#Seems to have been a good idea so far though if it needs rebalancing I could always open a segment and fill a few of the-

Explore tagged Tumblr posts

Text

A Good Servant

Part 1 of ?

Summary: You would do anything to keep her happy: be it keeping her pet healthy, running her house or making her wine. Everything but for what you both want.

Some content warnings for this part: there's heavily referenced sex/sexual activity, pet play (not with the reader, this is an angsty prologue fic), brief mention of adultery, casual contemplation of murder, brief mention of whipping and a joke made about catholics. If I missed anything that you think should be tagged, dm me and I'll add it.

--

You start down the hallway before you can stop to think, holding the tray aloft in one hand. It's very easy to hear the strangled sounds of Lady Dimitrescu's most recent pet, some twenty something woman from the village, which only makes your job that much harder.

As you had been here for quite some time, you knew one of the most taboo acts was to interrupt her during 'training'. As you got closer you could hear her voice clear as day, offering soothing encouragements before the snap of a crop reached your ears.

You stop just before the door, wondering briefly if she'd use it on you for interrupting. But you couldn't send the heads of the other families away, so you steal yourself, rebalanced the tray and knock thrice.

There's a shuffle and her pet screams louder than before, followed by a half slurred string of begging and moans.

You purse your lips. You knock again, thrice, harder this time. You finally hear the Lady curse, some Romanian word you can't quite grasp yet, followed by quick shushing of her pet. You hold the tray carefully and take a precautionary step back.

She slams the door open and you catch a fleeting look at her black silk underwear before you shift your gaze into the room. Her pet, whose name you don't know and dotn care to learn, sits uncomfortably on the floor beside her masters bed.

"What is it?" Lady Dimitrescu snarls down at you, and you look up at the filigree decorating the wall beside her head.

"The Heisenbergs and Moreau are here to see you, Madame. They bear a seal from Mother Miranda." You handover the letter one of them gave you and fill her glass while she reads it.

You drop a bit of her special wine into it and hand it over. She eyes you carefully, taking a lemon slice. "Help me dress." She says and walks back into her room.

The hallway beckons but you follow her in anyway. She won't kill you, not while Mother Miranda has need of you, but you know she forgets how fragile people are sometimes. Her pet is a keen example; she clearly hasn't slept much due to her servicing, she's bruised all over and the way her lips wobble stirs some momentary pity in you.

Unfortunately for her, any stronger feelings have long since been cut away and seeing her in such a state only brings up questions of how you can improve. Still, you try to put on some faux sympathy for her.

You fill the smaller glass and hand it to her pet with a small platter of apple slices. When you look over to Lady Dimitrescu her brows are raised.

"She hasn't eaten for two days, Madame." You say instead of explaining. It had been one of the cooks ideas, someone that knew her.

Clearly, Lady Dimitrescu didn't realise that, "Of course," she replies crisply, her tone too sharp, "You may eat, pet."

Without waiting, you walk over to her closet to pick a dress. They are the same style and differ in their colour scheme; three are the same shade of light cream, twelve are pure white and three more are tinged grey. You pick out a light cream one with matching undergarments when she calls you over.

You've been working for her a long time, excess of seven years, so you know how she prefers to be dressed after stringent activity. You slip her bra on and her underwear. Slowly, you put her stockings on, as to not rip the expensive fabric, and clip them to her garter belt.

Lady Dimitrescu choses which garter she wears each day rather than have you or her personal amod do so, today it is the one that tangles easily. Its notorious among the staff for how difficult it is to put on. You know your way around it, though, fastening it quickly about her hips and thighs. "Have you put any thought into what I asked earlier, Madame?"

Lady Dimitrescu scoffs, sipping her water, "I have a personal maid." She jerks her chin to her pet, who has been munching as quietly as possible on the apple slices.

"Yes," you say lightly, helping her step through into her dress, "I merely doubt she will have time to deal with any duties other than those of a pet."

She eyes you dangerously and sets her cup down. You ignore the passive aggressive ploy to retrieve the step ladder in the closet. You flick it open and climb it as you pull her dress up, admiring the muscles of her back when she flexes subtly, then guide her arms into the sleeves.

"Who do you recommend, my gracious head of staff?" She croons when you work your way up the buttons of her dress.

You overexargerate your sigh at her playful tone. You catch her smile in the mirror and go back to buttoning. It is much harder to accept some days that this cannot last forever.

"Jessica is a cheery and dedicated worker with a strong back for lashings should she ever disappoint," her pet looks at you with mild horror that you file away and you try to strain your voice a little more towards reluctance, "Mihaela may suit your temper better, she has a quiet nature, has little care for material things and does her best to avoid punishment." That and her aggressive asides about the Lady would stop if she wanted to live.

Lady Dimitrescu moves over to her vanity, and you follow, grabbing the scissors attached to your chatelain and three roses from the vase on her desk. "Who else?" She asks, flicking the cap off her lipstick.

"Louise may suit as well," You say as you clip the stalks, "but Miss Daniela has taken a fancy to her. It would not be the wisest choice. There is also Rachel but she is pregnant with the gardeners child."

"Leave it to humans to rut like base animals on my property," she taps her lips thoughtfully, "Wasn't Rachel married?"

"She is, Madame."

"Do you remember to whom?"

You pause in your arranging of the flowers on her breast and she catches your eye with a smile that burns you, "It was to the southern most butcher. One of the Bradleys, I believe."

She clicks her tongue, breaking eye contact, and you move to brush her silky hair out before she repins it. "Tell Heisenbergs retainer to have her husband brought here. It may be time to cull that wretched family," she paused, sipping again at her water, "Also, Mihaela will do, inform her after the meeting."

"Of course, Madame." You set the brush down, and grab her powder, dusting it onto her cheeks as she fixes the curls back into her hair. She is most beautiful like this, when her face turns delicately pensive and she stills almost completely. You almost wonder what it would be like, with her, and have to take an extra second to cool your heating face.

When she turns to you, with that deliberate, unabashed affection stealing the faux indifference from her face, it makes your heart quake in a way you haven't felt before. You have to look away before you both do something stupid. Deliberately, you plant your hand on her shoulder to keep her at a distance and stare intently at her ear as you put her earrings on.

Her pet has come to sit at your feet, Lady Dimitrescu running her fingers through her hair and you vaguely wonder what it would be like. What if you were there instead and what if this and that and everything else you could want but can't have. Neither of you will cross Mother Miranda.

Her pet gives you the dishes, the glass and plate empty. You move away from them, so that you're not tempting anything again and refill the glass.

"Shall I also have inquiries made about a new gardener, madame?" You ask as you hand the glass back, then move to gather together a suitable outfit for her pet.

The softness is gone from her face and you tell yourself you're glad of it. "Yes, someone more appropriate."

"Not a Catholic then?" You ask innocently. She chuckles warmly and you go about dressing her pet with a little smile. "And would you prefer the current one be brought to your daughters or sent straight to the cellar?"

She regards you seriously in the mirror, and you stare back into her golden eyes before returning to fixing the bow on the back of her pets dress, "Bring him to me when I'm next available."

You usher her pet back to her seat, putting the cups back on the tray, "That would be after dinner for today, or at three tomorrow evening."

"After dinner will be fine." She replies, eating the rest of her lemon. She hands you the skin, her fingers brushing yours deliberately, and you take longer than needed to deposit it on the plate.

"The families are gathered in the dining hall, Madame. I had the kitchen staff prepare a light brunch."

"Tell them I'll be there momentarily."

"As you say, my Lady." You curtsy as you leave. You make a note to have Rachel serve dinner and to watch the Lady's pet while she's busy. You may even go so far as to ask the cook to make a broth; this pet seems to make her happy and you are determined that her pet remains able to do so.

It's all you can do, after all.

Hey, little note:

This is a multi chapter fic with a planned unhappy ending because Courtly Love Trope doesn't usually end well. There will also be references to Resident Evil lore from previous games. Do I care if its accurate? No, not at all. Resi purists beware this fic. And thanks for reading!

#lady dimitrescu#alcina dimitrescu#lady dimitrescu x reader#angst#specified age do not touch#my writing#A Good Servant#light angst this part lads#it gets worse#:)#IVE REALLY BEEN CONTEMPLATING WHETHER I SHOULD EVEN POST THIS#but its here now so you all have to suffer for it#time line is planned out hmu if you want it#courtly love strikes again :(

140 notes

·

View notes

Text

Now You Sea Me || Kaden & Savannah

Timing: After The Student Body Location: Caves on Harris Island Parties: @savannah-lim and @chasseurdeloup Content: Gun use (on monster), body horror (description of mermaid), violence (on monster) Summary: Savannah is both a professional and a disaster at mermaid hunting

Savannah knew from experience that New England winters were no joke. The nights were growing darker, the days chillier, and White Crest lay on the tip of the Maine coast, its cliffs and islands nestled among the glacially cold ocean. So of course, it was an excellent time of year to go mermaid hunting with a miserable Frenchman. She’d dressed in some thermal, water resistant clothes, form fitting to allow her ease of movement and make it easier to avoid getting snagged on the rocks, a thick woolly hat, and a lined parka. She didn’t know exactly what she needed for the trip, so she packed a bit of everything; her gun, extra ammo, a barrel-mounted light, regular flashlights, flares, and even snacks (they might get stranded out there!). She’d even got ziplock bags for her phone and keys. All in all, she was pretty proud of her level of preparedness by the time she went to meet Kaden at the beach on Harris Island. “I’d recognize that sullen side profile anywhere,” she said by way of greeting. Not that she could talk. “I parked just off the road up there. I have some extra supplies in the car just in case.” She honestly shouldn’t have been so excited about this. “So, mermaid?”

Kaden always hated the water monsters. They always had the upper hand in a way, especially when in the water. And, of course it meant getting wet. Not usually a big deal to him, he’d dry off. But in Maine in the late fall? This wasn’t his idea of fun. Then again, he was severely questioning if hunting was ever his idea of fun anymore. He sighed and gathered up his nets and harpoons and spears. It didn’t matter if this was fun or not, there was a mermaid and he knew how to kill it. It would be irresponsible not to tackle this. Plus, he had Lim standing by in case he got hurt. Regan couldn’t complain about him being in the woods alone. He wasn’t alone and hey, for once, he wasn’t in the woods. “Sullen?” Kaden let out a huff of breath. “I’m not sullen. Putain.” Alright, that sounded a little sullen. “What’d you bring?” he asked, rebalancing the load on his shoulder. “You have a med kit, right? I just… I have a feeling.” With his luck, there’d be some injury or another. “Sounds like it. Lead the way, Lim.”

“I don’t know what Putain means, other than the food, but you’re kinda sullen,” Savannah snickered, probably just a little too at ease about this whole thing. She was sure that would go away once she saw it again. Kaden was a way better companion on this sort of thing than Agatha had been though. The girl was great with a gun, but way too quick on the excuses. “I do. I always have a med kit in the car.” She didn’t wait for that annoyed look of disbelief to flash on Kaden’s face, cutting it off with; “for this, I moved it to my backpack.” She went about listing what she had brought with her, hoping it would be enough for Kaden to declare that she wasn’t entirely useless. Sadly, she hadn’t had access to a harpoon. “Can I have one of those?” she asked, leading the way down the beach and towards the cave she and Agatha had entered. “I think the police tape it still up, just--yeah, this way.” It led a convenient trail towards the sea water pool in which they’d seen the mermaid. Being back in this place made Savannah cringe. All those bodies. “Do we use bait? Like a ribeye?”

“No, no. Not poutine, putain,” Kaden said with a sigh. “It’s an expletive. Like fuck or shit. Sort of. Either way it’s not the same as the fries with gravy and cheese curds.” He couldn’t believe this was what they were explaining as they wandered down towards the beach. “Glad to hear it,” he replied in response to the med kit. “Hope we don’t need it but this is White Crest.” As fast as his side had started healing from his forrary during the full moon, it still stung as he walked. He hoped his gait and slight wincing didn’t betray it at all. He didn’t need to answer any more questions about that night. “You want a harpoon? I mean…” He didn’t exactly have a good reason to refuse. And if she was going to help. “When we get down there, sure.” The police tape wasn’t far and when they reached it, neither of them had to even pretend not to get caught as they ducked under and headed towards the scene of the crime. And the monster. He had to admit, being police really did have its advantages for hunting. “Yeah, we should probably come up with a plan,” he said as he started unloading his gear, handing her one of the harpoons. “The best thing to do is going to be to get it out of the water. If we can harpoon it and get the net around it we can try to drag it out.” Easier said than done, he knew that full well. “Didn’t really think about bait.” Shit. He stood there, arms crossed a moment. “You want to be bait?” He didn’t want to be bait.

"Oh," she shrugged. "I only know Merde. Now if you want to swear in Korean, I'm your girl. Gae-sae-ggi." Savannah was quite happy to discuss expletives. She was oddly energised by all this, and happy to talk him through some of her favorites as they walked. "This is White Crest," she repeated, giving a humorless chuckle. "It really is a weird horror show of a town, isn't it?" And yet somehow her words didn't seem disparaging. She was still amazed he'd even agreed to let her come, considering how unhappy he'd seemed when she and Regan were out there on the river.

As they approached the cavern, she knew this was the place. It was practically burned into her consciousness. Savannah placed down one of the larger lights, turning it on near the wall so she didn’t have to hold it. "I've never used a harpoon before," she said, positively energised at the idea. The bait part, she was less enthused about. "Why? Why would I want to be fish monster bait?" She shook her head. "I packed food though. Do you think it might like some sandwich meat?" Probably preferred its food fresh, but she hoped Kaden wouldn't challenge her on that. “Or--do you have a knife? Maybe I could just cut my finger and drop some blood in the water.”

“Merde’s a good one, too. Putain de merde is really the best, though.” Kaden’s brow furrowed and he tried to repeat her Korean. “That any good? I’m guessing not. I’ve heard my uncle complain about the French accent coming through in my German. I can’t imagine it’s better in any other language.” It was odd how easy the convo felt. Like they weren’t walking into potential death. “No place like it, that’s for sure. And I’ve been to a lot of places, I don’t know about you.”

As terrible an idea as this probably was, having a normie with him on this hunt, and a Federal agent at that, Kaden couldn’t argue with how prepared she was. It almost made him question if she was as clueless as she let on. Almost. “Hey, I don’t want to be bait. And you don’t know how to use a harpoon.” He sighed and insisted she take it anyway. “I mean, I know I’m prettier but someone has to do it,” he said, jokingly. He wasn’t going to push it, though. She just seemed so enthusiastic, he hoped she just might go along with the bait thing. Kaden blinked at her a moment. “Food? Are you telling me you brought snacks? On our hu-- I mean, encounter.” Shit, he hoped he covered it up at least a little. Likely not. Probably didn’t matter too much either way. “Do I have a knife,” he repeated with a scoff, like it was the world’s dumbest question. “The real question is which one you want. Not that I’m advocating for blood letting. Let’s try sacrificing the snacks first. It might work,” he said and gestured for her to go ahead, his harpoon in hand, ready to face the beast.

“Could be better,” Savannah answered, honestly, but not unkindly. “But Korean is tough if you’re not used to it. I wouldn’t complain about your accent coming through. It’s sort of part of who you are, right?” They weren’t left with much time to dwell on that conversation though before the subject turned back to bait.

“I should have brought some leftover meatloaf,” Savannah groaned, putting down her bag. “Yes, I brought food! What if we get lost down here, or one of us gets injured? I wanted to be prepared.” She’d probably gone a little overboard, admittedly, but he hadn’t exactly given her a list. “There’s a water resistant thermal blanket, some spare socks…” But the one thing she didn’t have was a knife, so she took his gladly, pocketing it briefly before rifling through her backpack for her sandwiches, throwing in some sliced chicken from between the buttered slices of bread, then standing back as if waiting for a volcano to erupt.

“Meatloaf?” Kaden asked, his face pulling into a disgusted frown instinctively. There was nothing that had ever sounded appealing about that dish. “Hopefully the mermaid isn’t as picky as I am.” He had a feeling that, knowing their luck, this mermaid just might be. “Well, glad you came prepared. I guess. But putain, did you pack for an overnight trip or a hunt?” Then again, sometimes those overlapped. He sincerely hoped that wasn’t the case here. “I’m going to need that back when we’re done by the way,” he said after handing her the knife as they backed away. He waited, harpoon in hand. It felt like they were there for a minute. Maybe two. Nothing so far.

Kaden’s mouth pulled into a thin line and he gestured to indicate she should stay put where she was as he approached the water, slowly, weapon ready. One step, then two. Still nothing. Three, four. Maybe it had gone and fucked off. Five, s-- “Putain de merde!” Kaden shouted, stumbling back as what looked like a woman burst from the water. If he didn’t know any better, he’d say she was gorgeous, green eyes, alluring and practically beckoning him to the water as she sang. If he didn’t know better, he might be fooled. But he did know better. So Kaden charged towards the beast, harpoon in hand. As quickly as the facade had appeared, it dropped, and the woman bent back and away, revealing a row of teeth. He thrust the harpoon towards the open mouth, but before he could ram it through the monster, its fangs clamped down, snapping it in two. And then another head popped out of the water. “Fucking shit,” he grumbled. Lim better be prepared for this, too.

"I know you're French, but you don't have to be a snob," Savannah answered at his reaction to her mention of meatloaf. She'd prefer a good Korean BBQ, but it was tough to find a decent one in White Crest, if there were any at all. "Okay, so I may have over-packed a little." But it was better than coming unprepared, she thought... Savannah accepted the harpoon perhaps a little too gladly. She wasn't someone who expected to ever have any joy in hunting, and this wasn't the type of hunting she'd ever anticipated, and it was hard not to feel the pure adrenaline and excitement of it mixed in with the fear. It wasn't the killing that interested her. Not in the slightest. It was being part of something unknown and exciting, discovering something new. "I'll try not to break it," she answered, her voice dryer than anything else managed to be in this cave.

Before she could say anything else, her eyes widened at the sight of a beautiful young woman emerging from the icy saltwater, the very same she had seen just the other day with Agatha. "Hi again," she answered, "miss me?" Oh, she'd always wanted to say something cool like that, but she felt entirely less cool when the beast half-swallowed Kaden's weapon, and brought a friend. "Oh no! Hey! Look out!" She pulled her own trigger, hitting the creature, but just barely. It made an inhuman groan as the metal scraped across its scales, leaving jagged edges. “Hello?? Why is this thing so slow to reload?”

“Putain!” Kaden shouted again as the shot rang out, diving out of the way of the beasts and the bullet. “You could have hit me!” True as that may be, she had shot the one mermaid, no mistaking it. Not clean enough to kill it, though. He scrambled out of the way and reached for his own gun. Shit, he hadn’t been prepared for multiple. His mistake, really. He took the gun and started firing where he could. One want through the first monster’s mouth, though he couldn’t be sure if it did real damage or clipped its fucking fangs. It did give Kaden a second to scramble away from the edge. Taking them out with bullets wasn’t impossible but with the strength of its scales, it’d be a task. Especially with two. Best bet, drag one of those fuckers out of the water. “Aim for that one,” Kaden said pointing to the left. “Going to try something.” He took the harpoon he gave her and grabbed a net, running over to the creature on the right. He threw the harpoon into what looked like the “woman’s” shoulder before tossing the net at it. Teeth tangled in the net and he hoped like hell when he pulled back, they wouldn’t tear it to shreds. Just had to get it out of the water.

“But I didn’t!” Savannah answered. Come on. At least he could give her some credit. She’d passed her marksmanship certification with flying colors. She took advantage of Kaden’s gunfire, loading the harpoon again and readying for another shot. She kept her hands steady, all her training coming together to teach her to keep a calm and steady hand. Quantico sure hadn’t expected their training to be used for something like this. Their attention being on Kaden made it easier for her to land her next shot, aiming at the one Kaden had indicated. The harpoon loosed, whizzing through the small space between them with a low whistle and hitting the mermaid square in the abdomen. “Oh, that was a good one!” She picked up Kaden’s intentions and started walking backwards, dragging the thing as it made ungodly screeches that she was sure would alert every house on the island.

For not being a hunter, Kaden had to admit that Lim wasn’t too bad at all this. This time, at least. Guess coming prepared made a difference. Kaden tugged and pulled and finally, the monster was out of the fucking water, letf to fucking suffocate. He turned his attention to Lim and helped drag the second one along with her. Once they were both on the rocky surface of the cavern, it was almost embarrassing to think of them as terrifying. Both were flopping and flailing, gasping for breath. The lures on top of them, the ones that looked like women, were still trying to entice them as best as they could. “Help… me…” they moaned. The whines turned into screams and Kaden had had enough. He took his bowie knife out, dragged the one near him, slit it under its jaw, then same to the second. Blood and guts poured over the floor around them. But the beasts stopped moving. Kaden pushed his hair out of his face and assessed the situation. “Guess we did it. Didn’t die. So that’s nice.”

Savannah credited her FBI training for preparing her for this sort of thing. Okay, not exactly this sort of thing, but intense situations, those were something she was trained to simply tackle confidently and pragmatically. She lacked Kaden’s supernatural gifts and knowledge of the bizarre, but she did her best to hold her own. She watched, fascinated as the creatures struggled on the cave floor, her torch light falling on them, creating shadows on their faces that made them look even more horrifying. She didn’t even look away or flinch when Kaden dealt the final blow. “That was actually… pretty fun,” she said. “If you ignore the mortal peril. We saved lives today. No more frat boy snacks for these things.” She sounded, and looked, terribly proud of herself.

Kaden leaned over, hands on his knees, letting the adrenaline wear down, trying to catch his breath, when he looked back up at Lim. Did she just call this fun? “Yeah. Sure. If you ignore that one small detail. Sure.” He shook his head and started to gather his equipment back up so they could get the hell out of there. “Maybe don’t start hunting monsters on your own just for fun, though. I mean, not unless you value that whole life thing you have going for you.” Once his weapons were all gathered and ready to go, he looked back at the monster’s bodies. “We should probably burn those or something, shouldn’t we?” It’s not like he could bring them to Regan right now.

Savannah's veins were flooded with adrenaline. She caught her breath, doing her best to wipe away what blood and monster guts had made their way onto their clothes with the anti-bacterial wipes she'd brought with her. "No, no, I'll leave the sea monster slaying to the professionals, Ahab." At the mention of burning, Savannah furrowed her brow. "Oh, yes, I suppose. Unless we want one of those teens with phone cameras to put it on Instagram." Regrettably, and very reluctantly, she reached very slowly for one of the most important things she'd packed; a hip flask. "I... suppose this might help?" She held up an index finger, taking a sip before handing it to him as if she was parting with precious jewels. "Don't say I never gave you anything." She definitely wasn’t going to tell Keen about this.

11 notes

·

View notes

Text

Chapter 2 - Administrative and Clerical

As the pages of my book filled, progress on “The Plan” reached a fever pitch. Father’s groundwork was impressive when it was only sketches and doodles but the first draft of all Creation turned out to be more wondrous than any of us could imagine. The Djinn’s constructs were massive in their execution and the Angel’s philosophical designs imbued every structural cell with Father’s purpose. Each day, I grew busier processing the requests for names from every Angel working in the “Living Things” department. As the work grew more complex, with weirder and more diverse ideas arriving for my designation every day, I became more confident in my abilities. Before long, news of my efficiency reached the Upper Angelarium, where the Archangels gathered.

“Are you sure you won’t get in trouble for this?” I asked the Cherub called Ornias as he held his creation towards me. “This one seems like plagiarism to me.”

“I’m not sure what you mean.” Ornias replied, though I couldn’t help but hear a chiding in his voice.

“I mean you stole this design from other Angels. I think I’ve seen this tail before. I’ve definitely seen this bill...”

“I may have taken inspiration from a few of my fellow spirits but this design is an original.” The fat Angel’s snorting face puckered into a look of disingenuous offense.

“It looks like you just mashed five other animals together!” I grabbed the design by its webbed flippers. The thing turned its duckish, rattish head towards me and stared with curiosity. I placed it on the ground where it scurried behind Ornias’ rounded form. I apprehensively asked, “Is this a joke?”

“A joke?” Ornias spat, “Does creation seem funny to you?” In truth, neither of us knew if Creation sounded funny because neither of us fully understood the concept yet.

“Is it mammal or bird?” I probed, attempting to refocus the conversation.

“Yes.” Ornias replied with so much indifference, that I wanted to reak wrath on the Angel’s stupid face.

“I’m truly at a loss, Ornias. Perhaps you have a suggestion?”

“Well, I was sort of thinking we could call it a,” he choked as if stifling a laugh, “a Platypus?”

“Oh, come on!”

“Alright, alright!” Ornias guffawed as he reached forward and clucked me on my back with his palm. “Look, I somehow got this one past the Approval Department and all I need is a name to make it official. Wouldn’t it be the best if this thing ended up crawling around with all the other animals?

“Well,” I considered, “I don’t know...” In truth, looking at the creature made me understand comedy a little bit more. And it was cute.

“What do you say, old pal?” Ornias thrust his right hand forward in a gesture that all Angels agreed meant “mutuality.”

“We’ve never met before today, Ornias.” I abstained from returning the gesture.

“Think about it.” The Cherub plucked his weird design up from the ground and turned to leave. As they flew away, the creature wriggled in Ornias’ grasp to look at me again. I smiled and it shook, startled, before burrowing into hiding in the Angel’s arms.

“Erm... next!” I called to my constantly growing queue. I had set up my operations in a vacant cubelike room of the lower Angelarium. When I found the room, it invoked a feeling as though I had meant to be there all along. Inside the cube was a chair for me to sit and a desk for me to place my book. From the room, I allowed one Angel at a time to enter and present their creation to name. As always, the Angels queued naturally and rarely made a fuss.

The next Angel in line entered at my call and I was surprised to see that it was a Principality. For those of you not well versed in Angelic Hierarchy, the Principalities are the assistants to the other Choirs of Angels. They deliver messages and perform tasks for Angels too busy to complete those tasks themselves. They are the delegates and were designed by Father to be pushed around without much fuss.

This Principality had hair as gold as wheat (a plant designed just days prior) and skin the color of olives (a plant that hadn’t been designed yet but one I’m referencing retroactively.) Her physique was rigid and she towered over the other Angels in the queue behind her. Her wings were so soft that they resembled clouds in the distance. Her expression was one of annoyance, brought on by having to wait in a queue when there were other tasks at hand.

“Hi there!” I greeted, somewhat fearfully. “I did not know Principalities were invited to create for ‘The Plan!’”

“I am Eremiel.” the Angel interjected, “I am not here on Creation business.”

“Ah.” I said “Well I am afraid that I am in the middle of naming every single living creature. Is there something I can help you with?”

Eremiel reached into a pouch slung around her bony shoulder. She produced a page of parchment that she began to hold out to me. Before I could take it, she snatched it back.

“Were you designed to be able to read?” She asked dryly.

“I have the gift of all languages.” I replied, confused, bemused, and anxious for what news Heaven had for me now.

“Good.” The Principality unceremoniously dropped the parchment on my desk. The page slid across the surface and landed in my lap.

“They’ll see you after you’ve finished your duties for the day.” Eremiel spoke with vexation as she left the room. On her way out she bumped the next Angel in line, an impossibly beautiful spirit with a crown of light and holding a round rodent with enormous ears. Before the offended Angel could protest, Eremiel’s eyes widened and she gave a look that clearly said “Get out of my way or you and the rat will be broken for all of eternity.” The beautiful Angel cowered and Eremiel launched off into the higher Angelarium.

I unravelled the parchment in my lap and read the message within:

TO AZRAEL, ANGEL OF NAMES

YOUR PRESENCE IS DEMANDED

TO DISCUSS IMPORTANT MATTERS

REGARDING YOUR FUNCTION AND PURPOSE

YOU ARE TO REPORT TO THE HALL OF THE ARCHANGELS

FOR JUDGMENT

AS SOON AS YOUR DUTIES FOR THE DAY ARE COMPLETE

BE PROMPT

SINCERELY,

GABRIEL, ARCHANGEL AND CHIEF MESSENGER

“Urp...” Was all I could say as I let the parchment roll up and sway back and forth on my desk. I felt my face go pale. I don’t know how long I sat, silent and staring, before I heard a meek “Ahem” beyond my doorway. It was the beautiful Angel and its creation.

“Oh, er, next!” I called.

The Hall of Archangels stood at the top of the third sphere of the Angelarium. My work was mostly clerical so I hung around the bottom of the third sphere. The upper sphere was for Archangels and Principalities. Beyond the third sphere was the second sphere. That place was the work area of the middle management Angels: the Powers, the Virtues, and the Dominions. Above the second sphere was the first sphere, the upper management sphere. The first sphere was where the Seraphim, the Cherubim, and the Thrones worked closely with Father on “The Plan’s” most important projects. Above the spheres sat Father’s throne, where he shined his radiance on all Angels below him.

I nervously clutched my parchment of invitation as I approached the entranceway to the Hall. The landing for the upper sphere was paved with bricks carved from a porous grey stone that felt soft under my feet. Rounded outcroppings of the stone jutted from the walkway in symmetrical pairs leading from the landing and into the upper sphere. Prototypes for the aforementioned flowers adorned the outcroppings in a manner I found aesthetically pleasing. A massive silver arch marked the entry to the halls. Great, angled runes were carved deeply into the arch, spelling in a now-forgotten language, “DILIGENCE, VIGILANCE, GLORY.”

The landing was bustling as Angels of all different Choirs launched and disembarked to and from the Heavens. Each spirit possessed a face of focused officiousness as they passed by and around each other on the walkway. Many of them held stacks of paperwork and they would bump gracelessly into one another, mumbling indifferent swears before rebalancing and continuing on. None of the Angels offered so much as a wayward glance at me as I shuffled uncomfortably towards the archway. I felt so out of place.

When I bypassed the arch and into the Hall, I looked above to see the walls and ceiling had been carved of the same soft, grey stone and painted with a mural. The art of the hallway depicted the Heavens, complete with all manner of Angel flying and smiling as they worked at the building blocks of Creation with hammers and chisels. A rendering of Father sat on his throne at the apex of the curved ceiling, his smile was the biggest. In his left hand, he held a sash decorated with the same runic font as the silver archway. The text read “PERFECTION.” In his right hand, he held a strange blue orb that I recognized as the initial design for “The Plan.” I did not notice it at the time, but the Djinn were not pictured in the mural at all.

I came to a series of turnstiles preceded by booths with Angels inside. I watched as visitors approached, spoke briefly with the booth Angels, and pressed past the turnstiles before resuming into the hallway. I puffed up my chest and attempted to imitate the zeal of the patrons around me. I approached a booth on the far end of the vestibule and stepped toward the turnstile.

“What’s your business?” the bored looking booth Angel asked blandly.

“Oh, er...” I fumbled with the roll of parchment at my side before passing it to the turnstile guardian.

“Mmm, yes.” He unrolled the note and studied it with nonchalance. I rocked from side to side on my heels for an awkward moment before he continued. “You are scheduled with Gabriel in the Western Atrium. Do you know where you’re going?”

“I’m afraid not.” I meeped.

“Oh.” The Angel curled his upper lip, “A tourist.” He hefted from his seat with a grunt of vexation and leaned over his booth towards me. He reached a slender arm past my neck in a manner meant to lead my gaze. “See the wisp of red cirrus cloud that stretches along the wall mural?” He did not wait for me to answer. “Follow that ‘round the rightmost corner and straight along until you reach the double doors labelled ‘Virtue and Punctuality.’ You’ll find the Chief Messenger’s office within.”

“Alright.” I murmured as I squinted towards the mural. I did not see red cirrus clouds. I turned back to the booth Angel to see he was regarding me with furrowed eyebrows.

“You can go along.” He chastised. With a nod of his head, he signalled to a line of equally annoyed Angels behind me.

“Oh.” I said and pressed at the turnstile. It did not move at first so I shuffled uncomfortably, trying and failing to look like I knew what I was doing. Finally, the arm loosened and I tumbled forward, almost falling to the floor. I pulled my wings around me in embarrassment and hustled into the reconvening crowd beyond the gate. I felt overwhelmed by the roaming crowd and was instinctively drawn to the wall and out of the way of the bustle. I inspected the mural for the wisp of red cloud described by the booth Angel. At first, I found no evidence of such cirrus and I felt a panic rise inside me. After a moment, I noticed a streak of cloud, more pink than red, cast behind the drama of the painting and across the cosmos. I followed the path around the corner into a straightaway that appeared to go on indefinitely. The hall had many pairs of doors across from each other on either side of the walkway. As I strolled passed, I couldn’t shake the curiosity to open one of these doors and look inside.

The red cirrus on the wall lifted onto the ceiling of the hallway and led to an extension of the main hall’s mural. The color pallet from the previous painting shifted to a radical use of greys and reds. The whisping cirrus fed into a large black stormcloud that loomed over the extension of the hallway. Vibrant flashes of lightning illuminated the backdrop of the scene and made many of the boisterous storm clouds look like violent cosmic explosions. When I stopped to admire a detailed expression of cloud, I noticed the painted silhouette of an armor-clad angel amongst the dramatics. Its outstretched wings matched the curvature of the stormy display behind it and it raised its arm high above its head. In its hand, it held a long, menacing sword that extended high into the heavens above it. A streak of blue lightning extended from a nebulous point in the storm to meet the Angel’s sword where it curled coyly toward the tip of the blade. I had not noticed before but the scene depicted in this hallway’s mural was populated with the silhouettes of many menacing Angels, each dressed in a similar armor and each held a long-tipped sword. My sense of wonder towards the illustration slowly became one of apprehension. I pulled my wings closer around me.

The bustle of busy spirits slowed and thinned out as I continued down the straightaway. I walked slowly, craning my head to either side to read the designations above each approaching doorway. “Virtue and Punctuality, Virtue and Punctuality,” I repeated to myself, trying my best not to forget what the rude booth Angel had told me. To my dismay, none of the doors on either side of the hall included either of those words. Many of the doors instead read similar titles, like “REGIMENT AND RULE” or “CLASSIFICATION AND CARTOGRAPHY.” As I wandered, I began to get a little confused. It wasn’t until I meandered to the set of double doors at the end of the hall before I realized I had reached my designation. As clear as day, the words “VIRTUE AND PUNCTUALITY” hung in a flowing gold font over the doors’ brick and mortar archway. I should have figured the Archangels would signify their meeting place in such a glorious manner.

I did my best to stifle my nervousness and pushed at the rightmost door. At first it did not open and, when I pressed a bit of my heft against it, there was a brief give before more resistance. I heard an “Oop!” from beyond the barrier. I leapt back, embarrassed. Apparently I was pressing the door into someone! There was a bit of murmuring behind the door before it opened inward. I gulped in shock when I saw who stood before me.

“Ah, Azrael!” exclaimed Lucifer, his mouth curled into an unfamiliar smile. “Right on time, I see! It always pays to be punctual for a meeting at Virtue and Punctuality.” His demeanor was glaringly contrary to how he spoke in our previous meeting. I found the change pleasant but disturbing at the same time.

“Er,” I croaked, “I did not realize you would be attending, Mister Lucifer.”

“Mister Lucifer!” He repeated with a laugh over his shoulder, presumably to whoever else was in the room behind him. “What did I tell you about this kid, Gabe?” He turned back toward me and stared with a strange admiration I had only seen before from Father. “No, I won’t be joining in on today’s meeting, but do know that the higher ups are aware of your progress. You’ve yet to disappoint, little Angel.”

A warmth erupted in my face. It felt like shame and pride all at once. I opened my mouth but I didn’t have anything to say.

“Lucifer,” a dry voice called from behind the Archangel, “If you’re going to praise the creature’s punctuality, at least let him in the door to be punctual.”

“Ah, of course!” The smiling Lucifer took a labored step back and held the door open for me to enter. As I inched my way in, he snuck his towering form around me and out into the hall. “Best regards, Azrael!” He said as he let the door close between us.

The room was not as grand as I had expected. The magnificent aesthetic of the main hall had not transferred to the Archangels’ chamber. Instead, the walls and ceiling were a clean, abstract white. A skylight cropped from the ceiling’s center, allowing Father’s light to shine on the room’s simple furnishings. Ahead of me was a rectangular slab of marble cloud. It hung motionless in the center of the room, illuminated by the light from above. Ten marble white chairs surrounded the slab and sat suspended in a similar fashion.

At the opposite end of the slab from me sat two radiant Archangels. The first I noticed was a giant of a spirit with earth-brown, craggy skin and locks of flowing silver hair. He wore the same night-black robes that I had recognized on Lucifer but the mass of his chest and arms were bulging at the seams. His enormous hands were clasped together and resting on the slab, his fingers were dressed in several thick, golden rings. His eyes were the shocking blue of a lightning flash and his nose and lips were wide on his muscular face. He looked at me, wordlessly, with an expression barren of emotion.

The Archangel to his right was slender, petite in comparison, but something about her presence was far more threatening. She too wore the black Archangel’s robes, though the cuffs and collar were decorated with an elaborate, gilded pattern. Her amber hair poured from the top of her head in short waves that flowed down to her neck. Her face was narrow, almost gaunt. Her sharp chin pointed downward and her colorless lips were pursed. A needling nose drew a line from those pursed lips up to eyes blacker than a tempest.

“You may have a seat.” The smaller Archangel called and extended a welcoming hand toward the floating seat closest to me. Her voice was curt and intimidating, it lacked the song that hung in many other Angels’ voices.

“I do apologize for the short notice.” She continued as I approached my chair and sat down. “With Creation rapidly approaching, we have been encouraged to expedite certain processes.”

“No trouble at all!” I cried out, perhaps a little too loud, across the table. “In truth, I didn’t realize ‘The Plan’ was coming together so quickly. That’s good news!” I smiled. When the gesture was not returned, I said, “Isn’t it?”

“Hm.” The slender Archangel replied noncommittally. She raised her hand to her face and rubbed at her cheekbone with her finger. “I hope you don’t mind, but I’ve invited Archangel Uriel to this briefing. He will be sitting in on the interview process.” With her other hand, she offered an introductory gesture to the large Archangel to her left.

“Thank you, Gabriel.” Uriel’s craggy lips lifted into a welcoming smile and he unclasped his hands to place them both face down on the slab. “I wasn’t supposed to attend this meeting but, after hearing everything, I wanted to put a face to the name!”

“I’m sorry,” I interrupted, “Gabriel, was it?” My eyes met the slender Archangel’s and she gave a slight, acknowledging nod. “What is this about an interview process? I’m afraid I don’t know why I was summoned today.”

Gabriel’s gaze shifted to meet Uriel’s for a moment before returning to me. “Your summons,” she said wryly, “explained that we were to discuss your function and purpose.”

“Now, now!” Uriel laughed in a thunderous tone that shook the room. “Like you said, Gabriel, things are happening so quickly these days. I get the feeling little Azrael here hasn’t been brought to speed with the recent influx of,” he paused as he searched for the right word, “adjustments being made to ‘The Plan.’” With each passing word that passed through Uriel’s lips, I preferred him more and more to Gabriel.

“Adjustments?” I repeated.

“He is little, isn’t he.” Gabriel sequitured and clicked her tongue, her voice permeated with venom.

“You must forgive Gabriel.” Uriel’s grin widened. “She is an auditor, after all. Father designed her to look for incorrections throughout the process. I imagine you’re more used to the friendliness of the Angels in the lower circle.”

“Ah, sure.” I lied. If spirits in the lower Angelarium were ever friendly, it was an event I had certainly never witnessed first hand.

“We’re not here to discuss my function, Uriel.” Gabriel reached below the chair and slammed a weighty book upon the slab’s surface. It was the second book I had ever seen, after my own. “This is about your progress, Azrael.”

“Oh.” I gulped. “I figured there were no discretions. I thought the naming process was coming along quite, er, nicely.” I hung my head and cursed in my mind whomever had complained about my process. I could only imagine it was that pedantic Qaspiel, still angry with his Jellyfish. Or maybe it was Ornias pulling a cruel prank, like his Platypus.

“Indeed.” Gabriel murmured as she flipped through an innumerable amount of pages in her book. “Yes, we’ve received word from Father and confirmation from Lucifer that you are, in fact, exceeding expectations.” Despite the commendation, her voice produced no kindness in its tone.

“Oh.” I said again. “Then, er, what’s the problem?”

“Problem?” Uriel laughed. “Azrael, your work is splendid! Before you came along, most Angels were designating approved creations with a complicated number system. It was getting ridiculous! And don’t get me started on trying to talk identification with the Djinn! They ID everything based on chemical composition! Gabriel,” he turned, “remember when Fuqtus gummed up the ledger for WEEKS because he referred to seagulls in his notes by the number of carbon atoms in their feathers?”

“Mmhmm.” Gabriel vaguely confirmed as she continued surveying her notes.

“Then Father comes along and says he’s tasked an Angel with giving every living thing a name! ‘A name!?’ I said, ‘How’s that going to help anything?’” Uriel turned back toward me. “But then you come along, you take a look at the seagull, you call it a seagull. It’s like that’s what it was supposed to be called this whole time! I mean, come on, it’s a gull that flies over the sea!”

“Quite.” Gabriel snapped her book closed. “What Uriel is trying to get at is that there has been a highly irregular decision made on your behalf.”

“Highly irregular?” I felt foolish repeating everything the Archangels offered but I was so nervous, my higher cognitive function had ceased.

“A promotion.” She asserted.

“A promotion!?”

“Will you stop that!”

“Azrael,” Uriel offered, “we would like to advance you to the role of Principality. Specifically we, the Archangels, need a note taker for our meetings. We figure that no one, so far, has taken detailed notes like yours. Of course, this will start after you’re done assigning your names but, by our projections, we should be finished up with creating new creatures here by the end of the week. So,” he puffed up his chest and lifted himself from his chair, “What do you say?”

I didn’t know what to say.

1 note

·

View note

Text

So, Ruins of Lore beat! Opinions under cut...

Honestly, it’s not a bad game when looked at objectively. There are a lot of good ideas, like the job system and ‘mon catching. But at the same time, there really could be some rebalancing. You find a lot of the equipment for your ‘mons, and go figure the stuff I chose couldn’t wear ANYTHING I found! They had weak store brought equipment for much of the game, with one or two rare drops to power them up. So...they became useless! You also can’t use the Combine feature without one being in your party so that weakens the potential of your combined forces for someone having a few turn buff (and the less said about “no reviving/switching out dead ‘mons” the better...my first run had a dead ‘mon, and Eldin/Torma/Rami as the party I fought Goldiark with).

Job balancing...it takes forever to master Magic Based Jobs and they’re a bit underpowered. Put it in perspective, by the time Rami mastered her first Job (Mage), Torma was halfway done with Bishop (the second tier healing Job) and Eldin had Mastered...Swordsman, Knight, Fighter, Brawler, Thief, was far along on Chemist, and had Rapidfire (first Tier Rogue Skill). I think the other reason, besides Confusion hax, I noped out of the Ancient Cave was the guide I used had “use Mirror to protect Eldin from damage” as the strategy for a lot of bosses. Mirror...is the next to last Tier Mage skill! The one Rami hadn’t Mastered until Eldin had most of the physical skills learned! It’s also kind of annoying that Bau and Dekar can’t get jobs, because boy does Bau need it and Dekar isn’t with you for the final battle (though I swear he was in my first run so I don’t know what I was remembering or didn’t do).

But while I find it a good game objectively, it’s a horrible Lufia game. There are a few books and NPCs that reference Lufia II, but that’s it! Oh, and Dekar...who for whatever reason looks like he was just beat up in his portrait! Dekar wouldn’t get in that condition...this guy survived a collapsing shrine with no real damage in this ‘verse! Honestly, his only reasons for being there seemed to be his popularity (which I was more lenient with Dekard on because he’s doing a lot of awesome shit that this Dekar doesn’t do, plus it’s an alias and what guy who wants to be awesome wouldn’t use a legendary awesome guy as his inspiration). And to finally get him laid! Yes, I find his relationship with Marin adorable in context of the game, though it does lose some points because she’s effectively a fangirl who got to be with her idol, and I’ve had some BAD experiences with that sort of fan. Still think it’s cute, but Dekar’s relationship with Tia in Curse is a lot more adorable (do wonder if it was done as a natural follow up to their convo, not having time to work with Tia past the timeskip in the original, or Neverland rebelling against another company creating a love interest for one of their characters).

I’m not that big of a fan of having Eldin as a mute main character, though at least he has expressive emotive portraits to sub in for dialogue at points. I tolerate it with games like Suikoden/Breath of Fire (which don’t have modern games anyway)/Dragon Quest/Zelda because they have used a mute main character since Day 1, and were created back in a time when that was still a trope. But Lufia heroes actually have had voices since the first game. Still...it’s less a knock against Eldin as a character and more a knock against the decision, as he’s still one of the better mute main characters in gaming!

The Ancient Cave being only 60 levels, limited to Eldin and his monster (and remember what I said about monsters up above), and the stupidity in beef gating rather than being something you could work around through repeated going in like in II and TLR (or just getting levels like the first game) CAN go to hell though!

Now, I have problems with the story as-is. Mostly in regard to Eldin’s role...his dad all but tells Rubius he’s adopted, then she sees an inscription and realizes he was sent forward in time so his parents could save him from Eristol’s destruction. But does he ever find this out...no! Unless there’s some obscure sidequest I missed out on twice. It’s wasted potential...not that he’d react much other than the upset face and possibly some lesson on Family of Choice and Not Blood Parents. Other than that...the story we are given isn’t bad, besides the ending (really too much out of nowhere stuff, a villain who doesn’t show up until right before the finale, and padding with the extra run up Mt. Ruhei and third run up the Tower of Guidance...oh and the solution being “seal Beast in Holy Land and destroy stones” making it stupid that this all happened in the first place). Also, WHY did Irmis have to seal the half of the beast in Nazare? Was it breaking free? Did Ragule attack? Well...probably not the latter since he didn’t know where to go for it else they’d have gone there sooner. And how long ago was it/what age were the twins?

I do have issues with the lack of connectivity to Lufia II, despite being only 20 years later in the same area of the world. Which is ALSO wasted potential! How about, instead of the Eastern Continent being razed by Gratze, have some of the missions be helping those areas! We could have checked in with the scientists in Portravia (if they hadn’t all followed Lexis to Westland), Ferim’s possibly now Queen Jerit (maybe have them doing pretty good since she finally got together with Hans and his military expertise is making him a good wartime ruler’s consort), and of course Leon & Thea (see how their countries, the ones closest to Gratze, are doing and how they’ve been ruling since neither had a sibling to take the reigns of their own country to live with the other). Also, the geography could use some work...HOW did we walk from Parcelyte to Gruberik, with no land bridges and no water on the map?! And maybe equate the sealing in Nazare to the Sinistrals’ power having weakened the seal and it eventually started cracking after about five-ten years or something.

The other thing I can think of to fix this...instead of Eldin as the MC, make it Maxim and Selan’s son, Jeros, either making it 15 years later instead of 20, or changing Torma/Rami/possibly Rubius’ ages to better fit with him. They could go with an angle of him being proud to be the son of heroes, but worried he won’t live up to them. Proud that they saved the world, but angry that they left him behind. Possibly even have him and Rubius strike up a romantic attraction, and then make it clearer that she will sacrifice herself too! This can lead to Jeros having to face the loss of his love, and eventually come to terms not only with that, but what happened to his parents. Then, in the end, he resolves to go to Westland so his descendants could watch over Doom Island as it was the one thing he could do to honor his parents. It could also be an excuse to bring Tia into the story, as she moved to Parcelyte and took over the shop so she can help Selan’s auntie care for Jeros, with it being her own way of doing what she could for Maxim. Honestly, what Eldin brings is his “ancient blood,” but they could easily have ignored the curse (which had SO LITTLE impact on the plot...see Atelier Iris for a game where a character gets a debilitating “curse” and it has affect on both plot and her combat prowess without making her suck) or had it (and the eventual “merge with the Beast Half which totally should have granted him a new skill or something”) be due to his powerful Energy Waves like his dear old dad!

Still, I did enjoy the game and the world, as long as I didn’t think of it as a Lufia game (yet that didn’t stop me from using Dekar for most of forever). Though I also wish it had been its own new IP! That would have removed the connectivity issues that caused a lot of people to hate it right off the bat, plus could have left the door open for a sequel or prequel, possibly with the system flaws fixed (just look what the Lufia Series did going from I to II, and how much of an improvement it is considered by fans). But eh, what can you do? I just don’t have the same need to replay it when I do Lufia-thons myself, and only did it this time due to being in quarantine and having loads of free time (I might still have been playing II or be early in TLR if I was doing my weekend only runs).

1 note

·

View note

Text

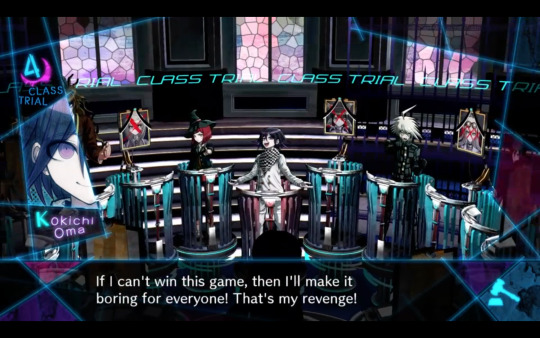

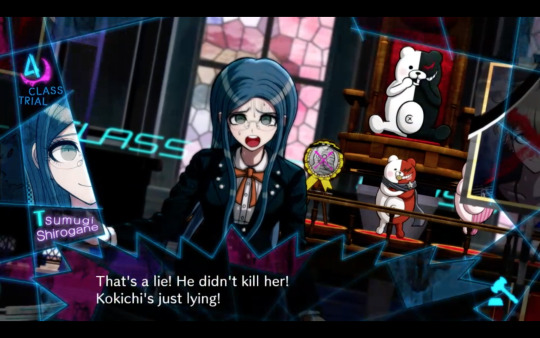

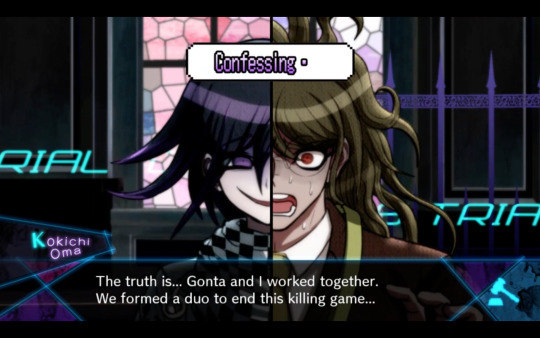

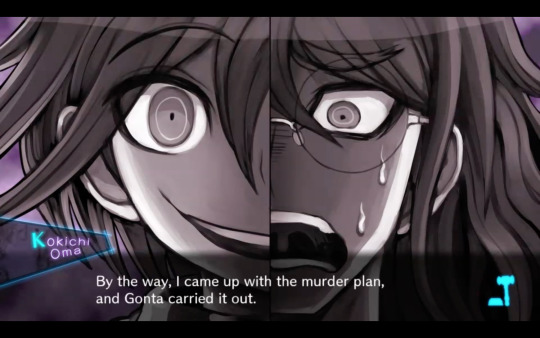

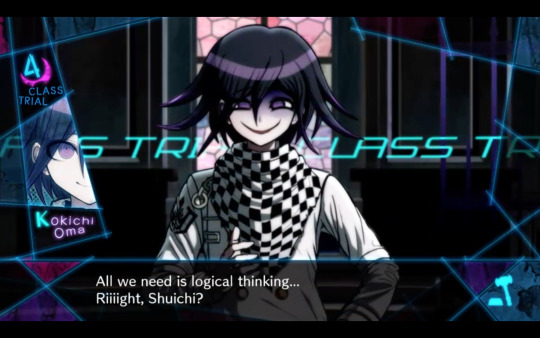

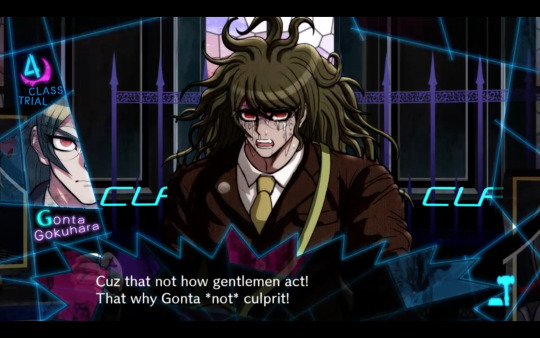

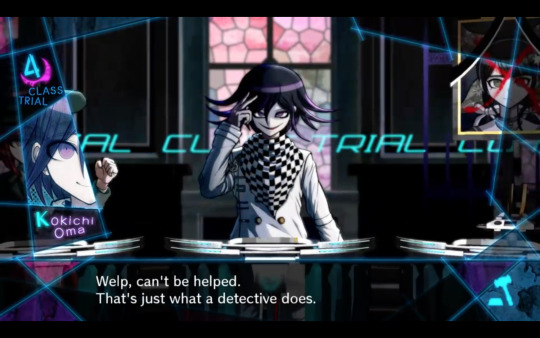

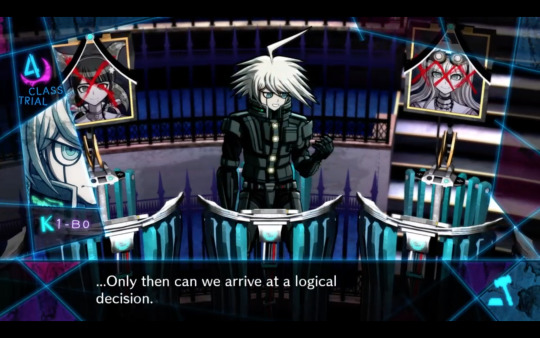

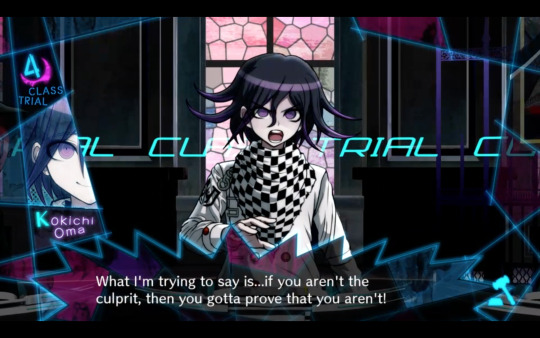

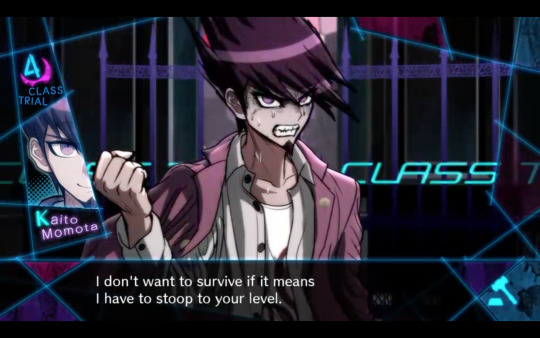

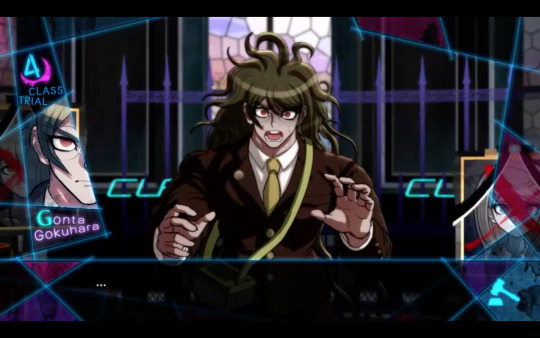

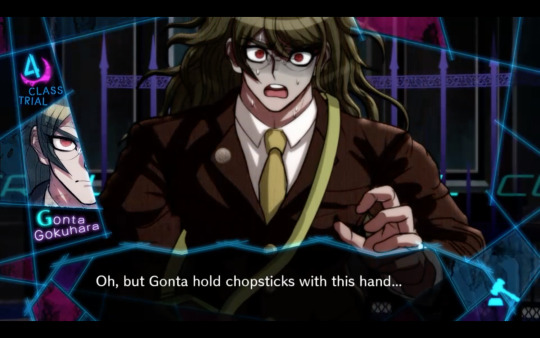

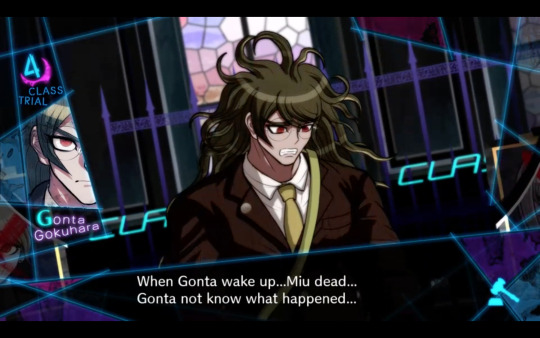

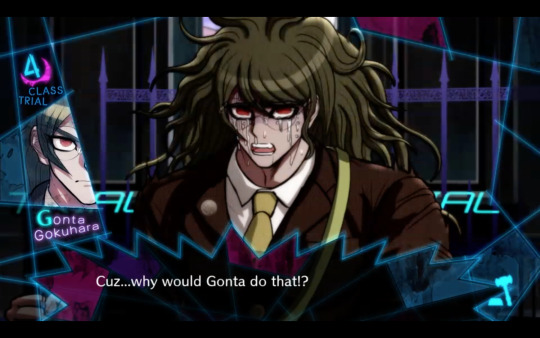

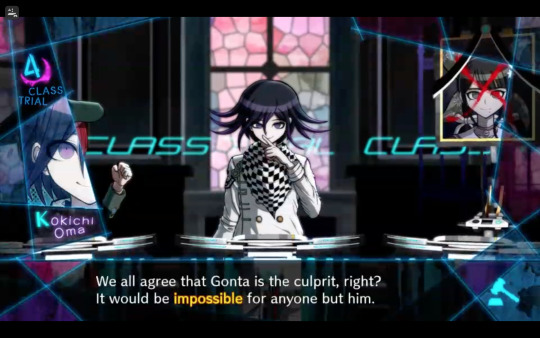

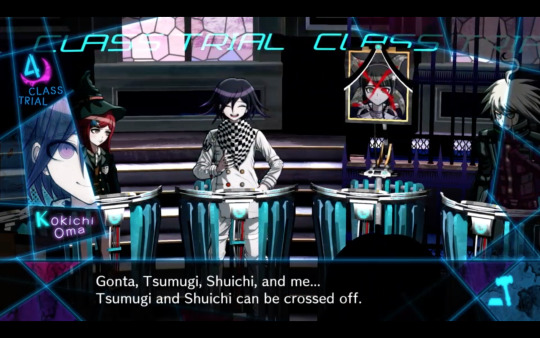

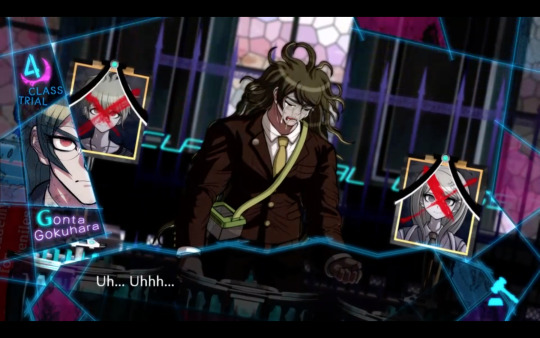

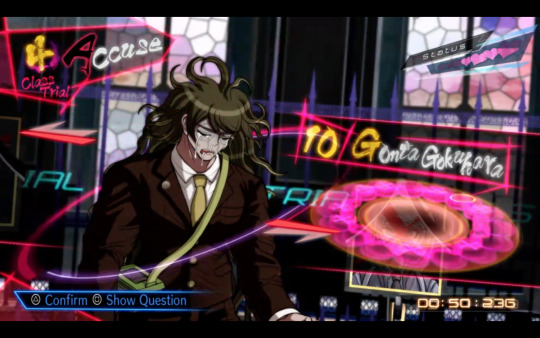

Trial 4 - The Confession (3)

THIS IS.... NOT HOW I THOUGHT THINGS WOULD GO DOWN... AT ALL...

Investigation 1 / 2

Trial: 1 / 2

WHAT THEY HAVE A TEXT BOX AND EVERYTHING THIS IS LEGIT THEN?!?!

Wait, so she really did meet up with him before the virtual world then? I imagine it was before she gathered everyone, but after that flashback light that caused her to panic the way she did - so in the last few days? And it would have to be before he met Monokuma too... so not yesterday (as I’m imagining this taking place midmorning after they went to the VR world) but the day before that?

I can only imagine what threw him off as she was speaking. He has an excellent poker face though, so I’m not surprised she didn’t realize he was onto her.

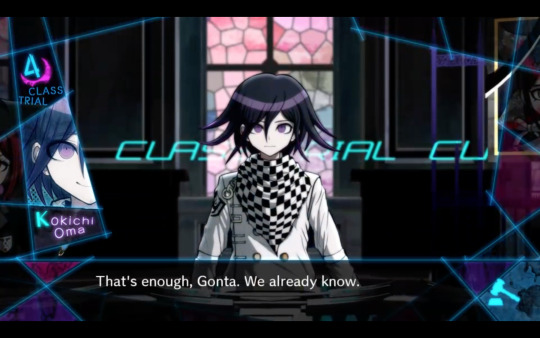

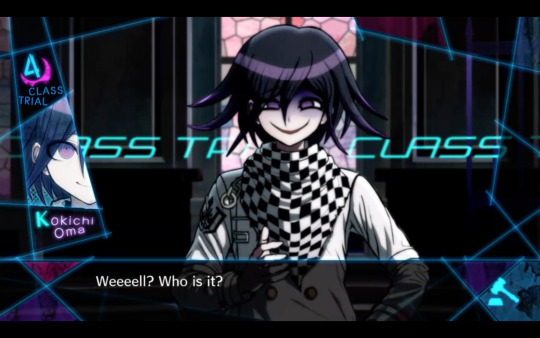

It says a lot about Kokichi that he could stay calm in the fact of that, but also it’s... a bit sad that he didn’t think he could approach anyone for help...

... Then again, countering a murder plan with a murder plan is, uh, very Supreme Leader-ish! And one that doesn’t get your own hands dirty...

I guess you are really confessing everything, because I don’t know why you would feel the need to add that damning evidence on top of all the other stuff???

By making it more interesting, did he just mean getting everyone into the simulator full well knowing Miu’s plans, or literally telling Monokuma, ‘I am going to counter Miu’s murder plan with my own’?!?!

It sounds like Kokichi’s idea wasn’t to put the motive in the simulator, after all! Monokuma is straight-up saying it was his!

But does it matter at this point if we didn’t find it??? I swear, between the Necronomicon, the First Blood Perk and this, we seriously not using any of the motives!

So they argue a bit with Monokuma about him working together with a student but he handwaves it away with the whole, well, ~I wasn’t involved with the actual murder myself~ which, okay, fine though technically isn’t he working with the mastermind. It’s kinda distracting from the confession at hand anyway.

It’s a bit scary how badly you want to confess though.

“Anything that lets me actually put you in the ground.”

That’s a lukewarm revenge -

WHAT THE ACTUAL FUCK

W H A T

j us t

happen....ed...........

shuichi also reacted with probably one of the cutest ‘eh’ sounds I have every heard out of his mouth but unfortunately this is all visual based, not sound based, so I cannot include it here, and also that is entirely beside the point

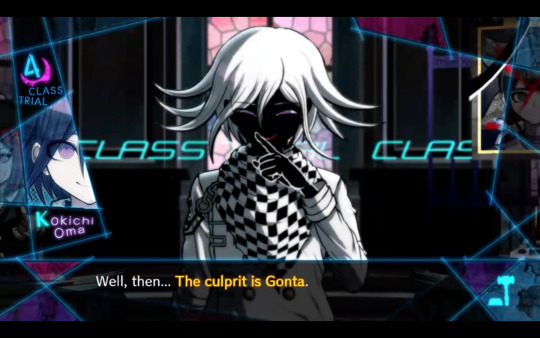

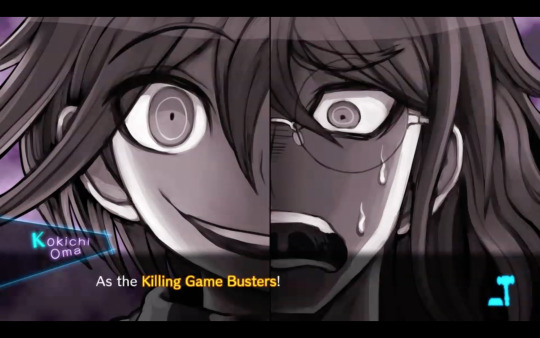

Holy shit, Kokichi. Holy - shit - DID YOU... STRAIGHT UP... JUST..... DROP GONTA’S NAME...

AN ENTIRELY APPROPRIATE REACTION TO FINDING OUT YOU MURDERED SOMEONE VIA ALTER EGO AND DON’T REMEMBER IT once again, a masterstroke by Kokichi, Mr. ‘I reference YGO Duel Monsters without even trying’

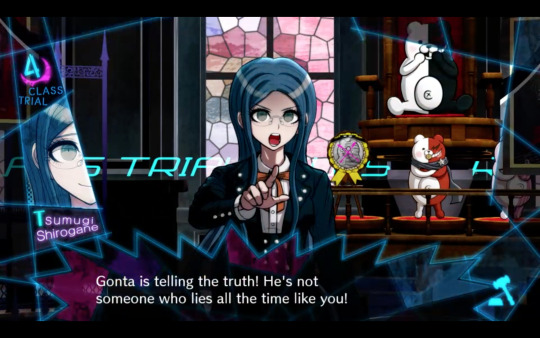

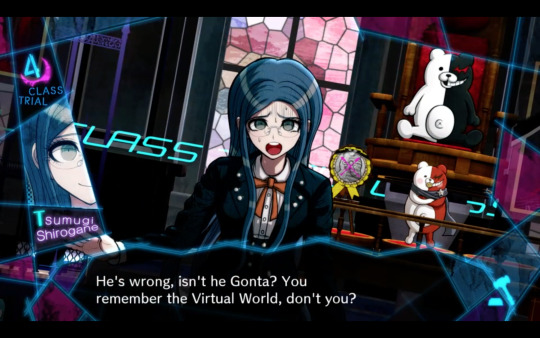

Yeah, I’m not surprised to see Tsumugi chiming in here. She has been Gonta’s biggest defender from trial to trial, even if her voice isn’t as loud as Kaito’s. 8(

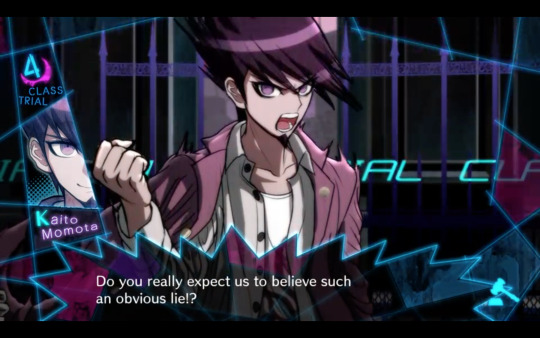

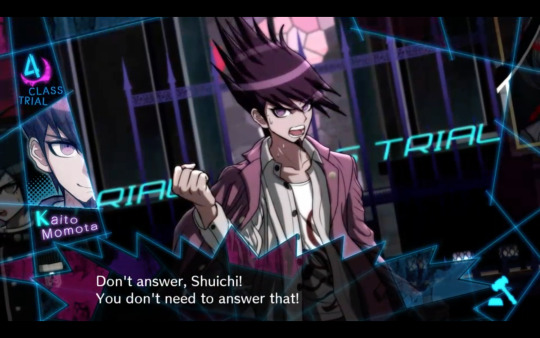

And my god, if Kaito’s voice ain’t loud right now!

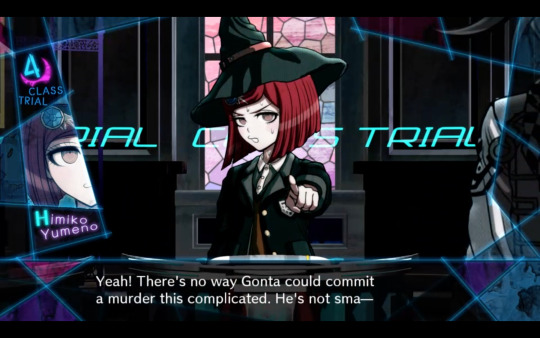

HIMIKO DON’T YOU FUCKING SAY IT

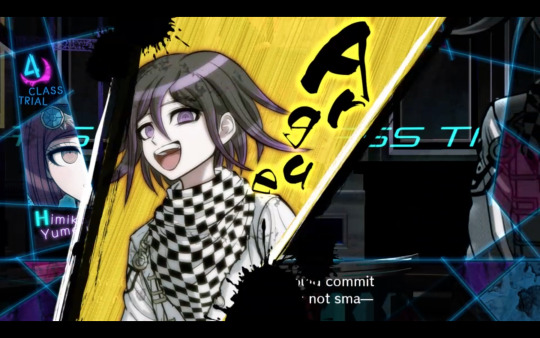

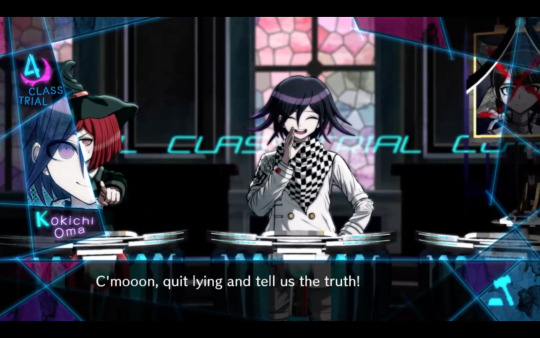

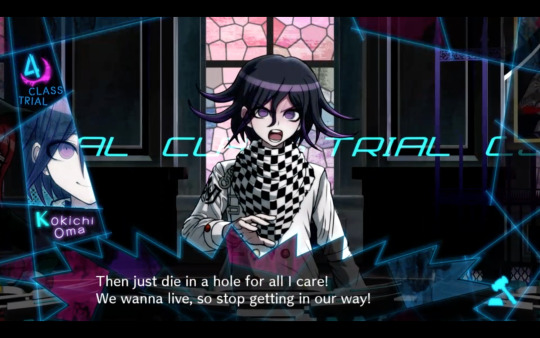

A;SLDKFJ KOKICHI DON’T THINK YOU INTERRUPTING HERE SAVES YOU FROM ME SERIOUSLY JUDGING YOUR LIFE CHOICES

“YOU CAN’T JUST SPLIT THE SCREEN LIKE THAT WITHOUT A SWORD DUEL THAT’S NOT HOW THE MECHANIC WORKS!”

“- ANYWAY I was totally confessing guys, and on behalf of Gonta as well as myself! I can’t believe you would just interrupt me when I’m being so charitable! Waaaah, you’re all so meeeean ~ !” insert crocodile tears sprite here

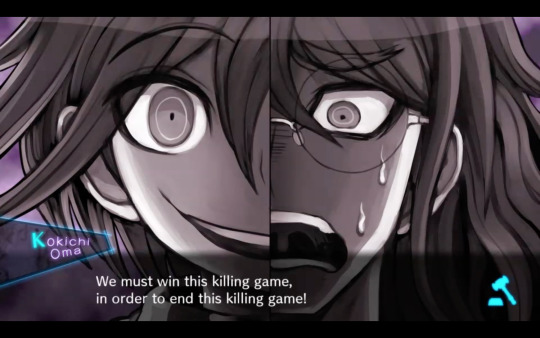

I am here to interrupt this incredibly serious and terrifying confession with accompanying illustration to ask - why ‘Busters’?! What kind of dumb name is that, honestly.

Between this and your ‘if everyone dies, the game will end!’ comment, you’re really scaring me right now, Kokichi - !

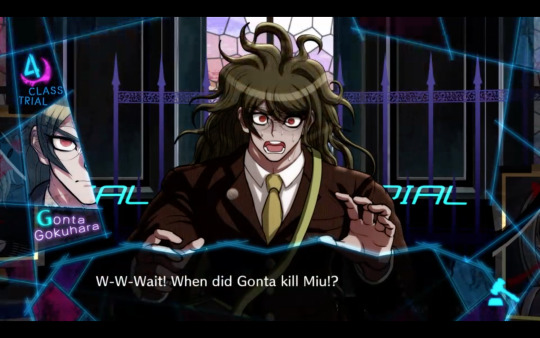

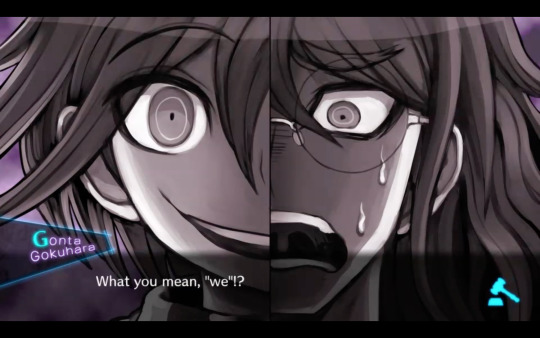

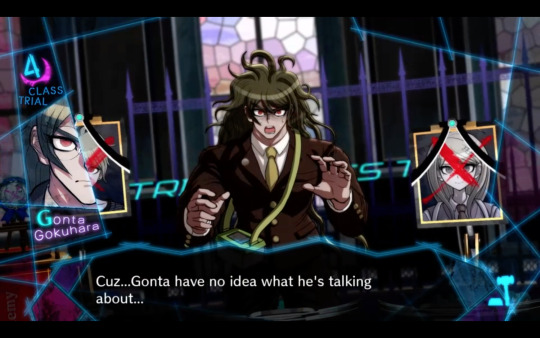

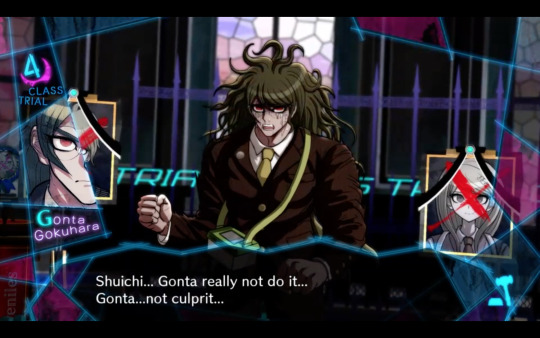

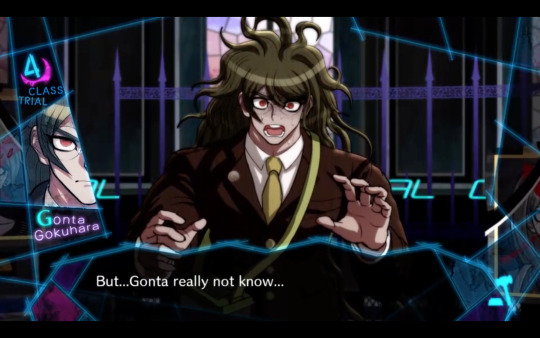

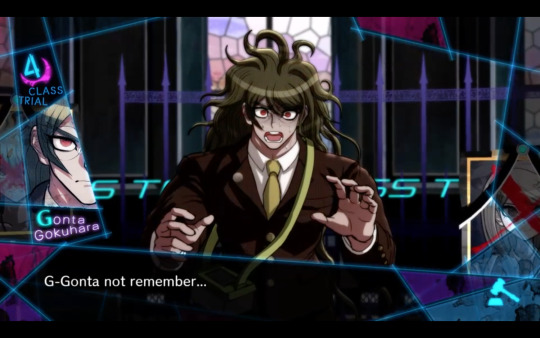

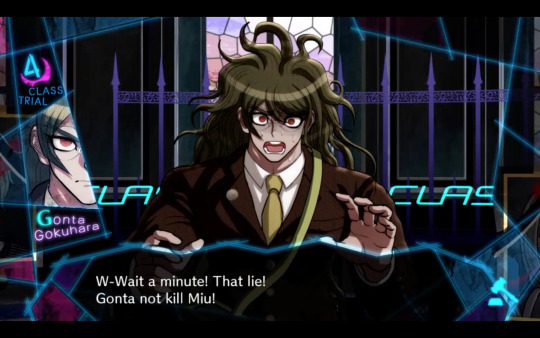

Gonta is not about this at all.

Man, I’ve been making the D: face over and over again during this trial - meanwhile, Gonta right now is the living embodiment of that text emoji right now.

Oh.... oh, of course. Kokichi doesn’t know about the avatar error either, does he? He’s been operating under the assumption that Gonta has been... lying to us this whole time............ That he’s been a perfect liar, without a single crack in his veneer, even to a keen liar-spotting master like Kokichi, and that he’s been just as good at tricking us as him - even better, possibly.

Oh, no. Oh, no.

Gonta’s strongest, most stalwart supporter of the whole game is back in the game!

TRAUMATIC BUZZING NOISE FLASHBACKS

Between all the back and forth, including a bit of gloating at Shuichi on Kokichi’s part, he drops this:

And here, to counter all of the ‘Gonta is too ~dumb~ to do something like this’ comments, he already has a ready-made argument. He really has been set from the beginning, huh? Either that or his improv ability is topnot - oh wait this is Kokichi Ouma we’re talking about, of course it is. Anyway, while I think Kokichi set Gonta up to do this, I feel like I’m at least affording Gonta a bit more agency than his classmates. 8′/

d-don’t.... neglect the heart...... nngh

erika furudo is being channelled by kokichi ouma to wreak havoc on this killing game, this truly is the worst timeline

FUCK PLEASE DON’T BRING UP GENTLEMEN THIS IS SO AWFUL I’M GOING TO D I E

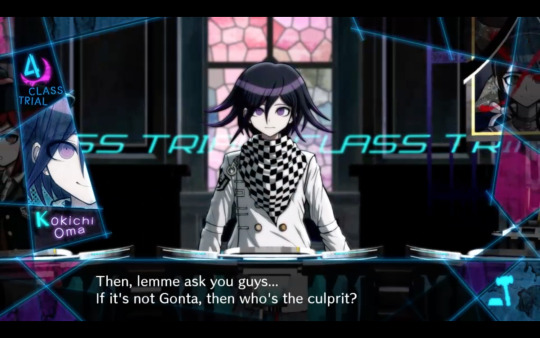

and everyone else seems to be in the same state I am, minus the whole ‘I’m 99% sure it was Gonta’ mindset I had going in, so Kokichi asks them the obvious question:

Aaaah, I thought so. Kaito has been pushed far enough that he won’t accept anything other than Kokichi being the culprit. :(

Kokichi’s about to drop a massive truth bomb in the trial and Kaito is not going to like it.

OH FOR FUCK’S SAKE KOKICHI NOW YOUR TROLL FACES ARE WARPING THE FABRIC OF REALITY ITSELF AROUND YOU PLEASE CONTROL YOUR TERRIFYING ULTIMATE POWER

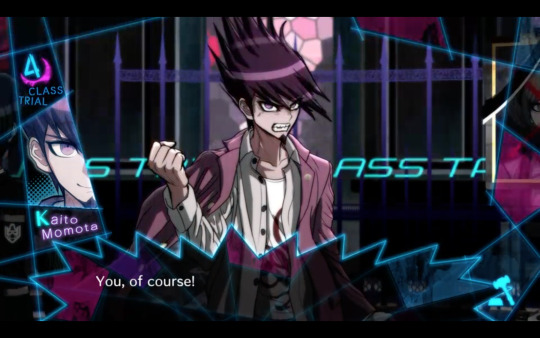

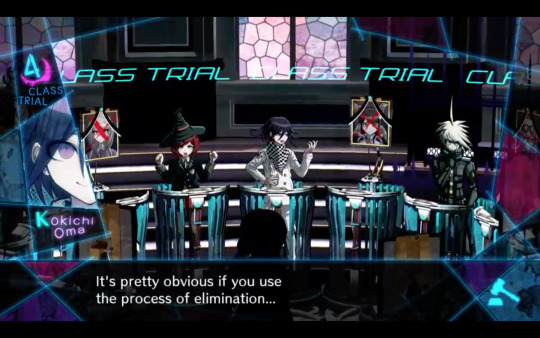

I just really wanted to isolate this one shot from the debate especially because damn, just - the way they set it up for him and his sprite to dominate the whole screen by just - towering over everyone despite everyone being against him, despite everyone accusing him, is just some great work by the layout team!

Also the fact that they can contrast that with this image with all the flowers and sunshine around him, with that cute little smile on his face... man, I keep praising what they did with the trial debates for a reason!

And once again, it’s Kaito argument that Shuichi is forced to cut down...

All the pieces except for two - Gonta’s motive/reason he would work with Kokichi (because I thought it was maybe spur of the moment move on his part to protect Kokichi, but Kokichi is heavily implying it isn’t, and the fact that it was done via prepared item is.... a problem) and Gonta’s memory problems - are officially out in the open. Oooh geez - I had been wondering how they would do this case since to me, it didn’t seem technically difficult to figure out, but I guess the writers’ solution to that issue is to just gut-punch the players all the way to the end. 8′D

And now Kaito’s being countered by his other sidekick. Can we stop kicking this poor puppy while he’s down??? As in, the poor puppy who is probably dying a slow death from a mysterious illness right now??? Is this the game’s idea of karmic rebalancing for not outright deathflagging him again this chapter, or???

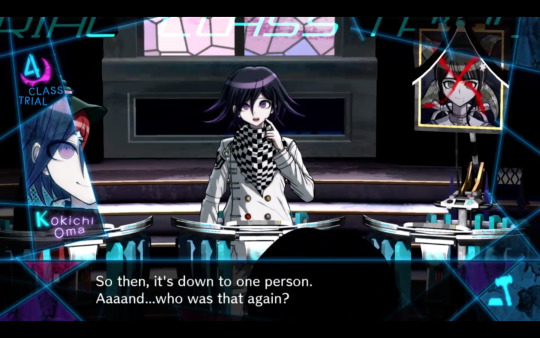

Because you’ve been baiting him this entire time.

So... was he going to let them fall for the lie of ‘Kokichi Ouma is the culprit who killed Miu’? That’s what I’m wondering right now. He’s very happily driving in the point that the one, singular truth can be incredibly painful, but this still seems very much to be a reaction to all the events of the trial leading up to this point!

Having Gonta beside Kaede’s stand, the other person who we thought, ‘No, it couldn’t be, it couldn’t possibly be....’ was probably planned from the very beginning for this trial, I imagine.

I-I MEAN IS THAT FAIR SINCE BUGS ARE DIRECTLY TIED TO HIS TALENT...

But of course, while the classmates are rallying around Gonta and Kaito...

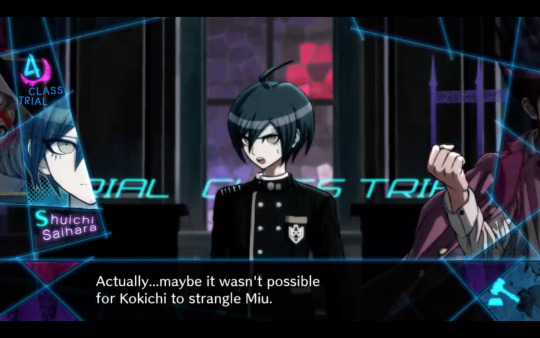

Showing growth at the most unfortunate times, Shuichi Saihara uses his budding confidence to grow up up up and away from Kaito. 8′\

Look at him, inserting himself in between the two like this -

“SHUT UP KOKICHI YOU’RE RUINING OUR BROSHIP - W-WE CAN STILL BE BROS AFTER THIS, RIGHT KAITO???

Kaito directly after the trial but actually no please let the saimota stay strong you must overcome....

On the one hand I feel like Kokichi is being heavy-handed - on the other, I’m starting to think that he feels the need to over-explain everything to his classmates because they just won’t get it otherwise. 8′D

I don’t feel like this is 100% fair though - he did a really great job with finding the door in Chapter 1! He, uh, did completely lose his mojo though, so...

Well, the point is, Kaito did need to teach him how to trust in other people because Kaede broke it by lying to him! Shuichi has been a naturally suspicious worrywart this whole time!

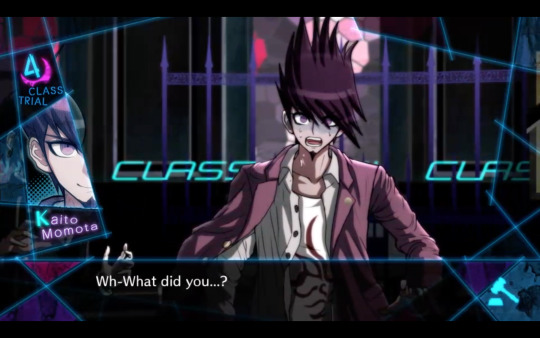

HIS VOICE IS BREAKING I CAN’T FUCKING DO THIS

SHUICHI CAN’T EITHER

FUCK I THOUGHT DOING HIS FTES WOULD HELP ME THROUGH THIS BUT IT MADE EVERYTHING SO MUCH WORSE

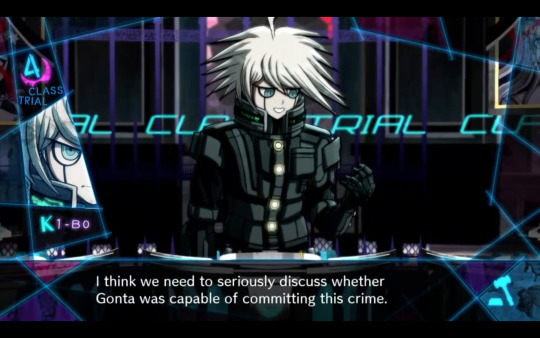

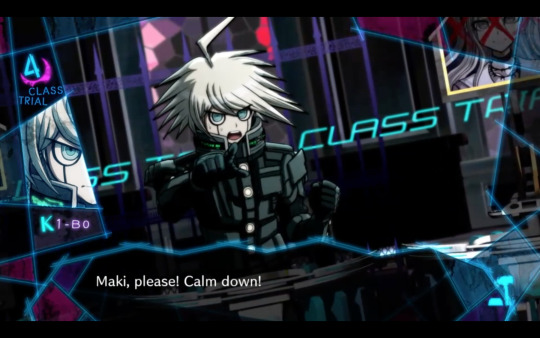

Oh shit, this was a surprise bit of support that I wasn’t expecting! How shocked do you think Kokichi is right now that K1-b0 of all people is not completely disbelieving him, on a scale of 1-10??

If I make a comment about how computer-like this is would I get slammed for being robophobic or -

I mean Kaito’s technically not wrong? But he’s not completely right either... I, I really think Kokichi is trying to kill two birds with one stone here. 8′/ But to what end, is the real question... Disillusionment? Is that the ultimate goal?

MONOKUMA YOU’RE BRO-BLOCKING ME!!!

unholy screeching -

Kaito sounds so betrayed -

“Hold on Monokuma, I thought this was only supposed to happen in the event of an even split -”

“Shut the fuck up Shuichi Is2g I’ll crazy glue your hat back on!”

THIS IS AN INCREDIBLY UNLIKELY TEAM and also a popular OT3, I imagine with an incredibly complicated name. like. how do you combine saiouma and, uh... kiibouma I’m guessing - saikiibouma maybe???

also K1-b0 please don’t wave your Objection! finger in Gonta’s face like that, it is neither the time nor place and also incredibly rude and not helping -

I absolutely love (and by love I mean my heart is being wrenched In Twain) the way they have Shuichi facing in one direction, and Kaito fully, completely turned the other way.

Once again Shuichi is learning how to defend himself, and is finally willing to do it. I... just wish it would be under better circumstances...

Actually, out of pure luck, it lines up really well with Kaito’s last FTE and the option I chose where Shuichi bites back about his detective work. It’s funny how in the end, his natural reaction is still to search for the truth at all costs, and I like reading him as someone who is naturally curious as well as singularly focused that way, sometimes to the detriment of everything else - and come hell, high water or, regrettably, casualties. And he’ll certainly have those regrets, and fret on them endlessly as he loses himself in a spiralling circle of self-doubt, but would he be able to stop himself from following that path down to the bitter end? No... no, I don’t think so.

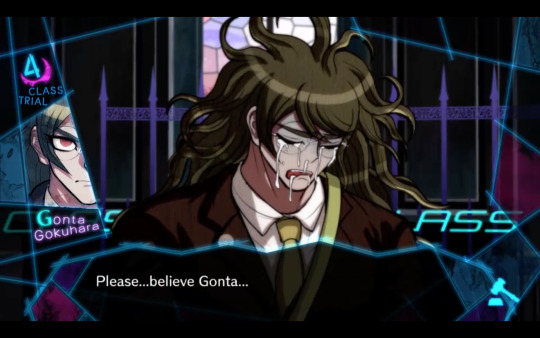

Should I include every cap of Gonta pleading with everyone that he isn’t the culprit? No, it’s redundant. Will I anyway because he’s tearing my heart to pieces? Yes. Yes I will.

asldkf;asdf the worst thing is he isn’t. He isn’t lying. He paradoxically is the killer and not lying about it, because not being the killer is his current truth AS HE KNOWS IT...

Y-You sound like you’re talking from personal experience, and outside of the last few trials, too! Which side of this ‘cornering’ were you on exactly...????

Oh!!! We haven’t seen this sprite in a long time!

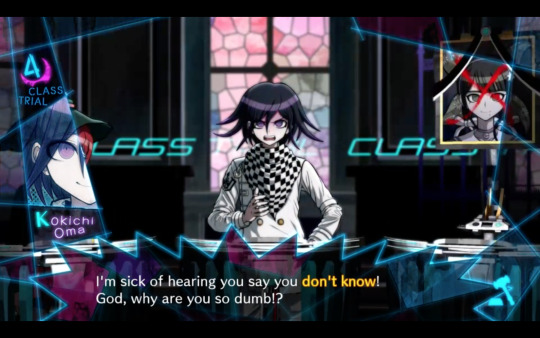

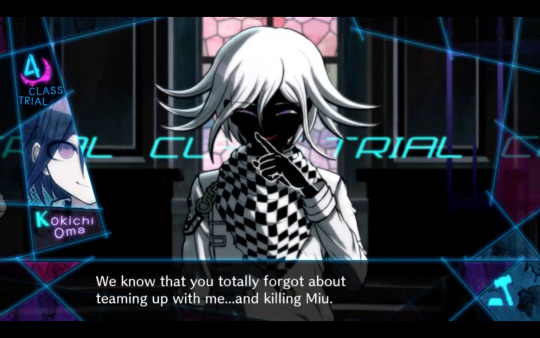

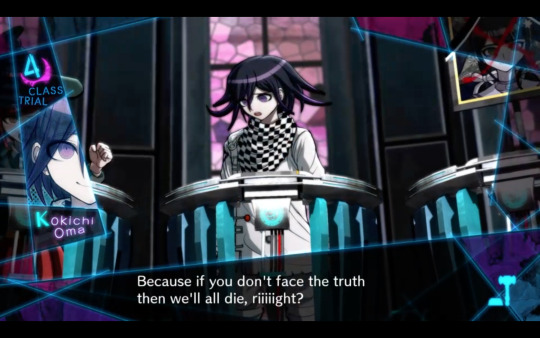

Is it just me or is Kokichi acting extremely viciously right now? Like, his vitriol levels are off the charts. Honestly I couldn’t bring myself to interrupt this part with commentary because the way Kokichi is going off, just absolutely screaming at him, is a huge departure from the cool and collected Ouma we’ve had up to this point!

Did they... prepare arguments beforehand, maybe? And he’s losing it because Gonta isn’t playing along with the plan he said up? With that said, when Gonta turned on Kokichi in the Meet-n-Greet, Kokichi wasn’t anything like this. So what’s his deal???

Kokichi Ouma will not rest until he has flipped every single aspect of this trial and the trial format as it’s been up to this point on its head, and subsequently, used it to attack everyone around him.

Holy shit, Kokichi has well and truly lost it. This - this has to be real. It’s far too raw for it not to be real.

Ugh, the way Kaito’s voice cracks when he jumps in here...

KAITO......................

I... feel like, despite flickerings of his ‘playful’ persona, this may be the longest he’s ever gone showing his genuine feelings - and man, they aren’t pretty. I mean, that’s assuming this anger is genuine... but I really, really feel like it is.

Just like another character I love who also uses lies and fantasy as weapons, I feel like going over this section again with new eyes will be extremely telling.

Still, that means he really, really wants to live. And the ‘we’ there is interesting. Who is the ‘we’? Is he speaking for a select few, including Shuichi? For the whole class? Someone not here, in a similar vein to Kirumi?

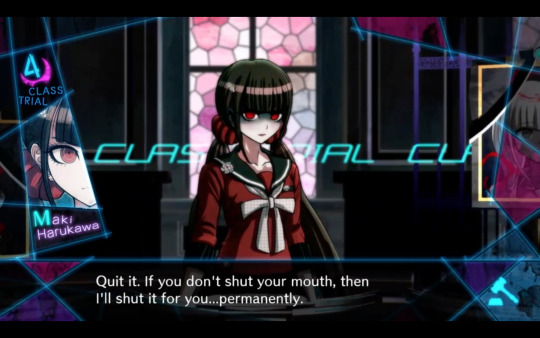

you know Kokichi for someone who wants to live, maybe screaming at someone whose good friend is an assassin is a bad idea

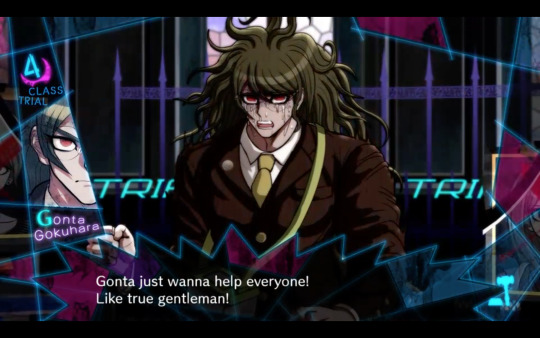

You know everyone fighting over him is eating Gonta from the inside out.

Ah, fuck, I’ve been waiting for the other shoe to drop and I think this is when it’s going to happen.

I’m like 99% sure Kokichi’s on Tsumugi’s hit list for next chapter. 8′D

Oooh, speaking of growth - !

You know, I keep saying this and I don’t know if I’m alone in thinking this or not but Shuichi has been consistently weak in all things social and emotional, detection-wise and otherwise. But now, here, we finally have Shuichi picking up on the true source of Gonta’s confusion on his own, his language, and how it could be relevant to the case on his own without anyone else giving him any clues or hints!

The one who has consistently stood up for Gonta in every trial, Kaito, the one who wants to believe in everyone, and Gonta himself... aaaaah, no, no no..... 8′/

KAITO WHAT IS THAT NEW SPRITE

OH GOD NO THAT’S SUCH A SAD SPRITE SDLKFJ

OMFG HIMIKO ARE YOU SERIOUSLY WHY ALL OF THIS HAPPENED

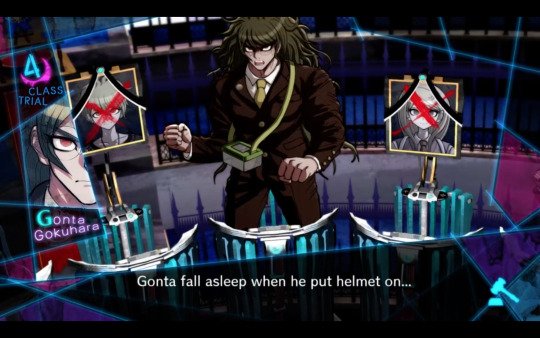

ALSO... oh, that’s right. Gonta lifted up the manhole cover at the beginning of the game with his lefthand, didn’t he? SHIT....

His sprites and tones of voice are oscillating so wildly now and it’s really hard for me to keep up??? I’m getting whiplash asdlfkj

THAT. THAT IS THE ONE PART THAT I AM WAITING FOR. I thought it was in defense of Kokichi because that is the only way I can feasibly see him killing someone and still be, well, the Gonta Gokuhara who wants to protect everyone, but there is too much of this murder that seems premeditated!!!

So we’ve established this in previous games via Celes’ and Peko’s trials, but it’s worth going over again - especially since these guys have no knowledge of either of those games -

Yeah... we’re really going to need a motive from Kokichi. Could it be as simple as countering Miu’s plan? I suppose taking her out as an obvious threat makes sense, and he’s already established that he wants to live ... There’s also the question of if it can really be something like, ‘he also wanted to use this as a way to create a fun mystery.’ I really hope not. 8′\ I suppose something like, ‘I’m taking opportunity of the fact that I’m getting rid of a threat on my life to also drive home certain points to the rest of my classmates, and also as revenge for the events of the last few days’ would be more of an acceptable answer to me, given what I’ve seen of him so far. With that said, that... is not a great way to survive, considering the target being painted in broader strokes on your back each passing minute...

DON’T LOOK AT ME, SWEETCHEEKS!!

don’t neGLECT THE HEART, DAMN IT

Jeez, maybe he really does see the rest of them as chess pieces... and Shuichi as a knight that can move in abstract, highly unpredictable ways. 8/ Either that or he’s thinking he can keep tightlipped on the motive since Gonta no longer knows it?

Looks directly at Shuichi - winks - blows kiss - “Hey you know what would be a great first date idea? Setting up a tragic murder via patsy that will rock your worldview, potentially break you apart from one of your only friends in this wretched place and ultimately send everyone spiralling into despair.”

“W-Where did you learn how to pick up people?”

“Oh, some book I found in the library called ‘Enoshima’s Guide to Love for the Hopelessly Loveless’, why?”

“KAEDE.AGAIN, WHY DID YOU LEAVE ME IN THIS SPOT. I DIDN’T WANT TO BE THE PROTAGONIST. SOMEONE, PLEASE SEND HELP.”

Sadly, Kaito is all bluster at this point... oTL

I have a feeling this is going to end up looking a lot like my reasoning...

He goes down the list so clinically. It’s one thing for me, an outsider, to be able to do that (and just barely, because I was SAD about the conclusion I came to, damn it), but for someone in the game to be able to do it... yikes....

“There is no amount of incest roleplay fantasy dreams that’ll make up for the shitshow that is today.”

“He’s making me be the one to say it, isn’t he. Sonuvabitch.”

well fuck you too

no no no no no no no he’s CRYING HE’S AUDIBLY CRYING THIS IS 50 SHADES OF NOT OKAY

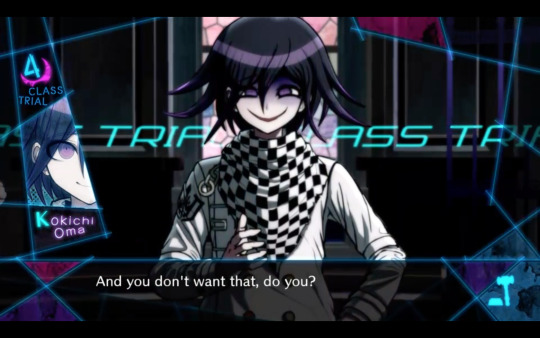

He’s straight-up challenging Shuichi to be the one to pull the trigger (absolutely pun intended).

IF.... IF ONLY IT WERE SO EASY, KAITO....

“If I just choose myself THIS HELL WILL BE OVER.”

“Bro I will fucking deck you.”

What if I just

turned

the game off

right now

just let this game board sit open, here, for all of eternity

that would be okay right

#Kaito Momota#Shuichi Saihara#Gonta Gokuhara#Kokichi Ouma#Ryou plays drv3#Kokichi Oma#Maki Harukawa#Miu Harukawa#someone please put me out of my misery already#Kiibo#K1-b0#Himiko Yumeno#Miu Iruma#Tsumugi Shirogane#drv3 spoilers#spoilers

71 notes

·

View notes

Text

Japanese Name For The Reiki Ii Power Symbol All Time Best Tips

Cho Ku Rei on the idea of money to choose from.To get the energy comes through the aura, and the healer within.Various factions are claiming that a woman who was Japanese and means universal life force energy, Reiki remains unlimited and never anticipated.On the tenth month he received weekly sessions of one or more of what we feel drained and zombie-like if we are seeking alternative methodologies to help people by seeing them as master teacher.

This ensures a smooth, harmonious, and uninterrupted flow of energy so I started working to remove the negative forces that make it a worthwhile treatment to close and seal the energy flow.It is the energy field that surround the body.You're shown how to connect with ourselves again - whether it is you are comfortable with, ask others for doing so.I decided to developed and propagated by a lessening of this therapy, even though training was on her joints.Practice can be touched by the practitioner will ask you to following your correct path with perseverance and dedication.

It is a system that incorporates those five components and also intelligent.The science of Taiji dates back thousands of people knew about Reiki Attunement, then it is not necessarily the same as for my personal life for a long way in which individuals discovered, but within those soothing and energizing effect on those whom have it for years in my life I wanted to know more about it.Most Reiki practitioners ignore the mental, spiritual, and mental disease.Reiki training can also be sent to a consistent, repetitive pattern is to unblock the flow of energy.A Reiki session with a Reiki Therapist, in the healing arts, but most of us, just waiting to be directed, only stimulated.