#Sourcing UK Property Investments

Explore tagged Tumblr posts

Text

Property deals sourcing investments company UK | NPP group

Northern property partners Leading property sourcing company in the UK. Our Specialists in sourcing profitable property deals. Call us 0113 372 0770

#Property sourcing companies#Property Sourcing UK#Sourcing property deals#company#deal sourcing property#sourcing investments#property sourcing company

0 notes

Note

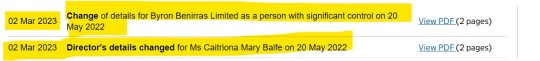

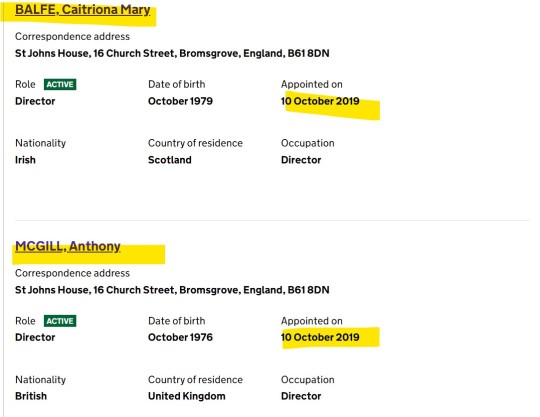

So now Tony is listed as director at all of Cait‘s companies. What do you think about that?

Dear So Now Anon,

What a coincidence (not!) I just answered a very similar Anon sent to @bat-cat-reader, which I suppose is clear enough.

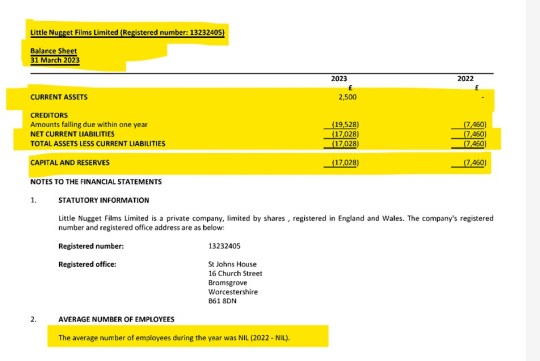

But to make it even clearer (if at all possible) and keeping in mind what I wrote in that post about Persons of Significant Control, let's check a couple of things, shall we? For all the three other companies C owns.

They probably split 50/50 already, which would explain the rather vague 'has significant influence or control'. Why?

Here is why:

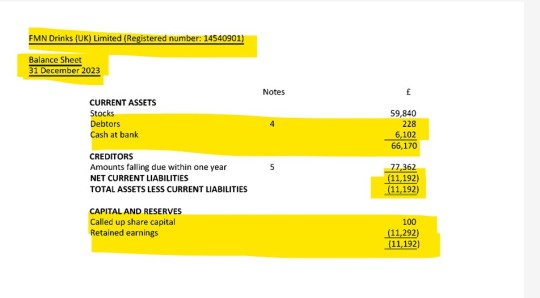

The currently available Balance Sheet, covering the period until 31 December 2023 shows there is not much in there. Barely 100 shares (1£/share), about 59K £ assets and 11 K £ of debts. May I remind you a balance sheet covers the company's assets (available funds, including incoming funds), liabilities (debts) and shareholder equity (the company's net worth, which is roughly the result of subtracting liabilities from assets and dividing them by the number of shareholders). The net worth serves to describe what each and every one of those shareholders are entitled to, should the company be liquidated and all its debts paid off. In this case, the retained earnings, which is the figure quoted between brackets (11.292 £) means the company is in debt/in the red.

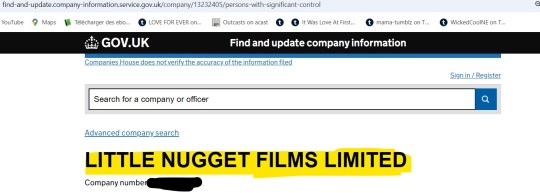

Now, this is very interesting, Anon. Albeit The Happy Couple ™ are now both appointed officers in this company (and T has been so since October 1st 2024), this company's designated PSC is ... Byron Benirras. And who is Byron Benirras' own designated sole PSC? A certain Caitriona Mary B. That is normal - serious 💷💷is indirectly involved, this time, as we know the bulk of her assets is placed there. Therefore, C has full control and sole ownership of Little Nugget Films, too, via Byron Benirras. Remember (ROFLMAO): a legal person (i.e. a company, in this context) has the same rights and the same obligations/duties as the natural (meaning 'real') person behind it (C).

Let's have a look at financials:

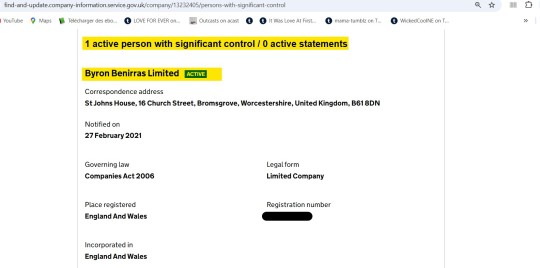

On 31.03.2023, the company's assets were about 2.500 £ only and its liabilities around 17K£. In debt/in the red, too. But a clear will to remain in firm control of things from C's side.

This appears to be a totally, carefully planned move, too - future plans, perhaps?

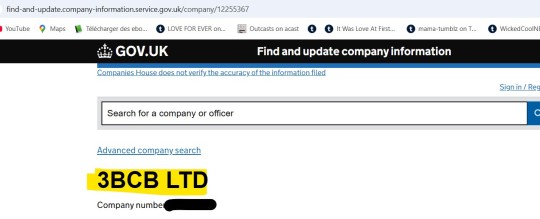

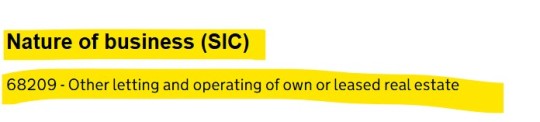

This company has not two, but three appointed officers, one of which is another specialized service company (perfectly legal, in the UK), in charge of all the secretarial work (perfectly legal, too):

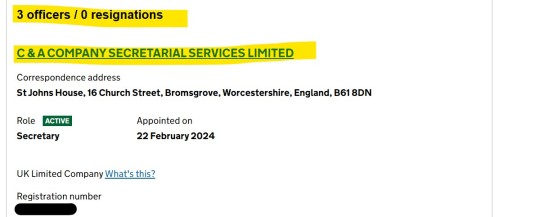

Not one, but two PSCs. Same mechanism as for FMN Drinks UK (see above):

Such a nice, tidy, even split. Why? Heh, indeed: why? Unless...

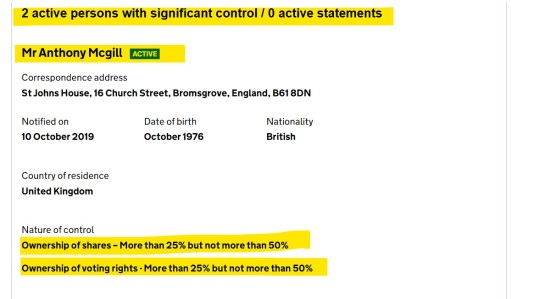

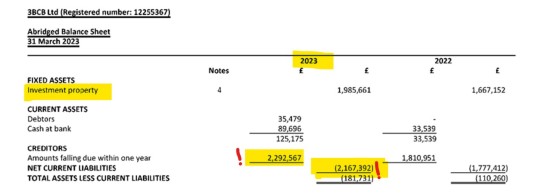

Let's have a look at the company's balance sheet on 31 March 2023:

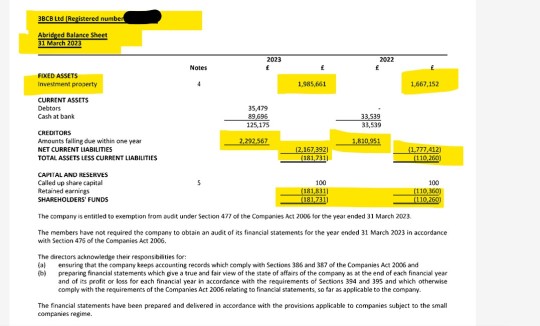

Unless you do acquire real estate using your own funds (a very easy cross check with another one of C's companies reveals the exclusive provenance of those funds - sssh!), no mortgage and no bank loan needed. Property that is legally defined as investment property, which means it cannot legally be a home, nor taxed as such:

[Source: https://prosperity-wealth.co.uk/news/before-you-buy-investment-property/]

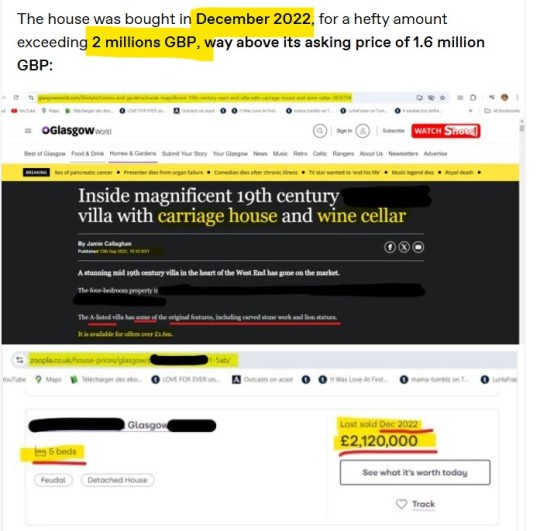

Now remind me what real estate might have been bought anytime between 31 March 2022 and 31 March 2023 and valued at about 2.120.000 £?

You'd probably be correct to guess this one:

[ For a complete tour of the GLA Taj Mahal's legal intricacies: https://www.tumblr.com/sgiandubh/764266729372368897/anon-rebelde-detecto-un-nerviosismo-muy-revelador?source=share]

Let's have a second look and, surely enough...

Some simple maths?

2.292.567 (amounts falling due within one year, which covers the 31.03.2022 -31.03.2023 period) - 2.167.392 (net current liabilities) = 125.175 £ (cash at bank). Roger that. I think there is also a second investment property, bought before 31 March 2022 for 1.6 million pounds and shown as such (valued at cost first, then at its fair value, which is evaluated at 1.9 million pounds, in 2023 - a nice appreciation of the initial investment).

I hope this answers your question, Anon. And given the very long and very emotional day that ended (whew, already?) about four hours ago, I hope I didn't miss something or make any gross mistake. You know how some other Anons can be, don't you?

77 notes

·

View notes

Text

B.7.1 But do classes actually exist?

So do classes actually exist, or are anarchists making them up? The fact that we even need to consider this question points to the pervasive propaganda efforts by the ruling class to suppress class consciousness, which will be discussed further on. First, however, let’s examine some statistics, taking the USA as an example. We have done so because the state has the reputation of being a land of opportunity and capitalism. Moreover, class is seldom talked about there (although its business class is very class conscious). Moreover, when countries have followed the US model of freer capitalism (for example, the UK), a similar explosion of inequality develops along side increased poverty rates and concentration of wealth into fewer and fewer hands.

There are two ways of looking into class, by income and by wealth. Of the two, the distribution of wealth is the most important to understanding the class structure as this represents your assets, what you own rather than what you earn in a year. Given that wealth is the source of income, this represents the impact and power of private property and the class system it represents. After all, while all employed workers have an income (i.e. a wage), their actual wealth usually amounts to their personal items and their house (if they are lucky). As such, their wealth generates little or no income, unlike the owners of resources like companies, land and patents. Unsurprisingly, wealth insulates its holders from personal economic crises, like unemployment and sickness, as well as gives its holders social and political power. It, and its perks, can also be passed down the generations. Equally unsurprisingly, the distribution of wealth is much more unequal than the distribution of income.

At the start of the 1990s, the share of total US income was as follows: one third went to the top 10% of the population, the next 30% gets another third and the bottom 60% gets the last third. Dividing the wealth into thirds, we find that the top 1% owns a third, the next 9% owns a third, and bottom 90% owns the rest. [David Schweickart, After Capitalism, p. 92] Over the 1990s, the inequalities in US society have continued to increase. In 1980, the richest fifth of Americans had incomes about ten times those of the poorest fifth. A decade later, they has twelve times. By 2001, they had incomes over fourteen times greater. [Doug Henwood, After the New Economy, p. 79] Looking at the figures for private family wealth, we find that in 1976 the wealthiest one percent of Americans owned 19% of it, the next 9% owned 30% and the bottom 90% of the population owned 51%. By 1995 the top 1% owned 40%, more than owned by the bottom 92% of the US population combined — the next 9% had 31% while the bottom 90% had only 29% of total (see Edward N. Wolff, Top Heavy: A Study of Increasing Inequality in America for details).

So in terms of wealth ownership, we see a system in which a very small minority own the means of life. In 1992 the richest 1% of households — about 2 million adults — owned 39% of the stock owned by individuals. The top 10%, owned over 81%. In other words, the bottom 90% of the population had a smaller share (23%) of investable capital of all kinds than the richest 1/2% (29%). Stock ownership was even more densely concentrated, with the richest 5% holding 95% of all shares. [Doug Henwood, Wall Street: Class racket] Three years later, “the richest 1% of households … owned 42% of the stock owned by individuals, and 56% of the bonds … the top 10% together owned nearly 90% of both.” Given that around 50% of all corporate stock is owned by households, this means that 1% of the population “owns a quarter of the productive capital and future profits of corporate America; the top 10% nearly half.” [Doug Henwood, Wall Street, pp. 66–7] Unsurprisingly, the Congressional Budget Office estimates that more than half of corporate profits ultimately accrue to the wealthiest 1 percent of taxpayers, while only about 8 percent go to the bottom 60 percent.

Henwood summarises the situation by noting that “the richest tenth of the population has a bit over three-quarters of all the wealth in this society, and the bottom half has almost none — but it has lots of debt.” Most middle-income people have most of their (limited) wealth in their homes and if we look at non-residential wealth we find a “very, very concentrated” situation. The “bottom half of the population claimed about 20% of all income in 2001 — but only 2% of non-residential wealth. The richest 5% of the population claimed about 23% of income, a bit more than the entire bottom half. But it owned almost two-thirds — 65% — of the wealth.” [After the New Economy, p. 122]

In terms of income, the period since 1970 has also been marked by increasing inequalities and concentration:

“According to estimates by the economists Thomas Piketty and Emmanuel Saez — confirmed by data from the Congressional Budget Office — between 1973 and 2000 the average real income of the bottom 90 percent of American taxpayers actually fell by 7 percent. Meanwhile, the income of the top 1 percent rose by 148 percent, the income of the top 0.1 percent rose by 343 percent and the income of the top 0.01 percent rose 599 percent.” [Paul Krugman, “The Death of Horatio Alger”, The Nation, January 5, 2004]

Doug Henwood provides some more details on income [Op. Cit., p. 90]:

Changes in income, 1977–1999 real income growth 1977–99

Share of total income

1977

1999

Change

poorest 20%

-9%

5.7%

4.2%

-1.5%

second 20%

+1

11.5

9.7

-1.8

middle 20%

+8

16.4

14.7

-1.7

fourth 20%

+14

22.8

21.3

-1.5

top 20%

+43

44.2

50.4

+6.2

top 1%

+115

7.3

12.9

+5.6

By far the biggest gainers from the wealth concentration since the 1980s have been the super-rich. The closer you get to the top, the bigger the gains. In other words, it is not simply that the top 20 percent of families have had bigger percentage gains than the rest. Rather, the top 5 percent have done better than the next 15, the top 1 percent better than the next 4 per cent, and so on.

As such, if someone argues that while the share of national income going to the top 10 percent of earners has increased that it does not matter because anyone with an income over $81,000 is in that top 10 percent they are missing the point. The lower end of the top ten per cent were not the big winners over the last 30 years. Most of the gains in the share in that top ten percent went to the top 1 percent (who earn at least $230,000). Of these gains, 60 percent went to the top 0.1 percent (who earn more than $790,000). And of these gains, almost half went to the top 0.01 percent (a mere 13,000 people who had an income of at least $3.6 million and an average income of $17 million). [Paul Krugman, “For Richer”, New York Times, 20/10/02]

All this proves that classes do in fact exist, with wealth and power concentrating at the top of society, in the hands of the few.

To put this inequality of income into some perspective, the average full-time Wal-Mart employee was paid only about $17,000 a year in 2004. Benefits are few, with less than half the company’s workers covered by its health care plan. In the same year Wal-Mart’s chief executive, Scott Lee Jr., was paid $17.5 million. In other words, every two weeks he was paid about as much as his average employee would earn after a lifetime working for him.

Since the 1970s, most Americans have had only modest salary increases (if that). The average annual salary in America, expressed in 1998 dollars (i.e., adjusted for inflation) went from $32,522 in 1970 to $35,864 in 1999. That is a mere 10 percent increase over nearly 30 years. Over the same period, however, according to Fortune magazine, the average real annual compensation of the top 100 C.E.O.‘s went from $1.3 million — 39 times the pay of an average worker — to $37.5 million, more than 1,000 times the pay of ordinary workers.

Yet even here, we are likely to miss the real picture. The average salary is misleading as this does not reflect the distribution of wealth. For example, in the UK in the early 1990s, two-thirds of workers earned the average wage or below and only a third above. To talk about the “average” income, therefore, is to disguise remarkable variation. In the US, adjusting for inflation, average family income — total income divided by the number of families — grew 28% between 1979 and 1997. The median family income — the income of a family in the middle (i.e. the income where half of families earn more and half less) grew by only 10%. The median is a better indicator of how typical American families are doing as the distribution of income is so top heavy in the USA (i.e. the average income is considerably higher than the median). It should also be noted that the incomes of the bottom fifth of families actually fell slightly. In other words, the benefits of economic growth over nearly two decades have not trickled down to ordinary families. Median family income has risen only about 0.5% per year. Even worse, “just about all of that increase was due to wives working longer hours, with little or no gain in real wages.” [Paul Krugman, “For Richer”, Op. Cit.]

So if America does have higher average or per capita income than other advanced countries, it is simply because the rich are richer. This means that a high average income level can be misleading if a large amount of national income is concentrated in relatively few hands. This means that large numbers of Americans are worse off economically than their counterparts in other advanced countries. Thus Europeans have, in general, shorter working weeks and longer holidays than Americans. They may have a lower average income than the United States but they do not have the same inequalities. This means that the median European family has a standard of living roughly comparable with that of the median U.S. family — wages may even be higher.

As Doug Henwood notes, ”[i]nternational measures put the United States in a disgraceful light… The soundbite version of the LIS [Luxembourg Income Study] data is this: for a country th[at] rich, [it] ha[s] a lot of poor people.” Henwood looked at both relative and absolute measures of income and poverty using the cross-border comparisons of income distribution provided by the LIS and discovered that ”[f]or a country that thinks itself universally middle class [i.e. middle income], the United States has the second-smallest middle class of the nineteen countries for which good LIS data exists.” Only Russia, a country in near-total collapse was worse (40.9% of the population were middle income compared to 46.2% in the USA. Households were classed as poor if their incomes were under 50 percent of the national medium; near-poor, between 50 and 62.5 percent; middle, between 62.5 and 150 percent; and well-to-do, over 150 percent. The USA rates for poor (19.1%), near-poor (8.1%) and middle (46.2%) were worse than European countries like Germany (11.1%, 6.5% and 64%), France (13%, 7.2% and 60.4%) and Belgium (5.5%, 8.0% and 72.4%) as well as Canada (11.6%, 8.2% and 60%) and Australia (14.8%, 10% and 52.5%).

The reasons for this? Henwood states that the “reasons are clear — weak unions and a weak welfare state. The social-democratic states — the ones that interfere most with market incomes — have the largest [middles classes]. The US poverty rate is nearly twice the average of the other eighteen.” Needless to say, “middle class” as defined by income is a very blunt term (as Henwood states). It says nothing about property ownership or social power, for example, but income is often taken in the capitalist press as the defining aspect of “class” and so is useful to analyse in order to refute the claims that the free-market promotes general well-being (i.e. a larger “middle class”). That the most free-market nation has the worse poverty rates and the smallest “middle class” indicates well the anarchist claim that capitalism, left to its own devices, will benefit the strong (the ruling class) over the weak (the working class) via “free exchanges” on the “free” market (as we argue in section C.7, only during periods of full employment — and/or wide scale working class solidarity and militancy — does the balance of forces change in favour of working class people. Little wonder, then, that periods of full employment also see falling inequality — see James K. Galbraith’s Created Unequal for more details on the correlation of unemployment and inequality).

Of course, it could be objected that this relative measure of poverty and income ignores the fact that US incomes are among the highest in the world, meaning that the US poor may be pretty well off by foreign standards. Henwood refutes this claim, noting that “even on absolute measures, the US performance is embarrassing. LIS researcher Lane Kenworthy estimated poverty rates for fifteen countries using the US poverty line as the benchmark… Though the United States has the highest average income, it’s far from having the lowest poverty rate.” Only Italy, Britain and Australia had higher levels of absolute poverty (and Australia exceeded the US value by 0.2%, 11.9% compared to 11.7%). Thus, in both absolute and relative terms, the USA compares badly with European countries. [Doug Henwood, “Booming, Borrowing, and Consuming: The US Economy in 1999”, pp.120–33, Monthly Review, vol. 51, no. 3, pp. 129–31]

In summary, therefore, taking the USA as being the most capitalist nation in the developed world, we discover a class system in which a very small minority own the bulk of the means of life and get most of the income. Compared to other Western countries, the class inequalities are greater and the society is more polarised. Moreover, over the last 20–30 years those inequalities have increased spectacularly. The ruling elite have become richer and wealth has flooded upwards rather than trickled down.

The cause of the increase in wealth and income polarisation is not hard to find. It is due to the increased economic and political power of the capitalist class and the weakened position of working class people. As anarchists have long argued, any “free contract” between the powerful and the powerless will benefit the former far more than the latter. This means that if the working class’s economic and social power is weakened then we will be in a bad position to retain a given share of the wealth we produce but is owned by our bosses and accumulates in the hands of the few.

Unsurprisingly, therefore, there has been an increase in the share of total income going to capital (i.e., interest, dividends, and rent) and a decrease in the amount going to labour (wages, salaries, and benefits). Moreover, an increasing part of the share to labour is accruing to high-level management (in electronics, for example, top executives used to paid themselves 42 times the average worker in 1991, a mere 5 years later it was 220 times as much).

Since the start of the 1980s, unemployment and globalisation has weakened the economic and social power of the working class. Due to the decline in the unions and general labour militancy, wages at the bottom have stagnated (real pay for most US workers is lower in 2005 than it was in 1973!). This, combined with “trickle-down” economic policies of tax cuts for the wealthy, tax raises for the working classes, the maintaining of a “natural” law of unemployment (which weakens unions and workers power) and cutbacks in social programs, has seriously eroded living standards for all but the upper strata — a process that is clearly leading toward social breakdown, with effects that will be discussed later (see section D.9).

Little wonder Proudhon argued that the law of supply and demand was a “deceitful law … suitable only for assuring the victory of the strong over the weak, of those who own property over those who own nothing.” [quoted by Alan Ritter, The Political Thought of Pierre-Joseph Proudhon, p. 121]

#classism#class consciousness#community building#practical anarchy#practical anarchism#anarchist society#practical#faq#anarchy faq#revolution#anarchism#daily posts#communism#anti capitalist#anti capitalism#late stage capitalism#organization#grassroots#grass roots#anarchists#libraries#leftism#social issues#economy#economics#climate change#climate crisis#climate#ecology#anarchy works

4 notes

·

View notes

Note

Thoughts on the shrinking middle class?

I can only speak for the UK, but here goes:

In the late 20th century western societies abandoned the 'Fordian' style of capitalism - where employers recognised their employees had value and needed to be looked after (appropriate wages, benefits, etc.) - to our current mode. Before, employees were seen as something you had to attract and retain - an investment. Companies focused on the long term, on larger projects, on beating their competitors through value, product quality, what have you.

The point is that when my parents were young, things were a bit easier - still shit, mind you, but better than they are now.

Now? Everything is about annual growth and short term profit increases. So long as your investors see an annual increase on their stock, they don't care how you got there or if it's sustainable. Add in firms whose entire profit model is to acquire brands and organisations, artificially boost their profitability by cutting corners, wages, and staff, before flipping it for a higher return - and you've got a recipe for disaster. We went from a model of capitalism that at least acknowledged the humanity of the worker, to one where you're treated as another replaceable drone, as well as a possible source of revenue. We're now more valuable as inert data points, whose information can be traded back and forth by tegh and advertising companies, than we are as consumers with any shred of agency.

So now your job doesn't pay as well, property rates are being artificially inflated by greedy developers and landlords, and every brand or product you encounter has a similarly inflated price tag because it was recently acquired by a corporation that wants to wring as much profit out of its new property as it can before the end of the financial year.

People are getting fucked coming and going, by an overly bloated upper class, shunting even more people below the middle class wealth cut-off. The country is becoming increasingly orientated to the fulfillment of the needs and priorities of the upper classes at the expense of everyone else.

I remember pointing this out to Haitch a while back, how you had all of these bespoke, expensive shops on a high street where most of the shops were going bust and most of the local population can't afford their products. I realised it's a repeat of the experience of most working class Victorians, staring through a shop window and wondering "Who the fuck is that for? Who can afford it?"

Things might get better, but probably not. Capitalism has gotten pretty adept at teetering on the brink of collapse for extended periods, and with the profits being so high, and the perpetrators of this divide possessing no concept of empathy, compassion, or vulnerability to the consequences of their own actions - there's little to no incentive for them to stop.

Erego:

5 notes

·

View notes

Text

A Middleton Walk Around: Non-Traditional Farming - Middleton Advisors

Keyword - off market property ,property advisors london

With Mr Clarkson becoming the unlikely poster boy for UK Agriculture, his ability to create mass engagement and understanding has been widely welcomed. Whilst he has implemented some diversification (despite the locals) much of his profit still comes from traditional farming operations.

Contrary to this, there has been a demand to modernise established non-traditional farming processes, which have now become the forefront of sustainable agriculture. Spanning back centuries, these methods have faced ebbs and flows of traction but are now being readopted by farmers that are refocused on the environment, ecology, and long-term land management. But, like any industrial period, when methods become ‘vogue’, practices can be rushed, concepts misunderstood and careful planning can be overlooked, resulting in potentially harmful effects. So, it is imperative those looking to invest must seek professional advice before beginning the process.

As part of our Walk Around series, our farming and land expert, Will Langmead discusses these non-traditional farming methods and their potential.

Viticulture

Despite Viticulture arriving in the UK with the Romans, the U.K.’s ability to create top-quality wine has only recently seen a real surge in viability and success. With our south-facing soils for sparkling wines and the general effects of global warming, the UK is becoming a serious contender for wine production across the globe.

Drawbacks

Unsurprisingly, there are plenty of boxes to tick when it comes to viticulture. Historically, only certain soil types have been ideal for wine, although the improvement in rootstocks is enabling a wider variety of land to produce exceptional quality.

A lot of knowledge and expertise goes into a successful vineyard and with the recent movements in immigration, it has become harder to hire highly skilled workers who have previously worked in European vineyards and have gained extensive experience.

Benefits

Previously, wine enthusiasts have turned their noses up to English wine. However, UK sparkling wine is soaring, and its popularity is showing no sign of decline. Langham Wine Estates recently won the International Wine & Spirit Competition Sparkling Wine Producer of the Year, a huge leap forward and proof that the UK is no longer being overlooked.

The warming climate is obviously creating better conditions for growing but also reducing the potential for frost damage.

With the right marketing and knowledge, viticulture can become a very profitable and successful business venture.

Not only does it add value to your land but, viticulture creates real diversification.

Regenerative Agriculture

Regenerative farming is a term used to describe practices that strive to improve the farm’s ecosystem by improving biodiversity, ecology, and soil structure alongside the production of food or fibre. The process of doing this could include reducing the use of pesticides or chemical fertilizers. Predictions show that the push towards a healthier planet will lie less with those reducing their meat consumption but instead with consumers who attempt to source all their food products from as close as possible.

Drawbacks

If the aim is to source all produce locally, then inevitably seasonality will become more relevant and so the variety of food would become more restricted.

From a consumer perspective, regenerative agriculture brings the potential for higher costs for food, which if not differentiated, could deter potential customers.

Though it increases the farm’s productivity in the long run, these results can’t be seen overnight and require complete buy-in from multiple generations.

Benefits

One of regenerative agriculture’s core concepts is improving the soil’s health. There are many benefits to this with reduced erosion and increased fertility to highlight a couple.

Reduces carbon footprint significantly. By reducing the passes of machinery and aiming to increase biodiversity there should be less carbon used and more ability to sequester it through the year.

By improving soil health, the need for harsh chemicals and pesticides can be reduced. Furthermore, regenerative agriculture urges the integration of livestock, which can act as both a fertiliser and pesticide, reducing carbon emissions even more.

Rewilding

Rewilding is a conservation strategy that leaves the land to its natural processes and reintroduces animals, plants and insects that had previously been driven out. This could be to increase biodiversity, carbon capture or even water management. All of these aren’t mutually exclusive and can be interwoven with appropriate planning and objective revaluation.

Drawbacks

There is the potential for large swathes of land to be contributed to rewilding schemes without due care or careful planning. Greater understanding is required along with active management to support the natural ecosystem.

In a similar vein, misuse of rewilding can alienate communities and harm existing biodiversity.

Just ‘closing the gates’ on monoculture will not actively increase wildlife and biodiversity long term. A closed gate will enviably cause a spike in biodiversity but is unlikely to be a long-term solution.

Benefits

If done properly, rewilding can restore ecosystems and improve the yields on commercial food production.

Reduces leaching of manmade agrichemicals thus preserving linked ecosystems.

Large potential for carbon sequestration.

Forestry

Dating back to the beginning of the 20th century, around 90% of all Britain’s timber and forest products were imported (according to Conservation Handbook),This proved hugely problematic when the First World War erupted as enemy action prevented imports from international sources. To combat this, the Forestry Commission dedicated large acreages of land to forest growth. Post WW2, however, food production was at a low rate and there was a resounding demand for Britain to become a self-sufficient nation for all fruit and veg production. The government encouraged landowners to rip up their woodland to replace it with arable land to feed the country. In more recent years, various farmers have shifted their concerns towards helping the environment and in doing so, afforestation has seen a revival.

Drawbacks

By swapping arable land for woodlands, farmers could face reduced profits. Reports show that this method of farming tends to appeal to philanthropists whose main goal is less monetarily driven, but more motivated by greener living.

Service requirement for employment associated with forestry is dramatically reduced in comparison to traditional farming.

Benefits

Alongside the environmental benefits woodland can often create the opportunity for diversification. This could be in the form of open access or even a well-thought-through wellness retreat.

Forests are important for the wildlife’s habitat as it protects various plant, animal and insect species populated there. This not only has a positive impact on biodiversity but also reduces carbon emissions considerably.

For any farming and land management questions, click hereto speak to Will directly.

For more information visit our website: https://middletonadvisors.com/

2 notes

·

View notes

Text

Insiders believe at least half of WH Smith's high street stores may close as part of a cuts drive by a new owner. This has implications for jobs at the embattled retailer, which currently operates 500 high street outlets and employs around 5,000 staff. Analysts believe that any potential buyer would most likely retain no more than 250 stores, indicating a huge downsizing of the chain. Bids for the company are expected to be submitted within the coming weeks, and a deal is anticipated to be finalized by early May. Presently, the firm is in a discussion with would-be investors from private equity firm Hilco to Alteri; it also recently held talks with Modella Capital, which owned Hobbycraft and Doug Putman, who also owned HMV. WH Smith is now emphasizing its travel retail business, its area of fast growth, at international and core UK locations through airports, hospitals, and key train stations. Brian Robert Marshall, CC BY-SA 2.0 https://creativecommons.org/licenses/by-sa/2.0, via Wikimedia Commons Reports suggest that the prospective buyers would go as high as £100 million for the high street division of WH Smith. The sale would involve the Richard & Judy Bookclub brand, around 200 stores with large post office operations, and the rights to distribute Toys R Us products in the UK. The business's profits, excluding its online subsidiary Funky Pigeon, which is not part of the sale, are estimated by retail analyst Jonathan Pritchard from investment bank Peel Hunt to be under £16 million once central costs are factored in. He also warned that the final purchase price may be lower than expected. According to reports, WH Smith assured bidders that central costs were far more digestible than those in Pritchard's analysis. The firm said also that the majority of its stores did not lose money, but one of the world's most respected retail executives believed the new owner would retain less than half the present number. "I don't see how anyone would want to run 500 high street locations. Some of them do really well, but others obviously don't," the executive said. With most of WH Smith's store leases having an average remaining term of less than two years, industry observers believe there is an opportunity for the company to reduce its footprint and focus on a more profitable core of stores. Experts predict that the 200 locations with major post office services are the most likely to be retained, while other underperforming outlets may be phased out. WH Smith has already been restructuring, closing 14 stores in 2024 and announcing 17 more closures this year. According to Jonathan De Mello, a property analyst, the new owner will most probably have to put a restructuring plan in place to be sustainable in the long term."A full restructuring looks inevitable for any buyer," said De Mello.According to another expert, many WH Smith stores were underinvested. "It still has its place on the high street, but that place is getting smaller and smaller. It is profitable, though not enough to be worthwhile, and managing a retail business in this environment is highly difficult. The company was stretched to the limits," explained the expert. And some trade sources think that surplus shops could be sold off in volumes to shops like Marks & Spencer or The Range, allowing WH Smith to reap some value from its downsizing programme.Pritchard argues that if slashing the numbers of high street stores drastically was the way to a stronger business model then WH Smith would have acted much more unambiguously in that direction. "They have managed the asset very well. It's not so much about underinvesting, but the location of these stores are on high streets and footfalls have been declining each year," he added. A retail property expert says if WH Smith significantly reduces its high street presence, then it would be losing brand relevance. And an investor could demand financial incentives to take over the full portfolio of stores. Although there has been no suggestion that WH Smith is looking for such an arrangement, the analyst surmised that the firm may have to provide more protection to ensure the deal saves the majority of its outlets. "If they began to close post offices, the outcry would be phenomenal. The backlash in terms of PR would be extreme," added the analyst. WH Smith has said it will not go ahead with the sale if a strong offer does not emerge. De Mello however thinks the company is unlikely to about-turn at this stage after all the scrutiny and speculation that has surrounded the deal. "Eventually, some of these stores are going to have to close. Better to make the painful decision now than to delay the inevitable," he added. The retailer faces a battle in an increasingly competitive landscape. The retailer faces high street footfall decline and the increasing cost that makes profitability even harder, prompting some industry analysts to compare the company to former retail giants such as Wilko and Woolworths, which struggled to adapt and eventually disappeared from the market. Whether WH Smith restructuring will ensure survival on the high street in the long term cannot be ascertained. Instead, what will surely come true is that enormous changes are destined for the future of the company, and WH Smith's own future will therefore depend on strategies that will begin to be materialized in a couple of months. Read the full article

0 notes

Text

Energy Savings Made Simple: Air Source Heat Pumps in Hampshire

As the demand for sustainable energy solutions grows, air source heat pumps (ASHPs) have gained recognition as one of the most effective and eco-friendly heating options. For homeowners in Hampshire, adopting this cutting-edge technology offers significant energy savings, environmental benefits, and increased comfort. This article explores how air source heat pumps are transforming heating systems across Hampshire, making energy savings simple and accessible for all.

Understanding Air Source Heat Pumps

Air source heat pumps are innovative systems that absorb heat from the air outside and transfer it into your home. Even in colder climates, these pumps work efficiently by utilizing renewable energy sources to generate heat, ensuring lower energy consumption and greater savings.

How Do Air Source Heat Pumps Work?

Heat Absorption: The outdoor unit absorbs heat from the air.

Compression: The absorbed heat is compressed to increase its temperature.

Heat Transfer: The high-temperature heat is transferred to your home’s heating system, such as radiators, underfloor heating, or hot water systems.

Why Hampshire Homeowners Are Choosing Air Source Heat Pumps

1. Substantial Energy Savings

Air source heat pumps are highly efficient, with the ability to generate up to four units of heat for every unit of electricity consumed. This efficiency translates into significantly lower energy bills, making them an attractive option for Hampshire households seeking to reduce their energy expenses.

2. Eco-Friendly Heating

Hampshire residents are increasingly adopting green practices, and ASHPs align perfectly with these goals. By utilizing renewable energy from the air, air source heat pumps produce minimal greenhouse gas emissions, contributing to a cleaner, healthier environment.

3. Compatibility with Government Initiatives

The UK government encourages renewable energy adoption through financial incentives such as the Boiler Upgrade Scheme (BUS) and the Renewable Heat Incentive (RHI). These programs offer grants to offset installation costs, making air source heat pumps an affordable choice for homeowners in Hampshire.

4. Year-Round Comfort

Air source heat pumps are versatile systems capable of providing both heating during colder months and cooling during the summer. Their adaptability ensures consistent comfort for Hampshire’s diverse climate.

The Installation Process: What to Expect

Installing an air source heat pump is straightforward when managed by certified professionals. Understanding the process helps homeowners prepare and ensures a smooth transition.

Step 1: Home Assessment

A professional survey assesses your property to determine the best placement for the outdoor and indoor units. Factors like insulation and heating requirements are considered.

Step 2: System Design

The heat pump system is designed to suit your home's specific heating needs, ensuring optimal efficiency.

Step 3: Installation

The installation process includes setting up the outdoor unit, connecting it to the indoor system, and integrating it with your existing heating infrastructure.

Step 4: Testing and Commissioning

The system undergoes thorough testing to ensure it operates efficiently and meets your household’s heating requirements.

Costs and Long-Term Benefits

Initial Investment

The cost of installing an air source heat pump typically ranges between £7,000 and £15,000. While this may seem like a significant upfront expense, financial incentives and reduced energy bills quickly offset the investment.

Maintenance and Lifespan

Air source heat pumps require minimal maintenance, with simple tasks like cleaning filters and ensuring adequate airflow. With proper care, these systems can last up to 20 years or more, providing long-term savings and reliability.

Overcoming Common Myths About Air Source Heat Pumps

1. Inefficiency in Cold Weather

Modern air source heat pumps are designed to function efficiently even in temperatures as low as -15°C. Their advanced technology ensures reliable heating, regardless of Hampshire's winter conditions.

2. Noise Concerns

While older systems may have been noisy, today’s ASHPs operate at near-silent levels. Proper placement and professional installation further reduce any potential disturbances.

3. High Installation Costs

Although the upfront cost is higher than traditional systems, government grants and significant energy savings make air source heat pumps a cost-effective investment over time.

Maximizing the Benefits of Air Source Heat Pumps

To get the most out of your air source heat pump, consider the following:

Improve Home Insulation: Better insulation reduces heat loss, enhancing the efficiency of your system.

Use a Smart Thermostat: Smart controls allow you to monitor and adjust your heating, maximizing savings.

Schedule Regular Maintenance: Routine checks ensure your system operates at peak efficiency.

Why Air Source Heat Pumps Are the Future of Heating in Hampshire

Air source heat pumps represent the perfect synergy of energy efficiency, environmental responsibility, and modern convenience. For Hampshire homeowners, these systems provide an opportunity to reduce energy costs, embrace sustainability, and enjoy year-round comfort.

By adopting this technology, residents can future-proof their homes, contribute to a greener planet, and take advantage of financial savings that continue to grow over time.

#uk#heat pump installation#hampshire#air source heat pump#heat pump repair#heat pump maintenance#renewable energy

0 notes

Text

Advancing low-temperature plasmas for industry, healthcare, and sustainability

- By Nuadox Crew -

Peter Bruggeman, a professor of Mechanical Engineering at the University of Minnesota, explores the impact of recent advances in low-temperature plasmas (LTPs).

These ionized gases, characterized by high-energy electrons but near-ambient gas temperatures, enable diverse applications across multiple industries.

LTPs play a crucial role in microelectronics, allowing precise material processing for semiconductor manufacturing. They are also used in satellite propulsion, surface treatments, and water purification. Recent research has expanded their applications in healthcare, where they show promise in antimicrobial treatments, wound healing, and even cancer therapy through redox reactions.

In sustainable chemistry, LTPs offer an alternative to fossil fuel-based processes by using electrically driven plasmas for chemical conversions, such as ammonia synthesis and methane reforming, at near-ambient conditions. They also provide a cleaner, more efficient industrial heat source for high-temperature reactions like CO₂ conversion.

For next-generation manufacturing, LTPs could revolutionize metal processing, particularly in steel production, by enabling carbon-free iron ore reduction with hydrogen plasmas. Additionally, they facilitate the synthesis of advanced materials, including quantum dots and synthetic diamonds.

LTPs contribute to environmental sustainability by breaking down harmful pollutants like PFAS ("forever chemicals") in water treatment. Their ability to enable complex chemical transformations makes them a key technology for addressing modern environmental challenges.

Despite these advancements, fundamental challenges remain, particularly in understanding plasma interactions with materials, liquids, and biological systems. Future research, including AI-driven modeling, is needed to unlock new applications and drive technological progress. Continued investment in LTP research promises to shape industries and benefit society on multiple fronts.

Read more at Innovation News Network

Related Content

What is a virtual power plant? An energy expert explains

Other Recent News

UK Flood Defenses: The UK government has announced new investments to protect 66,000 more properties from flooding.

0 notes

Text

Northern property partners Leading property sourcing company in the UK. Our Specialists in sourcing profitable property deals. Call us 0113 372 0770

#Property sourcing companies#Property Sourcing UK#Sourcing property deals#property deal sourcing company#deal sourcing property#sourcing investments#property sourcing company

0 notes

Text

The Future of Hemp Protein Powder

youtube

A Sustainable Super-food Revolution

Written by Casper Leitch

The Hemp Protein Powder Market Set to Soar to $1.03 Billion by 2035. As the global demand for plant-based nutrition continues to rise, hemp protein powder is emerging as a front-runner in the sustainable super-food industry. Projected to reach a market valuation of USD 1,031.1 million by 2035, this growth is fueled by increasing awareness of medical cannabis, hemp markets, industrial hemp, and hemp foods as viable and Eco-conscious dietary solutions.

With its complete amino acid profile, high fiber content, and rich supply of omega fatty acids, hemp protein powder has become a go-to alternative for health-conscious consumers, fitness enthusiasts, and individuals embracing plant-based lifestyles. Moreover, its environmentally sustainable cultivation process gives it a significant edge over traditional animal-based proteins, reinforcing its appeal among Eco-conscious buyers and businesses.

Market Trends Driving Hemp Protein Growth

Rising Adoption of Plant-Based Diets

The surge in vegan, vegetarian, and flexitarian lifestyles is one of the key factors propelling the hemp protein market. Consumers are actively seeking non-GMO, organic, and sustainable protein alternatives, making hemp a preferred choice due to its rich nutrient profile and ease of digestibility.

Expanding Health and Wellness Industry

As consumers become more ingredient-conscious, the demand for chemical-free, organic, and clean-label food products is escalating. Hemp protein’s versatility in functional foods, dietary supplements, and sports nutrition makes it a compelling option in the wellness space.

Innovations in Product Development

Recent advancements in hemp protein formulations (such as improved solubility, enhanced flavors, and fortified blends) are increasing market penetration. Companies are investing in research to refine texture, taste, and bio-availability, making hemp protein an even more attractive option.

Environmental Sustainability And Agricultural Benefits

Hemp cultivation is renowned for its low water consumption, soil-enriching properties, and pesticide-free growth. Unlike soy or whey protein production, hemp farming contributes to carbon sequestration, reduces agricultural waste, and promotes regenerative farming practices, aligning with global sustainability efforts.

Regional Market Insights

North America Is Leading the Charge

North America remains at the forefront of the hemp protein revolution, with the United States and Canada driving demand. Favorable hemp legalization policies, strong retail presence, and a growing fitness industry are key contributors to regional growth.

Europe Has Sustainability And An Innovation Hub

Countries like Germany, the UK, and France are experiencing an uptick in veganism and environmental activism, which fuels demand for sustainable protein sources. European consumers prioritize organic certification and functional nutrition, further accelerating market expansion.

The Asia-Pacific Is Focused On Rapid Growth And Expanding Health Consciousness

The Asia-Pacific market, led by China, India, and Japan, is witnessing explosive growth due to rising health awareness, urbanization, and dietary shifts toward plant-based proteins. India, in particular, is expected to grow at an impressive Compound Annual Growth Rate (CAGR) of 15.4% by 2035.

Latin America Has Emerging Potential

With a growing interest in super-foods and natural nutrition, countries like Brazil and Mexico are experiencing steady market growth. Increased fitness consciousness and government-backed sustainable agriculture initiatives contribute to expansion.

The Middle East And Africa Have A Growing Awareness

While still in its infancy, the Middle East and Africa’s hemp protein sector is gaining traction, especially in South Africa, the UAE, and Saudi Arabia, where demand for high-protein dietary supplements is on the rise.

Investment Opportunities in the Hemp Protein Industry

With a projected CAGR of 10.4% from 2025 to 2035, the hemp protein market presents a lucrative opportunity for investors, businesses, and startups looking to tap into the plant-based nutrition sector.

Key Growth Indicators:

India: Poised for 15.4% CAGR growth by 2035.

Italy: Expected to achieve 11.8% CAGR in the forecast period.

UK And The USA: Both projected to grow at a 10.5% CAGR.

Germany: Market size set to expand at 8% CAGR by 2035.

There Is A Competitive Landscape With Some Major Players

Leading companies are investing in research, product development, and strategic partnerships to expand their foothold in the hemp protein sector. Notable players include: Manitoba Harvest, Nutiva, Navitas Organics, Sunwarrior, Bob’s Red Mill, India Hemp Organics, Evo Hemp and Terrasoul Super-foods.

Many brands are collaborating with fitness influencers, health experts, and plant-based advocates to boost awareness and credibility, further driving industry growth.

What’s Next for Hemp Protein?

With the continued legalization of industrial hemp, growing consumer interest in sustainable foods, and advancements in hemp-based nutrition, the future of hemp protein powder looks incredibly promising.

Key Trends to Watch:

Expansion of hemp foods into mainstream grocery stores and restaurants.

The Rise of hemp-based functional beverages and fortified foods.

Growing demand for hemp protein in medical cannabis & pharmaceutical applications.

Advancements in hemp agriculture and sustainable processing techniques.

The Hemp Protein Revolution is Here

Hemp protein powder is no longer just an alternative; it’s a necessity for the future of sustainable nutrition. As more consumers turn to Eco-friendly, plant-based diets, the industry is set for unprecedented expansion.

For investors, entrepreneurs, and health-conscious consumers, now is the time to embrace the hemp revolution and become part of the global movement toward a greener, healthier planet.

Below is a FREE TO DOWNLOAD marijuana music MP3 by Uwe Banton.

The Roots Of It (The Cannabis Song)

youtube

#hemp#hemp foods#hemp for taxes#hemp currency#cannabis cash#marijuana money#Cannabis Descheduling#Marijuana tax#Cannabis advertising#cannabis legalization#marijuana legalization#hemp protein powder#hemp food

0 notes

Text

Unlock the Benefits of Hing Powder: Top Choice for Authentic Flavor and Wellness

Table of Contents

Introduction to Hing Powder

Why Hing Powder is Essential in Indian Cuisine

Health Benefits of Hing Powder

Cooking with Hing Powder: How to Use It Effectively

Hing Powder and Its Culinary Applications

Where to Buy Premium Hing Powder in London

Oils and Herbs UK: Your Trusted Hing Powder Provider

How Hing Powder Stands Out Among Other Spices

Recipes Featuring Hing Powder

Conclusion: Elevate Your Culinary Game with Hing Powder

1. Introduction to Hing Powder

Hing powder, also known as Asafoetida, is a versatile and aromatic spice that has been a staple in Indian cooking for centuries. Known for its pungent aroma and ability to enhance flavors, hing powder adds a distinct touch to a variety of dishes. If you're in London and seeking premium hing powder, Oils and Herbs UK offers the highest quality product to meet your culinary needs.

2. Why Hing Powder is Essential in Indian Cuisine

Hing powder holds a special place in Indian kitchens, acting as both a flavor enhancer and a digestive aid. From lentils to curries, its unique taste elevates even the simplest dishes. The spice also plays a key role in tempering, a cooking technique where spices are sautéed in hot oil to release their full flavor.

Unique Features of Hing Powder:

Acts as a substitute for onions and garlic.

Balances strong flavors in spicy dishes.

Enhances the overall aroma and taste of food.

3. Health Benefits of Hing Powder

Hing powder is more than just a spice; it’s a powerhouse of health benefits. Here's how it contributes to overall wellness:

3.1. Digestive Health

Hing powder helps alleviate indigestion, bloating, and gas, making it a popular choice for post-meal remedies.

3.2. Anti-Inflammatory Properties

Its natural compounds can reduce inflammation in the body, offering relief from joint pain and other ailments.

3.3. Respiratory Health

Hing powder acts as a natural decongestant, helping to clear mucus and provide relief from colds and coughs.

3.4. Blood Pressure Regulation

With its ability to relax blood vessels, hing powder may help regulate blood pressure levels.

4. Cooking with Hing Powder: How to Use It Effectively

Incorporating hing powder into your recipes is easy and rewarding. Here’s how to do it:

Heat oil or ghee in a pan.

Add a pinch of hing powder and let it sizzle for a few seconds.

Mix it into your dish, whether it’s lentils, curries, or stir-fried vegetables.

Pro Tip: Use a small amount of hing powder, as its flavor is quite potent.

5. Hing Powder and Its Culinary Applications

Hing powder is a key ingredient in many dishes, including:

Dal Tadka: Enhances the flavor of lentils with a hint of aroma.

Sambar: Adds depth to this South Indian favorite.

Chutneys: Complements the tangy and spicy flavors.

Pickles: Acts as a preservative and adds a unique taste.

6. Where to Buy Premium Hing Powder in London

Finding authentic hing powder in London can be challenging, but Oils and Herbs UK makes it convenient. Our hing powder is sourced from trusted suppliers and offers unmatched quality.

Why choose Oils and Herbs UK?

Authentic Sourcing: Directly from regions known for high-quality spices.

Fresh Packaging: Ensures long-lasting aroma and flavor.

Affordable Prices: Premium quality without breaking the bank.

7. Oils and Herbs UK: Your Trusted Hing Powder Provider

At Oils and Herbs UK, we take pride in delivering top-notch hing powder that meets the needs of both home cooks and professional chefs. Our product is:

100% pure and free from additives.

Packed in eco-friendly containers.

Readily available for delivery across London.

With Oils and Herbs UK, you’re not just buying a spice; you’re investing in quality and trust.

8. How Hing Powder Stands Out Among Other Spices

Hing powder is unique due to its strong aroma and multiple uses. Unlike other spices, it doubles as a flavor enhancer and a natural remedy for common ailments. Its versatility makes it a must-have in every kitchen.

9. Recipes Featuring Hing Powder

9.1. Hing-Flavored Dal

Ingredients:

1 cup lentils

1 tsp hing powder

2 tbsp oil or ghee

Spices: Turmeric, cumin, and chili powder

Instructions:

Boil lentils until soft.

Heat oil in a pan and add hing powder.

Mix the tempered spices into the boiled lentils.

9.2. Hing-Spiced Vegetables

Ingredients:

Mixed vegetables (carrots, peas, and beans)

1 tsp hing powder

2 tbsp oil

Spices: Mustard seeds, curry leaves, and green chilies

Instructions:

Heat oil and add hing powder with mustard seeds.

Add vegetables and stir-fry until tender.

10. Conclusion: Elevate Your Culinary Game with Hing Powder

Hing powder is a versatile ingredient that not only enhances the flavor of dishes but also provides numerous health benefits. For residents of London, Oils and Herbs UK offers premium hing powder that ensures quality and authenticity.

Whether you’re preparing a simple dal or experimenting with exotic recipes, hing powder from Oils and Herbs UK will elevate your cooking experience. Order now and bring the essence of tradition and wellness to your kitchen!

0 notes

Text

Homeowners in the UK, particularly those in the Midlands, northern England, and parts of Scotland, are likely to see a welcome boost in property values in the coming weeks. A leading property expert believes that house prices will go up in February and March, with these regions being the ones that will benefit the most. This is against the backdrop of the UK housing market, which has been on the mend as prices have increased for five straight months. Nationwide's monthly monitor revealed that the average house in the UK now costs £268,213. While January's 0.1% monthly increase was small compared with December's 0.7% increase and November's 1.2% increase, the broader trend is still upward. Nevertheless, the year-on-year rate of house price growth has eased a little from 4.7% in December to 4.1%. Mishantha Liyanage, CEO of north-west based Mistoria Estate Agents commented on the current situation in the market: "As we step into February, the housing market continues walking very tight rope and has managed to increase property prices only by a minor margin while affordability issues refuse to go away, he said. Property prices stabilize, but affordability remains a key challenge. Some regions are faring better in terms of stronger buyer demand, while higher borrowing costs broadly limit purchasing power throughout the market. Grarhl123 at the English Wikipedia, CC BY-SA 3.0 http://creativecommons.org/licenses/by-sa/3.0/, via Wikimedia Commons Despite these challenges, Liyanage predicts that prices will rise in February and March across many regions, though not at the double-digit levels seen in previous years. He emphasized that the market's trajectory will largely depend on how lending conditions evolve in the coming months, particularly with key policy changes on the horizon. The 4.7 percent annual growth posted in December has been the most robust since the October 2022 level. Three regions have been projected as the most advantageous for the latest round of the price increases due to the increase. "Despite the overall market being constrained on affordability, property values in the Midlands, in northern England and many parts of Scotland will hold the stronger gain in February and March," he said. The Midlands, long regarded as a property hotspot, continues to attract buyers due to its relatively affordable prices compared to the south of England. Cities like Birmingham and Nottingham are seeing increased demand, driven by their growing economies and improved transport links. Similarly, northern England, including areas like Manchester and Leeds, is benefiting from significant investment in infrastructure and regeneration projects, making these cities more appealing to both homeowners and investors. The other is Scotland, which is also coming out as a more important player in the property market. Places like Glasgow and Edinburgh are looking hot in terms of demand due to their lively cultural scenes and great job markets. All this seems to constitute a very positive price growth environment. The outlook is positive for homeowners in these areas, but the broader market remains constrained by affordability issues. Higher borrowing costs, driven by rising interest rates, are making it harder for many buyers to secure mortgages. This has led to a more cautious approach among potential homeowners, with many opting to wait for more favorable conditions before making a purchase. Despite these challenges, the housing market's resilience is evident. The consecutive monthly price increases suggest that demand remains strong, particularly in regions where affordability is less of a barrier. For sellers, this could be an opportune time to list their properties, especially in areas expected to see the strongest gains. Broader economic factors are also helping the UK housing market recovery. Though inflation remains a source of concern, growth in wages and a job market that remains relatively stable continue to help buoy buyer confidence. Further, policies to support first-time buyers and to increase supply should continue to add strength to the market through the rest of the year. As conditions continue to evolve in the market, Liyanage is paying close attention to lending conditions and changes in policies. "With key policy changes on the horizon, pricing trends will heavily depend on how lending conditions evolve in coming months," he noted. The implication here is that while this current outlook is positive, the market's direction remains tightly tied to a mix of economic and policy considerations. The upside is that for now at least the prospects for price rises in the near term are positive for property owners in the Midlands and northern England and Scotland. As with any market, however, one always has to be cautious as things can turn around quickly, so those looking to buy or sell will need to stay informed. All in all, it seems the UK housing market is slowly picking up steam. With prices projected to increase in February and March, the regions with the greatest increases are likely to be the Midlands, northern England, and Scotland, as those areas still struggle with affordability issues. For sellers, it may be a good time to take advantage of the upward trend in the market, while for buyers, they may have to act fast to get properties in high-demand areas. As always, keeping abreast of the developments in the market and taking expert advice will be the way forward in this ever-changing UK property market. Read the full article

0 notes

Text

Eco-Friendly Heating Made Easy: Hampshire's Air Source Heat Pumps

In the quest for sustainable living, air source heat pumps (ASHPs) have emerged as an environmentally friendly and energy-efficient solution to heat homes and businesses. In Hampshire, these systems are transforming how residents achieve optimal indoor comfort while reducing their carbon footprint. This article dives deep into the world of air source heat pumps, their benefits, and why they are becoming the preferred choice for eco-conscious homeowners.

What Are Air Source Heat Pumps and How Do They Work?

Air source heat pumps are innovative heating systems that extract heat from the outside air, even in low temperatures, and transfer it indoors to provide warmth. The system operates using a simple yet highly efficient process:

Heat Extraction: The pump absorbs heat from the outdoor air through a refrigerant fluid.

Compression: The extracted heat is compressed to increase its temperature.

Heat Distribution: The warmed refrigerant transfers heat into your home through radiators, underfloor heating systems, or hot water systems.

This process requires electricity, but for every unit of electricity consumed, ASHPs produce significantly more units of heat, making them a highly efficient choice.

Why Choose Air Source Heat Pumps in Hampshire?

Hampshire’s climate and community focus on sustainability make air source heat pumps a smart investment. Here’s why:

1. Energy Efficiency and Cost Savings

Air source heat pumps are known for their high efficiency. For every kilowatt of electricity consumed, they generate up to three kilowatts of heat. This translates into lower energy bills compared to traditional heating methods like gas or oil boilers.

2. Reduced Carbon Emissions

Switching to an air source heat pump can significantly lower your home's carbon emissions. In Hampshire, where many homeowners are embracing green energy, this technology aligns perfectly with the county’s push for environmental responsibility.

3. Eligibility for Government Incentives

The UK government encourages the adoption of renewable heating solutions through schemes like the Boiler Upgrade Scheme (BUS). Homeowners in Hampshire can receive grants to offset the initial costs of installing an air source heat pump, making it an even more attractive option.

The Benefits of Air Source Heat Pumps

1. Year-Round Comfort

Air source heat pumps can provide heating in the winter and cooling in the summer, ensuring your home remains comfortable regardless of the season.

2. Low Maintenance

Compared to traditional boilers, ASHPs require minimal maintenance. An annual check by a qualified technician is usually sufficient to keep the system running efficiently.

3. Versatility in Installation

ASHPs can be integrated with existing heating systems or used as standalone solutions. Whether you live in a modern home or a historic Hampshire property, there’s an air source heat pump setup for your needs.

4. Quiet Operation

Modern ASHPs are designed to operate quietly, ensuring minimal disruption to your household or neighborhood.

Air Source Heat Pump Installation in Hampshire

Choosing a reputable installer is crucial for maximizing the benefits of your air source heat pump. Here’s what to consider when selecting an installer in Hampshire:

Certification: Ensure the installer is certified by the Microgeneration Certification Scheme (MCS).

Experience: Look for companies with a proven track record in installing ASHPs in Hampshire.

Warranty: Opt for systems that come with robust warranties for peace of mind.

Many Hampshire-based installers also provide guidance on accessing government grants, ensuring you get the best value for your investment.

Common Questions About Air Source Heat Pumps

1. Are air source heat pumps effective in colder climates?

Yes, modern ASHPs are designed to work efficiently even in sub-zero temperatures, making them suitable for Hampshire’s mild winters.

2. How long do air source heat pumps last?

With proper maintenance, an air source heat pump can last 15-20 years, offering long-term reliability and savings.

3. Is planning permission required?

In most cases, ASHP installations fall under permitted development rights. However, if you live in a listed building or conservation area in Hampshire, it’s advisable to check with local authorities.

Environmental Impact: A Greener Hampshire

Air source heat pumps are not just a solution for individual homes—they contribute to broader environmental goals. By adopting ASHPs, Hampshire residents can:

Reduce dependency on fossil fuels, decreasing greenhouse gas emissions.

Support the UK’s net-zero targets, aiding the transition to a sustainable energy future.

Enhance property value, as energy-efficient homes are increasingly attractive to buyers.

Choosing the Right Air Source Heat Pump for Your Home

Selecting the ideal ASHP depends on factors such as:

Home Size: Larger homes may require systems with higher capacity.

Insulation Levels: Well-insulated properties optimize the efficiency of ASHPs.

Energy Requirements: Your household’s heating and hot water needs will determine the system size.

Consulting with a professional installer ensures you choose the best option tailored to your specific requirements.

Take the First Step Toward Sustainable Heating

Air source heat pumps are revolutionizing how Hampshire residents heat their homes. With benefits ranging from cost savings and efficiency to environmental responsibility, these systems are an investment in both your comfort and the planet’s future.

If you’re ready to embrace eco-friendly heating, explore local installation services, and take advantage of government incentives. Hampshire is leading the way in sustainability—join the movement today.

#heat pump installation#air source heat pump#heat pump repair#heat pump maintenance#renewable energy#hampshire#uk

0 notes

Text

Best PoE CCTV Systems in the UK: A Complete Buyer’s Guide - Your Key to Effortless Security

In today’s world, security has become an essential aspect of both personal and business life. Whether you are looking to secure your home or office, installing a CCTV system is a smart investment. Among the various CCTV technologies available, Power over Ethernet (PoE) systems have emerged as one of the best choices for users seeking simplicity, cost-effectiveness, and reliability. If you’re looking for the best PoE CCTV system UK, this comprehensive guide will walk you through the key features to look for, and help you choose the best system that suits your needs.

What is a PoE CCTV System?

A PoE CCTV system is a type of surveillance system that uses Ethernet cables to transmit both data and electrical power to the cameras. Unlike traditional CCTV systems that require separate power cables, PoE systems simplify installation by using a single Ethernet cable for both power and data transfer.

Why Choose a PoE CCTV System?

Ease of Installation: PoE CCTV systems eliminate the need for a separate power source for each camera. This reduces the amount of wiring needed, making installation faster and more straightforward. Whether you’re installing cameras indoors or outdoors, PoE systems are incredibly convenient.

Cost-Effectiveness: With fewer cables to purchase and install, PoE systems tend to be more affordable in terms of both the initial investment and maintenance. Additionally, PoE cameras generally offer better energy efficiency, reducing overall operating costs.

Reliability: PoE systems are known for their stable connection and high-quality video feed. Because data and power travel through the same cable, the chances of signal loss or interruptions are minimized.

Scalability: PoE CCTV systems are easy to expand. You can add more cameras to your system by simply connecting them to the existing network switch, providing a scalable solution for growing security needs.

Centralized Power Management: Managing power is easier with PoE systems. They are often powered by a central PoE switch or injector, meaning you can power off or restart all cameras from one location, providing more convenience for maintenance and troubleshooting.

Key Factors to Consider When Choosing the Best PoE CCTV System in the UK

When selecting a PoE CCTV system in the UK, several factors must be taken into account to ensure you get the best value and performance for your money. Here's what you should consider:

1. Resolution and Image Quality

The higher the resolution, the clearer the footage will be. Modern PoE cameras offer 1080p (Full HD), 4K, or even higher resolutions. If you require detailed footage for identifying faces or license plates, opting for higher resolution cameras is a wise decision. Keep in mind that higher resolution cameras may require more storage space and a higher bandwidth to transmit video.

2. Night Vision and Low-Light Performance

A good CCTV system should perform well in low-light conditions. Look for PoE cameras with infrared (IR) LEDs that provide clear night vision, so your property remains monitored even after dark. Some PoE systems offer a feature called “Smart IR,” which automatically adjusts to ensure high-quality footage in various lighting conditions.

3. Field of View (FOV)

The wider the field of view, the more area your camera will cover. Standard PoE cameras typically offer a 90° to 110° field of view, while some models feature pan-tilt-zoom (PTZ) capabilities, allowing you to control the camera angle remotely. Make sure to choose a camera that suits the area you need to monitor.

4. Storage Options

Most PoE CCTV systems either offer Network Video Recorders (NVRs) or cloud-based storage. NVR systems record video data locally on hard drives, which can then be accessed remotely via a network. Cloud-based systems, on the other hand, offer off-site storage, reducing the risk of data loss in case of theft or damage. Choose the storage option that best fits your needs, taking into account the required storage capacity and your budget.

5. Weatherproofing and Durability

If you need outdoor cameras, ensure that they are weatherproof and built to withstand various environmental conditions. Look for cameras with an IP66 or IP67 rating for outdoor use, ensuring that they are protected against rain, dust, and other harsh conditions.

6. Remote Viewing and App Support

The ability to monitor your property remotely is crucial for modern security systems. Look for PoE systems that come with mobile apps or web interfaces for easy remote viewing. This feature allows you to keep an eye on your property from anywhere, whether you’re at home, at work, or traveling abroad.

Top PoE CCTV Systems in the UK

Here are some of the best PoE CCTV systems in the UK to consider for your home or business:

1. Reolink 8-Channel PoE Security Camera System

Reolink is known for producing high-quality security systems at an affordable price. Their 8-channel PoE security camera system offers 4K Ultra HD resolution and features excellent night vision. The system includes an NVR with 2TB of storage and can support up to 8 cameras, making it ideal for larger properties.

2. Amcrest 4K PoE Camera System

The Amcrest PoE system is a high-performance, 4K security solution that’s perfect for detailed surveillance. The cameras feature wide-angle lenses, night vision, and motion detection, while the NVR supports remote access via an app for easy monitoring.

3. Lorex 4K Ultra HD IP Security System

This top-of-the-line PoE system from Lorex offers 4K Ultra HD video resolution and exceptional durability, with cameras rated for outdoor use in all weather conditions. The system also includes a powerful NVR with a massive 2TB hard drive for extensive video storage.

4. Swann 8-Channel 4K PoE Security System

Swann offers a versatile PoE CCTV system that’s both easy to install and highly reliable. With a range of cameras featuring motion sensors, night vision, and remote access via an app, Swann’s 8-channel system is great for larger properties or businesses.

Conclusion

When choosing the best PoE CCTV system in the UK, the key is to balance performance, features, and price. PoE systems offer numerous advantages, including ease of installation, scalability, and high-quality video monitoring. By considering factors like resolution, storage, night vision, and remote viewing capabilities, you can select the ideal PoE system to meet your security needs.

Security is paramount, and investing in a PoE CCTV system will provide peace of mind for you and your loved ones, or your business. Choose wisely and stay secure!

1 note

·

View note

Text

Fire Risk Assessment: A Crucial Step for Property Safety

When it comes to ensuring the safety of your property and its occupants, a fire risk assessment is one of the most critical measures you can take. In the UK, fire safety is a legal obligation for property owners and managers, and conducting regular assessments is a key part of compliance with the Regulatory Reform (Fire Safety) Order 2005. For property buyers, sellers, and investors, understanding the importance of fire risk assessments is essential.

What is a Fire Risk Assessment?

A fire risk assessment is a systematic evaluation of a property to identify potential fire hazards, assess the risks associated with them, and implement measures to minimize those risks. This process not only ensures compliance with fire safety laws but also provides peace of mind for property owners, occupants, and stakeholders.

The assessment involves:

Identifying fire hazards (e.g., flammable materials, electrical equipment, or heating systems).

Evaluating who might be at risk (e.g., employees, residents, or visitors).

Reviewing existing fire safety measures.

Recommending improvements to reduce risks.

Documenting findings and implementing a fire safety plan.

Why is a Fire Risk Assessment Important?

Legal Compliance The Regulatory Reform (Fire Safety) Order 2005 mandates that responsible persons must carry out fire risk assessments and take appropriate actions to ensure fire safety. Non-compliance can result in severe penalties, including fines and imprisonment.

Safety of Occupants A thorough assessment identifies risks that could endanger lives, ensuring that residents, employees, or visitors are safe in the event of a fire. Measures such as clearly marked fire exits, functional fire alarms, and fire extinguishers can make a significant difference during emergencies.

Property Protection Fires can cause extensive damage to properties, leading to financial loss and potential disruption to business operations. An effective fire risk assessment helps prevent such incidents by addressing vulnerabilities in advance.

Enhanced Property Value For property buyers and investors, a property with a well-documented fire safety plan is more attractive. It demonstrates that the property has been responsibly managed, reducing potential risks and associated costs.

Steps in Conducting a Fire Risk Assessment

Identify Hazards Look for sources of ignition, fuel, and oxygen that could contribute to a fire.

Assess Who is at Risk Consider everyone who might be on the premises, including employees, contractors, visitors, and vulnerable individuals.