#Public limited Company registration online in Bangalore

Explore tagged Tumblr posts

Text

#Public limited Company registration in Bangalore#Public limited Company registration in Bangalore online#Online Public limited Company registration in Bangalore#Public limited Company registration#Public limited Company registration in Karnataka#Public limited Company registration in India#Public limited Company registration online in Bangalore

0 notes

Text

Farmer Producer Organization (FPO Registration) - Process, Fees, Documents Required

The Indian economy is an agricultural-centric economy. Agriculture in India is the livelihood for a majority of the population as it employs more than 50% of the Indian workforce. But the sad part is producers and farmers are deprived of the agricultural process. They don’t have access to technology, knowledge, and funds. To address this issue, the concept of Producer Company was introduced in 2002, to help improve the lives of farmers and producers.

What is a Producer Company?

Producer company is a corporate body of producers, farmers and agriculturists with the objective of procurement, production, harvesting, grading, pooling, handling, marketing, selling or export of the members or import of goods and services for themselves. In simple words, this type of company is formed with the aim to improve the lives of people associated with the agriculture industry by providing them access to technology, market, credit, etc.

*Process of:

Step 1. Application for Digital Signature Certificate (DSC)

Step 2. Application for the Name Approval

Step 3. Filing of SPICe Form (INC-32): Details of the company, Details of members and subscribers, Application for Director Identification Number (DIN), Application for PAN and TAN, Declaration by directors and subscribers, Declaration & certification by professional

Step 4. Filing of e-MoA (INC-33) and e-AoA (INC-34)

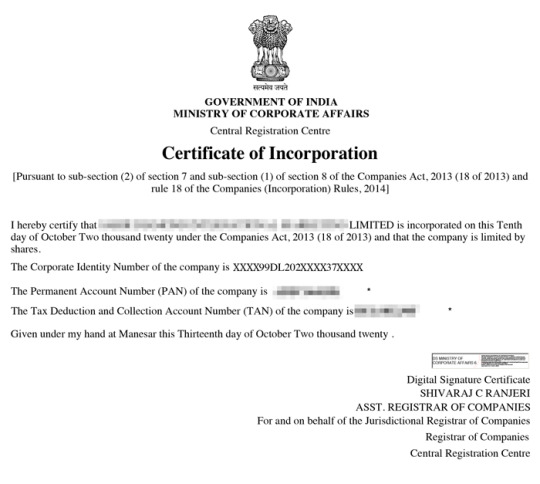

Step 5. Issuance of PAN, TAN, and Incorporation Certificate

Read more about documents, fees, and benefits of Farmer Producer Organization

#business#india#business growth#manage business#nidhi company registration#private limited company registration in bangalore#public limited company registration#public records#farming#agriculture#public company#digital signature certificate#digital signature online

0 notes

Link

Stay updated with current trends & Updates on GST Registration , Business Tips, Taxation, Startups help, Companies Act, Loans, Income Tax, Budget & Smart Skills.

0 notes

Link

#company#Public limited company#private limited company registration#Private limited company registration in hyderabad#company registration#one person company#company registration in chennai#Public Limited Company Registration in Chennai#company registration in bangalore#online company registration

0 notes

Text

How To Get A Company Registration Consultants In Bangalore?

How to get a company registration consultants in bangalore? It is the best Online Consultant services for getting Registered for your Company and its very Cost effective Compared to other online portal’s and the brief introduction for this Company registration is given below..

company registration consultants in HSR Layout is the Company registration services in HSR Layout Whenever we discus about the Companies in Bangalore, before starting any business in Bangalore you have to get register your own company ,now let’s learn how to get register your own company in a simple way , company registration bangalore HSR Layout its very simple to register your company in anywhere and anytime in Bangalore , company registration services in bangalore you will be in contact with our Kros-Chek business consultants will do a private limited company registration in hsr layout for your business in a simple way and in very quick period of time , company registration office in HSR Layout are essential for your business registration method and complete your registration procedure for an affordable price, and you can contact our consultants at any time for quires , and Company Incorporation consultants in Bengaluru are straight forward to include with same rules which are followed to all or any the business entities in cites , Kros-Chek is one of the best online services all over the cites in Bangalore, The belief that customer satisfaction is important as there services, our services have helped to establish garner a vast base of customers, which continues to grow day by day. this business aims to expand its line of services and provide with what is needed to a large client base in Bangalore, this establishment occupies a prominent location in Bangalore City .it is an effortless task in commuting to this establishment as there are various modes of readily available at Kros-Chek or you can visit our official Kros-Chek.in the website, which makes it easy for first-time visitors in locating this establishment .it is known to provide best Company registration services in HSR Layout.

What are such business structures in India?

Could we endeavor and fathom the sorts of business structures open in India. Here is a once-over of some of them:

One Person Company (OPC)

Actually introduced in the year 2013, an OPC is the best method for starting an association in case there exists simply a solitary promoter or owner. It enables a sole-proprietor to carry on his work in any case be significant for the corporate design.

Limited Liability Partnership (LLP)

An alternate genuine component, in a LLP the liabilities of assistants are basically limited solely to their agreed responsibility. A LLP is spread out under the Limited Liability Act, 2008 with the Registrar of Companies (ROC) says Kros-chek company registration services in bangalore.

Confidential Limited Company (PLC)

A PLC as per the law is seen as an alternate real substance from its originators It has financial backers (accomplices) and bosses (association authorities). Each individual is seen as a delegate of the association.

Public Limited Company

A Public Limited Company is a conscious relationship of people which is solidified under association guideline. It has an alternate genuine presence and the commitment of its people are limited to shares they hold says Kros-chek company registration office in HSR Layout .

You can pick what business structure suits your business needs best and fittingly register your business.

Various kinds of business structures integrate Sole proprietorship, Hindu Undivided Family, and Partnership firms. Compassionately recall, these plans don't go under the ambit of association guideline.

plan (like LLP, Company, etc) the monetary supporters will be more open to making an endeavor says Kros-chek private limited company registration in hsr layout.

Website Details :

Location: 365 Shared Space, 2nd Floor, #153, Sector 5, 1st Block Koramangala, HSR Layout ,Bengaluru, Karnataka 560102.

Contact Us:+91 9880706841

Mail Us: [email protected]

#CompanyRegistrationConsultantsInBangalore#CompanyRegistrationServicesInBangalore#CompanyRegistrationOfficeInHSRLayout

0 notes

Link

Company Setup India is a single stop for off-shore company formation, buying an off-the-shelf (readymade) company, entire range of business and legal services, online accounting and all support services concerning foreign investment in India.

The main services we provide:-

· Formation of One Person Company (OPC) in India

· Formation of Private Limited Company in India

· Formation of Public Limited Company in India

· Formation of Limited Liability Partnership in India

· Creation of a NBFC Company in India

· Set up of a Government Company in India

· Set up of a Holding/ Subsidiary Company in India

· Set up of a Foreign Company in India

· Buy a Readymade Company in India in India

· Formation of Company Under Section 8 in India

· Formation of Producer Company in India

· Acquiring a Non-Banking Financial Company (NBFC) in India

· Statutory Records & Compliances

· Mergers, Acquisitions & Demergers

· Amalgamation, Acquisition & Reconstruction

· Open a Branch Office in India

· Open Liaison Office in India

· Foreign Direct Investment in India

· All Post Incorporation Services such as TDS/Withholding Tax Registration, VAT/Sales Tax Registration,

· Service Tax Registration, Import Export Code (IEC) Registration, ESI/PF Registration etc.

· Business and Legal services

· Accounting and Auditing Service

· Service for Filling of Various Statutory Returns

· The law relating to a partnership firm is contained in the Indian Partnership Act, 1932.

Company Setup India is based at New Delhi NCR, India to service clients anywhere in the world. We have our network on PAN India basis & across globe. We have our regional offices at Mumbai, Kolkata, Chennai, Bangalore, Chandigarh, Ranchi and Muzaffarpur.

#Company Incorporation in India#Limited Liability Partnership#FDI in India#Compare Different Business#Conversion of Business#Supp.Co.Incorporation Service#Small Business Registration#Value added services#Post Incorporation Reg.#Consulting Services

1 note

·

View note

Text

Company registration in Bangalore

Today company incorporation in Bangalore and other administrative filings are paperless; documents are recorded digitally through the MCA site and is prepared at the Central Registration Center (CRC). In Bangalore, the Companies Act of 1956, directs the Company Incorporation (Formation of the Companies), which incorporates both public and private elements. An organization frames by enlisting the notice and articles of relationship with the State Registrar of the State where the foremost office of the organization finds. Global organizations who wish to work in India, are conceded consent by the Reserve Bank of India to work branch workplaces in our country. Organization Registration measure in Bangalore is totally on the digital. After finishing all enrollment customs, the Registrar of Companies issues a carefully marked Certificate of Incorporation (COI). Electronic authentications gave by the service can be checked by all partners on the MCA site itself.

Joining an incorporation certificate services in Bangalore is an orderly cycle of assortment and accommodation of subtleties needed according to the prerequisites of Companies Act 2013 and according to the interaction characterized by the Ministry of Corporate Affairs occasionally. The executives of the interaction need top to bottom information on legitimate prerequisites and also, the viable experience of something very similar. Enlistment center of Companies, Bangalore (ROC, Bangalore) is the legislative expert for Company Registration and LLP Registration and guideline of Limited Companies and Limited Liability Partnership (LLP) in Karnataka. Enrollment and administrative organization of Companies and LLP in India are controlled by the Companies Act, 2013/Limited Liability Partnership Act 2008 and directed by the Ministry of Corporate Affairs-MCA through the Offices of Registrar of Companies (ROC) in each State.

Steps to follow to get Company Registration Services in Bangalore

· Selection of the legitimate element with Directors and Shareholders.

· Proper compulsory archives of the Directors.

· Digital marks with USB Tokens of the Directors.

· Selection of the Name of a Company with MCA and Trademark Search.

· Preparation of rules of the Company strategy.

· Apply for the Permanent record number and Tax allowance account number.

· Selection of legitimate banking.

· Apply for the pertinent duty enrollment.

· Maintenance and filings to the ROC Bangalore.

Records Required to get Online Company Registration consultants in Bangalore

In Bangalore, private limited organization enlistment is impossible without appropriate personality and address verification. Recorded underneath are the archives acknowledged by the MCA for the online organization enlistment measure:

Identity and Address Proof

· Scanned duplicate of PAN card or identification (far off nationals and NRIs)

· Scanned duplicate of elector ID/identification/driving permit

· Scanned duplicate of the most recent bank articulation/phone or portable bill/power or gas bill

· Scanned identification estimated photo example signature (clear record with signature [directors only])

Enlisted Office Proof

· Scanned duplicate of the most recent bank articulation/phone or portable bill/power or gas bill

· Scanned duplicate of authenticated tenant contract in English

· Scanned duplicate of no-protest testament from the landowner

· Scanned duplicate of offer deed/property deed in English (in the event of possessed property)

Note: Your enlisted office need not be a business space; it tends to be your home as well.

How to get the best company registration services in Bangalore?

Do you want to get company registration in Bangalore, Karnataka? Then we are the top company incorporation service provider in Bangalore, feel free to send your inquiry to [email protected] or feel free to contact 7975187793 or visit https://www.consultry.in/

0 notes

Text

Start-up Registration Indiranagar – 7 Steps to Register your Start-up

A start-up is a new and fresh accepted business, it is started usually in a small business, started by a single or a group of persons. What converts it from other new businesses is that a start-up recommends new services or products that are not being provided anywhere in the same way. The keyword is the new technological innovation. The business either improves and develops new services or products or redevelops present services or products into something in better innovation.

Start-up Indiranagar

According to Start-up Business Consultants in Indiranagar Start-ups are being very established in India. To innovate and develop the Indian economy and fascinated skilled businessmen or entrepreneurs, the Indian Government, under the leadership of the Prime minister, has promoted and started the Start-up India initiative to promote and recognize start-ups.

Steps to Register Your Start-up with Start-up India

Step 1: Incorporate your Business

You should primarily incorporate your business as a Partnership firm or a Limited Liability Partnership or a Private Limited Company. You have to stick to every normal procedure for registration of any kind of business like acquiring the Certificate of Incorporation or the Partnership registration, PAN, and other necessary compliances.

Step 2: Register with Start-up India

After that, the business should be registered as a start-up firm. The complete procedure is easy and digitalized. All you have to do is log on to the Start-up India website and fill up and complete the form with details and records of your business. Next, put the given OTP that was sent to your given mail and other details like, name and stage of the start-up, start-up as the type of user, etc. After entering these details, then the Start-up India profile is created.

In Start-up company registration in Indiranagar once when your profile is created on the website, start-ups can register for several accelerations, incubators, or mentorship programs and many other challenges on the website along with getting access to resources like Government Schemes, State Polices for Start-ups, Learning and Development Program, and pro-bono services.

Step 3: Get DPIIT Recognition

After that, the immediate next step after creating the profile on the Start-up India Website is to make use of the Department for Promotion of Industry and Internal Trade (DPIIT) Recognition. This authorization assists the start-ups to make use of the benefits like relaxation in public procurement norms, self-certification under labor and environment laws, easy winding of company, access to high-quality intellectual property services and resources, access to Fund of Funds, tax exemption for 3 consecutive years and tax exemption on investment above fair market value.

For acquiring DPIIT authorization, select the ‘Get Recognised’ button if you are a new user. If you are already an existing user, then select the ‘Dashboard button’ and then ‘DPIIT Recognition’.

Step 4: Recognition Application

The ‘Recognition Application Detail’ page is displayed. On this page select the ‘View Details’ section under the Registration Details section. Fill up the ‘Start-up Recognition Form’ and select ‘Submit’.

Step 5: Documents for Registration

Registration or the Incorporation Certificate of your start-up

Details and Records of the Directors

Proof of concepts like pitch video or deck or website link(in case of a validation scaling stage start-up or early traction)

Trademark details or Patent (Optional)

PAN Number

Step 6: Recognition Number

Yes done! On registering you will instantly get an authorization number for your start-up firm. The certificate of authorization will be given after the inspection of all your documents which is usually done in 2 days after presenting the details online.

Start-up Registration services provider in Indiranagar as you see, you should be careful while submitting your documents. If they found the upcoming verification, it is found to be given that the necessary documentation is not uploaded properly or the fake document are uploaded or the forgery documents have been uploaded then you shall be responsible for a penalty of 50% of your paid-up capital of the start-up with an at most fine of Rs. 25,000.

Step 7: Other Areas

Trademarks, Patents, or design registration: If you require a patent for your innovation of technology or a trademark for your business, you can comfortably approach any from the list of facilitators that are given by the government. You will need to hold up only the approved fees thus availing of an 80% reduction in fees.

Funding: One of the major key challenges that are faced by most of the start-ups has been acquiring finance. Due to a lack of security or existing cash flows, entrepreneurs fail to attract investors and experience. The high-risk nature of start-ups, as a significant number of percentage stop to take off, puts off many investors.

To provide the funding assistance, the Government has made up a fund with an initial entity of INR 2,500 crore and a total entity of INR 10,000 crore for 4 years (that is INR 2,500 crore per year). The Fund is in the identity of Fund of Funds, which means that it will not invest straight into start-ups, but may take part in the capital of SEBI registered Venture Funds.

Self-Certification Under Employment and Labour Laws: Start-ups can self-certify under labour laws and environmental laws so that their consent costs are deducted. Self-certification is given to deduct regulatory loads, therefore, permitting them to concentrate on their core business. Start-ups are permitted to self-certify their consents under six labor laws and three environment laws for a period of 3 to 5 years from the date of business incorporation.

Units functioning under 36 white category industries as issued on the website of the Central Pollution Control Board do not need clearance under 3 environment-related Acts for 3 years.

Tax Exemption: Start-ups are free from income tax for 3 years. But to make use of these benefits, they must be authorized and certified by the Inter-Ministerial Board (IMB). The Start-ups incorporated on or after 1st April 2016 can register for the income tax exemption.

Documents Which Have Been Waived Off

Start-up India has converted the procedure of registration since its inception. It has free from most of the past requirements at present. Most of the documents which were required to be filed in the past are waived off. The list of documents and the records that are not essential to be organized at the period of the registration are-

Letter of Recommendations

Letter of funding

Sanction Letters

Udyog Aadhar

MSME Certificate

GST Certificate

How to Apply for STARTUP COMPANY REGISTRATION in Indiranagar?

Do you want to get a STARTUP COMPANY REGISTRATION in Karnataka? then we are here to help you, we are the top company incorporation service provider in Bangalore. feel free to send your inquiry to [email protected] or feel free to contact: 7975187793 or visit https://www.consultry.in/

0 notes

Link

Register a Company in Bangalore. Free ROC Consultation, 10+ Years of Experience, Quick Company Formation, PVT Ltd Registration, Public Limited Company Registration, OPC Registration, LLP Registration. Least Cost in Bengaluru. Simple Online Registration Process. Contact 78100-01800, 78100-01200 For More Information!

0 notes

Text

Business Registration Gov Cost in Karnataka

Business Registration Gov Cost in Karnataka

Are you looking for Company Registration in Karnataka, and then this is the right place for you. There are so many different types of business entity, which you can incorporate in Karnataka, like Limited Company, Partnership Company, Sole Proprietorship, Section 8 Foundation, Producer Company, Pvt Ltd Firm, OPC, Nidhi Company, NGO, LLP Firm, etc. Karnataka is one of the fastly developing State of Karnataka and there are various clients in Karnataka who has enrolled Business through FinanceBazaar. Right now FinanceBazaar is the one of the Top Business registration service provider in Karnataka, you can even read FinanceBazaar.com feedback on Google. As you know Karnataka is one of the fastest increasing state in India where you can do your business without any complications. Business formation in Karnataka is not an easy step for each person, because there are so many different formalities that you must need to follow and there are various legal paperwork that you have to fill for entire Firm establishment. But you have not need to stress concerning anything, because Finance Bazaar is providing online Firm registration service in Karnataka which you not need to do anything. you have to submit only papers and Gov Charges and we will look out of rest. Basically Firm formation process takes 7 to 10 working days that rest depends on your collaboration.

In this page you will get Each and Every answer regarding Cost To Register Company in Karnataka

What FinanceBazaar will provide

PAN and TAN

MOA and AOA

Digital Signature Certificate Token For Each Directors

Certificate of Business formation

Share Certificates

GST Number (If want)

Such details need for Business incorporation in Karnataka

Company Name: - The Firm name which you want to register will be committed by your side, but there are so many factors for selecting the Company name. You can't use general words and those words that are already formed or trademarked can't be suitable. Finance Bazaar Top CA will guide you as well in selecting Business name.

Authorized Capital: - At Least 1 Lakh Authorized money is required for Company formation in Karnataka . You can increase it as per your need. But if you will enlarge authorized fund, more than 10 Lakh, then registration duty will even increase.

Paid-up Capital: - You can start your Business from One Rupee paid-up money in Karnataka and you can expand it as you want, but you should informed the paid-up amount amount for life lower than the Authorized money.

Number of Directors: - Minimum two directors required for PVT LTD Company and one director for OPC Pvt Ltd Company. In PVT LTD Company you can increase the number of directors till 15.

Business Activity: - This is an major component of your Business, your business activity will define the business class in which your Firm name will be enrolled and it will as well specified in MOA and AOA.

Office address: - The office location where you required to register your Firm.

Each Directors email and mobile phone number: - Every director mail id and contact number necessary for Digital Signature Certificate (DSC) and Director DIN.

Required Documents for Company incorporation in Karnataka

These are some following documents that you must need to give for Firm formation in Karnataka:

Aadhar Card/Voter Card/Driving License/Passport of Every Directors

Pan Card of Each Directors

One utility bill (Electricity, Gas, Phone, Water Bill of any name) for office address proof

Updated Bank Statement of Each and Every directors/Any Current bill for address proof of Each and Every directors like Mobile Phone Bill, Gas Bill, Electricity Bill, etc.

Photographs of Every directors.

For GST Registration Rent Agreement Between company name and owner of the property where company has registered.

Fees for Business enrollment in Karnataka

Company Registration Charges in Karnataka is roughly Rs 6999/- (Six Thousand Nine Hundred Ninety Nine Rupees Only/-), but it can differ as per your condition. If we speak about fee structure, then from the start 1000 rupees goes to the Gov for Business name applying and you have two opportunities for your Firm name reservation, if your Firm name is exceptional, then it can be approved in first shot. If two times your Firm name has declined, then you must to pay 1000 rupees once again to the Gov for again apply other name application. After Firm name authorization you need to pay Government registration costs that can be vary as per your Authorized capital or state rules. Every Single states have particular rules also Karnataka in terms of registration costs for Company incorporation. If you required two directors in your Company, then roughly 500 Rupees Each and Every director Fees for DSC, if directors will increase, then the Digital Signature Certificate Fees will also increase correspondingly. PAN & TAN Fees also collect by Government that will not be vary. And lastly our registration charges includes for doing and preparation all documents, documentations and alternative work.

financebazaar.com providing These services in Karnataka

Public Limited Company Registration

GST Registration

NGO Registration

Nidhi Company Compliances

Director KYC Verification

12A 80G Registration

DIN Activation

MSME Udyog Aadhaar Registration

Partnership Firm Registration

Change Company Address or Registered Office

Startup India Registration

Private Limited Compliance

Society Registration

Commencement of Business Certificate

NGO Compliances

Company Registration

Nidhi Company Registration

Producer Company Registration

Copyright Registration

LLP Annual Compliance Service

ISO Certification

Digital Signature Certificate

LLP Registration

Sole Proprietor Registration

Chartered Accountant Consultation

Private Limited Company Registration

Import Export Code | IEC Certification

Producer Company Compliances

One Person Company Registration

Public Limited Company Compliances

Food License (FSSAI) Registration

Change Company Name

FCRA Registration

One Person Company Compliances

Section 8 Foundation Registration

Change, Add or Remove Company Director

Close or Winding Up Of a Company

Income Tax Return Filing

Section 8 Company Compliances

GST Return Filing

GST Surrender

Trust Registration

Trademark Registration

FinanceBazaar providing Each and Every services all over in India including Karnataka in All locations like Gulbarga, Ramanagaram, Kolar, Savanur, Mysuru, Sidlaghatta, Chikkamagaluru, Shiggaon, Belagavi, Afzalpur, Shrirangapattana, Tekkalakote, Dakshina Kannada, Tiptur, Madhugiri, Bidar, Wadi, Saundatti-Yellamma, Mulbagal, Lingsugur, Sira, Maddur, Ballari, Sindhnur, Malavalli, Hubballi-Dharwad, Magadi, Mundargi, Gokak, Udupi, Ramanagara, Hospet, Muddebihal, Belgaum, Piriyapatna, Haveri, Talikota, Chikkaballapur, Ramdurg, Nargund, Mahalingapura, Pavagada, Bangalore, Terdal, Puttur, Hassan, Kalaburagi, Tarikere, Surapura, Nanjangud, Mysore, Karnataka, Mudalagi, Bengaluru Rural, Sindhagi, Mandya, Madikeri, Ron, Shahpur, Sakaleshapura, Kodagu, Bijapur, Navalgund, Rabkavi Banhatti, Sedam, Lakshmeshwar, Dharwad, Raichur, Ranibennur, Davanagere, Gadag, Koppal, Sirsi, Sagara, Mangalore, Uttara Kannada, Arsikere, Chitradurga, Srinivaspur, Tumakuru, Bellary, Shivamogga, Bagalkot, Vijayapura, Bengaluru Urban, Siruguppa, Adyar, Shahabad, Yadgir, Malur, Nelamangala, Mudhol, Chamarajnagar, Manvi, Sindagi, Athni, Sanduru, Shikaripur, Tumkur, Mudabidri, Sankeshwara, etc.

0 notes

Text

#Public limited Company registration in Bangalore#Public limited Company registration in Bangalore online#Online Public limited Company registration in Bangalore#Public limited Company registration in Karnataka#Public limited Company registration online in Bangalore

0 notes

Text

Public Ltd Company Registration in India - Online Process, Documents Required, Fees

A Public Limited Company is a type of business entity which has limited liability features and offers shares to the general public for raising equity capital. It is governed by the Companies Act, 2013 and registered under the Ministry of Corporate Affairs. It can be incorporated with a minimum number of seven members and at least three members must be the directors of the company.

A Public Limited Company has the benefits of limited liabilities and it can sell its shares to the general public for raising capital. It is suitable for large businesses that require huge capital and are registered under the Companies Act, 2013.

Advantages of Public Limited Company registration:

Limited Liability

Separate Legal Entity

Raise Capital

Credibility and Attention

Free Transferability of Shares

Minimum requirements for Public Limited Company registration:

Minimum of seven members is required

Minimum of 5 lakh rupees is required for share capital

At least three members must be the directors of the company

Public Limited Company Registration Fees:

The total cost of Public Limited Company registration in India, including government and professional fees, starts from ₹11,999 and takes around 14-21 working days.

To know more (click here)

#public limited company registration#business#india#startup#business growth#manage business#nidhi company registration#partnership firm registration#private limited company registration in bangalore#private limited company registration in chennai#private limited company registration online#indian business

0 notes

Text

Where to get Private limited company registration in Jayanagar?

What do you mean by Private Limited Company?

Private limited company means: to start Pvt ltd Incorporation in Jayanagar minimum 2person and maximum 200 and they don’t issue public shares and PVT ltd should be added at the end the company name

Characteristics of Private Limited Company

1. Members: To run the business/company minimum number of 2 is required and the maximum number of 200 members as per the companies act 2013

2. Limited Liability: The liability of the shareholders are limited

3. Index of members: In private limited company index is not required compared to public companies

4. Perpetual Succession: Even in case of death, insolvency, bankrupt of any of its members, This leads to a perpetual succession of the business/company and the life of the business keeps on existing forever

5. Number of directors: the private company needs only two directors with them the only company can exist/run

6. Paid-up capital: there should be a minimum paid-up capital of Rs 1 lakh

7. Prospectus: In the case of a private limited company there is no such need to issue a prospectus because in Pvt ltd company they won’t invite the public to subscribe for the shares of the company

8. Name: It is compulsory /mandatory for all the private limited company to use the word private limited after its name

Procedure to get registers for Pvt ltd registration consultants in Jayanagar

First, they have applied for DSC (Digital Signature Certificate) and DIN (Director Identification Number)

· And they should apply for name

· They should file the MOA and AOA to register a private ltd company

· Apply for TAN and PAN of the company

· Certificate of incorporation will be issued by Roc with PAN and TAN

· Should have a current bank account on the company name

Advantages of the company

*limited liability: as company owners are not legally forced to pay outstanding company debts and it protects the personal assets of the person

*Professional status: A limited company is usually seen more professional operation than the unincorporated sole trader

*Protect your business name: when you register your company name in the registered office you are protected and other businesses/companies cannot use the name or logo this will protect your business

*Raising capital: you can raise your capital by issuing shares to the public and that can improve or grow your company capital investment in business

What are the disadvantages of private ltd companies?

*Legal requirements: There are required lots of requirements such as completing/maintaining annual accounts in business/company

*Getting paid: like a sole trader who takes his money out of his business without any permission/restriction but not in private ltd company it is more complicated he has to make legally transfer of money to him in the form of salary he doesn’t have rights to use company money/income for his personals use

*Setting up and closure: starting a private limited company in simple form but you need to register with the registered office and to inform HMRC and have to pay some certain amount/ fees.

How to get Private limited company registration in Jayanagar

You are at the right place, called consultry where you can register your company Pvt ltd Incorporation in Jayanagar and consultry is one of the top company in Bangalore and consultry are providing best online services to the client

0 notes

Link

#company#Public limited company#company registration#nidhi company registration#one person company#company registration in bangalore#online company registration#One Person Company Registration#Online Company Registration in Coimbatore#company registration in chennai#One Person Company Registration in Chennai#Private Limited Company Registration in Chennai#Company Registration in Madurai

0 notes

Text

STARTUP COMPANY REGISTRATION IN BANGALORE

Startup is a newly formed business, started by one person or by a group of individuals. A startup differentiates itself from other businesses by starting something new that does not exist in the market.

top start-up registration consultant in Banagalore.

1. Incorporate your business

You should first register your business as a private limited company or partnership firm or limited liability partnership. One must follow all required procedures like getting certification of incorporation, PAN, others.

2. Register with startup India

The business must register as startup. This process can also be done online. You should visit Startup India website and fill the required forms, Once the forms are filled you will receive an OTP to your mail or phone number. Then enter the OTP in the website and fill the required details. After registration we can learn about various state govt policies for new businesses.

3. You must get a DPIIT Recognition

This recognition will help the business to access high quality benefits like intellectual property services and resources, Relaxation in public protection rules.

4. Getting registration application

Open> registration application details

Click on> view details

Fill startup registration form.

Press on submit.

Startup Business Consultants in Bangalore

5. Documents to be uploaded for Registration

· Certificate of startup

· Details about the director

· Proof of your business.

· Patent details (if any)

· PAN number

6. Immediately get the recognition number

After submitting the details, it takes about 2 days to get your startup recognition number.

Be careful while uploading documents because if any wrong documents or mistakes are found in the documents in the uploaded documents You will be liable to pay 50% of your paid-up capital of startup and a minimum fine of 25,000.

Tax exemption

Startup are exempted from income tax for 3 years. The startup business which are registered on or after 1st April 2016 are allowed to apply for income tax exemptions.

Frequently asked questions:

Who can register under startup India?

A business that is registered under private limited company, Partnership or a limited liability company can incorporate under startup India program.

What are the benefits of signing up with startup India?

Startups are permitted to self-ensure their consistence for six work laws and three climate laws. This is taken into consideration an all-out time of a long time from the date of consolidation/enlistment of the business.

What kind of business structure should I choose for Startup?

The most preferred business for a startup is a private limited. A private limited business is legally recognized and usually favored by the investors. However, This business model has very strict rules and may cost higher.

Finally:

If your looking for assistance incorporating your start up visit our portal

Startup Registration services provider in bangalore our experts will make your work easy without any hassal.

0 notes

Text

Private Limited Company Registration in Bangalore

A Private Limited Company offers restricted risk and legitimate security to its investors. Register a private limited company in Bangalore lies somewhere close to an association firm and a generally possessed public organization. It tends to be enrolled with at least two persons. An individual can be both a chief and investor in a Private Limited Company. The risk of the individuals from a Private Limited Company (PLC) is restricted to the number of offers held by them. A Private Limited Company in Bangalore can start with activities subsequent to getting the Certificate of Incorporation. A PLC can be consolidated within 15 working days. Consultry is a famous business stage and a reformist idea. It helps in start to finish consolidation, consistency, warning, and the board consultancy administrations to customers in Bangalore and all over India. The cycle of Private Limited Company Registration Bangalore is simple, modest, and fast at Consultry. And furthermore gives Partnership Registration, HUF, LLP Incorporation and One Person Company enlistment and Secretarial Compliance Services. The private restricted organization enrollment measure is totally on the web, so you don't need to pass on your home to get your substance enrolled. At Consultry, we complete the enlistment cycle within 14 days.

Document Required for Online Company Registration

In India, private limited firm enlistment is impossible without appropriate personality and address evidence. Recorded underneath are the document acknowledged by the MCA for the online company registration measure:

Enlisted Address Proof

· Scanned duplicate of PAN card or identification

· Scanned duplicate of election ID/visa/driving license

· Scanned duplicate of the most recent bank passbook/ electricity bill

photo and signature (clear report with signature [directors only])

Enlisted Office Proof

· Copy of the most recent bank proclamation/phone or versatile bill/power or gas bill

· Copy of legally approved tenant contract in English

· Copy of no-complaint authentication from the landowner

· Copy of offer deed/property deed in English (if there should arise an occurrence of claimed property)

What are the benefits joining of a Private Limited Company in Bangalore?

· Restricted danger to individual resources The investors of a private restricted organization have restricted responsibility. This implies that as an investor you will be at risk to pay for the organization's responsibility just to the degree of the commitment made by you.

· Lawful Entity A PLC has a different legitimate element not quite the same as you. This implies that the Company is answerable for the administration of its resources and liabilities, borrowers, and lenders. Also, you are not liable for it. Thus, the leaders can't continue against you to recuperate the cash.

· Raising Capital Even however enlisting a PLC accompanies consistent prerequisites, it is liked by business people as it assists them with raising assets through value, growth and simultaneously restricts the obligation.

· Reliability Companies in India are enlisted with the Registrar of companies(ROC) under the Companies Act 2013. Anybody can check the subtleties of the organization through the Ministry of Corporate Affairs (MCA). Additionally, subtleties of the relative multitude of chiefs are given while the arrangement of the organization. Thus a PLC type of business structure is trusted more.

· Proceed with Existence an organization has 'unending progression', that is proceed or continuous presence until it is lawfully broken up. An organization, being a different legitimate individual, is unaffected by the demise or end of any part yet keeps on being in presence regardless of the progressions in enrollment.

How to get a PVT LTD Registration service provider in Bangalore?

Do you want start Private Limited Company registration in Bangalore? Then you are at right place, we are top chartered accountant’s services provider. feel free to send your inquiry to [email protected] or feel free to contact 7975187793 or visit https://www.consultry.in/

0 notes