#Soybean Market analysis

Explore tagged Tumblr posts

Text

Epoxidized Soybean Oil Market Size, Share, Demand, Rising Trends, Growth and Global Competitors Analysis

A Qualitative Research Study accomplished by Data Bridge Market research's database of 350 pages, titled as Global Epoxidized Soybean Oil Market with 100+ market data Tables, Pie Charts, Graphs & Figures spread through Pages and easy to understand detailed analysis.

Epoxidized Soybean Oil market report has been generated by considering a common theme throughout the marketing industry that suggests strategy and research need stronger alignment. This market study also analyzes the market status, market share, growth rate, future trends, market drivers, opportunities, challenges, risks, entry barriers, sales channels, distributors and Porter's Five Forces Analysis. The information and flow of this report can be employed by marketers from all walks of life to convert complex market research information into manageable, actionable marketing insights. Epoxidized Soybean Oil is the most promising market research report which has been structured in the way anticipated.

Access Full 350 Pages PDF Report @

Data Bridge Market Research analyses that the expoxidized soybean oil market will witness a CAGR of 6.50% for the forecast period of 2022-2029. Growth in the expoxidized soybean oil especially in the developing economies such as India and China, growing use of expoxidized soybean oil for a wide range of end user applications such as food and beverages, agriculture, healthcare and pharmaceuticals, and other applications, increasing investment by the government for research and development activities and surge in industrialization especially in the developing countries are the major factors attributable to the growth of the expoxidized soybean oil market.

The Epoxidized Soybean Oil Market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance.

Major Points Covered in TOC:

Epoxidized Soybean Oil Market Overview: It incorporates six sections, research scope, significant makers covered, market fragments by type, Epoxidized Soybean Oil Market portions by application, study goals, and years considered.

Epoxidized Soybean Oil Market Landscape: Here, the opposition in the Worldwide Epoxidized Soybean Oil Market is dissected, by value, income, deals, and piece of the pie by organization, market rate, cutthroat circumstances Landscape, and most recent patterns, consolidation, development, obtaining, and portions of the overall industry of top organizations.

Epoxidized Soybean Oil Profiles of Manufacturers: Here, driving players of the worldwide Epoxidized Soybean Oil Market are considered dependent on deals region, key items, net edge, income, cost, and creation.

Epoxidized Soybean Oil Market Status and Outlook by Region: In this segment, the report examines about net edge, deals, income, creation, portion of the overall industry, CAGR, and market size by locale. Here, the worldwide Epoxidized Soybean Oil Market is profoundly examined based on areas and nations like North America, Europe, China, India, Japan, and the MEA.

Epoxidized Soybean Oil Application or End User: This segment of the exploration study shows how extraordinary end-client/application sections add to the worldwide Epoxidized Soybean Oil Market.

Epoxidized Soybean Oil Market Forecast: Production Side: In this piece of the report, the creators have zeroed in on creation and creation esteem conjecture, key makers gauge, and creation and creation esteem estimate by type.

Keyword: Research Findings and Conclusion: This is one of the last segments of the report where the discoveries of the investigators and the finish of the exploration study are given.

The Report Can Answer the Following Questions:

Who are the global key players of Epoxidized Soybean Oil industry? How are their operating situation (capacity, production, price, cost, gross and revenue)?

What are the types and applications of Epoxidized Soybean Oil? What is the market share of each type and application?

What are the upstream raw materials and manufacturing equipment of Epoxidized Soybean Oil? What is the manufacturing process of Epoxidized Soybean Oil?

Economic impact on Epoxidized Soybean Oil industry and development trend of Epoxidized Soybean Oil industry.

What are the key factors driving the global Epoxidized Soybean Oil industry?

What are the key market trends impacting the growth of the Epoxidized Soybean Oil market?

What are the Epoxidized Soybean Oil market challenges to market growth?

What are the Epoxidized Soybean Oil market opportunities and threats faced by the vendors in the global Epoxidized Soybean Oil market?

Some of the major players operating in the expoxidized soybean oil market report are Dow, DuPont, CHS Inc., Ferro Corporation, Arkrema, Galata Chemicals, Guangzhou Xinjinlong Chemical Additives Co., Ltd., MAKWELL, Harima Chemicals Group, Inc., Hallstar., Shandong Longkou longda Chemical Co., Ltd.., FuJian ZhiShang Biomass Materials Co., Ltd.., DuPont, American Chemical Society, AM Stabilizers Corporation., Chang Chun Group., NAN YA PLASTICS CORPORATION, Hebei Jingu Plasticizer Co., Ltd., Akzo Nobel N.V., and Axalta Coating Systems LLC among others.

Browse Trending Reports:

Impact Modifier Market

Compressor Oil Market

High Temperature Grease Market

Stainless Steel Foil Market

Forage Harvester Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email: [email protected]

#Epoxidized Soybean Oil Market Size#Rising Trends#Growth and Global Competitors Analysis#market report#market trends#market share#market size#market analysis#marketresearch#markettrends#market research

0 notes

Text

#Soybean Market#Soybean Market size#Soybean Market share#Soybean Market trends#Soybean Market analysis#Soybean Market forecast#Soybean Market outlook

0 notes

Text

By combining food-bearing trees and shrubs with poultry production, Haslett-Marroquin and his peers are practicing what is known as agroforestry — an ancient practice that intertwines annual and perennial agriculture. Other forms include alley cropping, in which annual crops including grains, legumes, and vegetables grow between rows of food-bearing trees, and silvopasture, which features cattle munching grass between the rows. Agroforestry was largely abandoned in the United States after the nation’s westward expansion in the 19th century. In the 2022 Agricultural Census, just 1.7 percent of U.S. farmers reported integrating trees into crop and livestock operations. But it’s widely practiced across the globe, particularly in Southeast Asia and Central and South America. According to the U.N. Food and Agriculture Organization, 43 percent of all agricultural land globally includes agroforestry features. Bringing trees to the region now known as the Corn Belt, known for its industrial-scale agriculture and largely devoid of perennial crops, might seem like the height of folly. On closer inspection, however, agroforestry systems like Haslett-Marroquin’s might be a crucial strategy for both preserving and revitalizing one of the globe’s most important farming regions. And while the corn-soybean duopoly that holds sway in the U.S. heartland produces mainly feed for livestock and ethanol, agroforestry can deliver a broader variety of nutrient-dense foods, like nuts and fruit, even as it diversifies farmer income away from the volatile global livestock-feed market.

[...]

Trees actually have a much longer and more robust history in the Midwestern landscape than do annual crops. Think of the Midwestern countryside before U.S. settlers arrived, and you might picture lush grasses and flowers swaying in the wind. That vision is largely accurate, but it’s incomplete. Amid the tall-grass prairies and wetlands, oak trees once dotted landscapes from the shores of Lake Michigan through swathes of present-day Indiana, Illinois, Iowa, and Missouri, clear down to the Mexican border. These trees didn’t clump together in dense forests with closed canopies but rather in what ecologists call savannas — patches of grassland interspersed with oaks. Within these oak savannas, which were interlaced with prairies, tree crowns covered between 10 percent and 30 percent of the ground. They were essentially a transition between the tight deciduous forests of the East and the fully open grasslands further west. And in the region where Haslett-Marroquin farms — part of the so-called Driftless Area, which was never glaciated — trees proliferated even more intensely. In pre-settlement times, according to a 2014 analysis coauthored by Iowa State University ecologist Lisa Schulte Moore, closed-canopy forests of oaks, sugar maples, and other species covered 15.3 percent of the area, and woodlands (low-density forests) took up another 8.6 percent. Prairies — the ecosystem we readily imagine — composed just 6.9 percent. Oak savannas made up the rest.

10 September 2024

95 notes

·

View notes

Text

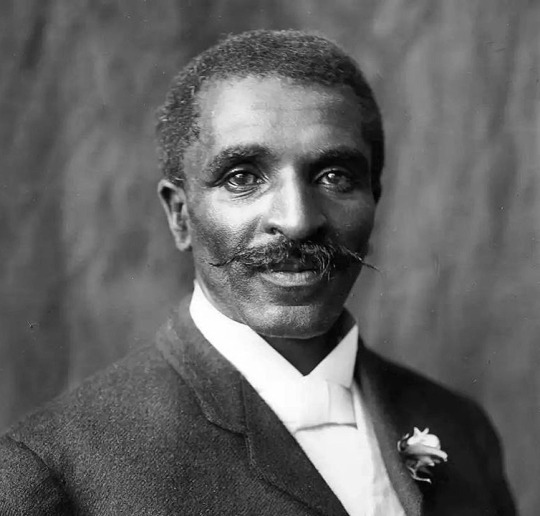

Today In History

Dr. George Washington Carver was an agricultural scientist and inventor who developed hundreds of products using peanuts, sweet potatoes and soybeans. He is believed to have been born the month of January in 1864.

Dr. Carver discovered over 300 products from peanuts, soybeans and sweet potatoes, which aided nutrition for farm families.

Dr. Carver wanted to improve the lot of “the man farthest down,” the poor, one-horse farmer at the mercy of the market and chained to land exhausted by cotton.

Unlike other agricultural researchers of his time, Dr. Carver saw the need to devise practical farming methods for this kind of farmer. He wanted to coax them away from cotton to such soil-enhancing, protein-rich crops as soybeans and peanuts and to teach them self-sufficiency and conservation.

He achieved this through an innovative series of free, simply-written brochures that included information on crops, cultivation techniques, and recipes for nutritious meals. He also urged the farmers to submit samples of their soil and water for analysis and taught them livestock care and food preservation techniques.

Dr. Carver took a holistic approach to knowledge, which embraced faith and inquiry in a unified quest for truth. Carver also believed that commitment to a larger reality is necessary if science and technology are to serve human needs rather than the egos of the powerful.

His belief in service was a direct outgrowth and expression of his wedding of inquiry and commitment.

One of his favorite sayings was:

“It is not the style of clothes one wears, neither the kind of automobile one drives, nor the amount of money one has in the bank, that counts. These mean nothing. It is simply service that measures success.”

CARTER™️ Magazine

#george washington carver#carter magazine#carter#historyandhiphop365#wherehistoryandhiphopmeet#history#cartermagazine#today in history#staywoke#blackhistory#blackhistorymonth

54 notes

·

View notes

Text

The Age of the Soybean: An Environmental History of Soy During the Great Acceleration

Edited by Claiton Marcio da Silva & Claudio de Majo (2022, open access!)

The soybean is far more than just a versatile crop whose derivates serve the protein needs of a meatless diet. One of the world’s most important commodities, soy represents the embodiment of mechanised industrial agriculture and is one of the main actors behind the socioeconomic, political and ecological transformations of industrial farming in several world regions. Despite the crop’s potential as a cheap source of vegetal protein for human consumers, most industrial soybean production has fuelled the global meat industrial complex, as animal feed. Soybean is thus, paradoxically, still a relatively ‘invisible’ crop to the public at large, although its global yields continue to increase at stupendous rates, lining the pockets of agribusiness and to the detriment of traditional agriculture. The transnational socio-ecological and economic entanglements characterising this versatile legume’s global expansion have prompted scholarly attention as researchers around the world have begun to unveil the main historical drivers behind the rise of the soybean in the global food chain. This book aims to expand the analysis, offering the most significant effort so far at an environmental history of soybeans. Interrogating the socioeconomic and ecological transformations determined by (and determining) the rise of soy in international food chains during the Great Acceleration, the volume gathers contributions from an international cast of researchers, working in numerous geographical contexts, from Japan and China, to India, African nations, the Southern Cone of Latin America, Northern Europe and the United States. Soybean farming, breeding, processing and marketing have bound together the histories of these diverse regions and altered beyond recognition their ecological and socio-economic contexts.

Globalizing the Soybean: Fat, Feed, and Sometimes Food, c. 1900–1950 Ines Prodöhl (2023, PDF open access)

Ines Prodöhl’s Globalizing the Soybean: Fat, Feed, and Sometimes Food, c. 1900-1950 (Routledge, 2023) is a history of how, why, and where the soybean became a critical ingredient in industry and agriculture in the first half of the twentieth century. Focusing on Japanese-dominated Manchuria, Germany, and the United States, Prodöhl shows that the soybean was a serendipitous solution to numerous and varied crises from the beginning of the century into the post-WWII decades. This story of imperialism, globalization, and technology begins in northeast China, the world’s soy cultivation center until the 1940s. It takes us to Germany, the number one importer of soybeans in the interwar period, and illuminates the various ways in which soy was integrated into the economy especially after the end of WWI as both an invaluable oilseed for industry and a source of protein-rich fodder for agriculture. Finally, Prodöhl explores how the United States first adopted the soybean mostly as a solution to overtaxed soils. Mixing economic, ecological, political, and technological/scientific history with a keen sense of the materiality of soy as a global product, Globalizing the Soybean is an accessible and enlightening book that will appeal to multiple audiences.

The Government of Beans: Regulating Life in the Age of Monocrops

Kregg Hetherington (2020)

The Government of Beans is about the rough edges of environmental regulation, where tenuous state power and blunt governmental instruments encounter ecological destruction and social injustice. At the turn of the twenty-first century, Paraguay was undergoing dramatic economic, political, and environmental change due to a boom in the global demand for soybeans. Although the country's massive new soy monocrop brought wealth, it also brought deforestation, biodiversity loss, rising inequality, and violence. Kregg Hetherington traces well-meaning attempts by bureaucrats and activists to regulate the destructive force of monocrops that resulted in the discovery that the tools of modern government are at best inadequate to deal with the complex harms of modern agriculture and at worst exacerbate them. The book simultaneously tells a local story of people, plants, and government; a regional story of the rise and fall of Latin America's new left; and a story of the Anthropocene writ large, about the long-term, paradoxical consequences of destroying ecosystems in the name of human welfare.

The Story of Soy

Christine M. Du Bois (2018)

The humble soybean is the world’s most widely grown and most traded oilseed. And though found in everything from veggie burgers to cosmetics, breakfast cereals to plastics, soy is also a poorly understood crop often viewed in extreme terms—either as a superfood or a deadly poison. In this illuminating book, Christine M. Du Bois reveals soy’s hugely significant role in human history as she traces the story of soy from its domestication in ancient Asia to the promise and peril ascribed to it in the twenty-first century. Traveling across the globe and through millennia, The Story of Soy includes a cast of fascinating characters as vast as the soy fields themselves—entities who’ve applauded, experimented with, or despised soy. From Neolithic villagers to Buddhist missionaries, European colonialists, Japanese soldiers, and Nazi strategists; from George Washington Carver to Henry Ford, Monsanto, and Greenpeace; from landless peasants to petroleum refiners, Du Bois explores soy subjects as diverse as its impact on international conflicts, its role in large-scale meat production and disaster relief, its troubling ecological impacts, and the nutritional controversies swirling around soy today. She also describes its genetic modification, the scandals and pirates involved in the international trade in soybeans, and the potential of soy as an intriguing renewable fuel. Featuring compelling historical and contemporary photographs, The Story of Soy is a potent reminder never to underestimate the importance of even the most unprepossesing sprout.

3 notes

·

View notes

Text

Critics of the federal program say it encourages more carbon-intensive farming and are calling for Congress to lower subsidies for big, wealthy producers.

(A farm in Iowa is surrounded by flood water.)

The country’s farmers took in a record $19 billion in insurance payments in 2022, many because of weather-related disasters, according to a new analysis that suggests climate change could stoke the cost of insuring the nation’s farmers and ranchers to unsustainable levels.

The Environmental Working Group, which has for decades critically scrutinized the Federal Crop Insurance Program, published new research Thursday, finding that the cost of the program has soared from just under $3 billion in 2002 to just over $19 billion last year.

“We found between 2002 and 2022 the crop insurance program sent over $161 billion to farmers, and annual payouts in 2022 were 546 percent more than they were in 2001,” said Anne Schechinger, an agricultural economist and director at EWG.

The crop insurance program has become increasingly popular with farmers over the past 20 years as a way to protect themselves from drops in prices and weather-related disasters.

Taxpayers subsidize about 60 percent of the premiums; farmers cover about 40 percent and pay deductibles on smaller losses.

“We know that part of the increase in payouts comes from an increase in participation in the program, as well as crop prices,” Schechinger said. “But we also know that payments for weather-related losses are also going up.”

EWG also analyzed who received the bulk of the payments, confirming previous research showing that most of them are going to large, wealthy farms that grow one or two crops.

Roughly 80 percent of subsidies go to the largest 20 percent of farms. That’s in part because they produce most of the crops, but also because smaller farmers have a more difficult time qualifying for the programs. This, critics say, encourages the growth of large farms that use production methods that are more fuel and carbon intensive.

In the past two decades, EWG found that roughly three-fourths of all indemnity payments, about $121 billion, went to corn, soybeans, wheat and cotton, and nearly $56 billion to corn growers alone.

Critics of the program worry that it will incentivize more carbon-intensive farming. Already U.S. farms are responsible for 11 percent of the country’s greenhouse gas emissions. A recent analysis suggests that percentage could rise to about 30 percent of the total by 2050—more than any other sectors of the economy—if farms and ranches don’t shrink their carbon impact.

EWG’s research dovetails with other recent studies showing that the warming atmosphere has increased crop insurance payments and discourages farmers from adapting to climate change. More research also suggests that climate change will likely stoke crop insurance payments in coming years and finds that crop insurance premiums will rise.

–

Crop insurance protects farmers from the free market of the ecosystem.

When your industry destabilizes the ecosystem and the ecosystem responds by destroying your product, the taxpayers will bail you out.

Rural America hates socialism but they love socialism when it helps them avoid the consequences of ecocide.

4 notes

·

View notes

Text

India Plant Protein Market Analysis, Growth, Report 2023-2030

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated India Plant Protein Market size by value at USD 427.9 million in 2023. During the forecast period between 2024 and 2030, BlueWeave expects India Plant Protein Market size to expand at a CAGR of 5.9% reaching a value of USD 629.9 million by 2030. The Plant Protein Market in India is propelled by abundant and diverse protein sources like soybeans, rice, peas, and wheat. The surge in the market growth is further amplified by the rising popularity of vegan and vegetarian lifestyles, particularly among internet-savvy youth influenced by vegan influencers. Over a million Indians have adopted plant-based diets, and younger generations increasingly opt for plant-protein-fortified foods over dairy products. A 2019 survey indicated that 63% of Indian respondents were open to replacing meat with plant-based alternatives. Companies like Evolved Foods and Schouten are introducing innovative products, such as vegan alternatives and tempeh, to meet the growing demand for plant protein.

Sample Request: https://www.blueweaveconsulting.com/report/india-plant-protein-market/report-sample

Opportunity – Government’s Increasing Support and Regulations

Government of India increasing support for alternative proteins, including plant-based proteins, presents a significant growth opportunity for the Plant Protein Market. At a recent food safety summit, Health Minister JP Nadda emphasized the need for regulatory reform to accommodate novel foods like cultivated meat, which could pave the way for broader acceptance and innovation in the sector. The Food Safety Standards and Authority of India (FSSAI) is actively working on a regulatory framework for these products, which will facilitate their market clearance. Additionally, India’s BioE3 policy, which focuses on supporting R&D and innovation in smart proteins, highlights the government’s commitment to advancing the plant-based protein industry. This policy, along with the establishment of dedicated research hubs and labs for alternative protein development, strengthens the market’s potential by addressing challenges in nutrition, price, and taste parity. With growing government interest and regulatory support, the Indian Plant Protein Market is well-positioned to expand rapidly over the forecast period.

North India Leads India Plant Protein Market

North India's strong agricultural foundation, particularly in the production of soy, wheat, and peas, positions it as the dominant player in India Plant Protein Market. The region's favorable climate, advanced irrigation systems, and government-backed farming initiatives contribute to high production levels. Coupled with a growing awareness of plant-based diets and a surge in demand for protein-enriched foods, North India's urban centers are witnessing increased adoption of plant protein products, driven by health-conscious consumers and the availability of innovative products. This trend is projected to continue, solidifying North India's dominance in India Plant Protein Market over the forecast period.

Impact of Escalating Geopolitical Tensions on India Plant Protein Market

India Plant Protein Market may face significant challenges from intensifying geopolitical tensions across the world. Disruptions in global supply chains could incentivize domestic sourcing and innovation, fostering local production and reducing reliance on international markets. However, increased tariffs, sanctions, and transportation delays could elevate production costs, and shifting consumer preferences may impact demand for plant-based products.

Competitive Landscape

India Plant Protein Market is highly fragmented, with numerous players serving the market. The key players dominating India Plant Protein Market include Conch Lifescience, Himalaya, Prime Herbonix Health Products, Chemvera Specialty Chemicals, Nutricore Biosciences, Kailash Dhanya Bhandar, Vencora Healthcare, Vv Farm, and Srimantha Medicos. The key marketing strategies adopted by the players are facility expansion, product diversification, alliances, collaborations, partnerships, and acquisitions to expand their customer reach and gain a competitive edge in the overall market.

Contact Us:

BlueWeave Consulting & Research Pvt Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Text

North America Corn Gluten Market: Key Trends and Market Share Analysis

Corn Gluten Market Insights

The Corn Gluten Market involves the production, distribution, and application of corn gluten, which is a byproduct of corn processing. Corn gluten is typically derived during the wet milling process, and it is primarily composed of corn proteins, starches, and fiber. Corn gluten is widely used in animal feed, as a natural herbicide, in food processing, and in industrial applications. The market for corn gluten has been steadily growing, driven by its versatility and increasing demand in various sectors, particularly agriculture, food, and animal nutrition.

Get a Free Sample Copy@ https://www.statsandresearch.com/request-sample/38241-covid-version-global-corn-gluten-market

Key Market Drivers

Animal Feed Industry:

Protein Source: Corn gluten is a rich source of protein and is used as a key ingredient in animal feed, especially for poultry and livestock. Its high protein content makes it a cost-effective substitute for other protein sources such as soybean meal.

Growing Demand for Meat and Poultry Products: The rising global demand for meat, dairy, and poultry products has fueled the need for corn gluten in animal feed formulations.

Increasing Use in Food Products:

Food Ingredients: Corn gluten is used in food processing as a natural binder, stabilizer, and emulsifier. It is used in the production of snack foods, processed meat, bakery products, and even gluten-free products, where it acts as a source of protein.

Rising Demand for Gluten-Free Products: As consumers increasingly seek gluten-free food options, corn gluten can serve as a source of protein in these products, boosting its market.

Use in Biocontrol:

Natural Herbicide: Corn gluten meal, a byproduct of corn gluten, is widely used as an organic herbicide. It prevents the germination of weed seeds, making it a popular choice in organic farming and residential gardening.

Sustainability Trends: The growing preference for sustainable and environmentally friendly agricultural practices is driving demand for natural herbicides, including corn gluten meal.

Sustainability and Byproduct Utilization:

The use of corn gluten as a byproduct of corn milling has a strong sustainability angle, as it reduces waste from the corn processing industry and finds multiple applications, contributing to a circular economy model.

Browse Full Report@ https://www.statsandresearch.com/report/38241-covid-version-global-corn-gluten-market/

Key Players in the Corn Gluten Market

Cargill, Inc.

Archer Daniels Midland (ADM) Company

Ingredion Incorporated

Tate & Lyle PLC

Bunge Limited

Roquette Frères

Huvepharma

Grain Processing Corporation

Key Trends in the Corn Gluten Market

Rising Popularity of Plant-Based and Sustainable Diets:

With the increase in plant-based diets, corn gluten's role as a sustainable, plant-derived protein source is gaining importance. It is being used more in food products like meat alternatives and protein bars, which align with health-conscious and environmentally aware consumer preferences.

Natural and Clean Label Movement:

Consumers are increasingly seeking natural ingredients with clean labels. Corn gluten, being a natural byproduct of corn, aligns with the clean label trend in the food industry, particularly for its use in plant-based, gluten-free, and non-GMO food products.

Technological Advancements in Corn Processing:

Advances in processing technology are improving the quality and efficiency of corn gluten production. These innovations also expand the range of its applications in various industries, particularly in animal feed, food ingredients, and biocontrol products.

Adoption of Organic and Sustainable Agriculture:

The growing adoption of organic farming practices is boosting demand for corn gluten meal as an organic herbicide, which does not harm beneficial insects or pollute the environment. This trend supports the shift towards sustainable agriculture.

Diversified Applications Beyond Animal Feed:

Corn gluten is being used in a wider range of industrial and agricultural applications, such as biofuels, bioplastics, and pharmaceuticals. The growth in these alternative uses is contributing to the overall market expansion.

Regional Analysis

North America:

United States: North America, particularly the U.S., dominates the global corn gluten market due to the country’s massive corn production, which makes corn gluten a readily available byproduct. The U.S. is a major producer of corn, and the market for corn gluten is bolstered by its widespread use in animal feed, food products, and as a natural herbicide.

Growth Drivers: The demand for corn gluten is supported by the strong animal agriculture sector, as well as the growing trend of plant-based food products and gluten-free diets.

Europe:

Europe is a significant market for corn gluten, with rising demand in animal feed, food products, and biocontrol applications. The market is influenced by stringent regulations on pesticide use, which boosts demand for natural herbicides like corn gluten meal.

Trends: Europe is increasingly adopting sustainable and organic farming practices, which is encouraging the use of corn gluten meal as an organic herbicide and natural feed ingredient. The popularity of gluten-free foods in countries such as the UK and Germany is also contributing to the demand for corn gluten.

Asia-Pacific:

China and India: The Asia-Pacific region is witnessing rapid growth in the corn gluten market, driven by the increasing demand for animal feed as the region’s livestock and poultry industries expand. Additionally, the increasing consumption of processed foods, including gluten-free products, is propelling the market.

Growth Drivers: The growth in urbanization, rising disposable incomes, and changing dietary habits in countries like China and India are key factors driving the demand for corn gluten. The region is also adopting sustainable agricultural practices, further boosting demand for corn gluten meal as a natural herbicide.

Latin America:

Latin America is a key market for corn gluten, especially in countries like Brazil and Argentina, which are major corn producers. The market growth is driven by the use of corn gluten in animal feed, as well as increasing demand in food products and biocontrol.

Trends: Latin America is seeing growth in sustainable agriculture, with organic and eco-friendly farming practices encouraging the use of corn gluten meal in organic farming and as a biocontrol agent.

Middle East & Africa:

The Middle East & Africa region is a smaller market compared to others, but it is witnessing growth due to increasing demand for animal feed and organic farming solutions. The growing interest in gluten-free products also supports the market for corn gluten in food products.

Trends: The Middle East is increasingly adopting plant-based diets, which is driving the demand for plant-derived ingredients like corn gluten. In Africa, corn is a staple crop, and the use of corn gluten in animal feed is growing in tandem with the increasing demand for livestock products.

Enquire Before Buying@ https://www.statsandresearch.com/enquire-before/38241-covid-version-global-corn-gluten-market

0 notes

Text

0 notes

Text

The global tofu market is experiencing significant growth, driven by increasing consumer demand for plant-based protein alternatives. Tofu, derived from soybeans, is celebrated for its high protein content, versatility, and health benefits, making it a popular choice among health-conscious consumers and those seeking sustainable food options. The rising prevalence of vegan and vegetarian diets, coupled with awareness about environmental sustainability, is further fueling the market's expansion. Innovations in tofu production, including flavored and fortified varieties, are broadening its appeal. Additionally, its use in diverse cuisines worldwide positions tofu as a key player in the evolving plant-based food industry.

0 notes

Text

Epoxidized Soybean Oil Market Size, Share, Trends, Demand, Industry Growth and Competitive Outlook

A Qualitative Research Study accomplished by Data Bridge Market research's database of 350 pages, titled as Global Epoxidized Soybean Oil Market with 100+ market data Tables, Pie Charts, Graphs & Figures spread through Pages and easy to understand detailed analysis.

Epoxidized Soybean Oil market report has been generated by considering a common theme throughout the marketing industry that suggests strategy and research need stronger alignment. This market study also analyzes the market status, market share, growth rate, future trends, market drivers, opportunities, challenges, risks, entry barriers, sales channels, distributors and Porter's Five Forces Analysis. The information and flow of this report can be employed by marketers from all walks of life to convert complex market research information into manageable, actionable marketing insights. Epoxidized Soybean Oil is the most promising market research report which has been structured in the way anticipated.

Access Full 350 Pages PDF Report @

Data Bridge Market Research analyses that the expoxidized soybean oil market will witness a CAGR of 6.50% for the forecast period of 2022-2029. Growth in the expoxidized soybean oil especially in the developing economies such as India and China, growing use of expoxidized soybean oil for a wide range of end user applications such as food and beverages, agriculture, healthcare and pharmaceuticals, and other applications, increasing investment by the government for research and development activities and surge in industrialization especially in the developing countries are the major factors attributable to the growth of the expoxidized soybean oil market.

The Epoxidized Soybean Oil Market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance.

Major Points Covered in TOC:

Epoxidized Soybean Oil Market Overview: It incorporates six sections, research scope, significant makers covered, market fragments by type, Epoxidized Soybean Oil Market portions by application, study goals, and years considered.

Epoxidized Soybean Oil Market Landscape: Here, the opposition in the Worldwide Epoxidized Soybean Oil Market is dissected, by value, income, deals, and piece of the pie by organization, market rate, cutthroat circumstances Landscape, and most recent patterns, consolidation, development, obtaining, and portions of the overall industry of top organizations.

Epoxidized Soybean Oil Profiles of Manufacturers: Here, driving players of the worldwide Epoxidized Soybean Oil Market are considered dependent on deals region, key items, net edge, income, cost, and creation.

Epoxidized Soybean Oil Market Status and Outlook by Region: In this segment, the report examines about net edge, deals, income, creation, portion of the overall industry, CAGR, and market size by locale. Here, the worldwide Epoxidized Soybean Oil Market is profoundly examined based on areas and nations like North America, Europe, China, India, Japan, and the MEA.

Epoxidized Soybean Oil Application or End User: This segment of the exploration study shows how extraordinary end-client/application sections add to the worldwide Epoxidized Soybean Oil Market.

Epoxidized Soybean Oil Market Forecast: Production Side: In this piece of the report, the creators have zeroed in on creation and creation esteem conjecture, key makers gauge, and creation and creation esteem estimate by type.

Keyword: Research Findings and Conclusion: This is one of the last segments of the report where the discoveries of the investigators and the finish of the exploration study are given.

The Report Can Answer the Following Questions:

Who are the global key players of Epoxidized Soybean Oil industry? How are their operating situation (capacity, production, price, cost, gross and revenue)?

What are the types and applications of Epoxidized Soybean Oil? What is the market share of each type and application?

What are the upstream raw materials and manufacturing equipment of Epoxidized Soybean Oil? What is the manufacturing process of Epoxidized Soybean Oil?

Economic impact on Epoxidized Soybean Oil industry and development trend of Epoxidized Soybean Oil industry.

What are the key factors driving the global Epoxidized Soybean Oil industry?

What are the key market trends impacting the growth of the Epoxidized Soybean Oil market?

What are the Epoxidized Soybean Oil market challenges to market growth?

What are the Epoxidized Soybean Oil market opportunities and threats faced by the vendors in the global Epoxidized Soybean Oil market?

Some of the major players operating in the expoxidized soybean oil market report are Dow, DuPont, CHS Inc., Ferro Corporation, Arkrema, Galata Chemicals, Guangzhou Xinjinlong Chemical Additives Co., Ltd., MAKWELL, Harima Chemicals Group, Inc., Hallstar., Shandong Longkou longda Chemical Co., Ltd.., FuJian ZhiShang Biomass Materials Co., Ltd.., DuPont, American Chemical Society, AM Stabilizers Corporation., Chang Chun Group., NAN YA PLASTICS CORPORATION, Hebei Jingu Plasticizer Co., Ltd., Akzo Nobel N.V., and Axalta Coating Systems LLC among others.

Browse Trending Reports:

Extrusion Coating Market

Sulfur Hexafluoride Sf6 Market

Epoxidized Soybean Oil Market

Polyimide Film Market

Self Cleaning Glass Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email: [email protected]

#Epoxidized Soybean Oil Market Size#Share#Trends#Demand#Industry Growth and Competitive Outlook#market trends#market analysis#market size#marketresearch#market share#markettrends#market report#market research

0 notes

Text

0 notes

Text

https://www.intellectualmarketinsights.com/report/soybean-derivatives-market-size-and-share-analysis/imi-008110

0 notes

Text

Isoflavones Market Segmented On The Basis Of Sources, Application, Region And Forecast: Grand View Research Inc.

San Francisco, 19 December 2024: The Report Isoflavones Market Size, Share & Trends Analysis Report By Sources (Soybeans), By Application (Food & Beverages, Nutraceutical, Cosmetics), By Region, And Segment Forecasts, 2018 – 2025 The global isoflavones market size is expected to reach USD 50.06 billion by 2025, according to a new report by Grand View Research, Inc. The significant rise in the…

View On WordPress

0 notes

Text

Growth and Outlook of the Fertilizer Market in Argentina: Trends, Challenges, and Forecast (2024-2032)

Argentina Fertilizer Market: Analysis and Growth Forecast (2024-2032)

In 2023, Argentina’s fertilizer market reached a volume of approximately 2.57 million tons, positioning itself as a key player in the global fertilizer sector. With a strong agricultural foundation, Argentina’s fertilizer industry plays an essential role in meeting the demand for agricultural productivity, particularly in key crops such as soybeans, corn, and wheat.

The fertilizer market in Argentina is expected to grow steadily during the forecast period from 2024 to 2032, with a projected compound annual growth rate (CAGR) of 2.80%. This growth trajectory is driven by several key factors, including increased agricultural output, a rising population that demands more food production, and the ongoing development of sustainable farming practices.

Factors Driving Growth

Agricultural Expansion and Crop Demand Argentina is one of the largest agricultural producers in the world, and its agricultural sector is continuously evolving. The demand for fertilizers is closely linked to the cultivation of key crops like soybeans, maize, and wheat, which are vital for both domestic consumption and export. Fertilizer use is integral to boosting crop yields and ensuring the continued success of the agricultural industry. As the demand for food and biofuels rises globally, so does the need for fertilizers to maintain and improve crop production.

Rising Adoption of Precision Agriculture Technological advances, such as precision farming, are becoming more popular in Argentina. This includes the use of advanced machinery, sensors, and data analytics to optimize fertilizer application. With precision agriculture, farmers can enhance productivity and reduce waste, further driving the demand for high-quality fertilizers. These innovations allow for more targeted and efficient use of fertilizers, contributing to both economic and environmental sustainability.

Export Demand Argentina is a leading exporter of agricultural products, and fertilizers are critical to maintaining the competitiveness of the country’s farming sector. Fertilizer demand is expected to remain strong due to export-oriented agricultural practices, especially for soybeans and cereals. As global food demand continues to rise, Argentina is expected to increase its export volume, further stimulating fertilizer usage.

Sustainability Trends In response to environmental concerns, Argentina is seeing a gradual shift toward sustainable farming practices. The use of bio-based fertilizers, organic amendments, and innovative solutions like slow-release fertilizers is gaining momentum. As environmental regulations become more stringent, and as consumer preferences lean toward eco-friendly agricultural products, the fertilizer market in Argentina is adapting to meet these challenges.

Government Support and Policy Initiatives The Argentine government has also shown support for the agricultural sector by providing incentives for the use of fertilizers and soil amendments. Initiatives aimed at enhancing soil fertility and improving agricultural sustainability will likely contribute to market growth. The government’s role in providing subsidies and promoting agricultural research further facilitates this development.

Market Segmentation

The Argentina fertilizer market is segmented into various categories based on the type of fertilizer, application methods, and crop types.

Fertilizer Types:

Nitrogen Fertilizers: The largest segment in the Argentine market, nitrogen fertilizers are primarily used to enhance crop yields by providing essential nutrients for plant growth.

Phosphatic Fertilizers: Phosphorous is critical for root development, and as such, phosphatic fertilizers are widely used for crops like wheat and corn.

Potash Fertilizers: Potash helps in the development of strong plant structures and is important for high-value crops.

Micronutrient Fertilizers: These fertilizers contain essential trace elements and are becoming increasingly important as farmers aim to optimize crop nutrition.

Application Methods:

Foliar Application: Increasing in popularity for delivering nutrients directly to plants through leaves.

Soil Application: The traditional method, where fertilizers are applied to the soil to supply nutrients.

Fertigation: Fertilizer is mixed with irrigation water and delivered to crops efficiently.

Crop Types:

Cereals & Grains: Corn, wheat, and barley are significant contributors to the fertilizer market in Argentina.

Oilseeds: Soybeans, the largest oilseed crop in Argentina, drives much of the fertilizer demand.

Fruits & Vegetables: Growing demand for diversified agricultural production leads to increased fertilizer usage in fruit and vegetable farming.

Challenges Facing the Fertilizer Market

Despite the positive growth prospects, the fertilizer market in Argentina faces some challenges. These include:

Price Volatility: Fertilizer prices are often influenced by global supply and demand, as well as geopolitical events. Price volatility can make it difficult for farmers to plan their budgets and for the industry to maintain stable growth.

Environmental Concerns: Excessive use of chemical fertilizers can lead to soil degradation and water contamination. There is a growing emphasis on promoting sustainable and environmentally friendly farming practices, which may increase the demand for more expensive, eco-friendly fertilizers.

Logistics and Supply Chain Issues: The transportation and distribution of fertilizers in Argentina can sometimes be a challenge, particularly in rural areas. The country's infrastructure and logistics capabilities must be improved to keep up with the growing demand for fertilizers.

Market Forecast (2024-2032)

Over the forecast period from 2024 to 2032, the Argentina fertilizer market is expected to grow at a CAGR of 2.80%. This growth is supported by the continued demand for agricultural production, technological advancements in fertilizer application, and the shift toward sustainable farming practices. By 2032, the market is projected to reach a volume of approximately 3.31 million tons.

The demand for fertilizers will likely increase as Argentina seeks to maintain and enhance its agricultural output in the face of a growing global population and changing environmental conditions. Furthermore, the adoption of new farming technologies and the continued focus on export growth will play a crucial role in sustaining the market’s positive trajectory.

0 notes

Text

North America Copra Cake Market: Key Trends and Market Share Analysis

Copra Cake Market Insights:

Copra cake, also known as copra meal, is the solid byproduct obtained after the extraction of oil from dried Coconut Meat (copra) Market. It is a high-protein, fibrous material commonly used in animal feed, especially in the livestock and aquaculture industries. Copra cake has a growing global market due to its cost-effectiveness and its nutritional value for feeding animals. It is primarily produced in tropical countries where coconuts are grown in abundance, such as the Philippines, Indonesia, India, and Sri Lanka.

Get a Free Sample Copy@ https://www.statsandresearch.com/request-sample/38157-covid-version-global-copra-cake-market

Market Overview

The copra cake market is expanding due to its increasing demand in animal feed, especially in emerging markets where livestock and aquaculture industries are booming. The global shift towards sustainable agricultural practices and natural feed ingredients is also contributing to the growth of the market. Copra cake is seen as a sustainable and low-cost alternative to other protein-rich ingredients used in animal feed, such as soybean meal and fish meal.

Key industries driving the copra cake market include:

Animal Feed Industry (Livestock & Poultry): Copra cake is widely used as a high-protein ingredient in feed for cattle, poultry, and pigs. Its fiber and fat content also make it a valuable feed additive.

Aquaculture Industry: With increasing demand for seafood and the growth of fish and shrimp farming, copra cake is used in the formulation of aquafeed due to its affordability and nutrient profile.

Fertilizer Industry: Due to its organic nature, copra cake is sometimes used as a natural fertilizer in agricultural practices, especially in coconut-growing regions.

Key Drivers of Market Growth

Rising Demand for Animal Products: The increasing global demand for animal products such as meat, dairy, and eggs is fueling the growth of the animal feed industry, which in turn is driving the demand for copra cake.

Growth of the Coconut Oil Industry: As the coconut oil industry expands globally, especially in health-conscious markets, the production of copra increases, thus increasing the supply of copra cake. This also contributes to the affordability of copra cake as a byproduct.

Cost-Effective Feed Ingredient: Copra cake is often more affordable compared to other protein sources like soybean meal and fishmeal, making it an attractive option for animal feed manufacturers, particularly in developing countries.

Sustainability and Waste Reduction: Copra cake is an important part of the circular economy, as it is a byproduct of coconut oil extraction. Its use reduces waste and contributes to more sustainable farming and production practices.

Increasing Adoption in Organic Feed: The growing demand for organic and natural feed ingredients is leading to the increased use of copra cake, particularly in organic livestock and aquaculture farms.

Get Browse Report@ https://www.statsandresearch.com/report/38157-covid-version-global-copra-cake-market

Key Trends in the Copra Cake Market

Expansion in Aquaculture Feed: The rapid growth of the aquaculture industry, driven by rising seafood consumption, is leading to greater adoption of copra cake in fish and shrimp feed formulations. Its high protein content and low cost make it a viable option for aquaculture feed manufacturers.

Rising Interest in Organic and Natural Animal Feed: With increasing demand for organic livestock products, there is a rising interest in using natural byproducts like copra cake in animal feed. The clean-label trend, which emphasizes natural ingredients, is also driving this shift.

Sustainability in Agricultural Practices: As environmental concerns grow, more farms and industries are adopting sustainable agricultural practices, which include using byproducts like copra cake to reduce waste and improve the sustainability of food production.

Technological Advancements in Copra Processing: Innovations in copra processing, particularly in oil extraction methods, are improving the efficiency of copra cake production. This is helping to increase its availability and reduce costs.

Diversification in Copra Cake Applications: While copra cake has traditionally been used in animal feed, there is a growing trend towards exploring its use in other sectors, including organic fertilizer, biofuels, and even human consumption in some markets, although this remains limited.

Key Players in the Copra Cake Market

Cargill, Inc.

Olam International

ADM (Archer Daniels Midland) Company

Tropix International

Kagoshima Feed Mill

The United Coconut Associations of the Philippines, Inc. (UCAP)

Regional Analysis

Asia-Pacific:

Largest Producer and Consumer: The Asia-Pacific region is the largest producer and consumer of copra cake. Countries like the Philippines, Indonesia, India, and Sri Lanka are key producers of copra, with the Philippines being the world’s largest exporter of copra and copra cake.

Growing Livestock and Aquaculture Industries: Asia’s expanding population and rising demand for animal protein are driving the growth of the livestock and aquaculture industries. As a result, the demand for cost-effective and protein-rich feed like copra cake is increasing in the region.

Sustainable Feed Practices: The rising interest in sustainable farming and organic feed in countries like India and Vietnam is also contributing to the market growth of copra cake.

North America:

United States and Canada: In North America, copra cake is mainly imported from coconut-producing regions for use in the animal feed industry. The United States, with its large livestock and poultry sectors, is one of the largest importers of copra cake, especially for use in animal feed.

Growing Aquaculture Sector: The increasing demand for sustainable feed ingredients in the U.S. aquaculture industry is driving the use of copra cake in fish and shrimp feed.

Focus on Sustainable and Organic Feed: As the U.S. and Canada move toward more sustainable and organic farming practices, there is growing interest in using natural byproducts like copra cake in livestock feed.

Europe:

Germany, France, and the UK: Europe is seeing an increasing demand for copra cake, driven by the growing livestock and poultry industries, as well as rising interest in sustainable and organic farming practices. Countries like Germany and France are major consumers of copra cake in animal feed.

Organic and Natural Feed Demand: The demand for organic livestock products is pushing the use of copra cake in organic feed. Europe’s commitment to sustainability is also fueling the growth of natural feed ingredients like copra cake.

Aquaculture Growth: European countries with significant aquaculture industries, such as Norway and Spain, are seeing increased use of copra cake in aquafeeds.

Latin America:

Brazil and Mexico: Latin America, particularly Brazil and Mexico, is seeing a rise in demand for copra cake as a protein-rich feed ingredient. Brazil’s expanding poultry and livestock industries are major consumers of copra cake in animal feed.

Increasing Adoption in Aquaculture: As the demand for seafood rises in the region, there is growing interest in using copra cake in the aquaculture feed industry.

Middle East & Africa:

Growing Demand for Animal Feed: In regions like the Middle East and Africa, there is increasing demand for animal feed as the livestock and poultry industries expand. Copra cake is a cost-effective alternative to more expensive protein sources, making it attractive for these regions.

Focus on Sustainability: With growing environmental awareness, Middle Eastern and African countries are turning to more sustainable feed ingredients like copra cake to reduce feed costs and environmental impact.

Enquire Before Buying@ https://www.statsandresearch.com/enquire-before/38157-covid-version-global-copra-cake-market

0 notes