#Rental property management Atlanta

Explore tagged Tumblr posts

Link

Explore The Best Rental Property Companies in Atlanta

To sell or purchase your property, you need rental property companies to manage your property. Aramis Realty, a rental property service company provides you the best protection and decision making for your investment. We serve many clients and treat their property with good attention and care.

1 note

·

View note

Text

Tenant retention strategies are the cornerstone of a successful property management approach. By prioritizing tenant satisfaction and implementing proactive measures to address their needs, property managers can foster a positive and harmonious living environment. Happy tenants are more likely to renew their leases, leading to increased occupancy rates and reduced turnover costs. Additionally, word-of-mouth referrals from satisfied tenants can attract new, high-quality renters, further enhancing the property's reputation. Investing in tenant retention not only strengthens the landlord-tenant relationship but also ensures a stable and profitable rental business. Ultimately, by keeping tenants happy and engaged, property managers create a win-win scenario, where both tenants and property owners benefit from long-term, mutually beneficial relationships. If you want to hire a reliable property management company in Atlanta to manage your rental properties then get connect with 3 Options Realty right away. For more details call us at (678) 397-1282 or visit our site now.

#real estate#rental property management#property management company#tenant retention strategies#property maintenance#property management#property managers in Atlanta#property management company in Atlanta

3 notes

·

View notes

Text

How Wall Street bought single-family homes and put them up for rent

Institutional investors may control 40% of U.S. single-family rental homes by 2030, according to MetLife Investment Management. And a group of Washington, D.C., lawmakers say Wall Street needs to back away from the market.

"What we're saying is don't have private equity buying up single-family homes," said Rep. Ro Khanna, a Democrat representing California's 17th Congressional District. Khanna is the lead author of the Stop Wall Street Landlords Act of 2022. "What's outrageous is your tax dollars are helping Wall Street buy up single-family homes," he said in an interview with CNBC.

The single-family rental industry got its start with government backing in the fallout after the 2008 financial crisis. "It was that rare opportunity that attracted the institutions to build a portfolio out of these foreclosed properties," said Steven Xiao, an assistant professor of finance and managerial economics at the University of Texas at Dallas.

Since the early 2010s, Tricon Residential, Progress Residential, American Homes 4 Rent and Invitation Homes have each bought thousands of homes. They've also added to the housing supply in some cases with built-for-rent communities.

Some of these companies are financed by private equity firms such as Blackstone and investment managers such as Pretium Partners.

"It's almost a captive market," said Jordan Ash, director of labor-jobs and housing at the Private Equity Stakeholder Project. "They've been very explicit about how people are shut out of the homebuying market and are going to be perpetual renters."

These calls come after fierce housing inflation hit many Sun Belt states, including Texas, Florida and Georgia, according to the National Association of Realtors.

The prices in some Sun Belt markets have outpaced national figures for rent inflation, according to research compiled by Zumper for CNBC. Between January 2020 and January 2023, rents for a two-bed detached home increased about 44% in Tampa, Florida, 43% in Phoenix, and 35% near Atlanta. That's compared with a 24% increase nationwide.

Industry advocates argue that they do not control enough market share to dictate prices in any market. Large institutions owned roughly 5% of the 14 million single-family rentals nationally in early 2022, according to analysts.

By 2030, the institutions may hold some 7.6 million homes, or more than 40% of all single-family rentals on the market, according to the 2022 forecast by MetLife Investment Management.

In the short term, however, some companies may retreat from the real estate market as correction concerns mount. "You will see some selling by us," said Jon Gray, Blackstone's chief operating officer, in a December 2022 interview with CNBC.

Included in this should be the billions of dollars worth of property bought by COS, most of which sits empty and the 1000s of acres Bill Gates has been purchasing. All of this to put a squeeze on home and property buyers.

4 notes

·

View notes

Text

What To Know Now About Hosting Rentals in Atlanta & Georgia

When managing a short-term rental, one important aspect to keep in mind is the importance of clear communication with your guests. From the moment they book, make sure to provide all necessary details about the property, check-in procedures, and local attractions. A friendly welcome message can set the tone for their stay, and offering quick responses to any questions they have during their visit…

0 notes

Text

Owning Beyond the Island: Trends in Bermudians Purchasing Property Overseas

As one of the world’s most beautiful islands, Bermuda is home to a community that appreciates the value of prime real estate. While many Bermudians cherish their island homes, there has been a growing trend of residents investing in property overseas. Whether motivated by financial opportunities, lifestyle changes, or long-term planning, Bermudians are increasingly looking beyond their shores for property ownership. Here, we explore the factors driving this trend and the most popular destinations for Bermudians Owning Overseas Property these investments.

Why Bermudians Buy Overseas

The decision to invest in overseas property is influenced by a variety of factors:

Diversification of Investments: Many Bermudians view real estate as a stable investment. By purchasing property abroad, they diversify their financial portfolios, reducing reliance on local markets and mitigating risks associated with economic fluctuations.

Educational and Career Opportunities: With many Bermudians studying or working abroad, owning property near major universities or business hubs provides a practical and long-term solution. Properties in cities like Toronto, London, and New York offer proximity to global opportunities while serving as a base for family members.

Retirement Planning: Some Bermudians look to invest in locations with a lower cost of living or appealing climates for retirement. Popular spots include southern U.S. states, Caribbean islands, and parts of Europe.

Vacation Homes: Beyond investment, the appeal of having a personal getaway is undeniable. Properties in sun-soaked destinations like Florida or culturally rich cities like Barcelona are highly sought after.

Top Destinations for Bermudian Property Investors

Canada: Canada’s strong ties to Bermuda, coupled with its stable economy and welcoming environment, make it a top choice for property investment. Cities like Toronto, Ottawa, and Vancouver attract Bermudians for their vibrant communities, excellent education systems, and diverse real estate options.

United States: Proximity and accessibility make the U.S. a natural choice for Bermudians. Florida’s warm climate and tax-friendly environment appeal to retirees, while metropolitan areas like New York City and Atlanta attract those seeking business opportunities or rental income.

United Kingdom: Bermuda’s historical connection to the UK continues to influence property purchases. London’s dynamic market, as well as charming towns across England and Scotland, provide opportunities for investment or second homes.

Caribbean Islands: Bermudians seeking a blend of familiarity and novelty often turn to neighboring Caribbean islands. Barbados, the Cayman Islands, and St. Lucia offer attractive investment opportunities with the added bonus of similar cultural elements.

Europe: For those looking to diversify further, Europe provides a mix of luxury and affordability. Countries like Portugal, Spain, and France attract Bermudians with their golden visa programs, vibrant lifestyles, and appealing real estate prices.

Challenges and Considerations

While owning property abroad is enticing, it comes with its share of challenges:

Legal and Tax Implications: Each country has unique property laws and tax regulations that Bermudians must navigate. Consulting with legal and financial experts is essential to avoid pitfalls.

Currency Fluctuations: Changes in exchange rates can impact the affordability and profitability of overseas investments. Monitoring currency trends and planning accordingly can mitigate risks.

Management and Maintenance: For those not residing near their overseas property, managing and maintaining it can be a logistical challenge. Hiring reliable property management services is often a necessary expense.

Cultural and Language Barriers: Investing in non-English-speaking countries may require additional effort to understand local customs and regulations.

The Appeal of Overseas Property

Despite these challenges, the benefits of owning overseas property outweigh the obstacles for many Bermudians. Real estate abroad offers:

Rental Income: Properties in high-demand areas can generate steady income, particularly in tourist hotspots or major cities.

Asset Appreciation: Real estate in growing markets often appreciates over time, providing long-term financial benefits.

Personal Use: For those who travel frequently or desire a vacation home, owning a property overseas eliminates the need for repeated rental expenses.

Legacy Building: An overseas property can serve as a legacy asset, benefiting future generations.

Future Trends

As global connectivity increases and the world’s real estate markets evolve, Bermudians’ interest in overseas property is likely to grow. The rise of remote work and digital nomad lifestyles could further influence investment patterns, with more people seeking properties in locations that offer both affordability and quality of life. Additionally, programs like golden visas and international mortgage options will continue to make overseas investments more accessible.

Conclusion

The trend of Bermudians purchasing property abroad reflects a blend of practical considerations and aspirational goals. Whether driven by the desire to diversify investments, secure a foothold in global markets, or enjoy a personal retreat, Bermudians are embracing the opportunities that overseas property ownership provides. By navigating the challenges with careful planning and expert guidance, they are turning their global dreams into tangible realities, all while maintaining strong ties to their island home.

1 note

·

View note

Text

Fourplex for sale in the USA: Urban Living with Southern Charm

If you’re considering urban living with a unique blend of southern charm, then looking at a house for sale in Atlanta, Georgia USA might be the right move. As one of the fastest-growing cities in the country, Atlanta offers an exciting real estate market, especially for first-time homebuyers and young professionals. With its dynamic economy, diverse culture, and rich history, Atlanta has become a popular destination for people looking to relocate or invest in a property.

From historic homes in Midtown to modern townhouses in Buckhead, Atlanta’s real estate market provides a variety of options at different price points. The city is known for its green spaces, excellent schools, and thriving arts scene, making it a desirable place to live for individuals and families alike.

Fourplex for Sale in the USA: An Investment Opportunity

For those interested in real estate investment, a fourplex for sale in the USA can be an excellent way to build wealth and generate passive income. A fourplex is a multi-family property that contains four separate units, allowing investors to rent out each one and collect multiple streams of rental income. These properties are ideal for those who want to invest in real estate without the complexity of managing several single-family homes.

Across the US, fourplexes are available in a variety of markets, including emerging neighborhoods and established areas. Properties in cities like Los Angeles, Houston, and Phoenix offer great potential for investors looking to expand their portfolios.

Finding Your Perfect Property

Whether you're in search of a beach house for sale in America, looking to buy a house in the USA, or exploring investment properties like a fourplex for sale in the USA, there are plenty of options to consider. To begin your search, websites like A.Land provide detailed listings of available properties, including houses in Florida, homes for sale in Atlanta, and investment properties across the nation.

In conclusion, the USA real estate market offers diverse opportunities for both homebuyers and investors. Whether you're looking for a peaceful retreat by the ocean, a vibrant city home, or an income-generating property, you'll find an array of options to fit your needs.

0 notes

Text

At OnSite Environmental Services, we simplify waste management for Greater Atlanta.

At OnSite Environmental Services, we simplify waste management for Greater Atlanta. Our locally-owned business offers flexible scheduling, ensuring a stress-free experience. We're fully insured, prioritize safety, and provide transparent, upfront pricing. Easily book online for dumpster rentals or curbside junk removal. We serve homeowners, contractors, landlords, and property managers. Let us handle the waste so you can focus on what matters most.

Name: OnSite Environmental Services Address: 6265 Cochran Mill Rd, Palmetto, GA 30268 Phone: 470-507-3569 Website: https://www.onsiteenvironmentalservices.com

1 note

·

View note

Text

Redfin Real Estate Agents Scraping

Redfin Real Estate Agents Scraping by DataScrapingServices.com

In the competitive world of real estate, having access to detailed and accurate data is crucial for making informed decisions and staying ahead of the competition. Redfin, a well-known real estate brokerage, offers a wealth of information on real estate agents, properties, and market trends. By leveraging Redfin Real Estate Agents Scraping services from DataScrapingServices.com, businesses can access a comprehensive database of real estate agents' information, enhancing their marketing efforts and strategic planning.

List of Data Fields

When scraping data from Redfin, DataScrapingServices.com ensures that you receive a wide array of essential data fields, including:

Agent Name: The full name of the real estate agent.

Contact Information: Email addresses and phone numbers for direct communication.

Agency/Office Details: The name and address of the agency or office the agent is affiliated with.

Specializations: Areas of expertise such as residential, commercial, rental properties, etc.

Years of Experience: Information on the agent’s experience in the real estate industry.

Active Listings: Current property listings managed by the agent.

Customer Reviews and Ratings: Feedback from clients that reflects the agent’s performance and reputation.

Social Media Profiles: Links to the agent’s social media accounts for additional insights.

Benefits of Redfin Real Estate Agents Scraping

Utilizing Redfin Real Estate Agents Scraping services from DataScrapingServices.com offers numerous benefits:

1. Enhanced Marketing Campaigns: With detailed information on real estate agents, businesses can tailor their marketing campaigns to target specific agents who are most likely to be interested in their services or properties. This targeted approach increases the effectiveness of marketing efforts and maximizes ROI.

2. Improved Networking: Access to comprehensive agent profiles allows businesses to establish connections with top-performing agents. Building strong relationships with these agents can lead to fruitful collaborations, referrals, and increased business opportunities.

3. Competitive Analysis: By analyzing the data on various agents, businesses can gain insights into the competition. Understanding the strengths and weaknesses of competitors helps in refining strategies and staying ahead in the market.

4. Data-Driven Decision Making: Having accurate and up-to-date information at your fingertips enables businesses to make informed decisions. Whether it’s selecting the right agents to partner with or identifying emerging market trends, data-driven decisions lead to better outcomes.

5. Time and Cost Efficiency: Automating the data extraction process saves valuable time and resources. Instead of manually collecting and organizing data, businesses can rely on automated scraping services to gather accurate information quickly and efficiently.

Best Real Estate Data Scraping Service Provider

Realestate.com.au Property Listings Scraping

Realtor.com Property Data Extraction

PropertyGuru Property Data Scraping

Scraping Compass.com Property Listings

Scraping RealtyTrac Real Estate Listings

Property.com.au Real Estate Data Scraping

Gumtree Property Ads Scraping

Nestoria.co.uk Property Price Scraping

PrimeLocation Property Data Extraction

PropertyValue.com.au Property Listings Scraping

Best Redfin Real Estate Agents Scraping Services in USA:

Chicago, Fort Worth, Kansas City, Orlando, Sacramento, Indianapolis, San Francisco, Austin, Philadelphia, Houston, Omaha, Mesa, Washington, Bakersfield, San Diego, Raleigh, New Orleans, Virginia Beach, Colorado, Fresno, El Paso, Long Beach, Nashville, Jacksonville, San Francisco, Atlanta, Memphis, San Antonio, Columbus, Milwaukee, Louisville, Seattle, Sacramento, Dallas, Boston, Long Beach, Colorado, Albuquerque, Wichita, Tulsa, Las Vegas, Denver, Fresno, Orlando, Charlotte, Oklahoma City, San Jose, Tucson and New York.

Conclusion

Redfin Real Estate Agents Scraping by DataScrapingServices.com is an invaluable resource for businesses in the real estate industry. By providing detailed and accurate data on real estate agents, this service enhances marketing efforts, improves networking opportunities, and enables data-driven decision-making. With a comprehensive database at your disposal, your business can stay competitive, build strong relationships, and achieve greater success in the dynamic real estate market. Contact DataScrapingServices.com today to learn more about how our scraping services can benefit your business.

Website: Datascrapingservices.com

Email: [email protected]

#redfinrealestateagentsscraping#redfinrealtorsdatascraping#scrapingpropertyaurealestatelistings#realtorpropertylistingdatascraping#realestatedatascrapingservices#datascrapingservices#webscrapingexpert#websitedatascraping

0 notes

Text

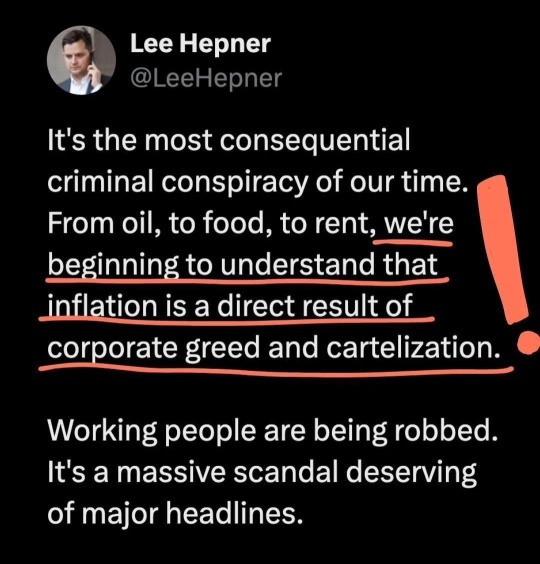

So, check this shit out. This is absolutely fucked beyond imagining, and almost certainly worse than you even thought, and they wrote this shit down:

Last month, the FBI reportedly conducted an unannounced raid of Cortland Management, a major corporate landlord based in Atlanta. The surprise search appears to be part of a Department of Justice criminal investigation, first reported by Politico in March, into an alleged scheme among many corporate landlords to artificially increase rents through collusion. ... According to the lawsuit filed by the State of Arizona in February, landlords that are supposed to be in competition with each other "outsource daily pricing and ongoing revenue oversight" to RealPage. The company allegedly facilitates and encourages landlords to work cooperatively to increase rents. [In other words, to illegally collude.] An e-book produced by RealPage says that the company allows corporate landlords who are “technically competitors” to "work together . . . to make us all more successful in our pricing." RealPage bragged that landlords that use its software “continually outpace the market in good times and bad.” In other words, RealPage helps landlords charge higher rates than they would in a truly competitive market. ... RealPage's former CEO revealed that participating landlords share "occupancy rates, rents charged for each unit and each floorplan, lease terms, amenities, move-in dates, and move-out dates." After feeding in this highly-detailed information that would normally be kept proprietary, "landlords agree to outsource their pricing authority to RealPage—rather than competing with one another on price." RealPage even has a feature called "auto-pilot" that lets the software set rent prices without any human approval or intervention. ...

...RealPage employs "pricing advisors" who "meet with landlords to ensure that properties are implementing RealPage’s set rates." This is described by Arizona as "policing the conspiracy to make sure no one cheats by lowering prices and trying to gain market share." RealPage training materials, cited in the DC lawsuit, advise that landlords "should be compliant" with the software's pricing recommendations. The Arizona lawsuit claims that landlords "agree that if they fail to consistently implement RealPage’s set rates, their contract with RealPage will be terminated." Jeffrey Roper, who created the RealPage algorithm, explained that if "you have idiots undervaluing, it costs the whole system."

... According to the plaintiffs, landlords using RealPage "account for over 53% of the multifamily rental market in the Atlanta Submarket."

Did you catch all of that? These landlords, who control over fifty percent of the multifamily rental market in the Atlanta Metro area, turned over a bunch of privileged information to a company which promises them greater profits. How does it do that? Well, RealPage literally requires them to collude with each other to fix prices. @artsekey saw the effects of that in real time: rents jumping $600 in a couple of days, and why? Well, in the words of Amber Ruffin, which I will take totally out of context:

youtube

So yeah, it's a fucking cartel. Literally, this is "an association of manufacturers or suppliers with the purpose of maintaining prices at a high level and restricting competition." That is the literal definition of a fucking cartel, and this absolutely meets that definition.

They wrote it down! They fucking WROTE IT DOWN! They're so confident that they put it in their fucking training materials.

youtube

(LegalEagle used that clip in a video about Trump so that line has been stuck in my head all fucking day, but SERIOUSLY Y'ALL.)

Greedflation is manifest.

25K notes

·

View notes

Text

Southern Comforts Lure Built-To-Rent Developers: The Sunbelt's Housing Revolution

Discover why the South is the epicenter of BTR construction and how developers are capitalizing on this trend.

The build-to-rent (BTR) phenomenon is reshaping the housing landscape, and its heart beats strongest in the Sunbelt. From Texas to Florida, developers are seizing the opportunity to create single-family rental communities that blend comfort, affordability, and lifestyle. Let's dive into the Southern comforts that are drawing both tenants and investors into this thriving market.

The BTR Surge

The National Association of Home Builders estimates that approximately 10% of new housing construction nationwide will be offered as BTR product. But it's in the South where the movement truly thrives. RealPage Analytics reports that over 113,000 BTR units were under construction in early November 2023, with a staggering 41% of them rising in the Southern states. Compare that to the Western U.S. (29%), the Midwest (13%), and the Northeast (2%), and it's clear: the South is where the action is.

What's Driving the Growth?

Several factors fuel the BTR surge. First, the high cost of single-family homes nudges renters toward more affordable options. Second, interest and mortgage rates play a role, making ownership less appealing. Third, the lack of savings among young families starting out pushes them toward rentals. But there's more to the story.

Population Migration Patterns

The South has been a magnet for population growth long before the pandemic. Job opportunities, warmer climates, and spacious living draw people in. Less-dense communities and outdoor amenities seal the deal. It's no surprise that the 9th annual Build-to-Rent Forum (East) chose Nashville—the capital of the New South—as its stage.

Meet the Players

Greystar’s Summerwell: Charleston-based Greystar entered the BTR sector with a bang. Their dedicated BTR brand, Summerwell, caters to renters seeking single-family lifestyles. Think yards, garages, and privacy, plus amenities like swimming pools, lazy rivers, and tennis courts. Summerwell communities dot the Sunbelt, from Texas to Florida.

Landmark Properties: Atlanta-headquartered Landmark broke ground on its first BTR developments last year. Their projects—like The Everstead at Conroe (Houston, Texas) and The Everstead at Madison (Huntsville, Alabama)—embrace the Southern spirit. Landmark knows what the South wants.

RangeWater Real Estate: With over $6.62 billion in total capitalization, Atlanta-based RangeWater is all about BTR. Their Storia brand graces more than 1,030 single-family and townhome units across the Sunbelt. Professionally managed communities? Check. Southern appeal? Absolutely.

The BeltLine Connection

RangeWater's conventional BTR and hybrid BTR/multifamily concepts have found a home along the Atlanta BeltLine. It's where innovation meets Southern hospitality, and renters find their slice of comfort.

The Sunbelt's BTR revolution is in full swing. Whether you're an investor eyeing returns or a tenant seeking a lifestyle upgrade, the South beckons. Welcome home! 🏡🌞

To delve deeper into the world of Build-to-Rent (BTR), visit Kaufman Real Estate & Consulting’s BTR page. There, you’ll find valuable insights, information, and resources about BTR townhome communities. Whether you’re an investor, a potential tenant, or simply curious, this resource will provide you with a wealth of knowledge! 🏡🔑 www.kaufmanrealestateandconsulting.com

#real estate#investment#danielkaufmanrealestate#economy#housing#daniel kaufman#construction#homes#housing forecast#real estate investing#build to rent

0 notes

Text

Hiring a property management company can be well worth the investment for many real estate investors. The benefits of having an experienced company handle screening tenants, collecting rent, addressing maintenance issues, and providing 24/7 service make the typical 8-12% fees worthwhile. Property managers have expertise in all aspects of rental properties and stay on top of ever-changing local landlord-tenant laws. Their services enable landlords to save time, reduce stress, and avoid the hassles that come with self-managing investment properties.

While some investors prefer a hands-on approach, those with multiple properties or limited time find that professional property management is vital to maximizing returns. For many real estate investors, partnering with a qualified property management company is an essential component for investment success. If you want to hire the best property management company in Atlanta to effectively manage your rental properties then 3 Options Realty can be your best bet. For more details call us at (678) 397-1282 or visit our site now.

#property maintenance#property management company#property managers in atlanta#real estate#rental property management

1 note

·

View note

Text

My Shopping Addiction

I know I haven’t done much of anything with this blog. But my shopping adventures has been really a roll coaster of emotions. In the last three years I developed a shopping habit to the point of recurring debt.

I never thought I would fall into the credit card trap but now I am in a hole. A hole that depleted my savings & left me at square one again. Especially during a time where the economy has triple everything. And my dream of owning my first property seems even further away.

It’s actually started during my last job. Five years ago I was in a good place with my job, my relationship (well at least I hoped) & my finances were stellar. Not anywhere over middle class but not broke either. But I had a budget, I was occupied being happy & when I did shop it wasn’t out of control. If I didn’t need it, I knew how to walk away. For travel & special occasions I saved then spent. Also I was in an balanced economic & situation where I could save & spend.

Then in 2020 I got fired because my job was laying off people & putting all the work on the rest of us & I couldn’t come into work without the look of pure unhappiness. So three strikes of mistakes & they wanted me to quit & give them two weeks but I told them to fire me instead.

Next month my ex girlfriend broke up with me, officially anyways. And it devastated me. I was so in love with her. I was disrespectful to her at the wrong time but she didn’t really love me to begin with either. So during that wrong time I lashed out. I should have left her after our first lease was over. After the first break up. #Lesbiandrama

When all that happened back to back, Covid was still present & annoying; I decided to fuck off a lot of things. I had a nice saving & decided to live in my car. I didn’t want another boss. I was fed up with corporate America. So fed up with having face to face with management & corporations that could care less about you. Our lease was also ending & I didn’t want to pay rent for nobody else. I didn’t want another relationship. I was tired of falling for someone that didn’t never love me in return. It was a waste of my time & I don’t want to feel heartbroken ever again.

So I made the leap to be single & houselessness in my car. I didn’t want to go back to my mother’s in my home state. I still had to pay my car note & insurance & didn’t want to leave Atlanta. Even though I wanted to travel. I thought I just travel in my car. But I ended up taking money from my 401k & saw all that money all at once in my checking account & I went crazy shopping. Emotional shopping.

I took a lot out to pay off my car note. But I decided to stay up North at the time & I needed to get a check to pay my car note in the amount of more than $5000. But I ended up buying food, shopping at Windsor & bought mostly ever summer dress they had on the rack. I just went on a spending spree like I had just won the lottery.

I tried to rationalize with myself that I can make the money back once I got a job I liked. I told myself the dream of getting a rental property was over. I was with my old company for five years & it disgusted me that I had to start all over again. To get any kind of home loan you have to be on the job at least two years. I said welp. I am not ready for a job right now. So I spent my savings.

Then I reopened my credit card. I started for one reason, I needed my car’s tire changed. I got a blowout. At this time I didn’t have the money & I lived in my car so I justified it as I needed the work done to live in my car. Then I used it for a rental car because I didn’t want to put miles on my car to Florida because at this point I have been constantly driving for Amazon.

I didn’t remember how fast money goes. I developed a habit/high of walking into a Marshalls or TJMaxx everyday because either I was bored in my car or didn’t want any people to see me in my car or I didn’t know where to go. I created a daily shopping habit for months. And it adds up, $20 here, $80 there, sometimes over $200. It was bad.

Since then I finally gotten a position of employment I enjoy. But it came too late. I depleted my savings. Still hadn’t paid off my car & I have two huge credit card debt. And now I am paying rent which I avoided for two years & went shopping instead. In fact I used that excuse. I said to myself “Well this money would have went to rent anyways”.

Living in my car didn’t have me save for anything. It’s one of those harsh life lessons that I wish I could go back & change. I definitely have to start from rock bottom again. Now with debt.

One would think to be smarter or doing better. But addiction mean addiction. I don’t need a therapist, I just have to believe & change my behavior. I have to want to save & build up my finances!

But, at the same time, I never saw the point of working just to pay bills. I can get me a little, tiny, make-myself-feel-good-present budget & also put into savings what I spend. But the rising cost of rent, food & gas & credit card bills makes me fucking upset. You would think the restraints of those factors should help curve my spending. It doesn’t. I still get carried away & don’t save. But honestly, I can do better. I just need to do the best I can & push myself to be better.

0 notes

Text

What To Know Now About Hosting Rentals in Atlanta & Georgia

When managing a short-term rental, one effective approach is to create a comprehensive guidebook for your guests. This guide should include essential information about the property, local attractions, dining options, and transportation. Not only does this help guests feel more at home, but it also reduces the number of questions they might have during their stay. By anticipating their needs and…

0 notes

Text

ATLANTA — Three corporate landlords control nearly 11 percent of the single-family homes available for rent in metro Atlanta’s core counties, according to a new analysis led by Taylor Shelton, a geographer at Georgia State University.

Shelton, an assistant professor in the Department of Geosciences at Georgia State, along with his collaborator Eric Seymour of Rutgers University, investigated the ownership of rental homes in metro Atlanta and found that more than 19,000 were owned by just three companies — Invitation Homes, Pretium Partners and Amherst Holdings. The findings were published recently in the article “Horizontal Holdings: Untangling the Networks of Corporate Landlords” in the Annals of the American Association of Geographers, the discipline’s flagship journal.

“These companies own tens of thousands of properties in a relatively select set of neighborhoods, which allows them to exercise really significant market power over tenants and renters because they have such a large concentration of holdings in those neighborhoods,” Shelton said.

Metro Atlanta is facing an affordable housing crisis, and corporate landlords may be one of the reasons for that, according to a book by fellow GSU researcher Dan Immergluck. Beginning with the 2007 foreclosure crisis and continuing in the wake of the COVID-19 pandemic, many local landlords and homeowners were forced or decided to sell their properties, enabling companies that purchase buildings and rent them out for a profit, called corporate landlords, to snap up large numbers of homes.

In this new landscape, figuring out exactly who owns each property can be incredibly complicated.

Many large companies in the United States operate through smaller companies called limited liability companies, or LLCs for short. In the case of corporate landlord companies, these LLCs help protect the larger parent companies from liability or legal action that tenants might take.

“If a tenant is able to sue an LLC and win — they receive some level of damages and compensation for whatever harm they experience — the structure in place means that only the assets held by the LLC are used in calculating the appropriate level of damages,” Shelton said.

Shelton said corporate landlords tend to have a lot of LLCs to protect themselves. In the core metro Atlanta counties in his study — Fulton, Clayton, DeKalb, Gwinnett and Cobb — the three largest landlord companies have more than 190 LLCs between them.

These LLCs usually have multiple addresses, making it difficult to trace the ties between their locations and their parent companies.

To make things even more complex, many of these large companies are not traded publicly on the stock market, meaning their total number of holdings is not easily available to the public. Because Invitation Homes is publicly traded, the total number of properties it owns is available to the public through documents it is required to file with the U.S. Securities and Exchange Commission.

“The other two we analyze in this paper, Pretium Partners and Amherst Holdings, are backed by private equity and not publicly traded,” Shelton said. “So, there is no way to ever know what the full scope of their holdings are without a method like the one we used.”

Tenants find themselves with few options when they have a problem with their corporate landlord.

“Layers of interaction that have to happen before you get to the person who’s ultimately making decisions are increased. You have to talk to your property manager,” Shelton said. “Then, the property manager has to talk to their supervisor, who talks to the local or regional manager. Then they have to run things up. It creates this distance where you don’t actually know who your landlord is, so you don’t actually know who to make demands of.”

This is particularly relevant for Atlanta, which is the largest market for this kind of corporate landlord activity in the country, according to another study byShelton and Seymour.

“You have to add up the next two or three largest markets in the U.S. together to have the same amount of corporate landlord investment that Atlanta has,” Shelton said.

Shelton said metro Atlanta is one of the largest markets for this kind of activity for a few reasons.

“Corporate landlords like places that are growing, and they like places where housing is relatively cheap,” Shelton said. “But the other box that Atlanta checks is that we have very lax tenant protections.”

To address the situation, Shelton and his fellow researchers decided to make their methods of investigation available to the public.

“The hope is that anybody can take this method and replicate it even if you don’t have significant technical skills,” Shelton said. “We wanted to get to the skeleton of the logic of this process so that anyone can do it for anywhere and any company. All you need to have is the right data and then you can go from there.”

1 note

·

View note

Text

Why does Wall Street want to buy your house?

How to invest in U.S. real estate like a Wall Street Investment Bank with America Mortgages

Goldman Sachs, Blackrock, JP Morgan, Vanguard, Fidelity – There are new players in the U.S. real estate game — multibillion-dollar Wall Street hedge funds and cash-flush investors — buying up properties and pushing regular homebuyers out of the market with aggressive buying and rental tactics. Investors and hedge funds currently own roughly 80,000 single-family homes in the Las Vegas area alone, which is about 14% of the county’s housing stock of 563,000, according to Shawn McCoy, director of UNLV’s Lied Center for Real Estate. Some prime targets that are appealing to these investors are growing Sunbelt cities like Las Vegas and Phoenix and other secondary markets such as Charlotte, North Carolina, Atlanta, and various cities in Florida.

“From mid-2020, when interest rates started going up, hedge funds bought up a ton of properties and immediately turned them into rentals, pricing out local buyers,” says industry experts. “Now a big portion of our homes are owned by investors.” Institutional investors may control 40% of U.S. single-family rental homes by 2030, according to MetLife Investment Management.

These funds pay top dollar to some of the smartest and brightest analysts in the world before spending billions of dollars. This should be a sign for all real estate investors to research, learn, and follow. Currently, investors target single-family “starter homes” below the median home sale price of $447,435, sometimes renting out to the same demographic they outbid for the properties, which further tightens supply and increases rental yield.

The reason for the specific areas targeted is that prices in some Sun Belt markets have outpaced national figures for rent inflation, according to research compiled by Zumper. Between January 2020 and January 2023, rents for a two-bed detached home increased about 44% in Tampa, Florida, 43% in Phoenix, and 35% near Atlanta. That’s compared with a 24% increase nationwide.

The realm of real estate investment is perpetually influenced by various economic factors, among which interest rates wield a substantial impact. Contrary to conventional wisdom, sophisticated investors often perceive high-interest rate periods as opportune moments to delve into the U.S. real estate market. This seemingly counterintuitive strategy is rooted in several compelling reasons that highlight the advantages and potential opportunities for astute investors.

Enhanced Bargaining Power

During high-interest rate environments, the housing market commonly experiences a slowdown. As a result, property sellers might be more amenable to negotiations, leading to a potential reduction in property prices. Sophisticated investors with the financial acumen and liquidity or access to high LTV mortgage lending (more than 65%) can capitalize on these conditions to acquire real estate assets at lower costs compared to periods of lower interest rates.

Favorable Cap Rates

High-interest rate environments often translate to higher capitalization rates (cap rates) for real estate investments. Properties with higher cap rates tend to generate more substantial income relative to the property’s cost. This can be especially appealing to sophisticated investors seeking income-generating assets, such as rental properties or commercial real estate, as they can yield greater returns on their investment.

Hedging Against Inflation

Real estate has historically served as a hedge against inflation. When interest rates are high, inflation is often a concern. Real assets like real estate tend to retain or increase their value over time, thereby shielding investors from the erosive effects of inflation. Experienced investors understand the value of having tangible assets in their portfolio that can safeguard against inflationary pressures.

Long-Term Investment Perspective

Many investors in real estate often adopt a long-term view. While high interest rates might seem daunting in the short term, they can take advantage of locking in fixed-rate loans, thereby securing a consistent interest rate over an extended period. This stability safeguards against potential future rate hikes and provides a reliable cost structure for the investment’s lifetime.

Risk Mitigation and Diversification

Diversification is a key principle in investment strategy. High interest rate periods may deter other forms of investment, making real estate a comparatively safer harbor. Investors who have been in the market for a while recognize the importance of diversifying their portfolio to mitigate risk, and real estate, particularly during high-interest rate climates, can be an integral component in a well-balanced investment strategy.

Other People’s Money, aka Leverage

Having access to leverage makes sense in every way – Capital efficiency, Tax benefits, Risk management, and Preservation of liquidity. As a Foreign National or U.S. Expat with America Mortgages, you can access bank leverage with LTVs up to 80%, even without U.S. credit. Qualify based on the property’s rental income, making the process easier and more accessible. It’s smart underwriting, as these properties should be treated as a pure commercial transaction.

Buy now and refinance later

In a well-balanced investment strategy, investors will go into a higher investment environment with the concept of “buy now and refinance later.” Global real estate investors recognize the unique flexibility of U.S. mortgages. Whether you’re 19 or 99 years old, you can secure a 30-year or 40-year amortization, making financing options readily available.

It’s a buyer’s market, as many novice real estate investors and owner-occupied buyers are sitting on the sideline waiting for interest rates to go down. What will that likely mean? Rates decrease, inventory is limited, buying power increases = FOMO (fear of missing out) – real estate prices will increase and increase quickly.

Final Thoughts

In essence, while high-interest rate periods might initially appear as a deterrent to real estate investment, sophisticated investors perceive these periods as windows of opportunity. Their ability to leverage market conditions, negotiate favorable deals, capitalize on higher cap rates, hedge against inflation, and adopt a long-term perspective with high LTV leverage distinguishes them in the real estate investment landscape.

Ultimately, the allure of U.S. real estate for experienced investors during high-interest rate periods lies in their capability to recognize and harness the unique advantages and opportunities that such environments offer. By employing smart financial strategies and seeing beyond short-term challenges, these investors position themselves to reap long-term rewards in the ever-evolving world of real estate investment.

Why does Wall Street want to buy your house? Now you know why!

We Understand Foreign National and U.S. Expat Mortgages Better Than Anyone

As a company, 100% of America Mortgages’ clients are living and working abroad while obtaining a U.S. mortgage loan. This is all we do, and no one does it better. “Would you take your Porsche to a Mazda dealership to get your car fixed?” states Robert Chadwick, CEO of America Mortgages. “Then why would you take a purchase 10x more to a broker or bank that doesn’t understand the complexities of non-resident lending?”

America Mortgages is the leading expert in U.S. mortgage lending. For a no-obligation consultation with one of our globally based U.S. mortgage loan officers, please use this 24/7 calendar link. With U.S. loan officers in 12 countries, we work in your time zone and in your language.

For more details, visit our website: https://www.americamortgages.com/

0 notes

Text

Redfin Real Estate Agents Scraping by DataScrapingServices.com

In the competitive world of real estate, having access to detailed and accurate data is crucial for making informed decisions and staying ahead of the competition. Redfin, a well-known real estate brokerage, offers a wealth of information on real estate agents, properties, and market trends. By leveraging Redfin Real Estate Agents Scraping services from DataScrapingServices.com, businesses can access a comprehensive database of real estate agents' information, enhancing their marketing efforts and strategic planning.

List of Data Fields

When scraping data from Redfin, DataScrapingServices.com ensures that you receive a wide array of essential data fields, including:

Agent Name: The full name of the real estate agent.

Contact Information: Email addresses and phone numbers for direct communication.

Agency/Office Details: The name and address of the agency or office the agent is affiliated with.

Specializations: Areas of expertise such as residential, commercial, rental properties, etc.

Years of Experience: Information on the agent’s experience in the real estate industry.

Active Listings: Current property listings managed by the agent.

Customer Reviews and Ratings: Feedback from clients that reflects the agent’s performance and reputation.

Social Media Profiles: Links to the agent’s social media accounts for additional insights.

Benefits of Redfin Real Estate Agents Scraping

Utilizing Redfin Real Estate Agents Scraping services from DataScrapingServices.com offers numerous benefits:

1. Enhanced Marketing Campaigns: With detailed information on real estate agents, businesses can tailor their marketing campaigns to target specific agents who are most likely to be interested in their services or properties. This targeted approach increases the effectiveness of marketing efforts and maximizes ROI.

2. Improved Networking: Access to comprehensive agent profiles allows businesses to establish connections with top-performing agents. Building strong relationships with these agents can lead to fruitful collaborations, referrals, and increased business opportunities.

3. Competitive Analysis: By analyzing the data on various agents, businesses can gain insights into the competition. Understanding the strengths and weaknesses of competitors helps in refining strategies and staying ahead in the market.

4. Data-Driven Decision Making: Having accurate and up-to-date information at your fingertips enables businesses to make informed decisions. Whether it’s selecting the right agents to partner with or identifying emerging market trends, data-driven decisions lead to better outcomes.

5. Time and Cost Efficiency: Automating the data extraction process saves valuable time and resources. Instead of manually collecting and organizing data, businesses can rely on automated scraping services to gather accurate information quickly and efficiently.

Best Real Estate Data Scraping Service Provider

Realestate.com.au Property Listings Scraping

Realtor.com Property Data Extraction

PropertyGuru Property Data Scraping

Scraping Compass.com Property Listings

Scraping RealtyTrac Real Estate Listings

Property.com.au Real Estate Data Scraping

Gumtree Property Ads Scraping

Nestoria.co.uk Property Price Scraping

PrimeLocation Property Data Extraction

PropertyValue.com.au Property Listings Scraping

Best Redfin Real Estate Agents Scraping Services in USA:

Chicago, Fort Worth, Kansas City, Orlando, Sacramento, Indianapolis, San Francisco, Austin, Philadelphia, Houston, Omaha, Mesa, Washington, Bakersfield, San Diego, Raleigh, New Orleans, Virginia Beach, Colorado, Fresno, El Paso, Long Beach, Nashville, Jacksonville, San Francisco, Atlanta, Memphis, San Antonio, Columbus, Milwaukee, Louisville, Seattle, Sacramento, Dallas, Boston, Long Beach, Colorado, Albuquerque, Wichita, Tulsa, Las Vegas, Denver, Fresno, Orlando, Charlotte, Oklahoma City, San Jose, Tucson and New York.

Conclusion

Redfin Real Estate Agents Scraping by DataScrapingServices.com is an invaluable resource for businesses in the real estate industry. By providing detailed and accurate data on real estate agents, this service enhances marketing efforts, improves networking opportunities, and enables data-driven decision-making. With a comprehensive database at your disposal, your business can stay competitive, build strong relationships, and achieve greater success in the dynamic real estate market. Contact DataScrapingServices.com today to learn more about how our scraping services can benefit your business.

Website: Datascrapingservices.com

Email: [email protected]

#redfinrealestateagentsscraping#redfinrealtorsdatascraping#scrapingpropertyaurealestatelistings#realtorpropertylistingdatascraping#realestatedatascrapingservices#datascrapingservices#webscrapingexpert#websitedatascraping

0 notes