#Quarterly Federal Excise Tax

Explore tagged Tumblr posts

Text

from @/wtp.resist on Instagram:

Tax Day is Monday, April 15th... just 4 days away ‼️ 💸 ⠀⠀⠀⠀⠀⠀⠀⠀⠀ Follow this outline for an easy-to-understand guide on how to participate in war tax resistance this year. If you are unable to participate in war tax resistance but still wish to legally protest, please see slide #7. We want to encourage people to think big and act with courage, but we also understand not everyone can resist in the same way, so we wanted to provide several measures of resistance and resistance support in our Act I — War Tax Resistance — Tax Blackout 2024 Campaign. ⠀⠀⠀⠀⠀⠀⠀⠀⠀ Our #TaxBlackout goal is 50 million people... with 16% of the U.S. population participating with at least 5% being redirected to vetted emergency relief in Gaza, Washington D.C. will receive a message loud and clear: ⠀⠀⠀⠀⠀⠀⠀⠀⠀ We will not fund Genocide and Imperialism!

transcript of all slides under the cut

slide 1: Act I Tax Resistance

by @ WTP.resist / We the People

The Tax Blackout 2024 Guide

Tax Resistance

slide 2: Is It Illegal?

Taking any type of direct resistance or civil disobedience action for peace often means taking risks. War tax resistance is no exception.

Since World War I, only two war tax resisters (James Otsuka (1949) and J. Tony Serra (2005)) have been brought into Federal court, convicted, or jailed because of war tax resistance. Most resisters have been taken to court for failure to file, "falsifying" 1040 forms, contempt of court (by refusing to produce records), or (in the early 1970s) "fraudulently" claiming too many dependents on their W-4 form.

slide 3: Filing And Refusing - Step-By-Step

How to File as a War Tax Resister (typical process):

1. File your Form 1040 on or before April 15

Fill out the form per IRS filing instructions. To avoid being considered a "frivolous filer" (an IRS category) and being subject to frivolous filing penalties, do not make claims or write your thoughts on the form.

2. You can enclose a letter that explains your refusal to pay part (or all) of your taxes

Many war tax resisters send letters to explain their refusal to pay is an act of conscience, of civil disobedience. War tax resistance is about refusal to pay for war, not promoting tax evasion or challenging the constitutionality of taxation or war taxes.

slide 4: Filing And Refusing - Step-By-Step

3. Refusal Options:

Refuse a symbolic amount, a percentage (at least 5%), or refuse all of the federal income tax (see next slides).

4. Withholding Adjustments:

Salaried employees can increase the # of deductions on their W-4 form at any time to owe federal income taxes on April 15, and then can choose how much you want to refuse. Take the form home fill it out and return only the first page of the form, not the worksheet (page 3), to your employer. If you are self-employed and don't use a W-4 form, you must adjust the amount of estimated taxes you pay quarterly to resist when you file.

slide 5: Methods Of Resistance

1. File and Refuse to Pay

This involves filling out a 1040 form and refusing to pay either a token amount of your taxes (we are asking at least 5%) a percentage representing a "military" portion, or the total amount (since a portion of whatever is paid still goes to the military).

2. Refuse to File a Tax Return

NWTRCC recommends filing your taxes or the IRS will file on your behalf. They cannot garnish wages until the tax debt has been assessed, which can take some time. The statute of limitations begins at the point the tax is assessed.

slide 6: Methods Of Resistance Continued

3. Earn Less Than The Taxable Income

This can involve having such a low income that you are not required to file federal income tax returns (approximately $12,550 for a single person in 2021), or it can mean filing and taking deductions so that no income tax is owed.

4. Tariffs and Excise Taxes

Today, thousands of people continue to "Hang Up On War" by refusing to pay the small amount on their local telephone bill listed as "Federal Excise Tax" or "Federal Tax." This federal excise tax, like many others, pays into the general fund of the U.S. government - the same place your federal income taxes go. The monies in the general fund help to pay for the Pentagon, the militarization of our culture, and war.

slide 7: Ways To Legally Resist

Send a letter of protest with your 1040 tax form. Enclose it along with (but do not staple it to) your form. Send copies to your elected officials.

Write letters to editors protesting taxes for war, especially when people are thinking about taxes during tax filing season between January and April.

Write a message of protest on the check you send with your tax forms.

Pay the tax with hundreds of small-denomination checks or coins.

Lobby for Peace Tax Fund legislation that would allow conscientious objectors to pay taxes to a fund that would not be used for military spending.

slide 8: Remember!

If at any time you have questions about risks and how to prepare:

War Tax Resistance Counselor: NWTRCC.org/resist/contacts-counselors

War Tax Resistance Hotline: TEL: +1-800-269-7464

slide 9: Sources

Is It Illegal?

nwtrcc.org/resist/consequences

Methods of Resisting:

nwtrcc.org/resist/how-to-resist/

Legal Protest

nwtrcc.org/resist/how-to-resist/

Step-By-Step

nwtrcc.org/resist/war-tax-resistance/filing-and-refusing-step-by-step/

Tax Withholding Calculator

irs.gov/individuals/tax-withholding-estimator

#tax resistance#war tax resistance#we the people#free palestine#palestine#EndIsraelsGenocide#tax blackout 2024#anti imperialism

29 notes

·

View notes

Text

What Is Excise Tax Registration and Return Filing, and How Can You Benefit From It?

Excise tax registration and return filing is a crucial process for businesses that deal with specific goods and services subject to excise tax, such as tobacco, energy drinks, and carbonated beverages. If your business is involved in producing or distributing these products, it is essential to understand how excise tax registration and return filing work. This guide will help you navigate the process, ensuring compliance with the law and avoiding penalties.

What Is Excise Tax?

Excise tax is a tax levied on certain goods that are harmful to human health or the environment. In many countries, including the UAE, excise tax is applied to products like tobacco, alcohol, sugary drinks, and other harmful goods. The purpose of this tax is to reduce consumption of these products and encourage healthier lifestyles. As a business dealing with excisable goods, you are required by law to register for excise tax and file returns regularly.

Why Is Excise Tax Registration Important?

Excise tax registration is mandatory for businesses that import, produce, or stock excisable goods. Failing to register for excise tax can lead to severe penalties and legal issues. By completing the excise tax registration process, you ensure that your business is operating legally and is in compliance with the tax authorities' regulations.

Additionally, excise tax registration allows your business to stay on top of tax obligations and avoid any potential delays or fines. It also demonstrates that your business is committed to meeting legal requirements, which can enhance your reputation among customers and stakeholders.

How Can You Register for Excise Tax?

Registering for excise tax involves submitting your business information to the tax authorities. In the UAE, businesses can register for excise tax through the Federal Tax Authority (FTA) online portal. The registration process is straightforward and involves providing details such as your company name, license number, and the type of excisable goods you deal with.

After completing the registration process, the FTA will provide your business with an excise tax registration number, which you will use when filing returns and paying taxes.

What Is Excise Tax Return Filing?

Once your business is registered for excise tax, you are required to file excise tax returns regularly. Return filing is the process of reporting the excise tax you owe to the tax authorities. This includes the total value of the excisable goods you have sold or imported and the excise tax amount due.

Excise tax returns must be filed at the end of each tax period, which is usually monthly or quarterly. Timely and accurate return filing is essential to avoid penalties and maintain a good standing with the tax authorities.

What Are the Steps Involved in Excise Tax Return Filing?

Recordkeeping: Keep detailed records of all transactions involving excisable goods, including sales, imports, and stock levels. This will make the return filing process smoother and ensure accuracy.

Calculate Tax Due: Based on the excisable goods sold or imported, calculate the total excise tax owed. The excise tax rate varies depending on the type of product, so it is important to apply the correct rates.

Submit Returns: Use the online portal provided by the Federal Tax Authority (FTA) to submit your excise tax return. Ensure that all details are accurate and that you submit the return before the deadline.

Pay the Tax: Once you have filed your excise tax return, you must pay the tax owed within the specified time frame. Delays in payment can lead to penalties.

Why Is Timely Excise Tax Return Filing Important?

Filing your excise tax returns on time is crucial for several reasons. First, it helps you avoid fines and penalties that can arise from late filing. Second, it keeps your business in compliance with tax regulations, reducing the risk of audits or other legal issues. Lastly, timely filing ensures that you maintain good standing with the tax authorities, which is essential for smooth business operations.

What Are the Penalties for Non-Compliance?

Non-compliance with excise tax registration and return filing requirements can result in significant penalties. These penalties can include fines, interest on unpaid tax, and, in severe cases, suspension of your business license. By staying compliant and filing your returns on time, you can avoid these costly consequences.

How Can RBS Auditing Assist You With Excise Tax Registration and Return Filing?

At RBS Auditing, we understand the complexities of excise tax registration and return filing. Our team of tax experts is here to help you navigate the process and ensure that your business remains compliant with all tax regulations. Whether you are registering for excise tax for the first time or need assistance with filing returns, we offer tailored services to meet your needs.

With our expertise, you can focus on growing your business while we handle your tax obligations. We will ensure that your returns are filed accurately and on time, helping you avoid penalties and maintain a smooth relationship with the tax authorities.

Conclusion

Excise tax registration and return filing are essential for businesses dealing with excisable goods. By understanding the process and staying compliant with tax regulations, you can avoid penalties and ensure that your business operates legally. If you need assistance with excise tax registration or return filing, RBS Auditing is here to help. Contact us today to learn more about how we can support your business in meeting its tax obligations.

1 note

·

View note

Text

Federal excise tax on trailers

Federal excise tax on trailers

In the highly competitive realm of freight transportation, obtaining the most advantageous deals on tractors and trailers frequently necessitates importing these vehicles from other countries. While considerable cost savings can be achieved, it is essential to comprehend the ramifications of the Federal Excise Tax (FET) associated with these imports. This blog post will guide you through when this tax becomes applicable, the possible exemptions, and important considerations regarding leasing arrangements.

Federal Excise Tax

When does the Federal Excise Tax Apply? The Federal Excise Tax is typically levied on the initial retail sale of certain heavy-duty vehicles, including tractors and trailers, in the United States. As stipulated in the Internal Revenue Code§4051, a 12% tax is charged based on the sale price of these vehicles. However, the tax implications become increasingly intricate when it comes to imported vehicles.

For Importers: If your business is involved in the importation of tractors and trailers, it is important to note that you are responsible for paying the FET once these vehicles enter the U.S. for use prior to their first sale.

FET Exemptions

Your company may be eligible for certain exemptions that allow you to avoid paying FET on imported tractors and trailers:

1. Weight-Based Exemptions:

- Trailers: The FET is not applicable to truck trailers and semi-trailer chassis and bodies that are designed for vehicles with a gross vehicle weight of 26,000 pounds or less (IRC §4051(a)(3)).

- Tractors: These are exempt if their gross vehicle weight does not exceed 19,500 pounds, and when combined with a trailer, the total gross weight remains at or below 33,000 pounds (IRC §4051(a)(4)).

2. Specialized Vehicles:

Vehicles that are specifically built for off-highway operation or for particular construction purposes may qualify for an exemption as long as their design significantly restricts their use on highways.

Federal Excise Tax

How G&S Accounting Can Assist You

Navigating the intricacies of Federal Excise Tax (FET) for imported tractors and trailers can be daunting. At G&S Accountancy, we are dedicated to assisting trucking companies in effectively managing their excise tax responsibilities. Our suite of services includes:

- Filing Excise Tax Forms:** We guarantee precise and punctual submission of Form 720, which is the Quarterly Federal Excise Tax Return.

- Exemption Assistance:** We guide you in identifying and qualifying for available exemptions to reduce your tax burden.

- Relief from Penalties and Interest:** Our established strategies have successfully helped clients obtain relief from penalties and interest, resulting in substantial savings.

Conclusion

Grasping and effectively managing the Federal Excise Tax on imported tractors and trailers is crucial for trucking companies aiming to enhance their operations and reduce expenses. Whether faced with intricate import situations or handling leasing agreements, partnering with a skilled CPA firm can significantly impact your success.

Reach out to G&S Accountancy today to discover how we can help you fulfill your FET responsibilities and shield you from possible penalties and interest. Allow us to support you in concentrating on what you excel at – running a thriving transportation business.

0 notes

Text

7 Tips To Make Sure Trucking Companies Pay Taxes Correctly

Ensuring that trucking companies pay taxes correctly is essential for maintaining compliance with tax laws and avoiding costly penalties or audits. Here are seven tips to help trucking companies navigate tax obligations effectively:

Understand Tax Obligations: The first step in ensuring tax compliance is to understand the specific tax obligations that apply to trucking companies. This includes federal taxes such as income tax, payroll tax, and excise tax, as well as state and local taxes that may vary depending on where the company operates or where its employees are located. Being aware of these obligations allows companies to plan and budget accordingly.

Maintain Accurate Records: Accurate record-keeping is crucial for calculating and reporting taxes correctly. Trucking companies should maintain detailed records of income, expenses, mileage, fuel purchases, payroll information, and any other relevant financial transactions. This documentation not only facilitates tax preparation but also provides evidence to support tax deductions or credits claimed.

Stay Up-to-Date with Tax Law Changes: Tax laws and regulations are subject to change, so it's important for trucking companies to stay informed about any updates or revisions that may affect their tax obligations. This includes changes to tax rates, deductions, credits, reporting requirements, and compliance deadlines. Consulting with tax professionals or subscribing to tax-related publications can help companies stay abreast of these developments.

Utilize Tax Deductions and Credits: Trucking companies can take advantage of various tax deductions and credits to reduce their tax liability. This may include deductions for fuel expenses, vehicle maintenance and repairs, insurance premiums, employee wages, and depreciation of equipment. Additionally, companies may be eligible for tax credits related to hiring certain employees, investing in renewable energy technologies, or participating in fuel-efficient transportation programs. Maximizing these tax benefits can significantly lower the company's tax burden.

Plan for Estimated Tax Payments: Trucking companies are often required to make estimated tax payments throughout the year to cover their anticipated tax liability. Failure to make these payments on time can result in penalties and interest charges. To avoid surprises come tax time, companies should carefully estimate their tax liability and make quarterly payments in accordance with IRS guidelines. Working with a tax professional can help ensure that estimated tax payments are calculated accurately.

Consider Tax Planning Strategies: Tax planning involves proactively managing finances and business operations to minimize taxes. Trucking companies can employ various tax planning strategies to optimize their tax position, such as structuring business transactions to maximize deductions, timing purchases or sales to take advantage of tax benefits, and exploring opportunities for income deferral or tax-free exchanges.

Seek Professional Tax Assistance: Given the complexity of tax laws and regulations, many trucking companies benefit from seeking professional tax assistance. Enlisting the help of a qualified accountant, tax advisor, or tax preparation service can provide valuable expertise and guidance in navigating tax compliance issues. Professionals providing trucking payroll services can offer personalized tax advice, prepare tax returns accurately and efficiently, and represent the company in the event of an IRS audit or dispute.

0 notes

Text

Revised Form 720

The IRS has released a revised Form 720, Quarterly Federal Excise Tax Return, the proper method to file and report PCORI fees. If you owe a PCORI fee, it must be paid using IRS Form 720 by July 31, following the last day of the policy year or plan year. Form 720 and the fee must be submitted on the same date. If your business does not owe a PCORI fee, IRS Form 720 does not need to be…

View On WordPress

#aca#healthinsurance#healthinsuranceinPA#healthinsurancenearby#HealthInsuranceNearMe#healthinsuranceNJ#affordable care act#guidance health insurance self insured HRA#marketplace health plans obamacare#The Marketplace

0 notes

Photo

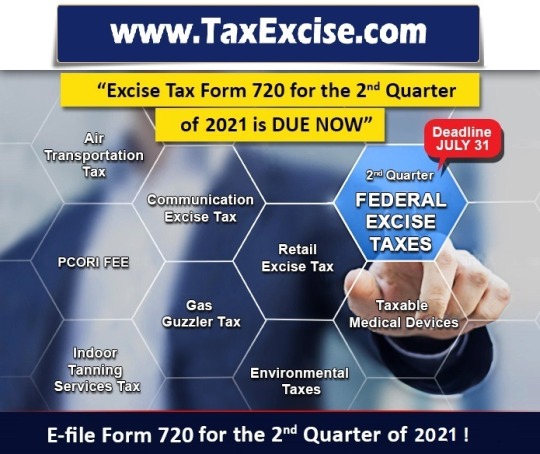

Federal #ExciseTax #Form720 & attachments are to report to the #IRS at end of every quarter listing the liabilities & pay the taxes collected. Efiling is fast & easy, do it in 3 simple steps @Taxexcise for faster processing of your tax return. Today August 2, 2021 is the deadline to report the 2nd Quarter Federal Excise Taxes. #tax720 #taxexcise #deadline

#Excise Tax#Federal Excise Tax#Quarterly Federal Excise Tax#Quarterly Federal Excise Tax Form 720#Quarterly Federal Excise Tax Due Date#Quarterly Federal Excise Tax Online#Quarterly Federal Excise Tax efile#Quarterly Federal Excise Tax efiling#Quarterly Federal Excise Tax Online today

0 notes

Photo

The PCORI fee initially applied to specified health insurance policies and applicable self-insured health plans with policy or plan years ending after September 30, 2012, and before October 1, 2019; however, in December 2019 the fee was extended for an additional 10 years under the Further Consolidated Appropriations Act, 2020 and now applies through plan years ending before October 1, 2029. #PCORIFee Excise Taxes can be reported online at @Taxexcise.com and it is easy.... do it today!

#federal excise tax#quarterly federal excise tax#2nd quarter excise tax#Form 720 PCORI fee#pcori fee#PCORI Fee Form 720#efile PCORI

0 notes

Text

To any Texans filing taxes this year:

“Following the recent disaster declaration issued by the Federal Emergency Management Agency (FEMA), the IRS is providing this relief to the entire state of Texas. But taxpayers in other states impacted by these winter storms that receive similar FEMA disaster declarations will automatically receive the same filing and payment relief. The current list of eligible localities is always available on the disaster relief page on IRS.gov.

The tax relief postpones various tax filing and payment deadlines that occurred starting on February 11. As a result, affected individuals and businesses will have until June 15, 2021, to file returns and pay any taxes that were originally due during this period. This includes 2020 individual and business returns normally due on April 15, as well as various 2020 business returns due on March 15. Among other things, this also means that affected taxpayers will have until June 15 to make 2020 IRA contributions.

The June 15 deadline also applies to quarterly estimated income tax payments due on April 15 and the quarterly payroll and excise tax returns normally due on April 30. It also applies to tax-exempt organizations, operating on a calendar-year basis, that have a 2020 return due on May 17.“

3 notes

·

View notes

Text

0 notes

Text

0 notes

Text

When are quarterly taxes due 2021

Standardized deductions are automatic, much faster, and easier. $12,400 for single or married filing separately.But that’s without any deductions or credits, so you can reduce your taxable income.įor the year 2020 the standardized deductions are: Your federal income tax bracket will determine how much you should be paying as a general foundation.įor example, someone making $95,000 annually and filing jointly as a married couple has a 22% tax rate. The 2020 Tax Rate Schedule is first determined by your filing status (Single, Married filing jointly, Married filing separately, and Head of Household) and your income. Common examples include fuel, environmental, and gambling/wagering excise taxes. Self-employed individuals pay the entire portion in quarterly estimated payment (15.3%), and then can deduct the half that would normally be covered by the employer in a traditional employment role.Įxcise tax: Certain industries are required to pay specialized taxes. Self-employment tax: In the absence of an employer, the Self-employment tax (or SE tax) is paid by the individual. These taxes are withheld from the employees’ paycheck and paid on their behalf by the employer. (This is one tax that does NOT go to the IRS.)Įmployment tax: Employers must pay a portion of the Social Security & Medicare, federal income, and federal unemployment taxes for their employees. Small businesses and self-employed individuals are required to collect sales tax on applicable transactions and pay receiving entities at regular intervals. Sales tax: Nearly all states require sales tax, and many counties and cities tack on their own additional sales tax. Income tax: Required for all except Partnerships (which file an “information” return), this tax is paid as you go based on the amount of income made.

0 notes

Text

2019 Guide for Business Owners

https://120profit.com/?p=1075&utm_source=SocialAutoPoster&utm_medium=Social&utm_campaign=Tumblr What Is the Small Business Tax Rate? The small business tax rate for 2019 is a flat 21% for a C-corporation. Business income from a sole proprietorship or from a pass-through entity—such as an LLC, partnership, or S-corporation—gets taxed at the owner’s individual income tax rate, minus a deduction of up to 20%. For such businesses, the income tax burden depends on the amount of business income and the type of business. Taxes are complicated, and many small business owners struggle to understand how their tax liability is determined. Many business owners don’t know the corporate income tax rate, what tax cuts they are eligible for, or what terms like pass-through income even mean. Plus, in addition to income taxes, businesses also have to pay payroll taxes, unemployment taxes, and other kinds of taxes. To complicate things even more, 2019 is the first year that tax reform—the Tax Cuts and Jobs Act—goes into effect. Many small business owners are confused about how the new law will impact their tax bill and change their reporting responsibilities. While understanding how small business taxes are calculated and applied can seem overwhelming to any business owner, learning some basics can help you while making decisions and working with your tax professional. This guide breaks down the types of business taxes your company may be subject to, the different rates applied to your business earnings, and how the new tax law will affect your business. Types of Small Business Taxes There are several types of federal taxes that a business must pay to the Internal Revenue Service (IRS). Your company might have to pay one or all of them, depending on your business structure, whether you have employees, or what products or services you provide to your customers or use to conduct business. In general, there are six types of business taxes: Income Tax Most people are familiar with income tax—individuals must pay income tax on wages, investment income, and gains from the sale of property they own. A corporation must also pay tax on the net income it earns each year. Net income means income after accounting for expenses. LLCs, sole proprietorships, and certain other business types are considered pass-through entities, meaning the business itself does not pay income tax. The owners pay tax on the business income at their individual tax rate and report the business income on their personal tax return. Not all income is treated the same. For instance, shareholders in a C-corporation pay a different tax rate on dividend income versus ordinary net income from the business. Employment/Payroll Tax If you have employees, you are responsible for paying employment taxes, also called payroll taxes, on their wages. Employment taxes include federal income tax withholding, Social Security and Medicare taxes, and federal and state unemployment taxes. Many businesses hire a payroll company to manage their payroll tax liabilities and file their tax forms on their behalf. Employment taxes can be complicated—failure to file and pay timely can result in stiff penalties and, in rare cases, criminal prosecution. Self-Employment Tax Self-employed individuals are responsible for paying self-employment taxes, which includes Social Security and Medicare. You must pay this tax if your net earnings from self-employment last year were at least $400. Most businesses pick up half of the tab for Social Security and Medicare taxes on their employees’ wages, while the other half is withheld from the employees’ paychecks and remitted by the business. But for self-employed individuals, they pay the entire amount for these taxes on their own. Some special rules apply here, such as for self-employed individuals who work for a church or on a fishing crew. Excise Tax If your business engages in certain types of industries or sells certain types of products or services, you might be responsible for excise taxes on these transactions and activities. An excise tax is an indirect tax, meaning it isn’t directly paid by the consumer of the product. Often, the tax is included in the price of the product or service, as with cigarettes and liquor. Businesses that sell products or services subject to excise tax are responsible for collecting the taxes and sending them to the IRS. Sales Tax There’s no federal sales tax in the U.S., but 45 states and thousands of localities levy sales tax. Business owners are responsible for calculating, collecting, and reporting sales tax to local and state governments. Customers pay sale tax on goods and services at the point of purchase. After a recent court decision, even some ecommerce sellers must collect and report sales tax from out-of-state customers. As a small business owner, it’s important to understand your state and locality’s rules on sales taxes. Property Tax If you own commercial property, land, or a brick-and-mortar location, then you’ll have to pay property taxes to the city or county where the real estate is located. When to Pay Small Business Taxes Just as important as the types of taxes you pay is when you have to pay them. Most individuals pay taxes one time before a specific deadline set by the IRS. However, most business owners have to pay estimated income taxes and self-employment taxes on an ongoing basis. Estimated taxes are taxes that you pay throughout the year, based on what you think your taxable income at the end of the year is going to be. Any business owner who expects to owe more than $1,000 in taxes for the year must pay estimated taxes on a quarterly basis. The estimated tax payments you make throughout the year are deducted from your total liability when you file your tax return. Federal tax is a pay-as-you-go tax and you can incur penalties and interest if you fail to make the required estimated tax payments when they are due. Small Business Tax Rates by Type of Tax The Tax Cuts and Jobs Act (TCJA) reduced the U.S. corporate income tax rate from a maximum of 35% to a flat rate of 21%. No matter how much income your C-corporation makes, this means you won’t pay more than a 21% rate on income. If you take a dividend or distribution from the business, that is subject to a different, capital gains tax rate. Since C-corporations pay a corporate tax rate, plus taxes on dividends, many people say that C-corporations are subject to double taxation. Pass-through entities include S-corporations, limited liability companies, and general partnerships. Owners of these types of businesses and sole proprietors report business income on their personal tax return and pay taxes at their individual tax rate. Individual tax rates are determined by your level of taxable income and filing status (single or joint filing). In general, individual income tax brackets are progressive, meaning that people with higher income pay more taxes than those with lower income. Here’s a summary of small business tax rates: Income Tax Rate for C-Corporations All C-corporations pay a flat 21% tax rate on net business income. Dividend Tax Rates for C-Corporations Shareholders of corporations must pay taxes on dividends or distributions from the business. The dividend tax rate depends on whether the dividends are qualified or unqualified. Dividends are qualified if you’ve held onto the underlying stock for at least 60 days. In 2019, the rate on qualified dividends ranges from 0% if you earn under $38,601 to 20% if you earn over $425,800 in income. On nonqualified dividends, sometimes also called ordinary dividends, the dividend tax rate is equal to the shareholder’s regular income tax rate. Income Tax Rates for Pass-Through Entities and Sole Proprietorships The tax rate for pass-through entities and sole proprietorships is equal to the owner’s personal income tax rate. For 2019, personal income tax rates range from 10% to 37% depending on income level and filing status. For example, a single filer who reports $100,000 in net business income will pay a 24% tax rate. The catch is that, for the first time in 2019, sole proprietors and owners of pass-through entities can deduct up to 20% of their business income before their tax rate is calculated. In the above example, the tax filer could deduct up to $20,000 from the net business income. Then, they’d only have to report $80,000 in income, reducing their tax rate to 22%. There are limits on this deduction based on income and type of business. In general, you must earn less than $157,500 (single filers) or $315,000 (joint filers) to qualify for the full deduction. And professional service businesses, such as law firms and doctor’s offices, typically can’t claim the full deduction either. Employment Tax Rates Employment taxes include all of the following: Social Security Tax: 12.4% on wages paid up to $128,400 for 2019. Employers pay half of this amount (or 6.2%), while the other half is deducted from the employee’s wages. If you’re self-employed, then you pay the full amount as part of your self-employment taxes. Medicare Tax: 2.9% of all wages paid to an employee (no wage threshold), with the tax split between employer and employee. There are additional medicare withholding requirements for employees paid above $200,000 per year. Federal Unemployment Tax: 6.2% of the first $7,000 you pay to an employee. You can usually take a credit against this tax if you’ve paid state unemployment taxes. If you’re entitled to the maximum 5.4% credit, the federal unemployment tax rate is reduced to 0.6%. State Unemployment Tax: Each state charges its own state unemployment taxes. The rate typically depends on the size and age of your company, the industry, the historical rate of turnover at your company, and how many of your former employees have applied for unemployment benefits. Excise Tax Rates Excise tax rates vary greatly based on the specific type of product or service that you’re selling. You can read more about the different types of excise taxes and rates in IRS’s Publication 510. Some states also charge excise taxes. Sales Tax Rates Sales tax rates vary greatly based on state and locality. The first thing you should do is determine if you’re in an origin-based state or a destination-based state. In origin-based states, like Texas and Pennsylvania, sales tax rates are based on where the seller or business operates. In destination-based states, like Florida and New York, sales tax rates are based on the customer’s location. Within states, rates might also differ based on which locality you’re in and what types of products you’re selling. Property Tax Rates Like sales taxes, property taxes vary greatly based on where city and county. When you purchase property, the property will be registered with the local tax authority. This agency will send you information about property tax rates and deadlines. Property taxes are levied on the property’s assessed value, not on the purchase price or fair market value. Tax Foundation State Small Business Tax Rates In addition to federal taxes, businesses also are responsible for complying with state and local tax obligations. With the exception of South Dakota and Wyoming, all states levy a tax or charge of some sort on business income. There are three main models for state small business tax rates: Corporate Income Tax: In most states, C-corporations must pay a corporate tax rate of 4% to 9% on net business income. Gross Receipts Tax: A few states, including Texas and Washington, charge a gross receipts tax instead of a corporate income tax. Gross receipts tax is levied on a business’s gross sales, instead of net income. A business usually can’t take deductions before this tax is calculated. Franchise Tax: Some states charge a franchise tax in addition to or instead of a gross receipts tax or income tax. A franchise tax is calculated on the value of a business’s stock or assets, and usually ranges from 0.1% to 0.9%. Keep in mind that even if a state doesn’t charge individual income tax, businesses might still have tax obligations. For instance, New Hampshire doesn’t levy an individual income tax, but does have a corporate income tax and franchise tax. In addition, states might charge their own equivalent of payroll taxes and excise taxes. Sales taxes are exclusively at the state and local levels. For more information about state business tax rates, contact your state’s business tax agency. Or, visit Tax Foundation, which annually maps out the most and least business-friendly states from a tax standpoint. Deductions and Credits Affect Your Small Business Tax Rate Figuring out your small business tax rate isn’t as easy as multiplying your net income by your tax rate. There are several factors that could affect your final tax bill: Tax Deductions: Many business owners take advantage of tax deductions on business expenses to lower their taxable income. Some deductions can make a huge difference to your bottom line. For example, the Section 179 deduction lets businesses deduct the total cost of an asset, like a vehicle or machinery, in the year of purchase. Net Operating Losses: Other companies might have net operating loss deductions carried forward from a prior year that reduce the amount of the current year’s taxable income. Tax Credits: Your business could also be eligible for tax credits that can reduce the amount of tax you pay and your effective tax rate. Tax credits are better than deductions because they allow you to subtract the amount of taxes you owe on a dollar-for-dollar basis. For instance, businesses that use alternative sources of fuel or alternative sources of energy might be eligible for a tax credit. Because of deductions and credits, two businesses with the same net income for the year could end up paying different amounts of federal income tax. Determining Your Small Business Tax Rate Ultimately, the truth is that the tax code is complicated. It’s complicated for individuals, but especially so for businesses due to the different types of tax obligations. It’s wise to work with a qualified tax professional, like a CPA, enrolled agent, or tax attorney. Their expertise can help you understand the types of taxes your business is responsible for and make sure you are paying the correct small business tax rate. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any of these entities. 120profit.com - https://120profit.com/?p=1075&utm_source=SocialAutoPoster&utm_medium=Social&utm_campaign=Tumblr

1 note

·

View note

Photo

Who must file Form 720?

You must file Form 720 if you were liable for, or responsible for collecting, any of the federal excise taxes listed on Form 720, Parts I and II, for a prior quarter or for the current quarter and you haven’t filed a final return.

How much it is to efile?

E-file is the fastest way, you could try for free and experience the difference. Form 720 reported every quarter would cost you $49.99 on single category. No other charges or no hidden charges, we won't ask for your card details upfront.

0 notes

Text

Additional Hurricane Ida relief from IRS on Cook & Co. News

New Post has been published on https://cookco.us/news/additional-hurricane-ida-relief-from-irs/

Additional Hurricane Ida relief from IRS

Sept. 15, Oct. 15 deadlines, other dates further extended to Jan. 3 for parts of Mississippi; Nov. 1 deadline still applies to the rest of the state.

Victims of Hurricane Ida in parts of Mississippi now have additional time–until Jan. 3, 2022–to file various individual and business tax returns and make tax payments, the Internal Revenue Service announced today.

Following last week’s disaster declaration by the Federal Emergency Management Agency (FEMA), the IRS is offering this expanded relief to those parts of the state newly designated for either individual or public assistance. Previously, the IRS had provided special relief to the entire state of Mississippi, generally postponing various tax-filing and tax-payment deadlines until Nov. 1, 2021.

Currently, the expanded relief applies to Amite, Claiborne, Copiah, Covington, Franklin, Georgia, Hancock, Harrison, Jackson, Jefferson, Jefferson Davis, Lawrence, Lincoln, Pearl River, Pike, Simpson, Walthall, Wayne and Wilkinson counties. Any jurisdiction added to the Oct. 22 FEMA declaration will automatically receive the expanded IRS relief.

The deadline remains Nov. 1 for affected taxpayers in other parts of Mississippi. The current list of eligible localities is always available on the disaster relief page on IRS.gov.

The new relief postpones various tax filing and payment deadlines that occurred starting on Aug. 28, 2021. As a result, affected individuals and businesses will have until Jan. 3, 2022, to file returns and pay any taxes that were originally due during this period. This means individuals who had a valid extension to file their 2020 return that ran out on Oct. 15, 2021, will now have until Jan. 3, 2022, to file. The IRS noted, however, that because tax payments related to these 2020 returns were due on May 17, 2021, those payments are not eligible for this relief.

The Jan. 3, 2022 deadline also applies to quarterly estimated income tax payments due on Sept. 15, 2021, and the quarterly payroll and excise tax returns normally due on Nov. 1, 2021. Businesses with an original or extended due date also have the additional time including, among others, calendar-year partnerships and S corporations whose 2020 extensions ran out on Sept. 15, 2021 and calendar-year corporations whose 2020 extensions ran out on Oct. 15, 2021. It also applies to calendar-year tax-exempt organizations whose 2020 extensions run out on Nov. 15, 2021.

In addition, penalties on payroll and excise tax deposits due on or after Aug. 28, 2021 and before Sept. 13, will be abated as long as the deposits were made by Sept. 13, 2021.

The IRS disaster relief page has details on other returns, payments and tax-related actions qualifying for the additional time.

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area. Therefore, taxpayers do not need to contact the agency to get this relief. However, if an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extended filing, payment or deposit due date falling within the postponement period, the taxpayer should call the number on the notice to have the penalty abated.

In addition, the IRS will work with any taxpayer who lives outside the disaster area but whose records necessary to meet a deadline occurring during the postponement period are located in the affected area. Taxpayers qualifying for relief who live outside the disaster area need to contact the IRS at 866-562-5227. This also includes workers assisting the relief activities who are affiliated with a recognized government or philanthropic organization.

Individuals and businesses in a federally declared disaster area who suffered uninsured or unreimbursed disaster-related losses can choose to claim them on either the return for the year the loss occurred (in this instance, the 2021 return normally filed next year), or the return for the prior year (2020). Be sure to write the FEMA declaration number – EM-3569 associated with the earlier relief or EM-4626 for the new relief−on any return claiming a loss. See Publication 547 for details.

The tax relief is part of a coordinated federal response to the damage caused by Hurricane Ida and is based on local damage assessments by FEMA. For information on disaster recovery, visit disasterassistance.gov.

0 notes

Photo

PCORI Fee that is reported on IRS Tax Form 720 can be reported online at TaxExcise.com, an IRS authorized efile provider and the most experienced. PCORI Fee is due in the 2nd Quarter of the tax year and August 1 is the due date. #EfilePCORIfee #PCORIfee

#Federal Excise Tax Form 720#Quarterly Excise Taxes on PCORI Fee#Form 720 PCORI fee#efile pcori fee#IRS Tax Form 720

0 notes