#Stock Market Candlestick Patterns

Explore tagged Tumblr posts

Text

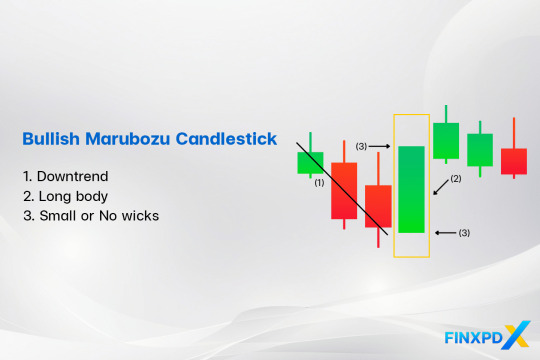

Bullish Marubozu: An Important Signal for Uptrend

Among candlestick patterns in market analysis, the Bullish Marubozu candlestick is a bullish indicator that is simple to understand and very effective. Unlike other candlesticks, which may show shadows or wicks, the Bullish Marubozu is unique in its simplicity—it has no shadows.

What Is the Bullish Marubozu?

The Bullish Marubozu candlestick is a bullish candlestick pattern that shows strong buying pressure throughout the trading session. It has a long white or green body with no shadows or wicks, meaning the price opened at its lowest and closed at its highest point.

The name “White Marubozu” is another name for a Bullish Marubozu candlestick that combines its appearance and Japanese origins. “White” refers to the bullish candle color, and “Marubozu,” meaning “bald” in Japanese, describes its lack of wicks.

Characteristics of the Bullish Marubozu Candlestick

Bullish Marubozu: Features a long, solid green body with little to no wicks.

Full Bullish Marubozu: No wicks at all, showing the strongest bullish control throughout the session.

Open Bullish Marubozu: No lower wick but a small upper wick, indicating a strong upward move with slight selling pressure at the end.

Close Bullish Marubozu: A small lower wick but no upper wick, reflecting strong buying with a slightly higher open.

Read more: FinxpdX

Download PDF: 35 Powerful Candlestick Patterns

#investing#finance#investment#financial#stocks#forex#forextrading#forex market#candlestick#candlestick patterns#Marubozu#bullish#forex indicators

4 notes

·

View notes

Text

The Japanese Candlestick Charting Technique

The Japanese candlestick charting technique second edition book was written by Steve Nison. He wrote the book to understand the candlestick patterns and analyze the market.

Steve Nison structures the book from basics to advanced strategies

This Second Edition book contains:

More about intraday markets

More focus on active trading for swing, and day traders

New tactics for getting maximum use from intraday charts

New Western techniques in combination with candles

A greater focus on capital preservation.

4 notes

·

View notes

Text

What makes the bearish harami a weak bearish reversal indicator?

A bearish harami is one of the weakest bearish trend reversal candlestick.It is due to the psychology behind it.

In simple terms, it is the bears and bull's behaviour in the market that makes the bearish harami a weak trend reversal pattern.

The above picture depicts the behaviour of bulls and bears in the market that leads to the formation of bearish harami and also makes it a weak indicator.

Click here to read the explaination about their behaviour.

#stock trader#investing stocks#stock market#future and option trading#forex trading#forex#earn money online#investor#candlestick pattern#crypto traders

12 notes

·

View notes

Text

Indian Stock Market Hit by SVB Crisis and Global Market Volatility

The Indian stock market is facing turbulence due to the SVB crisis and global market volatility. #OptionTrading #BankNifty #Nifty50 #BankCrises #IndianStockMarket #GlobalMarketVolatility

Indian Stock Market Hit by SVB Crisis and Global Market Volatility The Indian stock market is reeling from the recent failure of Silicon Valley Bank (SVB) in the United States and the ripple effect it is having on global equity markets. This comes on the heels of the Adani crisis, making it another blow to the market’s recovery efforts. Investors have lost a whopping Rs 6.6 lakh crore in the…

View On WordPress

#bank stocks#bearish momentum#candlestick patterns#candlestick trading#global market volatility#rate hike#Silicon Valley Bank#SVB crisis#technical analysis#trading strategies

2 notes

·

View notes

Text

Binance Exclusive: Start Trading with $100 for Free!

Take your first steps into the exciting realm of cryptocurrency trading with Binance! Sign up now and receive a complimentary $100 to kickstart your trading journey. Explore a diverse selection of cryptocurrencies, hone your trading skills, and potentially turn that initial $100 into something more. Don't miss this exclusive offer – seize the opportunity to trade on Binance with free funds! #binance #cryptotrading #freemoney Link Below : https://bit.ly/BinanceFree100

#Cryptocurrency#Forex#Stocks#Day Trading#Swing Trading#Technical Analysis#Fundamental Analysis#Trading Strategies#Risk Management#Options Trading#Futures Trading#Bull Market#Bear Market#Market Trends#Stop-Loss#Take Profit#Margin Trading#Leverage#Candlestick Patterns#Market Volatility

0 notes

Video

youtube

Mastering the DOUBLE BOTTOM FOREX TRADING for Maximum Gain 2023

#youtube#youtube trending#Double Bottom Pattern Explained#Trading Strategies with Double Bottom#Identifying Double Bottom Reversals#Double Bottom Chart Pattern Tutorial#How to Spot Double Bottoms in Forex#Double Bottom Candlestick Patterns#Double Bottom Trading Signals#Double Bottom vs. Double Top Differences#Double Bottom Formation Analysis#Successful Double Bottom Trading Tips#Double Bottom Pattern for Beginners#Real Examples of Double Bottom in Stock Market#Double Bottom Breakout Strategies#Double Bottom Technical Analysis Guide#Common Mistakes in Double Bottom Trading

0 notes

Text

#SHARE MARKET में CANDLESTICK CHART PATTERN (मोमबत्ती ) कैसे काम करती है ?#share market news#candlestick pattern hindi#all candlestick pattern#मोमबत्ती#stock market news in hindi#ecommerce#stock market news in india#share market news today#share market

0 notes

Text

All Candlestick Pattern PDF Free Download in Hindi

All Candlestick Pattern PDF Free Download: इस कैंडलस्टिक से आप आसानी से सीखेंगे और अपने नॉलेज को और भी इम्प्रूव कर सकेंगे। All Candlestick Pattern PDF Free Download कर सकते है, यह Candlestick Pattern PDF in Hindi में दिया गया है। तो चलिए हम आपको देंगे यहां पर आज कुछ पावरफुल कैंडलेस्टिक पेटर्न पीडीएफ जिसकी मदद से आप अपने नॉलेज को ज्यादा से ज्यादा इंप्रूव कर सकेंगे और कुछ नया सीख…

View On WordPress

0 notes

Text

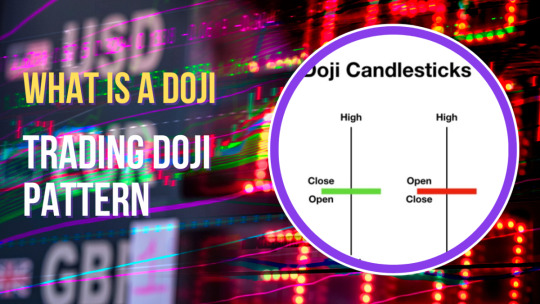

Doji Candlestick Pattern and Trading Doji

The doji pattern is a candlestick pattern commonly used in technical analysis to indicate indecision in the market. It occurs when the opening price and the closing price of an asset are very close to each other, resulting in a candlestick with a very small real body. The doji pattern can have different shapes, but the common characteristic is that it has a small real body, a long upper and…

View On WordPress

#candlestick patterns#Candlesticks#Doji#dragonfly doji#gravestone doji#learn technical analysis#long legged doji#Patterns#stock markets#stock trading#technical analysis#trading doji

3 notes

·

View notes

Text

Morning Star Pattern: Unlock Your Bullish Trading Skills

In the world of trading, finding reliable candlestick patterns is essential for success. The morning star pattern is one of the best signals to identify bullish reversals in the market.

What Is the Morning Star Pattern?

The morning star pattern is named for its resemblance to the morning star, the bright planet that appears just before sunrise, signaling the dawn of a new day. In the context of trading, this pattern serves as a visual metaphor for the transition from a bearish market (darkness) to a bullish market (light).

This pattern is a bullish reversal signal in technical analysis, indicating a downtrend’s end and an uptrend’s start. It features three candles: a long bearish candle, a short-bodied candle, and a long bullish candle. The pattern suggests a shift in market sentiment from bearish to bullish, indicating a potential buying opportunity. The morning star is particularly significant when it forms at a key support level or after a prolonged downtrend.

How to Identify the Morning Star Pattern

Identifying this candlestick pattern is essential for traders looking to capitalize on potential market reversals. This three-candlestick formation is a reliable indicator of a bullish trend change. Here’s how to spot it:

First Candlestick: Long Bearish Candle The pattern begins with a long bearish (red or black) candlestick, which confirms the continuation of the current downtrend. This candlestick should have a significant body, indicating strong selling pressure.

Second Candlestick: Small-Bodied Candle The second candlestick is a small-bodied candle, which can be bullish (green or white) or bearish. This candle often represents a period of market indecision. It can be a Doji (where the open and close prices are virtually the same) or a small real body, indicating that the sellers are losing control and the downward momentum is slowing.

Third Candlestick: Long Bullish Candle The third candlestick is a long bullish (green or white) candle that closes well into the body of the first bearish candle. This strong bullish candle indicates that buyers have taken control, and a reversal to an uptrend is likely. Ideally, this candle should open below or at the close of the second candlestick and close at least halfway up the body of the first bearish candle.

Key Characteristics to Confirm the Morning Star Pattern

Gap Down and Gap Up: Often, the small-bodied second candle will gap down from the first candle, and the third candle will gap up from the second. This indicates strong market sentiment changes.

Volume Increase: A noticeable increase in trading volume on the third day confirms the pattern, indicating strong buying interest.

Additional Indicators: Use technical indicators like the Relative Strength Index (RSI) or Moving Averages to confirm the reversal signal further.

Learn more: FinxpdX

#investing#investment#financial#forex#stocks#forextrading#forex market#candlestick#candlesticks pattern#forex indicators

0 notes

Text

WHEN A BEARISH ENGULFING PATTERN IS SIGN OF SIDEWAYS TREND?

A bearish harami can sometimes result in a sideways trend.This happens when the bearish harami takes a form called the high price harami.

#stock trader#stock market#technical analysis#candlestick pattern#crypto traders#future and option trading#forex trading#forex

15 notes

·

View notes

Text

Swing Trading in the Indian Stock Market: A Strategic Approach with SEBI Registered Investment Advisors and Effective Trade Ideas

The Indian stock market, known for its volatility and diverse investment opportunities, attracts many traders seeking short-to-medium-term gains. Swing trading, a strategy focused on capitalising on these price swings, can be rewarding but demands a disciplined approach, thorough research, and a clear understanding of market dynamics. This article explores the crucial role of SEBI registered investment advisors in guiding swing traders and emphasises the importance of developing effective trade ideas. This article is for informational purposes only and does not constitute financial advice. Consult with a SEBI registered investment advisor before making any investment decisions.

The Crucial Role of a SEBI Registered Investment Advisor for Swing Traders

In India, the Securities and Exchange Board of India (SEBI) regulates investment advisors to protect investor interests and maintain market integrity. Engaging a SEBI registered advisor provides several key advantages for swing traders:

Tailored Swing Trading Strategies: A SEBI registered advisor can help you develop a personalized swing trading plan that aligns with your specific risk tolerance, investment capital, time commitment, and overall financial objectives. This customized approach is essential for consistent results.

Specialized Market Expertise and Actionable Insights: They possess in-depth knowledge of market dynamics, technical analysis, and the specific nuances of swing trading within the Indian context. They can offer valuable insights into market trends, sector rotations, and potential trading opportunities.

Objective and Unbiased Guidance: They provide objective and unbiased advice, free from conflicts of interest, empowering you to make rational trading decisions based on sound analysis rather than emotional impulses or market hype.

Regulatory Compliance and Investor Protection: Operating under SEBI's stringent regulatory framework ensures transparency, accountability, and adherence to high ethical standards, protecting your investments.

A SEBI registered advisor can assist with:

Developing a Comprehensive Trading Plan: Creating a structured plan that outlines your trading objectives, risk tolerance, capital allocation, specific entry and exit strategies, position sizing rules, and comprehensive risk management protocols.

Implementing Effective Risk Management Techniques: Implementing crucial risk management techniques such as stop-loss orders, appropriate position sizing based on market volatility, and diversification across different sectors or asset classes to protect your trading capital and minimize potential losses.

Cultivating Trading Discipline and Emotional Control: Helping you avoid impulsive, emotionally driven trades and stick to your pre-defined trading plan, which is crucial for long-term success in the often-emotional world of swing trading.

Generating Effective Swing Trading Ideas: A Practical and Analytical Approach

Identifying potentially profitable swing trades requires a systematic approach that combines technical and fundamental analysis:

Technical Analysis as the Primary Tool: Utilize chart patterns (e.g., trendlines, support/resistance levels, candlestick patterns), technical indicators (e.g., moving averages, RSI, MACD, volume analysis), and price action to identify potential entry and exit points. This is the foundation of most swing trading methodologies.

Fundamental Analysis for Context and Risk Assessment: While swing trading primarily focuses on technicals, understanding a company's fundamental strength (earnings reports, news events, industry trends, competitive landscape, management quality) provides valuable context and helps avoid fundamentally weak companies that may experience prolonged downturns, even if they show short-term technical strength.

Efficient Screening and Filtering Techniques: Employ stock screeners and filters based on specific technical or fundamental criteria to efficiently narrow down potential trading candidates and save valuable research time.

Staying Informed with Real-Time Market News, Economic Data, and Catalysts: Monitor relevant news events, economic data releases, corporate announcements, and geopolitical developments that can trigger short-term price movements and create trading opportunities.

A Critical Perspective on "Best Stocks to Swing Trade" Recommendations and Unverified Stock Market Advisory

Exercise extreme caution when encountering lists or recommendations claiming to reveal the "best stocks to swing trade." Market conditions change rapidly, and past performance is not a reliable indicator of future results. These lists often lack crucial context, fail to consider individual risk profiles and trading styles, and can lead to ill-informed trading decisions. Similarly, be extremely wary of unsolicited "stock market advisory" or "tips" often disseminated through social media, online forums, and unregulated channels. These sources often lack credibility, promote biased or inaccurate information, and can lead to substantial financial losses.

The Synergistic Power of Combining Professional Guidance and Personal Research

The most effective approach combines the expertise of a SEBI registered investment advisor with your own diligent research and market understanding. Your advisor can:

Critically Evaluate Your Trade Ideas and Provide Expert Feedback: Discuss your potential trades with them to receive expert feedback, validate your analysis, and ensure alignment with your overall trading strategy and risk profile.

Refine Your Analytical Skills and Enhance Your Trading Knowledge: Learn from their experience and insights to improve your technical and fundamental analysis skills, enhancing your trade selection and execution over time.

Provide Emotional Support, Accountability, and Discipline for Consistent Performance: Navigate the emotional challenges of trading with the support of a professional who can help you stay disciplined, manage risk effectively, and avoid impulsive decisions driven by fear or greed.

Conclusion

Swing trading offers exciting opportunities for investors in the Indian stock market, but it's essential to approach it with a well-defined plan, a clear understanding of the inherent risks, and a commitment to continuous learning. Partnering with a SEBI registered investment advisor provides invaluable guidance, helping you navigate market complexities, develop a robust trading strategy, and manage risk effectively. Combining professional advice with thorough research, effective trade idea generation, and disciplined execution significantly increases your probability of achieving sustainable success in the dynamic world of swing trading.

0 notes

Text

Binance Exclusive: Start Trading with $100 for Free!

Take your first steps into the exciting realm of cryptocurrency trading with Binance! Sign up now and receive a complimentary $100 to kickstart your trading journey. Explore a diverse selection of cryptocurrencies, hone your trading skills, and potentially turn that initial $100 into something more. Don't miss this exclusive offer – seize the opportunity to trade on Binance with free funds! #binance #cryptotrading #freemoney Link Below : https://bit.ly/BinanceFree100

#Cryptocurrency#Forex#Stocks#Day Trading#Swing Trading#Technical Analysis#Fundamental Analysis#Trading Strategies#Risk Management#Options Trading#Futures Trading#Bull Market#Bear Market#Market Trends#Stop-Loss#Take Profit#Margin Trading#Leverage#Candlestick Patterns#Market Volatility

0 notes

Text

Swing Trading: Capturing Market Swings for Profitable Trades Swing trading is a popular trading strategy that focuses on capitalizing on short- to medium-term price movements in stocks, commodities, or other financial instruments. Unlike day trading, which involves buying and selling within a single day, swing trading positions are typically held for a few days to several weeks. This approach offers a balance between the fast-paced nature of day trading and the longer horizon of investing. What Is Swing Trading? Swing trading seeks to profit from "swings" in the market, such as upward or downward price trends. Traders use technical analysis, chart patterns, and sometimes fundamental analysis to identify opportunities. The goal is to enter positions at the beginning of a price move and exit before the trend reverses. Why Swing Trading? Flexibility: Swing trading allows you to trade while maintaining other commitments, making it ideal for part-time traders. Less Stress: Unlike day trading, you don't need to monitor markets constantly, reducing emotional strain. Profit Potential: With the right strategies, swing trading can yield significant returns in a shorter timeframe compared to long-term investing. Focus on Trends: Swing trading relies on catching clear price movements, simplifying decision-making. Key Strategies for Swing Trading Trend Trading Identify stocks in an uptrend or downtrend. Buy on pullbacks in an uptrend and sell on rallies in a downtrend. Breakout Trading Look for stocks breaking through significant resistance or support levels. Enter the trade as the price breaks out, and ride the trend. Reversal Trading Spot stocks that show signs of reversing their current trend. Use candlestick patterns, momentum indicators, or RSI (Relative Strength Index) to confirm reversals. Moving Average Crossovers Track when a short-term moving average crosses above or below a long-term moving average to signal a buy or sell opportunity. #SwingTrading #TradingStrategies #StockMarketEducation #ASJVentures #SmartTrading #TechnicalAnalysis #StockMarketTips #shorttermgains

#free stock market classes#free classes#stock trading#asj ventures#stock market#pune#freesharemarketclasses#free stock market courses#finance#stock market courses

0 notes

Text

A Comprehensive Guide to Share Market Courses in Delhi

The stock market is an ever-evolving platform that holds immense potential for those willing to learn and explore its intricacies. For individuals in Delhi aiming to excel in trading and investment, NISMC (National Institute of Stock Market Courses) provides a one-stop destination. This guide delves deep into the offerings, benefits, and features of Share Market Courses in Delhi provided by NISMC, helping you make an informed decision.

Why Choose Share Market Courses in Delhi?

Delhi is not just the political capital of India but also a growing hub for financial education. With a booming interest in financial literacy and investment, many aspiring traders and investors look for reliable and result-oriented educational platforms. This is where NISMC stands out with its holistic approach to stock market education.

Here are some reasons why you should consider pursuing a share market course in Delhi:

Expertise in Finance: Delhi houses some of the most reputed financial institutions and stock market experts, making it a great place to gain in-depth knowledge.

Vibrant Learning Environment: The city’s thriving community of learners ensures a collaborative and motivating atmosphere.

Job Opportunities: With the presence of several brokerage firms, financial institutions, and startups, completing a course in Delhi can lead to lucrative job offers.

Comprehensive Curriculum: Institutes like NISMC offer well-rounded courses tailored to meet the needs of both beginners and advanced learners.

What Makes NISMC Unique?

When it comes to share market courses, NISMC leads the way by offering structured programs that combine theoretical knowledge with practical experience. Here’s what sets NISMC apart:

1. Expert-Led Training

The courses are designed and taught by seasoned professionals with years of experience in stock market trading. These experts provide valuable insights, helping students understand real-world market scenarios.

2. Hands-On Practical Learning

Theory is important, but practical application is essential. NISMC emphasizes real-time trading exercises, case studies, and simulation tools to provide hands-on experience.

3. Flexible Learning Options

Whether you prefer online classes or in-person sessions, NISMC offers flexibility to suit your schedule and learning preferences. This ensures that working professionals, students, and entrepreneurs can seamlessly integrate learning into their routines.

4. Comprehensive Course Content

From fundamental analysis to technical analysis, risk management, and advanced trading strategies, NISMC’s curriculum covers every aspect of the stock market.

5. Networking Opportunities

NISMC connects learners with a vast network of alumni, professionals, and market experts, fostering collaboration and career growth.

Courses Offered at NISMC

NISMC caters to diverse learning needs by offering various courses that address the requirements of beginners, intermediate traders, and advanced investors. Here’s a closer look:

1. Beginner’s Guide to the Stock Market

Target Audience: New investors and traders.

Key Topics: Basics of stock trading, understanding market indices, how to buy and sell stocks, and introduction to fundamental and technical analysis.

Duration: 1 month.

2. Fundamental Analysis Course

Target Audience: Those looking to make long-term investments.

Key Topics: Financial statement analysis, valuation models, and understanding macroeconomic factors.

Duration: 6 weeks.

3. Technical Analysis Course

Target Audience: Short-term and intraday traders.

Key Topics: Chart patterns, candlestick analysis, indicators, and oscillators.

Duration: 2 months.

4. Options Trading Course

Target Audience: Intermediate to advanced traders.

Key Topics: Options strategies, pricing models, risk management, and hedging techniques.

Duration: 6 weeks.

5. Comprehensive Stock Market Mastery Program

Target Audience: Those aiming for a professional career in the stock market.

Key Topics: Combination of fundamental and technical analysis, portfolio management, derivatives, and algorithmic trading.

Duration: 4 months.

Benefits of Enrolling at NISMC

Enrolling in a share market course at NISMC comes with numerous benefits:

1. Learn from Market Experts

The instructors at NISMC bring real-world experience, ensuring you gain practical insights.

2. Gain Practical Skills

Courses emphasize hands-on learning, enabling you to apply theoretical concepts effectively.

3. Build a Strong Network

Networking opportunities with fellow learners, alumni, and industry professionals can open doors to exciting opportunities.

4. Flexible Scheduling

With options for weekend classes, online sessions, and flexible timings, NISMC ensures that learning never feels like a burden.

5. Access to Resources

Enrolled students receive access to extensive study material, trading tools, and mentorship support.

How to Choose the Right Course at NISMC

With multiple courses available, choosing the right one can be daunting. Here are some tips to help you decide:

Assess Your Goals: Determine whether you want to trade short-term, invest long-term, or build a career in the stock market.

Evaluate Your Knowledge Level: Opt for beginner courses if you’re new to the stock market, and advanced courses if you already have some experience.

Seek Guidance: NISMC’s counselors are always available to help you select the most suitable course based on your interests and goals.

Consider Your Schedule: Choose a course that aligns with your availability and preferred learning mode (online or offline).

Student Success Stories

Over the years, NISMC has helped numerous students achieve their financial goals. Here’s what some of our alumni have to say:

Ravi S., Entrepreneur: “The practical training and insights from NISMC’s stock market mastery course transformed the way I invest.”

Anjali K., Working Professional: “The flexible learning schedule allowed me to balance work and learning seamlessly.”

Manish T., Trader: “NISMC’s technical analysis course gave me the confidence to trade effectively.”

Conclusion

For anyone looking to dive into the world of stock trading and investment, NISMC’s share market courses in Delhi offer the perfect combination of knowledge, skill-building, and practical exposure. Whether you’re a beginner or an advanced trader, NISMC ensures a comprehensive learning experience that paves the way for financial success.

FAQs

Q. Who can enroll in NISMC’s share market courses?

Ans: Anyone with an interest in the stock market, regardless of their experience level, can enroll.

Q. Are the courses suitable for beginners?

Ans: Yes, NISMC offers beginner-friendly courses designed to introduce fundamental concepts and build a strong foundation.

Q. What is the duration of the courses?

Ans: The duration varies from 1 month to 4 months, depending on the course type.

Q. Can I take online classes at NISMC?

Ans: Absolutely. NISMC provides flexible online learning options for students who prefer remote education.

Q. How do I enroll in a course?

Ans: You can visit the official website of NISMC or contact their support team to get started.

0 notes

Text

The Hidden Patterns Driving AUD/JPY Price Action Trading When it comes to Forex trading, the Australian Dollar (AUD) paired with the Japanese Yen (JPY) is often the overlooked sibling in the currency family. Yet, beneath its unassuming surface lies a treasure trove of opportunities for savvy traders. If you’ve ever wondered how to make the AUD/JPY pair dance to your tune, buckle up—this article dives deep into price action trading, uncovering ninja tactics, hidden trends, and proven techniques to sharpen your edge. Why AUD/JPY Deserves Your Attention Most traders flock to the USD or EUR pairs, leaving AUD/JPY with fewer spectators. But this pair often offers smoother trends, making it a haven for price action traders. Why? Because AUD/JPY is influenced by: - Risk Sentiment: AUD’s sensitivity to global risk appetite vs. JPY’s safe-haven status creates predictable movements during market swings. - Commodity Prices: Australia’s reliance on commodities like iron ore and gold heavily impacts AUD, offering insights into potential price movements. - Time Zone Overlap: Asian trading hours dominate AUD/JPY activity, offering clear setups during quieter periods for other pairs. Pro Tip: Keep an eye on risk-on vs. risk-off market sentiment. If global markets are bullish, AUD/JPY often rises; if bearish, it’s likely to fall. The Unconventional Price Action Setup: Ninja Style Think of price action trading as reading the market’s diary. AUD/JPY’s diary, however, is full of plot twists. Here’s a step-by-step guide to spot setups that most traders miss: - Identify Key Levels: - Use weekly and daily charts to spot strong support and resistance levels. These levels are like magnets—price tends to gravitate toward them. - Example: AUD/JPY tends to respect round numbers like 85.00 or 90.00. Watch for price to react sharply at these levels. - Spot Price Rejections: - Look for long wicks (pin bars) at key levels. These indicate rejection, showing where traders tried and failed to push the price further. - Case Study: In early 2024, AUD/JPY tested 86.50 multiple times but failed to break. A pin bar on the daily chart signaled a reversal, leading to a 150-pip drop. - Wait for Confirmation: - Combine candlestick patterns like engulfing bars or inside bars with your key levels. Confirmation is the difference between precision and guesswork. - Enter Like a Pro: - Place your entry order just above/below the confirmation candle. Set a stop loss beyond the wick of the rejection candle. - Manage the Trade: - Use trailing stops to lock in profits. AUD/JPY trends tend to extend longer than expected—capitalize on this. Humorous Take: Missing a setup like this is like walking past a $100 bill on the sidewalk because you were checking your phone notifications. Don’t be that trader. Why Most Traders Get It Wrong (And How You Can Avoid It) The Myth: “More Indicators Equal Better Results” Indicators can clutter your charts and cloud your judgment. Price action trading thrives on simplicity. Avoid these common mistakes: - Overloading Charts: Using RSI, MACD, Bollinger Bands, and Fibonacci levels all at once is like wearing five pairs of sunglasses. Stick to the essentials. - Ignoring Market Context: Always check the economic calendar. Events like Australia’s employment data or Japan’s BOJ announcements can throw technical setups out the window. Fix It: Use one or two tools to complement price action, like a simple moving average to gauge trends. The Hidden Patterns That Drive the Market Correlation Secrets: AUD/JPY often moves in sync with stock indices like the Nikkei 225 or the S&P 500. A bullish Nikkei usually spells good news for AUD/JPY. Use this correlation to anticipate moves before they show up on the chart. Example: In December 2023, the Nikkei 225 rallied by 3%, and AUD/JPY followed with a 200-pip surge. Being aware of this connection gave traders a head start. Master-Level Risk Management: The “2% Rule” Reinvented Most traders know the 2% risk rule, but let’s take it up a notch. For AUD/JPY: - Adjust for Volatility: - Use the Average True Range (ATR) to determine appropriate stop-loss distances. AUD/JPY’s ATR tends to fluctuate between 60-100 pips. - Dynamic Position Sizing: - Adjust your lot size based on stop-loss distance. The farther the stop, the smaller your position size. Analogy: Think of this as eating sushi with chopsticks. If you’re clumsy, start small and gradually refine your technique. Conclusion: Turn Insights Into Action AUD/JPY offers a goldmine for price action traders willing to dig deeper. By focusing on key levels, hidden patterns, and unconventional setups, you can sidestep common pitfalls and make informed decisions. Remember, trading isn’t about perfection—it’s about consistency and adaptability. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes