#Quick Loan in Uttar Pradesh

Explore tagged Tumblr posts

Text

Financial emergencies can arise without warning, and in such situations, the need for quick and reliable financial support becomes essential. For the people of Uttar Pradesh, the concept of instant loans has proven to be a game-changer. Whether you need funds for a personal expense, a medical emergency, or business needs, an instant loan in Uttar Pradesh offers a fast, efficient, and hassle-free solution.

What Are Instant Loans?

Instant loans are short-term loans designed for quick disbursal and minimal paperwork. These loans are particularly appealing because they are processed online, cutting down the time spent on approvals and documentation. Unlike traditional loans, instant loans require no collateral and are highly flexible in terms of usage.

Why Choose Quick Loans in Uttar Pradesh?

Uttar Pradesh, with its vibrant cities and expansive rural areas, has witnessed a growing reliance on quick loans. Here’s why:

Rapid Disbursal: Loans are approved within hours, offering immediate financial relief.

Wide Accessibility: Thanks to online platforms, individuals in both urban and rural areas can access these loans.

No Collateral Needed: Instant loans are unsecured, meaning you don’t have to pledge assets to avail them.

Convenience: With digital platforms, you can apply for an online loan in Uttar Pradesh from the comfort of your home.

Types of Quick Loans in Uttar Pradesh

1. Personal Loans

Personal loans are highly versatile and can be used for various purposes such as education, weddings, or home improvements. These loans are a popular choice among residents of Uttar Pradesh.

2. Business Loans

Small businesses and entrepreneurs can benefit from business loans, which offer the necessary capital to expand operations or manage cash flow.

3. Emergency Loans

These loans are tailored for unexpected situations such as medical emergencies or urgent repairs.

4. Payday Loans

Payday loans are short-term loans designed to cover immediate expenses until the next paycheck arrives.

Benefits of Online Loans in Uttar Pradesh

With the rise of digital infrastructure, online loan in Uttar Pradesh have become increasingly popular. Here’s why:

1. Speed and Efficiency

Online loan applications are processed rapidly, with approval often granted within minutes.

2. 24/7 Accessibility

Unlike traditional banking, online platforms are available round-the-clock, ensuring you can apply anytime.

3. Paperless Process

Say goodbye to heaps of paperwork! Online loans require only basic documents, such as ID proof and bank statements.

4. Customizable Loan Options

Online lenders offer a variety of loan products with flexible repayment terms, allowing borrowers to choose a plan that suits their financial situation.

How to Apply for an Instant Loan in Uttar Pradesh

Step 1: Choose a Trusted Platform

Research and select a reliable online loan provider with transparent terms and competitive interest rates.

Step 2: Complete the Application

Fill out the online application form with accurate personal and financial details.

Step 3: Upload Documents

Submit the required documents such as Aadhaar card, PAN card, and income proof.

Step 4: Loan Approval

Once your details are verified, the loan is approved almost instantly.

Step 5: Fund Disbursal

The approved amount is transferred directly to your bank account, often within a few hours.

Eligibility Criteria for Quick Loans in Uttar Pradesh

To apply for an online loan in Uttar Pradesh, you must meet the following requirements:

Age: 21–60 years.

Income: Proof of a stable income source is necessary, whether you’re salaried or self-employed.

Credit Score: A good credit score improves your chances of approval, but many lenders also offer loans to individuals with no or low credit history.

Residency: Applicants must be residents of Uttar Pradesh and provide valid address proof.

Documents Required for an Online Loan in Uttar Pradesh

The documentation process is simple and includes:

Identity Proof: Aadhaar card, PAN card, or passport.

Address Proof: Utility bill, rental agreement, or Aadhaar card.

Income Proof: Salary slips, bank statements, or income tax returns.

Bank Details: Recent bank account statements to verify financial stability.

Factors Influencing Loan Approval

Several factors determine whether your loan application will be approved:

Credit Score: While not always mandatory, a good credit score increases approval chances.

Income Stability: Lenders assess your ability to repay based on your income.

Debt-to-Income Ratio: If you have existing debts, they may influence your eligibility for a new loan.

Interest Rates and Repayment Options

1. Competitive Interest Rates

Interest rates for online loans in Uttar Pradesh generally range from 10% to 25%, depending on the lender and your profile.

2. Flexible Repayment Tenures

Borrowers can choose repayment terms ranging from a few months to several years, based on their financial capacity.

3. Prepayment and Part-Payment Options

Many online platforms allow you to repay the loan early, often without penalties, reducing the overall interest burden.

Tips for a Smooth Loan Process

Choose the Right Loan Type: Select a loan that matches your specific needs, whether it’s personal, business, or emergency-related.

Borrow Responsibly: Avoid over-borrowing and ensure you can comfortably repay the loan on time.

Verify Lender Credibility: Always apply through reputable platforms to avoid scams.

Understand Loan Terms: Read the terms and conditions thoroughly to avoid hidden fees or penalties.

Risks and Precautions

While instant loans are incredibly convenient, borrowers must exercise caution:

Avoid Fraudulent Platforms: Stick to well-known loan providers with positive reviews.

Timely Repayments: Missing payments can lead to penalties and negatively impact your credit score.

Read the Fine Print: Ensure you fully understand the interest rates, repayment terms, and associated fees before accepting the loan.

Conclusion

Quick Loan in Uttar Pradesh have transformed the way individuals access financial assistance. They are fast, reliable, and tailored to meet diverse needs, from personal expenses to business investments. By choosing a trusted lender and borrowing responsibly, you can make the most of these quick and easy financial solutions. With minimal paperwork, flexible repayment options, and competitive rates, online loans are a boon for residents of Uttar Pradesh.

0 notes

Text

Business Registration Services We Offer || Global Taxman India Ltd

1. Business Registrations

GST Registration: Mandatory for businesses with an annual turnover exceeding ₹40 lakh. It ensures seamless tax compliance.

MSME Registration: Get recognized as a micro, small, or medium enterprise and avail government benefits.

Importer License: For businesses dealing in imports or exports.

FSSAI Registration: Essential for food-related businesses to ensure compliance with food safety standards.

Shop Act Registration: Ideal for shops and establishments to avoid penalties.

Trademark Registration: Protect your brand identity and intellectual property.

ISO Certification: Boost your business credibility with international quality certification.

ESIC/EPF Registration: Provide social security benefits to your employees.

2. Company Registrations

Private Limited Company: Best for startups and small businesses.

One Person Company: Suitable for solo entrepreneurs.

Nidhi Company: Ideal for finance and loan businesses.

Section 8 Company: Perfect for NGOs and non-profits.

Startup Registration: Avail tax benefits and other startup perks.

Producer Company: Great for agricultural businesses.

Public Limited Company: Suitable for large-scale operations.

Sole Proprietorship: Quick and simple business setup for small traders.

Partnership Registration: Great for businesses managed by two or more partners.

MCA Compliance and Tax Services

ROC Annual Filing: Annual compliance for registered companies.

GST Return Filing: Ensure timely filing of GST returns to avoid penalties.

Audit of Business: Keep your financials in check with professional audits.

Income Tax Return (ITR) Filing: Comply with income tax laws effortlessly.

Why Choose Global Taxman India?

At Global Taxman India, we provide end-to-end support for all your business registration and compliance needs. With our services spanning across Ranchi, Delhi NCR, Ghaziabad, Patna, Bihar, Jharkhand, Uttar Pradesh, and beyond, we ensure a hassle-free experience for entrepreneurs and established businesses alike.

Our Office Locations

Ghaziabad: C-19, Second Floor, near Vasundhara Hatt Complex, Sector 13, Vasundhara, Ghaziabad, Uttar Pradesh 201012.

Delhi NCR

Ranchi

Patna

Bihar

Jharkhand

📞 Contact us at:

Phone Number — +91–9811099550

website — www.globaltaxmanindia.com

Email- [email protected]

#accounting#finance#success#marketing#economy#taxation#gst registration#company registration#gst#itr filing

0 notes

Text

Get Personal Loan In Lucknow?

In need of an instant personal loan in Lucknow? As the capital of Uttar Pradesh, Lucknow is a city known for its rich cultural heritage and rapid modernization. With its thriving economy and growing business sectors, Lucknow provides a fertile ground for financial services to cater to the diverse needs of its residents. The city's expanding economy has made it an important destination for financial institutions to offer customised lending solutions. A recent report highlights the increasing demand for personal finance in Lucknow.

FastLoan offers instant personal loans in Lucknow at low interest rates, providing quick access to funds, urgent cash loans, or a line of credit with flexible and competitive terms to address your financial requirements.

0 notes

Text

Hero Bikes in Meerut: Affordable, Reliable, and Financed by Shree Shiv Shakti Automotive

If you're looking for a perfect blend of affordability, reliability, and convenience, Hero motorcycles are the ideal choice. For years, Hero has stood as a symbol of trust, offering bikes that are not just economical but also built to last. At Shree Shiv Shakti Automotive, we are proud to be one of the top Hero dealers in Meerut, providing the latest range of Hero bikes with unbeatable deals and finance options.

Why Hero Bikes are the Best Choice in Meerut

Meerut’s roads demand motorcycles that can endure daily wear and tear while providing comfort and fuel efficiency. Hero bikes, known for their durability and low maintenance costs, are a popular choice for students, professionals, and families alike. Whether you're navigating the busy streets or heading on longer journeys, Hero's range of motorcycles promises a smooth, efficient, and enjoyable ride.

Our Popular Models at Shree Shiv Shakti Automotive

At Shree Shiv Shakti Automotive, we offer a wide range of Hero bikes that suit every kind of rider. Some of our top models include:

Hero Splendor: A classic favorite, known for its mileage, affordability, and low maintenance. It's perfect for daily commuters.

Hero Xpulse: The adventure lover’s dream! This bike is rugged, built for off-roading, and packed with features that make it versatile for city and trail riding.

Hero Xtreme: For those who want a bit of thrill, Hero Xtreme is a sporty option that combines power and style.

Hero Scooty: Easy to ride, economical, and stylish, Hero scooters are a great option for anyone looking for convenience and comfort in city traffic.

Finance Your Dream Bike with Ease

At Shree Shiv Shakti Automotive, we understand that buying a bike is a significant investment. That’s why we offer flexible finance options to make your purchase as smooth as possible. We work with top financial institutions to provide you with easy loan terms, competitive interest rates, and quick approvals. Our finance services ensure that you can ride home on your dream Hero bike without breaking the bank.

Why Choose Shree Shiv Shakti Automotive?

When you choose Shree Shiv Shakti Automotive, you’re not just buying a Hero bike; you’re investing in a reliable dealership that values customer satisfaction. Here’s why we’re a top choice for Hero bikes in Meerut:

Experienced Staff: Our team is knowledgeable and passionate about Hero motorcycles. We guide you through the buying process, ensuring you find the perfect bike for your needs.

Top-notch Service: Beyond sales, we provide excellent after-sales services, including regular maintenance, repairs, and parts replacement.

Exclusive Offers: Enjoy special discounts, festive offers, and attractive exchange deals only at Shree Shiv Shakti Automotive.

Visit Us Today

Looking to buy a Hero bike in Meerut? Visit Shree Shiv Shakti Automotive today to explore our collection and experience hassle-free service. Whether you're buying your first bike or upgrading to a new one, we’re here to help you every step of the way.

Address: Ground Floor Modipuram, Meerut Bypass Road, Checkpost, near Modipuram, Meerut, Uttar Pradesh 250110

Contact: 092899 23014

Website: https://g.co/kgs/FScnNRn

0 notes

Text

Dairy Industry in India - UJA Market Report

India is the world’s largest milk producer

24% contribution to global milk production

India’s milk processing capacity is 126 million liters per day

For a decade, the country’s milk industry has been growing at a CAGR of 5.8%

Milk production in India registered more than 50% increase during the last ten years

Globally, India exported 67,572 million tons of dairy products during the year 2022–2023

80 million people are employed in the dairy sector

The industry contributes 5% to the national economy

Per capita availability of milk is 459 grams per day

Overview: Dairy Sector in India

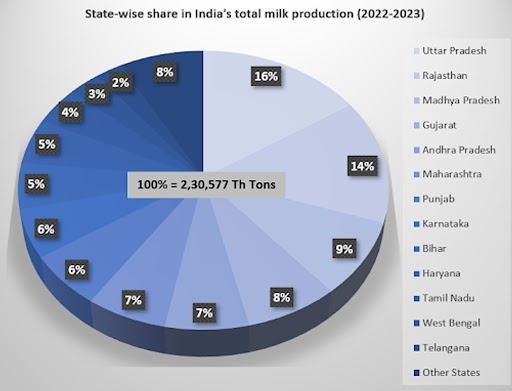

The top5 milk producing States are Uttar Pradesh, Rajasthan, Madhya Pradesh, Gujarat, and Andhra Pradesh. They together contribute around 53% of total milk production in the country.

The average yield per animal per day for exotic/crossbred is 8.55 Kg/day/Animal and for indigenous/non-descript is 3.44 Kg/day/Animal.

Milk production from exotic/crossbred cattle has increased by 3.75% and Indigenous/ non-descript cattle have increased by 2.63% as compared to the previous year.

The top13 states together contribute around 92% of total milk production in the country

India produced nearly 50% more milk than the US and more than three times as much as China.

The top5 milk producing States are Uttar Pradesh, Rajasthan, Madhya Pradesh, Gujarat, and Andhra Pradesh. They together contribute around 53% of total milk production in the country.

The average yield per animal per day for exotic/crossbred is 8.55 Kg/day/Animal and for indigenous/non-descript is 3.44 Kg/day/Animal.

Milk production from exotic/crossbred cattle has increased by 3.75% and Indigenous/ non-descript cattle have increased by 2.63% as compared to the previous year.

The top13 states together contribute around 92% of total milk production in the country

India produced close to 50% more milk than the US and more than three times as much as China.

India’s Dairy Industry Flow

The Indian dairy sector is divided into the organized and unorganized segments:

Unorganized segment consists of traditional milkmen, vendors, and self-consumption at home

Organized segment consists of cooperatives and private dairies

Indian dairy sector is dominated by an unorganized sector, selling 64% of the marketable surplus

Around 36% of the marketable milk is processed by the organized sector, with cooperatives & Government dairies, and private players contributing 50% each

Amul, the brand of Gujarat Coop Milk Marketing Federation (GCMMF) is the largest dairy co-operative and the largest organized player in India

It is the 9th largest dairy player in the world. It aims to be amongst the top 3 dairy players in the world. Amul plans to add 40–60 value-added products in the next 2 years.

Government & Milk Producers Initiatives

The governmentof India set up a 15,000 Cr fund for offering financial support to set up new units or expand existing units in areas of dairy processing & related value addition infrastructure, meat processing & related value addition infrastructure, and Animal Feed Plants. The benefits available are:

3% interest subvention on loans

2-year moratorium with 6-year repayment period

INR 750 Cr credit guarantee

The Rashtriya Gokul Mission has been extended till 2026 with an The INR 2,400 Cr commitment to boost productivity and milk output, making dairying more profitable for farmers.

50% Capital subsidy up to INR 2 Cr to eligible entrepreneurs, individuals, FPOs / FCOs, SHGs, JLGs, and Section 8 companies for the establishment of breed multiplication farms

Accelerated breed improvement program under the component subsidy of INR 5,000 for IVF pregnancy

National Program for Dairy Development (NPDD) scheme aims to enhance the quality of milk and milk products and increase the share of organized milk procurement, processing, value addition, and marketing. The scheme has two components:

Component ‘A’ focuses on creating/strengthening infrastructure for quality milk testing equipment as well as primary chilling facilities for State Cooperative Dairy Federations/ District Cooperative Milk Producers’ Union/SHG-run private dairy/Milk Producer Companies/Farmer Producer Organizations. The scheme will be implemented across the country for the period of five years from 2021–22 to 2025–26.

Component ‘B’ (Dairying Through Cooperatives) provides financial assistance from the Japan International Cooperation Agency (JICA) as per the project agreement already signed with them. It is an externally aided project, envisaged to be implemented during the period from 2021–22 to 2025–26 on a pilot basis in Uttar Pradesh and Bihar

In September 2023, AMUL had opened its 85th branch in Kutch, Gujarat. This new branch ensures the distribution of the entire range of Amul’s dairy products

In March 2024, Mother Dairy announced that it would invest INR 650 crore to set up two new plants for the processing of milk. The company will also invest INR 100 crore to expand the capacities

In December 2023, Karnataka Milk Federation (KMF) announced that the Company will start buffalo milk sales from December 21 in the country.

Want to know more info, click here https://uja.in/blog/market-reports/dairy-industry-in-india/

#Dairy Industry in India#Indian Dairy Sector#Dairy Sector#Milk Production#India’s Dairy Industry#Gujarat Coop Milk Marketing Federation#Rashtriya Gokul Mission#uja global advisory#uja global

0 notes

Photo

Making the Most of flats for rent in Ahmedabad

There are several compelling reasons to invest in Ahmedabad real estate. It is advantageous to have a flat in Ahmedabad Extension that is affordable and spacious. You can plan to support the real estate sector in this way and enjoy peace. If you need a standard location to reside and subsist, renting a flat in Ahmedabad is a good choice.

The Real Reasons for Renting a Flat in Ahmedabad

Here is a list of reasons and benefits that will convince you to rental flats in Ahmedabad. You can look over your possibilities and prepare to rent a home in this section of India.

You have the best reasons to invest in a 2 BHK flat for rent in Ahmedabad, and you can take advantage of the city's attractiveness. When you're in Ahmedabad, you'll feel like you're in a fancy neighbourhood, which will help you maintain a sophisticated demeanor throughout.

You can acquire a loan from SBI if you rent homes in Ahmedabad. You can even receive low-interest loans from other financial institutions. This will assist you in renting the house at the lowest price possible.

If you're looking to invest in rental flats in Ahmedabad, you can benefit from government incentives. This will enable you to rent the house for the lowest possible price.

The Pradhan Mantri Awas Yojana provides flats to renters in Ahmedabad Extension, which will make things more exciting this time.

Ahmedabad is the capital of Uttar Pradesh, and being a part of the houses with all the amenities will be an incredible sensation. It is a land of food and culture, and acclimating to the surroundings will be quick.

One of the reasons you should rent a house in Ahmedabad is that it goes above and beyond your expectations. It would be fantastic to buy plots here and be a part of the Ahmedabad Township.

The epicenters of rapid development are Uttar Pradesh and Ahmedabad. If you want to reside here, you can apply for a flat through the Ministry of Urban Development. These are wonderful residential solutions that will allow you to relax in quiet.

You may choose to have flats for rent in Ahmedabad because of the city's excellent road, rail, and air connectivity. The city is crossed by major highways, allowing for improved connection this time.

Renting or renting an apartment in Ahmedabad that is close to the city metro station is a wonderful idea. You can make use of the area's environmentally friendly attributes.

You must gather information about flats for rent in Ahmedabad, and once you have possession, you may enjoy the freedom of living. Getting the proper apartment in Ahmedabad will make it simple for you to stay connected to the rest of the city. Now you can stay here and carry on with your job and accomplishments for the rest of the time. The rented flats are perfectly sufficed with all essentialities, and this will make your stay highly comfortable.

0 notes

Text

Are You Finding Bank In Rural Areas?

Digi Sewa Pay service – Customer Service Point is a bank-led design that enables online interoperable commercial transactions like Cash Deposit/Withdraw & Mini Statement Enquiry through Aadhaar.Implementing Best Services to Retailers and Distributors with many new Features-

Domestic Money Transfer Features

"Single Page Remittance App" is an easy-to-operate and most user-friendly program where payment will move faster without OTP, IFSC and Bene computing. Financial Inclusion

AEPS

A bank-led model which provides online interoperable financial deals like Cash Deposit/Withdraw & Mini Statement Enquiry through Aadhaar.

Micro ATM Features:

Receive Payments or Withdraw on Your Smartphone/Tablet through our mATM Resolutions. Credit/Debit Card Accepted, Real-Time Settlement.

Insurance

Insurance is a record, interpreted by a policy, in which an individual or object receives financial security or compensation against loss.

MicroLoan Features:

Take Your Company to the Next Level With our Quick & Reliable Working Capital Loans. Payment - Document Upload - Get Offer - Loan Processed

Cash Collection

We empower your shop details like address, google location to clients Client send consumers directly to your shop, who want to transfer cash

Life Insurance:

Life Insurance of 2 Lakhs

Simple Application Process

Higher Margin Structure

Affordable Life Cover

BBPS & Recharge:

Mobile, DTH, Data Card & Postpaid

Utility Bill Payment

Automatic Refund Process

Rural banking is simply banking assistance that assists more modest, rural communities. They manage to be deeply embedded in the areas they serve.

In other words, rural banks accept savings, grant credit, secure proper monetary accounting, hold securities and most important of all, engage in any business activity that will improve social and economic development. The Central Bank exercises supervisory authority over all rural banks as a statutory function.

What is the role of rural banks?

Banking in rural areas play a crucial role in supporting inclusive development, particularly in the country by giving credit to primary food producers such as farmers, fisherfolks and small businesses that usually belong to the most marginalized areas of the economy.

MitrSewa (group of companies) is an independent organization of dedicated scenarios working for the cause of financial inclusion, social development, women empowerment, farmer welfare, enabling digital ecosystem and bank mitras.

MitrSewafoundationLimited is an Uttar Pradesh based company recorded on 20th Jan 2021 under the Companies Registration Act.

Our Assistant Concern MitrSewa Foundation welfare is a fine organisation of Mitr Sewak situations working for the cause of financial inclusion, social development, women empowerment, farmer welfare, enabling digital ecosystem, and strengthening Bank Mitras. The purposes of MitrSewa Foundation benefit are as follows:

Financial inclusion:

1) of previously suspended sections of the society

2) through Women Empowerment

3) with the help of FinTech

4) through Digital Payments

5) Enable farmers to double their income

6) By enabling and handholding Bank Mitras

The actions of MitrSewa Private Limited are as follows:

Women & Farmer Empowerment

Banking Outlet/ Business Correspondent Services

Distribution of Insurance Product

MitreStore (E-Commerce Portal) Vocal for Local

Mitr Easy Store

Composite Carrier Settings of multiple companies

0 notes

Text

How To Find An E-Stamp Near Me?

E-stamps are getting popular in Online Legal Documentation processes. It is an electronic way to get stamps on documents and pay the stamp duty online. The government of India is trying to make e-stamping, counterfeiting, and paying off the stamp duties in a straightforward process. Stamp papers are required for many purposes.

You will need stamp paper in Online Rental Agreement, mortgages, loans, etc. You can approach vendors to get the E Stamp Paper Online, but people are moving forward to an accessible online medium and using e-stamping on a large scale. Many states in India like Karnataka, Haryana, Himachal Pradesh, Uttar Pradesh now have EC Certificate Online through government websites.

Sometimes, it becomes challenging to find the right vendors for legal documentation, and people do not know how to get any. That’s where e-stamping change the game and help you have quick access to e-stamp papers with payments options for stamp duties along with it.

Everyone knows that Stamp duty is a must for all property-related transactions. Stamp duty is a type of tax paid to register your document as an agreement between two or more parties with the registrar. If you google search e stamp paper near me, then Doqfy is your one-stop solution.

Doqfy provides a convenient way to get your e stamp paper online, legally and accurately. Through e stamping, you can pay stamp duty in no time and from the convenience of home. Stamp duty is a tax levied by the government and is essential to be paid on all documents regarding the transfer of properties.

Stamp duty is a tax paid to register your document as an agreement between two or more parties with the registrar. If you google search e stamp near me, then Doqfy is your one-stop solution. Doqfy provides a quick and secure way to pay stamp duty online.

E-stamping is a speedy and easy process as you can digitally sign anytime, anywhere. Every website has legal authentication and security for its users and helps them in their legal documentation. Even if you do not have any lawyer or trouble finding legal vendors near you, go to the Doqfy website and make your work done in no time.

Not every stamp has the facility of Married Certificate and E-stamping, which is why you can check that on government websites. Nowadays, you can file taxes online and make digital payments for everything. The government of India is initiating these facilities for their services too and helping the ordinary person in every way it can.

E-stamping is not a highly complex process, and you can do it at home with the help of online legal vendors. You can also file stamping and franking paper online, even get an EC certificate on your doorstep in just a few steps. Cut down your rigid duties with online methods of Legal Documentation and Franking live an easy life.

#Legal Documentation#E-stamping#Franking#Married Certificate#EC Certificate Online#E Stamp Paper Online#Online Rental Agreement

0 notes

Text

Small biz, big trouble: Covid-19 disruption might prove fatal for many of India’s MSME units

New Post has been published on https://apzweb.com/small-biz-big-trouble-covid-19-disruption-might-prove-fatal-for-many-of-indias-msme-units/

Small biz, big trouble: Covid-19 disruption might prove fatal for many of India’s MSME units

In the afternoon of April 23, Thursday, more than 100 small businessmen around Mumbai and Thane met through a conference call over the online conferencing software Zoom, to discuss the reopening of businesses after the lockdown. There was a quick consensus in the meeting that went on for nearly two hours — no one is ready to restart immediately. The supply chains for raw material simply do not exist at this point, even though some units have permissions to operate and others are expecting it in early May.

The meeting, organised by the Mumbai-based IMC Chamber of Commerce and Industry, had businessmen seeing May-end as a plausible date for reopening. But there was another, more startling, consensus emerging at the meeting organised to discuss a reopening playbook — at least 25-30% of the businesses would not survive the crisis created by the Covid-19 pandemic.

ET Magazine spoke to a dozen businessmen from across India — owners of businesses that fit into the category of micro, small and medium enterprises (MSME) — and found that this feeling of staring at an abyss was pervasive. The biggest worry is, of course, a liquidity crunch, followed by a disrupted supply chain and labour availability. The sector employs almost 12 crore people, making a large number of the country’s households dependent on the 63 million MSME units. It also accounts for a third of India’s manufacturing output and 45% of exports.

Many units have paid their workers wages for March in full and are prepared for April payments. While there are no revenues now, there is a government mandate to keep paying salaries and wages. There are other bills like electricity and water that also have to be paid. But without revenues or substantial government support, there is no way they can carry on in May and beyond. “Wages and salaries are the biggest issue, and everyone is sweeping it under the carpet,” says Ashish Vaid, president of the IMC that is also a federation of 170 industry associations from western India.

Labour Lost Vaid, himself a realtor with annual sales of Rs 200 crore, says all MSMEs should be eligible for bank loans equivalent to three months wages at repo rates. Multiple industry associations, including the Confederation of Indian Industry, have petitioned the government for a bailout package for the MSME sector (essentially all businesses with capital investments up to a maximum of Rs 10 crore).

Apart from loans to cover wages, there are othercommon requests like suspension of contributions to employee’s provident fund and Employee State Insurance Corporation (ESIC) for six months. Some demand that there should be a clawback of GST that has already been paid. Easier access to bank loans, especially at low rates, with help from the state and central governments, is another common theme, as is a moratorium on repayments for six months and a 25% increase in working capital loans. Seeking more loans and a simultaneous moratorium on repayments are also a sign of underlying desperation in the sector.

Take first-generation entrepreneur Raja Shanmugam of Tiruppur. His 31-year-old knitted T-shirts manufacturing unit Warsaw International employs 650-800 workers. At least 150 workers are currently lodged in the company’s hostels at Tiruppur. It is a labour-intensive industry and the annual wages bill is almost 30% of sales. Payment from his Indian as well as European buyers stopped in March, and Shanmugam has not been able to ship completed orders either. He wants the government to use ESIC money to take care of the workers’ wages from April onwards.

DK Aggarwal, president of PHD Chamber of Commerce and Industry, an association of MSME organisations across states, says restarting units won’t be easy because of the liquidity crunch that the sector is facing. “Cash flow has stopped.

After paying April salaries, all MSMEs will be hand-to mouth.

Plus, there will be no demand, and workers would have also left for their villages.”

Reopening plants in May could lead to revenue flows restarting. But things won’t be so smooth. While there is general consensus that businesses should pay their workers through the lockdown, there are several restrictions on the use of the same workforce once a factory reopens.

Strict rules for social distancing while reopening are not viable for manufacturing units, especially MSME units that have small premises. Nayan Patel, a former president of IMC, explained that his own business, which makes motion control devices, needs a 150-member shift, with multiple processes, that cannot operate with fewer people.

The layout and configuration of machinery and workstations are such that it cannot be done. Many from across the country echo Patel’s view. For Jaipur-based switchgear maker Anil Saboo, the biggest worry is labour shortage, as many employees have left for their states in eastern India.

“There are 15 men living inside my factory today, but the moment the lockdown is lifted, they want to leave for home,” Saboo says.

Gurgaon-based Dev Goel, who runs a package substations and switchboard plant from Manesar, sees a big worry in maintaining social distance inside the factory while labourers work as welders, or lift large items. There was a fear of police action and FIRs being registered against factory owners if these norms were not followed and negligence led to Covid-19 infections in workers. The central government clarified last week that no businessperson will be arrested for workers getting infected with Covid-19 after reopening. However, restrictions have created impediments. Goel said almost 95% of the members of the Manesar Industries Welfare Association have decided to wait and watch and not rush into reopening their plants, in spite of having permission to restart.

Or, take the case of Chetanbhai Makwana, who runs a medicated soap manufacturing unit at Gheekanta, Ahmedabad. Makwana had started his soap unit as an essential service, with 20% staff, but had to shut it down on Friday as only one worker turned up for work.

Broken Chains Apart from cash crunches and labour dislocation, there are serious supply chain and regulatory issues that have affected the MSME sector.

For instance, permissions to restart operations do not come easily, even if you are deemed as an essential service. Amit Seksaria, managing director of RRL Steels Group in Kolkata, says he received a letter from Coal India on April 8, asking him to restart operations. His unit makes ground engaging tools for coal mining and hence is deemed to be an essential service linked to the power sector. However, his application for restarting, filed with the state government, is yet to elicit a reply. While one of his units is in a Covid-19 hotspot, the other one is in a rural area. Seksaria also exports to the Netherlands and Spain and export consignments have been loaded on containers at his factory near Kolkata for orders from these countries. “I am receiving urgent missives from my European buyers but I am not able to send these containers to the Haldia port, which I am told is operating,” Seksaria says.

An injection-moulding unit owner in Daman said he is in a similar predicament, as he manufactures packaging material for the pharmaceuticals industry, but his application for restarting his unit has been stuck at the collector’s office, while some of the larger plants have got permission. Unwilling to be quoted, he says that as a buyer of polypropylene from very large petrochemical companies and a supplier of bottle caps to big pharmaceutical companies, his cash flow is usually squeezed as he has to buy with cash and supply on credit. The crisis has aggravated his problem.

In large parts of Uttar Pradesh, while there is no ban, the non-vegetarian food chain has virtually shut down. Eggs, though, are selling. Mukul Tandon, president of the Merchant’s Chamber of Uttar Pradesh, owns a poultry business, with 75,000 eggs per day. “The retail channels have collapsed and we do not know how to sell the eggs. The industry as a whole in the state produces almost 6 lakh eggs per day. While costs are Rs 3.75 per egg, I am forced to sell them at Rs 2-2.5,” Tandon told ET Magazine.

Nitin Gadkari’s interview by Prerna Katiyar Various MSME chambers have sought relief measures. Is the government thinking of a package for MSMEs? To mitigate the impact on MSME sector, the RBI (Reserve Bank of India) has announced a set of relief measures on March 27. A second set of measures was announced on April 17. These measures were primarily meant to maintain adequate liquidity in the system, facilitate and incentivise bank credit flows, ease financial stress and enable the normal functioning of the sector.

The road ahead is not easy. As a nation, we need to fight this together. Industry associations have highlighted their demands in my interactions. Some suggestions require total government support, while others require policy changes and facilitation. We can’t be guided only by the response of other countries. Our economy has its own unique features and hence its own requirements for a return to normalcy. I can assure you that PM Modiji is fully aware of the situation and under his leadership we will be able to chalk a way forward for supporting MSMEs in the best possible way.

Is there any plan to help MSME units with wage payment if lockdown continues beyond May 3? The government on March 26 announced a Rs 1.7 lakh crore relief package under the Pradhan Mantri Garib Kalyan Yojana (PMGKY) for the poor to help them fight the battle against the coronavirus pandemic. As part of the said package, the Centre proposes to pay the EPF (Employees’ Provident Fund) contribution for next three months of certain categories of employees.

Our objective is to get the best impact of government support not only for MSMEs but also for the poor. There has to be a balance and the result should be the highest impact of government support on society.

The threat of an FIR in case a new infection is detected at a factory has scared many MSME owners. Would you like to reassure them? Social distancing is a reality. The Home Ministry has issued several orders and guidelines, which provide the framework for economic activity to resume, respecting norms of social distancing and personal hygiene. Industrial units and business establishments need to reinvent their workspaces to comply with the guidelines for their own safety as well as the safety of the workers. The Home Ministry has also clarified that the lockdown guidelines should not be misused to harass the management of manufacturing and commercial establishments. That should help in addressing any fears. We are proactively dealing with such issues.

Once business is disrupted, it is difficult for smaller players to recoup and restart. Seksaria says that unless there is an opportunity to start production in May, businesses will start crumbling. Goel of Manesar adds, the lockdown may be followed by lockouts.

Not every MSME business owner is pessimistic.

Bhopal-based entrepreneur Kunal Giani says his motto of constantly focusing on cash flows and staying debt free has held him in good stead today. Giani started his business in rebonded foam, a raw material for mattresses, in 2011, straight out of college. Giani’s father, a banker, had taken voluntary retirement in 2006 to start the business. Bad luck struck and he died in an accident before he could start.

Young Kunal completed his engineering education and took on the mantle.

No one was ready to lend to a young man selling mattress foam on a bike. The company is a debt-free operation today.

With sales of Rs 110-135 crore and two plants, one in Bhopal and another in Uttar Pradesh’s Secunderabad, Giani says he is in a good position to pay salaries for April. The raw material stock, chemicals imported from Southeast Asia, can also last a few months. The lockdown has, of course, impacted his plans to start a new factory in Colombo to supply the south Indian markets. It has also affected the launch of a new product, a mattress that comes in a box, priced at Rs 1,000.

Giani’s firm Sarva Foam Industries is an exception.

But he, too, wants to borrow today and is seeking easier access to credit. However, most small businesses in India are not built like that, points out Nayan Patel. “MSME businesses are usually a month-to-month operation, with little reserves for the future. A disruption like this might just mean restarting everything,” Patel says.

Therefore, a lot of hope is now pinned on moves by the government of India and state governments. Various MSME bodies have even sought income-tax sops. Many MSMEs operate as sole proprietorship firms or partnerships, and are not eligible for the lower corporate tax rates, announced by the finance minister in mid-2019. The US has announced a $484 billion stimulus package for small businesses. The MSME entrepreneurs are hoping that Finance Minister Nirmala Sitharaman will draw some inspiration from it and announce a package for Indian small businesses too. After all, her first package of Rs 1.7 lakh crore also drew inspiration from US action. Others, knowing the Indian government has little leeway, have set their eyes on social security funds like the EPF or the ESIC. For a large and critically important sector that generates a large number of jobs and supplies components for nearly every product that we use, no easy solutions are in sight.

In a Fix Over Accommodation by Prerna Katiyar It is 6 am when a bus pulls into Bhangel in Noida. A handful of employees of Medico Electrodes International Limited form a queue to board the vehicle provided by their employer. But first, an attender checks if they are wearing masks properly and sprays sanitisers on their hands. The bus is filled from the back — one in each seat, every other row. Except for the occasional ringing of mobile phones, the ride to office is eerily silent.

Medico, which makes disposable ECG electrodes, picks up its workers from multiple locations in a 3-4 km radius around its factory in Noida special economic zone (SEZ). It takes adequate precautions. “The buses are disinfected after every trip,” says company’s CMD Amit Mehra. “So is the factory after every shift.”

Before they enter the factory, workers also go through a thermal screening and hand washing-sanitising routine. They also get fresh masks are head caps.

In the shop floor, they work on alternate machines to ensure social distancing.

Employees maintain social distancing on the work floor

Medico, classified as an essential service unit, has been working at 50% staff capacity with 300 workers across three shifts since the lockdown. CMD Mehra has been busier than ever, juggling between video-conferencing with staff working from home and domestic and foreign clients. He visits the production floor regularly to check social distancing and other sanitation arrangements. “We give free ration to all workers every fortnight, provided additional Rs 3 lakh Covid-19 insurance cover and are providing transportation services,” he says. Regular counselling is also provided to help workers.

But Mehra, who managed to run his operations through the severe lockdown, faces a serious problem as the government partly opens economic activities.

An order issued on April 22 by the deputy commissioner of the district industries centre, Gautam Buddh Nagar, to provide accommodation to workers within or nearby factory has put him in a bind. “We have three days to comply with the order or shut shop. How can we make such arrangements for 250 people so fast? Besides, will the families of our 60-odd women workers allow them to stay at factories? We are a healthcare unit. Do we shut down now?” says Mehra.

As such, the operations at Medico had slowed due to social distancing. During lunchtime, only one worker is allowed to sit in a table. So it takes almost three hours for the entire team to finish their meals and return to work after a round of sanitisation.

Medico employees undergo a temperature check before boarding the company buses

The situation is almost same at the 13 essential sector units among the 250 factories operational at Noida SEZ now. As the morning shift comes to an end at Medico, workers toss the used head caps and masks in a bin, wash and sanitise their hands and wear fresh face covers. Soon they line up a metre apart to board the buses for a ride back home. All in a day’s work now.

if(geolocation && geolocation != 5 && (typeof skip == 'undefined' || typeof skip.fbevents == 'undefined')) !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '338698809636220'); fbq('track', 'PageView');

Source link

0 notes

Text

Running a business in Uttar Pradesh, whether in bustling cities like Lucknow or smaller towns, often requires financial support. Business loans provide the much-needed capital to grow, manage expenses, and achieve success. In this article, we’ll explore how to get a business loan in Uttar Pradesh, its benefits, and how you can apply easily.

Why Businesses in Uttar Pradesh Need Loans

Businesses, big or small, need funds to thrive. Here are some key reasons why a loan in Uttar Pradesh is helpful:

Expansion: Opening a new shop, factory, or office often needs significant investment.

Daily Operations: From buying stock to paying rent, loans help manage daily expenses.

Upgrading Equipment: Modern machinery or tools can boost efficiency and profits.

Seasonal Support: Businesses with seasonal demand, like tourism or farming, can use loans to cover off-season costs.

Benefits of Quick Business Loans

Getting a business loan comes with several advantages:

Fast Approvals: Many lenders now process loans quickly, sometimes within 24 hours.

Flexible Repayment: Repayment terms can be customized to suit your business needs.

Collateral-Free Options: Some lenders offer unsecured loans, which means you don’t need to pledge assets.

Online Applications: You can apply for loans easily from the comfort of your home or office.

Who Can Apply for a Business Loan in Uttar Pradesh?

Applying for a business loan in Uttar Pradesh is straightforward. Here’s what you need:

Eligibility:

Age: 21–65 years.

Business Age: The business should be running for at least 1–2 years.

Documents Needed:

Identity proof (Aadhaar, PAN).

Business proof (registration or GST certificate).

Bank statements (last 6 months).

Steps to Apply for a Loan in Uttar Pradesh

Here’s a simple process to get started:

Research Lenders: Look for banks, NBFCs, or online platforms offering business loans.

Fill Out the Application: Visit their branch or website and complete the form.

Submit Documents: Provide the required paperwork for verification.

Approval and Disbursement: After approval, the money is transferred to your account.

Types of Business Loans Available

There are different loans to meet your needs:

Working Capital Loans: For managing daily expenses like inventory and payroll.

Term Loans: Long-term loans for bigger projects like expansion.

Equipment Loans: To buy or lease machinery.

Government Schemes: subsidized loans like MUDRA or Stand-Up India.

Government Schemes for Business Loans in Uttar Pradesh

Uttar Pradesh entrepreneurs can also benefit from these initiatives:

MUDRA Loans: Loans up to ₹10 lakhs without collateral for small businesses.

PMEGP: Financial aid for setting up new microenterprises.

Stand-Up India: Loans for SC/ST and women entrepreneurs.

Choosing the Right Loan

When selecting a loan, keep these points in mind:

Compare Rates: Look for lenders offering low interest rates.

Check Repayment Terms: Choose flexible terms that match your cash flow.

Read Reviews: Ensure the lender has good customer feedback.

ConclusionSecuring a business loan in Uttar Pradesh is now simpler than ever, thanks to online platforms and government support. Whether you need funds to expand your business, manage daily operations, or invest in equipment, there’s a loan option for you. With quick approvals and easy applications, you can focus on growing your business without financial worries.

0 notes

Link

READ MORE-Get Instant Personal Loan, Advance Salary Online, Short term Loans | Phocket

Instant Loan in Delhi NCR, Personal Loan in Delhi NCR | Phocket

The National Capital Region (NCR) is a coordinated planning region centered upon the National Capital Territory of Delhi (NCT) in India. It encompasses the entire NCT of Delhi and several districts surrounding it from the states of Haryana, Uttar Pradesh.

Feeling a fund crunch for your necessities? There's an easy solution to all your cash problems NCR, with Instant Cash Loans from Phocket. Phocket provides Instant Cash to Salaried Professionals between INR 5,000 and 1,00,000 with single EMI option for loans up to INR 10,000, flexible EMIs option (1/2/3) for loans greater than INR 10,000 in Delhi NCR. Our process is super fast and fully automated and instant cash is processed on the Same Day in Delhi NCR. The Instant cash loan can be taken for multiple purposes like Meeting EMIs, Credit card payment, Education loans, Travel loans, House renovation, Medical emergencies, Shopping and even for Festivals or Celebrations. Phocket's Instant cash helps you not to worry about the cash shortage problems and let Phocket take care of your financial requirement in a hassle-free manner. Take Phocket's Instant Cash Loans and feel the difference from other instant cash loan providers in Delhi/ NCR.

Follow the following steps to avail the Phocket's Instant Cash -

Visit our Website phocket.in or download our mobile app from Google Play Store Fill Out a Quick Application Form, Upload the required documents and Submit your application to avail Instant Cash. READ MORE-Get Instant Personal Loan, Advance Salary Online, Short term Loans | Phocket

0 notes

Text

Shivalik Mercantile Co-operative Bank Ltd.

Shivalik Mercantile Co-operative Bank Ltd.

Shivalik Mercantile Co-operative Bank Ltd. Saharanpur. largest & multi-state co-operative bank in Uttar Pradesh offer gold loan interest rate with attractive interest rates and loan is a quick, safe and secure your loan against gold. We also make your banking by giving best banking services such as services net banking, internet banking best aeps services, best bank interest rates, loan against…

View On WordPress

0 notes

Text

Business Loan and Funding in Meerut

Meerut Business Loan - Apply for Business Loan and Funding in Meerut Check your eligibility and apply at firstentry. Compare Business Loan interest rates of different banks in Meerut. ... What is aBusiness Loan? Any person wanting to start a business or any individual wanting to expand their business need funds to do so

Business Loan Providers in Meerut, Uttar Pradesh. Get contact details and address of Business Loan firms and companies in Lucknow With funds at your disposal, you can now expand your business without hesitation So the Business Loan and Funding in Meerut is just few steps ahead of you, follow the following more

Business Loans in Meerut - Quick, easy & instant small business loan providers, lenders, brokers, consultants for firstentrycompanies with latest interest rates. Compare & apply to multiple banks for Business loan in Meerut.

http://www.firstentry.in/service/business-valuation

#Business Loan and Funding in Meerut#Business Loan and Funding in Lucknow#Business Loan and Funding in Meerut Business Loan and Funding in LucknowBusiness Loan Funding in Lucknow Funding in Meerut

0 notes

Text

Chhattisgarh: Incredible Expansion by Brijmohan Agrawal in Fisheries

Chhattisgarh has achieved major success in fish production under the invaluable guidance of Cabinet Minister Brijmohan Agrawal. The production is escalating at a quick pace. The production of fishes was about 2 lakh 51 thousand 315 metric tons until December 2015. Earlier in the year 2004-05, the production of fishes was around one lakh 20 thousand metric ton. There was an increase of 25 lakh metric ton in the past 12 years. Chhattisgarh is the largest producer of fish in the whole country. The State is independent in fish seeds’ production. Around 25 crore fish seeds had been produced in the year 2001-02 and it had increased to 135 crore fish seed in the year 2015-16. Two lakh fishermen are employed in the sector.

The State Government had taken several reliable & effective measures to surge fish production. Fingerlings of size 75 mm are being supplied to the fish farmers. Besides, Banks are willingly giving away loans worth Rs. One lakh at one percent interest rate to the farmers to boost fish production. Around 2975 kilogram per hectare fish is produced in village fish ponds, 19 kilograms in big ponds and 98 kilograms fish per hectare in medium-sized fish ponds.

Rare and extinct types of fish like Mangur, Chipala, Pabda are being grown. Mangur Hatcheries had been set up at Raipur, Korba, Kabhirdham, Korea, Bilaspur, Kondagaon and Durg districts to produce Mangur fish seeds. Sea Prawns (Vinnebai Species) are being grown in Dhamtari district which is on the verge of extinction. Twenty-five metric ton Prawns had been produced at the site.

The State is among the top in Cage Culture across pan India. Chhattisgarh Minister encouraged farmers living near Sarodasagar and Shirpaani water reservoirs in Kabhirdham district, Dhanda water bodies in Bilaspur, Jhumka waters in Korea district and Tauranga Waters in Gariyabandh district. Four metric ton fish is being produced at every Cage Culture. Till now 475 metric ton fish had been produced in Cage culture. Fish farmers and officers from across borders visit Chhattisgarh to observe Cage Culture and its advantages. The progressive farmers from Odisha, Maharashtra, Jharkhand, Bihar, Tamil Nadu, Andhra Pradesh, Uttar Pradesh, West Bengal and Himachal Pradesh had visited the State and learned the techniques.

Financial assistance is being given to rear fish at six thousand hectare water bodies. About Rs 78 lakh 69 thousand had been given as financial assistance in the year 2013-14. Around 3.14 lakh metric ton fish had been produced in the year 2014-15. The progressive farmers are producing 8,000-12,000 kilogram fish (Katla, Rohu, Mrugal) per hectare.

There are sufficient ponds, water bodies and rivers to produce fish of any variety in the State. Remote detecting survey will be done soon. Eight districts are in the list of the first survey. Digital maps will be prepared. All details relating to fish rearing will be available online.

0 notes

Link

Instant Loan in Ghaziabad, Personal Loan in Ghaziabad | Phocket

Instant Loans in Ghaziabad Ghaziabad is a city in the Indian state of Uttar Pradesh. It is sometimes referred to as the "Gateway of UP" because it is close to New Delhi, on the main route into Uttar Pradesh. It is a part of the National Capital Region of Delhi.

Feeling a fund crunch for your necessities? There's an easy solution to all your cash problems Ghaziabad, with Instant Cash Loans from Phocket. Phocket provides Instant Cash to Salaried Professionals between INR 5,000 and 1,00,000 with single EMI option for loans up to INR 10,000, flexible EMIs option (1/2/3) for loans greater than INR 10,000 in Ghaziabad. Our process is super fast and fully automated and instant cash is processed on the Same Day in Ghaziabad. The Instant cash loan can be taken for multiple purposes like Meeting EMIs, Credit card payment, Education loans, Travel loans, House renovation, Medical emergencies, Shopping and even for Festivals or Celebrations. Phocket's Instant cash helps you not to worry about the cash shortage problems and let Phocket take care of your financial requirement in a hassle-free manner. Take Phocket's Instant Cash Loans and feel the difference from other instant cash loan providers in Ghaziabad.

Follow the following steps to avail the Phocket's Instant Cash -

Visit our Website phocket.in or download our mobile app from Google Play Store Fill Out a Quick Application Form, Upload the required documents and Submit your application to avail Instant Cash. READ MORE-Get Instant Personal Loan, Advance Salary Online, Short term Loans | Phocket

0 notes

Link

Instant Loan in Noida, Personal Loan in Noida | Phocket

Located in Gautam Buddha Nagar district of Uttar Pradesh State, Noida is a short form for the New Okhla Industrial Development Authority.

Feeling a fund crunch for your necessities? Well, Noida, cash problems are a thing of the past with Instant Cash Loans from Phocket. Phocket provides Instant Cash to Salaried Professionals between INR 5,000 and 1,00,000 with single EMI option for loans up to INR 10,000, flexible EMIs option (1/2/3) for loans greater than INR 10,000. Our process is super fast and fully automated and instant cash is processed on the Same Day in Noida. The Instant cash loan can be taken for multiple purposes like Meeting EMIs, Credit card payment, Education loans, Travel loans, House renovation, Medical emergencies, Shopping and even for Festivals or Celebrations. Phocket's Instant cash helps you not to worry about the cash shortage problems and let Phocket take care of your financial requirement in a hassle-free manner. Take Phocket's Instant Cash Loans and feel the difference from other instant cash loan providers in Noida.

Follow the following steps to avail the Phocket's Instant Cash -

Visit our Website phocket.in or download our mobile app from Google Play Store Fill Out a Quick Application Form, Upload the required documents and Submit your application to avail Instant Cash. READ MORE-Get Instant Personal Loan, Advance Salary Online, Short term Loans | Phocket

0 notes