#sbi pulse credit card benefits

Explore tagged Tumblr posts

Text

Best SBI pulse credit card benefits in Hindi

SBI pulse credit card benefits in Hindi SBI pulse credit card benefits in HindiIntroductionA Lifestyle Upgrade with SBI Card Pulse1. Rewards and Cashback Offers2. Contactless Technology3. Lifestyle BenefitsAchieve Your Financial Goals with SBI Card Pulse1. EMI Options2. Balance Transfer3. Credit Card Bill Payment OptionsConclusion Introduction At SBI Card, we are committed to empowering our…

View On WordPress

#credit card#pulse credit card#pulse credit card sbi#pulse sbi credit card#pulse sbi credit card benefits#sbi bank pulse credit card#sbi card pulse#sbi credit card#sbi pulse card#sbi pulse credit card#sbi pulse credit card benefits#sbi pulse credit card benefits in hindi#sbi pulse credit card charges#sbi pulse credit card eligibility#sbi pulse credit card lifetime free#sbi pulse credit card review#sbi pulse credit card reward points

0 notes

Text

Union Budget 2025-26: Sectoral Impact and Key Beneficiaries

The Union Budget 2025-26 has introduced a series of transformative measures aimed at strengthening India’s economic foundation. From increased credit access for micro-enterprises to reforms in insurance and infrastructure, these initiatives are poised to benefit multiple sectors.

Read Budget report here

Here’s a breakdown of the key announcements and their expected impact.

1. Banking Sector: Strengthening Credit Access

📌 Enhancement of the credit guarantee cover for micro enterprises from ₹5 crores to ₹10 crores and the introduction of personalized credit cards for micro enterprises. ✅ Positive for: State Bank of India, ICICI Bank, and HDFC Bank.

This move is set to improve credit accessibility for small businesses, fueling entrepreneurship and economic growth. The introduction of personalized credit cards will further ease financial constraints for micro-entrepreneurs.

2. Cement Sector: Boosting Infrastructure Development

📌 Outlay of ₹1.5 lakh crores for 50-year interest-free loans to states for capital expenditure and incentives for reforms. 📌 A structured 3-year Public-Private Partnership (PPP) model for infrastructure development. ✅ Positive for: Ambuja Cement, Ultratech Cement, and ACC.

This initiative will drive infrastructure growth, increasing cement demand and boosting the sector’s performance.

3. Insurance Sector: Attracting Foreign Capital

📌 Increase in FDI limit for the insurance sector from 74% to 100%. ✅ Positive for: HDFC Life, SBI Life, and ICICI Prudential.

With higher FDI, the insurance industry is set to witness enhanced competition, improved capital inflows, and greater penetration.

4. Pharma Sector: Exemptions on Life-Saving Drugs

📌 36 life-saving drugs and their bulk components fully exempted from Basic Customs Duty, with six additional medicines added to the concessional duty list at 5%. ✅ Positive for: Sun Pharma, Divi’s Labs, Natco Pharma, Cipla, Dr. Reddy’s, and Biocon.

This decision will reduce treatment costs and improve accessibility to critical medications.

5. Agrochemical Sector: Strengthening Rural Economy

📌 Launch of the Prime Minister Dhan-Dhaanya Krishi Yojana’s Agri Districts Programme to boost agricultural productivity and rural prosperity. ✅ Positive for: RCF, Chambal Fertilizers, and Paradeep Phosphates.

The focus on agri-development will drive demand for agrochemical products, benefiting fertilizer companies.

6. Aquaculture Sector: Enhancing Exports

📌 Reduction in Basic Customs Duty from 30% to 5% on frozen fish paste (Surimi) for manufacturing and export of its analogue products. ✅ Positive for: Apex Frozen Foods and Avanti Feeds.

The lower import duty is expected to boost India’s seafood export industry, making products more competitive globally.

7. Auto and EMS Sector: EV and Battery Manufacturing Push

📌 Addition of 35 capital goods for EV battery manufacturing and 28 capital goods for mobile phone battery manufacturing to the exemption list. ✅ Positive for: Exide Industries, Amara Raja Batteries, and Dixon Technologies.

This move will accelerate India’s electric vehicle (EV) adoption and strengthen the electronics manufacturing ecosystem.

8. Tourism Sector: Private Sector Participation

📌 Under PM Gati Shakti, private sector access to infrastructure data and development of the top 50 tourist destinations with state partnerships. ✅ Positive for: EaseMyTrip, Lemon Tree Hotels, and Indian Hotels.

With improved infrastructure and policy support, India’s tourism sector is set for significant growth.

9. FMCG Sector: Rural Consumption and Tax Relief

📌 Aatmanirbharta in pulses and edible oils with a six-year mission focusing on Tur, Urad, and Masoor. 📌 No income tax up to ₹12 lakhs, expected to boost housing and consumption. ✅ Positive for: HUL, ITC, Marico, Zomato, and other FMCG players.

Higher disposable income and rural development will drive consumption demand, benefiting the FMCG sector.

Final Thoughts

The Union Budget 2025-26 lays a strong foundation for growth across sectors. With a focus on financial inclusion, infrastructure, and manufacturing, it aligns with India’s long-term economic vision. As these reforms unfold, market participants can expect significant opportunities in the highlighted sectors.

Which sector do you think will benefit the most? Share your thoughts in the comments! 🚀

0 notes

Text

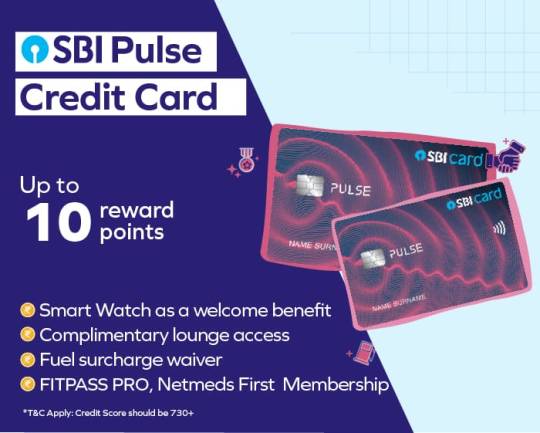

SBI Pulse Credit Card

In today's digital age, credit cards have become an essential tool for managing financial transactions conveniently and securely. Among the prominent players in the credit card industry, SBI Credit Cards stand out as a reliable and customer-centric option. With a wide range of cards tailored to suit various lifestyles and financial needs, SBI Credit Cards offer numerous benefits and rewards to their users. Let's explore the features and advantages that make SBI Credit Cards an excellent choice for individuals seeking a reliable financial companion. Benefits of SBI Pulse Credit Card Welcome Benefits - Get a Noise ColorFit Pulse 2 Max Smart Watch worth Rs. 5,999 on payment of joining fee Health & Benefits - Enjoy 1 year complimentary FITPASS PRO Membership, to be received every year, on card renewal - Enjoy 1 year complimentary Netmeds First Membership, to be received every year, on card renewal Rewards - Earn 10 Reward Points per Rs. 100 spent on Chemist, Pharmacy, Dining and Movies spends - Earn 2 Reward Points per Rs.100 spent on all your other spends Milestone - Waiver of Renewal Fee on annual spends of Rs. 2 Lakhs - Get Rs. 1500 E-Voucher on achieving annual retails spends of Rs. 4 Lakhs Travel - Complimentary 8 Domestic Lounge visits (Restricted to 2 per quarter) - Complimentary Priority Pass Membership for first two years of cardholder membership Others - 1% Fuel Surcharge waiver for each transaction between ₹500 & ₹4,000. Maximum Surcharge waiver of ₹250 per statement cycle, per credit card account - Get complimentary Air Accident Liability Cover of ₹50 Lakhs - Get complimentary credit card Fraud Liability Cover of ₹1 lakh - Loss of check in baggage up to ₹72,000 (1000 USD) - Delay of check in baggage ₹7,500 - Loss of travel documents up to ₹12,500 - Baggage Damage- Cover up to ₹5000 Eligibility Criteria Salaried - Age Group: 21 - 65 years - Income Range: ₹20,000+ - Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID - Income Proof: Salary certificate, Recent salary slip, Employment letter, etc. - You should be new to SBI Bank You must be an Indian resident - Credit Score should be 730+ Eligibility Criteria Self-employed ❏ Age Group: 21-70 years ❏ Income Range: ₹30,000+ ❏ Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, , or any other government-approved ID - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID - Income Proof: Certified financials, Recent ITR (Income Tax Returns), Audited profit and loss statement or balance sheet, etc. - You should be new to SBI Bank You must be an Indian resident - Credit Score should be 730+ Application Process Visit the SBI credit card website by clicking on the link shared by your advisor. Keep the following details handy to start the process - Your PAN card - Aadhaar card and - Bank account details 01 Click on ‘Start apply journey’ Now, select any card of your choice and click on ‘Apply Now’ Enter your personal details such as name, mobile number, tick the terms & conditions checkbox and click on 'Continue' 02 Enter your professional details such as employment type, office address and click on 'Continue to Digilocker' 03 Enter your Aadhaar number, Security code(captcha) and click ‘Next’ 04 Enter the OTP sent to your mobile number and click on 'Continue' 05 Your application has been 06 successfully submitted If your application is approved, the bank executive will contact you in the next 48 hours for verification and completion of KYC - On completion of the due process, the bank will take a final decision on card approval - Once approved, you will get the credit card within 7 to 15 days of the final decision Help & Support FAQs - Is SBI Pulse credit card beneficial for fitness freaks? Yes, you can say that the SBI Pulse credit card is made for fitness freaks, where the user gets a complimentary Noise ColorFit Pulse Smartwatch after paying the joining fee. You can track your fitness activities through this smartwatch. - How can I access my FITPASS PRO membership using the SBI Card Pulse? You will have to make a prior reservation using the FITPASS mobile application. - Can I use SBI Card Pulse internationally? Yes, SBI Card Pulse can be used in over 24 million outlets across the world. - Is SBI Card Elite credit card internationally acceptable? SBI ELITE credit card is accepted at over 24 million Visa outlets worldwide, including 3,25,000 outlets in India. - Does SBI Card Elite credit card provide Fraud liability cover? Yes, you get a cover of Rs. 1 Lakh against fraudulent transactions. - Does SBI Card Elite credit card offer fuel surcharge waiver & if yes, where can I avail it? Yes, SBI Elite Credit Card offers fuel surcharge waiver. It can be availed at any petrol pump in India. - How can I connect with SBI Bank customer care? Please call SBI's 24X7 helpline number i.e. 1800 1234 (toll-free), 1800 11 2211 (toll-free), 1800 425 3800 (toll-free),1800 2100(toll-free), or 080-26599990. Congratulations! Enjoy the benefits of SBI Credit Card. Read the full article

0 notes

Text

SBI Card PULSE

A recently released credit card called SBI Card Pulse offers customers extra health perks to help them manage both their health and their finances. You must pay Rs. 1,500 for registration, and as a thank-you gift, you receive a complimentary smartwatch worth Rs. 5,999. Additionally, Fitpass Pro and Netmeds First memberships are automatically renewed for the next year when you pay the annual cost. You earn 2 reward points for every 100 rupees spent on the rewards program, plus an additional 5 reward points when you purchase specific items. Earned Reward Points can be used to purchase a variety of things, including your statement balance. Check

Main Points

Annual fee: Rs. 499 (waived for the first year)

Reward points:

10 reward points per Rs. 100 spent on chemist, pharmacy, dining, and movies

2 reward points per Rs. 100 spent on all other spends

Reward redemption:

4 reward points = Rs. 1

Reward points can be redeemed against a wide array of gifts, including electronics, travel, and experiences

Other benefits:

Complimentary Air Accident Liability Cover of Rs. 50 lakhs

Complimentary credit card Fraud Liability Cover of Rs. 1 lakh

1% fuel surcharge waived on transactions between Rs. 500 and Rs. 4,000

Get up to eight complimentary domestic lounge access (2 every quarter)

Priority Pass Membership worth $99 for the first two years

One-year NetMeds membership complimentary and one-year FITPASS PRO membership

To be eligible for SBI Card PULSE, you must:

Be a resident of India

Have a minimum annual income of Rs. 3 lakhs

Have a good credit history

Conclusion

The SBI Card Pulse is an excellent choice for customers seeking a budget-friendly credit card with a reasonable reward rate and additional perks, and is most ideal for people who are health-conscious. The Axis Bank Aura Credit Card is an additional credit card option from Axis Bank that features excellent health benefits and a low annual fee. One of the best aspects of the Pulse card is the smartwatch you get as a welcome gift. You also receive complimentary annual renewal lifetime memberships to FitPass Pro and Netmeds First.

0 notes

Text

SBI SimplyCLICK Credit Card vs SBI Card PULSE

SBI SimplyCLICK Credit Card and SBI Card PULSE are two popular credit cards offered by State Bank of India. Here's a brief comparison between the two:

SBI SimplyCLICK Credit Card: The SBI SimplyCLICK Credit Card is designed for online shoppers and offers rewards on online spends. Cardholders can earn 1 reward point for every Rs. 100 spent on all purchases, except fuel. The card also offers accelerated rewards on specific categories such as online shopping, dining, and movies. Other benefits include discounts on partner websites, milestone rewards, and fuel surcharge waiver.

SBI Card PULSE: SBI Card PULSE is a credit card designed for health and wellness enthusiasts. Cardholders can earn rewards on health and wellness spends, including gym memberships, medical bills, and pharmacy purchases. The card also offers benefits such as discounts on gym memberships, free annual health checkups, and fuel surcharge waiver.

In conclusion, both SBI SimplyCLICK Credit Card and SBI Card PULSE offer unique benefits and rewards. The SimplyCLICK Credit Card is ideal for online shoppers, while the Card PULSE is tailored for health and wellness enthusiasts. Ultimately, the choice between the two will depend on your spending habits and lifestyle.

0 notes

Text

SBI Card PULSE

With a wide selection of credit cards, State Bank of India has consistently astounded its clients. A new credit card for fitness freaks was recently launched by SBI Card. SBI Pulse Credit Card is the name of the card. You receive welcome benefits and a one-year membership to Fitpass Pro with this card. It follows that there are many more advantages to having this card, such as reward points, free access to airport lounges, insurance coverage, and many others. Therefore, you must fully utilise all of this credit card's features and advantages. Before applying, make sure to review the card's fees and other costs.

Features and Benefits of SBI Card Pulse

This credit card has a tonne of great features and advantages, including financial savings on fitness-related spending. See how you can use the SBI Pulse Credit Card Benefits listed below to save money by looking at them.

Get Welcome Benefits

You will benefit from the following after you apply for this credit card from SBI Bank:

• A free Noise ColorFit Pulse SmartWatch, valued at INR 4,999.

• Obtainable after paying the joining cost.

Enjoy Health Benefits

Besides the welcome gift, the SBI Pulse also gives you health benefits by providing your the following fitness memberships.

Free Fitpass Pro Membership for 1 year

Free Netmeds First Membership for 1 year

0 notes

Text

Super Value Days by Amazon

Amazon has come back with yet again with another lucrative sale to woo its loving customers. The Super Value Days of Amazon is all set to amaze you with its whopping discounts and massive online shopping offers. The sale starts form 1st April 2021 to 7th April 2021. And accordingly, you can avail a discount up to 45 percent off on pantry. What more? SBI account holders can avail a 10 percent instant discount by using SBI credit card or credit card EMIs for purchase. The minimum amount of purchase needs to be Rs 2000 and the max benefit that you can avail is Rs. 300. This SBI bank offer is available on products listed on Super Value Day Store or Amazon Pantry Store, Amazon Fresh from April 01, 2021 to April 03, 2021.

The Super Value Days Sale has come up with hundreds of online shopping offers and up to 55 percent off on monthly groceries, Amazon brands and much more. Some of the highlights of this sale are as under –

1. Big savings on monthly restock – up to 25 percent off.

2. Cleaning essentials – Up to 20 percent off

3. Nourishment partners – Up to 10 percent off

4. Cooking oils – Up to 20 percent off

5. Nestle products – Up to 15 percent off

6. Daily essentials from Marico – Min 30 percent off

7. Tata consumer products – Up to 20 percent off

8. Deals on Kohinoor products – Up to 48 percent off

9. Wipro everyday essentials – Up to 50 percent off

10.Dawat Basmati – From Rs. 299

11.Tata Sampann products – Up to 20 percent off

12.Scotch Brite products – Up to 25 percent off

13.Personal Care products – Up to 20 percent off

14.Godrej products – Up to 30 percent off.

15.Dabur essentials – Up to 50 percent off.

16.Santoor products – Up to 20 percent off.

17.Kellogg’s – Rs. 25 off.

18.Nivea, Summer ready products – Up to 45 percent off.

19.Henko detergent powders – up to Rs. 105 off.

20.Specialised nutrition for children (PediaSure) – Flat 15 percent off

21.Coca Cola – Up to 10 percent off.

22.Assorted range of cookies – Up to 20 percent off

23.MTR products – Up to 25 percent off.

24.Betty Crocker products – Up to 15 percent off.

Let us explore these offers category wise –

1. Offers on groceries –

Products

Online shopping Offers

Pulses

Starting Rs. 85/Kg

Spices and Masala

Up to 30 percent off

Tea and Coffee

Up to 25 percent off

Breakfast essentials

Up to 30 percent off

Basmati Rice

Up to 40 percent off

Cooking Oil

Up to 20 percent off

Health drinks

Up to 15 percent off

Biscuits and Snacks

Up to 35 percent off

Dry Fruits and Nuts

Up to 40 percent off

Atta and Flour

Up to 40 percent off

Noodles and more

Up to 20 percent off

Beverages

Up to 30 percent off

2. Offers on Home and Hygiene Essentials –

Products

Online Shopping Offer

Laundry essentials

Up to 20 percent off

Dishwasher and Cleaners

Up to 20 percent off

Cleaning supplies

Up to 20 percent off

Oral care

Up to 15 percent off

Personal Hygiene

Up to 15 percent off

Shaving and hair removal

Up to 15 percent off

Home Essentials

Up to 20 percent off

Air Fresheners

Up to 25 percent off

Health care

Up to 15 percent off

Baby care

Up to 20 percent off

Pet Care

Up to 15 percent off

Kitchen essentials

Up to 20 percent off

3. Offers on Beauty –

Products

Online Shopping Offers

Body Lotions

Up to 40 percent off

Face Creams

Up to 25 percent off

Soaps

Up to 35 percent off

Shampoo

Up to 50 percent off

Hair Oil

Up to 40 percent off

Body wash

Up to 50 percent off

Face Wash and Scrubs

Up to 30 percent off

Deodorants

Up to 50 percent off

Conditioners

Up to 25 percent off

Hair colour and Styling

Up to 15 percent off

Make up and Talc

Up to 15 percent off

Value combos of beauty

Up to 40 percent off

With so many mega offers where all product categories are available, you can shop now and can store for the year round. With these exclusive deals which are available only on Amazon Super Saver Days, stocking products for long run would turn out to be great deal. Be it products related to immunity, personal care, hygiene, cleaning essentials or groceries – you name it, and these products are available with great discounts currently. Although it may seem like going on a shopping spree, you have that valid reason for it. So, save and save a lot more with these Super Saver Days. Happy Shopping!

0 notes

Text

SBI Pulse Credit Card

In today's digital age, credit cards have become an essential tool for managing financial transactions conveniently and securely. Among the prominent players in the credit card industry, SBI Credit Cards stand out as a reliable and customer-centric option. With a wide range of cards tailored to suit various lifestyles and financial needs, SBI Credit Cards offer numerous benefits and rewards to their users. Let's explore the features and advantages that make SBI Credit Cards an excellent choice for individuals seeking a reliable financial companion. Benefits of SBI Pulse Credit Card Welcome Benefits - Get a Noise ColorFit Pulse 2 Max Smart Watch worth Rs. 5,999 on payment of joining fee Health & Benefits - Enjoy 1 year complimentary FITPASS PRO Membership, to be received every year, on card renewal - Enjoy 1 year complimentary Netmeds First Membership, to be received every year, on card renewal Rewards - Earn 10 Reward Points per Rs. 100 spent on Chemist, Pharmacy, Dining and Movies spends - Earn 2 Reward Points per Rs.100 spent on all your other spends Milestone - Waiver of Renewal Fee on annual spends of Rs. 2 Lakhs - Get Rs. 1500 E-Voucher on achieving annual retails spends of Rs. 4 Lakhs Travel - Complimentary 8 Domestic Lounge visits (Restricted to 2 per quarter) - Complimentary Priority Pass Membership for first two years of cardholder membership Others - 1% Fuel Surcharge waiver for each transaction between ₹500 & ₹4,000. Maximum Surcharge waiver of ₹250 per statement cycle, per credit card account - Get complimentary Air Accident Liability Cover of ₹50 Lakhs - Get complimentary credit card Fraud Liability Cover of ₹1 lakh - Loss of check in baggage up to ₹72,000 (1000 USD) - Delay of check in baggage ₹7,500 - Loss of travel documents up to ₹12,500 - Baggage Damage- Cover up to ₹5000 Eligibility Criteria Salaried - Age Group: 21 - 65 years - Income Range: ₹20,000+ - Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID - Income Proof: Salary certificate, Recent salary slip, Employment letter, etc. - You should be new to SBI Bank You must be an Indian resident - Credit Score should be 730+ Eligibility Criteria Self-employed ❏ Age Group: 21-70 years ❏ Income Range: ₹30,000+ ❏ Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, , or any other government-approved ID - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID - Income Proof: Certified financials, Recent ITR (Income Tax Returns), Audited profit and loss statement or balance sheet, etc. - You should be new to SBI Bank You must be an Indian resident - Credit Score should be 730+ Application Process Visit the SBI credit card website by clicking on the link shared by your advisor. Keep the following details handy to start the process - Your PAN card - Aadhaar card and - Bank account details 01 Click on ‘Start apply journey’ Now, select any card of your choice and click on ‘Apply Now’ Enter your personal details such as name, mobile number, tick the terms & conditions checkbox and click on 'Continue' 02 Enter your professional details such as employment type, office address and click on 'Continue to Digilocker' 03 Enter your Aadhaar number, Security code(captcha) and click ‘Next’ 04 Enter the OTP sent to your mobile number and click on 'Continue' 05 Your application has been 06 successfully submitted If your application is approved, the bank executive will contact you in the next 48 hours for verification and completion of KYC - On completion of the due process, the bank will take a final decision on card approval - Once approved, you will get the credit card within 7 to 15 days of the final decision Help & Support FAQs - Is SBI Pulse credit card beneficial for fitness freaks? Yes, you can say that the SBI Pulse credit card is made for fitness freaks, where the user gets a complimentary Noise ColorFit Pulse Smartwatch after paying the joining fee. You can track your fitness activities through this smartwatch. - How can I access my FITPASS PRO membership using the SBI Card Pulse? You will have to make a prior reservation using the FITPASS mobile application. - Can I use SBI Card Pulse internationally? Yes, SBI Card Pulse can be used in over 24 million outlets across the world. - Is SBI Card Elite credit card internationally acceptable? SBI ELITE credit card is accepted at over 24 million Visa outlets worldwide, including 3,25,000 outlets in India. - Does SBI Card Elite credit card provide Fraud liability cover? Yes, you get a cover of Rs. 1 Lakh against fraudulent transactions. - Does SBI Card Elite credit card offer fuel surcharge waiver & if yes, where can I avail it? Yes, SBI Elite Credit Card offers fuel surcharge waiver. It can be availed at any petrol pump in India. - How can I connect with SBI Bank customer care? Please call SBI's 24X7 helpline number i.e. 1800 1234 (toll-free), 1800 11 2211 (toll-free), 1800 425 3800 (toll-free),1800 2100(toll-free), or 080-26599990. Congratulations! Enjoy the benefits of SBI Credit Card. Read the full article

0 notes

Text

Visa to Lead India Credit Card Market until 2025 – TechSci Research

Rising use of credit card for large purchases along with growing trend of e-commerce shopping to drive India credit card market through 2025

According to TechSci Research report, “India Credit Card Market By Type, By Service Providing Company, By Credit Score, By Credit Limit, By Card Type, By Benefits, By Region, Competition, Forecast & Opportunities, 2025”, credit card user base in India reached 47 million in 2019 and is poised to grow at a brisk rate during forecast period as well. Increasing availability of POS devices at stores and digital push by the government in the form of campaigns such as digital India are further positively influencing the market. Additionally, owing to increasing usage of credit card in the country, financial institutions are introducing new options and are expanding their credit card portfolio. Moreover, growth in the market can also be attributed to the fact that credit card helps to build a good credit history which can later be used for availing better interest rate on loan in future.

Browse 48 market data Figures spread through 90 Pages and an in-depth TOC on "India Credit Card Market"

https://www.techsciresearch.com/report/india-credit-card-market/4206.html

India credit card market can be segmented based on type, service providing company, credit score, credit limit, card type, benefits and region. On the basis of service providing company, Visa accounted for the largest share in 2019 and the trend is likely to continue in the forthcoming years as well. Based on the credit limit, INR 51K-2L range is the preferred credit limit by the consumers in India.

Leading companies operating in the credit card market in the country include HDFC Bank Ltd., SBI Cards and Payment Services Limited, ICICI Bank Limited, Axis Bank Limited, Citibank India and Bank of Baroda, among others. The companies operating in the credit card market are increasingly focusing on using advanced technologies in order to make credit cards more secure. For instance, ICICI Bank launched next generation cards, called as ICICI bank carbon, which allows to generate a highly secure dynamic passcode for the card.

Download Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=4206

Customers can also request for 10% free customization on this report.

“Credit card allows users to make big purchases or pay bills, offers rewards in the form of discounts or points and reduces the need to carry cash. All these benefits of credit cards are pushing their demand across India. Additionally, the use of a credit card over time helps to build better credit history, qualifying the user for better interest rates and other financial benefits.” said Mr. Karan Chechi, Research Director with TechSci Research, a research based global management consulting firm.

“India Credit Card Market By Type, By Service Providing Company, By Credit Score, By Credit Limit, By Card Type, By Benefits, By Region, Competition, Forecast & Opportunities, 2025” has analyzed the potential of credit card market across the country, and provides statistics and information on market sizes, shares and trends. The report will suffice in providing the intending clients with cutting-edge market intelligence and help them in taking sound investment decisions. Besides, the report also identifies and analyzes emerging trends along with essential drivers and key challenges faced by India credit card market.

Browse Related Reports

India Debit Cards Market By System Types (Online, Offline, Electronic Pulse Card Systems & Prepaid Debit Cards), By Type (Mastercard, Visa, RuPay, Visa Electron, Maestro, Contactless & Others), By Payment Terminals (POS & ATMs), Competition, Forecast & Opportunities, 2024

https://www.techsciresearch.com/report/india-debit-cards-market/4213.html

India Contactless Payment Market By Component (Solution & Services), By Device Type (Point of Sale Terminals, Cards, NFC Chips, Mobile Handsets & Others), By End User (Retail, Transportation, Hospitality, Healthcare & Others), Competition, Forecast & Opportunities, 2024

https://www.techsciresearch.com/report/india-contactless-payment-market/4257.html

India Fingerprint Payment Market By Application (Banking, Retail, Account Managing, Government and Others), Competition, Forecast & Opportunities, 2024

https://www.techsciresearch.com/report/india-fingerprint-payment-market/4240.html

Contact

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: [email protected]

#Credit Card Market#India Credit Card Market#India Credit Card Market 2025#India Credit Card Market Size#India Credit Card Market Share#India Credit Card Market Trends#India Credit Card Market Growth#India Credit Card Demand

0 notes