#Specs Prower

Explore tagged Tumblr posts

Text

Sunny & Artie #3 - Brother of the year

Lars would die for Specs, ‘nough said.

Also those are NOT Tails and Cream’s final adult designs. I just wanted to get the comic put out.

#Sunny & Artie#Sunny & Artie Comic#Specs Prower#LARS Prower#miles tails prower#cream the rabbit#taiream fankid#taiream#sonic fankid#sonic oc#sth

57 notes

·

View notes

Text

Cartoon canon often shows Shadow beating Tails because canon knows that if they were to interact outside of world ending fiasco or violence, they'd be gun buddies, they'd be too powerful

#plz let them be friends#Team Dark and Team Sonic would be amazing frnds.#Shadow and Taiks discussing specs and throwing around ideas while Omega and Knuckles geek out about destroying stuff#and Rouge and Sonic. plz Rouge and Sonic would be outright besties!#sonic the hedgehog#sonic#sth#team sonic#team dark#shadow the hedgehog#shadow the ultimate lifeform#miles tails prower#rouge the bat#e 123 omega#knuckles the echidna

52 notes

·

View notes

Text

Elenacore

A personal blog to archive images, videos and music that fit my personal aesthetic.

Tag Library:

Main:

#2000s nostalgia

#Icocore

#Kwaidancore

#Adventure by the Sea

#Aliens

#Ambience

#Atlus

#Boku no Natsuyasumi

#Boku no Natsuyasumi 2

#Cryptidcore

#Dreamcast

#Fatal Frame

#From Software

#Fumito Ueda

#Gran Turismo

#Gran Turismo 3: A-Spec

#Heian period

#Horror

#Ico

#Internet

#Iyashikei

#Kaidan

#KOEI TECMO

#Kuon

#Maiden of Black Water

#Mask of the Lunar Eclipse

#Millennium Kitchen

#Nico

#Nintendo

#Nintendo 64

#Persona

#Persona 3

#Persona 3 Portable

#PlayStation

#PlayStation 2

#PlayStation 3

#PlayStation Portable

#Polyphony Digital

#Project Zero

#Rain

#SEGA

#Sega AM2

#Shadow of the Colossus

#Shenmue

#Showa period

#Sonic Adventure

#Sonic Team

#Sonic the Hedgehog (2006)

#The Legend of Zelda

#The X-Files

#TV Series

#Umi no Bouken-hen

#Video games

#Wind Waker

#Wind Waker HD

#Wii U

#Xbox

#Xbox 360

#Yu Suzuki

#Y2K

Characters:

#Aigis

#Akihiko Sanada

#Blaze the Cat

#Boku-kun

#E-101 Beta

#E-105 Zeta

#Ico

#Junpei Iori

#Kageri Sendo

#Ken Amada

#Koromaru

#Kotone Shiomi

#Knuckles the Echidna

#Makoto Yuki

#Miku Hinasaki

#Miles Tails Prower

#Mitsuru Kirijo

#Rouge the Bat

#Ruka Minazuki

#Shadow the Hedgehog

#Shinjiro Agaraki

#Silver the Hedgehog

#Sonic the Hedgehog

#Utsuki

#Watashi

#Yorda

#Yoshika

#Yukari Takeba

Acronyms:

#LOZ

#LOZ WW

#P3

#P3P

#PSP

#SA1

#Sonic 06

#TLOZ

#TLOZ WW

Japanese:

#ぼくのなつやすみ

#ぼくのなつやすみ2海の冒険篇

#九怨

0 notes

Text

Sonic 2 development stories from character designer Judy Totoya

Yasushi Yamaguchi, AKA Judy Totoya, character designer and main graphic designer on Sonic 2, posted a few threads on Twitter for the 30th anniversary of Sonic 2:

About Tails: https://twitter.com/judy_totoya/status/1594372821794586624

“ A picture of him when he was just an admirer of Sonic. He's not chasing him yet. He imitated him and wore gloves and similar coloured shoes, but they were too big and he tied them up with a belt. “

The inclusion of a 2-player mode had already been confirmed and the American team submitted many ideas for creating this character, but the programmer, Mr. Naka, said he wanted to create a 1.5-player character that could be played with their sister (sic) and that even beginners could handle, so we created a character that was not a rival, but a sidekick character. Naka asked us to create a cute character like Urusei Yatsura's pure-hearted fox, and that's what I did.

At first, he only had one tail, but it didn't have enough impact, so I was inspired by Myau from Phantasy Star 1 and came up with the idea of using two tails as propellers. The first Sonic game was a huge success in the US, but not in Japan. So we tried to create a cute design with Japan in mind.

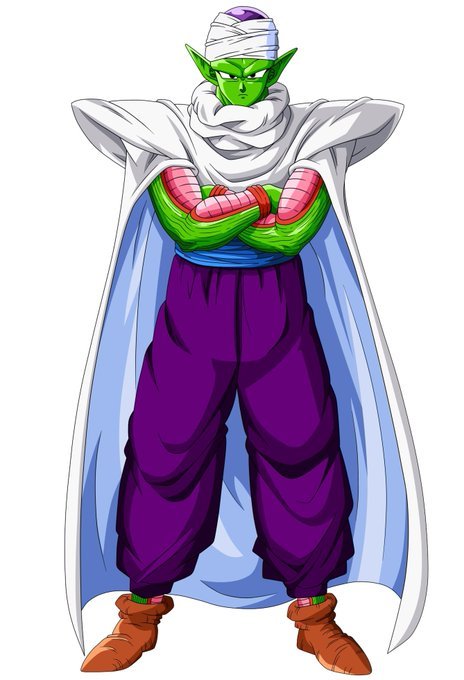

The characterisation and colours were designed to be symmetrical to Sonic's. His relationship with Sonic was determined with the image of Piccolo and the young Son Gohan from Dragon Ball in mind during the production of the game.

As you know, the etymology of the name comes from the word for speed (mph). The name Prower was coined by combining "per hour" and "power Bonus: Myau from Phantasy Star drawn by Judy Totoya for the 6th issue of Sega's official magazine, SPEC, published in September 1990. https://retrocdn.net/images/3/3e/SPEC_6.pdf

About Super Sonic: https://twitter.com/judy_totoya/status/1594389198852993024

“Due to the main reference, the original story is, needless to say, a secret one, so it was a super secret that only those who cleared a special stage of high difficulty could see. In the first place, Super Sonic would not have been born without the existence of manga artist Sakura Tamakichi (Super Mario Adventures). During the development of Sonic 2, in Famitsu's column 'Shiawase no Katachi', Tamakichi played Sonic 1 desperately to see the true ending, but the result deceived him so much that we decided to give a reward that would definitely pay off in Sonic 2. The basic specification of all Sonic's items with a time limit on the consumption of rings was decided relatively quickly, but the problem was the graphics, as it was impossible to redraw all the patterns in terms of time and capacity. We tried various effects, such as a seven-colour glowing figure, but none of them were good enough. In desperation, I tried drawing the current Super Sonic, but it was not realistic to draw all the patterns, so I replaced only the basic pattern, the transformation pattern and the normal running pattern, and cheated with colour changes for the rest. High-speed running was solved with two flying patterns. This managed to reach a realistic level, so it was implemented as a super-secret only. The schedule was very tight and I started work on the ending picture at 1am on the day of master-up. The program had been dummy-programmed, so all that was left to do was to replace the picture of the final pose, but if we had been an hour short, the Super Sonic picture would not have been ready in time and it would have remained as normal Sonic.“

About Mecha-Sonic: https://twitter.com/judy_totoya/status/1594694031396999168

“Several of his attacks could not be integrated into the game due to time constraints: long laser shot from his eye, homing missiles from its fingers (10 shots in total), Super Gravity Smash (a gravity projectile that disappears after a certain amount of time, but sucks up the rings if it gets too close), which is launched when his chest armour opens.

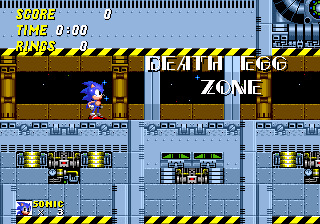

Due to the schedule, the creation of the Death Egg zone map was cancelled and replaced by two consecutive boss battles in the dedicated boss room, but originally Mecha-Sonic was planned to appear as a mid-boss in the middle of the zone.

Its design concept was based on the image of Mechagodzilla and Gigan, with a strong and painful look. “

(note: the designers also took inspiration from Gamera for one of the enemies)��

“After the game's graphics were completed, the blades would be flown during jump-rotation attacks as an additional attack, but they were completely retrofitted, so it was not clear where they would come from. “

About Sonic's sprite: https://twitter.com/judy_totoya/status/1595403450845892608 https://twitter.com/judy_totoya/status/1595443192803266561

"Sonic 2 uses the same basic pattern as Sonic 1, except for the additional pattern (only the running has longer legs). There was one palette for one character in Sonic 1, while Sonic 2 uses one palette for two characters, so the blue gradient has been reduced." Note: on Megadrive, 4 colour palettes can be displayed on screen. A palette consists of 16 colours, one of which is used as a transparent layer to display the elements behind the sprite. Red has been reduced from 3 to 2 shades. The yellow used for Eggman, which has the same palette as Sonic, has been adjusted slightly to orange and used as the main colour for Tails. The shade of red that was removed has been replaced with a shade of orange. "I wasn't involved, but I think it was very difficult to control the palette in Sonic 3 because the number of characters increased even more. "By the way, the enemies and the user interface (UI) have the same palette, but the bosses lacked color, so I used the black of the UI shadow for them. That's why when you damage a boss, the black part of it and the black part of the UI shadow will flash."

118 notes

·

View notes

Text

Colorado Bid Bonds

The listed below short article is a great introduction to bid bonds. Bid bonds, as you understand, are bonds used in the building market. These bonds guarantee that if someone quotes on a job, and is granted the agreement, then they will move forward with carrying out under the regards to the arrangement.

See the below article for more excellent details. You can see the initial article here: https://swiftbonds.com/bid-bond/colorado-2/

Colorado Bid Bonds

What is a Bid Bond in Colorado?

A bid bond is a type of surety bond, that guarantees that the bidder will accept the project and complete the contract according to its terms. It provides assurance to the project owner that the bidder has the knowhow and wherewithal to complete the job once the bidder is selected after winning the bid. The simple reason is that you need one to get the job. But the bigger question is why are more owners/developers requiring a bid bond? The simply explanation is risk. Given the uncertainty of the marketplace, which includes experienced contractors going out of business, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the work. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Colorado Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five (5%) or ten (10%) percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Colorado?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the P&P bond if you get the job. The cost of a bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges: 1) We do charge for Overnight fees 2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in CO?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Colorado. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

Bond Amount Needed Fee 2-3% >$800,000 1.5-3% >$1.500,000 1-3%

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Colorado?

We make it easy to get a contract bid bond. Just click here to get our Colorado Bid Bond Application. Fill it out and then email it and the Colorado bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each application for bid bonds and then submit it to the surety that we believe will provide the best bid bond for your company. We have a great success rate in getting our clients bid bonds at the best rates possible.

What is a Colorado Bid Bond?

A bid bond is a bond that guarantees that you will accept the work if you win the contract. The bid fee (usually five (5%) or ten (10%) percent) is a damages calculation that is paid when you win the bid, but then back out of doing the work.

Find a Bid Bond near Me

Typically, a bid bond and P&P bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is security risk insurance for the benefit of the owner.

Who Gets the Bond?

The general contractor is the company that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). However, it’s the general contractor that has to apply for the bond and be underwritten before the contract bond is written by the surety. This is also known as bonding a business.

Conejos Costilla Crowley Custer Delta Denver Dolores Douglas Eagle Elbert El Paso Fremont Garfield Gilpin Grand Gunnison Hinsdale Huerfano Jackson Jefferson Kiowa Kit Carson Lake La Plata Larimer Las Animas Lincoln Logan Mesa Mineral Moffat Montezuma Montrose Morgan Otero Ouray Park Phillips Pitkin Prowers Pueblo Rio Blanco Rio Grande Routt Saguache San Juan San Miguel Sedgwick Summit Teller Washington Weld Yuma

And Cities: Denver Colorado Springs Boulder Aspen Fort Collins Aurora Steamboat Springs Littleton Grand Junction Pueblo Vail

See our Connecticut bid bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Key Specifics When Thinking Of Bid Bonds

It is not incorrect to say that Bid Bonds are very complicated, specially if you don’t have any idea how this works. Most individuals are thinking about this as an insurance, but this is a type of guarantee that the principal will perform their work correctly. Insurance providers usually provide a Surety Bid Bond, but you cannot call it insurance because its function is different. Most folks will surely require you to get a Surety Bid Bond before they consider your services as it’s a kind of guarantee to them.

If you want to get a license bond, permit bond, commercial bond and more, you have to know how they work. We are going to provide some good info on the significance of Bid Bonds and how they work.

A Basic Explanation On Bid Bonds

Bid Bonds will invariably be asked for by the public because it will secure them and it will guarantee that the principal will fulfill their responsibilities. You are the principal so you have to obtain a license Surety Bid Bond to guarantee that your company will invariably adhere to the laws and you must get a contract bond to guarantee that a public construction project will be completed. There are examples which will provide an idea on Surety Bid Bond.

This is made for the clients since they will likely be protected by the bond, but it can also provide advantages to you since they will trust you in case you have this.

How It Works

Bid Bonds are considered as a three-party agreement between a surety company, the obliged and the principal. The principal is actually the employer or company that will offer the services and the obliged is the project owner. Construction companies will invariably be required to purchase Bid Bonds as soon as they will work on a public project. If they want to work on the project, the government will need the construction company to secure a number of bonds.

The work of the bonds is aimed at the subcontractors and workers to guarantee that they will likely be paid even if the contractor defaults. The contractor will likely be covering the losses, but as soon as they reached the limit, the duty will definitely fall to the surety company.

How Do You Apply For A Surety Bid Bond?

Bid Bonds are generally given by insurance businesses, but you could look for some standalone surety businesses that focus on these unique products. A surety company should be licensed by a state Department of Insurance.

It’s hard to apply for a bond because the applicants will definitely experience a procedure that’s comparable to applying for a loan. The bond underwriters will evaluate the financial history of an applicant, credit profile, managerial team and other key factors.

There’s a chance that you will not be accepted for a Surety Bid Bond, particularly when the bond underwriters saw something from your credit history.

How Much Is A Surety Bid Bond?

It is hard to quote an exact cost for a bid bond because the cost might be affected by numerous factors like the bond type, bond amount, where it will likely be issued, contractual risk, credit history of the applicant and more. There are thousands of different bonds available right now and the cost will always depend on the bond that you could get. The amount of bound that you may avail may also be a big factor because you can select a $10,000 bond or a $25,000 bond or higher.

If you already have a credit history of 700 and above or very near this number, you could qualify for the standard bonding market and you only need to pay 1 to 4 percent of the Surety Bid Bond amount. This implies that if you may get a $10,000 bond, you only need to pay $100 to $400 for the interest.

The Approval Of Your Request

There is a chance that your bond request will be declined by the insurance businesses and it will depend on the background check that they carried out. If they believe that issuing you a bond will be a big risk, they won’t release a Surety Bid Bond for you.

Credit score is also an issue because if you have a bad credit rating, it will likely be extremely tough for you to get bonded as the companies consider you as a risk. If you have a poor credit score, you could be approved for the bond, but you must pay an interest rate of 10 to 20 percent.

There is a chance that your application would be declined so you must check the requirements before applying.

If you’re going to get a Surety Bid Bond, make sure that you know what is entailed before deciding. It won’t be easy to apply for one, but if you actually understand more about this, it will be easier to be approved.

A Deeper Look At Quote Bonds in Building A Quote Bond is a type of surety bond utilized to make sure that a contractor bidding on a task or job will get in into the agreement with the obligee if granted.

A Quote Bond is provided in the amount of the agreement quote, with the identical requirements as that of an Efficiency Bond.

All About Quote Bonds in Construction The origins of our company was closely related to the provision of efficiency bonds to the contracting market. A little greater than one a century earlier, the federal authorities grew to become alarmed concerning the high failure fee amongst the personal companies it was using to bring out public building tasks. It found that the private contractor usually was insolvent when the job was granted, or grew to end up being insolvent earlier than the challenge was finished. Appropriately, the federal government was continually entrusted unfinished initiatives, and the taxpayers had been forced to cover the additional costs arising from the professional's default.

The standing of your surety firm is necessary, due to the fact that it guarantees you that when you have difficulties or if worse includes worst you'll have a trusted partner to rely on and get aid from. We work just with T-listed and a-rated business, most likely the most dependable corporations in the industry.

Usually no, they are different. Nonetheless, quote bonds mechanically become efficiency bonds in case you are awarded the agreement.

What Is A Building Surety Bond? The origins of our company was thoroughly linked with the arrangement of performance bonds to the contracting industry. Even if some jobs do not need expense and performance bonds, you will require to get bonded finally because the majority of public initiatives do require the bonds. The longer a small contractor waits to get bonded, the more long lasting it will be given that there will not be a observe report of meeting the mandatory requirements for bonding and performing bonded work.

It's your pre-authorized bond limits. Bond pressures welcome single and combination limits. The only restrict is the biggest bond you may get for one particular job. The aggregate limitation is the entire amount of bonded work offered you possibly can have without delay.

The Value Of Bid Bonds near You Arms, generators, radio towers, tree elimination, computer systems, softward, emergency alarm, decorative work, scaffolding, water towers, lighting, and resurfacing of existing roads/paved locations. Bid bonds furthermore function an additional assurance for task owners that a bidding specialist or subcontractor is qualified to execute the job they're bidding on. There are two causes for this.

https://swiftbonds.com/bid-bond/colorado-2/

1 note

·

View note

Text

Colorado Bid Bonds

The listed below short article is a great introduction to bid bonds. Bid bonds, as you understand, are bonds used in the building market. These bonds guarantee that if someone quotes on a job, and is granted the agreement, then they will move forward with carrying out under the regards to the arrangement.

See the below article for more excellent details. You can see the initial article here: https://swiftbonds.com/bid-bond/colorado-2/

Colorado Bid Bonds

What is a Bid Bond in Colorado?

A bid bond is a type of surety bond, that guarantees that the bidder will accept the project and complete the contract according to its terms. It provides assurance to the project owner that the bidder has the knowhow and wherewithal to complete the job once the bidder is selected after winning the bid. The simple reason is that you need one to get the job. But the bigger question is why are more owners/developers requiring a bid bond? The simply explanation is risk. Given the uncertainty of the marketplace, which includes experienced contractors going out of business, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the work. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Colorado Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five (5%) or ten (10%) percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Colorado?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the P&P bond if you get the job. The cost of a bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges: 1) We do charge for Overnight fees 2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in CO?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Colorado. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

Bond Amount Needed Fee 2-3% >$800,000 1.5-3% >$1.500,000 1-3%

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Colorado?

We make it easy to get a contract bid bond. Just click here to get our Colorado Bid Bond Application. Fill it out and then email it and the Colorado bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each application for bid bonds and then submit it to the surety that we believe will provide the best bid bond for your company. We have a great success rate in getting our clients bid bonds at the best rates possible.

What is a Colorado Bid Bond?

A bid bond is a bond that guarantees that you will accept the work if you win the contract. The bid fee (usually five (5%) or ten (10%) percent) is a damages calculation that is paid when you win the bid, but then back out of doing the work.

Find a Bid Bond near Me

Typically, a bid bond and P&P bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is security risk insurance for the benefit of the owner.

Who Gets the Bond?

The general contractor is the company that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). However, it’s the general contractor that has to apply for the bond and be underwritten before the contract bond is written by the surety. This is also known as bonding a business.

Conejos Costilla Crowley Custer Delta Denver Dolores Douglas Eagle Elbert El Paso Fremont Garfield Gilpin Grand Gunnison Hinsdale Huerfano Jackson Jefferson Kiowa Kit Carson Lake La Plata Larimer Las Animas Lincoln Logan Mesa Mineral Moffat Montezuma Montrose Morgan Otero Ouray Park Phillips Pitkin Prowers Pueblo Rio Blanco Rio Grande Routt Saguache San Juan San Miguel Sedgwick Summit Teller Washington Weld Yuma

And Cities: Denver Colorado Springs Boulder Aspen Fort Collins Aurora Steamboat Springs Littleton Grand Junction Pueblo Vail

See our Connecticut bid bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Key Specifics When Thinking Of Bid Bonds

It is not incorrect to say that Bid Bonds are very complicated, specially if you don’t have any idea how this works. Most individuals are thinking about this as an insurance, but this is a type of guarantee that the principal will perform their work correctly. Insurance providers usually provide a Surety Bid Bond, but you cannot call it insurance because its function is different. Most folks will surely require you to get a Surety Bid Bond before they consider your services as it’s a kind of guarantee to them.

If you want to get a license bond, permit bond, commercial bond and more, you have to know how they work. We are going to provide some good info on the significance of Bid Bonds and how they work.

A Basic Explanation On Bid Bonds

Bid Bonds will invariably be asked for by the public because it will secure them and it will guarantee that the principal will fulfill their responsibilities. You are the principal so you have to obtain a license Surety Bid Bond to guarantee that your company will invariably adhere to the laws and you must get a contract bond to guarantee that a public construction project will be completed. There are examples which will provide an idea on Surety Bid Bond.

This is made for the clients since they will likely be protected by the bond, but it can also provide advantages to you since they will trust you in case you have this.

How It Works

Bid Bonds are considered as a three-party agreement between a surety company, the obliged and the principal. The principal is actually the employer or company that will offer the services and the obliged is the project owner. Construction companies will invariably be required to purchase Bid Bonds as soon as they will work on a public project. If they want to work on the project, the government will need the construction company to secure a number of bonds.

The work of the bonds is aimed at the subcontractors and workers to guarantee that they will likely be paid even if the contractor defaults. The contractor will likely be covering the losses, but as soon as they reached the limit, the duty will definitely fall to the surety company.

How Do You Apply For A Surety Bid Bond?

Bid Bonds are generally given by insurance businesses, but you could look for some standalone surety businesses that focus on these unique products. A surety company should be licensed by a state Department of Insurance.

It’s hard to apply for a bond because the applicants will definitely experience a procedure that’s comparable to applying for a loan. The bond underwriters will evaluate the financial history of an applicant, credit profile, managerial team and other key factors.

There’s a chance that you will not be accepted for a Surety Bid Bond, particularly when the bond underwriters saw something from your credit history.

How Much Is A Surety Bid Bond?

It is hard to quote an exact cost for a bid bond because the cost might be affected by numerous factors like the bond type, bond amount, where it will likely be issued, contractual risk, credit history of the applicant and more. There are thousands of different bonds available right now and the cost will always depend on the bond that you could get. The amount of bound that you may avail may also be a big factor because you can select a $10,000 bond or a $25,000 bond or higher.

If you already have a credit history of 700 and above or very near this number, you could qualify for the standard bonding market and you only need to pay 1 to 4 percent of the Surety Bid Bond amount. This implies that if you may get a $10,000 bond, you only need to pay $100 to $400 for the interest.

The Approval Of Your Request

There is a chance that your bond request will be declined by the insurance businesses and it will depend on the background check that they carried out. If they believe that issuing you a bond will be a big risk, they won’t release a Surety Bid Bond for you.

Credit score is also an issue because if you have a bad credit rating, it will likely be extremely tough for you to get bonded as the companies consider you as a risk. If you have a poor credit score, you could be approved for the bond, but you must pay an interest rate of 10 to 20 percent.

There is a chance that your application would be declined so you must check the requirements before applying.

If you’re going to get a Surety Bid Bond, make sure that you know what is entailed before deciding. It won’t be easy to apply for one, but if you actually understand more about this, it will be easier to be approved.

A Deeper Look At Quote Bonds in Building A Quote Bond is a type of surety bond utilized to make sure that a contractor bidding on a task or job will get in into the agreement with the obligee if granted.

A Quote Bond is provided in the amount of the agreement quote, with the identical requirements as that of an Efficiency Bond.

All About Quote Bonds in Construction The origins of our company was closely related to the provision of efficiency bonds to the contracting market. A little greater than one a century earlier, the federal authorities grew to become alarmed concerning the high failure fee amongst the personal companies it was using to bring out public building tasks. It found that the private contractor usually was insolvent when the job was granted, or grew to end up being insolvent earlier than the challenge was finished. Appropriately, the federal government was continually entrusted unfinished initiatives, and the taxpayers had been forced to cover the additional costs arising from the professional's default.

The standing of your surety firm is necessary, due to the fact that it guarantees you that when you have difficulties or if worse includes worst you'll have a trusted partner to rely on and get aid from. We work just with T-listed and a-rated business, most likely the most dependable corporations in the industry.

Usually no, they are different. Nonetheless, quote bonds mechanically become efficiency bonds in case you are awarded the agreement.

What Is A Building Surety Bond? The origins of our company was thoroughly linked with the arrangement of performance bonds to the contracting industry. Even if some jobs do not need expense and performance bonds, you will require to get bonded finally because the majority of public initiatives do require the bonds. The longer a small contractor waits to get bonded, the more long lasting it will be given that there will not be a observe report of meeting the mandatory requirements for bonding and performing bonded work.

It's your pre-authorized bond limits. Bond pressures welcome single and combination limits. The only restrict is the biggest bond you may get for one particular job. The aggregate limitation is the entire amount of bonded work offered you possibly can have without delay.

The Value Of Bid Bonds near You Arms, generators, radio towers, tree elimination, computer systems, softward, emergency alarm, decorative work, scaffolding, water towers, lighting, and resurfacing of existing roads/paved locations. Bid bonds furthermore function an additional assurance for task owners that a bidding specialist or subcontractor is qualified to execute the job they're bidding on. There are two causes for this.

https://swiftbonds.com/bid-bond/colorado-2/

0 notes

Text

Colorado Bid Bonds

The listed below short article is a great introduction to bid bonds. Bid bonds, as you understand, are bonds used in the building market. These bonds guarantee that if someone quotes on a job, and is granted the agreement, then they will move forward with carrying out under the regards to the arrangement.

See the below article for more excellent details. You can see the initial article here: https://swiftbonds.com/bid-bond/colorado-2/

Colorado Bid Bonds

What is a Bid Bond in Colorado?

A bid bond is a type of surety bond, that guarantees that the bidder will accept the project and complete the contract according to its terms. It provides assurance to the project owner that the bidder has the knowhow and wherewithal to complete the job once the bidder is selected after winning the bid. The simple reason is that you need one to get the job. But the bigger question is why are more owners/developers requiring a bid bond? The simply explanation is risk. Given the uncertainty of the marketplace, which includes experienced contractors going out of business, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable finish the work. Accordingly, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Colorado Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually five (5%) or ten (10%) percent, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Colorado?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the P&P bond if you get the job. The cost of a bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges: 1) We do charge for Overnight fees 2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in CO?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Colorado. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

Bond Amount Needed Fee 2-3% >$800,000 1.5-3% >$1.500,000 1-3%

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Colorado?

We make it easy to get a contract bid bond. Just click here to get our Colorado Bid Bond Application. Fill it out and then email it and the Colorado bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We fully review each application for bid bonds and then submit it to the surety that we believe will provide the best bid bond for your company. We have a great success rate in getting our clients bid bonds at the best rates possible.

What is a Colorado Bid Bond?

A bid bond is a bond that guarantees that you will accept the work if you win the contract. The bid fee (usually five (5%) or ten (10%) percent) is a damages calculation that is paid when you win the bid, but then back out of doing the work.

Find a Bid Bond near Me

Typically, a bid bond and P&P bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is security risk insurance for the benefit of the owner.

Who Gets the Bond?

The general contractor is the company that gets the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). However, it’s the general contractor that has to apply for the bond and be underwritten before the contract bond is written by the surety. This is also known as bonding a business.

Conejos Costilla Crowley Custer Delta Denver Dolores Douglas Eagle Elbert El Paso Fremont Garfield Gilpin Grand Gunnison Hinsdale Huerfano Jackson Jefferson Kiowa Kit Carson Lake La Plata Larimer Las Animas Lincoln Logan Mesa Mineral Moffat Montezuma Montrose Morgan Otero Ouray Park Phillips Pitkin Prowers Pueblo Rio Blanco Rio Grande Routt Saguache San Juan San Miguel Sedgwick Summit Teller Washington Weld Yuma

And Cities: Denver Colorado Springs Boulder Aspen Fort Collins Aurora Steamboat Springs Littleton Grand Junction Pueblo Vail

See our Connecticut bid bond page here.

More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Key Specifics When Thinking Of Bid Bonds

It is not incorrect to say that Bid Bonds are very complicated, specially if you don’t have any idea how this works. Most individuals are thinking about this as an insurance, but this is a type of guarantee that the principal will perform their work correctly. Insurance providers usually provide a Surety Bid Bond, but you cannot call it insurance because its function is different. Most folks will surely require you to get a Surety Bid Bond before they consider your services as it’s a kind of guarantee to them.

If you want to get a license bond, permit bond, commercial bond and more, you have to know how they work. We are going to provide some good info on the significance of Bid Bonds and how they work.

A Basic Explanation On Bid Bonds

Bid Bonds will invariably be asked for by the public because it will secure them and it will guarantee that the principal will fulfill their responsibilities. You are the principal so you have to obtain a license Surety Bid Bond to guarantee that your company will invariably adhere to the laws and you must get a contract bond to guarantee that a public construction project will be completed. There are examples which will provide an idea on Surety Bid Bond.

This is made for the clients since they will likely be protected by the bond, but it can also provide advantages to you since they will trust you in case you have this.

How It Works

Bid Bonds are considered as a three-party agreement between a surety company, the obliged and the principal. The principal is actually the employer or company that will offer the services and the obliged is the project owner. Construction companies will invariably be required to purchase Bid Bonds as soon as they will work on a public project. If they want to work on the project, the government will need the construction company to secure a number of bonds.

The work of the bonds is aimed at the subcontractors and workers to guarantee that they will likely be paid even if the contractor defaults. The contractor will likely be covering the losses, but as soon as they reached the limit, the duty will definitely fall to the surety company.

How Do You Apply For A Surety Bid Bond?

Bid Bonds are generally given by insurance businesses, but you could look for some standalone surety businesses that focus on these unique products. A surety company should be licensed by a state Department of Insurance.

It’s hard to apply for a bond because the applicants will definitely experience a procedure that’s comparable to applying for a loan. The bond underwriters will evaluate the financial history of an applicant, credit profile, managerial team and other key factors.

There’s a chance that you will not be accepted for a Surety Bid Bond, particularly when the bond underwriters saw something from your credit history.

How Much Is A Surety Bid Bond?

It is hard to quote an exact cost for a bid bond because the cost might be affected by numerous factors like the bond type, bond amount, where it will likely be issued, contractual risk, credit history of the applicant and more. There are thousands of different bonds available right now and the cost will always depend on the bond that you could get. The amount of bound that you may avail may also be a big factor because you can select a $10,000 bond or a $25,000 bond or higher.

If you already have a credit history of 700 and above or very near this number, you could qualify for the standard bonding market and you only need to pay 1 to 4 percent of the Surety Bid Bond amount. This implies that if you may get a $10,000 bond, you only need to pay $100 to $400 for the interest.

The Approval Of Your Request

There is a chance that your bond request will be declined by the insurance businesses and it will depend on the background check that they carried out. If they believe that issuing you a bond will be a big risk, they won’t release a Surety Bid Bond for you.

Credit score is also an issue because if you have a bad credit rating, it will likely be extremely tough for you to get bonded as the companies consider you as a risk. If you have a poor credit score, you could be approved for the bond, but you must pay an interest rate of 10 to 20 percent.

There is a chance that your application would be declined so you must check the requirements before applying.

If you’re going to get a Surety Bid Bond, make sure that you know what is entailed before deciding. It won’t be easy to apply for one, but if you actually understand more about this, it will be easier to be approved.

A Deeper Look At Quote Bonds in Building A Quote Bond is a type of surety bond utilized to make sure that a contractor bidding on a task or job will get in into the agreement with the obligee if granted.

A Quote Bond is provided in the amount of the agreement quote, with the identical requirements as that of an Efficiency Bond.

All About Quote Bonds in Construction The origins of our company was closely related to the provision of efficiency bonds to the contracting market. A little greater than one a century earlier, the federal authorities grew to become alarmed concerning the high failure fee amongst the personal companies it was using to bring out public building tasks. It found that the private contractor usually was insolvent when the job was granted, or grew to end up being insolvent earlier than the challenge was finished. Appropriately, the federal government was continually entrusted unfinished initiatives, and the taxpayers had been forced to cover the additional costs arising from the professional's default.

The standing of your surety firm is necessary, due to the fact that it guarantees you that when you have difficulties or if worse includes worst you'll have a trusted partner to rely on and get aid from. We work just with T-listed and a-rated business, most likely the most dependable corporations in the industry.

Usually no, they are different. Nonetheless, quote bonds mechanically become efficiency bonds in case you are awarded the agreement.

What Is A Building Surety Bond? The origins of our company was thoroughly linked with the arrangement of performance bonds to the contracting industry. Even if some jobs do not need expense and performance bonds, you will require to get bonded finally because the majority of public initiatives do require the bonds. The longer a small contractor waits to get bonded, the more long lasting it will be given that there will not be a observe report of meeting the mandatory requirements for bonding and performing bonded work.

It's your pre-authorized bond limits. Bond pressures welcome single and combination limits. The only restrict is the biggest bond you may get for one particular job. The aggregate limitation is the entire amount of bonded work offered you possibly can have without delay.

The Value Of Bid Bonds near You Arms, generators, radio towers, tree elimination, computer systems, softward, emergency alarm, decorative work, scaffolding, water towers, lighting, and resurfacing of existing roads/paved locations. Bid bonds furthermore function an additional assurance for task owners that a bidding specialist or subcontractor is qualified to execute the job they're bidding on. There are two causes for this.

https://swiftbonds.com/bid-bond/colorado-2/

0 notes