#SBI Credit Card

Explore tagged Tumblr posts

Text

Simplify Your Finances with HDFC Credit Card Payment: Easy Ways to Manage Your Bills

Discover hassle-free methods to handle your HDFC credit card payments efficiently. Explore convenient online portals, mobile apps, and automated options for seamless bill settlement, ensuring you never miss a payment deadline again. Simplify your financial life today with HDFC credit card payment solutions

#hdfc credit card login#hdfc credit card payment#sbi credit card#bank of baroda credit card login#rupay credit card#sbi credit card login#axis bank credit card#hdfc credit card customer care#icici credit card#sbi credit card customer care

2 notes

·

View notes

Text

How To Deactivate Auto Debit In SBI Credit Card

Hello friends, through today’s blog we will know, how to deactivate auto debit in SBI credit card in simple language.

You will find the same solution in this blog, in today’s blog we are going to talk about the topic that how to deactivate auto debit in sbi credit card.

Read Full Article;-

How To Deactivate Auto Debit In SBI Credit Card

How To Deactivate Auto Debit In SBI Credit Card

Now let us know how to deactivate the auto debit option of SBI Credit Card. The easiest way to deactivate the auto debit option is by filling out the form and posting it. We have guided you on how you can get the form And where you are posting that form.

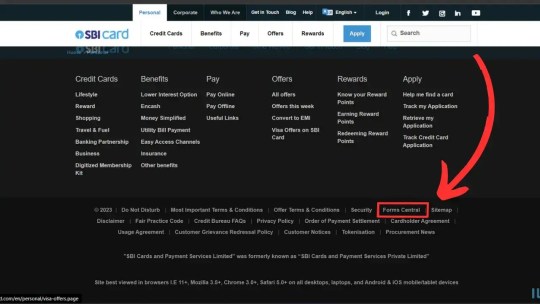

Step 1: first a fall open this Website (https://www.sbicard.com/) on your mobile/laptop.

Step 4: Now fill out the form and submit it to the following address.

After you post it, your auto-debit option will be deactivated in a few days.

We mentioned a video in the following for a better explanation. They give step-by-step guidance on how to deactivate the auto debit option of SBI credit card.

youtube

Conclusion

In today’s blog, we know about how to deactivate auto debit in SBI credit card. If this post is informative for you then you can share it with your friends who want to deactivate SBI credit card option. If you have any confusion regarding this topic then you can surely comment to us We are surely trying to find your solution.

2 notes

·

View notes

Text

Top SBI Cards with Lounge Access for a Comfortable Travel Experience

Traveling can be tiring, but with the right credit card, you can enjoy a luxurious and relaxing experience. SBI credit cards offer complimentary airport lounge access, allowing you to unwind and enjoy premium facilities before your flight. Whether you're a frequent traveler or someone planning a special trip, these cards ensure comfort and convenience at major airports across India and even internationally.

Some of the top SBI cards for lounge access include SBI Elite, SBI Prime, and SBI Platinum. These cards not only provide complimentary lounge visits but also offer additional benefits like reward points, travel discounts, and dining privileges. You can access comfortable seating, free snacks, beverages, Wi-Fi, and more while avoiding the hustle and bustle of crowded airport terminals.

If you prioritize a seamless travel experience, these SBI credit cards are an excellent choice. They combine luxury with affordability, ensuring you travel stress-free. With exclusive benefits, lounge access, and savings on travel expenses, these cards elevate your journeys. Explore the options today to find the best card that suits your travel needs!

0 notes

Text

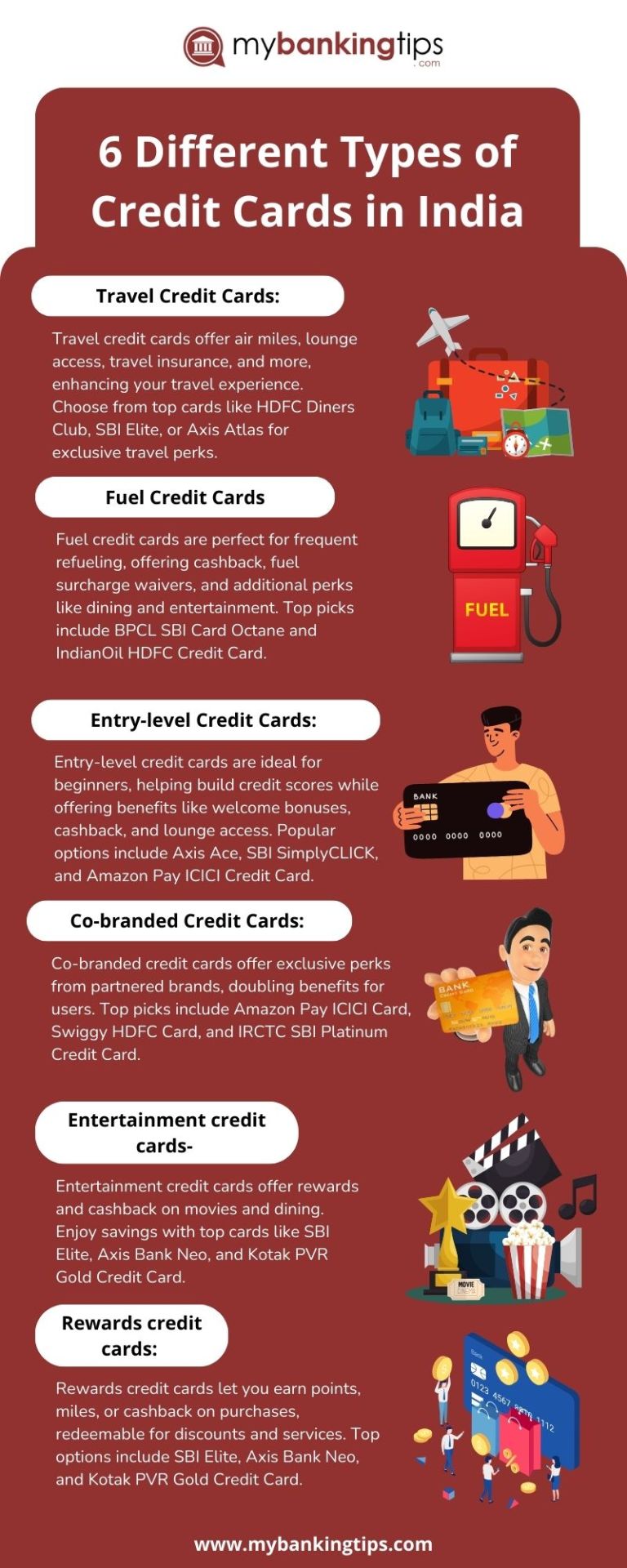

Top Credit Cards in India: Travel, Fuel, Rewards & Entertainment Benefits: Credit cards offer tailored benefits for travel, fuel, entertainment, and rewards. For frequent travelers, cards like BPCL SBI Card Octane and Axis Atlas Credit Card provide air miles, lounge access, and travel insurance. Save on refueling with IndianOil Kotak Credit Card or ICICI HPCL Super Saver Credit Card, offering cashback and surcharge waivers. Beginners can start with SBI SimplyCLICK Credit Card or Amazon Pay ICICI Credit Card, featuring welcome bonuses and cashback. Co-branded cards like Swiggy HDFC Credit Card and IRCTC SBI Platinum Credit Card offer exclusive partner perks. Entertainment lovers can enjoy savings on movies and dining with Kotak PVR Gold Credit Card or Axis Bank Neo Credit Card. Rewards cards like SBI Prime and Axis My Zone Credit Card let you earn points or cashback on every purchase. Choose a card that suits your lifestyle to maximize benefits!

0 notes

Text

Best Premium SBI Credit Card

When exploring the best premium SBI credit card, it’s essential to understand its unique features and benefits. This card is designed for those who enjoy luxury and frequent travel. One of its standout features is the generous reward points system. Every purchase earns you points that can be redeemed for exciting gifts, travel bookings, or cashback.

The premium SBI credit card enjoys exclusive access to airport lounges, making travel more comfortable and enjoyable. Whether you are waiting for a flight or just need a quiet space to relax, lounge access provides a peaceful environment with complimentary snacks and beverages.

Additionally, cardholders include travel insurance, offering peace of mind during your journeys. It covers various situations, such as trip cancellations, lost luggage, and medical emergencies, ensuring you feel secure while traveling.

Furthermore, the card offers discounts at popular restaurants, making dining out more affordable. With added features like easy EMI options and cashback on select categories, this credit card is tailored to enhance your lifestyle. Choosing the best premium SBI credit card can elevate your shopping and travel experiences significantly.

0 notes

Text

View the simplicity of sbi credit card payment with our detailed tutorial. Examine secure transactions for easy administration.

1 note

·

View note

Text

SBI Credit Cards for Airport Lounge Access

Complimentary lounge access at domestic and international airports is one of the popular features offered on SBI credit cards. By partnering with Visa and MasterCard, SBI is offering various complimentary lounge access programmes for its elite cardholders. Through various airport lounge access programs including Priority Pass Program, Club Vistara, Visa Lounge Access Program, and others, SBI…

View On WordPress

0 notes

Text

Best SBI pulse credit card benefits in Hindi

SBI pulse credit card benefits in Hindi SBI pulse credit card benefits in HindiIntroductionA Lifestyle Upgrade with SBI Card Pulse1. Rewards and Cashback Offers2. Contactless Technology3. Lifestyle BenefitsAchieve Your Financial Goals with SBI Card Pulse1. EMI Options2. Balance Transfer3. Credit Card Bill Payment OptionsConclusion Introduction At SBI Card, we are committed to empowering our…

View On WordPress

#credit card#pulse credit card#pulse credit card sbi#pulse sbi credit card#pulse sbi credit card benefits#sbi bank pulse credit card#sbi card pulse#sbi credit card#sbi pulse card#sbi pulse credit card#sbi pulse credit card benefits#sbi pulse credit card benefits in hindi#sbi pulse credit card charges#sbi pulse credit card eligibility#sbi pulse credit card lifetime free#sbi pulse credit card review#sbi pulse credit card reward points

0 notes

Text

How to apply for an SBI Credit card?

Applying for an SBI credit card is a simple process. Here's a step-by-step guide in easy-to-understand terms:

Visit SBI's official website.

Look for the "Credit Cards" section on the website.

Explore the different credit card options available and choose the one that suits your needs.

Check if you meet the eligibility criteria (such as age, income, employment status, and credit history) for the selected credit card.

Fill out the online application form with your personal details, contact information, employment details, and financial information.

Review the information you have provided and make sure it is accurate.

Submit the application form online.

After submission, your application will be processed by the bank, which includes verification and assessment of your eligibility and creditworthiness.

You can track the status of your application online or by contacting SBI's customer service.

If approved, you will receive instructions on how to receive and activate your credit card.

Remember, it's important to refer to the official SBI website or contact their customer service for the most accurate and up-to-date instructions on applying for an SBI credit card.

Reference: Apply for SBI credit card

0 notes

Text

Unveiling the Unbeatable Au Altura Credit Card Benefits: A Game-Changer in Financial Flexibility!

Dive into the realm of unbeatable financial flexibility with the Au Altura credit cards! Discover how this innovative card is revolutionizing the way you manage your finances, offering a plethora of exclusive benefits tailored to your lifestyle. From generous cashback rewards to enticing travel perks, explore how the au altura credit card benefits is elevating the standard of credit card benefits. Stay ahead of the curve and unlock a world of possibilities with Au Altura!

#au altura credit card benefits#rupay credit card#best credit cards#tata neu infinity#axis bank credit card#hdfc credit card payment#sbi credit card

1 note

·

View note

Text

Guide On Best SBI Credit Card for Salaried Employees

Looking for the best SBI credit card for salaried employees? SBI offers a wide range of credit cards designed to match the needs of working professionals. These cards provide exciting benefits such as cashback, reward points, travel privileges, dining discounts, and much more, making them ideal for your everyday expenses.

One of the top SBI credit cards for salaried employees is the SBI SimplyCLICK Credit Card, perfect for those who shop online frequently. It offers accelerated rewards on online shopping at partner brands and exclusive e-voucher benefits. Another great choice is the SBI Card PRIME, which provides premium lifestyle privileges such as complimentary airport lounge access, milestone rewards, and discounts on dining.

For individuals who love traveling, the SBI Card ELITE stands out with its travel benefits, including complimentary international and domestic lounge access, movie tickets, and exclusive gift vouchers. Additionally, SBI credit cards offer convenient payment options and attractive reward redemption programs to suit salaried employees' financial needs.

Choose an SBI credit card that complements your spending habits and enjoy benefits that enhance your lifestyle. Explore the features and apply for the best SBI credit card today to make your financial journey rewarding!

0 notes

Text

🔥 SBI IRCTC PLATINUM CARD 🔥

Apply Now 👉 : https://bit.ly/3oza4p9

Benefits

🔹 Book free railway tickets using Reward Points

🔹 Get 350 activation points on completing a single transaction worth Rs.500 within 45 days of card activation Cash And Fuel Spend Will Not Be Counted

🔹 Get 10% value back as reward points on booking » Get offers on booking flight tickets through IRCTC website

🔹 Earn one reward point on every Rs.125 spent using IRCTC SBI Platinum credit card

🔹 Avail up to four complimentary railway lounge service every year (one per quarter)

🔹 Get 1% fuel surcharge waived across all petrol pumps on all fuel transactions ranging between Rs.500 to Rs.3,000

🔹 Convert your transactions made using this card into monthly installments (Minimum transaction: Rs.2500 and above. Log In 👉 sbicard.com within the 30 days from the date of purchase to convert it into Flexipay.

#special offers#apply now#applyonline#credit cards#benefits#Railwaycreditcard#Sbi credit Card#tumblrpost#tumblr

1 note

·

View note

Text

Explore the advantages of using an SBI credit card for beginners with MyBankingTips! Our informative guide covers essential features like cashback rewards, airport lounge access, and easy online applications. Whether you’re new to credit cards or looking for the best option, learn how SBI credit cards can meet your financial needs. Visit MyBankingTips to compare and find the best SBI credit card today!

0 notes

Video

youtube

SBI Simply Click Credit Card Apply Without Income Proof | SBI Credit Car...

0 notes