#Rental Mobil Expander

Explore tagged Tumblr posts

Text

Rental Mobil Xpander Bogor Terbaik

Rental Mobil Xpander Bogor Terbaik: Memenuhi Kebutuhan Perjalanan Anda Rental mobil telah menjadi pilihan yang populer bagi banyak orang ketika mereka membutuhkan kendaraan yang nyaman dan fleksibel untuk perjalanan mereka. Di Bogor, ada banyak pilihan penyedia jasa rental mobil yang menawarkan berbagai jenis kendaraan. Namun, jika Anda mencari rental mobil yang terbaik di Bogor, Rental Mobil…

View On WordPress

#Bogor#Harga Sewa Mobil Bogor#Layanan Sewa Bogor#Rental Mobil#Rental Mobil Bogor#Rental Mobil Bogor Berkualitas#Rental Mobil Expander#Rental Mobil Expander Bogor#Rental Mobil Expander Bogor Terbaik#Sewa Mobil Bogor#Sewa Mobil Bogor Terbaik#Sewa Mobil Bogor Termurah#Sewa Mobil Expander Bogor

0 notes

Text

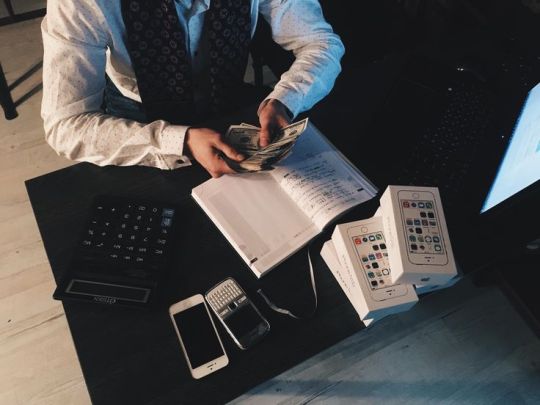

Top 10 Business Ideas That Will Make You Rich

In today's fast-paced and ever-evolving world, entrepreneurship offers countless opportunities to build wealth. Whether you're a seasoned entrepreneur or a budding innovator, exploring the right business idea can lead to significant financial success. Here are ten business ideas that have the potential to make you rich.

1. E-commerce Store

E-commerce continues to thrive, with online shopping becoming the norm for consumers. Launching an e-commerce store that caters to a niche market can be incredibly profitable. By offering unique, high-quality products, and leveraging digital marketing strategies, you can reach a global audience. Subscription boxes, eco-friendly products, or personalized items are examples of niches with high demand.

2. Digital Marketing Agency

As businesses shift towards online operations, the demand for digital marketing services has skyrocketed. Starting a digital marketing agency that specializes in SEO, social media management, content marketing, or pay-per-click advertising can be highly lucrative. Success in this field requires staying updated with the latest trends and delivering measurable results to clients.

3. App Development

The mobile app industry is booming, with millions of apps available on various platforms. If you have a background in coding or can collaborate with skilled developers, creating innovative apps can lead to substantial profits. Whether it's a gaming app, a productivity tool, or a social networking platform, a successful app can generate revenue through in-app purchases, ads, or subscriptions.

4. Real Estate Investment

Real estate has long been a proven way to build wealth. Investing in rental properties, flipping houses, or even starting a real estate development company can yield high returns. The key is to research markets thoroughly, understand property values, and manage your investments wisely. In addition to traditional real estate, consider emerging trends like vacation rentals and co-living spaces.

5. Health and Wellness Products

The health and wellness industry is experiencing rapid growth, driven by an increased focus on healthy living. Starting a business that offers health supplements, organic foods, fitness equipment, or wellness coaching can be very profitable. Consumers are willing to invest in products and services that promote a healthier lifestyle, making this sector a promising area for entrepreneurs.

6. Online Education and E-learning

The rise of remote work and online learning has created a massive demand for e-learning platforms and online courses. If you have expertise in a particular field, you can create and sell online courses, or develop a platform that connects educators with learners. This business model offers scalability and the potential for passive income, as courses can be sold repeatedly without additional production costs.

7. Renewable Energy Solutions

With the global push towards sustainability, businesses in the renewable energy sector are thriving. Starting a company that offers solar panel installation, energy-efficient appliances, or green building materials can be highly profitable. Governments and consumers are increasingly seeking eco-friendly solutions, making this an ideal time to enter the market.

8. Freelance Services Platform

The gig economy is expanding rapidly, with more people seeking freelance opportunities. Creating a platform that connects freelancers with clients in fields like graphic design, writing, programming, or virtual assistance can be a successful business venture. By charging a commission on transactions, you can build a profitable business while providing a valuable service.

9. Artificial Intelligence and Automation

AI and automation are transforming industries across the board. Starting a business that offers AI-driven solutions, such as chatbots, predictive analytics, or robotic process automation (RPA), can lead to significant wealth. Companies are eager to adopt AI technologies to streamline operations, reduce costs, and improve customer experiences, making this a high-demand area.

10. Subscription Box Service

Subscription box services have gained immense popularity, offering consumers curated products delivered to their doorsteps regularly. From beauty products to gourmet foods, subscription boxes cater to a wide range of interests. Starting a subscription box business allows for recurring revenue and customer loyalty, provided you offer unique and valuable products.

For more such content visit on Tanishq website .

Conclusion

These ten business ideas represent some of the most promising opportunities for building wealth in today's economy. While each requires a different level of expertise, investment, and commitment, the potential rewards are substantial. Success in any of these ventures will depend on thorough market research, innovative thinking, and relentless execution. By choosing the right idea and dedicating yourself to its growth, you can achieve significant financial success and long-term wealth. Click here to open other post.

2 notes

·

View notes

Text

Chapter 3

A few days later. After passing the screening, Kyoka-san has officially become a client. The request was to act as a groom and hold a pseudo wedding ceremony. Today we will start deciding who will be in charge and discuss our next action. Kosaka-san and I from the Main Office, Kou-san from the Simulation Dept., and…

Shizuka-san from the Watchdog Dept. have been summoned.

Yuzuru: The results of the investigation were not particularly different from what Yashiro-san and the rest had heard.

Kou: Her reputation from those around her is that she is "living for work."

However, according to an interview with her, she dated someone in the past few months.

Ito: Yes. Apparently, she felt a difference in values soon after they started dating, so they only dated for a short time...

Her ex-partner was reluctant to accept the breakup, so I heard it was a bit one-sided.

Kou: I see.

So that's why Shizuka-san is here today.

Ito: …….Yes.

Shizuka: ……..

When someone is involved with yellow flag situations or dangerous circumstances for a character acting substitution, the Watchdog Dept. will be assigned to protect them. This time, it's the latter.

Shizuku: After close inspection, the characteristics of the “man who stared at them from afar” that Mika and Aizawa saw on the day they first met the client were almost identical to that of the ex-lover.

They can't say for sure since it was from a distance, but both of them said they got a rather unpleasant feeling from him, so I think it doesn't hurt to be cautious. What does the client want?

Ai: Due to budget constraints, no security guard was requested. The precautionary measures should be included in the category of “necessary expenses to provide the service without any problems.”

Shizuka: How many people can I mobilize?

Ai: In addition to the groom, there is one other person, Yashiro, who will handle the store, and one more. That makes it 3.

Shizuka: Haaa... I kind of had a hunch when I saw her sitting here. Yashiro got herself involved in a delicate and dangerous request again.

Ito: My main job is in the store anyway.…. I will try to cause you as little trouble as possible.

Shizuku: Try not to get yourself hurt. We can handle the rest.

Ito: …………Yes. I'll do my best.

Shizuka: I hope you’re aware of what you’ve gotten yourself into.

Ai: Give up, Fushimi. It’s a waste of time. Once Yashiro starts saying this, she won't yield. She just keeps saying "I’ll do my best" with a stubbornness that makes no sense.

Ito: (I will just assume that this is his way of saving time….)

Kou: Ahaha. Well, that's just how guarding works.

If she’s going to have a normal ceremony, she’ll need a fair amount of money and preparation, but this is just a small one, right?

Ito: That's right. It may not be large scale, but she wants it to be in a proper place, not a restaurant or rental space.

There are a few options within the budget, but... at the moment there is no place where I can make a reservation for the date and time she wants. Finding a venue is likely to be the most difficult task here.

Kou: Yeah, it’s pretty sudden after all.

We have no choice but to expand the range, but considering our client's mother, I don't think we should go far away from Tokyo, where her doctor is.

Ai: I'll take care of that.

Ito: Eh?

Ai: If I explain the situation, I’m more than certain the owner will cooperate.

Ito: (The owner... Ah.)

The venue for the next dress-up event?

Ai: Considering that he’s a wedding reception hall owner who asked us to advertise the place because he hasn’t received any reservations, we might as well start the ceremony right now.

That kind of structure should be enough for a pseudo-wedding ceremony if we work on the layout.

Not to mention, it’s very easy to negotiate the price.

Kou: Oh, I see. An acquaintance of His Majesty?

Ito: (Ah... I see. If one place can be used for two purposes, we could keep the budget down even further...)

Ito: Umm, Kosaka-san….

Ai: You can use the event supplies for this request as well. Make sure you discuss the use of costumes and other items borrowed from the venue.

Proceed with that in mind.

Ito: (That was fast...!)

Thank you.

Kou: Although things are coming together nicely, I have some unfortunate news from the Simulation Dept.

I just checked the schedule and everyone, including me, is booked for that date.

Ito: ……!

As I was thinking about what to do, Fushimi-san, who had been silent for a while, started talking.

Shizuka: Well, isn’t that perfect?

Kou: Huh?

Shizuku: I can't move much if there's only one guard.

It would be best if someone who can also be a guard took the role of the groom.

Kou: Oh….... I see?

Ito: (Two roles, one person...?)

Shizuka: Only if Kosaka is fine with it. What do you think?

Ai: Given the situation, it's a reasonable choice. I'll allow it this time.

……As long as that person is Aizawa.

Ito: !

Ai: However, this is a request outside of my responsibility. So I’ll give him the right to refuse. If that happens, as I said earlier, arrange one groom and one security guard.

Shizuka: Got it.

I’d prefer it if he didn’t refuse, though. I'll talk to him.

Ito: (Eh?)

Ai: You do you.

Kou: Then, I’ll leave the rest to you~

Ito: (...Was it just my imagination?)

(Does Aizawa-kun even have a right to refuse to begin with...?)

Chapter 4

5 notes

·

View notes

Note

Sibiiiiiiiii! Thank you!!! I 💜 you!!! And yes please write the Greece trip/ Kook’s trip and tell us where else these hot vampires own property! 😩😩😩 As if they weren’t hundreds of years old and hot as fuck, they own villas and castles and houses all over?! 😩😩😩 Please give us as many HCs as you want!

Of course they do 😏😩 I mean djsjs not all of them obviously. Hear me out

Jungkook is the BROKEST vampire ever. Because of his curse, he couldn’t ever get a real job which in return meant that he never aquired enough money to invest it in passive income. So that man is as broke as one could get jsjsjs.

Hobi has decent amount of money. He came from a upper middle class family and saved enough money to invest in a small passive income, which has gathered a good amount these days. But because he is still technically only in his sixties, his wealth is very much in human levels still.

Jimin is the third brokest vamp of the bunch. Example given: how he had to live while he was still persumed dead. I mean, one could argue that he was in hiding and didn’t want to risk getting found out, but there is also a good possibility that he is simply broke in vampire terms. Most property he owns, Tae either bought for him or they bought it together. And then there was also the whole part of where he had to live as Namjoon’s slave for centuries, so he didn’t really have alot of opportunity to, you know, buy property. He does have a very healthy sum on his bank accounts though, mostly because of the shared property with Tae and because Tae is tranferring him money on a monthly basis.

I would place Seokjin next. This man was already wealthy when he was still human and had two properties and some factories/warehouses as well as ships in his human years and he also invested in a lot of start-ups which bring in a lot of money these days. He is actually a huge stock holder in the mobile phone market and has his fingers in other techonological fields as well. For properties he owns the one Sanguis spent their "frat years" in, owns a house in South Korea and bought Emma her own shop in town so she could expand her perfume business. He also owns an apartment complex where he gets constant income. Fun fact? OC actually rented an apartment in the complex when she first moved here, which is why she never got in trouble for randomly stopping to pay rent. She and Seokjin laugh about the coincidence these days. He gets most of his money from his countless shares though.

And now this is where it gets hard to talk about because damn those vampires are RICH jdjdjs they're old, they've seen too much and they got way too much money to spend.

Taehyung I'd place third. He's both share holder in many businesses, owner of multiple art galleries and possesses property which is used commercially, as rentals or as his private escapes. So passive income is very much guaranteed on a constant. He owns a homely cottage in the Austrian Alps, owns a chateau at the coast of France and a small farm in the French countryside, owns a little Greek ocean house and invested in apartments in Paris, New York, Hong Kong as well as London. If he spends money he spends it on new property, promising shares and other investments. If he spends fun money he spends it on trips, whatever expensive item suits his taste, art and fashion. He also regularly wires money to Jimin and ever since recently, he opened two separate accounts for Jungkook and OC where he also makes monthly deposites. Trust that this man does not feel any change in his numbers with those new tranfers. And also that he LOVES spending his money most when he can spend it on his darlings.

And then there is Yoongi. Woof woof. I would say that he and Tae aren’t that far apart actually despite their age difference. One must consider though that eventhough Yoongi’s been alive for ages, it was rather difficult to make money which can still be used in the 21st century. You get me? He does own a lot of castles though from the earlier days. The one they all currently live in he bought around the time of the French Revolution, but he owns another castle in Romania and one in Germany. He also owns a town mansion in Geneva and has a penthouse in New York, which he never uses. He won’t ever mention it, but he owns a private island in the Carribbeans and treated himself to a very secluded cottage somewhere in the deepest Canadian forests. He also forgot about it already, but he owns property in South Korea and a villa in Osaka. It brings in money as they are both used as rentals, but Yoongi hasn’t set foot in either of them in decades. He gets most of his passive income through the various rentals he owns as well as being shareholder in some of the biggest markets these days. He also regularly buys property and sells it again to a higher price. Right now he plans on buying a house with OC close to Meredith's place and he also thinks about surprising OC with her own small plant shop in town. He doesn’t transfer to their accounts, but he never says no. If anyone of the family wants something, he'll get it for them no questions asked. He will also regularly hand over his black card with a nonchalant "don't look at the numbers, princess" and he genuinely gets pouty when she wants to pay for something when he’s with her. This man always pays even if she sometimes complains about it. And no sum is ever too big for him. You remember those 100€ he gave her in Paris for a cab? Yeah that was the equivalent to a few cents for him.

I don’t know where to put Namjoon on the list because being stolen of his powers and then hidden from the world kinda just cut him off from his wealth. You know? I do believe though that in his prime, he was the richest. And also the one who spent his money on the most fucked up shit.

8 notes

·

View notes

Text

The most special cars presented at the Tokyo Motor Show

After a four-year absence, the Tokyo Auto Show is coming back in force in 2023, under a new name: Japan Mobility Show and the PHP Rent a Car Cluj Napoca Airport rental office announces that this change of identity reflects the organizers' decision to expand the attraction event and increase participation by including auto component suppliers, technology companies, and transportation devices other than cars such as mopeds, bicycles, and electric scooters, among others. However, the event itself looks set to be one of the most exciting convention auto shows in recent years, full of bold concepts and enthusiast cars, some of which are destined for series production:

https://www.phprentacar.ro/en/b-the-most-special-cars-presented-at-the-tokyo-motor-show

4 notes

·

View notes

Text

Quicken vs QuickBooks: Which One is Right for Your Business?

Are you struggling to choose the right accounting software for your business? Look no further! In this post, we'll be comparing Quicken vs QuickBooks – two of the most popular accounting software on the market. Both are powerful tools that offer features to manage your finances, but which one is right for you? Join us as we dive into what makes these two options unique and how to make an informed decision based on your business needs. Let's get started!

Comparing Quicken vs QuickBooks

When it comes to managing your business finances, Quicken and QuickBooks are two of the most popular software options available. While Quicken vs QuickBooks both programs offer similar accounting features such as tracking expenses and income, there are some key differences between them.

Quicken is designed primarily for personal finance management. It's a great option if you're self-employed or run a small business with just a few employees. With Quicken, you can track your bank accounts, credit cards, investments and more in one place.

On the other hand, QuickBooks is more ideal for businesses that require robust accounting tools like inventory management and payroll processing. It's also suitable for larger organizations with multiple users who need access to financial data simultaneously.

Another difference between these two platforms is their pricing models. Quicken offers a one-time purchase fee while QuickBooks has monthly subscription plans based on the features required by your business.

Ultimately, choosing between Quicken vs QuickBooks depends on your specific needs as well as the size and complexity of your organization. Consider factors such as budget constraints and which features are necessary for efficient financial management before making a decision.

What is Quicken?

Quicken is a personal finance management software that has been around since 1983. It was originally designed to help individuals manage their finances by tracking income and expenses, creating budgets, and generating reports. Today, Quicken offers various versions of its software that cater to different financial needs.

One version of Quicken is called Quicken Deluxe which allows users to track investments in addition to managing their personal finances. Another version is called Quicken Premier which includes features for managing rental properties as well as investment tracking.

Quicken also offers a mobile app that allows users to access their financial information on the go. Users can sync their data across devices so they always have access to up-to-date information.

Quicken is best suited for individuals or small businesses looking for an easy way to manage their personal finances without needing advanced accounting knowledge.

What is QuickBooks?

QuickBooks is a popular accounting software designed for small businesses to manage their financial transactions, invoices, bills and expenses. It was developed by Intuit and first released in 1983 as a desktop application. Since then, it has expanded its features and services to cater to the growing needs of businesses.

This software allows users to track inventory levels, create sales orders, generate reports and integrate with other applications such as payroll systems. QuickBooks also offers cloud-based versions that enable users to access their data from anywhere at any time.

One of the key benefits of using QuickBooks is its user-friendly interface which makes it easy for beginners to navigate through various financial tasks. The program also provides tutorials and customer support resources for those who need additional assistance.

Another great advantage of this software is that it can be customized according to specific business requirements. Users can choose from different plans based on the size of their business or opt for add-ons like payroll management or payment processing services.

QuickBooks has become a go-to solution for small businesses looking for an efficient way to handle their finances while staying organized and compliant with tax laws.

The Difference between Quicken vs QuickBooks

Quicken and QuickBooks are both financial management software options, but they serve different purposes. Quicken is a personal finance management tool that can help individuals with their budgeting, banking, and investment tracking needs. On the other hand, QuickBooks is an accounting software designed specifically for small businesses.

One of the key differences between Quicken vs QuickBooks is in their functionality. While Quicken focuses on managing personal finances, QuickBooks offers more comprehensive features such as invoicing, payroll processing, inventory management, and accounts payable/receivable. This makes it a better option for small business owners who need to manage multiple aspects of their financial transactions.

Another difference between these two accounting tools is their pricing model. Quicken typically charges a one-time fee for purchasing its software while QuickBooks follows a subscription-based model where users pay monthly or annually depending on the plan they choose.

Deciding whether to use Quicken vs QuickBooks depends largely on your individual needs as well as those of your business if you have one. If you're looking for robust accounting capabilities with features like invoicing or inventory tracking then go for QuickBooks while if you're just looking to manage personal finances then stick with Quicken

Which One is Right for Your Business?

When it comes to deciding which accounting software is right for your business, there are a few factors you should consider. One of the first things you need to determine is what specific features your business needs. For example, if your business requires inventory tracking or payroll management, QuickBooks may be the better option for you.

Another important consideration is the size of your business. Quicken may be more suitable for small businesses or sole proprietors who don't require as many advanced features as larger companies. On the other hand, QuickBooks can handle multiple users and large amounts of data, making it ideal for medium-sized and larger businesses.

The level of technical expertise required to use each software platform is also an important factor to consider. If you have limited experience with accounting software and want something user-friendly and easy-to-learn, Quicken may be a better choice. However, if you're comfortable with technology and want more advanced capabilities like custom reports or integrations with other software tools, QuickBooks might suit your needs better.

Ultimately, choosing between Quicken vs QuickBooks depends on understanding what your business requirements are in terms of functionality, size and technical aptitude. By taking these factors into account when selecting an accounting solution that best meets those criteria will help ensure success over time.

How to Choose the Right Accounting Software for Your Business

Choosing the right accounting software for your business can be overwhelming, especially with so many options available. Here are some important factors to consider when selecting the best fit for your needs:

Business Size: Consider the size of your business and whether you need a basic or advanced accounting system.

Features: Look at the features offered by each platform and determine which ones are essential for managing your finances.

User Interface: Make sure that you choose a user-friendly interface that is easy to navigate and understand.

Integration: Check if the software integrates with other tools such as payment processors, CRMs, or inventory management systems.

Support: Choose a platform that offers reliable customer support in case any issues arise.

Security: Ensure that the software has robust security measures in place to safeguard sensitive financial data from potential cyber threats.

Pricing: Determine whether there are any upfront costs, monthly fees or hidden charges associated with using the accounting software before making a final decision.

By considering these factors carefully when choosing an accounting system, you'll have greater confidence in finding one that meets all of your requirements and helps drive success for your business!

Conclusion

After comparing Quicken vs QuickBooks and analyzing the features of both accounting software, it's clear that they have significant differences.

Quicken is best suited for individuals or small business owners who need to manage their personal finances or do basic bookkeeping tasks. On the other hand, QuickBooks provides a more robust platform with advanced tools and features that cater to larger businesses.

Choosing the right accounting software depends on your individual needs and budget. Consider factors such as business size, industry type, level of financial expertise, and future growth plans when making your decision.

Whichever software you choose between Quicken vs QuickBooks will help streamline your financial management processes and improve the accuracy of your accounting records. So take time to evaluate both options carefully before deciding which one is right for your business!

3 notes

·

View notes

Text

Benefits Of Investing in Real Estate

Are you on the hunt for a savvy investment that will yield advantageous long-term benefits? Look no further because the current king on the throne of investments is real estate! Investing in real estate is guaranteed to yield far superior results in comparison to any other investment opportunity out there.

Capital Appreciation

Let's be candid, when investing in any asset, we all have hopes that the value will increase. However, many depreciate with time, such as automobiles, bikes, and technological gadgets like mobile phones or laptops. But, with real estate, the opposite is true! The value of a property purchased today is projected to increase over the coming years due to rental incomes and the appreciation of residential real estate. The icing on the cake is that if you decide to sell your property in the future, chances are you'll make a profit!

2. Easily Build Equity

Have you ever reflected on how buying a home could pave the way to building equity? Let's break it down for you. Once you complete your final mortgage payment, your assets begin to accumulate, and your property transforms into a firm foundation for expanding your monetary worth. As your equity increases, you gain the freedom to purchase additional properties and receive a higher cash flow. This situation is beneficial for all parties, resulting in a symbiotic outcome.

3. Long Term Security

In our fast-paced world, we often crave the instant gratification of easy money without any entanglements. But we mustn't forget that such money can be flimsy and fleeting. On the other hand, putting down roots in residential real estate at a young age can provide you with lifelong stability. Renting out these properties as co-living spaces offers a profitable opportunity to dip your toes into the world of commercial or residential real estate.

4. Tax Benefits

Worried about the harsh taxes that plague real estate investments? Fear not, as co-living spaces can act as your knight in shining armor. You don't have to fret about property taxes, mortgage rates, property management interest, repairs, or insurance policies when your property is a soaring success story. Say goodbye to tax worries and welcome extra income with open arms!

5. Diversification

Investment opportunities come in all shapes and sizes - from trading stocks to buying luxury cars. However, we must remember that life is an unpredictable rollercoaster, and stocks may plummet in value overnight. During such episodes of market turmoil, real estate remains our reliable companion, steadily appreciating in value and serving as a steady and dependable fallback option. Placing all our eggs in one basket is unwise and risky. Therefore, diversification is key - and investing in REAL ESTATE is certainly one of those doors worth knocking on!

6. Multiple Income Source

Transforming your dwelling into a co-living utopia is a masterful strategy to cultivate myriad money making channels. Infusing your residence with communal vibes taps into the burgeoning trend of shared living, satisfying the needs of renters seeking flexible and budget-friendly accommodations. Converting your personal space into a co-living hub is a stellar opportunity to optimize your investment and broaden your fiscal horizons.

7. Leverage

Investing in real estate during your youth is a stroke of brilliance. You see, your CIBIL score tends to be at its prime during this time, and if you've got a hefty chunk of change for the down payment, you can take out a loan to cover the rest. The cherry on top? You don't have to wait until the debt is paid off to call yourself a property owner. It's a wise decision, indeed. But hold on, what if you're no spring chicken? Fret not, because it's never too late to hop on the real estate bandwagon!

8. Tangible Asset

Real estate investing is akin to holding a tangible treasure. You can physically touch it, see it's worth firsthand, and enjoy the feeling of absolute ownership. It's not some abstract, intangible investment like stocks or bonds. Nay, it's a concrete, solid asset that can provide stability and financial security. Owning property not only means you have a roof over your head, but it's also an investment that always has the potential to grow. Whether you opt to rent it out or sell it later, your investment continues to be a beacon of peace and security. All in all, if you're on the hunt for a reliable, smart long-term investment plan, real estate is a savvy bet.

Are you seeking to make your mark in the real estate game? Well, listen up because your 20s is prime time to make that happen! Investing in property can be a seriously shrewd financial decision, and converting your real estate into a co-living hub is the savvy choice to make. Luckily, companies like 'Xtra Income Homes' have streamlined the process, making it simple for you to get started on your investment journey. Simply head to their website via the link below, and discover all the tools and knowledge you need to make your mark on the property ladder:

Remember, with so many options out there, it's all about taking your time and finding the property that truly speaks to you. The perfect investment home is waiting just for you!

2 notes

·

View notes

Text

Top Singapore Car Rental Services: Comparing Options for Every Budget

When exploring Singapore car rental services, Drive lah stands out as a peer-to-peer car-sharing platform connecting car owners with renters. This model offers a diverse selection of vehicles at competitive rates, with rentals typically 30–40% more affordable than traditional car rental companies. Drive lah's comprehensive insurance coverage and 24/7 roadside assistance ensure a secure and reliable rental experience, making it a top choice for those seeking convenience and value in Singapore's car rental market. Exploring Singapore's diverse car rental services reveals options tailored to various preferences and budgets. From traditional rental agencies to innovative car-sharing platforms, the island offers a plethora of choices for both residents and visitors.

Traditional Car Rental Agencies Offering a Wide Range of Vehicles

Established car rental companies like SIXT provide a vast selection of vehicles, from economy to luxury models. With multiple locations, including Singapore Changi Airport and Sentosa, they cater to diverse customer needs. SIXT emphasizes exceptional service, ensuring a smooth rental experience for travelers.

Peer-to-Peer Car-Sharing Platforms Providing Affordable and Flexible Rentals

Platforms such as Drive lah connect car owners with renters, offering a diverse range of vehicles at competitive rates. This peer-to-peer model often results in more affordable pricing and flexible rental terms, appealing to a broad audience seeking convenience and value.

Car-Sharing Services with Extensive Fleets and Convenient Locations

Services like GetGo have rapidly expanded their fleets, boasting over 3,000 vehicles across 1,700 locations as of early 2024. Their widespread presence ensures that users can easily access vehicles, making spontaneous rentals both feasible and convenient.

Hourly Rental Services Catering to Short-Term and Budget-Friendly Needs

For those requiring a vehicle for a few hours, services like Shariot offer competitive rates starting from $3.90 per hour during off-peak times. With a fleet of over 300 cars across 85 locations, Shariot provides flexibility for short-term rentals without long-term commitments.

Luxury and Exotic Car Rentals for Special Occasions and Enthusiasts

Companies such as Ace Drive specialize in luxury, sports, and exotic car rentals, featuring brands like Maserati, Porsche, and BMW. Ideal for special occasions or enthusiasts, their fleet offers high-performance vehicles for a memorable driving experience.

Electric Vehicle (EV) Sharing Services Promoting Sustainable Transportation

BlueSG offers an all-electric car-sharing service, promoting eco-friendly transportation options. With a fleet of 667 cars and 374 charging stations as of late 2020, BlueSG provides convenient access to EVs, supporting Singapore's sustainability goals.

Comprehensive Car Rental Solutions for Corporate and Commercial Clients

Companies like Motorway Car Rentals cater to corporate clients with a range of vehicles suitable for business needs. Their services include both short-term rentals and long-term leasing options, supported by a dedicated service center ensuring vehicle reliability.

Conclusion

Singapore's car rental landscape is rich and varied, offering solutions for every budget and requirement. Whether you're seeking a luxury vehicle for a special event, a budget-friendly option for daily use, or a convenient car-sharing service for short-term needs, the island's car rental services cater to all. By exploring the options outlined above, you can select a service that aligns with your preferences and enhances your mobility experience in Singapore.

0 notes

Text

Affordable PC on Rent in Kolkata | Latest Models Available

In today’s digital-first world, access to high-performance computing is no longer a luxury—it’s a necessity. Whether for professional tasks, online learning, gaming, or content creation, the demand for reliable and up-to-date desktops is ever-increasing. For individuals and businesses alike, investing in brand-new systems may not always be feasible. That’s where the option of getting a PC on Rent in Kolkata becomes a game-changer.

Why Renting a PC Makes Sense

The rental economy has expanded its reach across multiple domains, and technology is no exception. Opting for a computer on rent provides not just convenience but also unmatched flexibility. Users can select configurations tailored to specific needs, ranging from basic systems for documentation and browsing to high-end machines equipped with the latest processors, GPUs, and RAM for demanding applications.

Businesses setting up temporary workstations, startups looking to reduce initial capital expenditure, or students in need of short-term access to a device can all benefit significantly from this cost-effective approach.

Access to the Latest Technology

Technology evolves at breakneck speed. A device bought today may become obsolete in just a couple of years. Renting eliminates this obsolescence trap. Providers offering PC on Rent in Kolkata consistently upgrade their inventory to keep pace with industry standards. From Intel Core i7 and AMD Ryzen series processors to SSD storage, full-HD monitors, and advanced peripherals—rental systems now come fully equipped with the latest components.

This allows renters to experience top-tier performance without bearing the cost of outright purchase or worrying about future depreciation.

Flexible Rental Plans for Every Need

Whether it’s a daily rental for a training session, a monthly package for freelance work, or a long-term lease for an office setup, service providers offer dynamic plans suited to diverse requirements. Options for short- and long-term rentals, bundled maintenance, and even upgrade opportunities make the proposition even more attractive.

For instance, professionals involved in video editing, 3D rendering, or game development can rent high-spec computers for intensive tasks without committing to ownership. At the same time, educational institutions and coaching centers can deploy multiple systems for temporary classrooms.

Seamless Service and Technical Support

Most companies offering computer on rent include value-added services such as installation, configuration, and on-call technical assistance. This ensures smooth operation and minimal downtime. Many providers also offer doorstep delivery and pickup, saving precious time and logistical hassle.

In addition, backup systems and on-site replacements are often part of the service-level agreements—especially crucial for businesses where uptime is non-negotiable.

Ideal for Remote Work and Hybrid Models

As remote work and hybrid office models continue to gain traction, demand for plug-and-play tech solutions is skyrocketing. A rented PC serves as a fast, economical solution for equipping employees without the overhead of permanent infrastructure.

Freelancers, consultants, and gig workers can also benefit immensely from the ability to rent electronics like desktops without being tied to long-term commitments. It’s the perfect fusion of utility, mobility, and affordability.

Cost-Efficient Solutions for Every Segment

Affordability remains the linchpin of the rental model. Compared to purchasing a new desktop, renting can reduce costs by up to 70%, depending on the duration and specifications required. These savings can be channelled into other critical areas, such as software subscriptions, employee training, or marketing strategies.

Furthermore, many providers offer bundled deals where customers can rent electronics in bulk, including PCs, printers, monitors, and networking devices—all under one rental agreement. This simplifies budgeting and enhances procurement efficiency.

Environmentally Responsible Choice

Renting technology contributes to sustainability by promoting reuse and reducing e-waste. Every time a PC on Rent in Kolkata is reused, it extends the life cycle of the device and curbs unnecessary manufacturing. For eco-conscious users and companies, this offers a dual benefit: economic and environmental.

Conclusion

Choosing a PC on Rent in Kolkata is more than just a financial decision—it’s a strategic one. It empowers users with the latest computing power, operational flexibility, and unparalleled support—all without the burden of ownership. Whether you're a student, a startup, or a corporate entity, embracing computer on rent services can be the key to staying ahead in a fast-paced digital landscape. And with the option to rent electronics of all types under one roof, the process becomes not only efficient but also incredibly streamlined.

0 notes

Text

Cycle Software: Driving Efficiency in the Cycling World

As cycling grows in popularity — whether for commuting, sport, or leisure — the businesses and organizations supporting the industry are turning to technology for smarter solutions. Enter cycle software — a broad term encompassing digital tools designed to manage and optimize cycling-related operations. From bike shop management to route tracking and rental systems, cycle software is becoming an essential part of the modern cycling ecosystem.

What Is Cycle Software?

Cycle software refers to specialized digital platforms developed to assist with tasks in the cycling industry. These platforms can serve a wide range of purposes depending on the user — from retail bike shops and repair centers to cycling clubs, event organizers, and even individual riders.

Whether you're managing inventory in a bike store, scheduling service appointments, renting out bikes, or analyzing training data, there's cycle software built for that specific need.

Types of Cycle Software

1. Bike Shop Management Systems

These are designed to help retail and repair shops run more efficiently. Features often include:

Point-of-sale (POS) systems

Inventory and supplier management

Repair booking and tracking

Customer relationship management (CRM)

Integration with online stores

One example is CycleSoftware, a well-known platform used in Europe by bike shops to manage sales, service, and inventory under one roof.

2. Cycling Training & Performance Apps

Used by athletes, hobbyists, and coaches, these tools track performance metrics like speed, cadence, power, and heart rate.

Popular apps: Strava, TrainerRoad, Zwift

Features: GPS tracking, virtual training, data analysis, performance history

3. Bike Rental and Sharing Systems

Cities and tourism operators use cycle software to manage bike fleets, handle bookings, and monitor bike locations.

Real-time fleet tracking

Mobile app booking

Payment integration

Usage analytics

4. Event and Club Management

Cycling clubs and race organizers use software to handle memberships, plan group rides, and manage race registrations.

Online registration and waivers

Event calendars and route planning

Rider tracking and timing solutions

Benefits of Cycle Software

Efficiency: Automates time-consuming tasks like inventory updates, appointment scheduling, and sales tracking.

Customer Experience: Makes it easier to serve customers quickly, provide accurate service updates, and personalize offers.

Data Insights: Helps businesses and individuals analyze trends and performance for better decision-making.

Scalability: Allows bike shops and cycling organizations to grow without adding administrative overhead.

The Future of Cycling Technology

As the cycling industry continues to expand with the rise of e-bikes, bike tourism, and health-conscious transportation, cycle software will play an increasingly important role. Businesses that embrace these tools can expect improved operations, happier customers, and greater long-term success.

Whether you're a local bike shop owner, a professional cyclist, or someone building a new bike-sharing startup, the right cycle software can help you pedal further, faster, and smarter.

0 notes

Text

Boost Your Travel Business with Top Hotel Booking API Solutions in 2025

The landscape of online travel is fiercely competitive, and in 2025, having a robust and efficient hotel booking system is no longer an option – it's a necessity for survival and growth. At the heart of any successful online travel agency (OTA) or travel application lies a powerful Hotel Booking API Solution. These APIs provide seamless connectivity to a vast inventory of accommodations, enabling businesses to offer their customers a wide range of choices and a frictionless booking experience.

A Hotel Booking API acts as a digital bridge, linking your platform with numerous hotel databases and global distribution systems (GDS). This integration allows your users to search for hotels based on various criteria like location, dates, price, and amenities, view real-time availability, and complete bookings directly within your application or website. By leveraging these APIs, travel businesses can significantly enhance their offerings, streamline their operations, and ultimately boost their revenue.

The power of Hotel Booking APIs often extends beyond just facilitating reservations. A comprehensive travel platform might also integrate a Flight Booking API Solution to offer flight options, a Travel API service provider for broader travel-related content, and even a Payout Settlement API to manage payments to hotels and refunds to customers. While a DMT Money Transfer API might be less directly involved in the core booking process, it could be useful for facilitating payments for ancillary services or in peer-to-peer travel scenarios. The Fast Tag Payment API, while specific to toll payments, highlights the importance of seamless transaction capabilities within the travel journey.

Why Top Hotel Booking API Solutions are Crucial in 2025:

In the ever-evolving travel industry of 2025, integrating a top-tier Hotel Booking API solution offers several critical advantages:

Expanded Inventory: Access a global network of hotels, from budget-friendly hostels to luxury resorts, offering your customers a wider selection.

Real-time Availability and Pricing: Display accurate and up-to-the-minute information, ensuring users see the latest deals and availability.

Enhanced User Experience: Provide a seamless and intuitive booking process, reducing friction and improving customer satisfaction.

Increased Efficiency: Automate the booking process, eliminating manual data entry and reducing the risk of errors.

Scalability: Easily handle increasing booking volumes as your business grows.

Competitive Advantage: Offer a more comprehensive and efficient booking experience than competitors with outdated systems.

Data-Driven Insights: Gain valuable data on customer preferences and booking patterns to optimize your offerings.

Integration with Other Services: Seamlessly integrate hotel bookings with flights, car rentals, and other travel services for a holistic travel planning experience.

Mobile-First Approach: Top APIs are designed for mobile responsiveness, catering to the growing number of travelers who book on their smartphones.

Key Features to Look for in a Hotel Booking API Solution:

When selecting a Hotel Booking API solution in 2025, consider these essential features:

Vast Hotel Database: Access to a wide range of hotels across various geographies and price points.

Real-time Data Updates: Accurate and timely information on availability and pricing.

Flexible Search Options: Ability to search by location, dates, price range, amenities, star rating, and more.

Detailed Hotel Information: Comprehensive descriptions, high-quality images, and guest reviews.

Secure Booking Process: Integration with secure payment gateways to protect user data.

Multi-Currency Support: Ability to display prices and process payments in multiple currencies.

Multi-Language Support: Catering to a global audience with support for various languages.

Robust Reporting and Analytics: Tools for tracking bookings, revenue, and customer behavior.

Easy Integration and Documentation: Well-documented APIs and developer support for seamless implementation.

Mobile-Friendly Design: Ensuring the API works flawlessly on mobile devices.

Boosting Your Business with the Right API:

By integrating a top-tier Hotel Booking API solution, your travel business can unlock significant growth potential in 2025. You can attract more customers by offering a wider selection and a better booking experience, increase conversion rates with real-time information and competitive pricing, and streamline your operations to improve efficiency and reduce costs.

Cyrus Recharge: Your Partner for Cutting-Edge Travel Technology

Cyrus Recharge is a leading software development and API provider company in India, dedicated to empowering businesses with innovative and reliable technology solutions. While their expertise spans various domains, including potentially facilitating secure payment processing through integrations akin to a Payout Settlement API or contributing to the infrastructure of services utilizing fastag recharge api, Flight Booking API Solutions, or even integrating with Money Transfer API providers for comprehensive travel platforms, their core strength lies in building robust and scalable API solutions for the travel industry. Cyrus Recharge can provide tailored Travel API service provider solutions, with a strong focus on delivering seamless and high-performing Hotel Booking API Solutions. Their commitment to understanding the evolving needs of the travel market in 2025, providing easy integration, and offering reliable support makes them an ideal partner for businesses looking to elevate their online hotel booking capabilities.

In Conclusion:

In the competitive landscape of online travel in 2025, a top-notch Hotel Booking API solution is no longer a luxury but a fundamental requirement for success. By providing access to a vast inventory, real-time data, and a seamless booking experience, these APIs empower travel businesses to attract more customers, increase revenue, and streamline their operations. Choosing the right API provider is a crucial decision that can significantly impact your business's growth and competitiveness in the years to come.

Frequently Asked Questions (FAQs):

What are the typical costs associated with integrating a Hotel Booking API? The costs of integrating a Hotel Booking API can vary depending on the provider and the pricing model. Common models include per-booking fees, monthly subscription fees, or a combination of both. Some providers may also offer different pricing tiers based on the volume of bookings or the features accessed. It's crucial to carefully evaluate the pricing structure of different providers and choose one that aligns with your business volume and budget.

How does a Hotel Booking API ensure data accuracy and prevent overbooking? Reputable Hotel Booking API providers maintain direct connections with hotel property management systems and global distribution systems to ensure real-time data synchronization. This helps prevent issues like overbooking by reflecting the latest availability accurately. They employ sophisticated systems to manage inventory and update availability across all connected platforms in real-time.

Can a Hotel Booking API be customized to match my brand and website design? Yes, most modern Hotel Booking APIs offer a degree of customization to allow integration that aligns with your brand and website design. This can include options to customize the look and feel of the booking interface, integrate with your existing user authentication systems, and tailor the booking flow to match your specific requirements. However, the level of customization can vary between different API providers.

0 notes

Text

The Future of Apartment Living in Abu Dhabi: Trends to Watch Out For

The future of apartment living in Abu Dhabi is being shaped by a dynamic blend of innovation, sustainability, and lifestyle-focused development, positioning the emirate as one of the most forward-thinking urban centers in the region. As the city evolves into a global hub for business, culture, and tourism, the demand for smarter, more luxurious, and environmentally conscious living spaces is rapidly increasing. Developers are now focusing on creating residential communities that not only provide comfort and convenience but also align with modern values such as energy efficiency, connectivity, and wellness. Smart homes are becoming a standard in new developments, with features like automated lighting, temperature control, voice-command appliances, and security systems offering residents unprecedented levels of convenience. These tech-integrated apartments not only enhance the quality of living but also contribute to energy conservation, a crucial priority as the UAE moves toward its ambitious sustainability goals. For those looking to invest or relocate, exploring options for an Apartment for sale in Abu Dhabi has never been more appealing, especially with the increasing availability of futuristic residences that blend luxury with intelligent design. Moreover, there is a rising trend of mixed-use developments that combine residential units with retail, dining, leisure, and wellness facilities all within the same complex.

This concept appeals especially to professionals and families seeking convenience without sacrificing lifestyle. Communities such as Al Maryah Island, Saadiyat Island, and Reem Island are prime examples, offering seamless integration of work, play, and living. Additionally, wellness-focused living is making a significant impact, with new buildings emphasizing natural lighting, green spaces, fitness centers, and even wellness concierge services. Apartments are being designed with mindfulness in mind—think tranquil interiors, spa-inspired bathrooms, and communal areas that foster social connection and mental well-being. These features are particularly attractive to residents seeking a sanctuary from fast-paced city life, and many renters are increasingly prioritizing these elements when searching for an Apartment for rent in Abu Dhabi. Affordability and flexible leasing terms are also evolving in response to market demands. With a diverse population that includes young professionals, expatriates, and families, the rental market is adapting by offering fully furnished units, short-term leases, and co-living spaces that provide both privacy and shared amenities. The concept of co-living, though relatively new to the region, is gaining traction among millennials and digital nomads who value affordability and community.

At the same time, premium rental options are expanding, with a surge in high-end developments offering concierge services, rooftop pools, and private gyms, which elevate the entire rental experience. These properties cater to tenants looking for luxury without the commitment of ownership, making an Apartment for rent in Abu Dhabi an attractive choice for many. In terms of architecture and design, future apartments are embracing biophilic elements and sustainable materials. Developers are incorporating features such as vertical gardens, green rooftops, and energy-efficient glass façades that minimize environmental impact while maximizing aesthetic appeal. Abu Dhabi’s commitment to sustainability is further reflected in government regulations that encourage eco-friendly construction and building certifications like Estidama, which ensures developments adhere to rigorous green building standards. As urban planning in the emirate continues to advance, accessibility and mobility are also being prioritized. New residential developments are being built with close proximity to public transportation, cycling paths, and walkable retail areas. This focus on connectivity not only enhances daily convenience but also reduces dependence on private vehicles, contributing to a cleaner and more sustainable city. The integration of AI, data analytics, and Internet of Things (IoT) into property management is another game-changer. Property managers and landlords now use digital tools to monitor energy usage, anticipate maintenance issues, and improve tenant satisfaction. Residents, in turn, benefit from mobile apps that allow them to control everything from rent payments to community events, bringing apartment living into the digital age. This level of innovation is particularly noticeable in the luxury segment of the market, where investors seeking an Apartment for sale in Abu Dhabi are finding futuristic options that go far beyond traditional real estate offerings.

With Expo 2030 and Vision 2030 driving long-term development goals, Abu Dhabi’s residential landscape is poised for exponential growth. Foreign investors and long-term residents alike are keeping a close watch on this transformation, and as the city’s skyline continues to grow, so does the sophistication of its residential offerings. The introduction of freehold ownership zones and investor-friendly policies further encourages global interest, solidifying Abu Dhabi’s position as a top destination for both buying and renting apartments. Whether you're looking to secure your own slice of the future with an Apartment for sale or prefer the flexibility and luxury of an Apartment for rent in Abu Dhabi, the city offers a compelling array of choices that cater to every lifestyle and aspiration. From smart technologies and sustainable architecture to wellness living and community-focused designs, the future of apartment living in Abu Dhabi is undoubtedly bright, forward-thinking, and tailor-made for a new era of urban sophistication.

0 notes

Text

Explore the Best Modular Portable Lounge Solutions in India and Delhi Modular Portable Lounge Solutions

The attractiveness the appeal Modular portable Lounge Solutions lies in their ability to mix modern comfort with modern design. As more people are conscious of space and functionality These lounges provide the ideal mix of form and purpose.

Modular Portable Lounge Solutions in India

The increasing the demand of Modular Portable Lounge Solutions in India reflect the evolving preferences of Indian customers. With the rise of urbanization and real estate becoming smaller modular furniture is thought of as a necessity more than an option for high-end item.

From cities in the metropolis to emerging cities, Modular Portable Lounge Solutions in India are being welcomed by both businesses and individuals. Furniture manufacturers across the nation offer modular lounges that are not just simple to set up and move but also sustainable and eco-friendly. These lounges are ideal for those who want changing their homes frequently but without purchasing new furniture every time.

Modular Portable Lounge Solutions in Delhi

In the middle of the country Modular portable lounge solutions located in Delhi are making waves in the field of interior design. It is a place that blends contemporary and traditional, Delhi is a thriving market for chic and functional modular lounges. From chic cafés to Hauz Khas and corporate office spaces located in Connaught Place, Modular Portable Lounge Solutions in Delhi are everywhere that offer the best of both elegance and comfort.

A variety of local designers and furniture companies are specialized with Modular portable lounge solutions in Delhi offering customized designs to fit any room and design. If it’s a residence construction or commercial space The flexibility of these products makes them the top choice for Delhiites.

Modular Portable Lounge Solutions in New Delhi

If you’re looking for premium choices, top-of-the-line, Modular Portable Lounge Solutions in New Delhi deliver on both sophistication and quality. These lounges are ideal for luxurious houses, boutique hotels and office spaces that want to stand out from the crowd without sacrificing functionality.

A lot of homeowners and developers across New Delhi are investing in modular furniture to make their homes flexible and ready for the future. From luxurious homes situated in South Delhi to artistic studios in Central Delhi, Modular Portable Lounge solutions located in New Delhi are making an impressive impact.

Modular Cottages in India

Alongside lounges, market in modular cottages across India is increasing rapidly particularly in the field of eco-friendly construction and tourism. They are a quick and easy installation as well as mobility and affordability which makes them perfect for farmhouses, resorts and holiday rental properties.

Private and developer buyers alike are embracing Modular Cottages located in India to find smart living options that blend the best of sustainability, comfort, and contemporary design. Many of these homes come furnished with Modular Portable Lounge Solutions that provide an elegant, complete and efficient space.

FAQs — Modular Portable Lounge Solutions in India

Question 1: What is Modular Portable Lounge Solutions? A: These are modern modular seating systems that can be moved, expanded and moved around easily providing comfortable seating for your home office spaces, events, and offices.

Q2: What are the benefits of Modular Portable Lounge Solutions in India? A: With growing space restrictions and ever-changing interior demands, Modular Portable Lounge Solutions in India provide the flexibility, affordability, and modern design for all kinds of areas.

Q3 What is the best way to find Modular Portable Lounge Solutions located in Delhi easily accessible? A: Yes, Delhi offers a variety of options that can be found through local showrooms as well as online retailers that specialize on Modular Portable Lounge Solutions within Delhi.

4. What is it that makes Modular Portable Lounge Solutions in New Delhi special? A: Modular Portable Lounge Solutions in New Delhi are known for their superior design, premium finishes, and appropriateness for commercial and high-end interior settings.

Q5 What are the advantages from Modular Cottages located in India? A: Modular Cottages in India are quick to set up as well as cost savings and environmentally-friendly design, making them the perfect choice for modern-day vacation homes and eco-friendly living.

#Modular Portable Lounge Solutions#Modular Portable Lounge Solutions in India#Modular Portable Lounge Solutions in Delhi#Modular Portable Lounge Solutions in New Delhi#Modular Cottages in India

0 notes

Text

Travel credit card market: Key drivers fueling rapid global growth and consumer adoption trends in 2025

The global travel credit card market has seen substantial growth over the last decade, fueled by a confluence of factors ranging from increased international travel to evolving consumer spending habits. As more individuals seek value, flexibility, and rewards from their credit card usage, travel credit cards have emerged as a popular financial product. These cards not only offer convenience but also deliver compelling incentives that align with the lifestyles of frequent travelers. Below are the key drivers propelling the travel credit card market forward.

1. Growth in Global Travel and Tourism

One of the most significant drivers of the travel credit card market is the surge in global travel. As air travel becomes more accessible and affordable, people are traveling more frequently for both leisure and business purposes. According to data from the World Tourism Organization (UNWTO), international tourist arrivals rebounded strongly post-pandemic and are projected to surpass pre-pandemic levels in the coming years. This growth directly correlates with increased demand for travel-related financial products, especially those that provide rewards such as airline miles, hotel points, and travel insurance.

2. Increased Demand for Rewards and Loyalty Programs

Modern consumers are value-conscious and seek to maximize every dollar spent. Travel credit cards often feature robust rewards programs that appeal to this mindset. These cards offer points or miles for purchases, which can be redeemed for flights, hotel stays, car rentals, and more. Additionally, partnerships between credit card issuers and airline or hotel loyalty programs have made it easier for cardholders to earn and redeem points within preferred ecosystems. The more attractive and flexible the rewards structure, the greater the appeal to prospective cardholders.

3. Technological Advancements and Digital Integration

Technological innovation has significantly impacted the credit card industry. Travel credit cards now come with features such as mobile integration, contactless payments, real-time transaction alerts, and AI-powered expense tracking. Moreover, mobile apps and online platforms enable users to book flights, manage rewards, and access exclusive travel deals, all in one place. Fintech solutions have further simplified the application process, making it quicker and more user-friendly, thus encouraging more consumers to explore and adopt these financial products.

4. Rising Middle-Class Population and Disposable Income

Economic development in emerging markets has given rise to a growing middle class with increased disposable income. Regions like Asia-Pacific and Latin America are witnessing an upsurge in outbound travel, thanks to a combination of urbanization, higher education levels, and improved living standards. As more people travel internationally, the demand for travel-related services—including credit cards tailored for travelers—continues to grow. Travel credit cards often appeal to this demographic due to their promise of status, access, and convenience.

5. Enhanced Travel Benefits and Perks

Beyond earning rewards, travel credit cards often include a suite of perks that enhance the travel experience. These may include airport lounge access, concierge services, complimentary travel insurance, zero foreign transaction fees, and priority boarding. Such benefits cater to the needs of frequent flyers and luxury travelers, making premium travel credit cards especially attractive. As competition in the market intensifies, issuers continue to expand their offerings to differentiate their products and capture consumer interest.

6. Strategic Partnerships and Co-Branding

Strategic alliances between banks, credit card issuers, and travel service providers have been pivotal in driving the market. Co-branded credit cards with airlines, hotel chains, and online travel agencies allow issuers to tap into loyal customer bases and offer targeted benefits. For instance, a co-branded airline credit card might offer double miles on ticket purchases, free checked bags, and exclusive upgrades. These partnerships create a win-win situation for both consumers and businesses by enhancing brand loyalty and delivering tailored value.

7. Millennial and Gen Z Consumer Behavior

Younger generations are becoming a powerful force in shaping market trends. Millennials and Gen Z, in particular, place high value on experiences, flexibility, and digital convenience. Travel credit cards that align with their preferences—offering mobile-first functionality, sustainable travel options, and social-media-friendly perks—are more likely to succeed. These consumers are also more open to experimenting with new financial products, especially those that offer a seamless, tech-forward user experience.

8. Post-Pandemic Shift in Travel Trends

The COVID-19 pandemic temporarily slowed travel and impacted the credit card industry. However, the rebound has been strong, with "revenge travel" becoming a significant phenomenon. Consumers are eager to explore destinations again, and travel credit cards serve as a tool to make those experiences more affordable and rewarding. Many issuers have also adapted to the changing landscape by introducing flexible redemption options, waiving annual fees, or offering credits for staycations and local travel.

In conclusion, the travel credit card market is thriving due to a combination of socio-economic, technological, and behavioral trends. As travel continues to regain momentum globally, and as consumers increasingly seek financial tools that enhance their travel experiences, the demand for travel credit cards is poised to rise even further. Industry players who can innovate, personalize, and strategically position their offerings will be best positioned to capitalize on this dynamic market.

0 notes

Text

🚀 Ayodhya: From Sacred City to Smart City

Ayodhya, revered as the birthplace of Lord Ram, is no longer just a spiritual haven etched in the pages of the Ramayana. Today, it’s undergoing a seismic transformation, evolving from a quiet pilgrimage town into a bustling hub of economic activity and modern development. The Ram Mandir inauguration in January 2024 has acted as a catalyst, igniting unprecedented interest in Ayodhya real estate and positioning it as India’s next big real estate boom. Backed by ambitious state-led infrastructure upgrades, a surge in spiritual tourism, and growing NRI investment interest, Ayodhya is fast becoming a smart city with immense potential.

This transformation isn’t just about faith—it’s about opportunity. With over ₹85,000 crore earmarked for infrastructure development, including high-speed rail, four-lane highways, a revamped international airport, and smart city initiatives, Ayodhya is poised to rival established real estate markets like Gurgaon, Noida, or Pune. Add to that an estimated 10 crore+ annual tourists by 2030 (up from over 2 crore today), and you have a city on the cusp of a historic economic leap. Whether you’re an investor seeking high ROI in real estate, a developer eyeing hospitality projects, or an NRI looking for a blend of emotional and financial returns, Ayodhya in 2025 is where your next big move begins.

In this comprehensive guide, we’ll explore why investing in Ayodhya is a golden opportunity, break down the hottest investment zones, analyze rental income potential, and provide expert insights to help you capitalize on this once-in-a-lifetime real estate surge. Let’s dive into why Ayodhya real estate in 2025 is the most searched and sought-after investment topic today.

📈 Economy Boost: A City on the Rise

The ₹85,000+ Crore Infrastructure Revolution

The Uttar Pradesh government, in collaboration with the central government, has rolled out an ambitious Ayodhya Master Plan 2031, committing over ₹85,000 crore to transform the city into a cultural and economic powerhouse. This isn’t a small-scale facelift—it’s a full-blown reimagination of Ayodhya as North India’s next big destination. Key projects include:

High-Speed Rail: Plans for a bullet train corridor connecting Ayodhya to major cities like Delhi, Lucknow, and Varanasi are in the pipeline, slashing travel times and boosting connectivity.

Four-Lane Highways: New roads like Ram Path, Bhakti Path, and Dharma Path, inspired by the four Vedas, are enhancing intra-city mobility while linking Ayodhya to national highways like NH-27.

Maharishi Valmiki International Airport: Operational since December 2023, this airport is set to expand with direct global connections, making Ayodhya accessible to international pilgrims and investors alike.

Smart City Initiatives: Ayodhya is being developed as a smart city, with features like digital payment systems (QR codes at shops and donation counters), sustainable urban planning, and modern civic amenities such as curated parks, sewage networks, and reliable electricity.

These developments aren’t just about infrastructure—they’re about creating a multiplier effect. Improved connectivity and modern facilities are driving real estate demand, attracting businesses, and positioning Ayodhya as a cultural and economic capital of North India.

Tourism: The Economic Engine

Ayodhya’s tourism potential is staggering. With the Ram Mandir now open, the city is projected to attract over 10 crore tourists annually by 2030, according to industry estimates. This is a massive jump from the current 2 crore+ visitors per year, fueled by:

Spiritual Tourism Surge: Ayodhya is a cornerstone of the Ramayana Circuit, a government-backed initiative to promote pilgrimage tourism across India. The city’s significance as Lord Ram’s birthplace ensures year-round footfall, unlike seasonal tourist hotspots.

Global Appeal: With the international airport now functional and plans for direct flights from countries with large Hindu diaspora populations (e.g., the US, UK, and Southeast Asia), Ayodhya is set to become a global pilgrimage destination.

Economic Impact: Experts estimate that spiritual tourism in Ayodhya could generate ₹1 lakh crore in nationwide business, with ripple effects in hospitality, retail, and real estate.

This tourism boom is the backbone of Ayodhya’s economic rise, making it a magnet for real estate investment in 2025 and beyond.

💰 Real Estate Boom: Why Now is the Time to Invest

Skyrocketing Land Prices

The Ram Mandir effect has sent Ayodhya real estate prices soaring. In the last three years alone, land prices in core zones—such as the Ram Janmabhoomi periphery—have surged by 300–500%. Here’s a snapshot of the trend:

Pre-2019: Before the Supreme Court verdict, land in Ayodhya’s outskirts (e.g., Faizabad Road) hovered around ₹400–700 per sq ft.

Post-Ram Mandir Verdict: Prices in these areas jumped to ₹2,000–₹6,000 per sq ft, with prime locations near the temple hitting ₹18,000–₹20,000 per sq ft by 2024.

2025 Forecast: Experts predict a further 12–20x increase in property values over the next decade as infrastructure projects mature and tourist footfall peaks.

While core zones are now premium-priced, peripheral zones and upcoming residential townships remain undervalued, offering savvy investors an affordable entry point with high growth potential.

Smart City Projects Unlocking New Markets

The Ayodhya smart city initiative is creating new micro-markets ripe for investment. The Ayodhya Development Authority (ADA) has launched housing schemes, such as an 80-acre plotted development along the Lucknow-Gorakhpur Highway, and is acquiring hundreds of acres for future townships. These projects are:

Expanding residential and commercial opportunities beyond the temple-centric core.

Integrating modern amenities like parks, shopping zones, and recreational facilities, making Ayodhya attractive for long-term residents and investors.

Driving demand in areas like Ring Road, Airport Road, and the Faizabad-Ayodhya integration zone.

This strategic urban planning ensures that real estate in Ayodhya isn’t just a short-term boom—it’s a sustainable growth story.

Hospitality and Residential Sectors: High ROI Potential

The twin pillars of Ayodhya’s real estate boom are hospitality and residential properties, both primed for long-term returns:

Hospitality: With major chains like Taj, Marriott, and IHCL (Indian Hotels Company Limited) signing deals to build hotels, the sector is exploding. Smaller guest houses and homestays are also thriving, catering to budget-conscious pilgrims.

Residential: Demand for second homes, retirement homes, and vacation properties is surging, driven by senior citizens, NRIs, and investors seeking rental income or capital appreciation.

Investing now means getting in before prices peak, locking in substantial ROI in real estate as Ayodhya’s transformation accelerates.

🏨 Proposed Rental Income Potential

A Year-Round Rental Market

Unlike seasonal tourist destinations like Goa or Shimla, Ayodhya’s pilgrimage tourism ensures consistent demand for accommodation throughout the year. Since the Ram Mandir’s opening, hotel and guest house bookings have reported 90–95% occupancy during temple events, with rates spiking during festivals like Ram Navami and Diwali. Here’s why rental income in Ayodhya is a game-changer:

Studio Apartments and Service Flats: These compact units, ideal for short-term stays, are projected to yield 6–10% annual rental returns, far outpacing urban markets like Mumbai or Bangalore.

Hotel Boom: Major chains are betting big, with projects like the 100-room Vivanta and 120-room Ginger hotels by IHCL set to open within 36 months. This signals strong confidence in the market’s rental potential.

Short-Term Rental Models: Innovative options like fractional ownership or co-owned properties managed by operators are emerging, offering investors steady rental income without the hassle of management.

Pilgrimage Tourism = Stability

Ayodhya’s unique selling point is its year-round occupancy. Unlike beach or hill stations, spiritual destinations see consistent visitor traffic, driven by devotion rather than weather. This stability translates into reliable rental income, making Ayodhya real estate investment a low-risk, high-reward proposition.

🧳 Ayodhya as a Tourism Powerhouse

The Ramayana Circuit and Beyond

Ayodhya is the crown jewel of the Ramayana Circuit, a government initiative to connect key sites from the epic, including Chitrakoot, Shringverpur, and Janakpur (Nepal). This trail is amplifying Ayodhya’s appeal, drawing not just domestic pilgrims but also international tourists from countries with significant Hindu populations, such as Indonesia, Thailand, and Mauritius.

International Airport: A Game-Changer