#Seven Antonopoulos

Explore tagged Tumblr posts

Photo

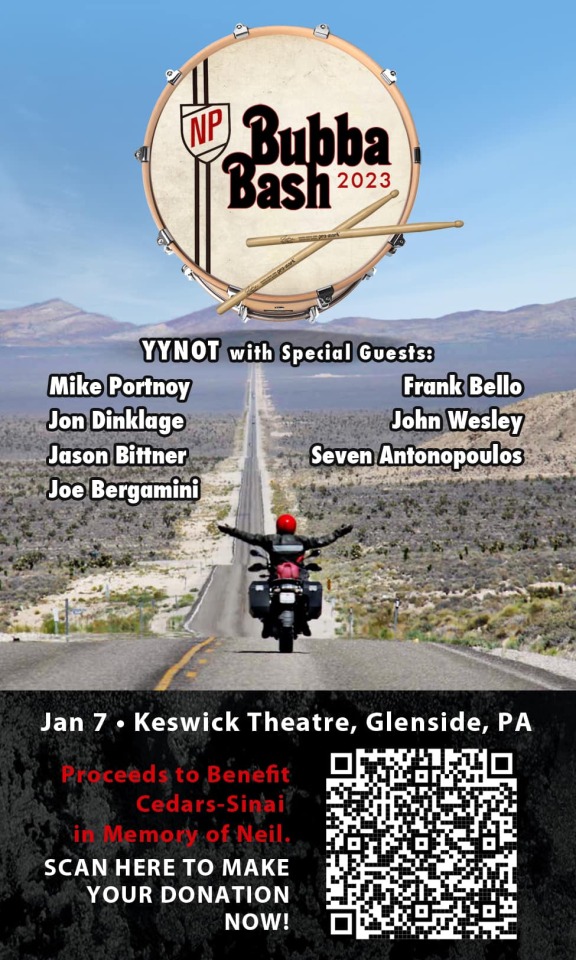

YYNOT presents Bubba Bash January 7, 2023 Keswick Theater Glenside, Pennsylvania Bubba Bash takes place on the third anniversary of Neil Peart’s death. All proceeds go to benefit Cedars Sinai. Check the following links for tickets and auction items. Here is the Blabbermouth article on the event. Get your tickets before they are sold out. It’s one event you don’t want to miss. Auction items - YYNOT.com Tickets - https://bit.ly/3FAaT6U

#RUSH#Neil Peart#Bubba Bash#YYNOT#Billy Alexander#Tim Starace#Mike Hetzel#Patty Pershayla#Mike Portnoy#Jon Dinklage#Jason Bittner#Joe Bergamini#Frank Bello#John Wesley#Seven Antonopoulos#Keswick Theater

1 note

·

View note

Link

1 year since reissuing half of the great middle-aged, boozy, Greek-Armenian chanteuse Virginia Magidou’s recordings, I got my hands on 5 more clean 78s of hers. So, you get Vol 2.

I just like her a lot.

Very little is known about Virginia Magidou. Her name appears on no public records that I have been able to locate, and I have assumed for years that it is a stage name. The Greek music and dance expert Joseph Graziosi has suggested that her last name is, in fact, Μαγκιδης, a name not uncommon in the Marmara region of north-western Turkey.

We know that she certainly sang on about 28 Greek-language sides and 2 Turkish sides for the Metropolitan and Kaliphon labels (as well as a few sides on a related label named for her) in New York City in the mid-1940s, accompanied by violinist Nicola Doneff .(b. 1891, Dichin, Bulgaria), guitarist George Katsaros (b. 1888 Amorgos, Greece; d. 1997, Tarpon Springs, Florida), accordionist John Gianaros (b. 1904 on a boat en route to Pireus, Greece; d. 1998, Tarpon Springs, Florida) , oudist Marko Melkon (b. 1895, Smyrna, Turkey ; d. 1963 in New York), clarinetist Coastas Gadinis (b. 1890, Macedonia), kanunist Garbis Bakirgian (b. 1884; d. 1969, San Fernando, California), and others of the social circle . She appeared as an accompanying vocalist on a few other sides by Tasos Eleftheriadis. From the few photos that we have of her, and the circumstantial evidence of her peer group, we can guess that she was born roughly 1890-1900.

The majority of the information that we have about her comes from a seven-minute segment of the three and a half hours of interviews that Steve Frangos conducted with John Gianaros on November 17,1986 (available on the Florida Memory state archives site at: www.floridamemory.com/items/show/236618 ). In that interview, Gianaros gives a number of interesting memories of Virginia Magidou, of whom he is clearly deeply fond as a person and for whom he has deep respect as a performer, saying emphatically, “she was the best singer in New York! She was the top singer in Turkish.” Gianaros says that she lived on 8th Avenue in Manhattan between 28th and 29th Streets (less than a block from the Port Said club where Nick Doneff, Mary Vartanian, Marko Melkon, etc. often played). He says she often performed with the Greek singer and record producer Koula Antonopoulos. He says that Magidou’s father was Armenian and mother was Greek, that she sang not only in Turkish and Greek but also Armenian and Bulgarian, and that she was married twice – first to a Cypriot sailor named Tony (he gives no last name.) and later to an unnamed American. Asked if she was still alive at the time (in 1986), Gianaros asserts that she was but that she was blind, offering an anecdote on her recording habits as the cause of her blindness:

"I’ll tell you how she got blind. Any time it was to go into the studio for her to sing, he [the studio owner, an Austrian violinist] use to bring a gallon ouzo. Now the men who was in the machine there and his wife, they started laughing. […] Because Virginia, if she didn’t drink the half gallon, she couldn’t sing. She have to drink a half-gallon and then to start singing! They used to tell her, 'Virginia, did you leave anything for us?' She say, 'I left you half-gallon,' and she would start singing. That’s right! Half-gallon! And that thing was going six, seven times a year."

Ouzo is produced at an alcohol content level of about 50%, although it is often drunk watered. If she drank it unwatered, it would be roughly the equivalent of drinking about a quart of bourbon or a gallon of wine. That level of drinking could certainly have lead over time to macular degeneration. It may well also have gone some way toward explaining why a singer who was held in such high regard recorded so little, particularly during the 1920s when her contemporaries Koula Antonopoulos, Marika Papagika, and Amalia Bakas were all recording prolifically.

Asked by Frangos about her character, Gianaros raved: “She was the best humor person! She… how can I tell you? If she knew it that you need help, she could put up her pantalones and sell it to give you the money. That kind of person.”

3 notes

·

View notes

Video

youtube

Drum Talk TV Channel – Seven Antonopoulos at the Jan 2014 Bonzo Bash! Seven Antonopoulos joins us at Brian Tichy's Jan. 2014 Bonzo Bash! Seven talks to us about what makes drummers different from other musicians as a community, growing up with family support for music, what he insists his drum students learn, the Swiss music scene, how he developed his chops and set up - and more!

0 notes

Text

Bitcoin May Crash With the Stock Market as Economic Crisis Looms: Analyst

Bitcoin is not a hedge against traditional finance, according to Mati Greenspan, analyst and founder of Quantum Economics. On Monday, Greenspan tweeted a chart showing Bitcoin, crude oil, and US stocks bouncing in unison following mass market sell-offs over coronavirus fears. This evidence suggests that Bitcoin is a risk asset, as opposed to a safe haven. And so may suffer during an economic crisis as a result. Check out this short term graph showing #bitcoin getting a critical bounce at the exact same moment as the US stock market and crude oil. If anything, it's really showing signs of behaving like a risk asset. pic.twitter.com/jILohCtFC6 — Mati Greenspan (@MatiGreenspan) February 24, 2020 The spread of Coronavirus Is Fueling Economic Panic Monday’s stock market plunge, over fears of the spread of coronavirus, saw a 1000 point drop (-3.6%) on the Dow Jones Industrial Average. With many companies warning that disruption to supply chains could result in more suffering in the months ahead. Dow Jones 5 day chart. (Source: google.com) Up until yesterday, the US economy seemed largely unaffected by concerns over coronavirus. But as South Korea and Italy confirm a number of new cases, fears of a worldwide spread finally caught up. While the number of confirmed US cases has been relatively low, Diane Swonk, Chief Economist at Grant Thornton said the fallout from coronavirus may force the US Federal Reserve to cut interest rates as soon as next month. “It may not be called a health pandemic yet but it is an economic pandemic.” And as markets panic, some maximalists point to an impending economic crisis as an opportunity for Bitcoin to truly succeed. But based on recent form, it has not risen to the task in hand. Bitcoin May Not Be a Safe Haven Asset And with that, the flight to safety has seen gold at a seven-year high, closing in $1,700/ounce. Whereas, for the past week or so, Bitcoin has stagnated following another rejection at $10k. Bitcoin daily chart. (Source: tradingview.com) As such, the lack of correlation with gold means the case for Bitcoin being a safe haven asset grows weaker. This would suggest that an economic crisis would hit the number one cryptocurrency hard. Indeed, in a recent interview on BlockTV, Andreas Antonopoulos spoke about how he sees cryptocurrency being affected by an economic crisis. And he believes a slow down in the economy would see investors shunning riskier, unproven asset classes. “I think there’s just as much chance that a slow down in economic activity, especially in the tech sector, will reduce the economic investments in the crypto space as well.” On that note, Antonopoulos slated the attitude of Bitcoin investors who look forward to economic turmoil. Saying that cryptocurrency is currently unfit to serve the transaction needs of the planet. “This could cut both ways. And we shouldn’t be gleefully expecting to test the security of the lifeboats by sinking the ship. We’re not ready for that kind of test. Cryptocurrency is not capable of supporting the scale of millions or even billions of people who might need to use it during an economic crisis.” from CryptoCracken SMFeed https://ift.tt/2HQnfci via IFTTT

0 notes

Text

Bitcoin May Crash With the Stock Market as Economic Crisis Looms: Analyst

Bitcoin is not a hedge against traditional finance, according to Mati Greenspan, analyst and founder of Quantum Economics. On Monday, Greenspan tweeted a chart showing Bitcoin, crude oil, and US stocks bouncing in unison following mass market sell-offs over coronavirus fears. This evidence suggests that Bitcoin is a risk asset, as opposed to a safe haven. And so may suffer during an economic crisis as a result. Check out this short term graph showing #bitcoin getting a critical bounce at the exact same moment as the US stock market and crude oil. If anything, it's really showing signs of behaving like a risk asset. pic.twitter.com/jILohCtFC6 — Mati Greenspan (@MatiGreenspan) February 24, 2020 The spread of Coronavirus Is Fueling Economic Panic Monday’s stock market plunge, over fears of the spread of coronavirus, saw a 1000 point drop (-3.6%) on the Dow Jones Industrial Average. With many companies warning that disruption to supply chains could result in more suffering in the months ahead. Dow Jones 5 day chart. (Source: google.com) Up until yesterday, the US economy seemed largely unaffected by concerns over coronavirus. But as South Korea and Italy confirm a number of new cases, fears of a worldwide spread finally caught up. While the number of confirmed US cases has been relatively low, Diane Swonk, Chief Economist at Grant Thornton said the fallout from coronavirus may force the US Federal Reserve to cut interest rates as soon as next month. “It may not be called a health pandemic yet but it is an economic pandemic.” And as markets panic, some maximalists point to an impending economic crisis as an opportunity for Bitcoin to truly succeed. But based on recent form, it has not risen to the task in hand. Bitcoin May Not Be a Safe Haven Asset And with that, the flight to safety has seen gold at a seven-year high, closing in $1,700/ounce. Whereas, for the past week or so, Bitcoin has stagnated following another rejection at $10k. Bitcoin daily chart. (Source: tradingview.com) As such, the lack of correlation with gold means the case for Bitcoin being a safe haven asset grows weaker. This would suggest that an economic crisis would hit the number one cryptocurrency hard. Indeed, in a recent interview on BlockTV, Andreas Antonopoulos spoke about how he sees cryptocurrency being affected by an economic crisis. And he believes a slow down in the economy would see investors shunning riskier, unproven asset classes. “I think there’s just as much chance that a slow down in economic activity, especially in the tech sector, will reduce the economic investments in the crypto space as well.” On that note, Antonopoulos slated the attitude of Bitcoin investors who look forward to economic turmoil. Saying that cryptocurrency is currently unfit to serve the transaction needs of the planet. “This could cut both ways. And we shouldn’t be gleefully expecting to test the security of the lifeboats by sinking the ship. We’re not ready for that kind of test. Cryptocurrency is not capable of supporting the scale of millions or even billions of people who might need to use it during an economic crisis.” from Cryptocracken WP https://ift.tt/2HQnfci via IFTTT

0 notes

Text

Bitcoin May Crash With the Stock Market as Economic Crisis Looms: Analyst

Bitcoin is not a hedge against traditional finance, according to Mati Greenspan, analyst and founder of Quantum Economics. On Monday, Greenspan tweeted a chart showing Bitcoin, crude oil, and US stocks bouncing in unison following mass market sell-offs over coronavirus fears. This evidence suggests that Bitcoin is a risk asset, as opposed to a safe haven. And so may suffer during an economic crisis as a result. Check out this short term graph showing #bitcoin getting a critical bounce at the exact same moment as the US stock market and crude oil. If anything, it's really showing signs of behaving like a risk asset. pic.twitter.com/jILohCtFC6 — Mati Greenspan (@MatiGreenspan) February 24, 2020 The spread of Coronavirus Is Fueling Economic Panic Monday’s stock market plunge, over fears of the spread of coronavirus, saw a 1000 point drop (-3.6%) on the Dow Jones Industrial Average. With many companies warning that disruption to supply chains could result in more suffering in the months ahead. Dow Jones 5 day chart. (Source: google.com) Up until yesterday, the US economy seemed largely unaffected by concerns over coronavirus. But as South Korea and Italy confirm a number of new cases, fears of a worldwide spread finally caught up. While the number of confirmed US cases has been relatively low, Diane Swonk, Chief Economist at Grant Thornton said the fallout from coronavirus may force the US Federal Reserve to cut interest rates as soon as next month. “It may not be called a health pandemic yet but it is an economic pandemic.” And as markets panic, some maximalists point to an impending economic crisis as an opportunity for Bitcoin to truly succeed. But based on recent form, it has not risen to the task in hand. Bitcoin May Not Be a Safe Haven Asset And with that, the flight to safety has seen gold at a seven-year high, closing in $1,700/ounce. Whereas, for the past week or so, Bitcoin has stagnated following another rejection at $10k. Bitcoin daily chart. (Source: tradingview.com) As such, the lack of correlation with gold means the case for Bitcoin being a safe haven asset grows weaker. This would suggest that an economic crisis would hit the number one cryptocurrency hard. Indeed, in a recent interview on BlockTV, Andreas Antonopoulos spoke about how he sees cryptocurrency being affected by an economic crisis. And he believes a slow down in the economy would see investors shunning riskier, unproven asset classes. “I think there’s just as much chance that a slow down in economic activity, especially in the tech sector, will reduce the economic investments in the crypto space as well.” On that note, Antonopoulos slated the attitude of Bitcoin investors who look forward to economic turmoil. Saying that cryptocurrency is currently unfit to serve the transaction needs of the planet. “This could cut both ways. And we shouldn’t be gleefully expecting to test the security of the lifeboats by sinking the ship. We’re not ready for that kind of test. Cryptocurrency is not capable of supporting the scale of millions or even billions of people who might need to use it during an economic crisis.” from Cryptocracken Tumblr https://ift.tt/2HQnfci via IFTTT

0 notes

Text

Learn Blockchain Programming (curriculum)

New Post has been published on https://hititem.kr/learn-blockchain-programming-curriculum/

Learn Blockchain Programming (curriculum)

Hello world it’s Suraj and who’s ready to learn some blockchain for me to be able to write the decentralized applications book two years ago I needed to study blockchain technology hard AF and fast AF and efficiently AF since I was simultaneously traveling through different parts of Asia so if I were to start learning blockchain from scratch today this is the two-month study plan I’d make for myself but I’m gonna open-source it for you wizards since I love you this is a two month curriculum dedicated to in order one week of cryptography two weeks of Bitcoin two weeks of aetherium one week of other crypto currencies and lastly two weeks of decentralized applications but before you do anything else remember to hit the subscribe button if you haven’t yet to stay updated on my content this channel is my life’s work as you learn this technology make sure to follow several blockchain authorities on Twitter to keep up with the pulse in this space and yes in Soviet Russia blockchain authorities follow you oh and for more things to remember before we get started with this curriculum first watch videos at 2x speed and eventually 3x speed as your brain learns to adapt to faster pacing take notes by hand as you watch for memory retention dedicate at least 2 hours every single day to uninterrupted learning and yes that includes weekends and find a study buddy in our slack channel or someone in real life it will help keep you motivated remember this is not a game the links for everything will be in the video description before you get into the weeds with crypto currencies you have to understand why the word crypto is used in cryptocurrency crypto short for cryptography is the art of securing information given some sensitive data it asks the question how do we prevent a third party a an adversary from reading that data most people don’t realize just how crucial cryptography is for Humanity pretty much any kind of money transfer authentication flow and mission-critical system relies very heavily on cryptographic techniques to help maintain secrecy and cryptography itself sits at the intersection of math computer science and even physics but luckily for us its prerequisites aren’t worthy of dedicating weeks of study to we can pick them up in a single well structured cryptography course after reading some reviews it seems that the intro to cryptography course on Coursera is the best option here to get started it’s a seven week course that we’re going to complete in a single week don’t do any of the graded projects until you finish all of the videos knock them out one by one at the end of this week do the final exam for week seven really put in an effort then double check your answers to learn from your mistakes now on to weeks two and three we’re gonna focus on the blockchain that started it all Bitcoin so normally I almost never recommend reading books to learn this kind of thing since videos are so efficient but sometimes there are exceptional books out there like the deep learning book and Where’s Waldo in this case I’m gonna recommend my friend Andreas Antonopoulos book mastering Bitcoin it’s open source and available to read on github Andreas does such a great job of breaking down all the moving parts of the Bitcoin protocol his technical writing skills are next-level there are 12 chapters in this book we’re gonna read two to three chapters every single day until we finish them all pacing ourselves included in the book are technical instructions for configuring and using the Bitcoin protocol go ahead and do those via your terminal if you get an error at some point try to fix it but if no luck don’t get too caught up on it for too long just move on after you’ve completed the book go ahead and the official Bitcoin white paper specifically an annotated version to make it easier to understand those concepts then download a Bitcoin wallet and buy some Bitcoin it can be a really small amount but it’s mostly just to feel like you’re a part of the network and experience the cryptocurrency world firsthand for the second week of Bitcoin learning take the Bitcoin and cryptocurrency technologies course on Coursera when you’re done with that spend the rest of the week building a blockchain that uses the proof-of-work consensus algorithm from scratch in your favorite programming language of choice I’d recommend either Python or JavaScript there’s a great article that explains how to do this that I’ll add to in the links add as many features to it as you can to get some hands-on experience in blockchain technology now that you’ve got a handle on Bitcoin it’s time to go down the second rabbit hole theory on Bitcoin removed the need for an intermediary when sending someone money over the Internet recording all transactions on a public database the etherium developers realized that they could use the same underlying blockchain technology to remove the need for an intermediary for running code think of it like a world computer a decentralized virtual machine to build unsensible applications on top of there’s a free really short aetherium course on udemy that you should first check out to help you understand the etherium architecture then you should read the annotated aetherium white paper for a better understanding it’s much more complex than the Bitcoin one so really take the time to go through all the details it will help you as soon as you start building aetherium apps using the solidity programming language oh and speaking of solidity once you’ve finished the course you can learn solidity using this crypto zombies game where you learn how smart contracts work by building them and applying them to this game world is actually pretty fun lastly black geeks.com has a collection of really in-depth articles on aetherium that I’d recommend checking out just hit them up one by one once you search for the etherium keyword until you understand all the parts of the architecture so Bitcoin and aetherium are out of the way but what about the other billion crypto currencies out there with all of their unique features and ideas are they worthless Yes No some of these projects have synthesized some really great ideas so we should dedicate this week to learning about some of those best ideas I’ve got a great playlist that goes over the crypto currencies I find the most interesting right here on YouTube that you should definitely check out remember to go through the Associated code and helpful learning links in the video description for each of them to get a better understanding you can spread this bit out to an entire week there are rabbit holes you could go down for any of the crypto currencies I talked about from Minh arrows ring signatures to cardano’s settlement slayer let your curiosity guide you this week and for the last part of this curriculum you’re going to wrap it all up by learning about the longer-term vision for all of these technologies decentralized applications start off by reading my book on the topic you can find a free version if you google the name with the word free afterwards also if someone posts a link to the free version in the comments I’ll pin it so you can check it out that’ll take you a full week and a lot of the code is deprecated now because of all the dependencies being updated over time but the pseudo code the ideas and the theories remain for the very last week build a decentralized application yourself pick an idea ride sharing or social networking for example and use the fastest method to prototype approach to build something in a single week and that’s it I just launched my decentralized applications course at the school of AI but we currently got a full class so sign up there if you want to be notified when the next course opens up I hope you found these tips useful please subscribe for more programming videos and for now I’ve got to upgrade the web so thanks for watching

0 notes

Link

Very little is known about Virginia Magidou. Her name appears on no public records that I have been able to locate, and I have assumed for years that it is a stage name. The Greek music and dance expert Joseph Graziosi has suggested that her last name is, in fact, Μαγκιδης, a name not uncommon in the Marmara region of north-western Turkey. We know that she sang on about 28 Greek-language sides and 2 Turkish sides for the Metropolitan and Kaliphon labels (as well as a few sides on a related label named for her) in New York City in the mid-1940s, accompanied by violinist Nicola Doneff .(b. 1891, Dichin, Bulgaria), guitarist George Katsaros (b. 1888 Amorgos, Greece; d. 1997, Tarpon Springs, Florida), accordionist John Gianaros (b. 1904 on a boat en route to Pireus, Greece; d. 1998, Tarpon Springs, Florida) , oudist Marko Melkon (b. 1895, Smyrna, Turkey ; d. 1963 in New York), clarinetist Coastas Gadinis (b. 1890, Macedonia), kanunist Garbis Bakirgian (b. 1884; d. 1969, San Fernando, California), and others of the social circle . She appeared as an accompanying vocalist on a few other sides by Tasos Eleftheriadis. From the few photos that we have of her, and the circumstantial evidence of her peer group, we can guess that she was born roughly 1890-1900. The majority of the information that we have about her comes from a seven-minute segment of the three and a half hours of interviews that Steve Frangos conducted with John Gianaros on November 17,1986 (available on the Florida Memory state archives site at: www.floridamemory.com/items/show/236618 ). In that interview, Gianaros gives a number of interesting memories of Virginia Magidou, of whom he is clearly deeply fond as a person and for whom he has deep respect as a performer, saying emphatically, “she was the best singer in New York! She was the top singer. in Turkish.” Gianaros says that she lived on 8th Avenue in Manhattan between 28th and 29th Streets (less than a block from the Port Said club where Nick Doneff, Mary Vartanian, Marko Melkon, etc. often played). He says she often performed with the Greek singer and record producer Koula Antonopoulos. He says that Magidou’s father was Armenian and mother was Greek, that she sang not only in Turkish and Greek but also Armenian and Bulgarian, and that she was married twice – first to a Cypriot sailor named Tony (he gives no last name.) and later to an unnamed American. Asked if she was still alive at the time (in 1986), Gianaros asserts that she was but that she was blind, offering an anecdote on her recording habits as the cause of her blindness: "I’ll tell you how she got blind. Any time it was to go into the studio for her to sing, he [the studio owner, an Austrian violinist] use to bring a gallon ouzo. Now the men who was in the machine there and his wife, they started laughing. […] Because Virginia, if she didn’t drink the half gallon, she couldn’t sing. She have to drink a half-gallon and then to start singing! They used to tell her, 'Virginia, did you leave anything for us?' She say, 'I left you half-gallon,' and she would start singing. That’s right! Half-gallon! And that thing was going six, seven times a year." Ouzo is produced at an alcohol content level of about 50%, although it is often drunk watered. If she drank it unwatered, it would be roughly the equivalent of drinking about a quart of bourbon or a gallon of wine. That level of drinking could certainly have lead over time to macular degeneration. It may well also have gone some way toward explaining why a singer who was held in such high regard recorded so little, particularly during the 1920s when her contemporaries Koula Antonopoulos, Marika Papagika, and Amalia Bakas were all recording prolifically. Asked by Frangos about her character, Gianaros raved: “She was the best humor person! She… how can I tell you? If she knew it that you need help, she could put up her pantalones and sell it to give you the money. That kind of person.” “Mortissa Gennetheka” (originally recorded by Rosa Eskenazi, translation by Bobby Damore) Aaach, I was born a tough chick, I’ll die a tough chick Because I didn’t find more beauty to make of this life. I like the tough life, and if I’m lucky I’ll be rich. In this lying world, I’ll live even tougher. Chrous: Bring santouris and violins, ouzo to get drunk. This false world, I just want to party in it. Aaach, I would like to have a man who feels, a tough guy, or gangster. To be the love of the crazy guys who are a little troublesome, That’s how I like the men who feel, and if I’m lucky I’ll love one. In a tough guy’s lips, my eyes will close. "Tsiapkina Amerikana” (translation by Geroge Sempepos) I spend the night straight through daybreak with the American chick She's stolen my mind, that super-fine beautiful lady Chorus: Stop already, with your frustrating carrying on with the cabbies Stop already carrying on with the good-looking sailors. You mess with the cabbies who come down from Athens You also mess with all the young guys who come down to drink retsina My Amerikana tsakpina, come to your senses And don't force me to become a murderer in your neighborhood!

9 notes

·

View notes

Text

Learn Blockchain Programming (curriculum)

New Post has been published on https://hititem.kr/learn-blockchain-programming-curriculum/

Learn Blockchain Programming (curriculum)

Hello world it’s Suraj and who’s ready to learn some blockchain for me to be able to write the decentralized applications book two years ago I needed to study blockchain technology hard AF and fast AF and efficiently AF since I was simultaneously traveling through different parts of Asia so if I were to start learning blockchain from scratch today this is the two-month study plan I’d make for myself but I’m gonna open-source it for you wizards since I love you this is a two month curriculum dedicated to in order one week of cryptography two weeks of Bitcoin two weeks of aetherium one week of other crypto currencies and lastly two weeks of decentralized applications but before you do anything else remember to hit the subscribe button if you haven’t yet to stay updated on my content this channel is my life’s work as you learn this technology make sure to follow several blockchain authorities on Twitter to keep up with the pulse in this space and yes in Soviet Russia blockchain authorities follow you oh and for more things to remember before we get started with this curriculum first watch videos at 2x speed and eventually 3x speed as your brain learns to adapt to faster pacing take notes by hand as you watch for memory retention dedicate at least 2 hours every single day to uninterrupted learning and yes that includes weekends and find a study buddy in our slack channel or someone in real life it will help keep you motivated remember this is not a game the links for everything will be in the video description before you get into the weeds with crypto currencies you have to understand why the word crypto is used in cryptocurrency crypto short for cryptography is the art of securing information given some sensitive data it asks the question how do we prevent a third party a an adversary from reading that data most people don’t realize just how crucial cryptography is for Humanity pretty much any kind of money transfer authentication flow and mission-critical system relies very heavily on cryptographic techniques to help maintain secrecy and cryptography itself sits at the intersection of math computer science and even physics but luckily for us its prerequisites aren’t worthy of dedicating weeks of study to we can pick them up in a single well structured cryptography course after reading some reviews it seems that the intro to cryptography course on Coursera is the best option here to get started it’s a seven week course that we’re going to complete in a single week don’t do any of the graded projects until you finish all of the videos knock them out one by one at the end of this week do the final exam for week seven really put in an effort then double check your answers to learn from your mistakes now on to weeks two and three we’re gonna focus on the blockchain that started it all Bitcoin so normally I almost never recommend reading books to learn this kind of thing since videos are so efficient but sometimes there are exceptional books out there like the deep learning book and Where’s Waldo in this case I’m gonna recommend my friend Andreas Antonopoulos book mastering Bitcoin it’s open source and available to read on github Andreas does such a great job of breaking down all the moving parts of the Bitcoin protocol his technical writing skills are next-level there are 12 chapters in this book we’re gonna read two to three chapters every single day until we finish them all pacing ourselves included in the book are technical instructions for configuring and using the Bitcoin protocol go ahead and do those via your terminal if you get an error at some point try to fix it but if no luck don’t get too caught up on it for too long just move on after you’ve completed the book go ahead and the official Bitcoin white paper specifically an annotated version to make it easier to understand those concepts then download a Bitcoin wallet and buy some Bitcoin it can be a really small amount but it’s mostly just to feel like you’re a part of the network and experience the cryptocurrency world firsthand for the second week of Bitcoin learning take the Bitcoin and cryptocurrency technologies course on Coursera when you’re done with that spend the rest of the week building a blockchain that uses the proof-of-work consensus algorithm from scratch in your favorite programming language of choice I’d recommend either Python or JavaScript there’s a great article that explains how to do this that I’ll add to in the links add as many features to it as you can to get some hands-on experience in blockchain technology now that you’ve got a handle on Bitcoin it’s time to go down the second rabbit hole theory on Bitcoin removed the need for an intermediary when sending someone money over the Internet recording all transactions on a public database the etherium developers realized that they could use the same underlying blockchain technology to remove the need for an intermediary for running code think of it like a world computer a decentralized virtual machine to build unsensible applications on top of there’s a free really short aetherium course on udemy that you should first check out to help you understand the etherium architecture then you should read the annotated aetherium white paper for a better understanding it’s much more complex than the Bitcoin one so really take the time to go through all the details it will help you as soon as you start building aetherium apps using the solidity programming language oh and speaking of solidity once you’ve finished the course you can learn solidity using this crypto zombies game where you learn how smart contracts work by building them and applying them to this game world is actually pretty fun lastly black geeks.com has a collection of really in-depth articles on aetherium that I’d recommend checking out just hit them up one by one once you search for the etherium keyword until you understand all the parts of the architecture so Bitcoin and aetherium are out of the way but what about the other billion crypto currencies out there with all of their unique features and ideas are they worthless Yes No some of these projects have synthesized some really great ideas so we should dedicate this week to learning about some of those best ideas I’ve got a great playlist that goes over the crypto currencies I find the most interesting right here on YouTube that you should definitely check out remember to go through the Associated code and helpful learning links in the video description for each of them to get a better understanding you can spread this bit out to an entire week there are rabbit holes you could go down for any of the crypto currencies I talked about from Minh arrows ring signatures to cardano’s settlement slayer let your curiosity guide you this week and for the last part of this curriculum you’re going to wrap it all up by learning about the longer-term vision for all of these technologies decentralized applications start off by reading my book on the topic you can find a free version if you google the name with the word free afterwards also if someone posts a link to the free version in the comments I’ll pin it so you can check it out that’ll take you a full week and a lot of the code is deprecated now because of all the dependencies being updated over time but the pseudo code the ideas and the theories remain for the very last week build a decentralized application yourself pick an idea ride sharing or social networking for example and use the fastest method to prototype approach to build something in a single week and that’s it I just launched my decentralized applications course at the school of AI but we currently got a full class so sign up there if you want to be notified when the next course opens up I hope you found these tips useful please subscribe for more programming videos and for now I’ve got to upgrade the web so thanks for watching

0 notes

Photo

New Post has been published here https://is.gd/y99sov

Hodler’s Digest, June 3–9: Top Stories, Price Movements, Quotes and FUD of the Week

This post was originally published here

Coming every Sunday, the Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions, and much more — a week on Cointelegraph in one link.

Top Stories This Week

Mt. Gox’s Karpeles: “Press Rumors About My Blockchain Plans Are False”

Mark Karpeles, the former CEO of long-defunct Japanese cryptocurrency exchange Mt. Gox, denied press claims this week that he is returning to blockchain. Karpeles said that his activities with Tristan Technologies will not involve the cryptocurrency sector, as previously reported, and that the firm is not a startup and not related to blockchain. In comments to Cointelegraph, Karpeles said that he wasn’t “sure how this got reported wrong” and that his main goal is to “try to bring back Japan near the top of the IT industry.” A judge acquitted Karpeles of embezzlement in March and is currently appealing a lesser conviction of data manipulation, all in relation to the hack of Mt. Gox.

SEC Sues Kik for Conducting Allegedly Unregistered $100 Million ICO in 2017

Canadian startup Kik has been sued by the United States Securities and Exchange Commission (SEC) for an unregistered $100 million token offering. According to the SEC’s complaint, the commission alleged that Kik’s digital token sale was not compliant with U.S. securities laws, as it had not registered the offering with the proper authorities. The SEC’s complaint comes right after Kik’s recent announcement that the company is launching a $5 million crypto initiative to fund a lawsuit against the SEC, with a campaign called DefendCrypto. Steven Peikin, co-director of the SEC’s Division of Enforcement, said in a press release that, by conducting its kin token sale, Kik “deprived investors of information to which they were legally entitled and prevented investors from making informed investment decisions.”

Tron’s Justin Sun Wins eBay Charity Auction in $4.57M Bid to Lunch With Warren Buffett

Justin Sun, Tron founder and CEO, has won an eBay charity auction to have lunch with Warren Buffett, renowned investor and CEO of Berkshire Hathaway. In order to win the lunch, which Buffett has participated in for 20 years, Sun allegedly bid a record-breaking $4,567,888. The winner will be able to bring along seven friends to a New York steakhouse, and all proceeds from the auction go to San Francisco-based nonprofit Glide Foundation. Sun wrote in a statement that the bid was a key priority for the Tron and BitTorrent team. Buffett has long been known for his negative stance on cryptocurrencies, although he has made positive comments in regard to blockchain.

LocalBitcoins Confirms Removal of Local Cash Trades

Global peer-to-peer (p2p) crypto exchange LocalBitcoins officially confirmed this week the removal of trading in local fiat currencies. The Finland-based exchange had previously removed the cash trading option on June 1 with no announcement, which caused some outrage in the crypto community. In an official statement this week, the exchange noted that its liabilities are determined by the Act on Detecting and Preventing Money Laundering and Terrorist Financing, which requires them to follow certain regulations. The move comes on the heels of the news that LocalBitcoins will soon become monitored by the Financial Supervisory Authority of Finland, as the Finnish government passed new legislation for crypto assets earlier this year.

Report: Facebook to Announce Cryptocurrency Project This Month

Social media giant Facebook will reportedly announce its cryptocurrency project this month, and employees will be allowed to take part of their salary in the coin. According to unnamed sources, the white paper for the coin will be released on June 18. As well, Laura McCracken, Facebook’s head of financial services and payment partnerships for Northern Europe, said in an interview this week that the stablecoin would not only involve a U.S. dollar peg. Other media reports this week have noted that there are now 100 people known to be working on the crypto project via profiles on professional networking platform LinkedIn. Winners and Losers

This week in the markets, bitcoin is below $8,000, trading at around $7,933, ether is at $245 and XRP at $0.41. Total market cap is about $253 billion.

The top three altcoin gainers of the week are posscoin, bitcoin 2 and hempcoin. The top three altcoin losers of the week are bzedge, pandemia and quantis network.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“The unwillingness to allow more competitors to offer geared ETFs seems to be another example of denying or curtailing access to a product that would be useful to some investors.”

Hester Peirce, commissioner at the SEC

“What a difference it would have made a decade ago if blockchain technology on a private distributed ledger accessible to regulators had been the informational foundation of Wall Street’s derivatives exposures.”

J. Christopher Giancarlo, United States Commodity Futures Trading Commission (CFTC) Chairman

“I don’t think I’m a Neanderthal, which is what I’ve been called when I’ve said I didn’t want to own bitcoin.”

Stanley Druckenmiller, American billionaire investor

“I don’t recommend bitcoin in either direction because I don’t really care for it in terms of an asset, but I do care for it as a signalling mechanism that I think was a tip-off to this bounce in gold.”

Peter Boockvar, chief investment officer at financial planning and wealth advisory firm Bleakley Advisory Group

“My love for Japan has not changed. Japan used to be engineering superpower in terms of its PCs but right now, taking the cloud for example, it’s the U.S. that dominates. But I still believe in the potential Japan has and I would like to develop that.”

Mark Karpeles, former CEO of the now-defunct bitcoin exchange Mt. Gox

“The lack of financial inclusion is not a ‘bug’ of the traditional financial system. It’s a direct result of the regulatory architecture and the intermediaries policies.”

Andreas Antonopoulos, well-known bitcoin educator and crypto commentator

“I do not know what bitcoin is.”

Jair Bolsonaro, president of Brazil

Report: Polish Exchange Shuts Down and Disappears With Customers Funds

Coinroom, a Polish cryptocurrency exchange, has reportedly shut down its operations and disappeared with customer funds. While the total amount lost has not been disclosed, some users said that they had up to 60,000 zloty (around $15,790) in their accounts. Before ending its operations, Coinroom reportedly asked customers in an email to withdraw their money in one day, while in reality, customers have said that they were unable to get all of their money in this final withdrawal. A spokesperson for the district prosecutor’s office in Warsaw said that proceedings had been initiated against Coinroom for unregistered crypto payment services.

New Malware Campaign Spreads Trojans Through Clone Crypto Trading Website

According to Twitter user and malware researcher Fumik0_, a new website is spreading cryptocurrency malware. The aforementioned site reportedly imitates the website for Cryptohopper, a site where users can program tools to perform automatic cryptocurrency trading. After a user goes on the site, which displays the logo of Cryptohopper in an attempt to trick the user, it automatically downloads a setup.exe installer that will infect the computer once it runs. The installer infects the computer with an information-stealing Trojan, which then also installs two other Qulab Trojans for mining and clipboard hijacking deployed once every minute to collect data.

Report: Nearly $10 Million in XRP Stolen in GateHub Hack

Cryptocurrency wallet service GateHub said this week that hackers compromised almost 100 XRP Ledger wallets, resulting in the loss of around $10 million. In a statement, GateHub said that it was notified by community members of the loss of funds, following which it discovered increased application programming interface (API) calls coming from a small number of IP addresses. While one of those who warned GateHub about the breach reported that almost 13,100,000 XRP ($5.37 million) had already been laundered through exchanges and mixer services, GateHub has stated that the investigation is still ongoing.

Best Cointelegraph Features

The Land of the Free: Why Decentralization Matters in the Crypto Republic

After Tezos updated without forking and Iota introduced an ostensibly centralization-killing element, Cointelegraph examines the importance of decentralization by some of the large players in the crypto community.

Satoshi Posers — Why So Many Takers for the Bitcoin Crown?

With some anonymous Satoshi Nakomoto posers coming out of the woodwork, as well as one very not-so-anonymous Craig Wright, Cointelegraph looks at the potential motivations for claiming to be bitcoin’s father.

What Is a Satoshi, the Smallest Unit on the Bitcoin Blockchain?

In this analysis, Cointelegraph explains what exactly a “satoshi” is, why this buzzword has become popular recently, and who came up with the term itself.

#crypto #cryptocurrency #btc #xrp #litecoin #altcoin #money #currency #finance #news #alts #hodl #coindesk #cointelegraph #dollar #bitcoin View the website

New Post has been published here https://is.gd/y99sov

0 notes

Photo

New Post has been published on http://www.drumpad.video/seven-antonopoulos-apx-show-no-mercy-tour/

Seven Antonopoulos - APX 'Show No Mercy' Tour

youtube

SABIAN endorser Seven Antonopoulos during the recent APX ‘Show No Mercy Tour’ which showcased SABIAN’s new APX cymbal line. http://www.sabian.com/EN/products/apx.cfm

0 notes

Text

All The Highlights From Our #FASHIONforall Relaunch Party Last Night

Last night, an eclectic mix of the city’s most stylish came together at the Design Exchange on Bay Street to fête the relaunch of FASHION Canada as an all-inclusive brand aimed at all sizes, ages, ethnicities, genders and sexual orientations. Notable guests included Ladyfag, Skin, Vivek Shraya, Christina Schmidt, the Beckermans, Yasmin Warsame, Traci Melchor, The Rebel Mamas, Dorian Rahimzadeh, Suzanne Boyd, Mei Pang and Jacques Claude Esader.

“We love fashion, you love fashion and we love you!” Editor-in-chief Bernadette Morra declared to the crowd, after taking the mike from DJ Baby Girl. Creative and Fashion Director George Antonopoulos then introduced Tush, a duo he discovered on Instagram.

The CBC’s Nil Koksil, the Toronto Star’s Shinan Govani and Soho House’s Markus Anderson, who is part of Meghan and Harry’s inner circle, cheered on the steamy performance, before the dance floor was filled again with non-stop action. A disco ball and lasers by EPiQVision added to the fabulousness of the space.

The creative vibe was sparked from the get go with guests making their way through a neon-lit tunnel before reaching a blacklight installation by Bruno Billio on the stairway up to the party. The ‘gram-worthy space was a hit with a seemingly endless stream of guests staging their own photoshoots on the stairs throughout the night.

Inside the main party space, oversized images of each of our seven cover stars adorned one wall – providing a stylish backdrop to the nibbles from Oliver & Bonacini and Roll This Way Sushi that helped keep guests fuelled for a night of dancing.

The pink velvet BOSS lounge – where imagery from the brand’s newest campaign hung on the walls – was a happening destination providing guests with a chic place to sit and sip as they people-watched and took in the ambience.

Key moments were also created inside the event thanks to Diana VanderMeulen’s sculpture garden, florals by Jackie O and roaming models dressed in French Fetish Burlesque-inspired couture ensembles from Toronto-based brand Maison Chardon.

Drinks were flowing with beer from Stella Artois, wine from MezzaCorona and cocktails courtesy of Bulleit Bourbon, Don Julio Tequila, Johnnie Walker Black Label, Tanqueray No. Ten Gin and Ciroc Vodka. Guests stayed hydrated thanks to Vellamo Water.

Sweet tooths were also satiated via a FASHION-branded gelato stand from Love Gelato, and an immersive chocolate-smashing experience from CXBO Chocolates. Meanwhile, the canna-curious congregated in the dosist corner where the company informed many guests about their dose-controlled cannabis pens and range of mood options.

Scroll down to see more highlights from the night below:

Want more? Click here to see our round-up of must-see looks from the party.

The post All The Highlights From Our #FASHIONforall Relaunch Party Last Night appeared first on FASHION Magazine.

All The Highlights From Our #FASHIONforall Relaunch Party Last Night published first on https://borboletabags.tumblr.com/

0 notes

Text

Let's Talk Bitcoin! #421 Stone Money and Echoes of the Past

On Today's Show...

We're listening to echoes of the past. In the midst of the biggest bubble yet, finding ourselves in the "then they laugh at you" phase, and with the china narrative rising for the first time as trade volumes overtook the rest of the world, I was joined by Stephanie Murphy and Andreas M. Antonopoulos in early 2014 for a conversation that is very different, yet somehow the same as we reacted in real time to all-time high prices of $220,

But first, In the nearly seven years since we started talking Bitcoin, my favorite segment from my favorite writer is without question, the island of stone bitcoins by then-LTB managing editor George Ettinger. Bitingly funny and still one of the easiest ways to accurately explain how blockchains and tokens work without the need for technology at all, even if you know this story you'll learn a thing or two, at least I did.

This episode is sponsored by Brave.com and eToro.com, and is distributed in partnership with CoinDesk.com

from Money 101 https://letstalkbitcoin.com/blog/post/lets-talk-bitcoin-421-stone-money-and-echoes-of-the-past via http://www.rssmix.com/

0 notes

Text

Let's Talk Bitcoin! #421 Stone Money and Echoes of the Past

On Today's Show...

We're listening to echoes of the past. In the midst of the biggest bubble yet, finding ourselves in the "then they laugh at you" phase, and with the china narrative rising for the first time as trade volumes overtook the rest of the world, I was joined by Stephanie Murphy and Andreas M. Antonopoulos in early 2014 for a conversation that is very different, yet somehow the same as we reacted in real time to all-time high prices of $220,

But first, In the nearly seven years since we started talking Bitcoin, my favorite segment from my favorite writer is without question, the island of stone bitcoins by then-LTB managing editor George Ettinger. Bitingly funny and still one of the easiest ways to accurately explain how blockchains and tokens work without the need for technology at all, even if you know this story you'll learn a thing or two, at least I did.

This episode is sponsored by Brave.com and eToro.com, and is distributed in partnership with CoinDesk.com

from The Let's Talk Bitcoin Network https://ift.tt/2YPrcFL via IFTTT

0 notes

Text

US Judge Denies Customer’s Plea to Quash IRS Bitstamp Inquiry

New Post has been published on https://coinmakers.tech/news/us-judge-denies-customer-s-plea-to-quash-irs-bitstamp-inquiry

US Judge Denies Customer’s Plea to Quash IRS Bitstamp Inquiry

US Judge Denies Customer’s Plea to Quash IRS Bitstamp Inquiry

A Washington Western District Court judge has rejected petitioner William Zietzke’s appeal to stop the U.S. Internal Revenue Service (IRS) from accessing his Bitstamp trade data. An IRS summons invoked Zietzke to file a petition to quash the tax agency’s investigation into his private accounts. Even though the presiding Judge John Coughenour believes the IRS summons is “overbroad,” he still denied Zietzke’s petition.

Washington Judge Will Allow IRS to Summons Bitstamp Over a Customer’s Transactions in 2016

William Zietzke filed a motion to quash an IRS summons on June 27, 2019, and the Washington case was then in limbo up until November 25. Court filings detail that in 2016, Zietzke used the platform Turbo Tax and said he thought he made two major transactions by filing a capital gain for more than $100K. After the tax filing, he realized he made a mistake and amended the return. Only this time Zietzke claimed a $410 capital gain and the IRS countered the changes by initiating an audit into his financial affairs.

Zietzke explained that the transactions did not occur in 2016 and he only realized his mistake after his accountant started helping him prepare for retirement. According to the filing on November 25, Zietzke claimed to have only used crypto services like Armory Wallet for his personal holdings and companies like Purse.io and Coinbase. Despite the admission, during the audit, the IRS discovered Zietzke also used the exchange Bitstamp.

“The IRS learned that petitioner used Bitstamp to conduct at least one Bitcoin transaction in 2016. Upon learning of this transaction, the IRS issued a summons to Bitstamp,” the document details.

Zietzke believes that the Bitstamp summons infringes on his Fourth Amendment rights and that he gave the IRS all that it needs for the investigation. However, even though Judge John Coughenour noted that the audit was “overbroad,” he decided he would deny Zietzke’s petition to quash.

“Having considered the parties’ briefing and the relevant record, the court finds oral arguments unnecessary and denies the petitioner’s petition,” Coughenour said. “However, because the court finds the summons overbroad, the court orders the government to file a proposed amended summons that complies with this order. Until the court approves an amended summons, the court postpones ruling on the government’s motion to enforce,” the judge added.

Zietzke v. the United States of America, case # 2:19-cv-01234 filed on June 27, 2019.

Judge Coughenour Rules Cryptocurrencies Have Tax Consequences and Exchange Records Are Not Immune From Inspection

In addition to the denial, Coughenour remarked that “as with many things in life, cryptocurrency transactions have tax consequences.” Coughenour underlined that in 2014 the tax agency in the U.S. set forth its position on those consequences using IRS Notice 2014-21, 2014-16. The IRS recently updated the tax compliance guidelines for US taxpayers, but as far as capital gains are concerned “virtual currency is treated as property and general tax principles applicable to property transactions apply to transactions using virtual currency.” The Washington judge further said if Zietzke plans to oppose the proposed amended summons, he’s got seven days from the government’s amended actions.

“[The petitioner] may oppose the proposed amended summons only insofar as it requests information that is not relevant to the tax implications of transactions in 2016,” Coughenour declared.

In 2019 the IRS ramped up tax enforcement against cryptocurrency owners.

The latest judgment follows the IRS sending out letters to 10,000 Americans concerning cryptocurrency use and tax implications. Following the letters, the IRS also informed the public of a new draft for the latest 1040 tax form, which is used by more than 150 million American taxpayers. The latest court case involving Bitstamp transactions also reminds crypto supporters of when Coinbase was compelled by the U.S. tax agency to provide data on 13,000 customers.

The cryptocurrency question on the draft Schedule 1- 1040 reads: “At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

In February 2018, the well known speaker Andreas Antonopoulos tweeted that he was one of the 13,000 Coinbase users. “Received notice from Coinbase today, that my account is one of the 13,000 that they will have to turn over to the IRS under the court order,” Antonopoulos said at the time. “Not surprised, I knew I would be in that group. In case you were wondering, I’ve filed and paid taxes for my bitcoin income, gains/losses.” These broad investigations into crypto exchanges and customer data, reiterates the fact that governments have full access to global exchange trade logs by simply threatening criminal enforcement. With the Washington court judgment, Coughenour doesn’t believe Zietzke’s Fourth Amendment rights will be violated if the tax agency investigates his Bitstamp transactions.

“Because Bitstamp’s records do not implicate the privacy concerns — [William Zietzke] lacks a legitimate expectation of privacy in those records,” Coughenour concluded. “Consequently, the IRS’s request for those records does not infringe upon the petitioner’s Fourth Amendment rights.”

Source: news.bitcoin

0 notes

Text

South Africa: Team SA Dominates With 12 Medals At Africa Games

South Africa: Team SA Dominates With 12 Medals At Africa Games

Rabat — Team SA picked up 12 medals on Wednesday at the African Games in Rabat and Casablanca.

There were seven gold medals, three silver medals and two bronze medals from Tiffany Keep (cycling), and Erin Gallagher, Emma Chelius, Kaylene Corbett, Christin Mundell, Michael Houlie, Samantha Randle (two), Martin Binedell, Carla Antonopoulos, women’s 4x100m freestyle (swimming) and men’s 4x100m…

View On WordPress

0 notes