#Public Liability Insurance Service

Explore tagged Tumblr posts

Text

Unveiling the Power of Liabilities Insurance: Your Guide to Public Liability Insurance

Hey there, lovely readers! Are you ready to dive into the world of liabilities insurance and uncover the magic of public liability insurance? Well, buckle up because we're about to take you on an exciting journey where we break down these insurance terms and help you understand why they matter in today's world.

What Exactly Are Liabilities?

Liabilities might sound like a complex financial term, but at its core, it's simply what you owe to others – debts or obligations that arise from various situations. Think of it as the money you might have to pay out if something goes wrong. And hey, life isn't always smooth sailing, right? That's where liabilities insurance comes into play.

The Superpower of Liabilities Insurance

Liabilities insurance is like a safety net for both individuals and businesses. It's designed to protect you from unexpected financial hits that might arise from situations where you're deemed responsible for damage or injuries to others. Whether it's a slip-and-fall incident at your business premises or accidental damage caused by your products, liabilities insurance has got your back.

Public Liability Insurance: Your Shield in the Public Sphere

What's the Buzz About Public Liability Insurance?

Now, let's zoom in on one particular aspect of liabilities insurance: public liability insurance for business. Imagine you own a bakery and a customer slips on a wet floor, resulting in an injury. Public liability insurance steps in to cover the medical expenses and any potential legal fees – saving you from a financial headache!

Why Your Business Needs It

Customer-Centric Safety Net: If you interact with the public, whether you own a store, a restaurant, or even run events, public liability insurance is your safety net. Accidents can happen, and having this coverage ensures that you can focus on delivering great experiences instead of worrying about the unexpected.

Legal Compliance and Contracts: Many venues and partners might require you to have public liability insurance before collaborating. It's a sign that you're a responsible business owner who cares about your customers' well-being.

Peace of Mind: Knowing that you're protected in case of mishaps lets you navigate your business journey with confidence. No more sleepless nights over "what ifs."

Navigating the Liabilities Insurance Landscape

Types of Liabilities Insurance

General Liability Insurance: This covers a broad range of situations where you might be held liable for injuries or damages.

Product Liability Insurance: Perfect for businesses that manufacture or sell products, as it provides coverage against potential damages caused by your products.

Professional Liability Insurance: Also known as errors and omissions insurance, this is crucial for service-based businesses, protecting you from claims related to professional mistakes or negligence.

Tailoring Coverage to Your Needs

Remember, one size doesn't fit all when it comes to insurance. Consider factors like the nature of your business, the scale of your operations, and potential risks. Working with an insurance expert can help you customize the coverage that suits your unique situation.

Embrace Protection Today!

In this unpredictable world, liabilities insurance, especially public liability insurance, is your secret weapon. It's the shield that guards your financial well-being when unexpected events unfold. So, whether you're a business owner or an individual, take the leap and explore the world of liabilities insurance. Your peace of mind is worth it!

Remember, accidents happen, but being prepared makes all the difference. Ready to embark on your journey of financial security? Start by exploring the world of public liability insurance and let those worries melt away.

Stay covered, stay confident!

Source:https://runacresfinancial.finance.blog/2023/09/01/unveiling-the-power-of-liabilities-insurance-your-guide-to-public-liability-insurance/

0 notes

Text

The reason you can’t buy a car is the same reason that your health insurer let hackers dox you

On July 14, I'm giving the closing keynote for the fifteenth HACKERS ON PLANET EARTH, in QUEENS, NY. Happy Bastille Day! On July 20, I'm appearing in CHICAGO at Exile in Bookville.

In 2017, Equifax suffered the worst data-breach in world history, leaking the deep, nonconsensual dossiers it had compiled on 148m Americans and 15m Britons, (and 19k Canadians) into the world, to form an immortal, undeletable reservoir of kompromat and premade identity-theft kits:

https://en.wikipedia.org/wiki/2017_Equifax_data_breach

Equifax knew the breach was coming. It wasn't just that their top execs liquidated their stock in Equifax before the announcement of the breach – it was also that they ignored years of increasingly urgent warnings from IT staff about the problems with their server security.

Things didn't improve after the breach. Indeed, the 2017 Equifax breach was the starting gun for a string of more breaches, because Equifax's servers didn't just have one fubared system – it was composed of pure, refined fubar. After one group of hackers breached the main Equifax system, other groups breached other Equifax systems, over and over, and over:

https://finance.yahoo.com/news/equifax-password-username-admin-lawsuit-201118316.html

Doesn't this remind you of Boeing? It reminds me of Boeing. The spectacular 737 Max failures in 2018 weren't the end of the scandal. They weren't even the scandal's start – they were the tipping point, the moment in which a long history of lethally defective planes "breached" from the world of aviation wonks and into the wider public consciousness:

https://en.wikipedia.org/wiki/List_of_accidents_and_incidents_involving_the_Boeing_737

Just like with Equifax, the 737 Max disasters tipped Boeing into a string of increasingly grim catastrophes. Each fresh disaster landed with the grim inevitability of your general contractor texting you that he's just opened up your ceiling and discovered that all your joists had rotted out – and that he won't be able to deal with that until he deals with the termites he found last week, and that they'll have to wait until he gets to the cracks in the foundation slab from the week before, and that those will have to wait until he gets to the asbestos he just discovered in the walls.

Drip, drip, drip, as you realize that the most expensive thing you own – which is also the thing you had hoped to shelter for the rest of your life – isn't even a teardown, it's just a pure liability. Even if you razed the structure, you couldn't start over, because the soil is full of PCBs. It's not a toxic asset, because it's not an asset. It's just toxic.

Equifax isn't just a company: it's infrastructure. It started out as an engine for racial, political and sexual discrimination, paying snoops to collect gossip from nosy neighbors, which was assembled into vast warehouses full of binders that told bank officers which loan applicants should be denied for being queer, or leftists, or, you know, Black:

https://jacobin.com/2017/09/equifax-retail-credit-company-discrimination-loans

This witch-hunts-as-a-service morphed into an official part of the economy, the backbone of the credit industry, with a license to secretly destroy your life with haphazardly assembled "facts" about your life that you had the most minimal, grudging right to appeal (or even see). Turns out there are a lot of customers for this kind of service, and the capital markets showered Equifax with the cash needed to buy almost all of its rivals, in mergers that were waved through by a generation of Reaganomics-sedated antitrust regulators.

There's a direct line from that acquisition spree to the Equifax breach(es). First of all, companies like Equifax were early adopters of technology. They're a database company, so they were the crash-test dummies for ever generation of database. These bug-riddled, heavily patched systems were overlaid with subsequent layers of new tech, with new defects to be patched and then overlaid with the next generation.

These systems are intrinsically fragile, because things fall apart at the seams, and these systems are all seams. They are tech-debt personified. Now, every kind of enterprise will eventually reach this state if it keeps going long enough, but the early digitizers are the bow-wave of that coming infopocalypse, both because they got there first and because the bottom tiers of their systems are composed of layers of punchcards and COBOL, crumbling under the geological stresses of seventy years of subsequent technology.

The single best account of this phenomenon is the British Library's postmortem of their ransomware attack, which is also in the running for "best hard-eyed assessment of how fucked things are":

https://www.bl.uk/home/british-library-cyber-incident-review-8-march-2024.pdf

There's a reason libraries, cities, insurance companies, and other giant institutions keep getting breached: they started accumulating tech debt before anyone else, so they've got more asbestos in the walls, more sagging joists, more foundation cracks and more termites.

That was the starting point for Equifax – a company with a massive tech debt that it would struggle to pay down under the most ideal circumstances.

Then, Equifax deliberately made this situation infinitely worse through a series of mergers in which it bought dozens of other companies that all had their own version of this problem, and duct-taped their failing, fucked up IT systems to its own. The more seams an IT system has, the more brittle and insecure it is. Equifax deliberately added so many seams that you need to be able to visualized additional spatial dimensions to grasp them – they had fractal seams.

But wait, there's more! The reason to merge with your competitors is to create a monopoly position, and the value of a monopoly position is that it makes a company too big to fail, which makes it too big to jail, which makes it too big to care. Each Equifax acquisition took a piece off the game board, making it that much harder to replace Equifax if it fucked up. That, in turn, made it harder to punish Equifax if it fucked up. And that meant that Equifax didn't have to care if it fucked up.

Which is why the increasingly desperate pleas for more resources to shore up Equifax's crumbling IT and security infrastructure went unheeded. Top management could see that they were steaming directly into an iceberg, but they also knew that they had a guaranteed spot on the lifeboats, and that someone else would be responsible for fishing the dead passengers out of the sea. Why turn the wheel?

That's what happened to Boeing, too: the company acquired new layers of technical complexity by merging with rivals (principally McDonnell-Douglas), and then starved the departments that would have to deal with that complexity because it was being managed by execs whose driving passion was to run a company that was too big to care. Those execs then added more complexity by chasing lower costs by firing unionized, competent, senior staff and replacing them with untrained scabs in jurisdictions chosen for their lax labor and environmental enforcement regimes.

(The biggest difference was that Boeing once had a useful, high-quality product, whereas Equifax started off as an irredeemably terrible, if efficient, discrimination machine, and grew to become an equally terrible, but also ferociously incompetent, enterprise.)

This is the American story of the past four decades: accumulate tech debt, merge to monopoly, exponentially compound your tech debt by combining barely functional IT systems. Every corporate behemoth is locked in a race between the eventual discovery of its irreparable structural defects and its ability to become so enmeshed in our lives that we have to assume the costs of fixing those defects. It's a contest between "too rotten to stand" and "too big to care."

Remember last February, when we all discovered that there was a company called Change Healthcare, and that they were key to processing virtually every prescription filled in America? Remember how we discovered this? Change was hacked, went down, ransomed, and no one could fill a scrip in America for more than a week, until they paid the hackers $22m in Bitcoin?

https://en.wikipedia.org/wiki/2024_Change_Healthcare_ransomware_attack

How did we end up with Change Healthcare as the linchpin of the entire American prescription system? Well, first Unitedhealthcare became the largest health insurer in America by buying all its competitors in a series of mergers that comatose antitrust regulators failed to block. Then it combined all those other companies' IT systems into a cosmic-scale dog's breakfast that barely ran. Then it bought Change and used its monopoly power to ensure that every Rx ran through Change's servers, which were part of that asbestos-filled, termite-infested, crack-foundationed, sag-joisted teardown. Then, it got hacked.

United's execs are the kind of execs on a relentless quest to be too big to care, and so they don't care. Which is why their they had to subsequently announce that they had suffered a breach that turned the complete medical histories of one third of Americans into immortal Darknet kompromat that is – even now – being combined with breach data from Equifax and force-fed to the slaves in Cambodia and Laos's pig-butchering factories:

https://www.cnn.com/2024/05/01/politics/data-stolen-healthcare-hack/index.html

Those slaves are beaten, tortured, and punitively raped in compounds to force them to drain the life's savings of everyone in Canada, Australia, Singapore, the UK and Europe. Remember that they are downstream of the forseeable, inevitable IT failures of companies that set out to be too big to care that this was going to happen.

Failures like Ticketmaster's, which flushed 500 million users' personal information into the identity-theft mills just last month. Ticketmaster, you'll recall, grew to its current scale through (you guessed it), a series of mergers en route to "too big to care" status, that resulted in its IT systems being combined with those of Ticketron, Live Nation, and dozens of others:

https://www.nytimes.com/2024/05/31/business/ticketmaster-hack-data-breach.html

But enough about that. Let's go car-shopping!

Good luck with that. There's a company you've never heard. It's called CDK Global. They provide "dealer management software." They are a monopolist. They got that way after being bought by a private equity fund called Brookfield. You can't complete a car purchase without their systems, and their systems have been hacked. No one can buy a car:

https://www.cnn.com/2024/06/27/business/cdk-global-cyber-attack-update/index.html

Writing for his BIG newsletter, Matt Stoller tells the all-too-familiar story of how CDK Global filled the walls of the nation's auto-dealers with the IT equivalent of termites and asbestos, and lays the blame where it belongs: with a legal and economics establishment that wanted it this way:

https://www.thebignewsletter.com/p/a-supreme-court-justice-is-why-you

The CDK story follows the Equifax/Boeing/Change Healthcare/Ticketmaster pattern, but with an important difference. As CDK was amassing its monopoly power, one of its execs, Dan McCray, told a competitor, Authenticom founder Steve Cottrell that if he didn't sell to CDK that he would "fucking destroy" Authenticom by illegally colluding with the number two dealer management company Reynolds.

Rather than selling out, Cottrell blew the whistle, using Cottrell's own words to convince a district court that CDK had violated antitrust law. The court agreed, and ordered CDK and Reynolds – who controlled 90% of the market – to continue to allow Authenticom to participate in the DMS market.

Dealers cheered this on: CDK/Reynolds had been steadily hiking prices, while ingesting dealer data and using it to gouge the dealers on additional services, while denying dealers access to their own data. The services that Authenticom provided for $35/month cost $735/month from CDK/Reynolds (they justified this price hike by saying they needed the additional funds to cover the costs of increased information security!).

CDK/Reynolds appealed the judgment to the 7th Circuit, where a panel of economists weighed in. As Stoller writes, this panel included monopoly's most notorious (and well-compensated) cheerleader, Frank Easterbrook, and the "legendary" Democrat Diane Wood. They argued for CDK/Reynolds, demanding that the court release them from their obligations to share the market with Authenticom:

https://caselaw.findlaw.com/court/us-7th-circuit/1879150.html

The 7th Circuit bought the argument, overturning the lower court and paving the way for the CDK/Reynolds monopoly, which is how we ended up with one company's objectively shitty IT systems interwoven into the sale of every car, which meant that when Russian hackers looked at that crosseyed, it split wide open, allowing them to halt auto sales nationwide. What happens next is a near-certainty: CDK will pay a multimillion dollar ransom, and the hackers will reward them by breaching the personal details of everyone who's ever bought a car, and the slaves in Cambodian pig-butchering compounds will get a fresh supply of kompromat.

But on the plus side, the need to pay these huge ransoms is key to ensuring liquidity in the cryptocurrency markets, because ransoms are now the only nondiscretionary liability that can only be settled in crypto:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

When the 7th Circuit set up every American car owner to be pig-butchered, they cited one of the most important cases in antitrust history: the 2004 unanimous Supreme Court decision in Verizon v Trinko:

https://www.oyez.org/cases/2003/02-682

Trinko was a case about whether antitrust law could force Verizon, a telcoms monopolist, to share its lines with competitors, something it had been ordered to do and then cheated on. The decision was written by Antonin Scalia, and without it, Big Tech would never have been able to form. Scalia and Trinko gave us the modern, too-big-to-care versions of Google, Meta, Apple, Microsoft and the other tech baronies.

In his Trinko opinion, Scalia said that "possessing monopoly power" and "charging monopoly prices" was "not unlawful" – rather, it was "an important element of the free-market system." Scalia – writing on behalf of a unanimous court! – said that fighting monopolists "may lessen the incentive for the monopolist…to invest in those economically beneficial facilities."

In other words, in order to prevent monopolists from being too big to care, we have to let them have monopolies. No wonder Trinko is the Zelig of shitty antitrust rulings, from the decision to dismiss the antitrust case against Facebook and Apple's defense in its own ongoing case:

https://www.ftc.gov/system/files/documents/cases/073_2021.06.28_mtd_order_memo.pdf

Trinko is the origin node of too big to care. It's the reason that our whole economy is now composed of "infrastructure" that is made of splitting seams, asbestos, termites and dry rot. It's the reason that the entire automotive sector became dependent on companies like Reynolds, whose billionaire owner intentionally and illegally destroyed evidence of his company's crimes, before going on to commit the largest tax fraud in American history:

https://www.wsj.com/articles/billionaire-robert-brockman-accused-of-biggest-tax-fraud-in-u-s-history-dies-at-81-11660226505

Trinko begs companies to become too big to care. It ensures that they will exponentially increase their IT debt while becoming structurally important to whole swathes of the US economy. It guarantees that they will underinvest in IT security. It is the soil in which pig butchering grew.

It's why you can't buy a car.

Now, I am fond of quoting Stein's Law at moments like this: "anything that can't go on forever will eventually stop." As Stoller writes, after two decades of unchallenged rule, Trinko is looking awfully shaky. It was substantially narrowed in 2023 by the 10th Circuit, which had been briefed by Biden's antitrust division:

https://law.justia.com/cases/federal/appellate-courts/ca10/22-1164/22-1164-2023-08-21.html

And the cases of 2024 have something going for them that Trinko lacked in 2004: evidence of what a fucking disaster Trinko is. The wrongness of Trinko is so increasingly undeniable that there's a chance it will be overturned.

But it won't go down easy. As Stoller writes, Trinko didn't emerge from a vacuum: the economic theories that underpinned it come from some of the heroes of orthodox economics, like Joseph Schumpeter, who is positively worshipped. Schumpeter was antitrust's OG hater, who wrote extensively that antitrust law didn't need to exist because any harmful monopoly would be overturned by an inevitable market process dictated by iron laws of economics.

Schumpeter wrote that monopolies could only be sustained by "alertness and energy" – that there would never be a monopoly so secure that its owner became too big to care. But he went further, insisting that the promise of attaining a monopoly was key to investment in great new things, because monopolists had the economic power that let them plan and execute great feats of innovation.

The idea that monopolies are benevolent dictators has pervaded our economic tale for decades. Even today, critics who deplore Facebook and Google do so on the basis that they do not wield their power wisely (say, to stamp out harassment or disinformation). When confronted with the possibility of breaking up these companies or replacing them with smaller platforms, those critics recoil, insisting that without Big Tech's scale, no one will ever have the power to accomplish their goals:

https://pluralistic.net/2023/07/18/urban-wildlife-interface/#combustible-walled-gardens

But they misunderstand the relationship between corporate power and corporate conduct. The reason corporations accumulate power is so that they can be insulated from the consequences of the harms they wreak upon the rest of us. They don't inflict those harms out of sadism: rather, they do so in order to externalize the costs of running a good system, reaping the profits of scale while we pay its costs.

The only reason to accumulate corporate power is to grow too big to care. Any corporation that amasses enough power that it need not care about us will not care about it. You can't fix Facebook by replacing Zuck with a good unelected social media czar with total power over billions of peoples' lives. We need to abolish Zuck, not fix Zuck.

Zuck is not exceptional: there were a million sociopaths whom investors would have funded to monopolistic dominance if he had balked. A monopoly like Facebook has a Zuck-shaped hole at the top of its org chart, and only someone Zuck-shaped will ever fit through that hole.

Our whole economy is now composed of companies with sociopath-shaped holes at the tops of their org chart. The reason these companies can only be run by sociopaths is the same reason that they have become infrastructure that is crumbling due to sociopathic neglect. The reckless disregard for the risk of combining companies is the source of the market power these companies accumulated, and the market power let them neglect their systems to the point of collapse.

This is the system that Schumpeter, and Easterbrook, and Wood, and Scalia – and the entire Supreme Court of 2004 – set out to make. The fact that you can't buy a car is a feature, not a bug. The pig-butcherers, wallowing in an ocean of breach data, are a feature, not a bug. The point of the system was what it did: create unimaginable wealth for a tiny cohort of the worst people on Earth without regard to the collapse this would provoke, or the plight of those of us trapped and suffocating in the rubble.

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/28/dealer-management-software/#antonin-scalia-stole-your-car

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#matt stoller#monopoly#automotive#trinko#antitrust#trustbusting#cdk global#brookfield#private equity#dms#dealer management software#blacksuit#infosec#Authenticom#Dan McCray#Steve Cottrell#Reynolds#frank easterbrook#schumpeter

994 notes

·

View notes

Text

"How come you guys get a parade but there's no parade for Military Appreciation Month?"

We actually don't get a parade. The military has three parades during the summer: memorial day, July 4, and Labor Day. I think that its okay if there isn't a parade in June if there's one in May, July, and September. There is also a military presence in the Christmas parade.

Parades are expensive! And they take a lot of planning and logistics! Someone has to clean up all the confetti. The police have to be present to barricade side streets. There's insurance. There's liability. Even just running a float in a parade or marching in a parade can be expensive and time consuming!

Do I think that a parade could be fun? Sure! But I'd end up being on the organizing end of it and that's a lot of work.

Our town has three parades with military themes, streets lined with banners for active duty service members, three memorial parks, and a lot of very showy events in public places.

The queers have a nonprofit organization, sponsorships of local businesses, a food pantry at our local hangout, and a four hour festival in a parking lot.

I'm sorry we didn't acknowledge Military Appreciation Month.

If it makes you feel better, I forgot Lesbian Awareness Week. And I'm a lesbian.

121 notes

·

View notes

Text

Today’s Legislative Updates February 17, 2025

Trans rights are still under attack in the United States. Please visit our website linked below to learn about your state and contact your reps. Here's a thread of today's updates:

Bathroom bills deny access to public restrooms by gender or trans identity.

They increase danger without making anyone any safer and have even prompted attacks on cis and trans people alike. Many national health and anti-sexual assault organizations oppose these bills.

New Bills:

West Virginia introduced bathroom bill SB456 last Thursday and sent it to the Senate Judiciary Committee.

Old Bills:

Kentucky sent bill HB5 to the House Judiciary Committee last Friday.

Utah’s governor signed bill HB0269 into law last Friday.

Mississippi sent bill HB188 to the Senate Corrections Committee last Friday.

North Dakota sent bill HB1144 to the Senate Education Committee last Friday.

Healthcare bills go against professional and scientific consensus that gender-affirming care saves lives. Denying access will cause harm.

Providers are faced with criminal charges, parents are threatened with child abuse charges, and intersex children are typically exempted.

New Bills:

Rhode Island introduced bill S0270 last Thursday and sent it to the Senate Health and Human Services Committee. This is a healthcare ban that also includes a provider liability extension.

Texas filed bill SB1257 last Thursday, This bill requires insurance to cover de-transitioning and to cover any adverse effects from gender-affirming care - something already required by default.

Old Bills:

Utah gave bill HB0252 its second Senate floor reading last Thursday.

Georgia sent bill SB39 to the House Health Committee last Thursday.

Georgia passed bill SB30 through its committee last Thursday and sent it to the Senate floor.

Montana passed bill SB218 through its second Senate floor reading last Saturday.

Drag Bans restrict access for folks who are gender non-conforming in any way.

They loosely define "drag" as any public performance with an “opposite gender expression,” as sexual in nature, and inappropriate for children.

This also pushes trans individuals out of public spaces.

Old Bills:

Wyoming sent bill HB0134 over to the Senate last Thursday.

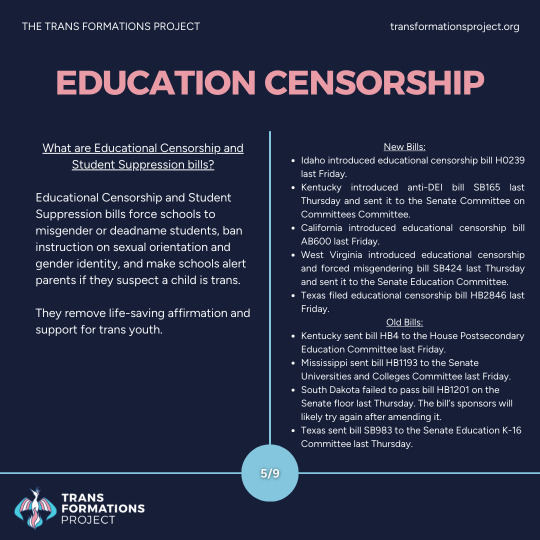

Educational Censorship and Student Suppression bills force schools to misgender or deadname students, ban instruction on sexual orientation and gender identity, and make schools alert parents if they suspect a child is trans.

They remove life-saving affirmation and support for trans youth.

New Bills:

Idaho introduced educational censorship bill H0239 last Friday.

Kentucky introduced anti-DEI bill SB165 last Thursday and sent it to the Senate Committee on Committees Committee.

California introduced educational censorship bill AB600 last Friday.

West Virginia introduced educational censorship and forced misgendering bill SB424 last Thursday and sent it to the Senate Education Committee.

Texas filed educational censorship bill HB2846 last Friday.

Old Bills:

Kentucky sent bill HB4 to the House Postsecondary Education Committee last Friday.

Mississippi sent bill HB1193 to the Senate Universities and Colleges Committee last Friday.

South Dakota failed to pass bill HB1201 on the Senate floor last Thursday. The bill’s sponsors will likely try again after amending it.

Texas sent bill SB983 to the Senate Education K-16 Committee last Thursday.

Trans Erasure bills create legal definitions of terms like “sex” designed to exclude or erase trans identity and insert them into various laws. This can have many different effects, depending on what laws are affected.

They can force a male or female designation based on sex assigned at birth.

Some target anti-discrimination statutes, legally empowering trans discrimination.

New Bills:

Minnesota introduced trans erasure bill HF700 last Thursday and sent it to the House Judiciary Finance and Civil Law Committee.

Old Bills:

Tennessee sent bill HB1271 to the House Judiciary Committee last Friday.

Most sports bills force schools to designate teams by sex assigned at birth.

They are often one-sided and ban trans girls from playing on teams consistent with their gender identity.

Some egregious bills even force invasive genital examinations on student athletes.

New Bills:

Rhode Island introduced sports bill S0304 last Thursday and sent it to the Senate Judiciary Committee.

Old Bills:

Utah passed bill HB0424 through its committee last Friday and sent it to the House floor.

Indiana passed bill HB1041 through its committee last Thursday and sent it to the House floor.

In other bills that either fit multiple categories or stand on their own, we have:

New Bills:

Missouri introduced bill SB704 last Wednesday. This bill prevents refusal to accept a child’s gender identity from being defined as child abuse and from being considered when deciding custody.

West Virginia introduced anti-DEI bill SB474 last Friday and sent it to the Senate Judiciary Committee.

Old Bills:

West Virginia bill HB2033 had a hearing today in the House Human Services Committee.

Utah passed bill HB0283 through the House last Friday and introduced it in the Senate.

It's not too late to stop these and other hateful anti-trans bills from passing into law. YOU can go to http://transformationsproject.org/ to learn more and contact your representatives!

#protect trans kids#lgbtq#trans#activism#trans formations project#transgender#trans rights#lgbt#anti trans legislation

25 notes

·

View notes

Text

Andrew Perez at Rolling Stone:

EARLIER THIS WEEK, two Democratic senators announced they have requested a criminal investigation into Supreme Court Justice Clarence Thomas — regarding, in part, a loan for a luxury RV provided by a longtime executive at UnitedHealth Group, one of America’s largest health insurers. Thomas apparently recused himself in at least two cases involving UnitedHealth when the loan was active, according to a Rolling Stone review. Yet, he separately chose to participate in another health insurance case and authored the court’s unanimous opinion in 2004. The ruling broadly benefited the industry — shielding employer-sponsored health insurers from damages if they refuse to cover certain services and patients are harmed. Thomas’ advice to patients facing such denials? Pull out your checkbook.

While UnitedHealth was not a party to the case, the company belonged to two trade associations that filed a brief urging the Supreme Court to side with the insurers. “As we saw so starkly this term, Supreme Court decisions can have sweeping collateral implications: If the court rules in favor of one insurance giant, for instance, it tends to be a boon for all the other insurance giants, too,” says Alex Aronson, executive director at the judicial reform group Court Accountability. “That was the case here, and it’s a perfect example of why justices shouldn’t accept gifts — especially secret ones — from industry titans whose interests are implicated, whether directly or indirectly, by their rulings.” The public had no way of knowing about Thomas’ RV loan at the time of the decision: The loan was only exposed by The New York Times last year. Senate Democrats investigating Thomas believe that much or all of the loan, for a $267,230 motor coach, was ultimately forgiven. Sens. Sheldon Whitehouse (D-R.I.) and Ron Wyden (D-Ore.) recently requested the Justice Department investigate whether Thomas reported the forgiven portion of the loan on his tax filings, after he failed to disclose it in ethics forms.

Meanwhile, Thomas’ health insurance opinion has had wide-ranging, long-lasting ramifications, according to Mark DeBofsky, an employee benefits lawyer and former law professor. “It hasn’t been rectified. The repercussions continue,” DeBofsky tells Rolling Stone. “People who are in dire need of specific medical care, and [their] insurance company turns around and says, ‘That care is not medically necessary,’ and there’s an adverse outcome as a result of the denial of the treatment, or hospitalization, or service — there’s no recompense for what could have been an unnecessary death or serious injury.” Since last year, the Supreme Court has faced an unprecedented ethics crisis, with much of the focus aimed squarely at Thomas. ProPublica reported that Thomas received and failed to disclose two decades worth of luxury gifts from a conservative billionaire, Harlan Crow, who allegedly provided free private jet and superyacht trips to Thomas and his wife; bought a house from Thomas and allowed the justice’s elderly mother to live there for free; and paid for at least two years of boarding school tuition for Thomas’ grandnephew.

[...] Federal law requires Supreme Court justices to recuse themselves in any case where their “impartiality might reasonably be questioned.” The justices decide for themselves when such a move is necessary — and when they do withdraw from a case, they rarely say why. Thomas does not appear to have explained his decision to withdraw from the two matters that directly involved UnitedHealth. Thomas did not take similar steps in Aetna Health Inc. v. Davila, a case that broadly affected the health insurance industry. He instead authored the court’s opinion, which expanded insurers’ favorite tool for limiting liability: ERISA. Congress passed the Employee Retirement Income Security Act, commonly known as ERISA, in 1974 to protect employee benefits. The law is relatively vague when it comes to “welfare benefits,” and contains a broad preemption clause. The courts have filled in the blanks — including in the Aetna Health case — with distressing results for patients. Half of Americans have employer-sponsored health insurance coverage; nearly all of these plans are governed by ERISA.

Rolling Stone exposes how SCOTUS Justice Clarence Thomas received a $267K RV from a health insurance executive.

#Clarence Thomas#SCOTUS Ethics Crisis#SCOTUS#Ethics#Ron Wyden#Sheldon Whitehouse#UnitedHealth Group#Health Insurance#Employee Retirement Income Security Act#Harlan Crow

21 notes

·

View notes

Note

Can I see a WIP you are currently really excited about???

Sorry I got to this so late! I had to think a little since a lot of them are all over the place (^~^;)ゞ

I would have to say my Quirk Laws/Acts + Different Vigilante groups!

I like to flesh out the world to see what might go on outside of our lovely set of characters ( ╹▽╹ )

Quirk Laws and Acts

Quirk registration: All individuals with quirks must register with the government, providing their quirk type, power level, and other relevant information.

Quirk insurance: Quirk users may be required to carry liability insurance in case their powers cause damage or harm to others.

Quirk education: Children with certain quirks may be required to attend special schools or receive specialized training to learn how to control their powers. (Think of children with dangerous quirks or quirks that are always activated/easily triggered)

Quirk Discrimination Act - This law makes it illegal to discriminate against someone based on their quirk. It could be similar to Japan's Equal Employment Opportunity Law, which prohibits discrimination in employment based on certain characteristics such as race, gender, and religion (Do they always enforce this? No. No they don't...)

Quirk Licensing and Regulation Act - This law requires individuals to obtain a license in order to use their quirk in public.

Quirk Medical Treatment Act - This law requires certain medical professionals to receive special training in the treatment of quirks and establishes protocols for emergency medical care for those with quirks. (Pays more than your standard doctor. Have you read a fic where someone got hit with a quirk and went to the hospital? These should be the people they're going to)

Any individual who operates as a vigilante without a license is committing a criminal offense and is subject to punishment under the law.

Quirk Level: For Vigilantes with low-level quirks, such as those that do not pose a significant threat to public safety, the punishment for using their quirk without a hero license will be a warning for the first offense. However, any subsequent offenses will result in a fine of up to 500,000 yen.

Quirk Level and Seriousness of Crime: For Vigilantes with high-level quirks, such as those that can cause significant damage or harm to the public, the punishment for using their quirk without a hero license will be imprisonment for up to five years for the first offense. Any subsequent offenses will result in imprisonment for up to ten years and a fine of up to 10,000,000 yen.

Repeat Offenders: For Vigilantes who have been caught multiple times, regardless of their quirk level, the punishment will be more severe. For the second offense, the fine will be doubled, and the individual may also face community service or probation. For the third offense, the individual will face a mandatory prison sentence, and their quirk may be permanently restricted

Causing Injury or Death: If a Vigilante's actions result in significant harm to the public or a hero, they will face imprisonment for up to fifteen years and a fine of up to 50,000,000 yen. If their actions result in death, the punishment will be life imprisonment without parole.

I'm still working on this list (aka last worked 2 years ago) but I'd love to use it more in my writing! I encourage others to do the same if they wish!

As I was saying in my post yesterday as well, I also made some laws for what I believe would've been made when quirks first started appearing. I like to think that at the first real signs of quirks starting to appear, government officials and those in power wanted to quickly cull the group that they thought were "infected". So the laws at the time could've been downright awful, in order to separate those deemed unnatural

These all vary by the generation. The earlier the generation, the harsher and more immediate the laws were. Later generations it just turned into plain discrimination instead of Death - still bad but not nearly on the same level

Emergency laws and regulations that were put into place during the early stages of the development of quirks:

Quirk Containment: All individuals exhibiting signs of having a quirk were to be immediately apprehended and taken to containment facilities for observation and study.

Forced Registration: All individuals with quirks were required to register with the government and provide detailed information about their quirk, their abilities, and their personal information.

The Quarantine Act - People with quirks were forcibly removed from their homes and quarantined in special facilities, separated from their families and loved ones.

The Prohibition Act - The use of quirks was prohibited in all public spaces, and individuals caught using their quirks could face severe punishment.

Hmm... I thought I had more? I guess not

I have my fun thinking about how the MHA world functions ( ˶>ᴗ<˶) I want to make more of these, I thought I had more written down but I guess it was labeled 'WIP' for a reason (^_^;)

Writing wise; I would have to say the fics that are so close to being finished that I somehow never get around to (´-﹏-`;)

My Escaping The Night series. I'm pretty much 90% done with the latest chapter and I keep forgetting to work on that! It's my favorite thing that I'm writing above everything else ʕ→ᴥ←ʔ

In The Wake of Chaos; started the Final Act. I had it planned and was so close to finishing. Unfortunately forgot what ending I wanted to is stuck where it is right now ( ̄ヘ ̄;)

Purity Prevails at Midnight: one of the longest asks I've ever received, but the plot was very cool! I've BARELY started on it though, a lot to get done (;^ω^)

A Glimpse of Tomorrow: a Shirakumo fic I'm almost done with! Excited because there's barely any Shirakumo content (๑•﹏•)

Thanks for the ask! If I had unlimited free time then there's no telling what I'd get done lol

#really really really want to flesh these out (>///<) SO BAD#but i barely have time to sleep (─.─||) Let alone do anything creative#maybe during summer break (^~^;)ゞ#💬#my hero academia#boku no hero academia#bnha#mha#📝#copycat writes#my friends ♡#geekandafreak

6 notes

·

View notes

Text

Understanding Fleets: Key Organizations in the Trucking Industry

The trucking industry is a vital component of the global economy, responsible for moving goods efficiently across vast distances. Within this intricate network, various organizations play essential roles in shaping operations, regulations, and the future of trucking. Understanding these key organizations is crucial for industry stakeholders, from fleet managers to logistics providers.

For-hire carriers and Private Fleets

For-hire carriers are companies that transport goods for others in exchange for compensation.

Common Carriers: These carriers offer services to the general public and are obligated to transport goods as long as they have the capacity and are lawful.

Contract Carriers: These carriers provide services based on specific contracts with shippers, allowing for tailored transportation solutions that meet unique customer needs.

Private Fleets, on the other hand, are operated by companies to transport their products. Firms like Walmart and Coca-Cola manage private fleets to control logistics and distribution effectively, ensuring timely deliveries and cost efficiency. 2. American Trucking Associations (ATA)

The American Trucking Association is the largest national trade organization representing the trucking industry. Founded in 1933, the ATA advocates for the interests of trucking companies, working on issues such as safety regulations, infrastructure funding, and tax policies. They provide valuable resources, including industry research, educational programs, and networking opportunities, helping members stay informed about best practices and legislative changes. 3. Trucking Industry Defense Association (TIDA)

The Trucking Industry Defense Association focuses on legal and regulatory issues affecting the trucking sector. TIDA works to protect the interests of trucking companies in legal matters, providing resources, education, and representation to help navigate complex legal challenges. Their efforts ensure the latest legal developments and the necessary support to address potential liabilities. 4. National Association of Small Trucking Companies (NASTC)

The National Association of Small Trucking Companies represents the interests of smaller trucking businesses. NASTC offers resources, advocacy, and networking opportunities tailored to the unique challenges faced by small operators. The association provides members access to discounted services, insurance programs, and training opportunities, helping to level the playing field with larger competitors. 5. Fleet Management Associations

Numerous associations focus on fleet management, promoting best practices, and providing resources to help companies improve their operations. These organizations offer training, certifications, and networking events aimed at enhancing fleet efficiency and safety. Key associations include:

The Association for Fleet Management Professionals (NAFA): NAFA provides resources and education for fleet managers, focusing on innovative practices, sustainability, and regulatory compliance.

The National Private Truck Council (NPTC): NPTC represents companies that operate private fleets, offering members access to industry research, benchmarking data, and educational resources specific to private fleet operations. 6. Regulatory Bodies

Various regulatory bodies oversee the trucking industry to ensure safety and compliance. Key organizations include:

Federal Motor Carrier Safety Administration (FMCSA): The FMCSA regulates the trucking industry in the United States, establishing safety standards, monitoring compliance, and enforcing regulations to protect public safety.

Department of Transportation (DOT): The DOT oversees transportation infrastructure and policies, ensuring that roads and highways are for safe and efficient trucking operations.

Conclusion

Understanding the key organizations in the trucking industry is essential for navigating the complexities of fleet management and logistics. From advocacy groups like the American Trucking Associations to regulatory bodies like the FMCSA, these organizations play vital roles in shaping the industry landscape. By engaging with these entities, trucking companies can enhance their operations, stay informed about industry trends, and advocate for their interests in a rapidly changing environment. As the trucking industry continues to evolve, collaboration and support from these organizations will be critical to ensuring efficient and sustainable transportation solutions.

#trucking companies#immense trucking solutions ltd#real-time tracking#trucking company#National Association#communication tools#sustainability#efficient

2 notes

·

View notes

Text

Tree Removal in Harkaway: A Comprehensive Guide to Safe and Efficient Services

Harkaway, a picturesque suburb nestled in the southeastern region of Melbourne, is known for its lush greenery and expansive landscapes. As beautiful as the trees and natural surroundings may be, there are times when tree removal becomes necessary for safety, property maintenance, or landscape aesthetics. Whether you are a homeowner dealing with a potentially hazardous tree or simply want to enhance your garden’s beauty, understanding the tree removal process is essential. In this guide, we will explore everything you need to know about tree removal Harkaway, including when and why it's necessary, how to choose the right tree removal service, and the steps involved in the process.

Why Tree Removal Is Necessary

Trees provide a range of benefits, from improving air quality to offering shade and enhancing the beauty of your property. However, there are situations where tree removal becomes unavoidable. Below are some common reasons why tree removal in Harkaway may be necessary:

Safety Concerns Trees that are damaged, decaying, or leaning dangerously can pose a significant risk to people and property. A weakened tree can fall during a storm or high winds, causing serious injury or damage to homes, vehicles, or power lines. Removing hazardous trees before they become a problem is crucial for ensuring the safety of your family and neighbors.

Disease or Decay Trees affected by disease or pest infestations can become structurally compromised, making them more susceptible to falling. In some cases, the disease can spread to nearby trees, threatening the health of your entire landscape. If a tree is beyond saving, removal may be the only option to prevent further damage.

Property Damage Prevention Overgrown or poorly placed trees can damage buildings, fences, or underground utilities. The roots of large trees can crack foundations or block drainage systems, leading to costly repairs. In such cases, tree removal helps to protect your property from damage and reduce future maintenance costs.

Improving Aesthetics Sometimes, tree removal is needed to improve the overall look of your yard or garden. Dead, dying, or poorly placed trees can detract from the beauty of your landscape. Removing these trees opens up space for new plantings or allows for a more attractive garden layout.

Construction and Renovation Projects If you’re planning a home renovation or building project, tree removal may be required to clear the area for construction. Ensuring that trees are removed safely and efficiently is essential to avoiding delays and potential damage to your property during the project.

Choosing the Right Tree Removal Service in Harkaway

Hiring a professional tree removal service in Harkaway is the best way to ensure that the job is done safely and efficiently. However, with many options available, it’s essential to choose a service that is experienced, qualified, and reliable. Here are some key factors to consider when selecting a tree removal service:

Experience and Expertise Look for a tree removal company with a solid track record of experience in handling a wide variety of tree species and situations. Trees in Harkaway come in all shapes and sizes, and each may require a different approach to removal. A professional service will have the necessary skills and knowledge to assess the tree and determine the safest way to remove it.

Licensing and Insurance Tree removal can be a hazardous task, so it’s crucial to hire a company that is fully licensed and insured. This protects you from liability in case of accidents or damage during the removal process. Always verify that the service you choose carries adequate insurance coverage, including worker’s compensation and public liability insurance.

Safety Practices Safety should be a top priority for any tree removal service. Ask about the company’s safety protocols, including the use of protective equipment and trained staff. A professional service will follow industry-standard safety practices to minimize the risk of accidents and ensure the safe removal of the tree.

Equipment and Technology Tree removal requires specialized equipment, such as chainsaws, cranes, and stump grinders. Ensure that the company you choose has access to the necessary tools and machinery to handle the job efficiently. Modern equipment not only speeds up the process but also reduces the risk of damage to your property.

Customer Reviews and Reputation Check online reviews and testimonials from previous customers to get an idea of the company’s reputation. A tree removal service with positive reviews and satisfied clients is more likely to deliver high-quality work. Additionally, ask for references from the company to verify their past performance.

Environmental Considerations A responsible tree removal service will take environmental factors into account. Ask about their policies for tree disposal and recycling. Many companies will chip and mulch removed trees for use in landscaping, ensuring that the tree is repurposed in an eco-friendly manner.

The Tree Removal Process: What to Expect

The tree removal process involves several steps, each designed to ensure that the tree is safely and efficiently removed. Here’s a breakdown of what you can expect during a typical tree removal in Harkaway:

Initial Assessment Before any work begins, a professional arborist will visit your property to assess the tree and its surroundings. They will determine the tree’s condition, size, and the best approach for removal. This may include checking for hazards such as power lines, nearby buildings, or other obstacles.

Tree Removal Plan Once the assessment is complete, the arborist will develop a removal plan tailored to the specific tree. This plan will include details on how the tree will be cut down, what equipment will be used, and how the surrounding area will be protected during the removal process.

Cutting Down the Tree The tree will be carefully cut down in sections, starting from the top and working downwards. Depending on the tree’s size and location, the team may use a crane to lift and lower large branches to the ground. This method ensures that the tree is removed safely without causing damage to nearby structures.

Disposal and Cleanup Once the tree has been removed, the remaining debris, including branches, leaves, and wood, will be cleared from your property. Many tree removal services will offer options for recycling the wood, such as chipping it into mulch or cutting it into firewood.

Stump Removal (Optional) After the tree has been removed, you may choose to have the stump removed as well. Stump removal involves grinding down the stump to below ground level, leaving your yard clear and ready for landscaping or replanting.

Conclusion

Tree removal Harkaway is a necessary service that ensures the safety and aesthetic appeal of your property. By hiring a professional tree removal service, you can rest assured that the job will be completed safely, efficiently, and with minimal disruption to your surroundings. Whether you’re dealing with a hazardous tree or simply looking to enhance your landscape, choosing the right service is key to a successful outcome. Make sure to consider the factors outlined above when selecting a tree removal service, and enjoy the peace of mind that comes with knowing your property is in good hands.

2 notes

·

View notes

Text

SACRAMENTO, California — California's public university campuses will not be opening campus jobs to undocumented students after Gov. Gavin Newsom rejected legislation to create such a mandate.

The Sunday veto avoids legal and political risks as it crushes the hopes of immigrant rights activists who have suffered a string of defeats this year.

The Democratic governor in his veto message said immigrant students' access to higher education opportunities is "important for local communities and California's economy," but he warned of legal risks.

“Given the gravity of the potential consequences of this bill, which include potential criminal and civil liability for state employees, it is critical that the courts address the legality of such a policy and the novel legal theory behind this legislation before proceeding,” Newsom wrote in his veto message.

Newsom has previously supported services and rights for undocumented Californians, including the expansion of the state’s health insurance system to include all eligible undocumented residents.

But he has now vetoed two proposals in short succession, including legislation that would have opened up state-supported home loans to undocumented people, as former President Donald Trump hits Vice President Kamala Harris over progressive California policies and immigration on the campaign trail.

The governor’s decision means thousands of students will continue to seek under-the-table pay at off campus jobs, compete for paid fellowships or forego income altogether as they complete their coursework. Undocumented students in California receive financial aid but many have been unable to work on campus since a federal judge closed applications for the Deferred Action for Childhood Arrivals program in 2021.

“The federal government has failed Dreamers and failed on immigration reform,” Democratic Assemblymember David Alvarez, author of the bill, said in a statement after state lawmakers passed his legislation.

Progressive legal scholars and student activists last year sought to ease those restrictions at the University of California system, host to prestigious campuses including UC Berkeley and UCLA. They argued a federal law banning employment of undocumented people does not apply to state governments such as public universities.

University leaders questioned that untested legal theory and decided against allowing campuses to hire the students — at least until after the election. They publicly cited legal risks to employers and students, but officials also told POLITICO the Biden administration had privately pressured them not to proceed at a time when the president’s reelection campaign was taking hits over the border. The UC’s governing board members — many of them Newsom appointees — ultimately postponed discussion of the idea until January of 2025.

Democratic state lawmakers attempted to override the decision, introducing legislation a month later that in its final form sought to require the University of California, California State University and California Community Colleges to offer jobs to undocumented students. It was unclear, however, whether Assembly Bill 2586 would have applied to the UC, which has constitutional autonomy from the Legislature.

UC leadership had also considered seeking declaratory relief on the issue, essentially asking a court whether the system could hire the students before proceeding. That step was unpopular with activists who worried that option would prevent students from ever being hired, but Newsom in his veto message again floated having the UC go that route.

"Seeking declaratory relief in court — an option available to the University of California — would provide such clarity," he said of the legal ambiguity surrounding the issue.

University leaders never formally opposed the legislation, but their lobbyists warned legislators that it could expose their systems to lawsuits and make undocumented students and the people hiring them vulnerable to criminal prosecution.

“Unfortunately, AB 2586 does not protect our undocumented students or employees from prosecution, nor does it protect the University from the risk of potentially losing billions in federal dollars,” UC Legislative Director Mario Guerrero wrote in a letter to the state Senate Appropriations Committee in July. He added, “We would welcome working with the author and Legislature on other legal options to support these students.”

2 notes

·

View notes

Text

Insuring Peace of Mind: How Public Liability Insurance Supports Your Business Growth

Picture this: you have poured your heart and soul into building your business from the ground up. Every decision, every late night, every ounce of effort has been dedicated to its success. But amidst the bustling excitement of entrepreneurship, there lingers an ever-present concern - the potential risks and liabilities that come with running a business.

In this comprehensive article, we will delve into the world of liabilities insurance and how public liabiltity insurance can be your steadfast companion in navigating uncertain waters.

Understanding Public Liability Insurance

Public liability insurance is a crucial aspect of protecting your business from unforeseen events and potential financial liabilities. This type of insurance provides coverage for third-party claims that may arise due to property damage, bodily injury, or other incidents on your business premises or during business operations.

By comprehending the intricacies of public liability insurance, you can make informed decisions that ensure the long-term growth and stability of your business.

Safeguarding Your Business Assets

In an unpredictable business landscape, protecting your assets is paramount to ensuring sustainable growth and long-term success. Public liability insurance for Business acts as a shield, guarding your business against unforeseen events and their financial implications. Whether it's a customer slipping on a wet floor or damages caused by faulty equipment, liabilities insurance provides a safety net that helps minimise the impact on your business.

By investing in this crucial coverage, you not only protect physical assets like property and inventory but also safeguard intangible assets such as your reputation and brand image. A single lawsuit or claim can have far-reaching consequences for your business, potentially leading to hefty financial losses and irreparable harm to your hard-earned reputation. Public liability insurance ensures that you can weather such storms with confidence, allowing you to focus on what truly matters – growing your business.

Building Trust and Credibility

In the competitive business landscape, trust and credibility are paramount to success. Public liability insurance plays a crucial role in enhancing these vital aspects. By having this coverage, you demonstrate your commitment to protecting your customers' interests. It sends a powerful message that you are prepared to take responsibility for any unforeseen accidents or damages that may occur during your business operations.

Moreover, public liability insurance acts as an assurance mechanism for potential clients or customers. When they see that you have taken proactive steps to mitigate risks and protect their well-being, it instills confidence in your professionalism and reliability. This sense of trust can be a significant differentiating factor in attracting new customers and securing long-term relationships.

With public liability insurance on your side, you can proudly emphasise that you prioritise the safety and satisfaction of those who engage with your business.

Meeting Legal Requirements

Meeting Legal Requirements:In the realm of business, navigating legal requirements can be a daunting task. However, when it comes to public liability insurance, it is not just a matter of choice but a legal obligation in many jurisdictions. Laws and regulations vary from country to country, but the underlying principle remains consistent: businesses must protect themselves and others from potential harm or damage.

The liabilities insurance serves as a vital safety net that ensures compliance with legal obligations. It demonstrates your commitment to meeting the standards set by authorities and shows that you take responsibility for any potential accidents or mishaps that may occur during the course of your business operations.

Ensuring Peace of Mind for Customers

Ensuring Peace of Mind for Customers:When it comes to running a successful business, gaining the trust and confidence of your customers is paramount.

Public Liability Insurance plays a pivotal role in instilling peace of mind among your client base. Imagine a scenario where a customer visits your store and accidentally slips on a wet floor, resulting in an injury.

Without liabilities insurance, the financial burden falls on you as the business owner. This can lead to legal battles and tarnish your reputation, ultimately driving customers away.

Conclusion

Public liability insurance is not just a legal requirement, but a powerful tool that protects your business and promotes its growth. By having this coverage in place, you provide assurance to your clients and customers that you take their safety and well-being seriously. This builds trust and credibility, essential factors in establishing long-term relationships. Moreover, public liability insurance grants you peace of mind, allowing you to focus on what truly matters – the success and expansion of your business.

Source:https://runacresfinancial.finance.blog/2023/07/06/insuring-peace-of-mind-how-public-liability-insurance-supports-your-business-growth/

#Liabilities Insurance#Public Liability Insurance#Public Liability Insurance for business#Public Liability Insurance Service#General Liabilities Insurance#Business Liabilities Insurance

0 notes

Text

Forthright Roofing specialises in all aspects of roofing, combining traditional methods passed down through generations with modern techniques. We strictly adhere to current British Standards and health and safety laws, ensuring your safety with comprehensive £2 million public liability insurance. Our services range from roof restorations to new installations, covering all sizes of projects. Whether replacing an existing roof or adding a new dormer through a loft conversion, we support you from planning to completion, ensuring a durable, long-lasting roof. Based in Milton Keynes, Forthright Roofing distinguishes itself from sales-driven companies by offering genuine, cost-effective roofing and home improvement solutions without high-pressure tactics. For a free, no-obligation quote or advice, feel free to call us. We're here to help.

Website: https://forthrightroofing.co.uk

Address: Atterbury, Fairbourne Drive, Milton Keynes, MK10 9RG

Phone Number: 01908 020018 0800 0468141

Contact Email: [email protected]

Business Hours: Mon - Sat : 09:00 am - 06:00 pm

2 notes

·

View notes

Text

Driving Success: Mastering DOT Drug Testing for Transportation Entrepreneurs

As a transportation entrepreneur, navigating the intricate landscape of DOT drug testing is not just a regulatory requirement but a crucial step in ensuring safety, reliability, and compliance within your business. In this blog, we'll explore the ins and outs of DOT drug testing, its importance, challenges, solutions, and the role of technology and service providers in simplifying compliance. Let's dive in!

Why DOT Drug Testing Matters:

DOT drug testing isn't just about following rules; it's about safeguarding lives. By ensuring a sober workforce, transportation businesses mitigate the risks of substance-related accidents, protecting employees, passengers, and the public. Compliance with DOT regulations fosters a culture of safety and responsibility, essential for maintaining trust and credibility in the industry.

Who Needs to Comply:

Understanding who falls under DOT drug testing requirements is essential. From commercial truck drivers to aviation personnel, railroad workers to mariners, employees in safety-sensitive positions across various transportation sectors must adhere to strict testing protocols to uphold integrity and reliability within the industry.

Testing Procedures and Requirements:

DOT drug testing involves screening for a range of substances, including marijuana, cocaine, opiates, amphetamines, phencyclidine, and alcohol. Testing procedures follow rigorous guidelines, from sample collection to laboratory testing, review by Medical Review Officers (MROs), and follow-up protocols in case of positive results.

When Tests Are Required:

DOT drug and alcohol tests are mandated in various situations, including pre-employment, random testing throughout the year, reasonable suspicion testing, post-accident testing, return-to-duty testing after a violation, and follow-up testing for employees undergoing substance abuse treatment.

Practical Tips for Compliance:

Staying informed about DOT regulations, educating your team, partnering with reliable testing services, implementing clear policies, and providing support for employees struggling with substance abuse are vital steps in ensuring compliance with DOT drug testing requirements.

The Importance of Compliance:

Compliance with DOT drug testing regulations isn't just about adhering to government rules; it's about cultivating a safety culture, maintaining reliability and trust, avoiding legal and financial consequences, mitigating insurance and liability risks, and promoting long-term business health.

Implementing a Drug Testing Program:

Establishing a comprehensive drug testing program involves understanding DOT regulations, selecting qualified service agents, crafting clear policies, conducting pre-employment and random testing, managing post-accident and reasonable suspicion testing, and ensuring confidentiality and record-keeping compliance.

Challenges and Solutions:

While DOT drug testing poses challenges such as managing costs, ensuring privacy, and handling positive test results, practical solutions such as negotiating discounts, maintaining confidentiality, and establishing clear policies can mitigate these challenges and ensure effective management of drug testing programs.

The Role of Technology and Service Providers:

Technology and service providers play a crucial role in simplifying DOT drug testing compliance through digital scheduling and management systems, electronic chain of custody forms, integration with HR systems, mobile apps, expert guidance, comprehensive testing services, training, legal assistance, and compliance support.

Conclusion:

Navigating DOT drug testing is a multifaceted endeavor that requires diligence, expertise, and strategic partnerships. By prioritizing safety, reliability, and compliance, transportation entrepreneurs can ensure the well-being of their workforce, passengers, and the public while maintaining a competitive edge in the industry. Embrace DOT drug testing as a cornerstone of your entrepreneurial journey, and pave the way for a safer, more responsible future in transportation.

FAQs

1. Who needs to comply with DOT drug testing regulations?

Businesses in the transportation sector, including trucking, aviation, and public transportation, among others.

2. What substances does DOT drug testing screen for?

Typically, the test screens for marijuana, cocaine, opiates, phencyclidine (PCP), and amphetamines/methamphetamines.

3. How often should DOT drug tests be conducted?

It depends on various factors, including the specific industry and whether the testing is pre-employment, random, post-accident, or other types.

4. What happens if an employee fails a DOT drug test?

The procedures can include removal from safety-sensitive duties, a mandatory evaluation by a substance abuse professional, and completion of a return-to-duty process.

5. Can small businesses afford to comply with DOT drug testing?

Yes, there are cost-effective solutions and service providers that can help small businesses manage the requirements efficiently.

2 notes

·

View notes

Text

Maximizing Savings through Income Tax Planning Services in Jabalpur with Swaraj FinPro

Residing in Jabalpur and seeking avenues to reduce tax burdens? Implementing income tax planning strategies can serve as an investment avenue to retain a larger portion of your earnings.

Through astute financial management and capitalizing on available tax-saving avenues, you can curtail tax obligations and bolster your savings.

Here's a breakdown of how you can minimize taxes through Income Tax lanning Services in Jabalpur:

Familiarizing Yourself with Tax Deductions and Exemptions: The Indian government offers various deductions and exemptions to individuals aiming to mitigate tax liabilities. By scrutinizing your expenditures and investments, you can pinpoint opportunities to claim deductions under sections such as 80C, 80D, 80CCD, etc., of the Income Tax Act. Contributions to schemes like PPF, EPF, life insurance premiums, home loan EMIs, and health insurance premiums are instrumental in reducing taxable income.

Harnessing Tax-Saving Investments: Allocating funds to tax-saving instruments like Equity Linked Savings Schemes (ELSS), National Pension System (NPS), and tax-saving fixed deposits not only aids in tax reduction but also fosters wealth accumulation over time. These investments offer the dual advantage of tax savings and potential returns, making them an appealing choice for individuals aiming to optimize tax planning.

Retirement Planning: Planning for retirement can yield significant tax benefits. Options such as the National Pension Scheme (NPS) and Public Provident Fund (PPF) facilitate systematic tax deductions, offering a tax-efficient approach to building a retirement corpus. These avenues ensure financial security during retirement and provide a steady income stream.

Seeking Guidance from Financial Advisors: Consulting with proficient Financial Advisors in Jabalpur is pivotal in formulating a comprehensive tax-saving strategy tailored to your unique financial scenario. Given the challenge individuals face in allocating a portion of their income to taxes, the Indian government provides diverse options to enhance income retention, secure retirement, and offer flexibility and diversification.

ELSS scheme : ELSS scheme is a great tax saving option under section 80c, allowed by Income tax department aims to save on tax and build wealth in longer term. A very important feature of the ELSS i.e. Equity Linked Saving Scheme is it has lowest lock in period for say only 3 years. If invested lumpsum or one time, it will be available to withdraw just after completing 36 months means complete 3 years. Another good point is it gives much better return than other tax saving options. Third very important aspect of ELSS fund is it's tax efficiency. It attracts Long Term Capital Gains Tax after completing 3 years tenure.

In such equity oriented schemes, Long Term Capital Gains rules are different from debt funds. In such cases, profit upto Rs 100000 is tax free and above Rs 1 Lakh profit, only 10% tax is applicable.

These all features make it a favourable case to save tax through ELSS.

In summary, income tax planning presents abundant opportunities for individuals to optimize tax liabilities and bolster savings. By staying abreast of tax-saving provisions, making prudent investment decisions, and soliciting professional advice, you can efficiently manage taxes while safeguarding your financial future.

Embark on your income tax planning journey today to pave the path for a financially secure tomorrow.

For personalized assistance and expert advice on income tax planning, don't hesitate to reach out to Swaraj Finpro, a premier financial services provider in Jabalpur.

#Income Tax Planning Services in Jabalpur#Mutual Fund Services In Jabalpur#personal financial planning in jabalpur#tax saving mutual fund services in jabalpur#mutual funds expert in jabalpur

4 notes

·

View notes

Text

This Week's Legislation Update

Prefiles have begun, and so once more trans rights are under attack in the United States. Please visit our website linked below to learn about your state and contact your reps. Here's a thread of last week’s updates:

Bathroom bills deny access to public restrooms by gender or trans identity.

They increase danger without making anyone any safer and have even prompted attacks on cis and trans people alike. Many national health and anti-sexual assault organizations oppose these bills.

Ohio SB104 passed the Senate last week and is currently headed to the Governor to be signed. Upon signing, the bill would force all trans people, including students, staff, faculty, or visitors, to use the incorrect bathroom. It also would ban all non-gendered facilities and co-ed housing for schools within the state.

Texas has prefiled several bathroom bills last week, including HB1014, HB1015, HB1016, SB240, and HB239. Broadly, these would apply to school bathroom facilities; however, SB240 and HB239 target all public and private bathrooms, including for those who are incarcerated.

Healthcare bills go against professional and scientific consensus that gender-affirming care saves lives. Denying access will cause harm.

Providers are faced with criminal charges, parents are threatened with child abuse charges, and intersex children are typically exempted.

Texas prefiled SB116 and SB115 last week. These bills target doctors who provide gender affirming care by extending the statutes of limitations for medical liability. They would allow patients to sue their doctors at any time before their 30th birthday for transition-related care they received as a minor, drastically increasing the risks for doctors who provide care. It could also be used to drive any doctors who have provided care into bankruptcy.

Another prefiled bill from Texas is HB778, a bill that targets insurance plans. The primary aim is to massively increase the cost for covering transition related care so as to either price trans people out of any care or incentivise insurance companies to cease coverage entirely. It does this by requiring any plan that covers any transition care to also cover all possible costs associated with “detransition”, despite not requiring all transition related costs to be covered.

Drag Bans restrict access for folks who are gender non-conforming in any way.

They loosely define "drag" as any public performance with an “opposite gender expression,” as sexual in nature, and inappropriate for children.

This also pushes trans individuals out of public spaces.

Texas has prefiled HB938 and HB1075, both of which are out and out drag bans that explicitly call drag performances “lascivious” and allow anybody who promotes or facilitates a drag performance to be sued if a minor was in attendance. This is a massive violation of free speech and a clear attempt to censor queer existence in public and private spaces.