#Reliance Jio IPO

Explore tagged Tumblr posts

Text

youtube

#gen z#financial#bse#memes#bangalore#youtube#investing#traders#us elections#nifty50#banknifty#finnifty#call option#put option#reliance jio ipo#jio#reliance#bangladesh#singham#singhamreturns#news#iran#israel#war#Youtube

2 notes

·

View notes

Text

Reliance Jio IPO GMP, Open Date, Price Band, Allotment Status, DRHP

Reliance Jio IPO open date is expected to be in June 2025. Its estimated book built issue is of Rs 40,000 cr. Reliance Jio IPO GMP quotation is not yet started.

Read more..

#Reliance Jio IPO#IPO Issue Size#IPO Price Band#IPO GMP#IPO Allotment Status#IPO dates#IPO Objectives#IPO Time Table#IPO Lot Size Details#IPO Registrar and Lead Managers#IPO FAQs#IPO details#IPO#Upcoming IPO#Current IPO#New IPO#Latest IPO#algo trading#algo trading app#bigul#algo trading india#algo trading platform#algo trading strategies#bigul algo#free algo trading software#algorithm software for trading#finance#algorithmic trading software free#algorithmic trading#algos

0 notes

Text

Discover the biggest IPO of the year as Reliance Jio, a subsidiary of Reliance Industries, gears up for its $120 billion public offering.

#jio Ipo#reliance jio#reliance jio ipo#multibagger stocks#best stock market advisor in India#jarvis artificial intelligence

0 notes

Text

Vodafone Idea Share Price History | Best Algo Trading Software India

Vodafone Idea Share Price History: A Complete Analysis

Introduction

Vodafone Idea (Vi) has been a prominent player in India's telecom industry, but its share price journey has been nothing short of a rollercoaster. Whether you are an investor, trader, or simply curious about its stock performance, understanding its historical price movements can offer key insights.

How has Vodafone Idea’s stock performed over the years? What factors have influenced its rise and fall? And how can the best algo trading software in India help investors make informed decisions?

Explore Vodafone Idea share price history & trends. Learn how the best algo trading software in India helps analyze stocks. Best algorithmic trading software India.

Vodafone Idea: A Brief Overview

Vodafone Idea Ltd. was formed in 2018 through the merger of Vodafone India and Idea Cellular. The company aimed to create a stronger telecom presence in India but faced financial and regulatory hurdles.

IPO and Early Share Performance

Before the merger, both Vodafone and Idea Cellular had their own stock performance trends. Idea Cellular had a decent market presence, while Vodafone was a global giant in telecom.

Impact of Vodafone and Idea Merger on Share Price

The merger was seen as a strategic move, but it led to an initial dip in share prices due to debt concerns and integration challenges.

Key Milestones in Vodafone Idea Share Price History

2018: Share prices dropped post-merger.

2019: AGR (Adjusted Gross Revenue) dues created financial distress.

2020: Government relief measures helped stabilize prices.

2021-2023: 5G rollout and investor interest brought fluctuations.

Regulatory Challenges and Their Effect on the Stock

Vodafone Idea has faced major regulatory issues, including AGR dues, spectrum fees, and government interventions, all of which impacted investor confidence.

Financial Performance and Quarterly Trends

Examining the company’s quarterly results reveals significant losses, debt burden, and revenue struggles, leading to volatility in stock prices.

Government and Policy Impacts on Share Price

Government decisions, including telecom relief packages, have played a major role in influencing the share price of Vodafone Idea.

Competitor Influence on Vodafone Idea Shares

Reliance Jio and Bharti Airtel’s aggressive pricing and expansion strategies have added pressure on Vodafone Idea, affecting its market share and stock value.

Investor Sentiment and Market Speculations

Stock prices often fluctuate based on investor sentiment, news coverage, and speculation about Vodafone Idea’s financial stability and future prospects.

How Algo Trading Helps Analyze Vodafone Idea’s Stock

Algorithmic trading helps traders analyze Vodafone Idea’s stock movements through:

Pattern recognition: Detecting price trends.

Automated execution: Faster trades based on preset conditions.

Risk management: Reducing human errors in trading decisions.

Best Algorithmic Trading Software India for Stock Analysis

Some of the best algo trading software in India for analyzing Vodafone Idea’s stock include:

Zerodha Streak – User-friendly and efficient.

TradeTron – AI-based automated strategies.

AlgoBulls – Offers pre-built trading models.

Future Predictions for Vodafone Idea’s Stock Price

Experts suggest that Vodafone Idea’s future depends on:

Debt restructuring and funding

Customer retention strategies

Government support and relief packages

Should You Invest in Vodafone Idea Shares?

Investing in Vodafone Idea requires a careful risk assessment. While it has potential for recovery, it also faces significant challenges.

Conclusion

Vodafone Idea’s share price history reflects its struggles and opportunities. While it remains a volatile stock, algorithmic trading can help investors make better trading decisions. If you’re considering investing, ensure you analyze the market trends using the best algorithmic trading software India has to offer.

FAQs

Why did Vodafone Idea’s share price fall?

Vodafone Idea’s stock declined due to high debt, AGR dues, and tough competition from Reliance Jio and Airtel.

Can Vodafone Idea stock recover?

Recovery depends on government support, financial restructuring, and business performance.

What is the best algo trading software in India for Vodafone Idea shares?

Top options include Zerodha Streak, TradeTron, and AlgoBulls for automated trading strategies.

How does algorithmic trading help in analyzing Vodafone Idea shares?

It enables automated trading decisions, pattern recognition, and risk management for better trade execution.

Should I invest in Vodafone Idea shares now?

Consider factors like financial health, market trends, and expert opinions before making an investment decision.

0 notes

Text

Key Events to Watch for in 2025 and Their Impact on the Markets

1. Federal Reserve’s Interest Rate Cuts: The Fed is expected to continue cutting interest rates to support growth, but persistent inflation could slow or pause these cuts. This will impact risk assets, particularly equities and bonds.

2. Global Economic Growth & China’s Slowdown: While global growth is expected to remain strong, China’s economic slowdown could negatively affect global trade and commodity demand.

3. Geopolitical Risks (Middle East): Any escalation in Middle East conflicts could drive oil prices higher, exacerbating inflation and impacting global markets.

4. Revival of the IT Sector: The IT sector, driven by cloud computing, AI, and cybersecurity, is expected to continue growing, benefiting tech stocks and innovation-driven companies.

5. Political Risks (Trump Administration): A potential return of Donald Trump to the U.S. presidency could create market uncertainty, particularly with aggressive trade and immigration policies.

6. India’s Union Budget 2025: The Indian government is expected to propose tax cuts and increased infrastructure spending to boost growth, with impacts on sectors like construction and manufacturing.

7. RBI’s Monetary Policy: The Reserve Bank of India may cut the repo rate to around 6%, aiming to stimulate economic activity. This could boost equity markets and consumer spending.

8. Inflation Concerns: High inflation, particularly in food and energy prices, remains a concern. Managing inflation will be key for global and Indian market stability.

9. Bihar and Delhi Elections: Elections in these key Indian states could influence local economic policies and affect market sentiment, especially in infrastructure and governance.

10. Reliance JIO is all set to bag the history as the biggest IPO country has seen.

Stay ahead with tradabulls.com

0 notes

Text

ஐபிஓ வெளியிட தயாராகும் ரிலையன்ஸ் ஜியோ | Reliance Jio IPO set for 2025

மும்பை: ரிலையன்ஸ் ஜியோ நிறுவனம் அடுத்த ஆண்டில் பொதுப் பங்கு வெளியீடு (ஐபிஓ) மேற்கொள்ள இருப்பதாக தகவல் வெளியாகியுள்ளது. இந்தியாவின் மிகப் பெரிய ஐபிஓ-வாக இது இருக்கும் என்று கூறப்படுகிறது. முகேஷ் அம்பானி 2007-ம் ஆண்டு ரிலையன்ஸ் ஜியோ நிறுவனத்தைத் தொடங்கினார். 2016-ம் ஆண்டு, ஜியோ நாடு முழுவதும் தொலைத்தொடர்பு சேவை வழங்க ஆரம்பித்தது. அறிமுகமான குறுகிய காலத்திலேயே தொலைத்தொடர்பு சந்தையில் ஜியோ முக்கிய…

0 notes

Text

Ambani’s Reliance Jio IPO set for 2025, retail debut much later on November 4, 2024 at 1:52 pm

Reuters was first to report that Indian billionaire Mukesh Ambani is targeting a 2025 Mumbai listing for his telecom business Jio, valued by analysts at over $100 billion, but plans to launch his retail unit’s IPO much later. The story shed light on the plans of Asia’s richest man, who has for years been silent on the timelines of the mega IPOs of Reliance Jio and Reliance Retail. Why it…

0 notes

Text

0 notes

Text

🚀 Get ready for the game-changer! The Reliance Jio IPO is set to revolutionize the telecom sector with a staggering valuation of ₹9.3 lakh crore! 📈💰 Will this move reshape the market? Join the discussion and find out how it impacts investors and the future of telecom! 💡✨ #RelianceJio #IPO #InvestmentOpportunities #TelecomRevolution #MarketImpact #MukeshAmbani #StockMarket #Finance

#RelianceJio#IPO#InvestmentOpportunities#TelecomRevolution#MarketImpact#MukeshAmbani#StockMarket#Finance

0 notes

Text

Reliance Jio's $100 billion IPO will come in 2025, retail unit's IPO later!

Mukesh Ambani-led Reliance Industries is preparing to launch an IPO of its telecom business, Jio, by 2025. Analysts estimate Jio's valuation at more than $100 billion. On the other hand, Reliance Retail's IPO is likely to come only after 2025. According to Reuters, this decision of the company (…)

0 notes

Text

Jio Financial Share Price Forecast 2025 and 2030 : An Comprehensive Analysis

Affiliated with Reliance Industries, Jio Financial Services (JFS) has swiftly risen to prominence in the Indian financial scene. The company's innovative stance on financial services, along with the solid reputation of Jio's brand, has caught the eye of investors and finance professionals. Focusing on big ambitions in the fintech and digital banking realms, the potential worth of Jio Financial's stock has been a matter of thorough debate.

In this article, we will analyze the expected stock values for Jio Financial Share Price Target 2024, 2025, and 2030, delving into the factors that could influence its upcoming direction.

Jio Financial Share Price Targets for 2024 and Beyond

Short-Term Goals:

The years ahead are crucial for Jio Financial as it expands into new sectors like digital lending, insurance, and wealth management. By 2024, the firm is expected to launch more sophisticated services aimed at attracting customers from both individuals and institutions.

Factors Driving Expansion:

Growth into digital finance solutions, including payment systems and small-scale loans.

Creation of strategic partnerships with banks and financial institutions.

Expansion of its clientele through the widespread use of Jio Telecom's services, which might easily integrate with JFS's offerings.

Expert Opinions on Potential Price Range for Jio Financial Share Price Target 2024:

Analysts suggest that the projected value for Jio Financial Share Price Target 2024 could range from ₹180 to ₹290, assuming the company executes its growth strategies effectively and benefits from the current digital transformation in India.

Predictions for Jio Financial Share Price Target 2025:

Mid-Range Expectations:

By 2025, it's anticipated that Jio Financial will solidify its position in the Indian financial sector. The company's venture into consumer finance, insurance, and digital banking sectors is expected to gain momentum, potentially establishing it as a leading financial service provider in the country.

Important Points to Consider:

Integration of AI and blockchain in its financial offerings could give it an edge in areas like automated trading and robo-advisory services.

Competition from established bodies such as HDFC Bank, ICICI Bank, and emerging digital fintech firms.

Changes in regulatory policies could either limit or enhance its activities in banking and lending.

If the company continues to innovate and grow, the Jio Financial Share Price Target 2025 could see a range from ₹310 to ₹560. This potential growth would be fueled by JFS's increasing market presence and technological innovations in the industry.

Projected Growth Trajectory for Jio Financial by 2030

Jio Financial Services is set to become a leading force in the Indian financial services industry. This growth is expected to be driven by its broad access to customer information through its telecom division, which puts Jio Financial Services at the forefront of creating tailored financial solutions using AI and extensive data analysis.

Potential Pathways to Expansion:

Moving into overseas markets, with a focus on those of developing countries, employing a digital-first approach.

Potential initial public offering (IPO) for Jio Financial Services, which would infuse additional funds for both expansion and innovation.

Gaining a leading role in sectors like digital payments, lending, insurance, and asset management, benefiting from its early market entry and technological prowess.

The successful implementation of these strategies could elevate the Jio Financial Share Price target 2030 , ranging from ₹750 to ₹1200, marking its position as a major contender not just in India but globally in the financial arena.

Factors Influencing Jio Financial Services Share Value:

Technological Progress: The adoption of cutting-edge technologies in financial services will be crucial for its growth. Jio's expertise in telecom and data solutions gives it a competitive edge in developing advanced financial solutions.

Competitive Environment: The activity of established financial entities and the emergence of new financial technology companies will continue to challenge Jio Financial Services. The company's ability to distinguish itself from the competition will be vital in securing a larger market presence.

Regulatory Scenario: The regulatory policies of the Indian government in the financial services, banking, and data security sectors will play a role in shaping JFS's direction. Favorable regulations could expedite its growth, while restrictive measures could impede its expansion plans.

Economic Indicators: The overall economic health of India, including Gross Domestic Product (GDP) growth, inflation rates, and consumer expenditure, will also affect the value of Jio Financial Services.

To sum up,

The potential for Jio Financial Services is considerable, with support from Reliance Industries and the technological capabilities inherent in the Jio ecosystem. The company is well-positioned to transform India's financial landscape, especially in areas like digital banking, lending, and insurance.

The expected range for Jio Financial Services' stock value by 2024 falls between ₹250 and ₹300, depending on immediate growth strategies. By 2025, analysts foresee a price range of ₹350 to ₹450 as the company secures a larger market share and solidifies its position in the financial market. By 2030, the target share price could rise to ₹600 to ₹800, assuming a strategy of expanding into new markets and introducing innovative financial products. Investors should keep an eye on the company's strategic decisions and the broader market trends, as these will be key in determining the future of Jio Financial Services' stock.

0 notes

Text

Reliance AGM 2024 today: Jio to Retail IPO — top 5 market expectations after Disney JV | Company Business News - Mint

http://dlvr.it/TCVwLf

0 notes

Text

Reliance Industries

Reliance Industries Limited is an Indian Multinational Conglomerate Headquartered in Mumbai. Its businesses include Energy, Petro-Chemicals, Natural Gas, Retail, Entertainment, Telecommunications, Mass Media and Textiles. Reliance is the largest public company in India. By market capitalization and revenue. The 100th largest company world wide. It is India's largest private taxpayer and largest exporter, accounting for 7 percent of India's total merchandise exports. The company has relatively little free cash flow and high corporate debt.

History

Reliance Commercial Cooperation was setup in 1958 by Dushyant Cooperation as a small venture firm trading commodities, especially spices and polyester yarn.

In 1965, the partnership ended and Dirubhai continued the polyester business of the firm. In 1975, company expanded its business into textiles, with "Vimal" becoming its major brand. The company held its initial public offering (IPO) in 1977.

The Reliance Textiles Industries Pvt. Ltd. was incorporated in Maharashtra. It established a synthetic fabrics mill in the same year at Naroda in Gujarat. The company expanded its polyester yarn business by setting up a Polyester Filament Yarn Plant in Patal Ganga, Raigad.

Name of the Company

In 1985, the name of the company was changed from Reliance Textiles Industries Ltd. to Reliance Industries Limited. The Hazira Petro-Chemical Plant was commissioned in 1991-92.

In 1993, the Reliance turned to the overseas capital markets for funds. In 1996, it became the first private sector company in India to be rated by International Credit Rating Agencies.

Moody's rated "BAA3" Investment grade, constraint by the sovereign ceiling.

In 1995-96, the company entered the telecom industry through a joint venture with 9YNEX USA and promoted Reliance Telecom Private Limited in India.

In 1998, Reliance took over Indian Petro-Chemicals Cooperation Ltd. During privatization of public sector enterprises. In 1998-99, RIL introduced packaged LPG in 15 Kgs Cylinders under the brand name Reliance Gas.

The years 1998-2000, saw the construction of the integrated Petro-Chemical complex at Jamnagar in Gujarat, the largest refinery in the world.

Baroda Plants was taken over by the IRL. Dahej Manufacturing Complexes came under RIL. Reliance Fresh was started in 2006.

In 2010, Reliance introduced Broadband Services with the acquisition of Infotech Broadband Services Limited. It also formed a 50:50 Joint BP(British Petroleum) for sourcing and marketing of Gas in India.

In 2017, RIL setup a Joint Venture with a Russian Company, Sibur for setting up a Butyl Rubber Plant in Jamnagar Gujarat. In August 2019, Reliance added FYND primarily for its consumer businesses and mobile phone services in the e-commerce space.

In February, RIL and the BHARAT GPT GROUP announced it will launch large language model (LLM), Hanuman's AI's System in 2024.

The model will work in 11 Local Languages in four major areas:- Health, Governance, Financial Services and Education.

In March 2024, RIL partnered with Disney to introduce Reliance Disney OTT Platform.

Jio Platform

Jio Platforms Ltd, essentially a technology company is a majority owned subsidiary of RIL. It has a valuation of more than $100 Billion on expert view as of October 2022. It is the result of a corporate restructuring announce in October 2019.

Reliance Retail

Mukesh Ambani has named his son, Akash Mukesh Ambani as the chairperson of Jio in 2022. Reliance retail is the retail's business wing of the Reliance's Industries. In March 2013, it had 1466 stores in India.

Many brands like Reliance Fresh, Reliance Footprint, Reliance Timeout, Reliance Digital, Reliance Wellness, Reliance Trends, Reliance Auto Zone, Reliance Super Mart, Reliance Store, Reliance Home Kitchens, Reliance Market (Cash and Carry) and Reliance Jewel come under the Reliance Retail Brand.

Mukesh Ambani Stepped down from the position of Chairperson of Reliance Retail and handed over the Job to his daughter Isha Ambani IRL Piramal.

Ambani announced it during the 45th Reliance AGM (Annual General Body Meeting), in 2022 as per reports this act is a part of Ambani's leadership transition.

Reliance Industrial Infrastructure

RIL is mainly engaged in the business of setting up and operating Industrial Infrastructure. The company is also engaged in activities involving leasing and providing services connected with computer software and data processing.

Network 18

Through Network 18, Reliance owns multiple news channels including CNN News 18 and News 18 India. Network 18 is a mass media company. It has interests in television, digital platforms, publication, mobile apps and films. It also operates two Joint Ventures, namely Viacom 18, History Tv 18 with Viacom.

It has also acquired a partial part of ETV Network and since renamed its channels under the Colors Tv Brand.

Reliance Demerger and Family feud

Ambani family holds around 45% of the shares in RIL. Since its inception, the company was managed by its founder and chairman Dirubhai Ambani. After suffering a stroke in 1986, he handed over the daily operations of the company to his sons Mukesh Ambani and Anil Ambani. After the death of Dirubhai Ambani in 2002, the management of the company was taken up by both the brothers in November 2004, Mukesh Ambani in an interview, admitted to having differences with his brother Anil over "Ownership Issues". He also said that the differences are in the private domain.

The share prices of RIL were impacted by some margin when this news broke out. In 2005, after bitter public feud between the brothers over the control of Reliance Empire, Mother Kokillaben Intervened to broker a deal splitting RIL Group business in to two parts.

In October 2005, the split of Reliance group was formalized.

Mukesh Ambani got Reliance Industries and IPCL. The Younger Brother Anil Ambani received Telecom, Power, Entertainment and Financial Services business of the group.

The Anil Dirubhai Ambani group includes Reliance Communications, Reliance Infrastructure, Reliance Capital, Reliance Natural Resources and Reliance Power.

The division of business between the two brothers also resulted in Demerger of four businesses from RIL. These businesses immediately became part of Anil Dhirubhai Ambani Group. The existing shareholders in RIL received shares in the demerged companies.

Criticisms and Controversies

The company has attracted controversy for reports of political corruption, cronyism, fraud, financial manipulation and exploitation of its customers, Indian Citizens and Natural Resources.

The chairmen of Reliance Industries, Mukesh Ambani, has been described as a Plutocrat.

ONGC Litigation

In May 2014, ONGC moved to Delhi High Court accusing RIL of Pilferage of 18 Billion cubic meters of Gas from its Gas-producing Block in the Krishna Godaveri Basin .

Subsequently, the two companies agreed to form an Independent expert panel to prove any pilferage.

Cronyism

Seminar magazine (2003) detail Reliance founder Dhirubhai Ambani's proximity to politicians, his enmity with Bombay Dyeing's Musliwadia, the exposes by the Indian Express and Arun Shouriy about Illegal imports by the company and overseas share transactions by shell companies and the botched attempt to acquire Larson and Toubro.

Criminal Investigation

The CBI charged a file sheet in a Mumbai court against Reliance Industries and four retired employees of National Insurance Company Ltd. and former CMD under provisions of the Prevention of Corruption Act for criminal conspiracy and other charges.

The 2005, the complaint had alleged irregularities in the issuance of insurance policies- for coverage of default payments- By NICL to IRL.

The chargesheet also mentioned criminal offences with dishonest intentions and causing wrongful laws totaling 147.41crores to NICL and wrongful gain to the private telecom provider.

IRL Plane Grounded

A business jet owned by RIL was grounded by the Directorate General of Civil Aviation on 22nd March 2014.

During a surprise inspection for carrying expired safety equipment on board, its pilot was also suspended for flying without a license.

Future Retail Deal and Possession

In February 2022, Reliance terminated the leases of 100s of future retail locations, the next largest retail chain in India and took possession of those Brick and Water Shops.

Future Retail had a deal to sell its assets to Reliance but that Deal was contested by Amazon.com which in 2019, acquired a stake in a sub unit of future retail along with certain rights with respect to the transfer of the retailers assets.

Stock Manipulation and Penalty

For manipulating shares of Reliance Petroleum Ltd, Reliance Industries was fined Rs/-950crore. The market crashed by 30% after it floated at roughly Rs/-100. RIL carried out an organized operation with the help of its agents in order to obtain unauthorized profits from the trading from its formerly listed unit RPL.

0 notes

Text

The Jio Platforms IPO Buzz: What Investors Need to Know

Introduction Ever since Jio Financial Services Ltd (JFSL) made its debut in July 2023, the Indian stock market has been buzzing with anticipation. Investors, financial analysts, and tech enthusiasts alike are eagerly waiting for the potential listing of Reliance Industries Ltd’s (RIL) telecom arm, Jio Platforms Ltd. Will it be through a vertical split or a public issue? This blog explores the…

0 notes

Text

Complete Guide to Intrinsic Value: How to Find a Stock’s True Worth

Investors often struggle to differentiate between a stock's price and its real worth. This is where intrinsic value comes in. It helps investors determine whether a stock is undervalued or overvalued, making it a critical tool for value investing.

In this guide, we’ll break down intrinsic value, how to calculate it, and its role in investment decisions. We’ll also explore real-world examples from the Indian stock market and discuss the best tools for valuation, including Strike.Money.

What Is Intrinsic Value? Why Does It Matter?

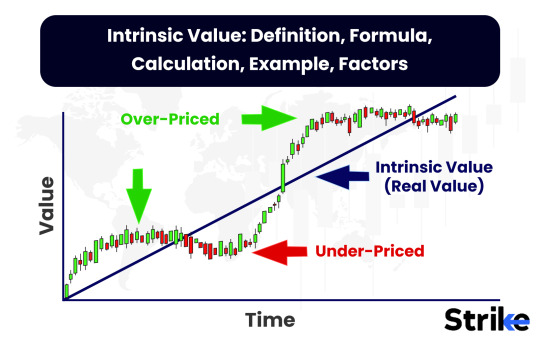

Intrinsic Value vs. Market Value

Market value is the current stock price driven by supply, demand, and investor sentiment.

Intrinsic value is a stock’s true worth based on its fundamentals, like earnings, assets, and future growth potential.

Why It Matters

Helps investors avoid overhyped stocks.

Identifies undervalued opportunities for long-term gains.

Used by legendary investors like Warren Buffett and Benjamin Graham.

🔹 Example: In 2020, Reliance Industries surged due to its Jio platform expansion, but its intrinsic value was debated as traditional valuation models struggled to account for digital growth.

Intrinsic Value vs. Market Value: The Real Difference

Market prices fluctuate daily due to: ✅ Investor emotions (fear & greed) ✅ News & rumors ✅ Speculation

However, intrinsic value is calculated using: ✅ Financial statements ✅ Cash flows & earnings growth ✅ Economic factors

🔹 Example: Zomato (NSE: ZOMATO) had a high IPO valuation, but skeptics argued its intrinsic value was lower due to profitability concerns.

📉 Many IPOs trade above intrinsic value at launch but correct later.

How to Calculate Intrinsic Value: The Most Reliable Methods

1. Discounted Cash Flow (DCF) Model

📌 Formula:

Used by professional analysts to estimate future earnings.

Best for: Growth companies like TCS (NSE: TCS).

🔹 Example: If Infosys (NSE: INFY) has projected cash flows of ₹10,000 Cr and a discount rate of 8%, its DCF value is calculated accordingly.

2. Price-to-Earnings (P/E) Ratio Approach

📌 Formula:

Useful for comparing stocks within the same sector.

Best for: Large-cap companies like HDFC Bank (NSE: HDFCBANK).

🔹 Example: If HDFC Bank has an EPS of ₹50 and the banking industry’s average P/E ratio is 20, its intrinsic value is ₹1,000.

3. Graham’s Formula (For Value Investors)

📌 Formula:

Developed by Benjamin Graham, mentor to Warren Buffett.

Best for: Defensive investors looking for undervalued stocks.

🔹 Example: Coal India (NSE: COALINDIA) has an EPS of ₹25 and a book value of ₹250. Using Graham’s formula, its intrinsic value is:

Why Intrinsic Value Matters for Indian Investors

📊 Intrinsic value helps investors make rational decisions in a volatile market.

How Value Investors Use It

Warren Buffett buys stocks when market value < intrinsic value.

Rakesh Jhunjhunwala followed similar strategies in Indian markets.

Historical Example: Infosys in 2000

Dot-com boom pushed Infosys stock above its intrinsic value.

After the crash, it corrected and became a long-term multibagger.

📌 Lesson: Short-term hype often misprices stocks, but intrinsic value helps identify true winners.

Best Tools to Calculate Intrinsic Value

1. Strike.Money (Advanced Charting & Valuation Tool)

🔹 Helps analyze stock fundamentals & calculate intrinsic value. 🔹 Ideal for tracking Indian stock market trends.

2. Morningstar

🔹 Provides intrinsic value ratings for Indian and global stocks.

3. Yahoo Finance

🔹 Offers P/E, EPS, and growth forecasts.

Limitations of Intrinsic Value: When It Fails

1. Market Sentiment Can Override Valuation

Overvalued stocks stay overvalued due to hype. 🔹 Example: Tesla (NASDAQ: TSLA) has traded above intrinsic value for years.

2. Black Swan Events Can Disrupt Predictions

COVID-19 crash made traditional valuation models ineffective.

3. Value Traps

Some cheap stocks remain cheap forever. 🔹 Example: Yes Bank (NSE: YESBANK) looked undervalued but was a value trap due to bad loans.

📌 Solution: Combine intrinsic value with technical analysis (Use Strike.Money for better insights).

FAQ: Common Questions About Intrinsic Value

❓ Is intrinsic value the same as book value? 📌 No, book value is the accounting worth, while intrinsic value includes future earnings potential.

❓ Does intrinsic value change? 📌 Yes, factors like earnings growth, interest rates, and market conditions affect it.

❓ Can beginners calculate intrinsic value? 📌 Yes! Start with P/E ratio and use tools like Strike.Money.

Final Thoughts: How to Use Intrinsic Value for Smart Investing

✅ Look for undervalued stocks with strong fundamentals. ✅ Avoid hype-driven investments with no real earnings. ✅ Use tools like Strike.Money to track valuation trends.

📌 Mastering intrinsic value will make you a better investor and help you navigate market volatility with confidence.

🔹 What’s Next? Start analyzing stocks today using Strike.Money and build a portfolio based on real value! 🚀

0 notes

Text

Nifty trades above 19,900 level; market breadth in favor of buyers.

Equity benchmarks hit fresh intraday high; auto shares in demand.

The domestic equity benchmarks extended their early gains and hit fresh intraday high in morning trade. The Nifty continued to hold above the 19,900 level. Auto stocks managed to edge higher for third day in a row.

The barometer index, the S&P BSE Sensex, was up 330.39 points or 0.50% to 66,929.30. The Nifty 50 index advanced 110.50 points or 0.56% to 19,930.45.

In the broader market, the S&P BSE Mid-Cap index rose 0.88% while the S&P BSE Small-Cap index added 0.77%.

The market breadth was strong. On the BSE, 2,243 shares rose and 1,213 shares fell. A total of 204 shares were unchanged.

Prime Minister Narendra Modi, in his role as the host of the G20 Summit, concluded the two-day event. Indian Prime Minister Narendra Modi and U.S. President Joe Biden pledged to deepen the partnership between both countries in their second bilateral meeting in less than six months.

New Listing:

Shares of Rishabh Instruments were currently trading at Rs 460.25 on the BSE, representing a premium of 4.37% as compared with the issue price of Rs 441.

The scrip was listed at Rs 460, exhibiting a premium of 4.31% to the issue price.

So far, the stock has hit a high of 469.65 and a low of 432.25. On the BSE, over 3.49 lakh shares of the company were traded in the counter so far.

The initial public offer (IPO) of Rishabh Instruments was subscribed 31.65 times. The issue opened for bidding on 30 August 2023 and it closed on 1 September 2023. The price band of the IPO was fixed at Rs 418-441 per share.

Shares of Ratnaveer Precision Engineering were currently trading at Rs 129.15 on the BSE, representing a premium of 31.79% as compared with the issue price of Rs 98.

The scrip was listed at Rs 128, exhibiting a premium of 30.61% to the issue price.

So far, the stock has hit a high of 134 and a low of 123. On the BSE, over 9.20 lakh shares of the company were traded in the counter so far.

The initial public offer (IPO) of Ratnaveer Precision Engineering was subscribed 93.99 times. The issue opened for bidding on 4 September 2023 and it closed on 6 September 2023. The price band of the IPO was fixed at Rs 93-98 per share.

Buzzing Index:

The Nifty Auto rose 0.97% to 16,258.45. The index has added 2.12% in three sessions.

Tube Investments of India (up 5.6%), Maruti Suzuki India (up 1.14%), Tata Motors (up 1%), Samvardhana Motherson International (up 0.7%) and Hero MotoCorp (up 0.61%) were the top gainers.

Among the other gainers were Balkrishna Industries (up 0.52%), Ashok Leyland (up 0.49%), MRF (up 0.38%), Mahindra & Mahindra (up 0.3%) and TVS Motor Company (up 0.3%).

On the other hand, Bosch (down 0.51%), Bharat Forge (down 0.34%) and Sona BLW Precision Forgings (down 0.24%) moved lower.

Stocks in Spotlight:

IRB Infrastructure Developers rallied 3.17%. The company’s gross toll collection jumped 24% to Rs 417 crore in August 2023 as compared with Rs 336 crore in August 2022.

Gateway Distriparks fell 1.21%. The company announced that its chief financial officer (CFO), Sandeep Kumar Shaw has tendered his resignation, effective from the close of business hours on 28 November 2023.

Reliance Industries (RIL) rose 0.53%. Jio Platforms on Friday 8 September 2023, announced its partnership with NVIDIA to develop a cloud-based AI compute infrastructure. This infrastructure aims to bolster India’s position in the field of artificial intelligence. The new AI cloud infrastructure will provide access to accelerated computing, high-speed networking, and secure cloud services to various individuals and organizations in India, such as researchers, developers, startups, scientists, and AI practitioners.

Adani Enterprises gained 1.71%. Adani Global Pte. Ltd., Singapore, a step down wholly owned subsidiary of the Company (AGPTE) has signed Joint Venture Agreement with Kowa Holdings Asia Pte. Ltd., Singapore (KOWA) on 8th September 2023. The agreement is for the sales and marketing of green ammonia, green hydrogen and its derivatives produced and supplied by Adani Group, in the agreed Territory.

Strides Pharma Science added 0.81%. The company said that its step-down wholly owned subsidiary, Strides Pharma Global has received approval for Sevelamer Carbonate for oral suspension USP, 0.8g and 2.4g, from the United States Food & Drug Administration (USFDA).

SJVN jumped 4.69%. The company said that its wholly owned subsidiary SJVN Green Energy (SGEL) has signed PPA with Bhakra Beas Management Board (BBMB) for 18 MW Solar Power.

Numbers to Watch:

The yield on India’s 10-year benchmark federal paper declined 0.15% to 7.188 from its previous close of 7.173.

In the foreign exchange market, the rupee edged higher against the dollar. The partially convertible rupee was hovering at 82.9200, compared with its close of 83.0275 during the previous trading session.

MCX Gold futures for 5 October 2023 settlement added 0.10% to Rs 58,955.

The US Dollar index (DXY), which tracks the greenback’s value against a basket of currencies, was down 0.36% to 104.72.

The United States 10-year bond yield rose 0.90% to 4.294.

In the commodities market, Brent crude for November 2023 settlement lost 14 cents or 0.15% to $90.51 a barrel.

Global Markets:

Asian stocks are trading mixed on Monday where key economic data from major economies will take center stage.

On Tuesday, India will release its inflation and industrial output figures for August, while China will announce its industrial output, retail sales, and most notably, house sale prices on Friday.

US stocks closed higher on Friday as Apple and other tech and growth stocks witnessed some buying after the recent fall due to China’s ban on iPhones for government employees.

0 notes