#Social & Governance (ESG) Consulting

Text

Environmental, Social & Governance (ESG) Consulting Market Size, Top Leading Companies and Forecast to 2031

The Environmental, Social & Governance (ESG) Consulting Market is a subject of profound significance and analysis, and the report by Metastat Insight presents a comprehensive exploration into this dynamic landscape. As we navigate the complex interplay of environmental, social, and governance factors, the consulting market emerges as a crucial facilitator in guiding businesses through the intricacies of sustainable and responsible practices.

Get Free Sample Report @ https://www.metastatinsight.com/request-sample/2683

Top Companies

Advisian, Allianz Global Corporate & Specialty (AGCS), Anthesis , Bain & Company, BNY Mellon, Broadridge Financial Solutions, FTI Consulting , GreenCo ESG Advisory, Inrate AG , KKS Advisors

The ESG consulting has witnessed a substantial surge in demand, underscoring an intensified global focus on corporate responsibility and ethical business practices. Metastat Insight’s report delineates the current landscape, revealing the multifaceted nature of ESG consulting services that transcend mere compliance, delving deep into strategies that integrate sustainability into the core fabric of corporate operations.

In this contemporary business landscape, the ESG consulting market becomes a linchpin for organizations seeking not only to meet regulatory requirements but also to authentically embed environmental, social, and governance principles into their operational DNA. The metamorphosis of the market is evident, reflecting a departure from a perfunctory adherence to ESG norms to a more profound and strategic embrace of sustainable practices.

Browse Complete Report @ https://www.metastatinsight.com/report/environmental-social--governance-esg-consulting-market

Metastat Insight’s report underscores the pivotal role of ESG consulting firms in guiding businesses toward a holistic and forward-looking approach. It illuminates the varied dimensions of environmental considerations, ranging from carbon footprint reduction to sustainable resource management. Social aspects encompass a broad spectrum, spanning diversity and inclusion initiatives to community engagement programs. Governance, in this context, extends beyond regulatory adherence, embracing transparent decision-making processes and ethical corporate governance structures.

0 notes

Text

What is ESG sustainability Investing?

ESG sustainability investing, also known as environmental, social, and governance investing, is an investment approach that takes into consideration environmental, social, and governance factors when evaluating the performance and sustainability of companies or assets. ESG factors are considered alongside traditional financial factors to assess a company's overall sustainability and its impact on society and the environment.

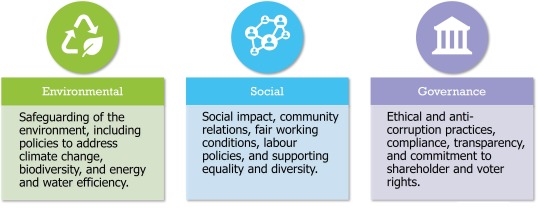

Here's a brief overview of the three components of ESG sustainability investing:

Environmental: This considers a company's impact on the environment, including its carbon footprint, resource usage, waste management, pollution, and other environmental risks and opportunities. It assesses how a company manages and mitigates its environmental impacts and its efforts towards sustainability and environmental stewardship.

Social: This focuses on a company's relationships with its employees, customers, communities, and other stakeholders. It considers factors such as labor practices, human rights, diversity and inclusion, community engagement, product safety, and social impacts. It evaluates how a company manages its social responsibilities and contributes positively to society.

Governance: This looks at a company's leadership, management, and governance practices. It assesses factors such as board composition, executive compensation, shareholder rights, transparency, and accountability. Good governance is seen as crucial for long-term sustainability, as it helps ensure ethical decision-making and responsible management practices.

ESG sustainability investing aims to generate positive financial returns while also considering the environmental, social, and governance impact of investments. It is based on the belief that companies with strong ESG performance are more likely to be resilient, sustainable, and better positioned to manage risks and capture opportunities in the long run. ESG sustainability investing has gained popularity in recent years as investors seek to align their investments with their values and contribute to a more sustainable and equitable world.

How ESG reporting can help investors and the companies?

ESG reporting, or the practice of disclosing a company's performance and practices related to environmental, social, and governance factors, can benefit both investors and companies in several ways:

Better decision-making for investors: ESG reporting provides investors with relevant data and information to assess a company's sustainability performance and risks. This helps investors make more informed investment decisions, identify companies that align with their ESG preferences or values, and integrate ESG considerations into their investment strategies. ESG reporting can also help investors identify potential risks and opportunities related to environmental, social, and governance factors that may impact a company's financial performance in the long term.

Enhanced risk management for companies: ESG reporting can help companies identify and manage ESG risks and opportunities, including environmental risks such as climate change or resource scarcity, social risks such as labor practices or community relations, and governance risks such as board effectiveness or executive compensation. By disclosing this information, companies can proactively manage ESG risks, develop strategies to mitigate them, and demonstrate their commitment to responsible and sustainable business practices.

Improved stakeholder engagement for companies: ESG reporting facilitates communication and engagement with stakeholders such as investors, customers, employees, regulators, and communities. By disclosing ESG performance, companies can engage in meaningful dialogues with stakeholders, address concerns, and build trust. This can lead to better stakeholder relationships, improved reputation, and increased access to capital and market opportunities.

Enhanced long-term performance for companies: Companies with strong ESG performance are more likely to be sustainable in the long run. ESG reporting can help companies set goals, measure progress, and demonstrate their commitment to sustainability and responsible business practices. Companies that prioritize ESG factors may also attract investors who value sustainability and responsible investing, which can positively impact their access to capital and valuation over the long term.

Regulatory compliance: ESG reporting is increasingly being mandated by regulators in many jurisdictions, which requires companies to disclose their ESG performance. By complying with these regulations, companies can avoid legal and reputational risks and demonstrate their commitment to transparency and accountability.

In summary, ESG reporting in India can benefit investors by providing them with relevant information for decision-making, and companies by helping them manage risks, engage with stakeholders, improve performance, and comply with regulations. It promotes transparency, accountability, and sustainability, benefiting both investors and companies in the long term.

What is the importance of ESG sustainability Investing?

ESG sustainability investing is important for several reasons:

Addressing pressing global challenges: ESG sustainability investing recognizes the urgent need to address pressing global challenges such as climate change, social inequality, and corporate governance failures. By integrating environmental, social, and governance factors into investment decisions, it can contribute to addressing these challenges and promoting more sustainable and responsible business practices.

Promoting sustainability and positive impact: ESG sustainability investing encourages companies to adopt sustainable practices that consider their impact on the environment, society, and governance. This can drive positive change by promoting responsible resource management, reducing greenhouse gas emissions, fostering social inclusion and diversity, and enhancing corporate governance and transparency.

Mitigating risks and capturing opportunities: ESG sustainability investing acknowledges that companies face risks and opportunities related to environmental, social, and governance factors that can impact their long-term financial performance. By considering these factors in investment decisions, investors can better understand and mitigate risks, as well as identify opportunities for sustainable growth and value creation.

Aligning investments with values and stakeholder preferences: ESG sustainability investing allows investors to align their investments with their values and stakeholder preferences. It provides an avenue for investors to incorporate ethical, social, and environmental considerations into their investment decisions, reflecting their broader interests beyond financial returns. This can help investors achieve their financial goals while also supporting companies that are aligned with their values.

Enhancing stakeholder engagement and accountability: ESG sustainability investing promotes transparency, accountability, and stakeholder engagement. By encouraging companies to disclose their ESG performance, it fosters greater transparency and accountability, and enables stakeholders such as investors, customers, employees, and communities to hold companies to higher standards of sustainability performance.

Driving long-term sustainable returns: ESG sustainability report investing recognizes that sustainability and financial performance are not mutually exclusive, but rather can be mutually reinforcing. Companies that prioritize ESG factors may be better positioned to manage risks, innovate, and capture opportunities, leading to potential long-term sustainable returns for investors.

Influencing corporate behavior: ESG sustainability investing can serve as a powerful tool to influence corporate behavior. By allocating capital to companies that demonstrate strong ESG performance, investors can incentivize companies to improve their sustainability practices and drive positive change across industries and sectors.

In summary, ESG sustainability investing is important as it promotes sustainability, mitigates risks, aligns investments with values, enhances stakeholder engagement, and has the potential to drive long-term sustainable returns while influencing corporate behavior towards more responsible and sustainable practices.

What is the need of sustainability reporting?

Sustainability reporting is necessary for several reasons:

Transparency and Accountability: Sustainability reporting provides a platform for companies to transparently disclose their environmental, social, and governance (ESG) performance, practices, and impacts. It enables companies to be accountable for their sustainability commitments, actions, and progress, and allows stakeholders such as investors, customers, employees, regulators, and communities to assess a company's sustainability performance and hold it to account.

Stakeholder Communication and Engagement: Sustainability reporting facilitates communication and engagement with stakeholders on ESG matters. It provides a structured way for companies to share information on their sustainability initiatives, goals, progress, and challenges. It allows companies to engage in meaningful dialogues with stakeholders, address concerns, and respond to feedback, fostering trust, and building stronger relationships with stakeholders.

Risk Management and Opportunity Identification: Sustainability reporting helps companies identify and manage ESG risks and opportunities. By disclosing information on ESG performance, companies can identify potential risks such as climate change impacts, supply chain disruptions, regulatory changes, or social controversies, and develop strategies to mitigate them. Sustainability reporting also helps companies identify opportunities for innovation, cost savings, market differentiation, and long-term value creation through sustainable practices.

Performance Measurement and Goal Setting: Sustainability reporting enables companies to measure and track their sustainability performance over time. It provides a framework for setting goals, monitoring progress, and reporting on achievements. This allows companies to benchmark their performance, identify areas for improvement, and drive continuous sustainability performance improvement.

Compliance with Regulations and Standards: Sustainability reporting is increasingly mandated by regulations and standards in many jurisdictions. Companies may be required to disclose their ESG performance and practices to comply with legal requirements or industry-specific standards. Sustainability reporting helps companies meet these regulatory obligations, avoid legal and reputational risks, and demonstrate their commitment to transparency and accountability.

Investor Expectations and Access to Capital: Investors are increasingly incorporating ESG environmental factors into their investment decisions. Sustainability reporting provides companies with an opportunity to disclose their ESG performance, strategies, and goals, which can attract investment from ESG-focused investors. Companies that demonstrate strong ESG performance and transparency may have better access to capital, as investors increasingly prioritize sustainability and responsible investing.

Reputation and Brand Building: Sustainability reporting can enhance a company's reputation and brand image. It demonstrates a company's commitment to responsible and sustainable business practices, which can improve its reputation among stakeholders, customers, and communities. Sustainability reporting can also enhance a company's brand value by showcasing its sustainability initiatives, achievements, and positive impacts.

In summary, sustainability reporting is needed to promote transparency, accountability, stakeholder engagement, risk management, performance measurement, compliance, access to capital, and reputation building. It helps companies demonstrate their commitment to sustainability reporting, manage risks, identify opportunities, and drive positive change, while meeting stakeholder expectations and regulatory requirements.

Read more This Blog :- What is ESG framework and metrics?

#esg investing#esg reporting#sustainability report#esg sustainability#esg financial#esg corporate governance#environment esg#esg consulting#esg reports and ratings#esg environmental social#esg in india#esg governance#esg framework

0 notes

Photo

ESG health checks are important for the wellness of an entity’s ESG strategy. Being one of the Best Environment, Social Governance (ESG) consulting firms in Dubai, Abu Dhabi, Sharjah & UAE, our experts at PKF UAE are committed to conducting the checks, based on your needs, to identify the material ESG risks and develop tailored actions plans for improvement. Contact us for reliable ESG Consulting Services in Dubai,UAE

visit: https://pkfuae.com/services/environment-social-and-governance-esg/

#ESG consulting services#Top ESG consulting firms#ESG consulting firms#ESG consulting companies#ESG environmental social and governance

0 notes

Link

Given the current context of rising social inequalities, an unprecedented scale of health crisis, mounting economic ramifications, a global climate crisis, and the acceleration of environmental degradation, company performance on Environment, Social, and Governance (ESG) metrics has emerged as a critical evaluation parameter.

#ESG#ESG consultation#ESG solution#esg services#esg investing#Environmental Social And Governances#Environmental Social And Governances reporting

0 notes

Text

The Ultimate Guide to ESG Investing: Strategies and Benefits

Socio-economic and environmental challenges can disrupt ecological, social, legal, and financial balance. Consequently, investors are increasingly adopting ESG investing strategies to enhance portfolio management and stock selection with a focus on sustainability. This guide delves into the key ESG investing strategies and their advantages for stakeholders.

What is ESG Investing?

ESG investing involves evaluating a company's environmental, social, and governance practices as part of due diligence. This approach helps investors gauge a company's alignment with humanitarian and sustainable development goals. Given the complex nature of various regional frameworks, enterprises and investors rely on ESG data and solutions to facilitate compliance auditing through advanced, scalable technologies.

Detailed ESG reports empower fund managers, financial advisors, government officials, institutions, and business leaders to benchmark and enhance a company's sustainability performance. Frameworks like the Global Reporting Initiative (GRI) utilize globally recognized criteria for this purpose.

However, ESG scoring methods, statistical techniques, and reporting formats vary significantly across consultants. Some use interactive graphical interfaces for company screening, while others produce detailed reports compatible with various data analysis and visualization tools.

ESG Investing and Compliance Strategies for Stakeholders

ESG Strategies for Investors

Investors should leverage the best tools and compliance monitoring systems to identify potentially unethical or socially harmful corporate activities. They can develop customized reporting views to avoid problematic companies and prioritize those that excel in ESG investing.

High-net-worth individuals (HNWIs) often invest in sustainability-focused exchange-traded funds that exclude sectors like weapon manufacturing, petroleum, and controversial industries. Others may perform peer analysis and benchmarking to compare businesses and verify their ESG ratings.

Today, investors fund initiatives in renewable energy, inclusive education, circular economy practices, and low-carbon businesses. With the rise of ESG databases and compliance auditing methods, optimizing ESG investing strategies has become more manageable.

Business Improvement Strategies

Companies aiming to attract ESG-centric investment should adopt strategies that enhance their sustainability compliance. Tracking ESG ratings with various technologies, participating in corporate social responsibility campaigns, and improving social impact through local development projects are vital steps.

Additional strategies include reducing resource consumption, using recyclable packaging, fostering a diverse workplace, and implementing robust cybersecurity measures to protect consumer data.

Encouraging ESG Adoption through Government Actions

Governments play a crucial role in educating investors and businesses about sustainability compliance based on international ESG frameworks. Balancing regional needs with long-term sustainability goals is essential for addressing multi-stakeholder interests.

For instance, while agriculture is vital for trade and food security, it can contribute to greenhouse gas emissions and resource consumption. Governments should promote green technologies to mitigate carbon risks and ensure efficient resource use.

Regulators can use ESG data and insights to offer tax incentives to compliant businesses and address discrepancies between sustainable development frameworks and regulations. These strategies can help attract foreign investments by highlighting the advantages of ESG-compliant companies.

Benefits of ESG Investing Strategies

Enhancing Supply Chain Resilience

The lack of standardization and governance can expose supply chains to various risks. ESG strategies help businesses and investors identify and address these challenges. Governance metrics in ESG audits can reveal unethical practices or high emissions among suppliers.

By utilizing ESG reports, organizations can choose more responsible suppliers, thereby enhancing supply chain resilience and finding sustainable companies with strong compliance records.

Increasing Stakeholder Trust in the Brand

Consumers and impact investors prefer companies that prioritize eco-friendly practices and inclusivity. Aligning operational standards with these expectations can boost brand awareness and trust.

Investors should guide companies in developing ESG-focused business intelligence and using valid sustainability metrics in marketing materials. This approach simplifies ESG reporting and ensures compliance with regulatory standards.

Optimizing Operations and Resource Planning

Unsafe or discriminatory workplaces can deter talented professionals. A company's social metrics are crucial for ESG investing enthusiasts who value a responsible work environment.

Integrating green technologies and maintaining strong governance practices improve operational efficiency, resource management, and overall profitability.

Conclusion

Global brands face increased scrutiny due to unethical practices, poor workplace conditions, and negative environmental impacts. However, investors can steer companies towards appreciating the benefits of ESG principles, strategies, and sustainability audits to future-proof their operations.

As the global focus shifts towards responsible consumption, production, and growth, ESG investing will continue to gain traction and drive positive change.

5 notes

·

View notes

Text

By: Claire Lehmann

Published: Jul 7, 2023

In medieval times, it was common practice for the wealthy to buy indulgences from the church to atone for their sins. These payments, the church assured, meant the person paying would not remain in purgatory for too long and would later ascend into heaven.

A wealthy person could even buy indulgences for their family members or ancestors who were long dead. Today we think of ourselves as far more enlightened than our medieval forebears. We secular folk would never pay a class of clerics large sums of money to atone for our sins. Or would we?

In recent years, billions of dollars have flowed into investment funds that market themselves as providing “environmental, social and governance” impacts. In Australia, industry super funds lead this trend, with money pouring into funds that then invest in companies that promote green, social justice, equity, diversity and inclusion causes.

The basic idea behind ESG, which has been promoted by organisations such as the World Economic Forum, is that one can make a profit and “do good” at the same time. Investors argue they can contribute to a net-zero future while making solid returns, or contribute to social justice alongside their fiduciary duty.

Rating agencies and research firms issue ESG “scores” to companies that are then used by bodies who advise institutional and retail investors which organisations they should invest in. Because ESG has no standardised metrics or even standardised definitions, such scores can be massaged by those companies that have enough money to play the game.

An entire industry of consulting agencies and non-profits exists today to implement cosmetic changes within companies to boost their ESG scores. Such cosmetic changes may include sponsoring a float at the Gay and Lesbian Mardi Gras or offering paid leave for staff who wish to change their gender.

As I commented in these pages last year, “gender affirmation leave” is offered by our two biggest supermarkets, Coles and Woolworths, and contributes to these companies earning “gold- and platinum-tier” status by the Australian Workplace Equality Index – despite the fact both companies are simultaneously implicated in wage theft scandals.

Sometimes called “wokewashing”, the practice of buying virtue through ESG allows corporate entities to deflect attention away from their PR embarrassments, like Henry VIII’s Indulgences allowed him to go on indulging.

Such practices are called wokewashing because these changes usually do not go deep enough to really cause change within a large organisation. By sheer virtue of their size, our largest corporations often make mistakes that only a complete overhaul of management practices could possibly address.

Take BHP, for example. The biggest company in Australia, and largest mining company in the world, is now embroiled in one of the biggest wage theft scandals in history. Accused of underpaying 28,500 workers $430m in wages for deducting public holidays from leave entitlements, BHP is now supporting the Yes vote in the voice referendum and has pledged a $2m donation to the campaign. This pledge is likely to boost its ESG score, but whether it satisfies the workers who have been underpaid is yet to be seen.

It is not just the mining industry that seeks ESG redemption. The banking industry wants to buy its way into heaven as well. Following on the heels of the disastrous royal commission into the sector, the Big Four are all doubling down on ESG. NAB faced criminal charges in 2021 for failing to pay casual employees long-service leave entitlements, but this is offset by its sponsorship of Midsumma – Melbourne’s queer arts and cultural festival. Last year ANZ was fined $25m for misleading consumer practices, but it also announced it was offering its staff paid leave for a sex change.

Commonwealth Bank has been in hot water in recent years for breaching money-laundering laws and Westpac was required to pay a $1.3bn fine after 250 customers made transfers that were linked to child exploitation. Both organisations are atoning for these sins by campaigning for the Yes vote.

Almost every large corporation that has signed on to the Yes campaign for the voice referendum is embroiled in some kind of scandal that involves their core business. Whether Coles is underpaying its staff, or Rio Tinto is dealing with dozens of accusations of sexual harassment, each company has significant work to do internally.

And this is why ESG is so popular among our corporate class. Symbolic gestures that can be outsourced to consultants and NGOs are an easy box-ticking exercise. Systemic changes to management habits, or making sure business practices are fair, is much more costly and time-consuming than simply waving a rainbow flag.

In the medieval period, wealthy elites would pay indulgences in order to curry favour with the church because the institution was incredibly powerful.

It is not surprising then that our biggest corporations are pledging their support for ESG goals that are also supported by the government, unions, the majority of our media, academia and non-profit sectors.

While commitment to ESG is not necessarily a sign of true moral fibre, if it can assist in washing away the stain of sin, then every dollar pledged will be money well spent.

==

Whenever a large corporation pledges its commitment to some movement or ideology, especially those that are unrelated to their actual business, you should assume that it's hiding something.

The more controversial the movement or ideology, the bigger the scandal they're trying to distract attention from.

For reference, the "Voice to Parliament" is a referendum to embed in the Australian constitution a vaguely defined independent body with unknown powers, unclear authority and unidentified influence to be a whisper in the ear of the Australian political system, supposedly representing all indigenous (Aboriginal) Australians. In essence, it functions as a form of "reparations."

When it's rejected, as current polling indicates it massively will be, as with Affirmative Action, citizens will be scolded by the supporters for their "racism," and the country will be told it's irredeemably racist. Rather than recognizing the diverse objections to the initiative: the lack of transparency of what the body is or does; progressives who insist it doesn't go far enough (e.g. a desire to literally "hand back" the land); Aboriginal Australians themselves who are concerned about establishing a "separate but equal" system; importing Critical Race Theory ideas from the US to racially divide the nation; the rather racist notion itself that any single "voice" could represent all indigenous people, ignoring that their viewpoints are as diverse as everyone else's; and the very simple answer of "I don't like this particular solution."

But while all of that is going on, the companies will be looking for their next diversion.

#Claire Lehmann#wokewashing#woke washing#voice referendum#voice to parliament#referendum#wokescreen#indigenous voice to parliament

6 notes

·

View notes

Text

Greenwashing concerns: Is Brazil paper company sustainable?

Latin America's biggest eucalyptus pulp producer, Suzano, attracts billions in green bonds despite accusations it harms forests and local communities. DW investigates the controversies surrounding Suzano.

Members of the Curvelandia community in Brazil's north-eastern Maranhao state used branches and palm fronds at the beginning of this year to create a barricade across the red dirt road that runs through their village.

They wanted Latin America's largest eucalyptus pulp producer, Suzano, to pave and manage the dirt road and reduce the number of trucks using it to get to nearby eucalyptus plantations.

They also want the Brazilian company to deal with environmental and land issues resulting from the construction of the road, which community member Sandro Lucio said was built on Curvelandia land, including his property.

"There was no agreement. They didn't pay anyone anything," he said, adding that they just turned up with heavy machinery. "They removed the fence from my land, and the truck ran over and killed my horse. They also installed water systems without saying they had permission from the state to draw water from the springs."

He argues they had no such permission, since the land was private.

Curvelandia is not an isolated case.

DW investigated eight ongoing socio-environmental conflicts on the ground in Brazil and spoke to officials, community leaders and union representatives who gave information on at least 40 more.

According to documents Suzano is required to submit to the US Securities and Exchange Commission, the company is facing 262 possible and probable civil and environmental proceedings, and 2,449 probable and possible labor proceedings.

Claims against the company range from indiscriminate use of pesticides and pollution of waterways to land grabbing and failure to consult with traditional communities on infrastructure projects.

Yet Suzano, which manages over a million hectares of eucalyptus plantations across the country and plans to almost double that in the next decade, has succeeded in achieving high environmental, social and governance (ESG) ratings. It has attracted billions in green investments.

Continue reading.

#brazil#politics#brazilian politics#environmentalism#environmental justice#mod nise da silveira#image description in alt

3 notes

·

View notes

Text

As if there wasn't exhaustive enough evidence that "ESG" is nothing but a scam, the Financial Times was out this week with a piece detailing how many companies with good ESG scores pollute just as much as their lower-rated rivals.

Don't say we didn't warn you; we have been writing about the ESG con for years now, which along with other "sustainable" investments continues to see hundreds of billions of dollars in inflows from investors.

The FT added to our skepticism by revealing this week that Scientific Beta, an index provider and consultancy, found that companies rated highly on ESG metrics - and even just the 'Environmental' variable alone - often pollute just as much as other companies.

Researchers look at ESG scores from Moody’s, MSCI and Refinitiv when performing the analysis. They found that when the 'E' component was singled out, it led to a “substantial deterioration in green performance”.

Felix Goltz, research director at Scientific Beta told the Financial Times: “ESG ratings have little to no relation to carbon intensity, even when considering only the environmental pillar of these ratings. It doesn’t seem that people have actually looked at [the correlations]. They are surprisingly low.”

He added: "The carbon intensity reduction of green [ie low carbon intensity] portfolios can be effectively cancelled out by adding ESG objectives."

“On average, social and governance scores more than completely reversed the carbon reduction objective,” he continued. “It can very well be that a high-emitting firm is very good at governance or employee satisfaction. There is no strong relationship between employee satisfaction or any of these things and carbon intensity."

“Even the environmental pillar is pretty unrelated to carbon emissions,” he said.

Vice-president for ESG outreach and research at Moody’s, Keeran Beeharee, added: “[There is a] perception that ESG assessments do something that they do not. ESG assessments are an aggregate product, their nature is that they are looking at a range of material factors, so drawing a correlation to one factor is always going to be difficult.”

“In 2015-16, post the SDGs [UN sustainable development goals] and COP21 [Paris Agreement], when people began to really focus on the issue of climate, they quickly realised that an ESG assessment is not going to be much use there and that they need the right tool for the right task. There are now more targeted tools available that look at just carbon intensity, for example,” he added.

MSCI ESG Research told the Financial Times its ratings “are fundamentally designed to measure a company’s resilience to financially material environmental, societal and governance risks. They are not designed to measure a company’s impact on climate change.”

Refinitiv told FT that “while very small, the correlation found in this study isn’t surprising, especially in developed markets, where many large organisations — with focused sustainability strategies, underpinned by strong governance, higher awareness of their societal impact and robust disclosure — will perform well based on ESG scores, in spite of the fact that many will also overweight on carbon”.

Global director of sustainability research for Morningstar Hortense Bioy concluded: “Investors need to be aware of all the trade-offs. It is not simple. In this case, investors need to think carefully about which aspects of sustainability they would like to prioritize when building portfolios: carbon reduction or a high ESG rating.”

2 notes

·

View notes

Text

Environmental, social, and

governance (ESG) criteria are a set

of indicators used by socially

conscious investors to evaluate

possible investments. In today's

business world, which is becoming

more competitive and erratic, ESG

factors are becoming more crucial

in determining things like

profitability, operational

performance, due diligence

practices, and divestments.

2 notes

·

View notes

Text

ESG Consulting

ESG Consulting Guidelines: Navigating the Path to Sustainable Success

In recent years, the focus on Environmental, Social, and Governance (ESG) factors has grown significantly, reshaping how companies operate and hire stakeholders. ESG consulting has emerged as an essential service, helping businesses navigate this complex landscape. The role of ESG consulting is to guide companies in integrating sustainable practices into their core operations, ensuring they comply with regulatory standards and contribute positively to society and the environment. This blog provides a detailed overview of the guidelines for effective ESG consulting.

Understanding the Basics of ESG Consulting

ESG consulting involves advising companies on effectively managing and improving their environmental, social, and governance practices. This process includes assessing a company's current ESG performance, identifying areas for improvement, and developing strategies to address these areas. ESG consultants are crucial in helping businesses understand and implement sustainable practices that align with sponsor expectations and regulatory requirements.

Critical Guidelines for Effective ESG Consulting

Comprehensive ESG Assessment and Benchmarking

The first step in ESG consulting is a comprehensive assessment of a company's existing ESG practices. This involves gathering data on various metrics such as carbon emissions, waste management, labor practices, and corporate governance structures. Once the data is collected and benchmarking against industry standards and best practices helps identify gaps and areas for improvement. This opening assessment forms the foundation for developing a tailored ESG strategy.

Stakeholder Engagement

Effective ESG consulting requires a deep understanding of the expectations and concerns of various stakeholders, including employees and investors, customers, and local communities. Engaging with stakeholders through surveys, interviews, and focus groups provides valuable insights into what matters most to them. This engagement is crucial in shaping a company's ESG strategy, ensuring it addresses the most relevant issues and gains stakeholder support.

Materiality Analysis

Not all ESG issues are equally relevant to every company. ESG consulting should include a materiality analysis to identify and prioritize the most significant problems for the business and its stakeholders. This analysis helps focus resources on areas that have the most significant impact on the company's long-term success and sustainability.

Strategic ESG Planning and Goal Setting

After identifying key ESG issues, the next step is to develop a strategic plan with clear goals and Key Performance Indicators (KPIs). The ESG strategy should be integrated into the company's overall business strategy, ensuring alignment with its mission and objectives. ESG consulting involves helping companies set realistic and measurable goals, such as reducing carbon emissions by a certain percentage within a specific timeframe or achieving diversity targets in leadership stands.

Implementation and Integration

A crucial aspect of ESG consulting is guiding companies through the implementation process. This involves integrating ESG practices into the company's operations, culture, and decision-making processes. Cross-departmental collaboration is essential to ensure that ESG principles are embedded throughout the organization. For instance, the human resources department might focus on diversity and inclusion initiatives while the supply chain team works on finding sustainable materials.

Transparent ESG Reporting and Disclosure

Transparency is critical to building trust with stakeholders. ESG consulting includes advising companies on best practices for reporting and disclosure. Utilizing recognized frameworks such as the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), or Task Force on Climate-related Financial Disclosures (TCFD) enhances the credibility of the company's ESG reports. Regular reporting keeps stakeholders informed and holds the company accountable for its ESG commitments.

Continuous Monitoring and Improvement

ESG is an ongoing journey, not a one-time project. ESG consulting emphasizes the importance of constant monitoring and improvement. Regularly reviewing ESG performance and adapting strategies to changing circumstances is essential for long-term success. This involves tracking advances against established KPIs, identifying new risks and prospects, and updating the ESG strategy.

Compliance and Risk Management

The regulatory landscape for ESG is rapidly evolving. ESG consulting helps companies stay informed about relevant regulations and ensure compliance. This includes advising on policies related to environmental impact, labor rights and data privacy, and anti-corruption. Incorporating ESG risks into the company's risk management framework is also dangerous. This proactive approach helps companies mitigate prospective risks and avoid legal or reputational issues.

Employee Training and Capacity Building

A successful ESG strategy requires buy-in from all levels of the organization. ESG consulting should include training and capacity-building initiatives to educate employees and leadership on ESG principles and their role in achieving the company's goals. Creating a culture of sustainability within the organization ensures that ESG practices are effectively implemented and sustained over time.

Third-Party Verification and Certification

To enhance the credibility of a company's ESG efforts, ESG consulting often recommends obtaining third-party verification or certifications. This can include certifications like ISO 14001 for environmental management or LEED for sustainable building practices. Third-party verification objectively assesses the company's ESG functioning and can boost stakeholder confidence.

The Value of ESG Consulting

ESG consulting is not just about acquiescence; it's about creating long-term value for the company and its stakeholders. By integrating ESG principles into the core of their operations, businesses can reduce risks, improve operational efficiency, and enhance their reputation. Investors increasingly consider ESG factors in their decision-making processes, and companies demonstrating strong ESG performance are more likely to attract investment.

In conclusion, ESG consulting is a vital service for businesses aiming to navigate the complexities of sustainability and achieve success in today's socially conscious market. By following these guidelines, companies can develop and instrument effective ESG strategies that meet regulatory requirements and drive positive change for society and the environment. As the demand for ESG consulting continues to grow, businesses that embrace these practices will be better positioned to thrive in a rapidly evolving world.

0 notes

Text

Environmental, Social, and Governance (ESG) Compliance for SMBs: A Strategic Necessity

Learn how ESG compliance consultants help SMBs navigate evolving regulations, manage risks, and build scalable ESG frameworks to ensure sustainable growth and stakeholder trust. Go here https://justpaste.it/esg-compliance-consultants

0 notes

Text

#ESG Consultant#environmental consulting firms#environmental compliance audit#environmental consultant#environmental consultants

0 notes

Photo

ESG stands for Environmental, Social, and Governance, and it refers to a framework that evaluates the sustainability and ethical impact of a company or investment. ESG metrics are quantitative and qualitative measures used to assess a company's performance in these areas. Here's a brief overview of each component of the ESG framework:

#esg investing#esg reporting#sustainability report#esg sustainability#esg financial#esg corporate governance#environment esg#esg consulting#esg reports and ratings#esg environmental and social governance#esg environmental social

0 notes

Text

Why Green Building Consultants Are Key to Achieving ESG Goals

In today's fast-paced world, achieving Environmental, Social, and Governance (ESG) goals has become a top priority for organizations worldwide. Businesses increasingly adopt sustainable practices to meet regulatory requirements and attract environmentally conscious investors. One of the most effective ways to align with ESG goals is by embracing green building practices, and that's where Green Building Consultants play a vital role.

Understanding the Role of Green Building Consultants

A Green Building Consultant helps organizations design, build, and operate sustainable structures that minimize environmental impact. Their expertise extends beyond energy efficiency; it includes areas such as water conservation, waste reduction, indoor air quality, and eco-friendly materials. By guiding businesses through sustainable construction and operational practices, green building consultants are instrumental in achieving ESG targets.

Green Building Consultancy services go beyond providing recommendations; they help businesses meet international certifications such as LEED (Leadership in Energy and Environmental Design), BREEAM (Building Research Establishment Environmental Assessment Method), and other global sustainability standards. Green building consultants ensure that a building meets the environmental criteria necessary to fulfil ESG mandates.

Green Building Consultancy in UAE

The UAE has been at the forefront of sustainable development in the Middle East. With its ambitious Vision 2030, the nation is committed to reducing its carbon footprint and promoting sustainability across industries. As part of this vision, Green Building Consultancy in the UAE has seen a significant rise in demand. Businesses looking to align with the UAE's sustainability goals are increasingly seeking the services of Green Building Consultants to ensure their projects meet the required green building standards.

Whether a commercial skyscraper in Dubai or a residential development in Abu Dhabi, Green Building Consultancy in Dubai and across the UAE is essential to minimizing environmental impact and improving social responsibility metrics, consultants' expertise helps organizations meet national regulations, attract investors, and gain a competitive edge in a rapidly evolving market.

Achieving ESG Goals with Agile Advisors

One of the leading firms in the sustainability space is Agile Advisors, a company dedicated to providing comprehensive green building consultancy services. Agile Advisors guides organizations in the UAE and beyond through the intricacies of sustainable construction and operational practices. Their team of experts works closely with businesses to help them meet their green building goals and their broader ESG objectives.

Agile Advisors provides customized solutions that address energy efficiency, water conservation, waste management, and compliance with local and international green building standards. Organizations can enhance their ESG credentials by leveraging their services while minimizing their environmental footprint.

How Green Building Consultants Drive ESG Success

Environmental Impact: The "E" in ESG is often the most visible, and green building consultants are critical players in reducing a company's environmental impact. By recommending energy-efficient designs, renewable energy sources, and sustainable construction materials, they help reduce carbon emissions, which is central to ESG goals.

Social Responsibility: Green building consultants also influence the "S" in ESG by improving indoor environmental quality ensuring building occupants' health and well-being. Buildings designed with sustainable materials and optimized energy systems create safer, more comfortable environments for employees and tenants, enhancing social responsibility.

Governance: From a governance perspective, adhering to green building standards demonstrates a company's commitment to sustainability and transparency. Green building consultants guide businesses in obtaining certifications and meeting regulatory requirements, which reflects positively on the organization's governance practices.

Conclusion

In a world where ESG goals are becoming increasingly important, Green Building Consultants are crucial in helping organizations achieve their sustainability objectives. For businesses in the UAE, partnering with a Green Building Consultancy like Agile Advisors is an intelligent move toward building a sustainable future. By doing so, they can meet regulatory requirements and gain a competitive edge, attract investors, and contribute to global sustainability efforts.

Incorporating sustainable practices into your building projects isn't just about being eco-friendly; it's about driving long-term value for the environment and your organization. As ESG standards continue to shape the business landscape, working with a green building consultant is essential to staying ahead.

#green building consultancy in uae#green building consultant#green building consultancy#green building consultancy in dubai#green building consultant in uae

0 notes

Text

assurance services Singapore

Comprehensive Audit and Assurance Services in Singapore

Navigating the complex landscape of financial regulations and compliance in Singapore requires expertise, precision, and a commitment to excellence. At PWCO, we offer a wide range of Audit and Assurance Services in Singapore to help businesses meet regulatory standards, enhance transparency, and build stakeholder confidence. Our team of highly skilled auditors delivers services tailored to your business needs, ensuring you stay compliant and focused on growth.

Why Choose Our Audit Services in Singapore?

As a leading Audit Company in Singapore, we provide comprehensive audit services designed to meet the unique needs of your business. Our audit approach is both thorough and insightful, aimed at understanding your business dynamics and providing valuable advice beyond mere compliance. We conduct statutory audits, internal audits, and special purpose audits, ensuring that every aspect of your business’s financial reporting is accurate and compliant with the Singapore Financial Reporting Standards (SFRS).

Expert Assurance Services in Singapore

In addition to our audit services, we specialize in offering Assurance Services in Singapore that provide an independent and objective evaluation of financial information. Our assurance services encompass various areas such as financial statement reviews, risk management assessments, and regulatory compliance checks. By engaging us for assurance services, businesses can achieve greater credibility in their financial reporting and gain the trust of investors and stakeholders.

Leading Provider of Corporate Tax Services in Singapore

Navigating Singapore’s corporate tax landscape can be challenging without professional guidance. Our team at PWCO offers expert Corporate Tax Services in Singapore that cover tax planning, compliance, and advisory services. We ensure that businesses optimize their tax positions while adhering to local tax regulations. Whether you need assistance with corporate income tax filing, tax dispute resolution, or international tax planning, our experienced tax advisors are here to help.

Business Consulting Services for Enhanced Growth

As businesses strive to innovate and grow, strategic consulting becomes crucial. We offer Business Consulting Services in Singapore tailored to different industries and business sizes. From financial advisory and business restructuring to operational efficiency enhancement, our consultants provide insights and strategies that drive sustainable growth. Our approach is to work closely with you to understand your business challenges and provide practical solutions that deliver measurable results.

Blockchain and Cryptocurrency Accounting Expertise

The rise of digital assets like blockchain and cryptocurrencies has revolutionized the financial sector, and proper accounting for these assets is essential. At PWCO, we provide specialized Blockchain and Cryptocurrency Accounting in Singapore to help businesses navigate this complex field. Our team is well-versed in the latest regulations and reporting standards related to digital assets, ensuring accurate financial reporting and compliance for businesses involved in blockchain technology and cryptocurrencies.

Top Audit Company in Singapore for ESG Services

Environmental, Social, and Governance (ESG) factors are becoming increasingly critical for businesses today. As a Top Audit Company in Singapore, we offer comprehensive ESG Services in Singapore to help businesses integrate sustainability into their strategies and operations. Our services include ESG reporting, sustainability strategy development, and stakeholder engagement. By leveraging our expertise, businesses can enhance their ESG performance and create long-term value.

Risk Advisory Services for a Secure Future

In an ever-changing business environment, managing risks effectively is crucial for success. Our Risk Advisory Services in Singapore help businesses identify, assess, and mitigate risks to safeguard their operations and reputation. We provide tailored risk management solutions that align with your business goals and regulatory requirements. From cyber risk management to internal controls and governance frameworks, our risk advisory team provides proactive strategies to manage uncertainties.

Choose PWCO for Reliable and Comprehensive Services

At PWCO, our mission is to provide reliable, comprehensive, and high-quality services that help businesses succeed in today's competitive landscape. Whether you need Audit and Assurance Services, Corporate Tax Services, Business Consulting, or Blockchain Cryptocurrency Accounting in Singapore, our team is here to assist you. Contact us today to learn more about how we can support your business growth and compliance needs.

0 notes

Text

What is ESG Controversy, and How Does It Impact Business?

Social media has augmented the power multimedia coverage has over public perception. The positive aspects of this situation include a rising demand for accountability and transparent corporate communication. However, the potential misuse of modern media, third-party firms’ intelligence, and news platforms can threaten the brand you develop through fake news. For instance, an ESG controversy, whether real or not, can impact a business. And this post explains how.

What is an ESG Controversy?

An ESG controversy encompasses all events concerning actual or alleged adverse impact assessments, sustainability non-compliance, data theft, etc. The environmental, social, and governance (ESG) factors help analysts create comprehensive reports and financial disclosures, highlighting potentially controversial business aspects.

Controversial events can decrease your company’s reputation, increase legal liabilities, and alienate the stakeholders. Besides, brand-related risks have long-term consequences. Therefore, corporations leverage ESG controversy analysis to identify the activities that can undermine their strategic vision, financial performance, and stakeholder interests.

What Causes an ESG Controversy?

Advanced technology empowers today’s world, empowering researchers, non-governmental organizations (NGOs), industry bodies, regional authorities, and consumers. They can quickly investigate if a brand has engaged in ESG non-compliant activities.

Employing child labor, discriminating against employees, polluting the environment, or engaging in corruption can affect your company’s relationships. Sometimes, old norms become obsolete, and new legal frameworks replace them. However, specific organizations might miss such dynamics or willfully postpone compliance.

Through ESG consulting, businesses can acquire thematic insights into sustainability compliance and controversy exposure. Themes include energy transition, labor rights, social good, carbon emissions, and waste disposal. So, investors, authorities, businesses, NGOs, and consumers can decide which brands to support or ignore.

How Does an ESG Controversy Impact a Business?

1| It Can Discourage Investors

Ethical and impact investors want to focus on enterprises working on socio-economically beneficial projects. They also employ exclusion strategies when building portfolios based on sustainable development goals (SDGs). Investors are less likely to include a brand with a controversial background in their portfolios.

2| ESG Controversy Can Lead to Consumer Boycott

Launching a new product or service will become more challenging if a company is part of a controversy. Consumers believe in buying from brands that share their values. Suppose they learn about a brand’s ESG controversy. They will deliberately avoid its products, events, and services. Simultaneously, social media and news platforms can accelerate the brand boycott trends.

3| Legal Processes Will Impact the Business

Addressing non-compliance issues can involve fulfilling legal requirements like account audits, independent inquiries, or financial penalties. These activities can make specific business operations inefficient for a while. Otherwise, the managers might get trade restrictions for an indefinite period.

4| ESG Controversy Makes Supply Chain Management Riskier

Consider a business that procures critical components from a supplier that employs child labor and releases untreated industrial effluent into water bodies. Therefore, the brand is at risk. After all, ESG controversy analysis does not stop at the company level. It inspects whether a few supplier relations can damage your stakeholder goodwill due to questionable practices.

Steps of Controversy Monitoring and Reporting

Recognizing the vulnerable aspects across the environmental, social, and governance pillars helps companies and investors streamline risk assessment. Think of the deforestation risks that will be higher in the case of construction projects. However, water resources will be more vulnerable to pollution from the heavy chemicals industry.

Later, you want to create a consolidated statistical method to rate the adverse impact according to ESG controversy risks. It will allow companies to benchmark their compliance.

Finally, investors must determine whether they want to buy or sell an asset using the final reports. Likewise, business leaders must explore opportunities to make their organizations more resilient to controversies.

Conclusion

Several possibilities affect how everyone essential to your business development perceives you. Their faith in your brand shakes once your organization becomes the focus of global and regional media coverage for the wrong reasons.

Still, every ESG controversy analyst will follow a unique system to evaluate the risks that business leaders must mitigate to have a positive impact. As a result, corporations must select analysts with an established track record of sustainability compliance and risk assessment.

3 notes

·

View notes