#Register for PAYE

Explore tagged Tumblr posts

Text

How to Register for PAYE

New Post has been published on https://www.fastaccountant.co.uk/how-to-register-for-paye/

How to Register for PAYE

Are you an employer in the UK? If so, it is important to understand how to register for PAYE (Pay As You Earn). PAYE is the system used by the HM Revenue and Customs (HMRC) to collect income tax and National Insurance contributions from employees’ salaries. To ensure compliance and avoid any penalties, it is essential to follow the correct process for PAYE registration. In this article, we will outline the steps you need to take to register for PAYE in a simple and straightforward manner.

Essential Information

What is PAYE?

PAYE stands for Pay As You Earn, which is a system used by the HM Revenue and Customs (HMRC) in the United Kingdom to collect income tax and National Insurance contributions from employees. Under the PAYE system, employers are responsible for deducting the correct amount of tax and NI from their employees’ salaries or wages before paying them.

Who needs to register for PAYE?

Any employer who pays one or more employees in the UK must register for PAYE. This includes businesses, organizations, and individuals who employ staff, regardless of the size of the workforce. It is important to register for PAYE as soon as you become an employer, even if you only have one employee or if you have casual or temporary staff.

What are the benefits of registering for PAYE?

Registering for PAYE not only ensures that you comply with UK tax regulations, but it also offers several benefits. Firstly, it enables you to accurately calculate and deduct the correct amount of tax and National Insurance from your employees’ pay. It also provides your employees with the reassurance that their taxes are being handled correctly and that they are contributing towards their statutory entitlements, such as state pension and sick pay. Finally, being registered for PAYE allows your employees to access other benefits, such as government-funded training and support.

When should you register for PAYE?

You should register for PAYE as soon as you become an employer, even if you don’t anticipate paying your employees immediately. It is a legal requirement to register before your first payday as an employer. In addition, you are not allowed to register more than two months before you start to employ people. Failing to register within the specified time frame may result in penalties and interest charges from HMRC.

Preparing for Registration

Gather necessary documents

Before you can register for PAYE, you will need to gather certain information. These may include:

Your National Insurance Number (If you are a sole trader)

The National insurance number of one of the directors (if you are a Ltd Company)

Your Unique Taxpayer Reference (UTR) if you are self-employed

Company registration details (if applicable)

Company UTR number (if applicable)

The date that you expect to start employing people

Registration method

The way you register for PAYE depends on the type of business. Most Limited companies can only register online through their HMRC business tax account. For other business structures such as sole traders and partnerships registration can be done through a business tax account or by completing an online registration form.

Registration Process

Through a business tax account

To register for PAYE through your business tax account, you will first need to create an online account on the HMRC website if you haven’t already got one. This account will serve as your portal for all tax-related matters. If you already have a business tax account, then log in to your account and register for PAYE.

If you are not a Ltd Company, you can choose to register via your business tax account if you have one. If you do not have a business tax account you can create one and then register your business for PAYE.

Submit online registration form

If you are not a Limited company, you have the option to complete an online registration instead of registering via a business tax account. This form will require you to provide detailed information about yourself and your business, such as your business name, your National Insurance number, your UTR Number, address, and contact details. Take your time to ensure that all the information provided is accurate and up to date, as any errors or omissions may cause delays in the registration process.

Once you have submitted the online registration form, you will receive a confirmation message from HMRC. This message will acknowledge that your registration has been received and provide you with a reference number for future correspondence. It is important to keep this reference number safe, as you will need it when communicating with HMRC regarding your PAYE scheme.

After Registration

Receive PAYE reference number

After successfully registering for PAYE, you will receive a PAYE reference number from HMRC. It can take up to 30 days for the PAYE reference number to arrive. This reference number is unique to your business and is essential for all future communications with HMRC regarding your PAYE scheme. It is important to keep this reference number safe and easily accessible for reference purposes.

Set up PAYE scheme

Once you have your PAYE reference number, you will need to set up your PAYE scheme. This involves stating the process of deducting tax and National Insurance from your employees’ salaries or wages and paying it to HMRC. You will also need to ensure that you are aware of your legal obligations and responsibilities under the PAYE system.

Submit regular payroll reports

As a registered PAYE employer, you are required to submit regular payroll reports to HMRC. These reports provide details of your employees’ earnings, deductions, and tax contributions. The frequency of these reports will depend on the size of your workforce and your PAYE scheme type. It is essential to meet the deadlines set by HMRC to avoid any penalties or fines.

Maintaining PAYE Registration

Keep payroll records up to date

To ensure compliance with PAYE regulations, it is crucial to maintain accurate and up-to-date payroll records. This includes keeping track of your employees’ salaries, benefits, deductions, and any changes in employment status. Retaining these records for at least six years is necessary to meet HMRC’s record-keeping requirements.

Notify HMRC about any changes

If there are any changes in your business, it is important to notify HMRC promptly. This may include changes to your company name, address, or contact details. Failing to notify HMRC about changes may result in incorrect tax calculations and potential penalties.

Ensure compliance with PAYE regulations

Compliance with PAYE regulations is essential to avoid penalties and fines from HMRC. This includes accurately calculating and deducting the correct amount of tax and National Insurance from your employees’ pay, making timely payments to HMRC, and submitting accurate payroll reports. Staying informed about changes in tax legislation and seeking professional advice when necessary is crucial for maintaining compliance.

youtube

Getting Help and Support

Contact HMRC helpline

If you need any assistance or have specific questions regarding PAYE registration or compliance, you can contact the HMRC helpline. The helpline is a valuable resource staffed by knowledgeable professionals who can provide guidance on various tax-related matters.

Use online resources

The HMRC website offers a wealth of online resources to help employers understand and navigate the PAYE system. You can access guides, tutorials, FAQs, and other useful information that will assist you in managing your payroll obligations effectively.

Consult an accountant or tax advisor

If you require further guidance or have complex tax matters to address, it may be beneficial to consult an accountant or tax advisor. These professionals specialize in tax matters and can provide expert advice tailored to your specific needs. They can help you understand your obligations, navigate tax legislation, and ensure compliance with PAYE regulations.

Frequently Asked Questions

What happens after registering for PAYE?

After registering for PAYE, you will receive a PAYE reference number from HMRC. You will need this reference number for all future communications with HMRC regarding your PAYE scheme. You will also need to set up your PAYE scheme and ensure that you comply with the regulations by deducting the correct amount of tax and National Insurance from your employees’ pay and submitting regular payroll reports to HMRC.

Can I register for PAYE if I have no employees?

Yes, you can register for PAYE even if you have no employees at the moment. Registering for PAYE will allow you to set up your payroll system and be ready to hire employees in the future. Additionally, registering for PAYE may be necessary if you have a director’s salary or if you are employing family members. It is important to inform HMRC if your circumstances change and you no longer have any employees.

Can I register for PAYE if I am self-employed?

No, if you are self-employed and do not have any employees, you do not need to register for PAYE. Self-employed individuals are required to report their income through the self-assessment tax system. However, if you later start employing individuals, you will need to register for PAYE and deduct the correct amount of tax and National Insurance from their salaries or wages.

0 notes

Text

How to Register for PAYE

Are you an employer in the UK? If so, it is important to understand how to register for PAYE (Pay As You Earn). PAYE is the system used by the HM Revenue and Customs (HMRC) to collect income tax and National Insurance contributions from employees’ salaries. To ensure compliance and avoid any penalties, it is essential to follow the correct process for PAYE registration. In this article, we will…

View On WordPress

0 notes

Text

Setting Up a Limited Company UK: A Comprehensive Guide by Masllp

Starting your own business is an exciting venture, but it can also be a complex and daunting task. One of the most important decisions you will need to make is how to structure your business. For many entrepreneurs in the UK, setting up a limited company is the preferred option. At Masllp, we understand the intricacies involved in this process and are here to guide you every step of the way. Why Choose a Limited Company? Before diving into the setup process, it’s crucial to understand why many business owners opt for a limited company structure. Here are some of the key benefits:

Limited Liability: One of the most significant advantages is that your personal assets are protected. Your liability is limited to the amount you’ve invested in the company.

Professional Image: Operating as a limited company can enhance your business's credibility and professionalism.

Tax Efficiency: Limited companies often benefit from various tax advantages compared to sole traders or partnerships.

Investment Opportunities: It's easier to attract investors as they can purchase shares in your company. Steps to Setting Up a Limited Company Setting up a limited company UK involves several steps, but with the right guidance, the process can be straightforward. Here’s a step-by-step guide by Masllp:

Choose a Company Name *Ensure your company name is unique and not already registered with Companies House. *Check for any trademarks to avoid legal issues.

Register Your Company Address *You must have a registered office address in the UK. *This address will be publicly available on the Companies House register.

Appoint Directors and a Company Secretary *You need at least one director to manage the company. There’s no legal requirement to appoint a company secretary, but many choose to do so. *Allocate Shares and Shareholders

Decide on the number of shares and their value. *Allocate these shares to your shareholders, who are the owners of the company. *Prepare Memorandum and Articles of Association

The memorandum of association is a legal statement signed by all initial shareholders agreeing to form the company. *The articles of association outline how the company will be run. Standard articles are available, but they can be customized if necessary.

Register with Companies House *You can register online, by post, or through an agent like Masllp. *The registration fee varies depending on the method of registration.

Register for Corporation Tax *Within three months of starting business activities, you must register for Corporation Tax with HMRC.

Set Up a Business Bank Account *It’s essential to keep your business finances separate from your personal finances.

Understand Your Ongoing Responsibilities

Submit annual accounts and a confirmation statement to Companies House.

Maintain accurate financial records and meet HMRC deadlines. How Masllp Can Help At Masllp, we specialize in helping entrepreneurs set up their limited companies efficiently and compliantly. Our services include: *Name Checking and Registration: We ensure your company name is available and register it on your behalf. *Preparation of Documents: We handle the preparation and submission of all necessary documents. *Tax Registration: We register your company for Corporation Tax and provide guidance on VAT and PAYE if needed. *Ongoing Support: We offer ongoing support to ensure you meet all legal requirements and deadlines. Conclusion Setting up a limited company UK can provide numerous benefits, but it’s essential to navigate the process correctly. With Masllp by your side, you can focus on building your business while we handle the complexities of company formation. Contact us today to get started on your journey to becoming a successful limited company owner.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ajsh#ap management services

5 notes

·

View notes

Text

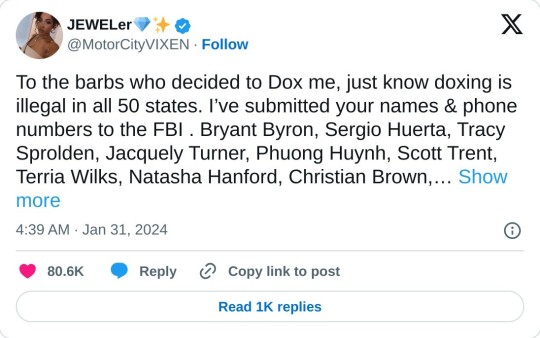

From @motercityvixen twitter “To the barbs who decided to Dox me, just know doxing is illegal in all 50 states. I’ve submitted your names & phone numbers to the FBI . Bryant Byron, Sergio Huerta, Tracy Sprolden, Jacquely Turner, Phuong Huynh, Scott Trent, Terria Wilks, Natasha Hanford, Christian Brown, Rashawn Simmons, Albertha Jaidah, Doris Paye, Mabintu Sesay, Abdi Ali,Tanika Whitaker, Nicolas Morales, Michel Williams, Rene Stacey, Emilion Dark, just to name a few. charges PRESSED, 💋‼️

This is just for the harassment calls. The text messages have been submitted as well, with all the death threats included. TELL A FRIEND TO TELL A FRIEND😘😘😘

I was advised by legal counsel that what I experienced is considered to be harassment & terroristic threats. Which is taken VERY seriously. Hope that helps 🫶🏽💋”

Imagine Doxing over celebs especially the queen of rape, the same queen of rape who had more energy doing coke and defending her husband she met a turkey giveaway raffle and somehow they share a child with but can’t go to their child pta meetings because he’s a rapist who has to remind everyone that he’s a registered sex offender then writing a decent track….WHEW! Hope some folks LEARN(ED) from this!

#❤️❤️❤️❤️❤️❤️❤️❤️❤️❤️❤️❤️❤️❤️❤️#This whole case had me changing my opinions and views(at least for the moment)#celebrating the police and the system#being xenophobic towards Canadian people#posting stories with reader plus white celebrities with fluffy or smutty material#nearly being racist towards black men#saying that some of them nigcels deserved to be another hashtag#and backing the death penalty.#megan thee stallion#i’m not sad for her#i’m outraged#i’m just glad she’s in a better place now#those people can speak for themselves they know who they are#and they can go straight to hell#they will pay for their crimes#for sucking that abusers meat#Instagram#As always a loud and sincere fuck you to everyone who has doubted her and supported that Canadian cuntery who must not be named#She went through unnecessary trauma for two years#That’s unforgivable#Next level fuckery#That that type of ish that would lead to an episode of snapped or deadly women#once again#🖕🏿daystar Peterson#annnnn boom#just like that#may all who come against black women rot#Don’t fuck with black women#If you can’t love them then at least don’t harm them#can’t wait to see that sociopath locked up on August 7th.

5 notes

·

View notes

Text

Mind Blowing Massage

“Your hands should be registered as lethal weapons,” said Penelope Payes, genius, billionaire, and secretly the superheroine Platinum Panther. The massage was making her entire body feel divine.

“Thanks, Ms. Payes. I’m just a killer … of tension,” the masseuse replied.

“Mmmm. I don’t normally like new people touching me,” Penelope muttered as her muscles seemed to melt, and yet her skin became aroused at the same time. “But I want to get to know your hands much better,”

“I’m sure we can arrange that,” the masseuse said as he pushed with his thumb just to the right of the superheroine’s spine. Penelope felt something shift inside her. She had never had an out-of-body experience before, but this must be what it felt like. It was like floating on a cloud of pleasure.

The masseuse felt the last of the tension go out of her. He grinned wickedly. “I’ve turned off your higher brain functions. Your willpower. Your judgment. Your short-term memory. Even that endless chatter you spout. All of them have been switched off. The brain is just one big nerve for the Nervewracker to control.”

Somewhere, Penelope remembered that the Nervewracker was a villain. Somewhere, she knew she was supposed to stop him, was supposed to fight.

But that was in the fog that remained of her mind. Her flesh only knew one thing: Obeying Nervewracker felt good. Too good to resist.

---

Like what you read? Will you buy me a coffee and request something rich to sink my teeth into? Or peek into the depths of my longer fiction?

All my fiction is on sale at Smashwords from December 15, 2022 through January 1, 2023, including my newest erotic novel, Panther’s Passion!

14 notes

·

View notes

Text

First Kiss - Opposite AU! Babette/Howdy

[Warnings: General Foul Language, Bribery]

[Word Count: 762]

[This fulfills my first prompt for Writer’s Month Pride Bingo! Comments and Reblogs are appreciated!]

“C’mon, not even an espresso?” Howdy asked, chewing the end of his cigar in frustration.

“Non,” Babette answered, throwing a puck in her own frustration toward the caterpillar. “Depuis que ton petit cul m'a trompé sur la dernière boisson du diable que tu as commandée, je refuse de te servir jusqu'à ce que tu payes!”

“Next person,” she called, but Howdy refused to move. She glared up at him. “Sortez du chemin, bâtard paresseux.”

Howdy huffed, pulling the cigar from his lips. Babette shoved a plate under the embers before he could burn her countertops. “God, I hate it when you do this–” He muttered. “I’m not moving until you say something to me in a language I can understand.”

“Putain de merde…” The doe rolled her eyes. “Je vais le dire lentement pour que vous compreniez. Pay up, or get–”

“The fuck–” Howdy’s frown deepened on his face, cigar crushed in his grip.

“Out.” Babette smirked when she saw his expression and stuck out her tongue at him. “And be mindful of what you do next. You might get banned.”

His tongue clicked then stepped aside, digging through his pockets for his wallet. Satisfied, Babette returned to serving other customers, tail wagging slow behind her. However, she’d just put in the last order of the line when her eyes caught something outside her windows. Her gaze narrowed then widened as she gasped then ducked under the counter. Quickly she dug around for her ‘On Break’ sign, shoving it up beside the register.

Caught off guard by her sudden disappearance, Howdy peered over with furrowed brows. He noticed her ears were straight up, one flopped back toward the door. The caterpillar glanced outside, and hummed at the sight of the stranger lurking outside the café. “What’s the issue? It’s just some guy.”

“It is not ‘some guy’, c'est mon ex-amoureux,” she informed in a huff, glaring up at him.

Howdy blankly stared at Babette. The doe groaned, rubbing her face. “Vous êtes inutile– Ex-boyfriend! An annoying one at that. ‘e comes around twice a month, begging.”

He raised his lip in disgust. “Begging for you back? Who in hell wants to date you?”

“I’ll have you know, people would be lucky to keep me.” Babette crossed her arms. Howdy snorted at the idea, earning himself an offended gasp from her.

“If he bothers you so much, why not just tell him that you’re seeing someone?” Howdy asked, rustling through his money before shoving what he owed in her tip jar.

“As if that stopped ‘im before. ‘E ‘as to see me with someone else for him to believe that–” An idea popped into her head and she shoved herself up to her hooves. “Quick, kiss me!”

“What?!” Howdy backed away from the counter. “Now, why the hell would I do that? In fact, why me?”

The doe groaned, tapping her hoof impatiently. “Because you’re only more handsome than my other options by a small margin, and you’re closer,” she informed, then huffed as she realized she’d have to bribe him for this favor. “And you get whatever you want next time, on the house.”

“That’s what I like to hear.” Howdy grinned, two hands braced on the edge of the counter as his other two cupped her face and pulled her into a deep kiss.

Both her ears and tail perked up as her body stiffened, but soon she relaxed and leaned into the kiss. Howdy hummed as he leaned his hip against the counter. He released the granite to wrap his hands around her waist and pick her up. She pulled away from the kiss to let out a noise of surprise before she was set back down, sitting on her countertop.

Then the two were at it again. Her arms wrapped around his neck, eyes closed. However a gasp left her as the hands holding her face moved to rub along her ears and brush through her tail. “Ah, ‘owdy–”

The bell over her door chimed, and she was shoved from her momentary bliss. Babette ripped herself from the kiss, looked toward the door, and saw her ex staring wide-eyed back at her. She pushed Howdy away, and pat down her fur as best she could, clearing her throat.

Howdy fixed his shirt, glancing toward Babette to admire one last memory of seeing her so ruffled. “I’ll let you get back to work, babe. See you tonight.” He smirked at her before turning for the door. However as he passed by her ex, he sent him a glare and snarl.

6 notes

·

View notes

Text

The fact that out of 12 “real” (and PAYE¹ is how I’m defining real) jobs I’ve had, 8 of the companies have gone out of business after I left them (and only one during me leaving them) and one of the 4 survivors is my own, is something I choose to treat as a threat to anyone who wishes to fuck with my employment.

[1] PAYE is “Pay As You Earn”, and in England is² when you are registered with the tax office as being employed primarily by this company, who then garnish your wages for taxes automatically on behalf of His Majesty’s Revenue Collection)

[2] This is a simplification of a tax system and should not be confused for actually reading an article on how it works.

[3] This footnote is false

37K notes

·

View notes

Link

0 notes

Text

Understanding Self-Assessment Tax Returns for Individuals in the UK

Self-assessment tax returns are an integral component of the UK system of taxation by allowing individuals to report their income along with capital gains to HMRC. This is important for self-employed persons, landlords, and others out of the realms of PAYE income. Understanding the nuances of self-assessment is critical in ensuring adherence to UK tax law and penalty avoidance. In this article, we show what self-assessment is, who needs to file, key deadlines, the steps involved in filing, and some tips on how to make it easier.

What is a self-assessment tax return?

A self-assessment tax return is HMRC’s method of collecting the income tax. Usually, the tax is deducted automatically from wages, pensions, and savings, but those people and businesses receiving other income are required to report this in a tax return. The whole self-assessment process means that an individual needs to work out his or her own tax liability and then report this to HMRC.

Who must submit a self-assessment tax return?

Not everyone in the UK must submit a self-assessment tax return. Usually, people need to file returns if they are:

Self-employed as a sole trader, and their profits were over £1,000 before deducting anything that they can claim tax relief on.

A partner in a business partnership

Receiving untaxed income-for example, income from letting out a property, tips and commission, savings, investments, and dividends

Have received more than £100,000 in a tax year

Must claim some tax reliefs or allowances

Receive a child benefit and their partner or themselves are earning in excess of £50,000

It’s important to note that even if you are on a PAYE system, you may still need to file a return if you fall into any of these categories. Checking with HMRC or a tax professional can help clarify your specific situation.

Key deadlines for self-assessment

The deadlines for self-assessment are worth remembering to avoid any penalties. The key dates include the following:

5th October: If you are a first time filer you must register for self-assessment.

31st October: Latest date for paper tax returns for the previous tax year.

31st January: Latest date for online tax returns for the previous tax year and latest date for paying any tax owed.

If you miss the deadline, there is a possible penalty of £100 to start with, and this could increase over time in case of failure to submit the return or pay the tax. Interest might also be charged on any late payments.

How to register for self-assessment

If you need to file a self-assessment tax return for the first time, you must register with HMRC. The registration process differs depending on your employment status:

Self-employed individuals or sole traders: Register using the online service.

Partners in a business partnership: Register online or by post.

Individuals needing to declare income or capital gains: Use form SA1 or register online.

Once registered, you will receive a Unique Taxpayer Reference (UTR) and will need to create an account on the Government Gateway. This account will allow you to access the self-assessment portal and file your tax return.

Steps to file a self-assessment tax return

Filing a self-assessment tax return can be straightforward if you follow these steps:

Gather Your Records: Collect all necessary documentation, such as P60s, P45s, and records of income and expenses if self-employed. You will also need details of any other income, such as dividends or rental income.

Sign in to Your Account: Use your Government Gateway credentials to sign in to your HMRC online account.

Complete the Tax Return: Follow the prompts to complete the sections relevant to your situation. These sections will ask for details about your income, expenses, and any reliefs or allowances you are claiming.

Calculate Your Tax: HMRC’s online system will automatically calculate your tax liability based on the information you provide.

Submit Your Return: Review your completed return carefully, ensuring all information is accurate. Submit the return online before the 31st January deadline.

Common mistakes to avoid

There are several common mistakes people make when filing their self-assessment tax returns:

Missing Deadlines: This is the most common error and can result in penalties and interest charges.

Incorrect Information: Providing incorrect or incomplete information can delay the process and result in fines.

Not Keeping Records: It’s vital to keep accurate records for at least five years after the 31st January submission deadline for that tax year.

Forgetting to claim allowances or reliefs: Ensure that you are aware of all the allowances and reliefs available to you, such as the Personal Allowance, Marriage Allowance, and expenses for self-employed individuals.

Pay Your Tax: Once submitted, you will be informed of the amount of tax due. Payment can be made online via various methods, including direct debit, credit card, or bank transfer.

Conclusion

Understanding self-assessment tax returns is of essence to UK individuals who derive income that is not PAYE or from another source that may be subject to taxation. The more one knows about the process, keeps good records, and observes deadlines, the better such a person complies with the requirements set forth by HMRC and avoids heavy fines. Since laws and regulations on tax are subject to change, it is very important to maintain one’s tax affairs up to date and seek professional advice where necessary.

Do you find the self-assessment process overwhelming and complicated? Let Integra Global Solutions help you with that. With qualified accountants, Integra gives full-service tax preparation with accounting services, which can be tailored to your needs. Be it self-employed, a landlord, or one with multiple sources of income, Integra will be able to provide the necessary guidance to enable you to prepare an appropriate tax return within the given time, so that you may well avoid any unnecessary penalty and optimise your tax position. For more information, please visit our website today at www.globalintegra.co.uk and let us assist you in any aspect of your self-assessment tax return and any other accounting need you may have.

0 notes

Text

Bookkeeper in Bromsgrove

Bookkeeping and Financial Services in Droitwich - JRMA Accountants

JRMA Accountants in Droitwich delivers comprehensive bookkeeping and financial services tailored to help businesses stay financially organized and compliant. With a team of experienced bookkeepers, JRMA provides streamlined solutions that cater to companies of all sizes, from startups to established enterprises, ensuring that each client's financial records are accurate, current, and aligned with industry regulations. Bookkeeper in Worcester

Expert VAT Services in Bromsgrove

For businesses in Bromsgrove, JRMA offers specialized VAT services, helping companies manage the complexities of VAT registration, calculation, and filing. The team’s expertise in VAT compliance ensures that businesses avoid costly errors and penalties, with VAT returns prepared accurately and submitted on time. JRMA assists clients with VAT planning to optimize cash flow and ensure they leverage VAT exemptions where applicable. Whether a company is newly registered for VAT or needs ongoing support, JRMA’s specialists provide dependable and efficient service. VAT in Redditch

Comprehensive Payroll Solutions in Redditch

Payroll management is crucial for any business, and JRMA’s payroll services in Redditch are designed to meet this need efficiently. Managing payroll can be time-consuming and requires meticulous attention to detail, from handling deductions and overtime to complying with PAYE regulations. JRMA’s payroll experts offer end-to-end payroll processing, ensuring that all calculations are accurate and compliant with UK employment laws. Services include weekly, biweekly, or monthly payroll, real-time information submissions to HMRC, and employee payslip distribution. For businesses looking to offload the complexities of payroll management, JRMA’s services are reliable and streamlined, allowing companies to focus on core operations without payroll worries. Payroll in Droitwich

Why Choose JRMA for Bookkeeping, VAT, and Payroll?

JRMA Accountants stands out for its client-centered approach, personalized service, and deep knowledge of UK accounting standards. By partnering with JRMA, businesses can reduce the burden of day-to-day financial management, minimize errors, and enhance their financial health. Whether you need ongoing bookkeeping in Droitwich, VAT assistance in Bromsgrove, or payroll support in Redditch, JRMA has the expertise to support your business’s financial needs.

0 notes

Text

A Quick Primer on Accountancy and Tax Responsibilities

Know-how the basics of accountancy and tax responsibilities is critical for any business, huge or small. Whether you’re a startup founder or a pro entrepreneur, having a hold close of those basics will make sure you live compliant and financially wholesome.

What is accountancy?

Accountancy entails recording, classifying, and summarizing economic transactions to offer a clean photo of a enterprise's financial fitness. It is no longer pretty much crunching numbers; it’s about strategic selection-making. Accountants assist in budgeting, financial forecasting, and advising on approaches to cut fees and maximize profits. With the aid of preserving accurate economic records, corporations can higher understand their overall performance and make informed choices for future growth.

Key tax responsibilities

Each commercial enterprise has tax duties. This consists of registering with hmrc, filing annual returns, and paying taxes on time. Lacking cut-off dates or filing wrong information can result in consequences and hobby prices. Right here are some key tax obligations to be aware of:

Income tax and enterprise tax: corporations must calculate and pay taxes on their earnings. Depending on the commercial enterprise shape—whether a sole dealer, partnership, or restrained organisation—the tax rates and filing methods will vary.

Vat (value introduced tax): in case your enterprise's accountancy and tax turnover exceeds a sure threshold, you need to sign up for vat and frequently submit vat returns. It’s vital to realize which charges are vat-deductible to reduce your vat invoice.

Payroll taxes: if you have personnel, you have to manage paye (pay as you earn) and countrywide insurance contributions. Staying compliant with those responsibilities is crucial to keep away from legal trouble.

Self-evaluation: many small enterprise proprietors must report self-evaluation tax returns. Maintaining detailed financial records during the year simplifies this system and guarantees accuracy.

How a expert accountant enables

A qualified accountant is a key ally in handling your business’s financial and tax duties. They can help navigate complex tax laws, maximize deductions, and make certain all filings are timely and accurate. Engaging an accountant saves you time and cash and reduces the danger of high priced errors.

Final thought

Knowledge your tax duties isn't always just about compliance; it is approximately leveraging economic insights to develop your enterprise. Partnering with a informed accountant can make all the difference in dealing with your budget effectively and riding success.

Note: For more detail click on Elan Tax

0 notes

Text

How to Start a Business in Kenya: A Comprehensive Guide

Kenya is emerging as a hub for business and investment in Africa, thanks to its strategic location, growing economy, and supportive government policies. For entrepreneurs looking to expand into new markets, Kenya offers immense potential. This guide will walk you through the steps involved in starting a business in Kenya, with a focus on the essentials, including the process of business registration in Kenya.

1. Research the Market

Before diving into the registration process, it’s crucial to conduct thorough market research. Understand the local market dynamics, target audience, competition, and regulatory environment. Identify the demand for your product or service and assess the feasibility of your business idea in the Kenyan market.

2. Choose the Right Business Structure

Kenya offers several business structures, including sole proprietorship, partnership, limited liability company (LLC), and branch office. Each structure has its benefits and legal implications:

Sole Proprietorship: Ideal for small businesses, with fewer legal requirements but unlimited liability.

Partnership: Suitable for businesses owned by two or more people, with shared profits and liabilities.

Limited Liability Company (LLC): Offers limited liability protection, making it the most popular option for foreign investors.

Branch Office: Allows foreign companies to operate as an extension of their parent company.

3. Register Your Business Name

Once you have chosen a suitable business structure, the next step is to register your business name. This process involves searching for the availability of your desired name through the eCitizen portal, the online platform provided by the Kenyan government. It is essential to ensure that your chosen name is unique and not already registered by another entity.

4. Obtain a Certificate of Incorporation

After registering your business name, you need to obtain a Certificate of Incorporation from the Registrar of Companies. This certificate officially recognizes your business as a legal entity in Kenya. To apply, you must submit the necessary documents, including:

Memorandum and Articles of Association.

Form CR1 (Application for Registration).

Form CR2 (Model Articles for a Company Limited by Shares).

Form CR8 (Notice of Registered Address).

5. Apply for Business Licenses and Permits

Depending on the nature of your business, you may need specific licenses and permits. For example, a trading license (Single Business Permit) is required for all businesses, while specialized businesses like healthcare, education, or manufacturing may require additional permits. You can apply for these through the eCitizen portal or relevant local authorities.

6. Register for Taxation

Registering for taxation is a mandatory step for all businesses operating in Kenya. You must obtain a Personal Identification Number (PIN) from the Kenya Revenue Authority (KRA) to file taxes, including VAT, PAYE, and corporate tax. This registration can be completed online through the KRA portal.

7. Open a Corporate Bank Account

To facilitate business transactions, it is essential to open a corporate bank account in Kenya. Choose a reputable bank that offers convenient services for foreign investors. Ensure that you have all the required documents, such as the Certificate of Incorporation, tax registration details, and a resolution from the company’s board of directors authorizing the account opening.

8. Secure an Office Location

Finding a suitable office location is critical for business success. Consider factors like proximity to your target market, accessibility, and rental costs. Nairobi, the capital city, is a popular choice for many businesses due to its status as an economic hub, but other cities like Mombasa and Kisumu also offer great opportunities.

9. Hire Local Talent and Comply with Labor Laws

Kenya has a growing pool of talented professionals across various sectors. When hiring employees, ensure compliance with local labor laws, including contracts, working hours, minimum wage, and employee benefits. You may also need to register with the National Social Security Fund (NSSF) and the National Hospital Insurance Fund (NHIF).

10. Promote and Grow Your Business

After completing the business registration in Kenya and setting up operations, focus on promoting and growing your business. Develop a marketing strategy that resonates with the local audience, leveraging both digital and traditional marketing channels. Establish strong networks within the local business community and explore partnerships to accelerate growth.

Conclusion

Starting a business in Kenya offers vast opportunities for growth and expansion. By following the outlined steps, including thorough market research, business registration in Kenya, obtaining the necessary licenses, and adhering to local regulations, you can establish a successful and compliant business presence. With its strategic location, favorable business environment, and diverse market, Kenya is a prime destination for entrepreneurs looking to tap into the African market.

Embark on your journey with confidence, knowing that Kenya’s vibrant economy and supportive ecosystem provide a fertile ground for business success.

0 notes

Text

Company formation in UK

Conquering the Kingdom: A Guide to Company Formation in UK So, you've dreamt of venturing across the pond and planting your entrepreneurial flag in the fertile soil of the UK? Fantastic! But before you unleash your business prowess upon the land, there's a crucial task at hand: Company Formation in UK. Fear not, brave adventurer, for this guide will equip you with the knowledge and tools to navigate the process with confidence.

Step 1: Choosing Your Company Structure First things first, decide what kind of kingdom you wish to build. The most popular choice is the limited company, offering personal liability protection and distinct legal identity from yourself. Consider other options like partnerships or sole traders, but weigh their limitations against your ambitions. Step 2: Naming Your Noble Steed Craft a company name that resonates with your brand and is available for registration with Companies House. Aim for something catchy, memorable, and reflective of your business. Remember, this is your banner in the marketplace, so choose wisely! Step 3: Gathering Your Loyal Subjects Assemble your founding team - directors and shareholders who will steer the company ship. Each member needs to provide personal details like addresses and shareholdings. If privacy is a concern, consider using nominee directors and shareholders, but be aware of the legalities involved. Step 4: Establishing Your Royal Address Every company needs a registered office address within the UK. This will be your official postal and public record location. Opt for a reliable provider who can offer virtual office services if a physical space isn't your immediate need. Step 5: Registering with Companies House This is where your company officially enters the realm of existence. You can register online through Companies House or utilize formation agents to ease the process. Be prepared to pay a registration fee and provide your chosen name, structure, and director/shareholder details. Step 6: Taxing Matters and More Once registered, you'll need to set up tax affairs with HMRC, including registering for Corporation Tax and PAYE if you plan to employ staff. Additional legal and administrative tasks may arise depending on your specific business nature. Bonus Tip: Seek Guidance from Wise Counsel While DIY formation is possible, navigating the nuances of UK company law can be tricky. Consider seeking expert advice from accountants, lawyers, or formation agents for a smoother journey. Remember, dear entrepreneur, with careful planning and this guide as your compass, forming your company in the UK can be a thrilling adventure. Go forth, conquer the market, and establish your business kingdom with pride! Masllp your way to success! This blog post offers a lighthearted and informative approach to company formation in UK. You can tailor it further by:

Including specific information about Masllp and its services related to Company formation in UK. Adding personal anecdotes or experiences to make the content more relatable. Highlighting unique aspects of the UK business landscape that appeal to international entrepreneurs. Providing links to useful resources and further information for readers. With a bit of creativity and Masllp-specific details, you can turn this guide into a valuable resource for your target audience and establish yourself as an expert in the field.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

3 notes

·

View notes

Text

UK Tax Essentials for New Restaurant Owners

Navigating the UK tax system can be a hard task for new restaurant owners. Understanding your tax obligations is crucial for compliance and financial health.

This guide provides an overview of key tax considerations and steps to ensure your restaurant meets its tax responsibilities.

1. Overview of UK Tax System

Types of Taxes

The UK tax system comprises several types of taxes that businesses must be aware of, including income tax, corporation tax, VAT (Value Added Tax), business rates, and National Insurance contributions. Each tax has specific rules and rates that apply to different aspects of your business.

HM Revenue and Customs (HMRC)

HMRC is the government body responsible for tax collection and enforcement. It provides resources and guidance to help businesses understand and comply with their tax obligations.

Are you considering opening a restaurant in the UK as a foreigner?

Check out our comprehensive guide on "How to Open a Restaurant in the UK as a Foreigner" for all the information you need.

2. Registering Your Business

Business Structure

The tax obligations of your restaurant depend on its legal structure. Common structures include sole trader, partnership, and limited company. Each structure has different tax implications and administrative requirements.

Registering with HMRC

Once you have chosen your business structure, you must register with HMRC. This registration includes setting up for self-assessment, VAT, and PAYE (Pay As You Earn) if you have employees.

3. Corporation Tax

Who Pays Corporation Tax?

If your restaurant operates as a limited company, it must pay corporation tax on its profits. The current corporation tax rate is 19%, but rates can change, so it's essential to stay updated with HMRC announcements.

Filing and Payment

Corporation tax is due nine months and one day after the end of your accounting period. You must file a corporation tax return (CT600) with HMRC within 12 months of the end of your accounting period.

4. Value Added Tax (VAT)

VAT Registration

VAT is a tax on the sale of goods and services. If your restaurant’s taxable turnover exceeds £85,000 in a 12-month period, you must register for VAT. You can also register voluntarily if your turnover is below this threshold.

VAT Rates

The standard VAT rate is 20%. However, certain goods and services, such as children’s car seats and some energy-saving products, are subject to a reduced rate of 5%, and some items, such as food and children’s clothing, are zero-rated.

VAT Returns and Payments

VAT-registered businesses must submit VAT returns to HMRC, usually every three months. The return reports the amount of VAT you have charged on sales and the amount of VAT you have paid on purchases. Any difference must be paid to HMRC.

5. Business Rates

What Are Business Rates?

Business rates are a tax on properties used for business purposes. The amount you pay is based on the property’s rateable value, which is determined by the Valuation Office Agency (VOA).

Small Business Rate Relief

You may be eligible for small business rate relief if your property’s rateable value is below a certain threshold. This relief can significantly reduce your business rates bill.

6. National Insurance Contributions (NICs)

Employer NICs

If you employ staff, you must pay employer NICs on their earnings above a certain threshold. The current rate for employer NICs is 13.8%.

Employee NICs

Employees also pay NICs, which you must deduct from their wages and pay to HMRC on their behalf. The rates vary depending on the employee’s earnings.

7. Income Tax for Sole Traders and Partnerships

Self-Assessment

Sole traders and partners in a partnership must pay income tax on their business profits. You must file a self-assessment tax return each year, detailing your income and expenses.

Income Tax Rates

Income tax rates are progressive, meaning they increase as your income rises. The current rates are 20% for basic rate taxpayers, 40% for higher rate taxpayers, and 45% for additional rate taxpayers.

8. Payroll and PAYE

Setting Up PAYE

If you employ staff, you must set up a PAYE system to handle income tax and NICs deductions from their wages. You must report payroll information to HMRC in real time, each time you pay your employees.

Employment Allowance

The Employment Allowance allows eligible businesses to reduce their employer NICs bill by up to £4,000 per year. Check if your restaurant qualifies for this allowance.

9. Record Keeping and Accounting

Maintaining Records

Accurate record-keeping is essential for tax compliance. Keep detailed records of all income, expenses, payroll, and VAT transactions. These records should be kept for at least six years.

Hiring an Accountant

Consider hiring an accountant to help manage your tax affairs. An accountant can ensure you meet all tax deadlines, optimize your tax position, and provide valuable financial advice.

10. Tax Reliefs and Allowances

Capital Allowances

Capital allowances allow you to deduct the cost of certain business assets, such as equipment and machinery, from your taxable profits. This can reduce your overall tax bill.

Research and Development (R&D) Tax Relief

If your restaurant undertakes innovative projects, you may qualify for R&D tax relief. This relief can provide substantial tax savings for qualifying expenditures.

11. Dealing with Tax Inspections

Preparing for an Inspection

HMRC may conduct inspections to ensure your tax affairs are in order. Keep your records organized and up-to-date to facilitate the inspection process.

Handling Disputes

If you disagree with an HMRC decision, you have the right to appeal. Seek professional advice to navigate the appeals process and resolve disputes effectively.

Conclusion

Understanding the UK tax system is crucial for the success of your new restaurant. By staying informed about your tax obligations, maintaining accurate records, and seeking professional advice, you can ensure compliance and focus on growing your business.

Check: How UK Expansion Worker visa will help businesses to set up a branch in the UK!

FAQs

What taxes do I need to consider when opening a restaurant in the UK?

You need to consider corporation tax, VAT, business rates, National Insurance contributions, and income tax (if you are a sole trader or partnership).

How often do I need to file VAT returns?

VAT returns are typically filed quarterly, but some businesses may be eligible for annual or monthly returns.

What is the threshold for VAT registration?

The current threshold for VAT registration is £85,000 in taxable turnover over a 12-month period.

Can I claim tax relief on business expenses?

Yes, you can claim tax relief on allowable business expenses, which can reduce your taxable profits and overall tax bill.

How long should I keep my business records? You should keep your business records for at least six years to comply with HMRC requirements.

#uk sponsor licence#uk business visa#how to open restaurant in the uk#uk business expansion visa#open restaurant in the uk as foreigner

0 notes

Text

Mind-Blowing Massage

“Your hands should be registered as lethal weapons,” said Penelope Payes, genius, billionaire, and secretly the superheroine Platinum Panther. The massage was making her entire body feel divine. “Thanks, Ms. Payes. I’m just a killer … of tension,” the masseuse replied. “Mmmm. I don’t normally like new people touching me,” Penelope muttered as her muscles seemed to melt, and yet her skin became…

View On WordPress

#body control#brainwashing#Caption story#fs#massage#md#mind control#Nervewracker#Platinum Panther#pleasure conditioning#seduction#skarletteone#superheroine#supervillain#Throwback

2 notes

·

View notes

Text

A Comprehensive Guide to Irish Company Registration and Tax Registration

Ireland is renowned for its favorable business environment, making it an attractive destination for entrepreneurs looking to establish a new venture. If you're considering starting a business in Ireland, understanding the process of Irish company registration and how to register for company tax is crucial.

Why Register a Company in Ireland?

Ireland’s business-friendly climate offers numerous advantages. The corporate tax rate is one of the lowest in Europe at 12.5%, and the country provides access to the European Single Market. Additionally, Ireland boasts a skilled workforce, strong legal framework, and extensive double taxation treaties, making it an ideal hub for both European and global operations.

Steps for Irish Company Registration

Choose a Unique Company Name: Your company name must be distinctive and not identical to any existing registered name. You can check name availability through the Companies Registration Office (CRO) website.

Select the Company Type: Common types include a Private Company Limited by Shares (LTD), Designated Activity Company (DAC), and Company Limited by Guarantee (CLG). Each type has different requirements and structures.

Prepare Necessary Documents: Essential documents include the company’s Constitution, details of directors, secretary, and shareholders. For an LTD, you need to complete and submit Form A1.

Register with the Companies Registration Office: Submit the required documents and Form A1 to the CRO. This can be done online for efficiency. A registration fee is also required.

Obtain a Company Seal: While not mandatory, it is customary to have a company seal for official documents.

Register for Company Tax: After successfully registering your company, the next crucial step is to register for company tax with the Revenue Commissioners. This includes Corporation Tax, VAT, and PAYE (Pay As You Earn) for employees.

How to Register for Company Tax in Ireland

Obtain a Tax Registration Number: Once your company is registered with the CRO, you will receive a Company Registration Number (CRN), which you will use to register for taxes.

Register with Revenue Online Service (ROS): Set up an account with ROS, Ireland’s online tax system. This will enable you to handle all tax-related matters electronically.

Complete the Registration Form: You need to complete the TR2 form for Corporation Tax, VAT, and PAYE. This form requires detailed information about your business activities, directors, and shareholders.

Submit the Form: Submit the completed TR2 form through ROS. The Revenue Commissioners will process your application and assign you the necessary tax registration numbers.

Compliance and Reporting: Ensure ongoing compliance by filing annual returns and tax returns. Keep accurate financial records and adhere to deadlines to avoid penalties.

Conclusion

Registering a company in Ireland and subsequently registering for company tax is a structured process that, when done correctly, can open doors to numerous business opportunities. Ireland’s advantageous tax policies and robust business infrastructure make it an excellent location for new and expanding businesses.

0 notes