#RetailLending

Explore tagged Tumblr posts

Text

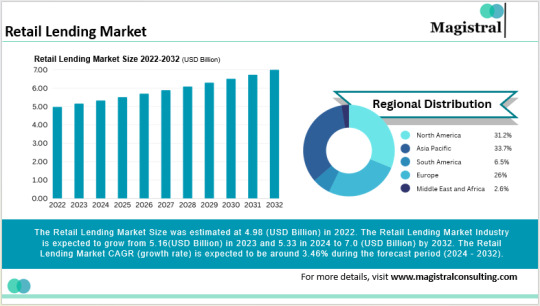

Retail Lending Solutions: A Deep Dive into Market Dynamics

#magistralconsulting#retaillending#lendingmarket#operationsoutsourcing#marketdynamics#lendingsolutions#fintech

0 notes

Text

#LoanOriginationSystem#LoanOriginationSoftware#CreditOriginationSystem#RetailLoanOriginationSystem#RetailLending#Automation#AI#MachineLearning#LoanProcessing

0 notes

Photo

China is about to dominate Asia's retail lending market. Check out the chart! #retaillending #retaillendingofficer #retaillendingdivision #retaillendinggroup #retaillendingworkshop #retaillendingawards2019 #retaillendingdept #retaillendingteam #retaillendingnight #retaillendingplusrewards https://www.instagram.com/p/B5NjxBHH32O/?igshid=1nmkanfqwxprw

#retaillending#retaillendingofficer#retaillendingdivision#retaillendinggroup#retaillendingworkshop#retaillendingawards2019#retaillendingdept#retaillendingteam#retaillendingnight#retaillendingplusrewards

0 notes

Photo

Workforce efficiency can be improved with higher productivity through accelerating digital lending by keeping following steps in mind- 1. Workflow simplification 2. Create seamless digital journeys 3. Integration mechanism 4. Intelligent cross selling 5. effective performance management

0 notes

Link

CMG Financial's Proprietary All In One Loan Live in Texas, Now Available Nationwide #Mortgages #Loans #AllinoneLoan #CorrespondentLender#Mortgage #NewHomeBuilders #RetailLender #WholesaleLender#Digitalmarketing #Onlinemarketing #ePRnews

#Mortgages#Loans#AllinoneLoan#CorrespondentLender#Mortgage#NewHomeBuilders#RetailLender#WholesaleLender#Digitalmarketing#Onlinemarketing#ePRnews

0 notes

Text

@retaillending: Hope to capture 20% market share in India: AP Moller-Maersk https://t.co/bMaoDXHiJU

from http://twitter.com/retaillending via IFTTT

0 notes

Text

Adm, Policy and Procedure

Adm, Policy and Procedure

The Policies and Procedures Administrator works independently to create andmaintaina formal databasethatdefines policies,procedures,and related bestpracticesfor each businessunitwithinthe division,for example Loan Servicingor RetailLending, Read the full post: : Adm, Policy and Procedure

View On WordPress

0 notes

Text

#LoanOriginationSystem#LoanOriginationSoftware#CreditOriginationSystem#RetailLoanOriginationSystem#RetailLending#Automation#AI#MachineLearning#LoanProcessing

0 notes

Text

#LoanOriginationSystem#LoanOriginationSoftware#CreditOriginationSystem#RetailLoanOriginationSystem#RetailLending#Automation#AI#MachineLearning#LoanProcessing

0 notes

Text

Revolutionizing Retail Lending: The Power of Retail Loan Origination Systems

The loan industry has undergone a significant evolution, making it easier for people's funds to reach borrowers at a lower cost. Yet, the rapid shift to digital platforms presents fresh hurdles for banks and financial institutions (FIs). These institutions are ramping up their offerings in the retail lending arena, aiming for customer-centric services that meet evolving compliance and data security standards. Today, the retail lending landscape is experiencing profound changes as it embraces modernization. The Retail Loan Origination System (RLOS) software has emerged as a key player in this transformation, empowering organizations to adapt swiftly to market shifts with flexibility and scalability.

RLOS is a software solution designed to automate and streamline the entire retail lending process, from application origination to loan management. Financial entities that have strategically invested in technology to drive digital transformation and improve operational efficiency are better equipped to navigate volatile market conditions.

Download Sample Report Here

By leveraging RLOS software, FIs can focus on essential tasks such as lead generation, credit risk assessment, asset management, and portfolio monitoring while efficiently managing high application volumes. The integration of AI and machine learning technologies, coupled with access to contextual data, enables lenders to grasp customers' evolving needs and deliver personalized experiences tailored to individual preferences. RLOS empowers FIs to swiftly and intelligently originate, process, and monitor loan applications with competitive underwriting practices.

Increasingly, lending institutions are turning to RLOS to enhance operational efficiency and elevate customer experiences. This solution addresses challenges related to data inconsistency, redundant processes, and complex credit assessment, yielding actionable insights and reducing application processing costs. Moreover, with global regulations tightening and regulators scrutinizing data privacy and transparency, RLOS vendors are enhancing compliance and reporting capabilities to meet regulatory requirements.

Some financial institutions are taking it a step further by integrating RLOS into their operations to achieve comprehensive solutions that streamline processes, enhance customer satisfaction, and ensure compliance with global and local regulations. By embracing RLOS, these institutions are poised to stay ahead in an ever-changing financial landscape while meeting the evolving needs of borrowers and regulators alike.

#LoanOriginationSystem#LoanOriginationSoftware#CreditOriginationSystem#RetailLoanOriginationSystem#RetailLending#Automation#AI#MachineLearning#LoanProcessing

0 notes

Photo

How to Boost Digital Collections?

0 notes