffy about it ever since I ended up outside the country with no idea how I’d got there.”

It didn’t matter. That wasn’t enough to stop the two of them from getting where they were needed.

—

Hard-Earned Fortune

“Give me one good reason why I shouldn’t just take you in right now,” Clover Field said to the man in front of her, the muzzle of her handgun buried in the messy white of his hair. “Why shouldn’t I throw you in the slammer like you deserve?”

A strained chuckle came from Aoi Kurashiki as he held his hands out to either side. “Is this any way to greet an old friend?”

Clover tilted the gun slightly, savouring the grind against the back of Aoi’s head. “Nine…” she hissed. “Eight. Seven…”

“Jeez!” Aoi exclaimed. “I’ll tell you why we called you out here. Calm the fuck down, already.”

Certainly, the dingy back alley the two of them were in was a good location for a clandestine meeting, which was probably why the mysterious note calling her out here had specified it as her destination. It was equally an excellent location for an ambush, which was why Light was sitting two blocks away in a van filled with reinforcements, waiting for the merest thought of alarm from her. And why Clover had undertaken to get the upper hand on whoever came to meet her, by every trick and method her SOIS training had instilled in her.

That strategy had led her here, sidearm planted satisfyingly in the back of the man who had kidnapped her and her brother only so many months ago. Still, Clover knew a single arrest wasn’t the objective of this little operation. She gritted her teeth, and said, “Go on. Tell me.”

“My sister and I were looking for a team-up. Join forces. Crash Keys and SOIS, having a nice little house party together.”

Clover could just imagine his smirk, even looking from the wrong side of him to see his face. “Why would we want to do that? What have we got to gain from teaming up with you?”

Aoi scoffed. “I’d have thought you’d already have a good guess on that. You gonna make me say it?” He shrugged, and Clover by well-ingrained instinct shifted her attention to his hands, making sure this wasn’t the start of him trying something. “Guess you are. Akane’s got some idea about the struggles you chumps are having with that so-called ‘mind virus’. And whatever you’re telling the average joes, we both know it’s morphogenetic in origin. You guys and us are the only fuckers who know anything about this, so we’re the only ones with any chance of dealing with it. Admit it. You need our help.”

“It’s not just that,” Clover snapped. “You’ve got some other angle on this. Haven’t you?!” The two Kurashiki siblings had kept up their façades for nine hours back then, impeccably. Clover was never gonna take anything either of them said at face value, ever again. “I just bet it’s some scheme to get one over us, while we’re busy trying to solve the real problems.”

“I’m not gonna try lying to you,” Aoi replied. “Of course we’ve got some agenda. Who the fuck hasn’t?”

“Then tell me! Tell me, or any deal’s off the table.”

Aoi Kurashiki grunted. “I can’t tell you just whatever… I’m not hiding anything that’ll be a problem to SOIS. Fucking god, Clover, I swear I’m not!”

“Then prove it! What are you hiding?”

“You think you can just do whatever you want, ’cause you’re with the government,” Aoi spat. His tone was as cocky as always, but something about him was almost… desperate. Clover was about to press him further when he suddenly spoke again. “A hostage.”

Clover squinted her eyes. “Huh? A hostage?”

“Yeah. Against Crash Keys’ good intentions.” Aoi’s shoulders relaxed and slumped as he let out one final half-laugh. “I guess you’re gonna get to throw me in the slammer after all.”

-

Back at SOIS HQ they’d set up a meeting room so that Alice’s squad of espers could prepare the next stage, as they moved on from just managing one crisis after another to actually being able to get ahead this thing. A meeting room specifically chosen so that Aoi Kurashiki could be handcuffed to the table.

“You really think this is necessary?” he complained, testing the range of motion the restraints gave him.

“Perhaps not,” Light said as he sat down on the opposite side. “Nevertheless, it cannot be denied that it is a reassuring precaution. Perhaps you could take a moment or two to reflect on why this has happened.”

Aoi scowled. Then he turned with a plaintive expression towards Alice, who’d taken position at the head of the table.

“I wouldn’t have gotten to where I am today if I hadn’t learned to trust my subordinates’ judgement,” she said to him.

As Aoi sulked and sank, defeated, into his seat, Clover opened up her laptop. “Here’s what we’ve got!” she exclaimed, plugging in the flash drive Aoi had brought along to the rendezvous. The maps it contained were projected onto screens around the room, to which Clover added streams of camera footage from her own investigations. “It really does look like this is the place all those people are going. See? There’s that group from New Mexico we lost track of, going into the big building.”

“Very good. That’s impeccable proof that this is where we need to go,” Alice replied. She glanced at Aoi. “How come your people knew about this place?”

“What can I say?” Aoi said with a languid gesture. “It wasn’t any great feat of detective work. These people just happened to use one of the same construction supply companies we did, back when we were retrofitting Building Q. We noticed people were purchasing the same sort of stuff, put three and six together, and got a great big screaming ‘look here’ sign.”

“Hey!” Ennea interjected, tapping the side of her head. “Is it, like, just a coincidence they used the same company?”

“Heh. No,” Aoi replied. He didn’t volunteer anything more.

“Now we have a target location,” Alice said, “we’ll need to infiltrate. Find out what’s in there, what’s causing the morphogenetic mind virus and, if possible, what we can do to cut it off for good.”

“What’s the plan?” Light asked.

“This one won’t be a direct assault. Until we know what’s inside, we can’t take the risk that some of them will escape and set up shop again somewhere else. Looks like a quiet infiltration’s on the cards.”

Aoi took that moment to interrupt. “And you’d better not step on Crash Keys’ toes while you’re at it. That’s half of why I’m here.”

Actually, the whole of why he was here was that Clover had hog-tied him and dragged him back to base. Clover let a scornful smirk in Aoi’s direction be her only acknowledgement of that fact.

“We’d be doing this anyway,” Aoi continued, “even if you chose not to co-operate with us. It’s too important to our organisation’s goals. Having your guys along for the ride is good, but mostly I just wanted to make sure you didn’t stumble into us halfway through and fuck this up.”

Alice sighed and rubbed her forehead with her fingers. “Yes. It looks like agents of Crash Keys will be engaging alongside you when you enter the building. Respect their expertise, but do not place your complete trust in them. I’m sure you understand why.”

“Do you have to talk about us like I’m not sitting right here?” Aoi said.

Into the silence that followed Nona hesitantly, shakily, raised her hand. “Alice… you said… when we enter the building. Us newbies?”

“Yes,” Alice said with finality. “It’ll be your first major mission. You’ll be supported by more experienced agents, sure. But, given the nature of what we’re looking for, you’ll need to be on the front lines. It might be that you’re the only ones who’ll be able to recognise the morphogenetic cause.”

At Alice’s pronouncement, a deathly pallor descended on the other espers in the briefing room. Nona, lips almost white with how much she was pursing them, wrapped her arms round her sister’s elbow; Ennea, in turn, leaned into it. For Light… well, no one else would have been able to tell that his demeanour had changed. But Clover knew her brother well enough to see his uncertainty. Who knew how it would have been if they weren’t all trying to keep brave faces in front of this outsider among their midst.

Clover gritted her teeth. She slammed her palms down on the table, half-standing up in the process from sheer momentum. “We can do this!” she hollered. “We’ll kick their asses.”

“That’s right, Clover,” Alice said, her smile warm and proud. “I wouldn’t have recommended you all for this mission if I thought there was any risk to my impeccable reputation. This is what all the training was for. We do our best here, and we can put the convulsions of the last few weeks behind us.” She pressed a button, bringing up a schematic of the building on the screens. “Now, the plan is…”

—

Markings of a Moment in Time

Akane Kurashiki peered around the corner, making a mental map of what would come next as they made their way through the building. A carefully application of pressure to the construction supply company had produced rough blueprints of the complex they were infiltrating, from which Crash Keys had been able to identify the likely heart of the facility. Through careful inspection of the plans, reasonable assumptions about how the people inside were using the space, and some morphogenetic insights Akane herself had supplied – with no desire to explain what it’d taken to arrive at them – they had plotted several routes to that central point with good opportunities for cover and that should avoid most of the foot traffic.

Akane had led a small team of Crash Keys agents along one such route. She knew that SOIS had infiltrated via the other routes. With luck, they would all make it through to here, on the ninth floor of the central building.

All Akane had to do now was ensure the safety of this last stretch. So she peered around the corner of the corridor, examining the path to the plain and simple, but strangely foreboding, door that was the entrance to the heart. She was ready to lead her people towards it – Not just yet. Someone was coming.