#Robinhood Trading

Explore tagged Tumblr posts

Text

https://join.robinhood.com/cecilm29 ROBINHOOD ROBINHOOD

#Robinhood app#Robinhood trading#Stock trading app#Commission-free trading#Financial technology#Online investing platform#Stock market app#Investment portfolio management#Trading stocks#Personal finance app#Cryptocurrency trading#Robinhood stocks#Investment app#Fintech services#Online brokerage app#Stock market investing#Robinhood investments#User-friendly investing#Stock market analysis#Robinhood features

0 notes

Video

youtube

Robinhood's 24-Hour Stock Trading Announcement: Game Changer or Investor...

0 notes

Text

2023 stock market rally

meta stock earnings 2023, meta earnings meta stock 2023, facebook, zuckerburg, stock market 2023, how to trade stocks 2023, trade stocks on phone, trade stocks usa, make money trading stocks, how to swing trade, how to trade options on robinhood, how to trade options in the stock market. Tesla stock 2023 gains, wallstbets, reddit stocks, stock forum, make money online 2023, work from home, how to get rich in the stock market,

#meta stock earnings 2023#meta earnings meta stock 2023#facebook#zuckerburg#stock market 2023#how to trade stocks 2023#trade stocks on phone#trade stocks usa#make money trading stocks#how to swing trade#how to trade options on robinhood#how to trade options in the stock market. Tesla stock 2023 gains#wallstbets#reddit stocks#stock forum#make money online 2023#work from home#how to get rich in the stock market

4 notes

·

View notes

Text

0 notes

Text

Brick & Mortal banks are so fucking useless. My partner just had Chase reject an ACH transfer, and then a bank wire transfer, a few days ago, while my online bank, Chime, just finalized an ACH transfer today, on Thanksgiving. All Chime accounts are free accounts. Only one of Chase’s account types are free. Institutional investors will look down on you for using an online bank, claiming they’re not real banks, with zero supporting evidence. Which is why I use Robinhood and just go around the “institutional” (middle men) investors. The actions of “institutional” banks and investors these days just screams insecurity and “I don’t actually know what I’m doing.”

I get deposits faster in my online bank accounts than I do in my brick & mortar bank accounts.

#Chase#Chime#Robinhood#bank transfers#institutional banking#internet banking#investors#investments#stock trading#crypto

1 note

·

View note

Text

BINC

iShares Flexible Income Active ETF

Fund Type: Taxable Bond

Issuer: iShares

Dividend Frequency: Monthly

youtube

My Robinhood Position

0.122898 Shares

Market Value: $6.49

Average Cost: $52.65

Portfolio Diversity: 1.91%

1 note

·

View note

Text

Robinhood Launches Futures Trading for S&P 500, Bitcoin, and Oil in Major Expansion

Robinhood Markets, Inc. has announced the rollout of in-app futures trading, allowing users to trade contracts based on the S&P 500, oil, and Bitcoin. This latest addition to the platform comes as part of a broader effort to attract seasoned traders by providing advanced tools at competitive fees. https://twitter.com/Cointelegraph/status/1846701356272271708 The company’s mobile app now…

#active traders#advanced trading#Bitcoin#fees#financial institutions#futures trading#index options#oil#Robinhood#Robinhood Gold#Robinhood Legend#S&P 500

0 notes

Text

#Build Stock Trading App Like Robinhood#Stock Trading Application#Custom Mobile App Development#Developing Stock Trading App#Stock Trading App Development#Stock Market App Development#Stock Market Trading App Developer#Trading App Development Cost#Stock Trading App Development Company

0 notes

Text

0 notes

Text

I reserved my spot for the new Robinhood Gold Card! Here's my link so you can get access too.

0 notes

Text

Top 10 Platforms to Buy Crypto

Buying cryptocurrency has become increasingly popular, and numerous platforms offer services to facilitate the process. This article explores the top 10 platforms to buy crypto, highlighting their features, benefits, and what sets them apart. 1. Coinbase Coinbase is one of the most user-friendly platforms for beginners. It offers a simple interface, a wide variety of cryptocurrencies, and…

View On WordPress

#Binance#Bitstamp#BlockFi#Coinbase#Crypto Trading#Crypto.com#Cryptocurrency#eToro#Gemini#Kraken#PayPal#Platforms to Buy Crypto#Robinhood

0 notes

Text

0 notes

Text

i rather enjoy being the dumb silly puppy until such point that someone in a discord server needs some investing 201 level financial advice. then the business degree that has branded my soul takes over and i rattle off some john bogle shit about exchange traded funds and lazy investing portfolios in a daze.

like, i am investing fuckin couch change and spare dollars into some robinhood account just because i want to do something with this degree i've otherwise not earned a dime off of cuz it beats going to a casino, but it's really funny to just go Professor Dog and have them be impressed and then go back to barking and such.

#it is infuriating to see like some r/wallstreetbets dummy drop $700k he inherited on intel cuz he thinks he's the 2nd coming of gordon gekko#meanwhile my rate of return is sitting at ~15.5% over the last year which is not GREAT but i could live for years off of 15.5% of $700k#but all i got from this degree was debt and now i'm an unemployed transgender dog girl on the internet with mental health issues#trying and failing to find entry level web dev work.#anyway. BARKBARKBARKBARKBARK.

54 notes

·

View notes

Note

would you be interested in doing a post on crypto? Such as your experience with it and how it works. And why it is important ? it still confusing for me to fully grasp. Thank you :)

Crypto is digital money that exists only electronically. It’s not controlled by central banks or governments. It uses blockchain technology—a ledger enforced by a network of computers.

You store your crypto in digital wallets and can use it for purchases and investments. Just like stock market you can convert to real dollars and withdrawal.

For the last couple of years, large financial companies have been testing a quantum financial system (ISO 20022) which would be an international standard for exchanging electronic messages in the financial industry. This is estimated to be rolled out on a large scale in about a decade.

XRP for example is a digital currency created by Ripple to enable quick money transfers. Some believe it could play a key role in a future global financial system, often referred to as the Quantum Financial System (QFS), by acting as a bridge currency that facilitates value exchange between different currencies and networks.

In plain words, cryptocurrency is a new form of currency and we are still in the beginning stages of it all. Which means the ability to make a ton of money easier than ever before :) Bitcoin is a perfect example, was at 40k I believe beginning of the year and now 100k, this means that if you invested $5,000 USD in January, you would now have made 13,000 USD letting it just sit there. If you are actively trading in crypto and meme coins you have the ability to 100x your returns. For example when people buy in to a coin that’s trending/ new/ getting hype, like XRP recently, there is a significant surge.

To trade crypto you can use centralized exchanges like Binance, Fidelity Investments, Robinhood Crypto, OANDA etc. These platforms allow you to buy, sell and trade various cryptos. This is basically what the general population does. There are other ways like using bots, staking, futures and options, margins and leverage etc.

With meme coins, as they trend you have the ability to make a lot of money overnight. This ofcourse depends on your ability to study the trends and the communities built around those coins. It is always a risk!!!!

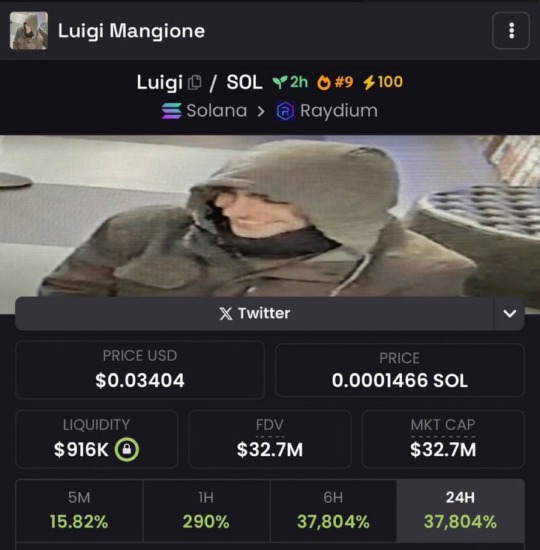

Here’s an example for meme coins:

$330k to $34M (100x) in less than 2h for a meme coin created for Luigi Mangione last week. So if you had put in $3,000 in the coin when it was at 330k, in 2 hours you would have made $300,000.

I can’t say enough that this involves you being on top of trends and markets.

THIS IS NOT FINANCIAL ADVICE!!! The market is very volatile and you are basically gambling your money! Staying informed is crucial!!!! :)

26 notes

·

View notes

Text

Millennials and Gen Zs were raised to be entrepreneurs of the self, to believe that, if they simply worked and studied hard enough, success and security were waiting in their futures. Failure was a personal blight for refusing to invest their time wisely, for failing to grind hard enough. Post-2008, that dream was shot. You could work and work, but that did not mean that you would have job security and freedom from roommates by your mid-30s. Maybe this was what was meant by burnout culture. In the aftermath of the crash, middle-class people spoke of the death of the dream – the postwar ethos that, if you were willing to work hard enough and play by the rules, upper mobility and success were waiting in your future. If their parents had believed in climbing the ladder and just rewards for their hard work, this path was now closed to their children. These generations are also a product of the speculative environment they were raised in. Most of the day-traders were teenagers or children in the financial crash, or just graduating college. Fledgling adults in the COVID-19 pandemic. Born between the mid-1980s and early 2000s, their identity is shaped by the vacuum of post-communist politics (I, personally, was sent, age five, to a fancy-dress party styled as the Berlin Wall) or shaped by the speculation and excess of the dotcom era, or racked by the uncertainty of the 2008 financial crash. They’ve encountered the death of the American dream (or in Ireland, where I’m from, the optimism of the Celtic Tiger) and felt the withdrawal of the state’s contract in everything from mounting student debt to inferior healthcare to the rising cost of living. The postwar security and investment in public goods like education and housing their grandparents and parents enjoyed has been replaced by volatility and risk. Retail trading forums like WallStreetBets and NFT Discords are spaces where people trade crazy investment advice, but it’s also where they articulate their loss of hope in those same dreams. What replaced the fantasy of the good life? Dreams of prepping for life on Mars or in the metaverse? Of financial security through wild trades, or finding a good man to take care of you so you could leave the hustle behind? And who are these new dreams in service of? If the tale of hard work and upward mobility kept us yoked to our employers and our 9-to-5 jobs, the fantasy of the YOLO investment ‘Lambos or food stamps!’ keeps its subjects attached to the market. To risking it all. And these dreams feed the market, as in the crypto winter of 2021 where many vulnerable investors were left holding the bag, or the post-GameStop frenzy where, despite feelgood stories about David and Goliath, the significant profiteer was the market-maker behind the Robinhood trading app.

50 notes

·

View notes

Text

Want to build a trading App like Robinhood?

In recent years, apps like Robinhood have changed trading. They made it easier and more appealing to everyday investors.

Robinhood has disrupted traditional trading. It did this by cutting commission fees and simplifying the user experience.

It has captured the attention of millions. This shift has opened the door for aspiring entrepreneurs and businesses. They want to create investment apps.

A winning fintech app demands more than inspiration. Meticulous planning, stellar UX, ironclad security, and strict legal adherence are essential.

This guide unveils the crucial components for aspiring developers to transform concepts into reality. We’ll explore how to craft an app that rivals Robinhood’s success, blending innovation with practicality.

From initial blueprints to final execution, learn to navigate the intricate landscape of financial technology and create a standout product in this competitive field. If you’re starting from scratch or want to expand your app with custom app development services, knowing these key areas will help ensure your app’s success.

Core Features of an App Like Robinhood

An app like Robinhood must have some key features for success. These features set Robinhood apart. They are a blueprint for any fintech app that wants to disrupt the market.

1. User-Friendly Interface

With a sleek design tailored for novices, Robinhood captivates users through its streamlined, user-friendly platform. Users want a simple experience. They want to trade, monitor their portfolio, and access key features without hassle. An app with a steep learning curve will quickly turn away new investors. To create a similar experience, prioritize a simple, user-centered design. It should boost engagement. Many businesses now hire Flutter mobile app developers to build cross-platform apps. They want sleek, responsive interfaces and consistent performance across devices.

2. Commission-Free Trading

Commission-free trading revolutionized Robinhood’s approach, distinguishing it from established brokers. This strategy lets users trade stocks, ETFs, and options without fees. For new app developers, offering low-cost or free trading is crucial to compete and succeed. It’s key to attract and keep users. This feature appeals to new and expert investors. They seek a cheaper way to invest.

3. Real-Time Data and Analytics

Users require up-to-date market data and analysis for informed decisions. Investors depend on the latest information. Quick, accurate data is crucial. Use reliable APIs for market data. Ensure low-latency updates. This will make your app stand out. Users should be able to monitor stock prices and track performance. They should trade with confidence, knowing they have the latest info.

4. Fractional Shares

Another feature that broadened Robinhood’s appeal was the ability to purchase fractional shares. This lets users buy parts of expensive stocks. It makes investing accessible to all, no matter their budget. For instance, someone with $50 can invest in high-value stocks, like Apple or Tesla. Those stocks would be out of reach otherwise. Fractional shares unlock investing for all, leveling the financial playing field. It can attract users who are intimidated by high stock prices.

5. Security and Data Privacy

Security is vital in any fintech app. Robinhood protects user data and investments Strong security measures build user trust and ensure legal compliance. Encryption protects data. Two-factor authentication adds extra security. Following GDPR and CCPA laws is vital. It ensures responsible data use and avoids fines. They protect sensitive user data. For a secure app, make sure your dev team follows the highest security standards.

Hire experts and focus on key features. You can then create a powerful, user-friendly app. It will attract and retain loyal users.

Choosing the Right Tech Stack

To build an app like Robinhood, choose the right tech. It must provide users with a seamless, secure, and scalable experience. Every part of the tech stack is critical to the app. It includes the frontend and the backend. They affect its performance and functionality.

1. Frontend Development

Flutter’s cross-platform prowess shines in front-end development. This versatile framework crafts responsive, user-friendly interfaces across devices. From a single codebase, it births high-performance iOS and Android apps. Robinhood exemplifies Flutter’s potential, showcasing its ability to create seamless experiences. Choosing the right framework is crucial, and Flutter stands out as a top contender for modern app development. This cuts development time and costs. It keeps a smooth, native-like experience for users. Many businesses that choose custom app development services prefer Flutter. It is flexible, fast, and easy to use. It helps create beautiful, intuitive designs.

2. Backend Development

The backend is the engine of your app. It powers its functionality. It manages data and handles real-time updates. For an investment app like Robinhood, users need real-time data and secure transactions. So, choosing the right backend technology is critical. Non-blocking and event-driven, Node.js excels at real-time data handling. Its design allows seamless processing of multiple concurrent requests, making it a top choice for developers seeking responsive, scalable applications. Alternatively, Django is a high-level Python framework. It is known for its security and fast development. So, it is another great option for fintech apps.

3. APIs and Integrations

To give users real-time market data and fast transactions, your app must connect to various third-party services. APIs that connect your app to banks and payment processors are essential. They also connect to stock exchanges. API integrations should be reliable and secure. They enable features like real-time stock quotes, instant fund transfers, and accurate portfolio tracking. Choosing the right custom app development services ensures seamless, secure integrations. Seamlessly combining compliance and convenience, this approach satisfies regulatory demands without burdening users.

Your app’s triumph hinges on its tech stack. Frontend, backend, and seamless integrations – each piece matters. Pick wisely for success. Informed decisions about your development approach will help you. They will help you deliver a high-quality product that meets users’ expectations. It will also help you stand out in the competitive fintech market.

Legal and Compliance Considerations

Building an app like Robinhood requires navigating strict financial and data laws. Ensuring compliance from the start is critical to avoid legal issues and maintain user trust.

1. Regulatory Framework

U.S. regulations are strict for investment apps like Robinhood. They must follow key rules from the SEC and FINRA. These regulations cover everything from trading to user protection. They ensure your app operates legally and transparently. Not following these rules can lead to heavy fines and harm your app’s reputation. A skilled team in custom app development will ensure your app meets financial compliance standards.

2. User Verification (KYC)

Fintech apps rely on Know Your Customer protocols to safeguard against fraud and illicit behavior. These KYC measures meticulously authenticate user identities, forming an essential defense in the digital financial landscape. By verifying clients, apps maintain integrity and comply with regulatory demands, ensuring a secure environment for all users. They typically require IDs, Social Security numbers, and bank details. Strong KYC systems ensure compliance with regulations and build trust by protecting data. When hiring Flutter app developers, ensure they know KYC integration. It improves functionality and security.

3. Data Protection (GDPR/CCPA)

User data protection reigns supreme in our interconnected world. As technology grows, protecting personal information becomes vital. Companies must focus on cybersecurity to keep trust and meet new rules. Apps like Robinhood gather sensitive data, including financial and personal information. They must comply with regulations like the GDPR and CCPA. These laws require: protect user data, be clear about data collection, and allow control over personal info. Following them prevents breaches and increases trust in in-app security.

By addressing legal and compliance issues, you can create a fintech app that offers a great user experience and meets legal standards. Working with a team experienced in regulatory compliance ensures your app is ready for the financial sector’s challenges and provides a safe, reliable platform.

Ensuring Scalability and Growth

Building an app like Robinhood is just the first step. Its scalability and long-term growth are key to success. As the app gets popular, you’ll need to attract users, handle demand, and add new features.

1. User Acquisition

Clever marketing drives app user growth. Tap into your existing base – referral incentives turn customers into advocates, expanding your reach organically. They do this by offering bonuses for both parties. Partnerships with banks, influencers, or fintech blogs can boost visibility and credibility. Digital marketing on platforms like Google Ads can help you reach your audience. So can social media. Targeted email campaigns can also help. Custom app development services will ensure your app can support user acquisition. It will do this by seamlessly integrating your marketing efforts and referral systems.

2. Scalability

As your user base grows, your app must handle more activity, especially during market surges. A scalable infrastructure is key. It keeps the app fast, responsive, and reliable under heavy load. Using cloud solutions, distributed systems, and load-balancing tech can help your app scale. For real-time market data or many trades, a skilled team in custom app development services is vital. They can ensure your app’s backend grows with its user base. This will provide a seamless experience during activity spikes.

3. Continuous Feature Updates

In the competitive world of fintech, retaining users requires constant innovation. Adding new features can keep users engaged. These include cryptocurrency trading, retirement accounts, and advanced portfolio management tools. Offering premium services or new investment options can add revenue. Custom app development services will let you update your app. This will keep it competitive in the fast-paced fintech industry.

Focus on user acquisition, scalability, and updates. Your app will grow and thrive in a competitive market.

Create Your Own Robinhood App!

We’ll help you build an intuitive trading platform that rivals Robinhood.

LET'S DISCUSS

Final Thoughts

An app like Robinhood offers great opportunities for fintech entrepreneurs. But, it also has unique challenges. The app must be well-planned and executed. To complete a stock trading app like Robinhood, the general development cost can fall between $20,000 to $50,000 as per market reports

It must have a user-friendly interface and comply with strict financial regulations. In a competitive market, security, scalability, and updates are vital. They attract and keep users.

If you’re ready to take the next step in your app development journey, consider leveraging expert guidance. Work with seasoned pros. Use the right tech stack, like Flutter for cross-platform apps. Then, you can bring your vision to life. Hire Flutter mobile app developers. They will meet modern fintech demands. They will also ensure high security and performance.

Check our resources on custom app development. Or, contact us to start building your next fintech success.

#Build Stock Trading App Like Robinhood#Stock Trading Application#Custom Mobile App Development#Developing Stock Trading App#Stock Trading App Development#Stock Market App Development#Stock Market Trading App Developer#Trading App Development Cost#Stock Trading App Development Company

0 notes